Amid macro volatility induced headwinds and tariff turmoil disrupting external facing trade, Bengaluru-based IT major Mphasis Ltd. has shifted focus to the micro aspects of the industry, particularly understanding client priorities and their evolution, said Chief Executive Officer Nitin Rakesh on Friday.

The company is also in the midst of a shift from being a services provider to a technology service provider, the CEO added, in a conversation with NDTV Profit post the company's release of their financial performance for the quarter ended March 31, 2025.

(Mphasis) is in a pivot from being a service provider to a tech service provider.Nitin Rakesh, CEO, Mphasis to NDTV Profit

"In this uncertain macro environment, our focus is on continued investments in growth, keeping tech and AI at the core, and leveraging solutions to transform and modernise our client's technology and operations stack," said Rakesh as per a press release.

Mphasis posted a 4% rise in consolidated net profit at Rs 446 crore for the quarter under review, as compared to Rs 428 crore in the previous quarter. This is in line with the consensus estimate of Rs 441.48 crore by Bloomberg analysts.

Revenue from operations grew over 4% to Rs 3,710 crore quarterly. The IT major also witnessed a gain of 4% in operating income, with margins flat at 15.3%.

The Chief Financial Officer, Aravind Viswanathan, stated that there will be leverage at a gross margin level, and some of it will be invested into specific investment— be it coverage, large deals, AI or more.

The wait for discretionary spending could be longer than expected, said Rakesh.

Mphasis Q4 Highlights (Consolidated, QoQ)

Revenue up 4.1% to Rs 3,710 crore versus Rs 3,563.10 crore (Bloomberg estimate at Rs 3,700.38 crore).

EBIT up 4% to Rs 567.20 crore versus Rs 547.20 crore (Estimate at Rs 704.79 crore).

Margin at 15.3% versus 15.4% (Estimate at 19%).

Net profit up 4% to Rs 446.40 crore versus Rs 427.80 crore (Estimate at Rs 441.48 crore).

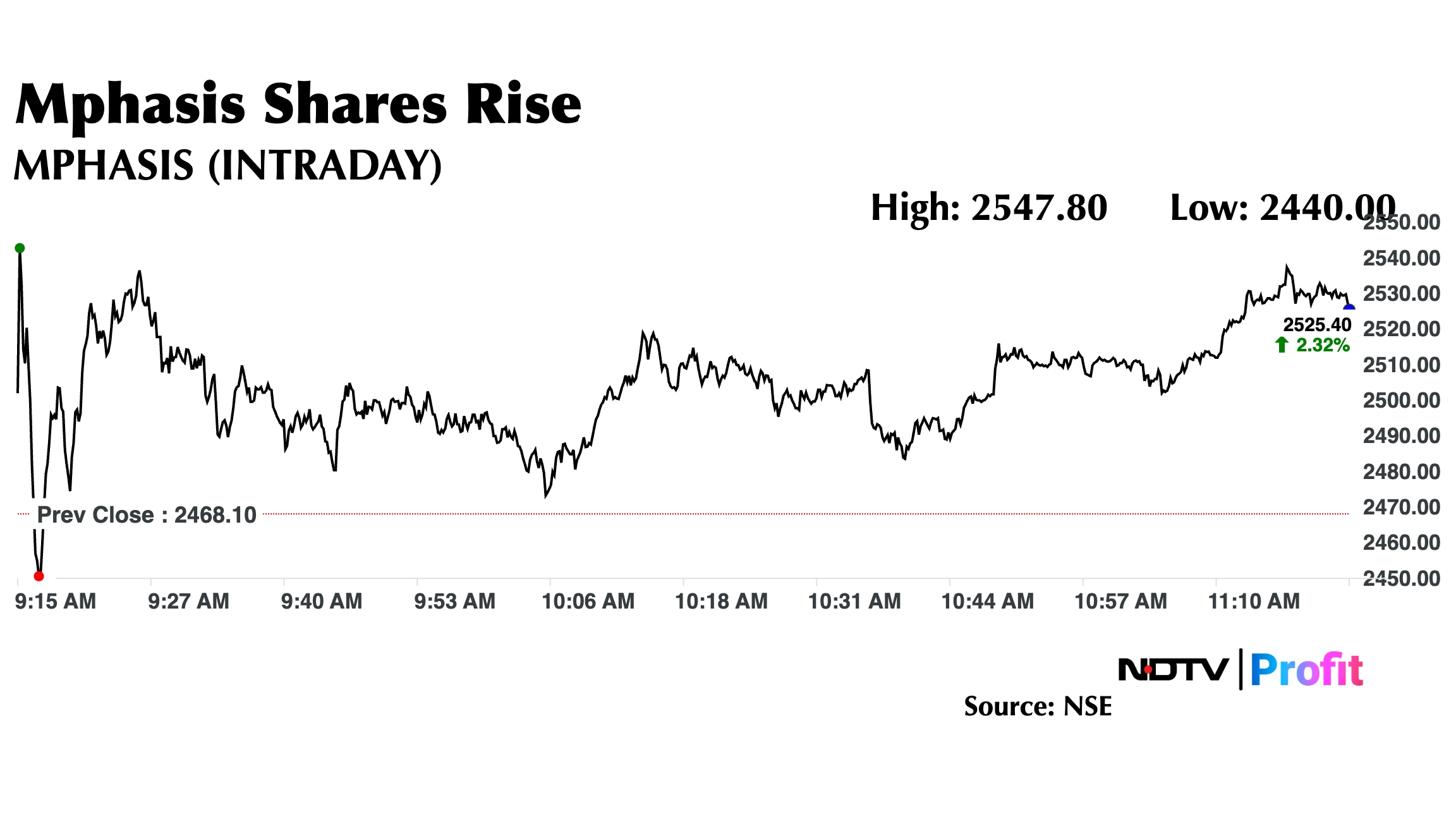

Mphasis Share Price Today

The scrip rose as much as 3.23% to Rs 2,547.80 apiece, the highest level since March 26, 2025. It pared gains to trade 2.52% higher at Rs 2,530.20 apiece, as of 11:19 a.m., widely outperforming the benchmark NSE Nifty 50, which was trading at a 1.27% decline in the NSE Nifty 50 index.

It has fallen 11.07% on a year-to-date basis, but has risen 13.52% in the last 12 months. Total traded volume so far in the day stood at 1.88 times its 30-day average. The relative strength index was at 43.96.

Out of 38 analysts tracking the company, 23 maintain a 'buy' rating, 10 recommend a 'hold,' and five suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 11.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.