Food delivery aggregator Zomato Ltd.'s shares plunged over 2% on Wednesday even after launching its 15-minute food delivery offering, two years after winding up a similar 10-minute feature.

Shares of the platform recently saw its inclusion in the benchmark BSE Sensex index. The scrip tumbled nearly 15% in the last four sessions as analysts downgraded over profitability concerns.

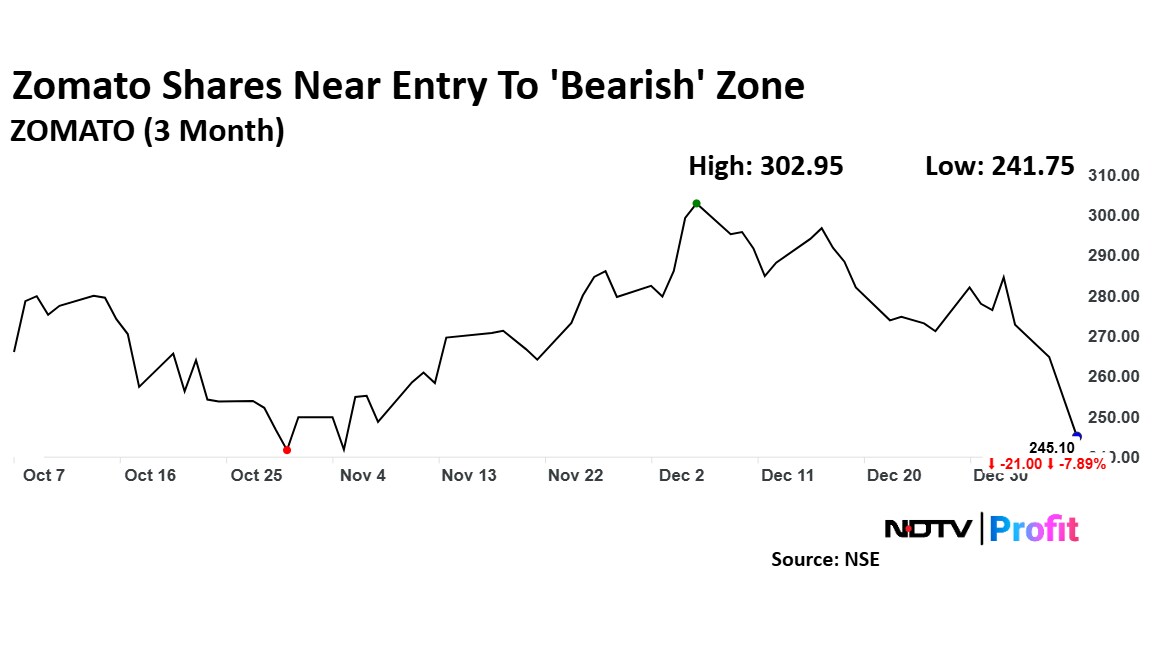

The stock fell as much as 19% to Rs 247 per share on Wednesday since its life high on Dec. 9 last year. A fall of over 20% from the respective 52-week peak is usually referred as a 'bearish' zone.

The counter trades below the 21-day exponential moving average and 14-day simple moving average, indicating a short-term negative bias. However, it currently trades above its key 200-day moving average.

Zomato's stock fell as much as 2.6% in early trade on the NSE, compared to the 0.42% decline in the benchmark Nifty 50 index. The stock fell past the level of 2 standard deviations below the 14-day moving average.

The immedia support for the scrip exists at the Rs 240 mark which is near the 200-DMA. A close below this level could set the tone for further negative bias. The stock is yet to see any trend reversal for any upside move.

Among the 27 analysts tracking the stock, 24 have a 'buy' rating, one suggests a 'hold' and two recommend a 'sell'. The average of 12-month analysts' price target implies a potential upside of 23%.

'Threat To Profitability'

The Gurugram-based company's 15-minute delivery feature is live across select locations in cities like Mumbai and Bengaluru. Zomato wound up Instant in January 2023, after a year of piloting in parts of Delhi, Gurugram and Bengaluru.

The shares of the food aggregator were downgraded by Jefferies to 'hold' as it revised the target lower, citing increasing competition as a threat to profitability.

Jefferies expect a year of consolidation for the stock after it doubled in value in 2024. Although valuations appear reasonable considering Zomato's strong execution and growth opportunities, Jefferies is "worried on the rise in quick commerce competition."

The stock recently replaced JSW Steel Ltd. to take its place in the benchmark Sensex with a potential inflow of $513 million in the latest December rejig.

HSBC has a stronger view on the shares of Zomato over its nearest rival Swiggy Ltd. The company's quick commerce business will see much higher climb, with 33% order growth and 35% gross order value growth in the same period, it said.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.