Stocks rose, while bonds and the yen fell, as hopes for a deal to end the longest US government shutdown boosted appetite for risk.

Contracts for the S&P 500 and the Nasdaq 100 rose 0.4% and those for the Nasdaq 100 index advanced 0.6% as Senate Republican leader John Thune said a deal is “coming together” as he planned a test vote Sunday on a narrow spending package that would end the 40-day government shutdown. A group of Senate Democrats is leaning toward voting to advance the package provided final details can be worked out.

Asian shares rose with gains in South Korea leading. As sentiment improved, bonds fell across the curve with the yield on 10-year Treasuries rising more than two basis points to 4.12%. The yen, a traditional safe haven currency, fell 0.2% against the dollar.

While hopes for a deal may provide some relief, markets remained on edge after last week's sharp selloff in technology shares reignited concerns about stretched valuations. Asian tech stocks were particularly vulnerable, having outperformed US peers this year on optimism around China's AI advances. Adding to the caution is a dearth of fresh data to guide investors on the health of the US economy.

“The week ahead will depend on whether the US government can orchestrate an end” to the shutdown, Kyle Rodda, a senior analyst at Capital.com, wrote in a note to clients. While Wall Street's rally late Friday had glossed over some of the negativity in markets, “the move was ultimately little more than putting lipstick on the proverbial pig.”

The record-breaking US government shutdown is nearing an end after a group of moderate Senate Democrats agreed to support a deal to reopen the government and fund some departments and agencies for the next year, people familiar with the talks said.

The chamber is set to hold a procedural test vote on Sunday. If that vote succeeds, the Senate will need the consent of all members to end the shutdown quickly. Any one senator can force days of delay and votes. The House would then need to pass the bill for the government to reopen and Speaker Mike Johnson has said he will give lawmakers two days notice to return.

Chinese assets will be in focus on Monday after consumer prices unexpectedly rose 0.2% in October from a year earlier, as holidays during the month boosted travel, food and transport demand. Factory-gate deflation also eased.

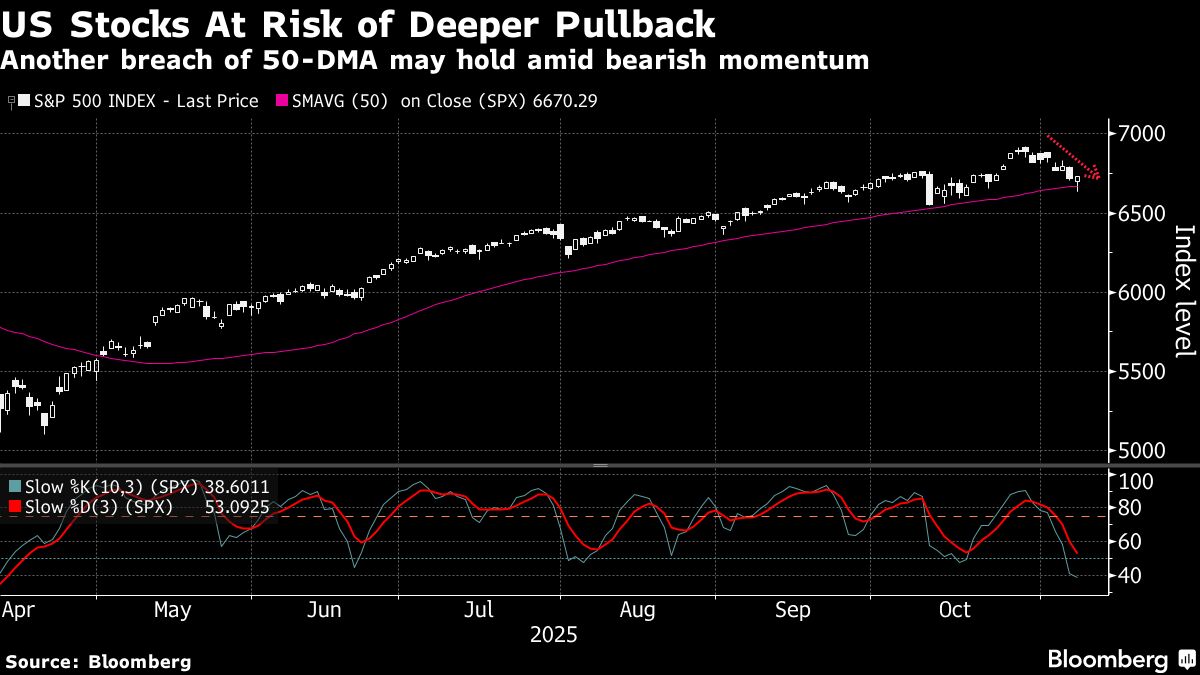

The S&P 500 rose 0.1% on Friday, rebounding from an earlier test of its 50-day moving average after a reading of US consumer sentiment fell to a more than three-year low. A gauge of the dollar edged up 0.1% in early Monday trading.

The greenback is likely to trade in a range for the time being, Commonwealth Bank of Australia strategists led by Joseph Capurso wrote in a note to clients. “Even if the shutdown ends this week, it will take some time for data to be released again. Several FOMC members have signaled reluctance to cut interest rates further while important economic data is not being released.”

Corporate News:

Pfizer Inc. agreed to buy Metsera Inc. for up to $10 billion, prevailing over Novo Nordisk A/S in a tumultuous bidding war after US regulatory opposition thwarted the Danish drugmaker's rival bid for the obesity drug startup.

Nvidia Corp. Chief Executive Officer Jensen Huang said he had asked Taiwan Semiconductor Manufacturing Co. for more chip supplies as artificial intelligence demand remains strong.

Visa Inc. and Mastercard Inc. are close to a new agreement that will attempt to settle a two-decade legal spat with merchants, according to a person with direct knowledge of the matter.

Some of the main moves in markets:

Stocks

S&P 500 futures rose 0.4% as of 9:18 a.m. Tokyo time

Hang Seng futures fell 0.3%

Japan's Topix rose 0.5%

Australia's S&P/ASX 200 rose 0.3%

Euro Stoxx 50 futures rose 1.3%

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro fell 0.1% to $1.1550

The Japanese yen fell 0.3% to 153.85 per dollar

The offshore yuan was little changed at 7.1251 per dollar

The Australian dollar rose 0.2% to $0.6504

Cryptocurrencies

Bitcoin rose 0.5% to $105,044.73

Ether was little changed at $3,583.81

Bonds

Australia's 10-year yield advanced three basis points to 4.38%

Commodities

West Texas Intermediate crude rose 0.3% to $59.92 a barrel

Spot gold rose 0.4% to $4,015.67 an ounce

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.

.jpg?im=FeatureCrop,algorithm=dnn,width=350)