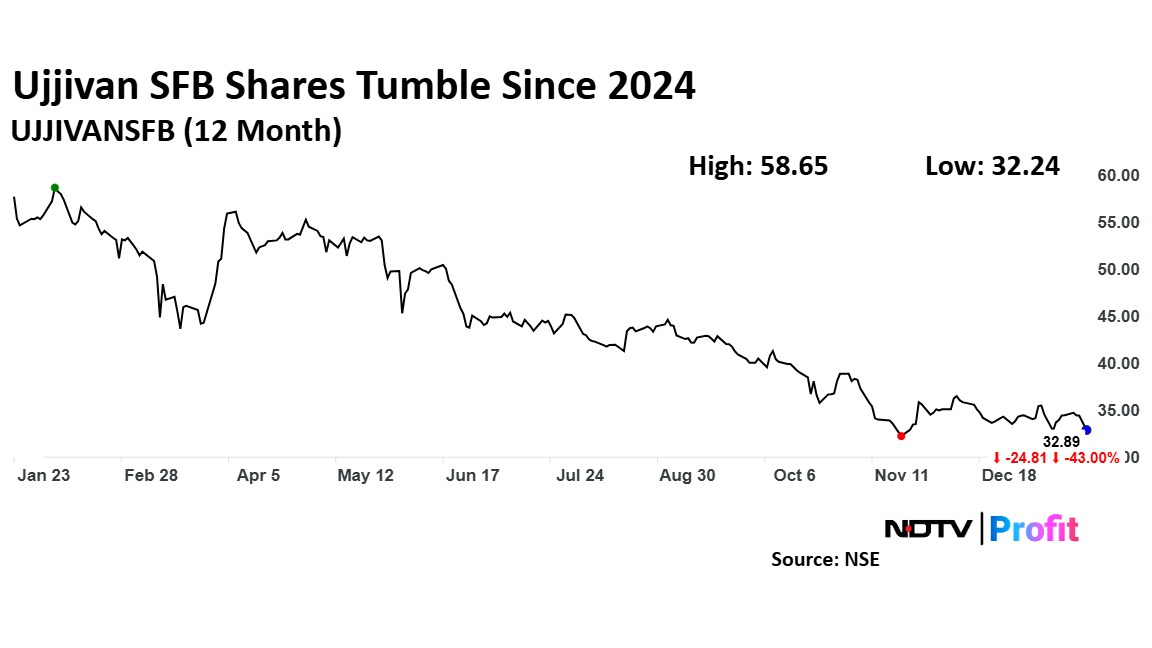

Shares of Ujjivan Small Finance Bank Ltd. extended their losses this year after tumbling nearly 45% in 2024. The lender's plan to apply for a universal banking license failed to cheer investors.

The stock of Ujjivan has fallen by 3% in 2025. It tumbled on Friday after the company's third-quarter profit fell 64%. The stock has been falling since hitting a life-high of Rs 63 per share in December 2023.

Ujjivan's stock trades below the long-term trend gauge — 200-daily moving average. The scrip currently is also below the 14-day simple moving average and the 21-day exponential moving average.

The counter currently faces support at Rs 32.6, which is also 2 standard deviations below the 14-day moving average. A breakout of that could send the stock towards Rs 32 level. On the upside, the stock faces resistance at Rs 35.5 and a breakout could send the stock to further upsides.

The stock fell as much as 6.9% to Rs 32.1 per share, compared to the 0.4% decline in the NSE Nifty 50. The relative strength index was at 38, trading near the oversold zone.

Thirteen of the 16 analysts tracking the company have a 'buy' rating on the stock, two suggest a 'hold' and one has a 'sell', according to Bloomberg data. The average of 12-month analysts' price target implies a potential upside of 35%.

Ujjivan Small Finance Bank reported a 64% fall in its profit on a yearly basis to Rs 109 crore during the three months ended December due to the rise in provisions. Sequentially, the bottomline of the bank declined 53%.

Provisions and contingencies of the bank rose to Rs 223 crore, sharply higher than Rs 63 crore a year ago.

The small finance bank's asset quality was mixed during the quarter, with the gross non-performing assets ratio marginally rising to 2.68% as of Dec. 31, compared to 2.52% in the previous quarter. The net NPA ratio was unchanged from a quarter ago at 0.56%.

The board of directors of the lender approved a proposal on Thursday to make an application to the Reserve Bank of India for a universal bank license. Earlier, AU Small Finance Bank and Fino Payments Bank applied for universal bank licenses with the central bank.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.