And that's all for NDTV Profit's live market coverage on Tuesday. Thank you for joining us. We wish you Happy Ganesh Chaturthi!

Rupee closed 10 paise weaker at 87.68 against US dollar

It closed at 87.58 a dollar on Monday

Source: Bloomberg

Benchmark Outperformed Broader Market Indices

Nifty fell over 200 points from the day’s high

Nifty close at its lowest point of last 7-days

Shriram Finance and Sun Pharma fell the most in Nifty

Nifty Midcap 150 fell over 1.5% for the day, drag by Vodafone Idea and FACT

Nifty Midcap 150 fell for the 4th consecutive day.

Nifty smallcap 250 fell nearly 2% for the day, drag by Swan Energy and Balrampur Chini Mills

Nifty Realty, PSU Bank and Oil and Gas drag the gains in Nifty

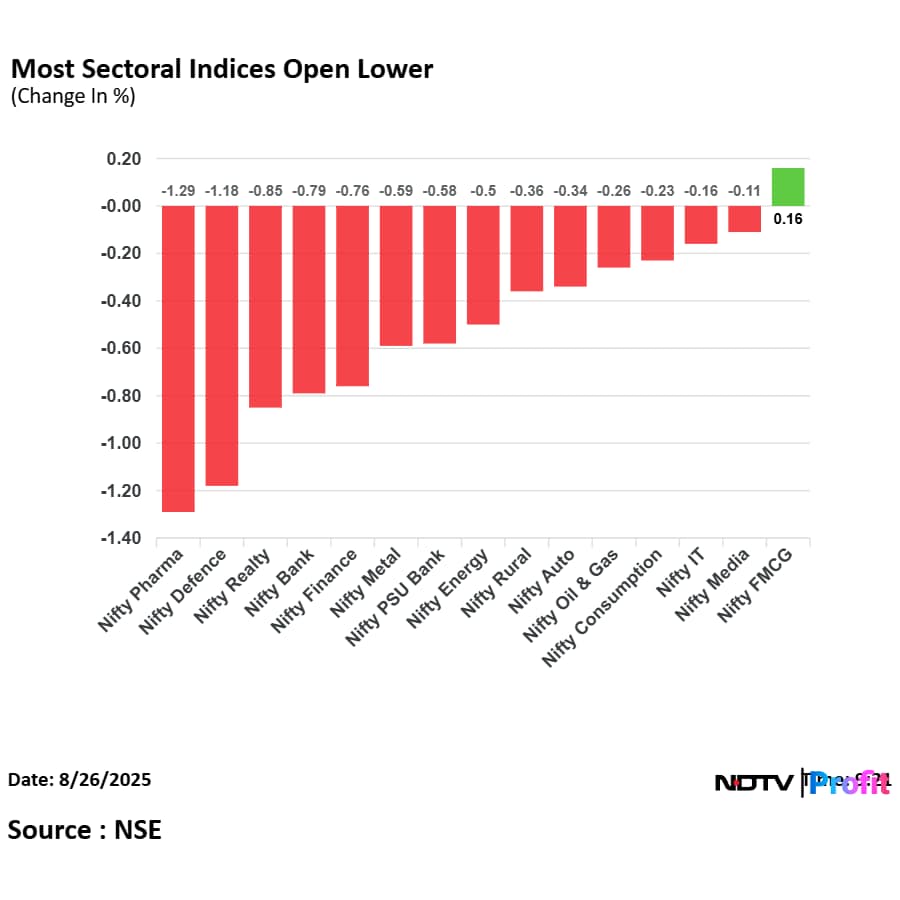

All sectoral Indices lose in Trade Barring Nifty FMCG

Nifty FMCG gains nearly 1% for the day, led by Britannia Industries and HUL

Nifty Realty emerges as the top losing sector, drag by Godrej Industries and Prestige Estate

Nifty FMCG snaps -day losing streak.

Nifty Bank and Financial Services fell for the 3rd consecutive day

Nifty pharma snaps 3-day gaining streak as trump said he will cut U.S. drug prices by 1,400% to 1,500%.

Nifty pharma snaps 3-day gaining streak as trump said he will cut U.S. drug prices by 1,400% to 1,500%.

Zydus lifesciences and Sun Pharma fell over 3% in Nifty Pharma

Nifty PSU Bank fell for 5th day in a row.

Markets are closed on Aug 27 for celebration of Ganesh Chaturthi.

Benchmark Outperformed Broader Market Indices

Nifty fell over 200 points from the day’s high

Nifty close at its lowest point of last 7-days

Shriram Finance and Sun Pharma fell the most in Nifty

Nifty Midcap 150 fell over 1.5% for the day, drag by Vodafone Idea and FACT

Nifty Midcap 150 fell for the 4th consecutive day.

Nifty smallcap 250 fell nearly 2% for the day, drag by Swan Energy and Balrampur Chini Mills

Nifty Realty, PSU Bank and Oil and Gas drag the gains in Nifty

All sectoral Indices lose in Trade Barring Nifty FMCG

Nifty FMCG gains nearly 1% for the day, led by Britannia Industries and HUL

Nifty Realty emerges as the top losing sector, drag by Godrej Industries and Prestige Estate

Nifty FMCG snaps -day losing streak.

Nifty Bank and Financial Services fell for the 3rd consecutive day

Nifty pharma snaps 3-day gaining streak as trump said he will cut U.S. drug prices by 1,400% to 1,500%.

Nifty pharma snaps 3-day gaining streak as trump said he will cut U.S. drug prices by 1,400% to 1,500%.

Zydus lifesciences and Sun Pharma fell over 3% in Nifty Pharma

Nifty PSU Bank fell for 5th day in a row.

Markets are closed on Aug 27 for celebration of Ganesh Chaturthi.

Lehar Footwears received order worth Rs 74.9 crore to supply toolkits to artisans and craftspeople registered under PM Vishwakarma Scheme, the company said in the exchange filing.

Ashiana Housing has acquired 22.71 crore land in Chennai with sales potential of nearly Rs 1,200 crore, the company said in the exchange filing.

HCLTech Ltd. is in pact with Thought Machine to accelerate AI and cloud-led transformation of banks, the company said in the exchange filing.

A burger being an indulgence that leaves one feeling greasy-guilt might just be a thing of the past now. This popular add-on in MacDonalds gives burgers a boost in terms of the protein intake Indians are now running after.

This slice, made from soy and pea protein, can be added to any burger for an extra Rs 25, providing an additional five grams of protein. A McSpicy Paneer burger, for example can be boosted from 20 grams to over 25 grams of protein with just one slice.

Stock Market Fall: In less than one hour after markets opened on Tuesday, the NSE Nifty 50 fell below the support level and the BSE Sensex lost nearly lost 700 points as weak global cues weighed on the markets.

The indices were trading 0.74% and 0.70% down, respectively as of 10:38 a.m. The market-cap of Nifty 50 companies declined Rs 1.4 lakh crore to Rs 192.05 lakh crore. The NSE India Volatility Index jumped 6.55% to 12.53. The index jumped after dropping over 7% shortly after open, which indicated the existing uncertainty among market participants.

The Trump administration's proposal to impose a 50% tariff on Indian goods has sparked fresh tension, weighing on Indian markets and economy. Manishi Raychaudhuri, CEO of Emmer Capital Partners, warned of long-term consequences for India's growth trajectory and corporate earnings.

“Markets have already had a flavour of sentiment depression that could occur,” Raychaudhuri said, referring to the anticipated impact of the tariff hike. “So this has been well telegraphed. I don’t think the market would react immediately.”

Nearly 200 applicants stake claims worth Rs 500 crore for BluSmart's assets so far

Bids for settling claims likely to be invited 4 weeks from now

Catalyst Trusteeship, which originally filed the petition, stakes claims worth nearly Rs 250 crore

IREDA stakes claims worth Rs 128 crore for BluSmart assets

Co-founder Punit Goyal, ex-CEO Anirudh Arun, ex-CBO Tushar Garg and ex-CTO Rishabh Sood have all staked claims worth over Rs 1 crore each

IPO-bound Tata Capital also claims Rs 5 crore as a creditor

Source: people in the know

Mazagon Dock Shipbuilders Ltd., fell over 1% in Tuesday morning trade after the company issued clarification on the Rs 70,000-crore deal for six submarines deal. On Monday, the company issued a clarification stating that there are currently 'no negotiations' with the Defence Ministry for the Rs 70,000-crore deal for six submarines that are to be built in India with German support under 'Project 75 India'.

UltraTech Cement Ltd., Ambuja Cements Ltd., and Shree Cement Ltd. are set to benefit as the cement industry moves towards higher pricing and GST cuts could fast track the premiumisation process, according to Nomura.

The GST Council will meet on Sept. 3 and 4 to decide on the Centre's proposed two-rate GST system. Cement is presently taxed at 28% and is expected to be migrated to the 18% bracket under the proposed reform.

Jyoti Structure extended tenure of Rajesh Kumar Singh's tenure as chief executive officer to July 31, 2028.

Indigrid Infrastructure Trist in pact to set up Battery Storage Systems project in Uttar Pradesh, the company said in the exchange filing.

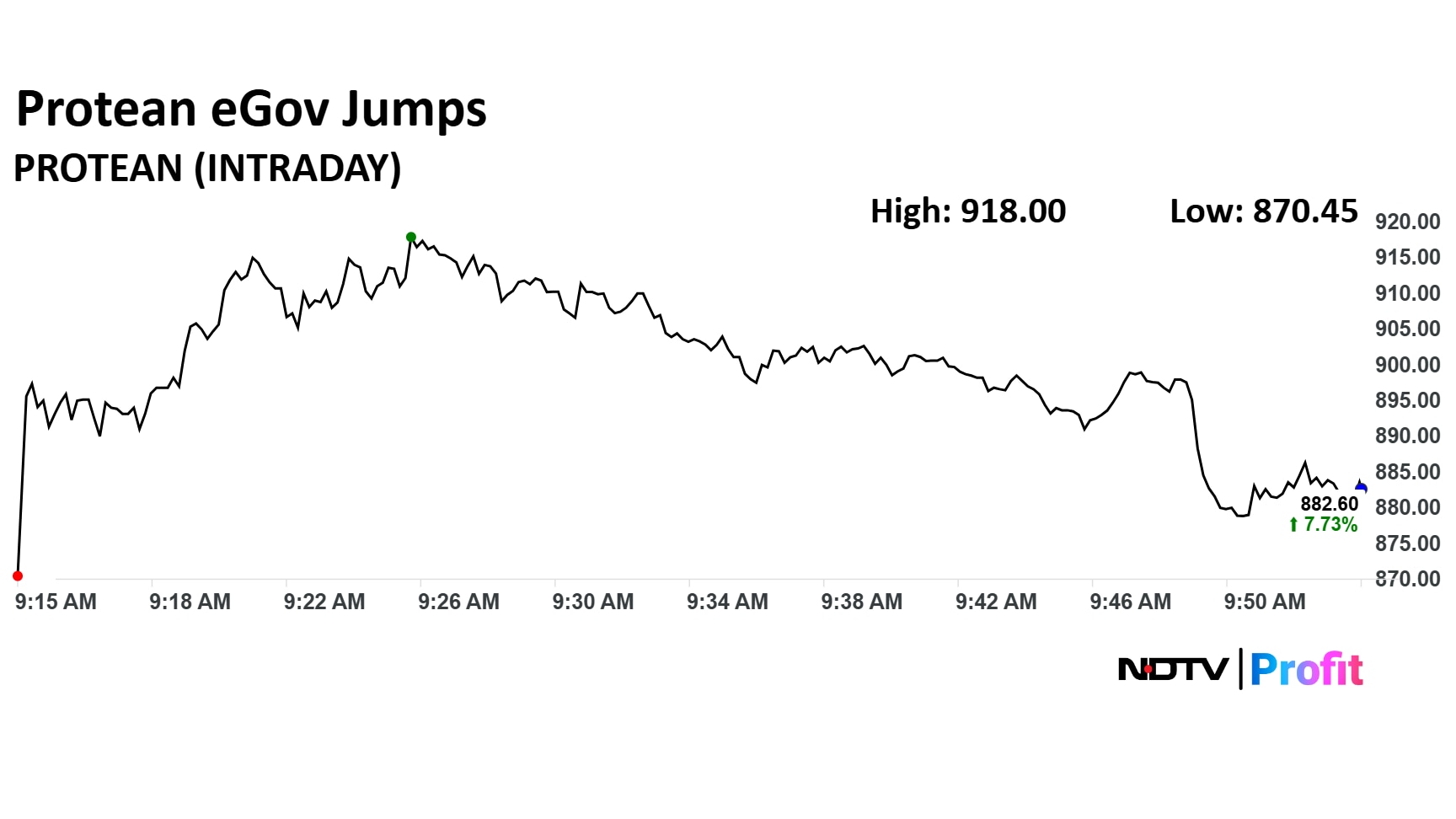

Protean eGov Technologies Ltd. share price jumped over 12% and hit the highest level in two months after securing an order worth Rs 1,160 crore from Unique Identification Authority of India to set up Aadhar Seva Kendra at district level.

As per the order from the Aadhar issuing centre, Protean eGov Technologies will set up services providing centre at 188 districts across India, the company said in the exchange filing. These service centres will provide appointment and walk-in based Aadhar Enrolment Update andother miscellaneous Aadhaar Services.

Ujaas Energy has approved bonus share issuance in the ratio of 2:1, the company said in the exchange filing.

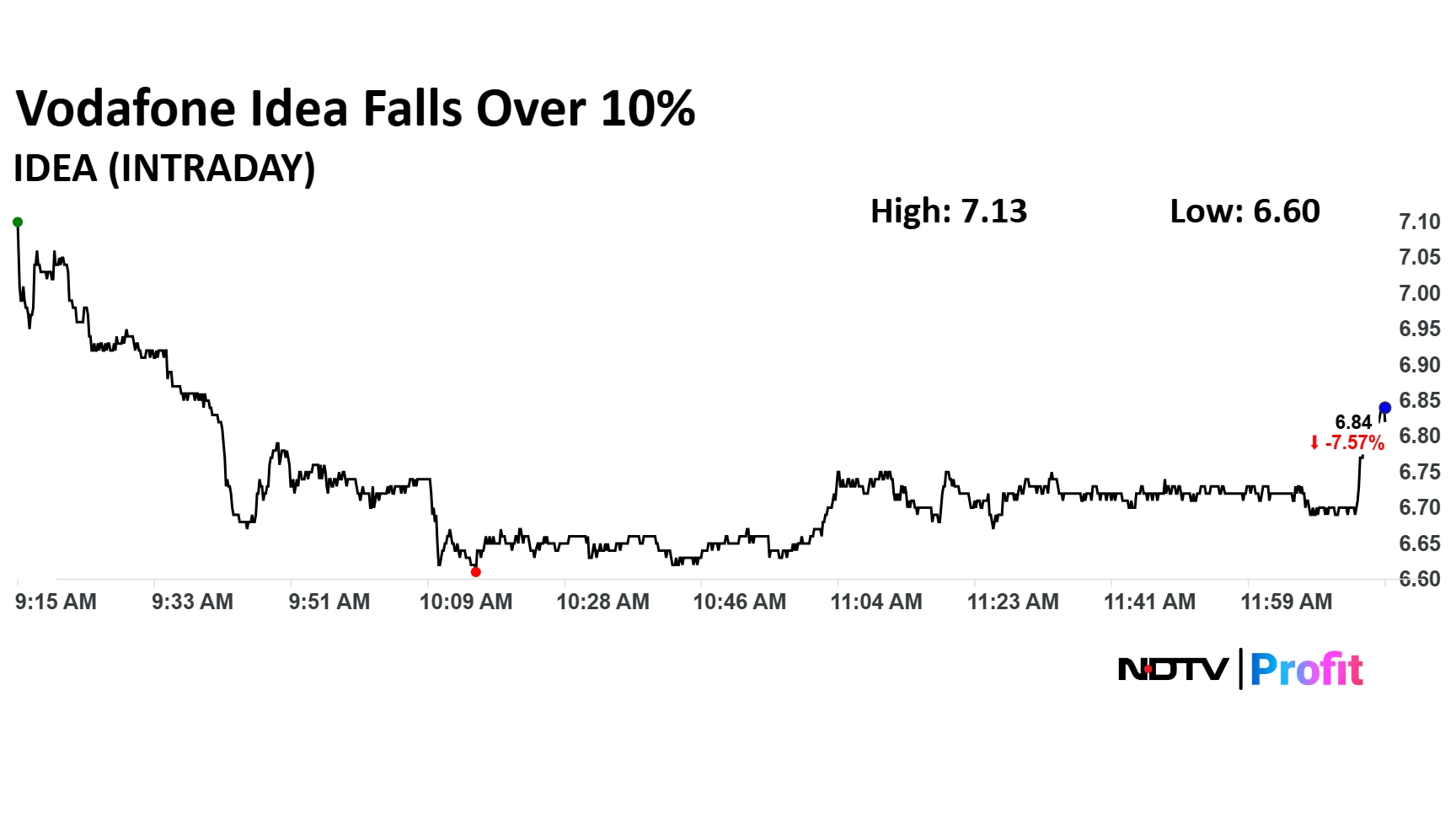

Vodafone Idea share price slumped 10.81% to Rs 6.60 apiece. The stock was trading 7.84% down at Rs 6.81 apiece as of 12:19 p.m.

Vodafone Idea share price slumped 10.81% to Rs 6.60 apiece. The stock was trading 7.84% down at Rs 6.81 apiece as of 12:19 p.m.

Royal Orchid has signed a new property in Jabalpur which expanded it Madhya Pradesh portfolio, the company said in the exchange filing.

Gland Pharma received the US Food Drug Administration approval for Vasopressin 5% dextrose injection. Vasopressin is used to increase blood pressure, the company said in the exchange filing.

Reliance Industries Ltd. (RIL) is scheduled to hold its 48th Annual General Meeting (AGM) on Aug. 29. The company is expected to announce a dividend at the AGM. An announcement regarding the initial public offering (IPO) for Jio is also expected at the AGM.

Eternal Ltd., which owns the Zomato and Blinkit brands, has received three orders from the GST department imposing a total tax demand of over Rs 40 crore, including interest and penalty.

E-Vitara to be exported to 100 countries

PM Modi has inaugurated TDS lithium-ion battery plant

TDS is a joint venture between Toshiba, Denso and Suzuki

TDS Lithium-ion Battery Plant to manufacture lithium-ion battery cell and electrodes for hybrid EVs

E-Vitara to be exported to 100 countries

PM Modi has inaugurated TDS lithium-ion battery plant

TDS is a joint venture between Toshiba, Denso and Suzuki

TDS Lithium-ion Battery Plant to manufacture lithium-ion battery cell and electrodes for hybrid EVs

Shreeji Shipping Global Ltd. made its market debut on Tuesday, listing at a premium of 8% over the IPO price. The scrip opened at Rs 271.85 apiece on the BSE and Rs 270 on the NSE. The IPO issue price was Rs 252.

The initial public offering was a book-built issue of Rs 410.71 crore. It comprised a fresh issue of 1.63 crore shares.

Gameskraft has no intention of pursuing any legal challenge to the legislation

Committed to operating within framework of law

Initiated structured internal discussions to chart road ahead

Source: Statement

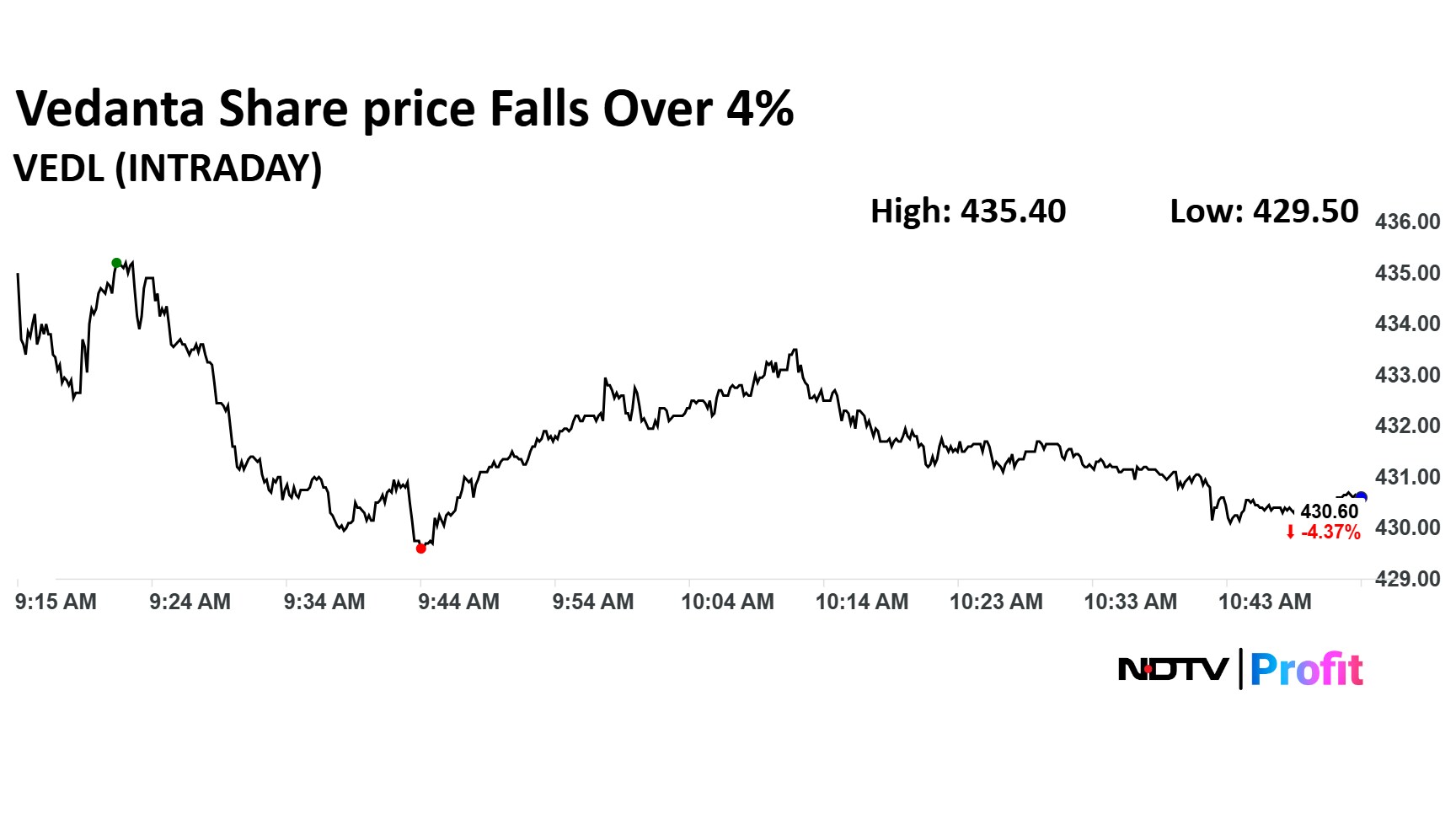

Vedanta share price fell as much as 4.62% to Rs 429.50 apiece. It was trading 4.41% down at Rs 430.45 apiece as of 10:55 a.m.

Vedanta share price fell as much as 4.62% to Rs 429.50 apiece. It was trading 4.41% down at Rs 430.45 apiece as of 10:55 a.m.

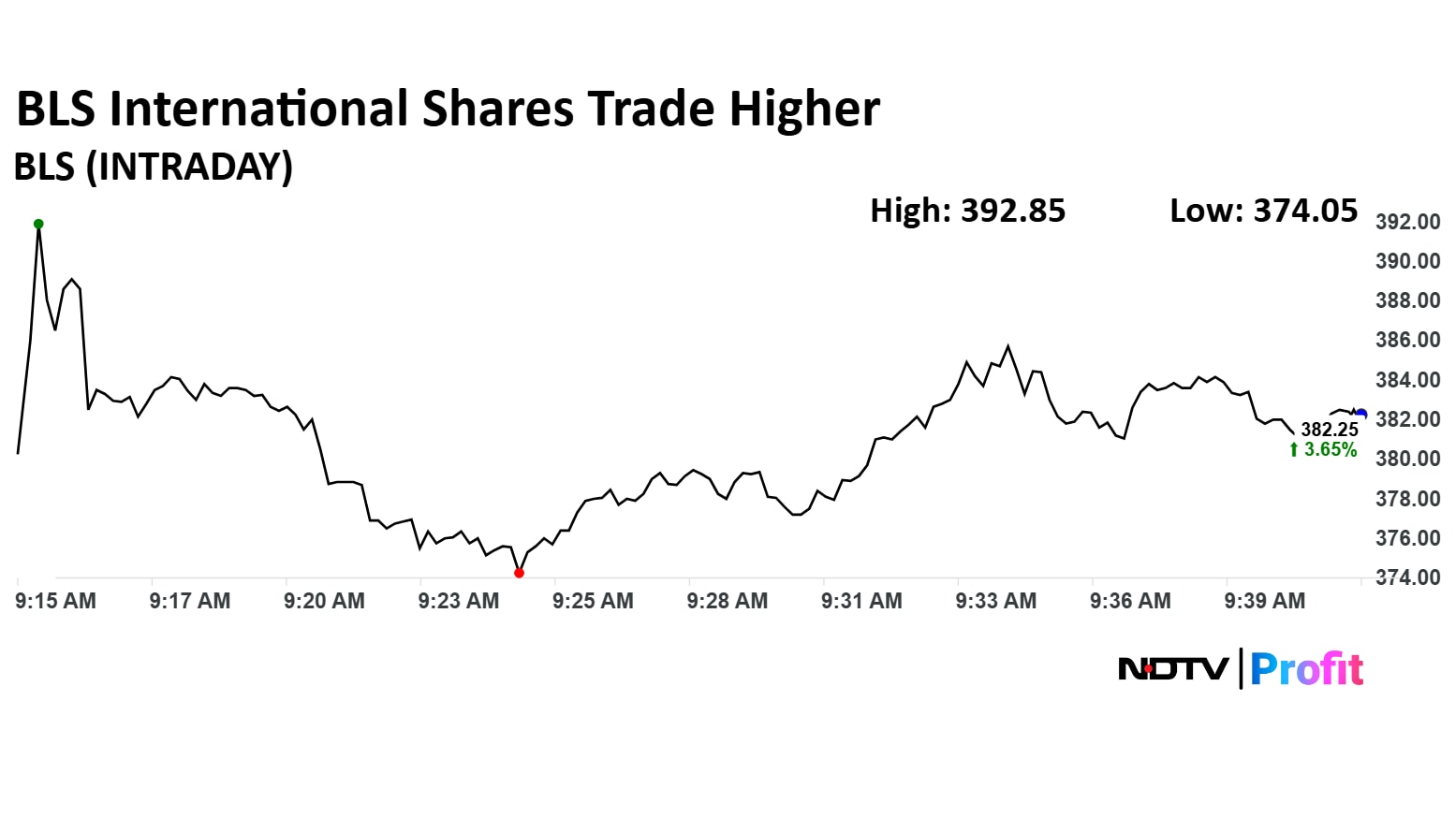

BLS International Services Ltd.'s share price rose over 6% during early trade on Tuesday after the company announced that it has received an order worth Rs 2,055 crore from Unique Identification Authority of India.

The company has received a work order from UIDAI, New Delhi, Government of India for providing services as 'Service Provider' for establishing and running district level Aadhaar Seva Kendra or ASK across India, according to an exchange filing.

BLS International Services Ltd.'s share price rose over 6% during early trade on Tuesday after the company announced that it has received an order worth Rs 2,055 crore from Unique Identification Authority of India.

The company has received a work order from UIDAI, New Delhi, Government of India for providing services as 'Service Provider' for establishing and running district level Aadhaar Seva Kendra or ASK across India, according to an exchange filing.

Gem Aromatics Ltd. made a laskluster debut on the stock market on Tuesday, with shares listing at a premium of just 2.5% over its IPO price. The share price opened at Rs 333.1 apiece on the NSE and Rs 325 on the BSE. The IPO issue price was Rs 325.

In the run-up to the listing, the IPO’s grey market premium signaled expectations of healthy gains for investors.

Protean eGov Technologies share price jumped over 12% and hit the highest level in two months after acquiring order worth Rs 1,160 crore.

Protean eGov Technologies share price jumped 12.05% to Rs 918 apiece, the highest level since June 19.

Protean eGov Technologies share price jumped over 12% and hit the highest level in two months after acquiring order worth Rs 1,160 crore.

Protean eGov Technologies share price jumped 12.05% to Rs 918 apiece, the highest level since June 19.

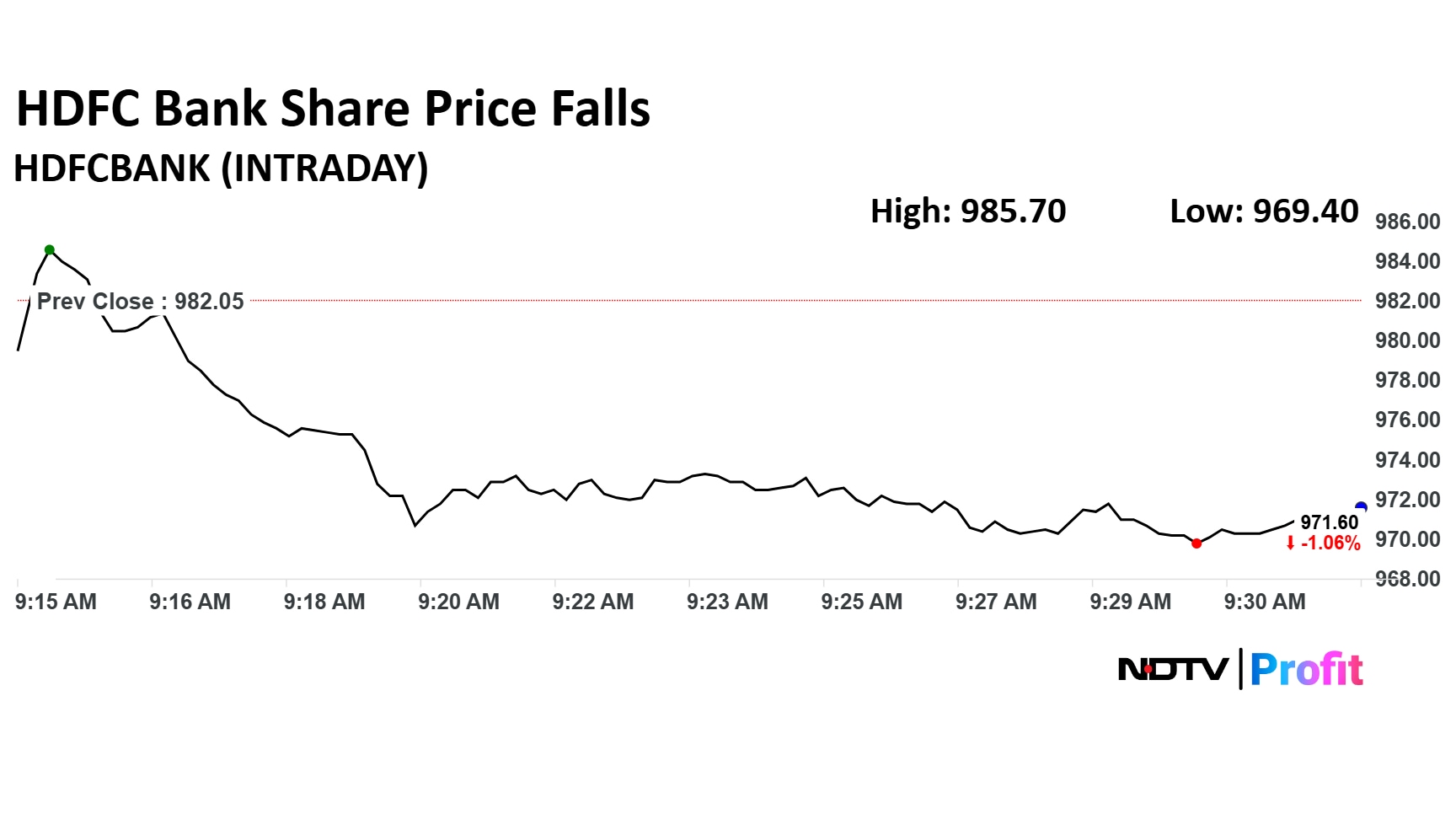

HDFC Bank Ltd. share price declined after the stock turned ex-bonus. With Tuesday's losses, the stock price has fallen three session in a row.

The private lender has given one free bonus equity share of face value of Rs 1 each for every one fully paid-up equity share held.

HDFC Bank Ltd. share price declined after the stock turned ex-bonus. With Tuesday's losses, the stock price has fallen three session in a row.

The private lender has given one free bonus equity share of face value of Rs 1 each for every one fully paid-up equity share held.

On National Stock Exchange, 14 sectoral indices opened lower with the NSE Nifty Pharma declining the most. The NSE Nifty FMCG rose the most.

On National Stock Exchange, 14 sectoral indices opened lower with the NSE Nifty Pharma declining the most. The NSE Nifty FMCG rose the most.

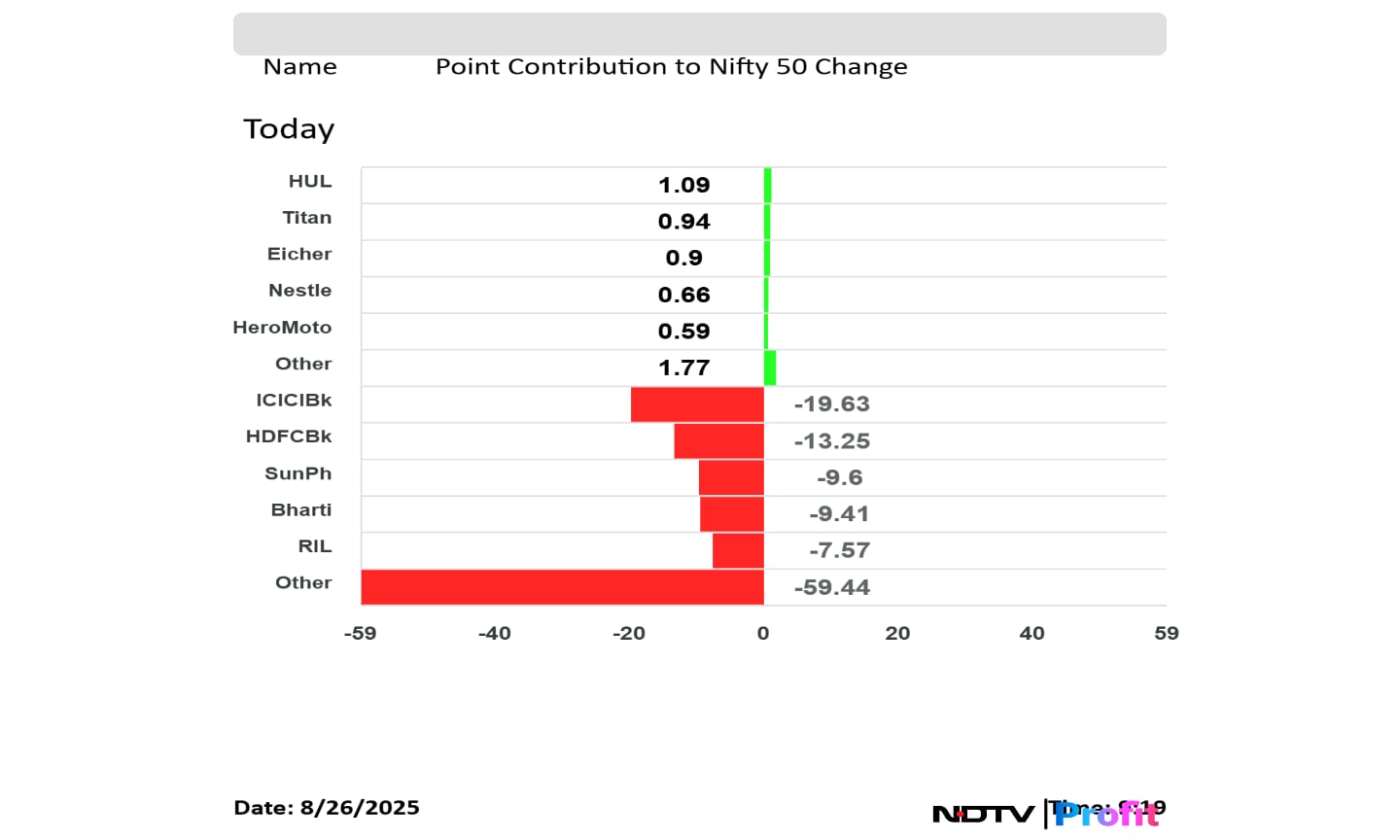

ICICI Bank Ltd., HDFC Bank Ltd., Sun Pharmaceutical Industries Ltd., Bharti Airtel Ltd., and Reliance Industries Ltd. weighed on the NSE Nifty 50 index.

Hindustan Unilever Ltd., Titan Co. Ltd., Eicher Motors Ltd., Nestle India Ltd., and Hero MotoCorp Ltd. limited losses in the NSE Nifty 50 index.

ICICI Bank Ltd., HDFC Bank Ltd., Sun Pharmaceutical Industries Ltd., Bharti Airtel Ltd., and Reliance Industries Ltd. weighed on the NSE Nifty 50 index.

Hindustan Unilever Ltd., Titan Co. Ltd., Eicher Motors Ltd., Nestle India Ltd., and Hero MotoCorp Ltd. limited losses in the NSE Nifty 50 index.

India is expensive for valid reasons— high return on equity, higher long-term growth potential and domestic appetite for equities, noted HSBC in its latest India Strategy note released on Tuesday.

The brokerage believes that the perceived risk for India is lower due to strong and proactive regulatory framework and institutions. Near-term slow growth and long-term deterioration in ROEs are downside risks, as per HSBC.

International investment firm UBS resumed coverage on Reliance Industries Ltd. with a 'buy' rating and hiked the 12-month target price of the stock. This comes ahead of the RIL annual general meeting on Friday, Aug. 29.

Analysts expect RIL to perform well in the coming 12 to 18 months as the group's earnings transformation of last five years open path towards value unlocking.

BLS International received Rs 2,055 crore order form UIDAI for being a service provider for establishing Aadhaar Seva Kendra. UIDAI stands for Unique Identification Authority Of India, the company said in the exchange filing.

The yield on the 10-year bond opened flat at 6.60%

Source: Bloomberg

Rupee opened 15 paise weaker at 87.73 against US dollar

It closed at 87.58 a dollar on Friday

Source: Bloomberg

GE Shipping signed a contract to buy Suezmax crude carrier of about 164,715 dwt, the company said in the exchange filing.

The names making the debut today are Vikram Solar, Patel Retail, Shreeji Shipping and Gem Aromatics. Stay with us as we cover the latest discovery prices, the Grey Market Premium and all the key details you need to know.

Follow the blog as we take you through the action right here!

Arisinfra Solutions' arm launched Merusri Landscape, a villa community in Bengaluru with Merusri Developers. This estimated a gross development value of Rs 250 crore for Bengaluru project, the company said in the exchange filing.

HDFC Bank Ltd. share price is set to adjust on Tuesday as the stock trades ex-date for the bonus issue. India's largest private sector lender will give one free bonus equity share of face value of Rs 1 each for every one fully paid-up equity share held.

As Tata Capital gears up for its much-anticipated IPO, early signs suggest that the price band may fall significantly below its current valuation in the unlisted market.

While Tata Capital's unlisted shares are currently being quoted around Rs 775, the actual IPO price could likely be set lower, mirroring the trajectory of other recent high-profile IPOs. HDB Financial Services, which had an unlisted price of Rs 1,550, debuted with a price band of Rs 700-740, and NSDL, trading at Rs 1,275 in the grey market, set its IPO band between Rs 700-800

India's state-run oil marketing companies (OMCs) are poised for gains this year after the Union Cabinet approved a Rs 30,000-crore fund earlier this month to reimburse Indian Oil Corp, Bharat Petroleum Corp Ltd, and Hindustan Petroleum Corp Ltd for losses in their liquified petroleum gas sales. However, the OMCs will still likely incur losses in the near-term after US President Donald Trump hiked the tariff rate on India from 25 to 50%.

Asia-Pacific markets were trading in losses as US President Donald Trump again threatened to impose steep tariffs on countries in the region. The Trump administration is planning to hit India 50% tariff and China with 200% in case the latter does not export rare-earth magnets.

The Nikkei 225 and CSI 300 were trading 1.04% and 0.42% down, respectively as of 7:36 a.m.

US stock futures declined as volatility increased after US President Donald Trump to fire Federal Reserve Governor Lisa Cook on allegation that she has falsified documents on mortgage application.

The S&P 500 and Nasdaq 100 futures were trading 0.15% and 0.25% down, respectively as of 7:29 a.m.

The GIFT Nifty was trading 0.04% or 10 points lower at 24,927 as of 6:58 a.m. This implied the NSE Nifty 50 may open 61.70 points down from its previous close.

On Monday, the Nifty 50 ended 0.39% higher at 24,967.75 and the BSE Sensex ended 0.40% higher at 81,635.91.

Market participants will keep an eye on Mazagon Dock Shipbuilders Ltd., Sona BLW Precision Forgings Ltd., and Tata Motors Ltd. share prices.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.