Benchmark Indices slightly outperform Broader Market Indices

Nifty reclaims 24,800 mark and ends higher.

Benchmark Indices extended gains for the 2nd straight session

L&T and NTPC are the top gainers in Nifty.

Nifty IT emerges as the Top gaining sector for the day, led by Coforge and LTIMindtree.

Nifty Midcap 150 gains slightly led by The New India Assurance and Coromandel International.

The New India Assurance jumps over 18% after its post Q1 results

Nifty Realty emerges as the top losing sector, lose nearly 1% intraday.

Brigade Enterprises and DLF are the top losers in Nifty Realty.

Nifty IT extended gains for the 2nd consecutive day.

Nifty FMCG extended gains for the 3rd straight day.

Nifty Pharma extended gains for the 6th day in a row.

Mahindra and Mahindra gains nearly 1% ahead of its Q1 Results.

Benchmark Indices slightly outperform Broader Market Indices

Nifty reclaims 24,800 mark and ends higher.

Benchmark Indices extended gains for the 2nd straight session

L&T and NTPC are the top gainers in Nifty.

Nifty IT emerges as the Top gaining sector for the day, led by Coforge and LTIMindtree.

Nifty Midcap 150 gains slightly led by The New India Assurance and Coromandel International.

The New India Assurance jumps over 18% after its post Q1 results

Nifty Realty emerges as the top losing sector, lose nearly 1% intraday.

Brigade Enterprises and DLF are the top losers in Nifty Realty.

Nifty IT extended gains for the 2nd consecutive day.

Nifty FMCG extended gains for the 3rd straight day.

Nifty Pharma extended gains for the 6th day in a row.

Mahindra and Mahindra gains nearly 1% ahead of its Q1 Results.

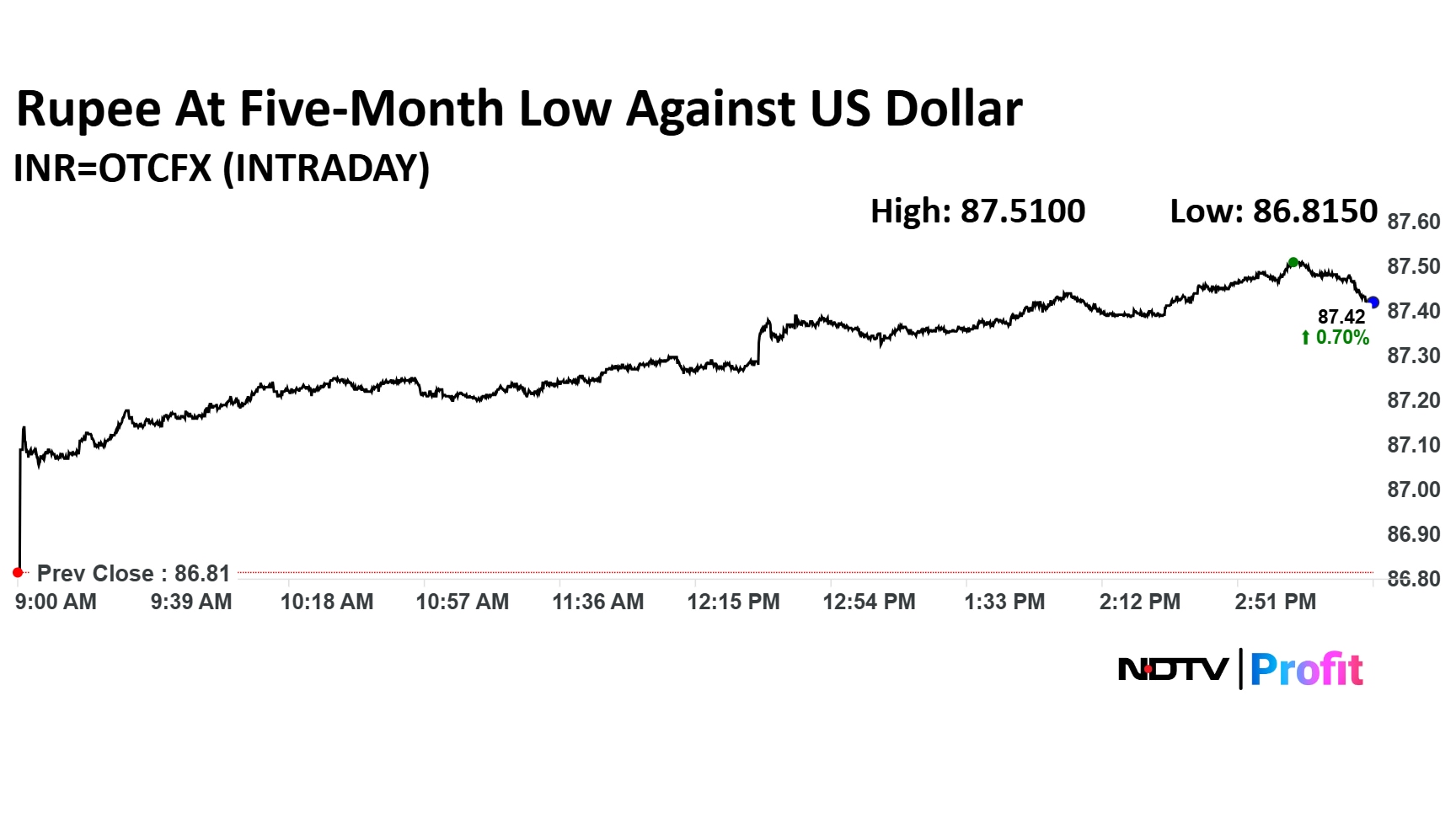

Rupee closed 61 paise weaker at 87.43 against US Dollar

It's the lowest close since Feb 28

It closed at 86.82 a dollar on Tuesday

Source: Cogencis

Rupee closed 61 paise weaker at 87.43 against US Dollar

It's the lowest close since Feb 28

It closed at 86.82 a dollar on Tuesday

Source: Cogencis

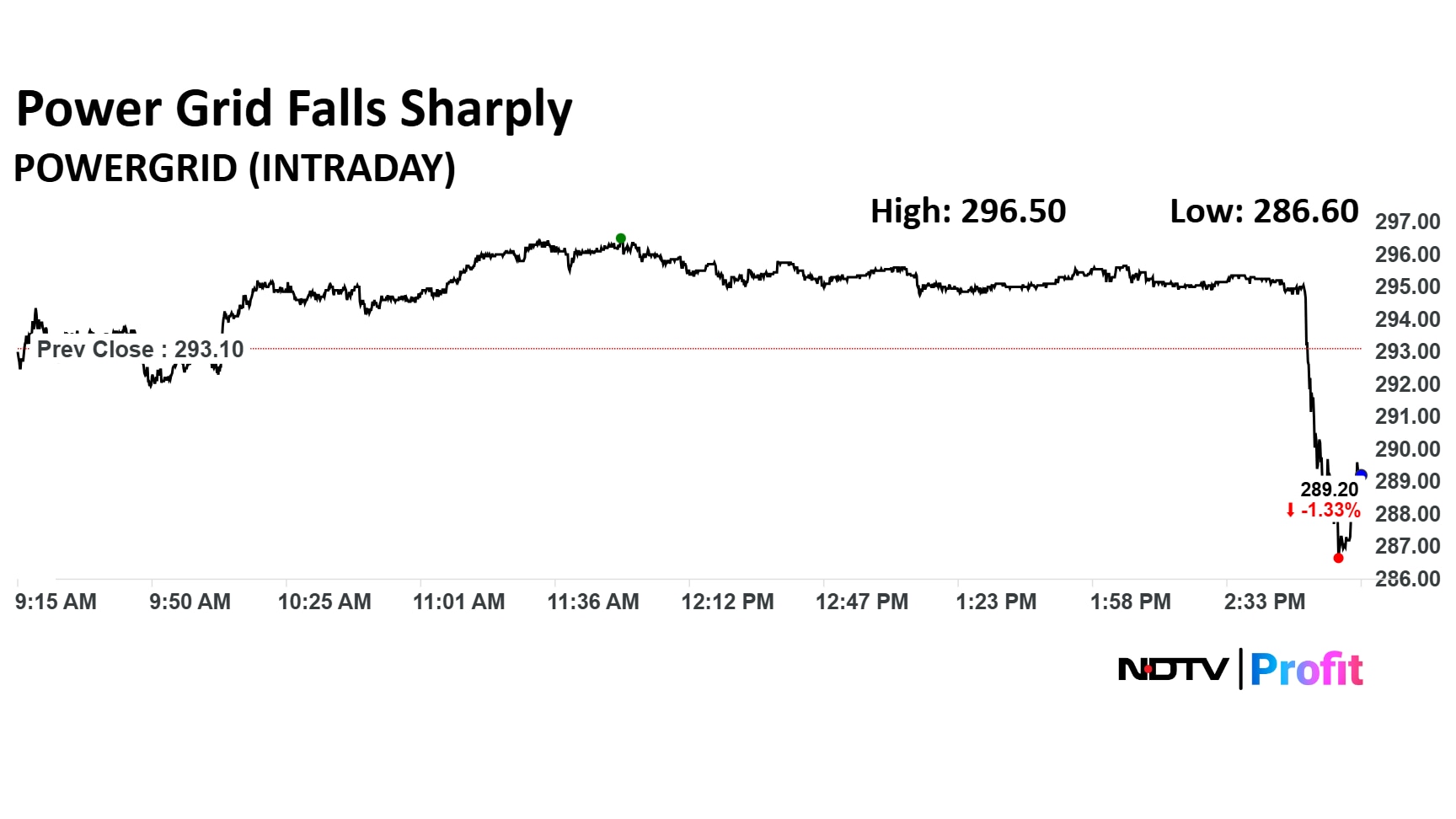

Power Grid Q1 Highlights (Consolidated, YoY)

Revenue up 1.7% to Rs 11,196.20 crore versus Rs 11,006.10 crore.

Ebitda down 4.7% to Rs 9,146.60 crore versus Rs 9,602.30 crore.

Margin at 81.7% versus 87.2%.

Net profit down 2.5% to Rs 3,630.50 crore versus Rs 3,723.90 crore.

Power Grid Q1 Highlights (Consolidated, YoY)

Revenue up 1.7% to Rs 11,196.20 crore versus Rs 11,006.10 crore.

Ebitda down 4.7% to Rs 9,146.60 crore versus Rs 9,602.30 crore.

Margin at 81.7% versus 87.2%.

Net profit down 2.5% to Rs 3,630.50 crore versus Rs 3,723.90 crore.

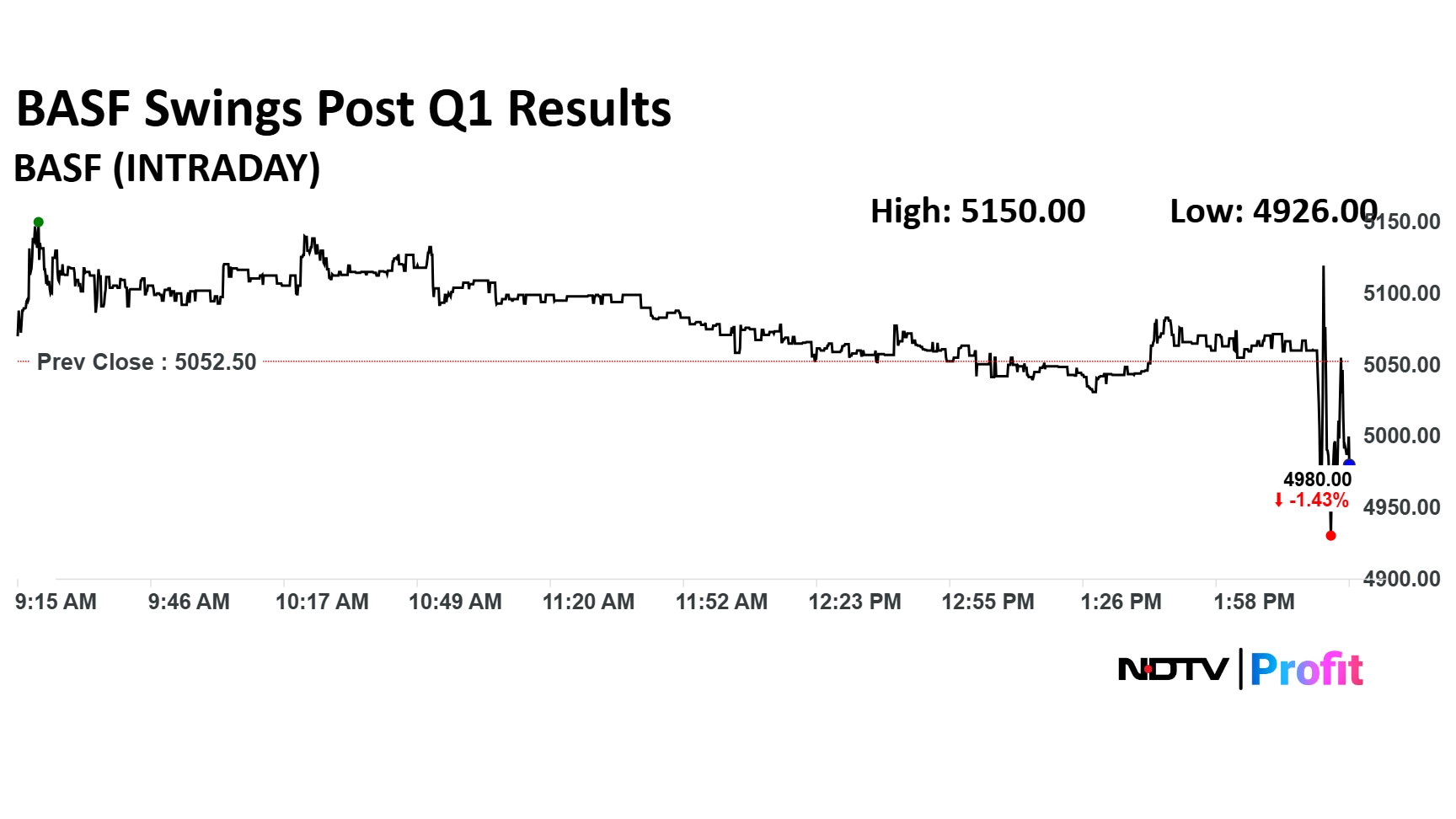

BASF India Q1 Highlights (Consolidated, YoY)

Net Profit down 37.7% at Rs 137 crore versus Rs 221 crore.

Revenue down 2.3% at Rs 3,874 crore versus Rs 3,967 crore.

EBITDA down 31.5% at Rs 214 crore versus Rs 312 crore.

Margin at 5.5% versus 7.9%.

BASF India Q1 Highlights (Consolidated, YoY)

Net Profit down 37.7% at Rs 137 crore versus Rs 221 crore.

Revenue down 2.3% at Rs 3,874 crore versus Rs 3,967 crore.

EBITDA down 31.5% at Rs 214 crore versus Rs 312 crore.

Margin at 5.5% versus 7.9%.

KPIT Tech Q1 Highlights (Consolidated, QoQ)

Revenue up 0.7% to Rs 1,539 crore versus Rs 1,528 crore.

EBIT down 10.6% to Rs 237 crore versus Rs 265 crore.

EBIT Margin at 15.4% versus 17.3%.

Net Profit down 29.8% to Rs 172 crore versus Rs 245 crore.

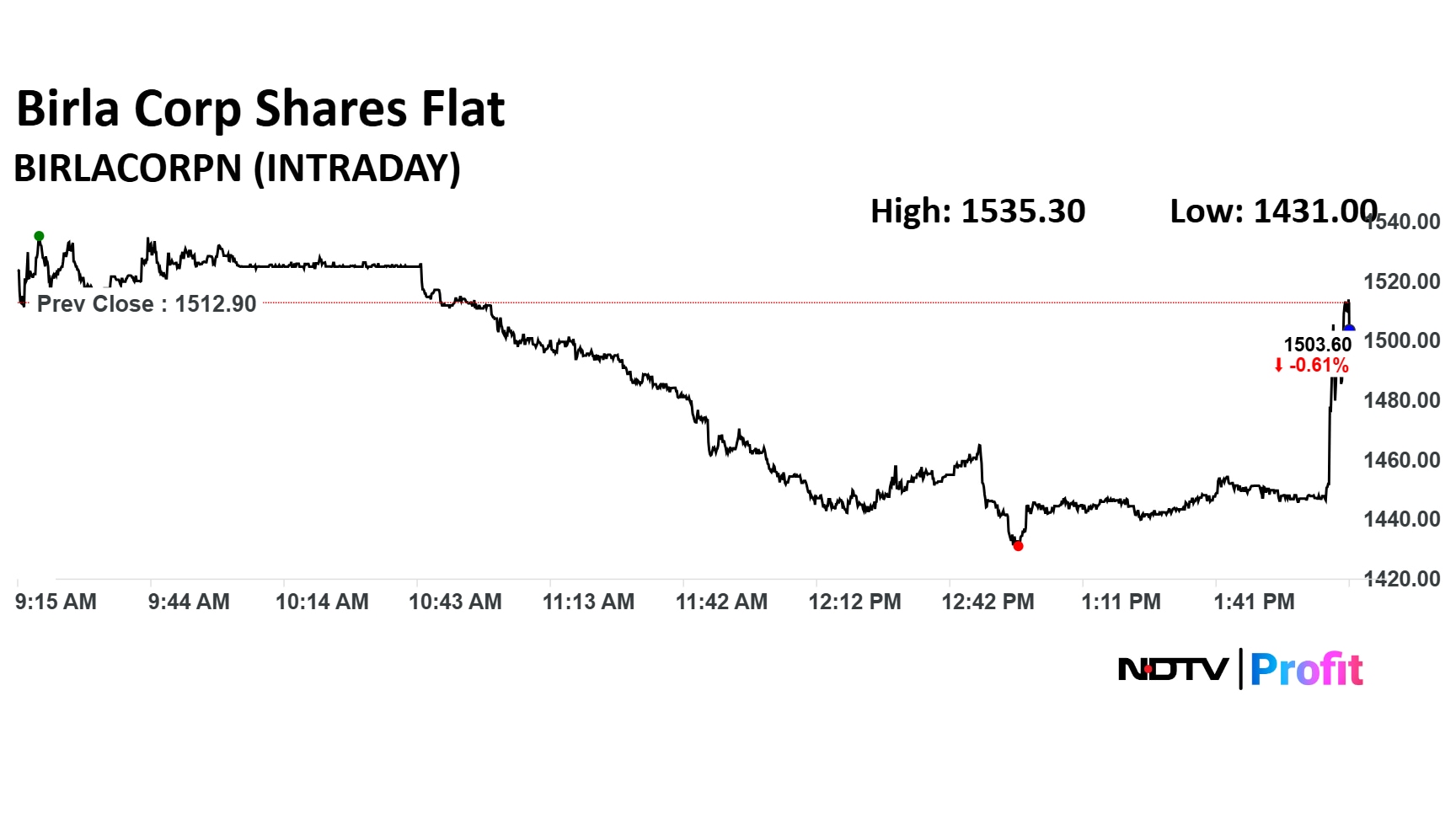

After posting first quarter results, the shares of Birla Corporation were trading lower compared to a 0.13% advance in the Nifty 50.

After posting first quarter results, the shares of Birla Corporation were trading lower compared to a 0.13% advance in the Nifty 50.

Birla Corporation Q1 Highlights (Consolidated, YoY)

Revenue up 12% to Rs 2,454 crore versus Rs 2,190 crore.

Ebitda up 34.3% to Rs 347 crore versus Rs 258 crore.

Margin at 14.1% versus 11.8%.

Net Profit at Rs 120 crore versus Rs 32.6 crore.

Indian Metals and Ferro Alloys Q1 Highlights (Consolidated, YoY)

Revenue down 3.14% at Rs 641.54 crore versus Rs 662.28 crore.

Ebitda down 22.21% at Rs 125.46 crore versus Rs 161.28 crore.

Margin down 479 basis points at 19.55% versus 24.35%.

Net profit down 18.35% at Rs 92.54 crore versus Rs 113.34 crore.

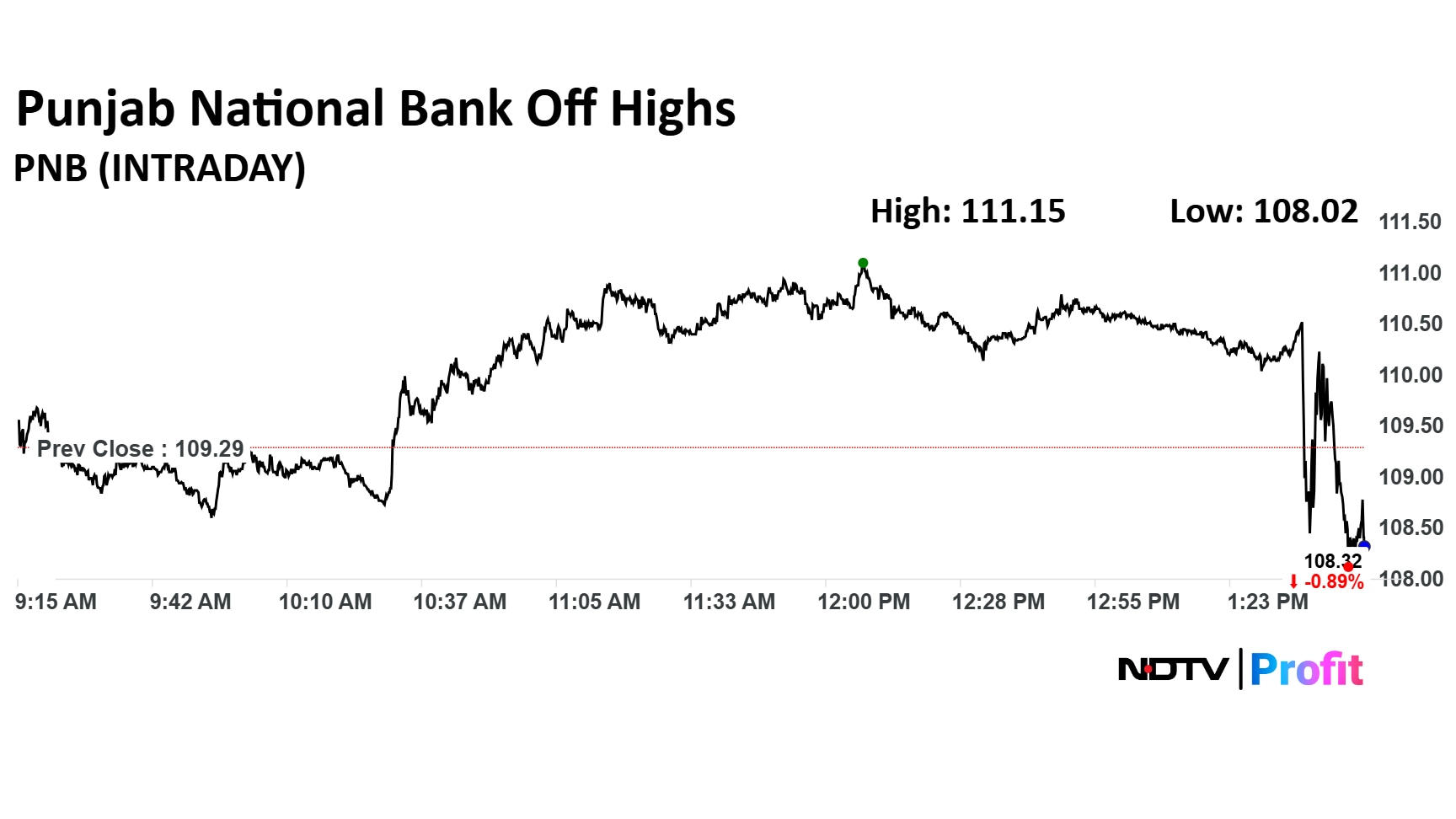

Punjab National Bank Q1 FY26 Highlights (Standalone, YoY)

Net profit down -48.5% to Rs 1,675 crore versus Rs 3,252 crore

Net interest income up 1% at Rs 10,578 versus Rs 10,476 crore.

Punjab National Bank Q1 FY26 Highlights (Standalone, YoY)

Net profit down -48.5% to Rs 1,675 crore versus Rs 3,252 crore

Net interest income up 1% at Rs 10,578 versus Rs 10,476 crore.

The Sri Lotus Developers and Realty Ltd. has launched its initial public offering today to raise up to Rs 792 crore. The price band is set at Rs 140-150 per share for the three-day IPO, which only comprises fresh issue with no offer for sale. The minimum application lot size is 100 shares.

The offer concludes on Friday, the company is set to list on the BSE and the National Stock Exchange. The real estate developer allotted 1.58 crore shares at Rs 150 apiece to 16 anchor investors.

The NSDL IPO has been fully subscribed as of 1:06 p.m. on Wednesday.

Qualified Institutions: 50%

Non-Institutional Buyers: 1.38 times.

Retail Investors: 1.11 times.

Portion reserved for employees: 1.92 times.

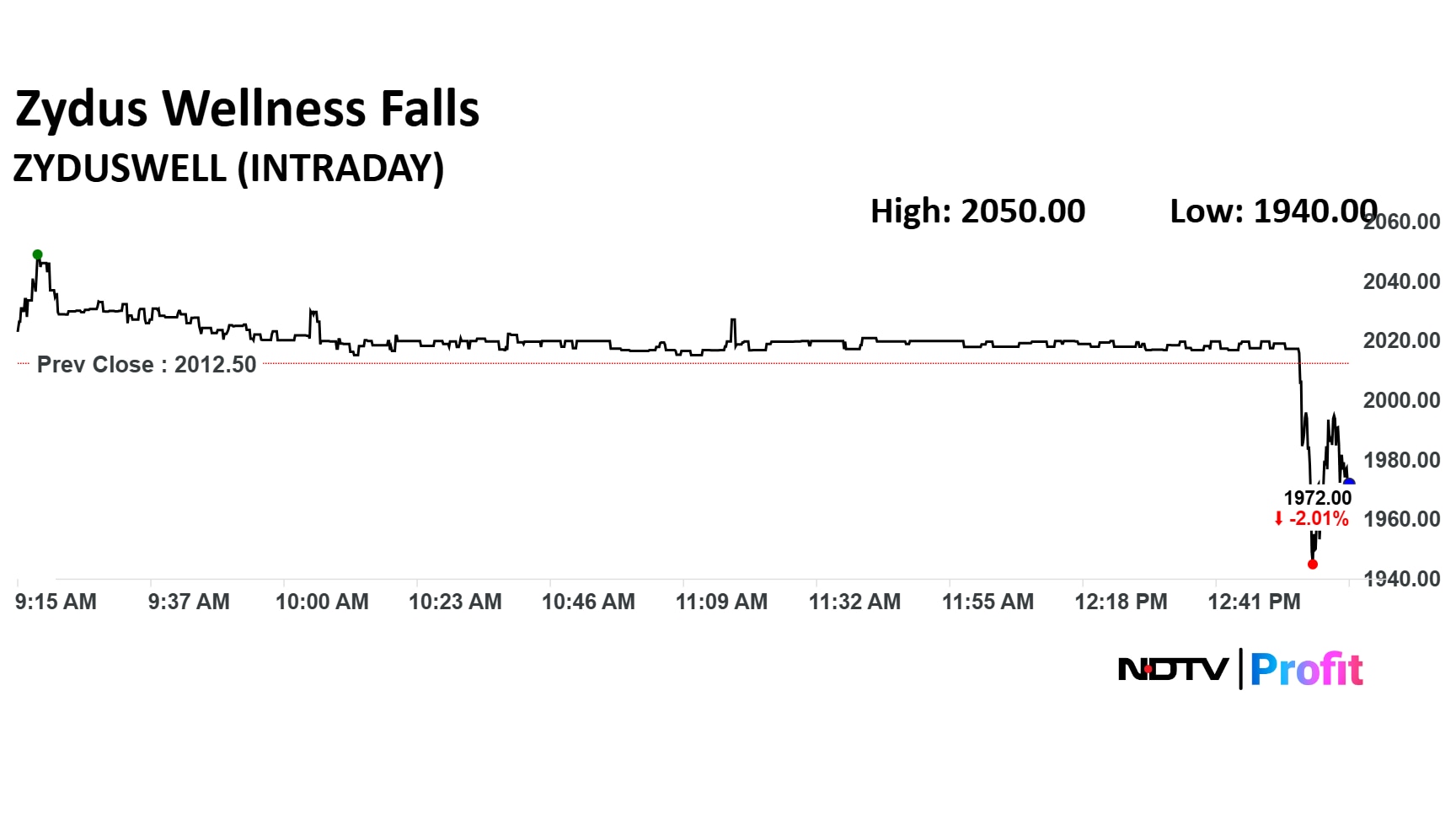

Zydus Wellness Q1 Highlights (Consolidated, YoY)

Revenue up 2.4% to Rs 861 crore versus Rs 841 crore.

Ebitda up 0.2% to Rs 156 crore versus Rs 155 crore.

Margin at 18.1% versus 18.5%.

Net Profit down 13.4% to Rs 128 crore versus Rs 148 crore.

Zydus Wellness Q1 Highlights (Consolidated, YoY)

Revenue up 2.4% to Rs 861 crore versus Rs 841 crore.

Ebitda up 0.2% to Rs 156 crore versus Rs 155 crore.

Margin at 18.1% versus 18.5%.

Net Profit down 13.4% to Rs 128 crore versus Rs 148 crore.

The NSE Nifty 50 and BSE Sensex will likely scale fresh highs by the end of the 2026 as growth recovery starts, according to Pankaj Murarka, chief investment officer, Renaissance Investment Managers. For next six-to-eight weeks, the Nifty 50 and Sensex will move in a narrow range, he said in an interview to NDTV Profit. The second half of this calendar year will likely be more steady.

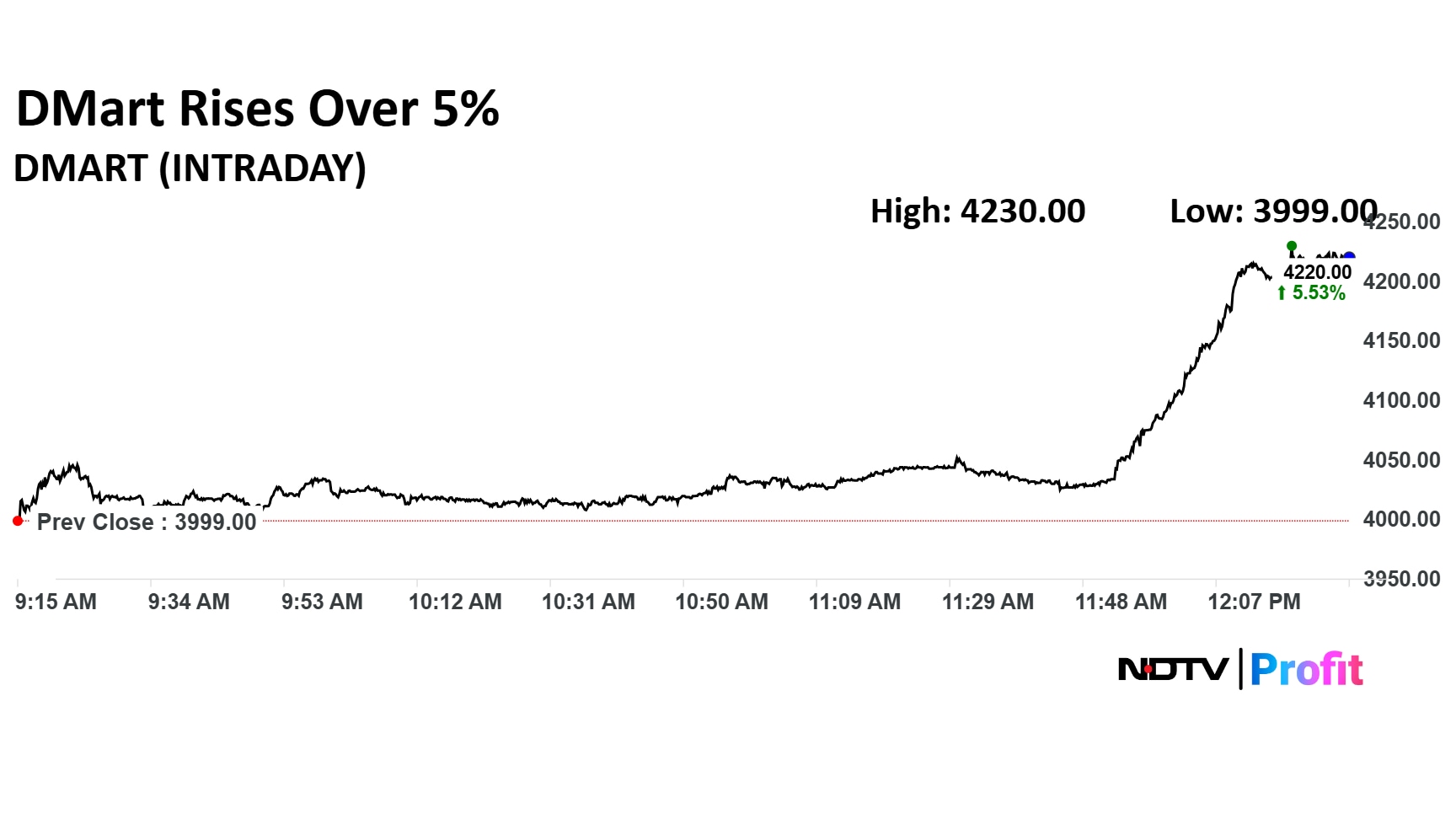

DMart or Avenue Supertmarts Ltd. share price jumped over 5% as it set to expand its DMart Ready services.

DMart or Avenue Supertmarts Ltd. share price jumped over 5% as it set to expand its DMart Ready services.

Ola Electric Mobility is in discussions with lenders to raise Rs 1,000 crore through high-yield debt financing, according to sources cited by Bloomberg. The move signals the company's push to secure capital amid its expansion and operational needs, Bloomberg reported.

Sona BLW Precision Forgings Ltd. has sent a cease and desist letter to Rani Kapur, accusing her of defaming the company and causing reputational and financial harm, according to people familiar with the matter

Kapur received the letter on Monday and her representatives have yet to decide on a response, the people said.

Oil and Natural Gas Corp receives notice from Andhra Pradesh Pollution Control Board to pay environmental compensation for three facilities, as per exchange filing.

Aster DM Healthcare to acquire an additional 13% stake in its subsidiary Dr. Ramesh Cardiac. The company will also lease property in Karnataka to set up a suite superspecialty hospital, as per exchange filing.

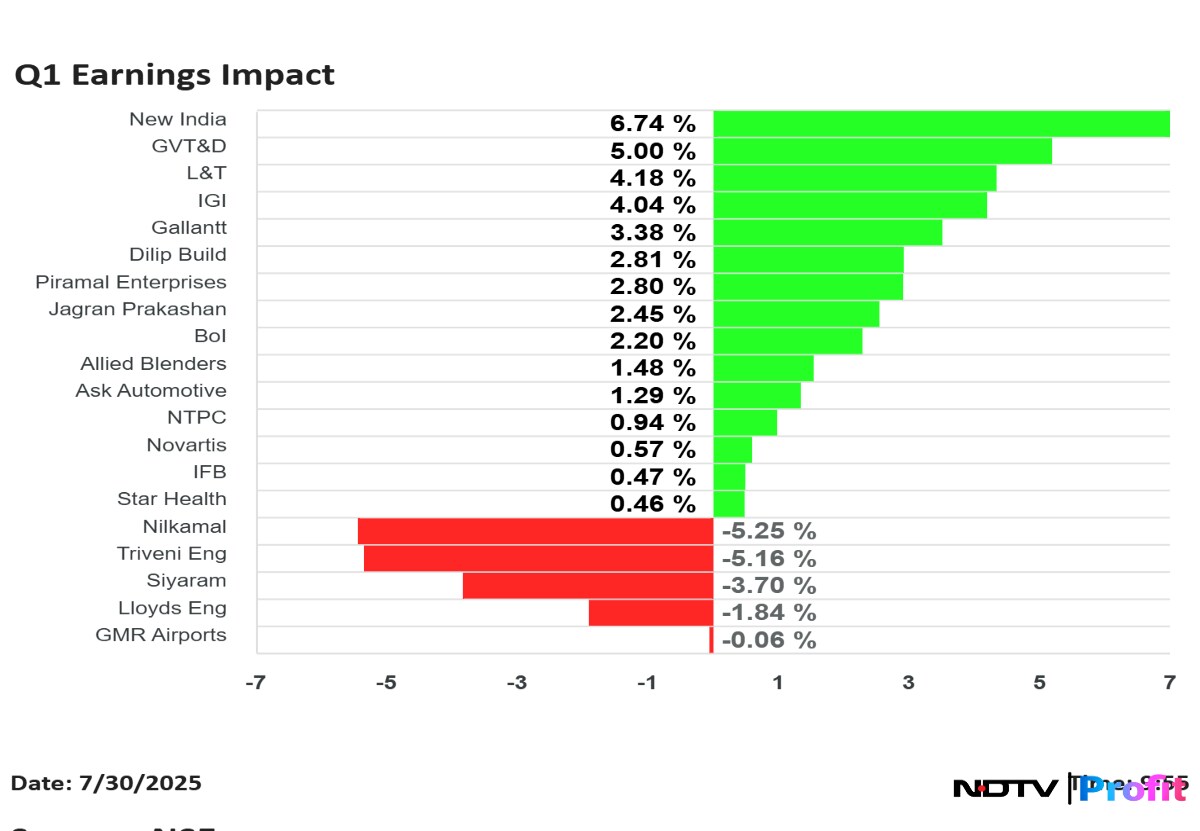

In Wednesday's session, Gallantt Ispat Ltd. and Allied Blenders And Distillers Ltd. hit record high after the companies reported an increase in their net profits for April–June period. Larsen & Toubro Ltd.'s share price jumped the most in two months after posting better profit than expected.

Track live updates on Q1 earnings here.

In Wednesday's session, Gallantt Ispat Ltd. and Allied Blenders And Distillers Ltd. hit record high after the companies reported an increase in their net profits for April–June period. Larsen & Toubro Ltd.'s share price jumped the most in two months after posting better profit than expected.

Track live updates on Q1 earnings here.

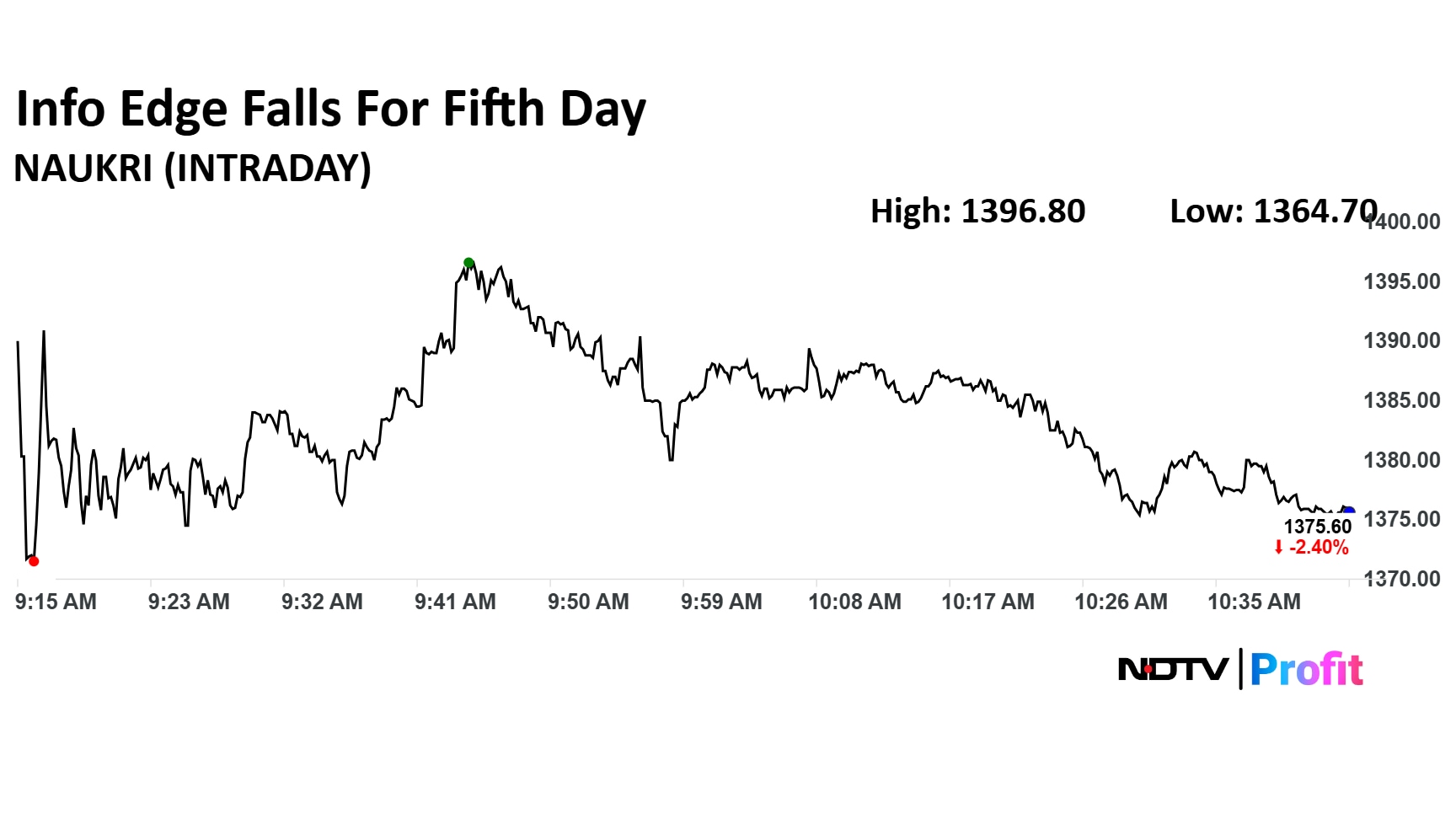

Info Edge shares fell for a fifth straight session on Wednesday after Bank of America downgraded the stock to underperform and reduced its target price, citing an unfavourable risk-reward profile and medium-term growth concerns.

BofA lowered its target price to Rs 1,360 from Rs 1,740 per share, implying a 4.9% downside from Tuesday’s closing price.

Info Edge shares fell for a fifth straight session on Wednesday after Bank of America downgraded the stock to underperform and reduced its target price, citing an unfavourable risk-reward profile and medium-term growth concerns.

BofA lowered its target price to Rs 1,360 from Rs 1,740 per share, implying a 4.9% downside from Tuesday’s closing price.

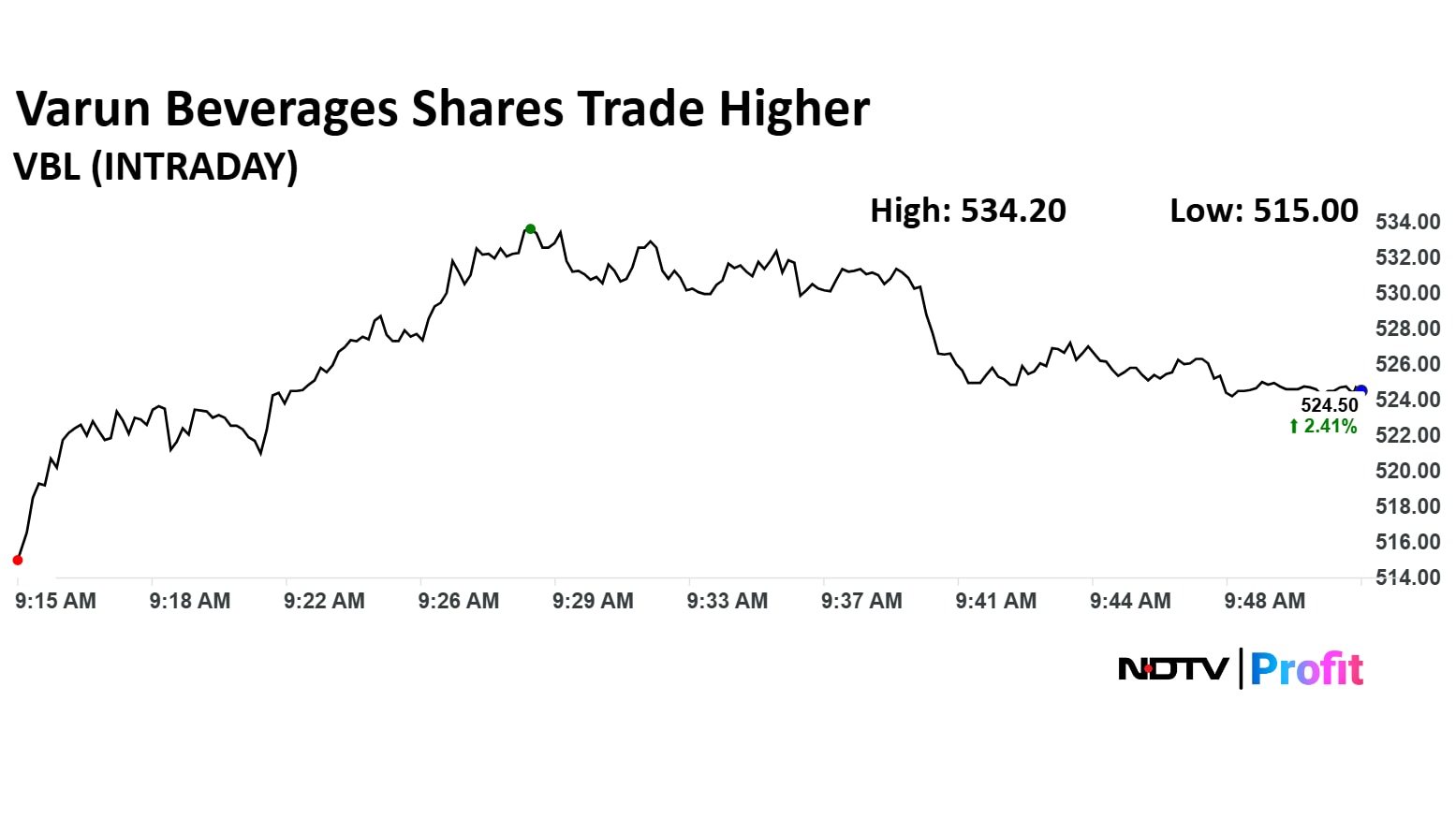

Shares of Varun Beverages Ltd. rose over 4% on Wednesday as Goldman Sachs maintained positive view with a raised target price. Analysts believe the company has a strong potential for good growth.

Goldman Sachs raised the target price to Rs 610 from Rs 590. The target price implied a 19% upside from Tuesday's close. The brokerage maintained the 'buy' rating.

Shares of Varun Beverages Ltd. rose over 4% on Wednesday as Goldman Sachs maintained positive view with a raised target price. Analysts believe the company has a strong potential for good growth.

Goldman Sachs raised the target price to Rs 610 from Rs 590. The target price implied a 19% upside from Tuesday's close. The brokerage maintained the 'buy' rating.

Shares of Indiqube Spaces Ltd. listed at a 9% discount to its IPO price on market debut on Wednesday.

The stock opened at Rs 216 on the National Stock Exchange, a 8.8% discount to its issue price of Rs 237. On the BSE, the stock debuted at Rs 218.70, a 7.7% discount.

Downgrade to Underperform from Buy; cut target price to Rs 1360 from Rs 1740

Downgrade to Underperform on modest hiring trends & medium-term headwinds

Turning more cautious: Jobs billing growth to stabilize

Gen AI: Headwinds for medium term industry hiring trends

Risks to core stub de-rating on modest hiring environment

Aadhar Housing Finance promoter to divest 4.414 crore shares to AXDI LDII SPV at Rs 425 per share, as per exchange filing.

Shares of Tata Motors slipped over 3% after reports of a deal with Italian truck maker Iveco.

Expected to be announced soon, according to an ET report, Tata Motors is reportedly close to acquiring Italian truck maker Iveco from the Agnelli family for $4.5 billion, potentially the group's second-largest acquisition.

GNG Electronics Ltd. made a stellar debut on the stock market as its shares listed at a premium of nearly 50% over the IPO price. The scrip started trading at Rs 355 on the NSE and Rs 350 on the BSE at 10:00 a.m. on Wednesday. The issue price was Rs 237.

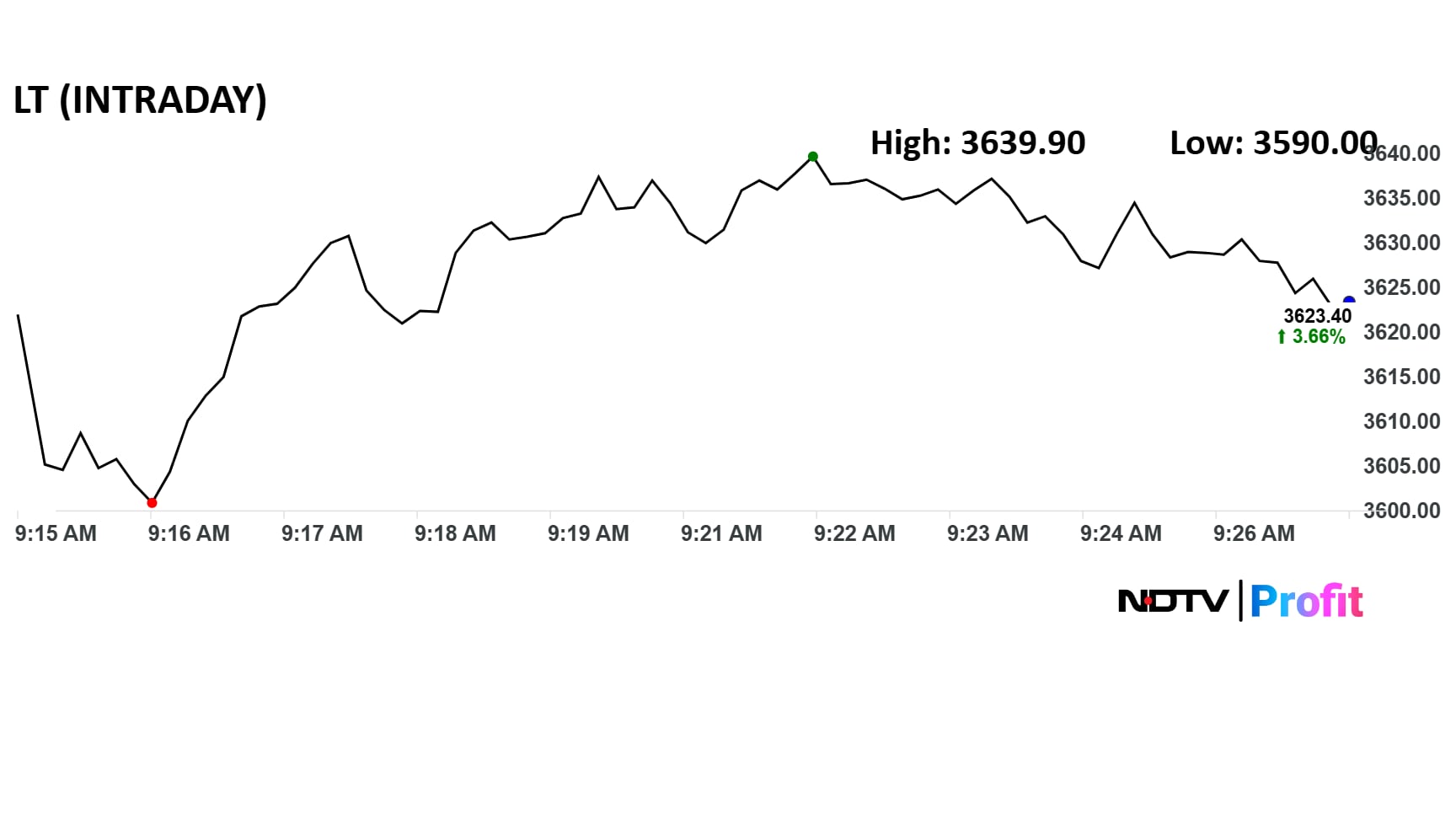

Larsen & Toubro Ltd. shares surged the most since mid-May on Wednesday morning after the company's first-quarter net profit fared better than street expectations. The scrip was the top point contributor in Nifty 50, India's benchmark index.

L&T share price advanced 4.13% intraday to Rs 3,639.9 apiece, the highest since July 2.

Larsen & Toubro Ltd. shares surged the most since mid-May on Wednesday morning after the company's first-quarter net profit fared better than street expectations. The scrip was the top point contributor in Nifty 50, India's benchmark index.

L&T share price advanced 4.13% intraday to Rs 3,639.9 apiece, the highest since July 2.

Larsen & Toubro Ltd. received multiple target price hikes from brokerages, including Goldman Sachs, after its first-quarter earnings beat estimates and provided a strong visibility for order book and business growth.

Of the 19 brokerages tracking the company and sharing their recommendation after the Q1 results, 17 place a 'buy' rating and one each has a 'sell' and a 'hold', as per Bloomberg.

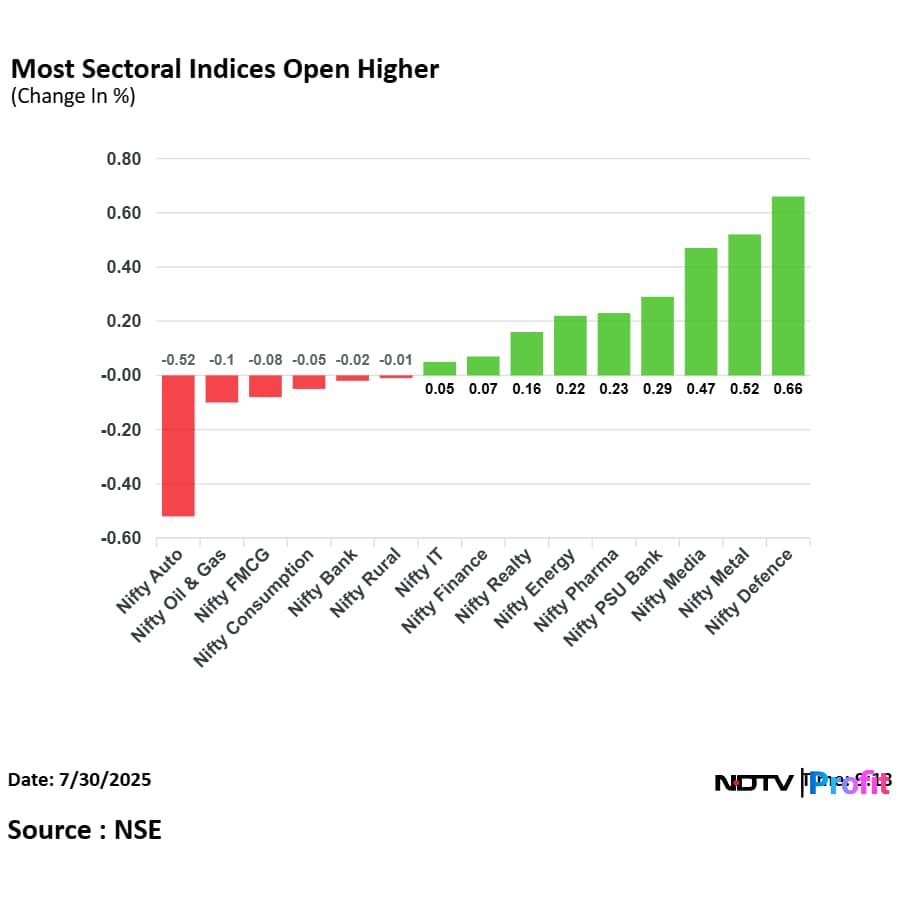

On National Stock Exchange, nine sectoral indices advanced, four declined, and two remained flat out of 15. The NSE Nifty Defence advanced the most, while the NSE Nifty Auto declined the most.

On National Stock Exchange, nine sectoral indices advanced, four declined, and two remained flat out of 15. The NSE Nifty Defence advanced the most, while the NSE Nifty Auto declined the most.

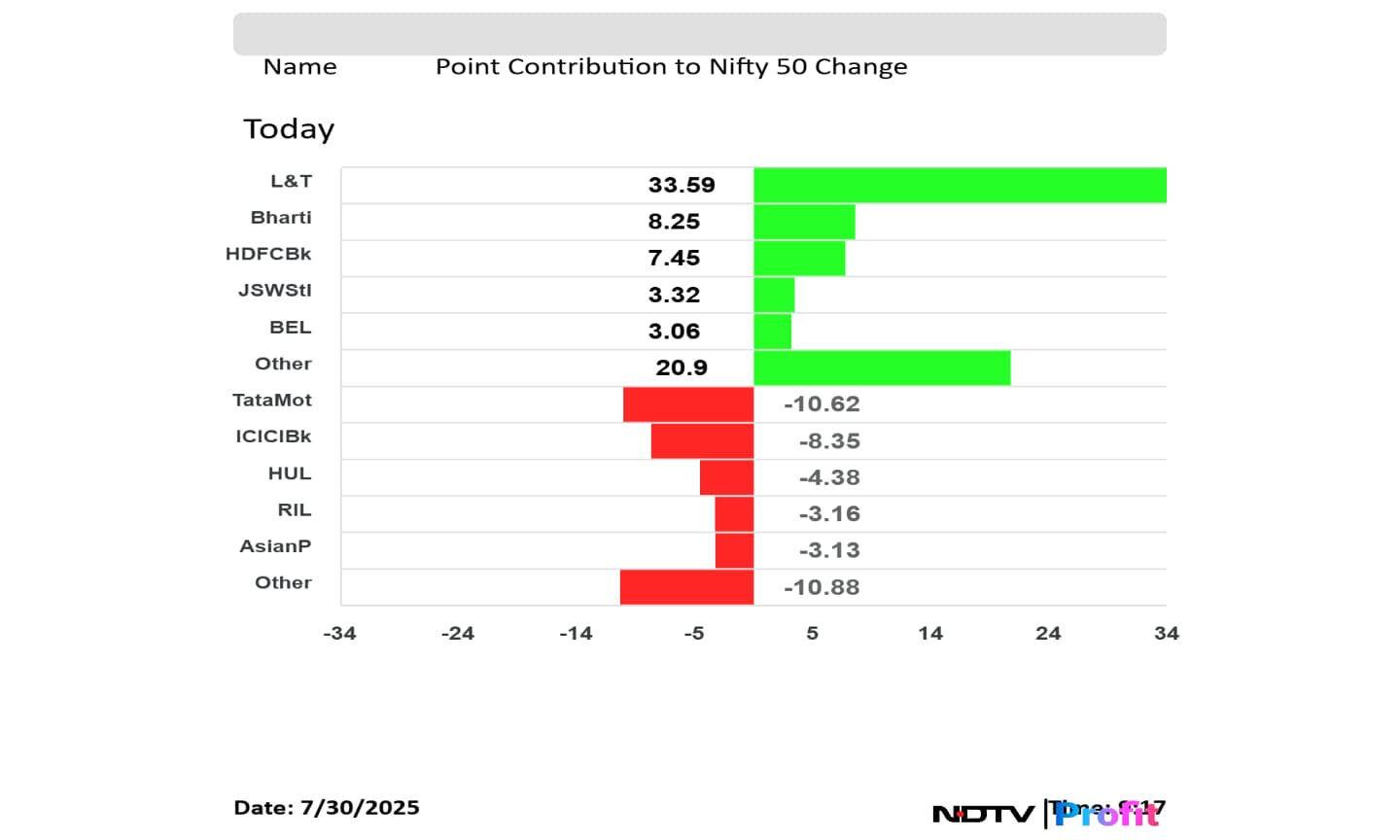

Larsen & Toubro Ltd., Bharti Airtel Ltd., HDFC Bank Ltd., JSW Steel Ltd., and Bharat Electronics Ltd. added to the NSE Nifty 50 index.

Tata Motors Ltd., ICICI Bank Ltd., Hindustan Unilever Ltd., Reliance Industries Ltd., and Asian Paints Ltd. weighed on the Nifty 50 index.

Larsen & Toubro Ltd., Bharti Airtel Ltd., HDFC Bank Ltd., JSW Steel Ltd., and Bharat Electronics Ltd. added to the NSE Nifty 50 index.

Tata Motors Ltd., ICICI Bank Ltd., Hindustan Unilever Ltd., Reliance Industries Ltd., and Asian Paints Ltd. weighed on the Nifty 50 index.

The NSE Nifty 50 and BSE Sensex opened higher on Wednesday as the Larsen & Toubro Ltd. and Bharti Airtel Ltd. shares led. Both the Nifty 50 and Sensex were trading 0.03% higher, respectively as of 9:26 a.m.

The NSE Nifty 50 and BSE Sensex opened higher on Wednesday as the Larsen & Toubro Ltd. and Bharti Airtel Ltd. shares led. Both the Nifty 50 and Sensex were trading 0.03% higher, respectively as of 9:26 a.m.

Ather Energy Ltd., has received a 'buy' rating from HSBC and Nomura, as the brokerages initiated coverage on the stock. HSBC has initiated coverage with a target price of Rs 450, and Nomura initiated with a target price of Rs 458.

HSBC highlighted Ather Energy as a good company in a tough industry. "Ather’s product quality, technology leadership and distribution expansion should drive its market share in a tough market," it added.

The 10-year bond yield opened flat at 6.35%

Source: Bloomberg

At pre-open, the NSE Nifty 50 was trading 0.28% higher at 24,890.40, and the BSE Sensex was trading 0.30% higher at 81,585.91.

Rupee opened 18 paise weaker at 87.00 against US Dollar

It is the lowest level since March 13

It closed at 86.82 a dollar on Tuesday

Source: Cogencis

Aditya Infotech Ltd.'s initial public offering will enter its second day of bidding on Wednesday. The IPO was fully subscribed at 2.05 times on the first day of bidding on Tuesday, led by demand from retail and non-institutional investors.

The Rs 1,300-crore IPO comprises a fresh issue of equity shares worth Rs 500 crore and an offer-for-sale of shares valued at Rs 800 crore. The bidding for the IPO will close on July 31. The bidding range is Rs 640 to Rs 675 per share.

Track live update on IPO here.

Analysts maintained their positive view on Varun Beverages Ltd., as they believed the company has a strong potential for good growth. Goldman Sachs raised the target price, while CLSA reduced the target price.

Goldman Sachs raised the target price to Rs 610 from Rs 590. The target price implied a 19% upside from Tuesday's close. The brokerage maintained the buy rating.

CLSA maintained a high-conviction outperform rating on Varun Beverages, while it reduced the target price to Rs 774 from Rs 786 apiece, which implied a 51% upside from Tuesday's close price.

The initial public offering (IPO) of Shanti Gold International Ltd. witnessed strong demand across investor categories during the three-day subscription period from July 25 to July 29. The mainboard IPO was booked 81.17 times on Tuesday. The allotment process for the Shanti Gold International is expected to be finalised today, on Wednesday, July 30.

At least 115 companies are set to announce their Q1FY26 results on July 30. The results will cover their financial performance for the April to June quarter.

Major companies scheduled to declare their Q1 results on Wednesday include Hyundai Motor India, InterGlobe Aviation (parent company of Indigo Airlines), Tata Steel, Kaynes Technology and Punjab National Bank, among others.

Oil prices continued to gain on optimism that there is potential of truce between Russia and Ukraine as US President Donald Trump warned of secondary sanction on Russia.

The October future contract of brent crude was trading 0.13% higher at $71.76 a barrel as of 7:42 a.m.

The S&P ASX 200 rose after the inflation fell to the lowest point since March 2021. It was at 2.1% compared to 2.4% in the corresponding period of the previous year.

The S&P ASX 200 was trading 0.48% higher at 8,746.10 as of 7:24 a.m.

In Asia session, most futures of the US indices were trading with slight gains as market participants braced themselves for the outcome of the Federal Reserve policy meeting. The central bank may hold rate steady.

The S&P 500 and Nasdaq 100 futures were trading 0.04% and 0.11% higher, respectively.

The GIFT Nifty was trading 0.01% or 1.50 points lower at 24,819.00 as of 6:34 a.m., which implied a flat-to-negative open.

Larsen And Toubro Ltd., NTPC Ltd., Lloyds Engineering, and Piramal Enterprises Ltd. shares are in focus because of first-quarter earnings.

India's benchmark equity indices snapped a three-session decline to close higher on Tuesday as investors bought into large-cap heavyweights Reliance Industries Ltd. and HDFC Bank Ltd. Realty and pharmaceutical stocks also surged.

The NSE Nifty 50 settled 140 points or 0.57% higher at 24,821.1 and The BSE Sensex added 447 points or 0.55% to close at 81,337.8.

Comprehensive Budget 2026 coverage, LIVE TV analysis, Stock Market and Industry reactions, Income Tax changes and Latest News on NDTV Profit.