The board of Sanghi Industries Ltd. approved the allotment of 50 crore additional preferential shares to Ambuja Cements Ltd. on Friday.

On a private placement basis, the company will allot 50 crore of 8% non-convertible cumulative redeemable preference shares with a face value of Rs 10, to Ambuja Cements. The total value of the allotted shares is Rs 500 crore, according to an exchange filing.

This allotment is above and beyond the allotment of an identical tranche of redeemable preference shares worth Rs 500 crores that the company approved to be allotted to Ambuja Cement on July 4, the filing said.

As a result, following today's allotment, the company has approved a total of 100 crore shares worth Rs 1,000 crore to Ambuja Cements. This is in line with shareholders' approval of issuing up to Rs 2,200 crore worth of 8% non-convertible cumulative redeemable preference shares early in June, according to the company's exchange filing.

Ambuja Cements owns 60.44% of the total outstanding shares of Sanghi Industries as of March, according to data on the National Stock Exchange.

Sanghi Industries has a total outstanding of 25.83 crore shares as of March. Out of this, the promoter group owns 78.52%, with the remaining 21.48% held by the public.

In August 2023, Adani Group-owned Ambuja Cements acquired Sanghi Industries for an enterprise value of Rs 5,000 crore.

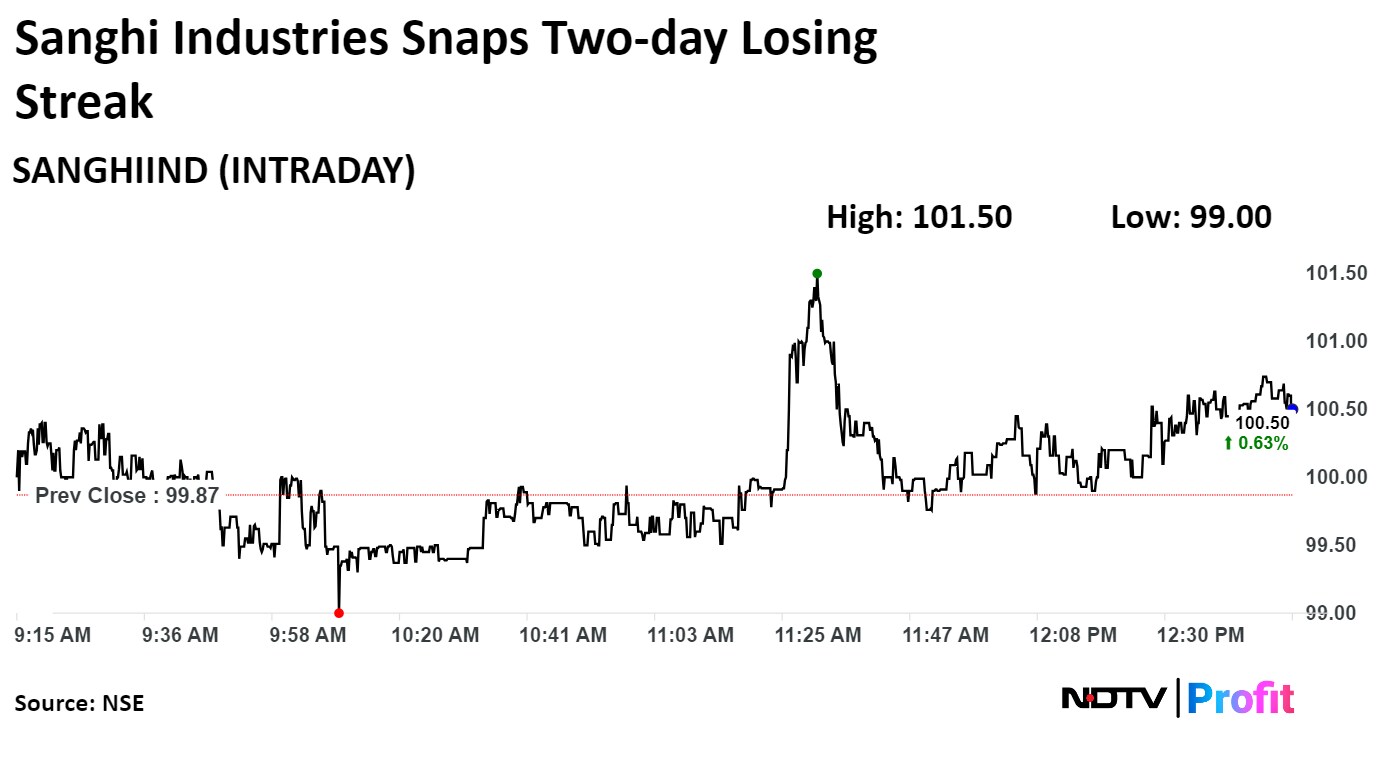

Shares of Sanghi Industries rose 1.63% to Rs 101.50. It was trading 0.83% higher at Rs 100.70 as of 12:48 p.m., compared to 0.09% decline in the NSE Nifty 50 index.

The stock gained 41.86% in 12 months and declined 20.74% on year to date basis. Total traded volume so far in the day on NSE stood at 0.42 times its 30-day average. The relative strength index was at 54.60.

One analysts tracking the company maintain a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target implies an upside/downside of 54.5%

Disclaimer: NDTV is a subsidiary of AMG Media Networks Limited, an Adani Group Company.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.