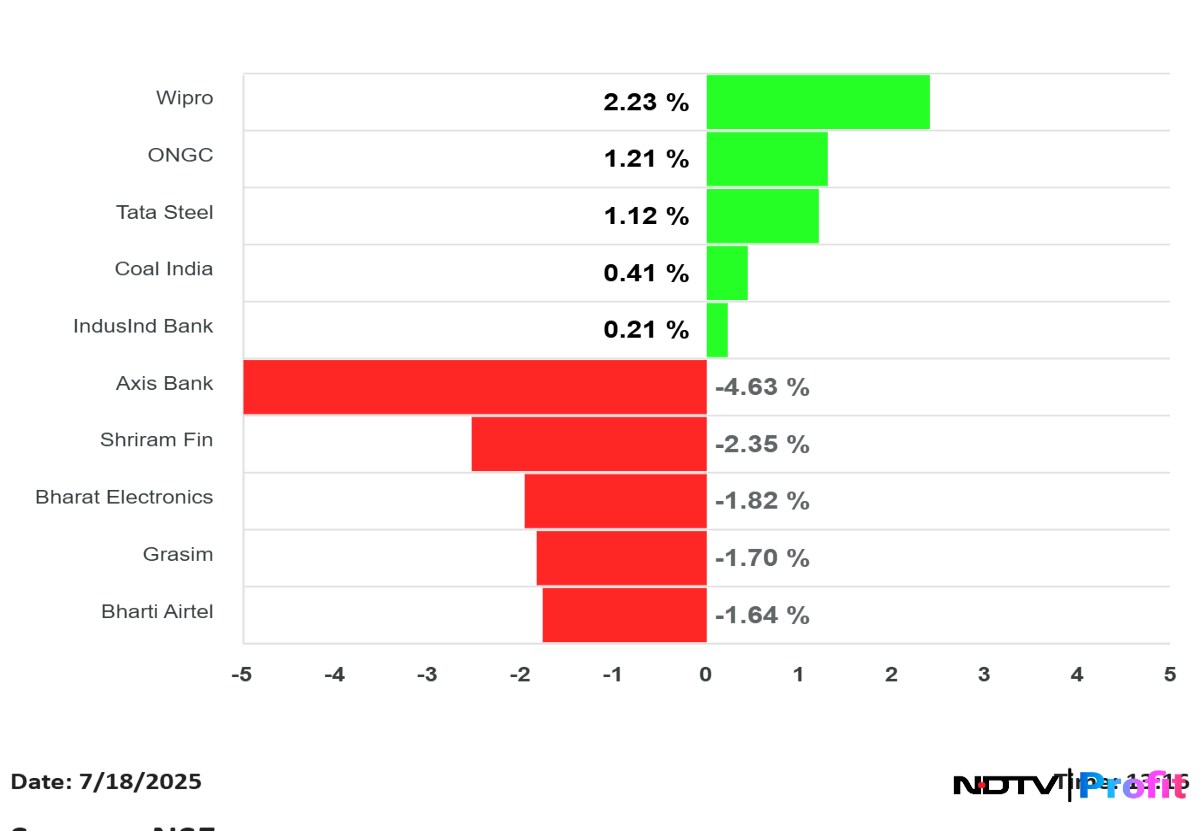

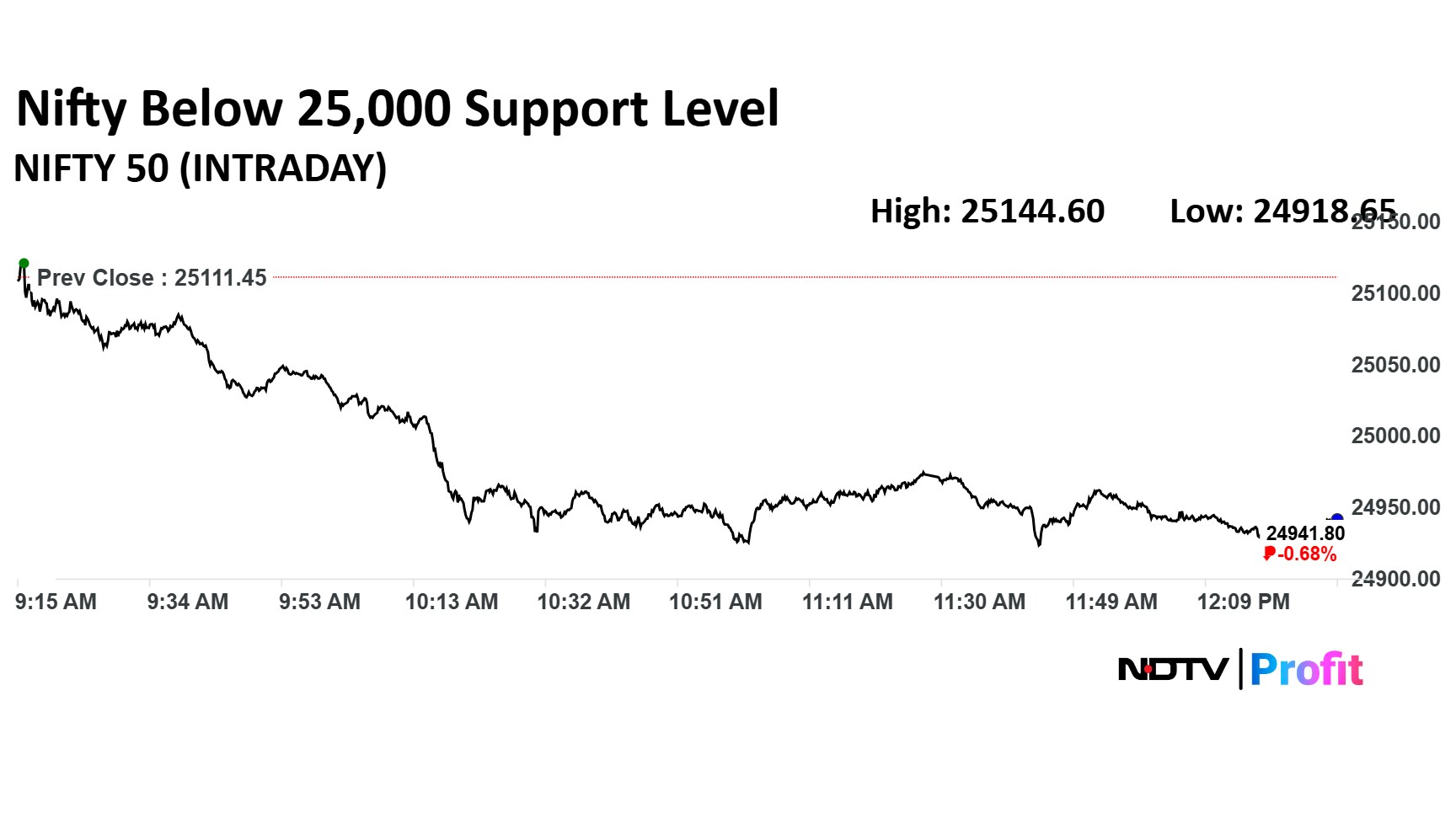

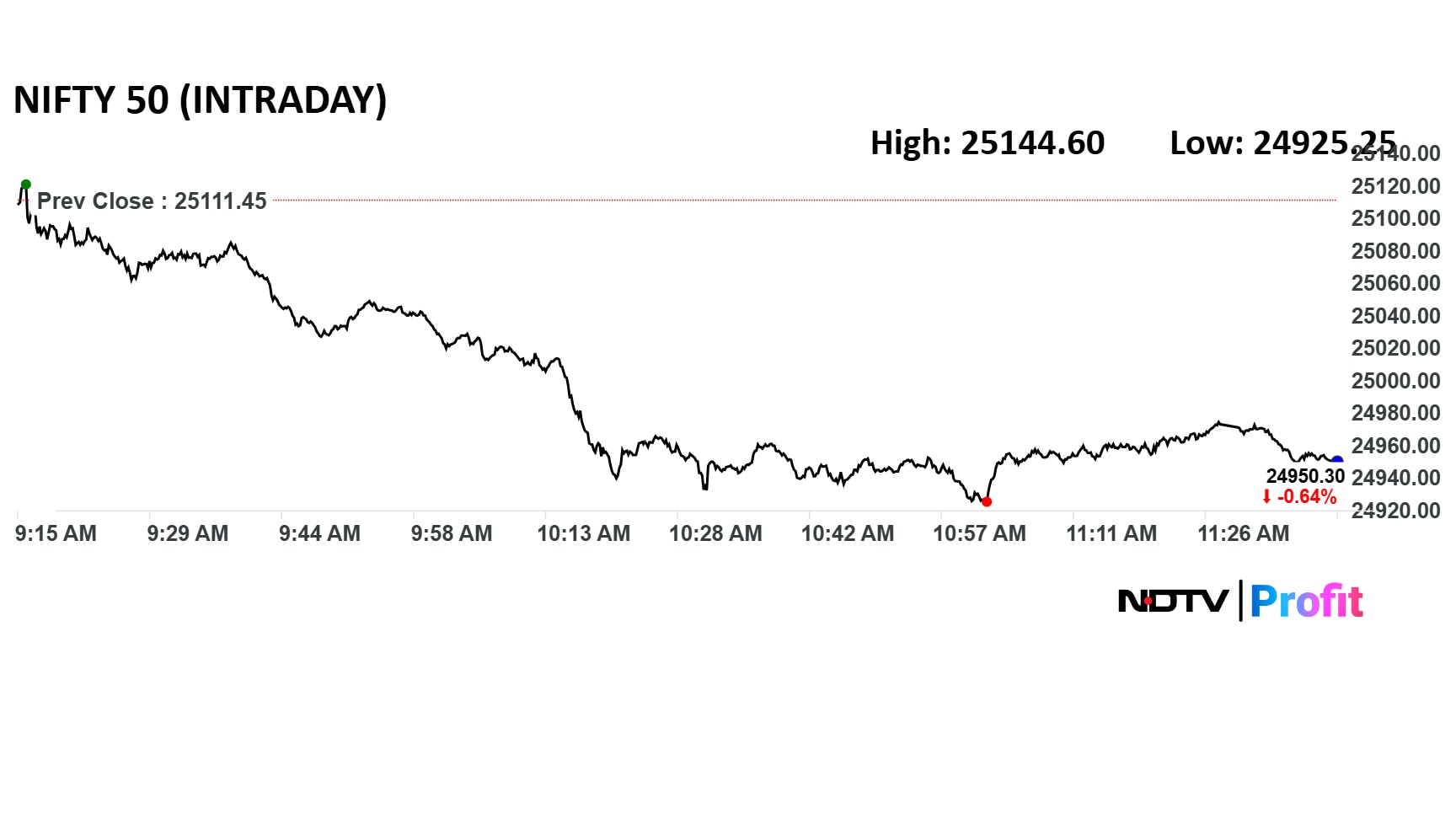

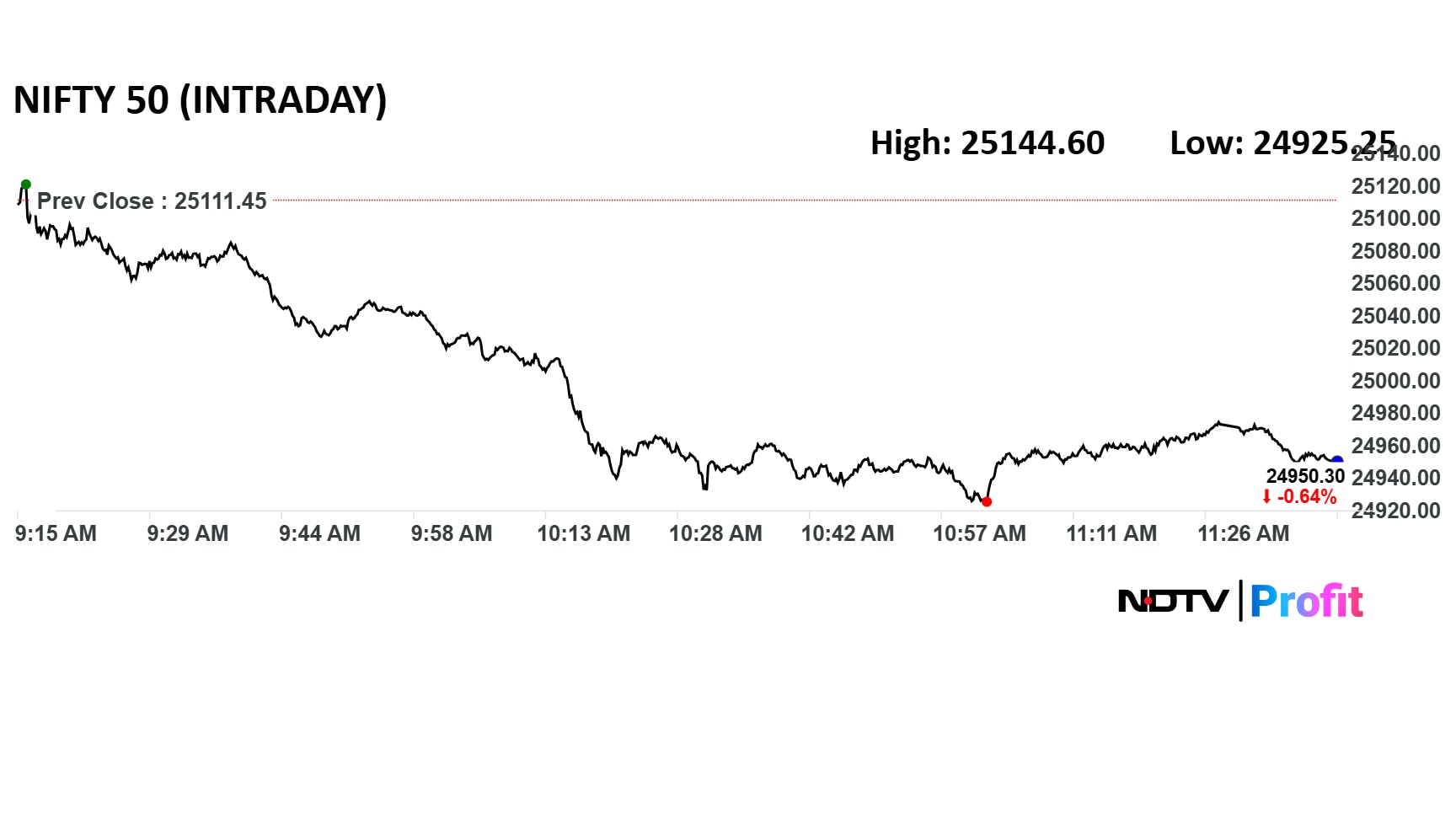

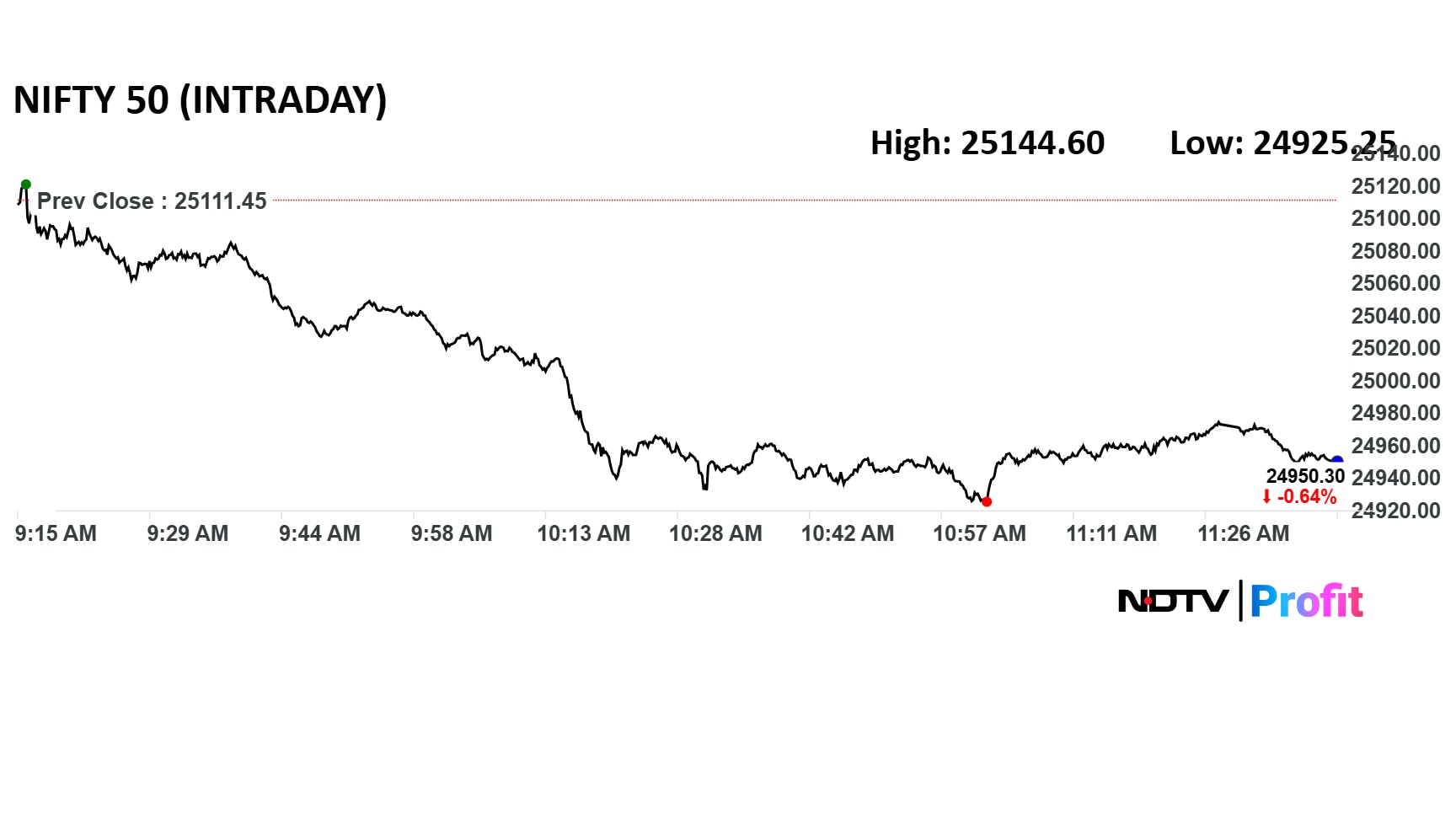

The benchmark indices closed lower today, marking their second consecutive day of decline. The Nifty notably fell below the 25,000 mark, primarily dragged down by the Financials sector.

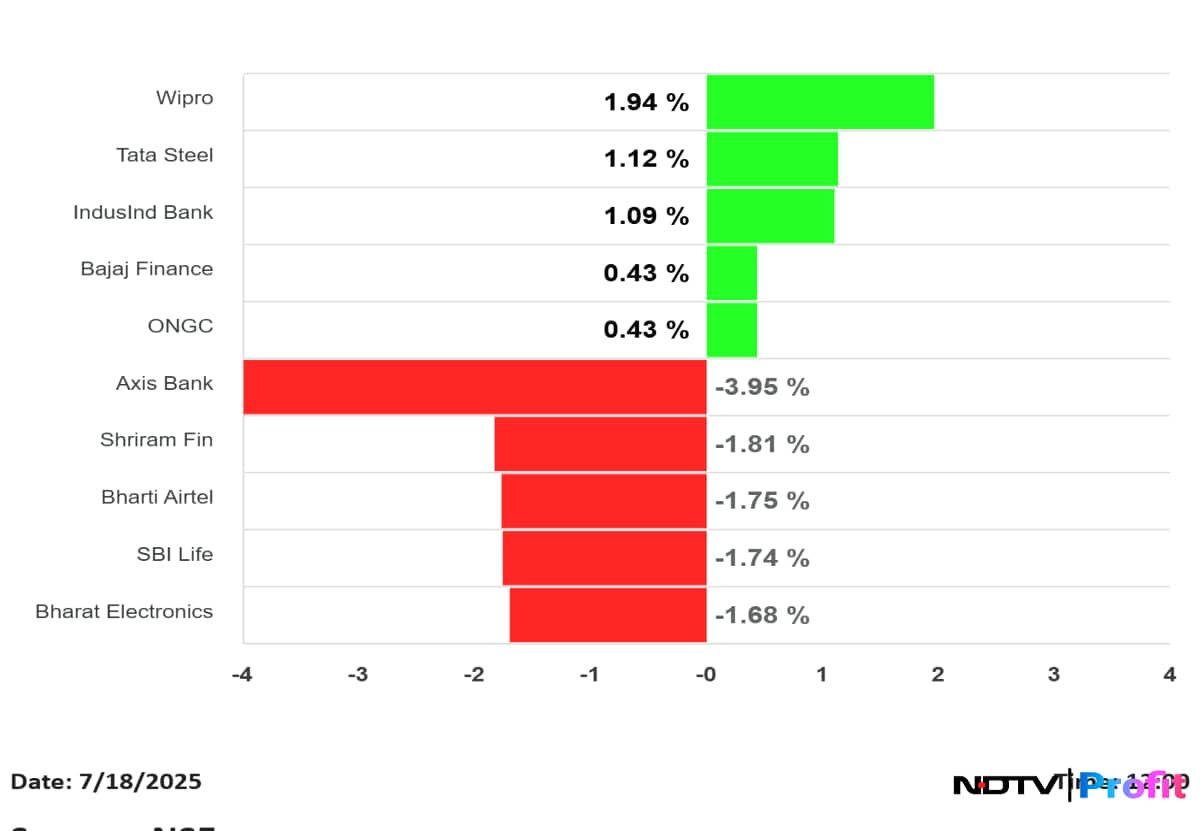

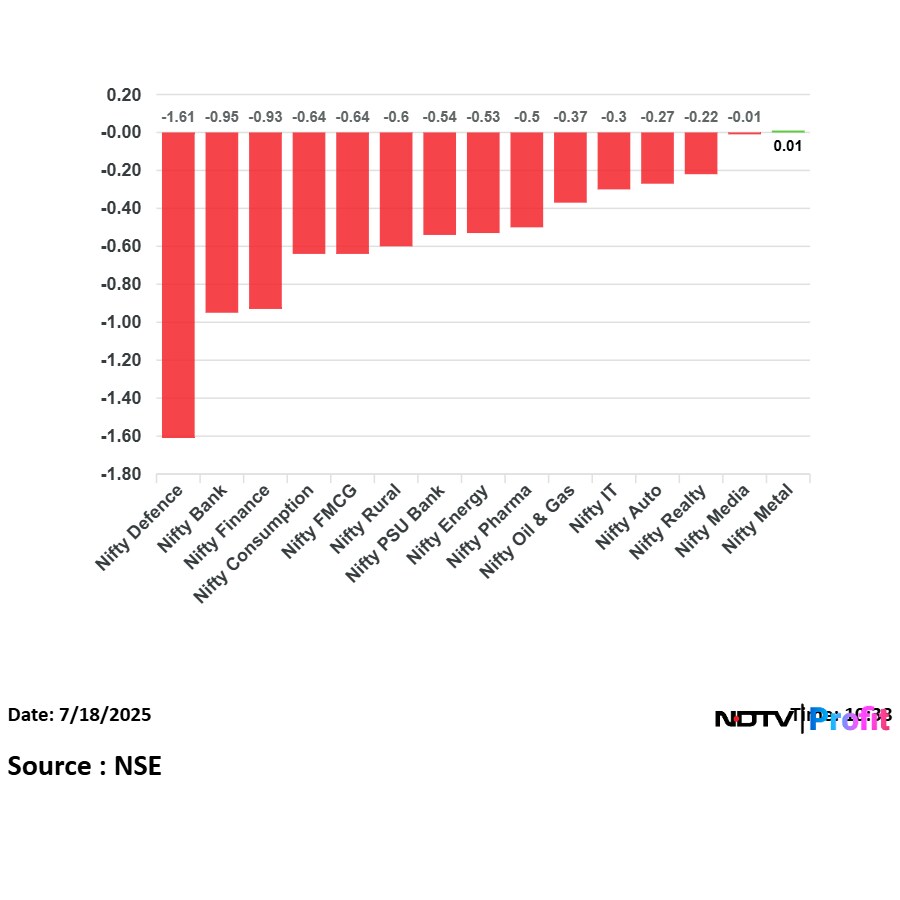

Within the Nifty, Axis Bank and Shriram Finance recorded the most significant losses. The Nifty Bank index, falling by nearly 1%, emerged as the top losing sector for the day, with Axis Bank and HDFC Bank being its biggest contributors to the decline. Overall, several key sectoral indices including Nifty IT, Oil & Gas, Auto, PSU Bank, and Nifty Bank, also experienced losses for the second consecutive day.

Adding to the broad market weakness, the Nifty Realty index snapped its four-day gaining streak, and the Nifty FMCG index ended its impressive five-day winning run. The Nifty Financial Services sector continued its downward trend, registering losses for the third day in a row.

In contrast to the overall market sentiment, the Nifty Media index posted a gain of more than 1% today, driven by strong performances from TV18 Broadcast and Saregama. This marks the Nifty Media index's second consecutive day of gains.

The benchmark indices closed lower today, marking their second consecutive day of decline. The Nifty notably fell below the 25,000 mark, primarily dragged down by the Financials sector.

Within the Nifty, Axis Bank and Shriram Finance recorded the most significant losses. The Nifty Bank index, falling by nearly 1%, emerged as the top losing sector for the day, with Axis Bank and HDFC Bank being its biggest contributors to the decline. Overall, several key sectoral indices including Nifty IT, Oil & Gas, Auto, PSU Bank, and Nifty Bank, also experienced losses for the second consecutive day.

Adding to the broad market weakness, the Nifty Realty index snapped its four-day gaining streak, and the Nifty FMCG index ended its impressive five-day winning run. The Nifty Financial Services sector continued its downward trend, registering losses for the third day in a row.

In contrast to the overall market sentiment, the Nifty Media index posted a gain of more than 1% today, driven by strong performances from TV18 Broadcast and Saregama. This marks the Nifty Media index's second consecutive day of gains.

Rupee closed eight paise lower at 86.16 against the US Dollar. It closed at 86.08 on Thursday according to Bloomberg data.

The shares of BEML traded lower despite the company getting a Rs 186 crore order to supply bulldozer from the Defence Ministry.

The scrip was trading 3.13% lower at Rs 4,404 compared to the 0.59% decline in the benchmark index Nifty 50.

The shares of BEML traded lower despite the company getting a Rs 186 crore order to supply bulldozer from the Defence Ministry.

The scrip was trading 3.13% lower at Rs 4,404 compared to the 0.59% decline in the benchmark index Nifty 50.

The shares of HDFC bank was trading 1% lower ahead of its first quarter earnings. ICICI Bank was trading flat ahead results along with Reliance Industries. Many of key sectoral players are set to announce their first quarter results today.

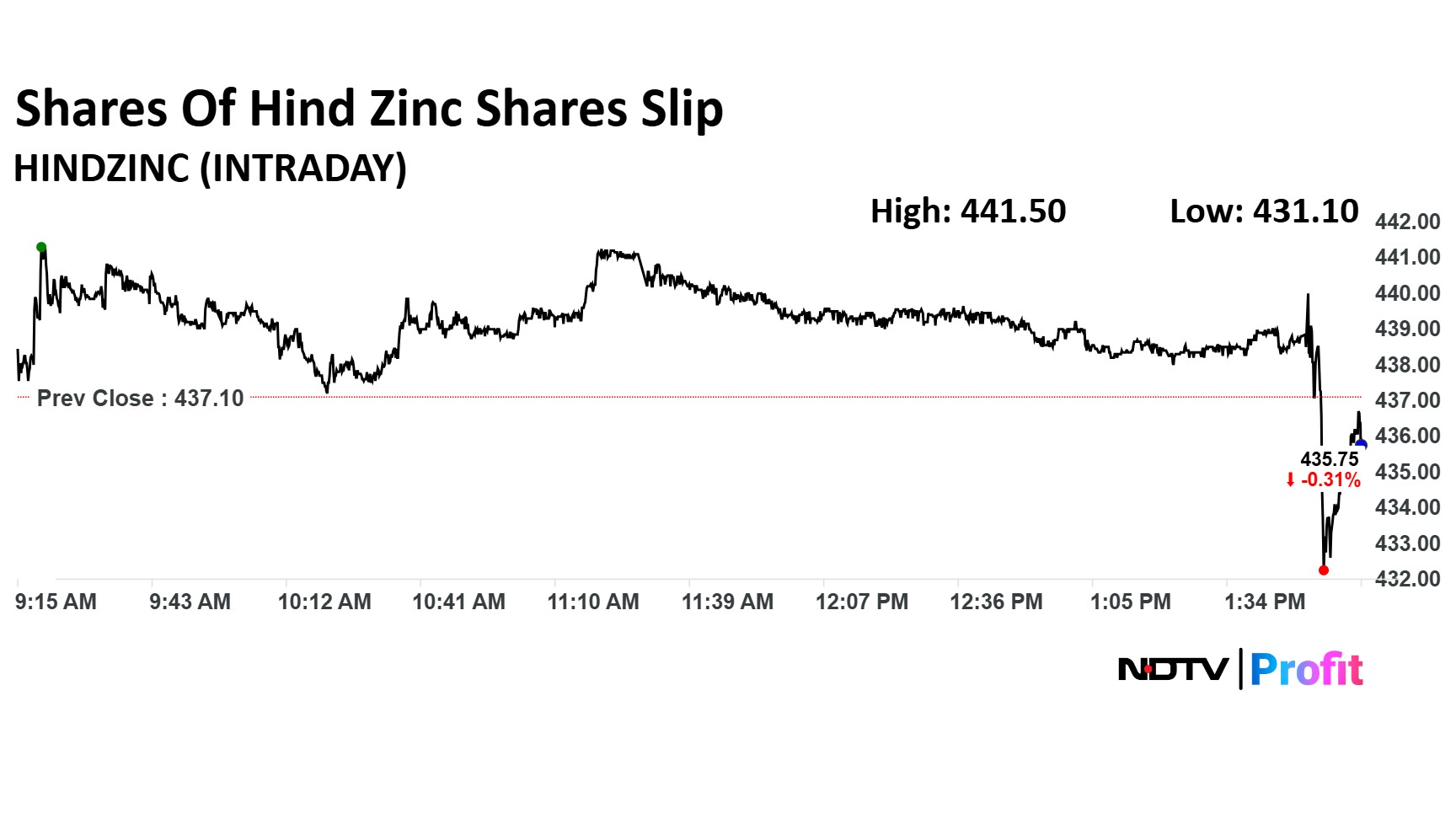

After posting disappointing first quarter results, the shares of Hindustan Zinc slip lower. The scrip was trading 0.23% lower at Rs 435 compared to a 0.57% decline in the benchmark index.

Revenue from zinc, lead and others was down 14.1% to Rs 6,116 crore versus Rs 7,118 crore. Revenue from silver down 15.5% to Rs 1,426 crore versus Rs 1,688 crore.

After posting disappointing first quarter results, the shares of Hindustan Zinc slip lower. The scrip was trading 0.23% lower at Rs 435 compared to a 0.57% decline in the benchmark index.

Revenue from zinc, lead and others was down 14.1% to Rs 6,116 crore versus Rs 7,118 crore. Revenue from silver down 15.5% to Rs 1,426 crore versus Rs 1,688 crore.

Kandiraju Venkata Sitaram Rao has resigned as CEO.

Source: Exchange filing

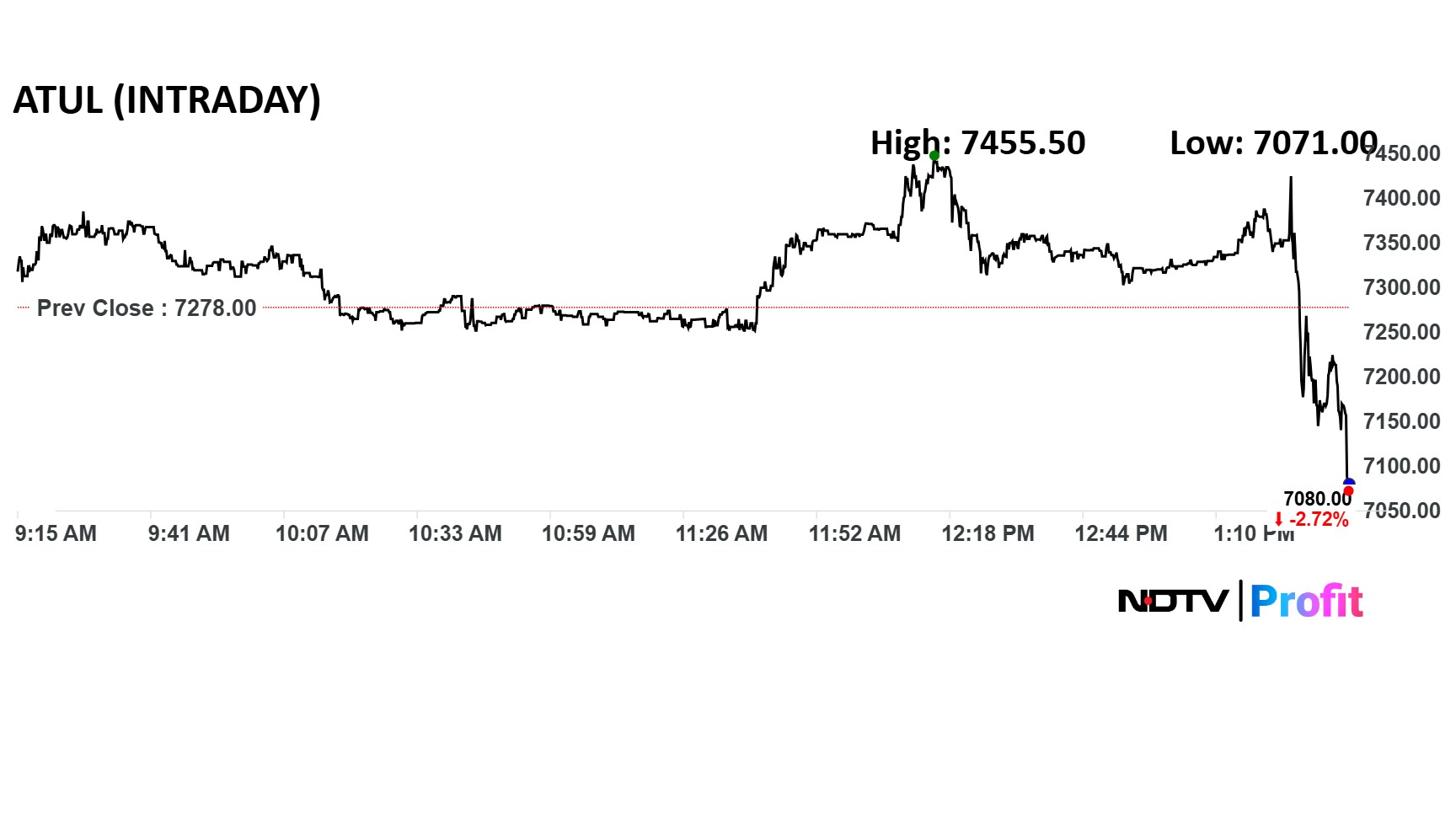

Atul Q1FY26 (Consolidated, YoY)

Revenue up 11.8% at Rs 1,478 crore versus Rs 1,322 crore.

Ebitda up 5.5% at Rs 236 crore versus Rs 223 crore.

Margin at 15.9% versus 16.9%.

Net Profit up 14.2% at Rs 128 crore versus Rs 112 crore.

Atul Q1FY26 (Consolidated, YoY)

Revenue up 11.8% at Rs 1,478 crore versus Rs 1,322 crore.

Ebitda up 5.5% at Rs 236 crore versus Rs 223 crore.

Margin at 15.9% versus 16.9%.

Net Profit up 14.2% at Rs 128 crore versus Rs 112 crore.

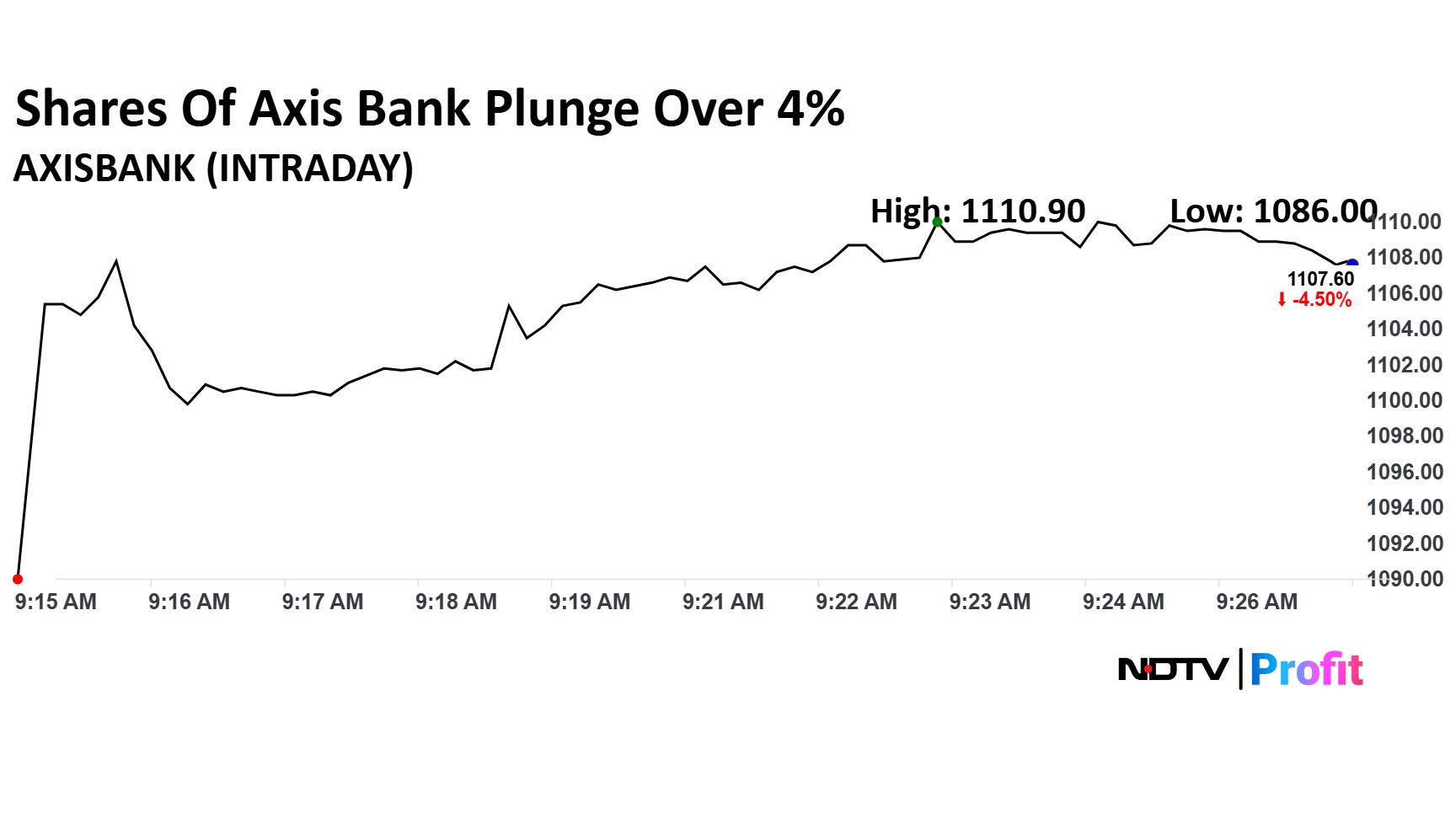

The heaviest weight dragging the benchmark index continued to be Axis Bank. The bank has extended the losses to nearly 5% and the rest of the names pulling on the index include heavy weight insurance companies too.

The heaviest weight dragging the benchmark index continued to be Axis Bank. The bank has extended the losses to nearly 5% and the rest of the names pulling on the index include heavy weight insurance companies too.

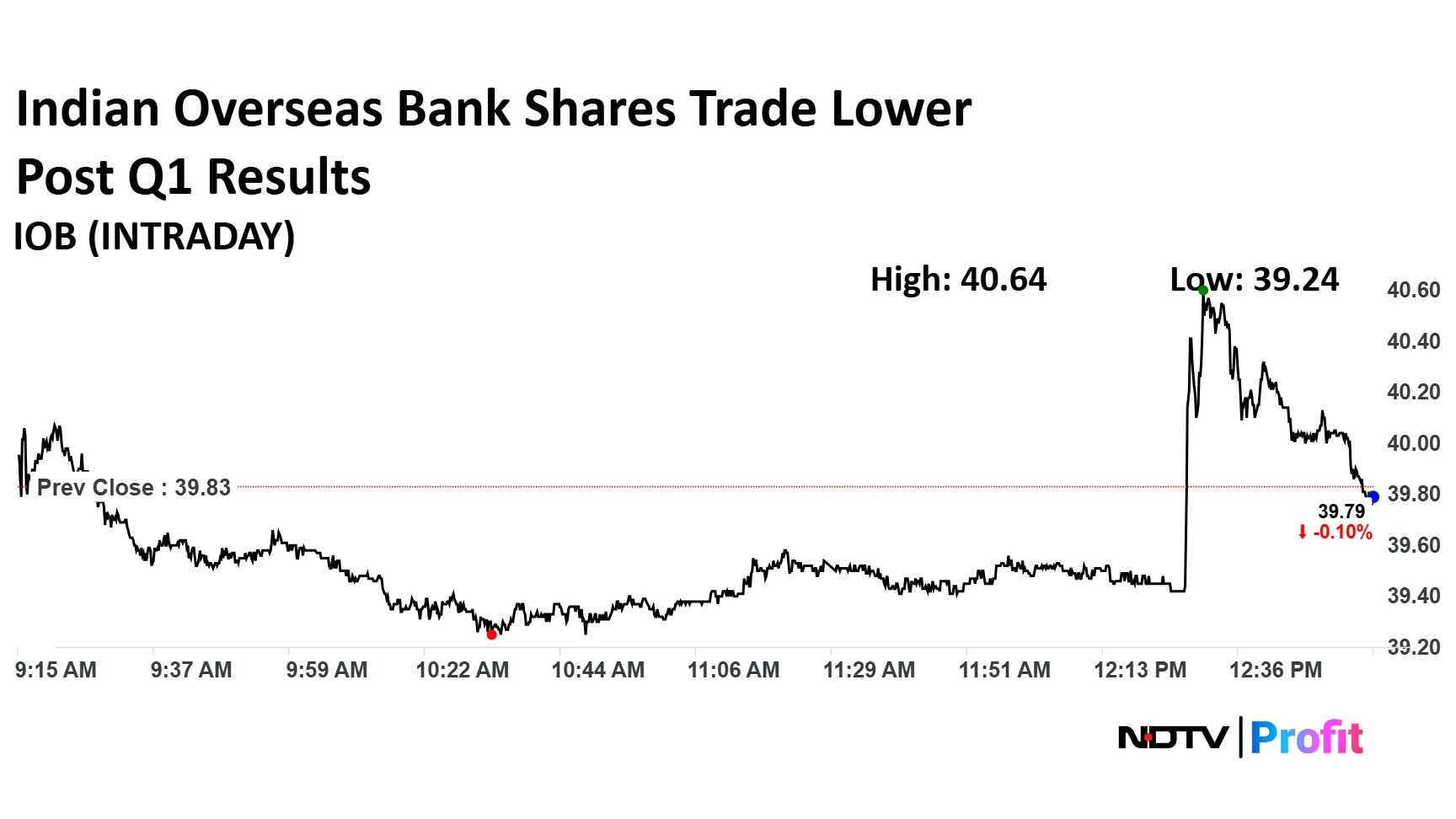

Indian Overseas Bank posted its first quarter results and the Net interest income was up 12% at Rs 2,746 crore compared to Rs 2,441 crore in the previous quarter. The net profit was also up 75.6% at Rs 1,111 crore against Rs 633 crore.

The scrip was trading 0.20% lower at Rs 39 compared to a 0.69% decline in the benchmark index Nifty 50 as of 1:00 p.m.

Indian Overseas Bank posted its first quarter results and the Net interest income was up 12% at Rs 2,746 crore compared to Rs 2,441 crore in the previous quarter. The net profit was also up 75.6% at Rs 1,111 crore against Rs 633 crore.

The scrip was trading 0.20% lower at Rs 39 compared to a 0.69% decline in the benchmark index Nifty 50 as of 1:00 p.m.

Feroze Azeez, Joint CEO at Anand Rathi Wealth, offered a more technical lens. He noted that short positions in index futures have reached 84%, a level that historically signals a potential bounce. “Every time it crosses 80 on either side, the market tends to reverse direction. This has held true in the last 12–13 instances,” Azeez said.

With the markets cracking, the way ahead is murky as there is the lack of solid positive triggers. This is further accelerating the slip as well.

"Market is waiting for some kind of positivity from earnings. Any surprise goodness from Reliance. We started with a sober or lukewarm from TCS so looking for positive triggers," according to Kranthi Bathini of WealthMills Securities.

On the technical front, the Nifty after violating the support levels may be looking to slip further according to this market expert.

"The Nifty is heading to test 50 day exponential moving average at 24,870. From there it can bounce, if it breaches 24,870 then it will highly likely swing as low as 24,733," said Anshul Jain, independent technical market analyst. With fresh support falling to 24,870, other experts have also called for a close eye on buying interest in the European markets.

On the technical front, the Nifty after violating the support levels may be looking to slip further according to this market expert.

"The Nifty is heading to test 50 day exponential moving average at 24,870. From there it can bounce, if it breaches 24,870 then it will highly likely swing as low as 24,733," said Anshul Jain, independent technical market analyst. With fresh support falling to 24,870, other experts have also called for a close eye on buying interest in the European markets.

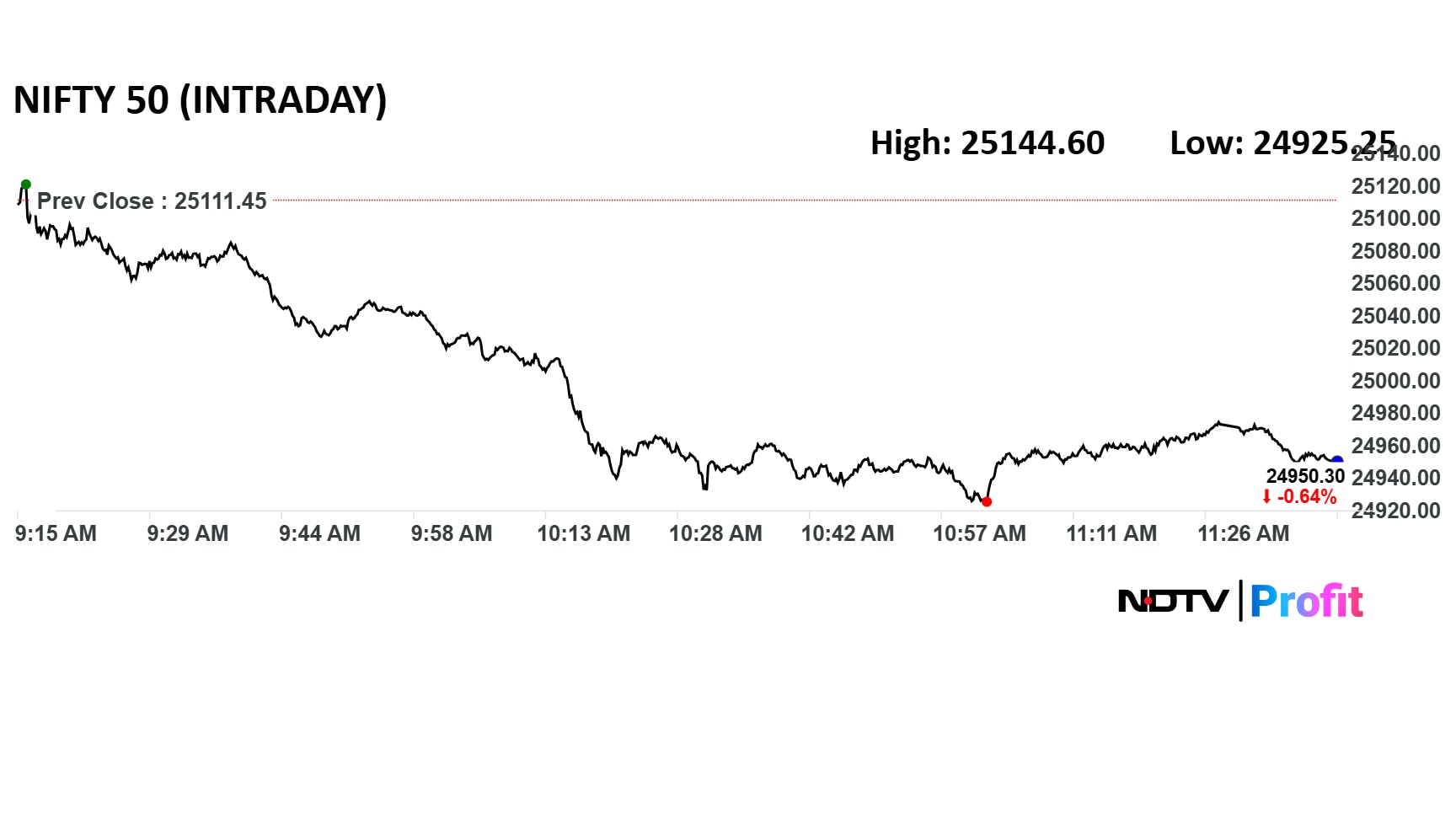

The Nifty 50's dip below 25,000 marked a nearly four-week low for the index, reflecting broad-based weakness across the market. The Indian equity markets are trading in a bearish tone as the Nifty has slipped below key support levels of 25,000.

Read the full story below

The benchmark index breached the support levels and slipped below teh 25,000 mark during trade today. The index was primarily dragged by private sector banks, insurance heavy weights and others.

The benchmark index breached the support levels and slipped below teh 25,000 mark during trade today. The index was primarily dragged by private sector banks, insurance heavy weights and others.

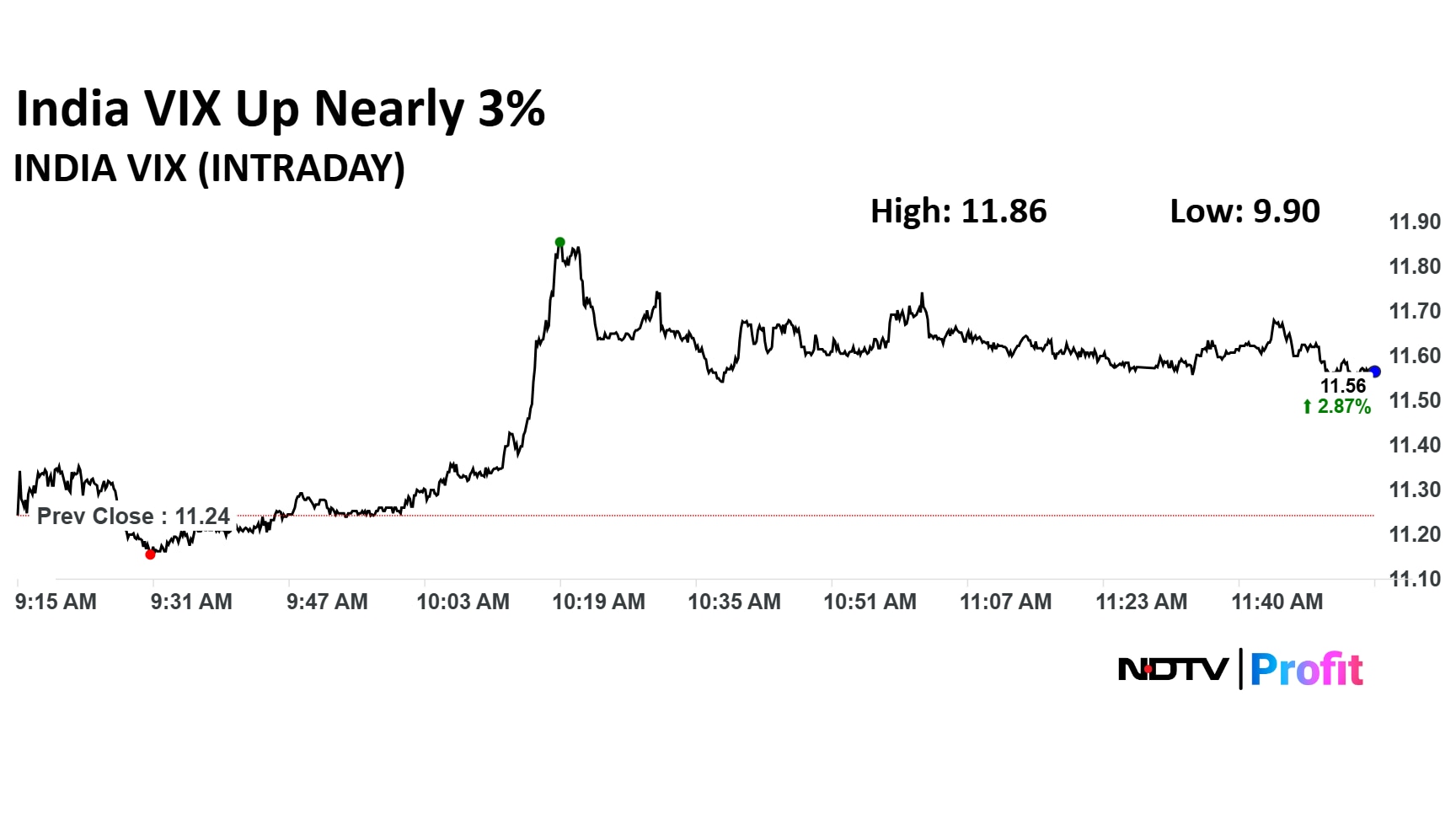

The Indian equity markets have been seeing a downturn on account of various cues from earnings, global cues and more. The India Volatility Index was up 2.91% as of 11:58 a.m. as the Nifty was down about 0.65%.

The Indian equity markets have been seeing a downturn on account of various cues from earnings, global cues and more. The India Volatility Index was up 2.91% as of 11:58 a.m. as the Nifty was down about 0.65%.

The Nifty 50 has slipped below key support level of 25,000, indicating bearish tone.

Bank Nifty opened gap-down on weak numbers from Axis Bank and ahead of HDFC Bank and ICICI Bank results.

The Nifty 50 has slipped below key support level of 25,000, indicating bearish tone.

Bank Nifty opened gap-down on weak numbers from Axis Bank and ahead of HDFC Bank and ICICI Bank results.

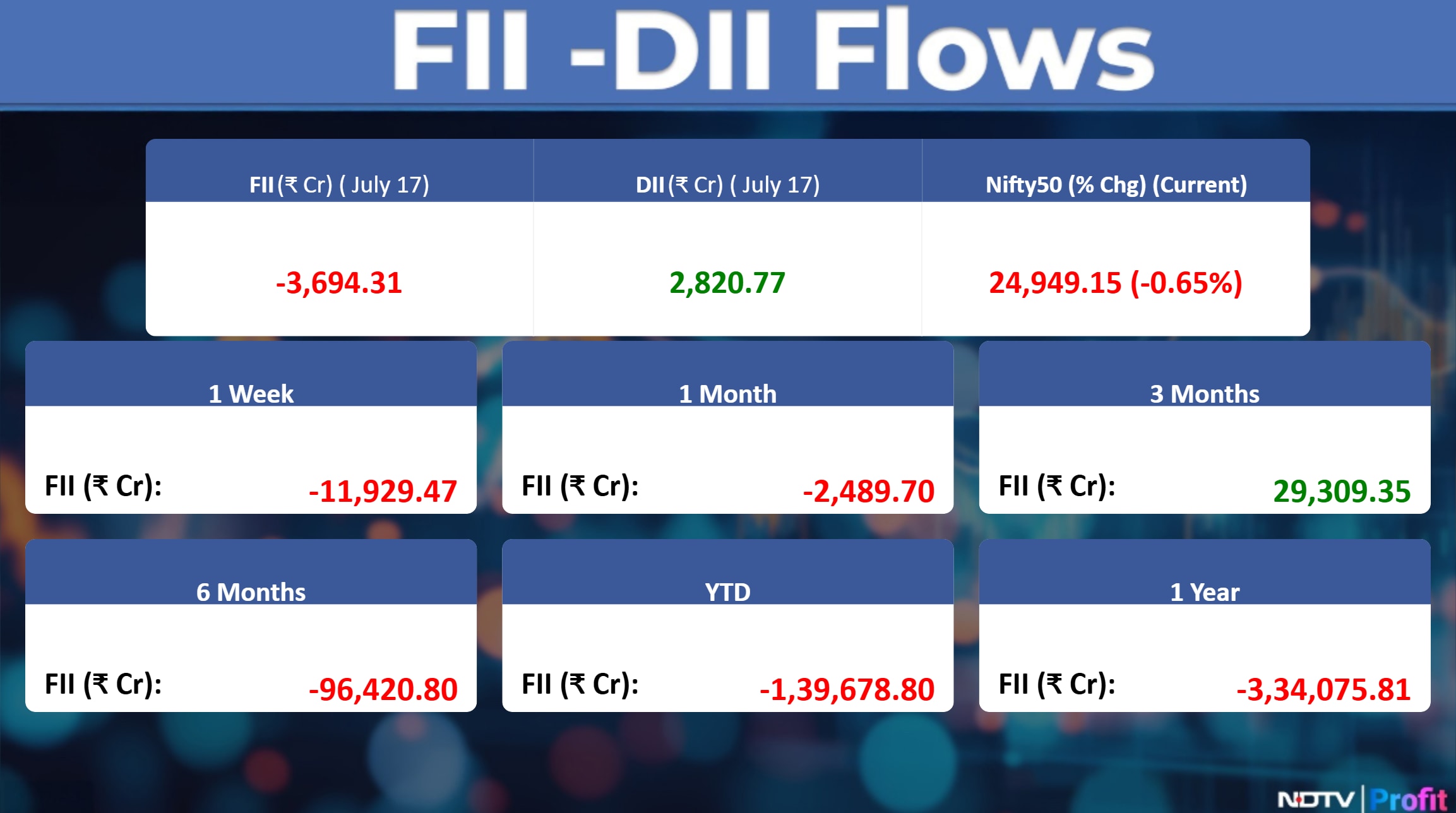

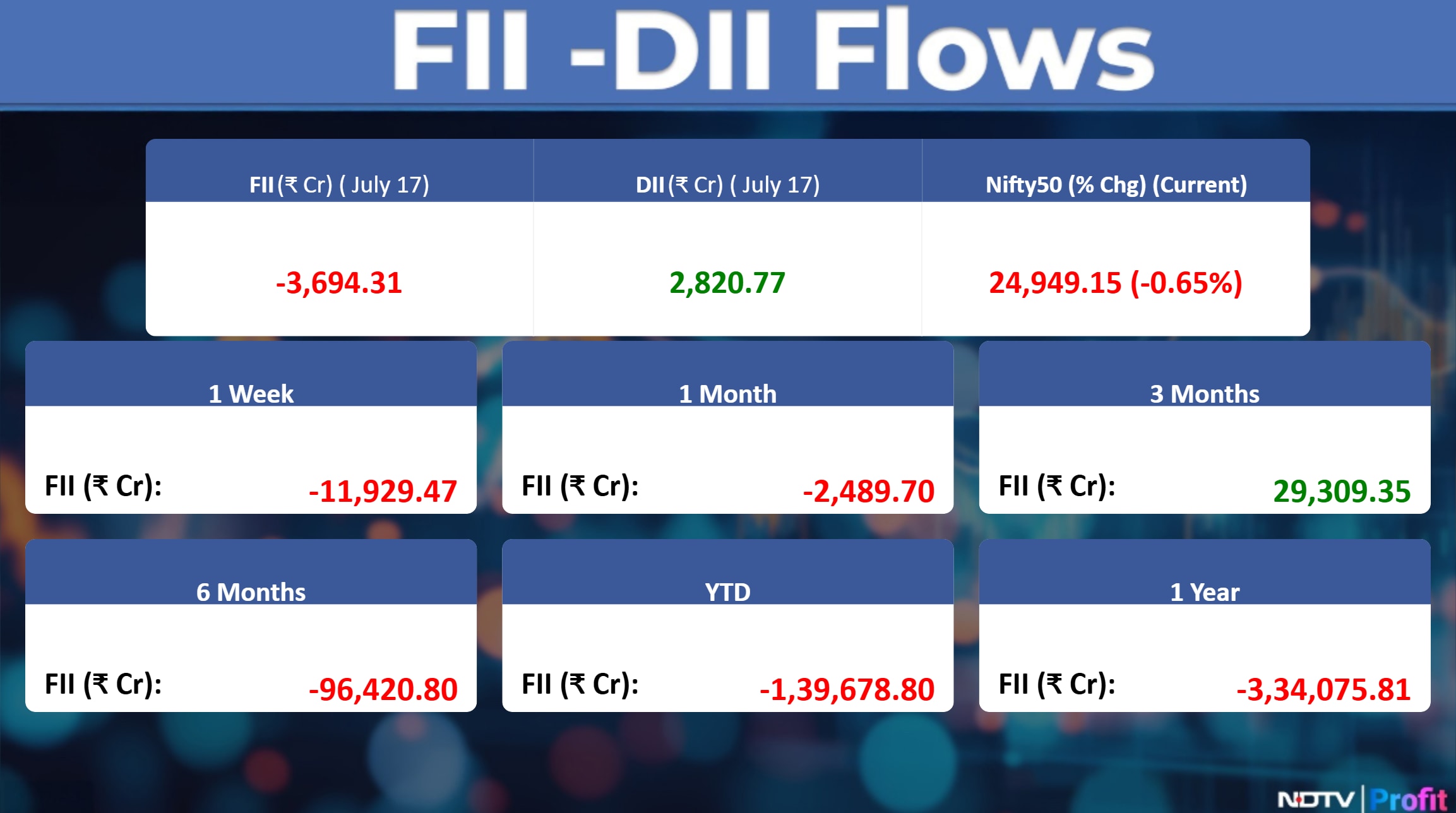

Foreign investors have been increasing short positions in derivative market, indicating bearishness. FII long short ratio — 83% shorts : 17% longs.

Besides, there has been consistent FII selling in cash market adding to pressure on the markets. FIIs have sold equities worth nearly Rs 12,000 crore in one week.

The Nifty 50 has slipped below key support level of 25,000, indicating bearish tone.

Bank Nifty opened gap-down on weak numbers from Axis Bank and ahead of HDFC Bank and ICICI Bank results.

The Nifty 50 has slipped below key support level of 25,000, indicating bearish tone.

Bank Nifty opened gap-down on weak numbers from Axis Bank and ahead of HDFC Bank and ICICI Bank results.

Foreign investors have been increasing short positions in derivative market, indicating bearishness. FII long short ratio — 83% shorts : 17% longs.

Besides, there has been consistent FII selling in cash market adding to pressure on the markets. FIIs have sold equities worth nearly Rs 12,000 crore in one week.

The Nifty 50 has slipped below key support level of 25,000, indicating bearish tone.

Bank Nifty opened gap-down on weak numbers from Axis Bank and ahead of HDFC Bank and ICICI Bank results.

The Nifty 50 has slipped below key support level of 25,000, indicating bearish tone.

Bank Nifty opened gap-down on weak numbers from Axis Bank and ahead of HDFC Bank and ICICI Bank results.

Foreign investors have been increasing short positions in derivative market, indicating bearishness. FII long short ratio — 83% shorts : 17% longs.

Besides, there has been consistent FII selling in cash market adding to pressure on the markets. FIIs have sold equities worth nearly Rs 12,000 crore in one week.

The Nifty 50 has slipped below key support level of 25,000, indicating bearish tone.

Bank Nifty opened gap-down on weak numbers from Axis Bank and ahead of HDFC Bank and ICICI Bank results.

The Nifty 50 has slipped below key support level of 25,000, indicating bearish tone.

Bank Nifty opened gap-down on weak numbers from Axis Bank and ahead of HDFC Bank and ICICI Bank results.

Foreign investors have been increasing short positions in derivative market, indicating bearishness. FII long short ratio — 83% shorts : 17% longs.

Besides, there has been consistent FII selling in cash market adding to pressure on the markets. FIIs have sold equities worth nearly Rs 12,000 crore in one week.

The Nifty 50 is down 0.63% at 24,956 while the Sensex shed over 500 points to trade lower at 81,735. Private Bank players like Axis Bank, Shriram Finance along with Kotak Mahindra Bank were in the red. While insurance names like SBI Life, HDFC Life also pulled on the Nifty 50.

The shares of Saregama were buzzing in trade today as volumes were up 20 times in 2-week average. The scrip was trading 5.45% higher at Rs 513.6 apiece compared to a 0.66% decline in the Nifty 50 as of 10:51 a.m.

The shares of Saregama were buzzing in trade today as volumes were up 20 times in 2-week average. The scrip was trading 5.45% higher at Rs 513.6 apiece compared to a 0.66% decline in the Nifty 50 as of 10:51 a.m.

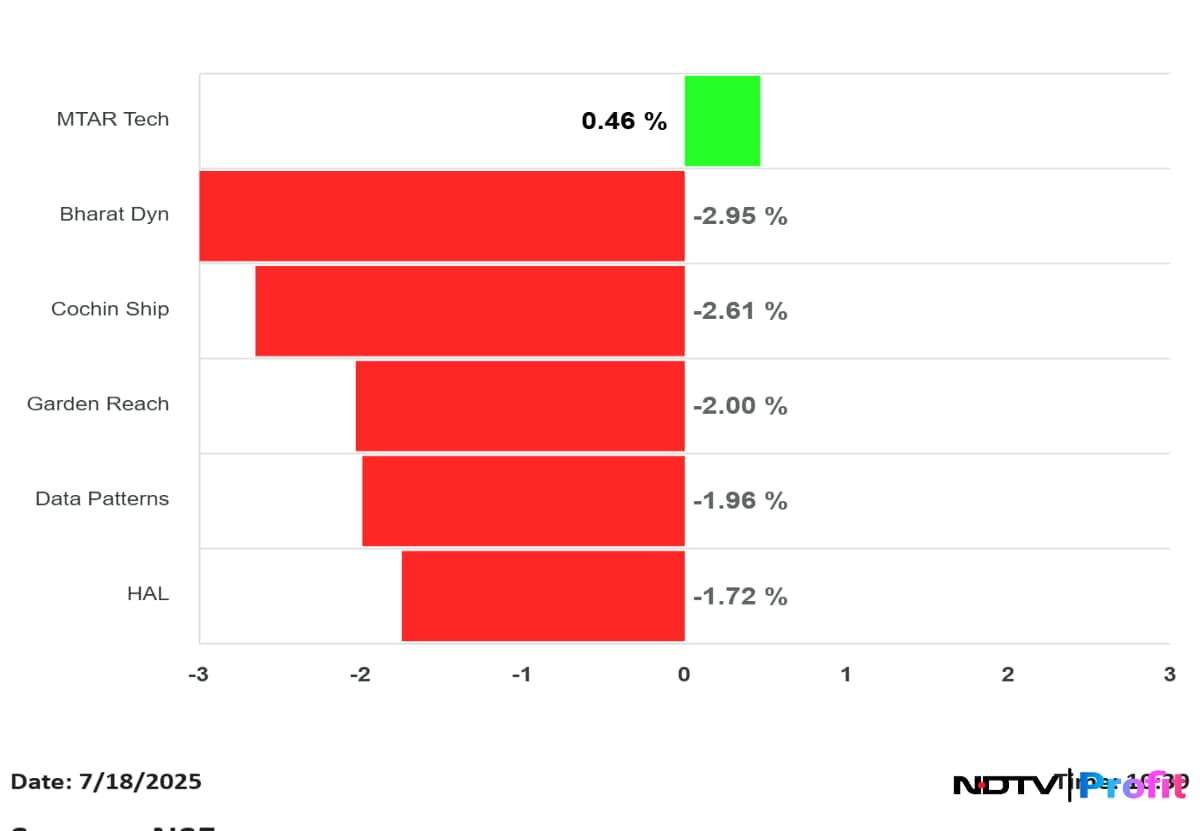

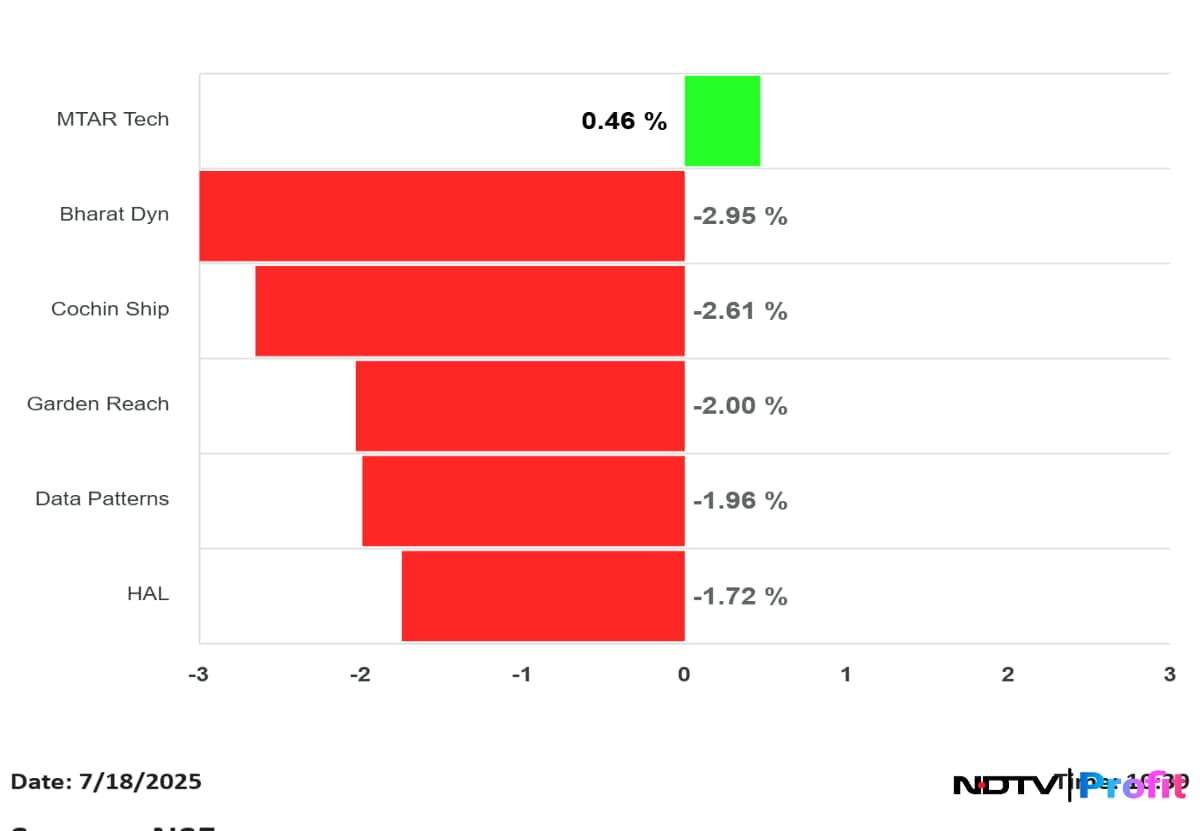

Among the sectors, Nifty defence marked the deepest losses as the sector was down nearly 2%. In the index, Bharat Dynamics was dragging the index by nearly 3% and Cochin Shipyard was also over 2% down. The decline was also visible in shares like Garden Reach, Data Patterns and HAL. MTAR Tech was the only player trading in green among the lot.

Among the sectors, Nifty defence marked the deepest losses as the sector was down nearly 2%. In the index, Bharat Dynamics was dragging the index by nearly 3% and Cochin Shipyard was also over 2% down. The decline was also visible in shares like Garden Reach, Data Patterns and HAL. MTAR Tech was the only player trading in green among the lot.

Among the sectors, Nifty defence marked the deepest losses as the sector was down nearly 2%. In the index, Bharat Dynamics was dragging the index by nearly 3% and Cochin Shipyard was also over 2% down. The decline was also visible in shares like Garden Reach, Data Patterns and HAL. MTAR Tech was the only player trading in green among the lot.

Among the sectors, Nifty defence marked the deepest losses as the sector was down nearly 2%. In the index, Bharat Dynamics was dragging the index by nearly 3% and Cochin Shipyard was also over 2% down. The decline was also visible in shares like Garden Reach, Data Patterns and HAL. MTAR Tech was the only player trading in green among the lot.

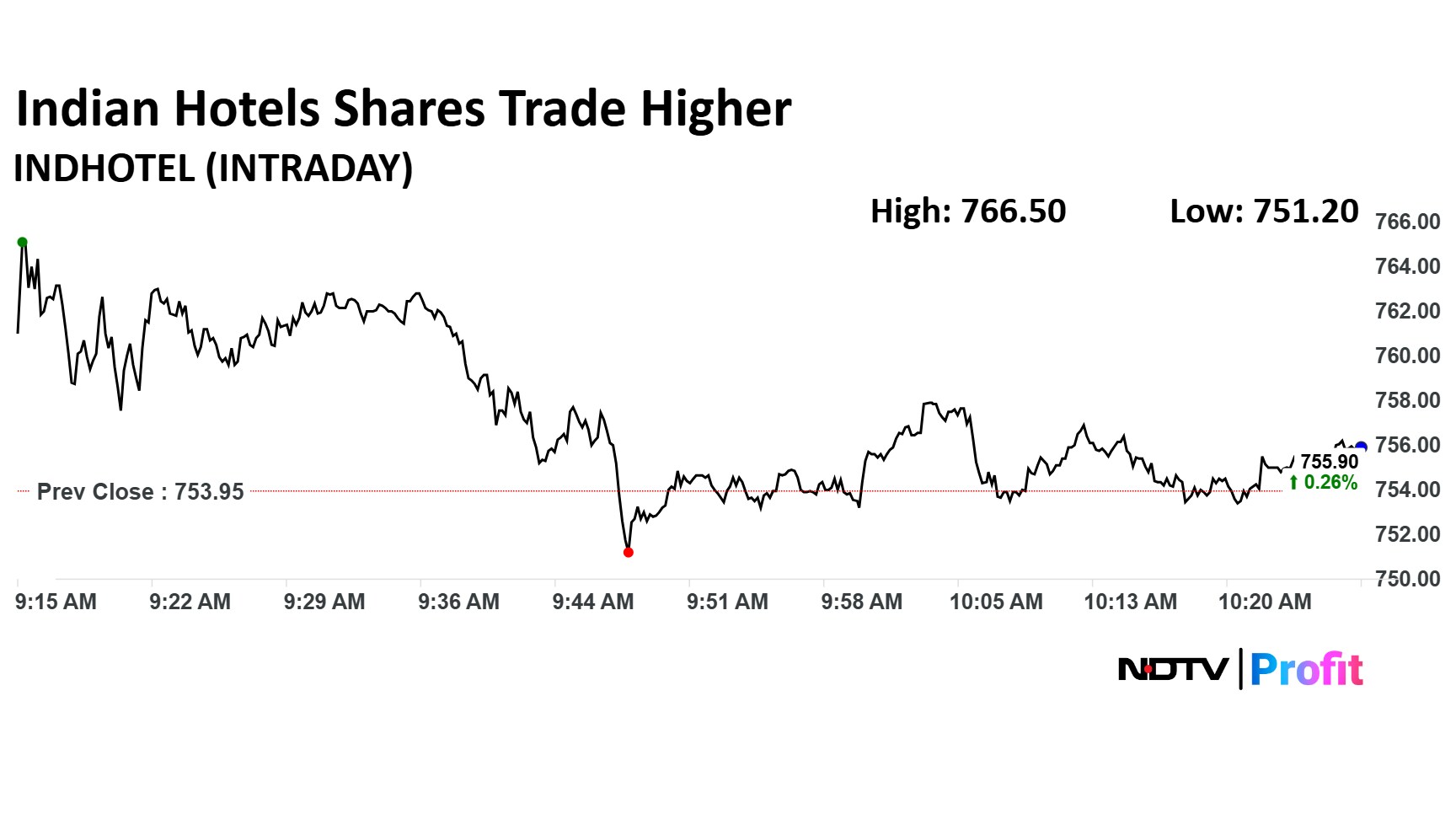

After posting first quarter results that garnered mixed views from brokerages, the shares of Indian Hotels were trading marginally higher.

Macquarie maintained a 'Neutral' rating with a target price of Rs 800, on the back of a resilient quarter, but expressed concerns about rising capital expenditure. In contrast, Jefferies maintained a 'Buy' rating and a higher target price of Rs 960, confident in the company's healthy expansion pipeline, and strategic management.

After posting first quarter results that garnered mixed views from brokerages, the shares of Indian Hotels were trading marginally higher.

Macquarie maintained a 'Neutral' rating with a target price of Rs 800, on the back of a resilient quarter, but expressed concerns about rising capital expenditure. In contrast, Jefferies maintained a 'Buy' rating and a higher target price of Rs 960, confident in the company's healthy expansion pipeline, and strategic management.

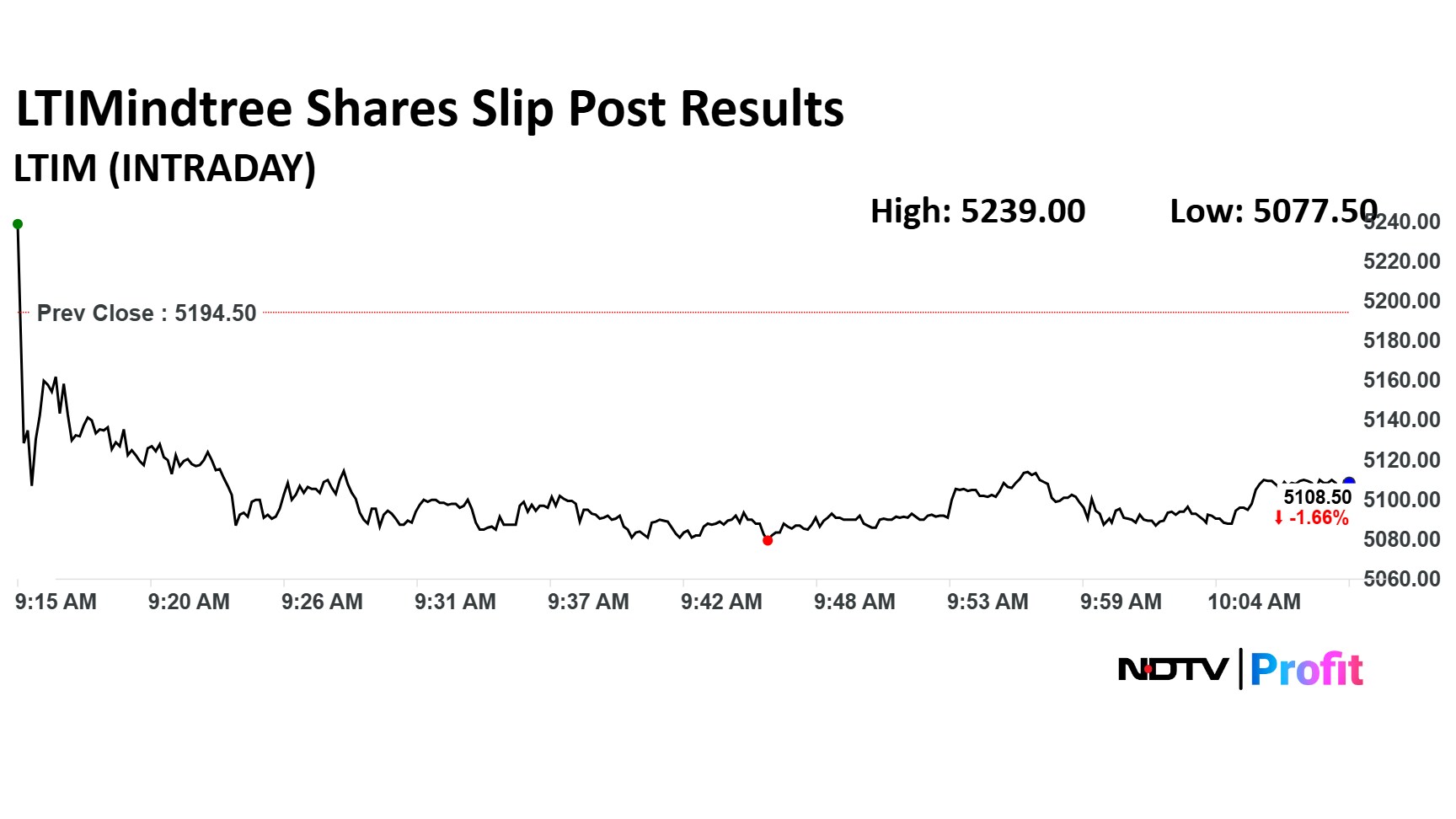

The share price of LTIMindtree was trading slightly lower after the company posted its first quarter results. The scrip was trading 1.68% lower at Rs 5,107 compared to a 0.39% decline in the Nifty 50.

The share price of LTIMindtree was trading slightly lower after the company posted its first quarter results. The scrip was trading 1.68% lower at Rs 5,107 compared to a 0.39% decline in the Nifty 50.

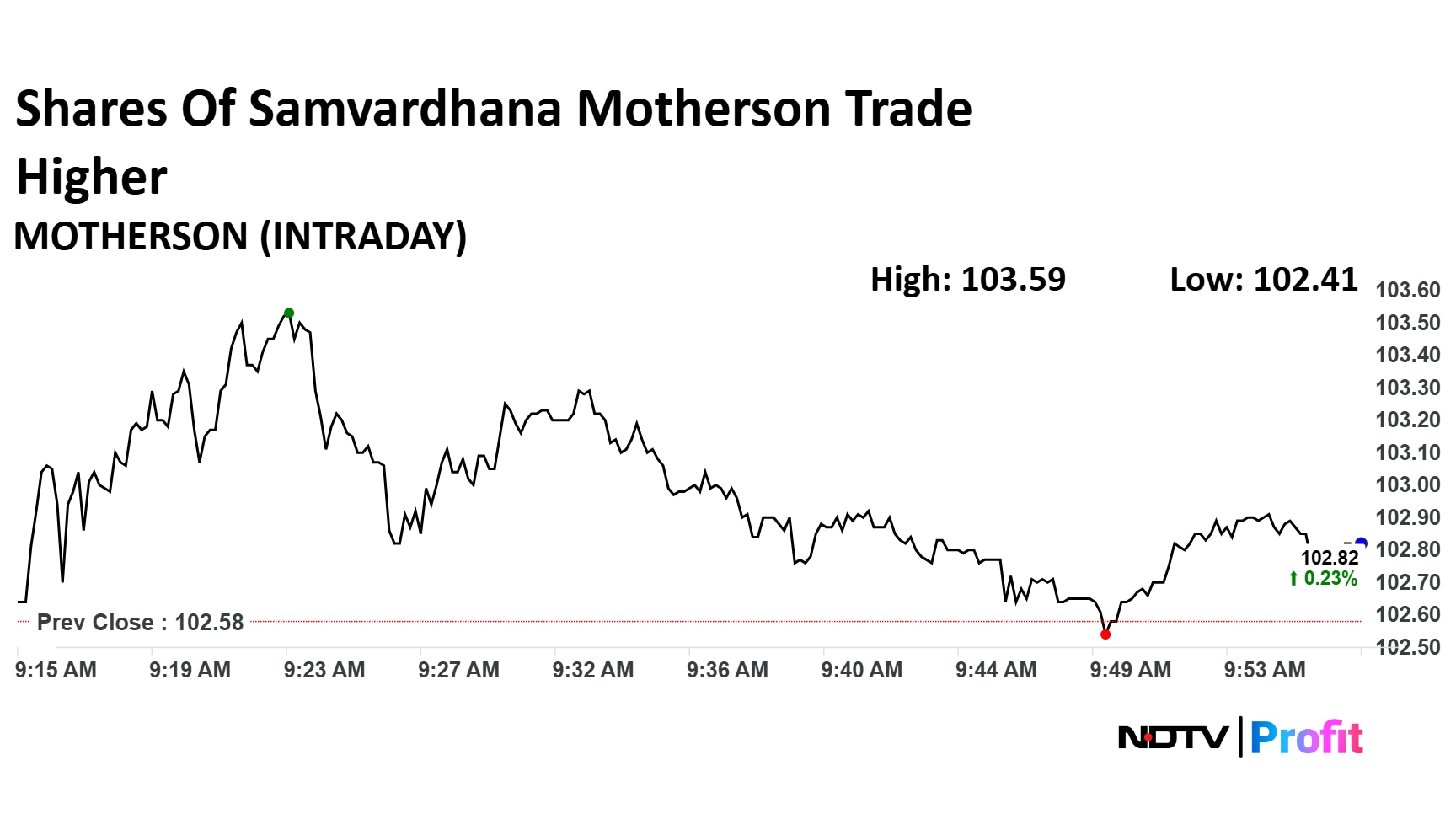

The shares of Samvardhana as it marks this last session for investors to buy shares before the record date for a bonus issue. The scrip was trading 0.19% higher at Rs 102 compared to a 0.30% decline in the Nifty 50.

The shares of Samvardhana as it marks this last session for investors to buy shares before the record date for a bonus issue. The scrip was trading 0.19% higher at Rs 102 compared to a 0.30% decline in the Nifty 50.

After posting first quarter results, the shares of Polycab was up over 2%. The scrip was trading 2.38% higher at Rs 7,050 and these gains compare to a 0.27% decline in the Nifty 50.

After posting first quarter results, the shares of Polycab was up over 2%. The scrip was trading 2.38% higher at Rs 7,050 and these gains compare to a 0.27% decline in the Nifty 50.

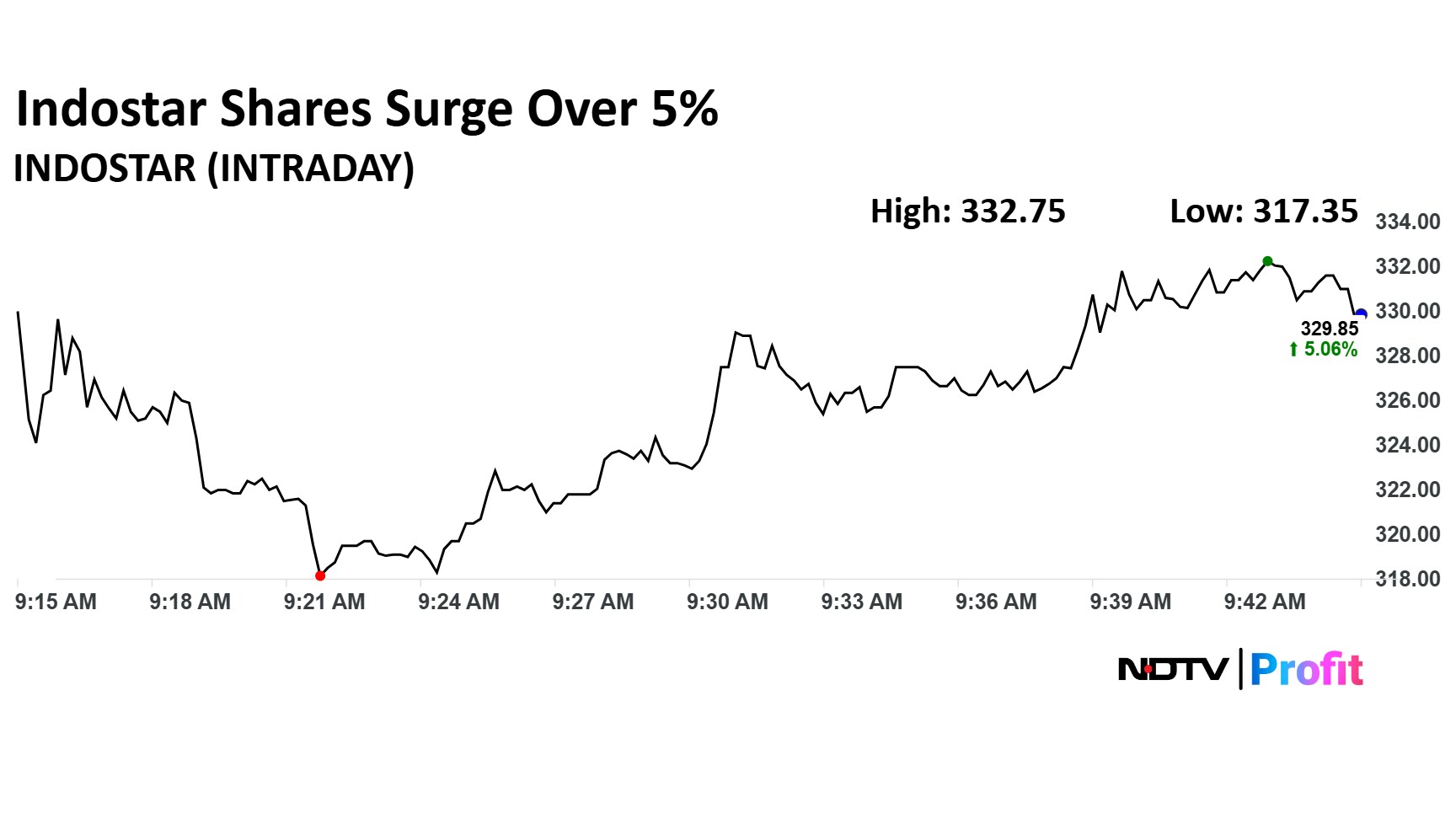

The shares of Indostar surged after the company completed the sale of its subsidiary Niwas Housing Finance to EQT’s affiliate Witkopoend B.V. for Rs 1,705.95 crore.

The scrip was trading 4.06% higher at Rs 326 apiece and these gains compares to 0.28% decline in the Nifty 50.

The shares of Indostar surged after the company completed the sale of its subsidiary Niwas Housing Finance to EQT’s affiliate Witkopoend B.V. for Rs 1,705.95 crore.

The scrip was trading 4.06% higher at Rs 326 apiece and these gains compares to 0.28% decline in the Nifty 50.

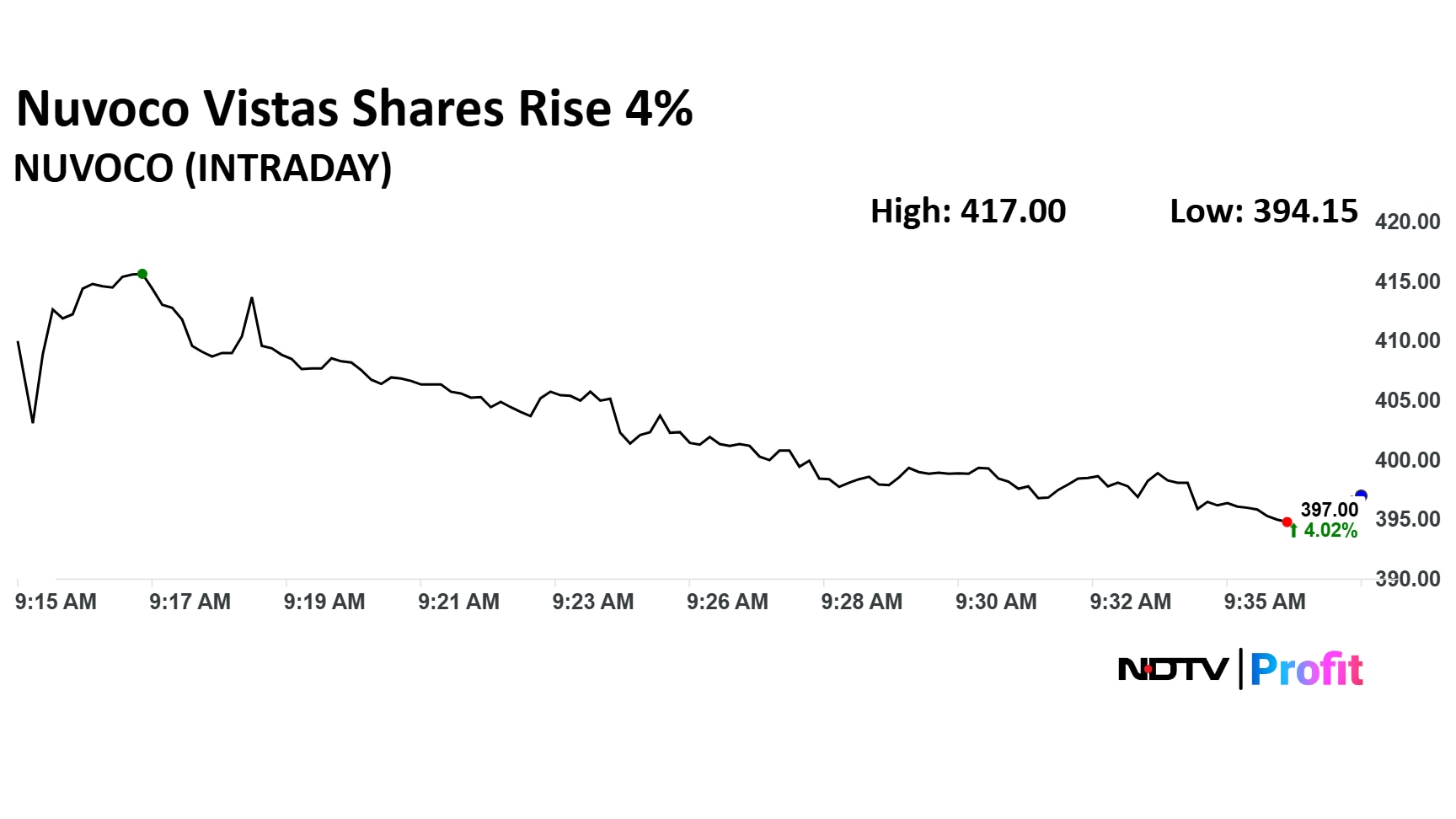

The shares of Nuvoco Vistas were trading higher after the company posted its first quarter results. The scrip was trading over 3.93% higher at Rs 396 compared to a 0.12% decline in the Nifty 50 as of 9:39 a.m.

The shares of Nuvoco Vistas were trading higher after the company posted its first quarter results. The scrip was trading over 3.93% higher at Rs 396 compared to a 0.12% decline in the Nifty 50 as of 9:39 a.m.

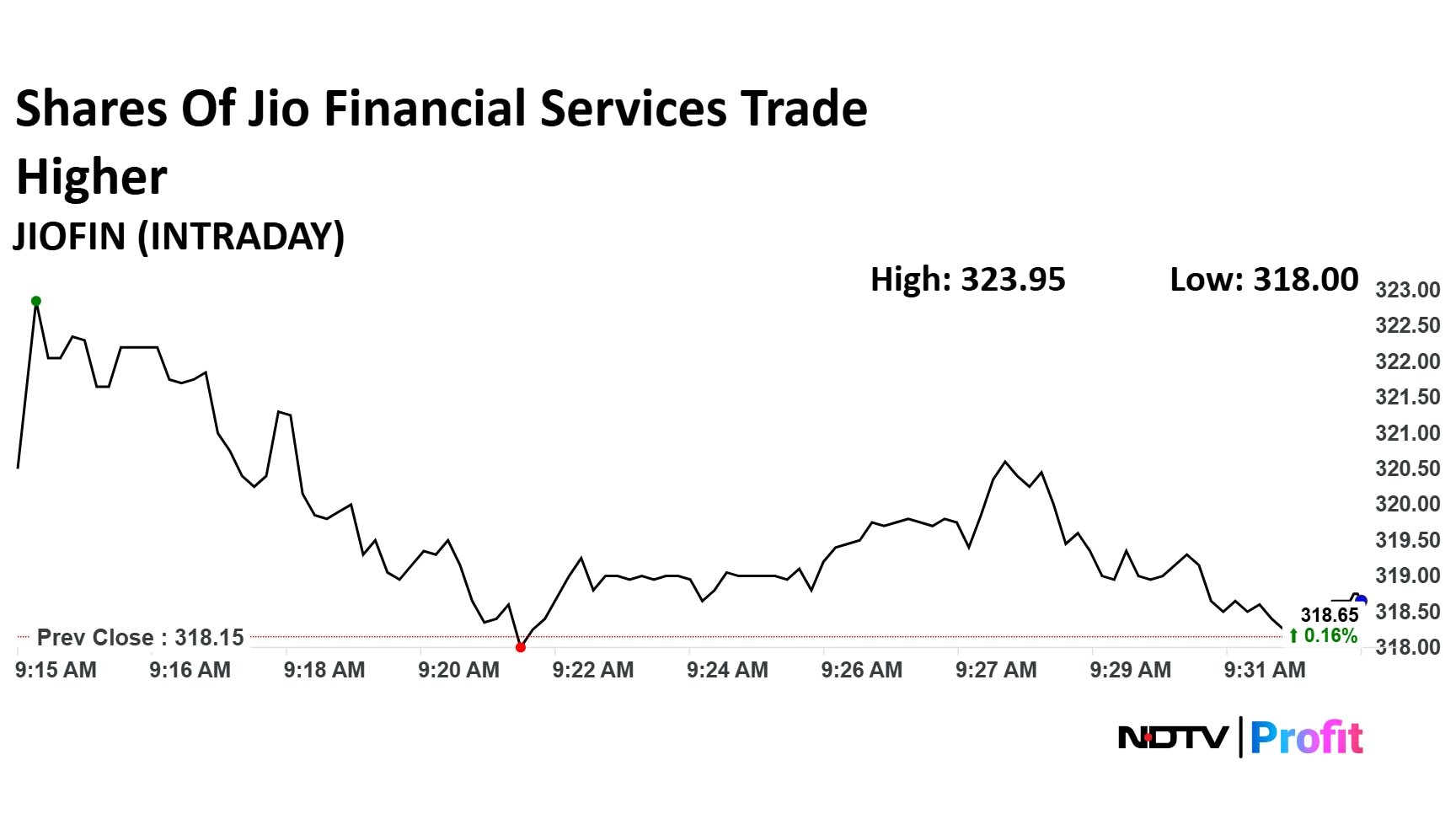

After posting its first quarter results, the shares of Jio Finacial Services were trading higher. The scrip was trading 0.49% higher at Rs 319 compared to a 0.14% decline in the Nifty 50 as of 9:35 a.m.

After posting its first quarter results, the shares of Jio Finacial Services were trading higher. The scrip was trading 0.49% higher at Rs 319 compared to a 0.14% decline in the Nifty 50 as of 9:35 a.m.

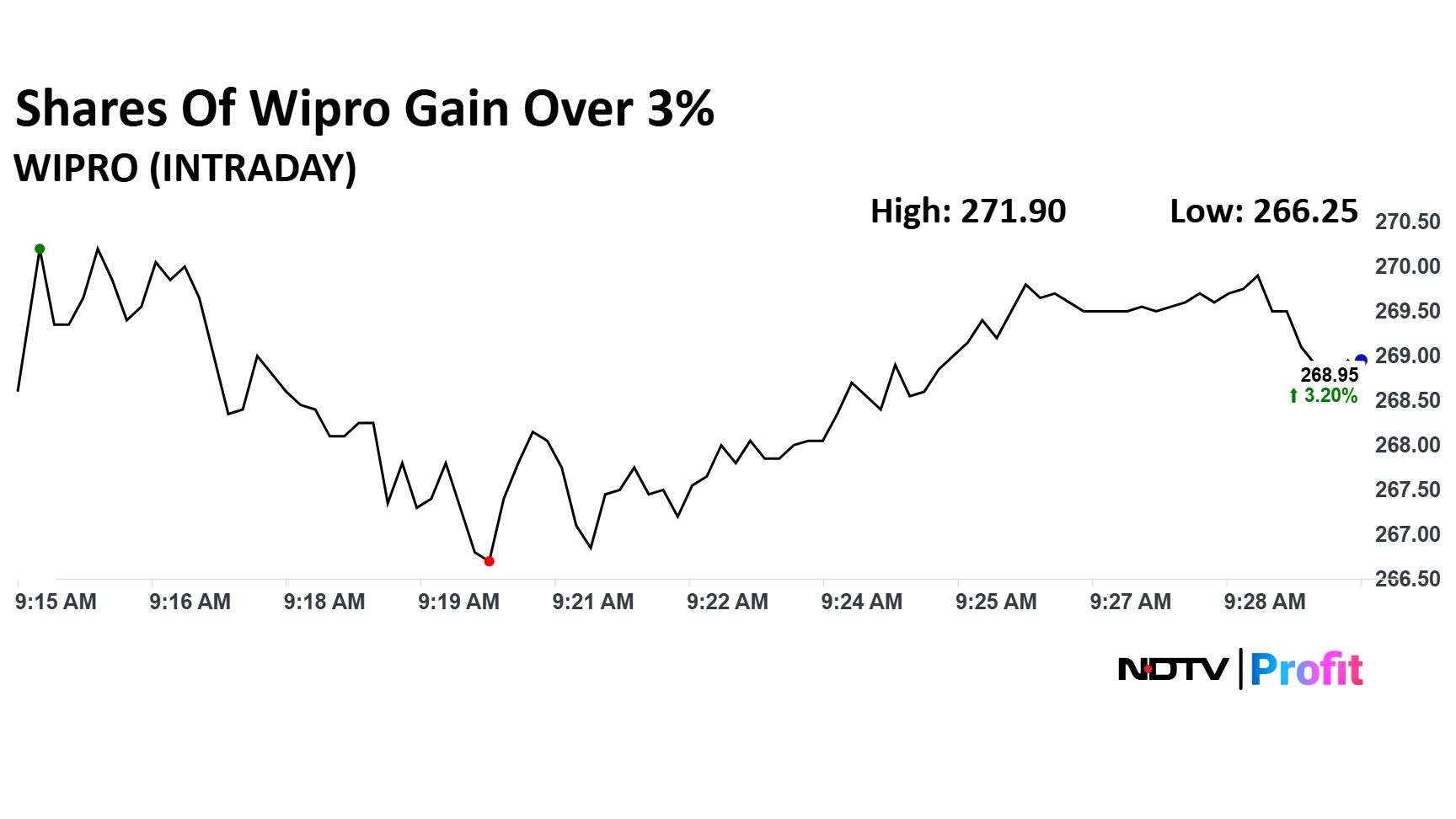

The shares of Wipro were up over 3% after the company posted its first quarter results. The scrip was trading 3.43% higher at Rs 269 apiece compared to a 0.14% decline in the Nifty 50 as of 9:32 a.m.

The shares of Wipro were up over 3% after the company posted its first quarter results. The scrip was trading 3.43% higher at Rs 269 apiece compared to a 0.14% decline in the Nifty 50 as of 9:32 a.m.

After posting first quarter results the share of Axis Bank were trading lower. The scrip was trading 4.47% lower at Rs 1,108 apiece compared to a 0.16% decline in the Nifty 50 as of 9:28 a.m.

After posting first quarter results the share of Axis Bank were trading lower. The scrip was trading 4.47% lower at Rs 1,108 apiece compared to a 0.16% decline in the Nifty 50 as of 9:28 a.m.

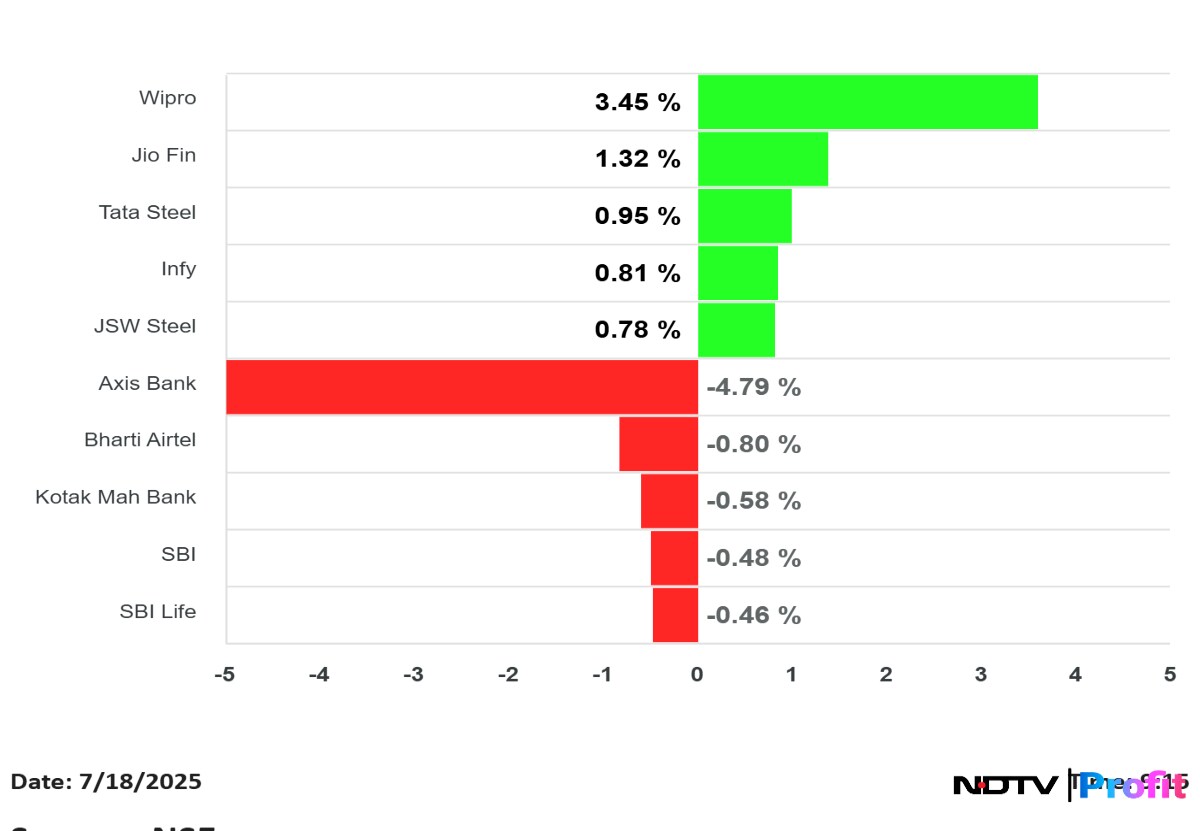

The top gainer pulling up the index was Wipro as the shares gainer over 3% after posting first quarter results. Jio Financial Services, Tata Steel and Infosys were also trading in the green.

The deepest losses of the lot were marked by Axis Bank after asset quality deteriorated in first quarter results. Bharti Airtel, Kotak Mahindra Bank and SBI were also trading in the red.

The top gainer pulling up the index was Wipro as the shares gainer over 3% after posting first quarter results. Jio Financial Services, Tata Steel and Infosys were also trading in the green.

The deepest losses of the lot were marked by Axis Bank after asset quality deteriorated in first quarter results. Bharti Airtel, Kotak Mahindra Bank and SBI were also trading in the red.

At pre-open, the NSE Nifty 50 was trading 12 points or 0.05% lower at 25,100. The BSE Sensex was 95 points higher at 82,331.

Rupee opened 6 paise lower at 86.13 against the US Dollar. It closed at 86.07 on Thursday according to Bloomberg.

Maintain an 'Underperform' rating; Hike target price to Rs 235 from Rs 200.

While the overall outlook is improving, the potential for upside in the stock appears capped.

Revenues are currently facing pressure due to challenges in large verticals.

A healthy pipeline of deal wins is expected to improve the future revenue outlook.

However, the ramp-up of these new deals is anticipated to impact profit margins.

Maintain 'Equal-weight' rating; Hike target price to Rs 285 from Rs 265.

The company's IT Services Q1 performance surpassed Street expectations.

The Q2 guidance provided was in line, with no negative surprises indicated.

Strong large deal wins are expected to contribute positively to growth acceleration in the second half of the fiscal year.

Improved capital allocation strategies are anticipated to support an uplift in the company's valuation multiples.

Despite the equal-weight stance, there is perceived potential for a re-rating of the stock.

US stocks finished at all-time highs Thursday as retail sales rebounded in June, easing concerns about a slowdown in consumer spending and underpinning a strong economy.

The S&P 500 Index rose 0.5% to briefly top the psychologically important 6,300 level, notching a fresh record for the first time in a week. The Nasdaq Composite climbed 0.7%, also closing at an all-time high. The Dow Jones Industrial Average added 0.5%.

Nifty July futures down by 0.3% to 25,170 at a premium of 59 points.

Nifty July futures open interest up by 0.68%.

Nifty Options 24 July Expiry: Maximum Call open interest at 26,000 and Maximum Put open interest at 24,000.

Securities in ban period: Angelone, Hindustan Copper, RBL Bank.

Good morning! Welcome to NDTV Profit's live coverage of the Indian equity markets. Here we bring you real-time updates, sharp analyst insights, top stock picks, and all the market moving news you need. Stay tuned and stay ahead of the curve.

The GIFT Nifty was trading near 25,200 early Friday. The futures contract based on the benchmark Nifty 50 rose 0.20% at 25,190 as of 7:05 a.m. indicating a start in green for the Indian markets.

India's benchmark equity indices pulled back on Thursday after two days of gains, weighed by heavyweights Infosys Ltd. and HDFC Bank Ltd.

The BSE Sensex lost 375.24 points or 0.45% to close at 82,259.24, while the NSE Nifty 50 ended 100.6 points or 0.4% lower at 25,111.45. The 50-stock gauge struggled to take out 25,200 due to call writing at that level on the weekly expiry day. Intraday, the index shed 0.44%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.