Nifty IT close higher for the fourth day in a row.

Nifty Financial Services close higher for the seventh day in a row.

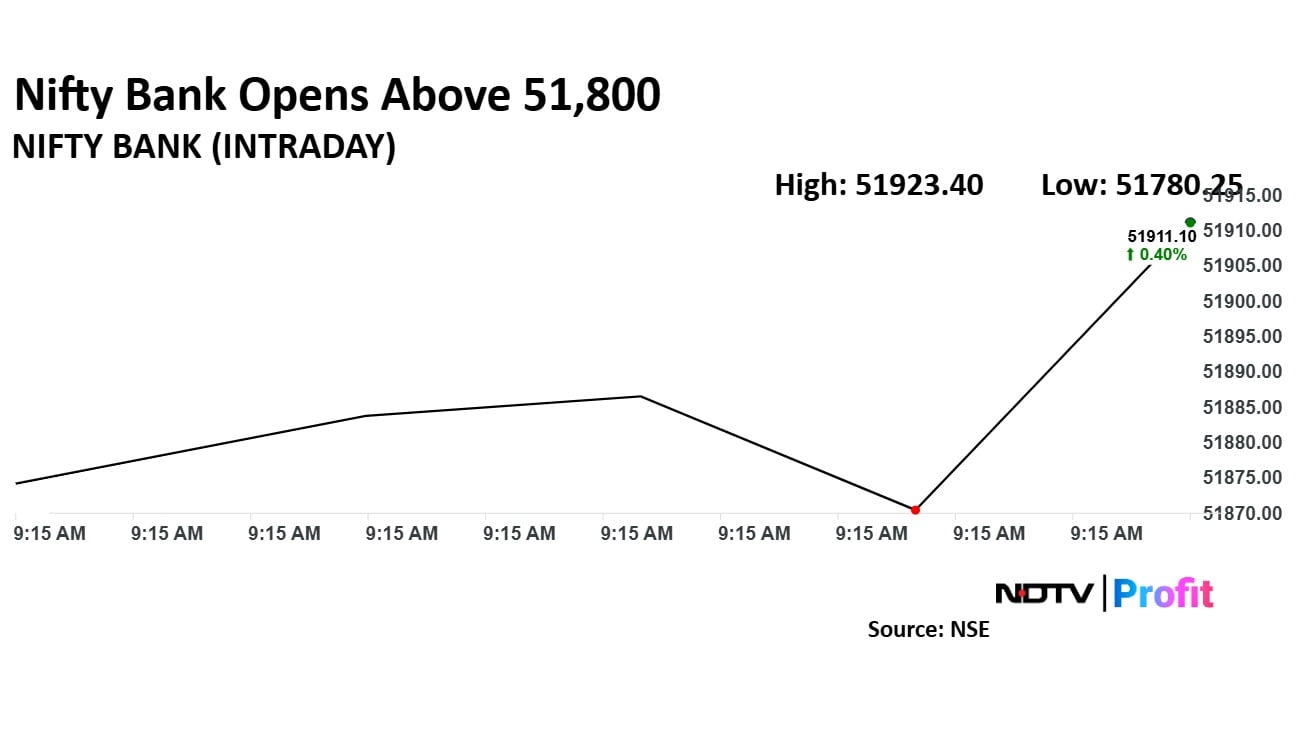

Nifty Bank snaps eight day gaining streak.

Nifty FMCG snaps three day gaining streak.

Nifty Auto, Pharma snaps six day gaining streak.

Nifty oil and Gas snaps five day gaining streak.

Nifty Metal, Media, PSU Banks snaps five day gaining streak.

Nifty ends higher for the seventh day in a row.

Nifty Midcap 150 snaps six day gaining streak

Nifty Midcap 250 snaps six day gaining streak

Nifty 50 closed 0.04% up at 23,668.65

BSE Sensex closed 0.04% up at 78,017.19

UltraTech Cement, Bajaj FinServ top gainer in Nifty.

Nifty Midcap 150 fell 1% for the day, dragged by Dixon Tech, Godrej Industries.

Nifty Smallcap 250 fell 1.3% for the day, dragged by Swan Energy, Home First Finance.

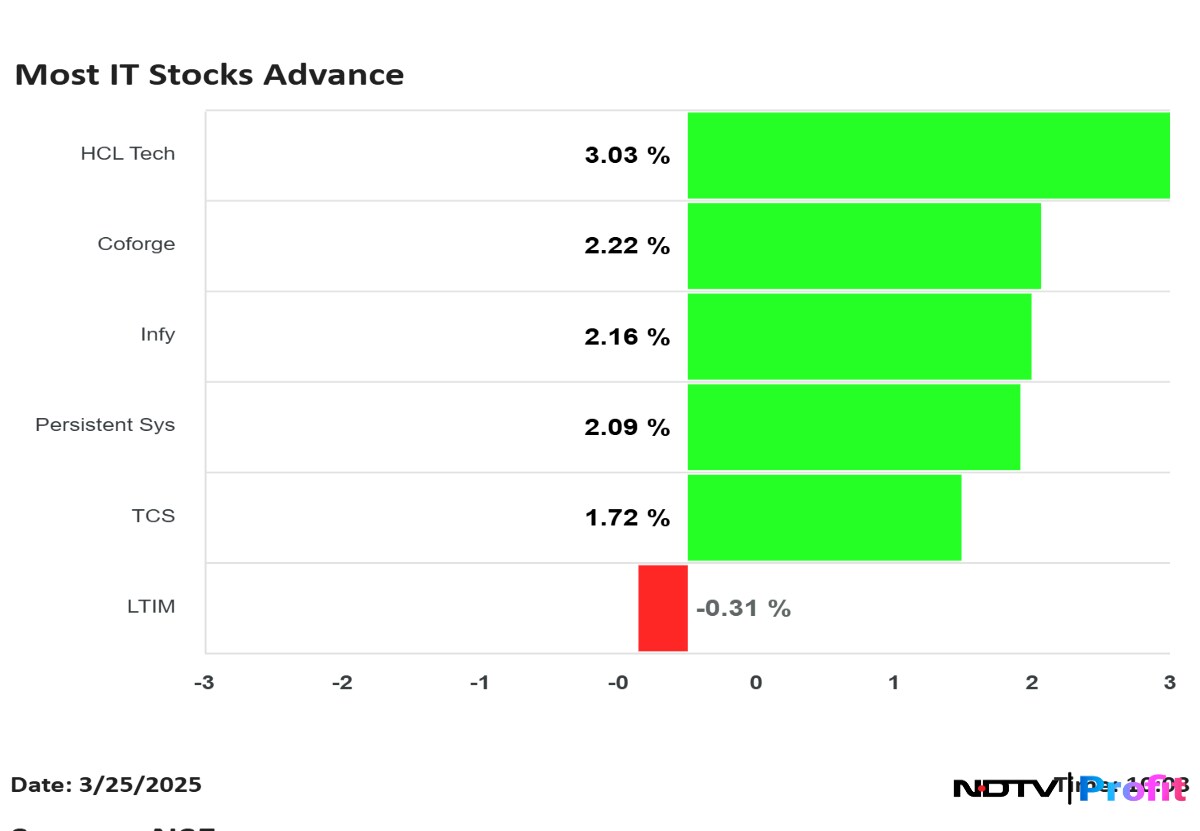

Nifty IT top sectoral gainers for the day, led by Persistent Systems, Coforge.

Nifty 50 closed 0.04% up at 23,668.65

BSE Sensex closed 0.04% up at 78,017.19

UltraTech Cement, Bajaj FinServ top gainer in Nifty.

Nifty Midcap 150 fell 1% for the day, dragged by Dixon Tech, Godrej Industries.

Nifty Smallcap 250 fell 1.3% for the day, dragged by Swan Energy, Home First Finance.

Nifty IT top sectoral gainers for the day, led by Persistent Systems, Coforge.

Rupee weakened 12 paise to close at 85.76 against US dollar as it ended at 85.64 a dollar on Monday.

Source: Bloomberg

KRN Heat Exchangers' subsidiary, KRN HVAC, has received approval and recognition as an approved vendor from the Ministry of Railways.

This development enables the company to participate in the supply of oil cooler radiators for converter transformers.

Additionally, KRN HVAC has obtained approval for capacity assessment, paving the way for future collaborations with the Ministry of Railways.

Source: Exchange Filing

Mining stocks are getting a fresh look after US President Donald Trump vowed to open coal-fired power plants, praising "beautiful, clean coal."

Australian coal futures, which had plunged 33% from an October high, are now pricing in a rebound.

Many miners offer double-digit free cash flow yields, attracting investors who bet other leaders will follow Trump's deregulation push.

Source: Bloomberg

Finance Bill proposes to remove 7 customs tariff rates for industrial goods

Social welfare surcharge will be removed from 82 tariff lines

Propose to remove customs duty on cobalt powder, other critical minerals

32 additional capital goods are proposed to be exempted from EV battery manufacturing

28 additional capital goods are proposed to be exempted from mobile phone manufacturing

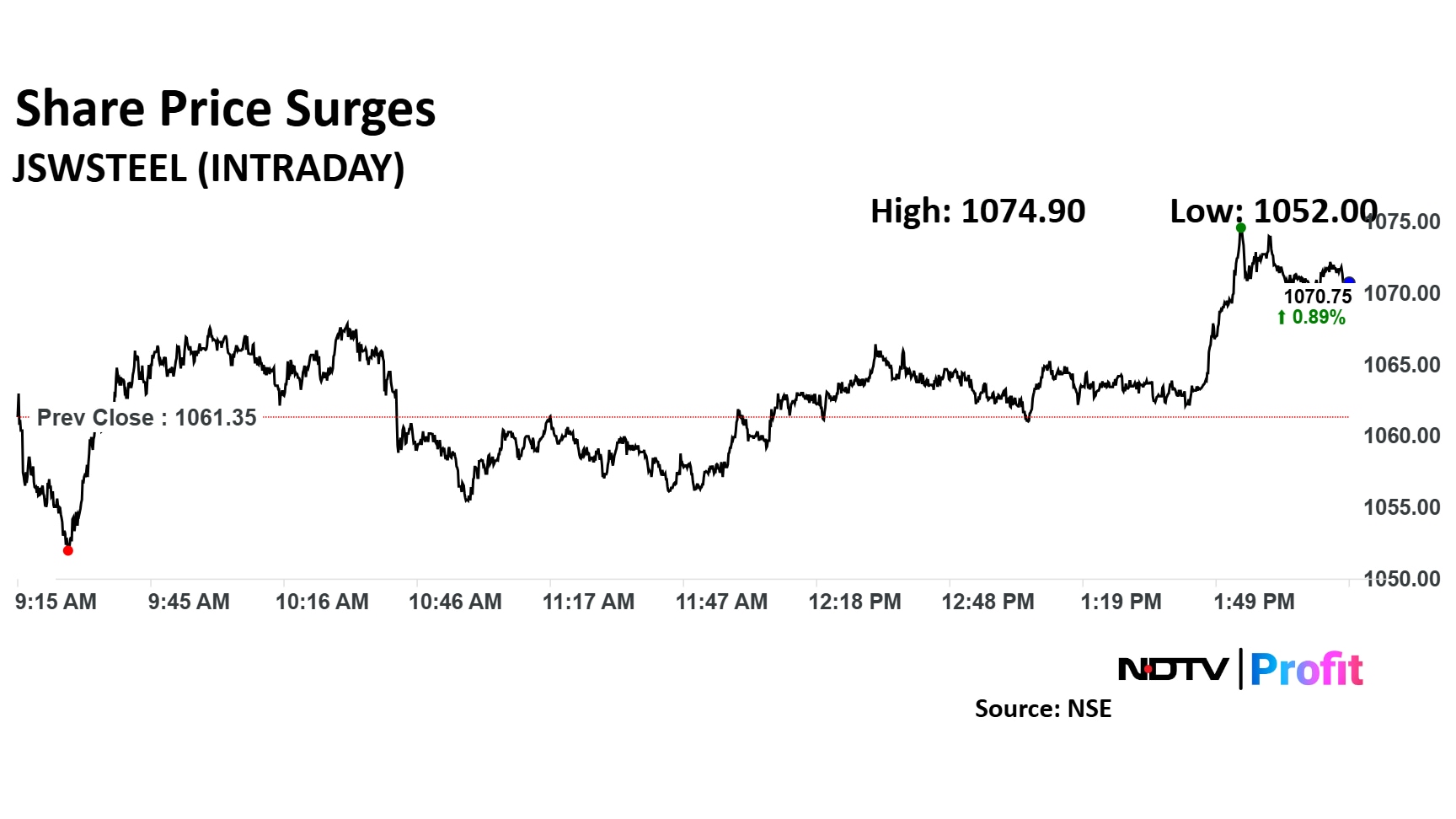

JSW Steel's board of directors has given the green light for a share buyback program. The company will repurchase 22.26 crore shares, aggregating to Rs 1,676.45 crore. The scrip rose 1.28% trading at Rs 1,074.90

JSW Steel's board of directors has given the green light for a share buyback program. The company will repurchase 22.26 crore shares, aggregating to Rs 1,676.45 crore. The scrip rose 1.28% trading at Rs 1,074.90

Finance Bill expanded scope of safe harbour rules

Propose to extend period of incorporation of start-ups by 5 years

Budget 2025 aims to boost domestic production

Finance Minister responds to discussion on Finance Bill in Lok Sabha

Finance Bill aims to provide tax clarity

Attempted to cater to aspiration of India in Finance Bill

Finance Bill rationalises a lot of provisions towards ease of doing business

Reduced thresholds on TDS and TCS provisions

State Bank of India's GIFT City branch has secured a $1 billion syndicated loan, moreover the bank chose not to exercise the greenshoe option, which would have allowed it to borrow an additional $250 million.

Source: Bloomberg

In a recently conducted review of the lending sector across Indian cities, HSBC Global Research found out that balance transfer in floating rate loans was high, and "irrational" competition was rising in a few segments, while asset quality remained stable.

HSBC Global Research preferred Shriram Finance Ltd., Cholamandalam Investment and Finance Co., Bajaj Finance Ltd., and SBI Cards & Payment Services Ltd. The brokerage has lifted the target price for the scrips, while keeping the ratings unchanged.

Read full story here.

KPI Green Energy receives letter of award for development of 13.80 MW solar power project under CPP Business segment.

Source: Exchange filing.

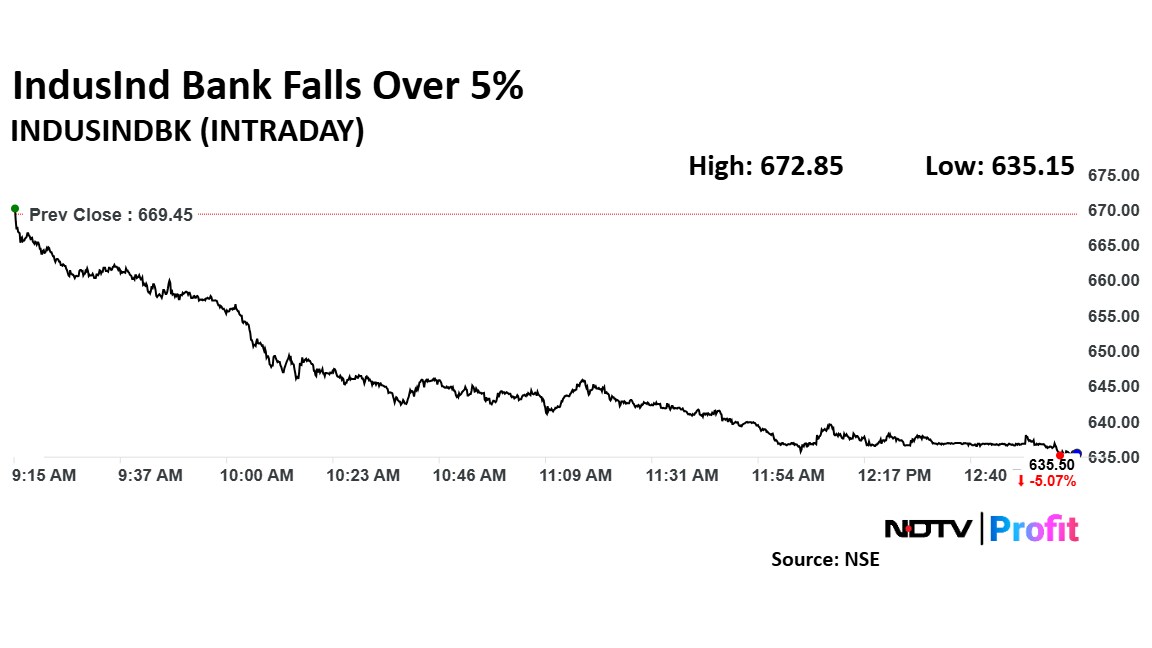

IndusInd Bank share price decline after PTI reported that External auditor PWC may submit report on IndusInd Bank's accounting discrepancies on Friday. According to estimates Rs 2,100 crore discrepancy in accounting may impact 2.35% of Bank's net worth. The report is expected to point out the actual loss to bank due to the accounting discrepancies.

IndusInd Bank share price decline after PTI reported that External auditor PWC may submit report on IndusInd Bank's accounting discrepancies on Friday. According to estimates Rs 2,100 crore discrepancy in accounting may impact 2.35% of Bank's net worth. The report is expected to point out the actual loss to bank due to the accounting discrepancies.

Benchmark indices Sensex and Nifty 50 have given up gains to trade flat on Tuesday. Nifty soared to reclaim the 23,800 mark in early trade on Tuesday and Sensex added 700 points.

Nifty 50 is down nearly 200 points at 23,694.85 and Sensex is down more than 700 points at 78,099.50

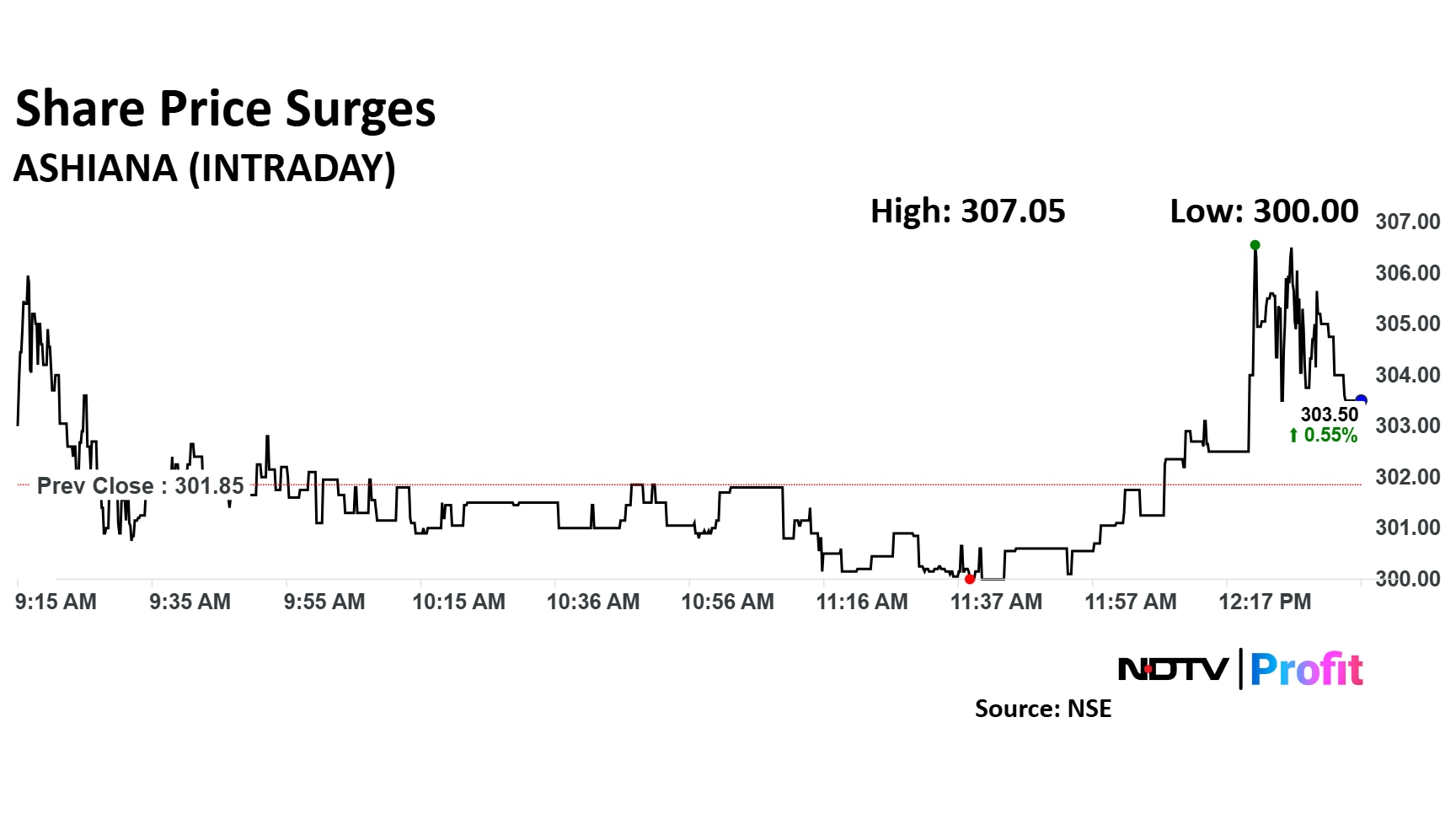

Ashiana Housing's stock rose 1.72% after the company secured bookings for 293 units at its Rajasthan project, valued at Rs 173 crore.

Ashiana Housing's stock rose 1.72% after the company secured bookings for 293 units at its Rajasthan project, valued at Rs 173 crore.

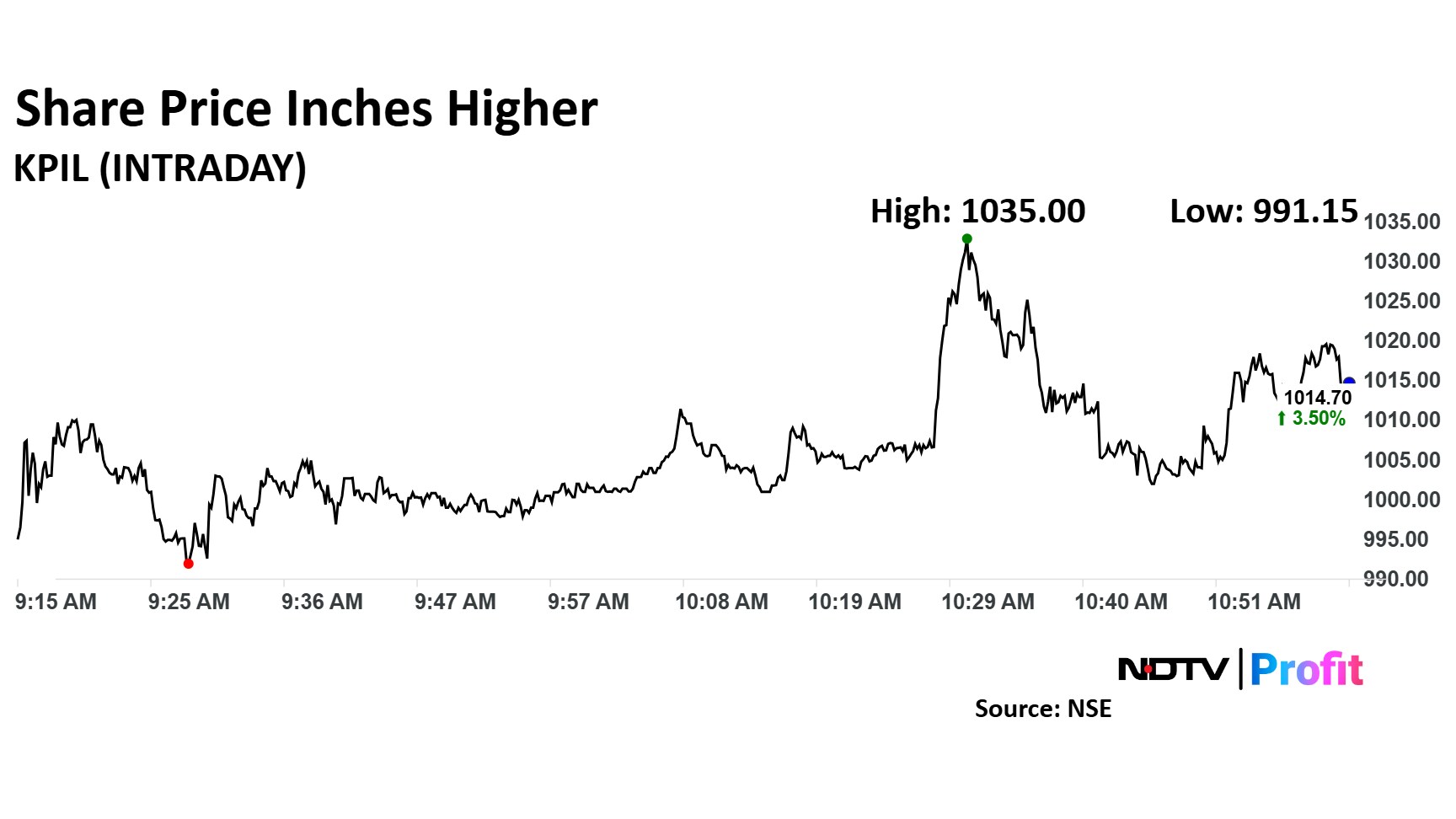

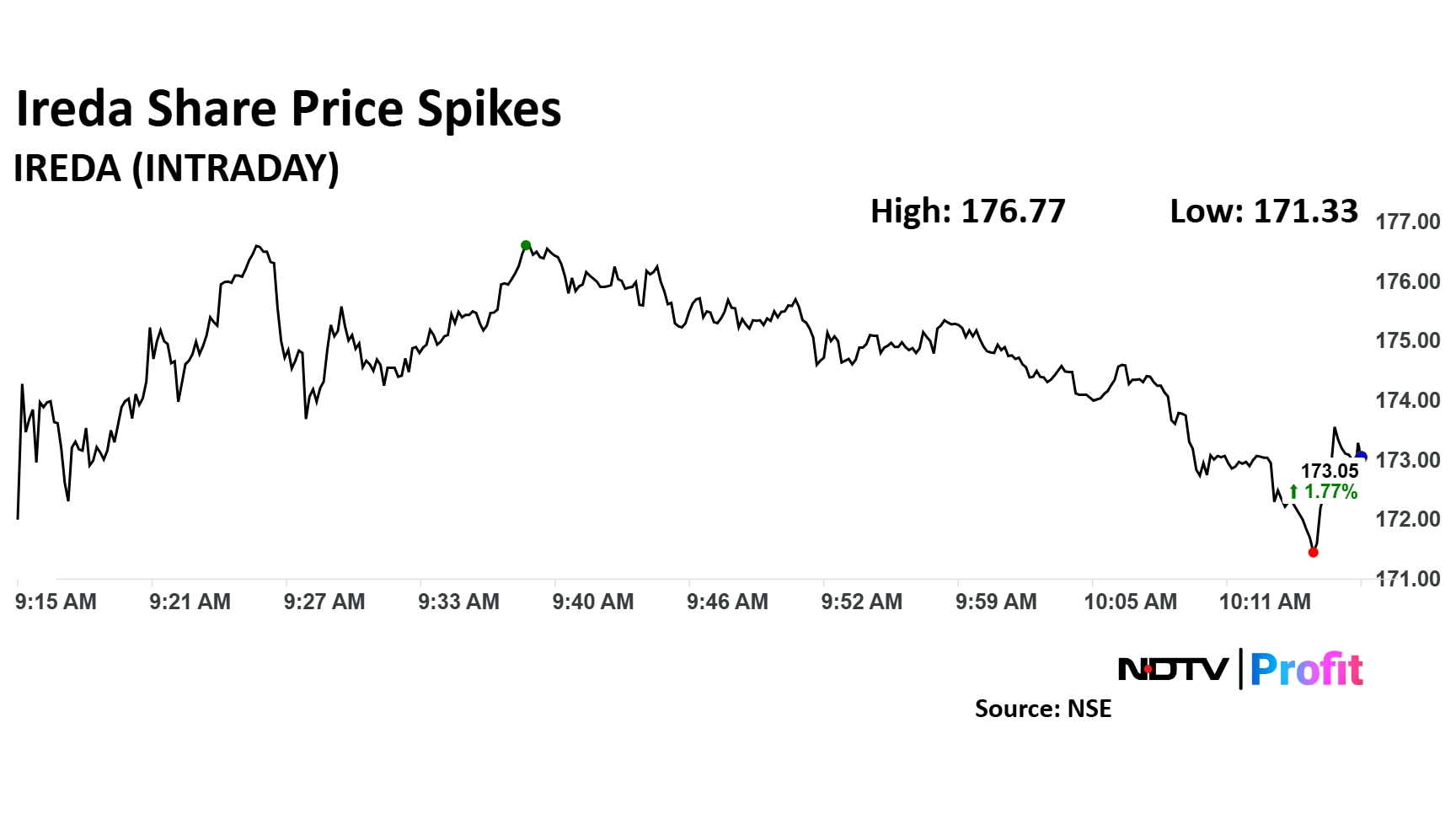

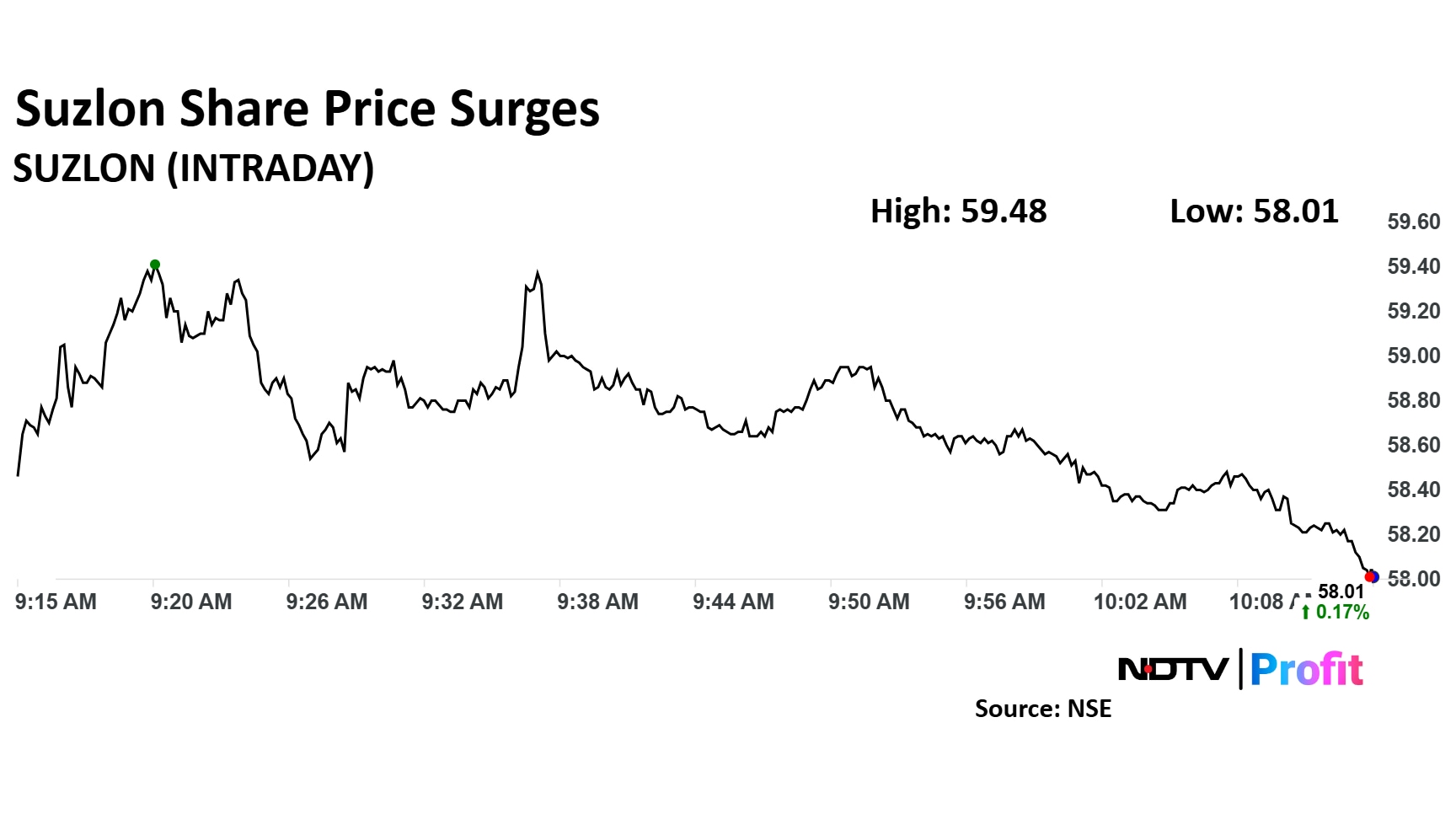

Six stocks that are buzzing at noon in Tuesday's trade include Ola Electric, Suzlon, Garden Reach Shipbuilders, Suzlon Energy, IREDA, Brigade Enterprises and Colgate Palmolive.

Read more about it here

Tech hiring outlook declines with 3 lakh fewer jobs to be added in FY26

Escalating global challenges dampening growth projections

Tech industry expected growth reduces from 5-7% to 3-5%

Growth rate reduction to bring down hiring from 12 lakh to 9 Lakh

IT Services sector specifically to add 1.2 lakh, decrease from 2.5 lakh under better macro conditions

Fresher hiring to comprise 15-17% of gross hires

Source - Analysts

Nifty was trading in the red after it rose over 23,800 on Tuesday.

It erased over Rs 3.5 lakh crore in Market-Cap from the day's highest point.

30 stocks out of 50 declines in trade.

Reliance Industries drag Nifty by over 20 points.

Most sectors turn negative with Nifty IT and Finance holding gains.

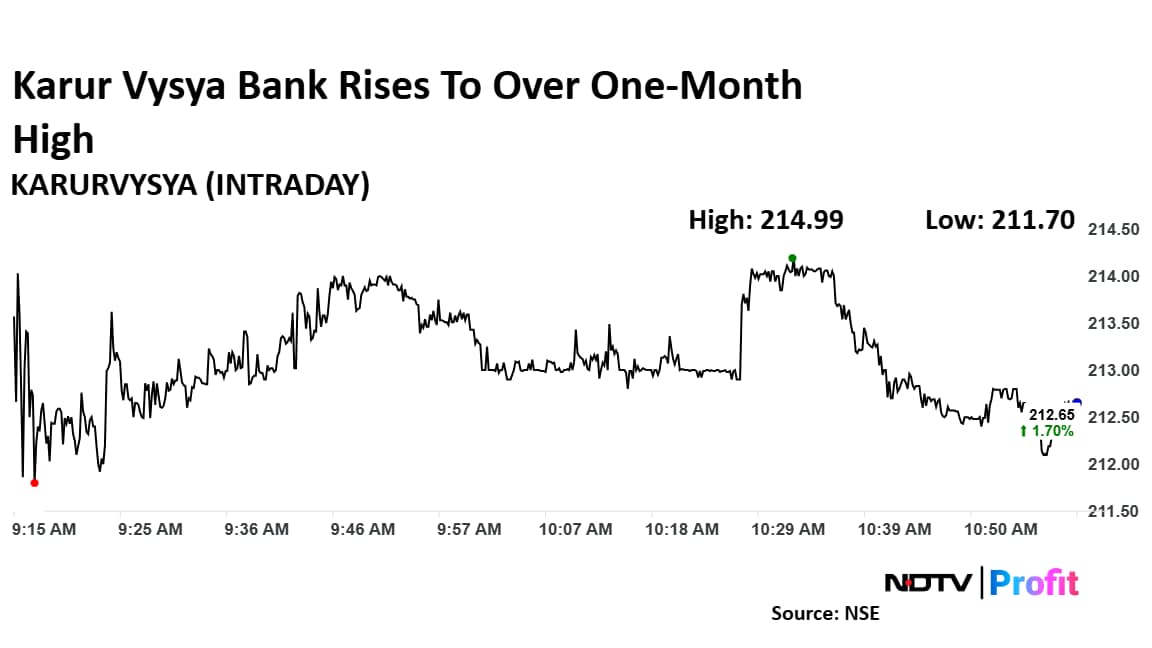

Karur Vysya Bank's shares surged to a one-month high on Tuesday, driven by Axis Capital's initiation of coverage with a 'buy' rating and a target price of Rs 295. This represents a significant 41% upside potential from current levels.

Karur Vysya Bank's shares surged to a one-month high on Tuesday, driven by Axis Capital's initiation of coverage with a 'buy' rating and a target price of Rs 295. This represents a significant 41% upside potential from current levels.

JSW Steel's current market cap stands at $30.31 billion.

JSW Steel Is top performer among Indian peers on year to date basis, gives 17.7% returns.

Source: NDTV Profit

Kalpataru Projects' shares jumped 4% after the company secured orders worth Rs 2,366 crore for its Transmission & Distribution, Buildings & Factories business.

Source: Exchange Filing

Kalpataru Projects' shares jumped 4% after the company secured orders worth Rs 2,366 crore for its Transmission & Distribution, Buildings & Factories business.

Source: Exchange Filing

UBS Global Research is optimistic about sectors driven by India's existing housing cycle, predicting a peak in the next three years. The brokerage favors.

Developers: DLF Ltd. and Prestige Estates Projects Ltd.

Consumer Durables: Havells India Ltd. and Voltas Ltd.Cement: UltraTech Cement Ltd. and Ambuja Cements Ltd.

Wires and Cables: Polycab India Ltd. and KEI Industries Ltd.

Adhesives: Pidilite Industries Ltd.

Read more about this here

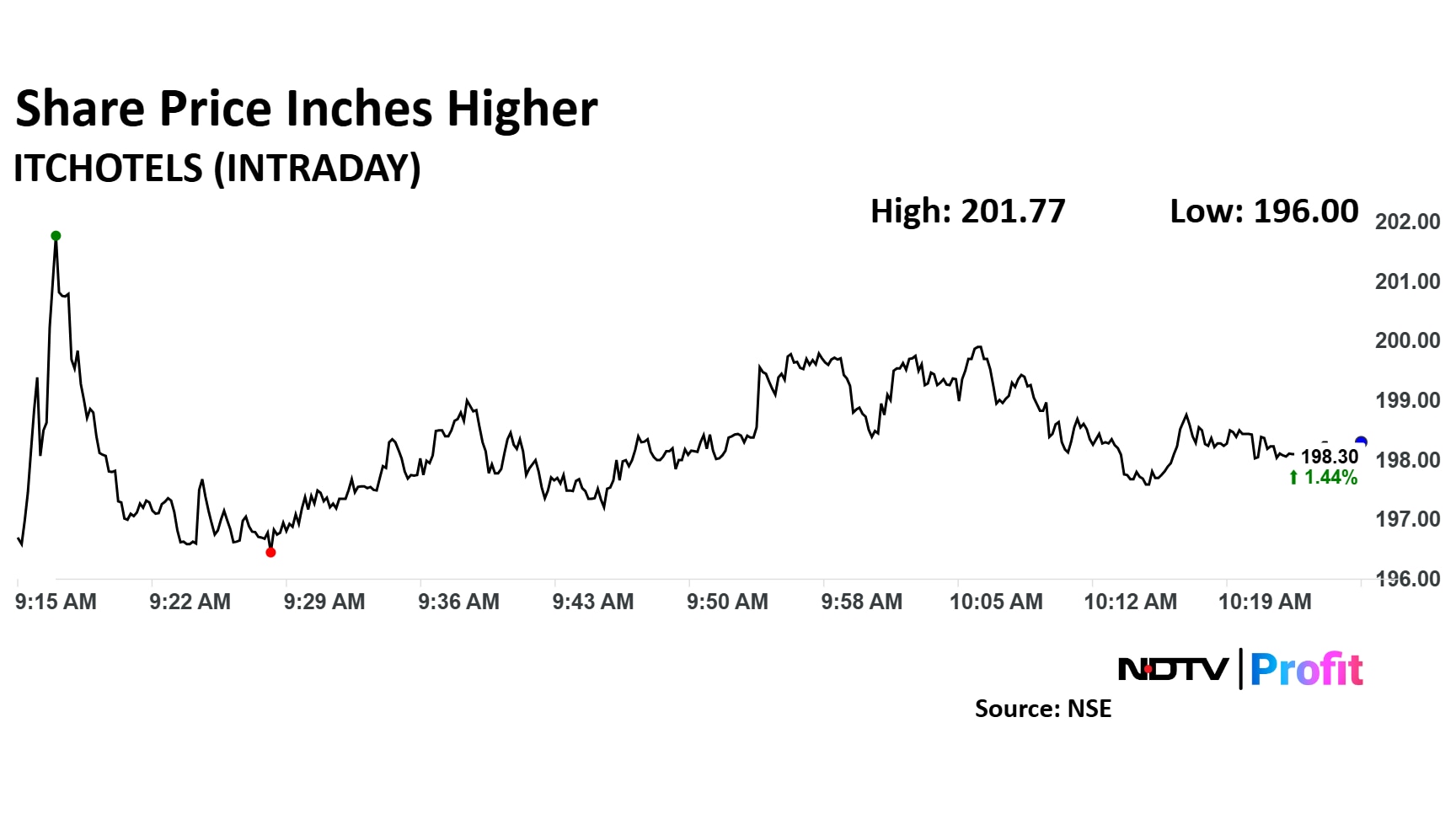

Shares of ITC Hotels surged over 3% on Tuesday after the stock declined 1.71% on Monday's trading session. As of 10:25 the scrip was trading 1.29% higher at Rs 198.01 apiece.

Shares of ITC Hotels surged over 3% on Tuesday after the stock declined 1.71% on Monday's trading session. As of 10:25 the scrip was trading 1.29% higher at Rs 198.01 apiece.

IREDA Ltd.'s shares continued their upward momentum, rising nearly 4% on Tuesday. This surge follows a nearly 12% gain during Monday's trading session

IREDA Ltd.'s shares continued their upward momentum, rising nearly 4% on Tuesday. This surge follows a nearly 12% gain during Monday's trading session

Suzlon Energy soars to three-month high on Motilal Oswal's bullish call. Brokerage initiates coverage with 21% upside projection.

Suzlon Energy soars to three-month high on Motilal Oswal's bullish call. Brokerage initiates coverage with 21% upside projection.

Garden Reach Shipbuilders' share price surges 5% on German order win.

Garden Reach Shipbuilders' share price surges 5% on German order win.

IT stocks rallied on Tuesday as the Nifty IT index soared over 2% on Tuesday. The gains were lead by HCL Tech which soared 3.42% at day's high.

IT stocks rallied on Tuesday as the Nifty IT index soared over 2% on Tuesday. The gains were lead by HCL Tech which soared 3.42% at day's high.

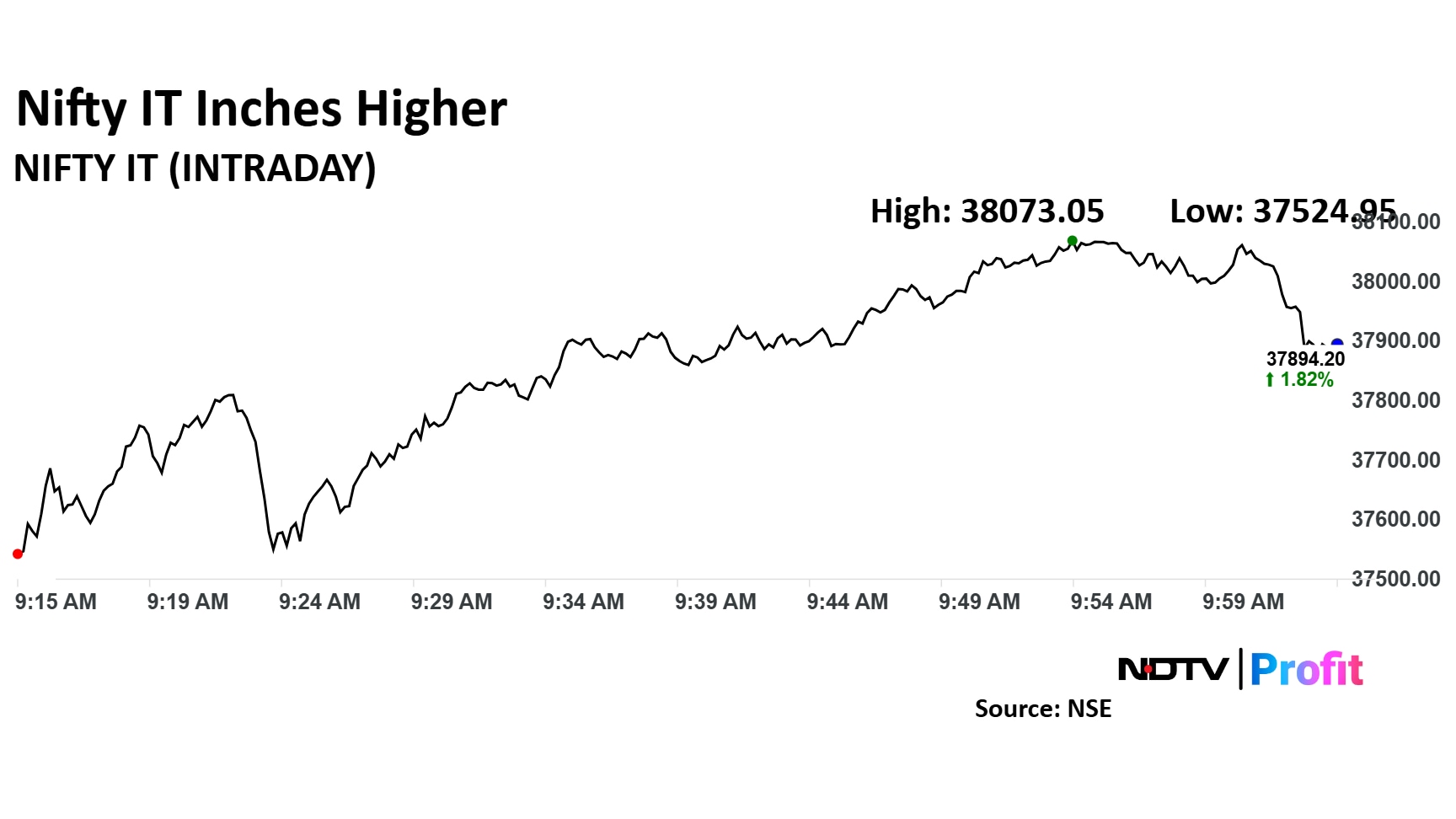

Nifty IT index surged 2.30% to trade at 38,073 on Tuesday. This was in line with benchmark indices soaring nearly 1%.

Nifty IT index surged 2.30% to trade at 38,073 on Tuesday. This was in line with benchmark indices soaring nearly 1%.

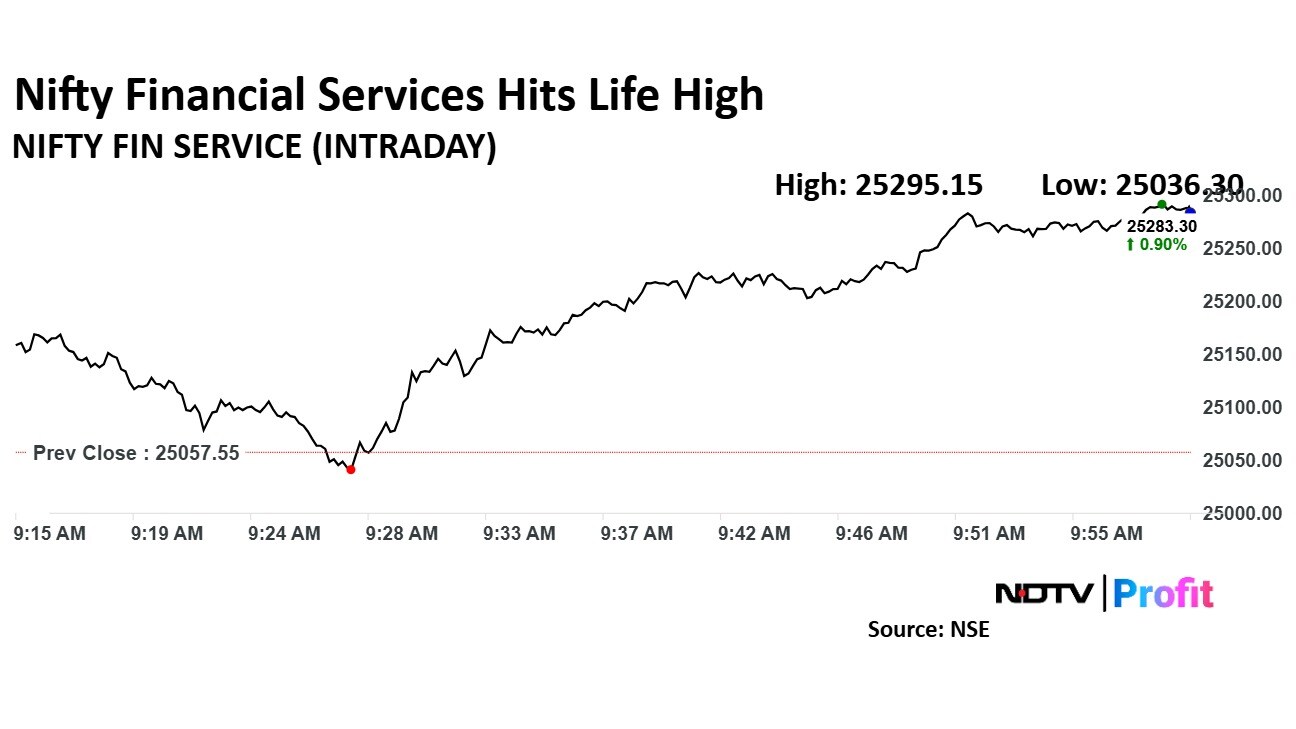

As markets continue to soar on Tuesday, Nifty Financial Services hit life high at 25,295.15.

As markets continue to soar on Tuesday, Nifty Financial Services hit life high at 25,295.15.

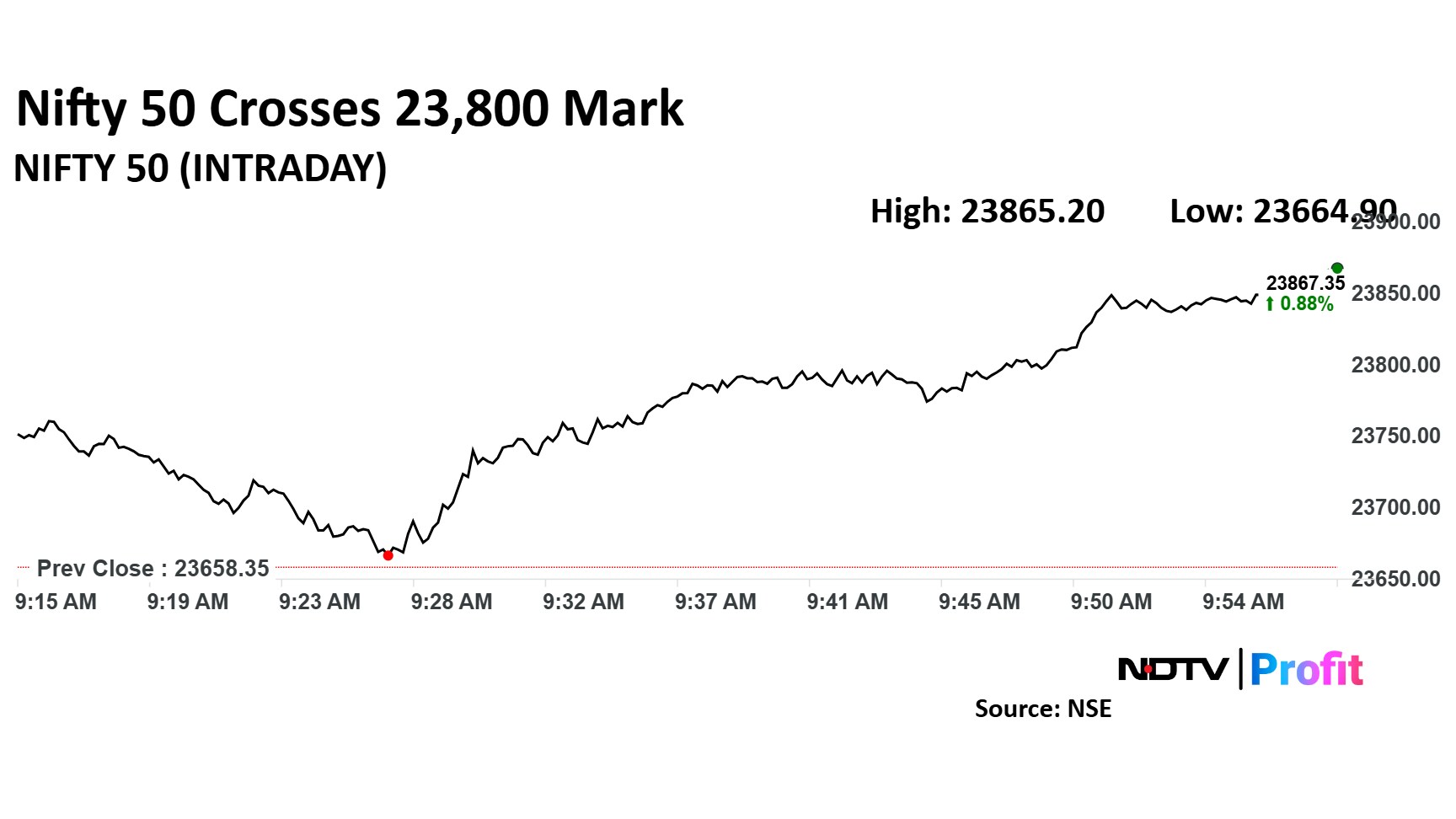

As the benchmark Nifty 50 reclaimed its 23,800 mark on Tuesday, Sensex also soared to add over 700 points to trade at 78,685.

In Tuesday's trading session both benchmark indices opened with gains. The NSE Nifty 50 index during early trade surged further to reclaim 23,800 mark, moving past it as it soared 0.82% to trade 23,852.85

In Tuesday's trading session both benchmark indices opened with gains. The NSE Nifty 50 index during early trade surged further to reclaim 23,800 mark, moving past it as it soared 0.82% to trade 23,852.85

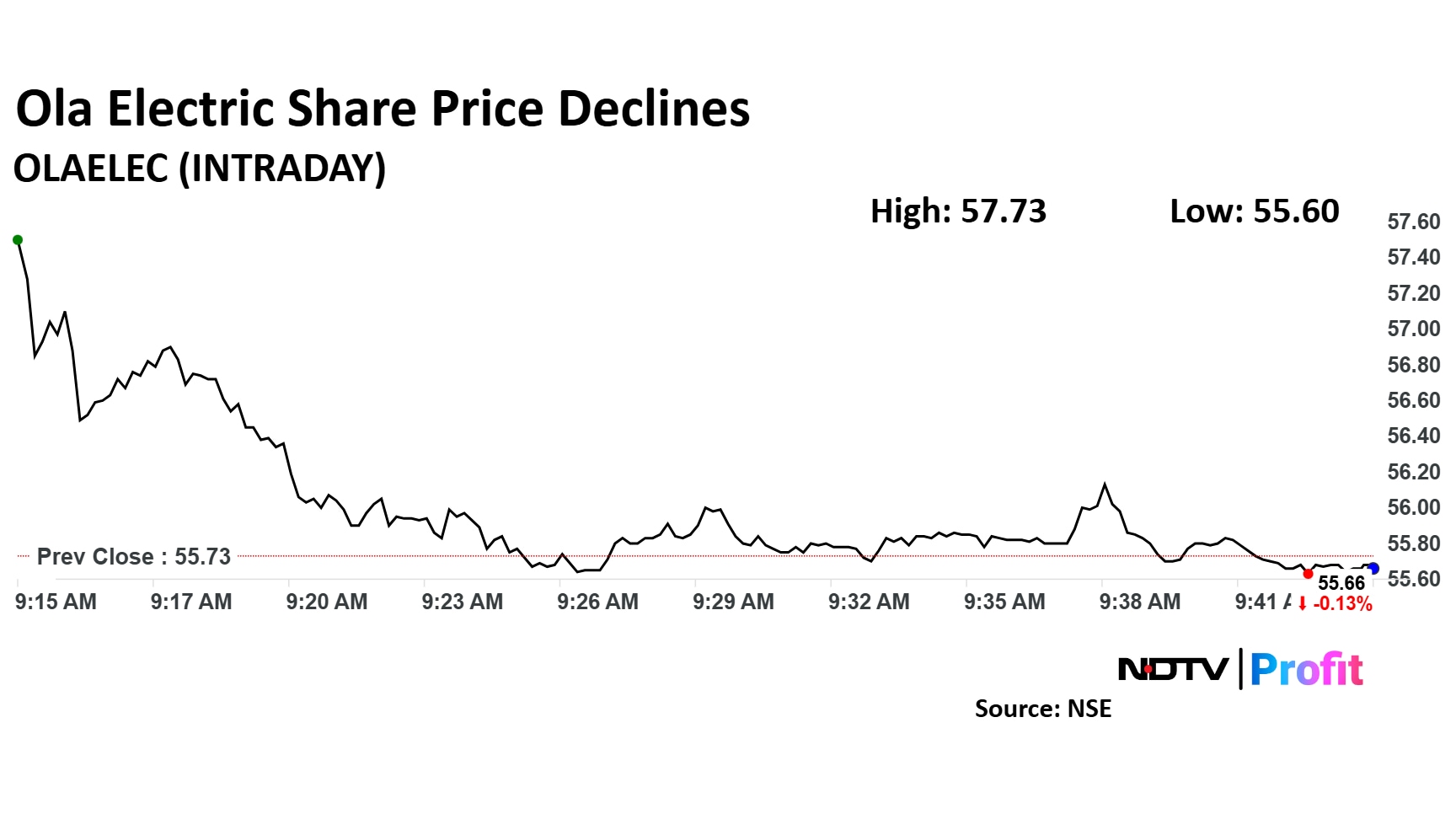

Ola Electric share price declined 3.18% on Tuesday. This after the company clarified that it has settled all outstanding dues with Rosmerta Group, totaling Rs 267.52 crore, and the latter has withdrawn its insolvency petitions against the EV maker.

Ola Electric share price declined 3.18% on Tuesday. This after the company clarified that it has settled all outstanding dues with Rosmerta Group, totaling Rs 267.52 crore, and the latter has withdrawn its insolvency petitions against the EV maker.

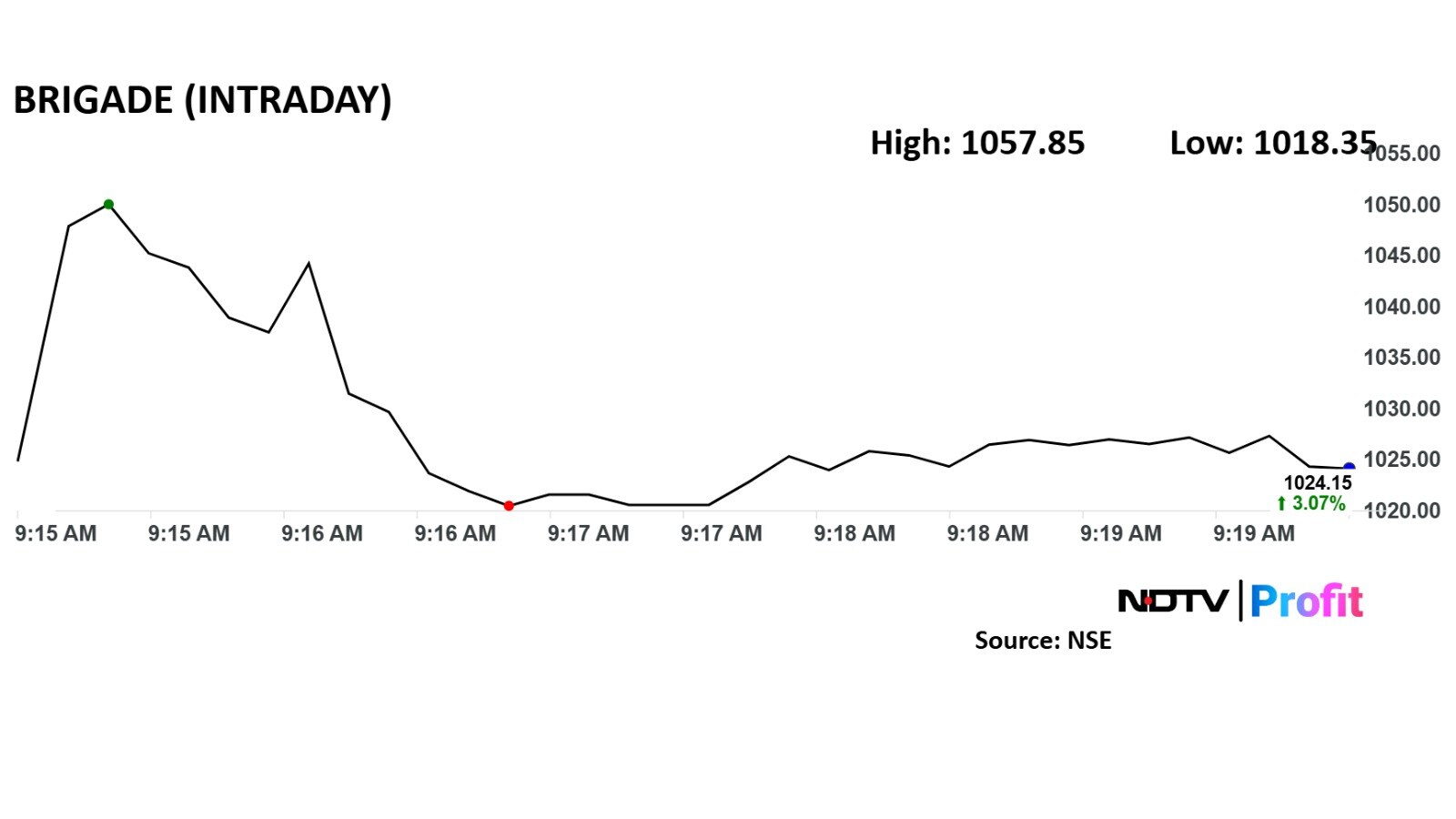

Brigade Enterprises stock jumps 6% after Bengaluru premium residential project.

Brigade Enterprises stock jumps 6% after Bengaluru premium residential project.

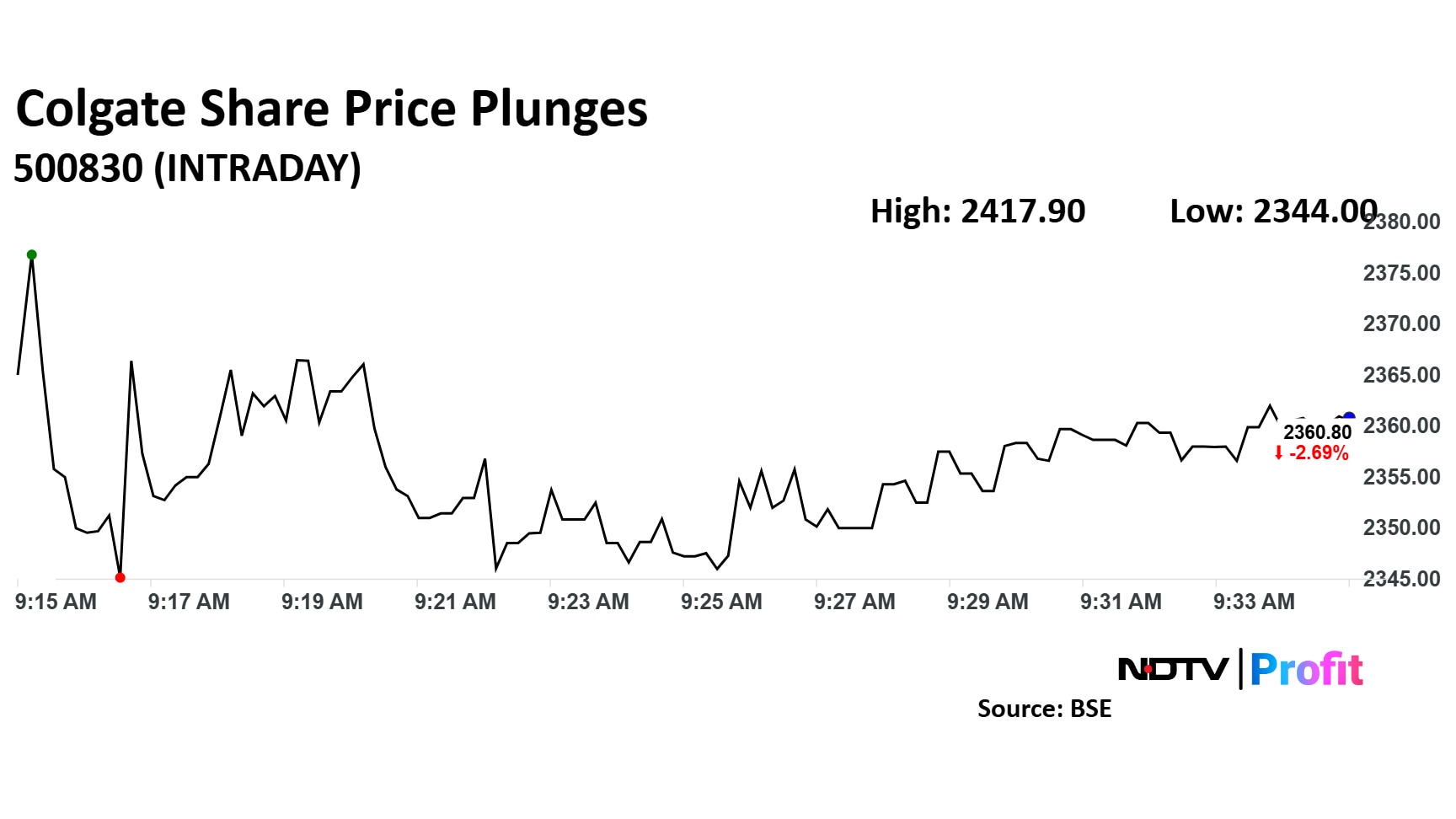

Colgate Palmolive's stock price has plummeted to a 52-week low, following analysts' warnings of impending challenges for the company.

Colgate Palmolive's stock price has plummeted to a 52-week low, following analysts' warnings of impending challenges for the company.

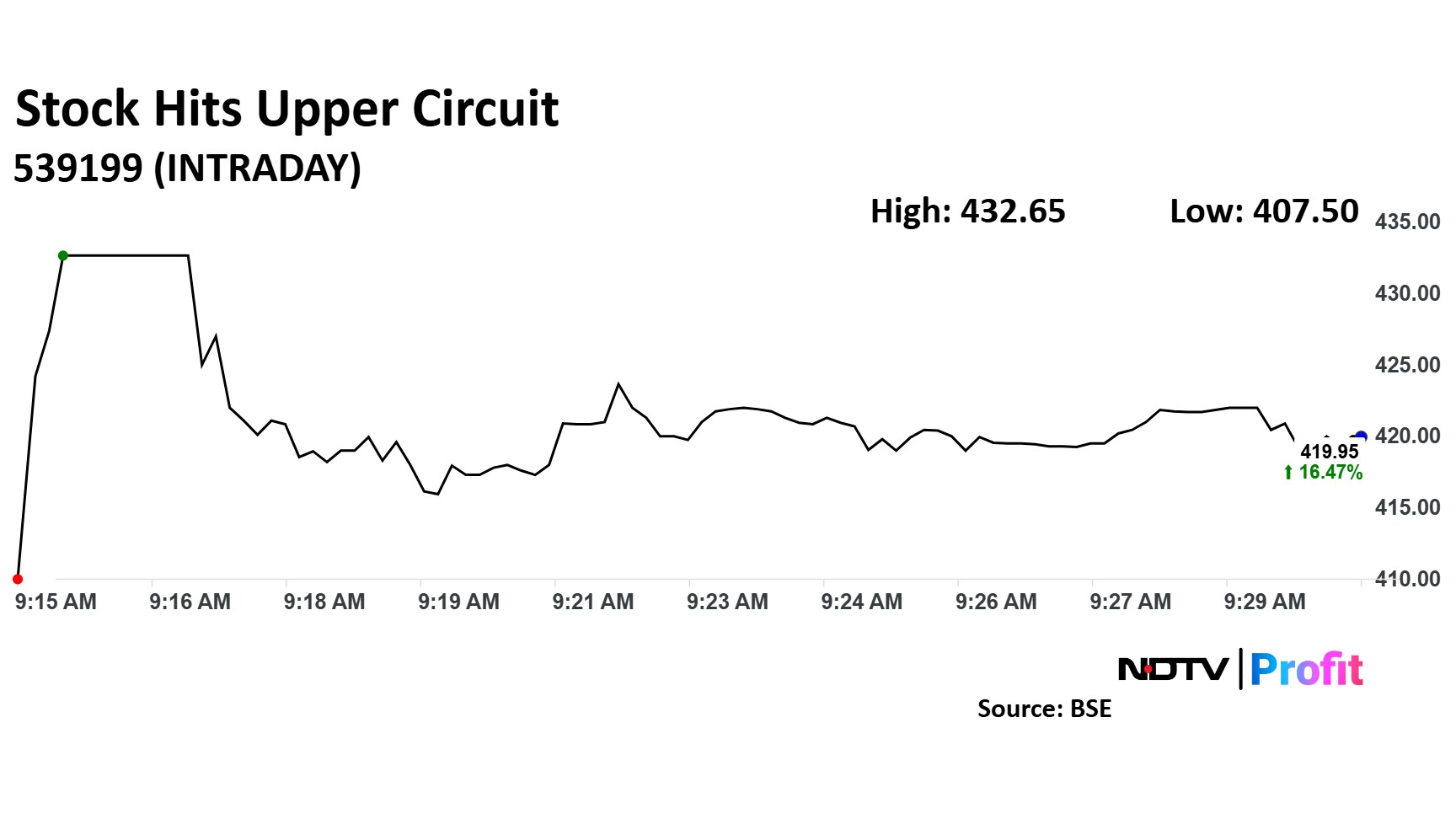

SG Finserve's share price surged 20% to hit upper circuit on Tuesday after Market veteran Madhu Kela's acquired a 1.7% stake in the company earlier.

SG Finserve's share price surged 20% to hit upper circuit on Tuesday after Market veteran Madhu Kela's acquired a 1.7% stake in the company earlier.

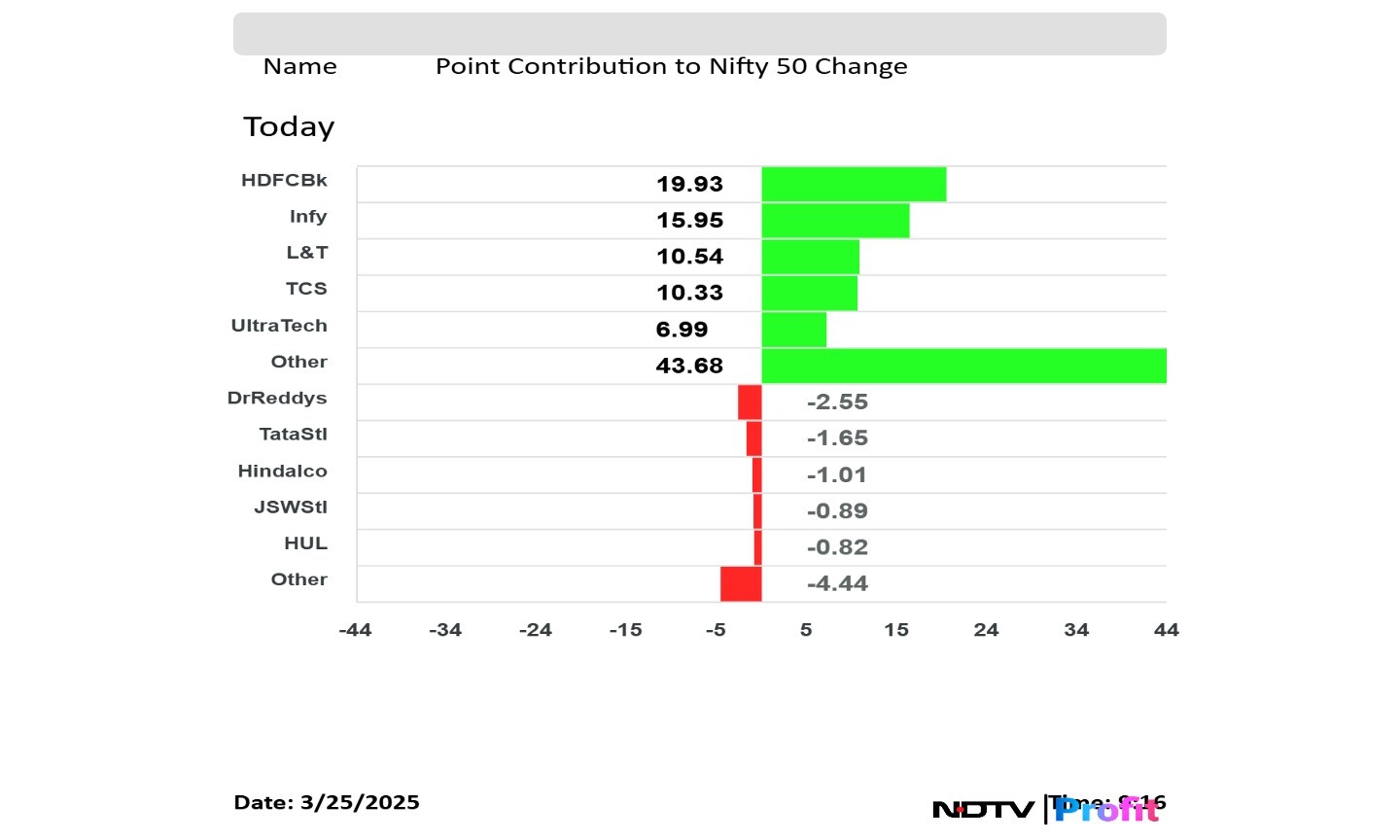

HDFC Bank, Infosys and L&T made for the top contributors to Nifty 50 on Tuesday.

HDFC Bank, Infosys and L&T made for the top contributors to Nifty 50 on Tuesday.

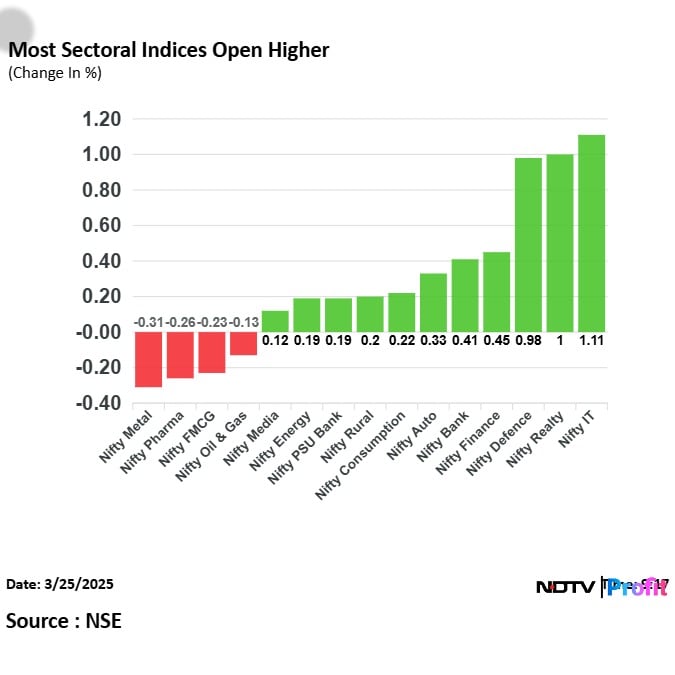

On Tuesday's trading session most sectoral indices opened higher as the Nifty IT and Nifty Realty lead the gains.

On Tuesday's trading session most sectoral indices opened higher as the Nifty IT and Nifty Realty lead the gains.

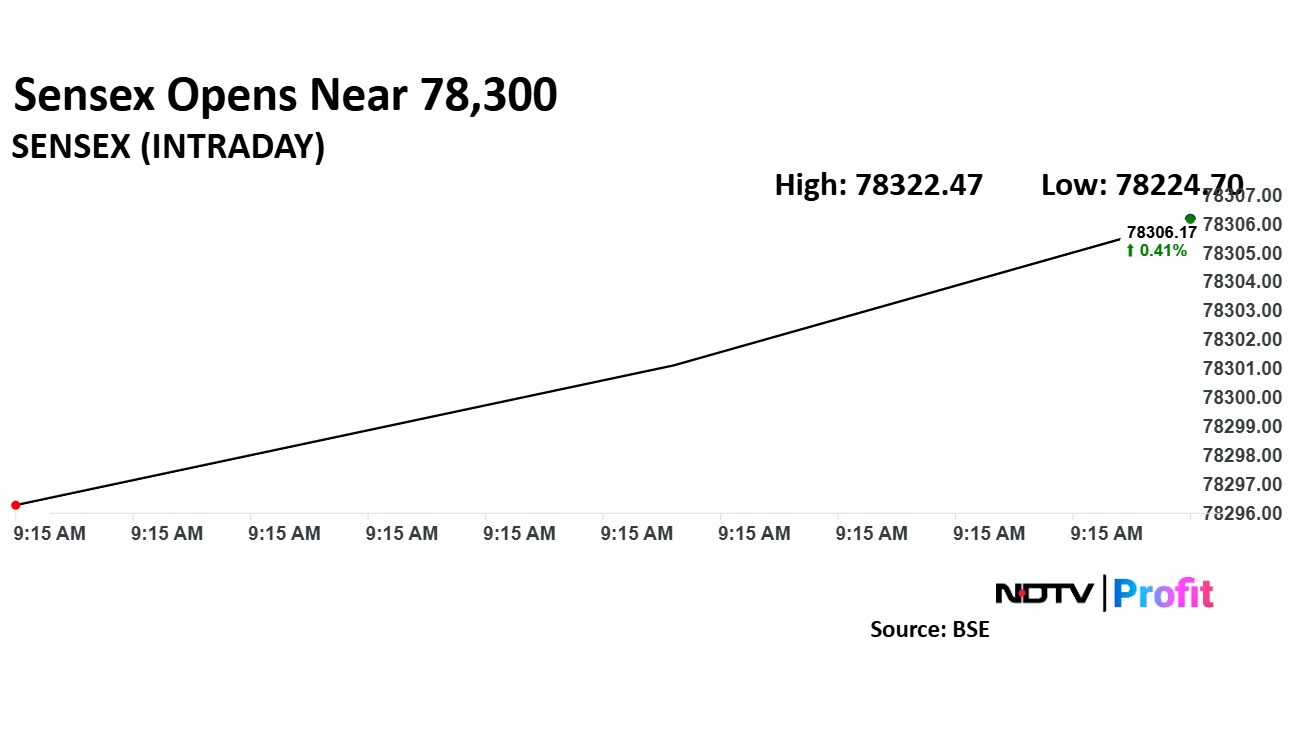

On Tuesday's trading session, Nifty 50 and Sensex opened higher for seventh consecutive session.

Nifty 50 opened 0.46% up as it gained 107.85 points to trade at 23,766 points.

Sensex opened 0.54% up as it gained 418.54 points to trade 78,402.92 points.

On Tuesday's trading session, Nifty 50 and Sensex opened higher for seventh consecutive session.

Nifty 50 opened 0.46% up as it gained 107.85 points to trade at 23,766 points.

Sensex opened 0.54% up as it gained 418.54 points to trade 78,402.92 points.

On Tuesday's trading session, Nifty 50 and Sensex opened higher for seventh consecutive session.

Nifty 50 opened 0.46% up as it gained 107.85 points to trade at 23,766 points.

Sensex opened 0.54% up as it gained 418.54 points to trade 78,402.92 points.

On Tuesday's trading session, Nifty 50 and Sensex opened higher for seventh consecutive session.

Nifty 50 opened 0.46% up as it gained 107.85 points to trade at 23,766 points.

Sensex opened 0.54% up as it gained 418.54 points to trade 78,402.92 points.

Nifty, Sensex both traded higher in market pre-open. Nifty 50 was trading 0.39% up and Sensex was 0.40% up.

The Indian rupee strengthened against the US dollar, opening 6 paise higher at 82.58 and closing at 82.64 per dollar on Monday.

The yield on the 10-year bond opened flat at 6.64%. It closed at 6.63% on Monday

Source: Bloomberg

EaseMyTrip.com received in-principle board approval to acquire a 49% stake in Big Charter Pvt., a prominent player in India’s charter aviation sector, to capitalise on high-margin segments like charter services and non-scheduled operator permit (NSOP) operations.

Market regulator SEBI has announced multiple reforms, including

Forming a high-level panel for conflict of interest disclosures by board members.

Easing disclosure norms for foreign portfolio investors.

Extending the fee collection period for research analysts to one year.

Read more about this here

UBS believes the IT sector's correction has been overdone, despite company-specific issues dragging revenue growth.

The brokerage expects 5-7% consensus earnings cuts, but still views FY26 as better than FY25.

UBS sees a near-term sector multiple rebound and maintains 'Buy' ratings on TCS, Infosys, Wipro, and HCL Tech, with reduced target prices.

Read more on this here

Ola Electric Mobility has settled all outstanding dues with Rosmerta Group, totaling Rs 267.52 crore, and the latter has withdrawn its insolvency petitions against the EV maker.

The settlement was reached amicably between Ola Electric's subsidiary and Rosmerta Group.

Source: Exchange Filing

Read more about this here

Central Bank of India has initiated a qualified institutional placement (QIP) to raise up to Rs 1,500 crore, with an option to increase the issue size by up to Rs 500 crore.

The QIP offers over 37 crore shares, with a greenshoe option of an additional 12.3 crore shares. The indicative price of Rs 40.49 per share represents a 13.7% discount to the last closing price.

The shares will be allotted to winning bidders on April 1 and will be tradable from April 3.

Read more about this here

Gold prices dipped to Rs 87,710 per 10 grams as on March 25, according to the India Bullion Association.

City specific rates saw Delhi at Rs 87,400, Mumbai at Rs 87,550, and Kolkata at Rs 87,430. Chennai recorded the highest price at Rs 87,800.

Brent Crude declined in Tuesday's session to trade at $72.98, down 0.03%. Meanwhile WTI Crude Oil was also down 0.04% trading at $69.08 per barrel.

The volatility comes in the wake of second round of tariffs set to be imposed by US President Trump starting April 2.

US stocks experienced one of their strongest sessions this year, with the Nasdaq 100 rising by 2.2%.

This surge was fueled by indications that US trade sanctions might be less severe than anticipated, including hints from President Trump that certain countries may receive exemptions.

The S&P 500 rose 1.8%. The Dow Jones Industrial Average added 1.4%.

Meanwhile, bonds and gold declined, and the dollar showed mixed movements.

Asian stocks climbed early on Tuesday, following a strong session for US equities. Signs that President Trump's trade sanctions might be less severe than expected boosted market sentiment.

Australian and Japanese indices also advanced, rebounding from recent selloffs.

The Nikkei was up 0.84%, S&P ASX 200 rose 0.52%, while Kospi advanced 0.22%. Hang Seng futures were up 0.31%.

US futures remained mixed, with contracts for S&P 500 flat and Nasdaq 100 declined 0.03%. Dow Jones was also down 0.03%.

On the second trading session of the week, the Gift Nifty was trading above the 23,500 mark, as it rose 0.24% to trade at 23,753 as of 7:28 a.m.

Wipro Ltd. is among stocks expected to react, as the company has introduced AI-driven autonomous agents for Agentforce, aiming to enhance and simplify experiences for patients and providers.

Hyundai Motor India Ltd. announced an investment of Rs 694 crore to establish a new tooling center in India.

GIC Housing Finance approved the appointment of Sachindra Salvi as managing director and chief executive officer.

The benchmark equity indices extended gains for the sixth straight session on Monday, the longest winning streak since September 2024.

The indices closed near a two-month high as the NSE Nifty 50 ended 307.95 points, or 1.32% higher at 23,658.35, while the BSE Sensex closed 1,078.87 points, or 1.4% up at 77,984.38.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.