Nifty gains more than 1% for the week, led by Eternal and Shriram Finance.

Sensex gains nearly 1% for the week.

Broader Market Indices outperformed Benchmark Indicies.

Nifty, Sensex snaps two weeks losing streak.

Nifty Midcap 150 and Smallcap 250 gain more than 2.5% each.

Cochin Shipyard gains more than 20% for the week.

Cochin Shipyard and FACT are the top gainers in Nifty Midcap 150.

Astrazeneca Pharma and Brigade Enterprises are the top gainers in Nifty small cap 250.

Nifty Midcap 150 gains for the second consecutive week.

Nifty small cap 250 gains for the fourth consecutive week.

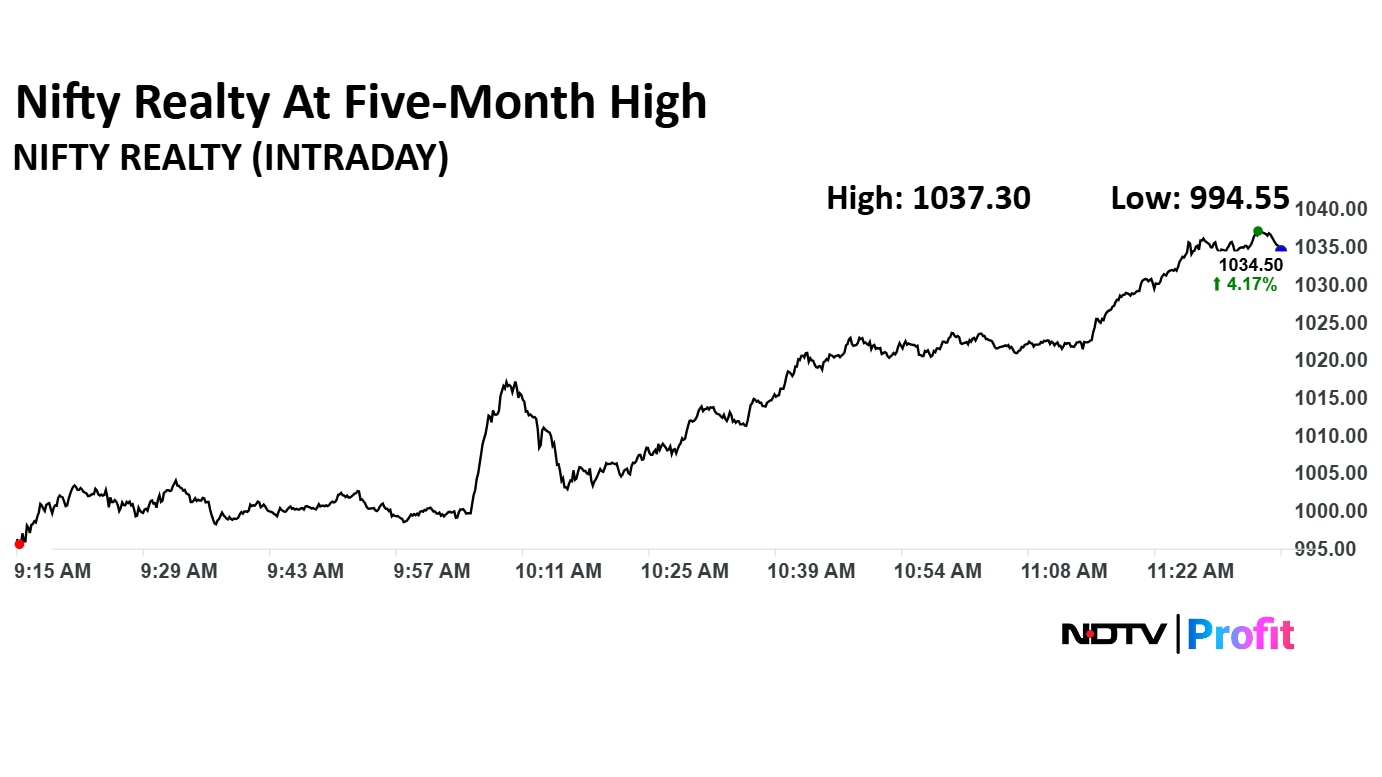

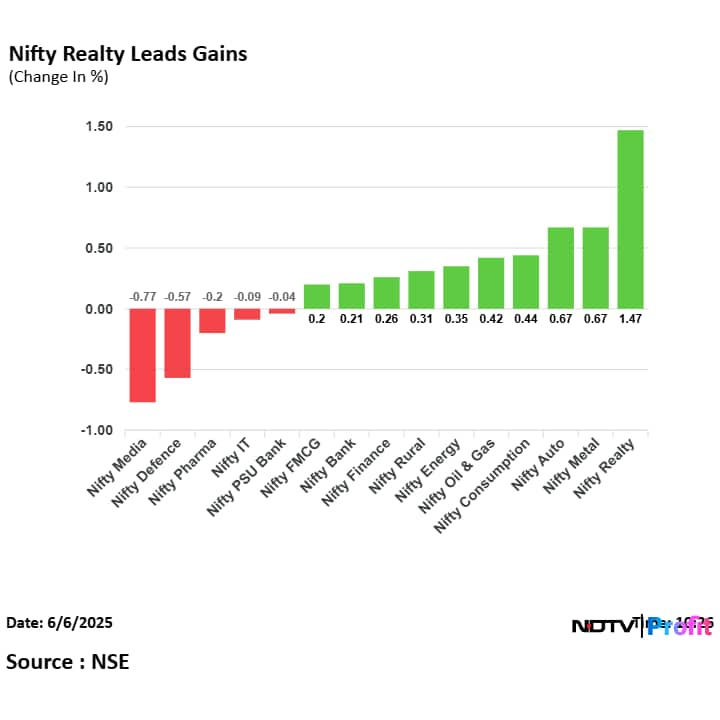

Nifty Realty gains more than 9% for the week, becomes the top performing sector for the week.

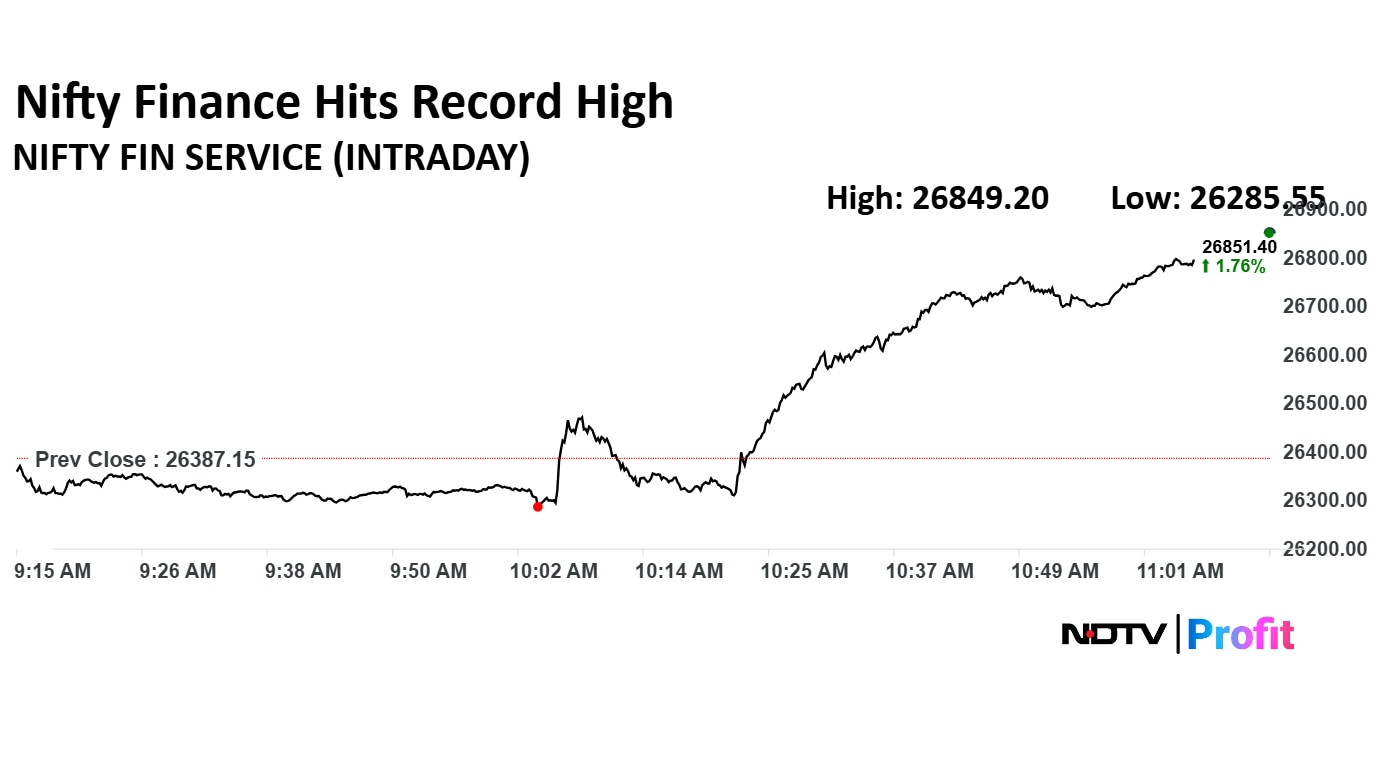

Nifty Realty, Financial Services, Nifty Bank, PSU Banks gains for the fourth consecutive week.

Nifty Metal gains more than 2% for the week, gains for the third consecutive day.

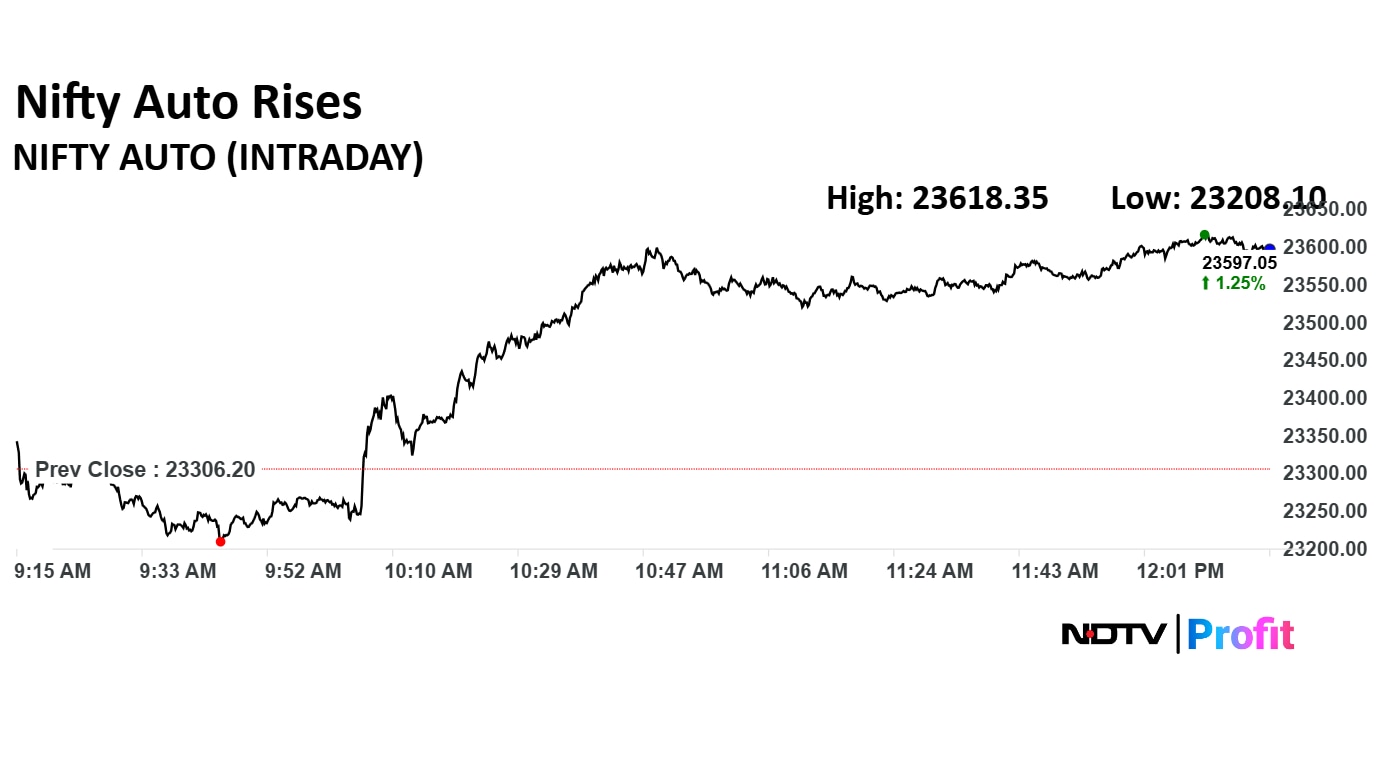

Nifty Auto, IT, FMCG snaps two week losing streak.

Nifty gains for the second week in a row.

Nifty snaps 4 week losing streak.

Nifty gains more than 1% for the week, led by Eternal and Shriram Finance.

Sensex gains nearly 1% for the week.

Broader Market Indices outperformed Benchmark Indicies.

Nifty, Sensex snaps two weeks losing streak.

Nifty Midcap 150 and Smallcap 250 gain more than 2.5% each.

Cochin Shipyard gains more than 20% for the week.

Cochin Shipyard and FACT are the top gainers in Nifty Midcap 150.

Astrazeneca Pharma and Brigade Enterprises are the top gainers in Nifty small cap 250.

Nifty Midcap 150 gains for the second consecutive week.

Nifty small cap 250 gains for the fourth consecutive week.

Nifty Realty gains more than 9% for the week, becomes the top performing sector for the week.

Nifty Realty, Financial Services, Nifty Bank, PSU Banks gains for the fourth consecutive week.

Nifty Metal gains more than 2% for the week, gains for the third consecutive day.

Nifty Auto, IT, FMCG snaps two week losing streak.

Nifty gains for the second week in a row.

Nifty snaps 4 week losing streak.

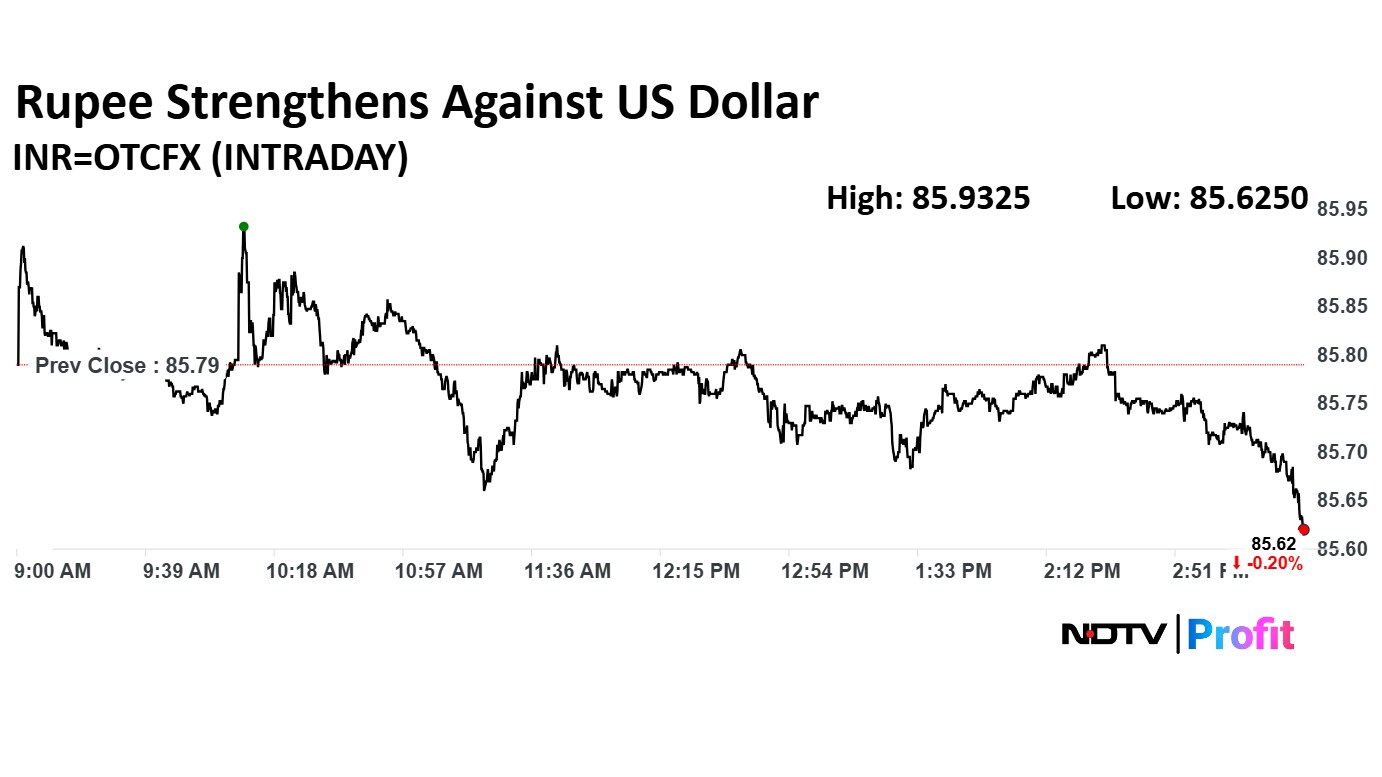

Rupee closed 16 paise stronger at 85.64 against US Dollar

It closed at 85.80 a dollar on Thursday.

Source: Bloomberg

Rupee closed 16 paise stronger at 85.64 against US Dollar

It closed at 85.80 a dollar on Thursday.

Source: Bloomberg

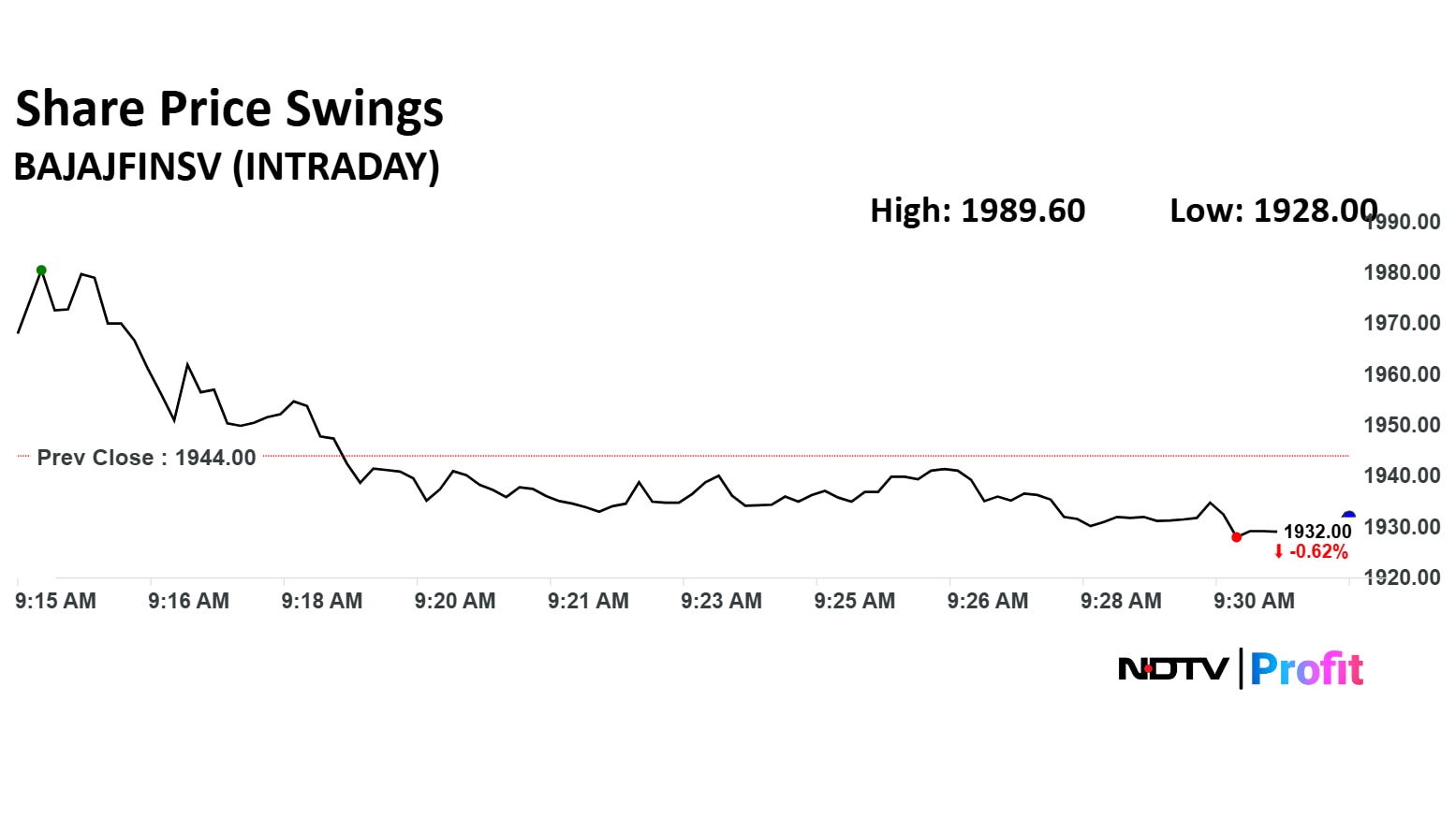

Bajaj Holdings & Investment sold 1.04 crore equity shares of Bajaj Finserv for Rs 2,002 crore via block deal, the company said in the exchange filing.

Larsen & Toubro Ltd. announced India’s first listed environmental social governance bond deal in partnership with HSBC, the company said in the exchange filing.

Housing & Urban Development Corp will raise funds through non-convertible debentures. The board approves to raise upto Rs 750 crore in bonds with 6.52% coupon.

Bajaj Finserv Ltd. saw its share price gain 2.35% before slipping 0.59% as promoters commenced a stake sale through a block deal. On Friday, 2.85 crore shares of Bajaj Finserv were exchanged in a substantial pre-market transaction.

The scrip rose as much as 2.35% but later slipped 0.59% to Rs 1,932.50 apiece.

Bajaj Finserv Ltd. saw its share price gain 2.35% before slipping 0.59% as promoters commenced a stake sale through a block deal. On Friday, 2.85 crore shares of Bajaj Finserv were exchanged in a substantial pre-market transaction.

The scrip rose as much as 2.35% but later slipped 0.59% to Rs 1,932.50 apiece.

Most markets across Eurozone decline Friday as concern rose about the US economy after unemployment claims rose more than expected. Moreover, Tesla Inc slumped over 14% following a virtual brawl between US President Donald Trump and Tesla CEO Elon Musk.

Euro Stoxx 50 and CAC 40 were trading 0.09% and 0.11% down, respectively as of 2:04 p.m. DAX fell 0.23%.

ZF Commercial Vehicle Control Systems India Ltd.'s promoter WABCO Asia will sell 3.16% stakes in the company, the company said in an exchange filing.

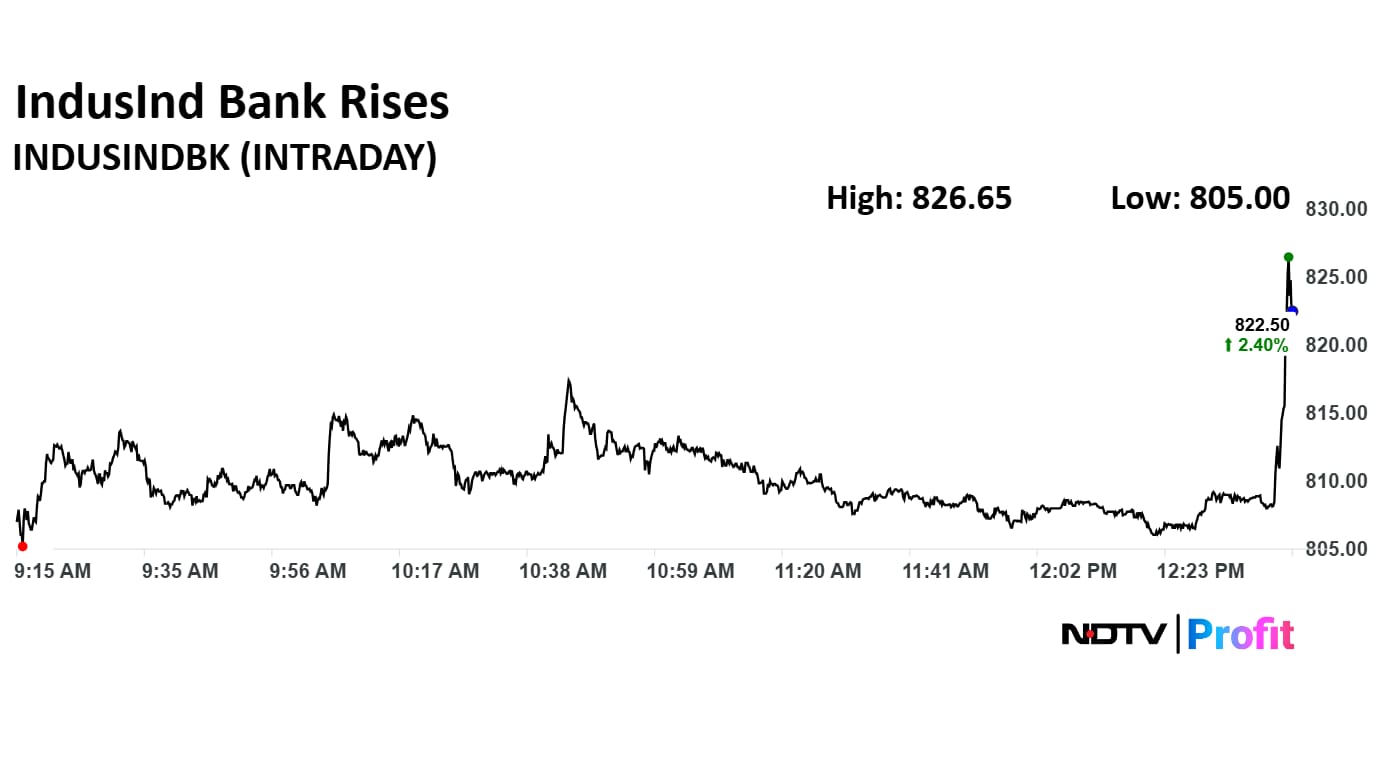

IndusInd Bank share price rose 3.76% to Rs 833.4 apiece after Reserve Bank of India Deputy Governor Swaminathan J said that the issue regarding the private lender will likely resolve soon. He said this in the post-policy press conference. Governor Sanjay Malhotra refrained from commenting on the bank.

IndusInd Bank share price rose 3.76% to Rs 833.4 apiece after Reserve Bank of India Deputy Governor Swaminathan J said that the issue regarding the private lender will likely resolve soon. He said this in the post-policy press conference. Governor Sanjay Malhotra refrained from commenting on the bank.

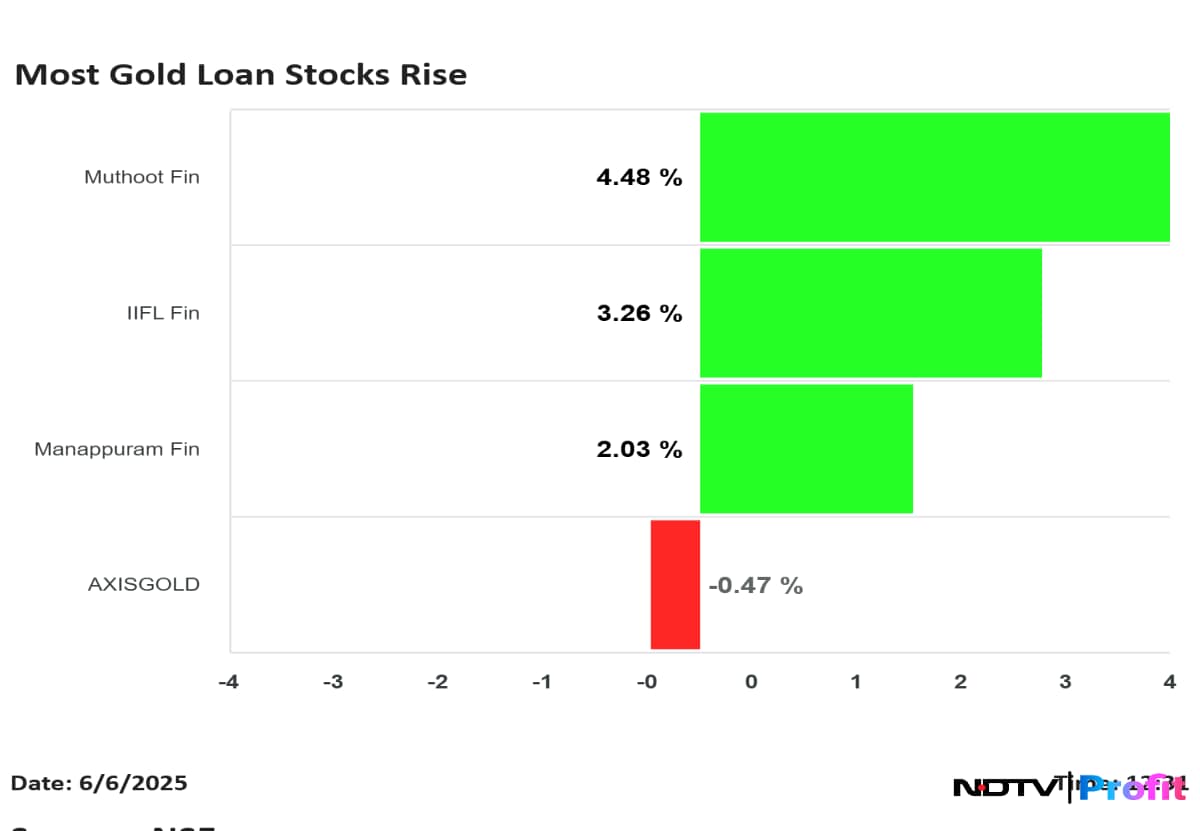

Shares of most gold loan companies rose after the Reserve Bank of India Governor Sanjay Malhotra said that loans amounting 2.5 lakh against the precious metal will likely be exempted from the upcoming latest Gold loan norms.

Last week, the Finance Ministry suggested RBI to exempt small borrowers in the draft gold loan norms. The Department of Financial Services suggested to exempt borrowers availing loans under Rs 2 lakh.

Shares of most gold loan companies rose after the Reserve Bank of India Governor Sanjay Malhotra said that loans amounting 2.5 lakh against the precious metal will likely be exempted from the upcoming latest Gold loan norms.

Last week, the Finance Ministry suggested RBI to exempt small borrowers in the draft gold loan norms. The Department of Financial Services suggested to exempt borrowers availing loans under Rs 2 lakh.

Indian equity markets surged on Friday after the Reserve Bank of India delivered a sharper-than-expected 50 basis points repo rate cut and shifted its policy stance from 'accommodative' to 'neutral'. The Nifty reclaimed the psychological 25,000 mark, while the Sensex jumped over 1,000 points from the day's lows.

Find out the factors behind markets' rally on Friday here.

The Nifty Auto rose as much as 1.20% intraday, following the Reserve Bank of India's Monetary Policy Committee decision to reduce the key lending rate by 50 basis points to 5.5%. This move is expected to stimulate economic activity by making borrowing cheaper for businesses and consumers.

The Nifty Auto rose as much as 1.20% intraday, following the Reserve Bank of India's Monetary Policy Committee decision to reduce the key lending rate by 50 basis points to 5.5%. This move is expected to stimulate economic activity by making borrowing cheaper for businesses and consumers.

KP Group has entered into three Memorandums of Understanding (MoUs) with Delta Electronics to enhance energy transmission solutions, KPI Green Energy said in an exchange filing.

The Reserve Bank of India's Monetary Policy Committee's post meet press conference started. Track live updates here.

The Nifty Realty index rose 4.47% to 1037.45, the highest level since Jan 6.

The Nifty Realty index rose 4.47% to 1037.45, the highest level since Jan 6.

"RBI monetary policy is 10/10, it has an all-round focus, maintaining growth momentum, by cutting rates by 50 bps, liquidity infusion by cutting CRR by 100 bps over the year and targeting inflation at 3.7%. “It is great to see both GOI fiscal policy and RBI monetary policy working in tandem to propel the Indian economy to a new growth trajectory. It augurs well for the industry and our country”Sadaf Sayeed, CEO, Muthoot Microfin

The NSE Nifty Financial Services index rose 1.89% to a record high of Rs 26,885.8. HDFC Bank Ltd. is the top contributor to the index. Financial services stocks are rising as rate cut and CRR cut both will infuse liquidity in the system and help policy transmission.

The NSE Nifty Financial Services index rose 1.89% to a record high of Rs 26,885.8. HDFC Bank Ltd. is the top contributor to the index. Financial services stocks are rising as rate cut and CRR cut both will infuse liquidity in the system and help policy transmission.

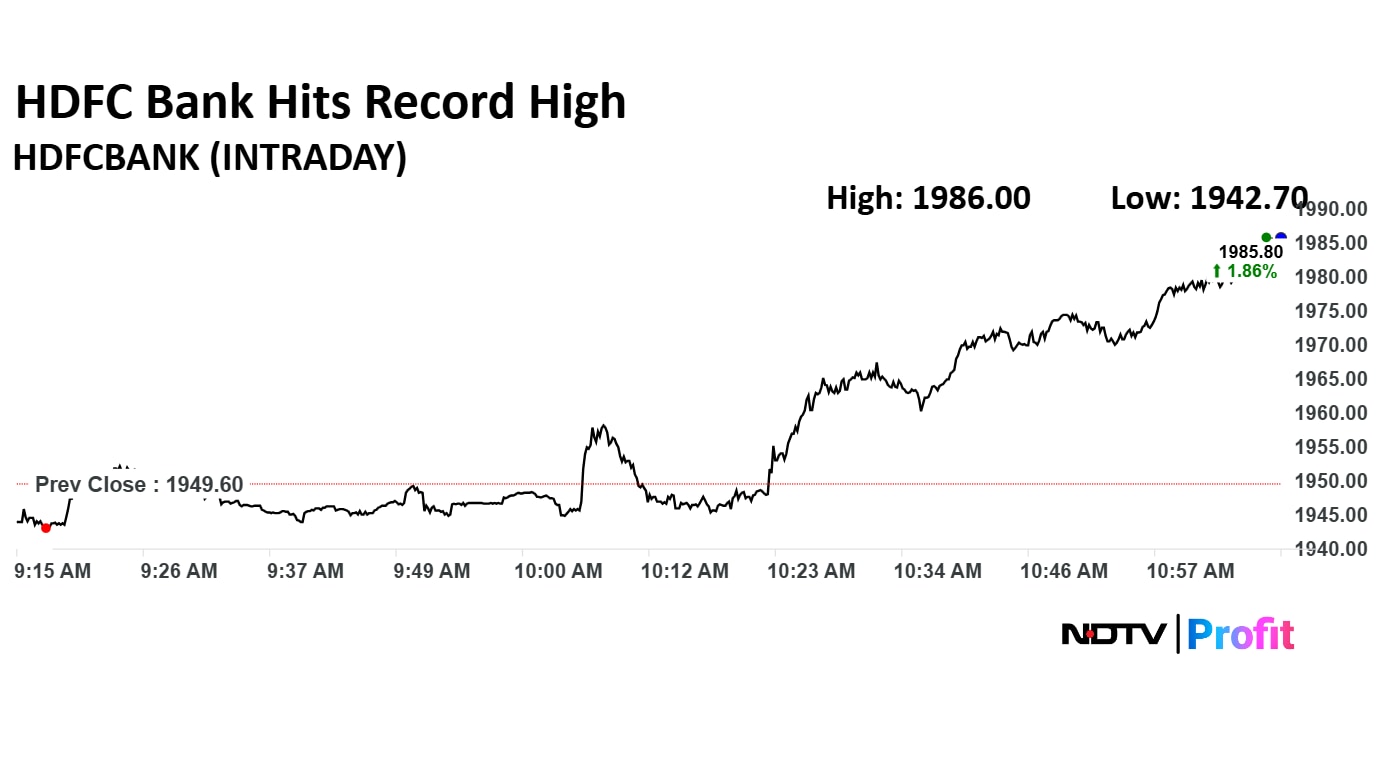

HDFC Bank Ltd. share price rose 2.01% to a record high of Rs 1,988.7 apiece. The stock is contributing the most to the Nifty 50 and Nifty Bank indices both.

HDFC Bank Ltd. share price rose 2.01% to a record high of Rs 1,988.7 apiece. The stock is contributing the most to the Nifty 50 and Nifty Bank indices both.

The NSE Nifty 50 and BSE Sensex both advanced 0.83% and 0.77% higher, respectively. The indices were trading at day's high as of 11:02 a.m.

The NSE Nifty 50 and BSE Sensex both advanced 0.83% and 0.77% higher, respectively. The indices were trading at day's high as of 11:02 a.m.

BEML Ltd. will pay final dividend of Rs 1.2 per share for financial year 2025, according to exchange filing.

The NSE Nifty Bank index rose 0.80% to a record high of 56,205 as HDFC Bank Ltd. and Axis Bank Ltd. share prices led. The Reserve Bank of India reduced repo rate by 50 basis points to 5.5% against 25-bps cut expected.

The central bank also reduced the cash reserve ratio by 100 basis points to 3% in the June policy meeting. These moves are expected to boost the monetary system of the country.

The NSE Nifty Bank index rose 0.80% to a record high of 56,205 as HDFC Bank Ltd. and Axis Bank Ltd. share prices led. The Reserve Bank of India reduced repo rate by 50 basis points to 5.5% against 25-bps cut expected.

The central bank also reduced the cash reserve ratio by 100 basis points to 3% in the June policy meeting. These moves are expected to boost the monetary system of the country.

The NSE Nifty Realty index rose the most compared to other sectoral indices after the Reserve Bank of India reduced rates more than expected. The central bank has also reduced Cash Reserve Ratio by 100 basis points.

The NSE Nifty Realty index rose the most compared to other sectoral indices after the Reserve Bank of India reduced rates more than expected. The central bank has also reduced Cash Reserve Ratio by 100 basis points.

The 10-year bond yield recovered to trade flat at 6.25%

Earlier, it yield on the 10-year bond falls 13 basis points to 6.13%

Source: Bloomberg

Rupee weakened 21 paise to 86.01 against US Dollar

It closed at 85.80 a dollar on Thursday.

Source: Bloomberg

The yield on the 10-year bond falls 13 basis points to 6.13%, the lowest level since Sept 23, 2021.

Source: Bloomberg

Azad Engineering received multiple large deals worth Rs 421 crore between Rs 1,603 and Rs 1,643. Volumes are at 21 times their 30 day average. Over 25.87 lakh shares traded across multiple large trades.

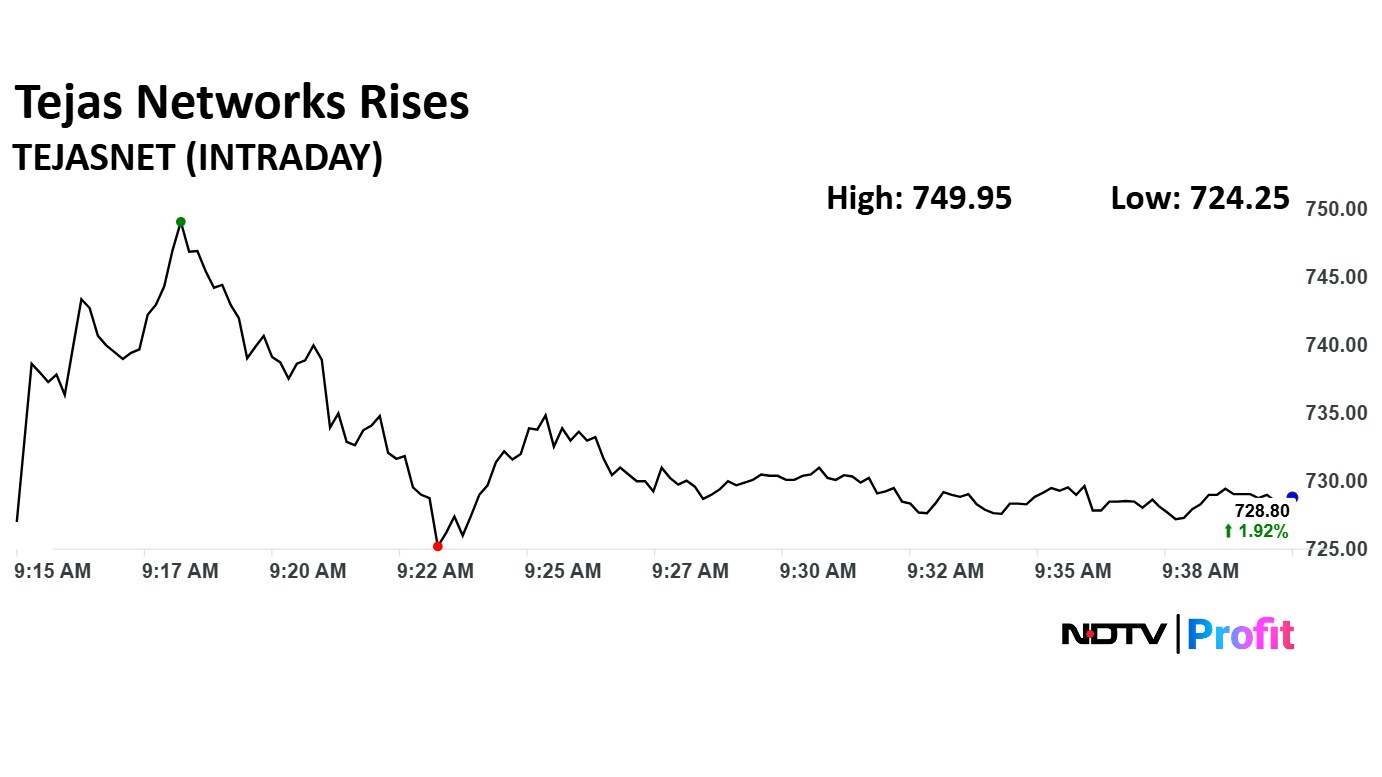

Tejas Networks Ltd. share price advanced in Thursday's session as the company receiving grants worth Rs 123 crore from the Ministry of Communication.

Tejas Networks Ltd. share price advanced in Thursday's session as the company receiving grants worth Rs 123 crore from the Ministry of Communication.

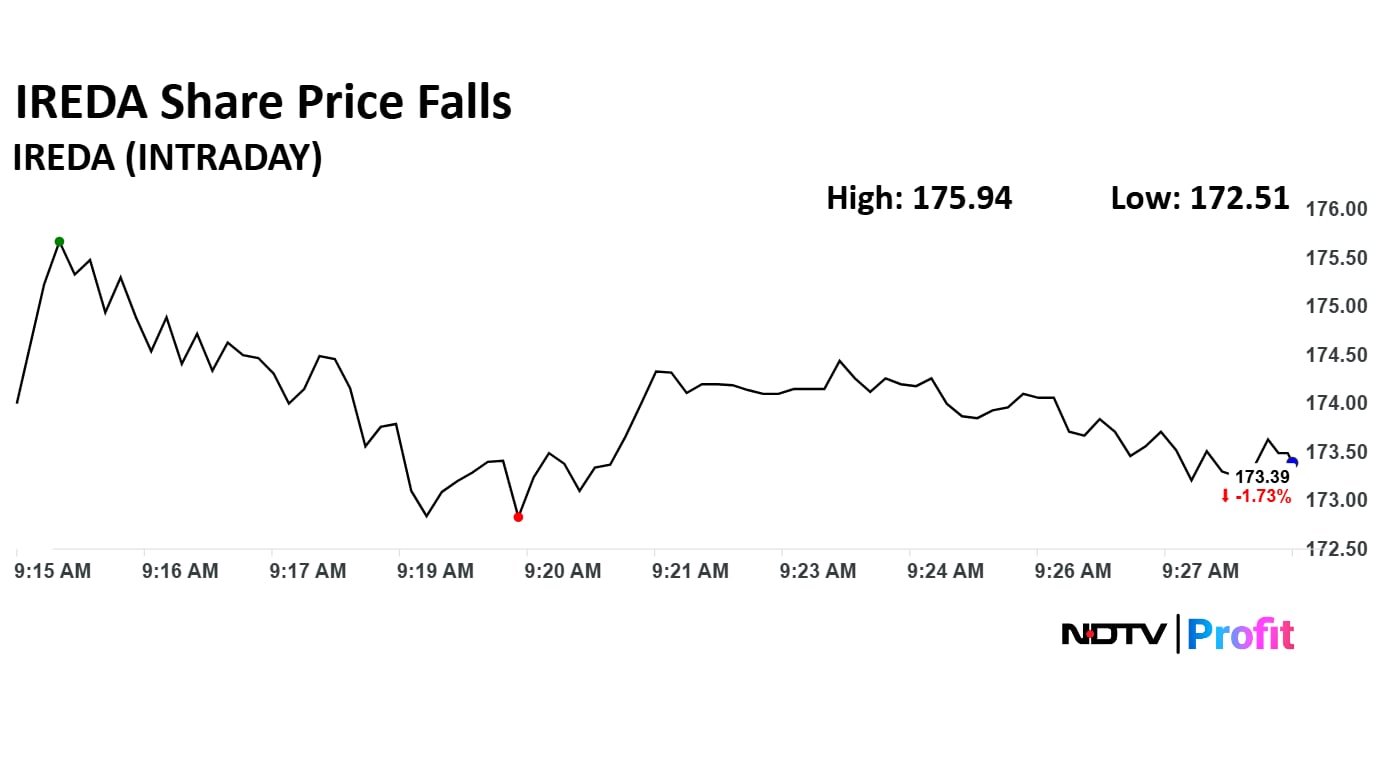

The Indian Renewable Energy Development Agency Ltd. saw its share price drop 2.23% after the board approved a fundraising initiative of up to Rs 5,000 crore through a qualified institutional placement. The board has set the floor price at Rs 173.83 per share, with the possibility of offering a discount of up to 5% on this price.

The Indian Renewable Energy Development Agency Ltd. saw its share price drop 2.23% after the board approved a fundraising initiative of up to Rs 5,000 crore through a qualified institutional placement. The board has set the floor price at Rs 173.83 per share, with the possibility of offering a discount of up to 5% on this price.

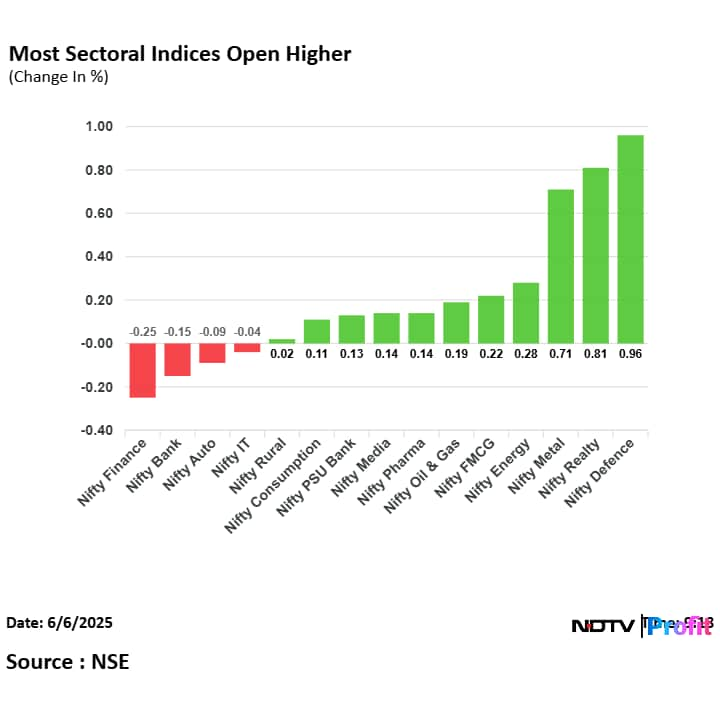

On NSE, 10 sectoral indices advanced, three sectoral indices declined, and two remained flat out of 15. The NSE Nifty Defence rose the most, and the Nifty Finance declined the most.

On NSE, 10 sectoral indices advanced, three sectoral indices declined, and two remained flat out of 15. The NSE Nifty Defence rose the most, and the Nifty Finance declined the most.

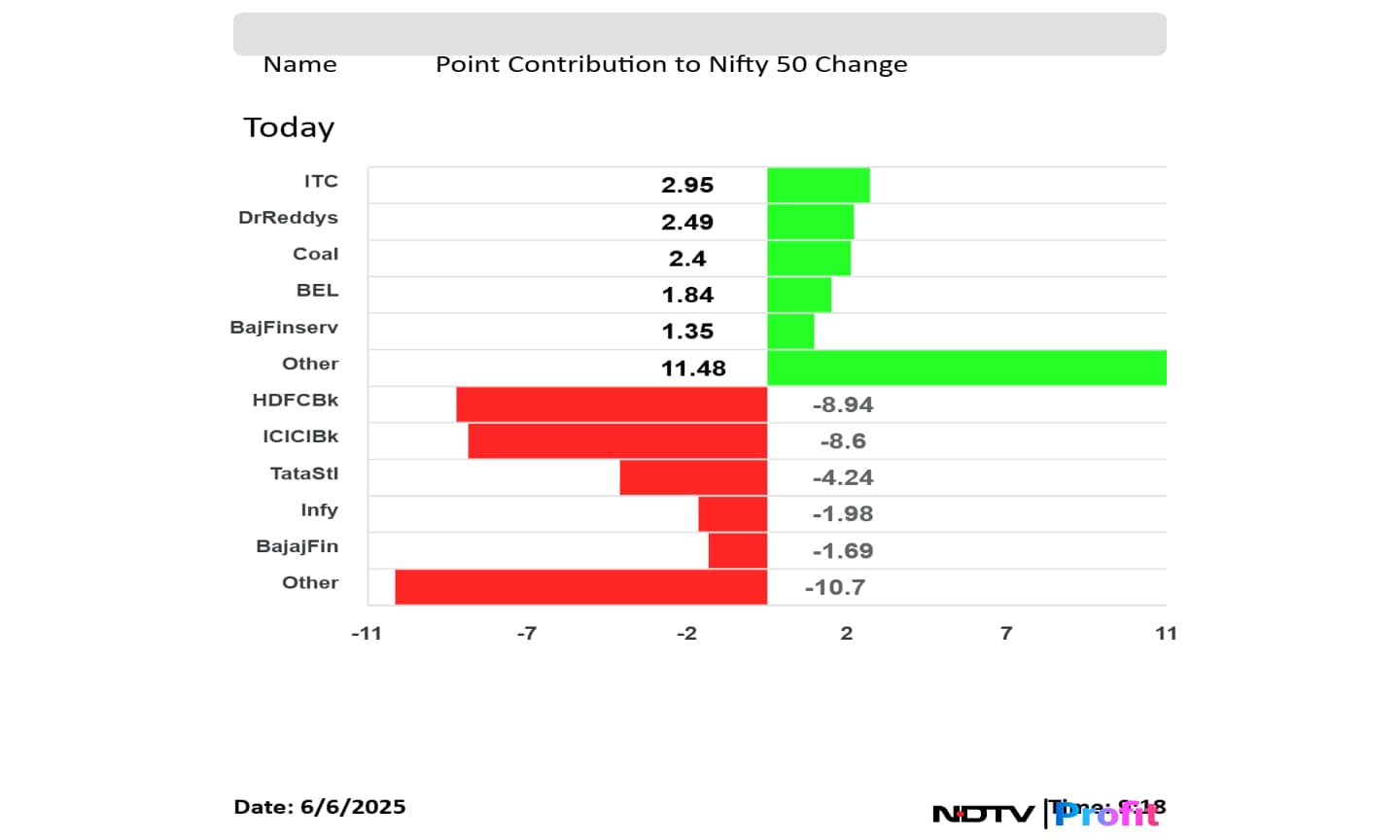

HDFC Bank Ltd., ICICI Bank Ltd., Tata Steel Ltd., Infosys Ltd., and Bajaj Finance Ltd. weighed on the Nifty 50 index.

ITC Ltd., Dr. Reddy's Laboratories Ltd., Coal India Ltd., Bharat Electronics Ltd., and Bajaj Finserv Ltd. limited losses to the Nifty 50 index.

HDFC Bank Ltd., ICICI Bank Ltd., Tata Steel Ltd., Infosys Ltd., and Bajaj Finance Ltd. weighed on the Nifty 50 index.

ITC Ltd., Dr. Reddy's Laboratories Ltd., Coal India Ltd., Bharat Electronics Ltd., and Bajaj Finserv Ltd. limited losses to the Nifty 50 index.

The NSE Nifty 50 and BSE Sensex opened flat on Friday as investors remained on the sidelines before the Reserve Bank of India's rate decision. Most traders expect the central bank to deliver a quarter-basis-point rate cut.

HDFC Bank Ltd. and ICICI Bank Ltd. were top detractors of the Nifty 50 index.

The Nifty 50 and Sensex were trading 0.02% and 0.08% down respectively as of 9:23 a.m.

The NSE Nifty 50 and BSE Sensex opened flat on Friday as investors remained on the sidelines before the Reserve Bank of India's rate decision. Most traders expect the central bank to deliver a quarter-basis-point rate cut.

HDFC Bank Ltd. and ICICI Bank Ltd. were top detractors of the Nifty 50 index.

The Nifty 50 and Sensex were trading 0.02% and 0.08% down respectively as of 9:23 a.m.

At pre-open, the NSE Nifty 50 was trading 0.01% down at 24,748.70, and the BSE Sensex was trading 0.01% down at 81,436.44.

The yield on the 10-year bond opened flat 6.25%

Source: Bloomberg

Rupee opened 6 paise weaker at 85.86 against US Dollar

It closed at 85.80 a dollar on Thursday.

Source: Bloomberg

First quarter FY26 spreads improve on better pricing

Cement spreads a leading indicator on industry unitary EBITDA

Our estimate suggests Rs. 165/ ton improvement for industry

Prices are up 12/ bag

Remain positive on the space led by higher volumes in FY26

Prefer large caps players like Ambuja, Ultratech, Shree Cement and Ramco

Urban lags rural but urban is where distribution is being challenged

Home and personal care companies fared worse with 4% YoY sales growth and a slight decline in Ebitda

Food and beverage fared a little better with 7% YoY sales growth and slight growth in Ebitda

QSR companies fared better with high-teen growth. -Overall, discretionary

consumption did better than staples.

Prefers F&B over HPC.

Top picks are Eternal, Swiggy, DMart, Varun Beverages, Britannia and Nestle.

Bearish on Hindustan Unilever, Godrej Consumer, Marico, Jubilant Foodworks, Asian Paints and ABFRL.

Investors keenly await the outcome of the Reserve Bank of India Monetary Policy Committee meet outcome, scheduled later today. A 25-basis-point rate cut is expected. Inflation and growth projections will be crucial to get fresh cues about the central bank's monetary policy going ahead.

Track live updates on RBI MPC Policy here.

RBI likely to cut rates

Inflation expected to stay below forecasts

Banking system liquidity highest in 3yrs

Sequential improvement seen in AngelOne numbers

Finance facility to buy health insurance gaining ground

IIFL Finance to higher bankers to beef up UHNI team

Zerodha sees 10-20% lower broking revenue in FY26

Morgan Stanley updated its "Risk Reward" analysis for Ashok Leyland

Rated overweight; increased price target from Rs 284.00 to Rs 288.00.

Target increase as positive impact of stronger net cash position outweighed lower EBITDA estimates.

Cut their domestic MHCV volume estimates by 2% for FY26, anticipating slower demand.

Increased their export volume estimates due to continued strong performance internationally.

Overall, their total volume estimates remain broadly unchanged.

Weaker realizations in Q4FY25 toned down Average Selling Price estimates for FY26 and FY27.

Despite margin cuts EPS estimates for FY26 and FY27 remained largely unchanged

Gold prices rose on Friday as unexpected increase in initial jobless claims raised hopes for a cut from the US Federal Reserve. Lower borrowing costs support bullion prices.

The Bloomberg spot gold was trading 0.32% higher at $3,363.38 an ounce as of 8:02 a.m.

Share indices in Asia-Pacific region rose on Friday as leaders of US and China held a call and agreed to further talk on trade related matters. Last week, concerns rose about two largest economies' trade relation after US President Donald Trump accused China of violating terms of the deal done in Switzerland.

The CSI 300 and S&P ASX 200 were 0.20% and 0.11% higher as of 7:33 a.m.

US share indices ended lower on Thursday as Tesla Inc stock slump weighed on heavyweight technology shares. Tesla Inc slumped over 14% because of virtual brawl between Elond Musk and President Donald Trump over the latest tax cut bill.

The Dow Jones Industrial Average fell 0.25% at 42,319.74. The S&P 500 fell 0.53% at 5,939.30. The Nasdaq 100 Futures fell 0.07% at 21,567.75

The GIFT Nifty was trading 0.06% or 15 points higher at 24,849.00 as of 6:34 a.m., which implied a higher open. Investors keenly await outcome of the Reserve Bank of India's Monetary Policy Committee meeting, scheduled for later today.

Investors will keep an eye on Ashok Leyland Ltd., Bajaj Finserv Ltd., Coal India Ltd., JSW Energy Ltd., and Life Insurance Corp shares because of the news flow overnight.

The benchmark equity indices closed higher for second straight session on Thursday, after ending a three-day losing streak on Wednesday.

The NSE Nifty 50 ended 130 points, or 0.53% higher at 24,750, while the BSE Sensex closed 443.79 points, or 0.55% up at 81,442.

Comprehensive Budget 2026 coverage, LIVE TV analysis, Stock Market and Industry reactions, Income Tax changes and Latest News on NDTV Profit.