Suzlon Energy Ltd. received a rating upgrade from 'hold' to 'buy' on its stock from Nuvama after strong third quarter earnings, order book and valuation comfort due to recent price correction.

The brokerage has set a target of Rs 60 for Suzlon Energy share price, implying a potential upside of 19% over the previous close. The target price is 35 times the fiscal 2027 earnings projection.

Nuvama has maintained a long-term positive outlook on the company and adjusted the earnings estimates over three years to reflect improved execution in the current fiscal from 1.44 GW to 1.5 GW, the Renom acquisition, and other factors.

The brokerage noted that the December quarter saw robust execution of 447 MW compared to estimate of 360 MW, resulting in a top line of nearly Rs 3,000 crore. The execution uptick is aided by capacity ramp up to 4.5 GW.

Operating margin improved due to higher wind turbine generator mix-led operating leverage, resulting in beat to forecast despite elevated depreciation and interest costs in the wake of Renom acquisition.

The 5.5 GW order book, which marks a 3.4 times jump from 2.29 GW in December 2023, is executable over 24 months, Nuvama said.

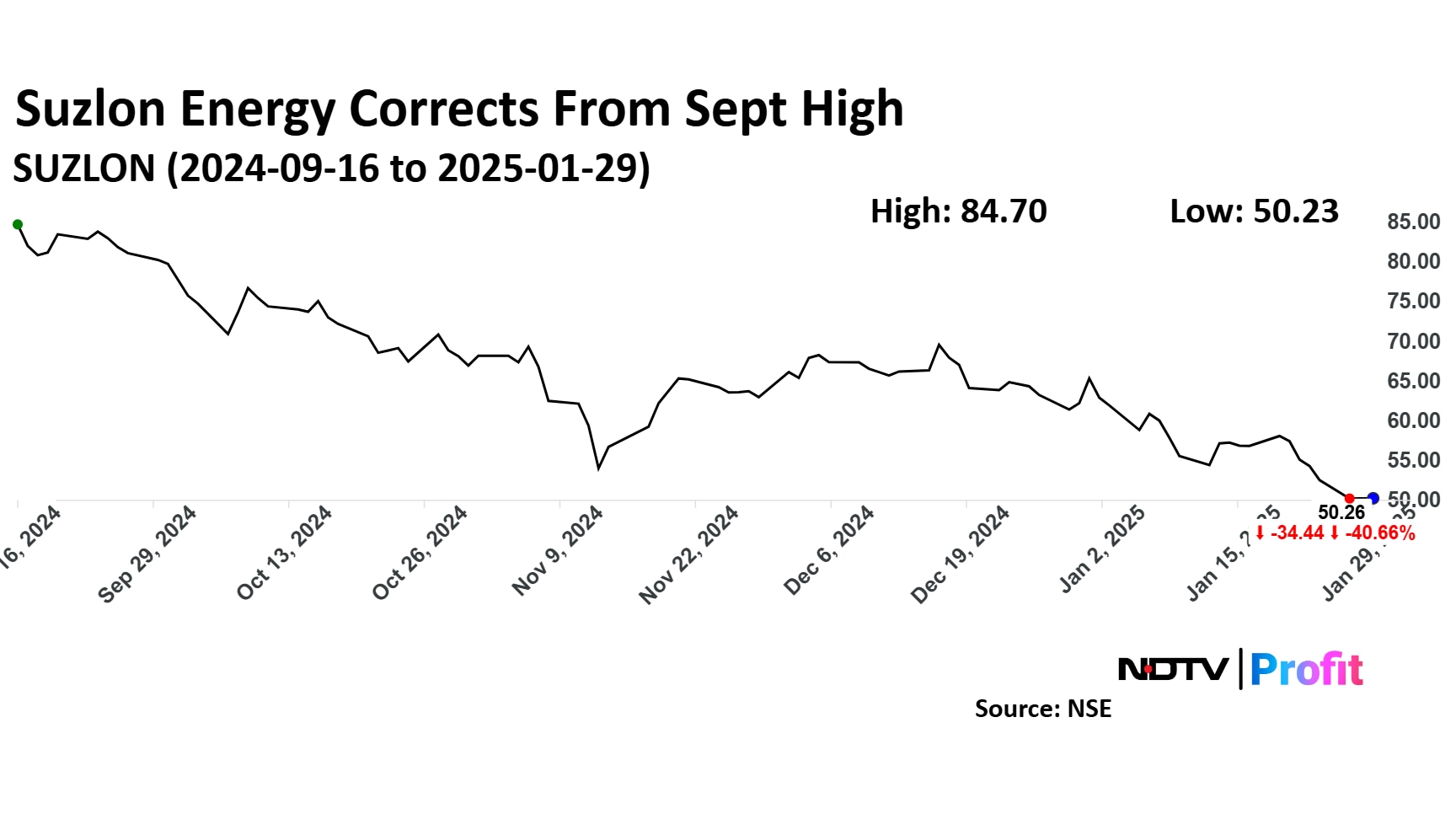

Suzlon Energy share price has corrected 40% since its life high in mid-September last year.

The wind turbine maker's consolidated net profit jumped 90% on an annual basis in the third quarter of the current financial year, beating analysts' estimates.

The company posted a profit of Rs 386 crore in the third quarter, according to an exchange filing on Tuesday. Analysts polled by Bloomberg had estimated a profit of Rs 350 crore.

Revenue surged 91% to Rs 2,968.8 crore, beating estimate of Rs 2,855 crore.

Shares of Suzlon Energy closed flat on Tuesday, ahead of the results.

Five out of the six analysts tracking Suzlon Energy have a 'buy' rating on the stock, one recommend a 'hold', according to Bloomberg data. The average of 12-month analyst price target of Rs 75.17 implies a potential upside of nearly 50%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.