Benchmark Indices outperformed broader market Indices.

Nifty gained higher led by Financials and Auto

Tata Motors and Shriram Finance are the top gainers in Nifty.

Nifty small cap 250 gained higher for the 4th day in a row led by TV18 Broadcast and Elgi Equipment

MRPL and Gland Pharma are the top gainers in Nifty Midcap 150.

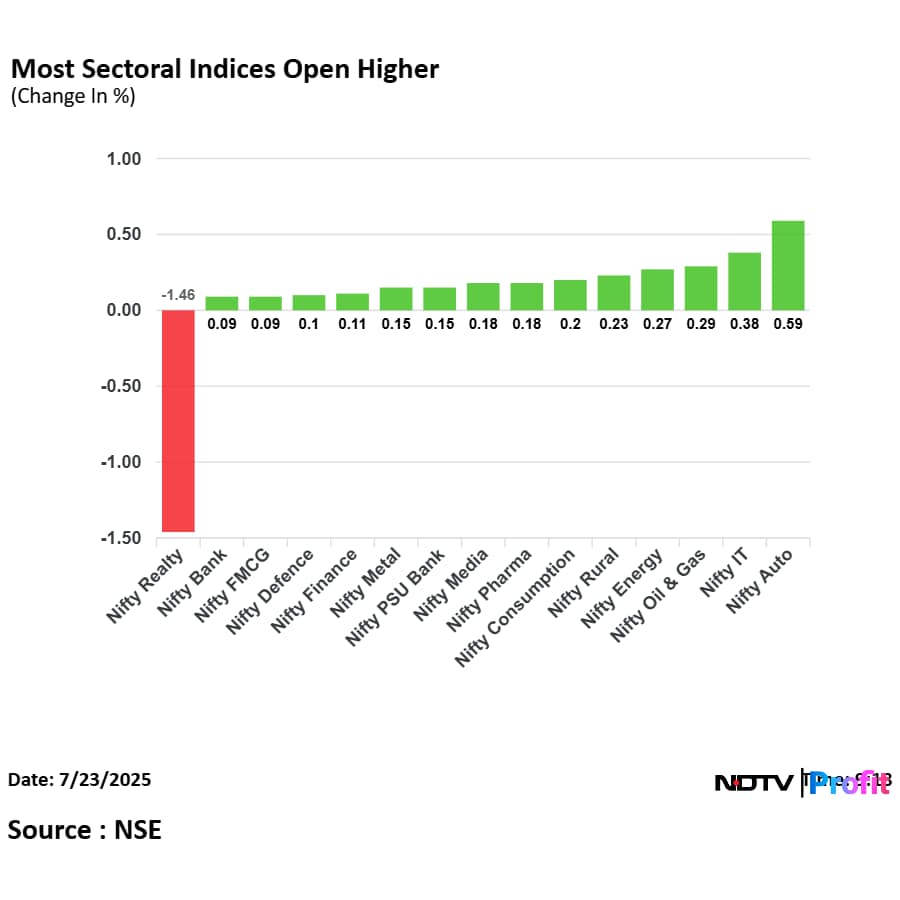

Nifty Auto emerge as top gaining sector for the day, led by Tata Motors and Apollo Tyres.

Nifty Realty fell more than 2% for the day, emerging as top losing sector for the day.

Brigade Enterprises and Oberoi Realty are the top losers in Nifty Realty.

Nifty Financial Services gained higher for the 3rd day in a row.

Nifty oil and Gas snaps 4-day losing streak.

Nifty Pharma snaps 3-day losing streak.

Nifty PSU Bank snaps 4-day losing streak.

Nifty IT snaps 2-day losing streak.

Nifty FMCG fell for the 4-day in a row.

Nifty Media, Realty fell for the 2nd consecutive day.

Benchmark Indices outperformed broader market Indices.

Nifty gained higher led by Financials and Auto

Tata Motors and Shriram Finance are the top gainers in Nifty.

Nifty small cap 250 gained higher for the 4th day in a row led by TV18 Broadcast and Elgi Equipment

MRPL and Gland Pharma are the top gainers in Nifty Midcap 150.

Nifty Auto emerge as top gaining sector for the day, led by Tata Motors and Apollo Tyres.

Nifty Realty fell more than 2% for the day, emerging as top losing sector for the day.

Brigade Enterprises and Oberoi Realty are the top losers in Nifty Realty.

Nifty Financial Services gained higher for the 3rd day in a row.

Nifty oil and Gas snaps 4-day losing streak.

Nifty Pharma snaps 3-day losing streak.

Nifty PSU Bank snaps 4-day losing streak.

Nifty IT snaps 2-day losing streak.

Nifty FMCG fell for the 4-day in a row.

Nifty Media, Realty fell for the 2nd consecutive day.

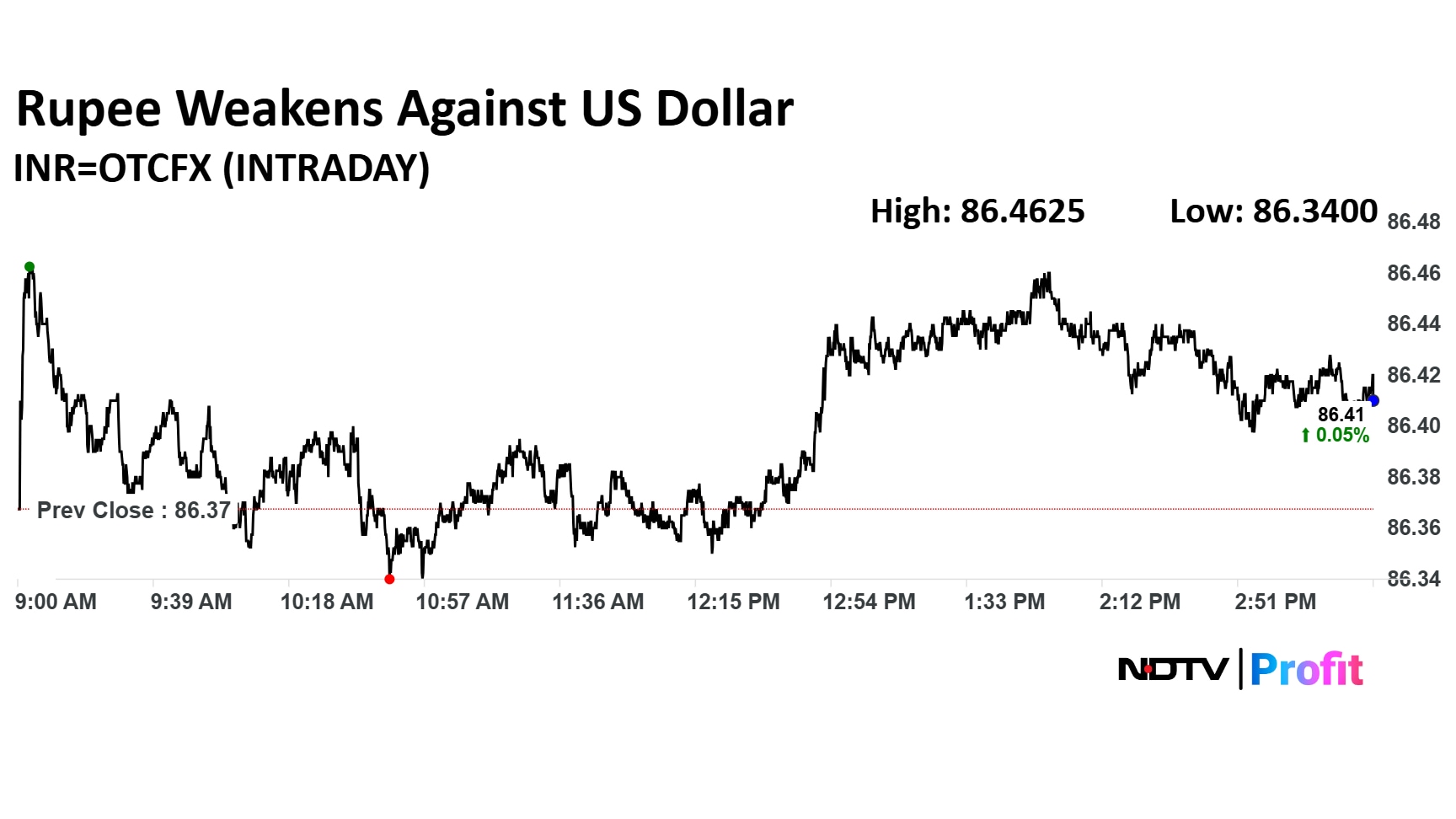

Rupee closed 4 paise weaker against US Dollar at 86.41

It closed at 86.37 a dollar on Tuesday.

Source: Cogencis

Rupee closed 4 paise weaker against US Dollar at 86.41

It closed at 86.37 a dollar on Tuesday.

Source: Cogencis

Aurum PropTech has approved the 100% acquisition of PropTiger through an equity swap with REA India. As part of the deal, REA India will receive 42 lakh shares of Aurum via preferential allotment.

Syngene International Q1FY26 (Consolidated, YoY)

Revenue up 10.7% at Rs 875 crore versus Rs 790 crore

Ebitda up 21.6% at Rs 206 crore versus Rs 170 crore

Margin at 23.6% versus 21.5%

Net profit up 14.5% at Rs 86.7 crore versus Rs 75.7 crore

Syngene International Q1FY26 (Consolidated, YoY)

Revenue up 10.7% at Rs 875 crore versus Rs 790 crore

Ebitda up 21.6% at Rs 206 crore versus Rs 170 crore

Margin at 23.6% versus 21.5%

Net profit up 14.5% at Rs 86.7 crore versus Rs 75.7 crore

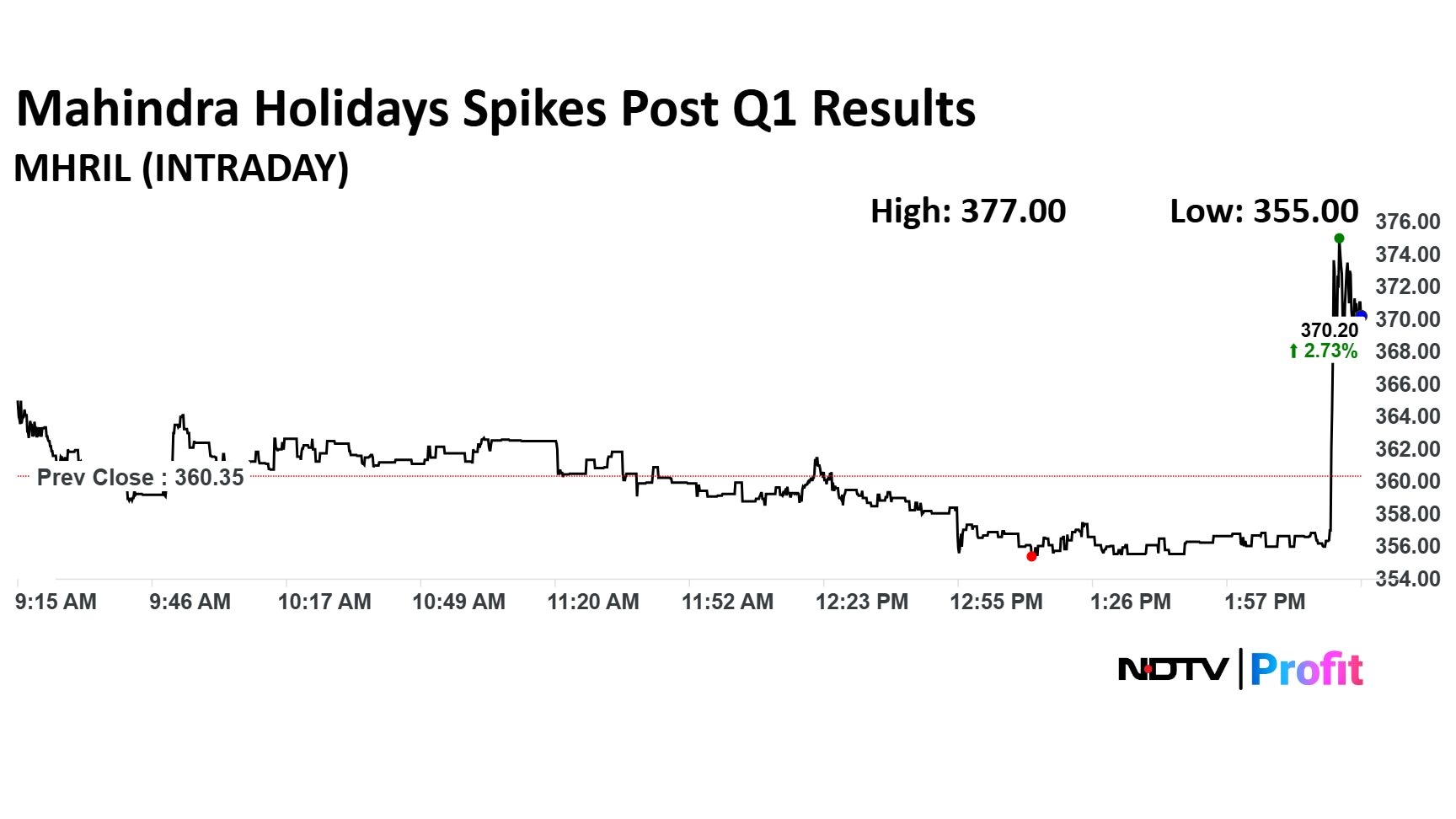

Mahindra Holidays Q1FY26 (Consolidated, YoY)

Revenue up 7.4% at Rs 701 crore versus Rs 653 crore

Ebitda up 16.2% at Rs 122 crore versus Rs 105 crore

Margin at 17.5% versus 16%

Net profit down 33.6% at Rs 8 crore versus Rs 6 crore

Mahindra Holidays Q1FY26 (Consolidated, YoY)

Revenue up 7.4% at Rs 701 crore versus Rs 653 crore

Ebitda up 16.2% at Rs 122 crore versus Rs 105 crore

Margin at 17.5% versus 16%

Net profit down 33.6% at Rs 8 crore versus Rs 6 crore

Tata Capital Ltd. is seeking a valuation of $18 billion to $20 billion in its planned initial public offering and could file an updated draft red herring prospectus as soon as this week, people familiar with the matter said.

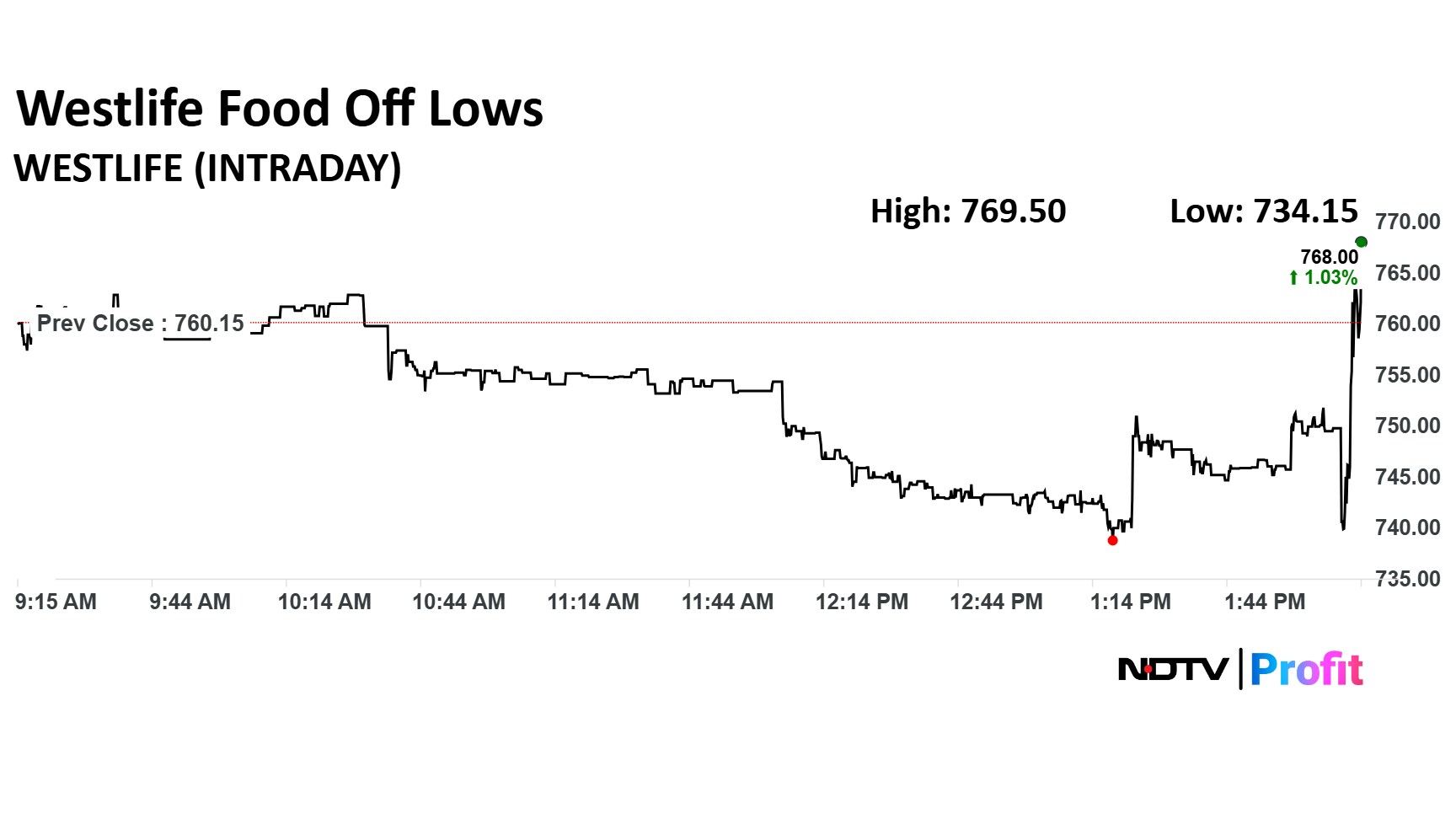

Westlife Foodworld Q1FY26 Highlights (Consolidated, YoY)

Revenue up 6.7% at Rs 658 crore versus Rs 616 crore

Ebitda up 8.5% at Rs 85.3 crore versus Rs 78.6 crore

Margin at 13% Vs 12.8%

Net profit down 62.5% at Rs 1.2 crore versus Rs 3.3 crore

Catch live updates on Q1 earnings here.

Westlife Foodworld Q1FY26 Highlights (Consolidated, YoY)

Revenue up 6.7% at Rs 658 crore versus Rs 616 crore

Ebitda up 8.5% at Rs 85.3 crore versus Rs 78.6 crore

Margin at 13% Vs 12.8%

Net profit down 62.5% at Rs 1.2 crore versus Rs 3.3 crore

Catch live updates on Q1 earnings here.

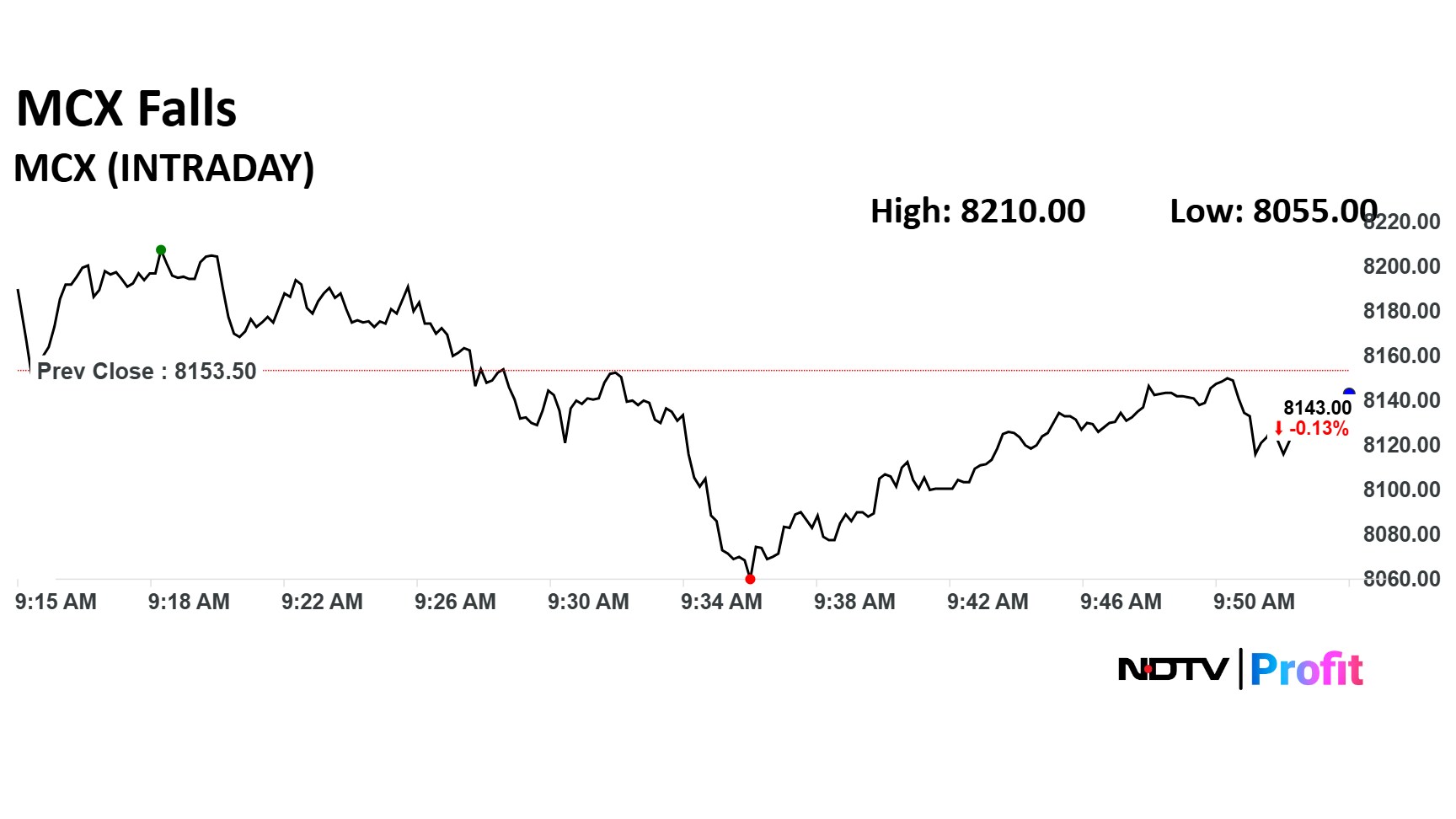

A series of technical glitches at the Multi Commodity Exchange of India (MCX) over the past few months led to a trading halt that affected its trading members and raised concerns about operational preparedness at one of India’s key commodity bourses.

Trading was halted on MCX this morning due to technical glitches but was restored around 10:15 am.

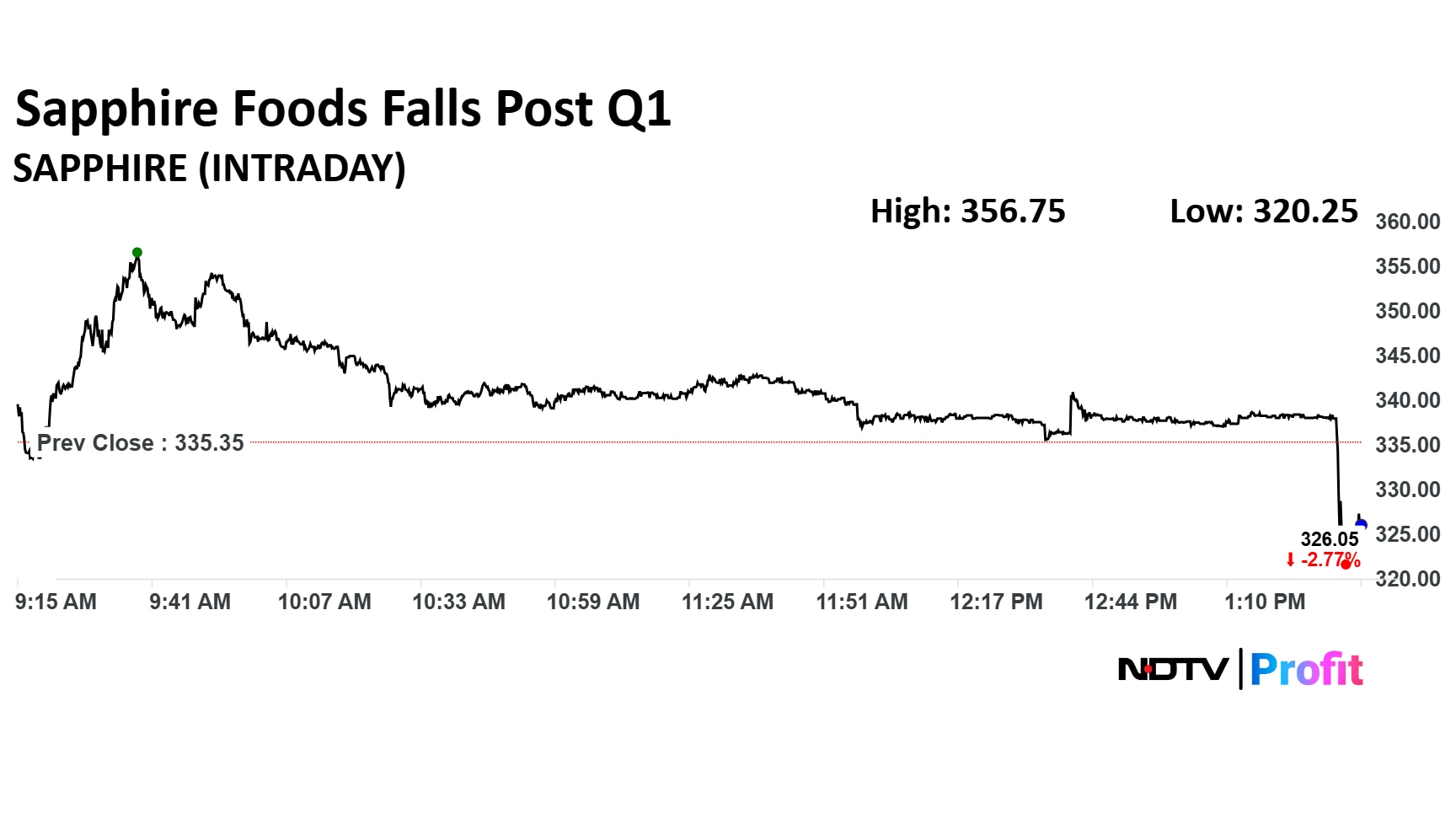

Sapphire Foods Q1FY26 (Consolidated, YoY)

Revenue up 8.3% at Rs 777 crore versus Rs 718 crore

Ebitda down 9% at Rs 113 crore versus Rs 124

Margin at 14.5% versus 17.3%

Net loss of Rs 1.8 crore versus profit of Rs 8.5 crore

Sapphire Foods Q1FY26 (Consolidated, YoY)

Revenue up 8.3% at Rs 777 crore versus Rs 718 crore

Ebitda down 9% at Rs 113 crore versus Rs 124

Margin at 14.5% versus 17.3%

Net loss of Rs 1.8 crore versus profit of Rs 8.5 crore

Surya Roshni gets orders worth Rs 175 crore order form construction and infrastructure development company to supply pipes, the exchange filing said.

Kernex Microsystems received order worth Rs 21 crore from Southern Railways, the exchange filing said.

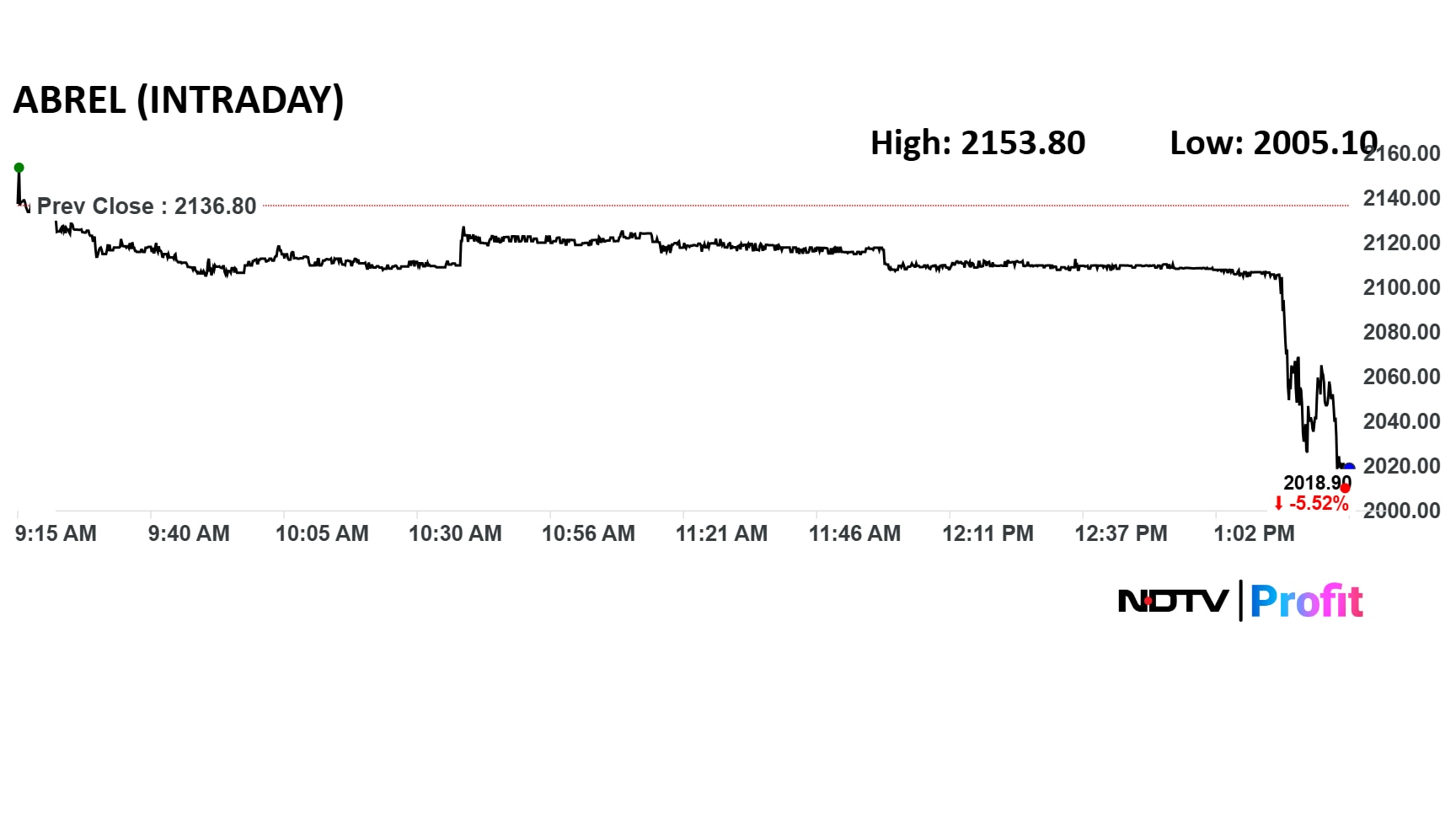

Aditya Birla Real Estate Q1FY26 (Consolidated, YoY)

Revenue down 58.8% at Rs 146 crore versus Rs 353 crore

Ebitda loss of Rs 39.9 crore versus Ebitda of Rs 45.5 crore

Net loss of Rs 25.5 crore versus profit of Rs 7.8 crore

Aditya Birla Real Estate Q1FY26 (Consolidated, YoY)

Revenue down 58.8% at Rs 146 crore versus Rs 353 crore

Ebitda loss of Rs 39.9 crore versus Ebitda of Rs 45.5 crore

Net loss of Rs 25.5 crore versus profit of Rs 7.8 crore

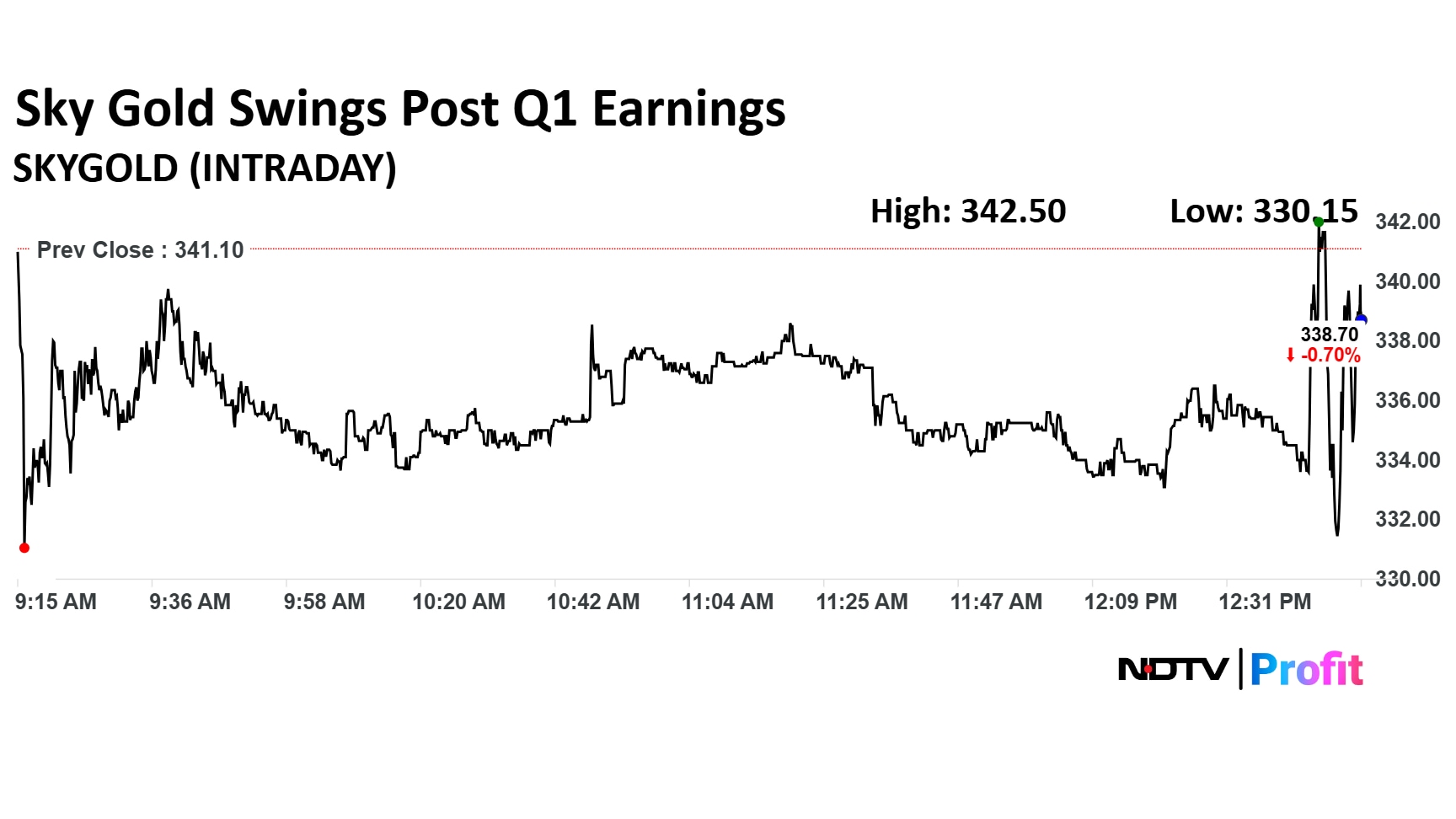

Sky Gold And Diamond Ltd. reported that its net profit surged 107% on-the year to Rs 43.6 crore during April–June.

Sky Gold And Diamond Ltd. reported that its net profit surged 107% on-the year to Rs 43.6 crore during April–June.

BCL Industries has received a letter of acceptance to supply extra neutral alcohol from its Punjab distillery for a period of six months.

Global Health has commenced operations at its Ranchi hospital with a capacity of 110 beds.

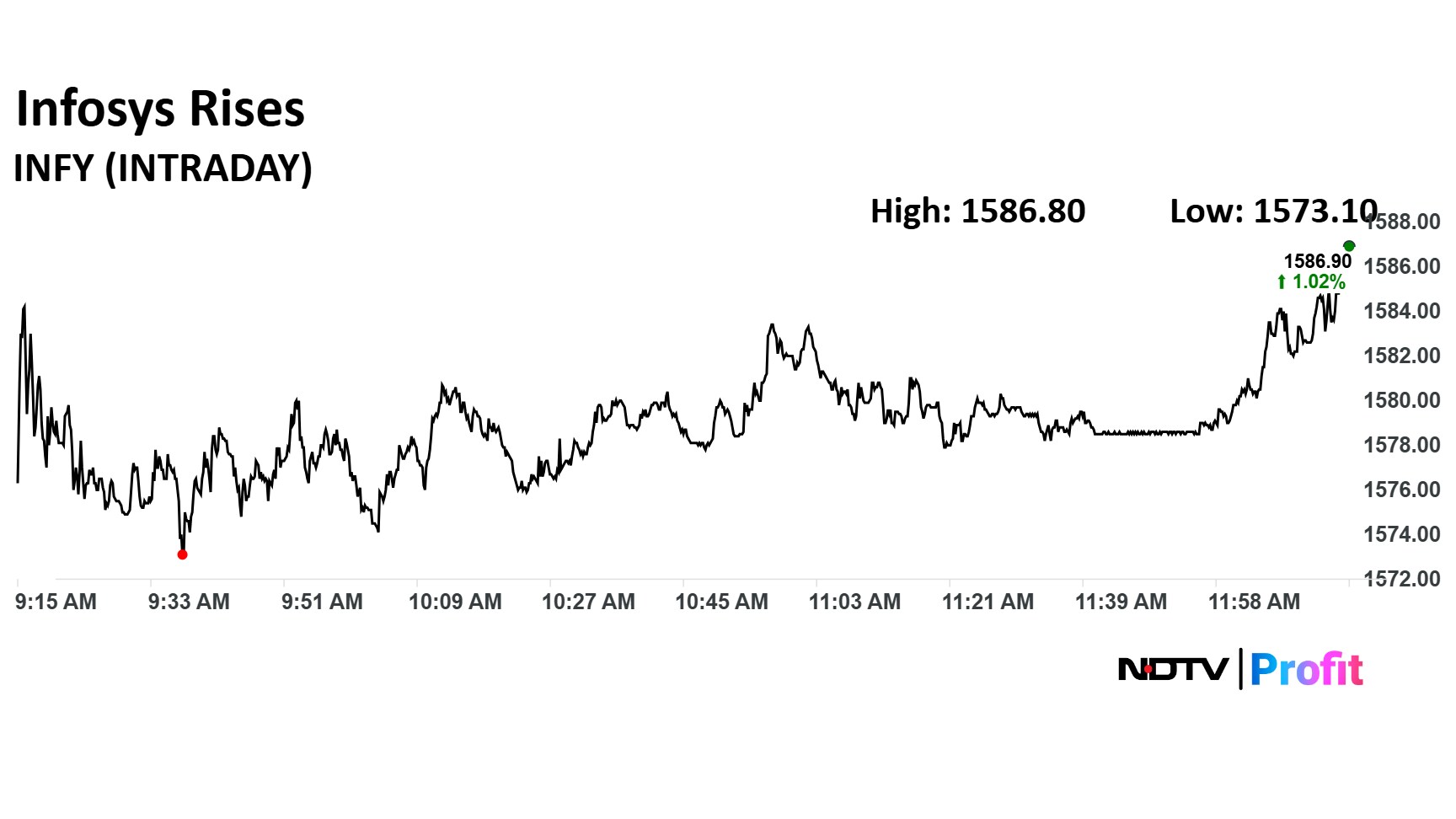

Infosys Ltd. share price was trading with marginal gains in Wednesday's session ahead of its first quarter-earnings. The Bengaluru-based technology giant is expected to modest topline and Ebitda growth. However, the forward guidance will likely be in focus.

Catch live updates on Infosys Q1 earnings here.

Infosys Ltd. share price was trading with marginal gains in Wednesday's session ahead of its first quarter-earnings. The Bengaluru-based technology giant is expected to modest topline and Ebitda growth. However, the forward guidance will likely be in focus.

Catch live updates on Infosys Q1 earnings here.

Indian Railway Finance Corporation sanctioned Rs 25,000 crore in loans with more in the pipeline, disbursed Rs 3,000 crore in Q1 FY26, and aims to sanction Rs 60,000 crore and disburse Rs 30,000 crore worth of loans in FY26.

MCX trading commenced at 10:15 AM today due to a delay in completing technical processes and file sharing. The company regretted the inconvenience caused.

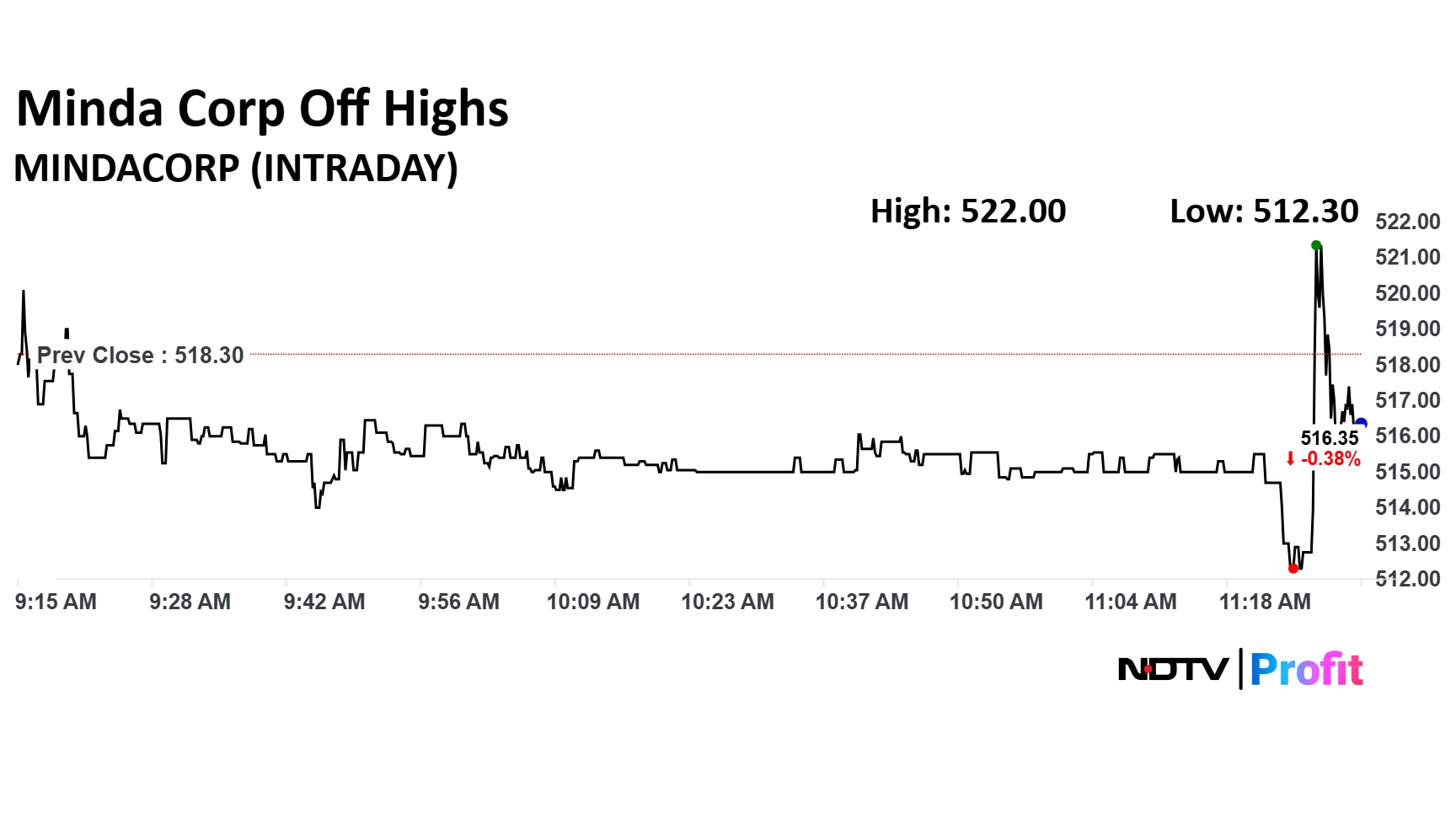

Minda Corporation has entered into a strategic partnership with Qualcomm Technologies to co-develop smart cockpit solutions for next-generation vehicles. The cockpit platform will be powered by Qualcomm’s Snapdragon technology to enhance in-vehicle user experience and connectivity.

Minda Corporation has entered into a strategic partnership with Qualcomm Technologies to co-develop smart cockpit solutions for next-generation vehicles. The cockpit platform will be powered by Qualcomm’s Snapdragon technology to enhance in-vehicle user experience and connectivity.

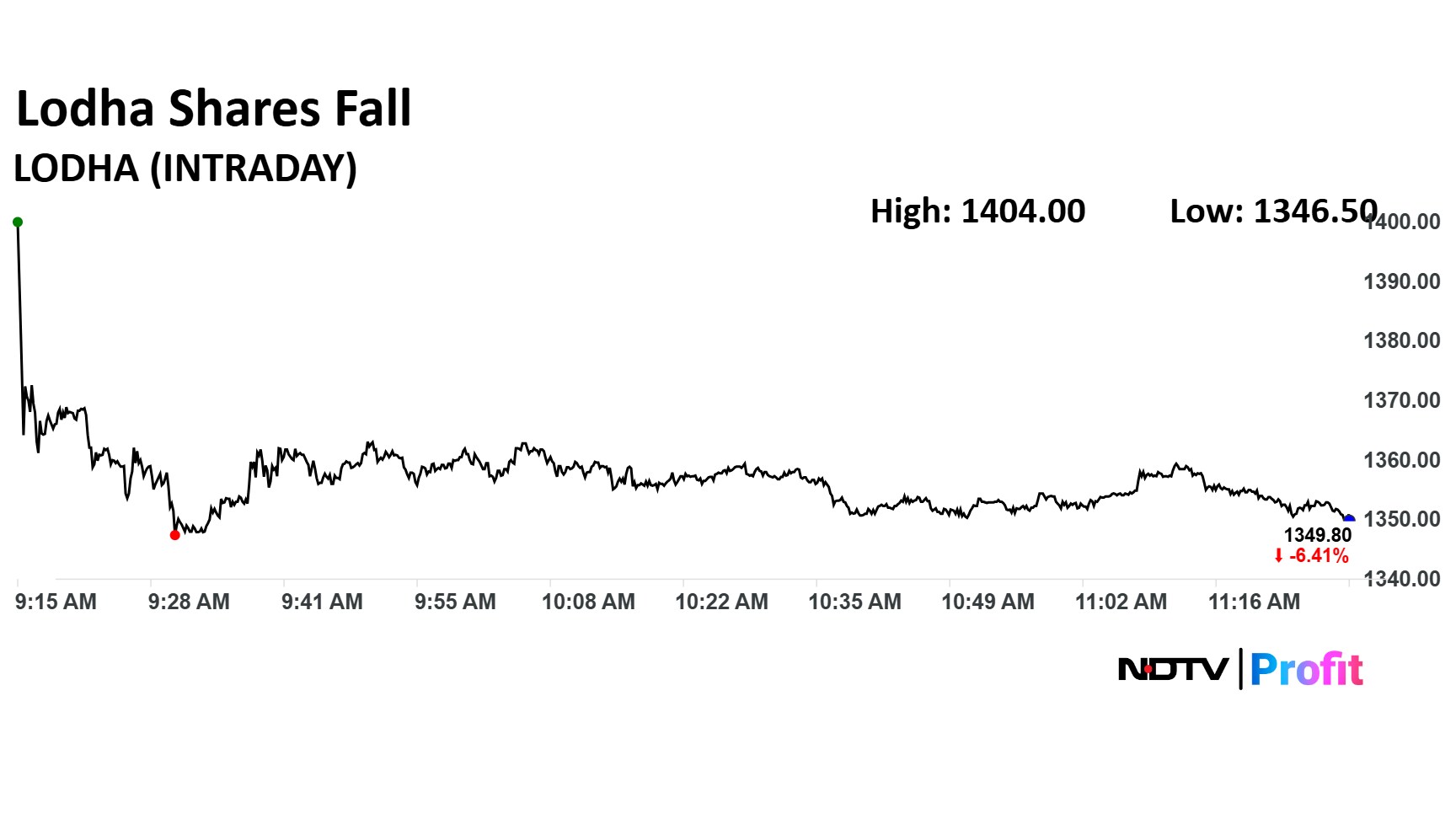

Shares of Macrotech Developers Ltd., better known as Lodha Developers, fell sharply on Wednesday after a major block deal saw nearly 1% of the company’s equity change hands at a discount to the previous closing price. The stock dropped 6.64% intraday, reflecting investor reaction to the sudden influx of supply in the market.

Shares of Macrotech Developers Ltd., better known as Lodha Developers, fell sharply on Wednesday after a major block deal saw nearly 1% of the company’s equity change hands at a discount to the previous closing price. The stock dropped 6.64% intraday, reflecting investor reaction to the sudden influx of supply in the market.

Fortis Healthcare has entered into an agreement with Gleneagles Healthcare, a subsidiary of the parent entity of its promoter, for operations and maintenance services at five hospitals in India.

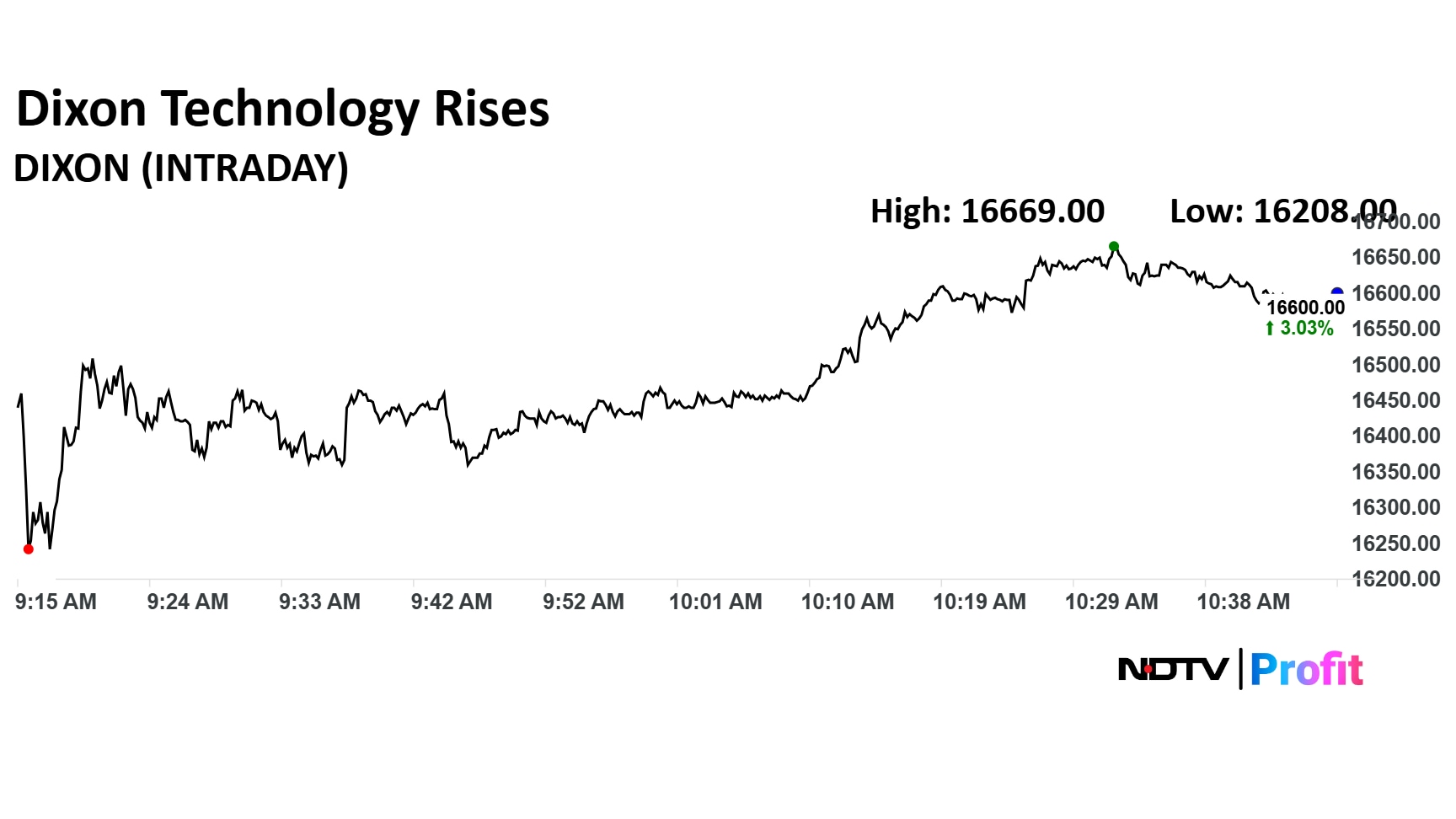

Shares of Dixon Technologies Ltd had a strong gap-up opening on Wednesday with gains of up to 3%.

Shares of Dixon Technologies Ltd had a strong gap-up opening on Wednesday with gains of up to 3%.

Shares of Hero MotoCorp, Radico Khaitan Ltd., UTI Asset Management Co., Hatsun Agro Products Ltd. and 13 other companies will be of interest on Wednesday as it marks the last session for investors to buy shares to qualify for receiving the dividend before the stock goes ex/record-date.

Find out more here.

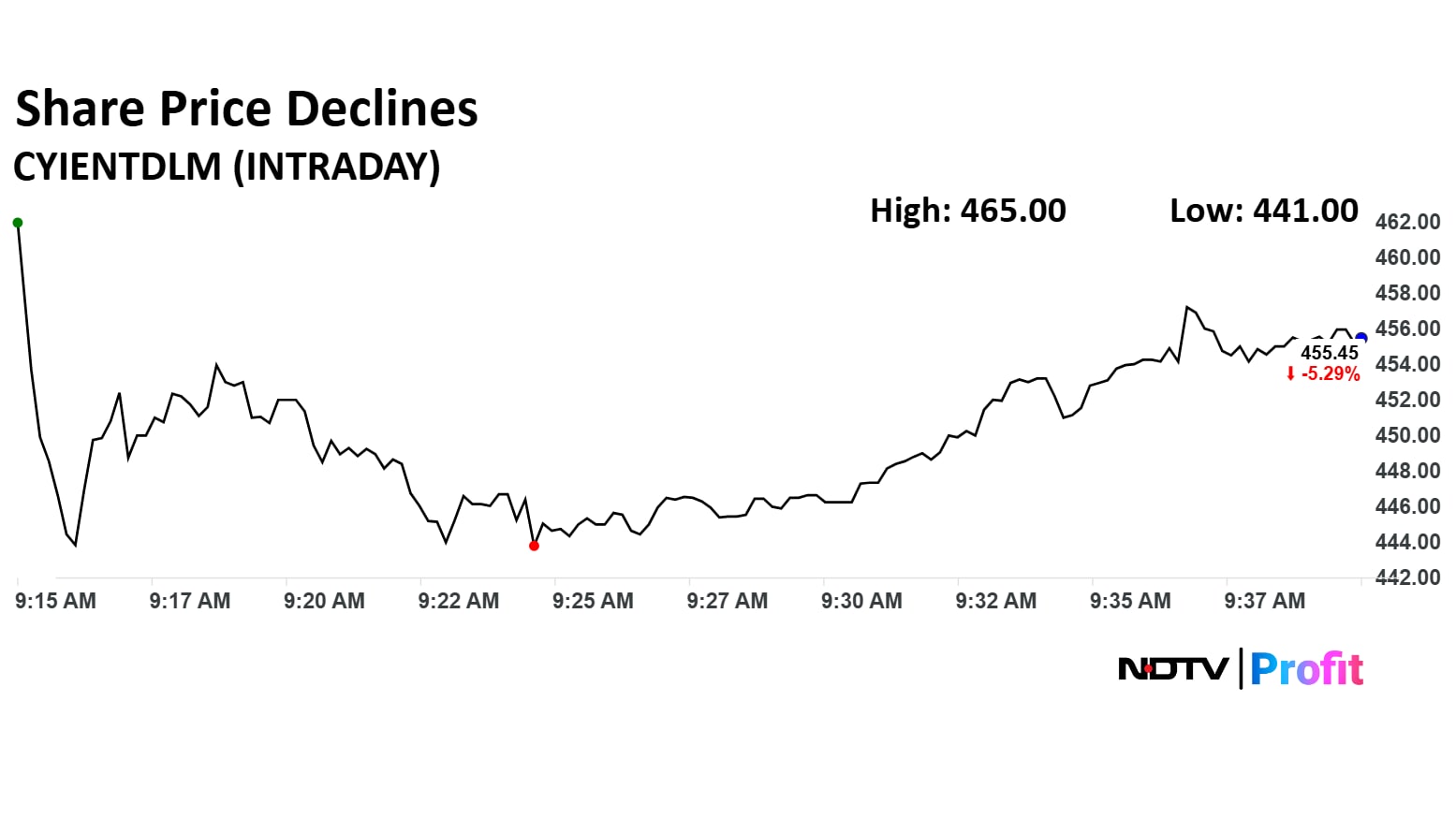

Shares of Cyient DLM Ltd. tumbled more than 8% on Wednesday, a day after the company reported a sharp drop in its quarterly net profit.

Shares of Cyient DLM Ltd. tumbled more than 8% on Wednesday, a day after the company reported a sharp drop in its quarterly net profit.

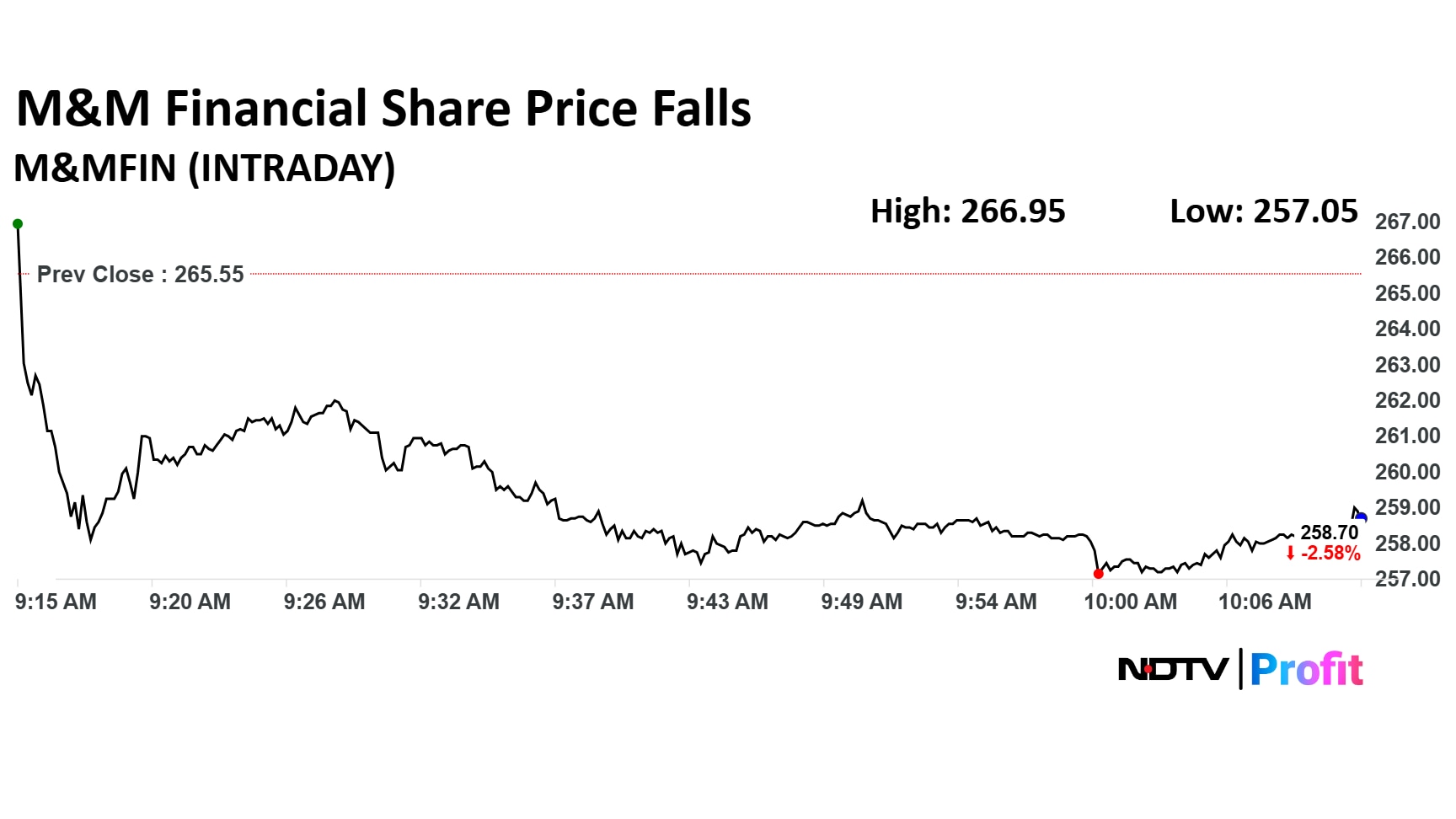

Shares of M&M Financial Services trade with cuts of more than 1.5% at Rs. 260 after the non-banking financial company reported its first quarter earnings for the financial year ending March 2025 on Tuesday.

Over a 12-month period, shares of M&M Financial have given a negative return of 9.3%.

Shares of M&M Financial Services trade with cuts of more than 1.5% at Rs. 260 after the non-banking financial company reported its first quarter earnings for the financial year ending March 2025 on Tuesday.

Over a 12-month period, shares of M&M Financial have given a negative return of 9.3%.

Public sector lender Canara Bank is set to announce its financial results for the quarter ended June 30, 2025, this week. Last month, the state-owned bank informed the stock exchanges about its scheduled Board meeting to consider and approve the financial results for the first quarter of the current financial year (Q1FY26).

Chembond Chemicals listed at Rs 164 apiece on BSE. It listed at Rs 170 on National Stock Exchange Ltd.

Multi Commodity Exchange of India has declined for second day in a row Wednesday while it deals with glitches in its trade platform.

Multi Commodity Exchange share price declined 1.21% to Rs 8,055.00, the lowest level since July 11.

Multi Commodity Exchange of India has declined for second day in a row Wednesday while it deals with glitches in its trade platform.

Multi Commodity Exchange share price declined 1.21% to Rs 8,055.00, the lowest level since July 11.

The Phoenix Mills has categorically denied rumors regarding the acquisition of McLeod Russel by the Ruia family. The company has refuted and rejected these claims as baseless in its exchange filing.

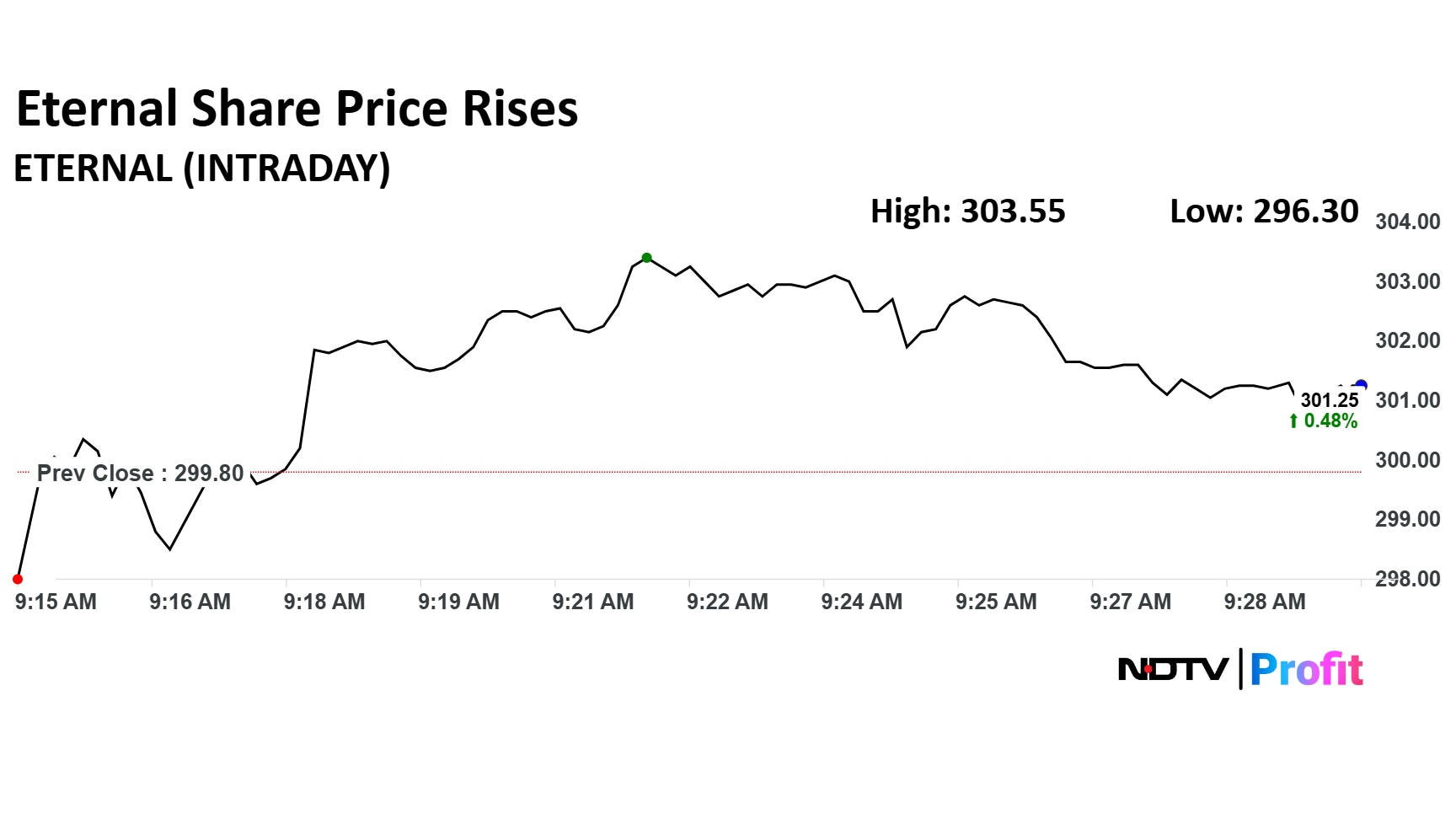

Zomato's parent Eternal Ltd. share priced extended rally to a third day after posting better-than-expected rise in revenues. The share price rose 1.25% to Rs 303.55 apiece so far today. It was trading 0.87% higher at Rs 302.4 apiece as of 9:32 a.m.

Zomato's parent Eternal Ltd. share priced extended rally to a third day after posting better-than-expected rise in revenues. The share price rose 1.25% to Rs 303.55 apiece so far today. It was trading 0.87% higher at Rs 302.4 apiece as of 9:32 a.m.

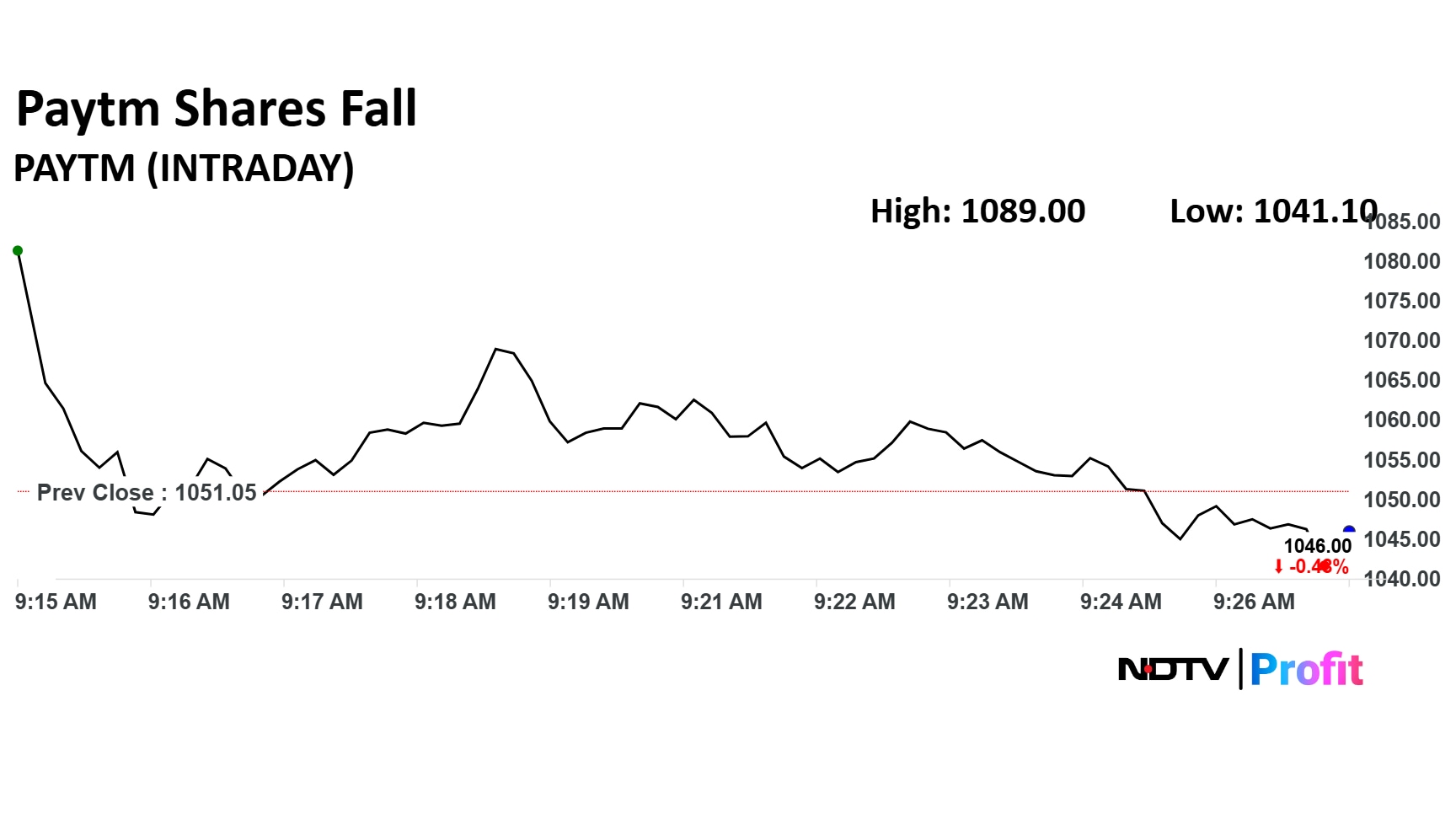

Shares of One97 Communications Ltd., the parent company of Paytm, swinged on Wednesday after the fintech firm reported its first quarterly net profit since going public in 2021.

Shares of One97 Communications Ltd., the parent company of Paytm, swinged on Wednesday after the fintech firm reported its first quarterly net profit since going public in 2021.

On NSE, 14 sectoral indices advanced, and one declined out of 15. The NSE Nifty Auto outperformed, and the NSE Nifty Realty declined the most.

On NSE, 14 sectoral indices advanced, and one declined out of 15. The NSE Nifty Auto outperformed, and the NSE Nifty Realty declined the most.

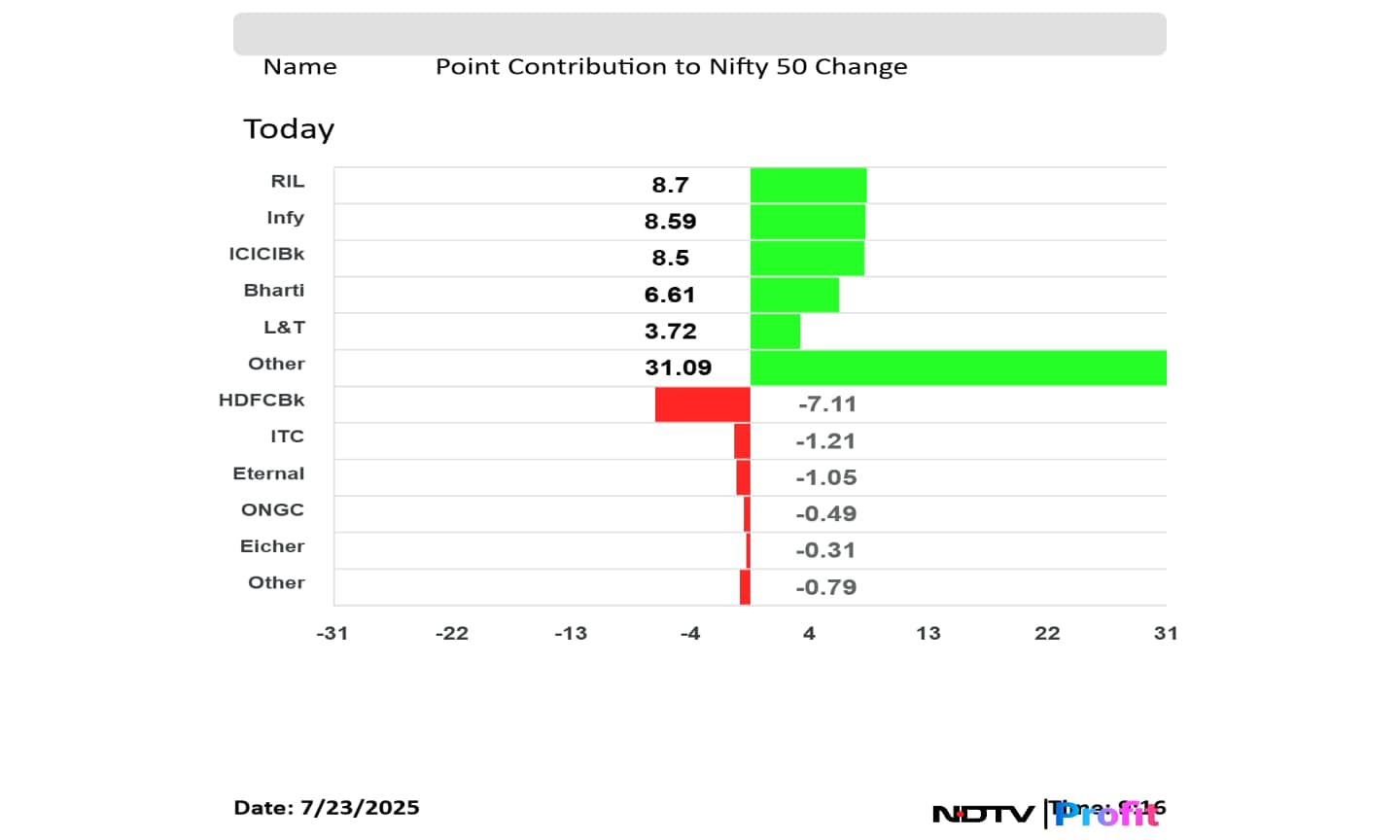

Reliance Industries Ltd., Infosys Ltd., ICICI Bank Ltd., Bharti Airtel Ltd., and Larsen & Toubro Ltd. added to the Nifty 50 index.

HDFC Bank Ltd., ITC Ltd., Eternal Ltd., Oil and Natural Gas Corp, and Eicher Motors Ltd. limited losses in the Nifty 50 index.

Reliance Industries Ltd., Infosys Ltd., ICICI Bank Ltd., Bharti Airtel Ltd., and Larsen & Toubro Ltd. added to the Nifty 50 index.

HDFC Bank Ltd., ITC Ltd., Eternal Ltd., Oil and Natural Gas Corp, and Eicher Motors Ltd. limited losses in the Nifty 50 index.

The Nifty 50 and Sensex opened higher on Wednesday as heavyweight Reliance Industries and Infosys advanced. Gains on global equities also supported Indian benchmark indices.

The Nifty 50 and Sensex opened higher on Wednesday as heavyweight Reliance Industries and Infosys advanced. Gains on global equities also supported Indian benchmark indices.

At pre-open, the NSE Nifty 50 was trading 0.32% higher at 25,139.35, and the BSE Sensex was trading 0.31% higher at 82,441.55.

The 10-year bond yield opened flat at 6.36%

Source: Cogencis

Rupee opened 4 paise weaker against US Dollar at 86.41

It closed at 86.37 a dollar on Tuesday.

Source: Cogencis

Biocon Biologics, a subsidiary of Biocon, has launched Nepexto, a biosimilar to Enbrel, in Australia. Nepexto is indicated for the treatment of autoimmune conditions like rheumatoid arthritis and psoriatic arthritis.

Maintain Outperform with a target price of Rs 1,100

Q1 a positive net profit line - an important milestone for the business

Profitability was achieved despite revenue staying almost unchanged QoQ

There were no one-offs driving the profitability this quarter

Believe the business will remain profitable in the quarters ahead

Sustainability of current levels of PAT will depend on sequential revenue growth

Maintain Neutral; Hike with a target price to Rs 1,160 from Rs 1,005

Q1: In-line revenues but profitability beat; Turns PAT positive

Guidance at 50’s range for contribution margin & 15-20% EBITDA margin

Post Q1, raise multiples in SOTP given healthy biz execution

Maintain Buy with a target price of Rs 20,000

Strong Q1; results allay competition fears

Q1 2-4% ahead of our est and 6-7% higher than consensus

Mgmt sounded confident of Mobile vols continuing to ramp-up

With Dixon focussing on components, it is strengthening its competitive positioning and increasing customer stickiness

Forecast EBITDA/PAT CAGRs of 38%/ 41% over FY25-28

Like mgmt's opportunistic approach and focus on increasing value addition without compromising on capital efficiency

Maintain Sell; Hike target price to Rs 11,110 from Rs 11,030

Good ramp-up; remain Sell on valuation and moderation of growth ahead

Value addition is good, whether it drives EMS customer stickiness is yet to be seen

See limited potential for the company to surprise on already optimistic-looking estimates

Oil prices rebounded from a three-day slump on Wednesday after the US announced a trade deal with Japan and Philippines. The brent crude was trading 0.39% higher at $68.86 a barrel as of 7:57 a.m.

Japan's benchmark index the Nikkei 225 jumped nearly 3% as the country sealed a trade deal with the US before the deadline. The Asian country will face now 15% tariff from the US compared to 25% imposed earlier. It will also invest $550 billion in the world's largest economy while opening its automobile, and agricultural sectors.

The Nikkei 225 was trading 2.70% higher at 40,856.50 as of 7:45 a.m.

US stock futures advanced in Asia session after US President Donald Trump announced a trade deal with Japan. As per the terms of the deal, Japan will invest $550 billion in the US.

Both the Dow Jones Industrial Average and S&P 500 Futures were trading 0.22% higher as of 7:39 a.m.

The GIFT Nifty was trading 0.10% or 26 points higher at 25,165 as of 6:55 a.m., which implied a positive start for the NSE Nifty 50 index.

Market participants will likely focus on Bajaj Finance Ltd. One 97 Communication Ltd., Dixon Technologies (India) Ltd., and Zensar Technologies shares will likely be in focus in Wednesday's session because of the overnight news and first earnings.

The benchmark equity indices end the session on a flat note on Tuesday as shares of Reliance Industries Ltd. and Infosys Ltd. weighed. The NSE Nifty 50 ended 29.8 points or 0.12% lower at 25,060.9, while the BSE Sensex closed 13.53 points or 0.02% down at 82,186.81.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.