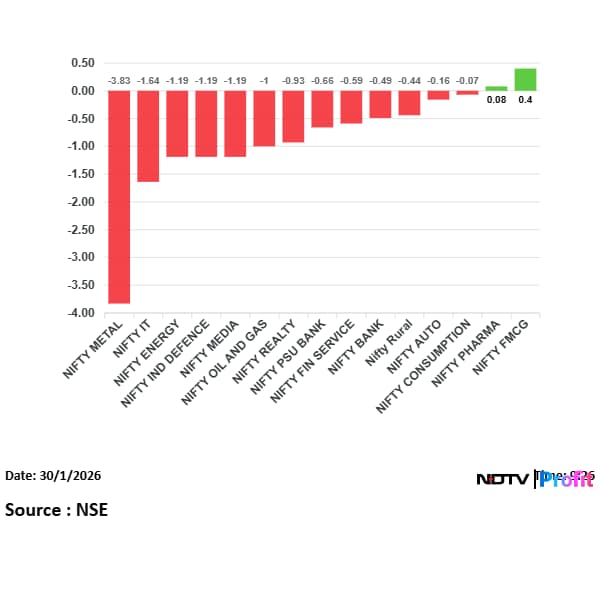

Good afternoon readers. The NSE Nifty 50 and BSE Sensex opened lower on Wednesday snapping its three-day gaining streak ahead of the Union Budget on Sunday. The Nifty 50 opened 0.67% lower at 25,247.55 and Sensex opened 0.75% down at 81,947.31. However, minutes after open Nifty was trading 0.70% lower and Sensex was down over 400 points. Nifty Metal and Nifty IT were leading the decline.

That's all for today and for this week folks. However, we will see you on Sunday as the markets remain open on account of Union Budget Presentations.

But before you log off for the day. Here are a few interesting and important stories to track:

See you on Budget day. Until then have a good weekend.

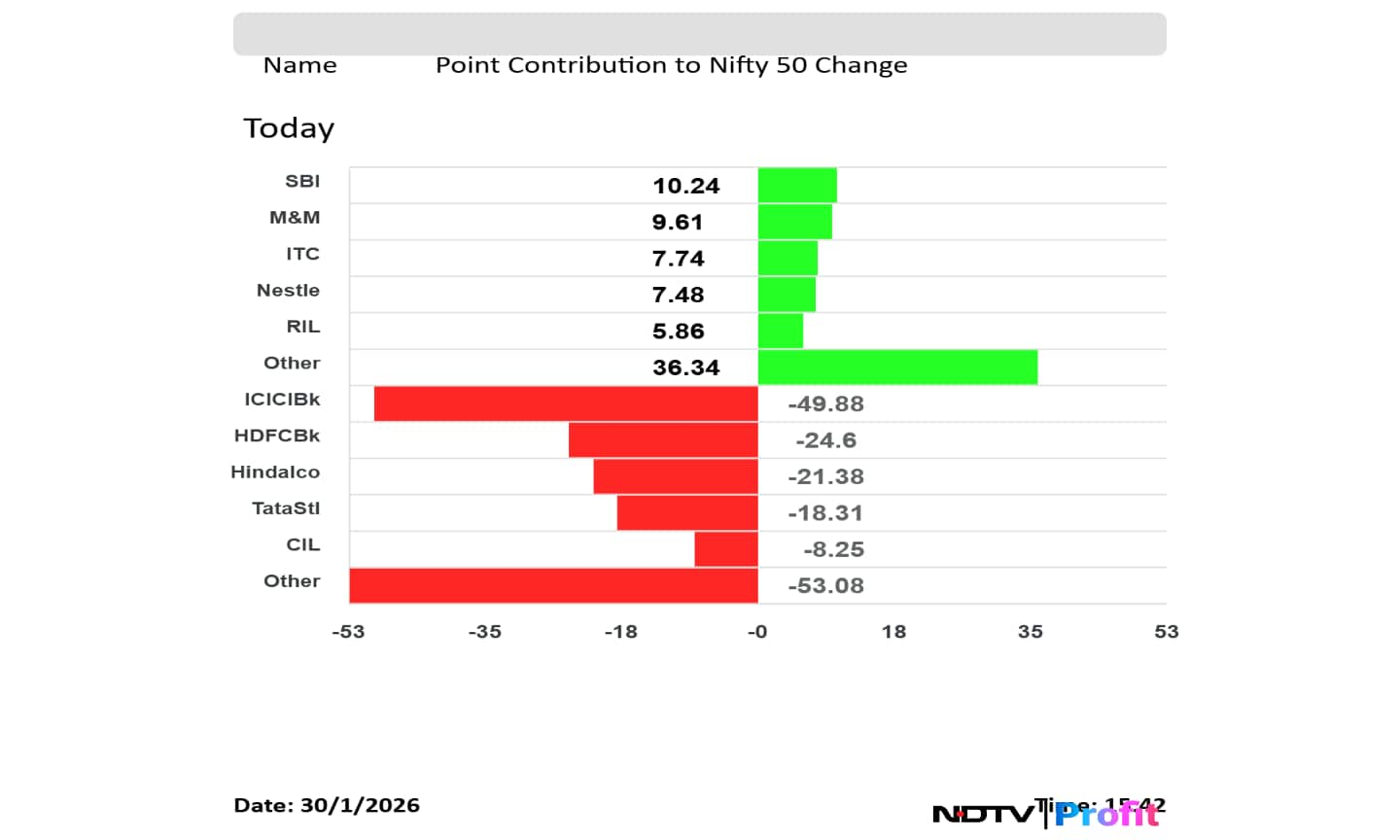

SBI, M&M, ITC, Nestle and RIL emerged as the top gainers for the day.

On the other hand, ICICI Bank, HDFC Bank, Hindalco, Tata Steel and Coal India were the worst performers of the Nifty 50 index.

However, broader indices ended in positive. Nifty Midcap 150 ended 0.03% lower and Nifty Smallcap 250 closed 0.85% lower.

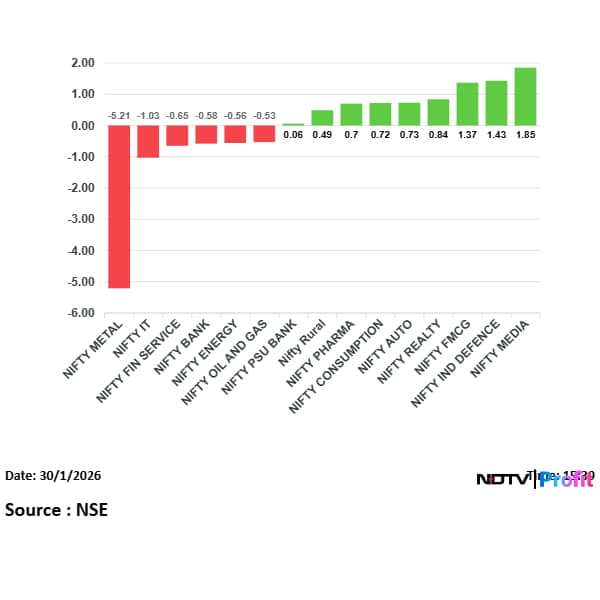

Most sectoral indices rose with Nifty Metal and Nifty IT leading the decline, while Nifty Media and Nifty Defence were in the green.

The market breadth was skewed in the favour of sellers, as 1,777 stocks declined, 2,426 advanced and 169 remained unchanged on the BSE.

Spot Gold drops below $5,000 a ton in broad metals sell-off. On the MCX, gold Feb futures fell 9% at Rs 1.67 lakh per 10 gm.

Silver spot copy drops below $100 an ounce as dollar rallies. On the MCX, silver March futures fell 15% to Rs 3.39 Lk per Kg.

Here is what the government proposed, and what it has delivered so far in FY26:

Budget Report Card | Hits, misses, and unfinished promises.@soumeet_sarkar breaks down what the government proposed, and what it has delivered so far in FY26.

— NDTV Profit (@NDTVProfitIndia) January 30, 2026

Watch it here👇 pic.twitter.com/Q27SUZzqdB

Ambuja Cements Q3 Highlights (Consolidated, YoY)

Note: Q3FY25 Had Other Income Of Rs 1,352 Crore

A new job usually entails more paperwork, greater responsibilities and a higher income. Many people overlook a crucial step in their haste: transferring their Employee Provident Fund (EPF) amount to the new employer. Leaving outdated EPF accounts might create complications and eventually reduce retirement funds.

The shares of Nestle rose nearly 4% on Friday after it announced its third quarter results.

After a sustained period of rally, silver prices declined sharply, plunging over 7% to trade near Rs 3.71 lakh per kg levels. The sharp fall comes on the back of silver, almost reaching Rs 4 lakh levels, mirroring the unprecedented rally seen in gold as well. On the multi commodity exchange (MCX), the white metal has crashed by more than 11% or Rs 30,000 to Rs 3,71,700 per kg from a record high of Rs 4,20,048 per kg. The price crash has also triggered concerns among investors, as even safe havens like gold and silver are now gripped by volatility.

Read more: Silver Prices Drop By 11% From Record High — Here's Why The White Metal Is Falling

Kotak Mutual Fund's Nilesh Shah said markets reward humility and defended his long-standing constructive stance on gold and silver, citing structural drivers such as central bank buying, geopolitics and diversification needs.

In a post on X, Shah said precious metals have delivered a strong rally driven by these factors. He noted that since 2020, post-Covid, Kotak's monthly outlooks as well as its multi-asset allocation funds and fund-of-funds have consistently remained constructive on gold.

Ace American investor Cathie Wood has warned about the potential pullback in gold, which has witnessed an extraordinary rally since 2025. The precious metal clocked nearly 75% gains in 2025 and continues to rise amid the ongoing geopolitical uncertainty.

In an X post on Friday, Wood argued gold looks expensive and vulnerable to a fall and made her case through a historical comparison. She pointed to the market value of gold relative to the US dollar and noted that the ratio has just hit a record high. It is higher than in 1980, when inflation and interest rates were extreme. It also matches levels last seen in 1934, during the Great Depression, the founder and CEO of US-based ARK Invest noted.

Read full story here: 'Odds Are High Gold Will Fall': Cathie Wood Warns Gold May Be Headed For A Pullback, Draws A Parallel With 1934. Heres Why

In a rare departure from the usual calendar, the stock market will be open for business on Sunday, Feb. 1, as the Union Budget is being presented on that day.

The National Stock Exchange of India (NSE), in an official notification, confirmed that a special trading session will be conducted during regular market hours.

Check timings and other details here: Union Budget 2026: Is The Stock Market Open Or Closed On Feb. 1?

Bajaj auto is in focus on Friday ahead of its third quarter results. The stock fell 1.36% to Rs 9,382.50 per share, however as of 12: 14 p.m. it was trading in green. Bajaj Auto is expected to post a 20% profit in the quarter ended December.

Ahead of Q3 results Nestle shares were trading 2.46% higher in comparison to an otherwise down market. The company is expected to post a 7% advance in its net profit in quarter ended December.

February has traditionally been a tricky month for Indian equity markets, largely because it coincides with the Union Budget. Despite expectations usually running high, market data from the past decade suggests that February has more often than not delivered negative returns.

Looking at the last 10 years, the Nifty 50 has closed February in the red seven times, with the average return declining 1.9%. Sharp corrections of more than 5% were seen in 2016, 2018, 2020 and 2025, highlighting that budget-related volatility can sometimes turn into meaningful downside.

This historical pattern suggests that while budgets may bring short-term excitement, markets often struggle to sustain gains through the month.

Read more: Budget Month Blues: Why February Is Historically Nifty's Cruelest Month

Entrepreneur Chamath Palihapitiya believes that a merger between SpaceX and Tesla would redefine modern corporate structure and resemble a 21st century Berkshire Hathaway.

“A merger between SpaceX and Tesla would instantly create the Berkshire Hathaway of the modern century. The capital raising and operational efficiencies if both were together are obvious,” the Social Capital founder said in an X post on Friday.

According to Palihapitiya, a single equity tied to Elon Musk's companies would be highly attractive for investors.

Syrma SGS shares hit three-month high on Friday. The shares rose 10.77% to Rs 742.20. This comes after the company announced its third quarter results.

Shares of Dixon Technologies Ltd. have surged more than 4% in trade on Friday after reporting its third-quarter earnings, where profit zoomed up to 68% on a year-on-year basis, even though operational numbers missed street expectations. The stock is currently trading at Rs 10,975, accounting for gains of 4.2% compared to Thursday's closing price of Rs 10,337.

Dixon Tech reported its Q3 earnings on Thursday. While profit saw an uptick, the firm's revenue largely remained flat, rising just 2.1% to Rs 10,672 crore compared to the previous year's Rs 10,454 crore. Its earnings before interest, taxes, depreciation and amortisation were up 6.1% at Rs 414 crore from the prior financial year's Rs 391 crore.

Over 2.65 million shares of ICICI Bank were traded via another block deal on Friday. The share of ICICI Bank fell as much as 1.11% to Rs 1,368.20 apiece.

Shares of Vedanta Ltd are in focus in today's trade. The shares are trading lower by over 5% despite posting strong December quarter results. The metals-to-oil conglomerate reported a 60% jump in net profit at Rs 7,807 crore on strong base metal prices. In the year-ago period, its net profit was Rs 4,876 crore.

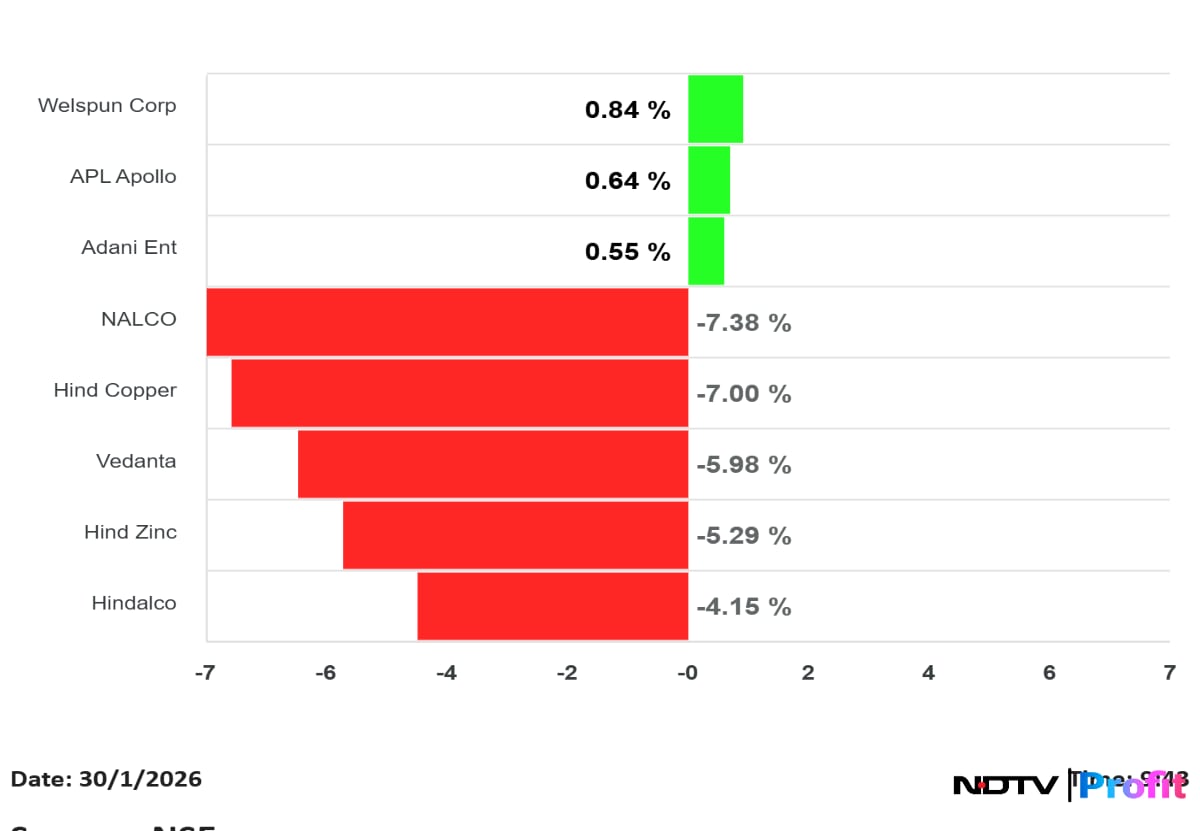

A key reason is the sharp selling pressure on metal stocks today. This is on the back of a steep correction in gold, silver and other base metals. Shares of Hindustan Zinc, Vedanta, Hindustan Copper, NALCO and several other metal stocks fell sharply during the session as a slide in commodity prices weighed heavily on overall sector sentiment.

Read more: Vedanta Shares Dip Over 5% Despite Strong Q3 Results

Over 1.03 million shares of ICICI Bank were traded via block deal on Friday. The share of ICICI Bank fell as much as 1.11% to Rs 1,368.20 apiece.

South Indian Bank shares hit over three-month low on Friday after the bank confirmed its Managing Director and Chief Executive Officer, PR Seshadri, has decided to step down and not offer himself for reappointment. This means he will no longer serve as the MD & CEO of South Indian Bank after his tenure ends on Sept. 30, 2026.

Read more here: South Indian Bank MD & CEO Steps Down; Shares Fall 18%

Shares of Swiggy on Friday dropped more than 7% after its December quarter earnings failed to cheer investors. The stock was trading at Rs 309.15 a piece. The shares hit over eight-month low, but pared gains to trade 6.61% lower at Rs 306.

Read more: Swiggy Shares Fall After Q3 Results Show Increased Losses

Nifty Metal dropped 5% on Friday, posting its biggest intra-day fall since April 7, 2025. NALCO and Hindustan Copper lead the fall.

Nifty 50 finds support around 25,200 level as markets snap three-day gaining streak.

On NSE, 13 of the 15 sectors were in the red. Nifty Metal and Nifty IT lead the fall, while Nifty FMCG and Nifty Pharma were the only sectors in green.

Broader markets on the other hand were trading higher, with the NSE Midcap 150 trading 1.04% lower and NSE Smallcap was trading 1.31% lower.

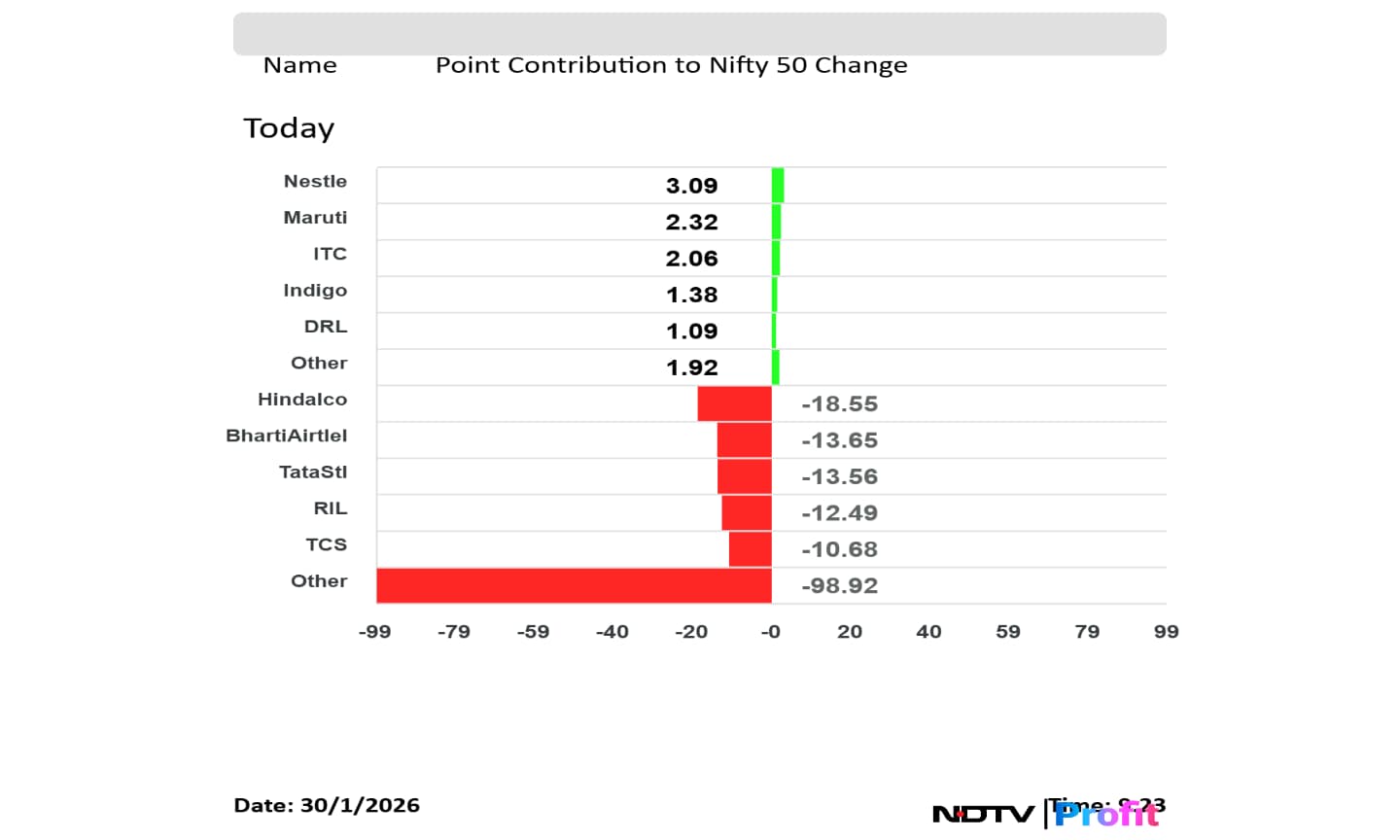

Hindalco, Bharti Airtel, Tata Steel, RIL and TCS weighed on the Nifty 50 index.

Nestle, Maruti Suzuki, ITC, Indigo and Dr. Reddy's added to the Nifty 50 index.

The NSE Nifty 50 and BSE Sensex opened lower on Wednesday snapping its three-day gaining streak ahead of the Union Budget on Sunday. The Nifty 50 opened 0.67% lower at 25,247.55 and Sensex opened 0.75% down at 81,947.31. However, minutes after open Nifty was trading 0.70% lower and Sensex was down over 400 points.

At pre-open, the NSE Nifty 50 was trading 171.35 points or 0.67% lower at 25,247. The BSE Sensex was 445.88 points lower at 82,120.49.

India's hospitality sector is firmly in the midst of a structural upcycle, with strong and broad-based demand colliding with supply constraints, according to a recent report by HSBC Global Investment Research. The brokerage argues that the current cycle is fundamentally stronger than previous ones, underpinned by rising room rates, record occupancy levels and a sustained recovery in both domestic and foreign travel.

HSBC notes that average room rates (ARRs) have risen consistently for four years, while occupancy has reached all-time highs. Importantly, demand growth is no longer limited to large metro cities. Smaller cities are increasingly contributing to incremental room nights, widening the base of the recovery and making it more resilient.

Jefferies on Dixon

Macquarie on Dixon

Jefferies on Swiggy

Morgan Stanley on Swiggy

Citi on Swiggy

Macquarie on Dixon

Jefferies on Dixon

Kotak Securities on Tata Motors CV

JPMorgan on Tata Motors CV

Nomura on Tata Motors CV

Silver prices on Thursday breached the Rs 4 lakhs per kilogram-mark in the national capital, while gold hovered near fresh record high of Rs 1.83 lakhs per 10 grams, tracking a sharp rally in global markets amid rising geopolitical and economic uncertainty.

Silver extended gains for the fourth consecutive day surging 5.06%, to an all-time high, reports news agency PTI.

South Korea's Kospi index rose 1% to 5,274.33 on Friday, This comes as South Korea’s industry minister met with the US commerce chief in Washington but failed to make progress in quelling fresh trade friction, with the two sides agreeing to resume talks Friday as Seoul seeks to head off President Donald Trump’s recent threat to raise tariffs.

Gold fell the most since October, reversing earlier gains that took the precious metal to a fresh record above $5,500 an ounce, as the US dollar strengthened.

A rebound in the greenback helped drive down bullion by as much as 5.7% in the biggest intraday drop since Oct. 21, before paring some of the losses.

Source: Bloomberg

The US Dollar index is up 0.32% at 95.340.

Euro was down 0.33% at 1.1929.

Pound was down 0.24% at 1.3773.

Yen was up 0.31% at 153.57.

Asian equities were poised for a mixed opening after a volatile session in the US, where uncertainty over whether massive investments in artificial intelligence will deliver meaningful returns weighed on sentiment. Futures in Australia advanced, supported by gains in key metals such as iron ore and copper. Japanese equity contracts were little changed, while those tied to Hong Kong slipped in early Friday trading. US equity futures slipped at the open after Apple Inc. warned that rising component costs may pressure its profit margins, adding to broader concerns about whether major tech firms' substantial spending on artificial intelligence will yield adequate returns.

Good morning readers.

The GIFT Nifty was trading near 25,500 early on Friday. The futures contract based on the benchmark Nifty 50 fell 0.20% at 25,465 as of 6:48 a.m. indicating a negative start for the Indian markets.

In the previous session on Thursday, the benchmark extended its gaining streak to the third day after it opened in the red. The Nifty ended 76.15 points or 0.30% higher at 25,418.90 and Sensex ended 221.69 points or 0.27% higher at 82,566.37.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.