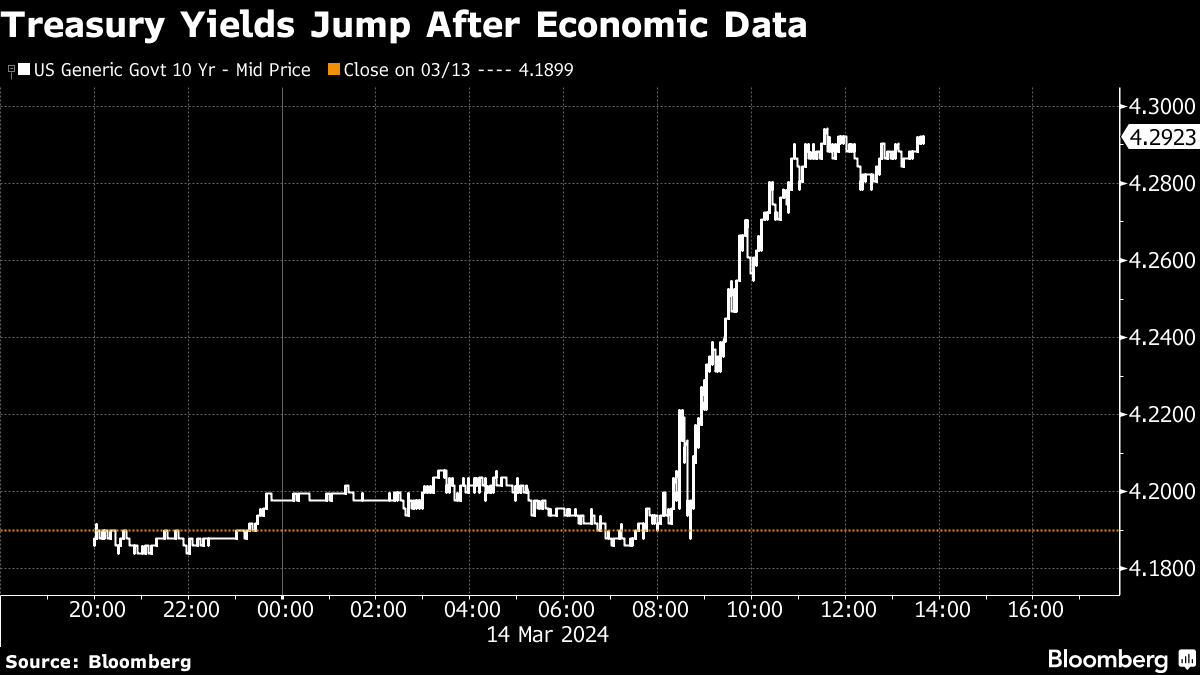

(Bloomberg) -- The world's biggest bond market sold off after another hot inflation report reinforced bets the Federal Reserve will be in no rush to cut rates even as some areas of the economy show signs of sluggishness.

Treasury yields rose as the data underscored the challenges the Fed faces in achieving the “last mile” toward its inflation goal. Following the steps of the consumer-price data, the producer price index also signaled a pickup in cost pressures. Meantime, retail sales showed signs of weakening. While it's probably way too early to draw any conclusions, the set of figures raised some eyebrows about the specter of stagflation.

“Well, this is a pickle,” said Chris Low at FHN Financial. “On the heels of a second steamy CPI, and just a week before the Fed meeting, the February PPI rises at twice the expected pace — while retail sales were ‘meh' at best, if not downright weak.”

Benchmark 10-year yields climbed 10 basis points to 4.29%. Fed swaps trimmed the odds of policy easing in 2024, with cuts now likely starting in July. The S&P 500 fell to around 5,140. Nvidia Corp. and Tesla Inc. once again led losses in megacaps. Homebuilders sank after Lennar Corp.'s weak forecast. The dollar rose against all of its developed-market peers. Oil hit $81.

To Ian Lyngen at BMO Capital Markets, there was nothing within this set of economic updates that will offer anything new for next week's Fed meeting. It's only a couple of prints and “insufficient” to draw any broad-based conclusion, he noted.

“In a way, today was the past month in microcosm — sticky inflation combined with signs of softness elsewhere in the economy,” said Chris Larkin at E*Trade from Morgan Stanley. “The questions now are, will traders rethink how soon the Fed will cuts rates, and will that slow down the stock market rally in any meaningful way?”

Michael Shaoul at Marketfield Asset Management says the February's producer price index suggests the tailwind of “transitory” inflation dropping out of the economy has ended — with input prices threatening to become a headwind later in 2024 if the commodity rally finds some legs.

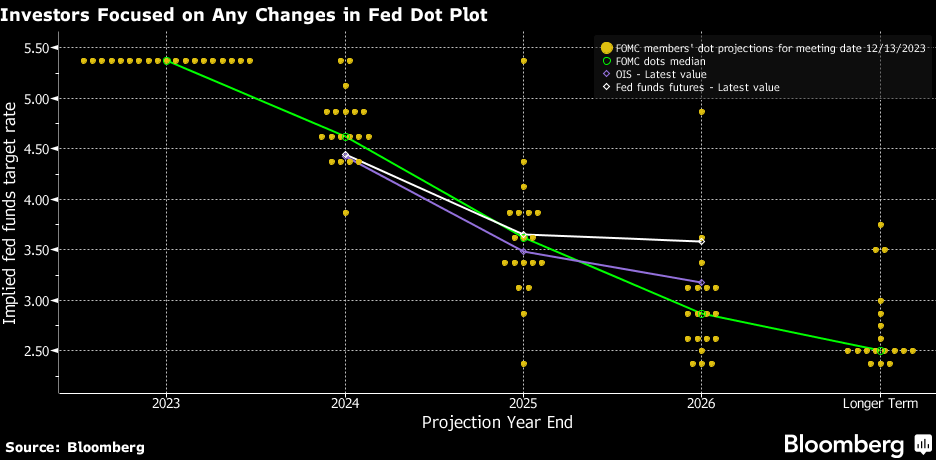

The Fed is expected to keep rates unchanged at the March 19-20 meeting for the fifth straight gathering. Coming on the heels of reports warning of persistently high inflation, there's a lot riding for the Treasury market from the Fed's new so-called dot-plot. The median forecast of Fed policymakers in December showed three quarter-point rate reductions for 2024.

“The inflation numbers are just not giving the Fed any incentive to ease,” said Andrew Brenner at NatAlliance Securities.

With February's CPI and PPI data in hand, Bloomberg Economics estimates that the core PCE deflator — the Fed's preferred inflation indicator — and core services excluding housing, known as “supercore,” will both moderate.

While the February PPI was stronger than expected, the details that affect PCE inflation were on the “softer side,” according to Bank of America Corp. economists including Michael Gapen.

“We continue to expect the Fed will start its cutting cycle in June,” they said. “However, it will need to see more improvement in the upcoming inflation data to have enough confidence to begin to ease.”

Amid all the uncertainties, equities also struggled to pick up any traction.

“Mixed overall would be our ruling on the reports in aggregate — which may continue to drive ‘choppy trading' in stocks over the short run,” said Dan Wantrobski at Janney Montgomery Scott .

Meantime, soaring valuations of a few megacaps have pushed some market observers to worry about a bubble.

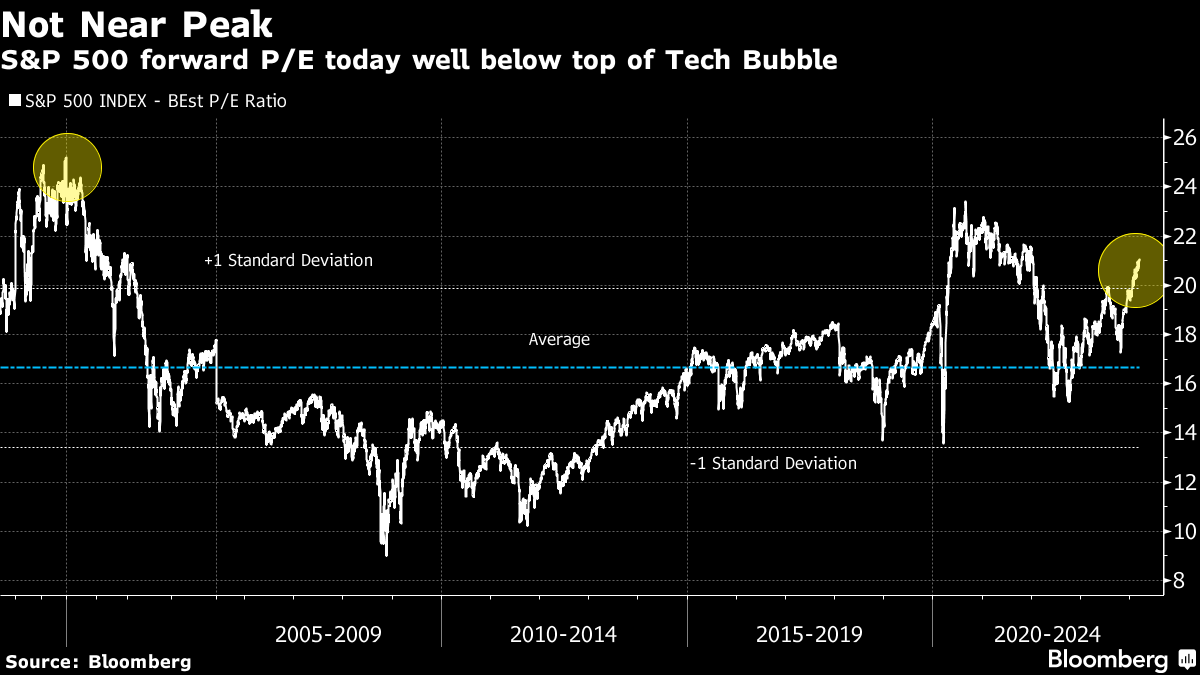

Markets are showing characteristics of a bubble in the record-setting surge by tech's so-called Magnificent Seven stocks and the all-time highs in cryptocurrencies, according to Bank of America Corp.'s Michael Hartnett.

With inflation re-accelerating, growth a little soft and risk assets unscathed, “that is very symptomatic of a bubble mentality,” Hartnett told Bloomberg Television.

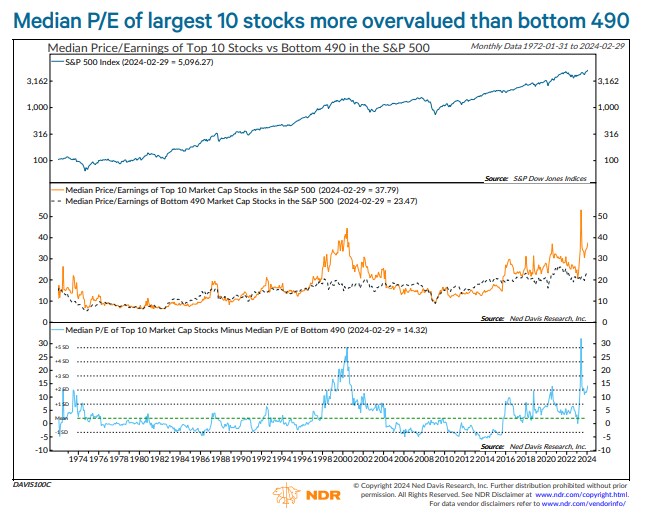

While the top 10 stocks in the benchmark index are indeed historically expensive relative to the rest of the market — the other 490 are also trading at multiples significantly above their long-term averages, according to Ned Davis Research's Ed Clissold.

If a bubble is forming in US stocks, it has plenty of room to expand before it bursts, according to strategists at Societe Generale SA.

A team at the bank led by Manish Kabra said the S&P 500 can climb to 6,250 — roughly 20% from its current level — before reaching the multiples seen at the peak of the dot-com boom in 2000. That suggests the stock market can continue its sharp advance despite brewing worries that it has run up too far.

Corporate Highlights:

- US Federal Trade Commission Chair Lina Khan said in a speech that Boeing Co. became “too big to fail” after it bought up domestic competitors and became the country's largest commercial aerospace maker.

- President Joe Biden said United States Steel Corp. should retain American ownership, coming out against a takeover by Japan's Nippon Steel Corp. despite the risk of upsetting a key ally.

- Lennar Corp., one of the biggest US homebuilders, says it is considering a $4 billion spinoff of land it holds.

- Dollar General Inc. gave a same-store sales outlook that beat Wall Street expectations, indicating that efforts to turnaround the business are starting to show results.

- Dick's Sporting Goods Inc. reported sales that surpassed analysts' expectations, spurred by strong demand for sports gear.

- Reddit Inc. is telling potential investors in its initial public offering that it expects revenue in 2024 to grow by more than 20% versus the previous year, according to a person familiar with the situation.

- New York Community Bancorp, the troubled commercial real estate lender that just got a capital infusion from a group led by Steven Mnuchin, said it will book a gain after selling a portfolio of consumer loans with a net book value of $899 million as well as a co-op loan.

- Match Group Inc., the owner of dating apps Tinder and Hinge, has attracted a second activist investor after Elliott Investment Management built a position in the company, people with knowledge of the matter said.

Key events this week:

- China property prices, Friday

- Japan's largest union federation announces results of annual wage negotiations, just ahead of Bank of Japan policy meeting, Friday

- Bank of England issues inflation survey, Friday

- US industrial production, University of Michigan consumer sentiment, Empire Manufacturing, Friday

Some of the main moves in markets:

Stocks

- The S&P 500 fell 0.5% as of 1:42 p.m. New York time

- The Nasdaq 100 fell 0.4%

- The Dow Jones Industrial Average fell 0.5%

- The MSCI World index fell 0.5%

Currencies

- The Bloomberg Dollar Spot Index rose 0.4%

- The euro fell 0.6% to $1.0882

- The British pound fell 0.4% to $1.2745

- The Japanese yen fell 0.3% to 148.27 per dollar

Cryptocurrencies

- Bitcoin fell 3.3% to $70,732.32

- Ether fell 3.3% to $3,858.58

Bonds

- The yield on 10-year Treasuries advanced 10 basis points to 4.29%

- Germany's 10-year yield advanced six basis points to 2.43%

- Britain's 10-year yield advanced seven basis points to 4.09%

Commodities

- West Texas Intermediate crude rose 2% to $81.35 a barrel

- Spot gold fell 0.6% to $2,160.55 an ounce

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Esha Dey, Alexandra Semenova and Liz Capo McCormick.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.