Asian stocks were mostly lower Tuesday amid concerns that the upcoming earnings season, a looming U.S. inflation print and China's struggle with Covid will stoke worries about economic prospects.

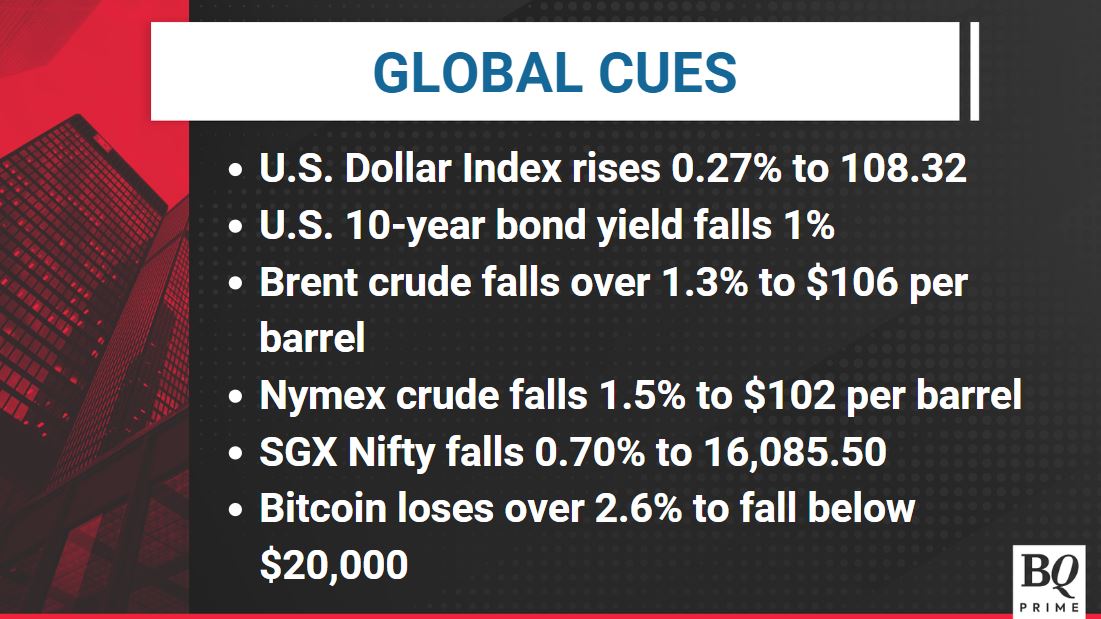

The U.S. dollar rose the most in a month to rise to an over 2-year high, spurring the Euro to close in on parity, amid gas shortage and fears of economic recession.

Japan led the regional decline, while Hong Kong futures were also in the red following the worst drop in U.S.-traded Chinese shares since May. U.S. contracts wavered after technology shares led a Wall Street slide, including a plunge in Twitter Inc. as Elon Musk walked away from his deal to buy the firm.

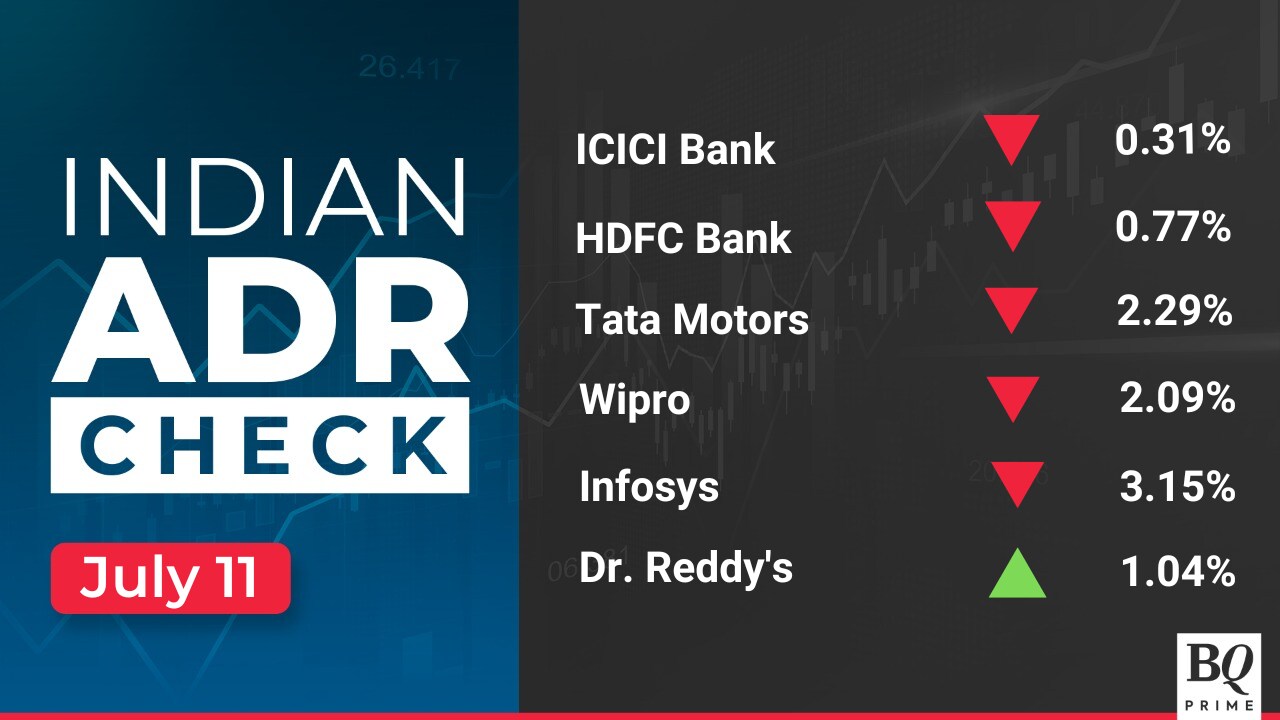

As of 7:30 a.m., the Singapore-traded SGX Nifty -- an early barometer of India's benchmark Nifty 50 -- fell 0.70% to 16,085.50. HCL Technologies, Sterling and Wilson Renewable Energy, National Standard (India), Delta Corp, Anand Rathi Wealth are among the companies scheduled to report their earnings for the quarter-ended June today.

Treasuries extended gains, taking the US 10-year yield to 2.98%. Crude oil shed 1%. Bitcoin dropped back below the $20,000 level.

Earnings Post Market Hours

Spandana Sphoorty Financial Q4 FY22 (Consolidated, YoY)

Revenue fell 39% at Rs 286.82 crore Vs Rs 473.91 crore

EBIT fell 33% at Rs 133.45 crore Vs Rs 198.85 crore

EBIT margin 46.5% Vs 42%

Net profit fell 42% at Rs 28.44 crore Vs Rs 49.06 crore

Revenue at Rs 84 crore vs Rs 88 crore

Profit before tax at Rs 10 crore vs Rs 6 crore

Net profit at Rs 7 crore vs Rs 4 crore

Stocks To Watch

Eureka Forbes: The company appointed Pratik Pota as Managing Director and Chief Executive Officer for a term of five years effective from August 16. The appointment was made following current MD and CEO Marzin R Shroff's resignation.

Star Health and Allied Insurance: The company has partnered with Common Services Centers, under Ministry of Electronics & Information Technology, to expand the insurance products to rural customers, across tier-II, tier-III cities and rural markets pan India.

Power Grid: The company has placed B.S. Jha under suspension with effect from July 5 after his arrest by CBI. The company said that it was not aware of any negotiations and that there is no material impact on the company.

Borosil Renewables: The company will consider fund raising through further public offer, issuance of American Depository Receipts or Global Depository Receipts, issuance of Foreign Currency Convertible Bonds, qualified institutions placement or through a combination on July 14.

Mangalore Refinery and Petrochemicals: To consider share issue for complying with minimum public shareholding requirements by issue of further public offer, preferential issue, qualified institutions placement on July 15.

HFCL: The company received an order from a domestic telecom company for their Fiber to the Home Network and Long Distance Fiber Network in various Telecom Circles. The order is worth Rs 59.22 crore.

Trident: The company production volumes for the month of June stood at 3,333 MT of Bath Linen, 1.95 million Meters for Bed Linen and 8,186 MT for Yarn. It also produced 12,500 MT Paper and 7,673 MT of Chemicals.

Earnings To Watch: HCL Technologies, Sterling and Wilson Renewable Energy, National Standard (India), Delta Corp, Anand Rathi Wealth

Pledge Share Details

Chambal Fertilisers & Chemicals: Promoter Zuari Industries created a pledge of 12 lakh shares on July 7.

Bulk Deals

BLS International Services: Nomura Singapore bought 12.5 lakh shares (0.61%) at 214 apiece.

Himadri Speciality Chemical: Narantak Dealcomm bought 27.9 lakh shares (0.66%) at 90.84 apiece.

Who's Meeting Whom

Rallis India: To meet investors and analysts on July 20.

AU Small Finance Bank: To meet investors and analysts on July 20.

Sterling and Wilson Renewable Energy: To meet investors and analysts on July 14.

Sonata Software: To meet investors and analysts on July 25.

Godrej Properties: To meet investors and analysts on August 2.

Polycab India: To meet investors and analysts on July 22.

Embassy REIT: To meet investors and analysts on July 21.

AGMs today:

Nippon Life India Asset Management

Punjab & Sind Bank

Tata Steel Long Products

IIFL Securities

Trading Tweaks

Ex-Date Dividend: REC, Avadh Sugar & Energy, Seshasayee Paper & Boards

Ex-Date Face Value Split: Steel Exchange India

Ex-Date Annual General Meeting: Avadh Sugar & Energy, Seshasayee Paper & Boards

Record-Date Bonus: GMM Pfaudler

Move Into Short-Term ASM Framework: Himadri Speciality Chemical

Move Out Of Short-Term ASM Framework: Orient Bell

Money Market Update

The rupee ended at Rs 79.43 against the U.S. Dollar on Monday as compared to Friday's closing of 79.25

F&O Cues

Nifty July futures ended at 16,189, a discount of 27 points.

Nifty July futures added 9.22% and 19,985 shares in Open Interest.

Nifty Bank July futures ended at 35,480, a premium of 10.35 points.

Nifty Bank July futures added 6.98%, 6,509 shares in Open Interest.

Research Reports

Anupam Rasayan - R&D At Core To Propel Growth: KRChoksey Initiates Coverage

Jindal Stainless - Ebitda/Tonne Guidance Of Rs 18000-20000/Tonne: ICICI Direct

Edible Oil - India's Bid To Reduce Imports And Become ‘Atmanirbhar': CareEdge

Tata Motors - JLR Wholesales Ahead Of Our Estimates; Retail Flat QoQ: Motilal Oswal

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.