US futures fell and Asian stocks were mixed Monday, amid challenges swirling around China and a reminder from Federal Reserve officials that their key objective is to fight high inflation.

S&P 500 and Nasdaq 100 futures shed about 1%, while bourses in Japan, South Korea and Australia made modest headway. The caution follows the best month for global shares since 2020, which pared their slump this year to 16%. At 7:00 am, the Singapore-traded SGX Nifty -- an early barometer of India's benchmark Nifty 50 -- traded 0.20% higher at 17,200 points.

The dollar was steady, oil retreated and Bitcoin slid

Earnings Post Market Hours

Cipla Q1 FY23 (Consolidated, YoY)

Revenue down 2% at Rs 5,375 crore Vs Rs 5,504 crore (Bloomberg estimate: Rs 5,459 crore)

EBITDA down 15% to Rs 1,143 crore from Rs 1,346 crore (Bloomberg estimate: Rs 1,062 crore)

EBITDA margins at 21.3% Vs 24.5% (Bloomberg estimate: 19.4%)

Net profit down 4% at Rs 686 crore Vs Rs 715 crore (Bloomberg estimate: Rs 628 crore)

Torrent Pharmaceuticals Q1 FY23 (Consolidated, YoY)

Revenue up 10% at Rs 2,347 crore Vs Rs 2,134 crore (Bloomberg estimate: Rs 2305.4 crore)

EBITDA up 5% at Rs 712 crore Vs Rs 677 crore (Bloomberg estimate: Rs 664.8 crore)

EBITDA margin 30% Vs 32%

Net profit up 7% at Rs 354 crore Vs Rs 330 crore (Bloomberg estimate: Rs 332 crore)

DLF Q1 FY23 (Consolidated, YoY)

Revenue up 26.5% at Rs 1,441.63 crore Vs Rs 1,139.53 crore (Bloomberg estimate: Rs 1,459.9 crore)

EBITDA up 5% at Rs 413.66 crore Vs Rs 395.44 crore (Bloomberg estimate: Rs 535 crore)

EBITDA margin 29% Vs 35%

Net profit up 39% at Rs 469.57 crore Vs Rs 337.1 crore (Bloomberg estimate: Rs 569.8 crore)

Cholamandalam Investment and Finance Q1 FY23 (Consolidated, YoY)

Revenue up 12% at Rs 2,770.02 crore Vs Rs 2,481.74 crore

EBITDA up 21% at Rs 1,896.10 crore Vs Rs 1560.98 crore

EBITDA margin 68% Vs 63%

Net profit up 71% at Rs 562.01 crore Vs Rs 328.55 crore

Metro Brands Q1 FY23 (Consolidated, QoQ)

Revenue up 26% at Rs 507.95 crore Vs Rs 403.16 crore

EBITDA up 41% at Rs 182.87 crore Vs Rs 129.84 crore

EBITDA margin 36% Vs 32%

Net profit up 52% at Rs 104.76 crore Vs Rs 68.78 crore

Stocks To Watch

Yes Bank: The bank approved proposal to raise Rs 8,898.47 crore from Carlyle Group and Advent International for 10% stake each.

NTPC: The company appointed Jaikumar Srinivasan, Director (Finance) as the Chief Financial Officer in place of Renu Narang with immediate effect.

Dr Reddy's Laboratories: The company has entered into a licensing agreement with Princeton based Slayback Pharma, to acquire rights in Slayback's Brimonidine Tartrate Ophthalmic Solution 0.025%, the private label equivalent of Lumify in U.S. Lumify is an over the counter eyedrop that can be used to relieve redness of the eye due to minor eye irritations. The agreement also provides the company exclusive rights to the product outside the U.S.

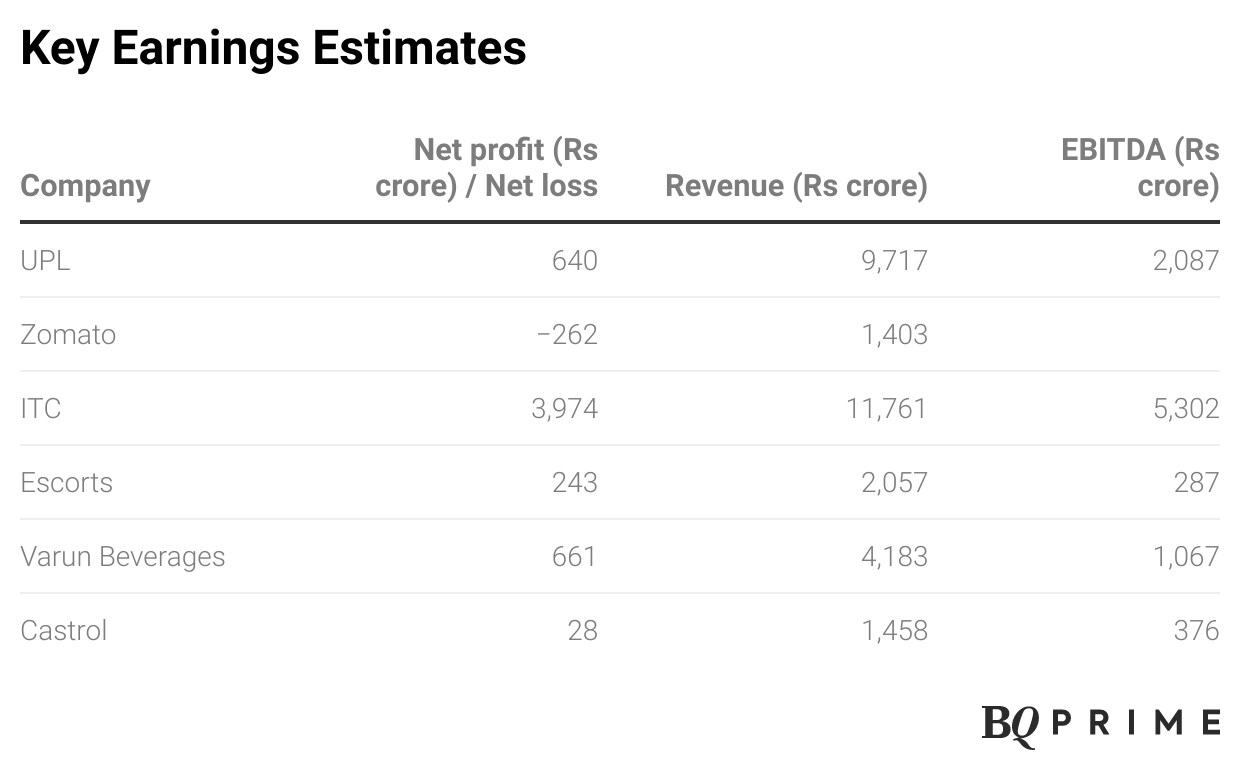

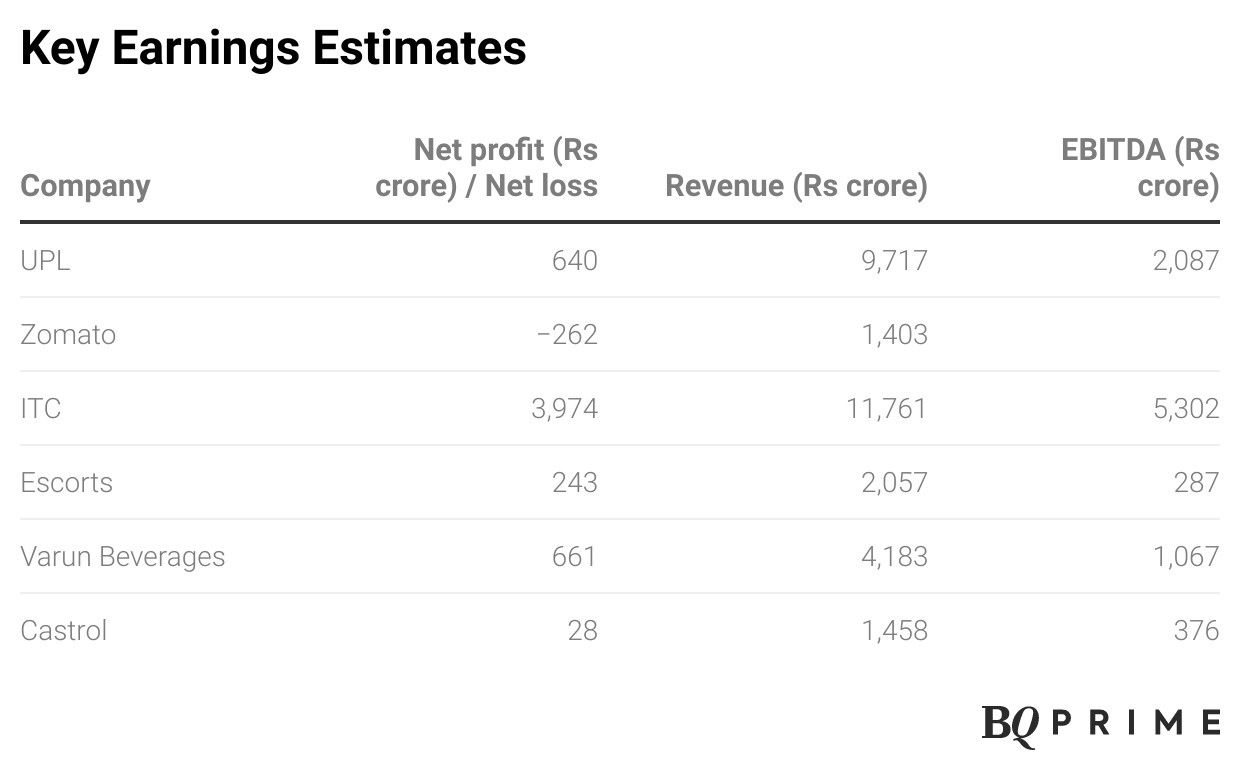

CEAT: The company will further invest Rs 3.5 crore in Greenzest Solar.

Earnings Today: UPL, Zomato, ITC, H.G. Infra Engineering, Escorts Kubota, Varun Beverages, Castrol, The Ramco Cements, Punjab & Sind Bank, Max Financial Services, Kansai Nerolac, Carborundum Universal, Barbeque Nation Hospitality, Alkyl Amines Chemicals, Eveready Industries, RateGain Travel Technologies, Thyrocare Technologies, Triveni Turbine

Pledge Share Details

Swan Energy: Promoter Group Dev Impex created a pledge of 79 lakh shares on July 29.

Insider Trades

Ramkrishna Forgings: Promoter Naresh Jalan bought 15,900 shares between July 27 and July 28.

Who's Meeting Whom

Aditya Birla: To meet investors and analysts on August 5

DLF: To meet investors and analysts on July 30

Punjab and Sind Bank: To meet investors and analysts on August 1

Saregama India: To meet investors and analysts on August 2

Indo Count Industries: To meet investors and analysts on August 2

PDS: To meet investors and analysts on August 2

Cigniti Technologies: To meet investors and analysts on August 1

EKI Energy Services: To meet investors and analysts on August 2

BLS International Services: To meet investors and analysts on July 30

HIL: To meet investors and analysts on August 2

Nitin Spinners: To meet investors and analysts on August 8

EKI Energy Services: To meet investors and analysts on August 2

FDC: To meet investors and analysts on August 5

Thermax: To meet investors and analysts on August 3

Divi's Laboratories: To meet investors and analysts on August 12

TCI Express: To meet investors and analysts on August 3

Shyam Metalics and Energy: To meet investors and analysts on August 3

Praj Industries: To meet investors and analysts on August 5

S H Kelkar And Company: To meet investors and analysts on August 12

Eveready Industries: To meet investors and analysts on August 3

Solara Active Pharma Sciences: To meet investors and analysts on August 4

Balrampur Chini Mills: To meet investors and analysts on August 5

Tips Industries: To meet investors and analysts on August 1

Max India: To meet investors and analysts on August 5

Pricol: To meet investors and analysts on August 5

Max Financial Services: To meet investors and analysts on August 2

Crisil: To meet investors and analysts on August 11

J Kumar Infraprojects: To meet investors and analysts on August 3

Gulf Oil Lubricants India: To meet investors and analysts on August 4

Indian Bank: To meet investors and analysts on August 1

Fineotex Chemical: To meet investors and analysts on August 1

AGMs today:

Fortis Healthcare

Trading Tweaks

Price Band Revised From 0% to 20%: NBCC (India)

Ex-Date Annual General Meeting: Kirloskar Industries, Igarashi Motors India, Unichem Laboratories, Gujarat Ambuja Exports, Punjab Chemicals & Crop Protection, E I D-Parry (India), Ratnamani Metals and Tubes

Ex-Date Dividend: Kirloskar Industries, Unichem Laboratories, Gujarat Ambuja Exports, Punjab Chemicals & Crop Protection, Bharti Airtel, Sudarshan Chemical Industries, Ratnamani Metals and Tubes

Ex-Date Final Dividend: GAIL (India), Nava Bharat Ventures, Paushak

Ex-Date Interim Dividend: IIFL Wealth Management

Ex-Date Income Distribution: Powergrid Infrastructure Investment Trust

Record-Date Income Distribution: India Grid Trust

Record-Date Final Dividend: AMI Organics

Money Market Update

The rupee ended at Rs 79.26 against the U.S. Dollar on Friday as compared to Thursday's closing of Rs 79.75

F&O Cues

Nifty August futures ended at 17,207.45, a premium of 49.2 points.

Nifty August futures added 8.51% and 15,214 shares in Open Interest.

Nifty August futures ended at 37,590, a premium of 98.6 points.

Nifty August futures added 7.9%, 5,776 shares in Open Interest.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.