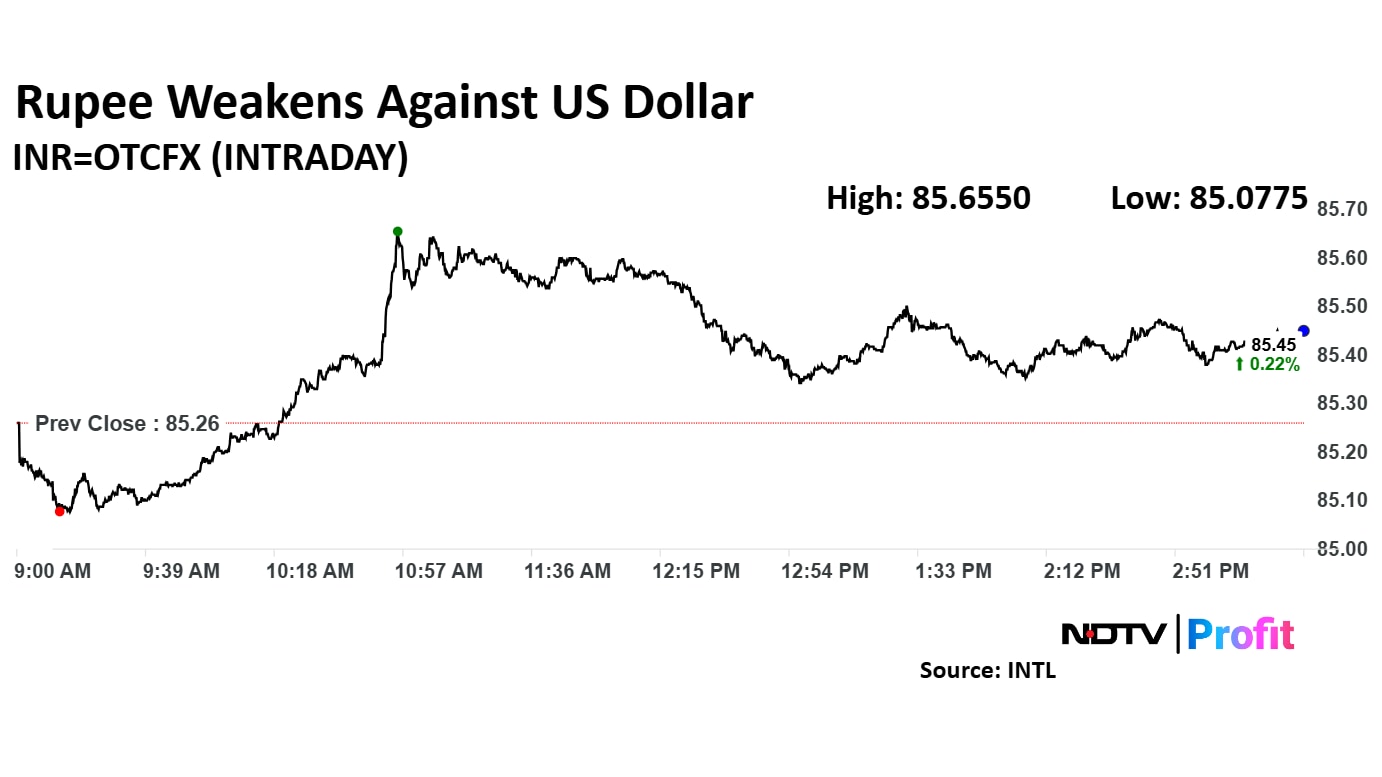

Rupee closed 18 paise weaker at 85.45 against US dollar

It closed at 85.27 a dollar on Thursday

Source: Bloomberg

Rupee closed 18 paise weaker at 85.45 against US dollar

It closed at 85.27 a dollar on Thursday

Source: Bloomberg

The NSE Nifty 50 and BSE Sensex extended gains to a second week on positive developments on trade talks.

The Nifty 50 and Sensex ended in losses despite higher open as investors turned wary on India and Pakistan border tension

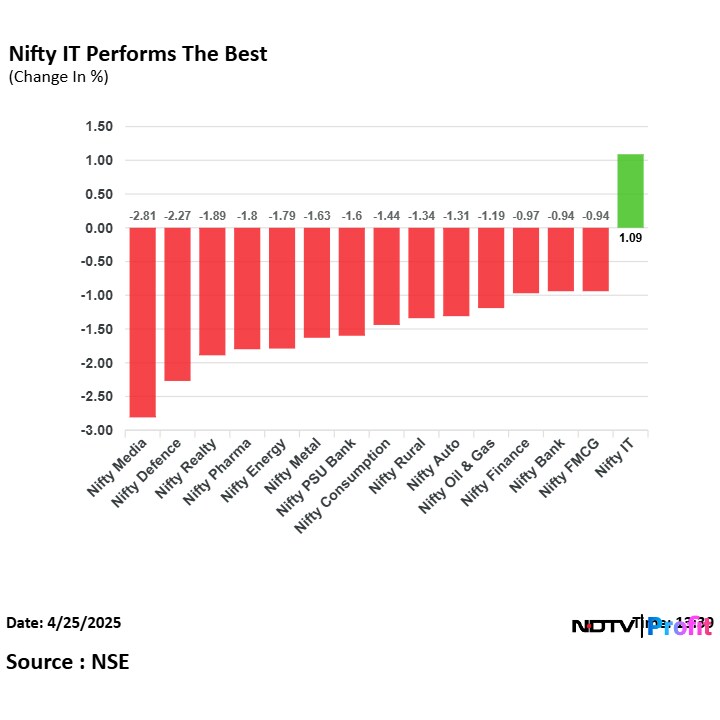

The Nifty IT is the best performer. It ended 0.52% higher.

The Nifty Media declined the most. It ended 3.54% lower.

The NSE Nifty Midcap 150 ended 2.67% down at 19,655.30.

The NSE Nifty Smallcap 250 ended 2.46% down at 15,524.15

The NSE Nifty 50 and BSE Sensex extended gains to a second week on positive developments on trade talks.

The Nifty 50 and Sensex ended in losses despite higher open as investors turned wary on India and Pakistan border tension

The Nifty IT is the best performer. It ended 0.52% higher.

The Nifty Media declined the most. It ended 3.54% lower.

The NSE Nifty Midcap 150 ended 2.67% down at 19,655.30.

The NSE Nifty Smallcap 250 ended 2.46% down at 15,524.15

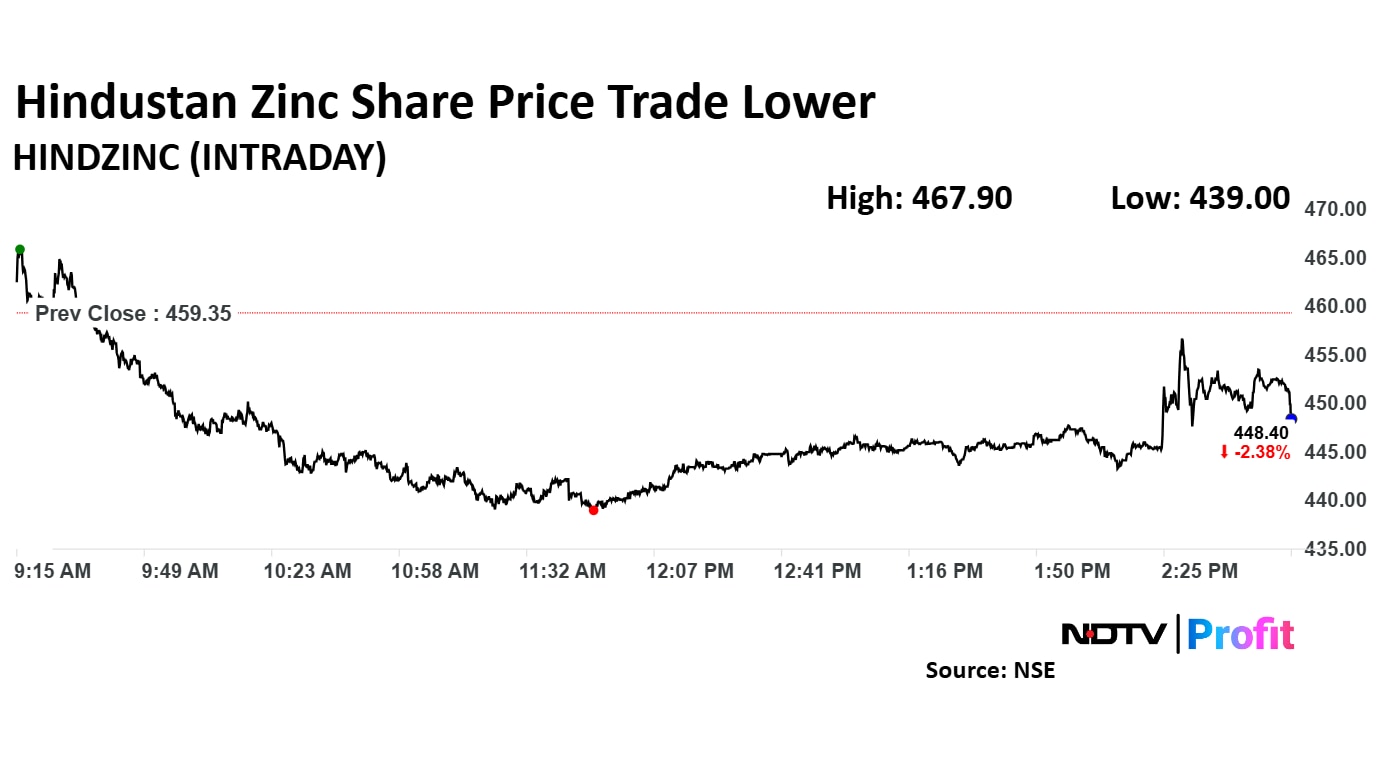

Revenue rose 13.41% to Rs 8,829 crore versus Rs 7,785 crore (Estimate: Rs 8497 crore).

Ebitda rose 17.42% to Rs 4,562 crore versus Rs 3,885 crore (Estimate: Rs 4375 crore).

Margin at 51.67% versus 49.9%, up by 176 basis points. (Estimate: 51.5%)

Net profit rose 47.35% to Rs 3,003 crore versus Rs 2,038 crore (Estimate: Rs 2522 crore)

Revenue rose 13.41% to Rs 8,829 crore versus Rs 7,785 crore (Estimate: Rs 8497 crore).

Ebitda rose 17.42% to Rs 4,562 crore versus Rs 3,885 crore (Estimate: Rs 4375 crore).

Margin at 51.67% versus 49.9%, up by 176 basis points. (Estimate: 51.5%)

Net profit rose 47.35% to Rs 3,003 crore versus Rs 2,038 crore (Estimate: Rs 2522 crore)

Maruti Suzuki India Q4 Highlights (Standalone, YoY)

Revenue up 6.4% to Rs 40,673.80 crore versus Rs 38,234.90 crore

Ebitda down 9% to Rs 4,264.70 crore versus Rs 4,685.00 crore

Margin at 10.5% versus 12.3%

Profit down 4% to Rs 3,711.1 crore versus Rs 3,877.8 crore

Board Recommends final dividend of Rs 135 per share for FY25

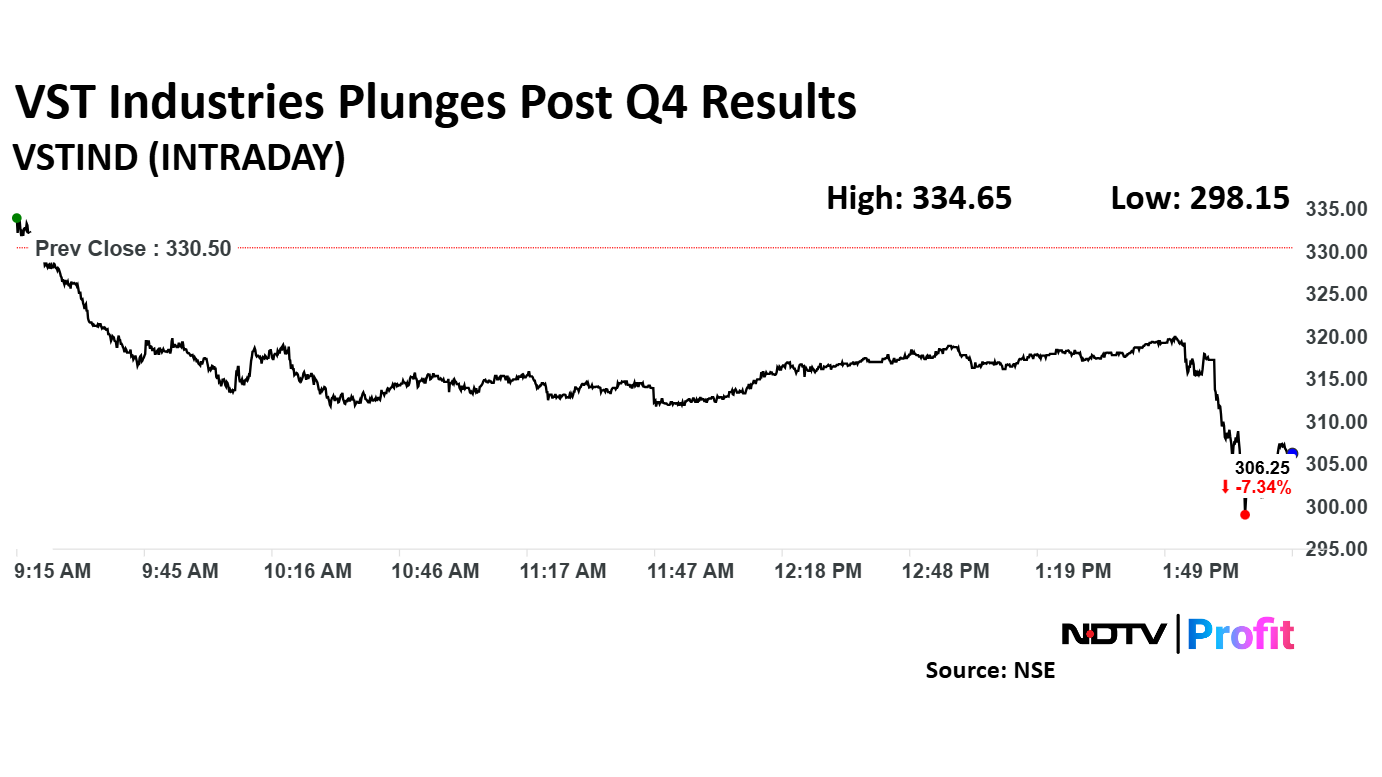

VST Industries Q4 Highlights (YoY)

Revenue up 4.6% to Rs 349.24 crore versus Rs 375.06 crore

Ebitda down 28% to Rs 69.54 crore versus Rs 96.59 crore

Margin at 19.9% versus 25.8%

Profit down 48% to Rs 14.02 crore versus Rs 27.01 crore

VST Industries Q4 Highlights (YoY)

Revenue up 4.6% to Rs 349.24 crore versus Rs 375.06 crore

Ebitda down 28% to Rs 69.54 crore versus Rs 96.59 crore

Margin at 19.9% versus 25.8%

Profit down 48% to Rs 14.02 crore versus Rs 27.01 crore

Markets in eurozone rose Friday as traders shrugged off worries about US and China trade ties after the former commented on softer lines. However, China refuted claims of any ongoing trade ties.

The Euro Stoxx 50 and FTSE 100 were trading 0.55% and 0.13% higher, respectively. The DAX index was trading 0.47% higher.

The NSE Nifty IT was the only sector which continued to trade in gains in Friday's session. The index rose as much as 1.80% to the day's high of 35,941.45 so far. Tata Consultancy Services Ltd., and Infosys Ltd. added to the index.

US Treasury Secretary Scott Bessent said that the discussions with India regarding trade is very close to a successful conclusion because the former doesn't want high tariffs, New York Post reported.

The NSE Nifty IT was the only sector which continued to trade in gains in Friday's session. The index rose as much as 1.80% to the day's high of 35,941.45 so far. Tata Consultancy Services Ltd., and Infosys Ltd. added to the index.

US Treasury Secretary Scott Bessent said that the discussions with India regarding trade is very close to a successful conclusion because the former doesn't want high tariffs, New York Post reported.

Sanofi Consumer Healthcare Ltd. has received a final assessment order from the Income Tax Department, determining a tax liability of Rs 39 crore for Assessment Year 2023.

Suven Pharma has announced that the effective date of the amalgamation of Cohance Lifesciences will be May 1.

Nearly 40 companies across various sectors and industries are expected to release their financial results for the quarter ended March 31, 2025 on Friday, with key blue-chip companies like Reliance Industries and Maruti Suzuki India, as well as leading players across sectors such as Hindustan Zinc, Bank of Maharashtra, RBL Bank, Shriram Finance, and Tata Technologies in the limelight.

You can catch live updates here.

LIC Housing Finance cuts lending rates by 25 bps making home loans cheaper.

Source: Statement

NTPC accepts IRFC's bid for Rupee Term Loan worth Rs 5,000 crore for capacity addition program.

Source: Exchange Filing

ED issues Look-Out Circular against Gensol promoters Puneet and Anmol Jaggi

ED summons Anmol Jaggi in foreign exchange violation case; reportedly in Dubai

Puneet Jaggi questioned for 7 hours at ED’s Delhi office

ED probing alleged diversion of around Rs 200- Rs 300 crore in foreign remittances

Suspect portion of term loans availed by Gensol routed overseas

ED collecting details on promoter-linked entities suspected of fund routing

Investigators probing possible use of cryptocurrency in fund diversion

Alert: ED searches premises linked to Gensol and its promoters on Thursday

Alert: ED quizzes Gensol Engineering co-founder Puneet Jaggi in Delhi

Amid macro volatility induced headwinds and tariff turmoil disrupting external facing trade, Bengaluru-based IT major Mphasis Ltd. has shifted focus to the micro aspects of the industry, particularly understanding client priorities and their evolution, said Chief Executive Officer Nitin Rakesh on Friday.

Read the article here.

The India VIX rose 8.15% to 17.57. It was trading 6.23% higher at 17.22 as of 12:02 p.m.

The India VIX rose 8.15% to 17.57. It was trading 6.23% higher at 17.22 as of 12:02 p.m.

Rupee weakened 39 paise to 85.66 against US dollar

Indian unit opened 8 paise stronger at 85.19 a dollar

It closed at 85.27 a dollar on Thursday

Source: Bloomberg

The yield on the benchmark 10-year bond rose 6 basis points to 6.38%

It opened flat at 6.32%

Source: Bloomberg

Hindalco Industries Ltd. has delivered 10,000 aluminum battery enclosures to Mahindra & Mahindra Ltd.from its Chakan facility and plans to double the production capacity to 160,000 enclosures per year.

The Indian stock markets gave up initial gains on Friday as cross-border tensions between India and Pakistan escalated after the Pahalgam attacks in Kashmir in which terrorists gunned down 26 people.

The Nifty 50 fell 1.22% to hit 23,950.15, while the Sensex was down 1.12% to 78,905.49. The market volatility gauge, VIX, rose nearly 6% in the early hours of trade.

Read the full article here.

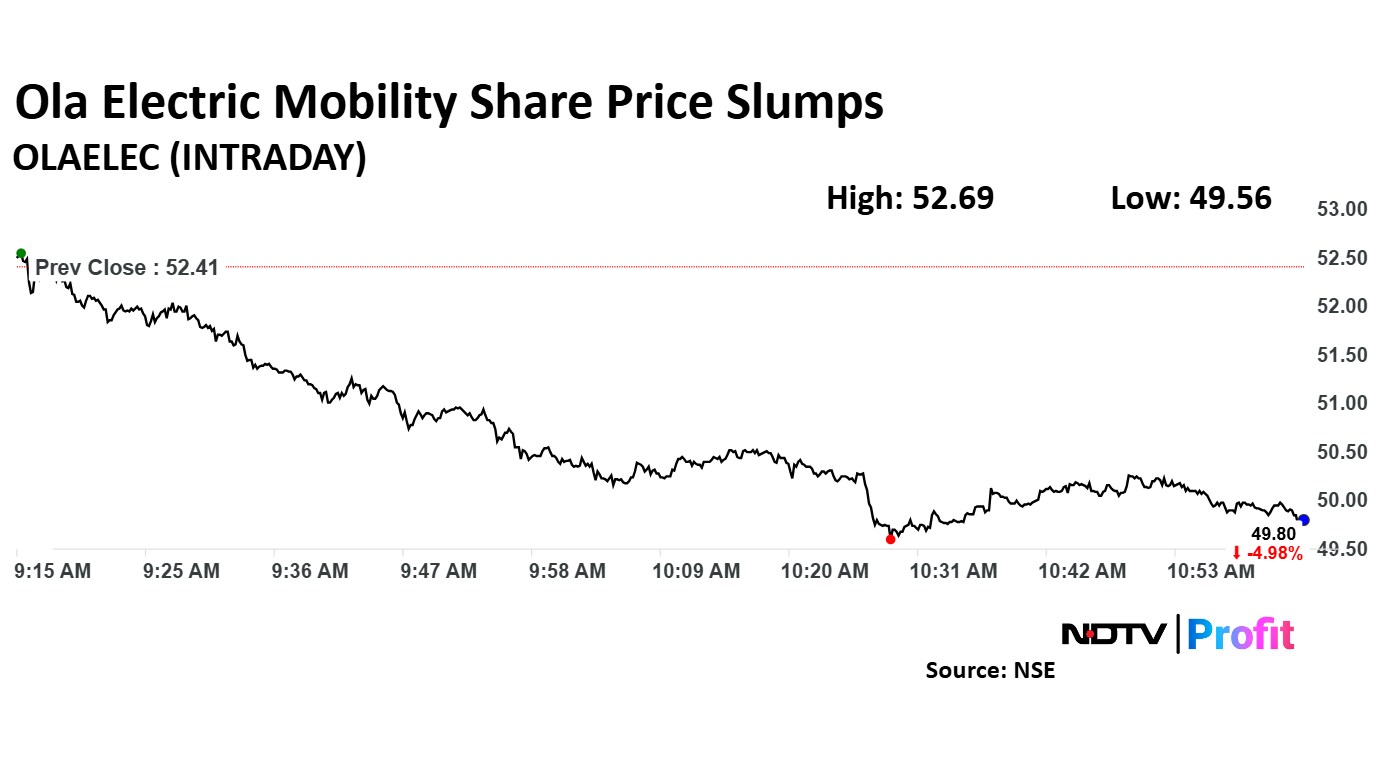

Ola Electric Mobility Ltd. is “not aware” of a closure notice against its stores in Maharashtra, a move that sent its stock into a tailspin on Friday.

Ola Electric Mobility share price fell 5.44% to Rs 49.56. It was trading 4.96% down at Rs 49.85 apiece as of 11:03 a.m., as compared to 1.39% decline in the NSE Nifty 50 index.

Ola Electric Mobility Ltd. is “not aware” of a closure notice against its stores in Maharashtra, a move that sent its stock into a tailspin on Friday.

Ola Electric Mobility share price fell 5.44% to Rs 49.56. It was trading 4.96% down at Rs 49.85 apiece as of 11:03 a.m., as compared to 1.39% decline in the NSE Nifty 50 index.

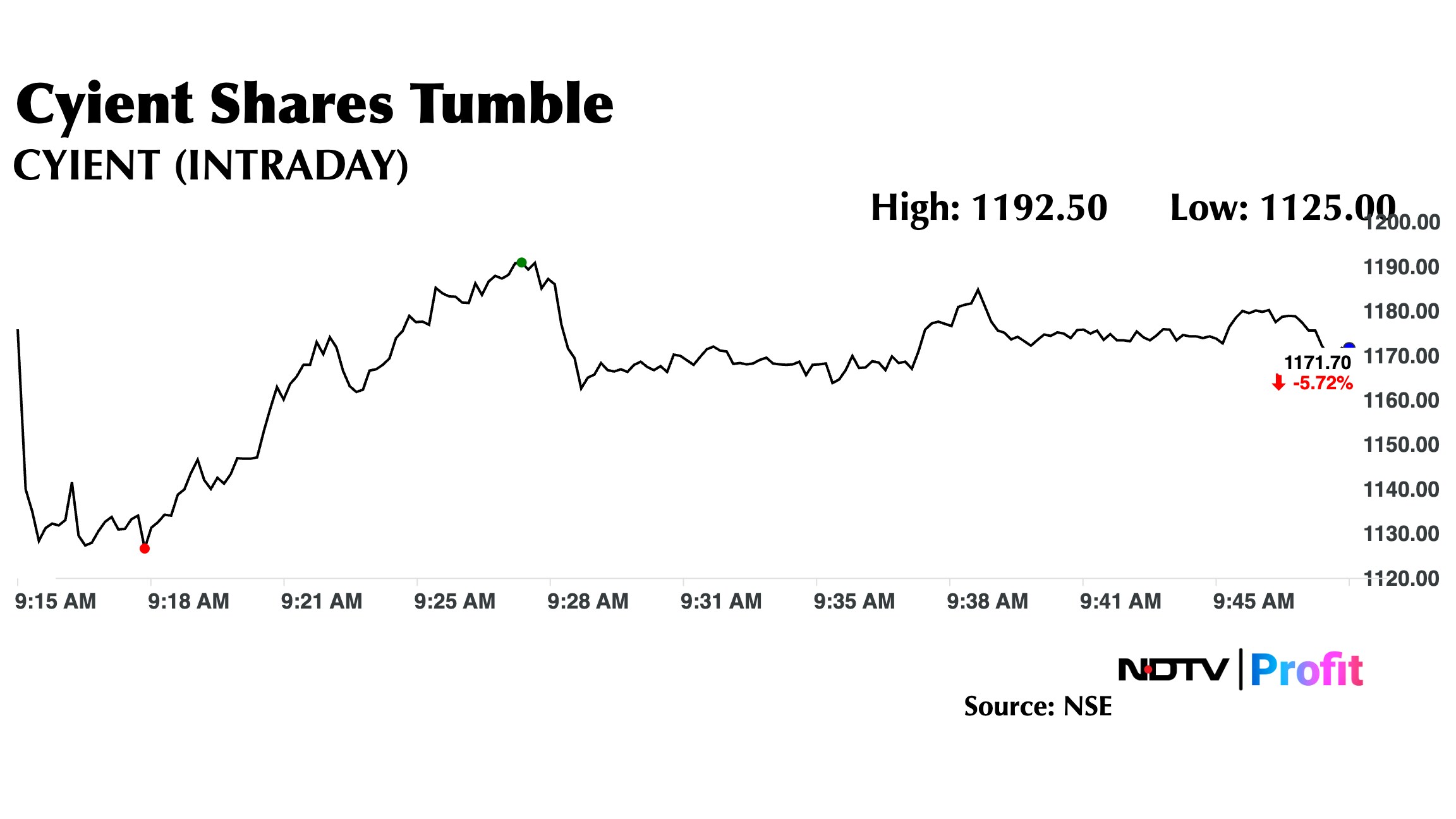

The share price of IT firm Cyient Ltd. slipped nearly 10% on Friday despite the company declaring a 39% rise in net profit and a marginal uptick in revenue for the quarter ended March, as brokerages remain bearish.

The scrip fell as much as 9.48% to Rs 1,125 apiece, the highest level since April 9, 2025.

The share price of IT firm Cyient Ltd. slipped nearly 10% on Friday despite the company declaring a 39% rise in net profit and a marginal uptick in revenue for the quarter ended March, as brokerages remain bearish.

The scrip fell as much as 9.48% to Rs 1,125 apiece, the highest level since April 9, 2025.

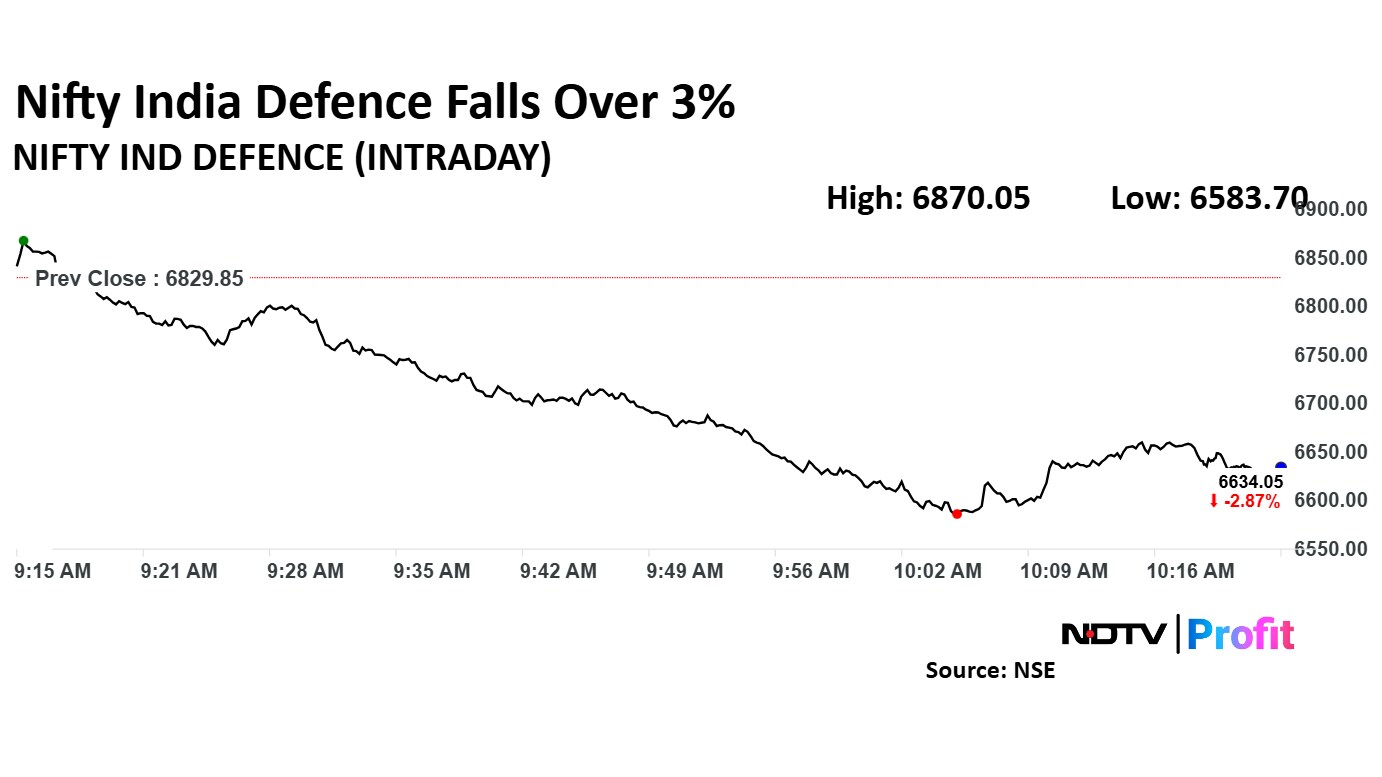

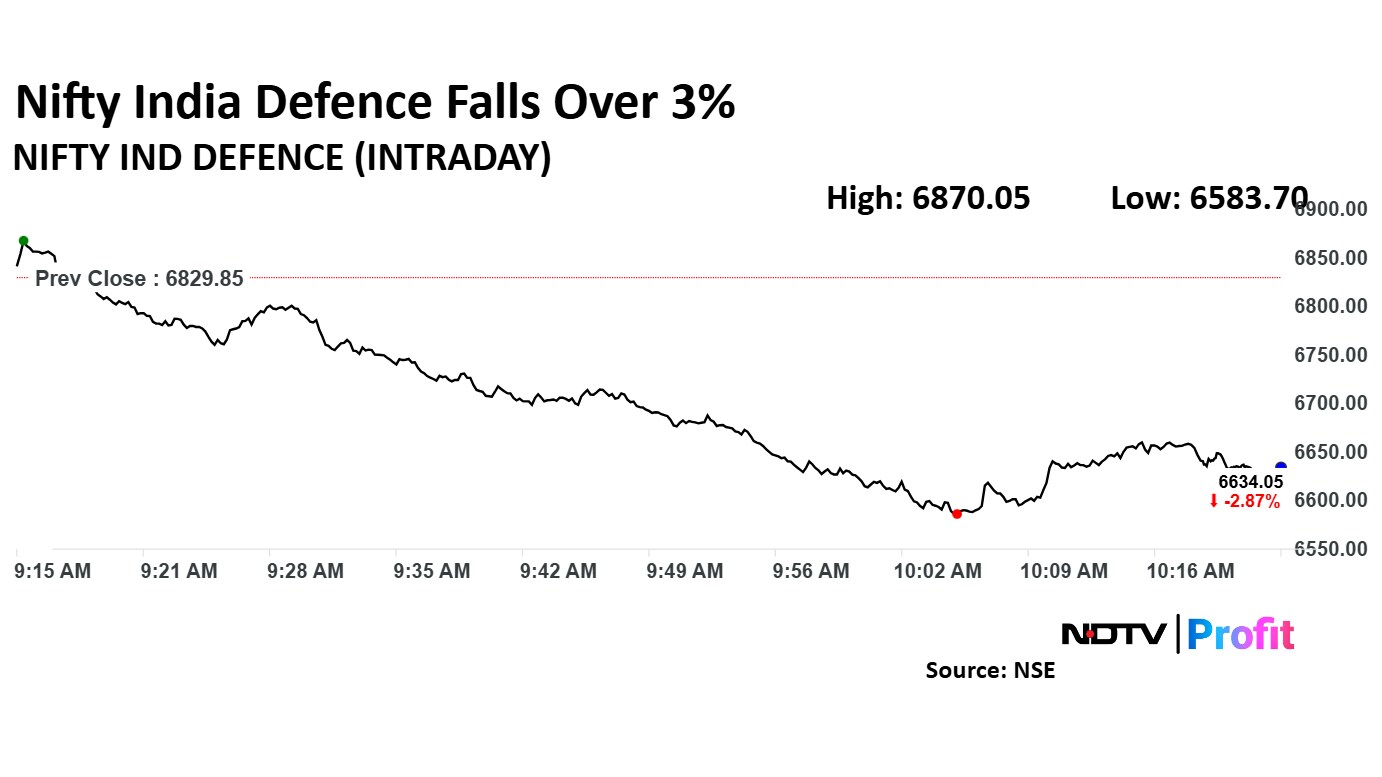

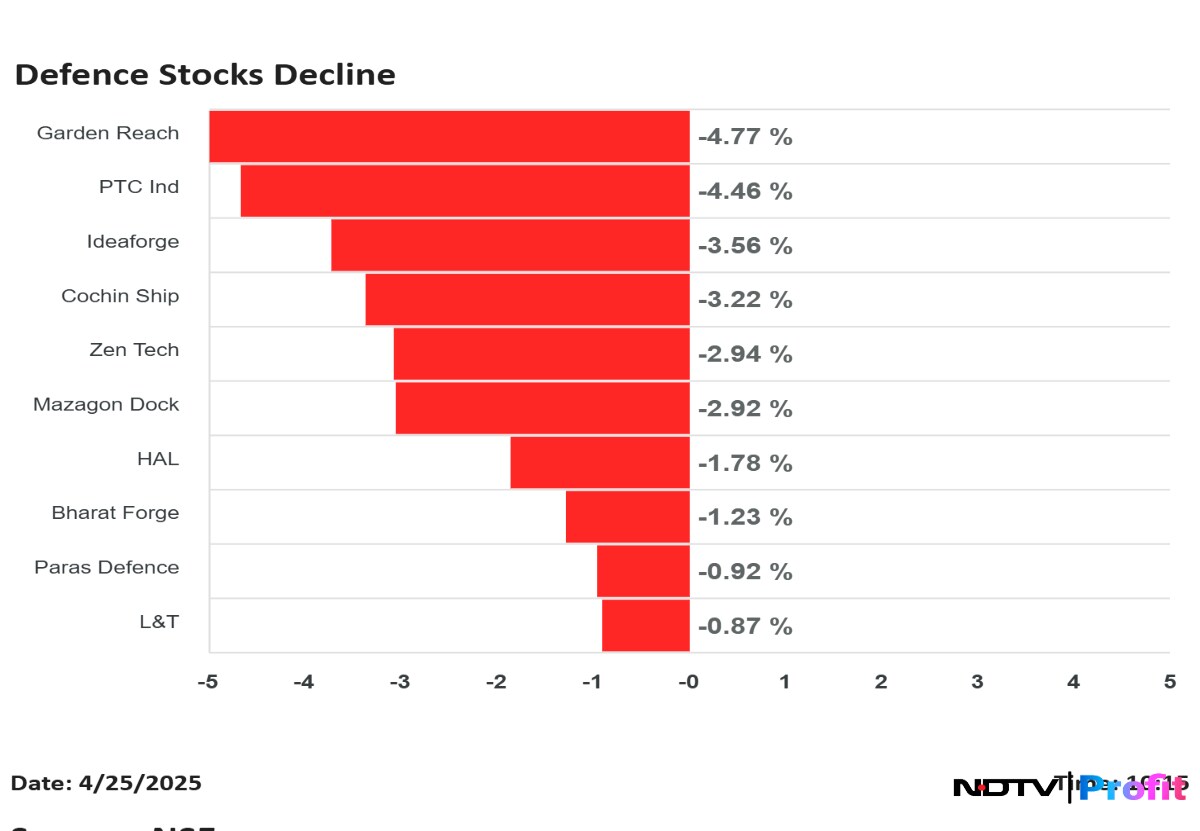

The NSE Nifty Defence index was the top laggerd compared to other sectoral indices. The index declined 3.60% to 6,583 as Solar Industries India Ltd., and Bharat Electronics Ltd. share prices weighed.

The NSE Nifty Defence index was the top laggerd compared to other sectoral indices. The index declined 3.60% to 6,583 as Solar Industries India Ltd., and Bharat Electronics Ltd. share prices weighed.

Garden Reach Shipbuilders Ltd., PTC Industries Ltd., and Ideaforge Technology Ltd. were top loser in the Nifty India Defence index.

The NSE Nifty Defence index was the top laggerd compared to other sectoral indices. The index declined 3.60% to 6,583 as Solar Industries India Ltd., and Bharat Electronics Ltd. share prices weighed.

The NSE Nifty Defence index was the top laggerd compared to other sectoral indices. The index declined 3.60% to 6,583 as Solar Industries India Ltd., and Bharat Electronics Ltd. share prices weighed.

Garden Reach Shipbuilders Ltd., PTC Industries Ltd., and Ideaforge Technology Ltd. were top loser in the Nifty India Defence index.

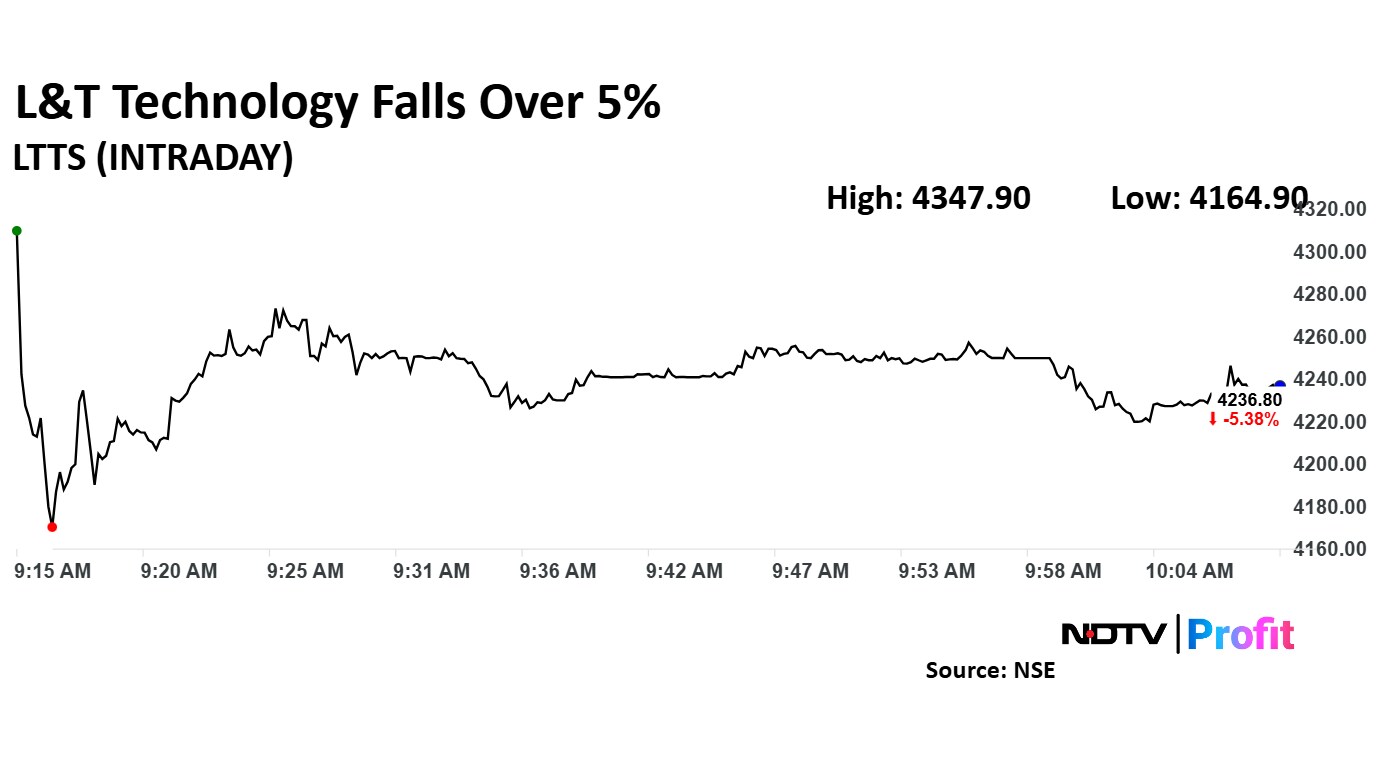

Shares of L&T Technology Services Ltd. fell on Friday after its fourth quarter net profit declined, despite a revenue rise. Shares of the company fell as much as 6.99% to Rs 4,164.90 apiece.

Shares of L&T Technology Services Ltd. fell on Friday after its fourth quarter net profit declined, despite a revenue rise. Shares of the company fell as much as 6.99% to Rs 4,164.90 apiece.

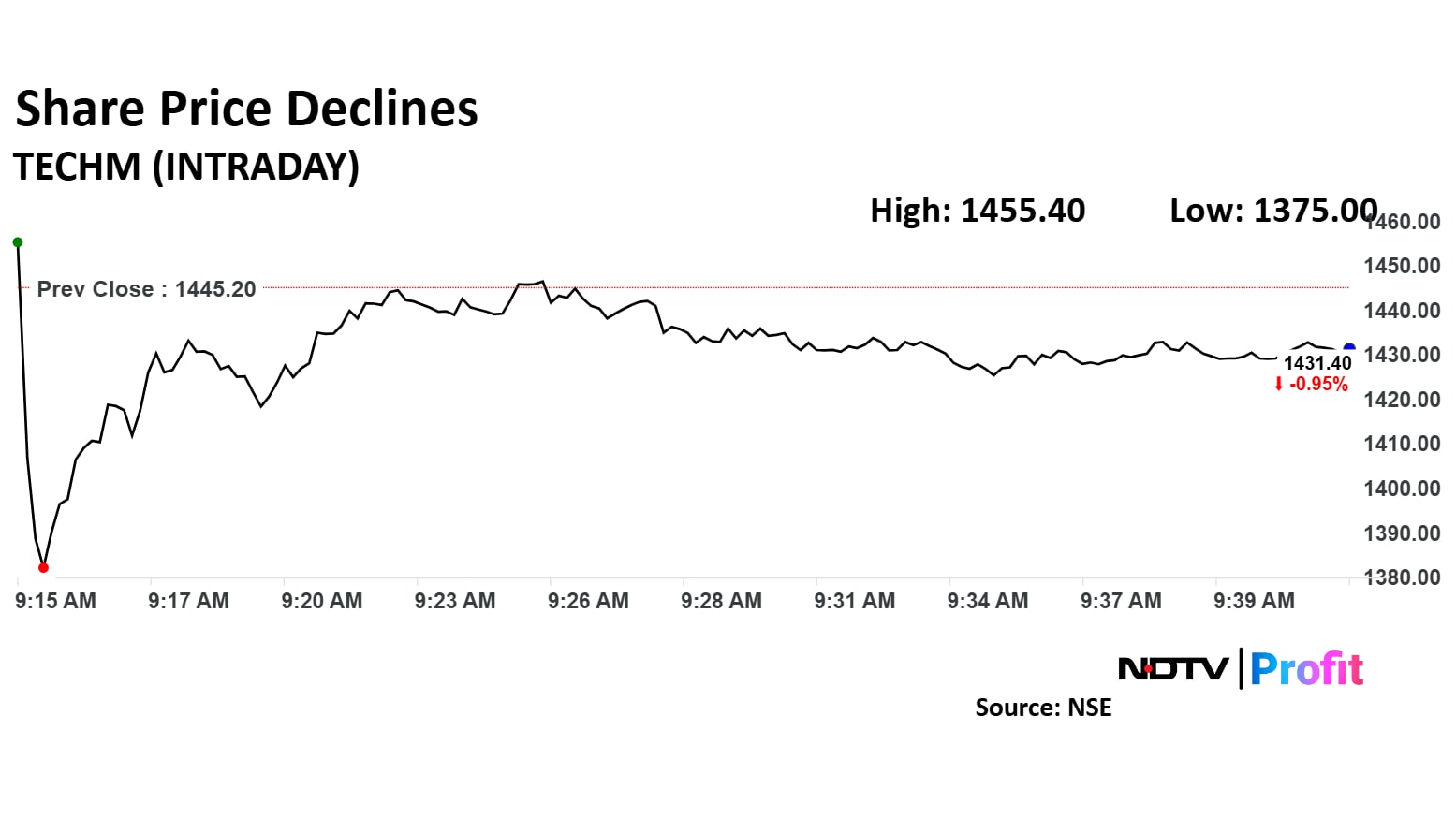

Tech Mahindra Ltd.'s share price declined nearly 5% on Friday after the company's fourth quarter revenue missed analysts' estimates. Shares of Tech Mahindra fell as much as 4.86% to Rs 1,375 apiece.

Tech Mahindra Ltd.'s share price declined nearly 5% on Friday after the company's fourth quarter revenue missed analysts' estimates. Shares of Tech Mahindra fell as much as 4.86% to Rs 1,375 apiece.

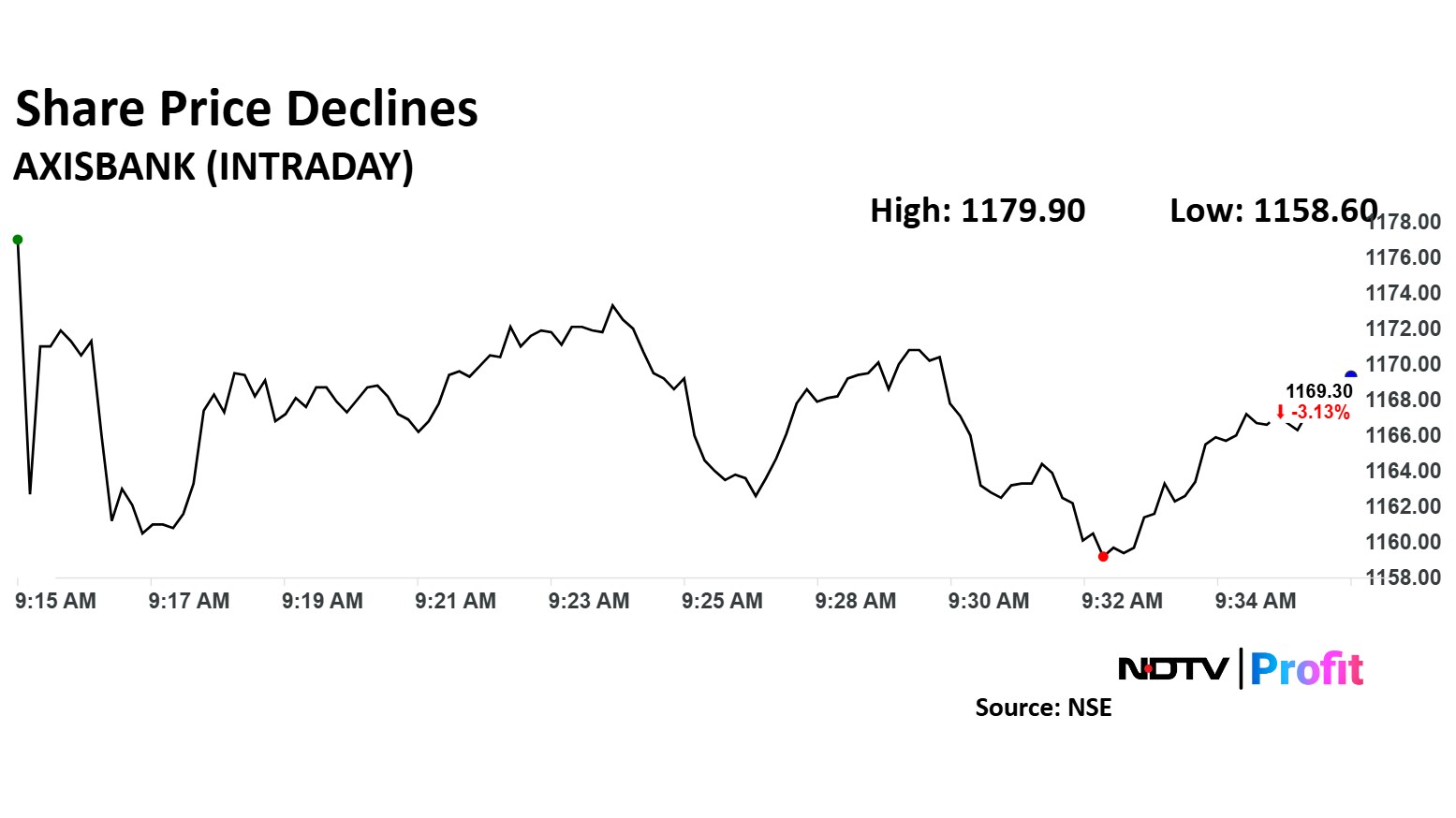

Axis Bank Ltd.'s share price declined over 4% on Friday after the company's net profit saw a marginal decline in the fourth quarter of fiscal 2025.

The private lender reported a net profit of Rs 7,117.5 crore for the quarter ended March 31, 2025, a marginal decrease of 0.1% year-on-year.

The scrip fell as much as 4.02% to Rs 1,158.60 apiece.

Axis Bank Ltd.'s share price declined over 4% on Friday after the company's net profit saw a marginal decline in the fourth quarter of fiscal 2025.

The private lender reported a net profit of Rs 7,117.5 crore for the quarter ended March 31, 2025, a marginal decrease of 0.1% year-on-year.

The scrip fell as much as 4.02% to Rs 1,158.60 apiece.

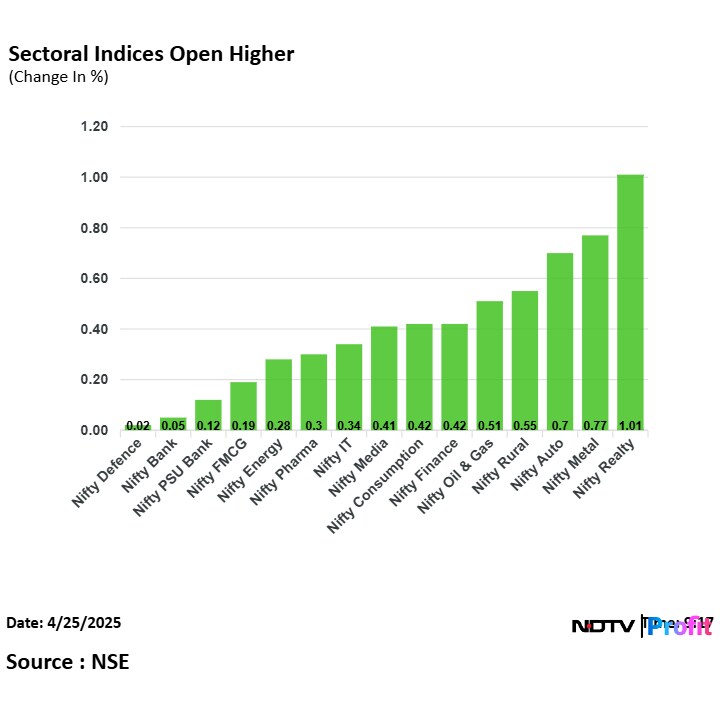

All 15 sectoral indices on National Stock Exchange advanced with the Nifty Realty rising the most. The NSE Nifty Defence rose the least.

All 15 sectoral indices on National Stock Exchange advanced with the Nifty Realty rising the most. The NSE Nifty Defence rose the least.

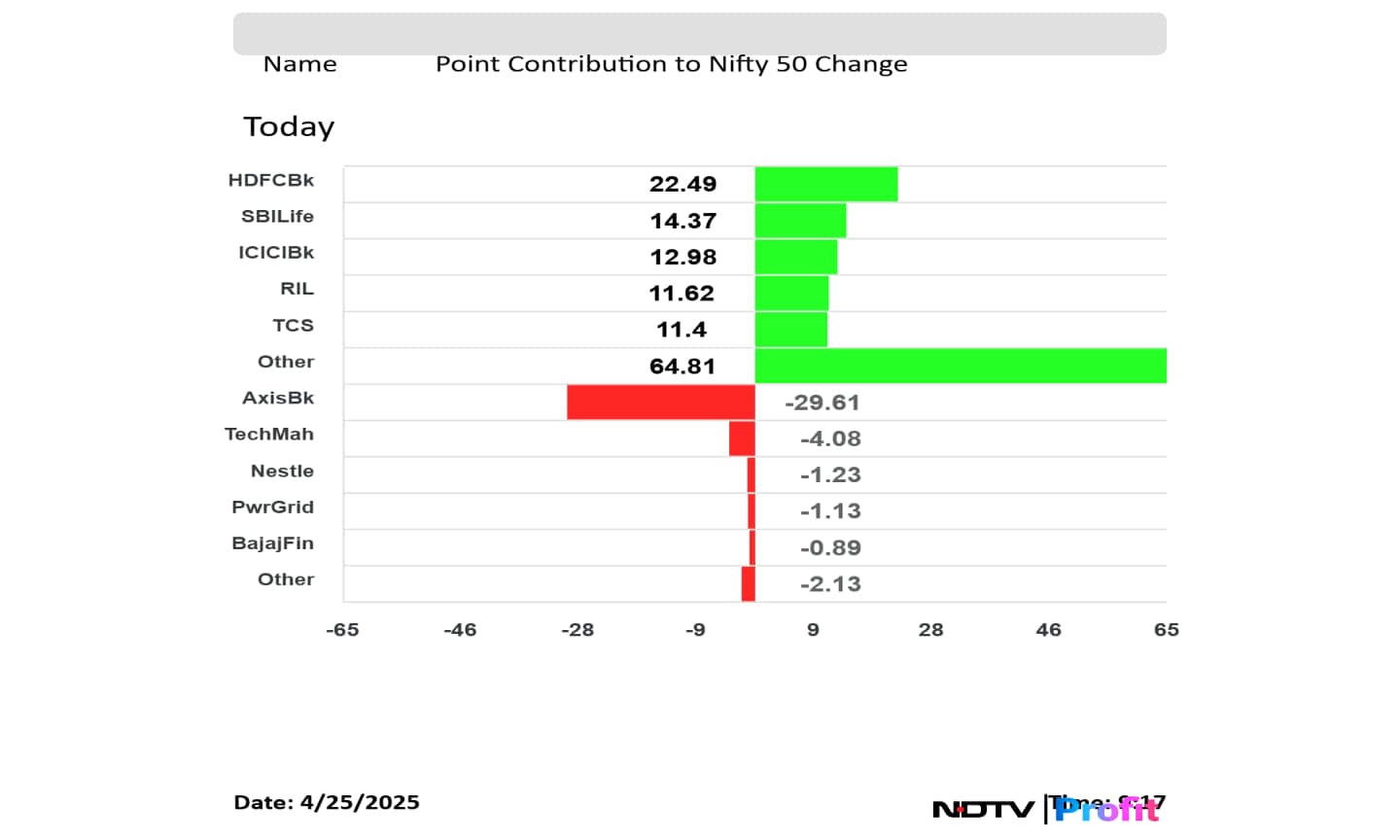

HDFC Bank Ltd., SBI Life Insurance Co, ICICI Bank Ltd., Reliance Industries Ltd., and Tata Consultancy Services Ltd. added to the Nifty 50 index.

Axis Bank Ltd., Tech Mahindra Ltd., Nestle India Ltd., Power Grid Corp of India, and Bajaj Finance Ltd. limited gains to the Nifty 50 index.

HDFC Bank Ltd., SBI Life Insurance Co, ICICI Bank Ltd., Reliance Industries Ltd., and Tata Consultancy Services Ltd. added to the Nifty 50 index.

Axis Bank Ltd., Tech Mahindra Ltd., Nestle India Ltd., Power Grid Corp of India, and Bajaj Finance Ltd. limited gains to the Nifty 50 index.

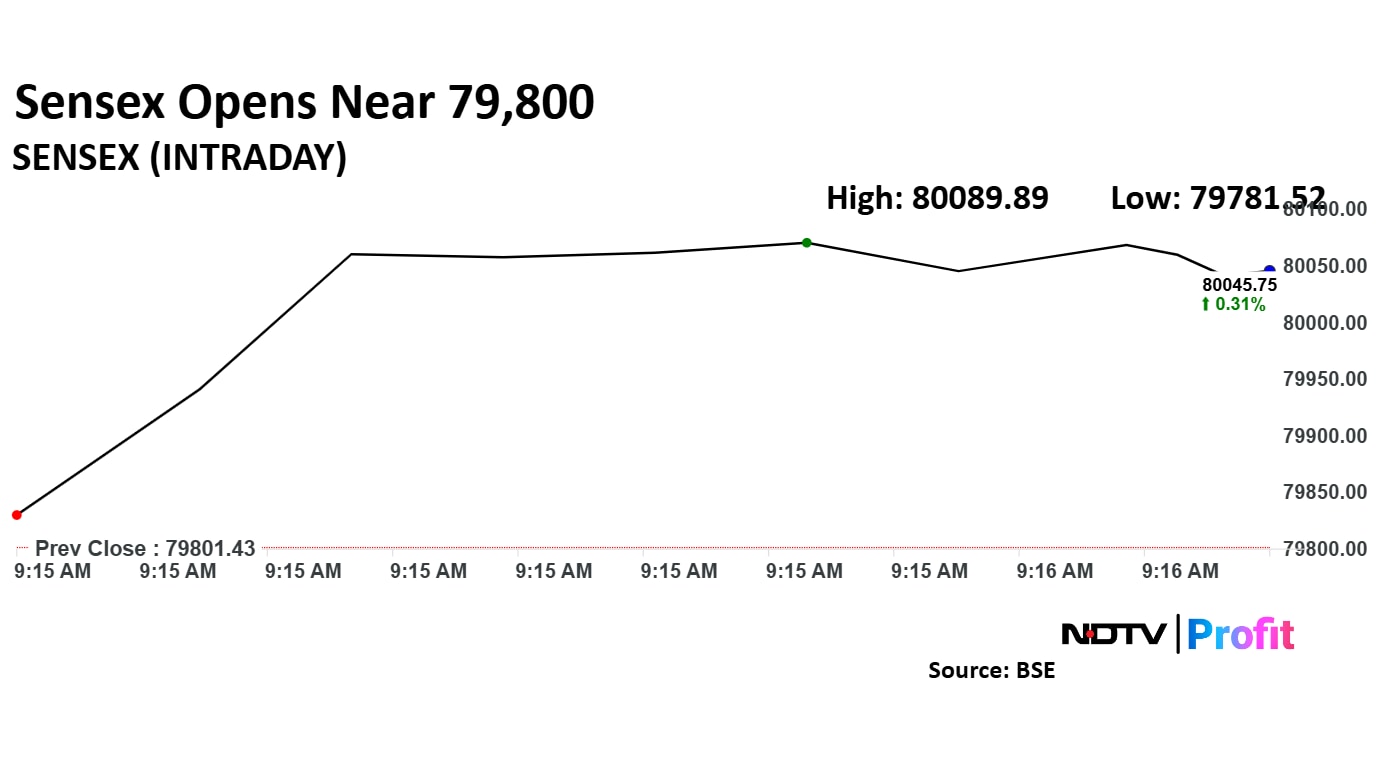

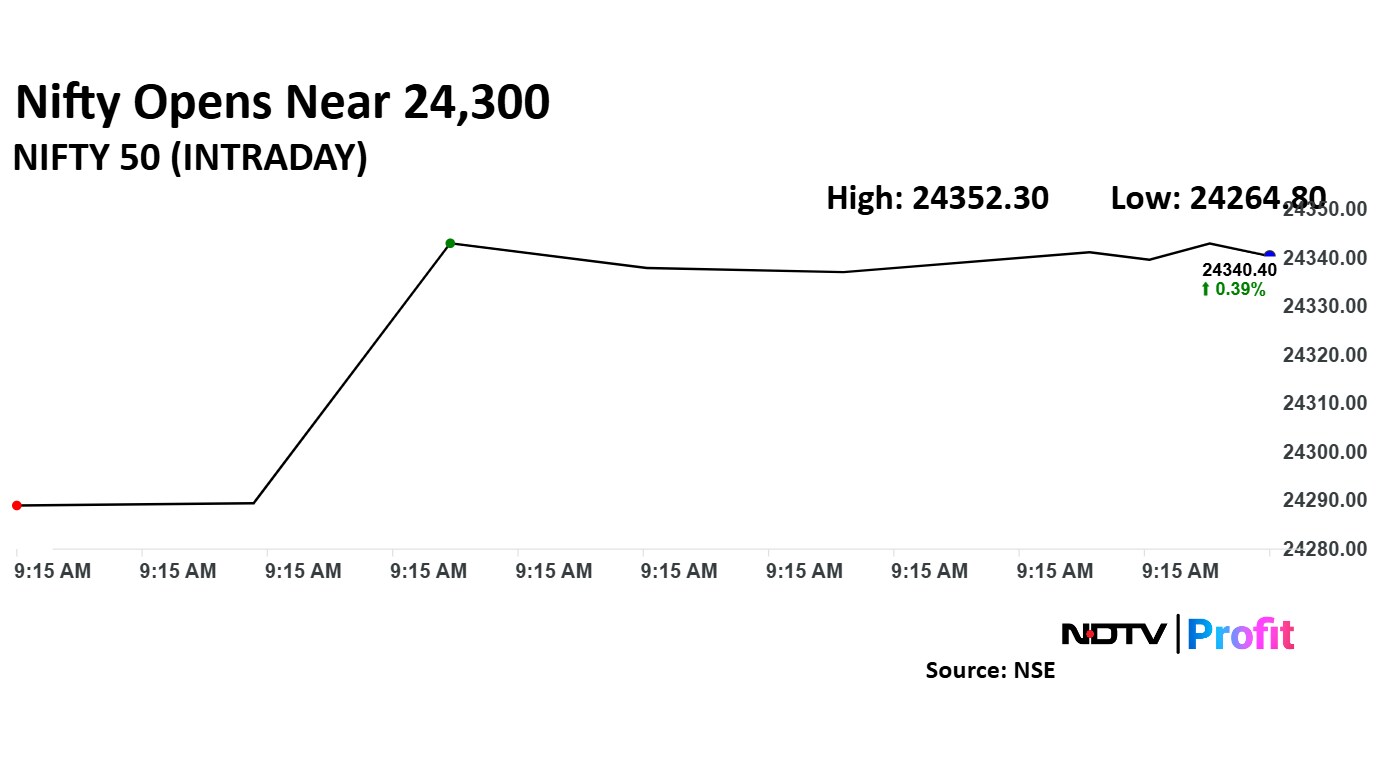

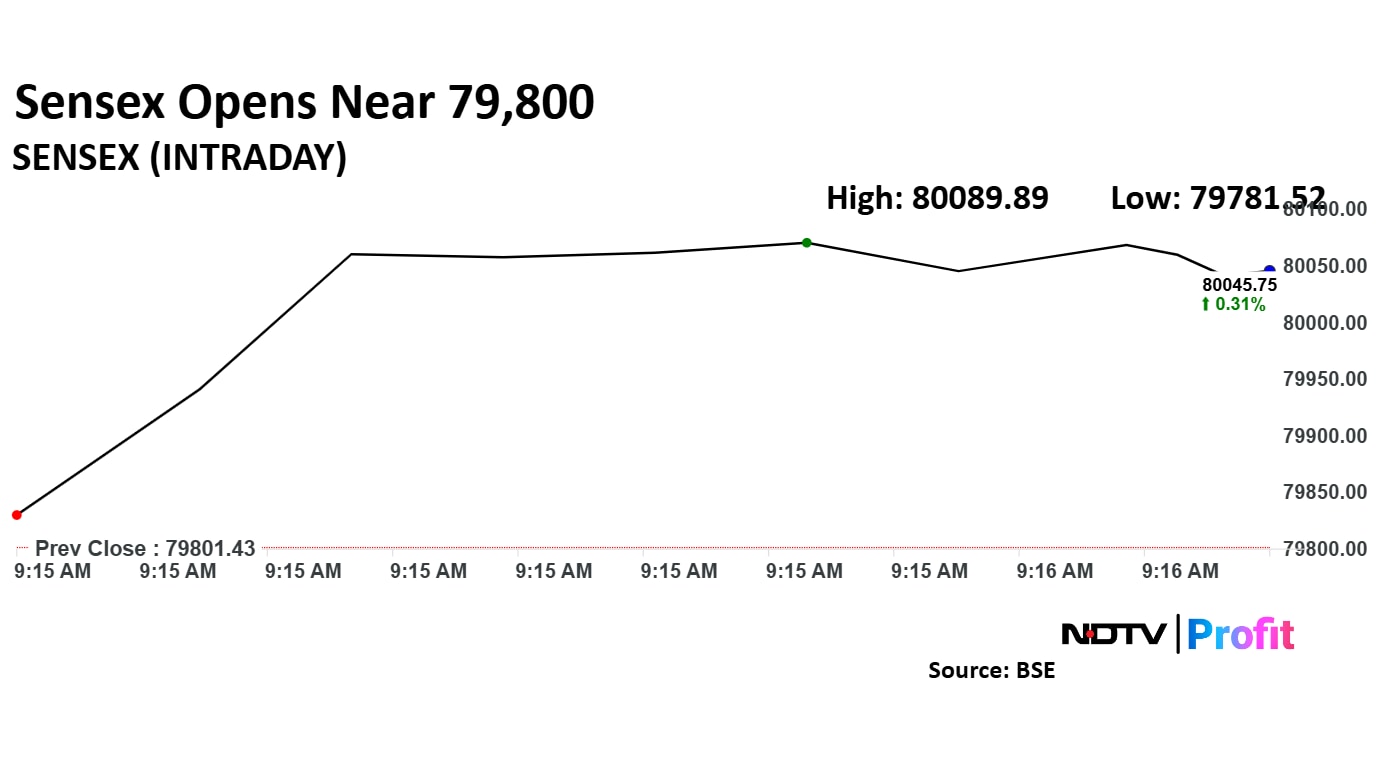

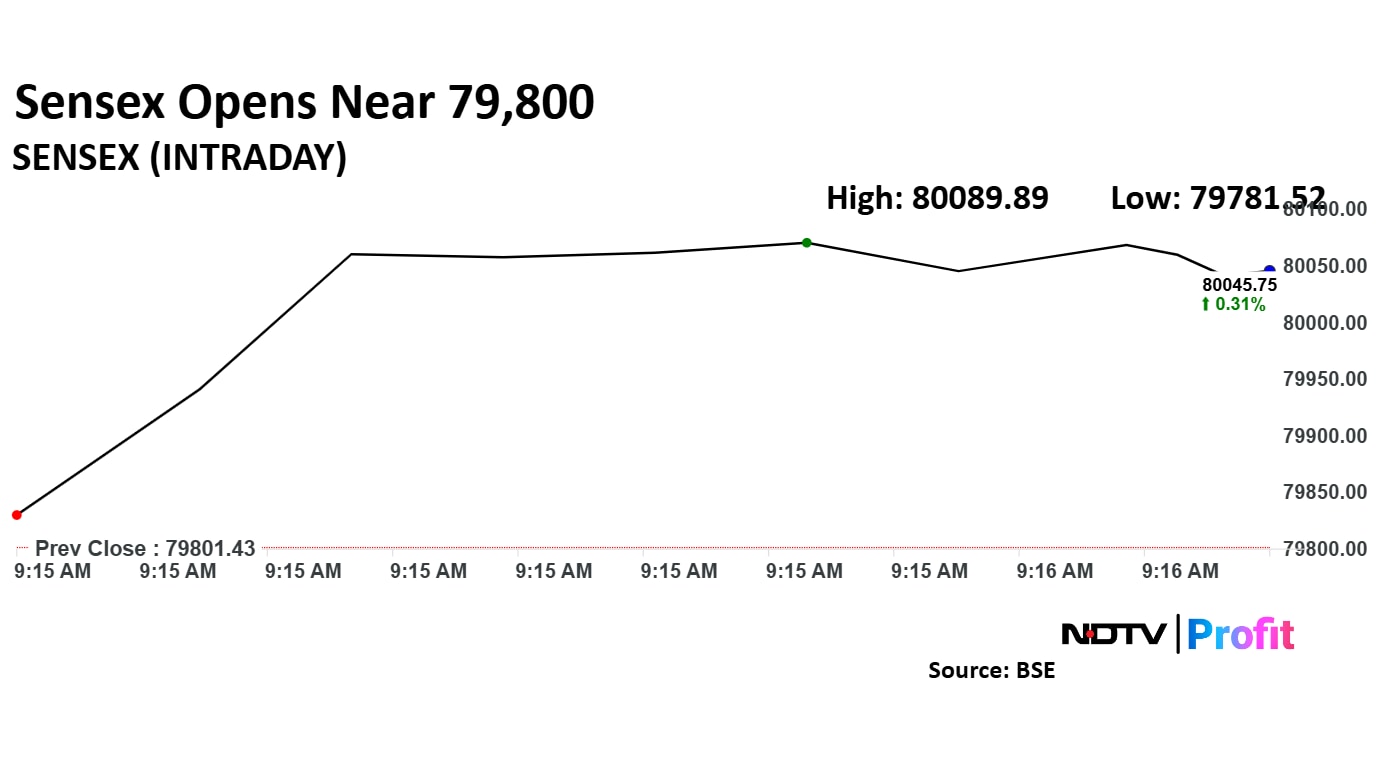

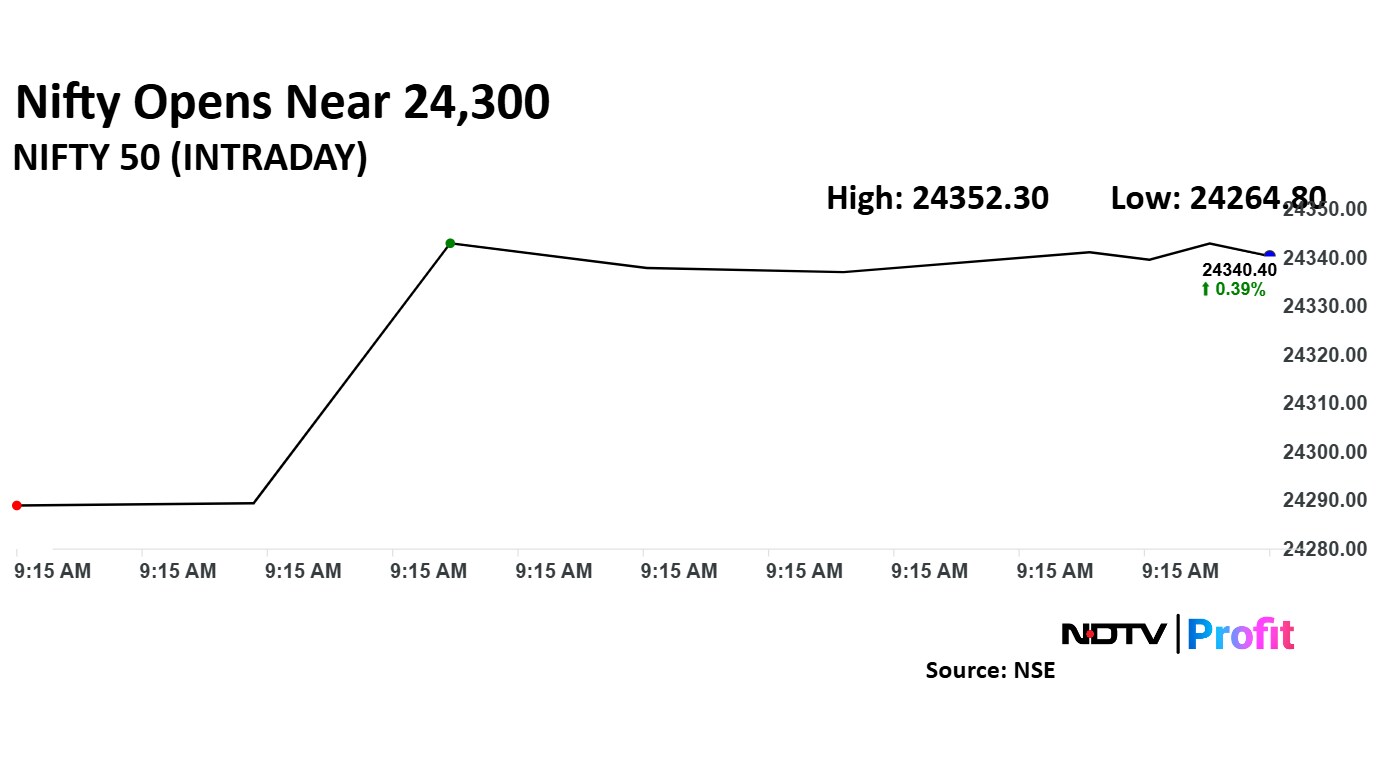

The NSE Nifty 50 and BSE Sensex erased losses from previous session at open as risk-sentiment fuelled after US officials indicated that India is likely to be the first country to strike a trade deal. HDFC Bank Ltd., and ICICI Bank share prices contributed the most to the Nifty 50 index.

US Treasury Secretary Scott Bessent said that the discussions with India regarding trade is very close to a successful conclusion because the former doesn't want high tariffs. India has a very few non-tariff barriers, government subsidies, and no currency manipulation hence reaching a deal with India is much easier, the New York Post reported.

The Nifty 50 rose 0.07% to 24,274.00, and the Sensex rose 0.11% to 79,904.83 as of 9:36 a.m.

The NSE Nifty 50 and BSE Sensex erased losses from previous session at open as risk-sentiment fuelled after US officials indicated that India is likely to be the first country to strike a trade deal. HDFC Bank Ltd., and ICICI Bank share prices contributed the most to the Nifty 50 index.

US Treasury Secretary Scott Bessent said that the discussions with India regarding trade is very close to a successful conclusion because the former doesn't want high tariffs. India has a very few non-tariff barriers, government subsidies, and no currency manipulation hence reaching a deal with India is much easier, the New York Post reported.

The Nifty 50 rose 0.07% to 24,274.00, and the Sensex rose 0.11% to 79,904.83 as of 9:36 a.m.

The NSE Nifty 50 and BSE Sensex erased losses from previous session at open as risk-sentiment fuelled after US officials indicated that India is likely to be the first country to strike a trade deal. HDFC Bank Ltd., and ICICI Bank share prices contributed the most to the Nifty 50 index.

US Treasury Secretary Scott Bessent said that the discussions with India regarding trade is very close to a successful conclusion because the former doesn't want high tariffs. India has a very few non-tariff barriers, government subsidies, and no currency manipulation hence reaching a deal with India is much easier, the New York Post reported.

The Nifty 50 rose 0.07% to 24,274.00, and the Sensex rose 0.11% to 79,904.83 as of 9:36 a.m.

The NSE Nifty 50 and BSE Sensex erased losses from previous session at open as risk-sentiment fuelled after US officials indicated that India is likely to be the first country to strike a trade deal. HDFC Bank Ltd., and ICICI Bank share prices contributed the most to the Nifty 50 index.

US Treasury Secretary Scott Bessent said that the discussions with India regarding trade is very close to a successful conclusion because the former doesn't want high tariffs. India has a very few non-tariff barriers, government subsidies, and no currency manipulation hence reaching a deal with India is much easier, the New York Post reported.

The Nifty 50 rose 0.07% to 24,274.00, and the Sensex rose 0.11% to 79,904.83 as of 9:36 a.m.

The NSE Nifty 50 and BSE Sensex erased losses from previous session at open as risk-sentiment fuelled after US officials indicated that India is likely to be the first country to strike a trade deal. HDFC Bank Ltd., and ICICI Bank share prices contributed the most to the Nifty 50 index.

US Treasury Secretary Scott Bessent said that the discussions with India regarding trade is very close to a successful conclusion because the former doesn't want high tariffs. India has a very few non-tariff barriers, government subsidies, and no currency manipulation hence reaching a deal with India is much easier, the New York Post reported.

The Nifty 50 rose 0.07% to 24,274.00, and the Sensex rose 0.11% to 79,904.83 as of 9:36 a.m.

The NSE Nifty 50 and BSE Sensex erased losses from previous session at open as risk-sentiment fuelled after US officials indicated that India is likely to be the first country to strike a trade deal. HDFC Bank Ltd., and ICICI Bank share prices contributed the most to the Nifty 50 index.

US Treasury Secretary Scott Bessent said that the discussions with India regarding trade is very close to a successful conclusion because the former doesn't want high tariffs. India has a very few non-tariff barriers, government subsidies, and no currency manipulation hence reaching a deal with India is much easier, the New York Post reported.

The Nifty 50 rose 0.07% to 24,274.00, and the Sensex rose 0.11% to 79,904.83 as of 9:36 a.m.

The NSE Nifty 50 and BSE Sensex erased losses from previous session at open as risk-sentiment fuelled after US officials indicated that India is likely to be the first country to strike a trade deal. HDFC Bank Ltd., and ICICI Bank share prices contributed the most to the Nifty 50 index.

US Treasury Secretary Scott Bessent said that the discussions with India regarding trade is very close to a successful conclusion because the former doesn't want high tariffs. India has a very few non-tariff barriers, government subsidies, and no currency manipulation hence reaching a deal with India is much easier, the New York Post reported.

The Nifty 50 rose 0.07% to 24,274.00, and the Sensex rose 0.11% to 79,904.83 as of 9:36 a.m.

The NSE Nifty 50 and BSE Sensex erased losses from previous session at open as risk-sentiment fuelled after US officials indicated that India is likely to be the first country to strike a trade deal. HDFC Bank Ltd., and ICICI Bank share prices contributed the most to the Nifty 50 index.

US Treasury Secretary Scott Bessent said that the discussions with India regarding trade is very close to a successful conclusion because the former doesn't want high tariffs. India has a very few non-tariff barriers, government subsidies, and no currency manipulation hence reaching a deal with India is much easier, the New York Post reported.

The Nifty 50 rose 0.07% to 24,274.00, and the Sensex rose 0.11% to 79,904.83 as of 9:36 a.m.

At pre-open, the NSE Nifty 50 rose 0.17% to 24,289.00, and the BSE Sensex rose 0.03% higher at 79,830.15.

Maintain Reduce; cut target price to Rs 1,150 from Rs 1,300

Yet another significant miss in operating performance

Suspends guidance; no respite from demand challenges in the near term

EBIT margin aspiration lowered and deferred

Cut FY26-28E EPS by 8-14%

Rupee opened 8 paise stronger at 85.19 against US dollar

It closed at 85.27 a dollar on Thursday

Source: Bloomberg

The yield on the 10-year bond opens flat at 6.32%

Source: Bloomberg

Banking and Financial Services up 5.6% QoQ in current currency terms

Technology, Media & Telco up 8.2% QoQ in CC terms

Expect to be above industry growth in FY26 across metrics

Targeting EBIT margin within band of 14.75% - 15.75%

Speakers: Nitin Rakesh, CEO, Mphasis Aravind Viswanathan, CFO, Mphasis

Downgrade to Sell from Hold; Hike TP to Rs 2386 from Rs 2379

Valuations outpacing growth expectations

Topline growth remains soft

Raw Material pressure weighs on operating margins

EPS cut of 2-3%; risk of revenue led downgrade

Oil prices extended gains in Asia session as conflicting stance regarding trade talks between the US and China, Russia-Ukraine tension, and probability of a supply increase from Organization of Petroleum Exporting Countries and allies weighed on investors' sentiment. Further, a decline in the dollar index supported the price.

The brent crude was trading 0.23% higher at $66.70 a barrel as of 8:16 a.m.

Asia-Pacific markets extended rally on Friday with the Japan's benchmark Nikkei 225 and TAIEX trading 1.36% and 2.42% higher, respectively. US Treasury Secretary Scott Bessent said that the US will reach agreement of understanding on trade soon.

Moreover, US Federal Reserve officials' comments gave hopes for rate cuts. Fed Governor Christopher Waller said that he would support the rate cuts in case high tariffs' impact on US economy affects job market in an interview to Bloomberg. Fed Cleveland President Beth Hammock said that the central bank move on rates early if it's get clear sign about economy's direction.

Taiwan's premier proposed special budget with $10 billion spending to deal with the impact of US tariffs, Reuters reported. US imposed 32% tariff on Taiwan. This supported the country's benchmark to rally.

US share indices ended higher on Thursday as Trump administration indicated that the country will likely sign deal with key trade partners soon. President Donald Trump said that talks are going on with China, however, the latter denied of having ongoing negotiation.

The Dow Jones Industrial Average and S&P 500 ended 1.23% and 2.03% higher, respectively. The Nasdaq Composite ended 2.74% higher.

The GIFT Nifty The GIFT Nifty was trading 0.05% or 12.50 points higher at 24,534.00 as of 6:41 a.m., signalling muted-to-higher start for the Nifty 50.

Axis Bank Ltd. and Tech Mahindra Ltd. reported higher than expected net profit for January and March period. Macrotech Developers Ltd., Mphasis Ltd., and Indian Energy Exchange Ltd. reported positive growth in its net profit for the fourth quarter. L&T Technology Services Ltd., Tanla Platform, and Aavas Financiers reported lower profit. The share prices of these companies may react because of the fourth quarter results.

The NSE Nifty 50 and BSE Sensex snapped a seven-day winning streak on Thursday, ahead of the earnings announcement from Axis Bank Ltd., and L&T Technology Service Ltd. ICICI Bank Ltd. and Bharti Airtel Ltd. share prices dragged the benchmark the most.

The Nifty 50 ended 82.25 points, or 0.34% down at 24,246.70, and the Sensex ended 315.06 points, or 0.39% lower at 79,801.43.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.