India's benchmark equity indices ended higher for a third consecutive session on Thursday, tracking gains in Asia.

Larsen & Toubro contributed most to the Nifty's gain after solid third quarter results, strong order wins and healthy margins.

ITC, IEX, Paytm, Cochin Shipyard, and Swiggy are among important earnings to watch today.

This live blog has ended. Thank you for reading. See you tomorrow!

Futures of three US equity benchmark indices are trading higher.

The Indian rupee closed near a record low level against the US dollar on Thursday. The local currency ended 17 paise weaker at 91.956.

Intraday, the INR weakened past 92 per dollar.

India's benchmark equity indices ended higher for a third consecutive session on Thursday, tracking gains in Asia.

Larsen & Toubro contributed most to the Nifty's gain after solid third quarter results, strong order wins and healthy margins.

Jefferies said January auto sales could show broad-based strength across manufacturers, with most original equipment makers reporting healthy year-on-year growth. Overall, January data may reflect a recovery in the two‑wheeler segment, steady demand in commercial vehicles, and modest but stable growth in passenger vehicles.

Brent oil hits $70 per barrel for the first time since September.

Oil advanced for a third day after US President Donald Trump warned Iran to make a nuclear deal or face military strikes, reviving concerns about potential unrest and disruption in the Middle East. In a social media post on Wednesday, Trump said US ships he ordered to the region were ready to fulfill their mission “with speed and violence, if necessary.”

Source: Exchange Filing

-Survey covers importance of manufacturing, exports in India's growth

-Unpredictable, dangerous uncertainties in a difficult global environment

-Growth momentum is sustained by domestic drivers

SBI Life posts industry-leading Q3 growth.

Here is what the MD & CEO Amit Jhingran said to NDTV Profit:

SBI Life posts industry-leading Q1 growth.

— NDTV Profit (@NDTVProfitIndia) January 29, 2026

MD & CEO Amit Jhingran in conversation with @Sharad9Dubey says performance is in line with annual guidance.

Strategy execution on track, outlook for the year remains confident. @SBILife pic.twitter.com/buy5Ed5JIk

The Nifty 50 had fallen 25,200 and Sensex dropping nearly 500 points. However, it pared losses to trade in the green. As of 1: 43 p.m. Nifty was trading 0.17% higher at 25,390.95 and Sensex was up 0.16% at 82,480.48. L&T and Axis Bank were leading gains.

The scrip fell as much as 4.55% to Rs 150.57 apiece on Thursday, lowest level since Jan 21. It pared losses to trade 3.65% lower at Rs 151.99 apiece, as of 1:24 p.m. This compares to a 0.01% advance in the BSE Nifty 50 Index.

It has fallen 2.21% year-to-date. Total traded volume so far in the day stood at 23.69 times its 30-day average. The relative strength index was at 56.25.

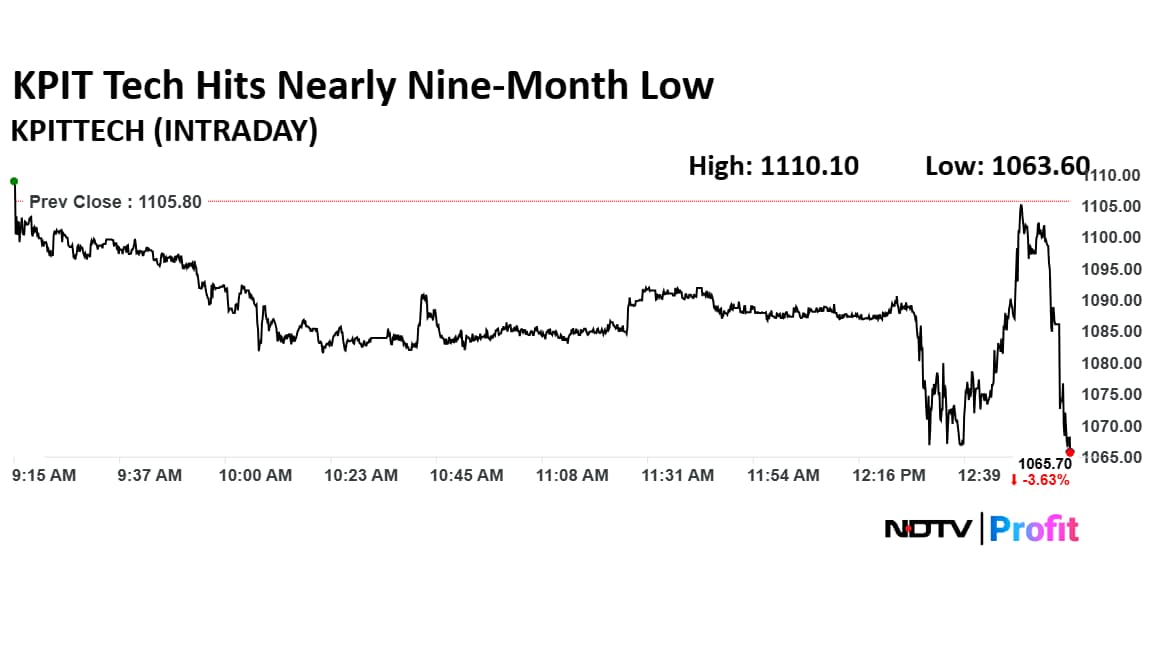

The scrip fell as much as 3.82% to Rs 1,063.60 apiece on Thursday, lowest level since April 9. It pared losses to trade 1.77% lower at Rs 1,086 apiece, as of 1:03 p.m. This compares to a 0.01% decline in the BSE Nifty 50 Index.

It has fallen 22.32% year-to-date. Total traded volume so far in the day stood at 1.39 times its 30-day average. The relative strength index was at 41.73.

It promises to be yet another action-packed day on Dalal Street, with a host of companies expected to declare results for Q3FY26. ITC, Tata Motors, Paytm, Swiggy and Adani Power are among the companies expected to report earnings today.

Some of these companies could also announce dividends. Several of them have also announced the schedule for their Q3FY26 earnings call to discuss the results with investors and analysts.

Check live updates here: Q3 Results Live Updates: ITC, Tata Motors, Paytm, Swiggy And Adani Power To Report Earnings Today

Finance Minister Nirmala Sitharaman tables Economic Survey 2025-26.

Get live updates here: Economic Survey 2026 Live Updates: FM Sitharaman Tables CEA Nageswaran's Document In Parliament

Vodafone Idea Ltd.'s earnings call turned to balance sheet risk when ace investor Madhusudan Kela on Wednesday questioned how the telecom operator would fund its turnaround if cash generation falls short, drawing an explicit response from promoters on their willingness to inject equity.

Kela laid out the company's expected cash requirements over the next three years, combining about Rs 49,000 crore of spectrum payments and Rs 45,000 crore of planned capital expenditure, and asked whether a shortfall would be met by promoters or passed on to shareholders.

The question goes to the centre of Vodafone Idea's equity story, as the company embarks on a capital-intensive network expansion while seeking to stabilise operations after years of stress.

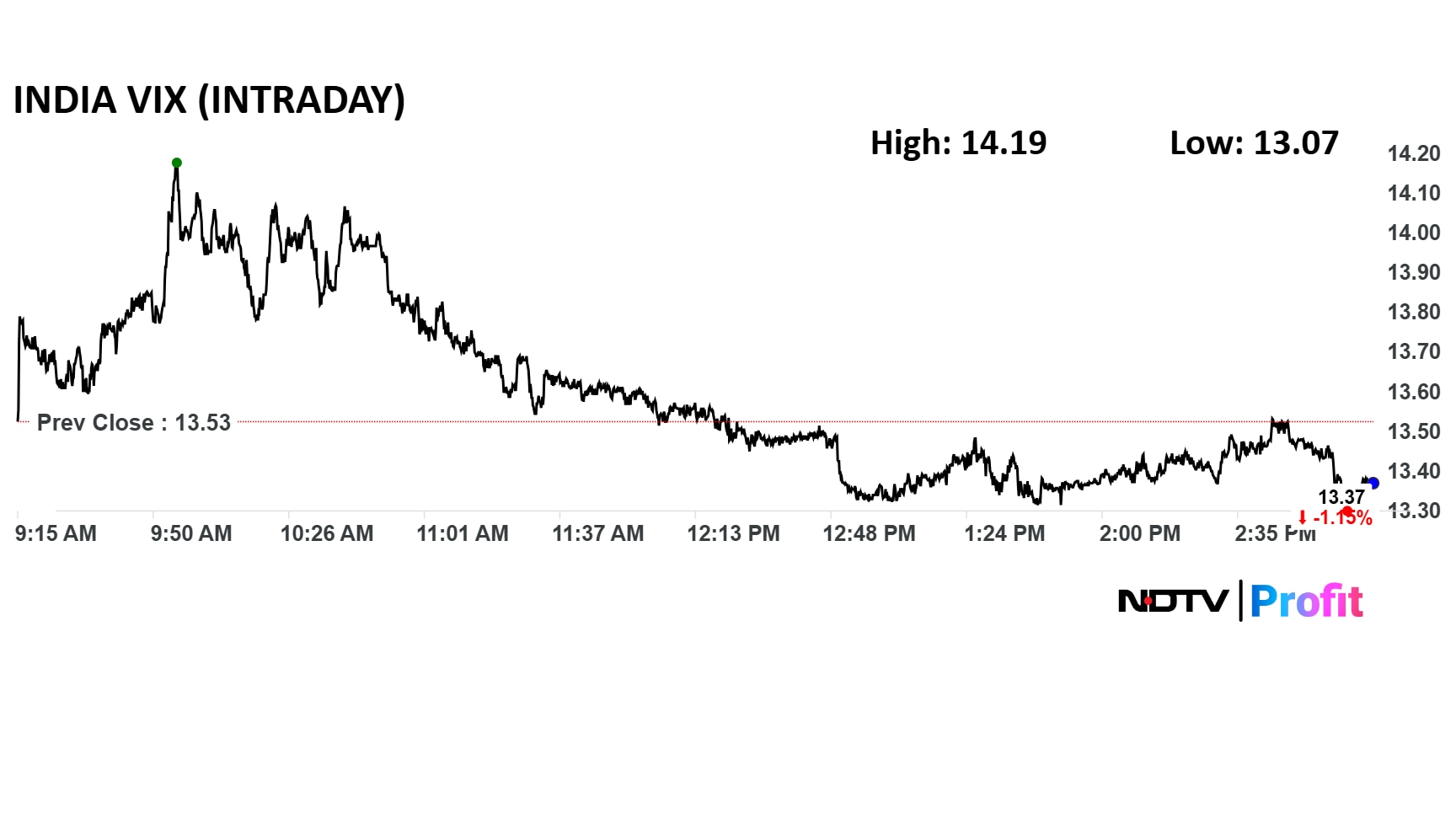

Indian equities were trading lower on Thursday snapping two day winning streak.

Intraday, both Nifty and Sensex fell nearly 1%.

Nifty fell as much as 0.31% at 25,267.75 as of 12 p.m.

Sensex was down 0.34% at 82,068.05.

Broader indices were trading lower. Nifty Midcap 150 was down 0.55%; Nifty Smallcap 250 was trading 0.57% lower.

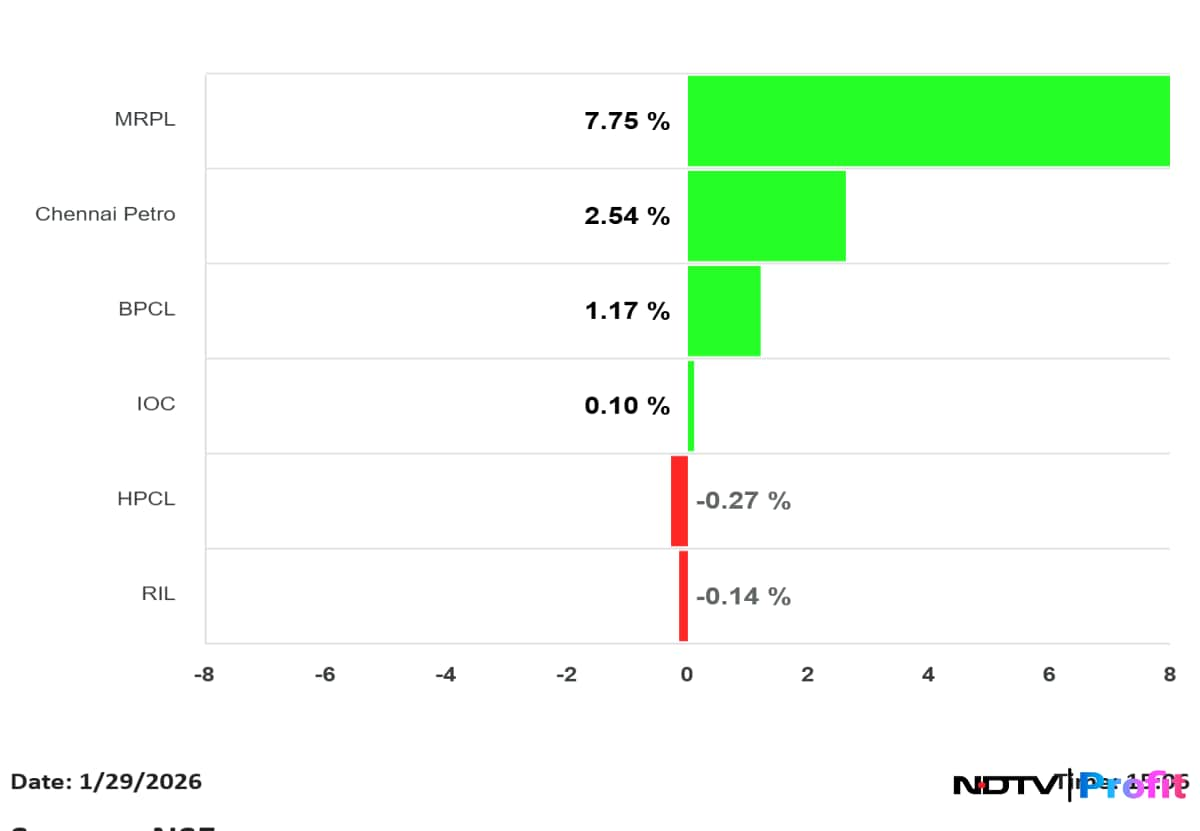

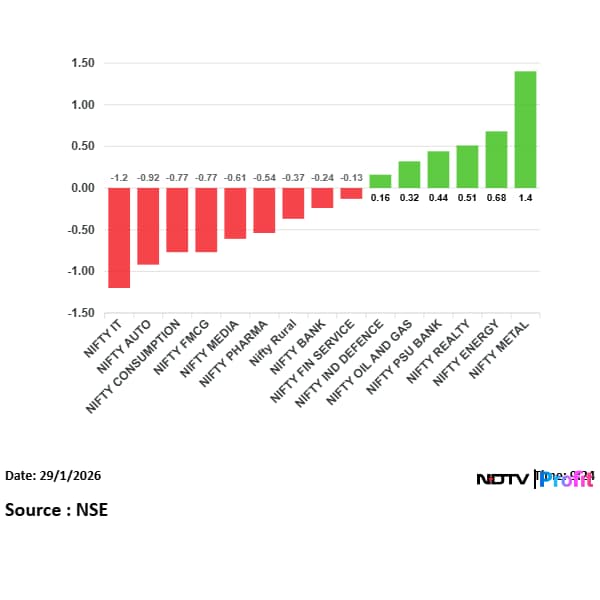

Most sectoral indices fell, led by Nifty Auto and Nifty Defence, while Nifty Metal rose the most followed by Nifty Energy.

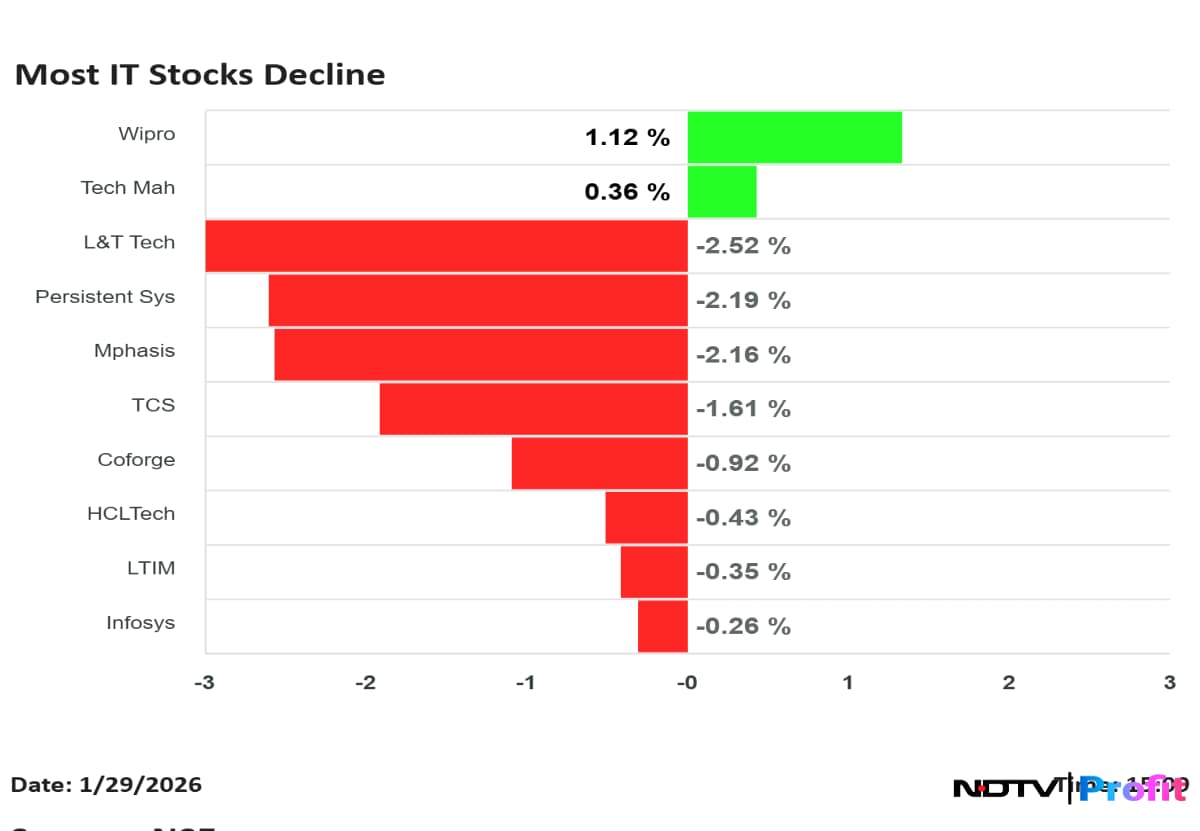

Nifty Bank rose 0.11%, Nifty IT was down 1.48%.

L&T, Axis Bank, NTPC, Hindalco and Tata Steel were top Nifty gainers.

M&M, TCS, Maruti Suzuki, HUL, Titan were top Nifty losers.

Over 1.23 million shares of ONGC were traded via block deal on Thursday. The share of ONGC rose as much as 2.66% to Rs 275.73 apiece.

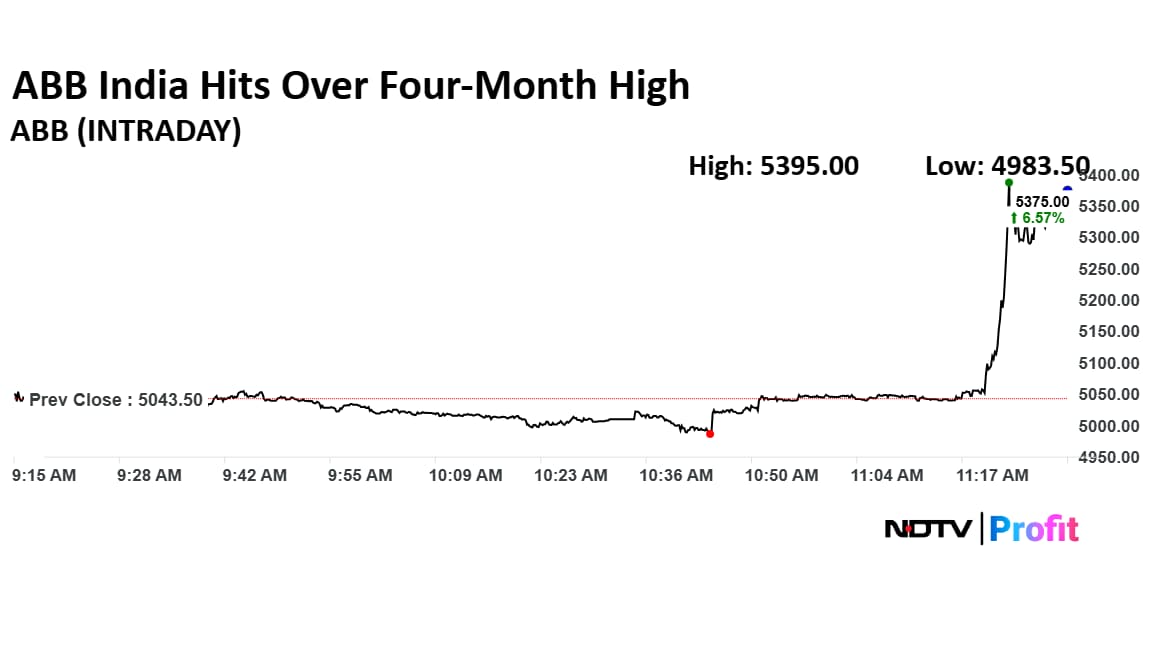

ABB India shares hit over four-month high on Thursday after ABB Global said India order inflow for the quarter rose 49% year-on-year. In addition, analysts estimates order inflow growth in the fourth quarter to be at 20%-26%.

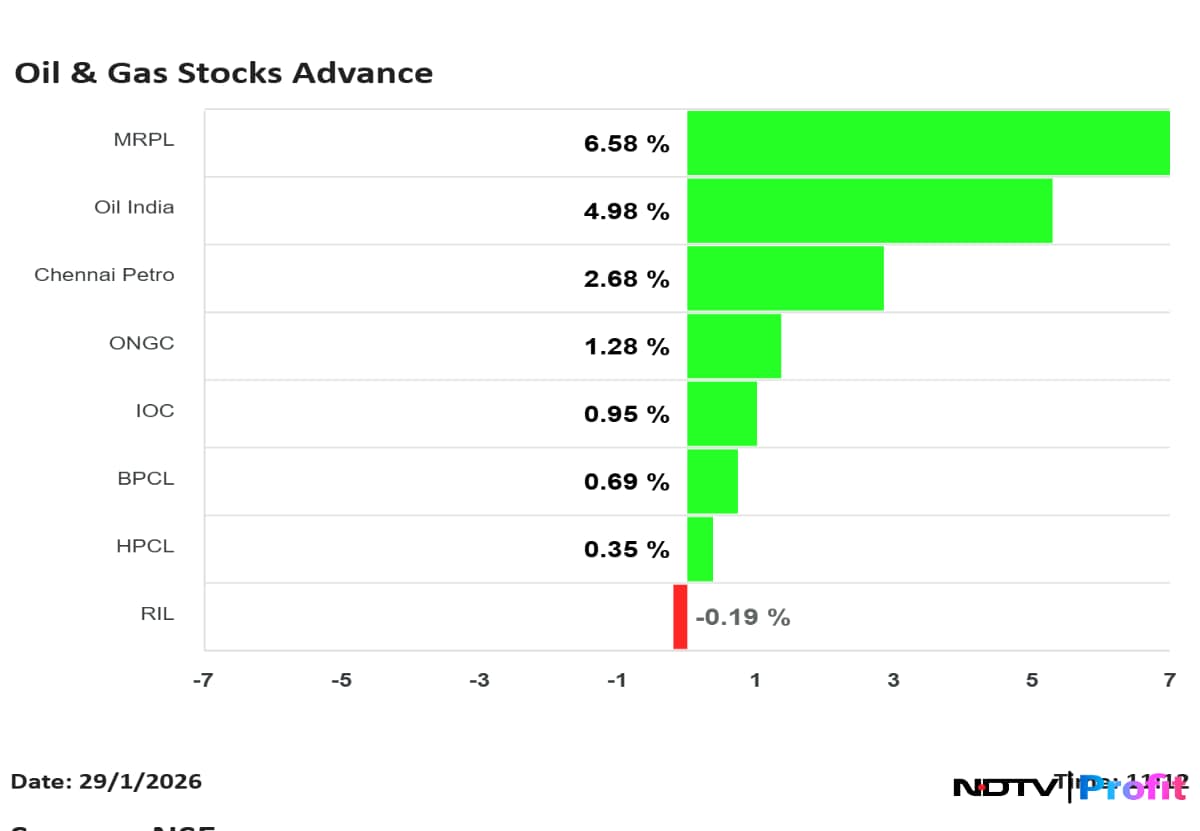

All oil and gas companies have risen in an otherwise down market. MRPL and Oil India lead gains as of 11:14 a.m.

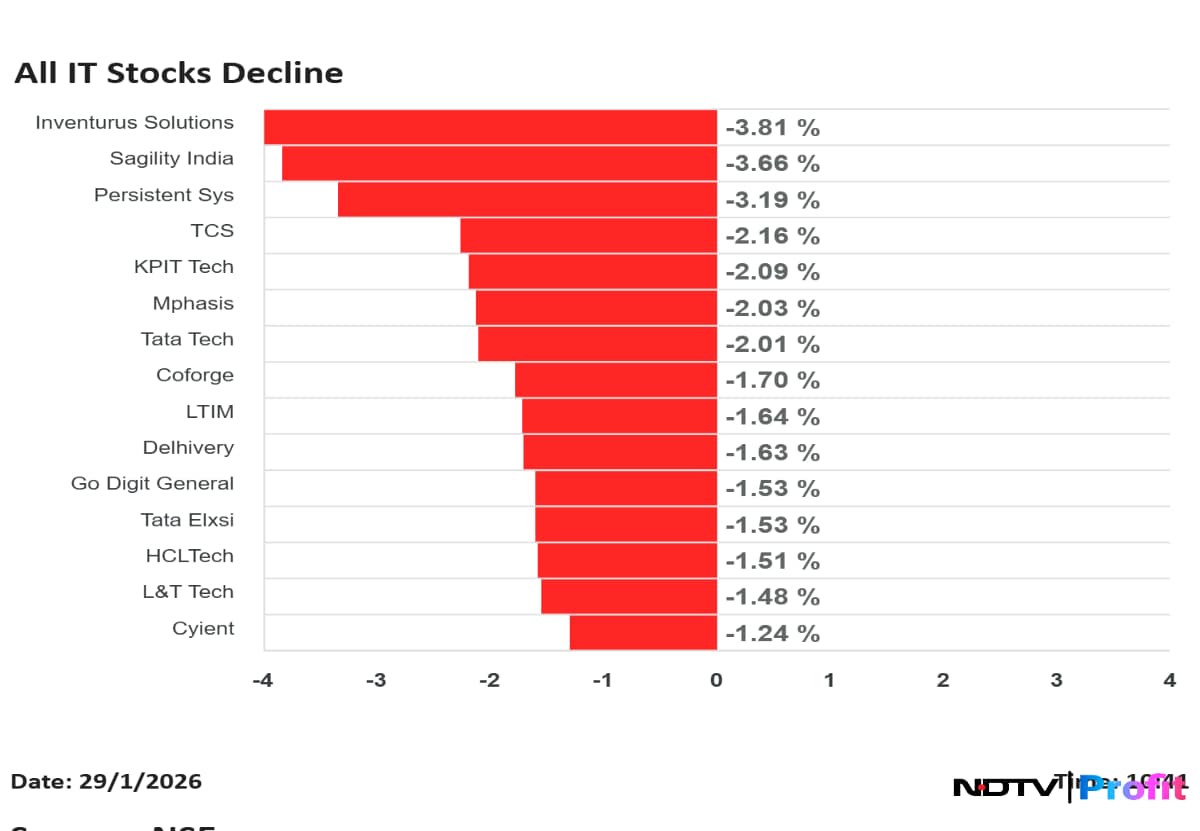

All IT stocks fell on Thursday with Inventurus Solutions and Sagility India leading the decline.

We're just three days away from the Union Budget 2026, and the Economic Survey sets the tone for Feb. 1. It offers a detailed snapshot of the thought process, and of where India stands financially before new policy decisions are announced. The Finance Minister Nirmala Sitharaman is to table the document in Parliament shortly.

Get live updates here: Economic Survey 2026 Live Updates: FM Sitharaman To Table CEA Nageswaran's Document In Parliament Shortly

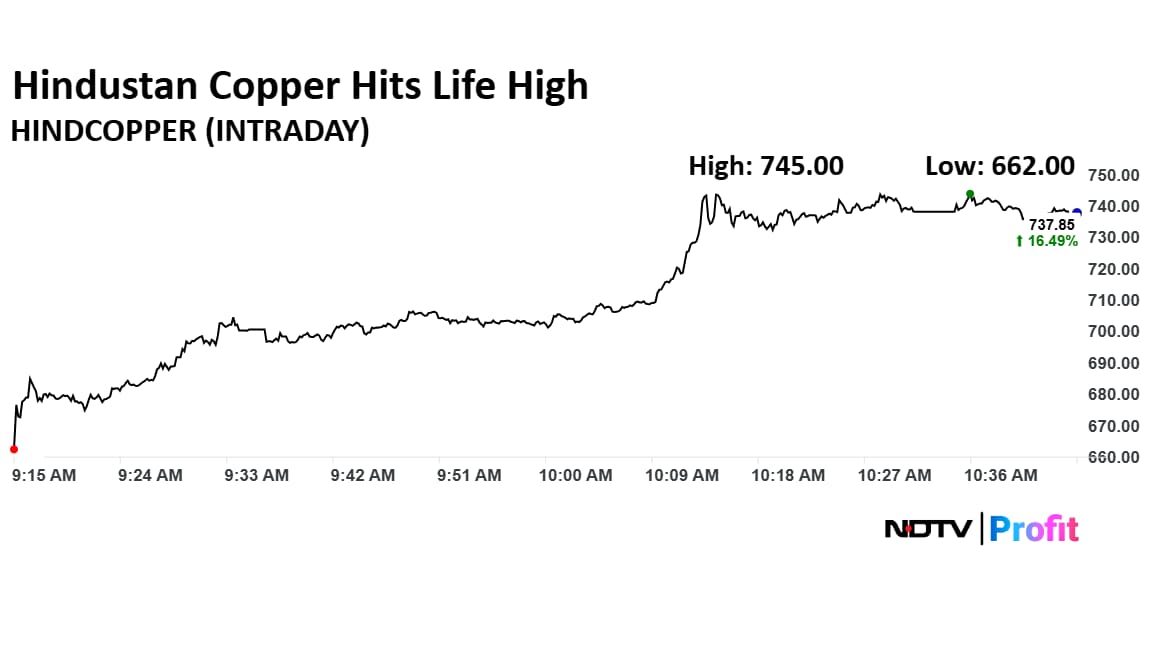

MCX copper contracts hit record high of Rs 1,432 per kg on Thursday.

Shares of Hindustan Copper hit fresh life high on Thursday after it rose 17%. This comes as Copper surges to record high in London as commodities rally.

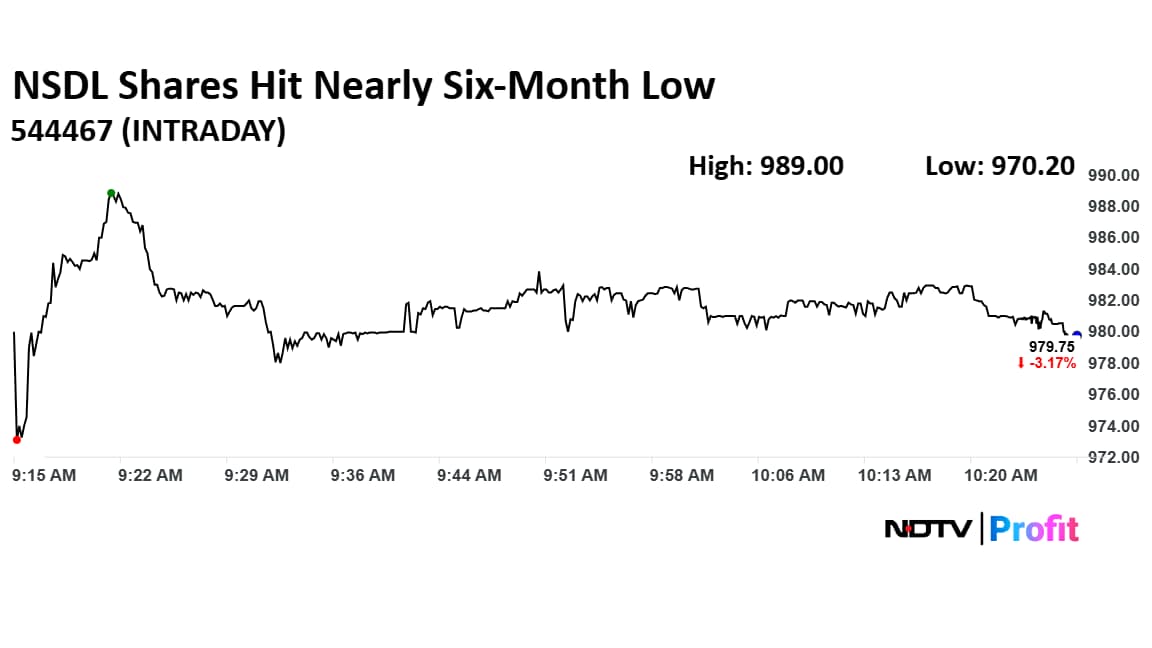

The shares of National Securities Depository Ltd. hit nearly six-month low on Thursday after it announced its third quarter results. The scrip fell as much as 4.12% to Rs 970.20 apiece on Thursday, lowest level since Aug. 7. It pared losses to trade 2.95% lower at Rs 982 apiece, as of 10:24 a.m. This compares to a 0.70% decline in the BSE Nifty 50 Index.

It has fallen 7.75% year-to-date. Total traded volume so far in the day stood at 0.33 times its 30-day average. The relative strength index was at 57.91.

Out of five analysts tracking the company, one maintain a 'buy' rating, two recommend a 'hold,' and two suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target stands at Rs 1,127 indicating an upside of 14.8%.

Over 7.16 million shares of Sunteck Realty were traded via block deal on Thursday. The share of Sunteck Realty rose as much as 3.57% to Rs 387.55 apiece.

Over 1.22 million shares of Hindustan Zinc were traded via block deal on Thursday. The share of Hindustan Zinc rose as much as 1.52% to Rs 719 apiece.

Shares of Garden Reach Shipbuilders Ltd. have surged more than 4% after the company reported its third-quarter earnings for the financial year ending March 2026. The stock is currently trading at Rs 2,574, accounting for gains of more than 2% compared to Wednesday's closing price of Rs 2,518.

This comes on the back of third-quarter earnings that saw the company post a net profit of Rs 171 crore in the quarter ended December, up nearly 75% as compared to Rs 98.2 crore in the year-ago period, according to the financial results declared by the company on Wednesday.

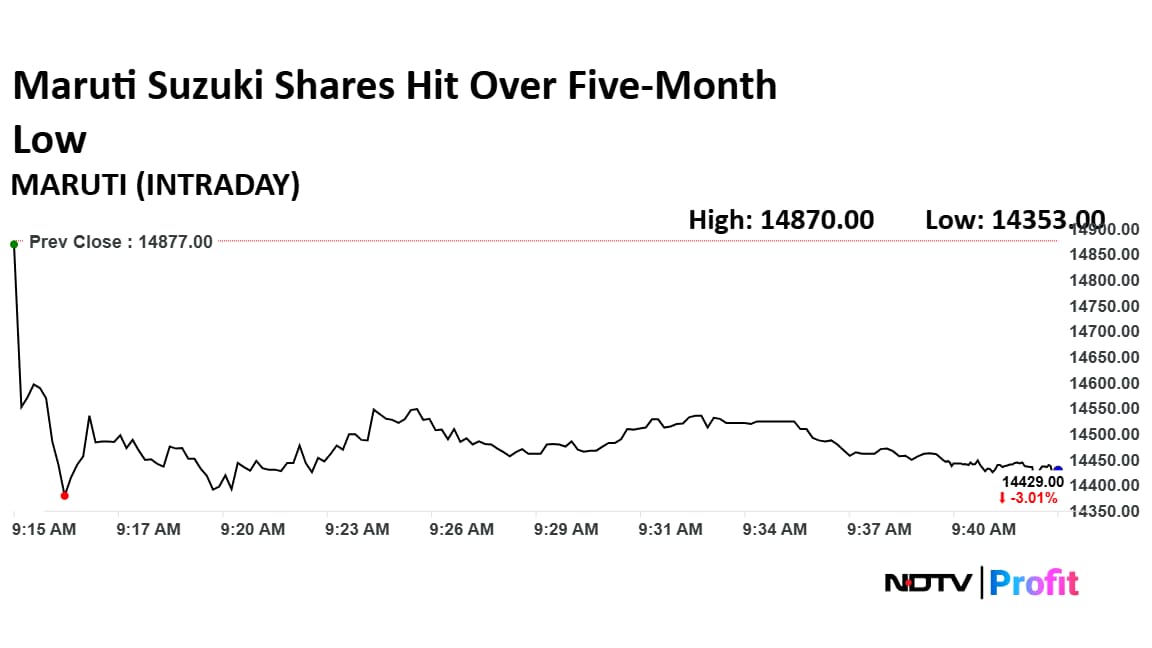

The shares of Maruti Suzuki fell as much as 3.52% to Rs 14,353 apiece on Thursday, highest level since Aug. 25. It pared losses to trade 2.29% lower at Rs 14,536 apiece, as of 9:39 a.m. This compares to a 0.48% advance in the NSE Nifty 50 Index.

It has fallen 20.64% in the last 12 months and 13.50% year-to-date. Total traded volume so far in the day stood at 1.97 times its 30-day average and 0.37 times its 20-day average. The relative strength index was at 45.97.

Out of 49 analysts tracking the company, 39 maintain a 'buy' rating, eight recommend a 'hold,' and two suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target stands at Rs 17,596 indicating an upside of 21.2%.

On NSE, nine of the 15 sectors were in the red. Nifty IT and Nifty Auto lead the fall, while Nifty Metal rose the most.

Broader markets on the other hand were trading higher, with the NSE Midcap 150 trading 0.12% higher and NSE Smallcap was trading 0.21% higher.

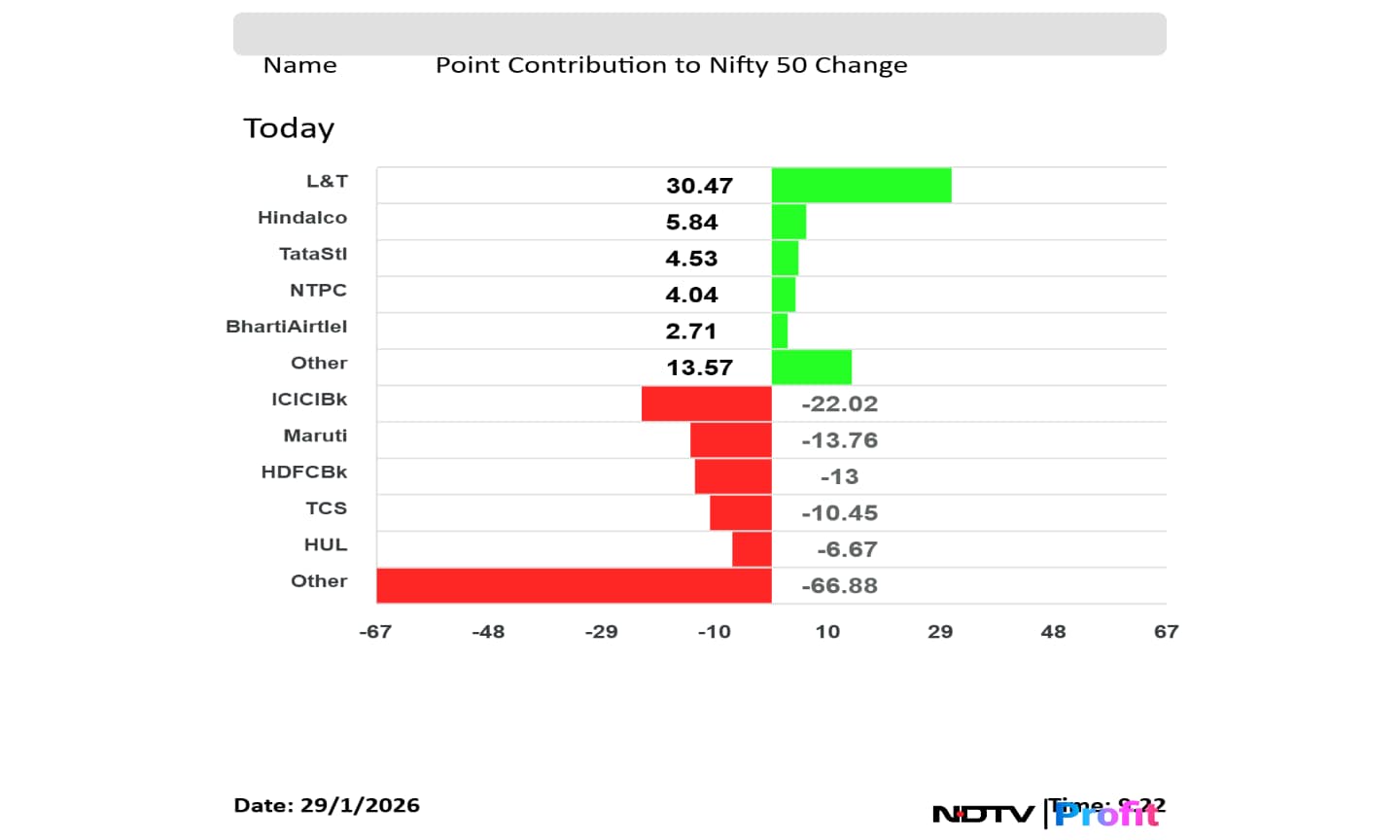

ICICI Bank, Maruti Suzuki, HDFC Bank, TCS and HUL weighed on the Nifty 50 index.

L&T, Hindalco, Tata Steel, NTPC and Bharti Airtel added to the Nifty 50 index.

The NSE Nifty 50 and BSE Sensex opened lower on Wednesday snapping its two-day gaining streak ahead of the Economic Survey. The Nifty 50 opened 0.01% higher at 25,345 and Sensex opened 0.05% up at 82,368.96. However, minutes after open the markets fell with Nifty slipping below 25,300 and Sensex dropping nearly 200 points.

At pre-open, the NSE Nifty 50 was trading 2.25 points or 0.01% higher at 25,345. The BSE Sensex was up 22.53 points at 82,367.

Rupee on Thursday breached the 92-mark and hits fresh record low.

Bharat Electronics Ltd said it expects a strong pickup in defence orders in the January–March quarter, led by a near-term decision on a major missile air defence programme and several electronic warfare and aircraft-related contracts, according to its top management.

The state-run defence electronics company said it is “more than 90% confident” of securing the Quick Reaction Surface-to-Air Missile, or QRSAM, order before the end of the financial year, with only a small possibility of the decision slipping into the next quarter.

“QRSAM itself we are hopeful that we may get by this year itself, means by Q4 itself,” Chairman and Managing Director Manoj Jain said on the earnings call on Wednesday after the results announcement earler in the day, adding that there was “some few percent chance only to spill over to Q1 of next year”.

READ MORE: Bharat Electronics Signals Q4 Defence Order Push Led By Missile Shield Deal

Macquarie on TVS Motor

Morgan Stanley on TVS Motor

Jefferies on TVS Motor

Jefferies on BEL

Macquarie on BEL

Citi on BEL

Citi on Maruti

Jefferies on Maruti

Morgan Stanley on Maruti

The US Federal Reserve kept interest rates steady in the range of 3.5-3.75%, for the first time since July 2025, a sharp pivot from the recent trend that has seen the Fed lower the benchmark rates three times in a row. The decision comes at a time of growing tension between the US Federal Government and the US Fed, with President Donald Trump openly looking to replace Fed Chair Jerome Powell.

Needless to say, Indian markets will be a key focus area as market participants closely monitor the spillover effect of the US Fed rate action on emerging economies.

An early indicator is usually the GIFT Nifty, which is trading with cuts of around 0.14% early morning. GIFT Nifty trading flat with a slight negative bias suggests the markets could be set for a flat open on Thursday.

Read more: US Fed Rate Decision: What Does It Mean For Indian Markets?

Silver rose as much as 2.3% to a record above $119.40 an ounce, its sixth straight day of gains. In China - where prices have ballooned beyond international benchmarks - the only pure-play silver fund turned away new investors while local authorities in Shenzhen set up a task force to oversee the operations of a gold-trading platform.

Source: Bloomberg

Gold jumped to a record high above $5,500 an ounce, extending a breakneck rally fueled by US dollar weakness and investor flight from sovereign bonds and currencies.

Bullion jumped as much as 3.2%, building on a 4.6% leap in the previous session - the biggest one-day gain since the height of the Covid-19 pandemic in March 2020. Gold rose 1.1% to $5,477.36 an ounce as of 9:05 a.m. in Singapore, having earlier hit an all-time high of $5,588.71.

Gold Surges Above $5,500 As Debasement Trade Fuels Record Rally

The Bloomberg Dollar Spot Index fell 0.2%, retracing some of the gains made after Treasury Secretary Scott Bessent said the US hadn’t intervened to support the yen and reiterated a strong dollar policy.

The US Dollar index is down 0.07% at 95.110.

Euro was up 0.08% at 1.1963.

Pound was up 0.02% at 1.3809.

Yen was down 0.13% at 153.24.

Asia-Pacific stocks delivered a mixed performance on Thursday. In Japan, the Nikkei 225 inched up 0.18%, while the broader Topix index fell 0.57%. South Korea's markets were stronger, with the Kospi rising 1.09% and the tech-heavy Kosdaq gaining 2.69%. Samsung Electronics' shares climbed 1.6% after the company reported that its fourth-quarter profit had more than tripled, supported by tight supplies in memory chips and robust demand for servers used in artificial intelligence. Futures for Hong Kong's Hang Seng Index were trading at 27,565, below the benchmark's previous close of 27,826.91.

US stock futures slipped in early trading as uneven results from major technology companies prompted renewed doubts about the strength of the AI-driven rally.

Good morning readers.

The GIFT Nifty was trading below 25,400 early on Thursday. The futures contract based on the benchmark Nifty 50 fell 0.22% at 25,390 as of 6:50 a.m. indicating a negative start for the Indian markets.

In the previous session on Wednesday, the benchmark extended its gaining streak to the second day. The Nifty ended 167.35 points or 0.66% higher at 25,342.75 and Sensex ended 487.20 points or 0.60% higher at 82,344.68.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.