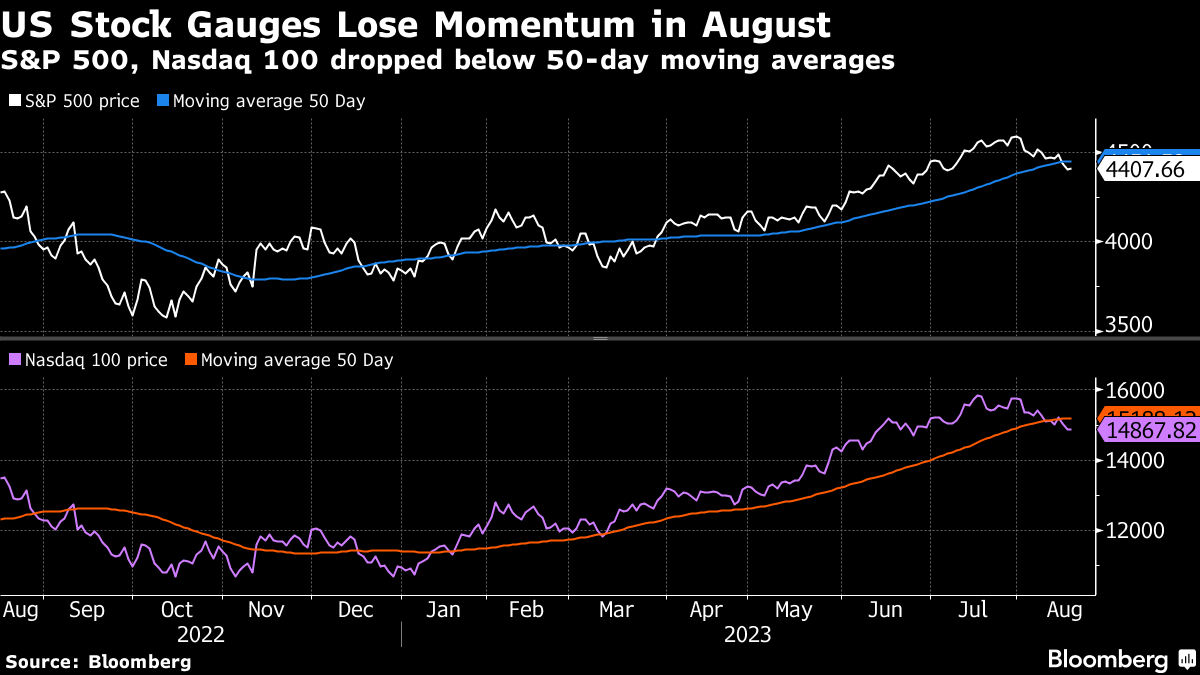

(Bloomberg) -- US stocks took a leg down putting equities back on track for a three-day slump as a global bond market selloff intensified.

The S&P 500 and Nasdaq 100 edged down in afternoon trading with tech behemoths like Apple Inc. and Intel Inc. weighing on the benchmarks. Investors are losing faith that the Federal Reserve is done raising interest rates after minutes from the last meeting suggested officials are considering tighter policy. The 10-year Treasury yield rose as much as 8 basis points to 4.33% on Thursday, approaching the highest level since 2007.

Data from before the New York market opened showed the labor market remains healthy, doing little to change the narrative.

“This week's data hasn't given them any reason to let their guard down,” said Mike Loewengart at Morgan Stanley Global Investment Office. “With housing starts, retail sales, and jobless claims all reinforcing the picture of a robust economy, another rate hike can't be ruled out, even if the Fed remains on hold next month.”

Investors will soon be turning to next week's gathering of policy makers at Jackson Hole in Wyoming to gauge Fed sentiment.

The moves across bond markets have been sharp and swift this week. Treasuries have been a key driver of the global debt selloff as resilience of the world's largest economy defies expectations that a run of Federal Reserve interest-rate hikes would spark a recession.

Read More: Global Yields March to 15-Year Highs as Rate-Hike Worries Build

“Our baseline is the Fed will not likely alter rates at the next meeting but the following meeting decision is yet to be determined,” Jeffrey Roach, chief economist at LPL Financial, wrote. “Treasury yields are hitting new highs as investors reset expectations about long-term inflation.”

In the UK, the surge in gilt yields comes after sticky inflation and strong wage data boosted investor bets that the Bank of England will need to raise interest rates further to 6% and keep them high for longer. Japan's 20-year bond yield surged after a debt auction drew tepid investor demand.

China also continued to weigh on sentiment. The picture emerging from property agents and private data providers suggest the slump in the real estate market may be worse than official reports show.

China ramped up its efforts to stem losses in its currency on Thursday by offering the most forceful guidance since October through its daily reference rate for the managed currency. Authorities told state-owned banks to step up intervention in the currency market this week, in a push to prevent a surge in yuan volatility, according to people familiar with the matter.

Meanwhile, the dollar took a breather from a five-day climb while the pound continued to outperform. Crude halted a three-day drop while gold edged up after closing below $1,900 an ounce for the first time since March.

Key events this week

- Eurozone CPI, Friday

Some of the main moves in markets:

Stocks

- The S&P 500 fell 0.3% as of 2:20 p.m. New York time

- The Nasdaq 100 fell 0.6%

- The Dow Jones Industrial Average fell 0.4%

- The MSCI World index fell 0.5%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro fell 0.2% to $1.0859

- The British pound was unchanged at $1.2732

- The Japanese yen was little changed at 146.28 per dollar

Cryptocurrencies

- Bitcoin fell 3.4% to $27,969.66

- Ether fell 3.7% to $1,741.39

Bonds

- The yield on 10-year Treasuries advanced seven basis points to 4.32%

- Germany's 10-year yield advanced six basis points to 2.71%

- Britain's 10-year yield advanced 10 basis points to 4.75%

Commodities

- West Texas Intermediate crude rose 1% to $80.17 a barrel

- Gold futures fell 0.7% to $1,914.90 an ounce

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Isabelle Lee, Alex Nicholson, Richard Henderson and Alice Gledhill.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.