The share price of Swiggy Ltd rose as high as 2.54% at market open on Monday and reversed gains shortly after the company's declaration of its financial performance for the quarter ended March. The company recorded a net loss of Rs 1,081 crore during the January-March period of fiscal 2025, as compared to Rs 799 crore in the year-ago period.

This development drew a mixed response from brokerages, with divergent views on its growth prospects and profitability trajectory, particularly in the quick commerce segment.

Analysts highlighted Swiggy's relatively stable food delivery business, but concerns around sustained losses in quick commerce remained dominant. While UBS maintained a bullish outlook on operational leverage from maturing dark stores, other brokerages suggested a longer and more uncertain path to profitability.

UBS expects margins to improve as newer stores scale with more daily orders, while Macquarie notes the margin gap with Zomato is narrowing, though long-term economics still remain weak.

Ambit sees Swiggy's valuation lowered on concerns over limited addressable market and prolonged cash burn. Motilal Oswal considers Megapod and Maxxsaver strategies as potential levers to improve AOV and margins.

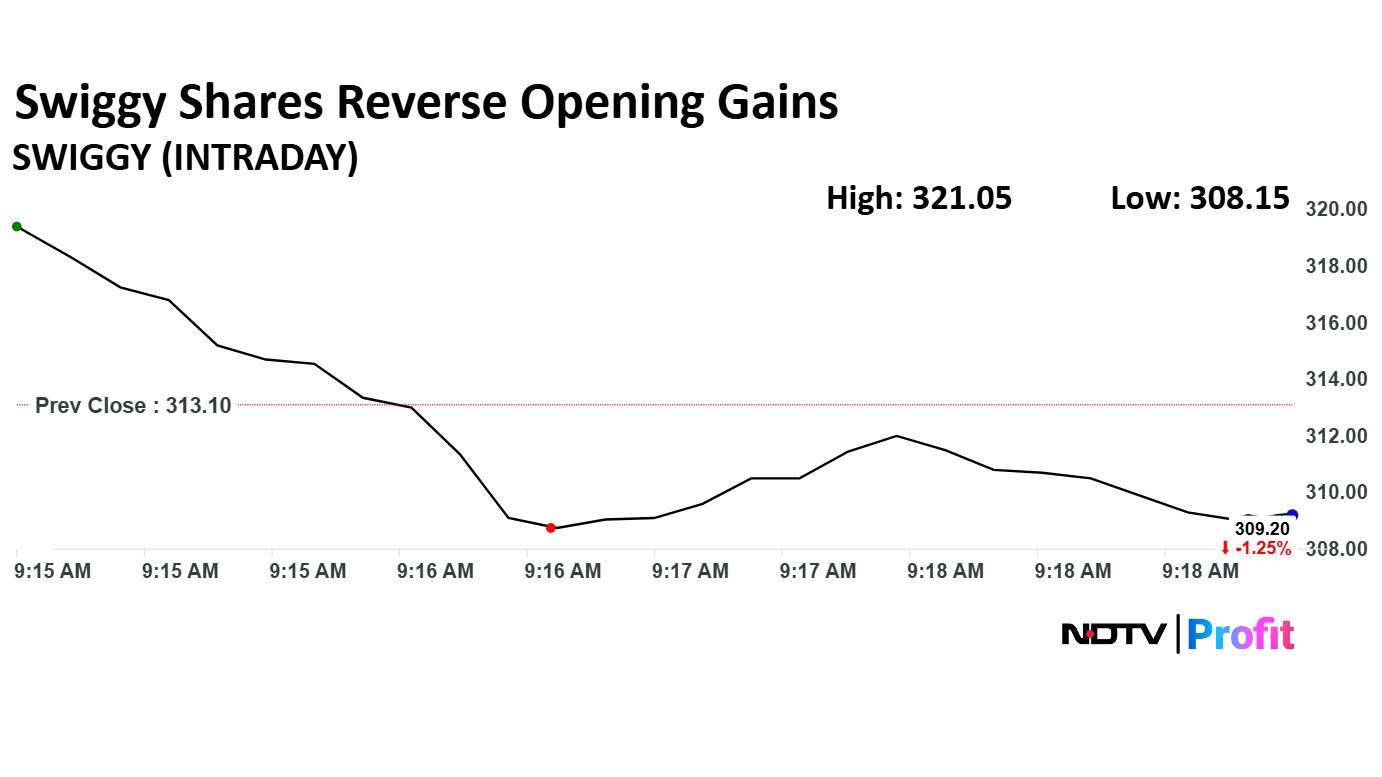

Swiggy Share Price Today

The scrip rose as much as 2.54% to Rs 321.05 apiece. It pared gains to trade 1.20% lower at Rs 309.35 apiece, as of 09:20 a.m. This compares to a 1.72% advance in the NSE Nifty 50 Index.

It has fallen 43.20% on a year-to-date basis. Total traded volume so far in the day stood at 0.33 times its 30-day average. The relative strength index was at 61.45.

Out of 20 analysts tracking the company, 13 maintain a 'buy' rating, three recommend a 'hold,' and four suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 33.6%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.