The NSE Nifty 50 and BSE Sensex rebounded from a two-day decline.

The Nifty 50 and Sensex ended 1.20% and 1.27% higher, respectively.

Reliance Industries Ltd., ICICI Bank Ltd., Axis Bank Ltd., State Bank of India are top contributors

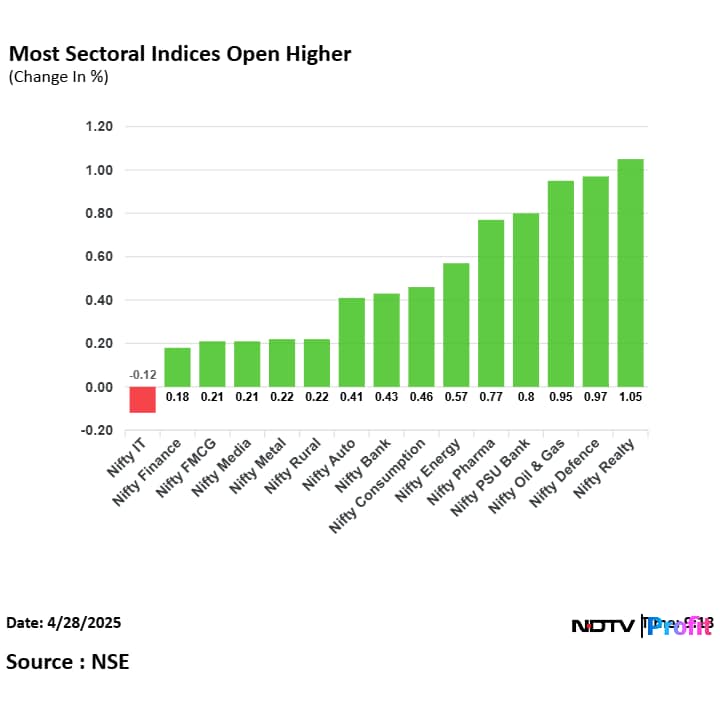

The NSE Nifty Defence rose the most, while the NSE Nifty IT declined the most.

The NSE Nifty Midcap 150 ended 1.38% higher at 19,966.70

The NSE Nifty Smallcap 250 ended 0.53% higher at 15,607.15

The NSE Nifty 50 and BSE Sensex rebounded from a two-day decline.

The Nifty 50 and Sensex ended 1.20% and 1.27% higher, respectively.

Reliance Industries Ltd., ICICI Bank Ltd., Axis Bank Ltd., State Bank of India are top contributors

The NSE Nifty Defence rose the most, while the NSE Nifty IT declined the most.

The NSE Nifty Midcap 150 ended 1.38% higher at 19,966.70

The NSE Nifty Smallcap 250 ended 0.53% higher at 15,607.15

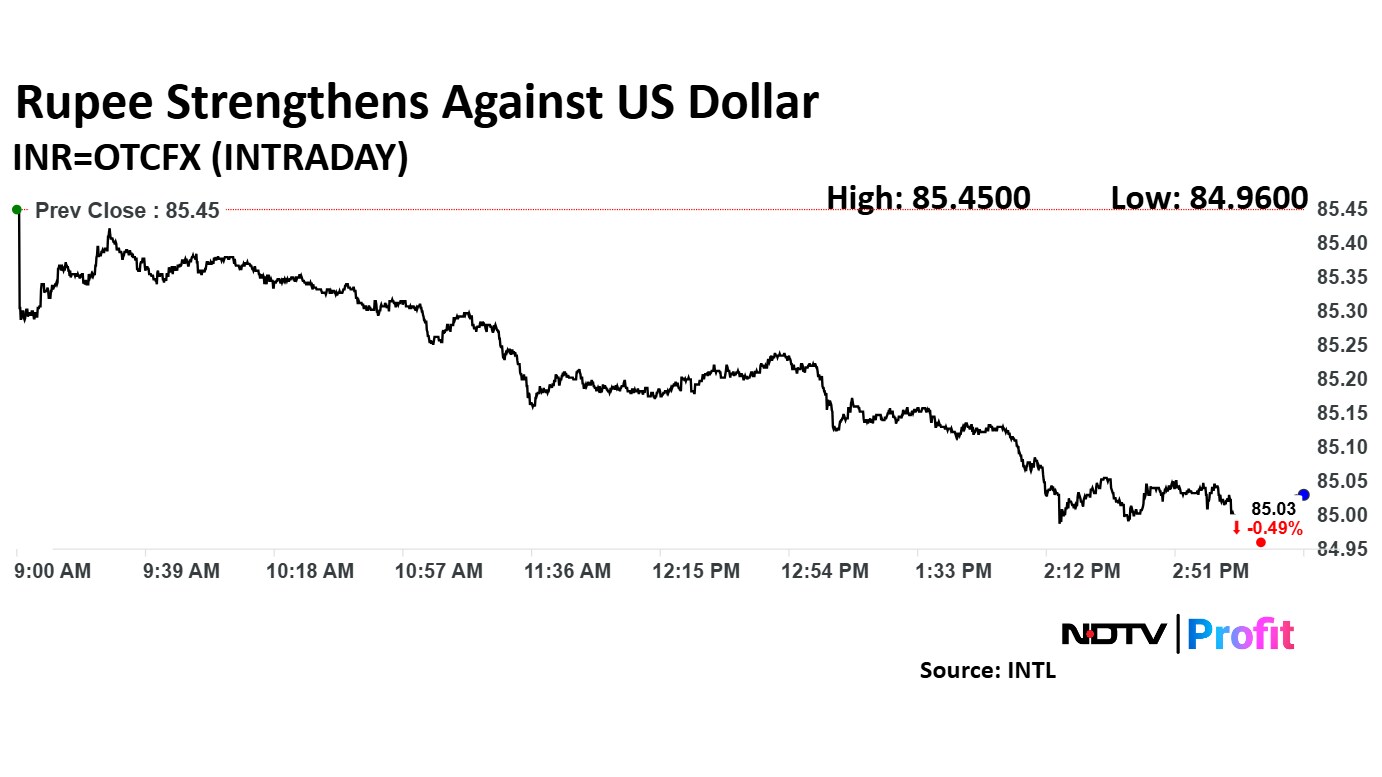

Rupee closed 42 paise stronger at 85.03 a dollar

Intraday, rupee jumped 50 paise to 84.95 a dollar

Intraday level is the highest since April 4

It closed at 85.45 a dollar on Friday

Source: Bloomberg

Rupee closed 42 paise stronger at 85.03 a dollar

Intraday, rupee jumped 50 paise to 84.95 a dollar

Intraday level is the highest since April 4

It closed at 85.45 a dollar on Friday

Source: Bloomberg

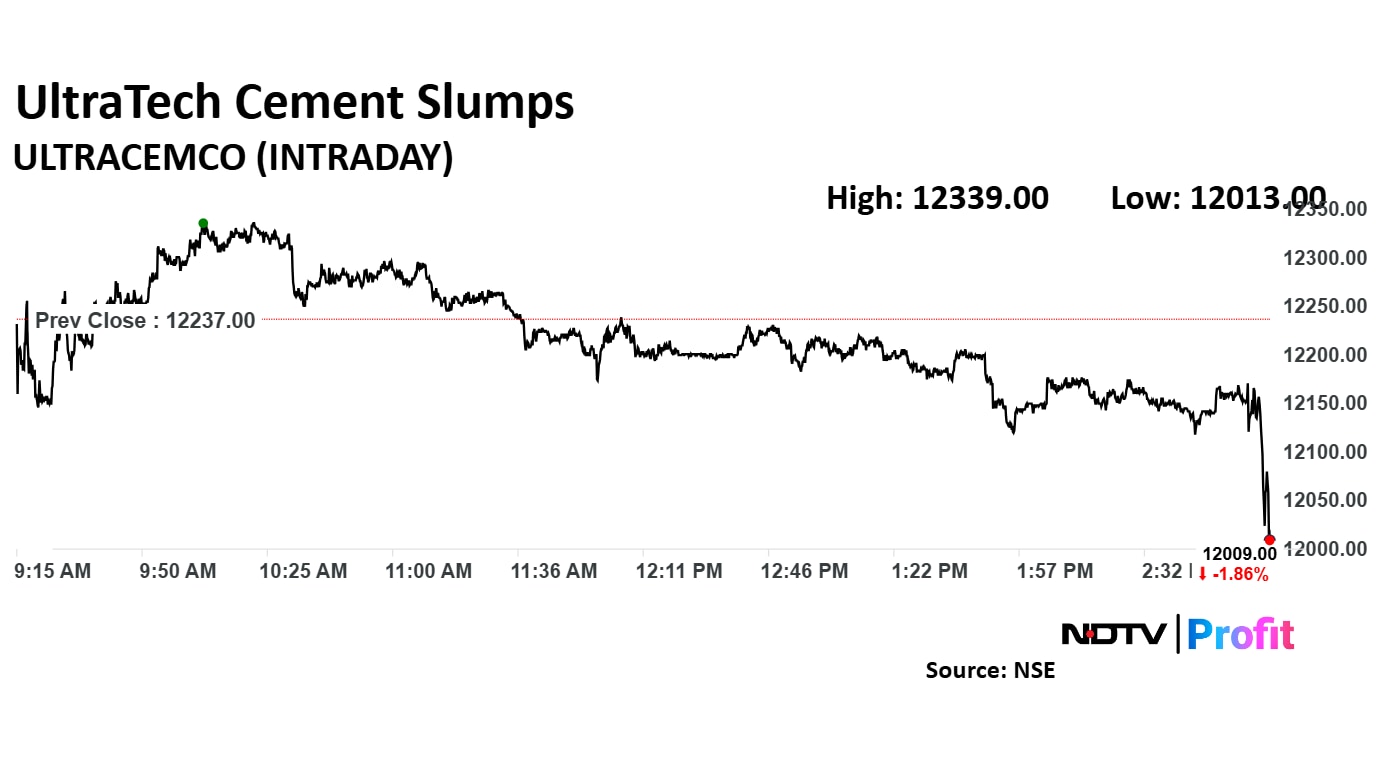

Revenue up 12.95% at Rs 23063.32 crore vs Rs 20418.94 crore (Est: 22,967.44 crore)

Ebitda up 12.26% at Rs 4618.44 crore vs Rs 4113.92 crore (Est: 4615.92 crore)

Margin at 20.02% vs 20.14% (Est: 20.1%)

Net profit up 9.91% at Rs 2482.04 crore vs Rs 2258.12 crore (Est: Rs 2538.39 crore)

Revenue up 12.95% at Rs 23063.32 crore vs Rs 20418.94 crore (Est: 22,967.44 crore)

Ebitda up 12.26% at Rs 4618.44 crore vs Rs 4113.92 crore (Est: 4615.92 crore)

Margin at 20.02% vs 20.14% (Est: 20.1%)

Net profit up 9.91% at Rs 2482.04 crore vs Rs 2258.12 crore (Est: Rs 2538.39 crore)

Global Health will acquire 3 acres of land owned by Assam Electricity Grid Corporation for Rs 30 crore.

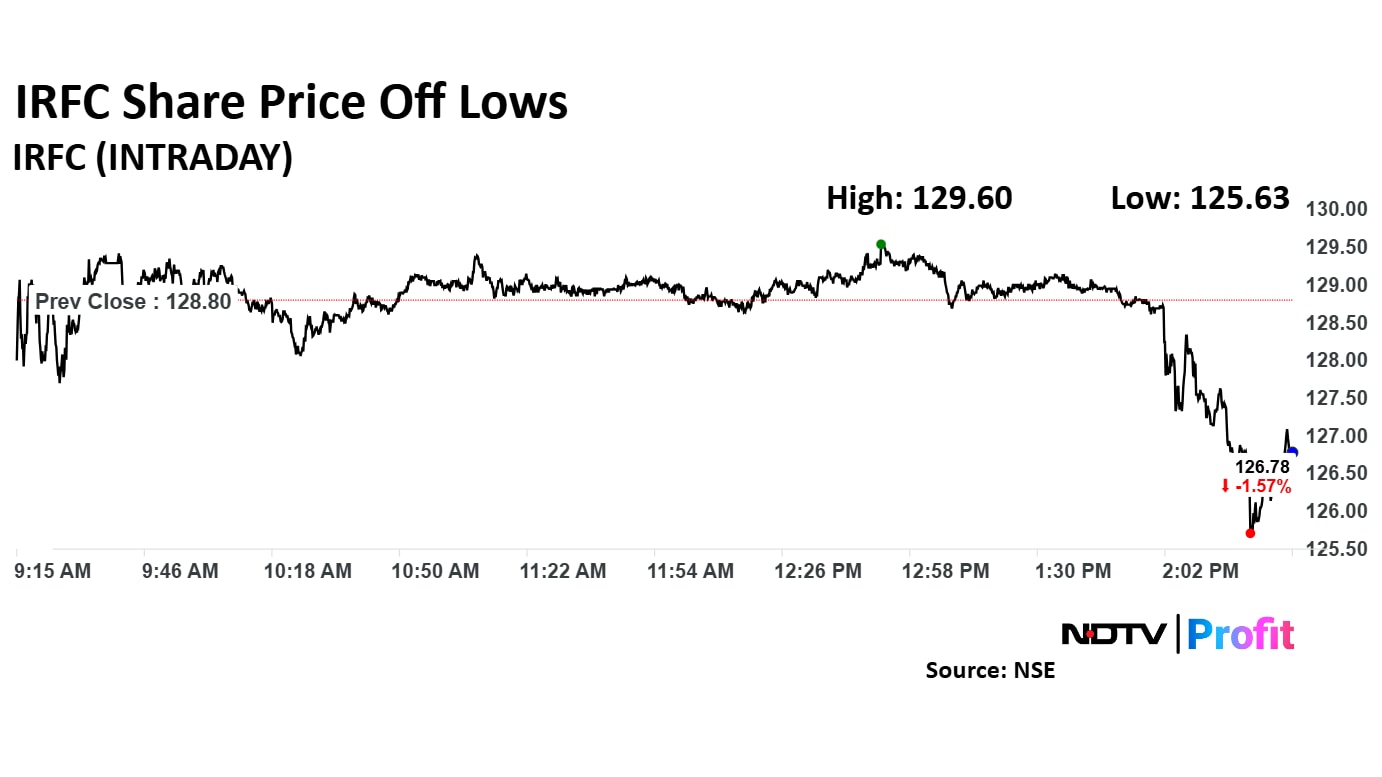

IRFC Q4 Highlights (YoY)

Revenue up 3.8% to Rs 6,723.80 crore versus Rs 6,477.99 crore

Net profit down 2% to Rs 1,681.87 crore versus Rs 1,717.32 crore

IRFC Q4 Highlights (YoY)

Revenue up 3.8% to Rs 6,723.80 crore versus Rs 6,477.99 crore

Net profit down 2% to Rs 1,681.87 crore versus Rs 1,717.32 crore

The NSE Nifty 50 and BSE Sensex resumed their rally on Monday, with Nifty surging 1.30% and Sensex climbing 1.38%, making Nifty the top gainer among Asian indices.

The three main reasons for this market surge are ongoing earnings, heightened market activity, and strong foreign and domestic institutional investor participation, alongside mixed global cues.

To know more click here.

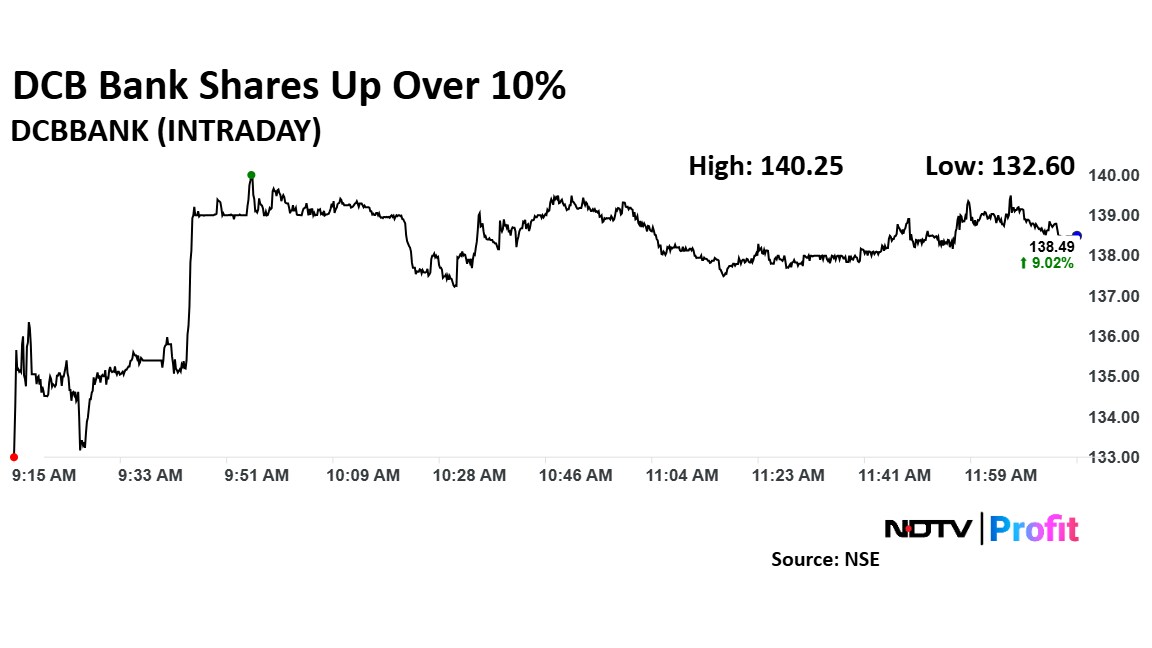

Shares of DCB Bank Ltd. rose over 10% after the private bank reported a 14% year-on-year rise in standalone net profit for the fourth quarter of financial year 2025. Net interest income also grew 10% during the same period. The board of DCB Bank recommended a dividend of Rs 1.35 per share, subject to shareholder approval.

Shares of DCB Bank Ltd. rose over 10% after the private bank reported a 14% year-on-year rise in standalone net profit for the fourth quarter of financial year 2025. Net interest income also grew 10% during the same period. The board of DCB Bank recommended a dividend of Rs 1.35 per share, subject to shareholder approval.

Thomas Cook moved to tap West Bengal’s high-potential market increases consumer access to 10 locations in the state, the company said in an exchange filing.

Mahindra & Mahindra is set to acquire SML Isuzu Ltd. in a deal valued at Rs 555 crore to bolster its presence in the large commercial-vehicle segment.

The Scorpio maker will pick up a 43.96% stake—or 63,62,306 shares—held by promoter Sumitomo Corp. and 15% stake—or 21,70,747 shares—from Isuzu Motors Ltd. at Rs 650 per share, according to an exchange filing on Saturday. That pegs the valuation of the 58.96% stake purchases at Rs 554.63 crore.

Read the full article here.

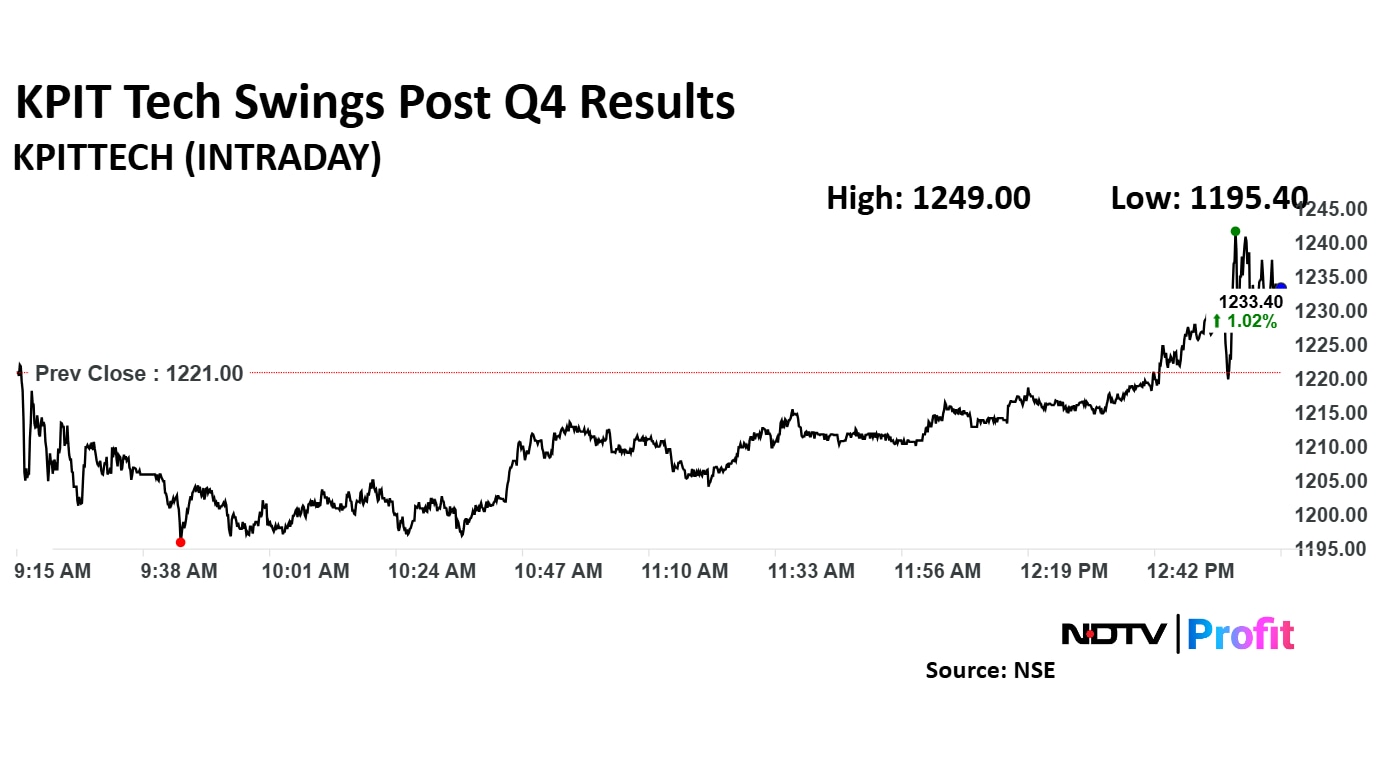

KPIT Technologies Q4 Highlights (Consolidated, QoQ)

Revenue up 3.4% to Rs 1,528.30 versus Rs 1,477.90 crore

Net profit up 31% to Rs 244.70 versus Rs 186.90 crore

Ebit up 4% to Rs 265 crore versus Rs 253.80 crore

Margins expand to 17.3% versus 17.2%

KPIT Technologies Q4 Highlights (Consolidated, QoQ)

Revenue up 3.4% to Rs 1,528.30 versus Rs 1,477.90 crore

Net profit up 31% to Rs 244.70 versus Rs 186.90 crore

Ebit up 4% to Rs 265 crore versus Rs 253.80 crore

Margins expand to 17.3% versus 17.2%

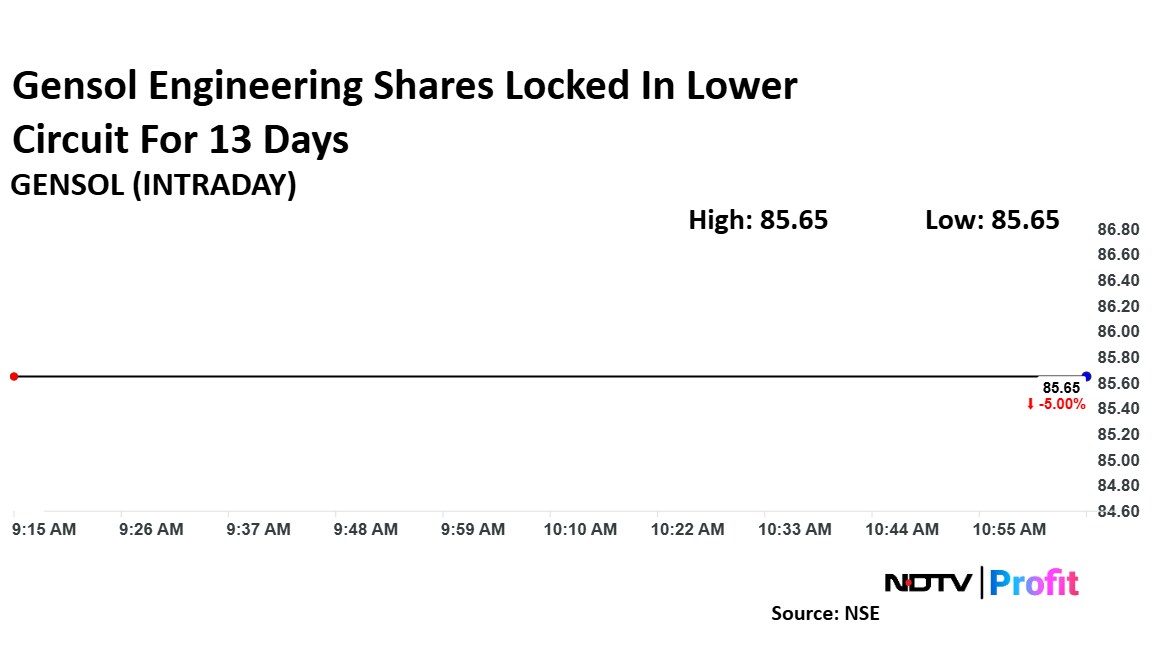

Gensol Engineering Ltd.'s shares hit a fresh record low on Monday, locked in the lower circuit for the 13th consecutive session. The stock has fallen below Rs 90 for the first time.

Gensol Engineering Ltd.'s shares hit a fresh record low on Monday, locked in the lower circuit for the 13th consecutive session. The stock has fallen below Rs 90 for the first time.

To discuss outcome of meeting of audit committee

Ongoing preliminary assessment showed certain irregularity in recording inventory

First such occurrence in company’s history

Appointed 2 reputed audit agencies to look at the discrepancy and submit report

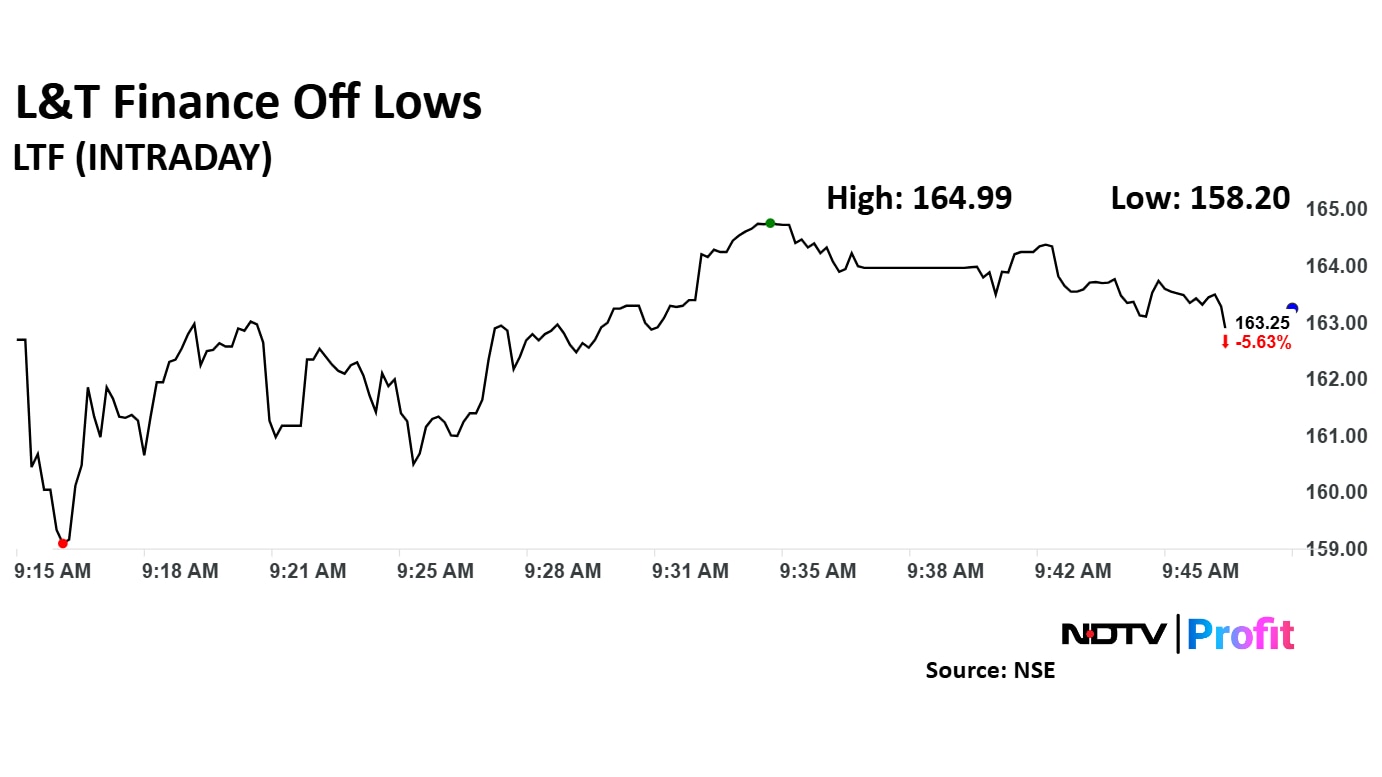

Microfinance sector remained a challenge during fourth quarter

Focus remains on shifting to 'Prime, Near-Prime' customers

L&T Finance has Rs 575 crore of unutilised prudential provisions for FY26

Utilised Rs 400 crore of Prudential Provisions in FY25

Expect collection efficiency to stabilise by Q2

Expect normalcy in rural microfinance book by Q2

Source: Informist

Sigachi Industries' arm, Sigachi MENA FZCO Limited, has signed an MoU with Respilon Group for drug delivery.

Vodafone Idea Ltd. will launch 5G services in Chandigarh and Patna.

Over 1.01 million shares of Mahindra Financial were traded via a block deal on Monday. The share price of the company fell as much as 1.25% to Rs 261.30 apiece.

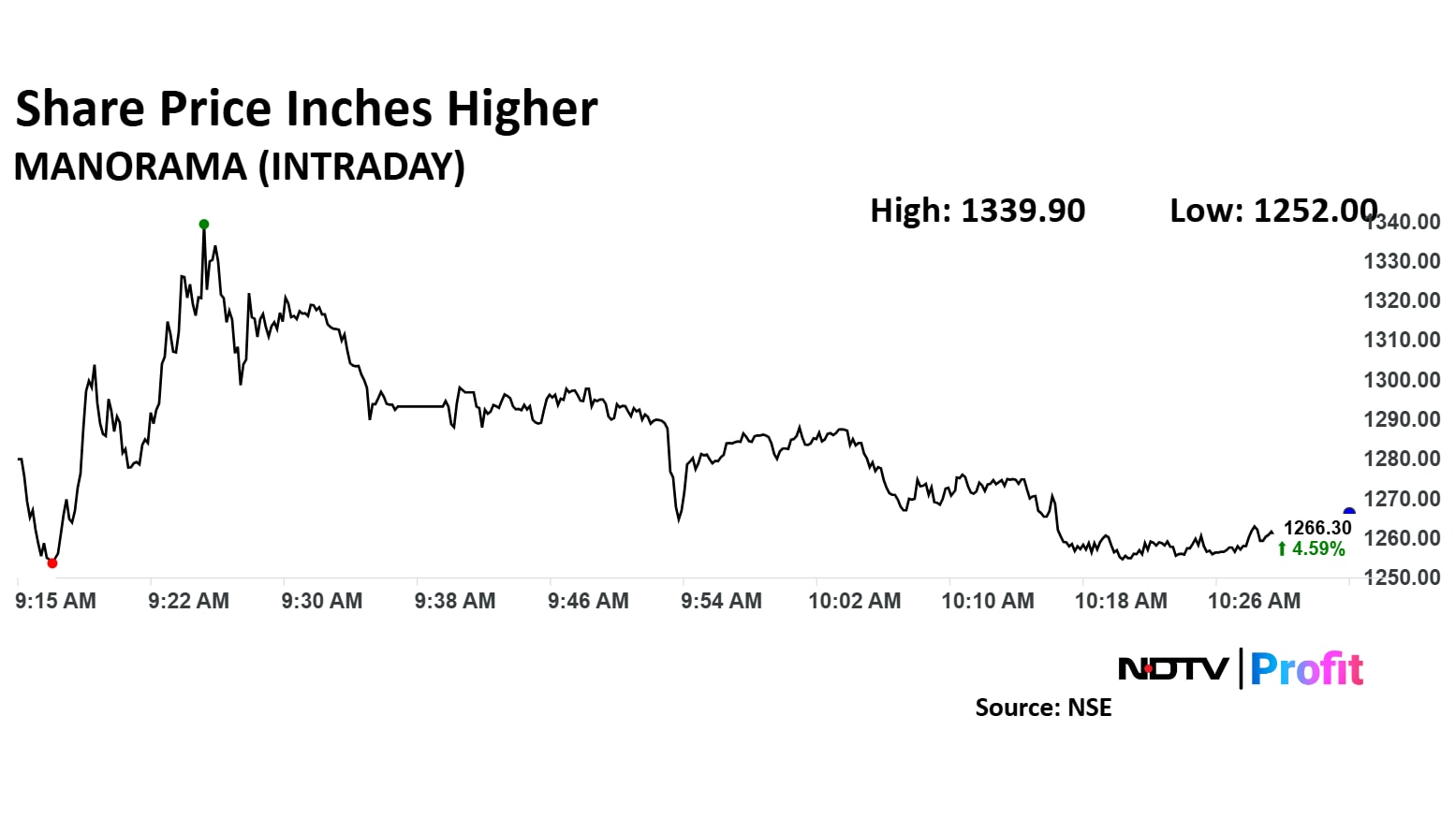

Manorama Industries Ltd.'s share price surged 10.67% on Monday following the release of its fourth quarter and financial year 2025 financial results.

Manorama Industries Ltd.'s share price surged 10.67% on Monday following the release of its fourth quarter and financial year 2025 financial results.

Servotech has announced the incorporation of its step-down arm, Dream League of India Private.

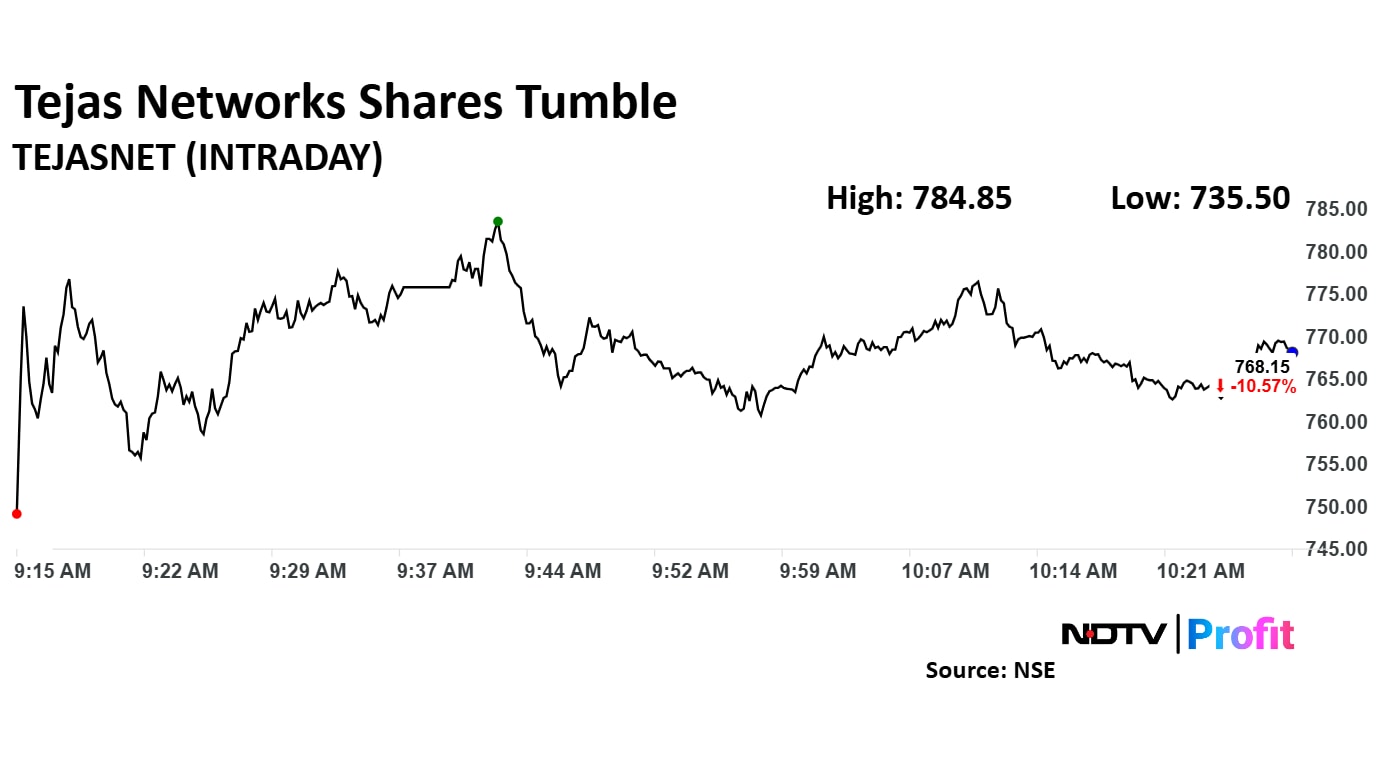

Share price of Tejas Networks Ltd. fell over 14% in trade on Monday after the company swung to loss in the quarter ended March 31, 2025. The scrip fell as much as 14.37% to Rs 735.50 apiece, the lowest level since April 7.

Share price of Tejas Networks Ltd. fell over 14% in trade on Monday after the company swung to loss in the quarter ended March 31, 2025. The scrip fell as much as 14.37% to Rs 735.50 apiece, the lowest level since April 7.

Maintain Overweight with target price of Rs 750

Believe the share prices will rise in next 60 days

Share price fall making short term valuation much more compelling

Believe the sharp negative reaction to the Q4 results is not warranted

Results were better than what they appeared to be

Higher underlying provisioning coverage drove two thirds of the credit cost miss

See valuations as undemanding for 17% tangible ROE and 15%+ EPS growth

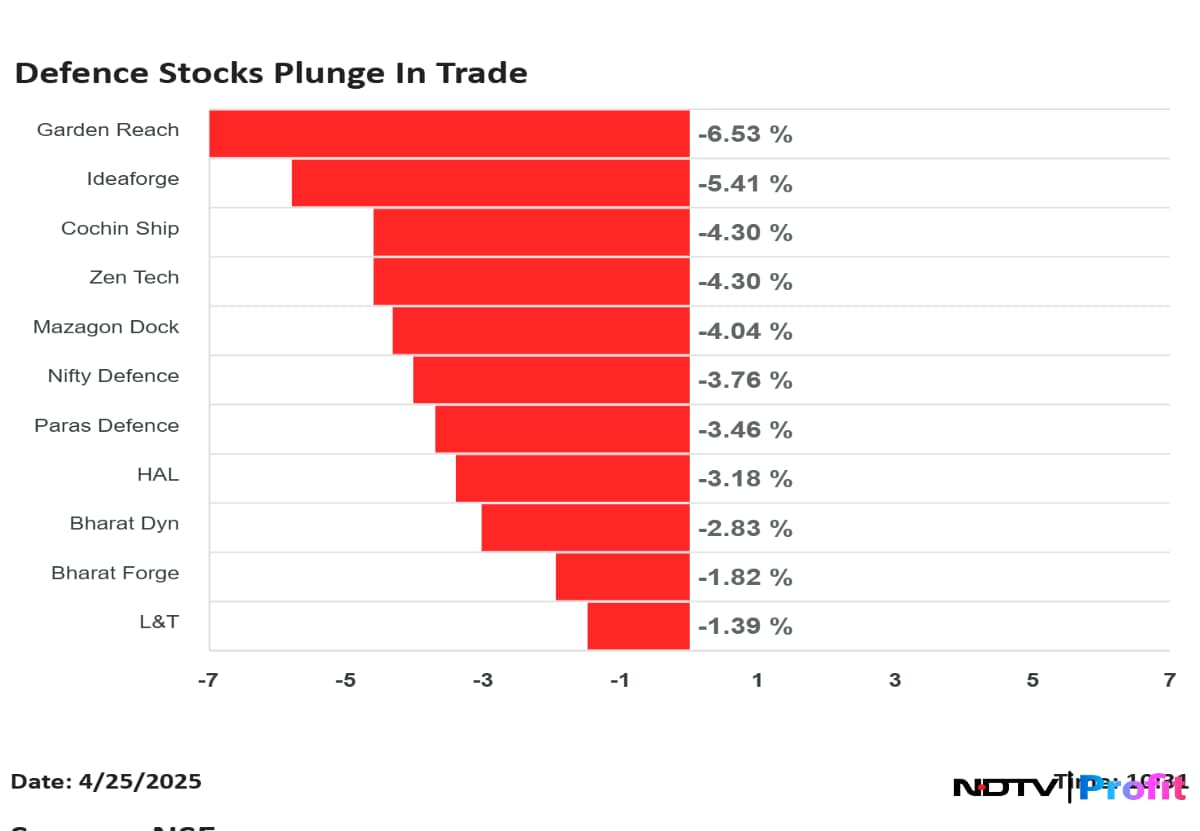

The entire defence pack came under pressure in early trade on Friday, with all 16 constituents of the Nifty Defence index declined.

Garden Reach Shipbuilders & Engineers Ltd., DCX Systems Ltd., Ideaforge Technology Ltd., Cochin Shipyard Ltd. and Zen Technologies Ltd. were the top losers in the segment, each falling over 3%.

Nifty Defence was down 2.91% to 6,630.9 and the benchmark Nifty 50 index was down 0.89% as of 10:25 a.m.

The entire defence pack came under pressure in early trade on Friday, with all 16 constituents of the Nifty Defence index declined.

Garden Reach Shipbuilders & Engineers Ltd., DCX Systems Ltd., Ideaforge Technology Ltd., Cochin Shipyard Ltd. and Zen Technologies Ltd. were the top losers in the segment, each falling over 3%.

Nifty Defence was down 2.91% to 6,630.9 and the benchmark Nifty 50 index was down 0.89% as of 10:25 a.m.

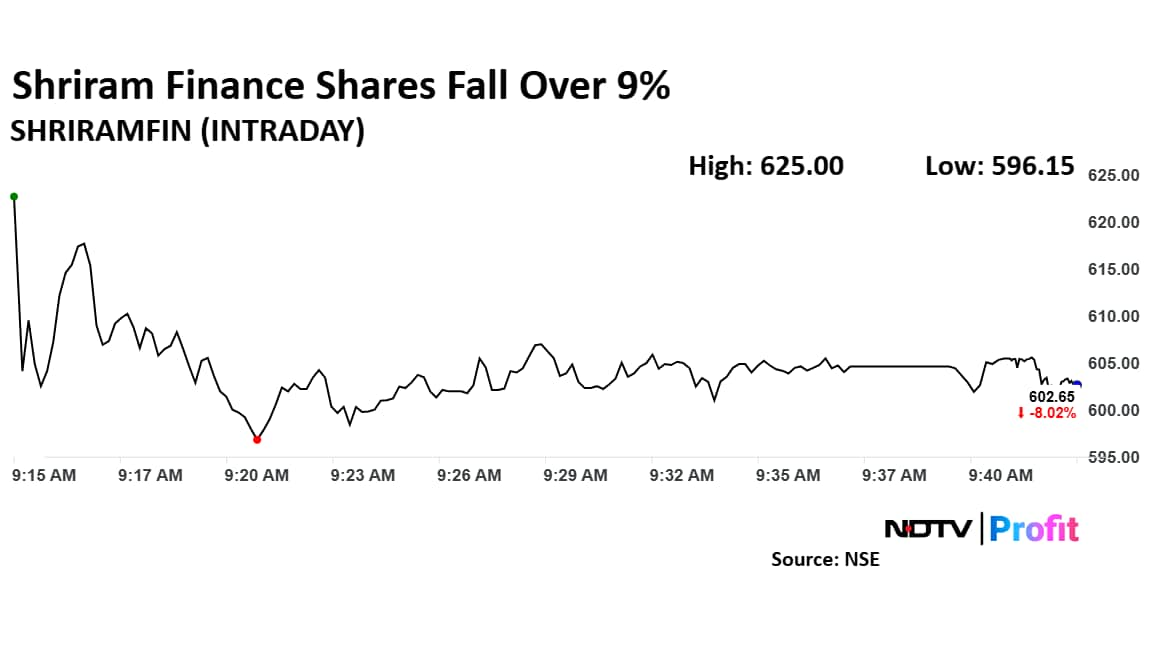

Shares of Shriram Finance Ltd. fell over 9% on Monday extending decline for the second day, after its fourth quarter net interest margin contracted. The stock fell 8.85% in the last trading session.

Shares of Shriram Finance fell as much as 9% to Rs 596.15 apiece, the lowest level since April 7.

Shares of Shriram Finance Ltd. fell over 9% on Monday extending decline for the second day, after its fourth quarter net interest margin contracted. The stock fell 8.85% in the last trading session.

Shares of Shriram Finance fell as much as 9% to Rs 596.15 apiece, the lowest level since April 7.

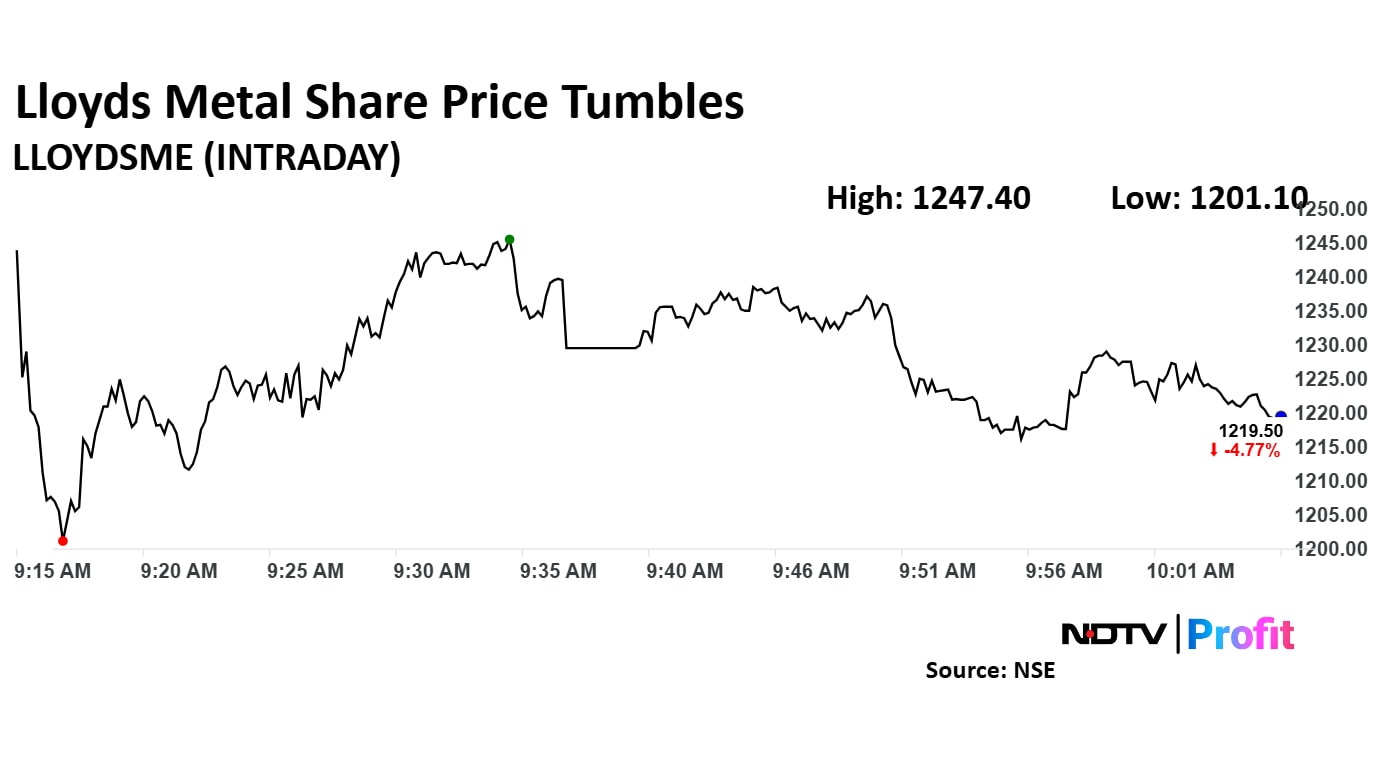

Lloyds Metal And Energy share price declined 6.21% to Rs 1,201.10 apiece as its consolidated net profit slumped 27% on the year to Rs 202 crore during January–March.

Lloyds Metals and Energy Q4FY25 (Consolidated, YoY)

Revenue down 23.5% to Rs 1,183 crore versus Rs 1,546 crore.

Ebitda down 44% to Rs 250 crore versus Rs 450 crore.

Margin at 21.2% versus 29.1%.

Net profit down 27% to Rs 202 crore versus Rs 277 crore.

The board has approved raising up to Rs 5,000 crore via bonds, securities, and other means.

Lloyds Metal And Energy share price declined 6.21% to Rs 1,201.10 apiece as its consolidated net profit slumped 27% on the year to Rs 202 crore during January–March.

Lloyds Metals and Energy Q4FY25 (Consolidated, YoY)

Revenue down 23.5% to Rs 1,183 crore versus Rs 1,546 crore.

Ebitda down 44% to Rs 250 crore versus Rs 450 crore.

Margin at 21.2% versus 29.1%.

Net profit down 27% to Rs 202 crore versus Rs 277 crore.

The board has approved raising up to Rs 5,000 crore via bonds, securities, and other means.

L&T Finance Ltd. share price declined over 8% in Monday's session despite posting good earnings for January-March quarter. It declined as much as 8.55% to Rs 158.20 apiece so far today.

L&T Finance Q4FY25 (Standalone, YoY)

Revenue up 8.2% at Rs 2,150 crore versus Rs 1,987 crore.

Net profit up 15.7% at Rs 631 crore versus Rs 545 crore.

Recommends final dividend of Rs 2.75 per share.

L&T Finance Ltd. share price declined over 8% in Monday's session despite posting good earnings for January-March quarter. It declined as much as 8.55% to Rs 158.20 apiece so far today.

L&T Finance Q4FY25 (Standalone, YoY)

Revenue up 8.2% at Rs 2,150 crore versus Rs 1,987 crore.

Net profit up 15.7% at Rs 631 crore versus Rs 545 crore.

Recommends final dividend of Rs 2.75 per share.

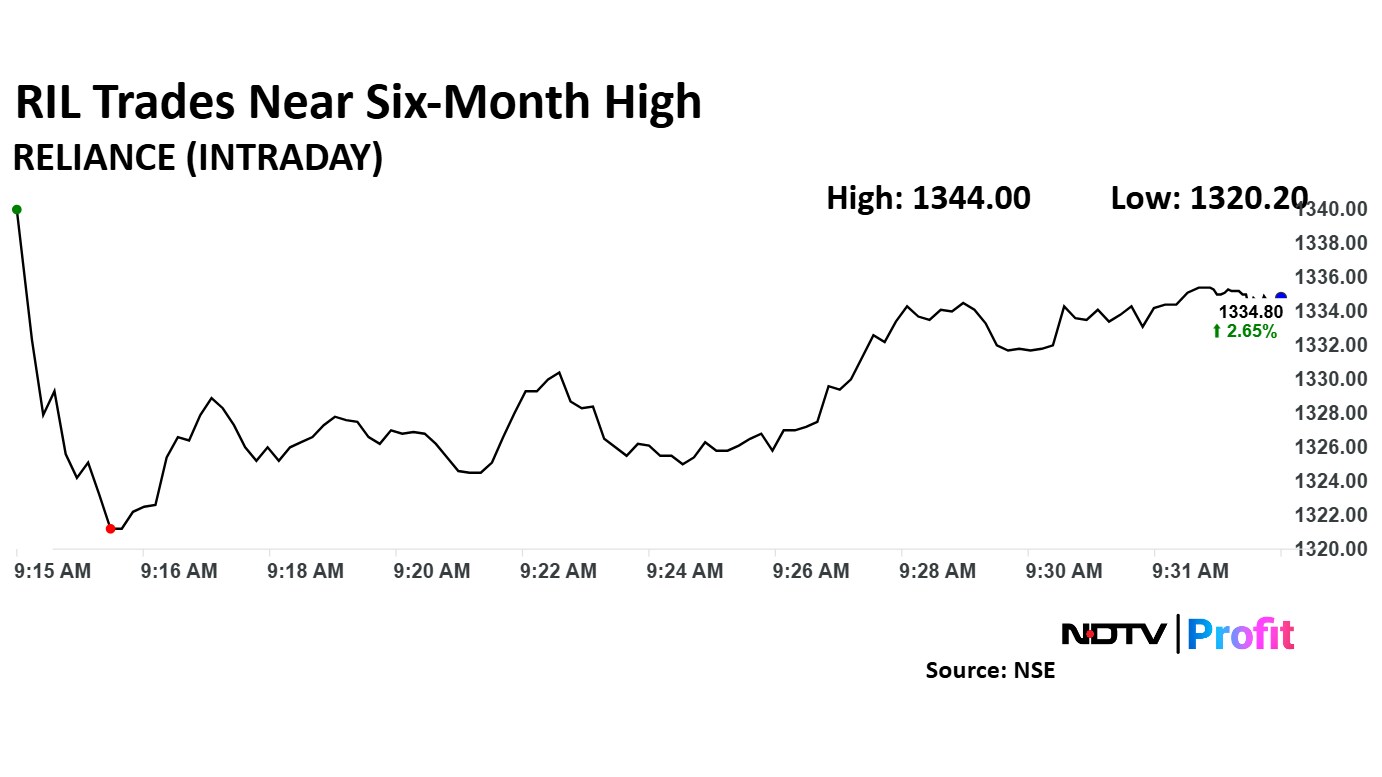

Reliance Industries Ltd. share price rose 3.35% to 1,344 apiece, the highest level since Oct 30. It was trading 2.68% higher at Rs 1,335.6 apiece as of 9:35 a.m. The share price rose following a 5% on the quarter increase in net profit.

Reliance Industries Q4FY25 (Consolidated, QoQ)

Revenue up 9% to Rs 2,61,388 crore versus Rs 2,39,986 crore.

Ebitda flat at Rs 43,832 crore versus Rs 43,789 crore.

Ebitda margin at 16.8% versus 18.2%, down 148 bps; biggest contraction in last 10 quarters.

Net profit up 5% to Rs 19,407 crore vs Rs 18,540 crore.

Reliance Industries Ltd. share price rose 3.35% to 1,344 apiece, the highest level since Oct 30. It was trading 2.68% higher at Rs 1,335.6 apiece as of 9:35 a.m. The share price rose following a 5% on the quarter increase in net profit.

Reliance Industries Q4FY25 (Consolidated, QoQ)

Revenue up 9% to Rs 2,61,388 crore versus Rs 2,39,986 crore.

Ebitda flat at Rs 43,832 crore versus Rs 43,789 crore.

Ebitda margin at 16.8% versus 18.2%, down 148 bps; biggest contraction in last 10 quarters.

Net profit up 5% to Rs 19,407 crore vs Rs 18,540 crore.

On National Stock Exchange, 14 sectoral indices were trading higher with the NSE Nifty Realty leading the gains. The NSE Nifty IT is the only sector to fall at open.

On National Stock Exchange, 14 sectoral indices were trading higher with the NSE Nifty Realty leading the gains. The NSE Nifty IT is the only sector to fall at open.

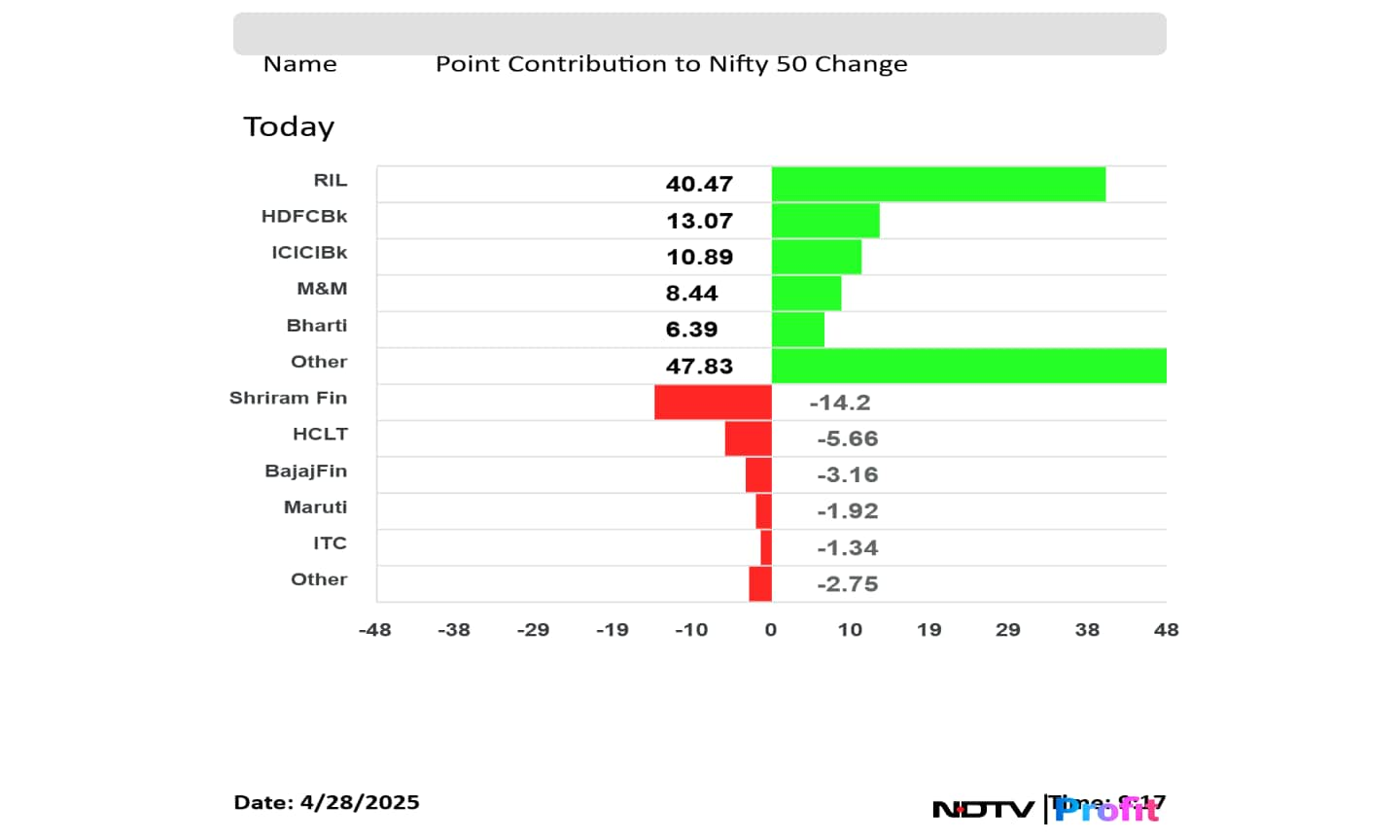

Reliance Industries Ltd., HDFC Bank Ltd., ICICI Bank Ltd., Mahindra & Mahindra Ltd., and Bharti Airtel Ltd. added to the Nifty 50 index.

Shriram Finance Ltd., HCLTech Ltd., Bajaj Finance Ltd., Maruti Suzuki India Ltd., and ITC Ltd. weighed on the Nifty 50 index.

Reliance Industries Ltd., HDFC Bank Ltd., ICICI Bank Ltd., Mahindra & Mahindra Ltd., and Bharti Airtel Ltd. added to the Nifty 50 index.

Shriram Finance Ltd., HCLTech Ltd., Bajaj Finance Ltd., Maruti Suzuki India Ltd., and ITC Ltd. weighed on the Nifty 50 index.

The NSE Nifty 50 and BSE Sense rebounded at Monday open as Reliance Industries Ltd. and Bharti Airtel Ltd. share prices led. Reliance Industries reported 5% quarter-on-quarter increase in net profit during January-March which boosted sentiment for the stock.

The Nifty 50 was trading 55.80 points or 0.23% higher at 24,095.15, and the Sensex was trading 328.73 points or 0.41% higher at 79,541.26 as of 9:27 a.m.

The NSE Nifty 50 and BSE Sense rebounded at Monday open as Reliance Industries Ltd. and Bharti Airtel Ltd. share prices led. Reliance Industries reported 5% quarter-on-quarter increase in net profit during January-March which boosted sentiment for the stock.

The Nifty 50 was trading 55.80 points or 0.23% higher at 24,095.15, and the Sensex was trading 328.73 points or 0.41% higher at 79,541.26 as of 9:27 a.m.

At pre-open, the NSE Nifty 50 rose 0.13% to 24,070.25, and the BSE Sensex rose 0.17% to 79,345.83.

Rupee opened 15 paise stronger at 85.30 a dollar

It closed at 85.45 a dollar on Friday

Source: Bloomberg

The yield on the benchmark 10-year bond opened flat at 6.36%

Source: Bloomberg

Sonata Software Ltd. has secured a $73 million AI-led digital modernization deal with a leading US-based TMT company.

Motilal Oswal Financial Services upgraded RBL Bank Ltd. to Buy from Neutral with a target price of Rs 220, which implied a 17% upside.

The brokerage hiked EPS estimates by 12% for FY26/FY27

Business growth gaining traction

Slippages to normalize by 2QFY26

Estimate C/I ratio to improve to 61% by FY27

Estimate FY26E RoA/RoE at 1.2%/12.8%

Earnings to recover gradually; slippages decline QoQ

NIMs remain broadly stable

Guides 16-17% loan growth for FY27E; NNPA moderates to 0.29%

Indus Towers' board will meet on April 30 to discuss options for boosting shareholder returns, including potential buyback and bonus share issuance.

Maintain equal-weight with a target price of Rs 503

See limited impact on earnings

Remained focussed on its margins and FCF

See this move as another positive step in that direction

Near term closure costs could keep margins under pressure

Oil prices gave up early gains as worries about the US and China trade relations weighed on investors' minds. There's a difference in statements from the US and China regarding trade talks. While US said that the negotiation with the China is underway, Beijing said there no talks between the countries have taken place.

The brent crude was as much as 1.05% to $67.05 a barrel in Monday's session. However, it erased all gains to trade 0.24% down at $66.71 a barrel as of 8:06 a.m.

Gold prices extended losses to a second day Monday as hopes for ease in trade tension rose following benign developments on trade talks between US and Asian countries. Further, the dollar index rose which weighed on the bullion.

The Bloomberg gold spot declined 1.38% to $3,273.99 an ounce as of 7:57 a.m.

Markets in Asia-Pacific region were trading on a mixed note Monday morning as traders assessed recent stimulus measure announcements from China. Over the weekend, China's Finance Minister Lan Fo'an said in a statement that the country will take more proactive macroeconomic measures and policies to support the growth target of the current financial year.

Despite stimulus announcement, the CSI 300 declined 0.17%. The Hang Seng index declined 0.36% as of 7:39 a.m.

Meanwhile, markets in Japan and South Korea rose. The Nikkei 225 and KOSPI were trading 0.64% and 0.28% higher, respectively as of 7:40 a.m.

The S&P 500 posted the longest winning streak since January on Friday as fears about trade war abated on positive development on trade talks. Moreover, a rally in megacap stocks boosted overall markets on Friday.

On Friday, the Dow Jones Industrial Average and S&P 500 ended 0.05% and 0.74% higher, respectively. The Nasdaq Composite ended 1.26% higher.

The GIFT Nifty traded a little changed at at 24,230.50 as of 6:56 a.m., signalling a muted start for Nifty 50.

Reliance Industries Ltd., Tata Technologies Ltd., IndusInd Bank Ltd., RBL Bank Ltd. share prices may see movement in Monday's session because of fourth quarter earnings released over the weekend.

The benchmark equity indices extended losses to the second day on Friday as investors pulled their money out on anticipation of escalation in tension between India and Pakistan.

The NSE Nifty 50 closed 207.35 or 0.86% down at 24,039.35, while the BSE Sensex ended 588.90 points or 0.74% lower at 79,212.53. Investors' wealth declined Rs 1.92 lakh crore to Rs 190.15 lakh crore.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.