That was all for Thursday's real-time market coverage. Thanks for staying with us!

Nifty close above 26,000 mark; snaps four-day losing streak

Nifty consolidating in 250-point range

TCS and SBI life Insurance gain the most in Nifty

Benchmarks Indices outperformed Broder Market Indices

Market recovers nearly 100 points from the day’s low

Nifty IT gains over 1.5% for the day; gains for the second straight session.

Nifty IT emerges as the top gaining sector for the day

LTTS and Coforge gain the most in Nifty IT

Nifty Midcap 150 close on a flat note; Hitachi Energy and Patanjali Foods fell the most

Nifty Smallcap 250 fell over 0.3%; Kaynes Tech and Amber Enterprises fell the most

Nifty close above 26,000 mark; snaps four-day losing streak

Nifty consolidating in 250-point range

TCS and SBI life Insurance gain the most in Nifty

Benchmarks Indices outperformed Broder Market Indices

Market recovers nearly 100 points from the day’s low

Nifty IT gains over 1.5% for the day; gains for the second straight session.

Nifty IT emerges as the top gaining sector for the day

LTTS and Coforge gain the most in Nifty IT

Nifty Midcap 150 close on a flat note; Hitachi Energy and Patanjali Foods fell the most

Nifty Smallcap 250 fell over 0.3%; Kaynes Tech and Amber Enterprises fell the most

Rupee closed 21 paise stronger at 89.98 against US Dollar

Intraday, it fell 23 paise to a new low of 90.42 against US dollar

It closed at 90.19 a dollar on Wednesday

Source: Bloomberg

Smartworks Coworking Spaces leased 1.7 lakh square feet office space in Kolkata to gloval IT service provider, the company said in the exchange filing.

Zaggle Prepaid Ocean Services will invest Rs 75 crore in Rvipe Technology in one or more tranches. It will acquire 81,429 shares of Rivpe Technology for Rs 22 crore, the company said in the exchange filing.

Ace investor Vijay Kedia in his latest song reflected on the latest market trends. “New High Hai Kahi, Portfolio Kahin..” he said that while markets are reaching new highs while one's own portfolio may not have kept pace. It’s a pithy, almost poetic take that resonates broadly among investors when markets climb fast but not all holdings gain equally.

Raymond Realty Ltd. is eyeing a strong finish to FY26 with pre-sales expected to touch Rs 3,000 crore, a 20% growth over last year’s Rs 2,300–2,400 crore. “We have given a guidance that we will be delivering 20% growth over last year, which takes the current year close to Rs 3,000 crore, and we are on target to achieve that number with all the launches we have planned,” said Harmohan H Sahni, MD & CEO of Raymond Realty.

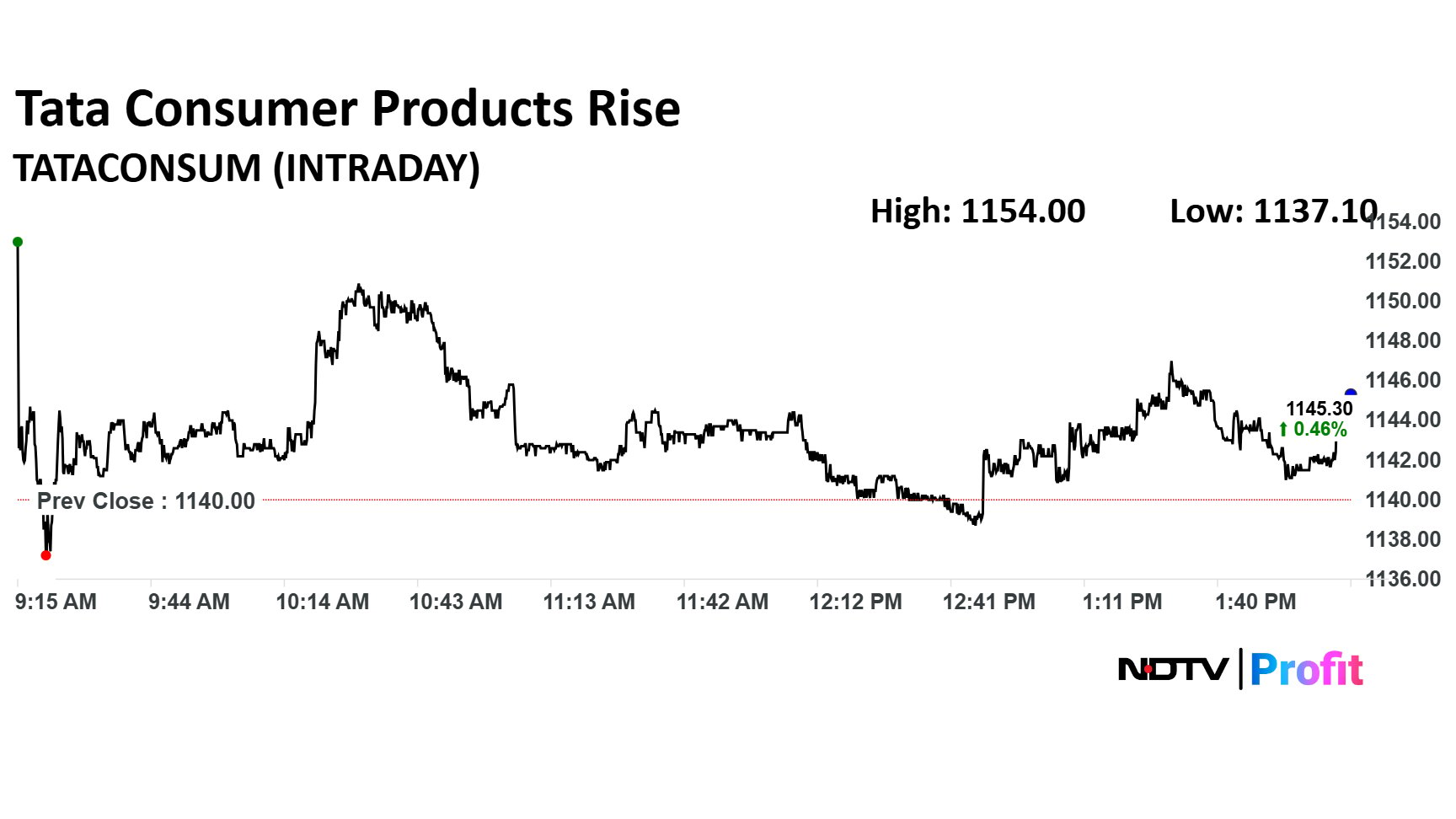

Tata Consumer Products Ltd. share price snapped a five-day losing streak as HSBC initiated coverage on the company with a buy rating. The brokerage has given a target price of Rs 1,340 apiece, which implies an 18% upside from Wednesday's close.

HSBC believes that there will likely recovery in the tea business margin and profitability will improve in the Growth business, which will drive the Ebitda CAGR of 18% over the financial year 2025 and 2028.

Tata Consumer Products Ltd. share price snapped a five-day losing streak as HSBC initiated coverage on the company with a buy rating. The brokerage has given a target price of Rs 1,340 apiece, which implies an 18% upside from Wednesday's close.

HSBC believes that there will likely recovery in the tea business margin and profitability will improve in the Growth business, which will drive the Ebitda CAGR of 18% over the financial year 2025 and 2028.

Brigade Enterprises bought 4.04 acre plot from Hyderabad Development Authority at a price of Rs 118 crore per acre, the company said in the exchange filing.

The rupee will likely retreat from a record low against the US dollar in the latter half of the calendar year 2026 post near-term volatility. The Indian currency is expected to move in a broad range of 87.00–92.00 in the next calendar year, according to forex traders. Clarity on the US and India trade deal and broad weakness in the dollar index will drive the recovery.

The prolonged delay in finalising a trade deal with the US has contributed to the rupee's 5.39% decline this year, its sharpest annual fall since 2022.

Lupin Ltd. signed exclusive licensing pact with the US-based Valorum Biologics for advance commercialisation and distribution of armlupeg in the US. The company will manufacture and supply armlupeg.

Lupin will receive upfront license fee, royalty payment on net sales of Armlupeg, which is used in patients undergoing chemotherapy

Hubtown will raise Rs 500 crore via preferential issue. It will use Rs 150 crore worth proceeds towards loan repayment, the company said in the exchange filing.

Godawari Power Ltd.'s board gave approval to invest in Deccan gold mines via rights issue, the company said in the exchange filing.

Zydus Lifesciences Ltd. classified Jarod unit as voluntary action indicated in the Establishment Inspection Report, the exchange filing said.

In short term, the Indian currency will trade with a depreciation bias against the US dollar.

India's trade deficit widened while the country is facing the highest tariff from the US. This is hurting the sentiment.

Muted FPI and FDI flows are also impacting

Source: Nuvama Institutional Equities FX and Commodity Head Abhilash Koikkara to NDTV Profit

The shares of Pine Labs Ltd. rose on Thursday after the company posted strong quarterly results.

The stock opened at Rs 249, up from the previous close of Rs 247 on Dec. 3, and traded as high as Rs 250.75 at 10:23 a.m. The uptick comes after Pine Labs reported a net profit of Rs 5.97 crore for Q2, as compared to Rs 32.01 crore loss from the previous fiscal year. The revenue is reported to have surged18% year-on-year.

Subros Ltd. received Rs 52.2 crore order from the Indian Railways for annual maintenance of Cab HVAC Units, the company said in the exchange filing.

Primary market investors are keeping a close watch on the upcoming initial public offering (IPO) of Wakefit Innovations Ltd., a leading manufacturer of mattresses, furniture and home furnishings. The company is gearing up to launch its IPO on Dec. 8.

Shares of Ola Electric Mobility Ltd. have hit an all-time low, after the company initiated a major service reboot to address its after-sales backlogs.

Ola Electric's share slipped as low as 4.39% to trade at Rs 36.36, marking the lowest levels hit by the stock since listing.

The Meesho IPO was subscribed 3.26 times as of 11:21 a.m. on Thursday.

Qualified institutional buyers (QIB): 2.13 times.

Non-Institutional investors (NII): 3.81 times.

Retail investors: 5.75 times.

Bank of America in its report on Thursday projected a steady but earnings-reliant market, with the Nifty likely to reach 29,000, translating to an upside of 11.4%.

The brokerage in its report said it continues to prefer large-caps over small and mid-caps, echoing the 2025 trends, though it notes that parts of the SMID universe are beginning to show selective opportunities, particularly in Financials, IT, Chemicals, Jewellery, Consumer Durables and Hotels.

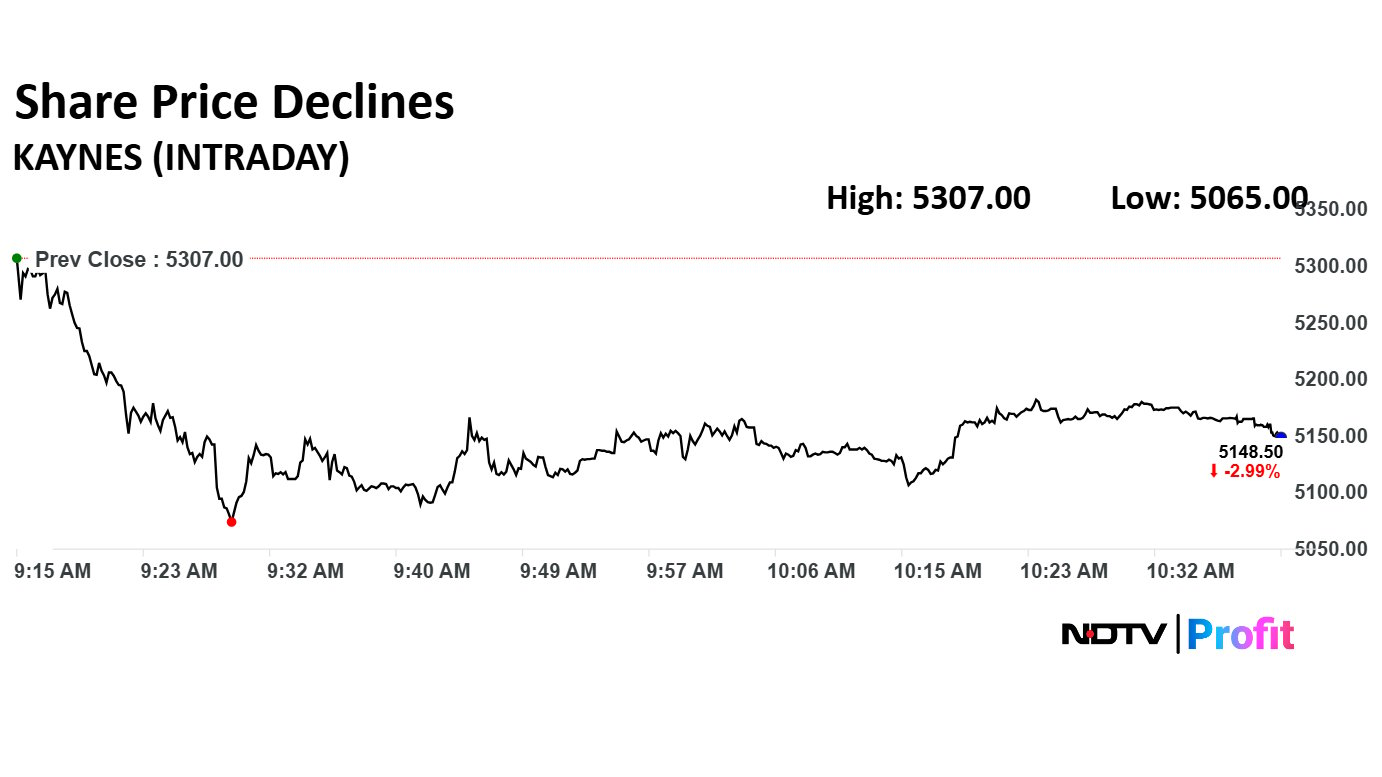

Kaynes Technology Ltd.'s share price fell 4.56% on Thursday to trade lower at Rs 5,065 apiece. The company' share price has fallen over 7% in last five days and nearly 22.7% in one month.

The scrip fell as much as 4.56% to Rs 5,065 apiece.

Kaynes Technology Ltd.'s share price fell 4.56% on Thursday to trade lower at Rs 5,065 apiece. The company' share price has fallen over 7% in last five days and nearly 22.7% in one month.

The scrip fell as much as 4.56% to Rs 5,065 apiece.

"The RBI is comfortable to let the rupee slide a bit more around 91 because India has very low inflation. There is no harm in supporting exporters."Anindya Banerjee, head, commodity and currency, Kotak Securities

"Dollar demand kept rising, feeding the idea that the RBI would not step in aggressively — at least not yet. That was enough to give speculators more confidence to push the rupee weaker."Amit Pabari, director, CR Forex Advisors

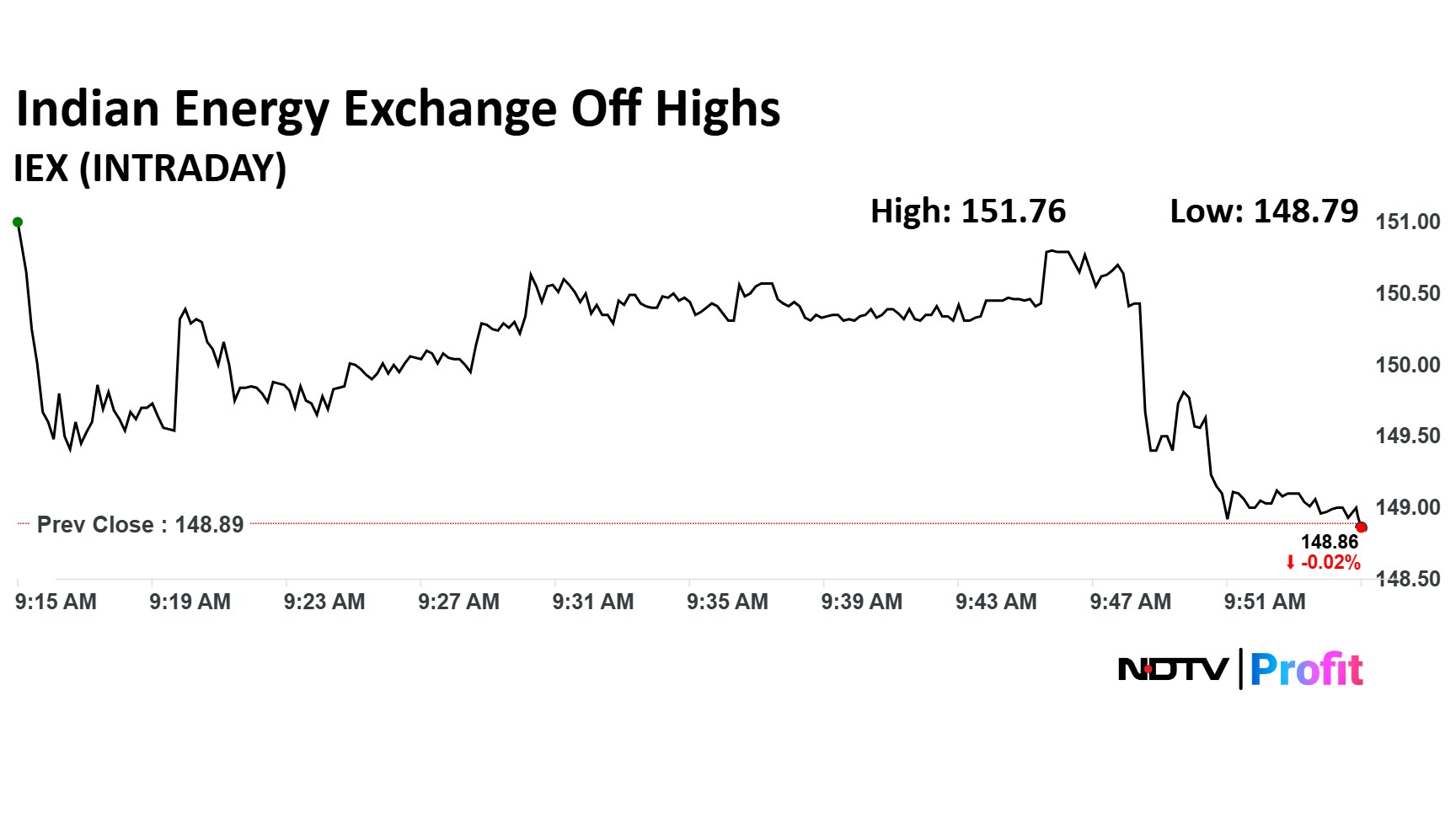

Indian Energy Exchange share price extended gains to fourth session as it reported a increase in trade volume of electricity in November.

Indian Energy Exchange share price extended gains to fourth session as it reported a increase in trade volume of electricity in November.

The rupee extended record against the US dollar on Thursday amid foreign fund outflows from domestic financial markets. The Indian currency slumped 23 paise to a new low of 90.42 a dollar.

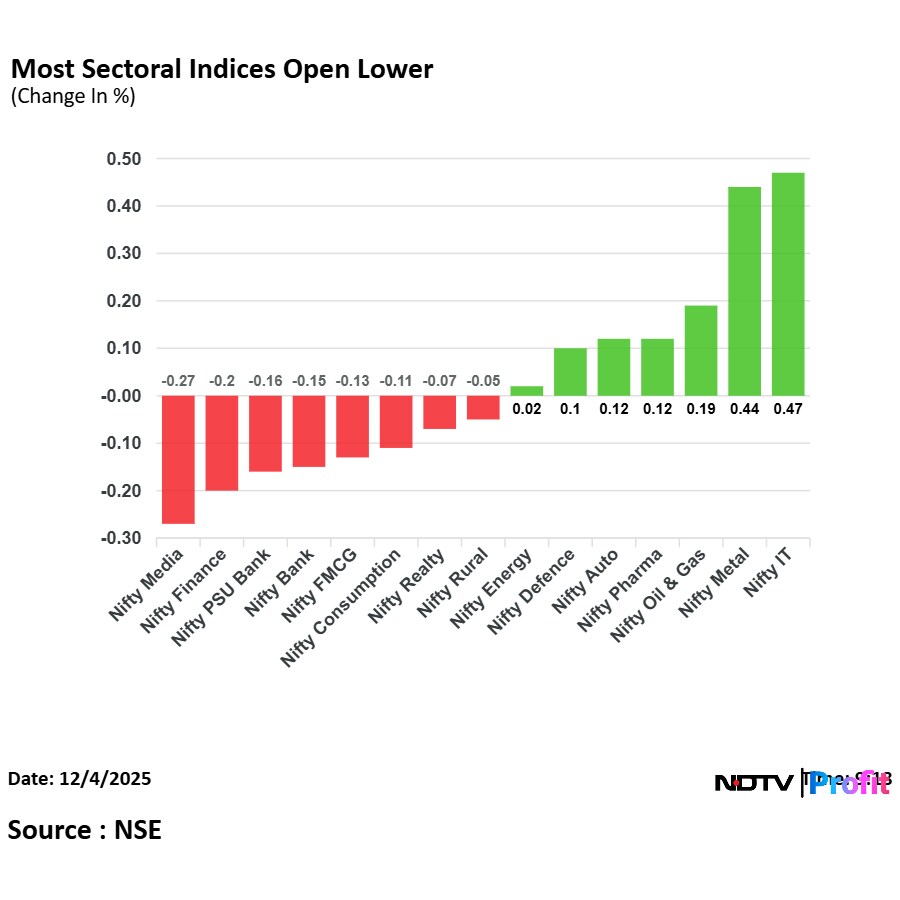

On National Stock Exchange, eight sectoral indices declined, six advanced, and one remained flat out of 15.

On National Stock Exchange, eight sectoral indices declined, six advanced, and one remained flat out of 15.

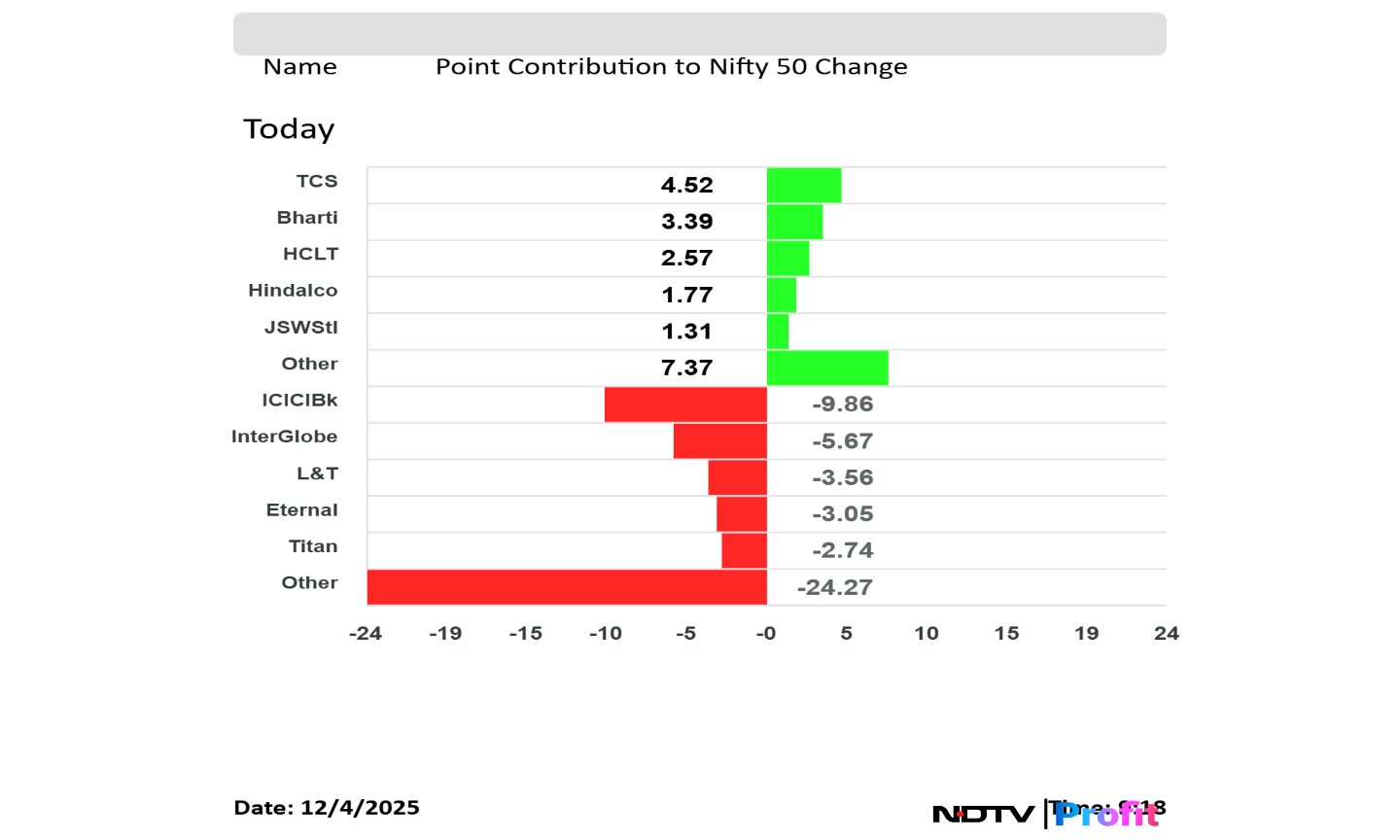

ICICI Bank Ltd., InterGlobe Aviation Ltd., Larsen & Toubro Ltd., Eternal Ltd., and Titan Co. Ltd. weighed on the NSE Nifty 50 index.

Tata Consultancy Services Ltd., Bharti Airtel Ltd., HCLTech Ltd., Hindalco Industries Ltd., and JSW Steel Ltd. limited losses in the NSE Nifty 50 index.

ICICI Bank Ltd., InterGlobe Aviation Ltd., Larsen & Toubro Ltd., Eternal Ltd., and Titan Co. Ltd. weighed on the NSE Nifty 50 index.

Tata Consultancy Services Ltd., Bharti Airtel Ltd., HCLTech Ltd., Hindalco Industries Ltd., and JSW Steel Ltd. limited losses in the NSE Nifty 50 index.

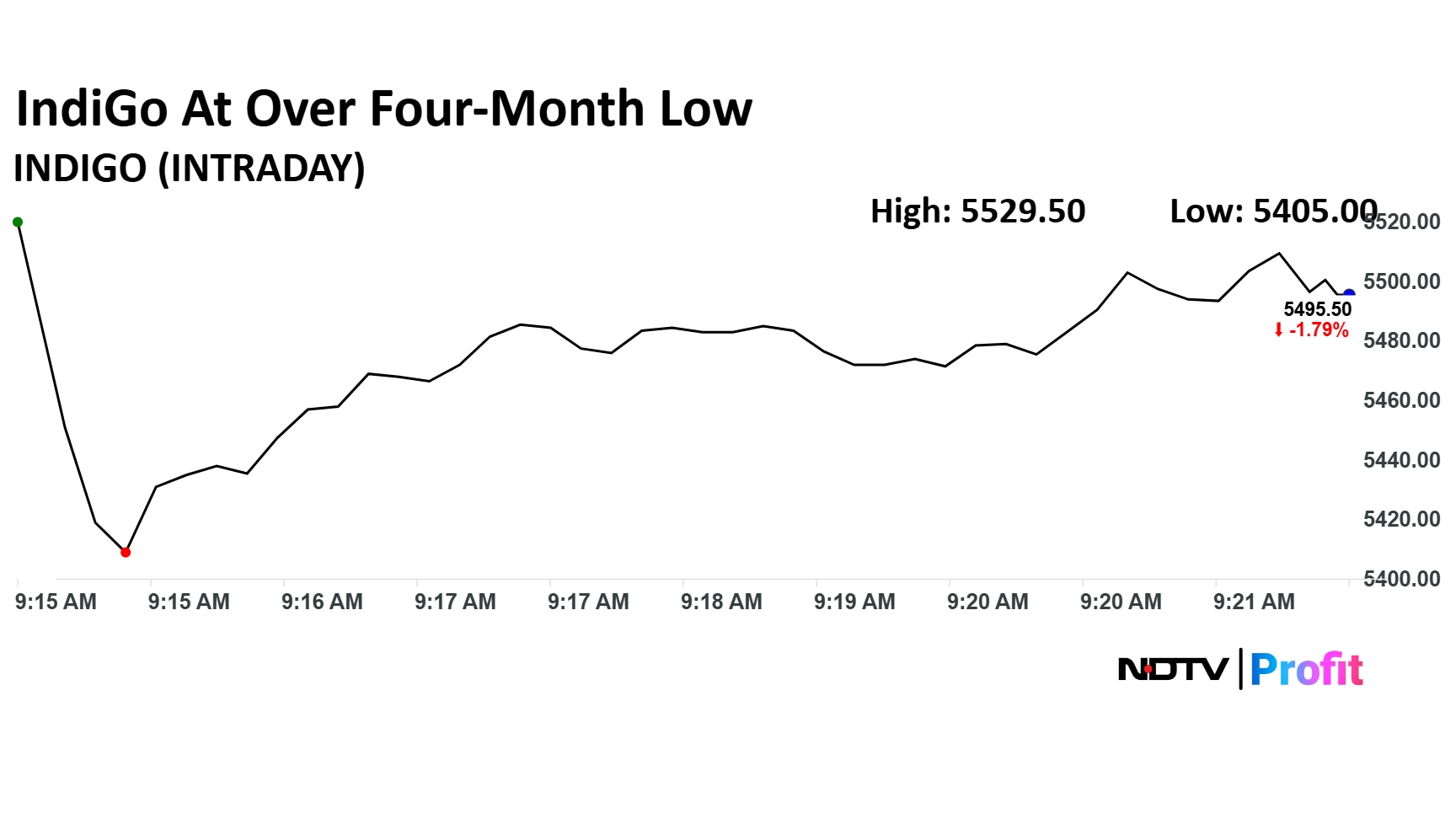

InterGlobe Aviation Ltd. share price declined 3.40% to Rs 5,405 apiece, the lowest level since June 23. The airline cancelled 200 flights across Delhi, Mumbai, Hyderabad and Bengaluru in recent period, due to issues arising out of the rollout of new flight duty-time limitation norms, as reported by NDTV.

InterGlobe Aviation Ltd. share price declined 3.40% to Rs 5,405 apiece, the lowest level since June 23. The airline cancelled 200 flights across Delhi, Mumbai, Hyderabad and Bengaluru in recent period, due to issues arising out of the rollout of new flight duty-time limitation norms, as reported by NDTV.

The NSE Nifty 50 and the BSE Sensex continued to decline on Thursday as InterGlobe Aviation Ltd. and Larsen & Toubro Ltd. shares weighed. Persistent foreign fund outflows, pressure on the Indian currency exerted pressure on Indian equities.

The Indices were trading 0.14% and 0.15% down, respectively as of 9:20 a.m.

The NSE Nifty 50 and the BSE Sensex continued to decline on Thursday as InterGlobe Aviation Ltd. and Larsen & Toubro Ltd. shares weighed. Persistent foreign fund outflows, pressure on the Indian currency exerted pressure on Indian equities.

The Indices were trading 0.14% and 0.15% down, respectively as of 9:20 a.m.

Rupee weakened 22 paise to new low of 90.41 against US Dollar

It closed at 90.19 a dollar on Wednesday

Source: Bloomberg

"The Nifty 50 index remains fragile below 26,326, though a potential bullish regrouping near 25,703 cannot be ruled out. Weak PMI data, a sliding rupee, and persistent FII outflows continue to weigh on sentiment, while upcoming RBI and US Fed policy decisions and geopolitical developments could add fresh volatility. For now, bears retain a marginal advantage, even as rate-cut expectations and U.S.–India trade optimism offer some support."Prashanth Tapse , Senior Vice President, Research, Mehta Equities

"Options data for current week expiry is still showing some negative sentiment with immediate support around 25,850 spot levels and resistance around 26,050-26,100 spot levels. Sustenance above 26,150 spot levels will reverse the swing direction in favour of prevailing uptrend that might take it towards its previous highs 26,325 spot levels."Vipin Kumar, Assistant Vice President Technical and Derivatives Research, Globe Capital Market

A gauge for emerging-market currencies rose on Wednesday, getting a lift from renewed bets of a Federal Reserve interest-rate cut next week after the latest batch of jobs data showed a weakening labor market.

The Colombian peso, Czech koruna and Polish zloty led the advance among peers as the Bloomberg Dollar Spot Index slipped 0.4%. Meantime, the index for emerging equities edged lower for the day.

In an effort to permeate the Indian tech ecosystem, Open AI is in talks with Tata Consultancy Services (TCS), the country's largest software exporter, to build an AI compute infrastructure in India.

OpenAI is also looking to partner with Tata to co-develop agentic AI solutions to enterprises across India, reports The Economic Times.

Gold prices in India rose to Rs 1,30,430 and silver was up at Rs 1,81,850 on Thursday, according to the India Bullion Association as of 7:15 a.m. However, silver in the spot market was near its record high after hitting another record high in the previous session.

This comes after US payroll data reinforced hope that the Federal Reserve will cut interest rates in its final policy meeting of the year.

Foreign portfolio investors pulled out more money from the domestic equity markets in just two days of December compared to November. FPIs have taken out Rs 4,211 crore in December, while in entire November they sold Indian equities worth Rs 3,765 crore.

Markets in Japan rose as the Wall Street recorded gains on hopes of a rate cut in the upcoming policy meeting of the US Federal Reserve in December post weak private jobs data. Market participants also focused on Japan's 30-year bond auction.

The Nikkei 225 and TOPIX were trading 1.26% and 1.11% higher, respectively as of 7:02 a.m.

The GIFT Nifty was trading 0.04% or 9.50 points higher at 26,101.00 as of 6:32 a.m. However, the Indian benchmark indices are expected to open 36 points lower. Market participants may remain on the sidelines, awaiting the outcome of the Reserve Bank of India's Monetary Policy Committee meeting.

Bajaj Auto Ltd., Oil and Natural Gas Corp, Oil India Ltd., Railtel Corp, Arkade Developers Ltd., and Vedanta Ltd. shares will likely be in focus because of the overnight news flow.

Focuse will also be on the Indian currency as it weakened to a new low of 90.30 a dollar in the previous session.

The benchmark stock market indices fell for the fourth session with the Nifty 50 slipping below 26,000 mark to close 0.18% lower at 25986. While the Sensex settled flat at 85106.81.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.