Coforge Q1FY26 (Consolidated, QoQ)

Revenue up 8.2% to Rs 3,688.60 crore versus Rs 3,409.90 crore (Bloomberg estimate: Rs 3,723 crore).

EBIT rises 4% to Rs 417.80 crore versus Rs 401.60 crore (Estimate: Rs 503 crore).

Margin at 11.3% versus 11.8% (Bloomberg estimate: 13.5%).

Net profit up 22% to Rs 317.40 crore versus Rs 261.20 crore (Bloomberg estimate: Rs 335 crore).

Cigniti Technologies Q1FY26 (Consolidated, QoQ)

Revenue up 0.8% at Rs 534 crore versus Rs 530 crore

Ebit flat at Rs 81.50 crore versus Rs 81.30 crore

Margin flat at 15.3%

Net profit down 10% at Rs 65.90 crore versus Rs 73.20 crore

Oracle Financial Services Q1FY26 (Standalone, YoY)

Revenue up 11.6% at Rs 1,468 crore versus Rs 1,315.2 crore

Net profit up 9.6% at Rs 587.2 crore versus Rs 536 crore

Force Motors Q1FY26 (Consolidated, YoY)

Revenue up 21.9% at Rs 2,297 crore versus Rs 1,885 crore

Ebitda up 33.3% at Rs 332 crore versus Rs 249 crore

Margin at 14.5% versus 13.2%

Net profit up 52.4% at Rs 176 crore versus Rs 116 crore

Bikaji Foods Q1FY26 (Consolidated, YoY)

Revenue up 14.2% at Rs 653 crore versus Rs 572 crore

Ebitda up 5% at Rs 96.2 crore versus Rs 91.6 crore

Margin at 14.7% versus 16%

Net profit up 2.8% at Rs 59.9 crore versus Rs 58.3 crore

Higher R&D spending due to focus on GLP-1 peptide products.

R&D spending for April-June accounts for 7.3% of sales.

Nicotine products portfolio integration completed.

Saw price erosion in Europe markets in April-June.

Nicotine products, new launches helped Europe operations grow in April-June.

Source: Earnings Presser

Tata Consumer Products Q1FY26 Highlights

India business growth enabled by strong growth in tea and salt

Tata Sampann continued its strong momentum

International business constant currency growth at 5%

India packaged beverages business revenue grew 12%

Coffee revenue growth of 67%

India Foods business revenue grew 14%

Value-added salt portfolio grew 31%

Source: Press Release

Tata Consumer Products Q1FY26 (Consolidated, YoY)

Revenue up 9.8% at Rs 4,778.91 crore versus Rs 4,352.07 crore (Bloomberg estimate: Rs 4,813 crore).

Ebitda down 9% at Rs 606.94 crore versus Rs 667.38 crore (Bloomberg estimate: Rs 648 crore).

Margin at 12.7% versus 15.3% (Bloomberg estimate: 13.40%).

Net profit up 15.1% at Rs 334.15 crore versus Rs 290.32 crore (Bloomberg estimate: Rs 355 crore).

Dr Reddy's Laboratories Q1FY26 (Consolidated, YoY)

Revenue up 11.4% at Rs 8,572 crore versus Rs 7,696 crore (Bloomberg estimate: Rs 8,693 crore).

Ebitda up 2% at Rs 2,174 crore versus Rs 2,130 crore (Bloomberg estimate: Rs 2,332 crore).

Margin at 25.4% versus 27.7% (Bloomberg estimate: 26.80%).

Net profit up 1.8% at Rs 1,418 crore versus Rs 1,392 crore (Bloomberg estimate: Rs 1,514 crore).

Persistent Systems Q1FY26 (Consolidated, QoQ)

Revenue up 2.8% at Rs 3,334 crore versus Rs 3,242 crore

Ebit up 2.5% at Rs 518 crore versus Rs 505 crore

Margin at 15.5% versus 15.6%

Net profit up 7.4% at Rs 425 crore versus Rs 396 crore

Thyrocare Technologies Q1FY26 (Consolidated, YoY)

Revenue up 23% at Rs 193 crore versus Rs 157 crore

Ebitda up 35.5% at Rs 57.8 crore versus Rs 42.6 crore

Margin at 29.9% versus 27.2%

Net profit up 61% at Rs 38.9 crore versus Rs 24.2 crore

For all the latest updates on the IT major's June quarter financials, follow our live blog here.

Bajaj Housing Finance Q1FY26 Highlights (YoY)

Total income up 18.6% at Rs 2,618.45 crore versus Rs 2,208.73 crore (Bloomberg Estimate: Rs 1,018 crore).

Net profit up 20.9% at Rs 583.3 crore versus Rs 482.61 crore (Bloomberg Estimate: Rs 568 crore).

Infosys Q1FY26 (Consolidated, QoQ)

Revenue up 3.3% at Rs 42,279 crore versus Rs 40,925 crore

Ebit up 3% at Rs 8,803 crore versus Rs 8,575 crore

Margin at 20.8% versus 21%

Net profit down 2% at Rs 6,921 crore versus Rs 7,033 crore

Shares of the IT major ended 0.76% lower at Rs 1,558.90 apiece on the NSE Nifty 50, ahead of announcing their June quarter results.

Syrma SGS Technology Q1FY26 (Consolidated, YoY)

Revenue down 18.6% at Rs 944 crore versus Rs 1,160 crore

Ebitda up 90.6% at Rs 86.6 crore versus Rs 45.4 crore

Margin at 9.2% versus 3.9%

Net profit up at Rs 49.7 crore versus Rs 19.3 crore

SRF has issued a dividend of Rs 4 per share.

Syngene International Q1FY26 (Consolidated, YoY)

Revenue up 10.7% at Rs 875 crore versus Rs 790 crore

Ebitda up 21.6% at Rs 206 crore versus Rs 170 crore

Margin at 23.6% versus 21.5%

Net profit up 14.5% at Rs 86.7 crore versus Rs 75.7 crore

SRF Q1FY26 (Consolidated, YoY)

Revenue up 10.2% at Rs 3,819 crore versus Rs 3,464 crore

Ebitda up 37.5% at Rs 830 crore versus Rs 603 crore

Margin at 21.7% versus 17.4%

Net profit up 71.4% at Rs 432 crore versus Rs 252 crore

MAS Financial Q1FY26 (Consolidated, YoY)

Net Profit up 19.3% at Rs 85.6 crore versus Rs 71.7 crore

Total Income up 27.7% at Rs 467 crore versus Rs 365 crore

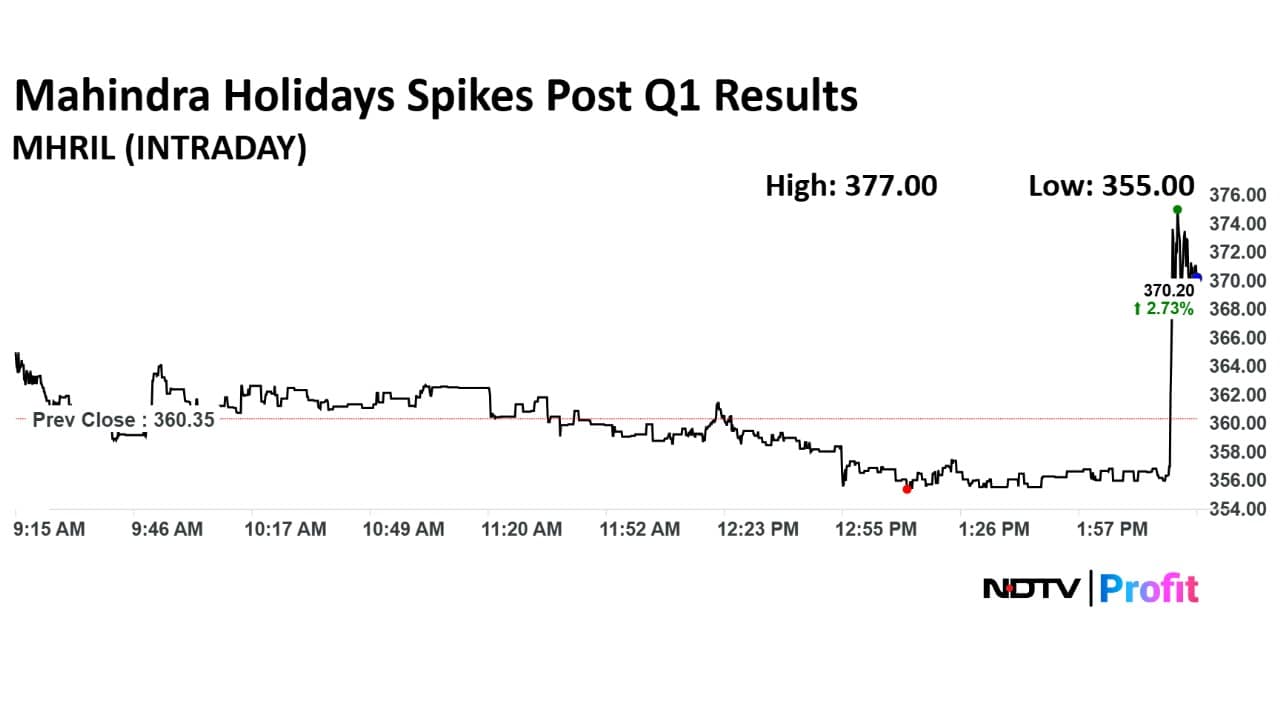

Mahindra Holidays Q1FY26 (Consolidated, YoY)

Revenue up 7.4% at Rs 701 crore versus Rs 653 crore

Ebitda up 16.2% at Rs 122 crore versus Rs 105 crore

Margin at 17.5% versus 16%

Net profit down 33.6% at Rs 8 crore versus Rs 6 crore

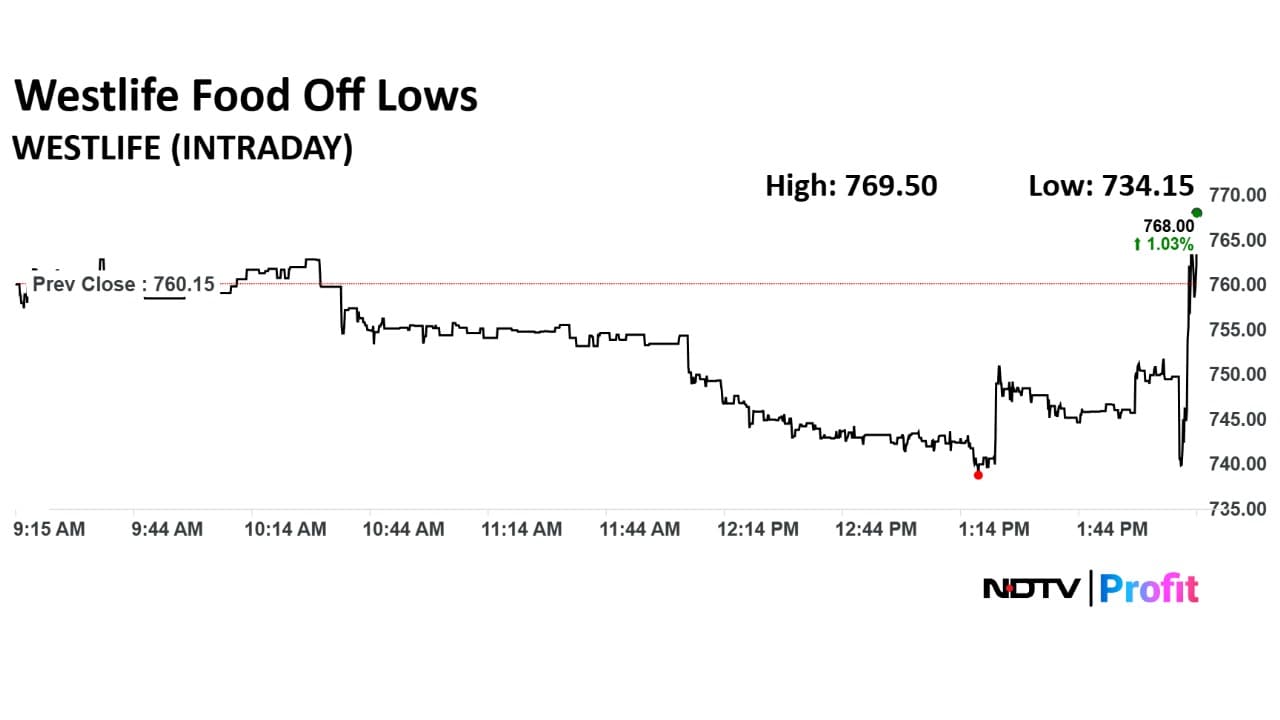

Westlife Foodworld Q1FY26 Highlights (Consolidated, YoY)

Revenue up 6.7% at Rs 658 crore versus Rs 616 crore

Ebitda up 8.5% at Rs 85.3 crore versus Rs 78.6 crore

Margin at 13% Vs 12.8%

Net profit down 62.5% at Rs 1.2 crore versus Rs 3.3 crore

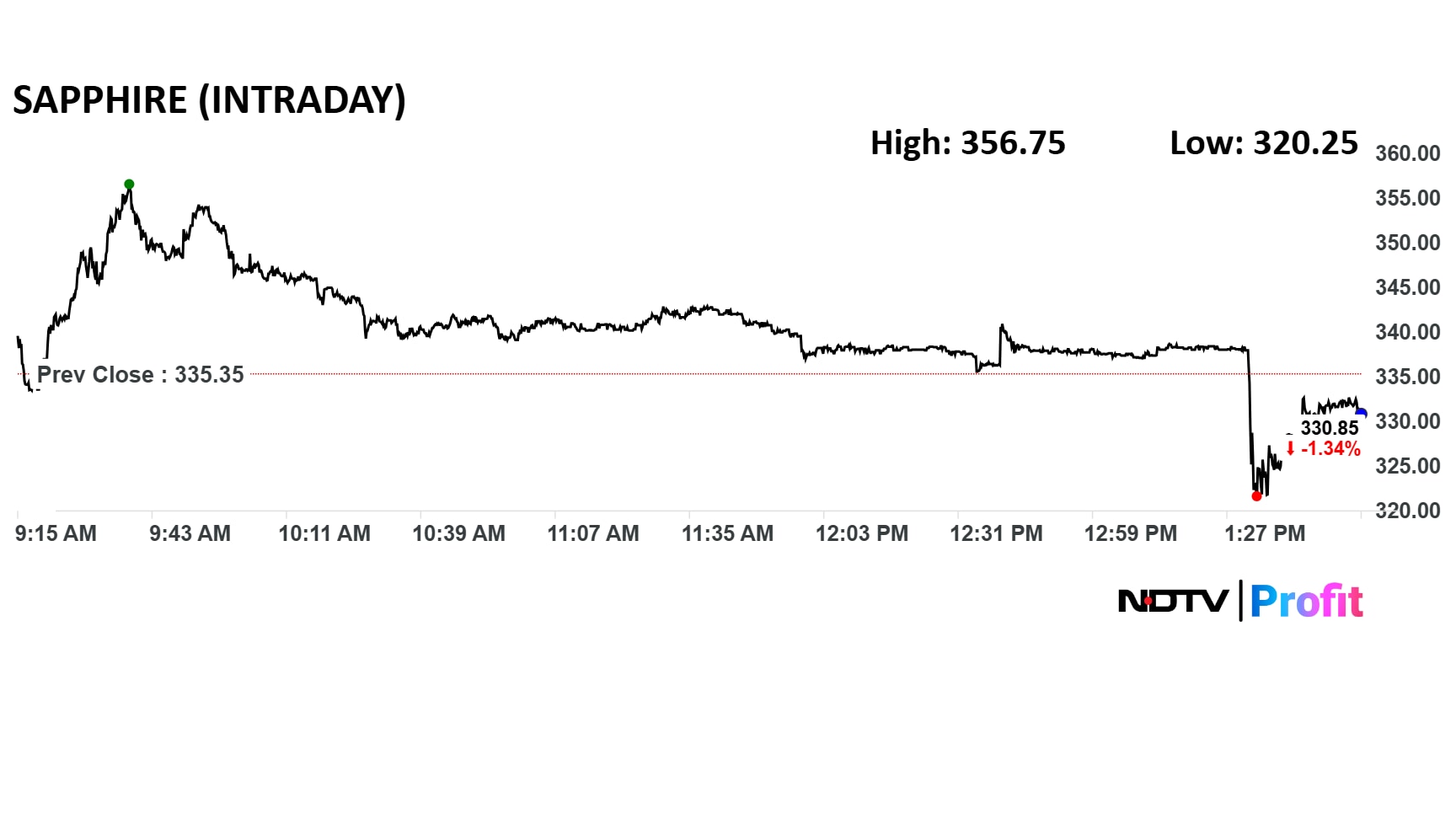

Shares of Sapphire Foods fell 4.5% after Q1 results.

Shares of Sapphire Foods fell 4.5% after Q1 results.

Sapphire Foods Q1FY26 (Consolidated, YoY)

Revenue up 8.3% at Rs 777 crore versus Rs 718 crore

Ebitda down 9% at Rs 113 crore versus Rs 124

Margin at 14.5% versus 17.3%

Net loss of Rs 1.8 crore versus profit of Rs 8.5 crore

Sapphire Foods Q1 Business Update

Pizza Hut revenue decreased by 5% YoY

Pizza Hut same-store sales decline 8%

Sapphire Foods total restaurant count is 974 as on June 30, 2025.

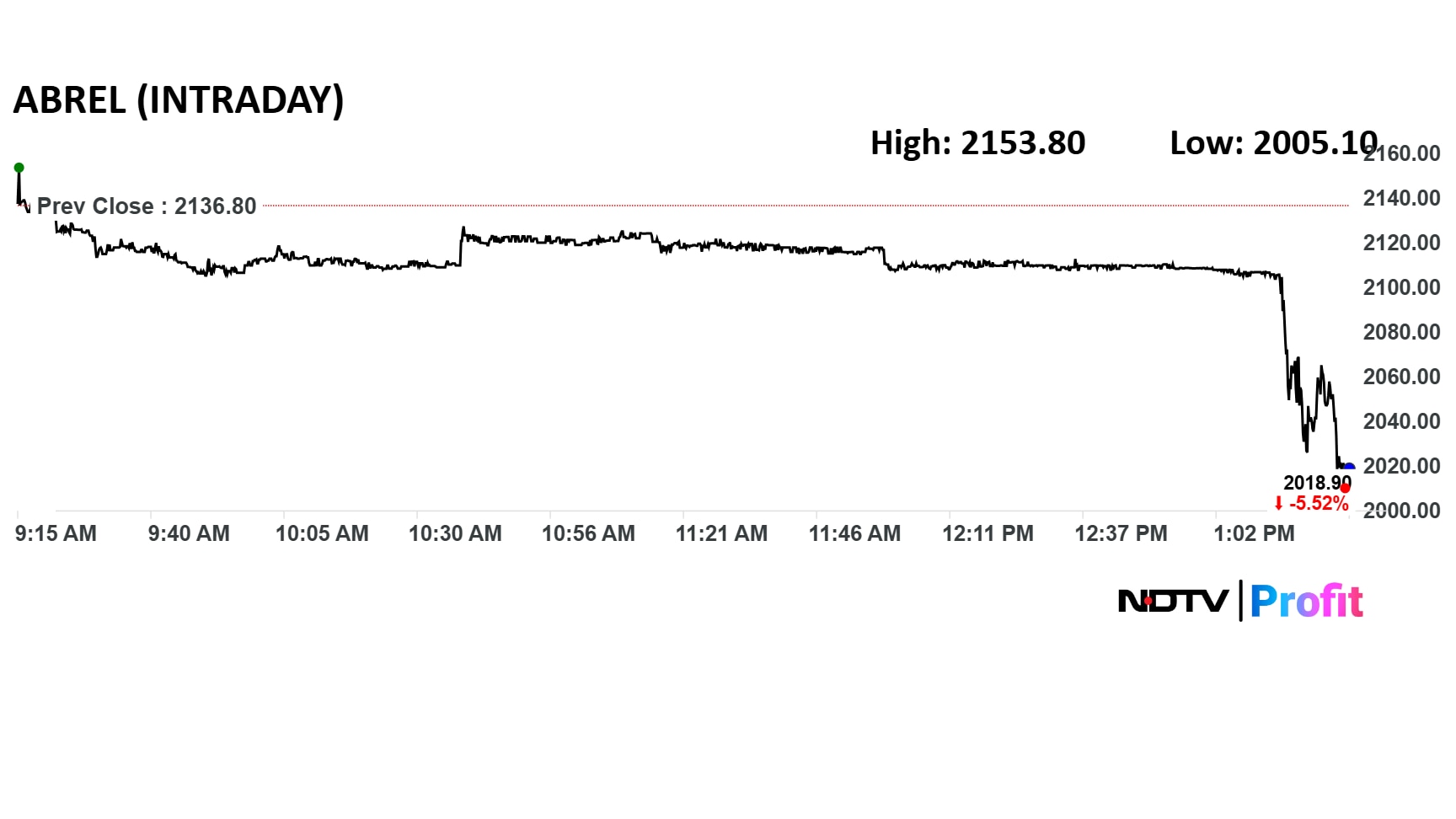

Shares of Adaitya Birla Realty fell over 5% after Q1 loss.

Shares of Adaitya Birla Realty fell over 5% after Q1 loss.

Aditya Birla Real Estate Q1FY26 (Consolidated, YoY)

Revenue down 58.8% at Rs 146 crore versus Rs 353 crore

Ebitda loss of Rs 39.9 crore versus Ebitda of Rs 45.5 crore

Net loss of Rs 25.5 crore versus profit of Rs 7.8 crore

Bajaj Housing Finance reported a rise in assets under management in the quarter ended June 2025, as per a quarterly business update released last month. The lender's assets under management as of the June quarter saw an advance of 24% to stand at Rs 1.2 lakh crore, as compared to Rs 97,071 crore in the same quarter during the preceding fiscal.

Loan assets of the Bajaj Group non-banking financial company stood at Rs 1 lakh crore, up from the Rs 85,283 crore in the corresponding quarter last year.

Bajaj Housing Finance recorded a gross disbursement of Rs 14,640 crore for the quarter, as compared to Rs 12,004 crore in the June quarter of fiscal 2025.

Analysts said the early start of seasonality is likely to help Dr Reddy's Laboratories in the first quarter, particularly after fairly muted growth in April and May. Export pharma performance could be highly variable in the first quarter based on gRevlimid sales, its pricing trends and new product launches.

Key risks for the sector include upcoming tariffs on US shipments, competition in exclusive products, adverse outcomes of regulatory inspections and the inclusion of more products under the National List of Essential Medicines in India.

Read Dr Reddy's Q1 preview here.

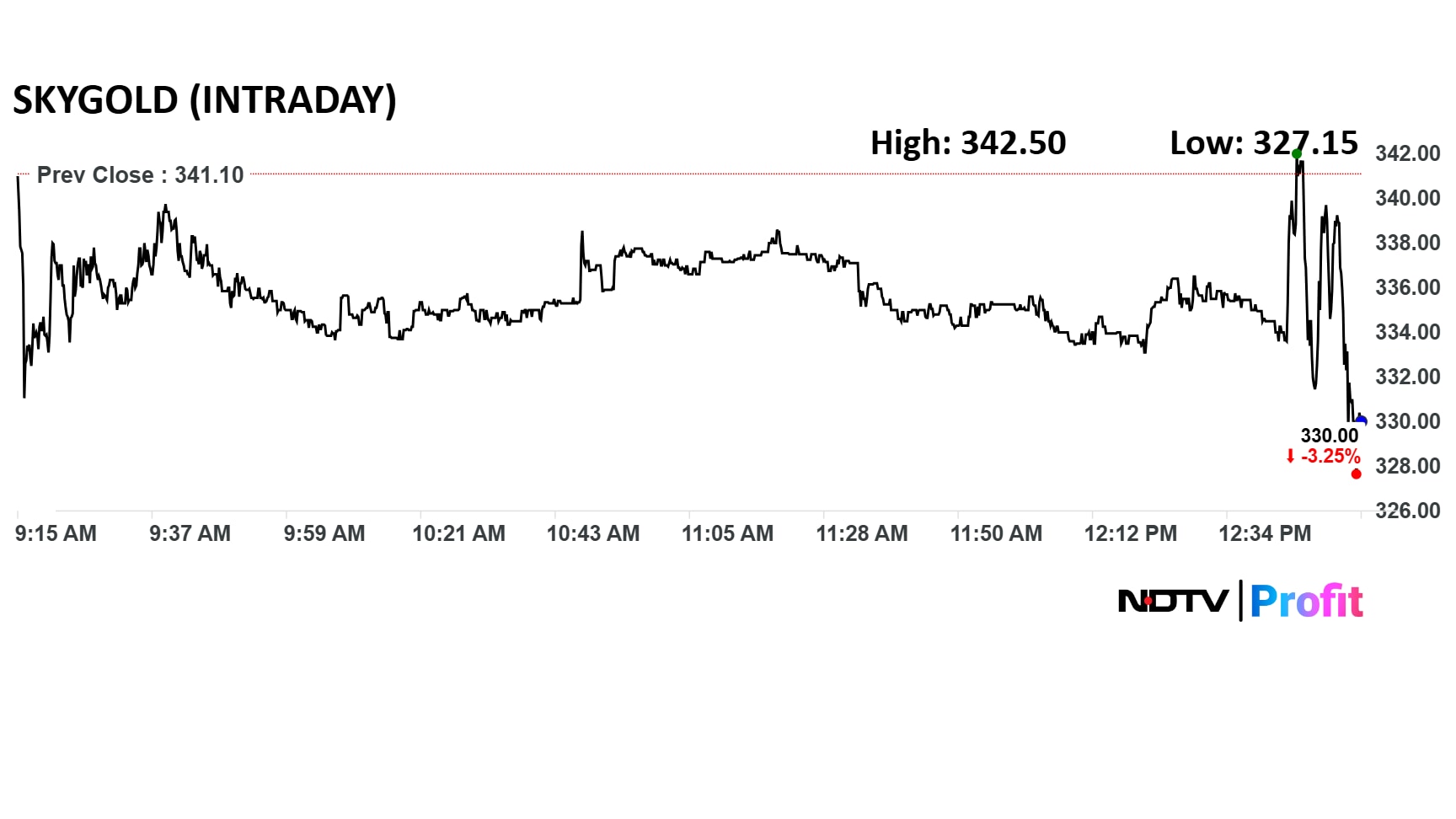

Sky Gold Q1 FY26 Highlights (Consolidated YoY)

Revenue up 56.5% at Rs 1,131 crore versus Rs 723 crore

Ebitda up 91.6% at Rs 71.4 crore versus Rs 37.3 crore

Margin at 6.3% versus 5.2%

Net Profit at Rs 43.6 crore versus Rs 21.2 crore

Infosys Ltd. is set to announce its first-quarter earnings on Wednesday, with analysts expecting modest sequential growth in revenue and Ebit, while investor focus remains on the company’s guidance for the ongoing financial year.

Most brokerages anticipate Infosys will narrow or raise the lower end of its full-year revenue growth guidance from the earlier 0–3% band, citing stable macro conditions and deal momentum. The consensus view suggests the company is unlikely to significantly raise the upper end of the guidance.

Revenue seen up 2% at Rs 41,724 crore versus Rs 40,925 crore

EBIT seen up 2% at Rs 8,727 crore versus Rs 8,575 crore

EBIT margin seen at 20.91% versus 20.95%

Net profit seen down 4% at Rs 6,778 crore versus Rs 7,033 crore

Read Infosys Q1 preview.

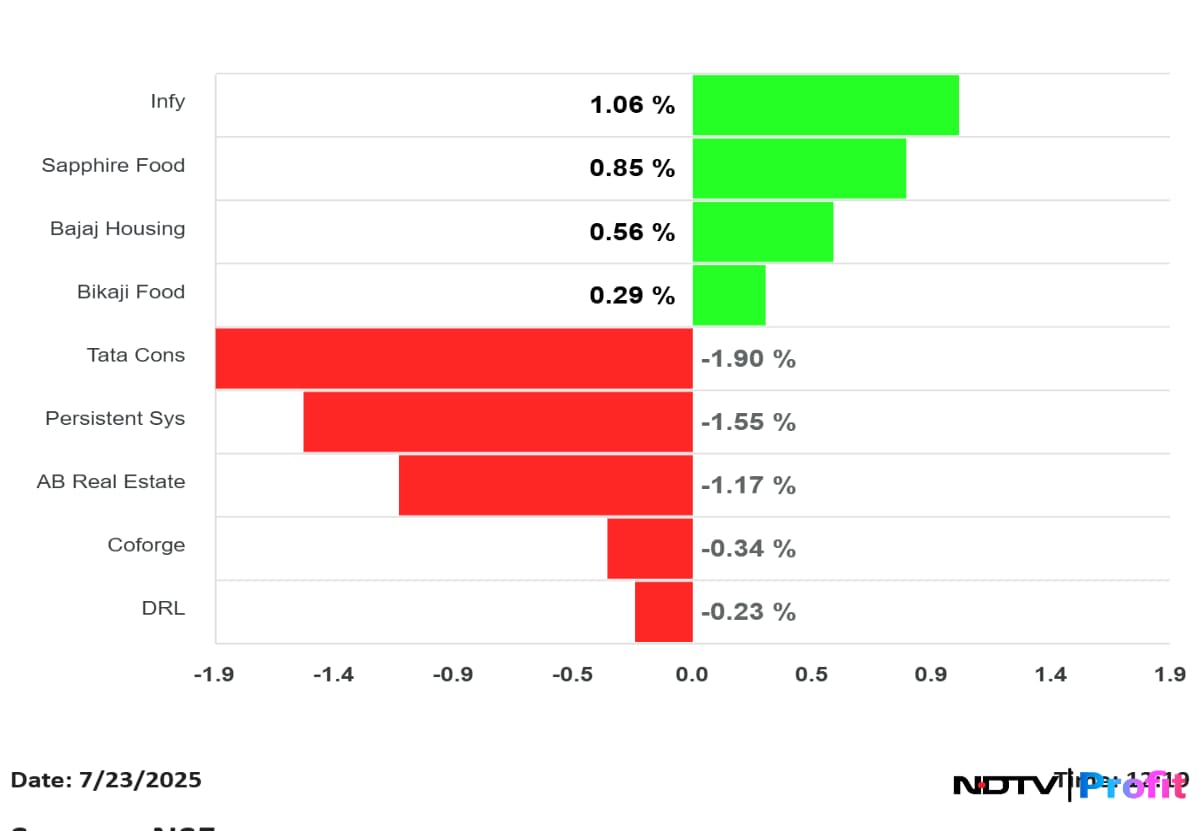

Shares of Infosys, Sapphire Foods and Bajaj Housing Finance were trading higher as of noon ahead of their Q1 results.

Tata Consumer Products and Persistent Systems are down.

Shares of Infosys, Sapphire Foods and Bajaj Housing Finance were trading higher as of noon ahead of their Q1 results.

Tata Consumer Products and Persistent Systems are down.

As many as 60 companies are set to report their financial results for the April-June quarter of FY 2025-26 on July 23. Major companies scheduled to announce their Q1 results on Wednesday include Infosys, Bajaj Housing Finance, Dr Reddy’s Laboratories, Persistent Systems, Tata Consumer Products and Bikaji Foods International, among others.

Check full list:

Bajaj Housing Finance Ltd., Bikaji Foods International Ltd., Coforge Ltd., Dr Reddys Laboratories Ltd., Jayatma Enterprises Ltd., Infosys Ltd., Maharashtra Scooters Ltd., Persistent Systems Ltd., RattanIndia Power Ltd., Sampann Utpadan India Ltd., Sapphire Foods India Ltd., Sky Gold And Diamonds Ltd., SRF Ltd., Tata Consumer Products Ltd., Westlife Foodworld Ltd., WSFx Global Pay Ltd., Bajaj Steel Industries Ltd., Aurum PropTech Ltd., Ace Alpha Tech Ltd., Asian Warehousing Ltd., Aditya Birla Real Estate Ltd., Biogen Pharmachem Industries Ltd., Cigniti Technologies Ltd., CMS Info Systems Ltd., DAM Capital Advisors Ltd. and Darjeeling Ropeway Company Ltd.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.