This blog is closed. Thank you for joining us today!

"Benchmark Nifty index crossed above 26,100 spot levels in day trade (first time since Oct 2024) but failed to hold at higher levels and fell on profit taking. The profit taking coincides with the fall in US index futures. Domestic markets are well placed on multiple chart frames till it is trading above 25600 spot levels on closing basis and likely to test 26,300 spot levels in the near term."Vipin Kumar, Assistant Vice President Technical and Derivatives Research, Globe Capital Market

Nifty 50 ends flat, closes below the crucial mark of 26,000

Benchmark outperforms broader markets

Drag in Nifty 50 was led by Eicher motors & Eternal

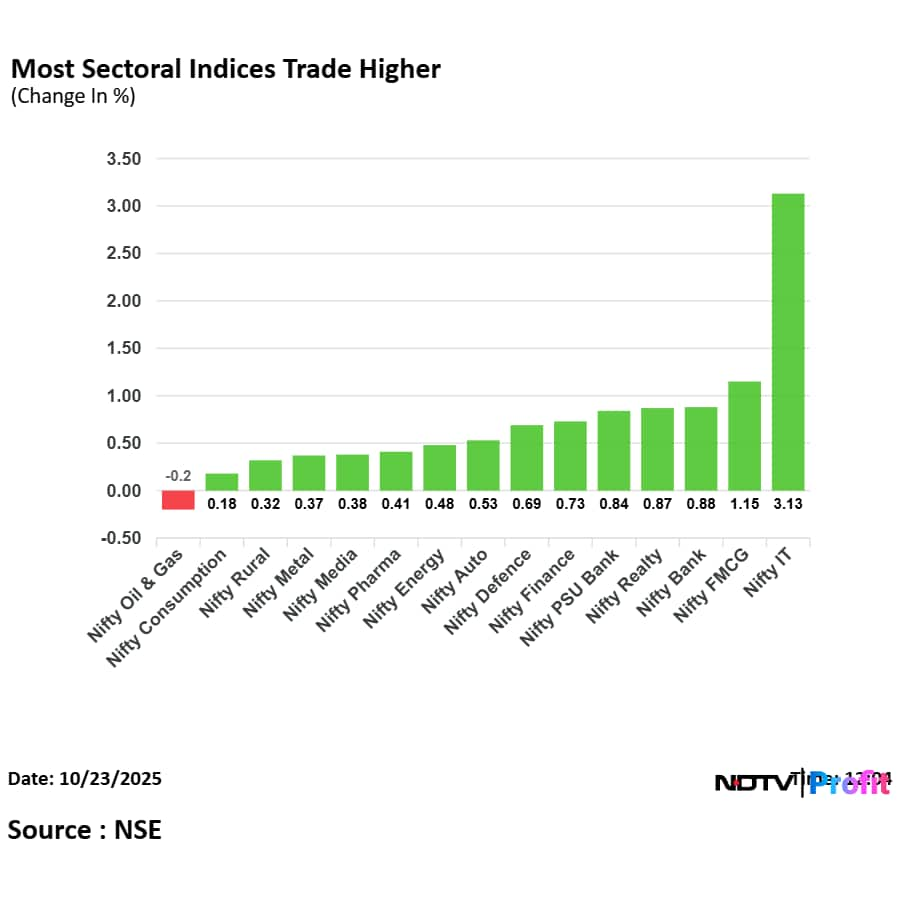

Nifty Oil & Gas marks as a top sectoral losers

Drag in Nifty oil & gas led by Hindustan Petroleum Corp Ltd. and Indian Oil

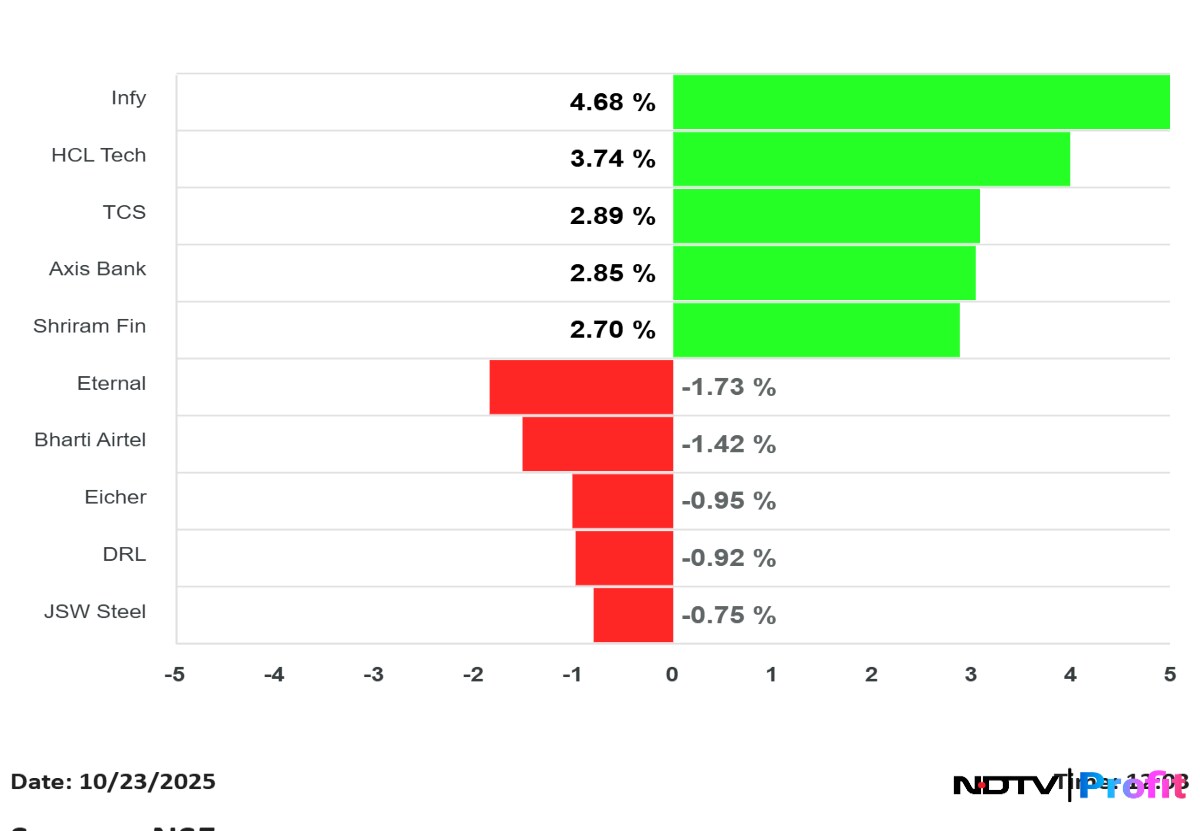

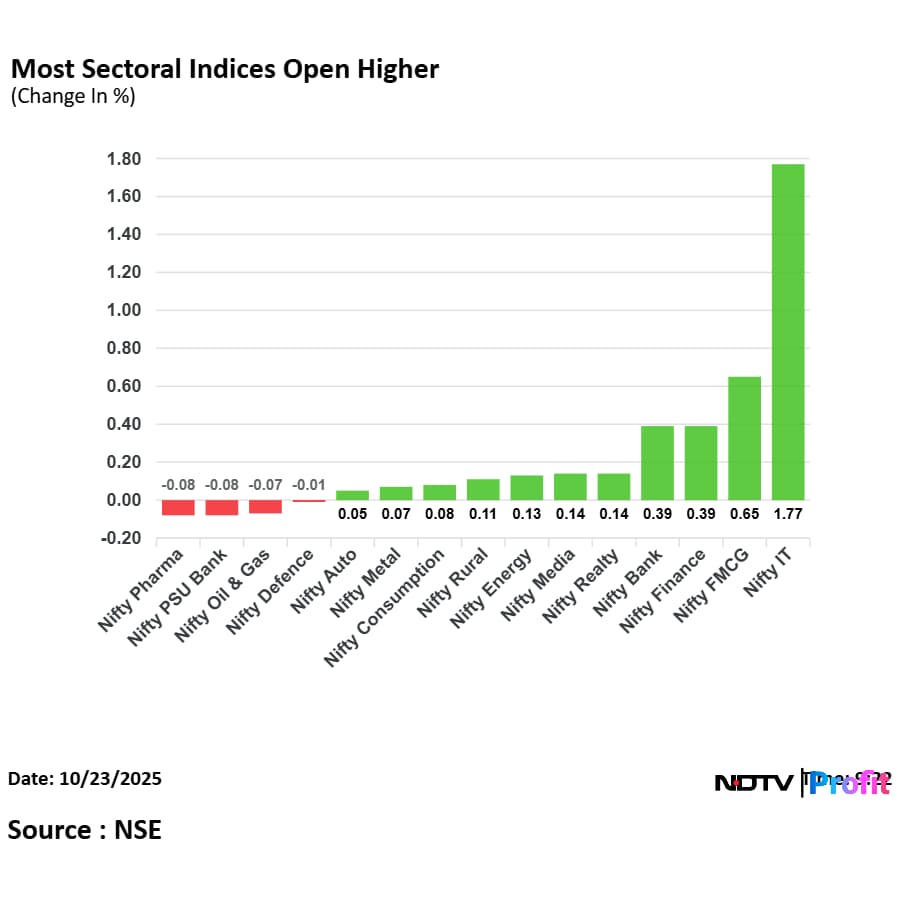

Nifty IT marks as a top sectoral gainer, gains led by Infosys & HCL tech

Infosys hit an intraday high of 5 % on the back of promotor opting out of Buyback

Sectors end on a mixed note

Nifty oil & gas snaps 5 day gaining streak

Nifty Auto gained for second consecutive day

Nifty Pharma snapped a five-day gain streak

Nifty IT & Nifty Media gains for third day in a row

Nifty 50 ends flat, closes below the crucial mark of 26,000

Benchmark outperforms broader markets

Drag in Nifty 50 was led by Eicher motors & Eternal

Nifty Oil & Gas marks as a top sectoral losers

Drag in Nifty oil & gas led by Hindustan Petroleum Corp Ltd. and Indian Oil

Nifty IT marks as a top sectoral gainer, gains led by Infosys & HCL tech

Infosys hit an intraday high of 5 % on the back of promotor opting out of Buyback

Sectors end on a mixed note

Nifty oil & gas snaps 5 day gaining streak

Nifty Auto gained for second consecutive day

Nifty Pharma snapped a five-day gain streak

Nifty IT & Nifty Media gains for third day in a row

Rupee closes 9 paise stronger at 87.84 against US dollar

It closed at 87.93 a dollar on Monday

Source: Bloomberg

Premier Energies Ltd. will acquire 51% stake in Transcon Ind for Rs 500 crore, the company said in the exchange filing.

Global gold prices experienced their steepest selloff in more than a dozen years on Tuesday, tumbling by as much as 6.3% after hitting a record peak of $4,381.52 an ounce the day prior.

The sudden rout brought an abrupt halt to a furious, weeks-long rally that has still left the precious metal up more than 50% this year.

Airfloa Rail Technology received order worth Rs 74 crore from integral coach factory in Chennai, the company said in the exchange filing.

Shares of Midwest Ltd. will debut on the stock market on Friday.

The initial public offering closed with a strong subscription on the last day of bidding on Friday. The mainboard IPO was oversubscribed 87.89 times on the third and final day, with investors bidding for 27,39,83,920 shares against the 31,17,460 shares on offer.

The share allotment status for the Midwest IPO was finalised on October 20. Successful bidders can expect the shares to be credited to their demat accounts on Thursday, October 23.

The unlisted shares of Midwest Limited have been trading at a premium in the grey market, but have shown a declining trend after getting fully subscribed on Day 1. The highest GMP recorded for the IPO was Rs 175.5 on October 15, which then later dropped below Rs 100.

Hindalco Industries' plan to acquire US-based AluChem Companies Inc. in an all-cash deal valued at $125 million or Rs 1,075 crore has been stalled.

The company said the US federal government shutdown began on October 1 and statutory deadlines under the regulatory review framework have been tolled. "Once the shutdown concludes and CFIUS formally accepts the final filing for review, the process may take up to approximately 105 days to complete. The Company will provide further updates upon completion of the review."

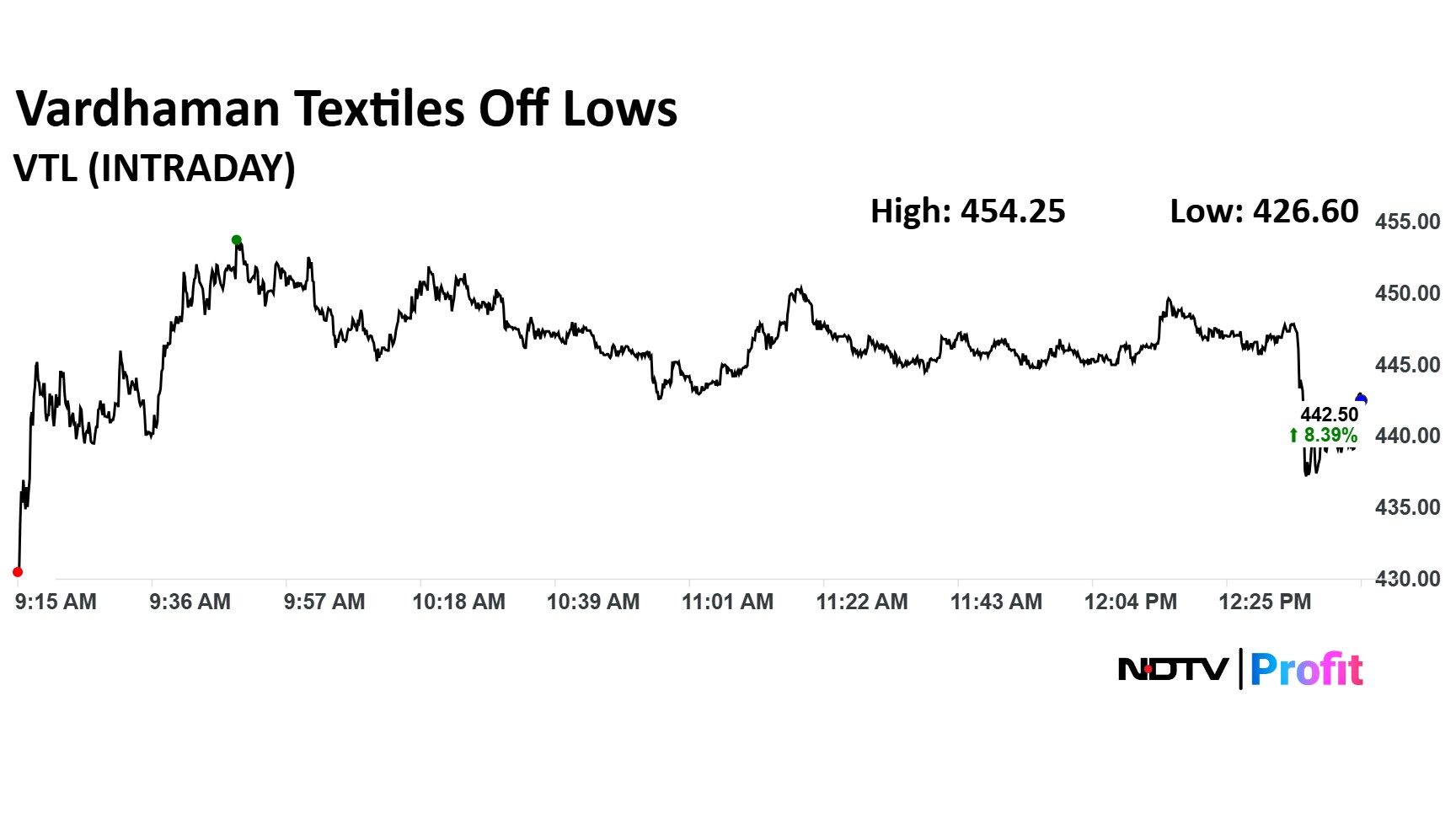

Vardhman Textiles Q2 Highlights (Consolidated, YoY)

Revenue down 1% to Rs 2,480 crore versus Rs 2,502 crore.

Ebitda up 6% to Rs 334 crore versus Rs 315 crore.

Margin at 13.47% versus 12.59%.

Net profit down 5% to Rs 187 crore versus Rs 197 crore.

Vardhman Textiles Q2 Highlights (Consolidated, YoY)

Revenue down 1% to Rs 2,480 crore versus Rs 2,502 crore.

Ebitda up 6% to Rs 334 crore versus Rs 315 crore.

Margin at 13.47% versus 12.59%.

Net profit down 5% to Rs 187 crore versus Rs 197 crore.

Pace Digitek received order worth Rs 1,159 crore order from SECI for BESS supply for 600 megawatt and 1,200 megawatt services, the company said in the exchange filing.

The NSE Nifty October Futures rose 0.95% to 26,162, with a premium of 71 points as of 12:45 p.m.

The Nifty Oct 28 Expiry: Most Call Open Interests are concentrated on 27,000 strike, while most Put OIs are seen at 26,000.

PTC Industries received order from GTRE to manufacture turbine blades . The gas turbine research establishment is a laboratory of DRDO Bengaluru, the company said in the exchange filing.

As the September quarter earnings season slowly unfolds, India's top two private lenders - HDFC Bank and ICICI Bank - have put out contrasting pictures in the quarter gone by.

While both lenders showed signs of strength, their paths diverged due to at least six reasons.

HDFC Bank, for its part, saw its bottom line get a booster dose from one-off treasury gains, with the lender reporting an 11% profit growth in the September quarter.

ICICI Bank had a slower growth in contrast, but the operational performance of the bank appeared healthier on paper.

Read the full article here.

IDBI deal may be delayed as Emirates NBD unlikely to bid

Emirates NBD announces majority stake buy in RBL Bank with $3 billion infusion

IDBI stake sale needs at least 2 competing bids

Fairfax, Emirates NBD were earlier seen as serious bidders

Oaktree Capital, Kotak Mahindra Bank other suitors in fray

Source: People In The Know

India's benchmark index, Nifty 50, on Thursday reclaimed the 26,000 mark after over a year, as multiple tailwinds helped boost positive sentiment. The 50-stock index rose for the sixth consecutive session, after reports said India and the United States are close to a trade deal.

The Nifty 50 on Thursday gained as much as 0.9% or 225 points to hit 26,099 intraday. The last time the index was above 26,000 was Sept. 30, 2024. The all-time high of 26,277 was hit on Sept. 27, 2024.

Kirloskar Industries's arm received order worth Rs 358 crore from Oil and Natural Gas Corp to supply tubing, pup joints, and cross overs, the company said in the exchange filing.

The NSE Nifty IT rose 3.22% to 36,437.6, the highest level since Sept 19. Infosys Ltd., Tata Consultancy Services Ltd., HCLTech Ltd. shares contributed the most to the rally of the NSE Nifty IT index. It was trading 3.13% higher at 36,405.95 as of 12:08 p.m.

The index is the top gainer among 15 sectoral indices as of 12:08 p.m.

The NSE Nifty IT rose 3.22% to 36,437.6, the highest level since Sept 19. Infosys Ltd., Tata Consultancy Services Ltd., HCLTech Ltd. shares contributed the most to the rally of the NSE Nifty IT index. It was trading 3.13% higher at 36,405.95 as of 12:08 p.m.

The index is the top gainer among 15 sectoral indices as of 12:08 p.m.

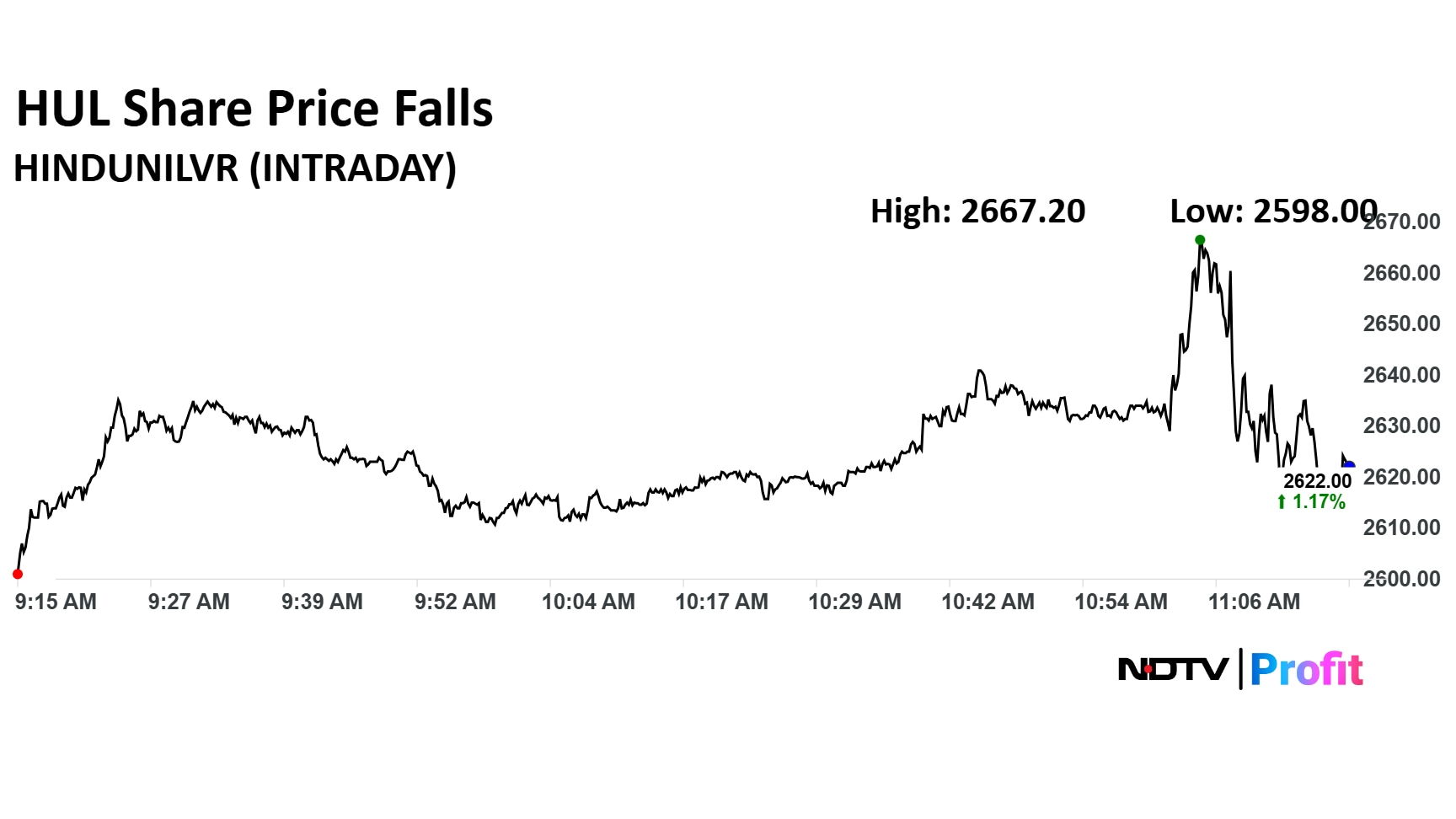

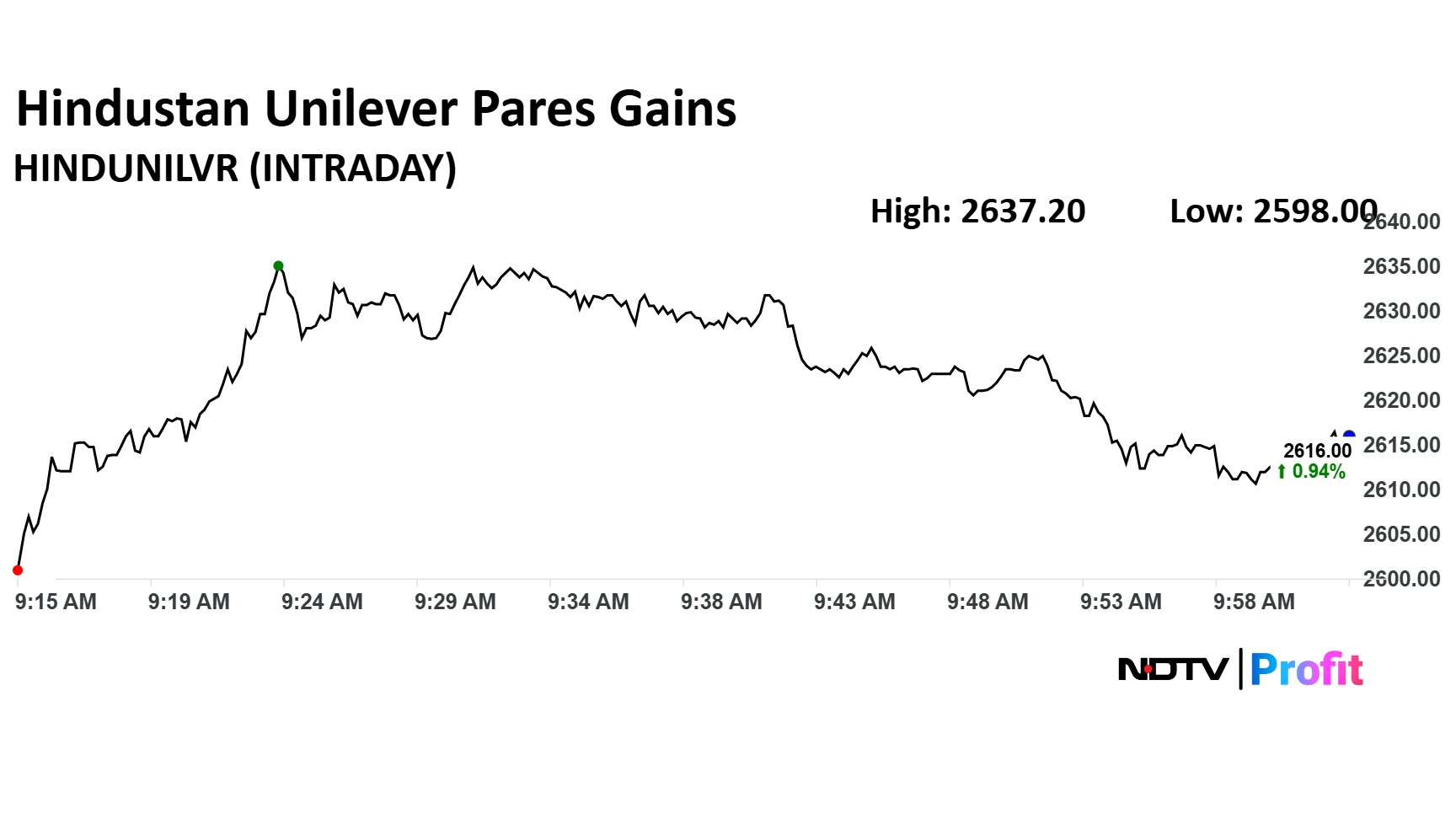

Both urban and rural has contributed to growth this quarter

Commodity pricing remains to be divergent

A&P expenses continue to go up as planned

Hindustan Unilever continues to remain positive to grow in terms of volumes

Source: Ritesh Tiwari, chief financial officer, Hindustan Unilever

Garuda Construction received order worth Rs 231 crore order to construct rehabilitation building in Mumbai. The total orderbook of the company now stands at Rs 3,461 crore, the company said in the exchange filing.

Choice International will acquire distribution business of Fintoo Group. The acquisition will contribute incremental asset under management of nearly Rs 300 crore to wealth management business, the company said in the exchange filing.

Hindustan Unilever Ltd. share price was trading 1.35% higher at Rs 2,629 apiece. The share price rose 2.91% to Rs 2,667 apiece earlier in the day.

Hindustan Unilever Ltd. share price was trading 1.35% higher at Rs 2,629 apiece. The share price rose 2.91% to Rs 2,667 apiece earlier in the day.

Flat Underlying Volume Growth In Q2

EBITDA Margin Expected To Remain At Current Level

Expect H2 To Be Better Than H1 FY26

Price Growth To Be In Low Single Digit If Commodity Prices Remain Constant

GST Related Disruption Continues Into October

Normal Trading Conditions Anticipated From Early November

Source: Hindustan Unilever on Second-Quarter earning

Hindustan Unilever Ltd. board approved an interim dividend of Rs 19 per share on Thursday.

HUL Q2 Highlights (Cons, YoY)

Revenue up 2% at Rs 16,241 crore versus Rs 15,926 crore

Ebitda down 1.7% at Rs 3,729 crore versus Rs 3,793 crore

Margin at 23% versus 23.8%

Net Profit up 3.6% at Rs 2,685 crore versus Rs 2,591 crore.

HUL Q2 Highlights (Cons, YoY)

Revenue up 2% at Rs 16,241 crore versus Rs 15,926 crore

Ebitda down 1.7% at Rs 3,729 crore versus Rs 3,793 crore

Margin at 23% versus 23.8%

Net Profit up 3.6% at Rs 2,685 crore versus Rs 2,591 crore.

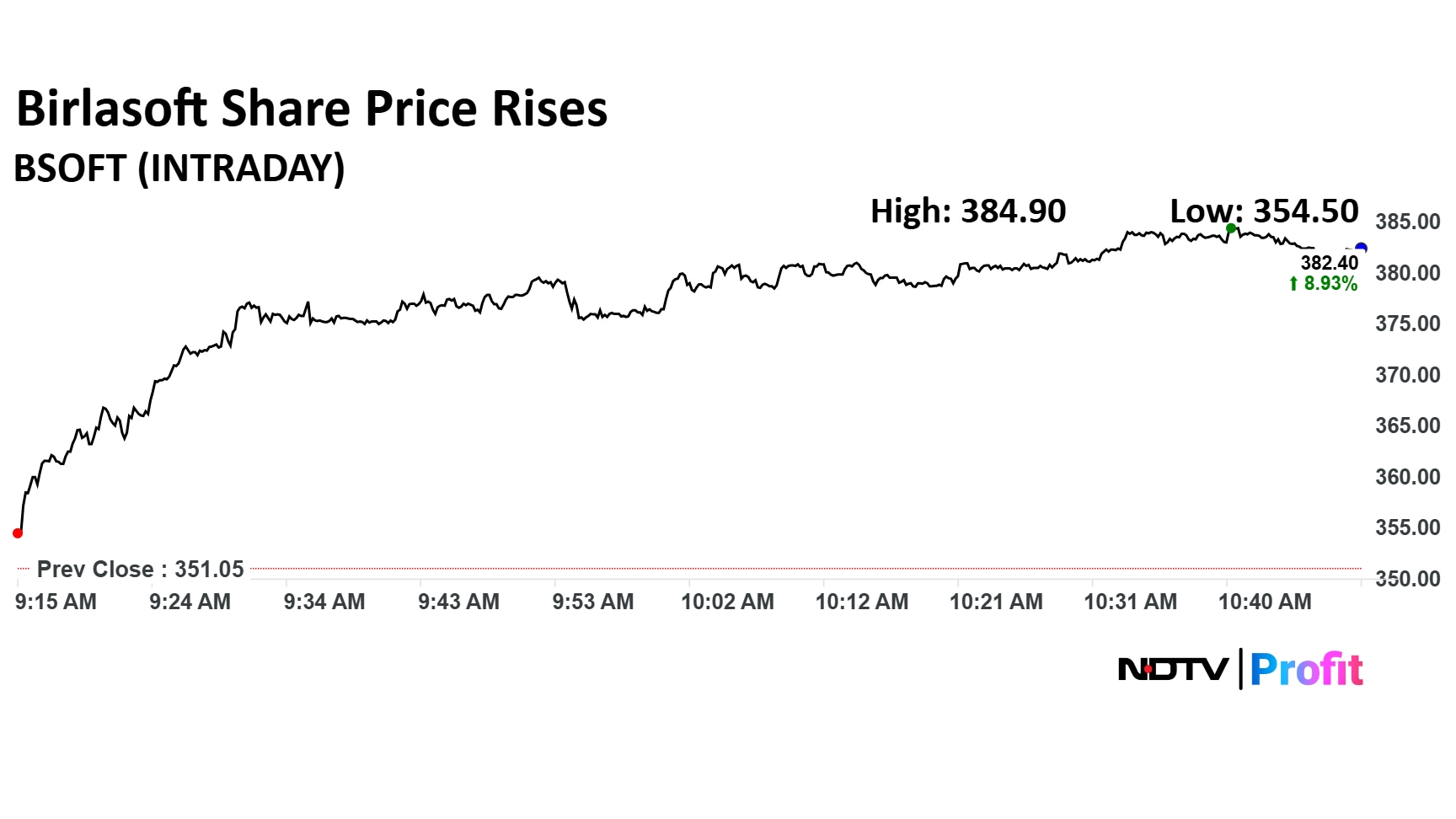

Birlasoft Ltd. share price rose to over an one-month high in Thursday's session. It was trading 9.64% to Rs 384.90 apiece, the highest level since Sept 19.

Birlasoft Ltd. share price rose to over an one-month high in Thursday's session. It was trading 9.64% to Rs 384.90 apiece, the highest level since Sept 19.

Textile stocks like Kitex, Welspun Living and KPR Mills gained notably during early trade on Thursday. This comes after the US President Donald Trump on Wednesday said he had spoken with Prime Minister Narendra Modi about trade, signalling renewed momentum in talks between the two countries.

Kitex Garments lead the gains in the pack with nearly 11% gains, followed by Welspun Living which rose nearly 5%.

Hindustan Unilever Ltd. share price rose to an over one-month high in Thursday's session before the company's second-quarter results, scheduled for release later today. India's largest FMCG company may report a 1.3% year-on-year decline in net profit for July–September period, according to Bloomberg estimate.

Hindustan Unilever Ltd. share price rose 1.76% to Rs 2,637.20 apiece, the highest level since Sept 11.

Get faster update on second-quarter earning of Hindustan Unilever here.

Hindustan Unilever Ltd. share price rose to an over one-month high in Thursday's session before the company's second-quarter results, scheduled for release later today. India's largest FMCG company may report a 1.3% year-on-year decline in net profit for July–September period, according to Bloomberg estimate.

Hindustan Unilever Ltd. share price rose 1.76% to Rs 2,637.20 apiece, the highest level since Sept 11.

Get faster update on second-quarter earning of Hindustan Unilever here.

US President Donald Trump may cut tarrifs on India to 15% from 50%

First cuts indicate strong festive season off-take

GST rate cut may further boost consumption

Foreign institutional investors' positioning was weak; buying seems to have start

Earnings growth expected in H2.

Valuations relatively cheap —12-month forward PE at 20x

On National Stock Exchange Ltd., 11 sectoral indices were trading in green, while three in red, and one remained flat out of 15.

On National Stock Exchange Ltd., 11 sectoral indices were trading in green, while three in red, and one remained flat out of 15.

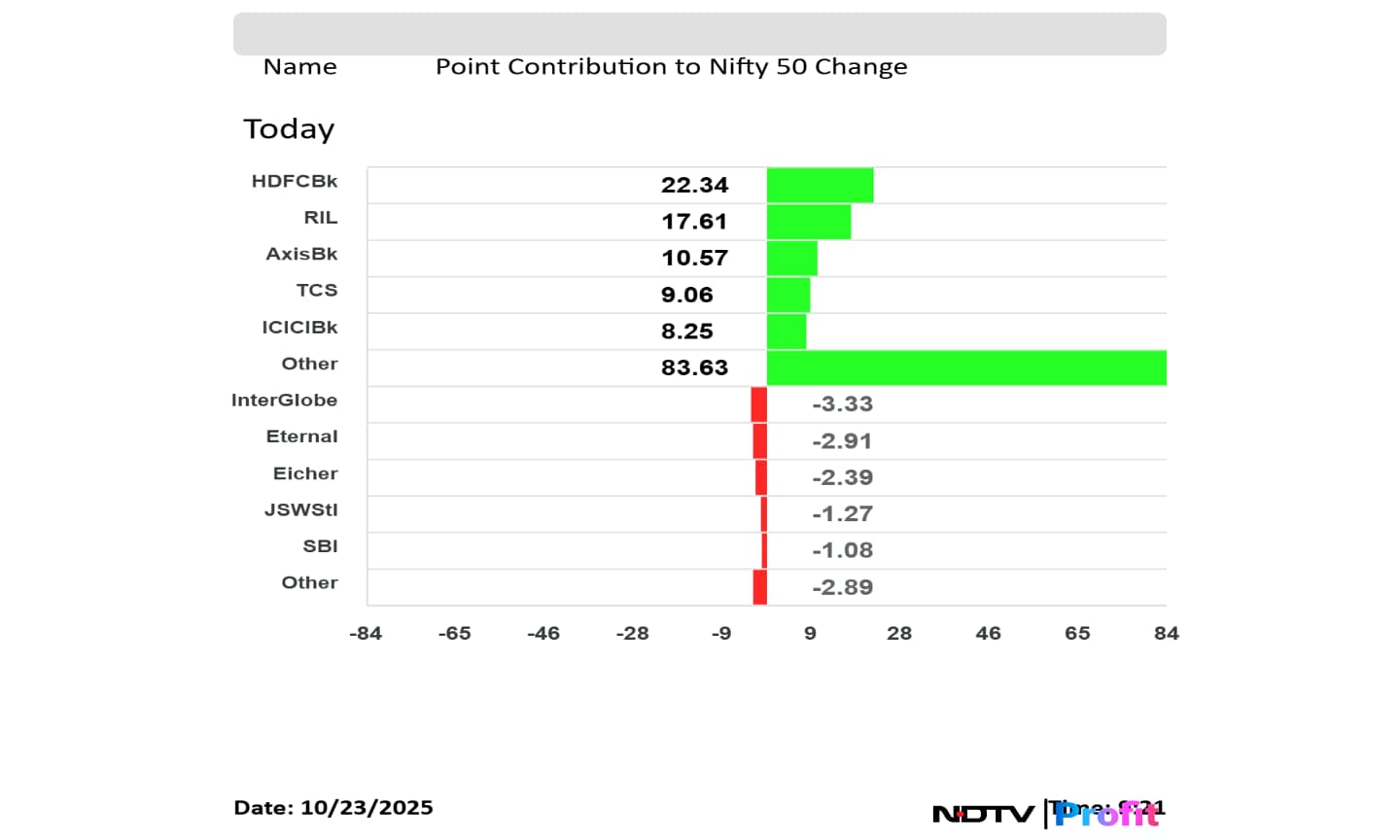

HDFC Bank Ltd., Reliance Industries Ltd., Axis Bank Ltd., Tata Consultancy Services Ltd., and ICICI Bank Ltd. added to the NSE Nifty 50 index.

InterGlove Aviation Ltd., Eternal Ltd., Eicher Motors Ltd., JSW Steel Ltd., and State Bank of India Ltd. limited gains in the NSE Nifty 50 index.

HDFC Bank Ltd., Reliance Industries Ltd., Axis Bank Ltd., Tata Consultancy Services Ltd., and ICICI Bank Ltd. added to the NSE Nifty 50 index.

InterGlove Aviation Ltd., Eternal Ltd., Eicher Motors Ltd., JSW Steel Ltd., and State Bank of India Ltd. limited gains in the NSE Nifty 50 index.

India's benchmark indices the NSE Nifty 50 and BSE Sensex surprised the street with its gap-up open when most Asian markets were trading in losses on Thursday. The Nifty 50 reclaimed 26,000 level for first time since Sept 30, 2024, and the Sensex reclaimed 85,000 since September 2024.

The indices were trading 0.70% and 0.86% higher, respectively as of 9:26 a.m.

India's benchmark indices the NSE Nifty 50 and BSE Sensex surprised the street with its gap-up open when most Asian markets were trading in losses on Thursday. The Nifty 50 reclaimed 26,000 level for first time since Sept 30, 2024, and the Sensex reclaimed 85,000 since September 2024.

The indices were trading 0.70% and 0.86% higher, respectively as of 9:26 a.m.

The yield on the 10-year bond opened flat at 6.49%

Source: Bloomberg

Rupee 10 paise stronger at 87.83against US dollar

It closed at 87.93 a dollar on Monday

Source: Bloomberg

"The Indian equity markets are expected to open on a positive note today, as indicated by the GIFT Nifty, which was trading around the 26,257 mark in early trades, reflecting an increase of 350 points. This suggests a cautiously optimistic sentiment, even as weak global cues and the absence of strong domestic triggers keep traders vigilant. Investors are likely to track global market trends, crude oil prices, and institutional flows for further direction."Amruta Shinde, Technical & Derivative analyst, Choice Broking

"GIFT Nifty indicates an opening near record highs. Any constructive development on the trade front between India and the U.S. could further bolster sentiment and potentially propel the index into uncharted territory. Derivative data also indicates emerging support around the 26,000 level. We expect the Nifty to trade within the 26,500–25,700 range in the medium term, maintaining a positive bias."Abhishek Goenka, Founder and CIO of Billionz

Tejas Networks supplied IP-MPLS routers and management system for multiple packages of BharatNet Phase III project, the company said in the exchange filing.

Nomura has initiated coverage on Tata Steel Ltd. with a ‘Buy’ rating and a target price of Rs 215, implying an upside potential of 25%. The brokerage sees strong growth in India, turnaround in Europe and improving macros.

“We initiate coverage of Tata Steel with a Buy rating on account of domestic focus amid strong demand dynamics, improved utilisation from Kalinaganar, a turnaround of European operations, a partial benefit of lower iron ore cost likely to persist after FY30F and valuation comfort.”

The brokerage initiated an Underweight rating with the target price of Rs 117

The company differentiated business and have steady growth in the price

Urban Company has a large addressable market in online home services

This is supported by competitive moats and an experienced founding team

Morgan Stanley gave an Underweight rating given growth is in the price

The brokerage expect core India consumer services NTV to grow at a healthy CAGR of 18-22% over financial year 2025-2028

High churn/supply constraints to drive growth at a calibrated pace

India consumer services (ex Insta) to reach 30% adj EBITDA margin medium term

Investments in Instahelp to drag profitability near term

Valuation multiples should sustain in line with strong and established business models in India Internet

Goldman Sachs initiated with a Neutral rating and a target price of Rs 140

Urban Company has a strong business model and execution track record

The brokerage expects a 24% revenue CAGR over financial year 2025 and 2030.

Goldman Sachs believe that the strength of the business model and outlook is already reflected in the company’s premium valuations

The growth compounding has a long runway

InstaHelp incremental growth driver but not meaningful to SOTP yet, the brokerage said.

Optionalities from international segment and B2C products

The company has a robust revenue growth with strong operating leverage

Ola Electric Mobility Ltd.'s board will consider fund raise proposal via share issuance and other means on Oct 25, the company said in the exchange filing.

Gold prices in India today slumped to Rs 1,22,320, after the festive season. On Tuesday, Gold prices slid the most in 12 years after a weeks-long furious rally.

Bullion's record high prices fell by as much as 6.3% after hitting a fresh peak of $4,381.52 an ounce the previous day.

Japan's benchmark index Nikkei 225 was trading over 1% down in early tarde on Thursday. SoftBank Group is the second top dragger of the index as it fell nearly 7%. The bank announced that it will issue US dollar and Euro-dominated bonds as the company is increasing its investment in artificial intelligence.

The Nikkei 225 was trading 1.18% down at 48,727 as of 7:24 a.m.

The GIFT Nifty was trading 0.02% or 5.,50 points lower at 26,282 as of 7:10 a.m.. However, the level indicated the NSE Nifty may open around 350 points higher open for the Nifty 50 index.

Ola Electric Mobility Ltd., Dr. Reddy's Laboratories Ltd., Federal Bank Ltd., and LTIMindtree Ltd. shares are in focus for Thursday's session.

On Tuesday, in a special annual session, the NSE Nifty 50 and BSE Sensex ended flat after it pared most gains from the beginning of the special session. ICICI Bank Ltd. and Kotak Mahindra Bank Ltd. shares were top draggers.

The Nifty 50 ended 0.10% higher at 25,868.60, and the Sensex ended 0.07% higher at 84,426.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.