(Bloomberg) -- The world's biggest bond market got hammered as a solid US jobs report made traders dial back their bets on Federal Reserve rate cuts.

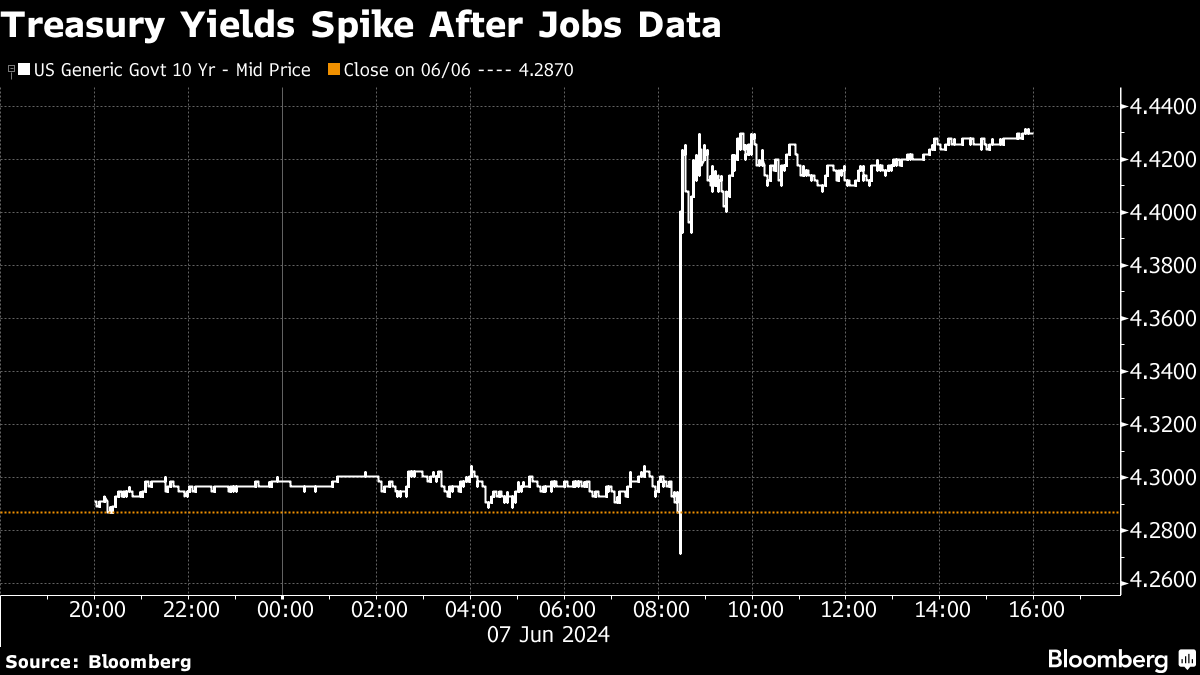

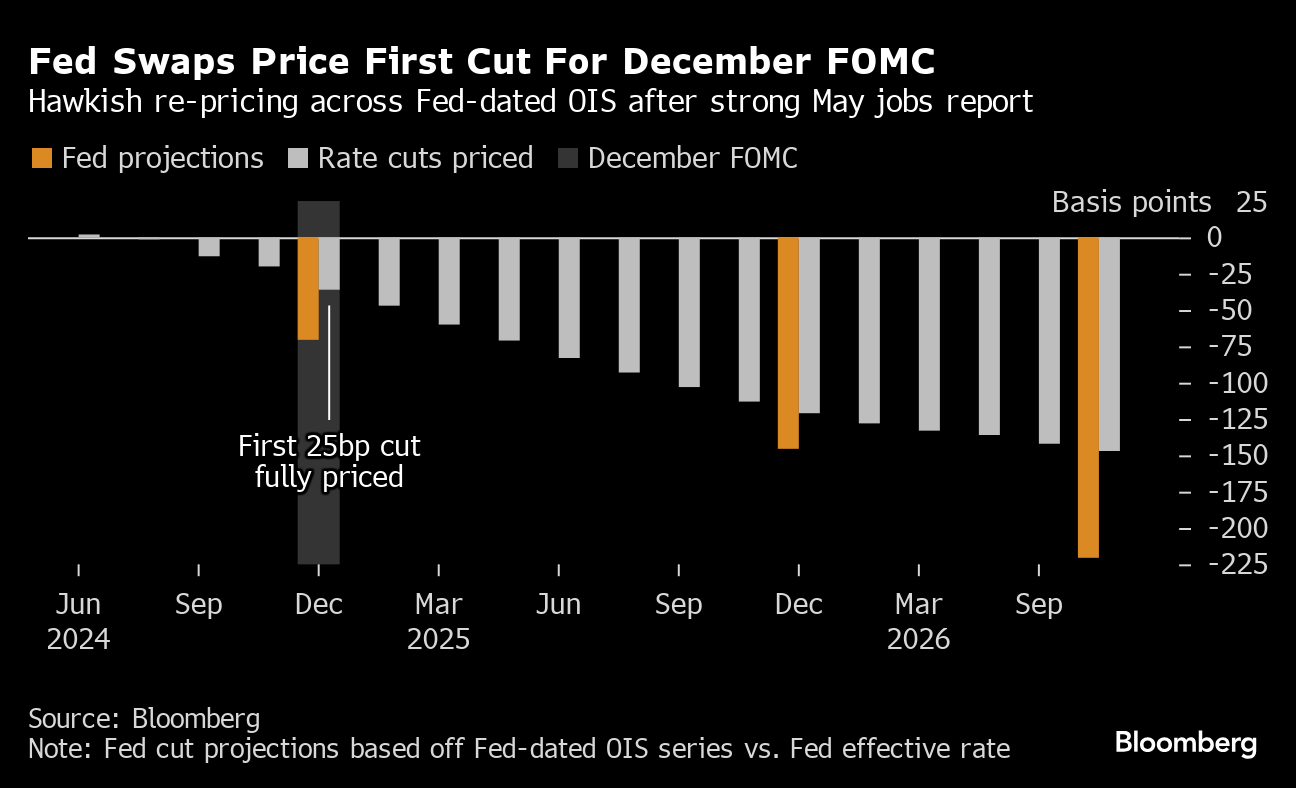

A selloff in Treasuries drove yields up over 10 basis points, with swaps no longer pricing in a Fed reduction before December. Nonfarm payrolls advanced 272,000 — beating estimates — and wages accelerated. The unemployment rate increased to 4%. Equities closed well off session lows as the data helped quell fears about an economic slowdown that could hurt Corporate America.

To Bret Kenwell at eToro, the jobs report is sort of a mixed bag. On the one hand, it calms worries the US is moving toward some sort of economic cliff. On the other hand, it pushes back bets on Fed easing.

“Today's jobs report may lower rate-cut expectations,” Kenwell said. “But at the end of the day, a strong labor market is hardly a bad thing — especially for an economy that's so dependent on consumer spending.”

The S&P 500 fell 0.1%, with all megacaps but Apple Inc. down. Banks rose. GameStop Corp. plunged after Keith Gill's appearance on the “Roaring Kitty” stream on YouTube — as well as the video-game retailer's unexpected earnings report and plans to sell up to 75 million additional shares.

Treasury 10-year yields jumped 14 basis points to 4.43%. The dollar climbed the most since January. Gold, silver and copper tumbled. Oil also fell. Bitcoin sank below $70,000.

To Jeff Schulze at ClearBridge Investments, Friday's jobs report likely takes a September rate cut off the table.

“The Fed can have patience and remain data-dependent over the next quarter to ensure that inflation is moving sustainably back to target,” he noted.

Swap traders had escalated rate-cut bets earlier in the week, emboldened by a slew of softer-than-forecast US economic data, the Bank of Canada's decision to ease monetary policy, and bets the European Central Bank would be the next to cut — a move that was confirmed by the ECB on Thursday.

The latest jobs figures highlight a labor market that continues to defy expectations and blunt the impact on the economy from high interest rates and prices. That strength risks keeping inflationary pressures stubborn, which will likely reinforce the Fed's cautious stance.

“We still expect the Fed to cut rates in September, but another set of prints like today's would likely also take that off the table,” said Seema Shah at Principal Asset Management. “The positive news, however, is that with a labor market this strong, the US economy is nowhere near recession territory.”

Economists at Citigroup Inc. and JPMorgan Chase & Co., among the few who were still predicting a Fed cut in July, changed their calls after the jobs report. Citi's Andrew Hollenhorst now sees cuts in September, November and December. JPMorgan's Michael Feroli predicts a Fed reduction in November.

This is one of the last major reports Fed officials will see before Wednesday's rate decision, when they're forecast to keep borrowing costs at a two-decade high. A key inflation print — the Consumer Price Index — is due on the same day.

While the strong US payrolls data underscore no urgency for the Fed to cut, it's inflation — not jobs — that will decide that, according to Krishna Guha at Evercore.

“Next week's CPI could help clarify whether the US is enjoying a ‘Goldilocks' moment of decelerating inflation combined with resilient employment or whether inflationary pressures are persisting,” said Ronald Temple at Lazard.

The June Fed meeting will be one of the most-pivotal this year as Chair Jerome Powell may provide the clearest hint yet to the rate-cut timetable, according to Anna Wong at Bloomberg Economics.

With the Fed widely expected to stay on hold, the focus of the meeting will be the new Summary of Economic Projections. Back in March, Fed officials maintained their outlook for three rate cuts in 2024.

“The new ‘dot plot' likely will indicate two 25-basis-point cuts this year,” Wong said.

Some of the main moves in markets:

Stocks

- The S&P 500 fell 0.1% as of 4 p.m. New York time

- The Nasdaq 100 fell 0.1%

- The Dow Jones Industrial Average fell 0.2%

- The MSCI World Index fell 0.3%

Currencies

- The Bloomberg Dollar Spot Index rose 0.8%

- The euro fell 0.8% to $1.0800

- The British pound fell 0.5% to $1.2721

- The Japanese yen fell 0.7% to 156.75 per dollar

Cryptocurrencies

- Bitcoin fell 2.1% to $69,185.63

- Ether fell 3.1% to $3,679.9

Bonds

- The yield on 10-year Treasuries advanced 14 basis points to 4.43%

- Germany's 10-year yield advanced seven basis points to 2.62%

- Britain's 10-year yield advanced nine basis points to 4.26%

Commodities

- West Texas Intermediate crude fell 0.3% to $75.30 a barrel

- Spot gold fell 3.7% to $2,288.74 an ounce

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Divya Patil, Sujata Rao and Elizabeth Stanton.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.