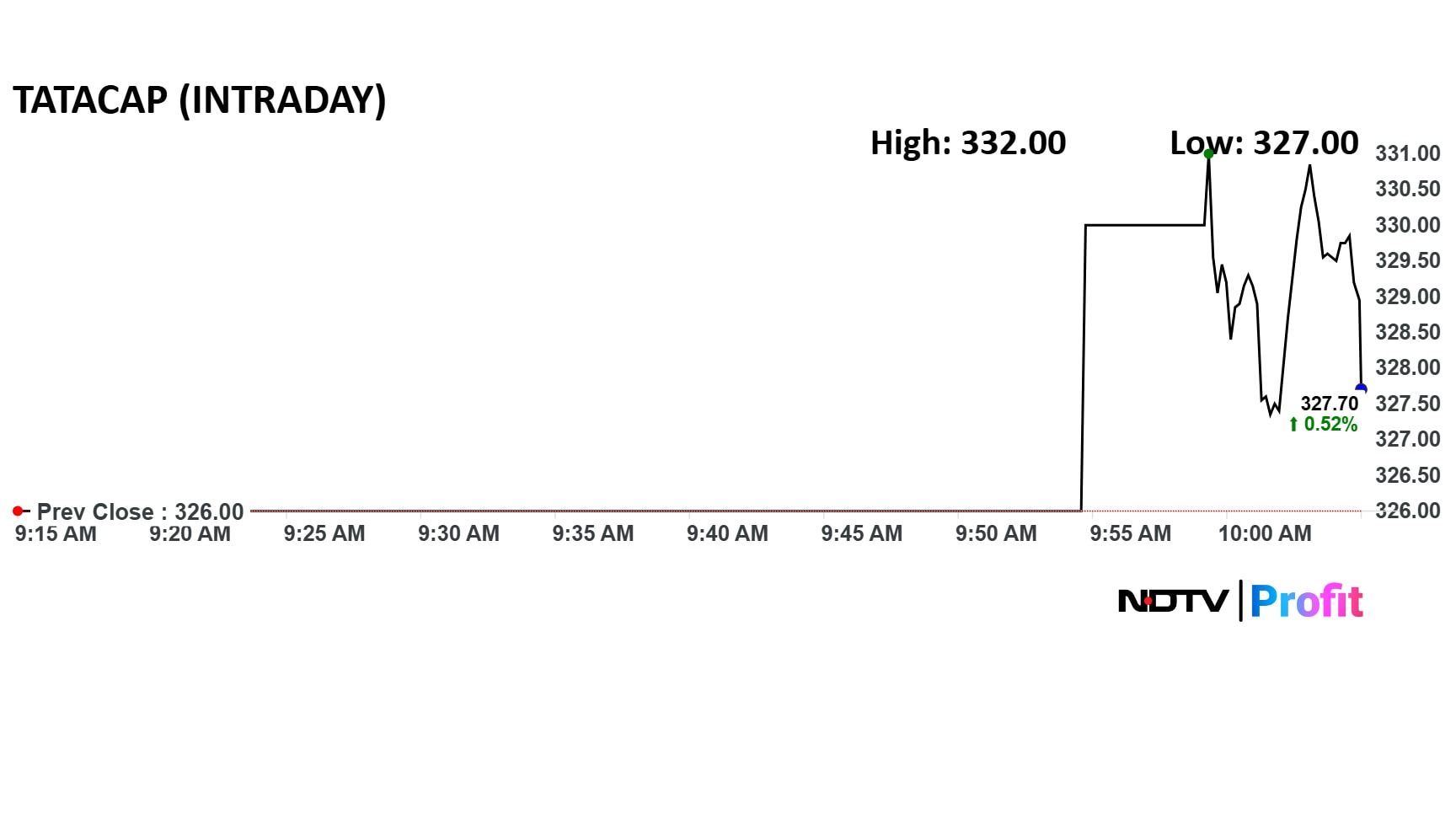

- Tata Capital Ltd. listed at Rs 330, a small premium over its Rs 326 IPO price

- Tata Capital is the 17th Tata Group company to be publicly traded on NSE and BSE

- The IPO was oversubscribed 1.95 times, with bids worth Rs 21,230 crore against an offer of Rs 15,511 crore

Tata Capital Ltd. listed at a small premium over its IPO price on Monday, becoming the 17th Tata Group company to be publicly traded. The share price opened at Rs 330 on both the NSE and BSE, compared to the issue price of Rs 326.

In the unlisted or grey market, shares of Tata Capital indicated no listing day gains.

Tata Capital share price managed to stay above the IPO price.

"Tata Capital has steadily chartered its own growth path in this ecosystem," Managing Director and CEO Saurabh Agrawal said during the listing ceremony at the NSE in Mumbai. "It took us 10 years to reach our first Rs 50,000 crore, but the latest Rs 50,000 crore was added in just one year. Tata Capital is defined by the breadth of our products and our best in class asset quality."

"Tata Capital has steadily chartered its own growth path in this ecosystem," Managing Director and CEO Saurabh Agrawal said.

The initial public offering of Tata Capital was oversubscribed 1.95 times on the third and final day of bidding on Oct. 8. The IPO received bids for worth Rs 21,230 crore against an offer of Rs 15,511.87 crore.

The Qualified Institutional Buyers (QIBs) booked the issue 3.42 times. The Non-Institutional Investors' (NIIs) category was subscribed 1.98 times. Retail investors booked their quota 1.10 times.

Tata Capital IPO was a book build issue of Rs 15,511.87 crore. It comprised a fresh issue of 21 crore shares worth Rs 6,846 crore and an offer-for-sale (OFS) of 26.58 crore shares amounting to Rs 8,665.87 crore.

The company will use proceeds from the IPO to augment its Tier–I capital base to meet future capital requirements, including onward lending. Further, a portion of the proceeds from the fresh issue will be used towards meeting offer expenses.

Domestic brokerage house Emkay Global initiated coverage on the stock with an 'Add' rating and a 12-month price target of Rs 360, a 10% potential upside over the IPO price.

Analysts at Master Capital Services Ltd. suggested IPO investors hold the stock for long-term and those who didn't get shares in the allotment can purchase when the price goes down.

Tata Capital is the flagship financial services company of the Tata group and a subsidiary of Tata Sons Pvt. Ltd., the holding company of the salt-to-software conglomerate.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.