That's all for today's real-time market coverage. Thank you for joining us, today!

Benchmarks snap two-day gaining streak; managed to stay above 25,200

Benchmarks underperform Broader Market Indices

Nifty Midcap 150 trade flat for the day; Tata Investment Corp, BSE gain the most

Nifty smallcap 250 close negative for the day; BLS international, Redington fell the most.

BLS International fell over 10% for the day; touches 1 year intraday low.

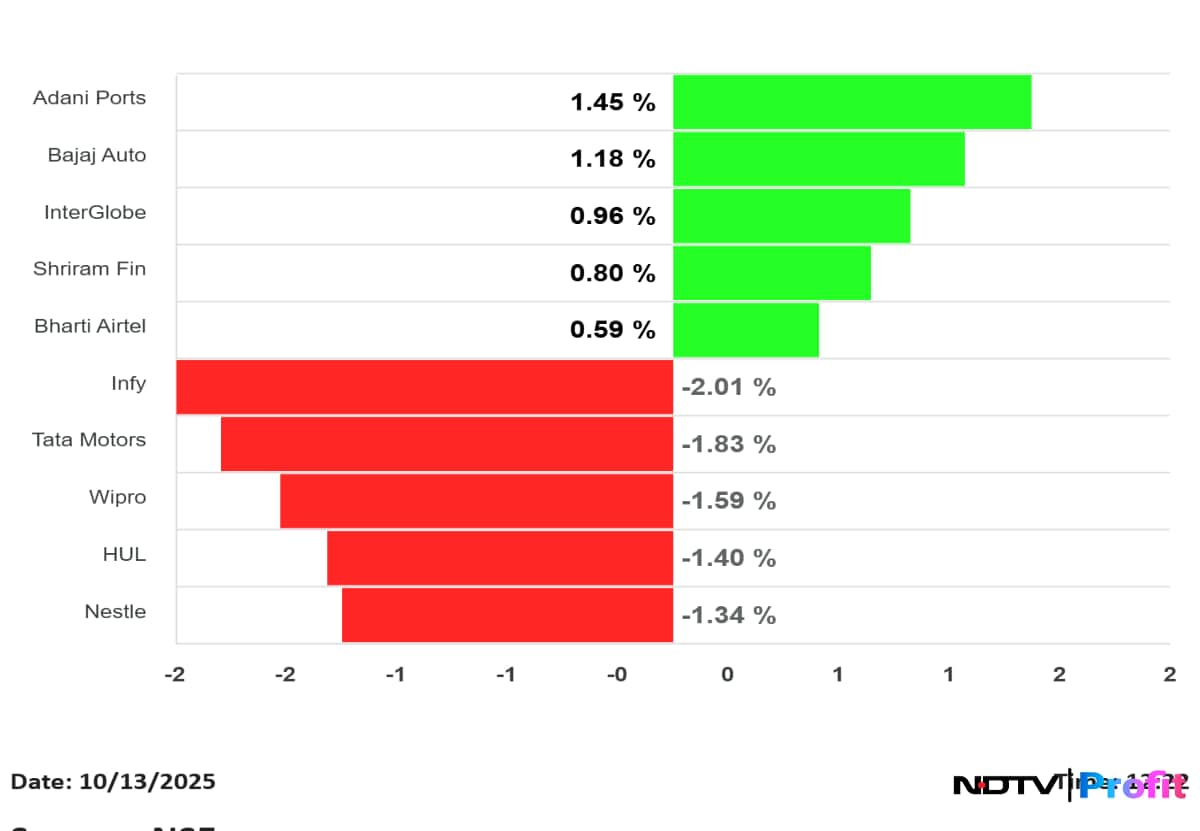

Tata Motors and Infosys emerge as the top losers in Nifty

Adani ports gain over 2% in trade; Top gainer in Nifty

Adani Ports emerge as the top nifty gainer after Investec Initiate Buy

Nifty FMCG fell the most; emerges as the top losing sector for the day.

Godrej Consumer and United Spirits fell the most in Nifty FMCG

Nifty FMCG, Pharma, Auto snap 2-day gaining streak

Nifty IT, Metal fell for the 2-day in a row.

Nifty Financial Services gain for the 3-day in a row.

Nifty PSU Bank gain for the 3-day in a row

Benchmarks snap two-day gaining streak; managed to stay above 25,200

Benchmarks underperform Broader Market Indices

Nifty Midcap 150 trade flat for the day; Tata Investment Corp, BSE gain the most

Nifty smallcap 250 close negative for the day; BLS international, Redington fell the most.

BLS International fell over 10% for the day; touches 1 year intraday low.

Tata Motors and Infosys emerge as the top losers in Nifty

Adani ports gain over 2% in trade; Top gainer in Nifty

Adani Ports emerge as the top nifty gainer after Investec Initiate Buy

Nifty FMCG fell the most; emerges as the top losing sector for the day.

Godrej Consumer and United Spirits fell the most in Nifty FMCG

Nifty FMCG, Pharma, Auto snap 2-day gaining streak

Nifty IT, Metal fell for the 2-day in a row.

Nifty Financial Services gain for the 3-day in a row.

Nifty PSU Bank gain for the 3-day in a row

Rupee closed 2 paise stronger at 88.68 against US dollar

It closed at 88.70 a dollar on Friday

Source: Bloomberg

See Most Banks Increasing Credit Growth While Maintaining Asset Quality: Informist

See Bank Credit Growth At Upper End Of 11.5-12.5% View On New RBI Norms: Informist

New RBI Norms To Ease Credit Availability For Large Corporates: Informist

New RBI Norms Give Banks Room To Keep Credit Flowing To Broader Economy: Informist

Banks On Firmer Footing For Expected Credit Loss Transition: Informist

JSW Steel Ltd.'s board to consider second-quarter earnings on Oct 17, the company said in the exchange filing.

India’s automobile retail sector posted a 5.22% year-on-year growth in Sept. 2025, with total vehicle registration reaching 18,27,337 units, according to data released by the Federation of Automobile Dealers Associations. It's not just auto sales benefiting from the GST cuts.

Hero MotoCorp signed a distribution pact with Italy's Pelpi International, the company said in the exchange filing.

Dr. Reddy's Laboratories Ltd.'s board to consider second-quarter results on Oct 24.

Taj GVK Hotels signed hotel management agreement with IHCL for upcoming five-star hotel in Bengaluru. A 20-year pact with IHCL started from Bengaluru Hotel's opening date.

Bajaj Auto Ltd.'s board will consider second-quarter earnings on Nov 7.

Pan European stock gauge, Euro Stoxx 50 and Germany's benchmark index, DAX were trading higher like most markets in the region. US President Donald Trump said that there is unlikely further tension escalation with China which soothed some jittery nerves.

The Euro Stoxx 50 and DAX were trading 0.10% and 0.48% higher, respectively as of 2:25 p.m.

HCLTech is expected to post steady sequential growth in the July–September quarter, with analysts tracking its margin expansion and the potential cost impact from the recent H-1B visa fee hike. The company will announce its Q2 FY26 results on Oct. 13.

The US government’s decision to impose a $100,000 charge on new H-1B visa petitions has drawn close scrutiny from the IT sector. While TCS remains one of the largest visa users, peers such as HCLTech could also face higher onsite costs as the rule takes effect.

At a time when most global markets are under pressure due to geopolitical uncertainty and tariff wars, the Pakistan benchmark index, KSE 100, is on a tear.

The Pakistan index has almost doubled over one year, rising from 83,300 levels in October 2024 to 1,60,000 levels currently after recently hitting a recent all-time high of 1,69,000. In comparison, the MSCI Emerging Markets Index is up 16.4%.

Spandana Sphoorty Financial's board approved raising of Rs 400 crore via issuance of 40,000 non-convertible debentures on a private placement basis.

Tata Motors shares are in focus today given that Oct. 13 is the last day for Tata Motors to trade as a consolidated entity. The record date for the commercial vehicles business demerger has been fixed as Tuesday, Oct. 14.

The shareholders in the registrar will be eligible for shares of demerged entity as well. However, the key question among shareholders is what could be the reduction in share price starting the next day?

Rupee strengthened 11 paise to 88.59 against US dollar

It closed at 88.70 a dollar on Friday

Source: Bloomberg

IT Department conducts searches at Go Fashion's offices and warehouses completed on Oct 11. IT officials have vacated all premises of company.

Non-Banking Financial Company (NBFC) HDB Financial Services Ltd. is set to announce the results for the second quarter of FY26 this week. It was incorporated in 2007 and has been accredited with CARE AAA & CRISIL AAA ratings for its long-term debt and bank facilities. HDB Financial Services’ businesses include lending and BPO services. Here’s everything you need to know about its Q2FY26 results schedule.

SBI Life Insurance Co's board will meet on Oct 24 to consider second-quarter earnings, the company said in the exchange filing.

The NSE Nifty Realty index rose 0.31% to 899.4 as Brigade Enterprises Ltd., Anant Raj Ltd., and Lodha Developers Ltd. led gains. The index was leading gains among sectoral indices after overtaking NSE Nifty Media.

The NSE Nifty Realty index rose 0.31% to 899.4 as Brigade Enterprises Ltd., Anant Raj Ltd., and Lodha Developers Ltd. led gains. The index was leading gains among sectoral indices after overtaking NSE Nifty Media.

Bajaj Housing Finance allotted 1 lakh non-convertible debentures up to Rs 1,000 crore on a private placement basis, the company said in the exchange filing.

Vodafone Idea Ltd. share price declined 3.65% to Rs 8.72 apiece so far today. The Supreme Court deferred the hearing date for AGR case to Oct 27.

Vodafone Idea Ltd. share price declined 3.65% to Rs 8.72 apiece so far today. The Supreme Court deferred the hearing date for AGR case to Oct 27.

The NSE Nifty 50 October Future declined 0.62% to 25,253.1, at premium of 73 points as of 11:34 a.m.

The Nifty Oct 14 Weekly Expiry: Maximum Call Open Interests were at 25,200 strike, while Put OIs were also concentrated on the same level

Larsen & Toubro Ltd. received orders in the range of Rs 2,500-5,000 crore for power transmission and distribution business in Middle East, the company said in the exchange filing.

Overall Subscription At 67% On Day 3 Of Issue

Retail Investors Lead With 96% Subscription On Day 3

NIIs Subscription At 88% On Day 3

Source: BSE

HDFC Bank Ltd.'s trading volume on National Stock Exchange was 6.65 times its 30-day average as of 10:39 a.m.

Eternal's trading volume on NSE was 5.55 times its 30-day average as of 10:40 a.m.

Power Grid Corp's trading volume on NSE was 4.95 times its 30-day average as of 10:41 a.m.

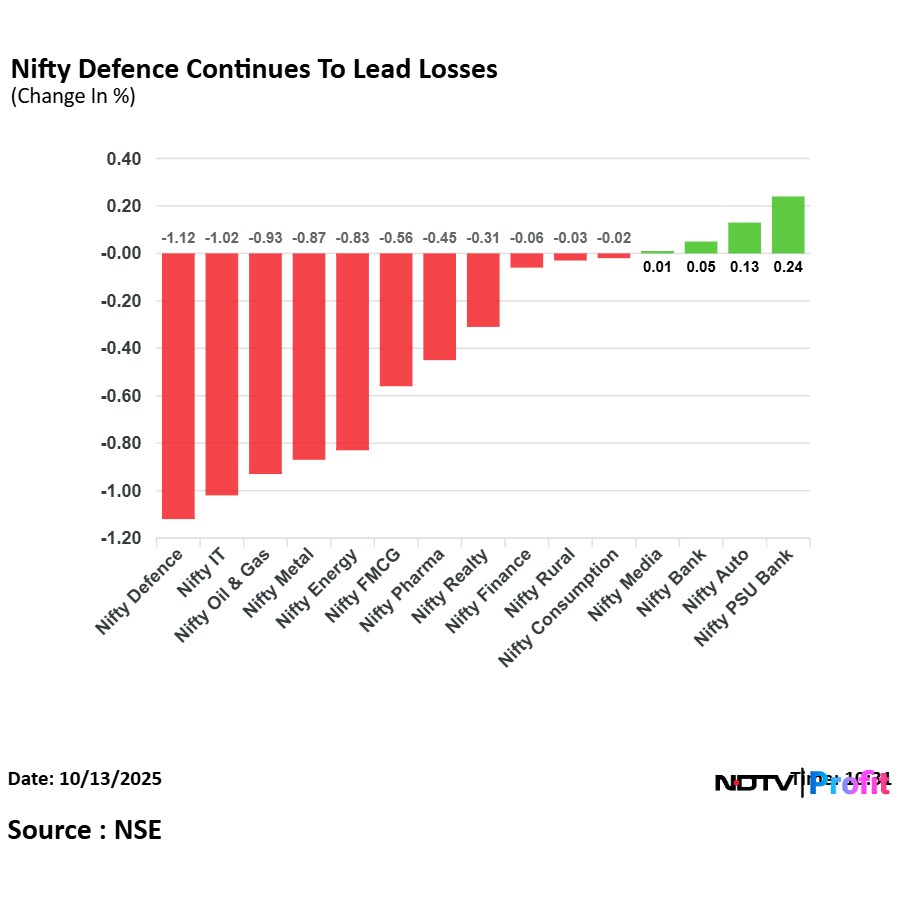

The NSE India Nifty Defence index declined 1.48% to 7,976.60 so far today. The index continued to lead losses among other sectoral indices.

The NSE India Nifty Defence index declined 1.48% to 7,976.60 so far today. The index continued to lead losses among other sectoral indices.

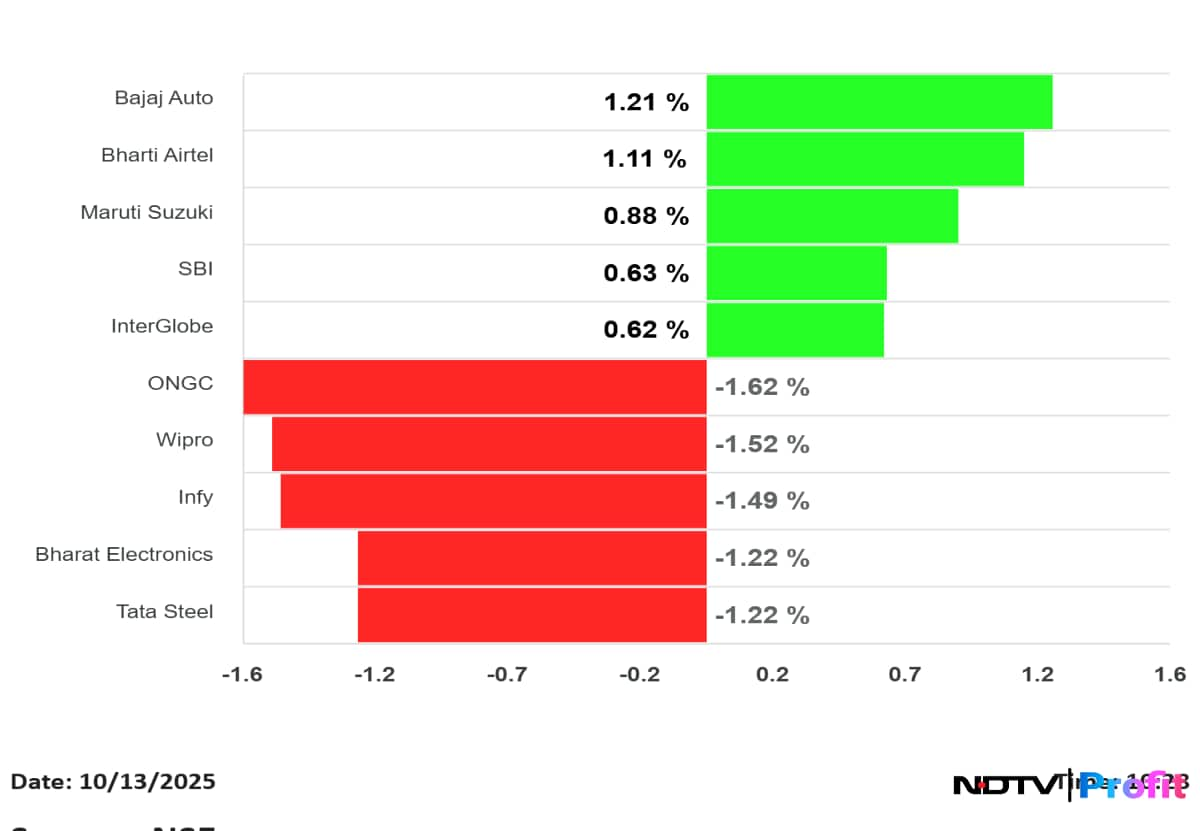

Among the NSE Nifty 50 stocks, Oil and Natural Gas Corp, Wipro India Ltd., Infosys Ltd., Bharat Electronics Ltd., and Tata Steel Ltd. shares declined the most.

Bajaj Auto Ltd., Bharti Airtel Ltd., Maruti Suzuki India Ltd., State Bank of India, and InterGlobe Aviation Ltd. rose the most.

Among the NSE Nifty 50 stocks, Oil and Natural Gas Corp, Wipro India Ltd., Infosys Ltd., Bharat Electronics Ltd., and Tata Steel Ltd. shares declined the most.

Bajaj Auto Ltd., Bharti Airtel Ltd., Maruti Suzuki India Ltd., State Bank of India, and InterGlobe Aviation Ltd. rose the most.

Servotech Renewable received order from South Eastern Railway for 2.58 megawatt solar rooftop project in Ranchi Division, the company said in the exchange filing.

Tata Capital Ltd. listed at a small premium over its IPO price on Monday, becoming the 17th Tata Group company to be publicly traded. The share price opened at Rs 330 on both the NSE and BSE, compared to the issue price of Rs 326.

In the unlisted or grey market, shares of Tata Capital indicated no listing day gains.

Track live update on listing here.

Tata Capital Ltd. listed at a small premium over its IPO price on Monday, becoming the 17th Tata Group company to be publicly traded. The share price opened at Rs 330 on both the NSE and BSE, compared to the issue price of Rs 326.

Read more about it here

Tata Trusts, which holds a controlling 66% stake in Tata Sons Pvt., is generally unfavorable towards listing of shares on the stock market, according to sources.

The philantrophic body derives significant CSR funding for their charitable activities from the dividends of Tata Sons and seek to maintain their traditional governance structure.

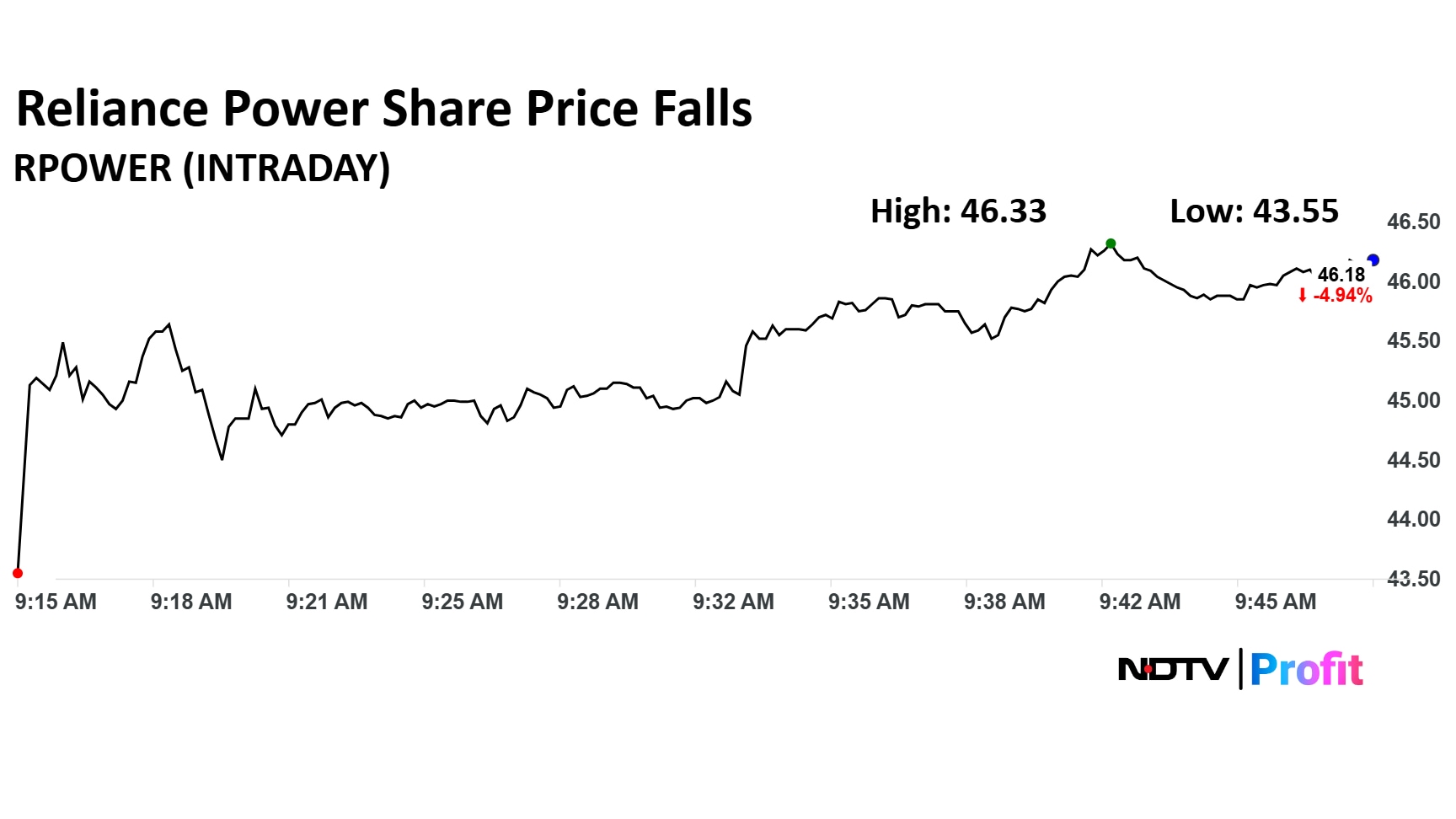

Reliance Power share price slumped 10.35% to Rs 43.55 apiece, the lowest level since Aug 18. The stock pared some losses to trade 5.31% down at Rs 46.03 apiece as of 9:48 a.m. compared to 0.22% decline in the NSE Nifty 50 index.

Reliance Power share price slumped 10.35% to Rs 43.55 apiece, the lowest level since Aug 18. The stock pared some losses to trade 5.31% down at Rs 46.03 apiece as of 9:48 a.m. compared to 0.22% decline in the NSE Nifty 50 index.

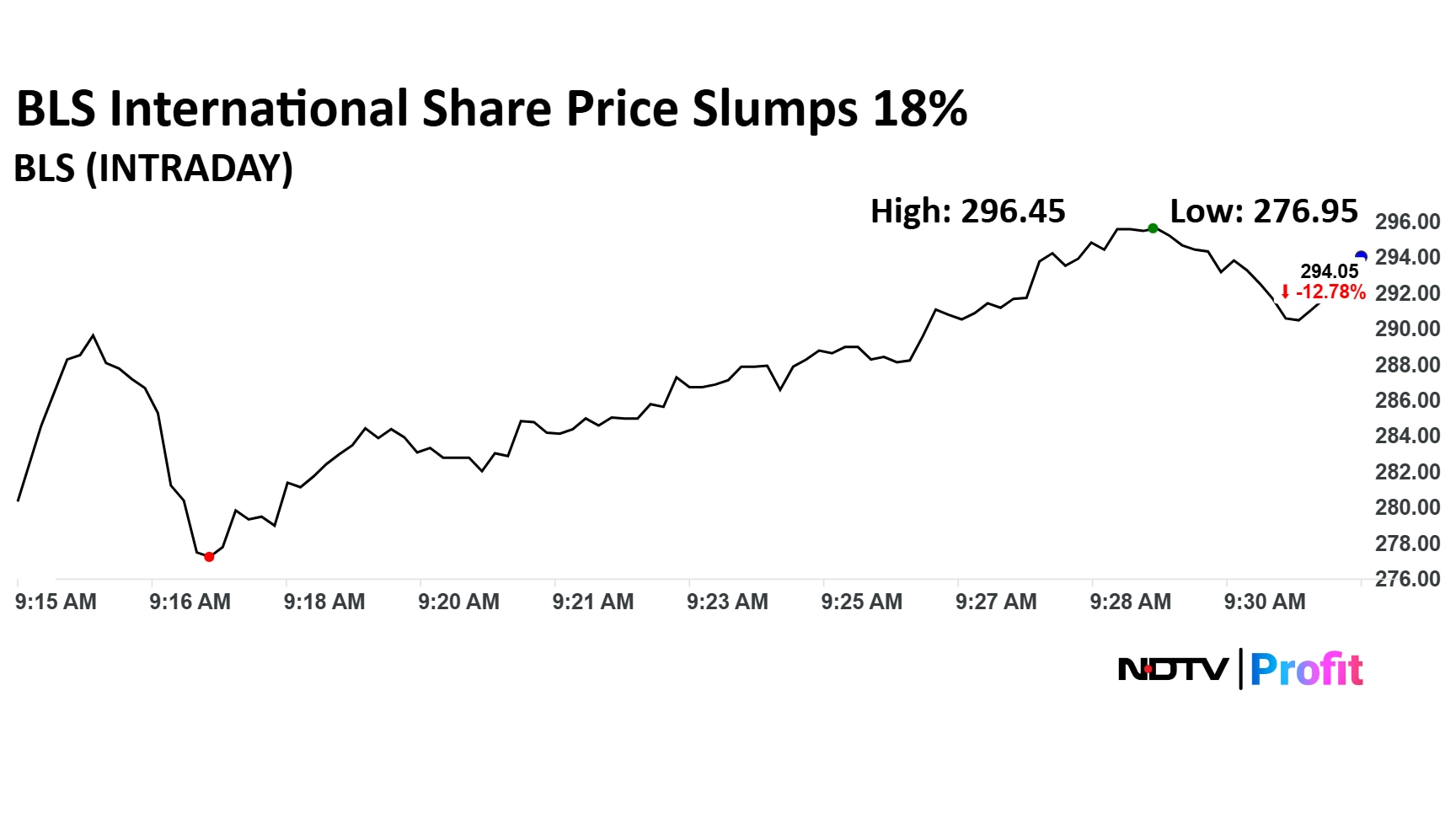

BLS International Services share price slumped 17.86% to Rs 276.95 apiece, the lowest level since March 13, 2024. The company informed the exchanges that it got debarred from participating in future tenders from the Ministry of External Affairs, and Indian Mission projects.

Ongoing projects with MEA will continue. The company said the imapct from restriction is unlikely to impact the financial performance. MEA contributed 12% of revenue and 8% of Ebitda.

BLS International Services share price slumped 17.86% to Rs 276.95 apiece, the lowest level since March 13, 2024. The company informed the exchanges that it got debarred from participating in future tenders from the Ministry of External Affairs, and Indian Mission projects.

Ongoing projects with MEA will continue. The company said the imapct from restriction is unlikely to impact the financial performance. MEA contributed 12% of revenue and 8% of Ebitda.

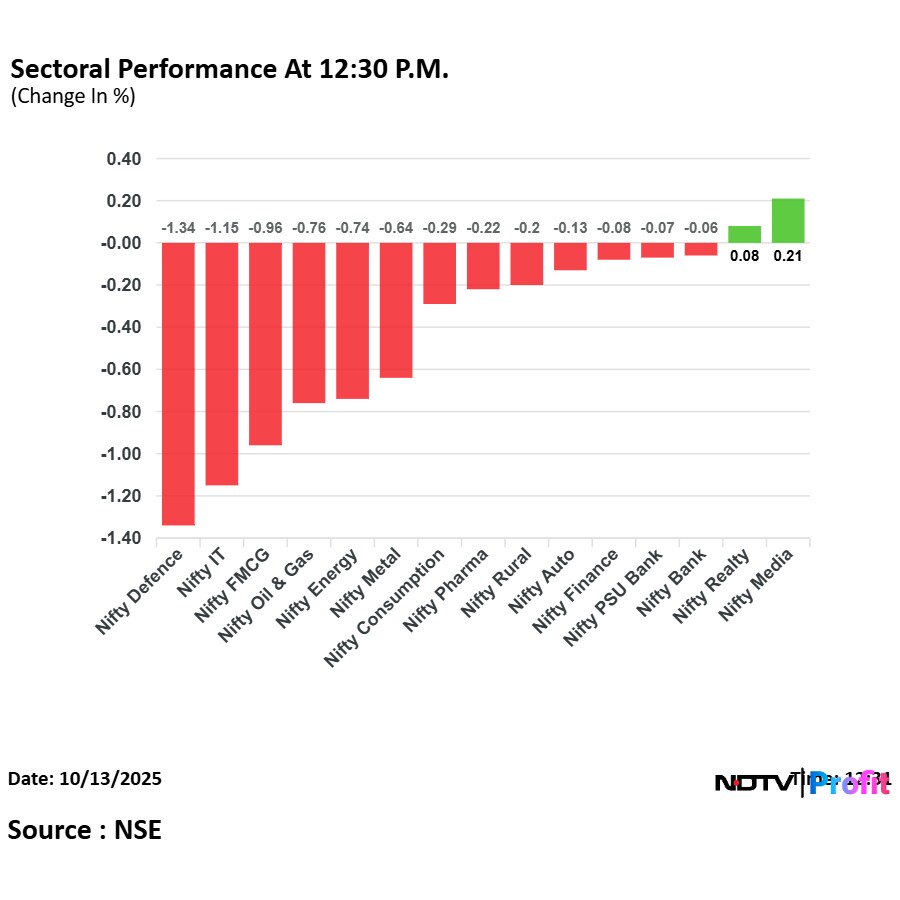

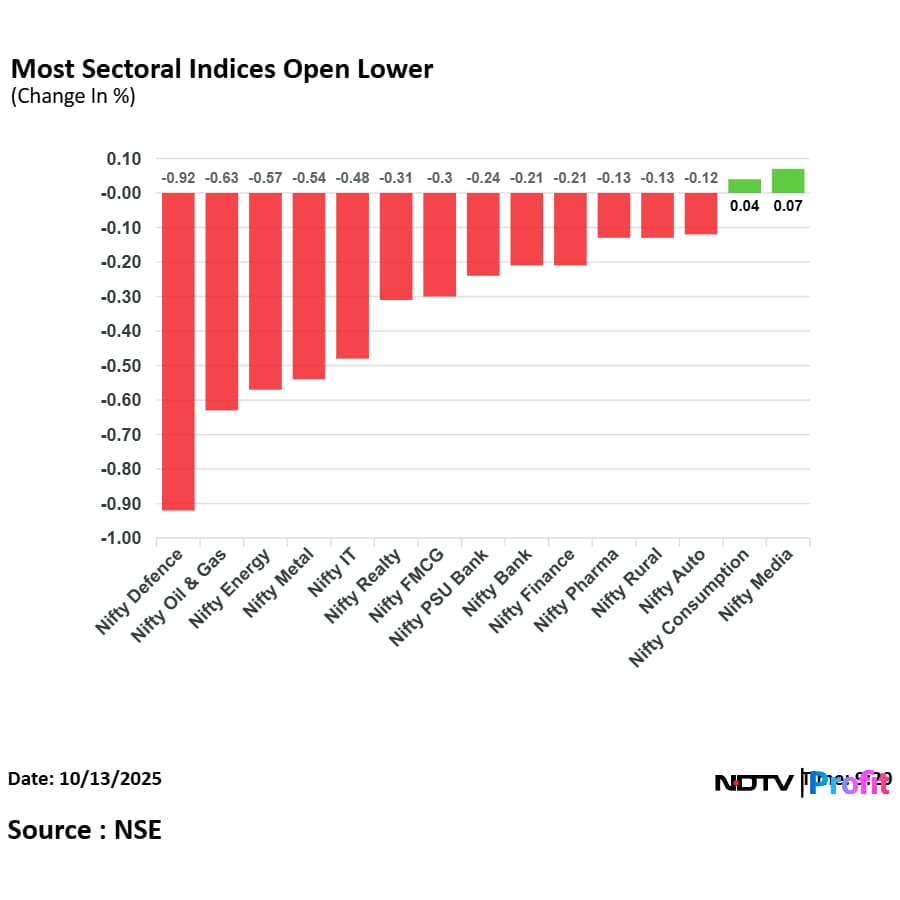

On National Stock Exchange, 13 sectoral indices declined, one advanced, and one remained flat out of 15. The NSE Nifty Defence index fell the most, while the NSE Nifty Media rose the most.

On National Stock Exchange, 13 sectoral indices declined, one advanced, and one remained flat out of 15. The NSE Nifty Defence index fell the most, while the NSE Nifty Media rose the most.

HDFC Bank Ltd., Reliance Industries Ltd., Larsen & Toubro Ltd., Axis Bank Ltd., and ITC Ltd. weighed on the NSE Nifty 50 index.

Bharti Airtel Ltd., ICICI Bank Ltd., InterGlobe Aviation Ltd., Eternal Ltd., and Maruti Suzuki India Ltd. limited losse to the NSE Nifty 50 index.

HDFC Bank Ltd., Reliance Industries Ltd., Larsen & Toubro Ltd., Axis Bank Ltd., and ITC Ltd. weighed on the NSE Nifty 50 index.

Bharti Airtel Ltd., ICICI Bank Ltd., InterGlobe Aviation Ltd., Eternal Ltd., and Maruti Suzuki India Ltd. limited losse to the NSE Nifty 50 index.

"The RSI at 61 stays in bullish territory but below overbought levels, suggesting room for further upside while keeping momentum healthy. The Immediate support is seen at 25,000–24,900, where the moving average aligns, while resistance lies near 25,600–25,700, the recent swing high zone. The Highest Call OI has remains concentrated at the 25,500 strike, while Put OI is positioned at the 25,200 strike for the upcoming weekly expiry."Jigar Trivedi, Senior Research Analyst, Reliance Securities

"Although President Trump later softened his stance, saying the U.S. does not intend to “hurt China,” which led to a recovery in U.S. stock futures, investor caution persists amid renewed global uncertainty. Beyond the immediate volatility, investors are likely to stay focused on key catalysts such as Q2 earnings, domestic CPI inflation, and U.S. inflation data, which could shape near-term market sentiment."Ponmudi R, CEO, Enrich Money

The NSE Nifty 50 and BSE Sensex snapped a two-day winning streak on Monday morning as HDFC Bank Ltd. and Reliance Industries Ltd. shares weighed on the index.

The indices were trading 0.29% and 0.35% down, respectively as of 9:22 a.m.

The NSE Nifty 50 and BSE Sensex snapped a two-day winning streak on Monday morning as HDFC Bank Ltd. and Reliance Industries Ltd. shares weighed on the index.

The indices were trading 0.29% and 0.35% down, respectively as of 9:22 a.m.

At pre-open, the NSE Nifty was trading 0.43% or 108.05 points down at 25,177, and the BSE Sensex was trading 0.55% or 450.25 points down at 82,050.57.

The yield on the 10-year bond opened 2 basis points lower at 6.52%

It closed at 6.54% on Friday

Source: Bloomberg

Rupee opened 6 paise stronger at 88.76 against US dollar

It closed at 88.70 a dollar on Friday

Source: Bloomberg

Brokerages shared bullish calls on Avenue Supermarts Ltd. after the company registered its earnings for the September quarter of the fiscal year ending March 2026, with multiple firms hiking the target price.

Nuvama and Motilal Oswal are among the brokerages that hiked target prices on the counter, while Elara Capital said the D-Mart Ready realignment is finally coming through.

Investors will have one last chance to trade Tata Motors as a consolidated entity as Monday marks the final trading day for Tata Motors Ltd. shares before the demerger record date.

Once the demerger kicks in, Tata Motors is set to split into two different entities by dividing the commercial vehicle business and the passenger vehicle business - a move aimed at unlocking growth between the two distinct operations.

The GIFT Nifty was trading 0.43% or 108.50 points higher at 25,321, which hinted at a positive open for the NSE Nifty 50 and BSE Sensex. This comes after US futures saw an uptick following US President Donald Trump's latest post on China saying "it will all be fine".

Traders will keep an eye on Avenue Supermarts Ltd., HCLTech Ltd., Zen Technologies Ltd., Waaree Technologies Ltd., and BLS International Ltd. on the back of their second-quarter earnings and overnight news flow.

The NSE Nifty 50 and BSE Sensex ended higher on Friday, for the third day in a row. The Nifty 50 ended 0.41% or 103.55 points higher at 25,285.35, and the Sensex ended 0.40% or 328.72 points higher at 82,500.82.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.