US index futures are pointing to a lower open later today.

S&P 500: 0.14%

Dow Jones Industrial Average: 0.06%

Nasdaq: 0.29%

Rupee strengthened 23 paise to end at 86.57 against the US Dollar. Intraday, rupee strengthened 26 paise to 86.54 a dollar.

Source: Bloomberg

Nifty Recorded its best intraday session since Feb. 4

ICICI Bank, M&M, L&T top sectoral gainer in Nifty

Nifty, Sensex ended higher by 1.5% for the day.

Nifty Midcap 150 ended higher by 2.13%

Nifty Smallcap 250 ended higher by 2.65%

Nifty Media to sectoral higher for the day led by TV18 broadcast, PVR Inox and Dish TV.

Nifty Bank best intraday session since Nov 25.

Nifty Media snaps five days losing streak.

Nifty Realty snaps three days losing streak.

Nifty FMCG, Oil and Gas snaps two days losing streak.

Nifty Auto, Metal, Financial Services, Pharma, IT ends higher for the second day in a row.

Nifty Bank ended higher for the fourth day in a row.

Nifty Recorded its best intraday session since Feb. 4

ICICI Bank, M&M, L&T top sectoral gainer in Nifty

Nifty, Sensex ended higher by 1.5% for the day.

Nifty Midcap 150 ended higher by 2.13%

Nifty Smallcap 250 ended higher by 2.65%

Nifty Media to sectoral higher for the day led by TV18 broadcast, PVR Inox and Dish TV.

Nifty Bank best intraday session since Nov 25.

Nifty Media snaps five days losing streak.

Nifty Realty snaps three days losing streak.

Nifty FMCG, Oil and Gas snaps two days losing streak.

Nifty Auto, Metal, Financial Services, Pharma, IT ends higher for the second day in a row.

Nifty Bank ended higher for the fourth day in a row.

Maintain Outperform rating, target price of Rs 210, likely upside of 63%

Stock has potential to double at 1x PEG levels.

Current pipeline indicates no of rooms will increase by ~50% by 2028.

Highest FCF margin potential of 40% to drive ROCE from 12% in FY24 to 24% by FY28E.

Currently trades at 15% discount to the comp group on EV/ FY27E EBITDA.

Additional upside could come from multiple expansion, potential M&A Fleur IPO.

The Reserve Bank of India has signed a Memorandum of Understanding with the Bank of Mauritius to promote the use of local currencies for bilateral transactions, aiming to reduce reliance on foreign currencies and optimize transaction costs.

Intraday, the rupee strengthened 26 paise to 86.54 against US Dollar, marking the highest level since Feb 21. The domestic unit opened at 86.74 a dollar Tuesday.

The rupee ended at 86.80 a dollar on Monday, according to data on Bloomberg

JM Financial initiated coverage on Bazaar Style with a 'buy' rating and a target price of Rs 400. Bazaar Style's strong presence and high-growth market position enables the company to capitalise on opportunities, said the brokerage.

The key risks cited by the brokerage include high revenue concentration, heavy reliance on apparel sales, increased competition and the dependency on a limited number of suppliers.

The brokerage also notes that the company is investing in system and process automation software to boost expansion and reduce operational costs.

Read full story here.

Zerodha co-founder and CEO Nithin Kamath has advised traders to critically apply risk management for sustained trading success, drawing from his experience as both a trader and broker.

In a post on X on Mar. 17, Kamath acknowledged the current period of market fear and said that it is hard to maintain an objective mindset in such turbulent times. In a bid to help the investors, Kamath also shared several tips including the ‘Turtle Rule’ followed by legendary trader Jerry Parker by quoting his words from an old interview.

Read story here.

Commerce Minister Piyush Goyal said FTA talks between India and New Zealand will be vibrant, enhance bilateral ties anbd boost trade by over 10 times within 10 years.

"Few areas of sensitivity can be easily managed. Agriculture, food, dairy, critical minerals, forestry, tourism, sports, renewable energy, education are some fields of common interest," he said.

New Zealand Prime Minister Christopher Luxon said he has "huge expectations" from the trade ministers to complete the deal within 60 days.

CG Power board approved interim dividend of Rs 1.3 per share for FY25.

Source: Exchange Filing

CG Power board approved interim dividend of Rs 1.3 per share for FY25.

Source: Exchange Filing

Brigade Enterprises partnered with Gruhas, the investment arm of Nikhil Kamath and Abhijeet Pai, to drive PropTech and sustainability with Rs 300 crore Earth Fund.

Source: Exchange filing

Makers of summer treats like ice-cream and colas are already seeing record sales, even though it is only March. With heatwave days projected to exceed the usual average nationwide, demand is expected to rise 25-30% during the season, boosting profits, say industry executives.

"We have been seeing solid sales since January, and we have doubled our production capacity ahead of the peak season," said Jayen Mehta, managing director of Amul, which sells ice-cream, packaged drinks and dairy products like curd and buttermilk. Sales have been 20% higher between January and March so far across products, he added.

Manish Bandlish, managing director, Mother Dairy, expects demand to increase by over 30%. "With enhanced capacities, cold chain infrastructure and early asset mobilisation, we are well poised to handle such upsurge," he said.

Premium ice-cream chain, Baskin Robbins, is also seeing a sudden rise in footfall at its parlours, according to Mohit Khattar, CEO of Graviss Foods, master franchisee for Baskin Robbins in India.

Read full report here.

After Vicky Kaushal, PVR Inox is praying for Salman Khan's success as Eid 2025 will see the Sikandar hit cinemas on March 28. The last few quarters have been a struggle for the Hindi movie business but the recent box office success of Chhaava in February has brought much needed respite and trade analysts are hopeful that Khan will carry the momentum.

A note by research firm Nuvama also expects that the ongoing fourth quarter will see the tide turn for tinseltown and has thus give an almost 100% target price hike for PVR Inox.

"Sikandar, set for a release in the end of Q4FY25, is anticipated to deliver strong opening numbers. The pipeline (also) includes Hollywood movies such as Thunderbolts and First Steps," the note said.

The much-awaited uptick also means PVR Inox is on track to reach pre-Covid operating margins of 18% as footfalls increase.

Read full report here.

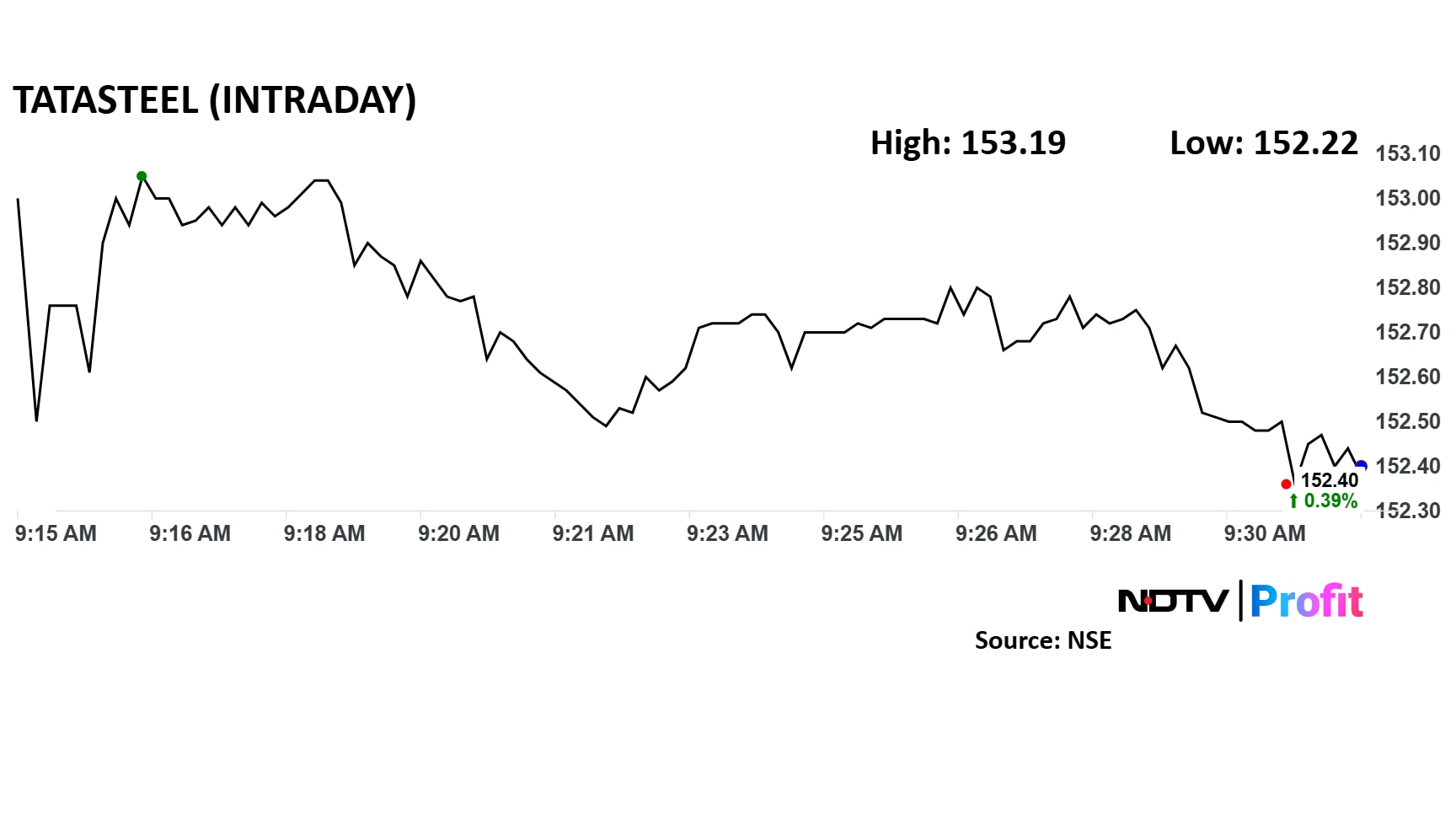

Tata Steel stock had another large trade of over 20 lakh share in a block deal.

TARC board has approved raising up to Rs 409 crore via non-convertible debentures

Source: Exchange Filing

Upgrade to add from reduce; target price of Rs 1,525 (6.5% potential upside).

Stock has corrected sharply by 36% in the past three months.

Concerns are growth and profitability.

Slowdown concerns include slower ULIPs, lower motor sales and lack of identifiable near-term growth drivers for the industry.

Company has multiple growth segments to toggle.

PB Fintech remains a strong and indispensable franchise.

Ola Electric: Up 13.53%, turnover of Rs 536 crore

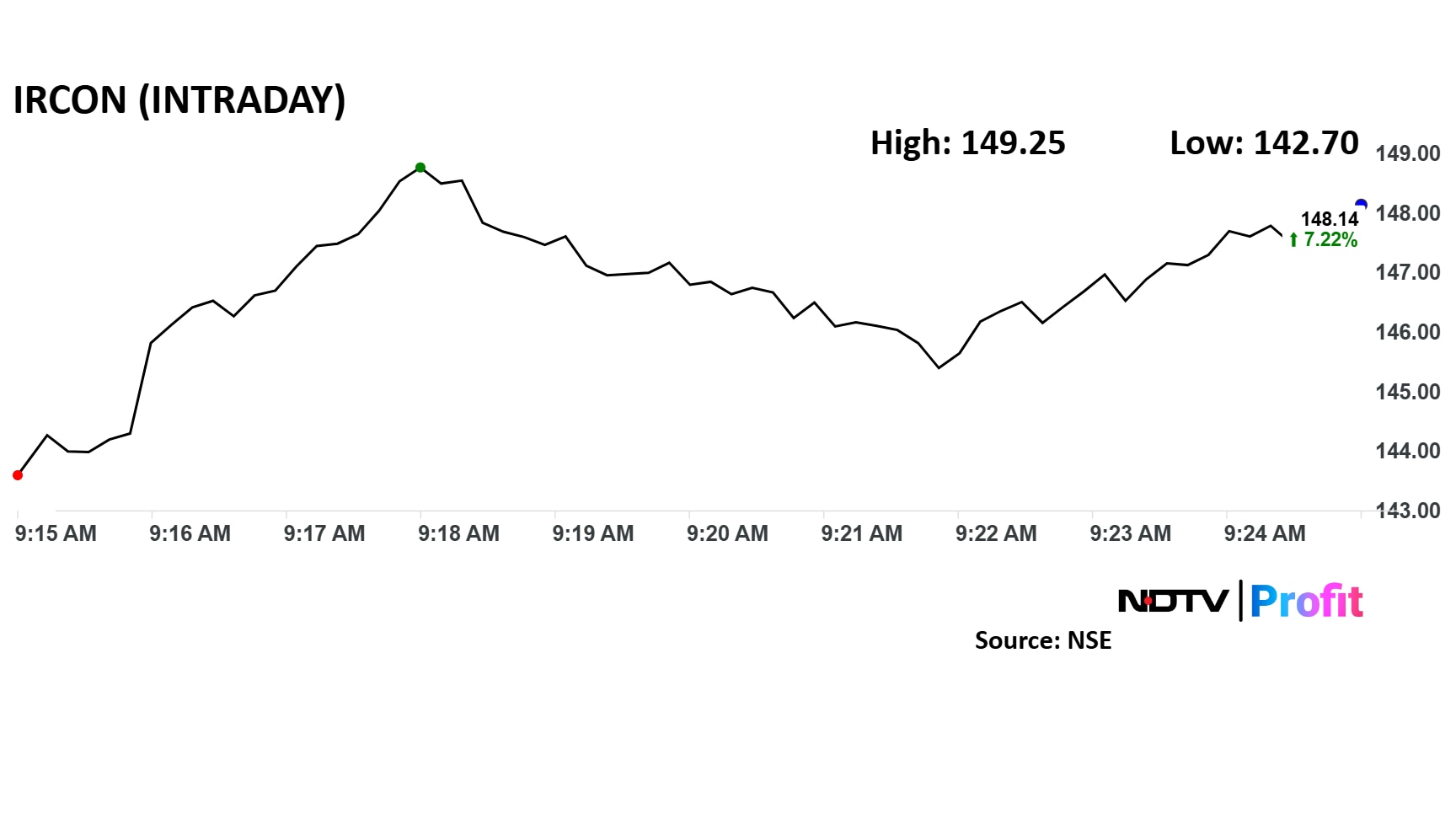

Ircon: Up 5.52%, turnover of Rs Rs 399 crore

Jyoti Structures: Up 16.4%, turnover of Rs 49.4 crore

NMDC: Up 2.36%, turnover of Rs 134.38 crore

PC Jeweller: Up 2.54%, turnover of Rs 23.56 crore

Ola Electric: Up 13.53%, turnover of Rs 536 crore

Ircon: Up 5.52%, turnover of Rs Rs 399 crore

Jyoti Structures: Up 16.4%, turnover of Rs 49.4 crore

NMDC: Up 2.36%, turnover of Rs 134.38 crore

PC Jeweller: Up 2.54%, turnover of Rs 23.56 crore

Large Caps

ICICI Bank: Rs 20,500 crore

HDFC Bank: Rs 16,200 crore

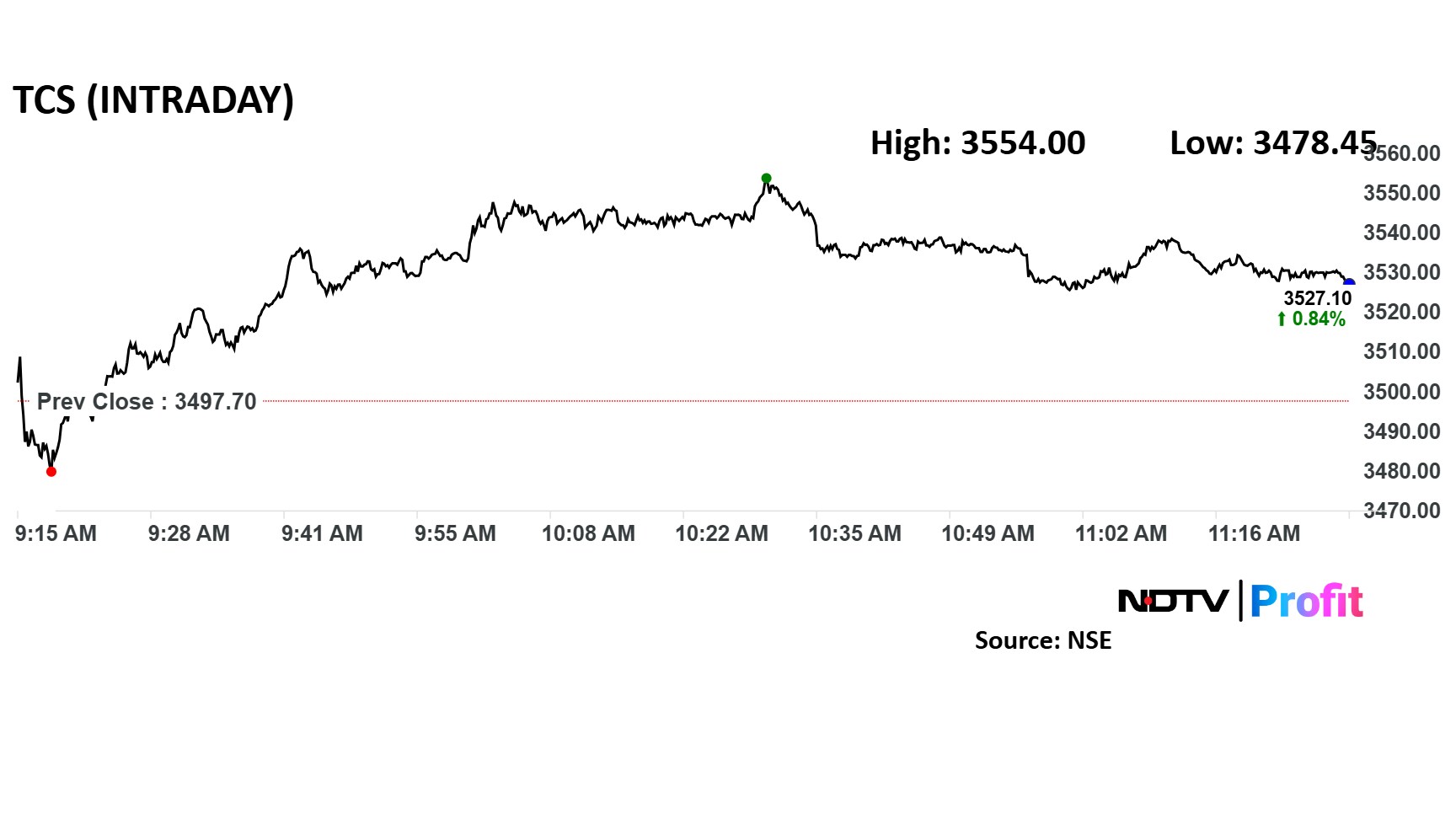

TCS: Rs 11,600 crore

Mid caps

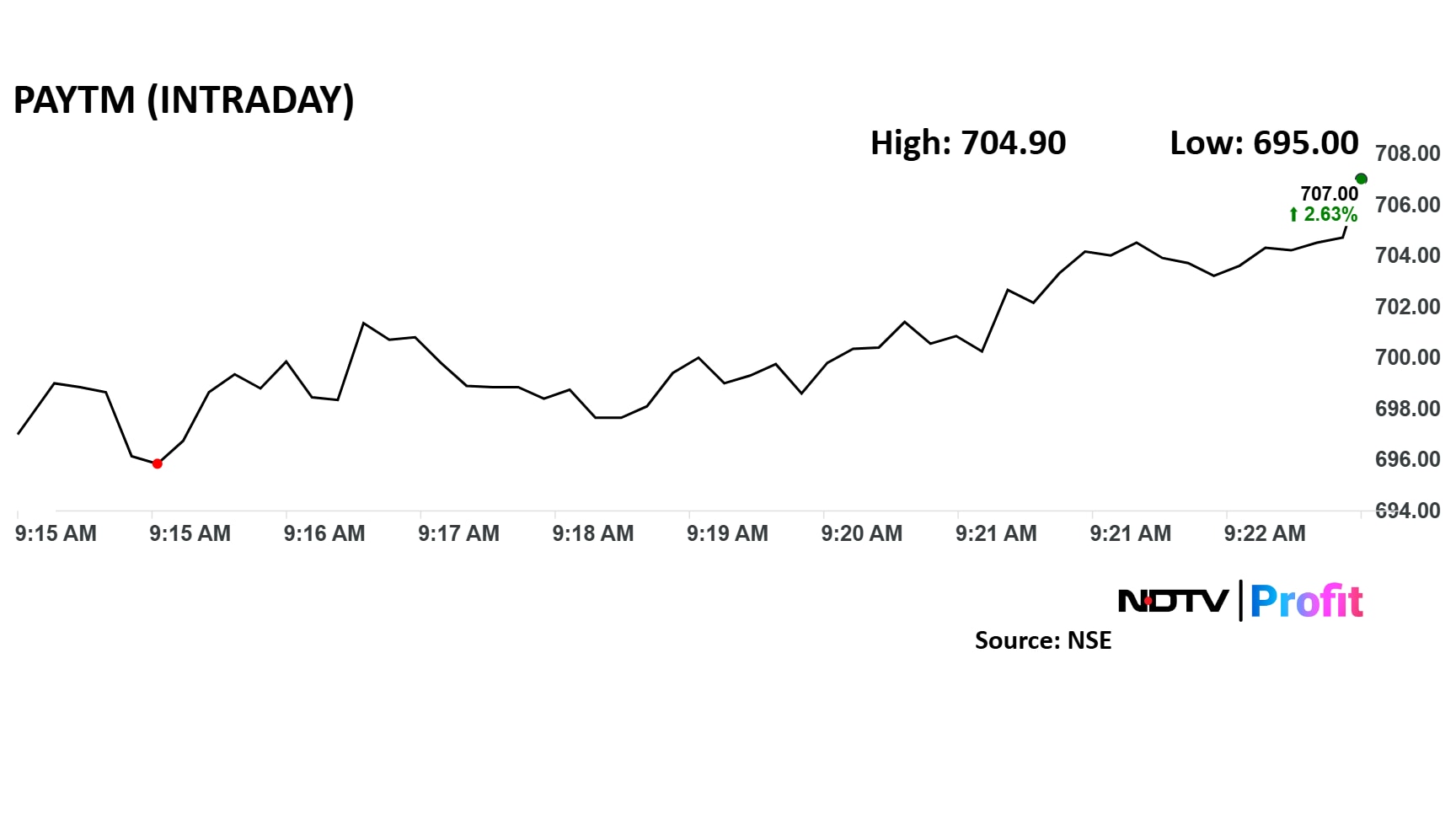

Paytm: Rs 3,300 crore

PB Fintech: Rs 2,800 crore

Jindal Steel and Power: Rs 2,700 crore

Small caps

Ratnamani Metals & Tubes: Rs 1,700 crore

Cholamandalam Financial Holdings: Rs 1,400 crore

Triveni Turbine: Rs 1,400 crore

Tata Consultancy Services share price target has been reduced by Citi from Rs 3,900 to Rs 3,205. It has maintained its 'sell' rating on the stock.

The brokerage revised its three year estimates marginally to incorporate changes in the exchange rate and operational parameters. The recent derating in the sector due to ongoing macro uncertainty is likely to impact the near-term growth outlook.

Tata Consultancy Services share price target has been reduced by Citi from Rs 3,900 to Rs 3,205. It has maintained its 'sell' rating on the stock.

The brokerage revised its three year estimates marginally to incorporate changes in the exchange rate and operational parameters. The recent derating in the sector due to ongoing macro uncertainty is likely to impact the near-term growth outlook.

The LG Electronics Inc.'s India unit has received approval from India's market regulator for its initial public offering. The consumer electronics giant is looking to raise around Rs 15,000 crore through the offer.

Mahindra & Mahindra will acquire 57% stake in arm Mahindra - BT Investment for $14.3 million.

Source: Exchange Filing

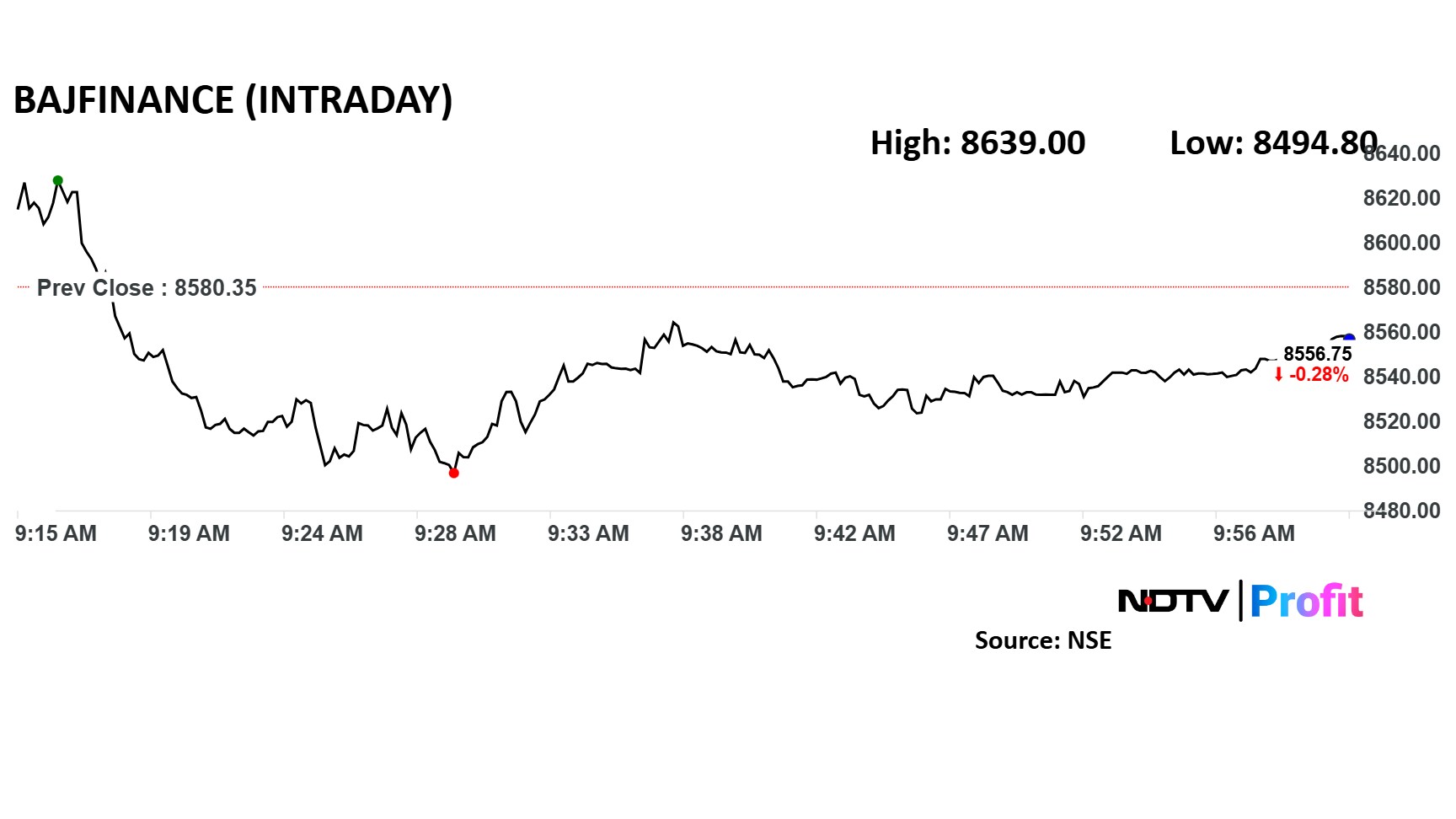

Morgan Stanley has maintained its 'Overweight' rating on Bajaj Finance with a target price of Rs 9,300, implying a 10% upside. The brokerage has linked the stock's outlook to Rajeev Jain's management role after his tenure as Managing Director ends on March 31.

While sentiment surrounding management changes could affect valuation multiples, Bajaj Finance's strong fundamentals, including declining credit costs and favorable macro conditions, provide a solid foundation for growth. Morgan Stanley’s bull case target of Rs 11,360 suggests a 35% upside, driven by continued growth in assets and improved profitability.

Read full story here.

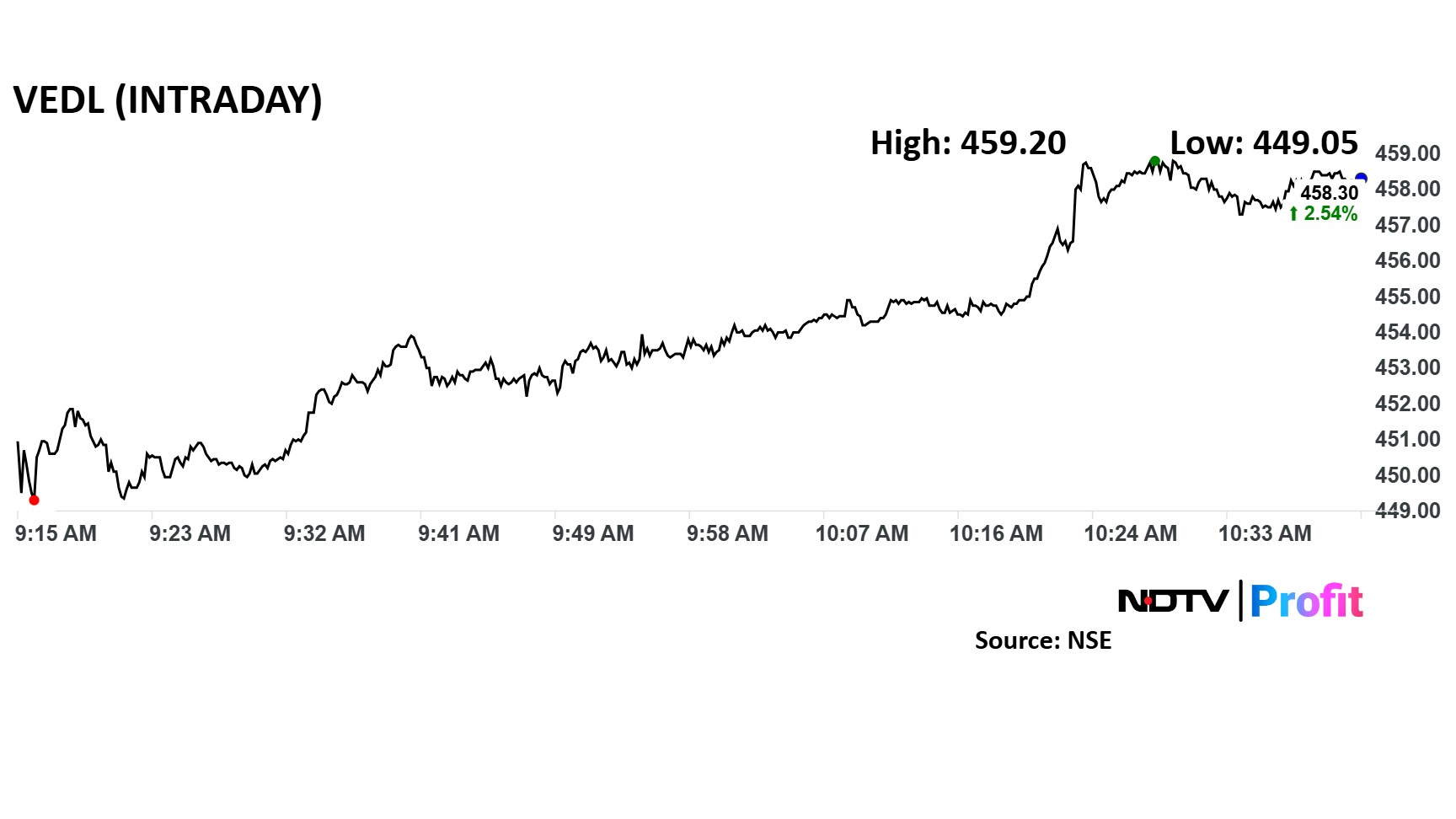

Vedanta share price went up by over 2% after Chairman Anil Agarwal said that each of the company’s four demerged entities has the potential to grow into a $100 billion business.

In a letter to stakeholders, he said the restructuring would create independent companies with strong capital structures, sector focus, and growth opportunities.

Vedanta share price went up by over 2% after Chairman Anil Agarwal said that each of the company’s four demerged entities has the potential to grow into a $100 billion business.

In a letter to stakeholders, he said the restructuring would create independent companies with strong capital structures, sector focus, and growth opportunities.

The Nifty 50 and BSE Sensex scaled 1% intraday on Tuesday. The Sensex added over 800 points to hit 75,000.

The Nifty went past 22,750, a level not seen since mid-February.

Bajaj Finance said S&P Global Ratings has revised long-term rating outlook to ‘Positive’ from ‘Stable’. S&P Global Ratings revises standalone credit profile to BBB from BBB-.

Source: Exchange Filing

Bajaj Finance said S&P Global Ratings has revised long-term rating outlook to ‘Positive’ from ‘Stable’. S&P Global Ratings revises standalone credit profile to BBB from BBB-.

Source: Exchange Filing

Carnelian Asset Management's Vikas Khemani says market correction occurs every two-three years and the current bout may settle at these levels.

"There are no structural issues in India. Growth slowed down as RBI tightened liquidity to defend the rupee, government spending slowed, and there was clamp down on unsecured lending etc. RBI has now put more accomodative stance, and government has started spending as well," he told NDTV Profit.

The Nifty has managed to scale 22,700, way above the 22,600-level resistance seen by analysts. It gained 0.86% intraday.

Sensex added over 600 points to briefly touch 76,800.

Inventurus Knowledge Solutions Ltd., a recently listed IT outsourcing firm, received a 'hold' rating on its stock as Jefferies initiated coverage. It placed a target price of Rs 1,575 per share.

The brokerage expects the company to achieve a 14% compounded annual growth rate in dollar revenues in two years to $412 million, driven by increasing outsourcing and integrated offerings. This, combined with improving operating margins and debt reduction, should support a 34% earnings per share growth.

However, with pricey valuations at a 50-90% premium to peers, the upside to IKS stock is limited, Jefferies said in a note.

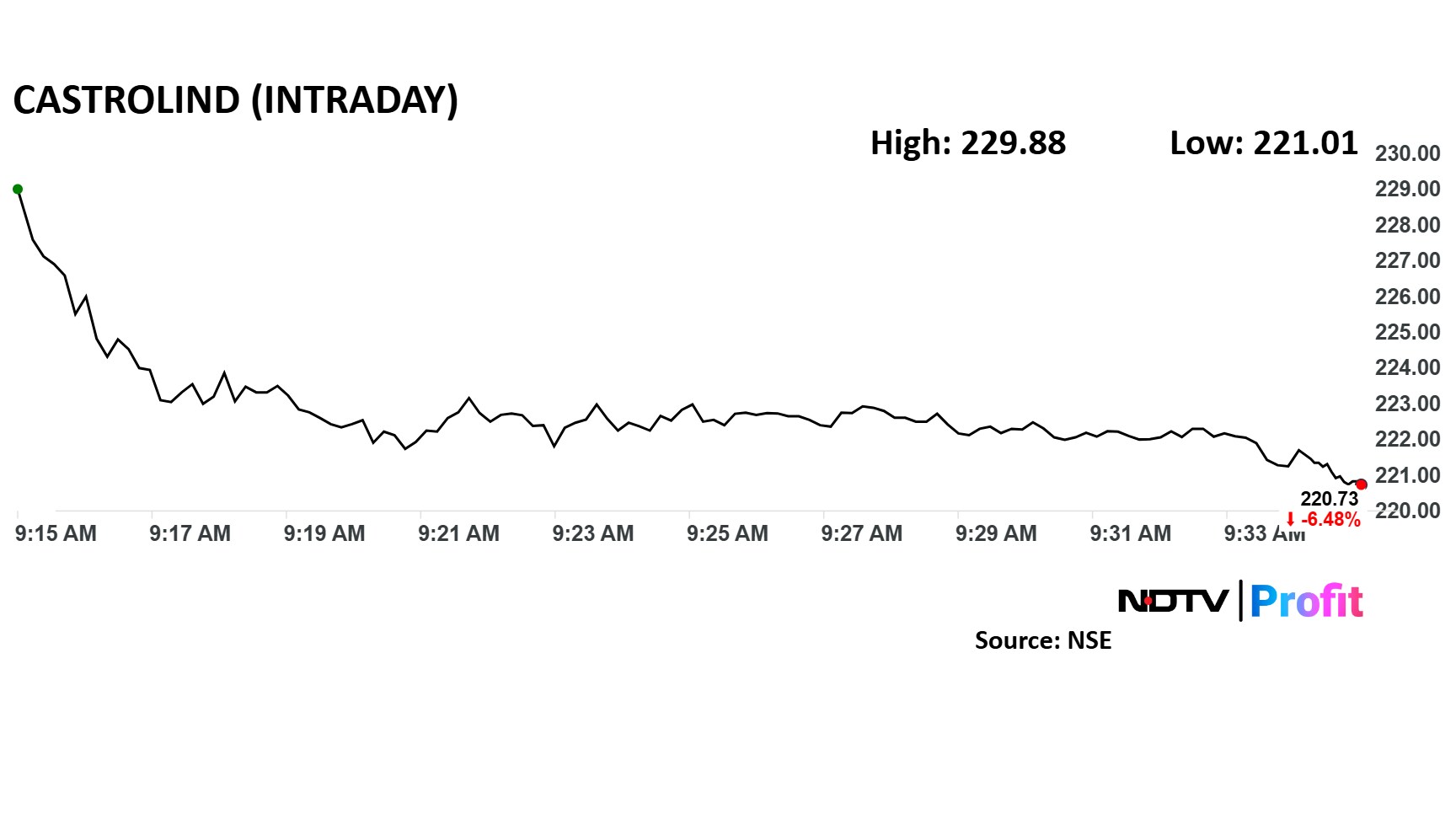

Castrol India share price traded lower as the stock went ex-dividend. The company will offer a final dividend of Rs 5 and special dividend of Rs 4.5 for FY25.

Castrol India share price traded lower as the stock went ex-dividend. The company will offer a final dividend of Rs 5 and special dividend of Rs 4.5 for FY25.

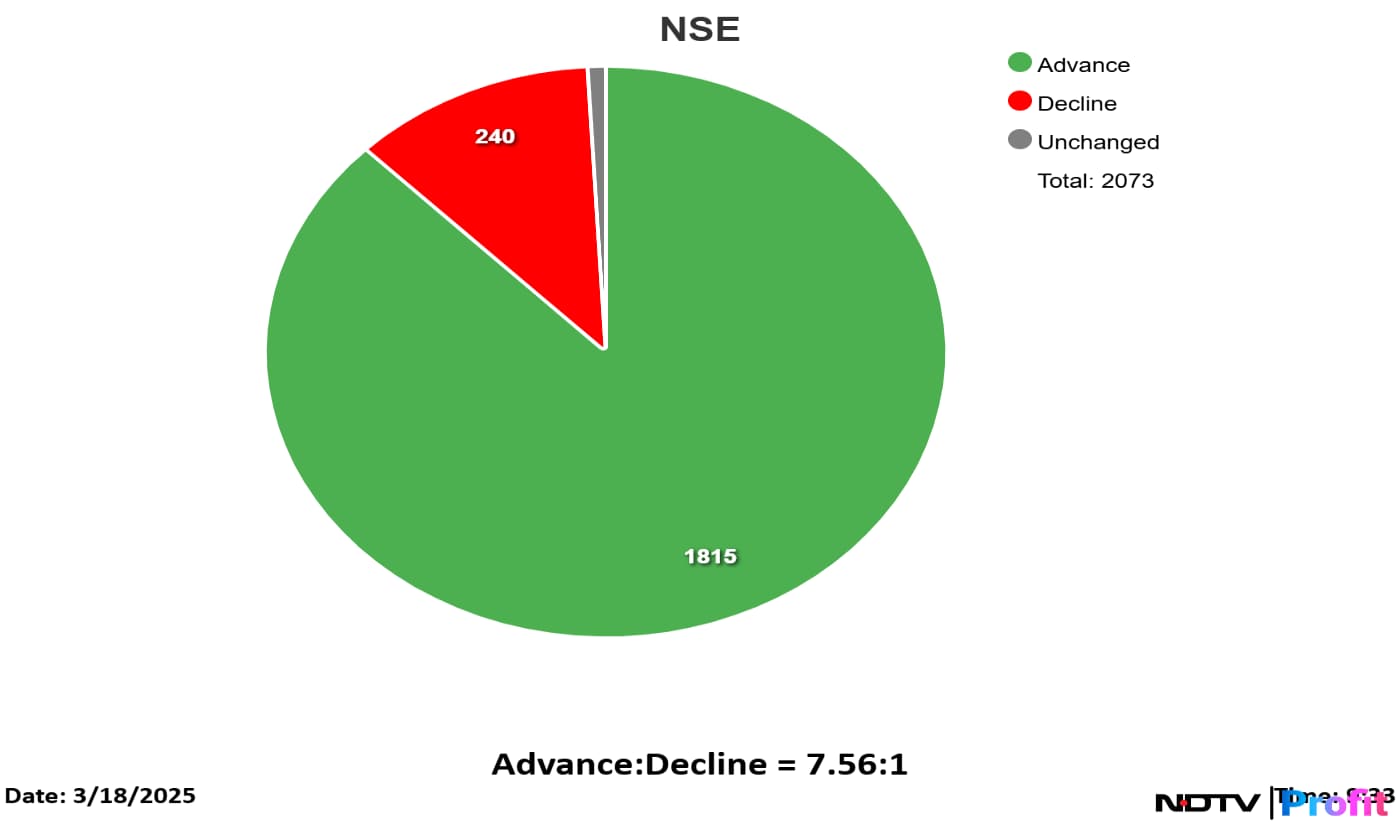

Over 1,800 stocks advanced during early trade on the NSE, while under 250 were in red.

Over 1,800 stocks advanced during early trade on the NSE, while under 250 were in red.

Tata Steel stock witnessed a large trade of nearly 30 lakh shares in a block deal, as per Bloomberg.

The stock is trading higher.

Tata Steel stock witnessed a large trade of nearly 30 lakh shares in a block deal, as per Bloomberg.

The stock is trading higher.

Ircon International stock gained 8% after a joint venture received Rs 1,096 crore letter of award from Meghalaya government to construct New Secretariat Complex on EPC basis.

Ircon's share in the JV is at Rs 285 crore.

Read here.

Ircon International stock gained 8% after a joint venture received Rs 1,096 crore letter of award from Meghalaya government to construct New Secretariat Complex on EPC basis.

Ircon's share in the JV is at Rs 285 crore.

Read here.

The Securities and Exchange Board of India has approved the registration of Paytm Money as a Research Analyst, enabling the company to offer SEBI-compliant research services. The development marks a significant milestone for Paytm Money as it expands its offerings in the financial services sector.

The stock gained as much as 2.5% on the news.

The Securities and Exchange Board of India has approved the registration of Paytm Money as a Research Analyst, enabling the company to offer SEBI-compliant research services. The development marks a significant milestone for Paytm Money as it expands its offerings in the financial services sector.

The stock gained as much as 2.5% on the news.

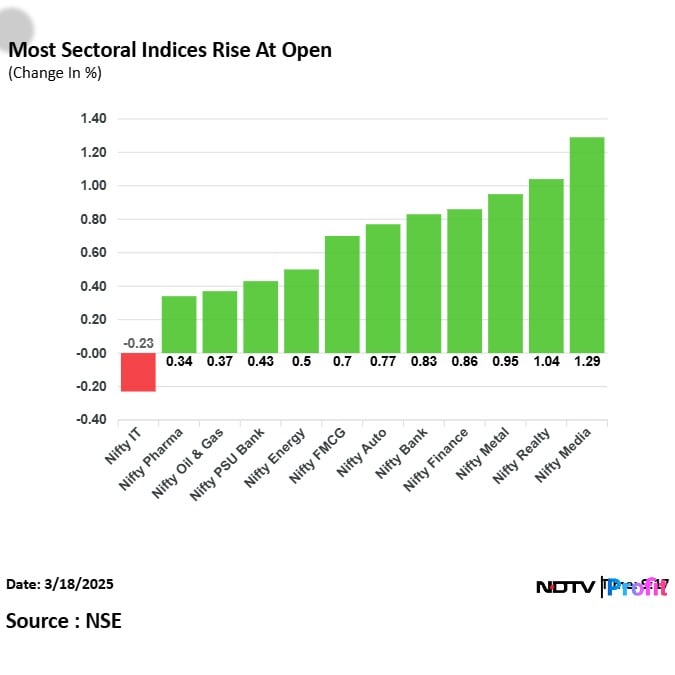

On the NSE, Nifty Realty and Nifty Metal were among the top gainers. Only the Nifty IT was in red.

On the NSE, Nifty Realty and Nifty Metal were among the top gainers. Only the Nifty IT was in red.

India's benchmark equity indices opened higher on Tuesday, following positive global cues.

The Nifty 50 opened 0.68% higher at 22,662, while the BSE Sensex added 400 points or 0.6% to start at 74,608.

India's benchmark equity indices opened higher on Tuesday, following positive global cues.

The Nifty 50 opened 0.68% higher at 22,662, while the BSE Sensex added 400 points or 0.6% to start at 74,608.

MCX Gold April Futures up 0.4% at Rs 88,374 per 10 grams.

MCX Silver May Futures up 0.4% at Rs 1 lakh per kg.

Silver Futures above Rs 1 lakh mark for the first time.

Shares of Power Finance Corp. will be of interest on Tuesday, as the day marks the last session for investors to buy shares to qualify for receiving interim dividend before the stock goes ex/record-date.

The record date determines the eligible shareholders, who will receive the dividend payment. The ex-dividend date, which mostly coincides with the record date, marks when the share price adjusts to reflect the upcoming payout.

Last week, Power Finance Corp.'s board declared the fourth interim dividend of Rs 3.5 per share for the financial year 2025. To determine the shareholders eligible for the dividend payout, the board has fixed a record date of March 19, with payments on or before April 11.

Given India's T+1 settlement cycle, shares purchased on the record date (March 19 in this case) will not be eligible for the dividend payment. Therefore, investors who own shares by March 18 will be the beneficiaries.

Through the fourth interim dividend, PFC will pay shareholders nearly Rs 1,155 crore.

The yield on the benchmark 10-year government bond opened flat at 6.69%.

Source: Bloomberg

The rupee strengthened six paise to open at 86.74 against US Dollar. It ended at 86.80 a dollar on Monday.

Rupee is reacting more to trade deficit data. The dollar index has recovered in Asia session.

Source: Bloomberg

The Nifty March futures were up 0.65% to 22,584.30 at a premium of 75.55 points, with the open interest down 2.04%.

The open interest distribution for the Nifty 50 March 20 expiry series indicated most activity at 23,500 call strikes, and the 22,000 put strikes had the maximum open interest.

The NSE Nifty 50's immediate support is at 22,200–22,300 after the stock markets ended in the green on Monday, while 22,600 will be the immediate resistance, according to analysts.

The index formed a bullish piercing-line candlestick pattern, indicating buying interest at lower levels near the 50% retracement of the previous upward move, according to Bajaj Broking Research.

A move above Monday's high at 22,577 can trigger an upside towards 22,700 and 23,000 in the coming sessions. Immediate support is seen at 22,200–22,300 and sustaining above this level will maintain the current pullback trend, it added.

The rupee strengthened sharply against the US dollar on Monday as India's back-to-back strong economic data continued to fuel investors.

The domestic unit ended 20 paise higher at 86.80 against the greenback, the highest close since Feb. 24. Intraday, the rupee rose 24 paise to 86.76, according to Bloomberg data.

The local currency gained further in offshore market and is likely to open around 86.70, according to India Forex And Asset Management (IFA Global).

"We expect it to trade a 86.55-86.80 range intraday with sideways price action. The one-year forward yield ended at 2.16% while three-month ATMF implied volatility ended at 3.57%," IFA Global said.

Bajaj Finserv: Allianz SE has signed binding agreements to sell its 26% stake in Bajaj Allianz General Insurance Co. and Bajaj Allianz Life Insurance Co. to Bajaj Group for approximately €2.6 billion. The proceeds may be received in multiple tranches.

Religare Enterprises: The board initiated a governance review of REL and its subsidiaries, Religare Finvest and Religare Housing Development Finance. During the review, a cash flow gap was identified for the upcoming months. To address this, the board has reached out to the Burman Group for immediate financial support and assistance.

Vedanta: On Monday, Chairman Anil Agarwal stated that each of the company’s four demerged entities has the potential to become a $100 billion enterprise. In a letter to stakeholders, he highlighted that the restructuring would result in independent companies with robust capital structures, clear sector focus, and promising growth prospects.

Asian stocks were trading higher early Tuesday, tracking gains on Wall Street buoyed by US retail sales data that eased recession concerns, and renewed optimism for China’s economy.

Japan's Nikkei 225 was up 1.25%, while Australian benchmark S&P/ASX 200 gained 0.5%. South Korea's Kospi was up 0.88%. Futures showed Hong Kong’s benchmark may also open higher.

In the US, the S&P 500 ended 0.44% higher while the Dow Jones Industrial Average added 0.85%. The Nasdaq gained 0.3%.

The GIFT Nifty is trading below 22,800. The futures contract based on the Nifty 50 is up 0.02% or five points 22,745 as of 7:30 a.m., indicating a higher open for the index.

India's benchmark equity indices ended higher on Monday, following a jump in global markets. The NSE Nifty 50 ended 111.55 points or 0.5% higher at 22,508.75, while the BSE Sensex closed 341.04 points or 0.46% up at 74,169.95.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.