Shares of Styrenix Performance Materials Ltd. hit a life high after the company announced the acquisition of the Thailand-based INEOS Styrolution (Thailand) Co. The strategic deal worth $20 million will be carried out through its unit.

The specialty chemical company's board approved the acquisition from the Thai firm's existing shareholders, i.e. INEOS Styrolution Group GmbH., INEOS Styrolution APAC Pte. and INEOS Styrolution Hong Kong Co., according to an exchange filing on Monday.

INEOS Thailand is a global supplier with a focus on manufacturing and distribution of speciality ABS, high heat ABS, and SAN polymers, with its customer base in Thailand, South East Asia and China.

The Thailand unit reported a revenue of Rs 976 crore in the financial year 2023 compared to Rs 1,484 crore in fiscal 2022. The acquisition is expected to be completed by early 2025, subject to completion of customary conditions, it said.

Further, the board also approved the incorporation of a step-down subsidiary in Thailand in which 99.99% shares will be held by Styrenix Performance Materials FZE, Dubai, a wholly owned subsidiary of the company. "Name of the proposed step-down subsidiary would be available once it is incorporated," the statement said.

The specialty chemical firm also announced an interim dividend of Rs 31 per share for the fiscal 2024-25, with Dec. 17, 2024 as the record date to determine the eligible stockholders.

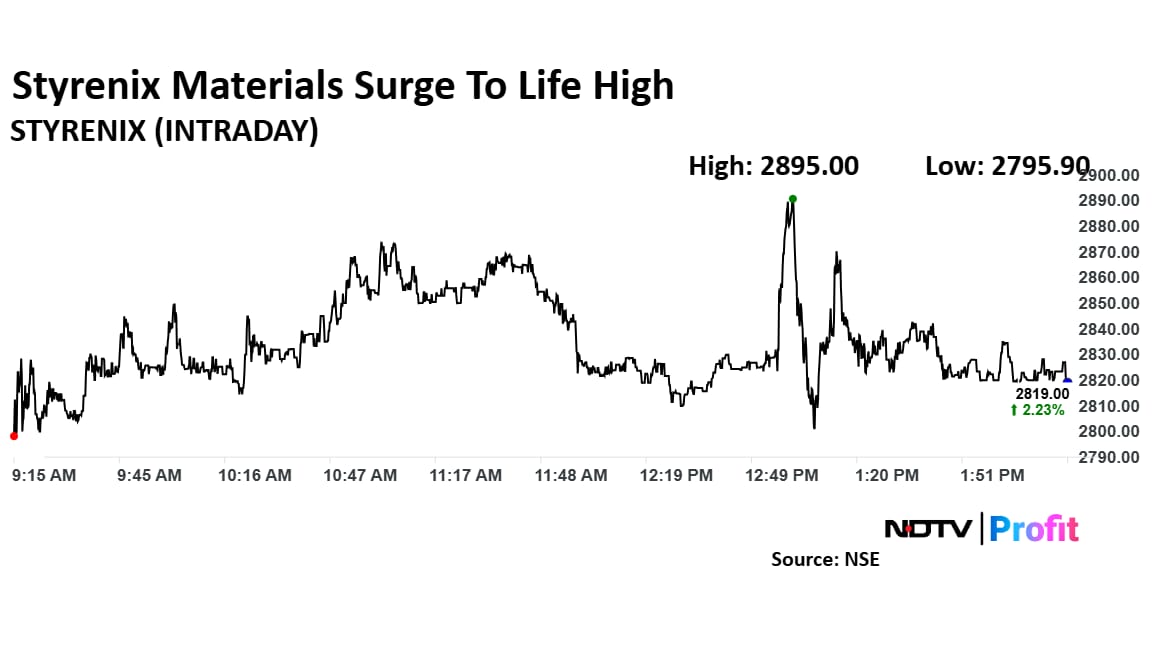

Styrenix Performance's stock rose as much as 4.98% during the day to a life high of Rs 2,895 apiece on the NSE. It was trading 2.39% higher at Rs 2,823.35 apiece, compared to a 0.25% decline in the benchmark Nifty 50 as of 02:17 p.m.

It has risen 82% during the last 12 months and has advanced by 95% on a year-to-date basis. The total traded volume so far in the day stood at six times its 30-day average. The relative strength index was at 76, indicating that the stock is overbought.

One analyst tracking the company have a 'hold' rating on the stock, according to Bloomberg data.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.