Shares of Swiggy Ltd. surged to a life high in trade on Tuesday as traders gear up for the food delivery aggregator's results for the quarter ended September.

The Bangalore-headquartered delivery platform's board said on Nov. 26 that it will consider and approve the unaudited financial results (standalone and consolidated) for the quarter and half year ended Sept. 30, 2024.

Swiggy made its market debut on Nov. 13, after its Rs 11,327-crore IPO that was subscribed 3.6 times. The shares were listed at Rs 420 apiece on the NSE, up 7.69% as compared to the upper end of the IPO price band of Rs 390. Since its listing, Swiggy's stock has gained by nearly 10%.

Swiggy had reported a net loss of Rs 611 crore in the April-June period and a total income of Rs 3,310 crore. In fiscal 2024, Swiggy's loss stood at Rs 2,313 crore on a topline of Rs 11,247 crore.

The loss was narrower as compared to Rs 4,170 crore in fiscal 2023, when the revenue logged by the company stood at Rs 8,265 crore.

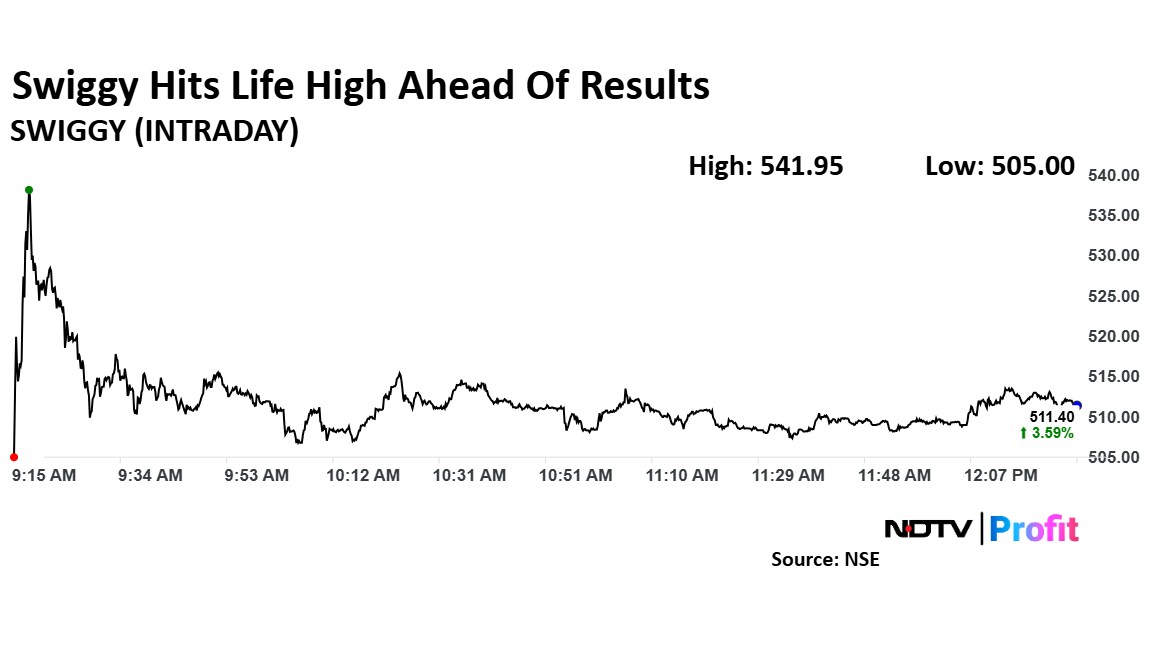

Swiggy Share Price Today

Swiggy's stock rose as much as 9.77% during the day to a life high of Rs 541.95 apiece on NSE. It was trading 3.63% higher at Rs 511.6 apiece, compared to a 0.45% advance in the benchmark Nifty 50 as of 12:25 p.m.

It has risen 12% since its listing on the stock exchanges. Total traded volume so far in the day stood at 0.9 times its 30-day average. The relative strength index was at 70.

Four of the six analysts tracking the company have a 'buy' rating on the stock, one suggests a 'hold' and one has a 'sell', according to Bloomberg data. The average of 12-month analysts' price targets implies a potential downside of 13%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.