The NSE Nifty 50 and BSE Sensex declined for third sessions in a row.

The Nifty 50 and Sensex ended 1.05% and 1.06% down, respectively.

HDFC Bank Ltd., Reliance Industries Ltd., and ICICI Bank Ltd. weighed on the Nifty 50 index.

Tata Steel Ltd., Coal India Ltd., and Oil Natural Gas Corp limited gains to the Nifty 50 index.

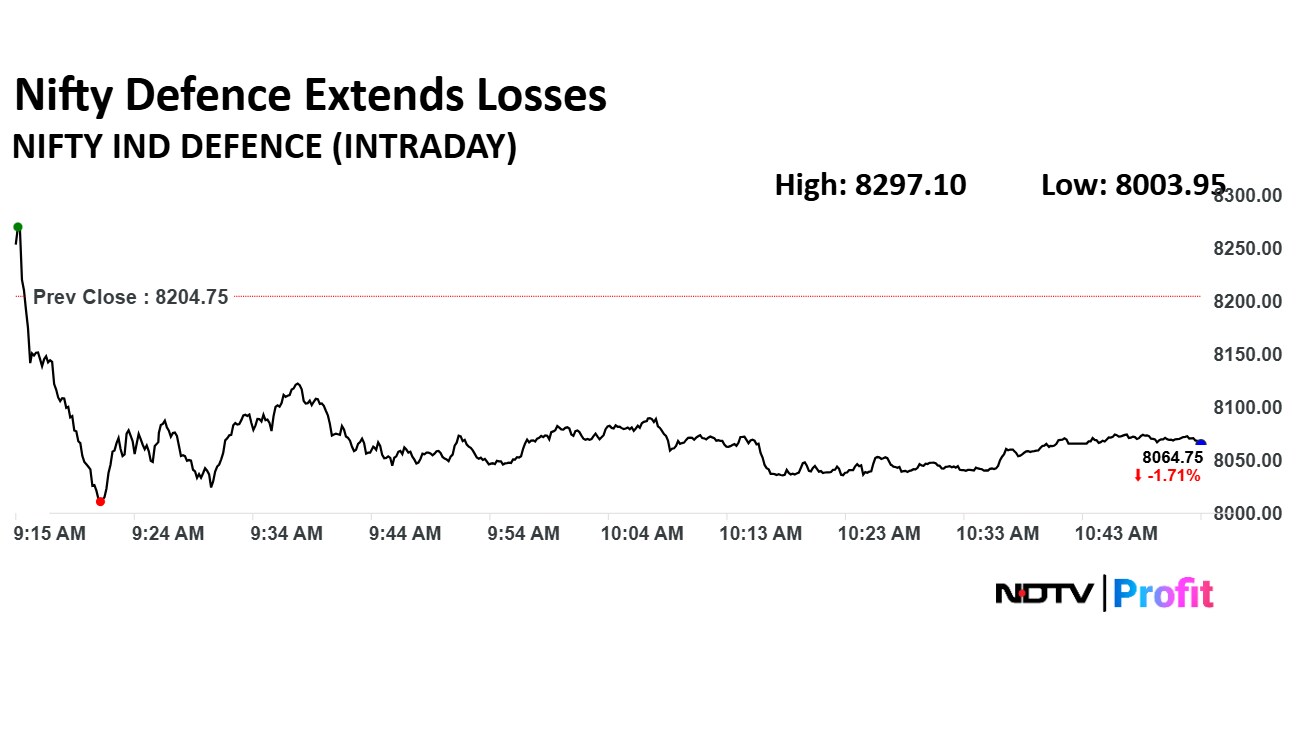

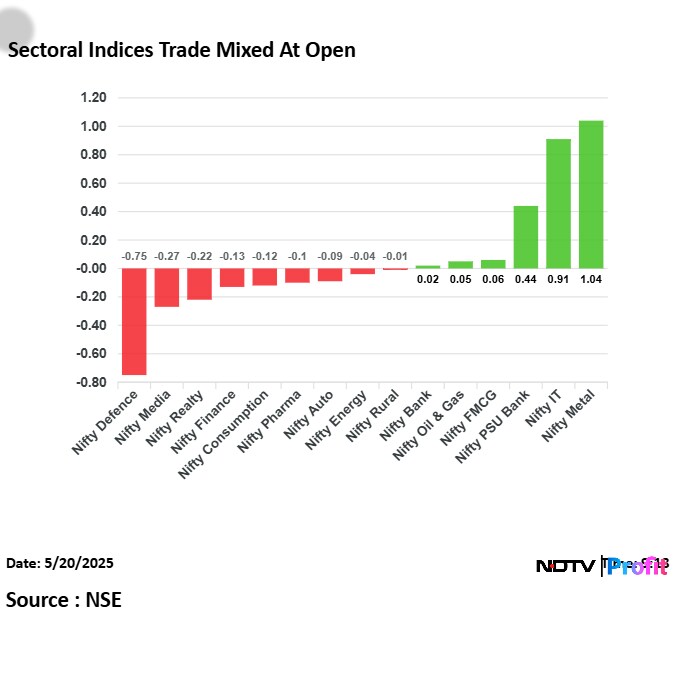

The NSE Nifty Defence was the worst performing index, while the NSE IT index logged the least gain

The NSE Nifty Midcap 150 and NSE Nifty Smallcap 250 ended 1.56% and 0.90% lower, respectively.

The NSE Nifty 50 and BSE Sensex declined for third sessions in a row.

The Nifty 50 and Sensex ended 1.05% and 1.06% down, respectively.

HDFC Bank Ltd., Reliance Industries Ltd., and ICICI Bank Ltd. weighed on the Nifty 50 index.

Tata Steel Ltd., Coal India Ltd., and Oil Natural Gas Corp limited gains to the Nifty 50 index.

The NSE Nifty Defence was the worst performing index, while the NSE IT index logged the least gain

The NSE Nifty Midcap 150 and NSE Nifty Smallcap 250 ended 1.56% and 0.90% lower, respectively.

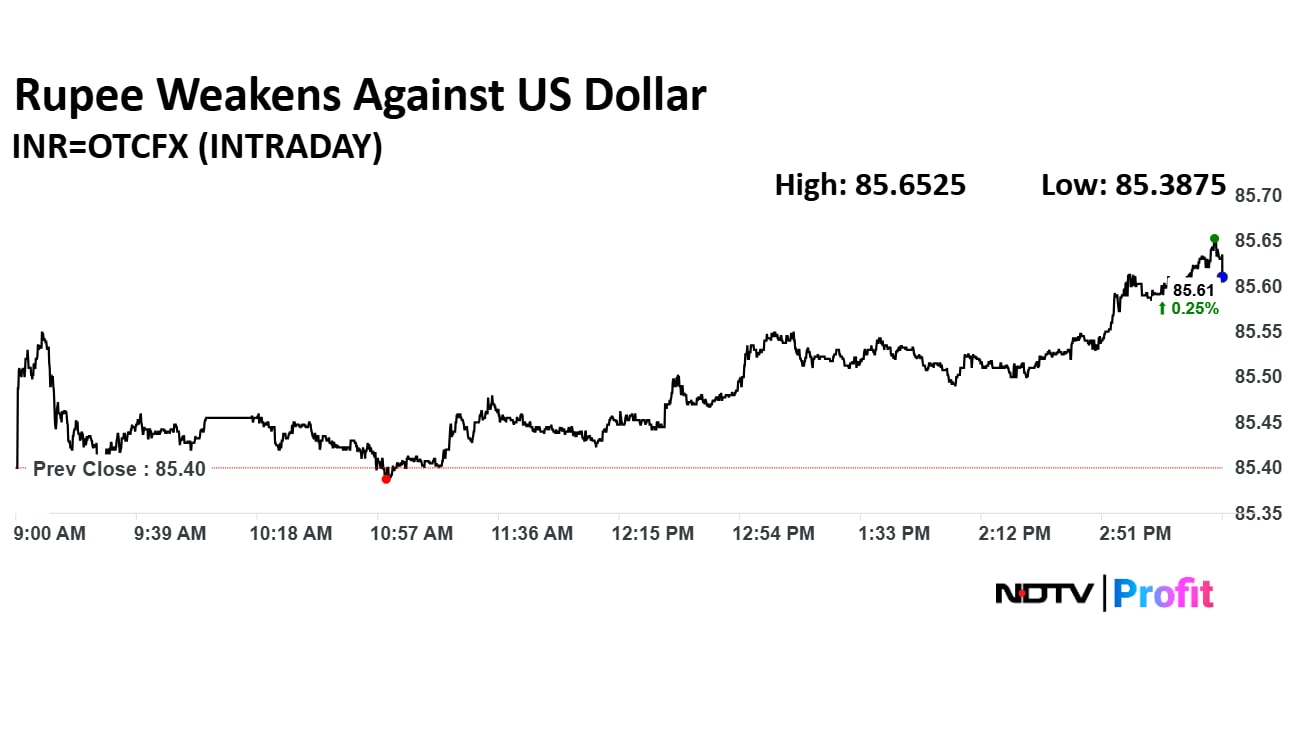

Rupee closed 24 paise weaker at 85.64 against US Dollar

It closed at 85.40 a dollar on Monday

Source: Bloomberg

Rupee closed 24 paise weaker at 85.64 against US Dollar

It closed at 85.40 a dollar on Monday

Source: Bloomberg

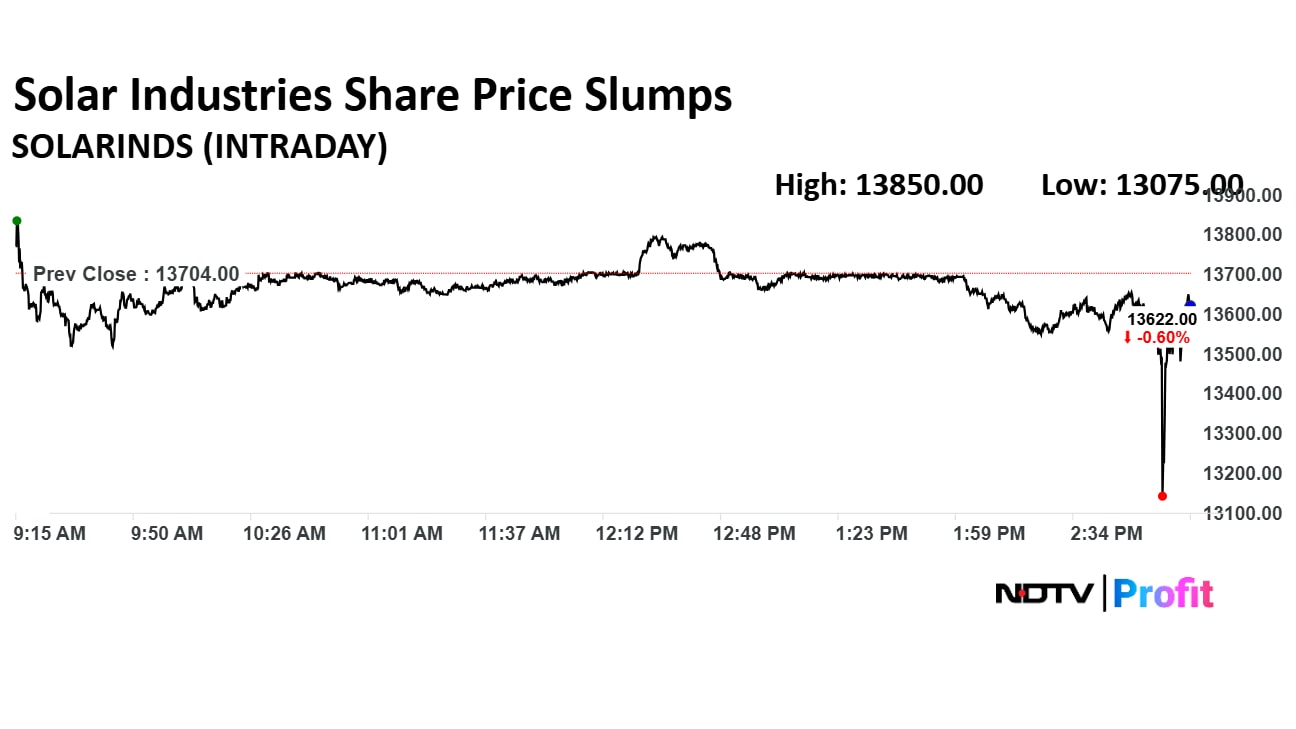

Solar Industries Ltd. share price declined 4.59% to Rs 13,075 apiece despite reporting good performance in the fourth quarter.

Solar Industries Q4 Highlight (Consolidated, YoY)

Revenue up 34.5% to Rs 2,166.55 crore versus Rs 1,610.71 crore.

Net Profit up 37% to Rs 322.23 crore versus Rs 235.05 crore.

Ebitda up 53% to Rs 539.67 crore versus Rs 353.70 crore.

Margin at 24.9% versus 22.0%.

Announces dividend of Rs 10 per share.

Solar Industries Ltd. share price declined 4.59% to Rs 13,075 apiece despite reporting good performance in the fourth quarter.

Solar Industries Q4 Highlight (Consolidated, YoY)

Revenue up 34.5% to Rs 2,166.55 crore versus Rs 1,610.71 crore.

Net Profit up 37% to Rs 322.23 crore versus Rs 235.05 crore.

Ebitda up 53% to Rs 539.67 crore versus Rs 353.70 crore.

Margin at 24.9% versus 22.0%.

Announces dividend of Rs 10 per share.

Hindalco Industries Q4 Highlights (Consolidated, QoQ)

Revenue up 11.1% to Rs 64,890.00 crore versus Rs 58,390.00 crore.

Net Profit up 41% to Rs 5,283.00 crore versus Rs 3,735.00 crore.

Ebitda up 17% to Rs 8,836.00 crore versus Rs 7,583.00 crore.

Margin at 13.6% versus 13.0%.

To pay dividend of Rs 5 per share.

Hindalco Industries Q4 Highlights (Consolidated, QoQ)

Revenue up 11.1% to Rs 64,890.00 crore versus Rs 58,390.00 crore.

Net Profit up 41% to Rs 5,283.00 crore versus Rs 3,735.00 crore.

Ebitda up 17% to Rs 8,836.00 crore versus Rs 7,583.00 crore.

Margin at 13.6% versus 13.0%.

To pay dividend of Rs 5 per share.

Revenue down 1% to Rs 294 crore versus Rs 297 crore.

Net Profit up 17.8% to Rs 76.9 crore versus Rs 65.3 crore.

Ebitda at Rs 106 crore versus Rs 49.6 crore.

Margin at 36.2% versus 16.7%.

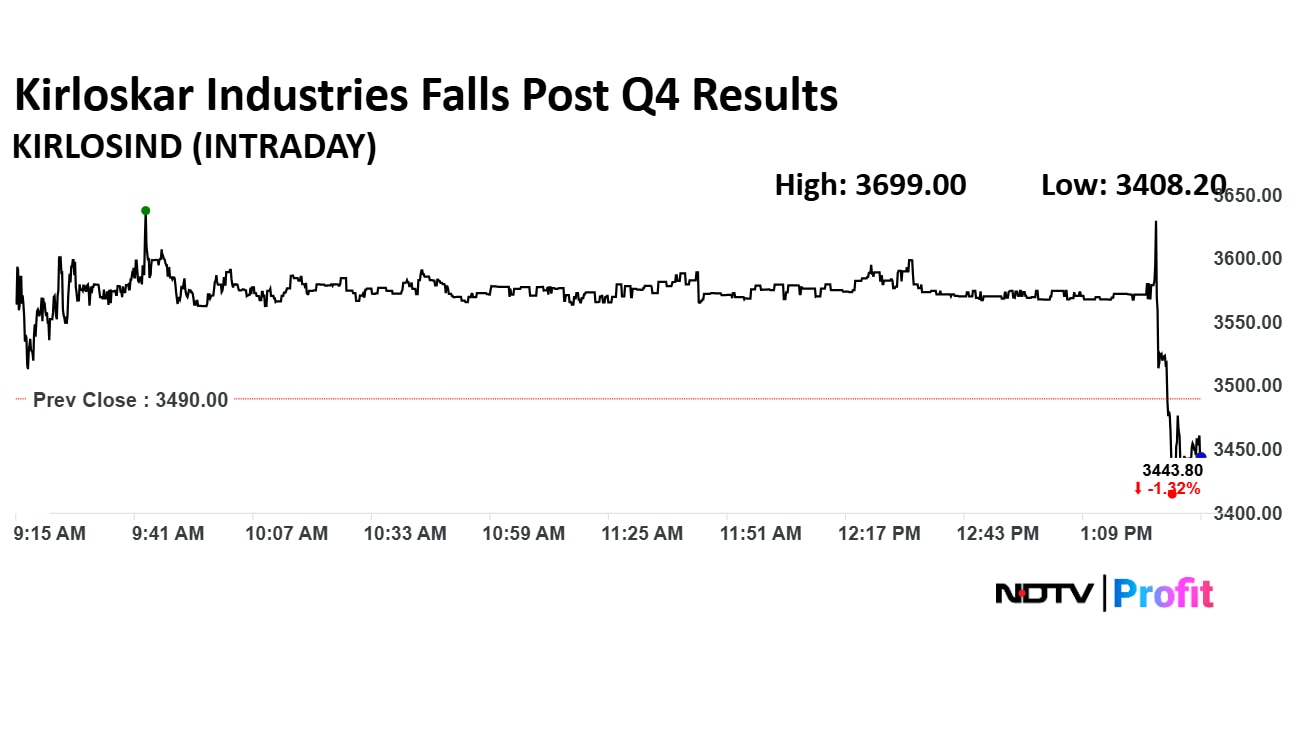

Kirloskar Industries share price declined 2.34% to Rs 3,408.20 apiece after net profit falls.

Kirloskar Industries Q4 Highlight (Consolidated, YoY)

Revenue up 1% to Rs 1,748 crore versus Rs 1,729 crore.

Net Profit down 23.6% to Rs 46.8 crore versus Rs 61.2 crore.

Ebitda down 14.3% to Rs 206 crore versus Rs 240 crore.

Margin at 11.8% versus 13.9%.

To pay final dividend of Rs 13 per share.

Kirloskar Industries share price declined 2.34% to Rs 3,408.20 apiece after net profit falls.

Kirloskar Industries Q4 Highlight (Consolidated, YoY)

Revenue up 1% to Rs 1,748 crore versus Rs 1,729 crore.

Net Profit down 23.6% to Rs 46.8 crore versus Rs 61.2 crore.

Ebitda down 14.3% to Rs 206 crore versus Rs 240 crore.

Margin at 11.8% versus 13.9%.

To pay final dividend of Rs 13 per share.

PNB Housing Finance approved issue of non-convertible debenture of up to Rs 400 crore through private placement, the company said in an exchange filing.

Zydus Lifesciences share price declined 1.88% to Rs 894.15 apiece after its fourth quarter net profit declined.

Zydus Lifescience Q4 Highlight (Consolidated, YoY)

Revenue up 18% to Rs 6,527.90 crore versus Rs 5,533.80 crore.

Net Profit down 1% to Rs 1,170.90 crore versus Rs 1,182.30 crore.

Ebitda up 30% to Rs 2,125.50 crore versus Rs 1,630.50 crore.

Margin at 32.6% versus 29.5%.

To pay final dividend of Rs 11 per share.

Track live update on Q4 earnings here.

Zydus Lifesciences share price declined 1.88% to Rs 894.15 apiece after its fourth quarter net profit declined.

Zydus Lifescience Q4 Highlight (Consolidated, YoY)

Revenue up 18% to Rs 6,527.90 crore versus Rs 5,533.80 crore.

Net Profit down 1% to Rs 1,170.90 crore versus Rs 1,182.30 crore.

Ebitda up 30% to Rs 2,125.50 crore versus Rs 1,630.50 crore.

Margin at 32.6% versus 29.5%.

To pay final dividend of Rs 11 per share.

Track live update on Q4 earnings here.

Unicommerce EsolutionPartners with Tata 1mg to Optimise E-Commerce Operations Co to automate order processing & enable accurate tracking of stock levels for Tata 1mg company to utilise demand forecasting to minimize overstocking for Tata 1mg, the company said in an exchange filing.

ICICI Securities reckon improved execution may trump this challenge. In the medium-term, portfolio premiumisation may support margin expansion. The brokerage upgrade to Buy from Add.

Read the full article here.

Som Distilleries And Breweries dispatched from Bhopal plant registered a growth of over 32% in April, the exchange filing said.

IDFC First Bank Ltd. shareholders approve resolution for fundraise of Rs 7,500 crore. Shareholders approved resolution for corresponding reclassification of authorised share capital, the company said in an exchange filing.

Lupin Ltd. planned to use Honeywell’s Solstice Air Propellant to Transform respiratory care The company is set to become first Indian company to fully integrate Honeywell’s Solstice Air In Respiratory inhalers at scale, the company said in an exchange filing.

Aeroflex Industries Ltd. announced the resignation of Kiran Kagalkar as chief operating officer effective June 30, the company said in an exchange filing.

Bharti Airtel Ltd. partnered with Google to offer Google One Subscription to postpaid and Wi-Fi Customers, according to exchange filing.

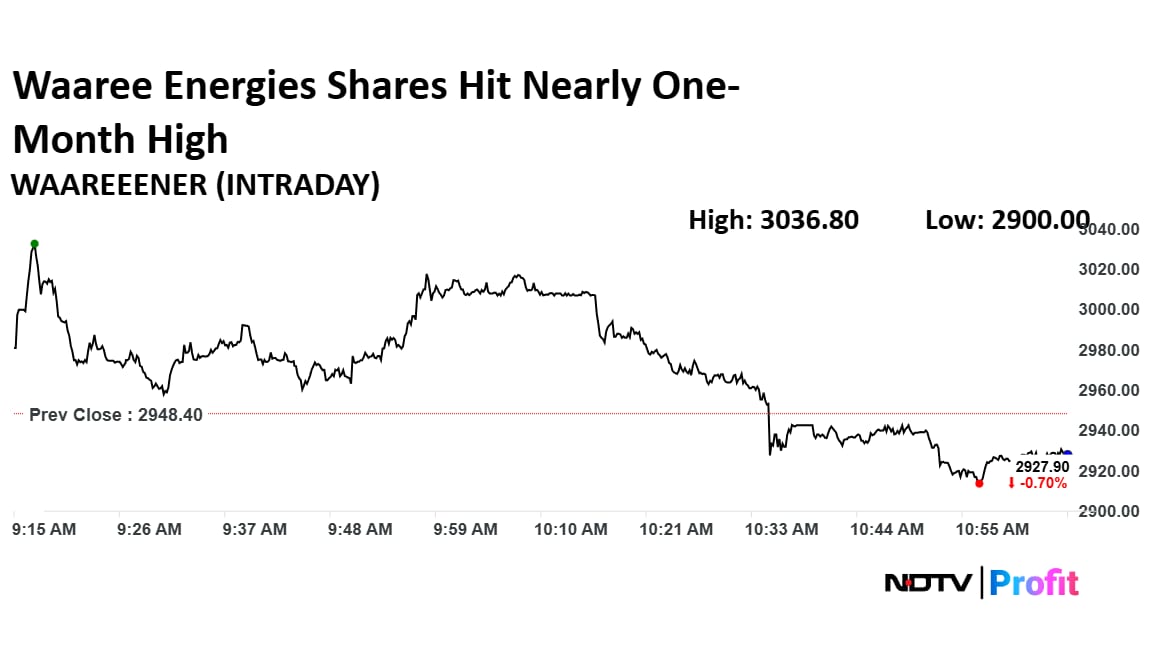

Shares of Waaree Energies Ltd. hit nearly one-month high on Tuesday after the board of directors approved the acquisition of Kamath Transformers Pvt.

Shares of Waaree Energies Ltd. hit nearly one-month high on Tuesday after the board of directors approved the acquisition of Kamath Transformers Pvt.

IndusInd Bank signed a memorandum of understanding with Department for Promotion of Industry And Internal Trade, the company said in an exchange filing.

The regulator adds approximate 100 employees every two years

The regulator hence needs provisions to be made

Source: People In The Know

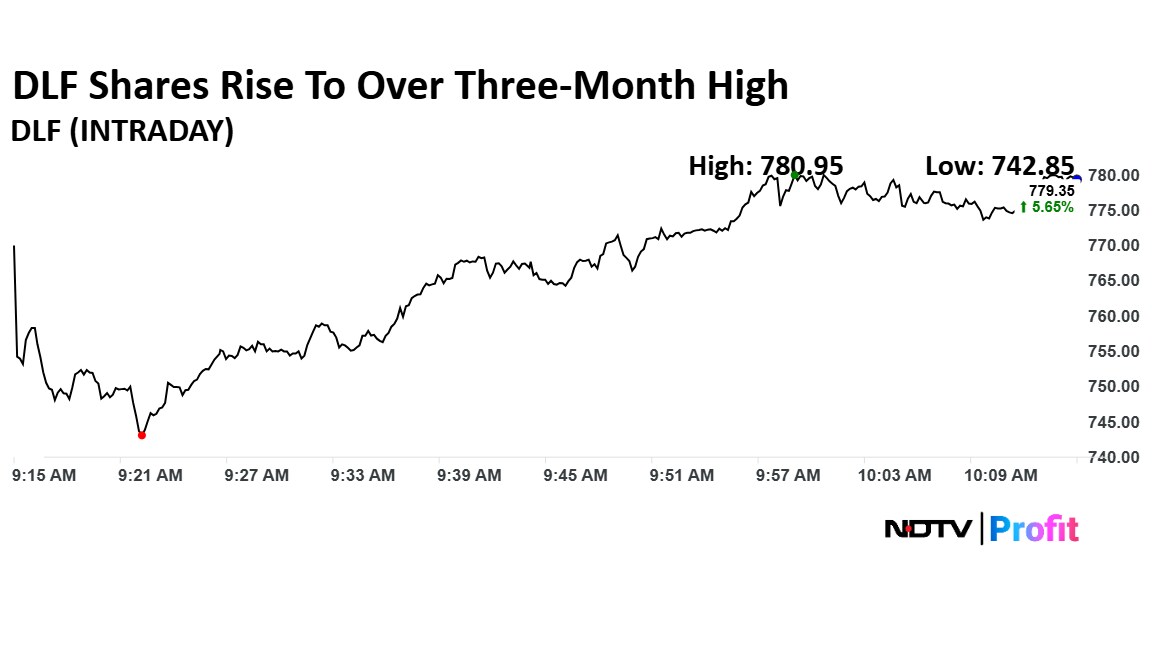

Shares of DLF Ltd. rose to nearly three-month high after its fourth quarter profit rose 39% year-on-year, according to an exchange filing on Monday. Shares of DLF rose as much as 5.87% to Rs 780.95 apiece, the highest level since Feb. 6.

Shares of DLF Ltd. rose to nearly three-month high after its fourth quarter profit rose 39% year-on-year, according to an exchange filing on Monday. Shares of DLF rose as much as 5.87% to Rs 780.95 apiece, the highest level since Feb. 6.

The NSE Nifty Defence fell as much as 2.45% to Rs 8,003.95 apiece. Cochin Shipyard Ltd., and Paras Defence and Space Technologies Ltd. were top losers in the index as of 10:56 a.m.

The NSE Nifty Defence fell as much as 2.45% to Rs 8,003.95 apiece. Cochin Shipyard Ltd., and Paras Defence and Space Technologies Ltd. were top losers in the index as of 10:56 a.m.

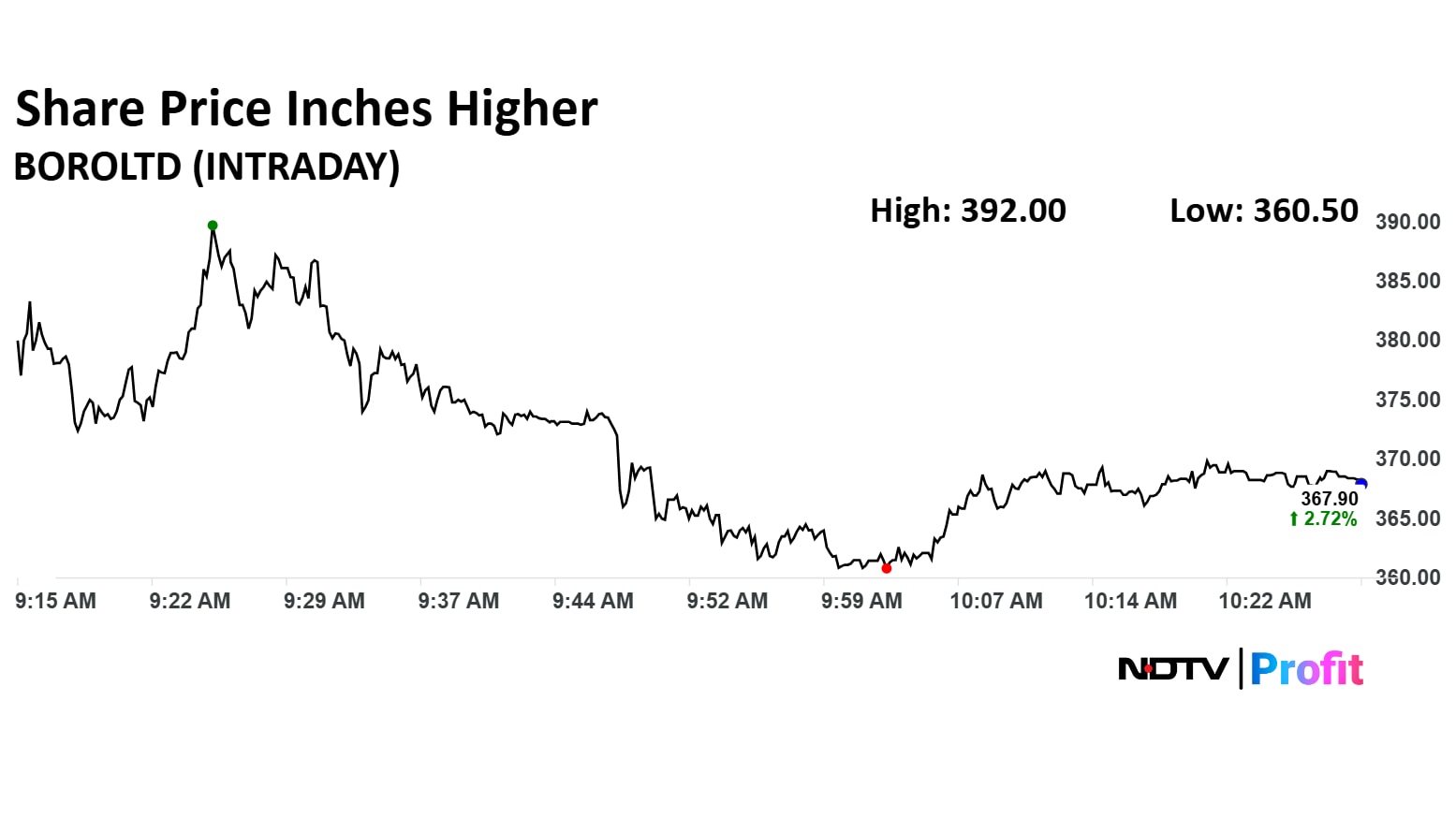

Borosil Ltd. saw its share price surge by 9.45% on Tuesday, following the announcement of its fourth-quarter results.

Borosil Ltd. saw its share price surge by 9.45% on Tuesday, following the announcement of its fourth-quarter results.

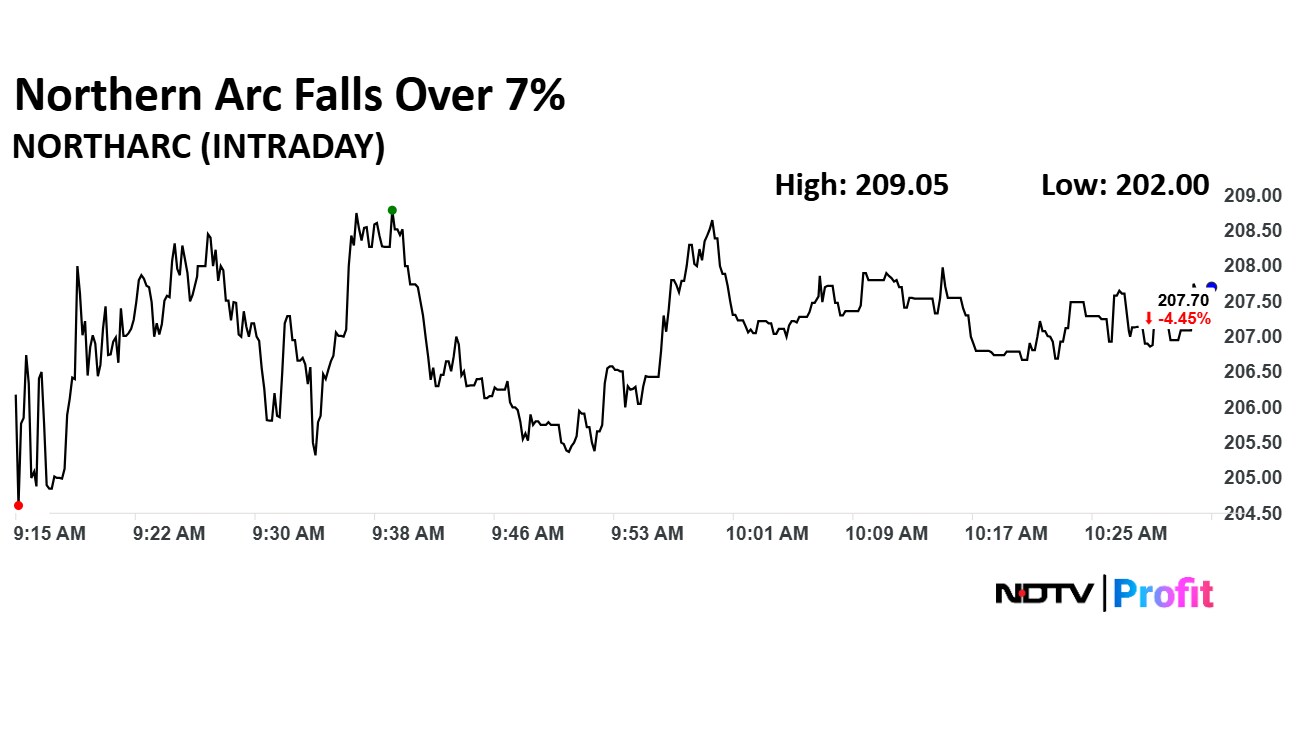

Northern Arc Capital Ltd. share price declined 7.08% to Rs 202 apiece, the lowest level since May 12. The share price declined as the company's net profit more than halves in January–March quarter.

Northern Arc Capital Ltd. share price declined 7.08% to Rs 202 apiece, the lowest level since May 12. The share price declined as the company's net profit more than halves in January–March quarter.

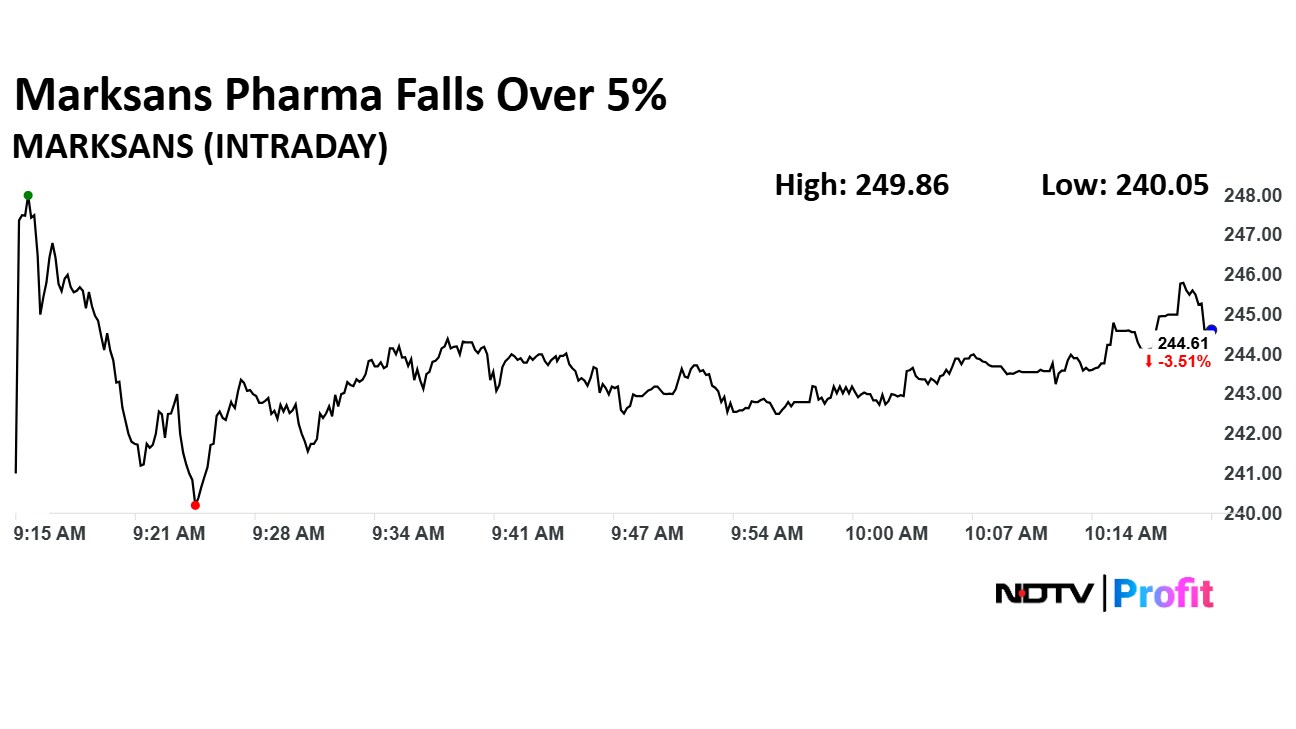

Marksans Pharma Ltd. share price declined 5.31% to Rs 240.05 apiece. The share price declined despite reporting good performance in the fourth quarter.

Marksans Pharma Ltd. share price declined 5.31% to Rs 240.05 apiece. The share price declined despite reporting good performance in the fourth quarter.

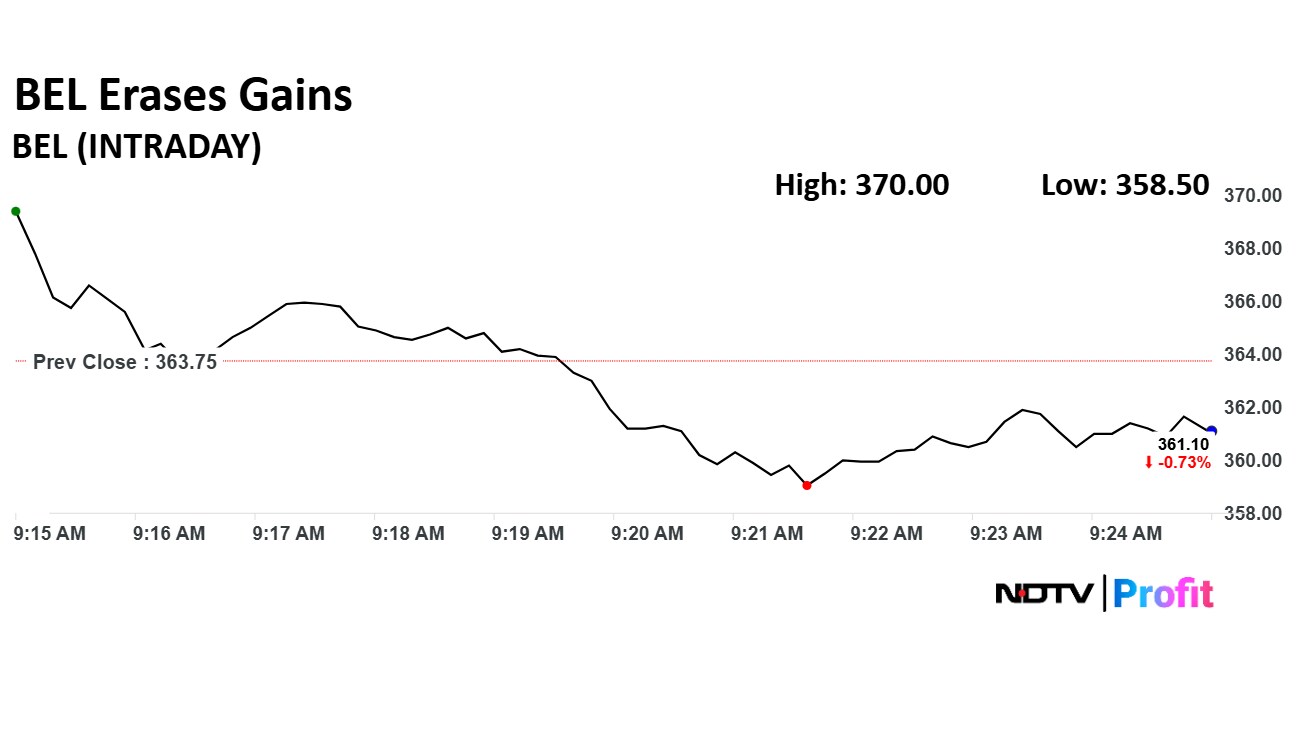

The company were forward in lot of areas in recent geopolitical developments

Bharat Electronics Ltd. was expecting Rs 30,000 crore QRSAM order by March, in worst case scenario may shift to April

Expecting major order for Next Generation Corvettes from shipbuilding cos this year

In addition to QRSAM, expect additional 27,000 crore orders

Total order inflows should cross 57,000 crore for FY26

Major subsystems for s-400 by DRDO will be developed by BEL

Current ratio has remained stable at 1.7x, working capital has remained fair

For NGC program sub-systems, expect 6,000-10,000 crore order inflows

Planning $120 million in exports revenue, up 15% from last year

Can see 20% growth in exports from next year onwards

BEL Guidance FY26

Expect 15% revenue growth

Margins at 27%

Capex of more than 1,000 crore

Defence to Non-Defence Mix of 90% and 10%

Order inflows excluding QRSAM at Rs 27,000 crore

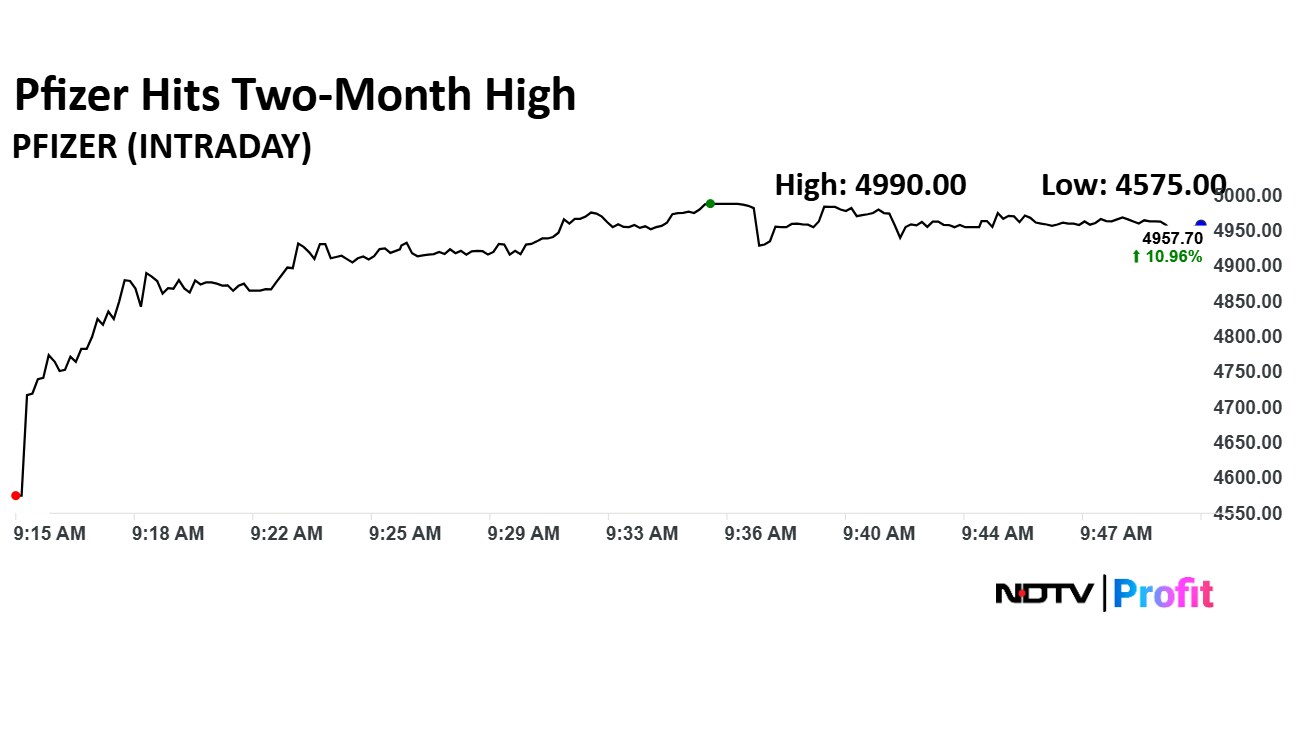

Pfizer Ltd. share price rose 11.68% to Rs 4,990 apiece, the highest level since March 20.

Pfizer Q4 FY25 Results Highlights (Consolidated, YoY)

Revenue up 8.3% to Rs 591.91 crore versus Rs 546.63 crore

Net Profit up 85% to Rs 330.94 crore versus Rs 178.86 crore

Ebitda up 20% to Rs 227.50 crore versus Rs 189.43 crore

Margin at 38.4% versus 34.7%

To pay final dividend of Rs 35 per share.

Pfizer Ltd. share price rose 11.68% to Rs 4,990 apiece, the highest level since March 20.

Pfizer Q4 FY25 Results Highlights (Consolidated, YoY)

Revenue up 8.3% to Rs 591.91 crore versus Rs 546.63 crore

Net Profit up 85% to Rs 330.94 crore versus Rs 178.86 crore

Ebitda up 20% to Rs 227.50 crore versus Rs 189.43 crore

Margin at 38.4% versus 34.7%

To pay final dividend of Rs 35 per share.

Bharat Electronics Ltd. beat fourth quarter estimates due to better margin, according to JPMorgan. The Bengaluru-headquartered aerospace company reported a 30.8% Ebitda margin, which is ahead of JPMorgan's estimate of 26%, and consensus estimate of 25.3%.

Its earning call is scheduled at 10:00 a.m. on Tuesday. JPMorgan will review their estimates after hearing management commentary. The brokerage will watch out for any comment on order flows, revenue growth, and margin profile, it said.

Read the full article here.

Bharat Electronics Ltd. beat fourth quarter estimates due to better margin, according to JPMorgan. The Bengaluru-headquartered aerospace company reported a 30.8% Ebitda margin, which is ahead of JPMorgan's estimate of 26%, and consensus estimate of 25.3%.

Its earning call is scheduled at 10:00 a.m. on Tuesday. JPMorgan will review their estimates after hearing management commentary. The brokerage will watch out for any comment on order flows, revenue growth, and margin profile, it said.

Read the full article here.

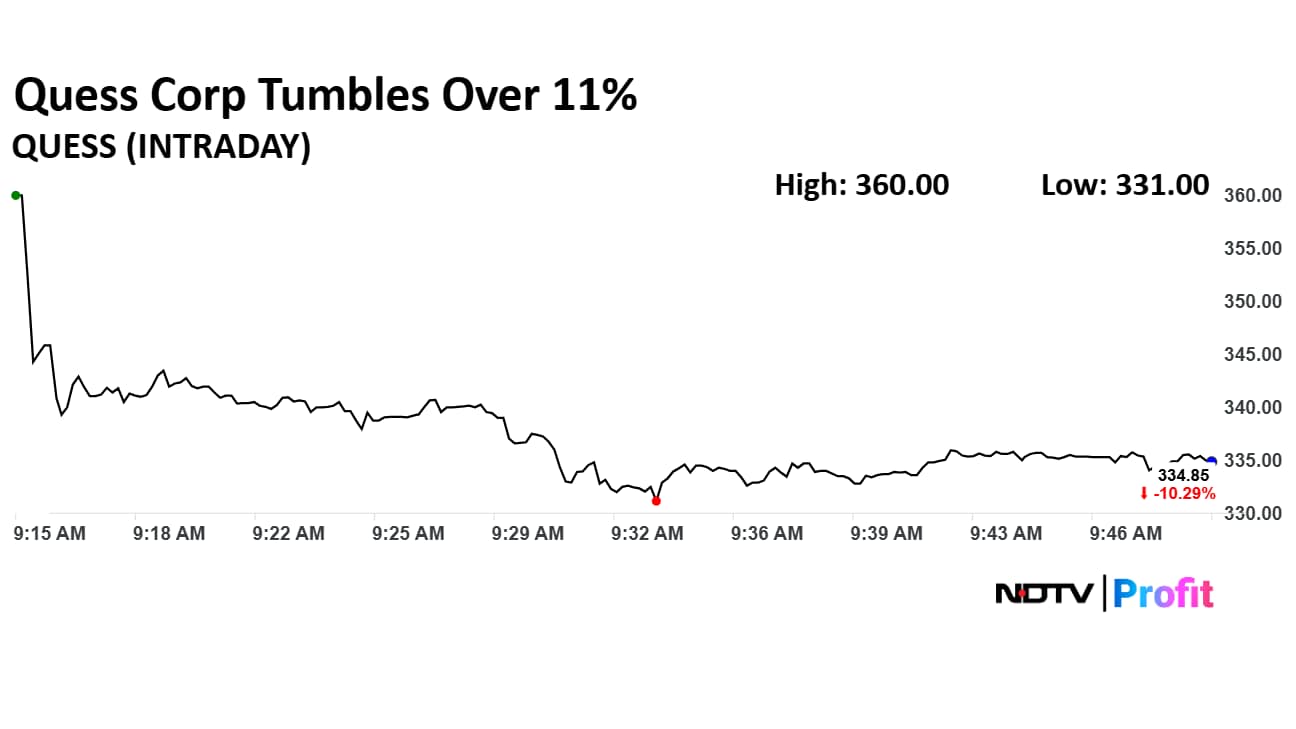

Quess Corp Ltd. share price slumped 11.32% to Rs 331.00 apiece, the lowest level since May 9. The share price slumped as the company reported a loss of Rs 95.5 crore in fourth quarter compared to Rs 41.7 crore net profit in the corresponding period of previous quarter.

Quess Corp Ltd. share price slumped 11.32% to Rs 331.00 apiece, the lowest level since May 9. The share price slumped as the company reported a loss of Rs 95.5 crore in fourth quarter compared to Rs 41.7 crore net profit in the corresponding period of previous quarter.

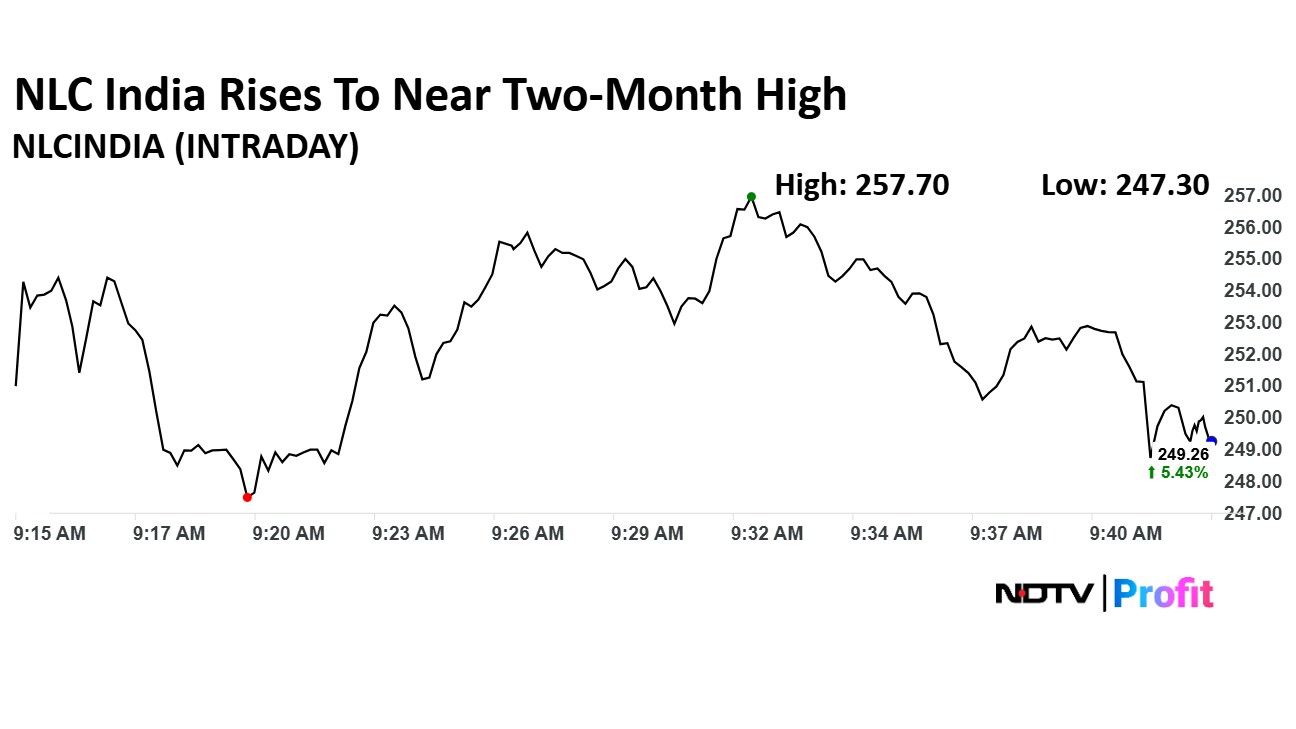

NLC India Ltd. share price rose 9% to Rs 249.40 apiece, the highest level since March 25. It pared gains to trade 5.77% higher at Rs 250.02 apiece as of 9:48 a.m.

NLC India Q4 FY25 Results Highlights (Consolidated, YoY)

Revenue up 8.3% at Rs 3,836 crore versus Rs 3,541 crore

Ebitda up 43% at Rs 861 crore versus Rs 602 crore

Margin at 22.5% versus 17%

Net profit up at Rs 482 crore versus Rs 114 crore

Income of 820.64 crore in current quarter due to movement in regulatory referral account.

Deferred tax Credit of 108 crore in Q4 FY24.

NLC India Ltd. share price rose 9% to Rs 249.40 apiece, the highest level since March 25. It pared gains to trade 5.77% higher at Rs 250.02 apiece as of 9:48 a.m.

NLC India Q4 FY25 Results Highlights (Consolidated, YoY)

Revenue up 8.3% at Rs 3,836 crore versus Rs 3,541 crore

Ebitda up 43% at Rs 861 crore versus Rs 602 crore

Margin at 22.5% versus 17%

Net profit up at Rs 482 crore versus Rs 114 crore

Income of 820.64 crore in current quarter due to movement in regulatory referral account.

Deferred tax Credit of 108 crore in Q4 FY24.

On NSE, seven sectoral indices declined, five advanced, and three remained flat out of 12. The NSE Nifty Defence declined the most, while the NSE Nifty Metal rose the most.

On NSE, seven sectoral indices declined, five advanced, and three remained flat out of 12. The NSE Nifty Defence declined the most, while the NSE Nifty Metal rose the most.

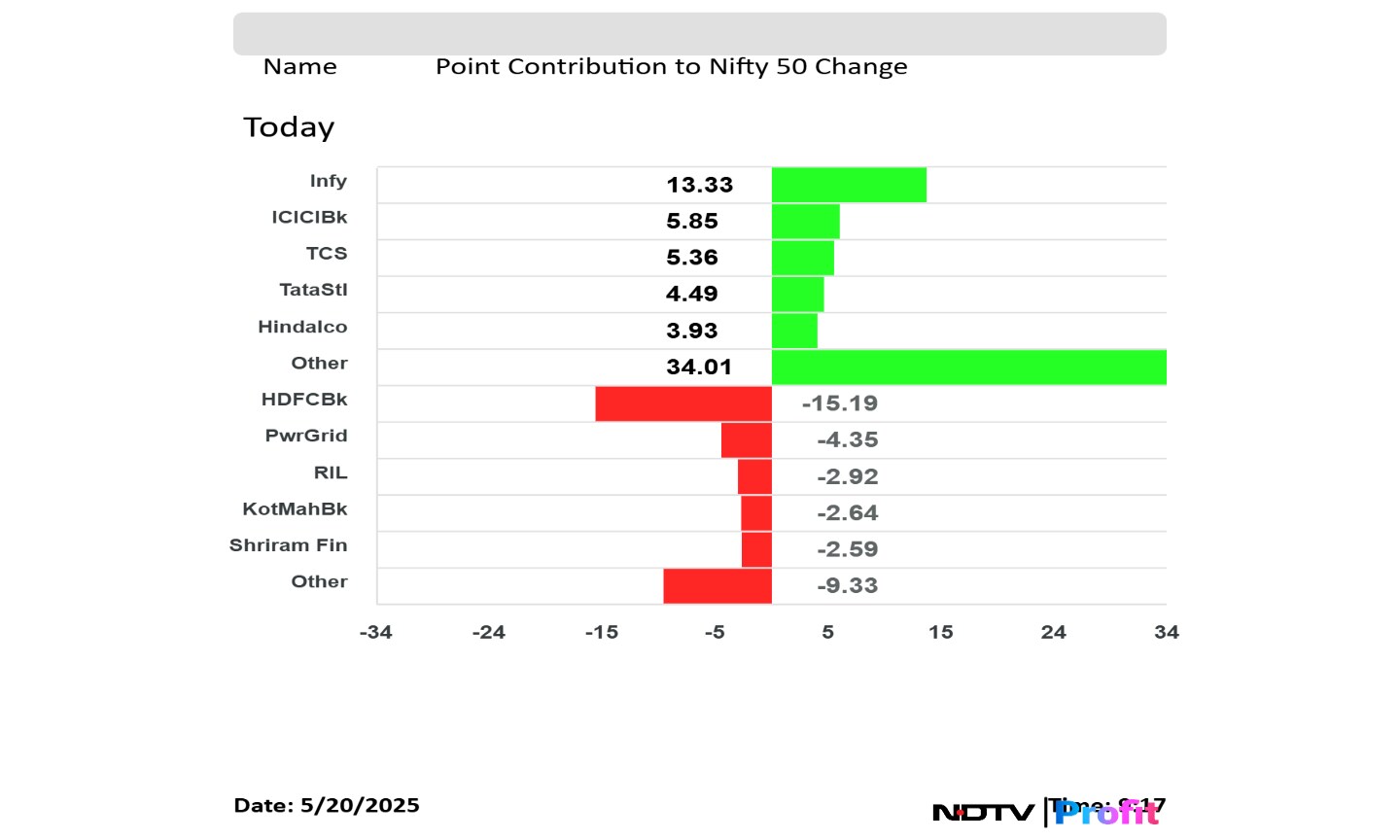

Infosys Ltd., ICICI Bank Ltd., Tata Consultancy Services Ltd., Tata Steel Ltd., and Hindalco Industries Ltd. added to the Nifty 50 index.

HDFC Bank Ltd., Power Grid Corp of India, Reliance Industries Ltd., Kotak Mahindra Bank Ltd., and Shriram Finance Ltd. weighed on the Nifty 50 index.

Infosys Ltd., ICICI Bank Ltd., Tata Consultancy Services Ltd., Tata Steel Ltd., and Hindalco Industries Ltd. added to the Nifty 50 index.

HDFC Bank Ltd., Power Grid Corp of India, Reliance Industries Ltd., Kotak Mahindra Bank Ltd., and Shriram Finance Ltd. weighed on the Nifty 50 index.

The NSE Nifty 50 and BSE Sensex rebounded from a two-day decline at open tracking a rise in Infosys Ltd., and Larsen & Toubro Ltd. share prices. The Nifty 50 was trading 26.00 points or 0.10% higher at 24,971.45, and the Sensex was trading 53.29 points or 0.06% higher at 82,112.71 as of 9:21 a.m.

The NSE Nifty 50 and BSE Sensex rebounded from a two-day decline at open tracking a rise in Infosys Ltd., and Larsen & Toubro Ltd. share prices. The Nifty 50 was trading 26.00 points or 0.10% higher at 24,971.45, and the Sensex was trading 53.29 points or 0.06% higher at 82,112.71 as of 9:21 a.m.

Eternal Ltd. shareholders approved capping foreign ownership upto 49.5%, the company said in an exchange filing.

At pre-open, the NSE Nifty 50 was trading 0.20% or 50.75 points higher at 24,996.20, and the BSE Sensex was trading 0.06% or 47.73 points higher at 82,107.17.

The yield on the 10-year bond opened flat at 6.28%

Source: Bloomberg

Rupee opened 7 paise weaker at 85.47 against US Dollar

It closed at 85.40 a dollar on Monday

Source: Bloomberg

Premier Energies received a target price hike from JP Morgan from Rs 940 to Rs 1,013 for fiscal 2026 amid expansion of Ebitda margin and a rise in net profit in its earnings for the fourth quarter.

Downgrade to Neutral from Buy and hiked target price to Rs 5,600 from Rs 5,440

Near term triggers are in the price; downgrade to Neutral

Long-term growth thesis in place; manufacturing ramp-up due

Asian share indices advanced Tuesday tracking a rebound on Wall Street, and as China infused more liquidity into the system to extend more support to its economy.

The Nikkei 225 and KOSPI were trading 0.35% and 0.10% higher, respectively. The CSI 300 was 0.21% higher as of 7:55 a.m.

US share indices rose Monday on dip-buying as traders look past Moody's rating downgrade. The S&P 500 rose for sixth day and finished on the brink of a bull market, as reported by Bloomberg.

On Monday, the Dow Jones Industrial Average rose 0.32% at 42,792.07. The S&P 500 rose 0.09% at 5,963.60. The Nasdaq Composite rose 0.02% at 19,215.46.

The GIFT Nifty was trading 0.10% or 24 points down at 25,081.50 as of 7:07 a.m., which implied 136 points higher open for the Nifty 50 compared to Monday's close.

Bharat Electronics Ltd., DLF Ltd., Marksans Pharma Ltd., and Quess Corp Ltd. released their fourth quarter results which may affect their share price movements in Tuesday's session.

The benchmark equity indices closed lower on Monday for the second consecutive session amid volatility in the stock markets following Moody's downgrade of the US by a notch.

The NSE Nifty 50 closed 74.35 points or 0.3% lower at 24,945.45 and the BSE Sensex ended 271.17 points or 0.33 down at 82,059.42.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.