.jpeg?downsize=1080:540)

The NSE Nifty 50 and BSE Sensex rose for second session in a row

The Nifty 50 and Sensex ended 0.47% and 0.37% higher, respectively.

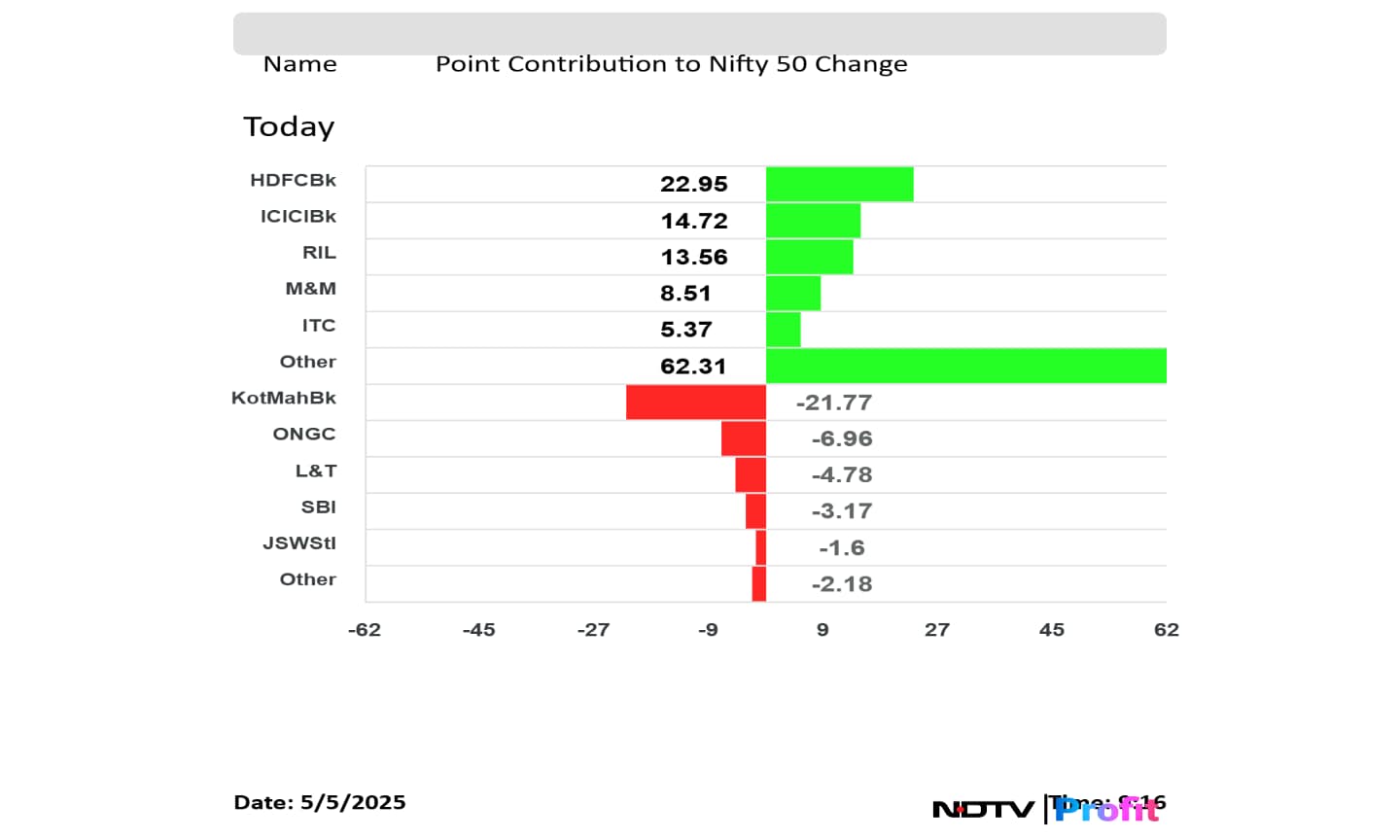

Mahindra & Mahindra Ltd., HDFC Bank Ltd., and Reliance Industries Ltd. added to the Nifty 50 index.

Kotak Mahindra Bank Ltd., State Bank of India, and Axis Bank Ltd. weighed on Nifty 50 index.

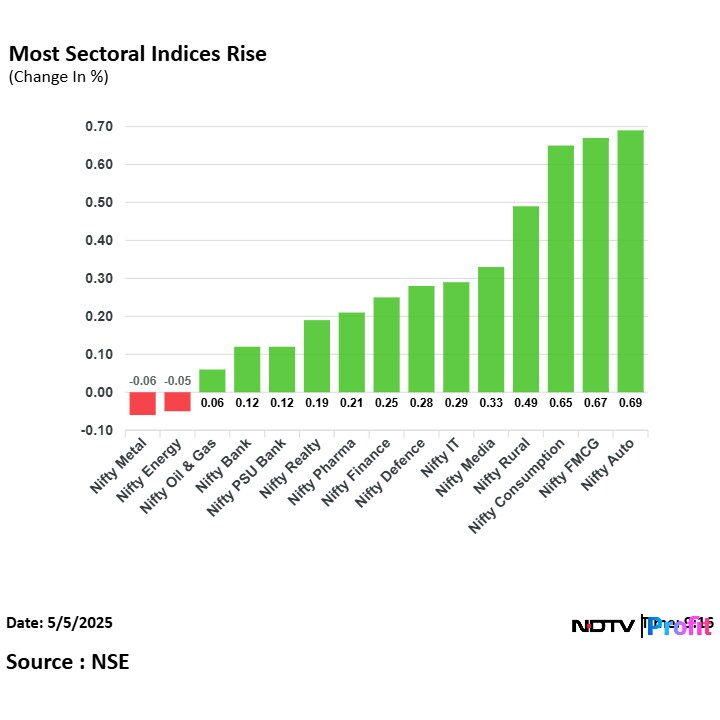

The NSE Nifty Auto rose the most, while the NSE Nifty Bank declined the most.

The NSE Nifty Midcap 150 ended 1.58% higher at 20,049.15

The NSE Nifty Smallcap 250 ended 1.13% higher at 15,528.30

The NSE Nifty 50 and BSE Sensex rose for second session in a row

The Nifty 50 and Sensex ended 0.47% and 0.37% higher, respectively.

Mahindra & Mahindra Ltd., HDFC Bank Ltd., and Reliance Industries Ltd. added to the Nifty 50 index.

Kotak Mahindra Bank Ltd., State Bank of India, and Axis Bank Ltd. weighed on Nifty 50 index.

The NSE Nifty Auto rose the most, while the NSE Nifty Bank declined the most.

The NSE Nifty Midcap 150 ended 1.58% higher at 20,049.15

The NSE Nifty Smallcap 250 ended 1.13% higher at 15,528.30

Rupee closed 31 paise stronger at 84.25 against US dollar

It closed at 84.56 a dollar on Friday

Source: Bloomberg

Tatva Chintan Pharma Chem receives an export order worth Rs 29.95 crore for the supply of specialty chemicals.

Markets in eurozone were trading on a mixed note as market participants remained on the sideline awaiting earnings and policy decisions from central banks. The US Federal Reserve and the Bank of England will announce their policy decision later this week.

Novo Nordisk, BMW, Maersk and Commerzbank will release their earnings.

The Euro Stoxx 60 and CAC 40 were trading 0.01% and 0.58% down, respectively. DAX was trading 0.34% higher as of 2:44 p.m.

The government is working on its stake sale in IDBI Bank and expects it to complete by the end of 2025, said M Nagaraju, Secretary of Department of Financial Services.

"It's on track and the process is on. We will finalise as per the time schedule which will be in this calendar year," Nagaraju told reporters on the sidelines of an event hosted by National Housing Bank.

Read the full article here.

It's a dog eat dog; rat eat rat game out there. A game of margins. The food delivery and quick commerce players are jostling for every inch and experimenting with models in a bid to eke out profits. A deeper reading of the Eternal's last reported quarter's numbers reveals that a viable model may be emerging for the players.

Read the full article here.

Goldiam International receives purchase orders worth Rs 80 crore to manufacture and export lab-grown diamond jewelry.

Over 1 million shares of Varun Beverages were traded via a block deal on Monday. The share of Petronet LNG rose as much as 1.36% to Rs 316.65 apiece.

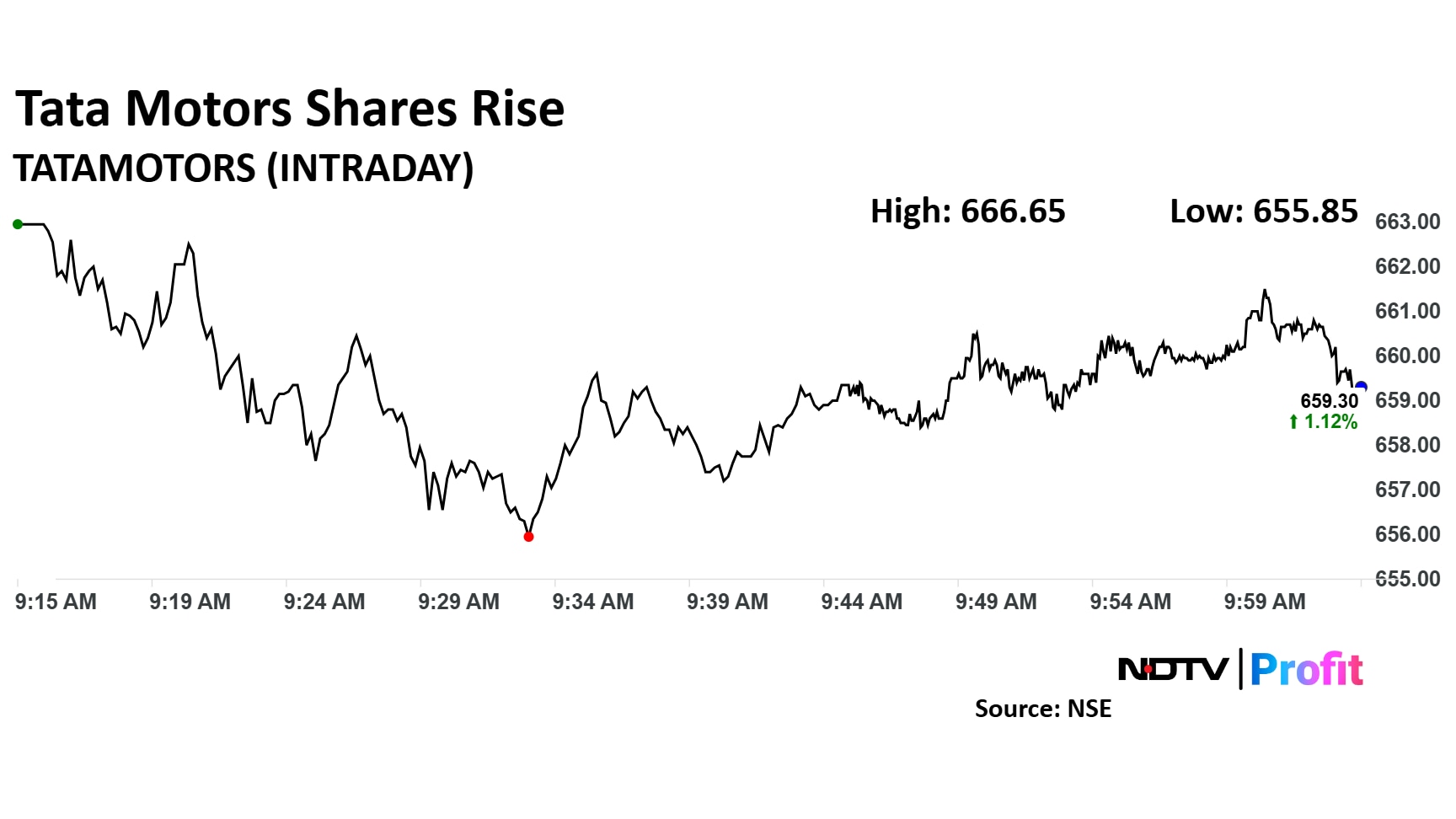

Shares of Tata Motors Ltd. rose over 2% in early trade on Monday, after its UK subsidiary, Jaguar Land Rover, resumed exports to the United States, after a month-long pause, despite an auto tariff still in place.

The scrip rose as much as 2.25% to Rs 666.65 apiece, the highest level since April 30.

Shares of Tata Motors Ltd. rose over 2% in early trade on Monday, after its UK subsidiary, Jaguar Land Rover, resumed exports to the United States, after a month-long pause, despite an auto tariff still in place.

The scrip rose as much as 2.25% to Rs 666.65 apiece, the highest level since April 30.

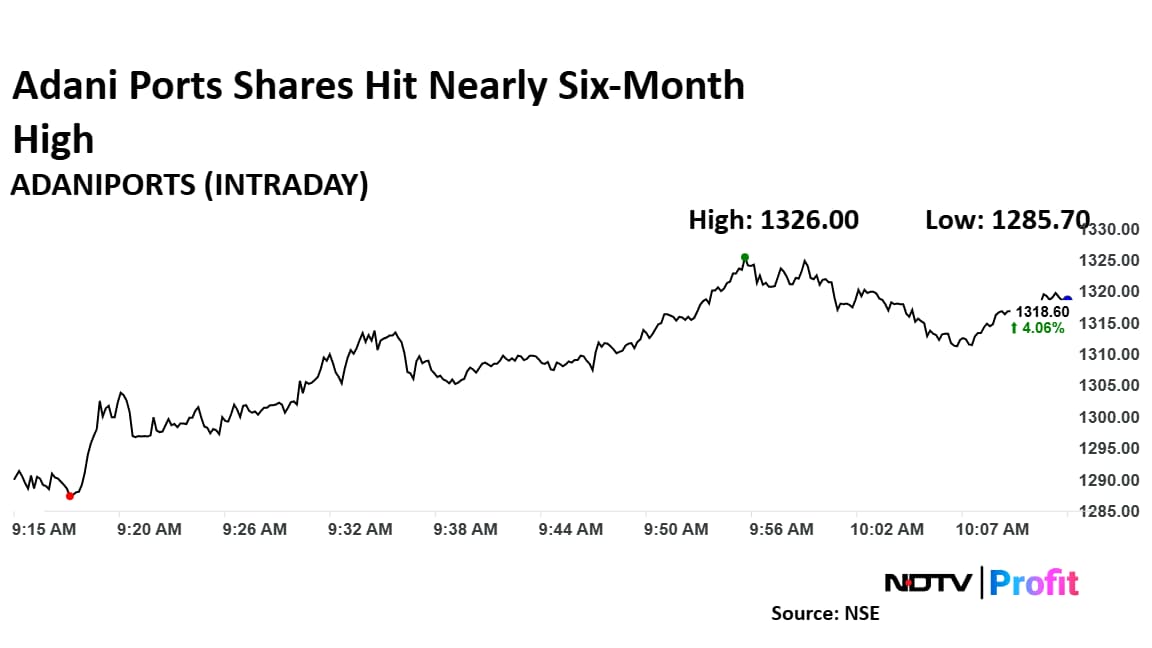

Shares of Adani Ports and Special Economic Zone Ltd. rose over 4% on Monday to hit nearly six-month high after the company reported a strong performance for April, with cargo volume increasing 4% year-over-year to 37.5 million metric tons.

Shares of Adani Ports and Special Economic Zone Ltd. rose over 4% on Monday to hit nearly six-month high after the company reported a strong performance for April, with cargo volume increasing 4% year-over-year to 37.5 million metric tons.

Disclaimer: NDTV is a subsidiary of AMG Media Networks Limited, an Adani Group Company.

Star Health And Allied Insurance Co board appointed Rajeev Kher as Chairperson

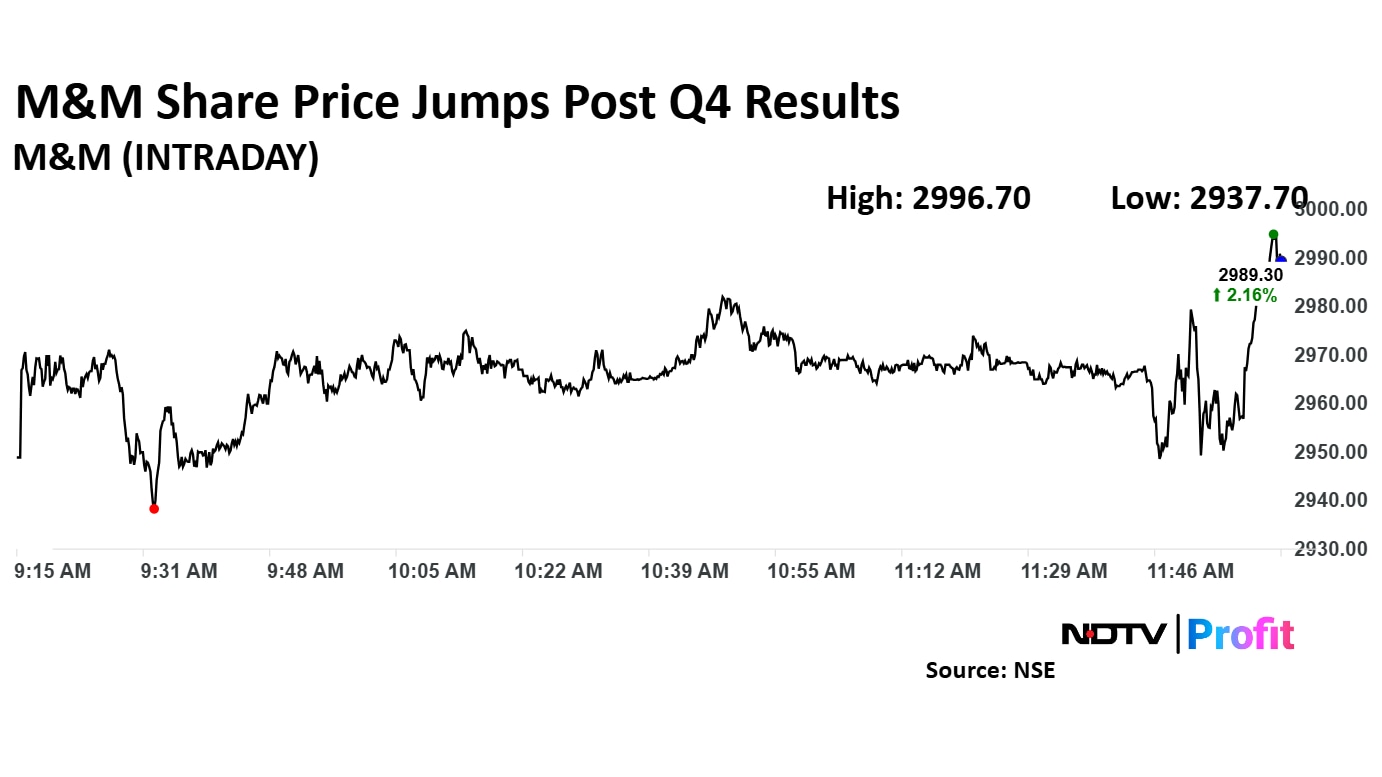

Mahindra & Mahindra Ltd. share price jumped 2.42% to Rs 2,996.70 apiece. It was trading 1.52% higher at Rs 2,988.60 apiece as of 12:06 p.m.. The share price rose as it posted 22% on-year rise in its net profit for January–March.

Mahindra & Mahindra Ltd. share price jumped 2.42% to Rs 2,996.70 apiece. It was trading 1.52% higher at Rs 2,988.60 apiece as of 12:06 p.m.. The share price rose as it posted 22% on-year rise in its net profit for January–March.

For faster Q4 earnings update click here.

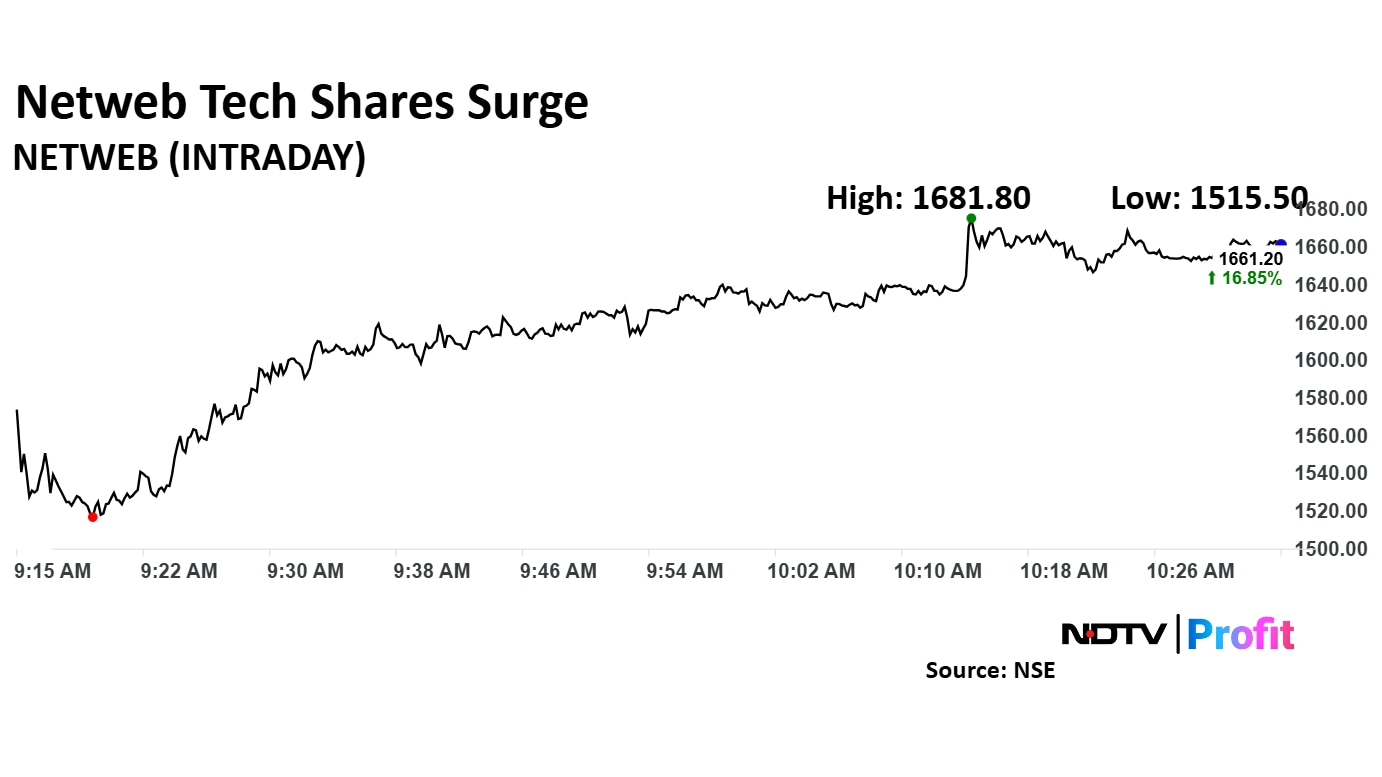

Shares of Netweb Technologies India Ltd. surged over 18% in trade on Monday after the company reported a rise of over 40% in its net profit for the quarter ended March 31.

Shares of Netweb Technologies rose as much as 18.29% to Rs 1,681.80 apiece, the highest level since March 25.

Shares of Netweb Technologies India Ltd. surged over 18% in trade on Monday after the company reported a rise of over 40% in its net profit for the quarter ended March 31.

Shares of Netweb Technologies rose as much as 18.29% to Rs 1,681.80 apiece, the highest level since March 25.

Goodluck India's board will consider and approve the conversion of share warrants into fully paid-up equity shares issued on a preferential basis.

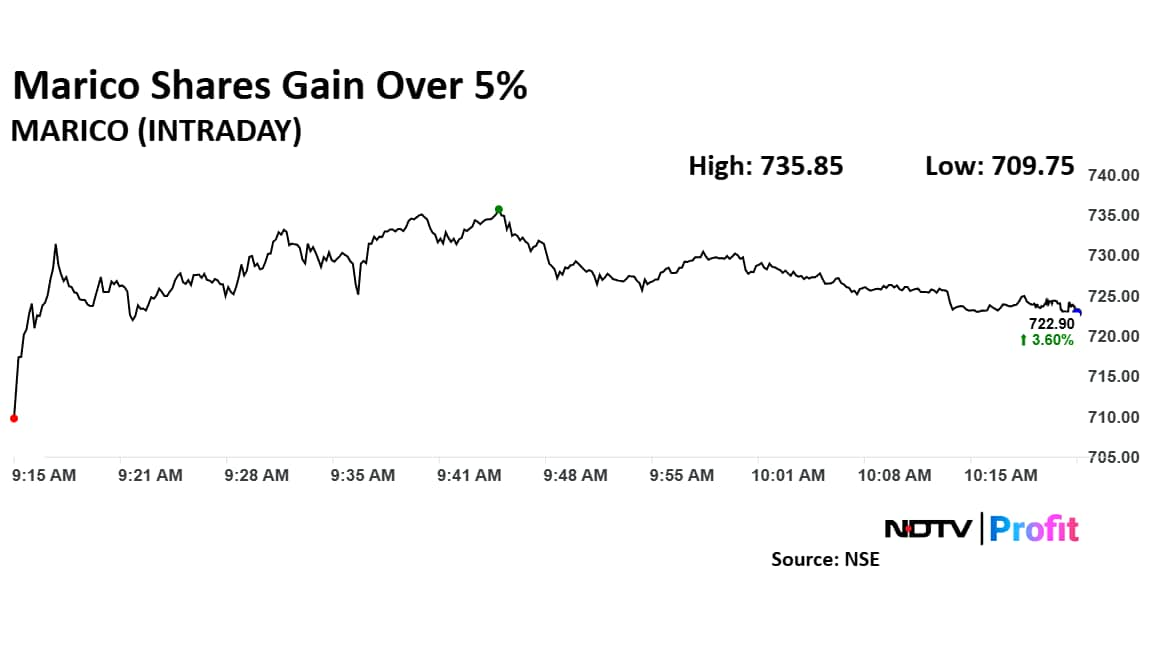

Marico Ltd.‘s share price rose over 5% on Monday after the company posted an 8% rise in fourth-quarter profit, broadly in line with analysts’ expectations.

Marico stock rose as much as 5.46% during the day to Rs 735.85 apiece on the NSE.

Marico Ltd.‘s share price rose over 5% on Monday after the company posted an 8% rise in fourth-quarter profit, broadly in line with analysts’ expectations.

Marico stock rose as much as 5.46% during the day to Rs 735.85 apiece on the NSE.

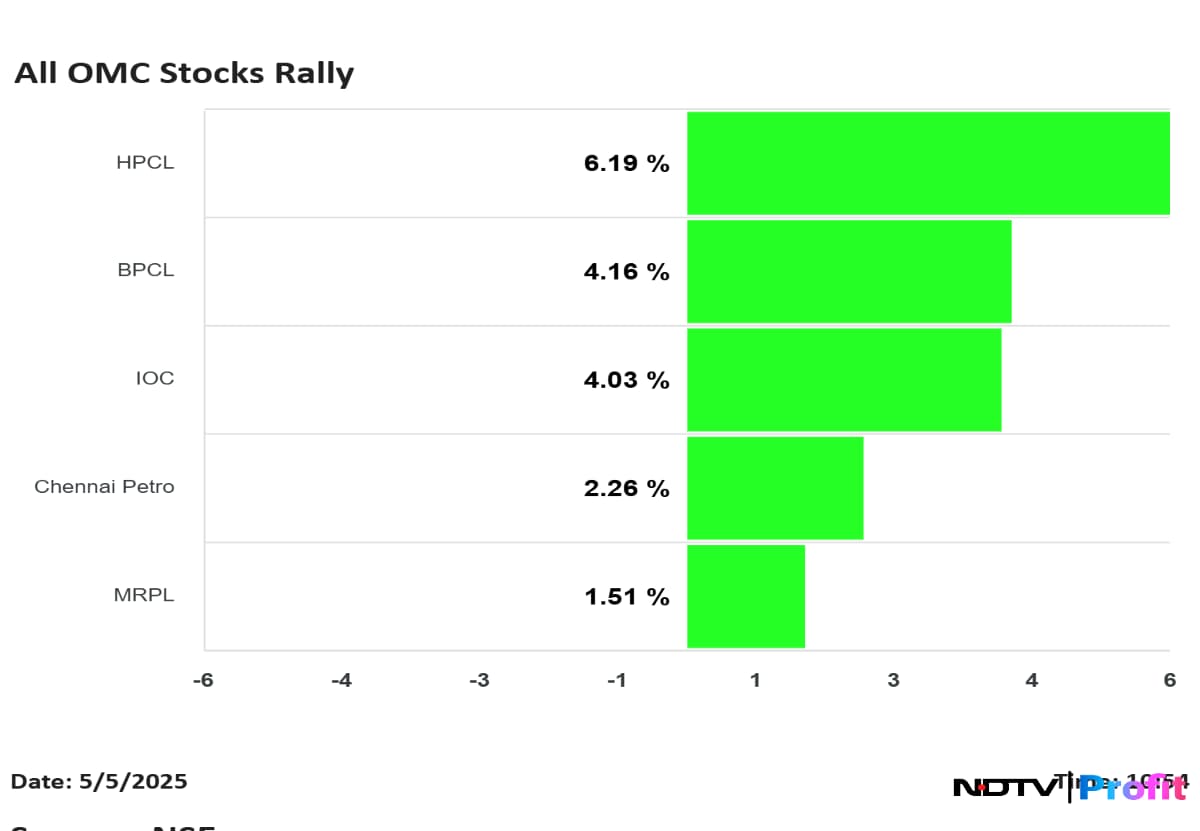

Shares of major Indian oil marketing companies rallied on Monday as Brent crude prices slid below the $59 per barrel mark — their lowest level since February 2021.

Hindustan Petroleum Corp. led the rally, jumping 6.27% to Rs 409.20 — its highest level since Jan. 6. Bharat Petroleum Corp. and Indian Oil Corp. also surged over 4%, reaching six-month highs of Rs 325.45 and Rs 149.60 respectively.

Shares of major Indian oil marketing companies rallied on Monday as Brent crude prices slid below the $59 per barrel mark — their lowest level since February 2021.

Hindustan Petroleum Corp. led the rally, jumping 6.27% to Rs 409.20 — its highest level since Jan. 6. Bharat Petroleum Corp. and Indian Oil Corp. also surged over 4%, reaching six-month highs of Rs 325.45 and Rs 149.60 respectively.

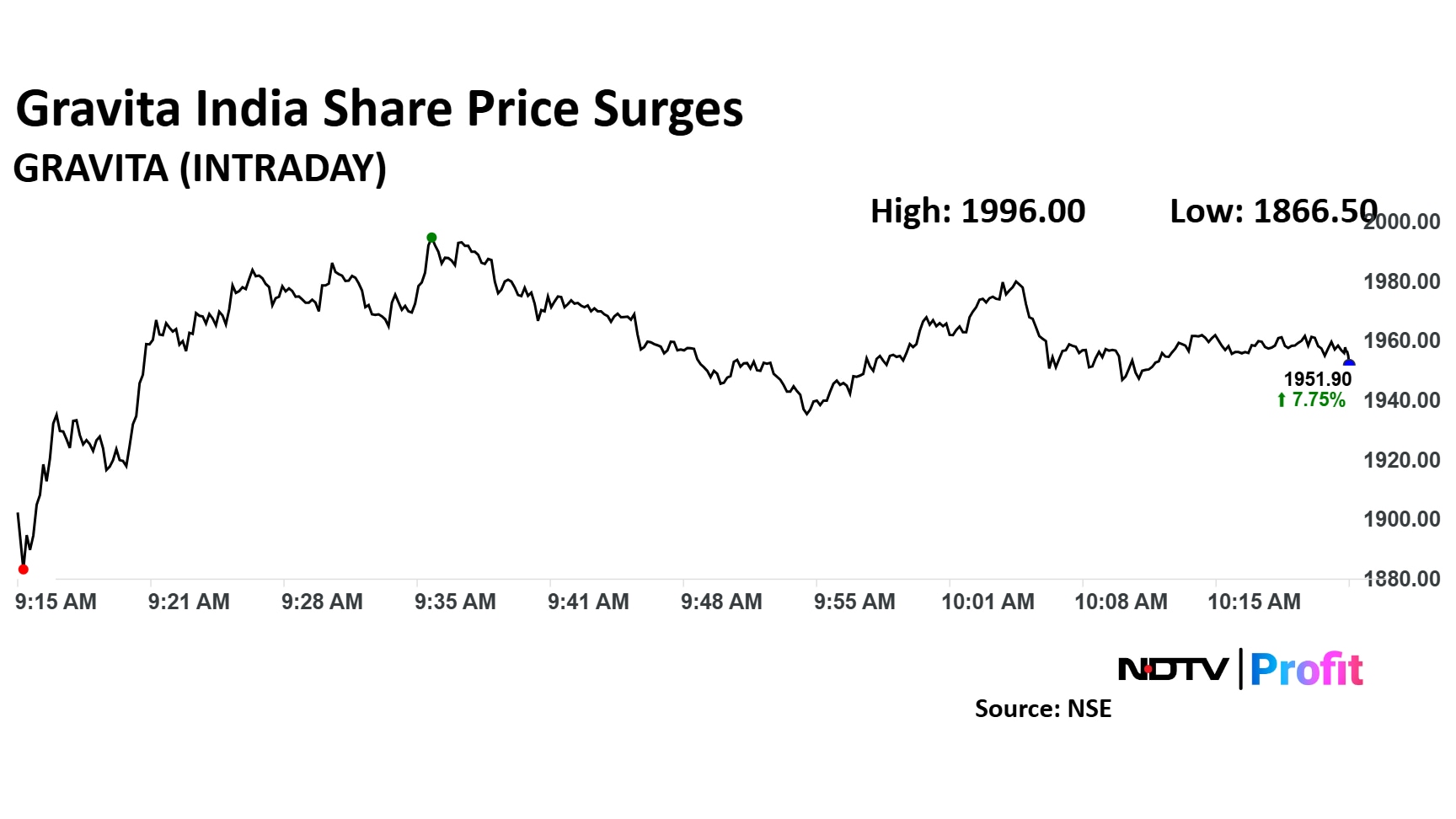

Share price of Gravita India Ltd. jumped as high as 10% on Monday after its fourth quarter revenue and profit rose. Shares of Gravita India rose as much as 10.18% to Rs 1,996 apiece, the highest level since April 23, 2025.

Share price of Gravita India Ltd. jumped as high as 10% on Monday after its fourth quarter revenue and profit rose. Shares of Gravita India rose as much as 10.18% to Rs 1,996 apiece, the highest level since April 23, 2025.

Axiscades Engineering Technology appoints Ravikumar Joghee as Chief Strategy and Marketing Officer.

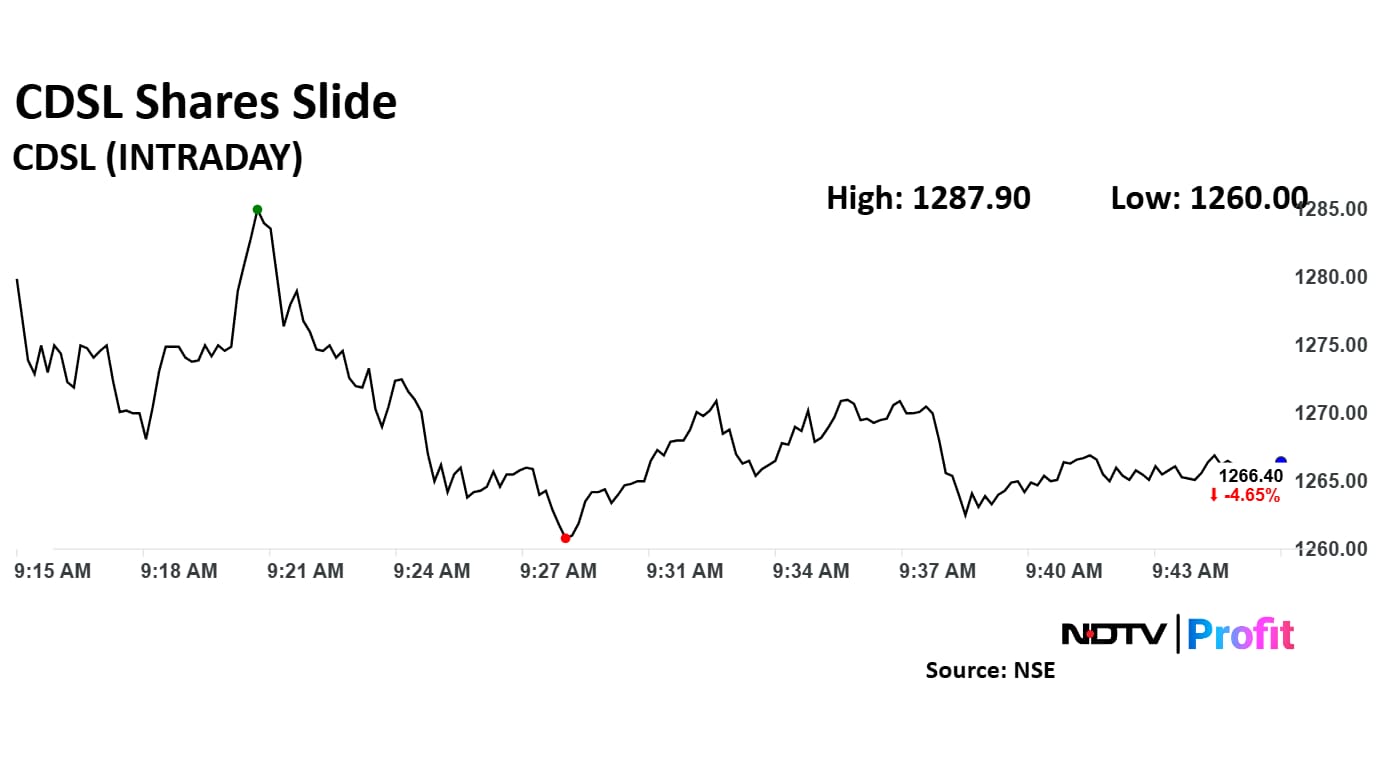

Shares of Central Depository Services (India) Ltd. declined over 5% in early trade on Monday, after the company posted a disappointing performance in the final quarter of fiscal 2025.

Shares of Central Depository Services (India) Ltd. declined over 5% in early trade on Monday, after the company posted a disappointing performance in the final quarter of fiscal 2025.

UltraTech Cement's total domestic grey cement capacity is 184.8 MTPA. Debottlenecking efforts have added 1.4 MTPA capacity, bringing the global capacity to 190.16 MTPA

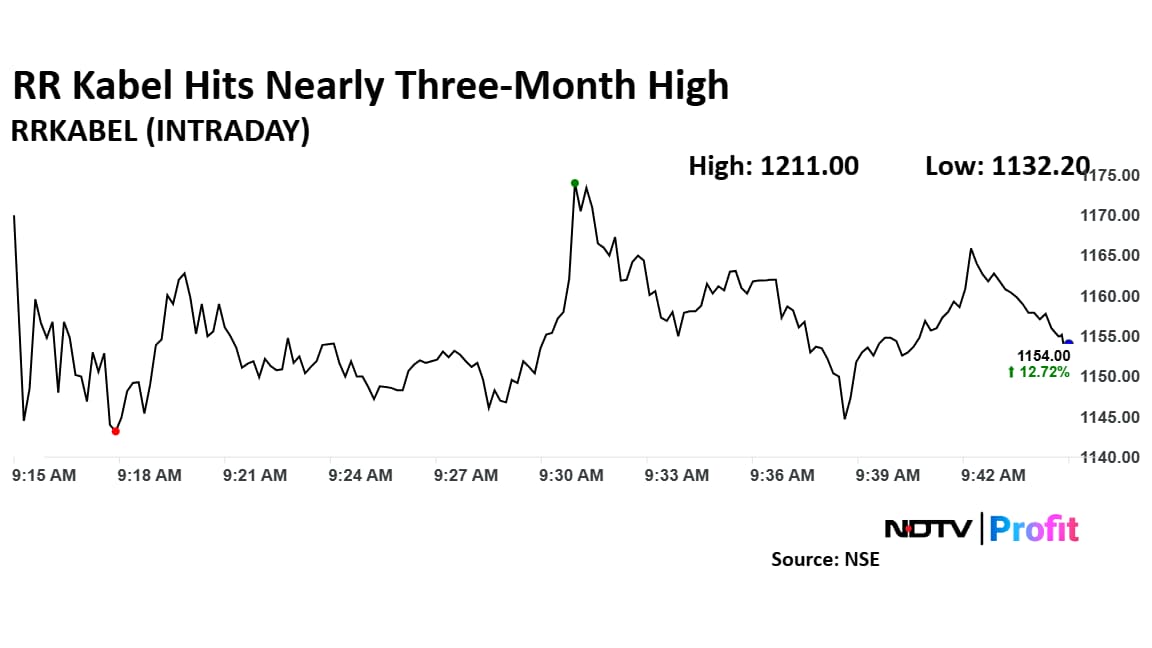

Shares of R R Kabel Ltd. hit a three-month high after the company posted a 63% advance in its consolidated net profit during the quarter ended March, according to the financial results declared by the wires and cables manufacturer on Friday.

Shares of R R Kabel Ltd. hit a three-month high after the company posted a 63% advance in its consolidated net profit during the quarter ended March, according to the financial results declared by the wires and cables manufacturer on Friday.

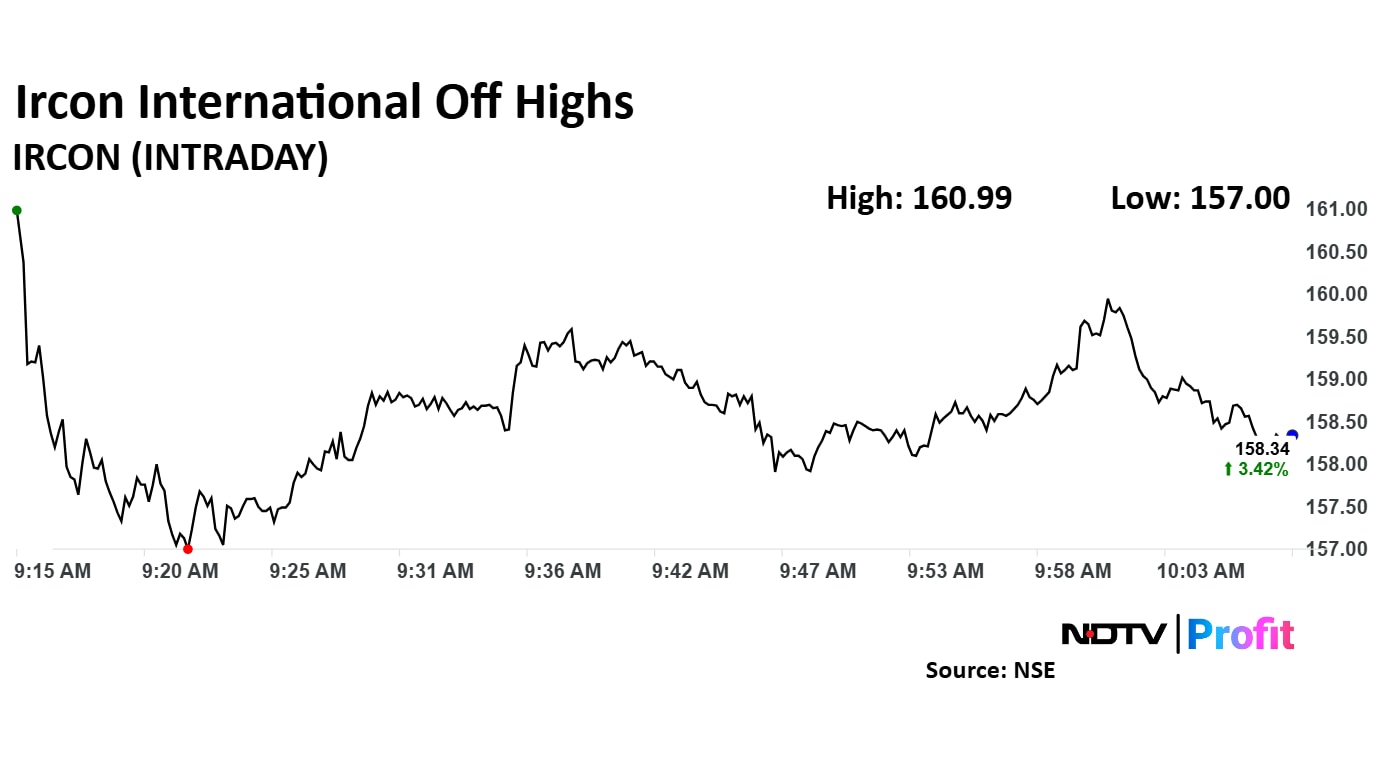

Ircon International share price rose 5.15% to Rs 160.99 apiece. The company received an order worth Rs 458 crore from Northeastern Electric Power Corp. It was trading 3.43% higher at Rs 158.2 apiece as of 10:12 a.m., as compared to 0.51% advance in NSE Nifty 50 index.

Ircon International share price rose 5.15% to Rs 160.99 apiece. The company received an order worth Rs 458 crore from Northeastern Electric Power Corp. It was trading 3.43% higher at Rs 158.2 apiece as of 10:12 a.m., as compared to 0.51% advance in NSE Nifty 50 index.

Axis Bank – Downgrade to Neutral from Buy; Cut TP to Rs 1,300 from Rs 1,350

Valuations continue to trade at a discount to peers

Any re-rating likely delayed as growth/asset quality performance likely to remain soft near term

RoAs also to come under pressure from the rate cut cycle

IDFC First Bank – Upgrade to Buy from Underperform; Hike TP to Rs 80 from Rs 65

RBL Bank – Upgrade to Buy from Underperform; Hike TP to Rs 235 from Rs 175

AU Small Finance Bank – Upgrade to Buy from Underperform; Hike TP to Rs 800 from Rs 630

Upgrades – benefit from rate cut cycle, favorable balance sheet mix, MFI and unsecured retail related asset quality issues now behind us

See scope for PE multiples to re-rate more than 20% as EPS growth trajectory meaningfully improves through FY26-27

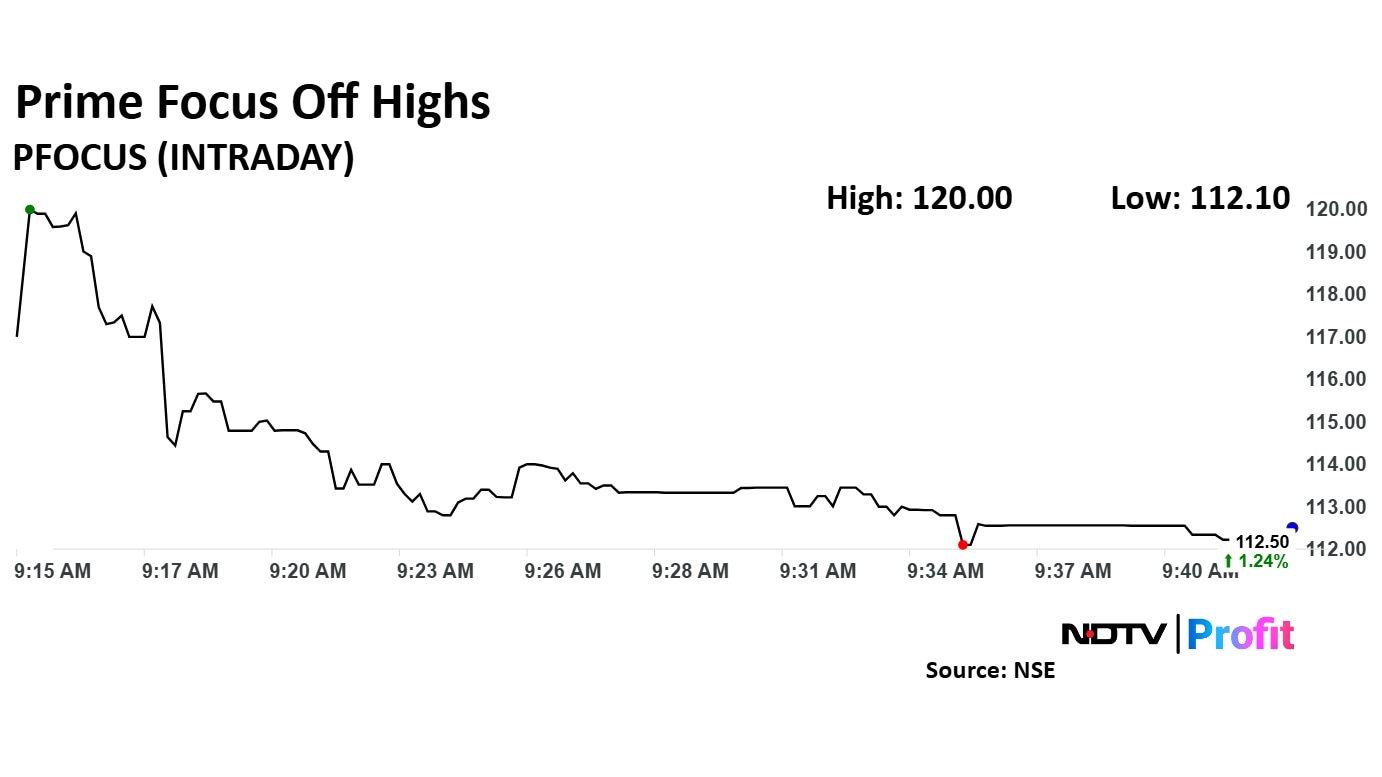

Prime Focus Ltd. share price jumped 8% in Monday's session as it will invest Rs 3,000 crore in Mumbai’s infrastructure development. In this regard, the company signed a agreement with the Maharashtra Government. The Maharashtra Government to develop a new global Entertainment Ecosystem in Mumbai.

Prime Focus Ltd. share price jumped 8% in Monday's session as it will invest Rs 3,000 crore in Mumbai’s infrastructure development. In this regard, the company signed a agreement with the Maharashtra Government. The Maharashtra Government to develop a new global Entertainment Ecosystem in Mumbai.

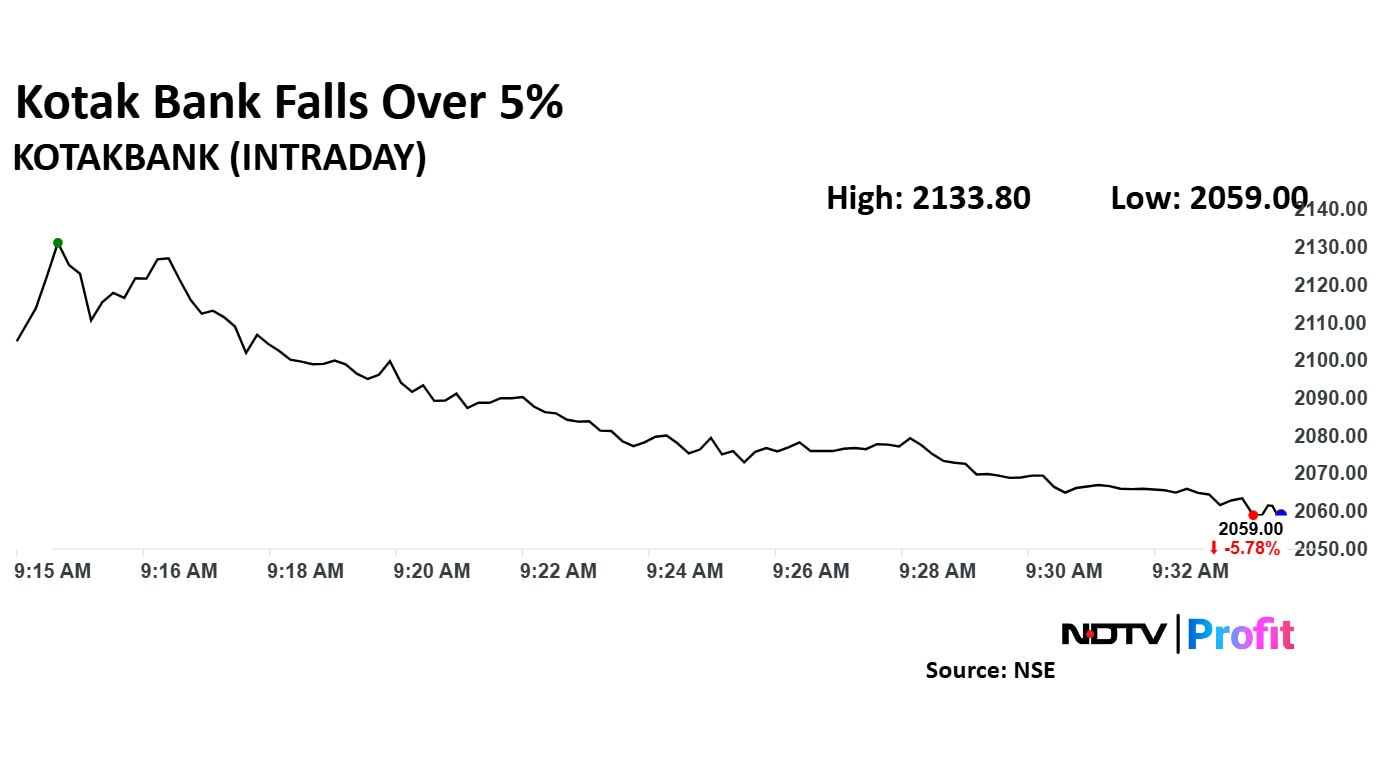

Kotak Mahindra Bank Ltd. share price fell 5.82% to Rs 2,058 apiece, the lowest level since April 11. The share price declined as the private bank reported a 14% on-year decline in its net profit during January–March.

Kotak Mahindra Bank Q4FY25 Highlights (Standalone, YoY)

Net Interest Income up 5.4% to Rs 7,284 crore versus Rs 6,909 crore (Bloomberg estimate: Rs 7,347 crore)

Net NPA at 0.31% versus 0.41% (QoQ)

Gross NPA at 1.42% versus 1.50% (QoQ)

Net Profit down 14% to Rs 3,552 crore versus Rs 4,133 crore (Estimate: Rs 3,606 crore)

Provisions up 14.5% to Rs 909 crore versus Rs 794 crore (QoQ)

Operating profit up 0.2% to Rs 5,472 crore versus Rs 5,462 crore

Board proposes dividend of Rs 2.5 per share

Kotak Mahindra Bank Ltd. share price fell 5.82% to Rs 2,058 apiece, the lowest level since April 11. The share price declined as the private bank reported a 14% on-year decline in its net profit during January–March.

Kotak Mahindra Bank Q4FY25 Highlights (Standalone, YoY)

Net Interest Income up 5.4% to Rs 7,284 crore versus Rs 6,909 crore (Bloomberg estimate: Rs 7,347 crore)

Net NPA at 0.31% versus 0.41% (QoQ)

Gross NPA at 1.42% versus 1.50% (QoQ)

Net Profit down 14% to Rs 3,552 crore versus Rs 4,133 crore (Estimate: Rs 3,606 crore)

Provisions up 14.5% to Rs 909 crore versus Rs 794 crore (QoQ)

Operating profit up 0.2% to Rs 5,472 crore versus Rs 5,462 crore

Board proposes dividend of Rs 2.5 per share

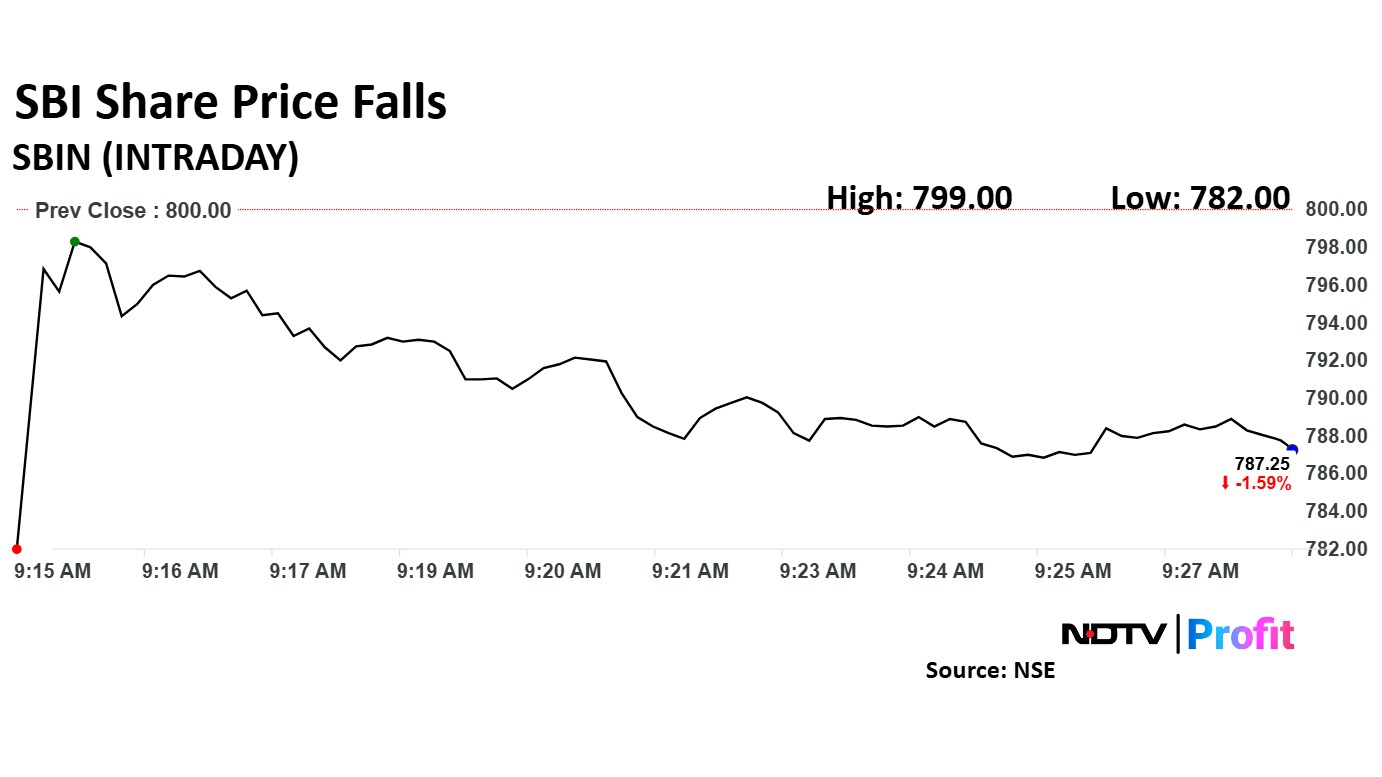

State Bank of India share price declined 2.25% to Rs 782 apiece, the lowest level since April 17. It was trading 1.84% down at Rs 785 apiece as of 9:30 a.m. as compared to 0.40% advance in the Nifty 50 index.

State Bank of India Q4FY25 Highlights (Standalone, YoY)

Net Profit down 10% to Rs 18,643 crore versus Rs 20,698 crore (Bloomberg estimate: Rs 17,800 crore)

Net Interest Income up 2.7% to Rs 42,775 crore versus Rs 41,655 crore (Bloomberg estimate: Rs 43,405 crore)

Operating profit up 8.8% to Rs 31,286 crore versus Rs 28,748 crore

Net NPA at 0.47% versus 0.53% (QoQ)

Gross NPA at 1.82% versus 2.07% (QoQ)

Provisions at Rs 6,442 crore versus Rs 1,608 crore (YoY) and Rs 911 crore (QoQ)

Approves raising up to Rs 25,000 crore via QIP in one or more tranches during FY26.

Board declared a dividend of Rs 15.9 per share.

State Bank of India share price declined 2.25% to Rs 782 apiece, the lowest level since April 17. It was trading 1.84% down at Rs 785 apiece as of 9:30 a.m. as compared to 0.40% advance in the Nifty 50 index.

State Bank of India Q4FY25 Highlights (Standalone, YoY)

Net Profit down 10% to Rs 18,643 crore versus Rs 20,698 crore (Bloomberg estimate: Rs 17,800 crore)

Net Interest Income up 2.7% to Rs 42,775 crore versus Rs 41,655 crore (Bloomberg estimate: Rs 43,405 crore)

Operating profit up 8.8% to Rs 31,286 crore versus Rs 28,748 crore

Net NPA at 0.47% versus 0.53% (QoQ)

Gross NPA at 1.82% versus 2.07% (QoQ)

Provisions at Rs 6,442 crore versus Rs 1,608 crore (YoY) and Rs 911 crore (QoQ)

Approves raising up to Rs 25,000 crore via QIP in one or more tranches during FY26.

Board declared a dividend of Rs 15.9 per share.

Marico's board approves the re-appointment of Saugata Gupta as Managing Director and CEO.

On NSE, 13 sectoral indices advanced, and two declined out of 15. The NSE Nifty Auto rose the most, and the NSE Nifty Metal declined the most.

On NSE, 13 sectoral indices advanced, and two declined out of 15. The NSE Nifty Auto rose the most, and the NSE Nifty Metal declined the most.

HDFC Bank Ltd., ICICI Bank Ltd., Reliance Industries Ltd., Mahindra & Mahindra Ltd., and ITC Ltd. shares added to the Nifty 50 index.

Kotak Mahindra Bank Ltd., Oil and Natural Gas Corp, Larsen & Toubro Ltd., State Bank of India, and JSW Steel Ltd. weighed on the Nifty 50 index.

HDFC Bank Ltd., ICICI Bank Ltd., Reliance Industries Ltd., Mahindra & Mahindra Ltd., and ITC Ltd. shares added to the Nifty 50 index.

Kotak Mahindra Bank Ltd., Oil and Natural Gas Corp, Larsen & Toubro Ltd., State Bank of India, and JSW Steel Ltd. weighed on the Nifty 50 index.

The NSE Nifty 50 and BSE Sensex opened higher on Monday tracking gains in private bank stocks. The Nifty 50 was trading 95.10 points or 0.39% higher at 24,441.80, and the Sensex was trading 361.79 points or 0.45% higher at 80,863.78.

The NSE Nifty 50 and BSE Sensex opened higher on Monday tracking gains in private bank stocks. The Nifty 50 was trading 95.10 points or 0.39% higher at 24,441.80, and the Sensex was trading 361.79 points or 0.45% higher at 80,863.78.

At pre-open, the NSE Nifty 50 rose 0.30% to 24,419.50, and the BSE Sensex rose 0.19% to 80,656.98.

Rupee opened 11 paise stronger at 84.45 against US dollar

It closed at 84.56 a dollar on Friday

Source: Bloomberg

The yield on the 10-year bond opened flat at 6.36%

Source: Bloomberg

Biocon's arm secures multiple market access agreements for Yesintek in the US. Yesintek is used to treat plaque psoriasis, according to an exchange filing.

Maintain Buy and hike target price to Rs 800 from Rs 780

A Reasonable Outcome

India volume growth appears impressive in the context of tough macro

International growth was also strong

Ebitda margin however remained under pressure due to GM pressure along with higher A&P spends

Management outlook is reasonably positive on growth in core as well as growth portfolio

Oberoi Realty registers a gross booking value of Rs 970 crore with the launch of Elysian Tower D at Goregaon, Mumbai. The project has a carpet area of 2.1 lakh square feet and a saleable area of 3.25 lakh square feet.

Maintain Sell and cut target price to Rs 3,250 from Rs 3,350

EBITDA/adj PAT missed Citi est by 5%/8% due to EBITDA margin contraction

Q4: Double Whammy of Competition on gross margin and Opex

EBITDA growth has lagged revenue growth in 10 of the last 11 quarters, likely due to competition from quick commerce

Expect Avenue Supermarts to turn into net debt from net cash over the next 2-3 years

Seek a better entry point/valuation as risk-reward seems unfavorable

Initiate Buy with a target price of Rs 1,450

A good, strong growth story

Healthy visibility into rapid growth ahead

Growth drivers: Scale-up of pharma CDMO and specialty chemicals businesses

Financials: 30%/35% CAGRs in revenues/EPS over FY25-30

Key risks: Tariff roadblocks, regulatory challenges, execution missteps

Gold prices rebounded from losses in Asia session Monday as market participants braced themselves for the outcome of the US Federal Reserve, later this week. The US central bank is widely expected to hold rate steady despite President Donald Trump's pressure to lower rates. Commentary from the Chair Jerome Powell will be significant for future cues.

The Bloomberg spot gold was trading 0.61% higher at $3,260.04 as of 7:52 a.m.

Crude oil prices declined to nearly one-month low Monday on antcipated supply increase in near future after Organization and Petroleum Exporting Countries and its allies decided to increase output for second consecutive month. In June, output will likely increase by 411,000 barrels per day.

The July future contract of brent crude fell 4.55% to $58.50 a barrel, touching the lowest level since April 9. It was trading 3.64% down at $59.06 a barrel as of 7:27 a.m.

Share indices in Australia declined Monday after Prime Minister Anthony Albanese won a second term and returned to power. The S&P ASX 200 was trading 0.74% down at 8,175.90 as of 7:43 a.m.

Market participants will closely monitor upcoming US Federal Reserve policy meeting and US–China trade talks. Beijing said that it's mulling an offer from the US to hold trade talks between US and China.

Financial markets in Japan, South Korea, and China are closed for public holidays.

US share indices ended higher Friday as upbeat jobs data assuaged some of the tension about the economy and hope of negotiation between China and US. The S&P 500 rose for ninth consecutive session to mark the best winning streak from 2004. The Dow Jones Industrial Average also hit a nine-day winning streak, which is the longest since December, 2023.

On Friday, the Dow Jones Industrial Average and S&P 500 ended 1.39% and 1.47% higher, respectively. The Nasdaq Composite ended 1.51% higher.

The GIFT Nifty was trading 0.09%, or 22 points down at 24,517.00 as of 6:48 a.m., indicating a negative start for the benchmark NSE Nifty 50.

State Bank of India, Kotak Mahindra Bank Ltd., and Avenue Supermarts Ltd. reported a decrease in net profit during the January–March quarter. Life Insurance Corp. of India raised stake in Tata Steel Ltd. RailTel Corp. of India, and Ircon International Ltd. reported order wins over the weekend. Investors may keep an eye on these stocks for movements on Monday.

On Friday, India's benchmark equity indices ended a holiday-shortened week higher, swinging to green after a day of decline. The NSE Nifty 50 closed 0.05% higher at 24,346.70, while the BSE Sensex ended 0.32% up at 80,501.99.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.