Rupee strengthened 33 paise to close at 85.46 against US dollar

It ended at 85.79 a dollar on Thursday

Source: Bloomberg

Nifty ends 0.72% higher and Sensex gained 0.66% for the week.

Nifty ends higher for the week, led by Bajaj Finserv, Grasim and UltraTech Cement.

Benchmark indices outperformed broader market indices.

Nifty Midcap 150 closes lower for the week, drag by Vodafone Idea, Indian Overseas Bank.

Nifty smallcap 250 ended lower for the week, drag by TVS Supply Chain Solutions, Easy Trip Planners.

Nifty PSU Bank emerged as top sectoral gainer for the week, Led by BoB, PNB.

Deepak Fertilisers, Garden Reach Shipbuilders top Nifty Smallcap 250 gainers in FY25

Mazagon Dock Shipbuilders, BSE top Nifty Midcap 150 gainers in FY25

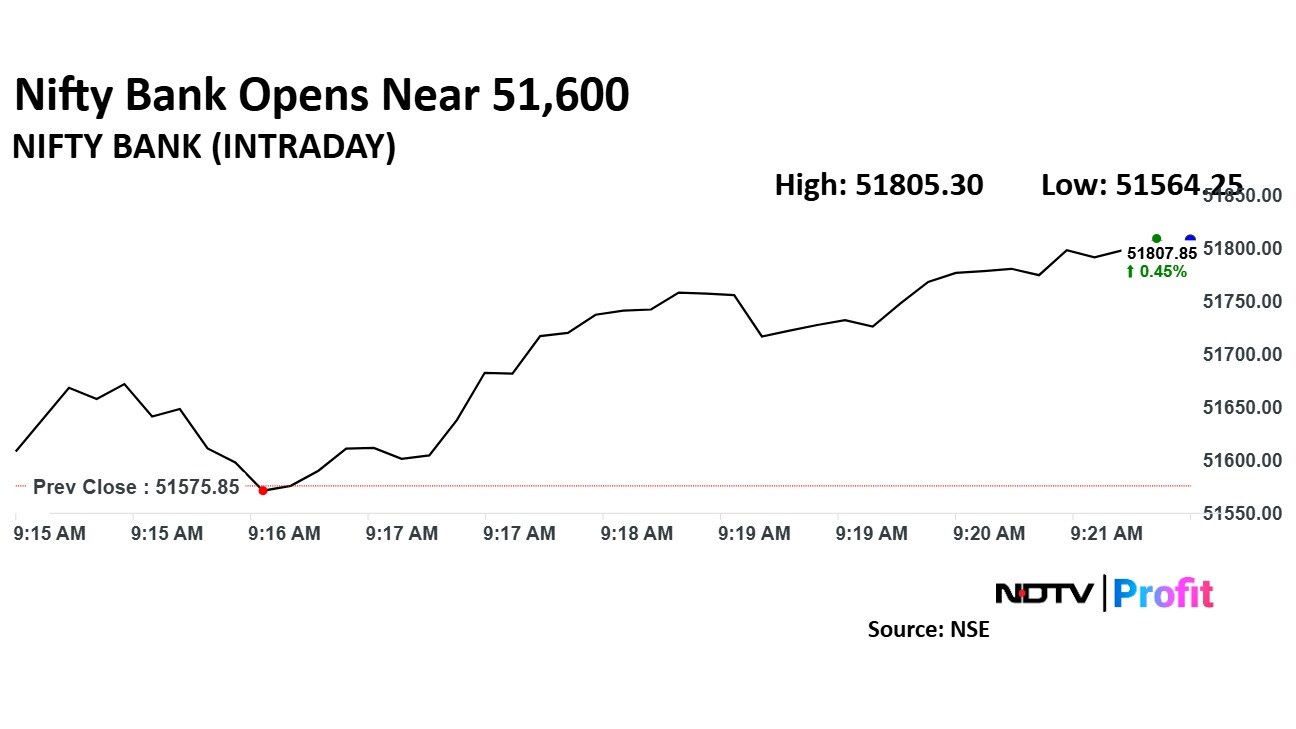

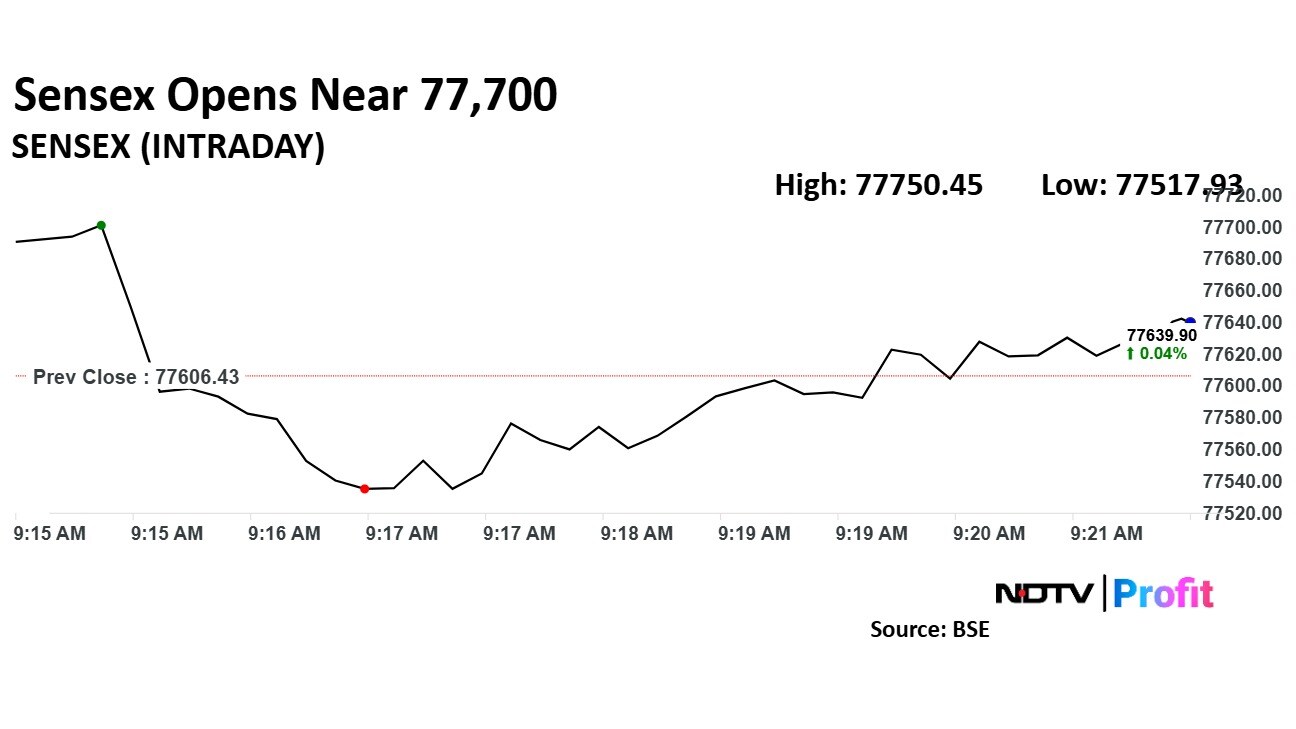

Sensex, Nifty 50 gained near market close on Thursday. March 28 marks the last trading session for the financial year 2025. Nifty 50 was trading 0.04% at 23,600 and Sensex was 0.07% higher at 77,659.

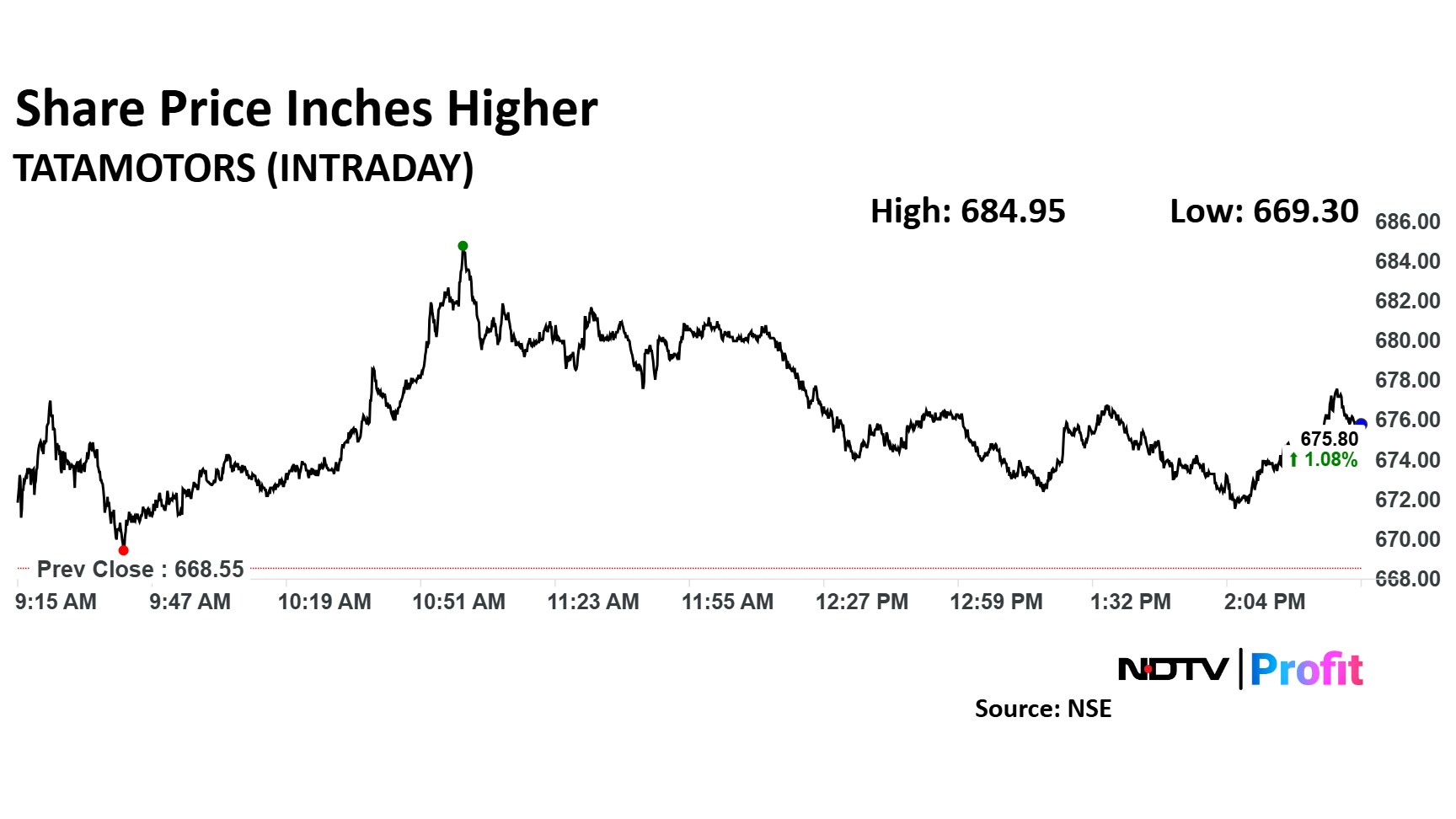

Tata Motors Launches EV Portfolio In Mauritius. Tata Motors share price surged 2.45% to trade at Rs 684 apiece at intraday high.

Source: Informist

Tata Motors Launches EV Portfolio In Mauritius. Tata Motors share price surged 2.45% to trade at Rs 684 apiece at intraday high.

Source: Informist

Board approves reappointment of Ajay Kapur as MD for 2 years effective April 1

Approves appointment of Vinod Bahety as whole-time director & CEO for 3 years effective April 1

Board approves appointment of Rakesh Tiwary as CFO effective April 1

Laurus Labs is set to acquire 26% stake in Kurnool Renewable for Rs 35 crore

Source: Exchange Filing

Nifty Financial Services top gaining sectoral index in FY25, up 19%.

Nifty Media, PSU Bank decline the most among sectoral peers in FY25.

Nifty records gain for second fiscal year in a row, up 5% in FY25.

Nifty recovers over 10% from lowest point in FY25, ends the fiscal 5% higher.

BEL, Bharti Airtel top performing Nifty constituents in FY25.

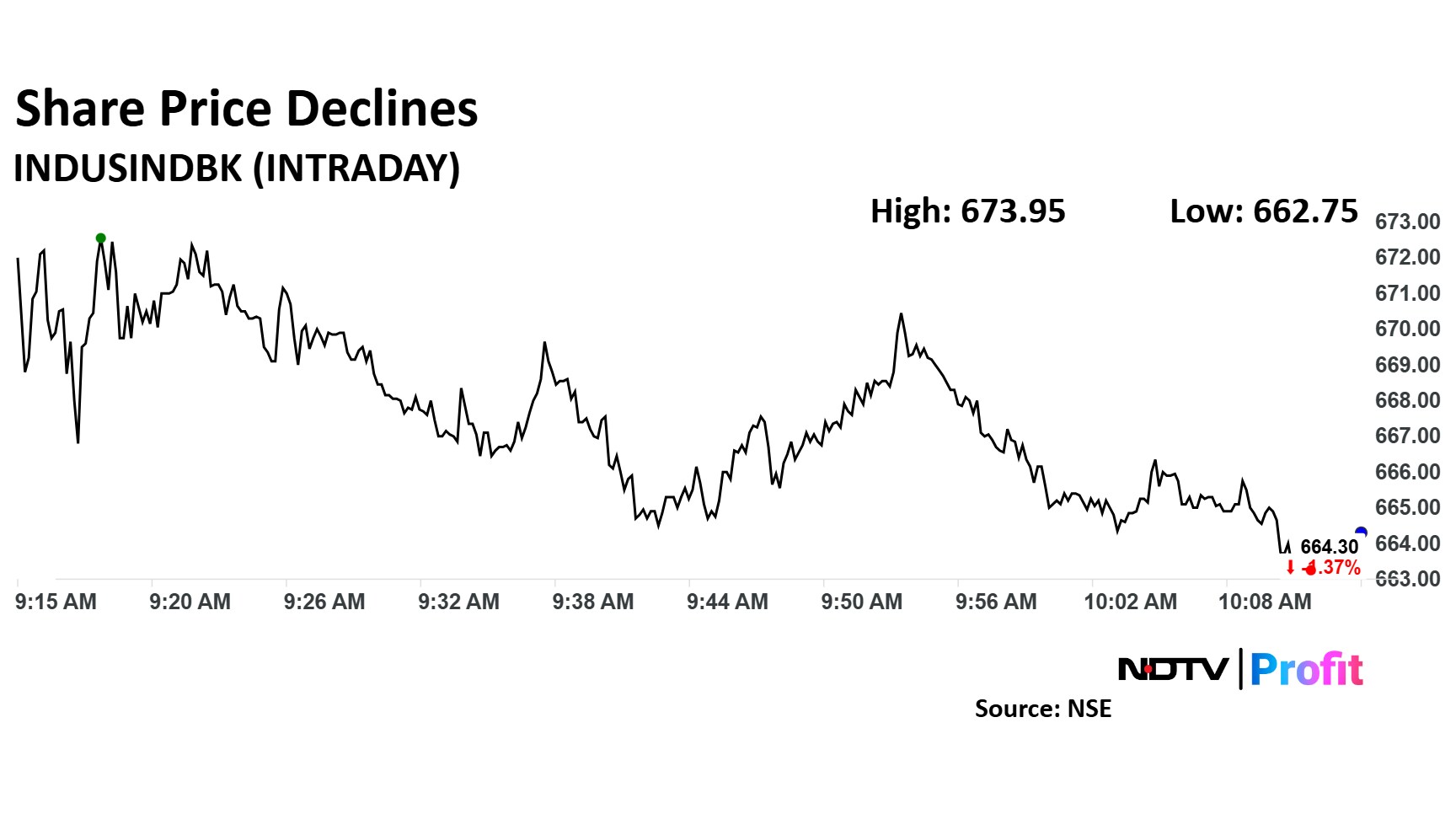

IndusInd Bank worst performing Nifty constituent in FY25, falls 58%.

HDFC Bank, ICICI Bank, Bharti Airtel top Nifty contributors, add 1,317 points to index level in FY25.

Reliance Industries, Tata Motors, IndusInd Bank drag Nifty the most in FY25, cut 595 points from index level in FY25.

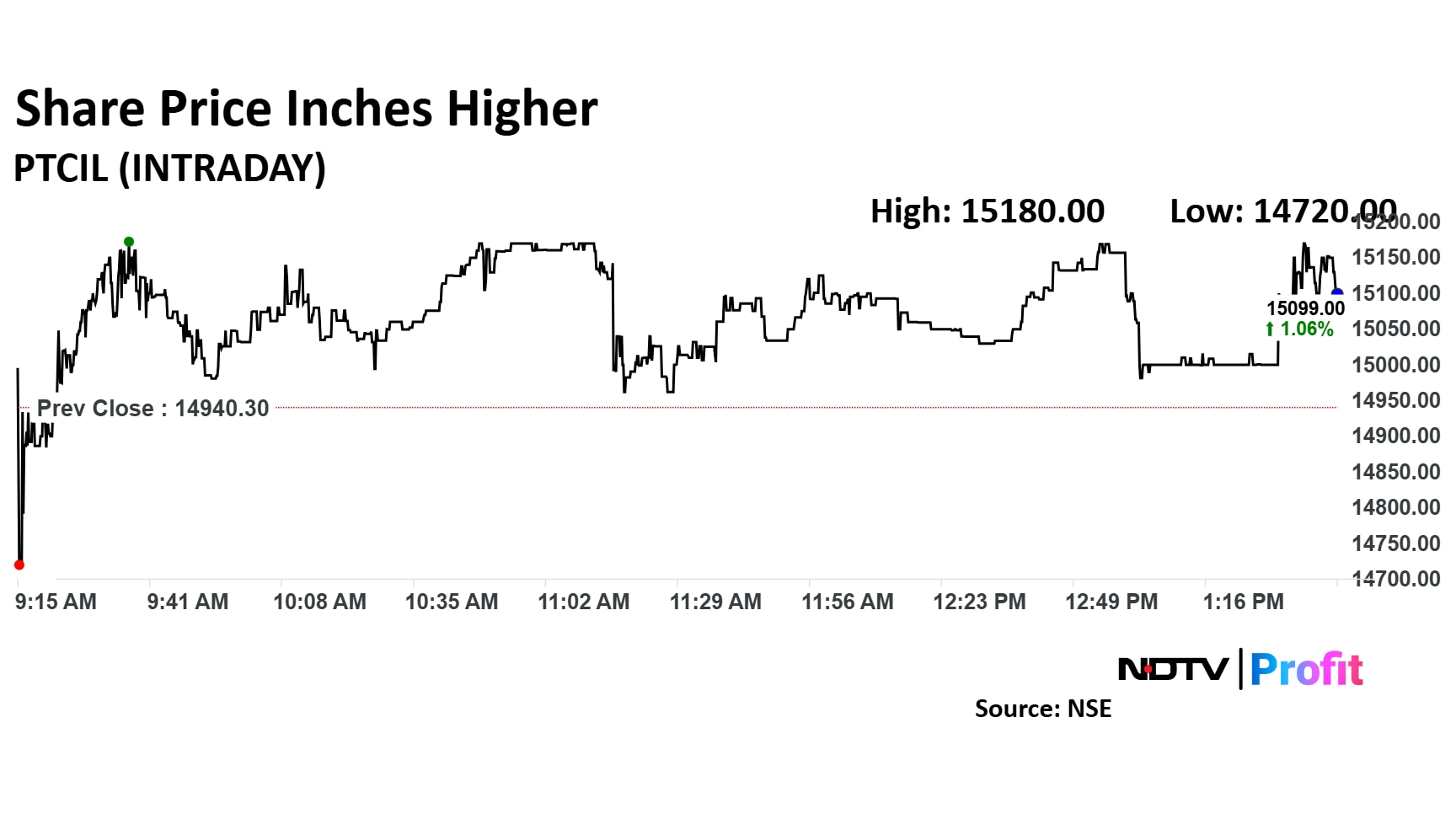

PTC Industries arm gets order to supply 7 aero-engine components from Safran Aircraft Engines. Share price spikes 1.60%.

PTC Industries arm gets order to supply 7 aero-engine components from Safran Aircraft Engines. Share price spikes 1.60%.

Infosys, HDFC Bank, M&M top contributors to Nifty's decline

Broader market indices outperform benchmark Nifty, Sensex

Jio Finance advances on first day of Nifty inclusion, Zomato record declines

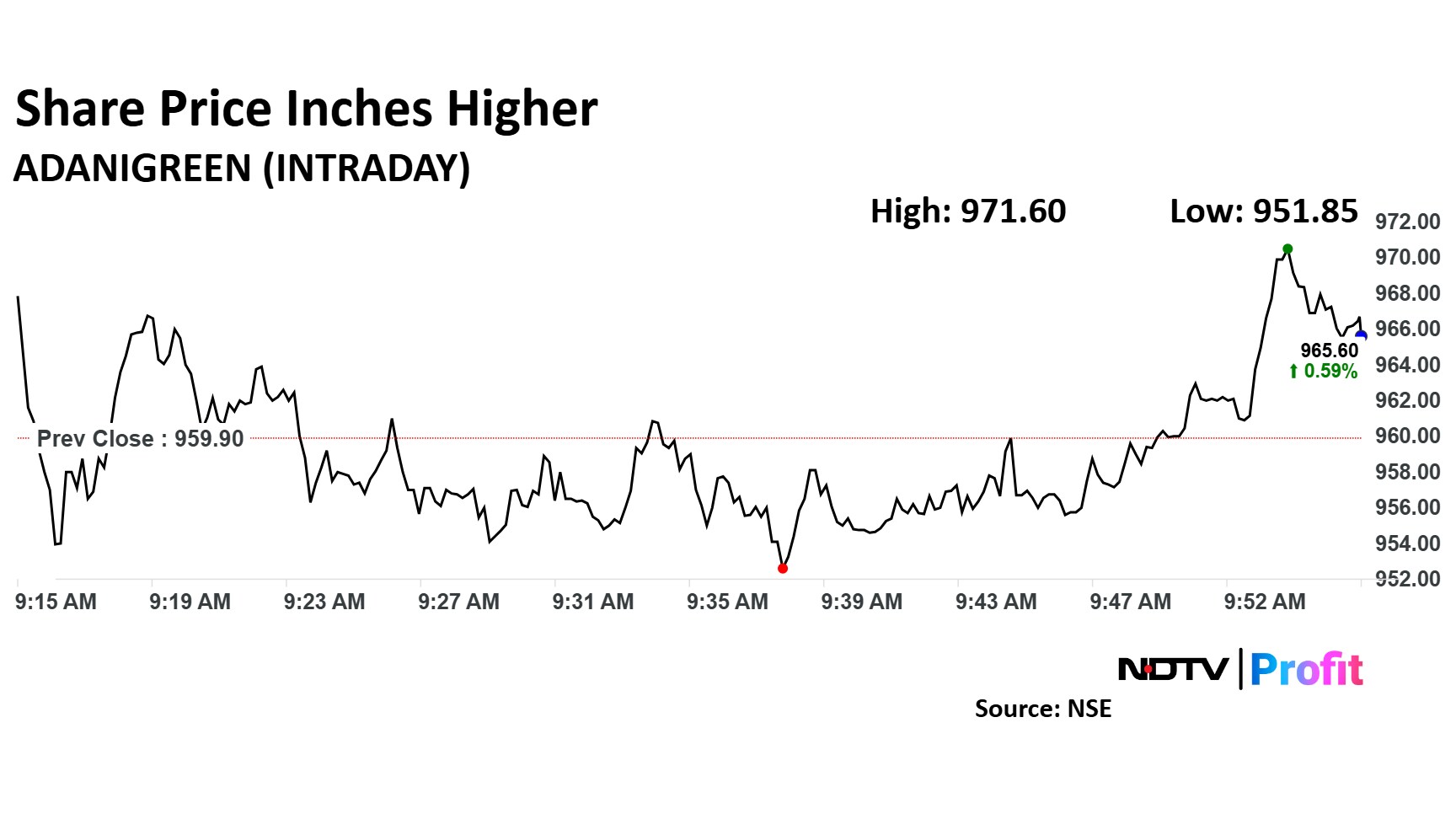

Adani Green Energy's subsidiary has successfully commissioned a 212.5 MW solar project at Khavda.

This new addition boosts the company's total operational renewable generation capacity to an impressive 13,700.3 MW.

GR Infra is in pact with Indus Infra trust to transfer stake in arm GR Galgalia Bahadurhanj highway for Rs 226 crore.

Source: Exchange Filing

GR Infra is in pact with Indus Infra trust to transfer stake in arm GR Galgalia Bahadurhanj highway for Rs 226 crore.

Source: Exchange Filing

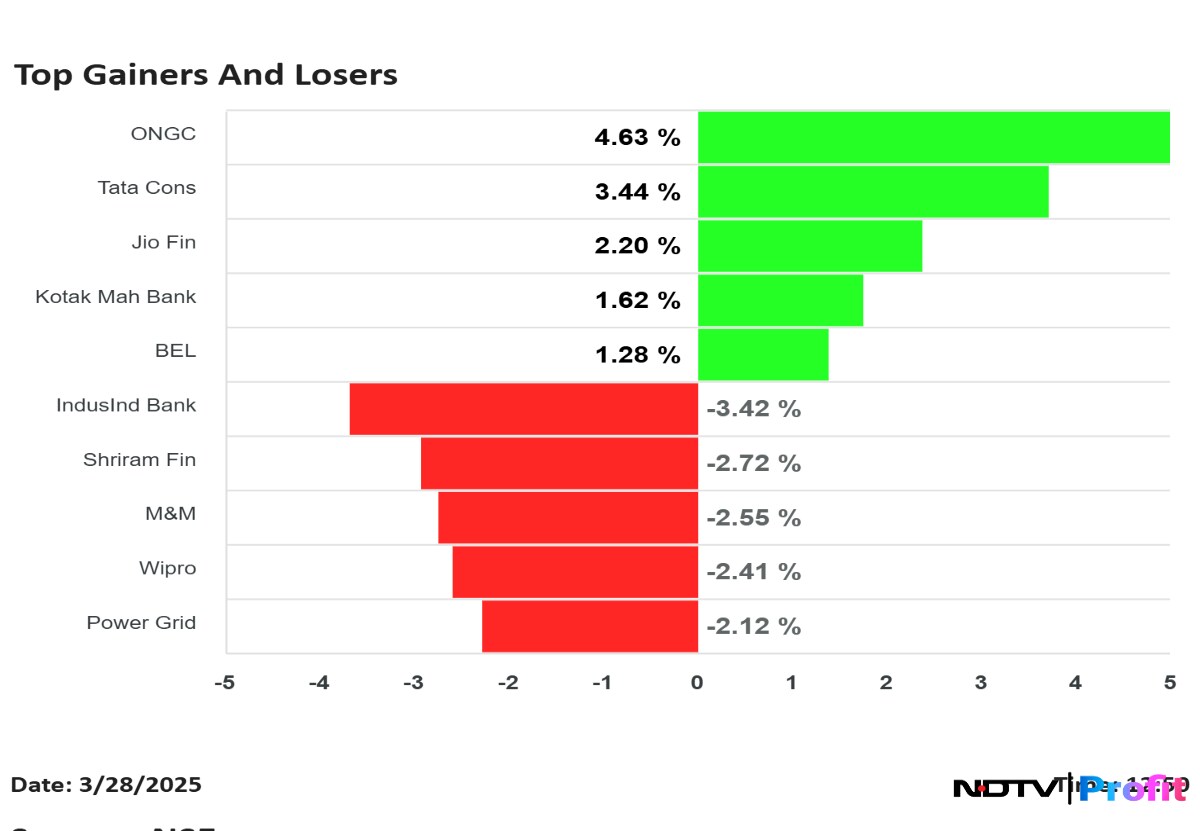

As stock market continues to decline in Friday's trade, IndusInd Bank, Shriram Finance, Mahindra and Mahindra emerged as top losers.

As stock market continues to decline in Friday's trade, IndusInd Bank, Shriram Finance, Mahindra and Mahindra emerged as top losers.

The benchmark indices continued their downward trajectory on Friday as Nifty 50 declined 0.38% and Sensex declined 0.41%.

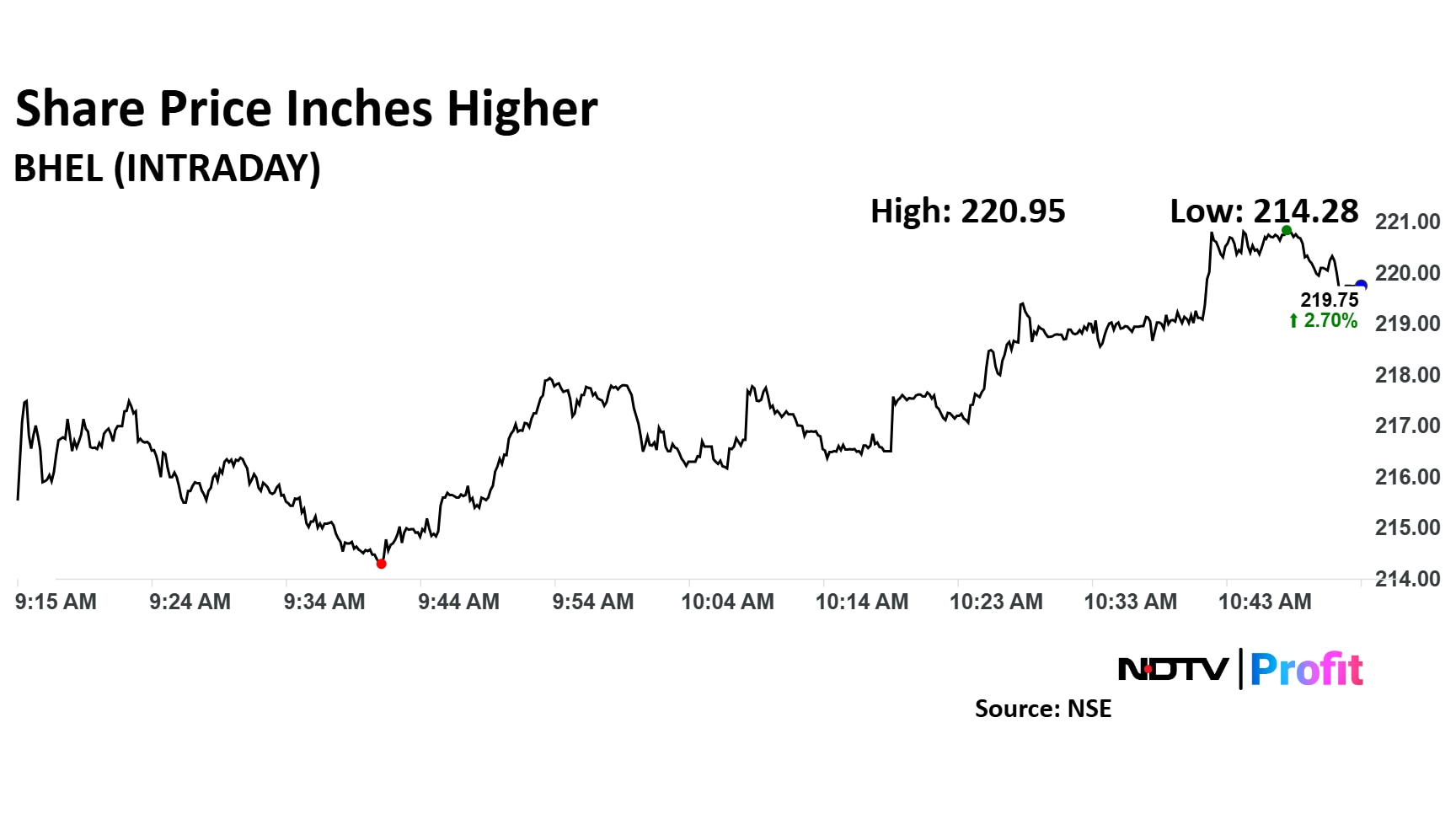

The markets at noon was trading with a spot of red as the Nifty 50 was trading 0.03% lower at 23,585 points. The Sensex was also 0.08% down and was at 77,547 points at noon on Friday. The stocks moving the most in Friday's session were, BHEL, BSE, BEML, DCM Shriram, ONGC and DMart.

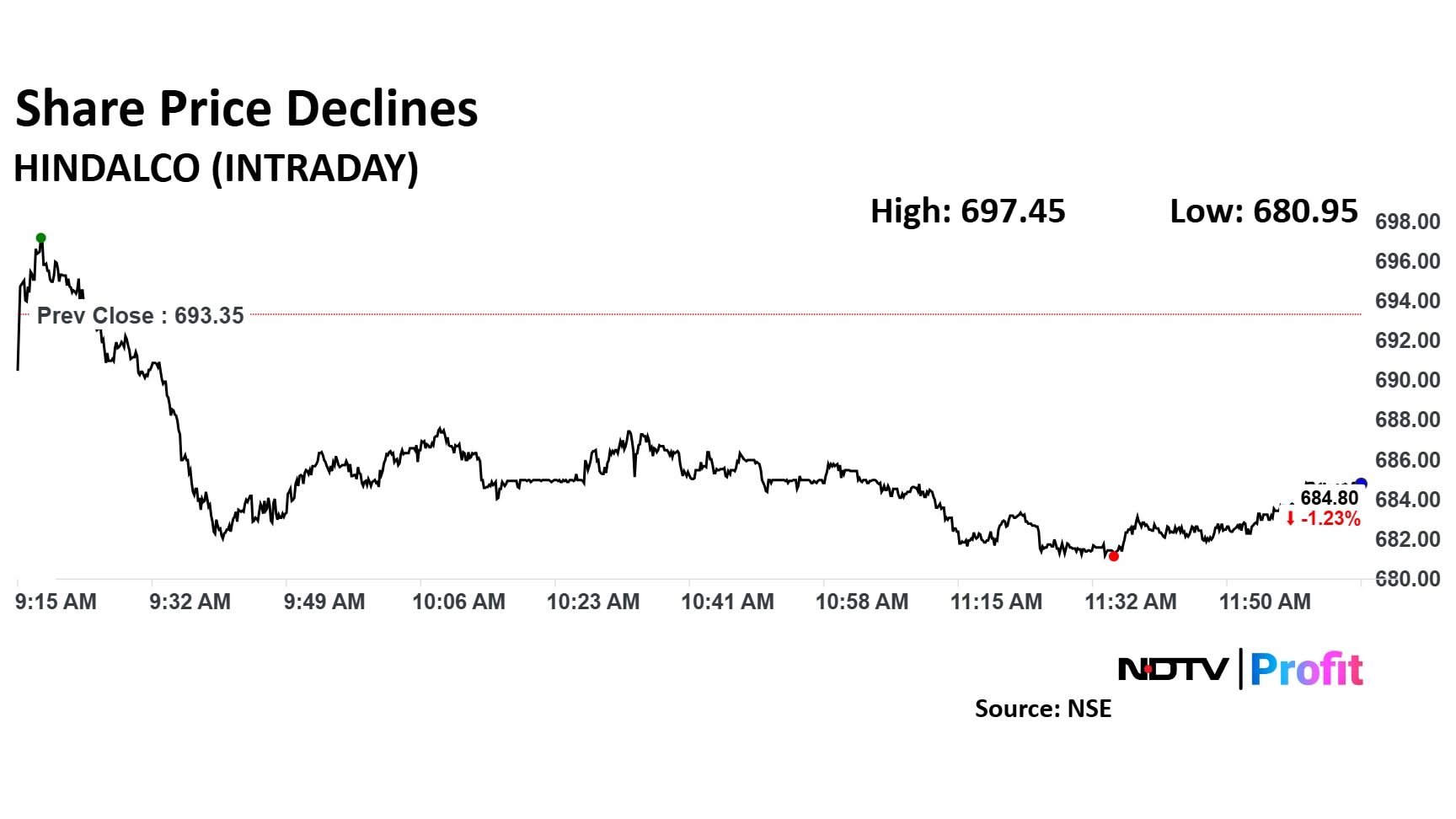

Hindalco Industries has announced that its Board of Directors will meet on May 20 to review and consider the company's Q4 earnings.

Source: Exchange Filing

Hindalco Industries has announced that its Board of Directors will meet on May 20 to review and consider the company's Q4 earnings.

Source: Exchange Filing

Maintain Outperform with TP of Rs 5360 – 32% upside.

As of March 27, DMart had added 15 stores in Q4, taking the FY25 total to 37.

Expect it to add 10 more stores in the last four days of the year.

Believe the company is well-positioned to accelerate store additions.

DMart tends to open stores in line with cash generated in previous years.

DMart remains one of our top picks for India.

Jefferies' Chris Wood Replaces Axis Bank, Godrej Properties with these stocks in portfolio Rejig

Read more about it here

Goldman Sachs downgraded LTIMindtree to 'neutral, while it cut target prices for Tata Consultancy Services Ltd., Wipro Ltd., Tech Mahindra Ltd., Infosys Ltd., and HCLTech Ltd.

The brokerage has also lowered estimates and multiples for Indian IT services companies to factor in the macroeconomic headwinds, stemming mostly from the US.

Read more about it here

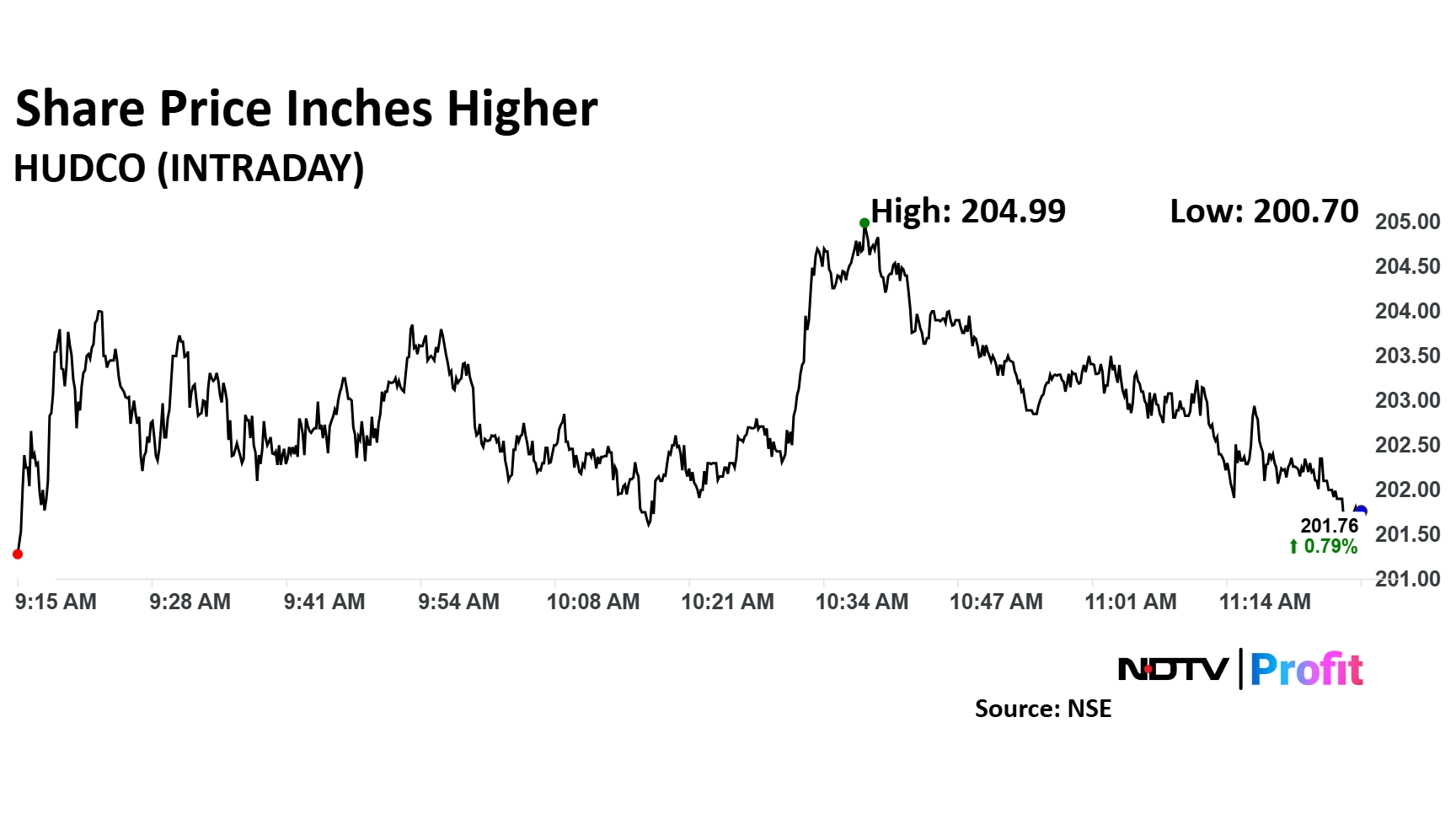

HUDCO is set to consider a borrowing program of up to Rs 65,000 crore for the fiscal year 2026 during a meeting on April 4.

Source: Exchange Filing

HUDCO is set to consider a borrowing program of up to Rs 65,000 crore for the fiscal year 2026 during a meeting on April 4.

Source: Exchange Filing

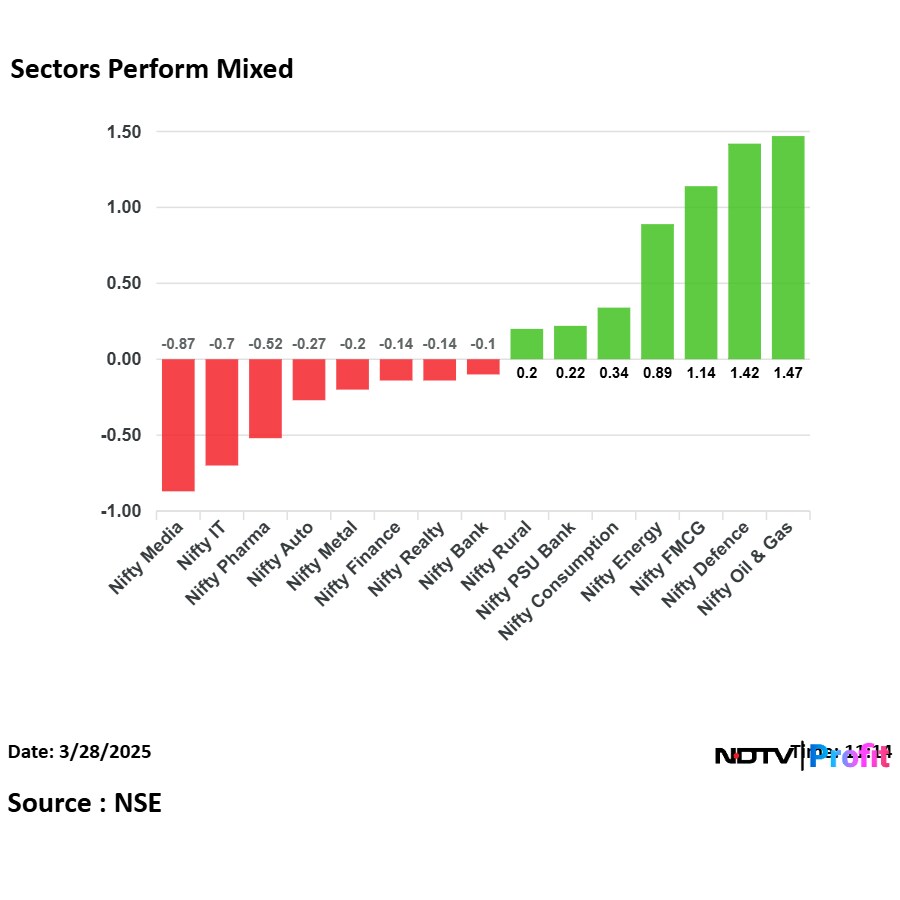

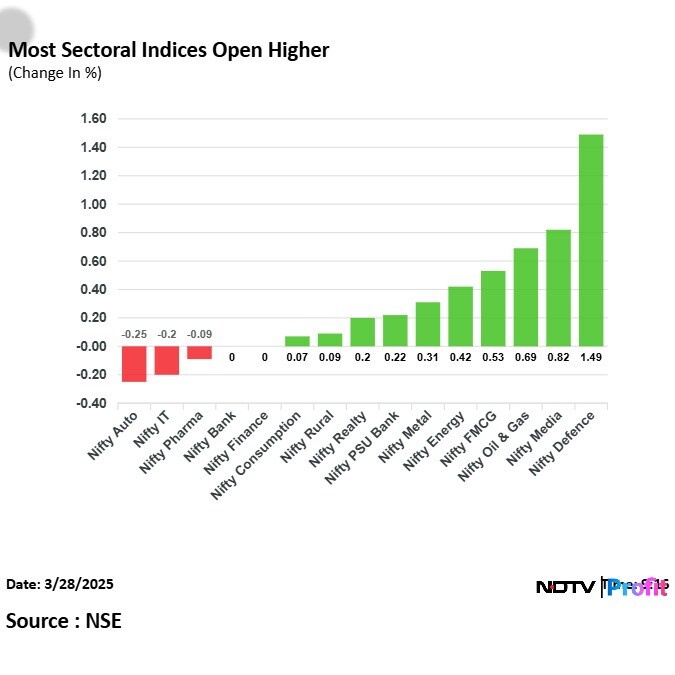

On last trading session of March, sectoral index showcased mixed performance as eight sectors declined and seven surged.

On last trading session of March, sectoral index showcased mixed performance as eight sectors declined and seven surged.

'Buy' GAIL India maintains ICICI Securities on attractive valuation; strong prospects, sees up to 35% upside

Read more about it here

BHEL share price surged 3.26% after the company secured an order worth Rs 11,800 crore for the Engineering, Procurement, and Construction (EPC) package of a 2x660 MW thermal power plant in Chhattisgarh.

BHEL share price surged 3.26% after the company secured an order worth Rs 11,800 crore for the Engineering, Procurement, and Construction (EPC) package of a 2x660 MW thermal power plant in Chhattisgarh.

Ashok Leyland on Friday won multiple Defence orders worth Rs 700 crore. The company will supply logistics vehicles to Indian Army.

The shares of Ashok Leyland fell 1.66% on Friday to Rs 205.06 per share. It pared losses to trade 0.69% lower at Rs 207.08 apiece as of 10:40 a.m.

Ashok Leyland on Friday won multiple Defence orders worth Rs 700 crore. The company will supply logistics vehicles to Indian Army.

The shares of Ashok Leyland fell 1.66% on Friday to Rs 205.06 per share. It pared losses to trade 0.69% lower at Rs 207.08 apiece as of 10:40 a.m.

The owner of MTR and Eastern Spices brands is currently working with advisers on the potential share sale and may file for an IPO as soon as the first quarter of fiscal 2026, according to people familiar with the matter.

Read more about this here

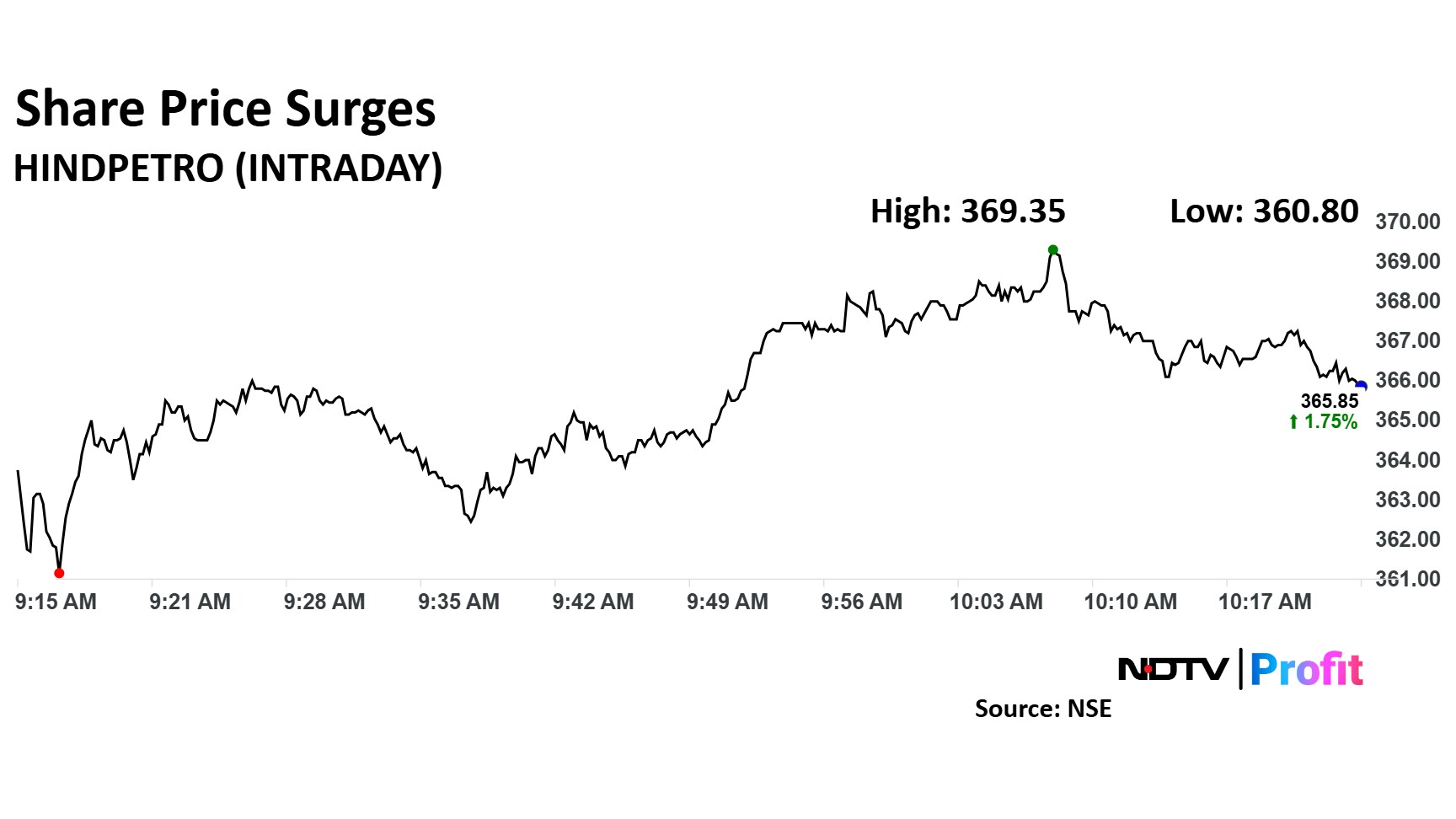

HPCL has appointed Rajneesh Narang as the Chief Financial Officer (CFO) of the company

HPCL has appointed Rajneesh Narang as the Chief Financial Officer (CFO) of the company

Share price of IndusInd bank fell 1.53% ahead of PwC report on bank today.

Share price of IndusInd bank fell 1.53% ahead of PwC report on bank today.

The potential for higher defence and oil and gas imports from the US could help offset some of the impact from expected tariff hikes.

However, some sectors, including automobiles, pharmaceuticals, textiles, and alcohol, could face adverse effects from these increased tariffs, Jefferies said in a note on Friday.

Read more on this here

Adani Green Energy's arm, Adani Renewable Energy, has secured an order to supply 400 MW of solar power to Uttar Pradesh Power Corporation at a competitive tariff of Rs 2.57/kWh for 25 years.

Adani Green Energy's arm, Adani Renewable Energy, has secured an order to supply 400 MW of solar power to Uttar Pradesh Power Corporation at a competitive tariff of Rs 2.57/kWh for 25 years.

During early trade the market continued to slide as Nifty 50 fell 0.37% to 23,504.90 and Sensex fell 0.38% to 77,309.79.

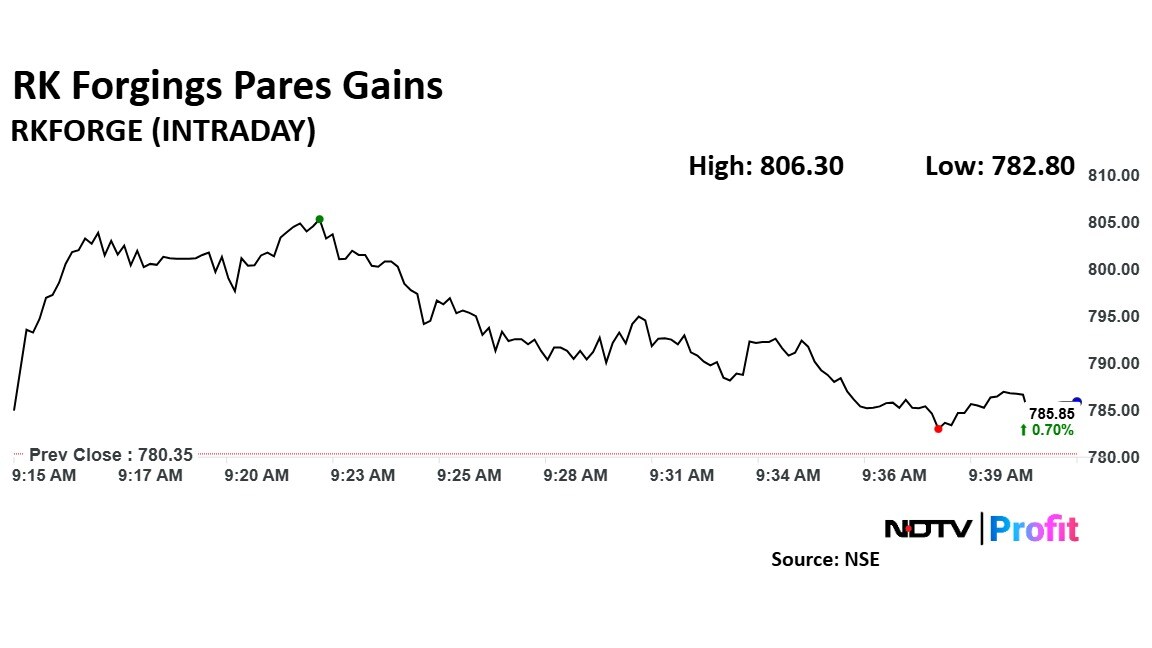

Ramkrishna Forgings' share price surged 3.33% after it commenced operations at its new manufacturing facility, which boasts a capacity of 14,250 metric tons.

Ramkrishna Forgings' share price surged 3.33% after it commenced operations at its new manufacturing facility, which boasts a capacity of 14,250 metric tons.

Hyundai Motor India Debuts in NIFTY Next 50, NIFTY 100, NIFTY 500, S&P BSE 500 and other Key Capital Market Indices.

Source: Exchange Filing

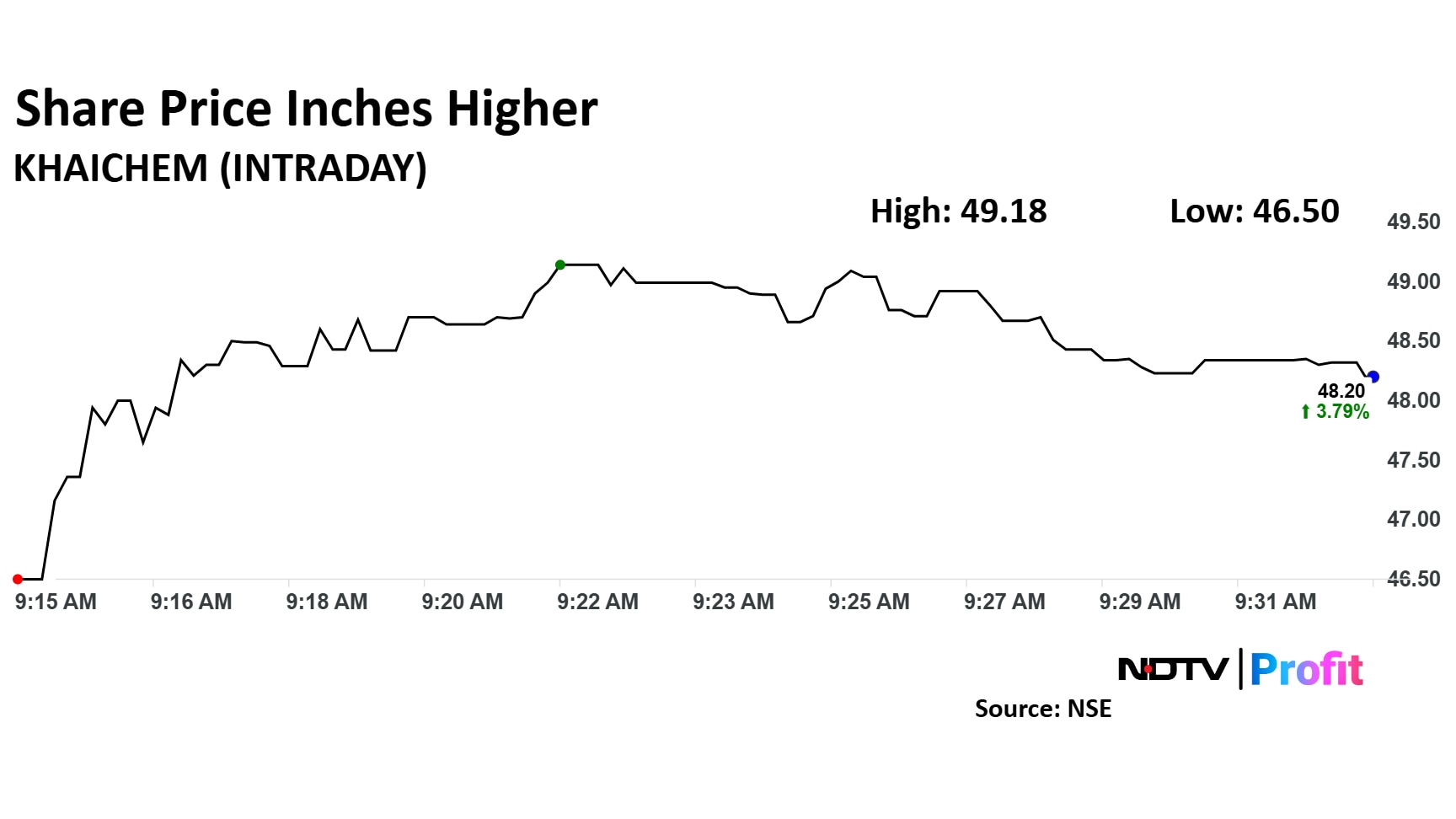

Khaitan Chemicals & Fertilizers' share price surged nearly 6% after the company reappointed Shailesh Khaitan as chairperson and MD effective April 1.

Khaitan Chemicals & Fertilizers' share price surged nearly 6% after the company reappointed Shailesh Khaitan as chairperson and MD effective April 1.

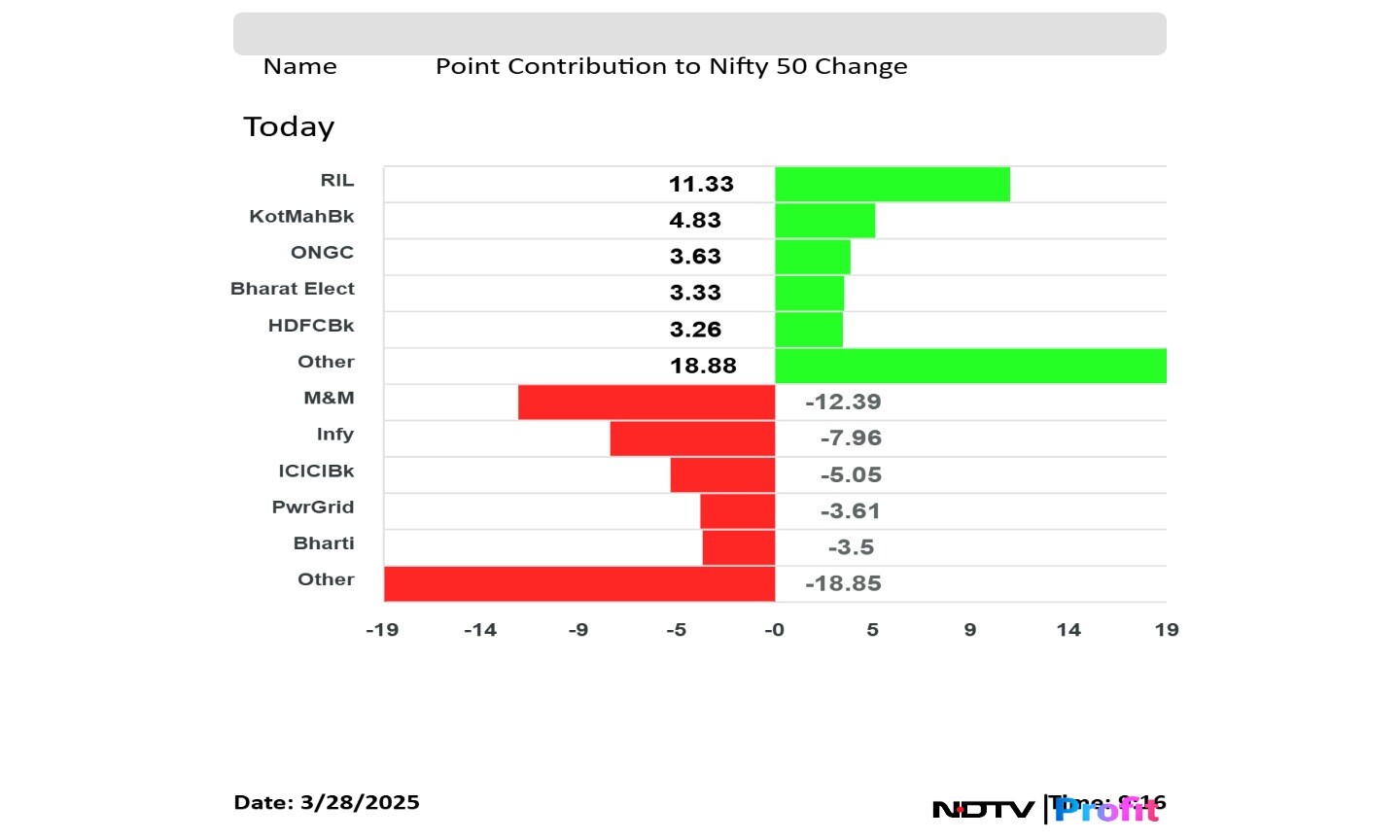

In Nifty point contribution Mahindra and Mahindra, Infosys and ICICI Bank were the top laggards.

In Nifty point contribution Mahindra and Mahindra, Infosys and ICICI Bank were the top laggards.

At market open on Friday most sectoral indices opened with gains. Nifty Defence and Nifty Media surged the most.

At market open on Friday most sectoral indices opened with gains. Nifty Defence and Nifty Media surged the most.

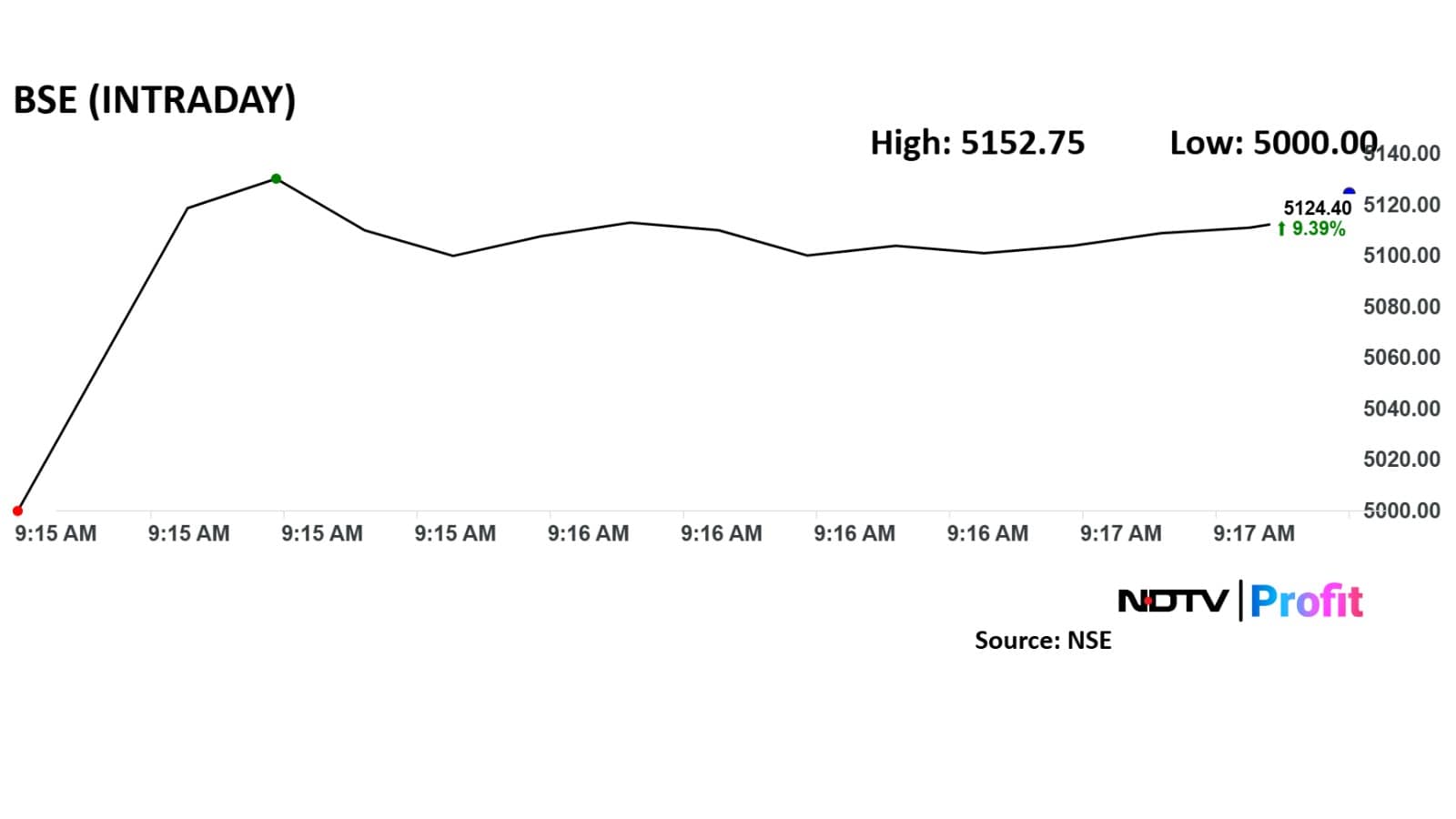

BSE stock jumped 10% after SEBI proposed that exchanges should stay with F&O expiry on Tuesday & Thursday.

BSE stock jumped 10% after SEBI proposed that exchanges should stay with F&O expiry on Tuesday & Thursday.

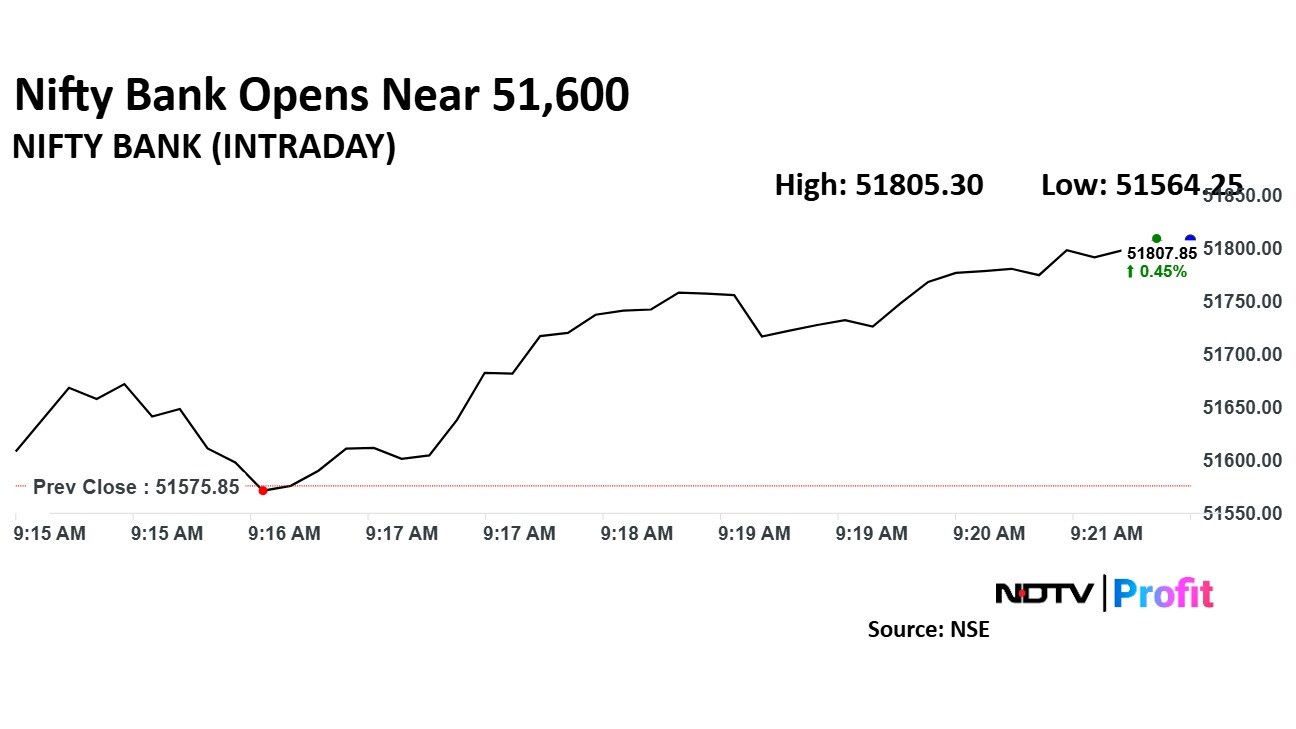

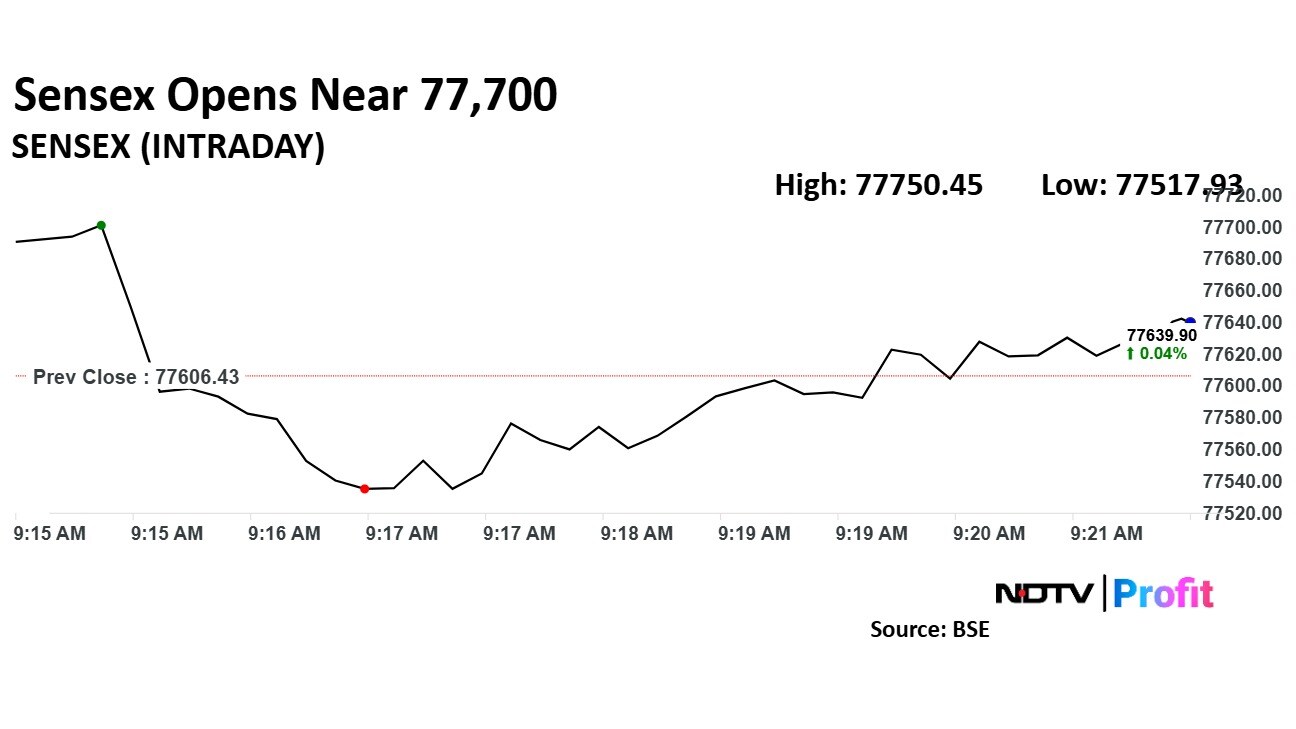

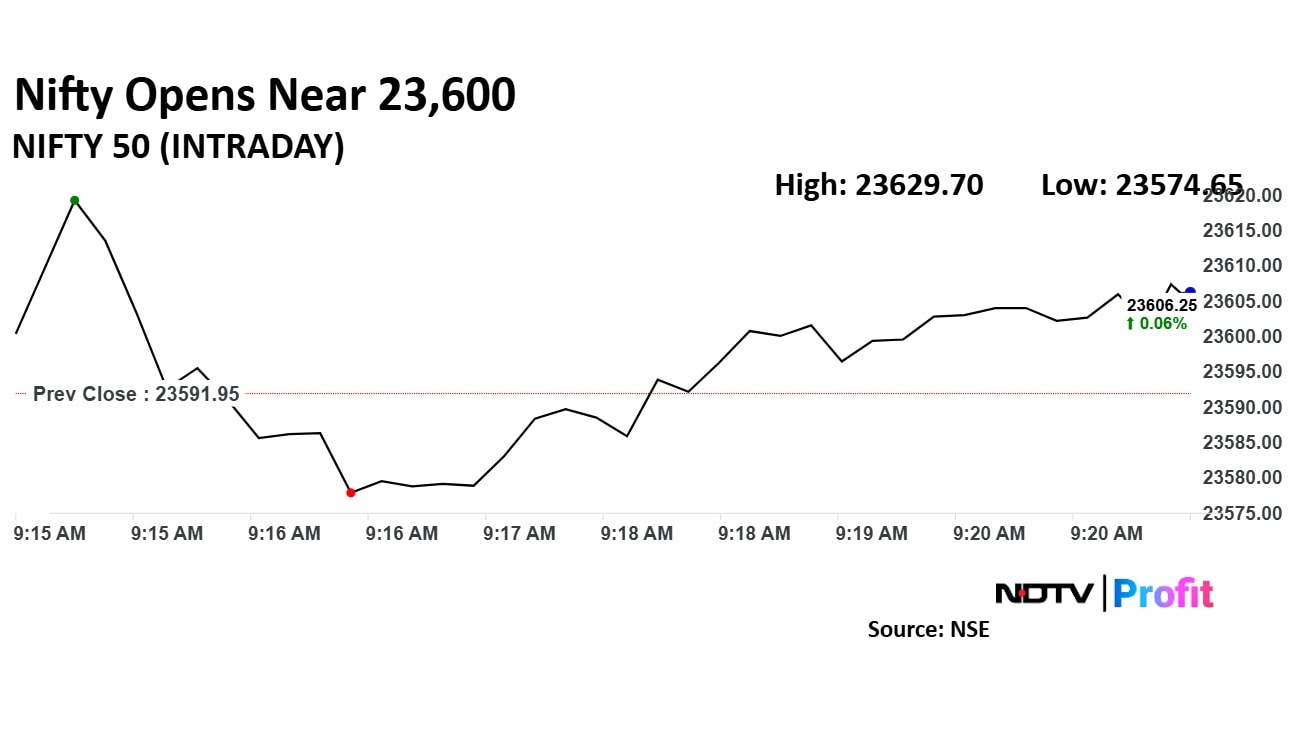

Friday marks the last trading session for the month. On March 28 the benchmark indices opened flat and quickly slipped into losses as Sensex tumbled 0.11% and Nifty 50 fell 0.07%.

Friday marks the last trading session for the month. On March 28 the benchmark indices opened flat and quickly slipped into losses as Sensex tumbled 0.11% and Nifty 50 fell 0.07%.

Friday marks the last trading session for the month. On March 28 the benchmark indices opened flat and quickly slipped into losses as Sensex tumbled 0.11% and Nifty 50 fell 0.07%.

Friday marks the last trading session for the month. On March 28 the benchmark indices opened flat and quickly slipped into losses as Sensex tumbled 0.11% and Nifty 50 fell 0.07%.

Friday marks the last trading session for the month. On March 28 the benchmark indices opened flat and quickly slipped into losses as Sensex tumbled 0.11% and Nifty 50 fell 0.07%.

Friday marks the last trading session for the month. On March 28 the benchmark indices opened flat and quickly slipped into losses as Sensex tumbled 0.11% and Nifty 50 fell 0.07%.

Friday marks the last trading session for the month. On March 28 the benchmark indices opened flat and quickly slipped into losses as Sensex tumbled 0.11% and Nifty 50 fell 0.07%.

Friday marks the last trading session for the month. On March 28 the benchmark indices opened flat and quickly slipped into losses as Sensex tumbled 0.11% and Nifty 50 fell 0.07%.

At market pre-open on Friday the benchmark indices gained. Nifty 50 gained 0.04% at 23,600 and Sensex gained 0.11% at 77.690.

Rupee strengthened 13 paise to open at 85.66 against US dollar.

It ended at 85.79 a dollar on Thursday.

Source: Bloomberg

New launches have historically driven volume growth in PVs.

Maruti's launch cycle turns positive in FY26E vs muted industry launch pipeline)

Maruti targeting 2 major upcoming ICE SUVs (5-seater likely in Sep-25E; 7-seater likely in Jan-26E;

New launches coincides with early signs of improvement seen in small cars.

Build in 8% FY25E-27E volume CAGR, with 12.5% margin by FY27E vs 11.6% in Q3.

Believe valuations at 21x Mar-27E PER are attractive.

Oil and Natural Gas Corp., BSE Ltd., Jubilant FoodWorks Ltd., and pharma stocks were among top companies and sectors on brokerages' radar on Friday.

Read more on this here

ONGC Invests Rs 3,300 Cr In Wholly-Owned Subsidiary ONGC Green Via Subscription On Right Basis

Investment Proceeds Were Utilised By OGL For Further Investment Of Rs 3,153 Cr In ONGC NTPC Green

NTPC Green Energy & Promoter Of ONGPL Invest Same Amount To Maintain Shareholding Structure

ONGC NTPC Green Is 50:50 Joint Venture Company Of OGL (ONGC Green Ltd.) & NTPC Green Energy

ONGPL completes acquisition of 100% stake in Ayana Renewable Power Private for Rs 6,249 Cr

OGL’s share in acquisition of stake in Ayana Renewable Power Private is Rs 3124 Cr

Source: Exchange Filing

UltraTech Cement Ltd., Bharat Electronics Ltd., Infosys Ltd., Hindustan Aeronautics Ltd. and BEML Ltd. will be the stocks to watch before going into trade on Friday.

Read more about it here

The market regulator has suggested limiting derivative contract expiries to Tuesdays or Thursdays. This proposal could disrupt the NSE's plan to move the weekly index option expiry to Monday.

Read more about this here

Brent Crude surged in Thursday's session to trade at $74.05, up 0.03% during the early morning trend. The oil price later declined to trade at $73.99, down 0.05%.

The volatility comes in the wake of second round of tariffs set to be imposed by US President Trump starting April 2.

On March 28, gold prices in India rose to Rs 88,900 per 10 grams, according to the India Bullion Association.

Rates varied across major cities: New Delhi at Rs 88,580, Mumbai at Rs 88,620, Kolkata at Rs 88,620, Bengaluru at Rs 88,810, and Chennai at Rs 88,990, the highest in the country.

Stocks declined as the US implemented tariffs on automakers, heightening fears of an expanding trade war and overshadowing data that revealed faster-than-expected growth in the world's largest economy.

With just days left in a quarter poised to be the worst for the S&P 500 since 2023, the index slipped once again.

The S&P 500 lost 0.3%. The Nasdaq 100 fell 0.6%. The Dow Jones Industrial Average slid 0.4%.

The yield on 10-year Treasuries rose one basis point to 4.36%. The dollar wavered.

Asian stocks fell on Friday, tracking US market losses, as fears of looming "reciprocal tariffs" and escalating trade tensions eclipsed strong US economic growth data.

Japan and South Korea's markets fell, following declines in the S&P 500 and Nasdaq 100. US equity futures also edged lower in early Asian trade.

The Nikkei and Kospi were trading 1.90% and 1.39% down, respectively as of 7:09 a.m. The ASX 200 was up 0.38%.

On Friday, Gift Nifty was trading near the 23,700-mark at 23,747, as it declined 6 points or 0.03% as of 07:24 a.m.

In today's trade, several stocks are expected to react due to recent developments.

UltraTech Cement Ltd. commissioned new capacity and expansion projects across multiple locations.

BEL stock is likely to see movement after receiving additional orders worth Rs 1,385 crore, bringing the total orders for the current financial year to Rs 18,415 crore.

Infosys Ltd. is also anticipated to be in focus following its partnership with LKQ Europe to implement a unified, cloud-based digital platform for HR processes across 18 countries.

Benchmark indices ended Thursday's trading session with gains. Sensex closed 0.41% higher at 77,606.43 and Nifty 50 advanced 0.45% to 23,591.95.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.