Good morning!

The GIFT Nifty is trading flat at 25,132 as of 6:50 a.m., indicating a muted open for the benchmark Nifty 50.

US index futures were up while European contracts were down during early Asian trade.

S&P 500 futures up 0.09%

Eutp Stoxx 50 futures down 0.09%

Markets On Home Turf

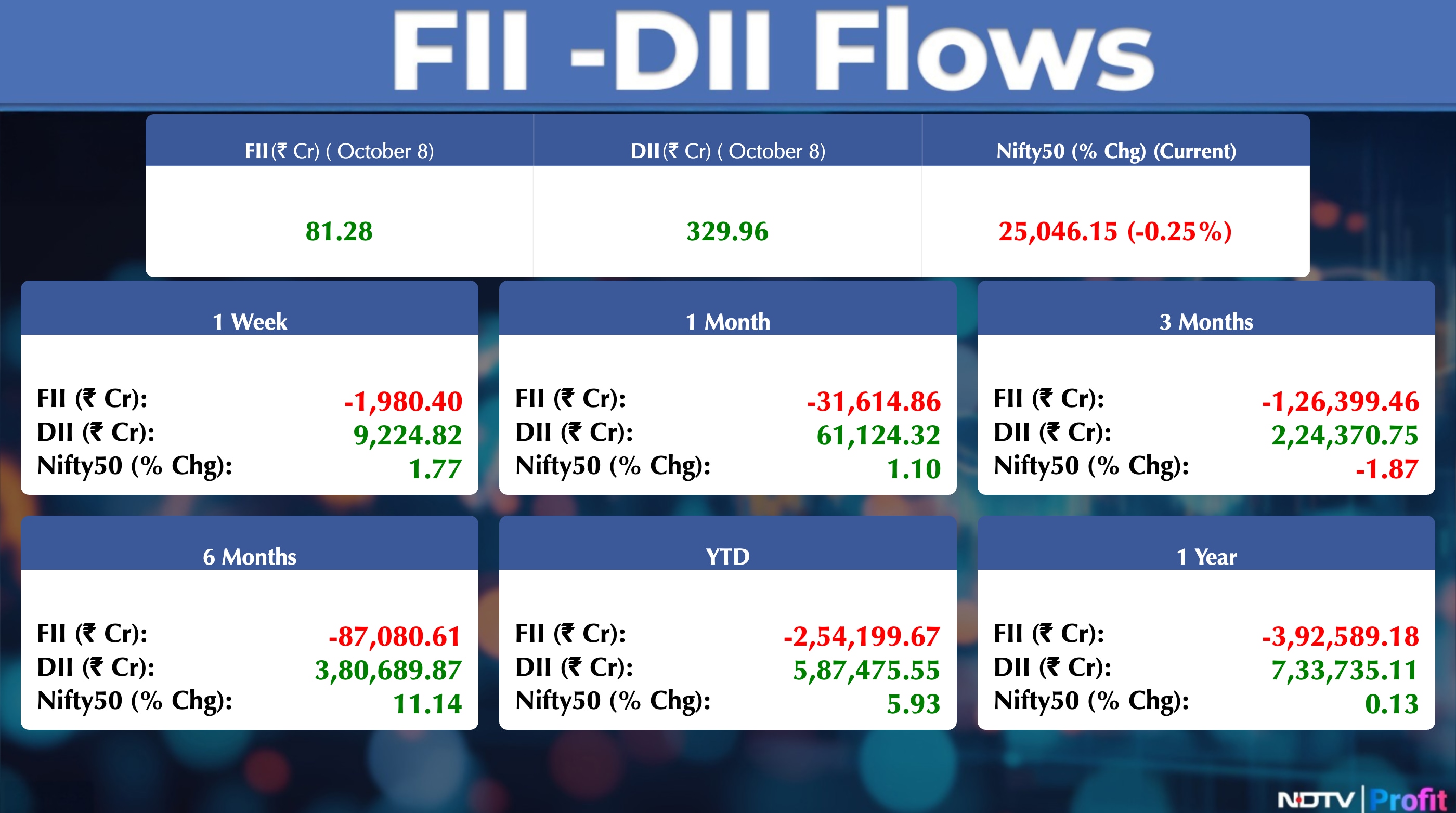

The benchmark indices NSE Nifty 50 and BSE Sensex on Wednesday snapped their four-day streak of gains. The Nifty 50 closed 0.25% lower at 25,046.15, while the Sensex closed 0.19% lower at 81,773.66.

The foreign portfolio investors on Wednesday stayed net buyers of Indian shares for the second day. The FPIs bought stocks worth approximately Rs 81.28 crore, according to provisional data from the National Stock Exchange. The DIIs that have stayed net buyers for over a month bought stake worth Rs 329.96 crore.

Wall Street Recap

The US market remained resilient, driven by AI boom, with traders also parsing minutes from the Federal Reserve's September meeting that showed a willingness to lower interest rates further this year.

The S&P 500 Index was up 0.6%, notching its 33rd all-time high in 2025. The benchmark had snapped seven straight sessions of gains a day earlier when a drop in Oracle Corp. But the Nasdaq 100 Index rose 1.2% on Wednesday, with Oracle shares climbing 1.5% after sliding as much as 7.1% Tuesday, reports Bloomberg.

Asia Market Update

Asian shares rose after a renewed wave of buying in companies linked to the AI boom sent Wall Street benchmarks to new peaks.

An index of US-listed Chinese stocks gained 0.9% as investors prepared for the reopening of mainland Chinese markets after the Golden Week break.

Nikkei up 1.35%

S&P/ASX 200 up 0.38%

KOSPI up 2.7%

Shanghai CSI 300 up 0.46%

Commodities Check

Oil retreated as traders focused on cooling tensions in the Middle East and higher US inventories, reports Bloomberg.

Brent fell below $66 a barrel after adding more than 1% on Wednesday, while West Texas Intermediate was near $62.

Gold prices, on the other hand, fell from record low after peaking at an all-time high above $4,000 an ounce on Wednesday. This comes on the back of a torrid rally that's left prices vulnerable to pullbacks amid signs that the precious metal is trading at overheated levels.

Bullion declined as much as 0.7% in early Asia trading on Thursday to around $4,015 an ounce, after closing 1.4% higher in the previous session, reports Bloomberg.

Key Events To Watch

Prime Minister Narendra Modi will meet UK Prime Minister Keir Starmer to review India–UK Strategic Partnership and Vision 2035 Roadmap.

Both leaders will also address at Global Fintech Fest 2025.

Earnings

Saatvik Green Q1FY26 Highlights (Consolidated, YoY)

Revenue at Rs 916 crore versus Rs 246 crore

Ebitda at Rs 177 crore versus Rs 32.5 crore

Margin at 19.3% versus 13.2%

Net Profit at Rs 119 crore versus Rs 21.3 crore

Business Updates

Container Corp (Q2, YoY)

Total throughput is up 10.5% at 14.4 lakh TEUs

Senco Gold (Q2, YoY)

Total revenue is up 6.5%

Retail business grew by 16% in H1

Launched 5 new showrooms in Q2

Outlook for consumer demand in Q3 & Q4 remains optimistic

Prestige Estates Projects (Q2, YoY)

Sales volume up at 47% at 4.42 million square feet

Collections up 54% at Rs 4,212.8 crore

Sales up 50% at Rs 6,017 crore

Stocks In News

Oswal Agro Mills: The company updates resignation of Narinder Kumar as CEO and Whole-Time Director.

Paradeep Phosphates: The company's board approved NCLT-sanctioned merger scheme between Mangalore Chemicals and Fertilizers and the company.

Aditya Birla Capital: The company launches AI-powered features and innovations on its flagship omnichannel direct-to-consumer platform ABCD.

Bondada Engineering: The company commissions seventy-eight point three megawatt of solar projects in Tamil Nadu and Maharashtra.

Kirloskar Electric Company: The company executes supplementary agreement to sell property in Hubli.

IIFL Finance: The company appoints Girish Kousgi as Managing Director and CEO of its arm IIFL Home Finance.

Coal India: The company enters into a pact with IRCON International for development of rail infrastructure.

Panorama Studios International: The company executes a pact with Vintage Creative Media to distribute theatrical and non-theatrical rights of Marathi film 'Yakshini'.

SML Isuzu: The company approves change of name to 'SML Mahindra' from 'SML Isuzu'.

Bombay Stock Exchange: The company appoints Viral Davda as Chief Information Officer effective Nov. 4.

Marine Electricals (India): The company updates that Bombay High Court upholds arbitral award against GE Power Conversion.

Crompton Greaves Consumer Electricals: The company gets Rs 51.6 crore order for supply of solar rooftop from Telangana body.

Saatvik Green Energy: The company to launch UDAY Series 'On-Grid Solar Inverters' on Oct. 9.

EPL: The company updates that Anand Kripalu retires as Managing Director and Global CEO effective December 31 and appoints Hemant Bakshi as CEO designate effective Oct. 13.

Escorts Kubota: The company to invest up to Rs 2,000 crore on existing plants in Haryana by 2031.

Adani Power: The company is seeking consent for approval of additional amount of Rs 2,000 crore for an already approved Material Related Party Transaction.

Cholamandalam Investment and Finance Company: The company approves conversion of thirty thousand seven hundred compulsorily convertible debentures into twenty-two lakh forty thousand shares at conversion rate of Rs 1,369.05 per share.

Lupin: The company plans to build a manufacturing unit in Florida with projected cumulative investment of $250 million.

Ashoka Buildcon: The company acquires forty-four lakh five hundred thousand Class A CCDs and one crore Class B CCDs worth up to Rs 882 crore.

Uniparts India: The company's board will meet on October 13 to consider a special interim dividend.

PVR Inox: The company launches India's first luxury dine-in cinema at multiplex at M5 Ecity Mall in Bengaluru.

IRB Infrastructure Developers: The company to acquire eleven crore ninety lakh units of IRB InvIT Fund for up to Rs 753 crore.

Centum Electronics: The company has entered into a Memorandum of Understanding with Garden Reach Shipbuilders and Engineers for advancing indigenous capability in high-technology navigation systems for the Indian Navy.

HFCL: The company gets an order worth Rs 303 crore for supply of optical fiber cables from a renowned international customer.

GR Infraprojects: The company gets a Letter of Award worth Rs 290 crore from Jharkhand body for construction of Giridih Bypass Road.

Garuda Construction: The company gets work order worth Rs 144 crore for civil works of redevelopment project in Mumbai.

Hyundai Motor India: The company gets relief by Income Tax Appellate Tribunal with regards to miscellaneous petition; relief granted by ITAT will result in refund.

Dr Agarwal's Health Care: The company completes acquisition of 12.25% stake of its arm Aditya Jyot Eye Hospital for Rs 6.25 crore.

Narayana Hrudayalaya: The company incorporates arm Narayana Hrudayalaya UK.

UGRO Capital: The company approves the issuance of three lakh non-convertible debentures worth up to Rs 300 crore on private placement basis.

IRB InvIT Fund: The company launches QIP of Rs 3,000 crore, deal can be upsized by another Rs 250 crore. Indicative offer price of Rs 60 per unit at 2.8% discount to CMP.

Sun Pharmaceutical Industries: The company approves scheme of arrangement involving amalgamation of five arms.

Triveni Turbine: The company updates that promoter Nikhil Sawhney Trust acquires additional 26.6% stake in Subhadra Trade. Promoter's total stake in Subhadra Trade and Finance now stands at 63.3%. Subhadra Trade and Finance holds 27.28% in Triveni, hence promoter gains indirect control.

Insolation Energy: The company incorporates wholly-owned arm MGNJ Green Infra to set up solar power plants.

Other News

Securities and Exchange Board of India: SEBI raises minimum order size in block deal window to Rs 25 crore

IPO Offering

Tata Capital: The company is in diversified financial services and a subsidiary of Tata Sons. The public issue was subscribed to 1.95 times on day three. The bids were led by qualified institutional investors (3.42x), non-institutional investors (1.98x), retail investors (1.1x).

LG Electronics: The public issue was subscribed to 3.32 times on day two. The bids were led by qualified institutional investors (2.59x), non-institutional investors (7.6x), retail investors (1.9x).

Anantam Highways Trust: Indian infrastructure investment trust (InvIT) focused on investing in road infrastructure. The public issue was subscribed to 0.33 times on day two. The bids were led by institutional investors (0.24 times), other investors (0.43 times).

IPO Opening

Rubicon Research: The company operates in the pharma space and is engaged in manufacturing of differentiated formulations. The company will offer shares for bidding on Thursday. The price band is set from Rs 461 to Rs 485 per share. The Rs 1,377.5 crore IPO has fresh issue of Rs 500 crore and OFS of Rs 877.5 crore.

Canara Robeco Asset Management: The company operates in Asset management space and serves as investment manager for Canara Robeco Mutual Fund. The company will offer shares for bidding on Thursday. The price band is set from Rs 253 to Rs 266 per share. The IPO is for Rs 1,326 crore, entirely OFS.

Bulk & Block Deals

3i Infotech: Bank of India sold 3.29 lakh shares.

Infibeam Avenues: Samyaktva Construction LLP bought 1.49 crore shares at Rs 19.12 a piece.

RBL Bank: Societe Generale bought 33.22 lakh shares at Rs 284 apiece.

EFC: Abakkus Diversified Alpha Fund bought and Forbes Emf sold 3.5 lakh shares at Rs 296.10 apiece.

Corporate Actions

Sensex Weekly Expiry

Q2 Earnings

Tata Consultancy Services

Tata Elxsi

Board Meeting

Jana Small Finance Bank: To discuss fund raising

5Paisa Capital: To discuss other business matters

Gallantt Ispat: To discuss other business matters

Trading Tweaks

List of securities shortlisted in Short - Term ASM Framework Stage – I : Indraprastha Medical Corp

F&O Cues

Nifty Oct futures is down 0.45% to 25,112.50 at a premium of 66.35 points.

Nifty Oct futures open interest down by 1.76%

Nifty Options 14th Oct Expiry: Maximum Call open interest at 26,000 and Maximum Put open interest at 25,000.

Securities in ban period: RBL Bank

Currency/Bond Market

The rupee closed two paise weaker at 88.80 (provisional) against the US dollar on Tuesday, near its all-time low level. The yield on the 10-year bond ended one point lower at 6.50%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.