The local currency weakened by 2 paise to close at 83.45 against the U.S. Dollar.

It closed at 83.43 a dollar on Wednesday.

Source: Bloomberg

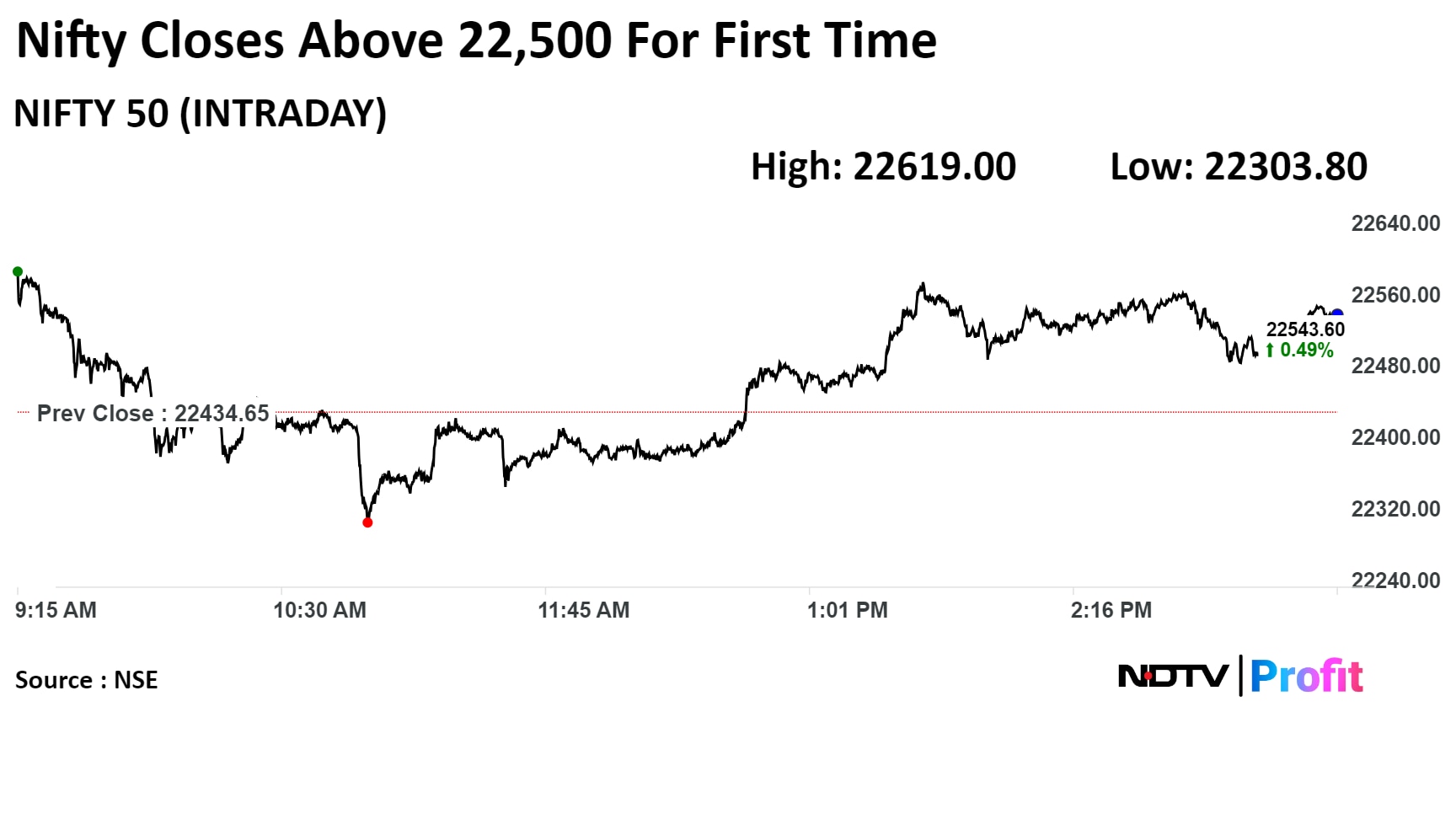

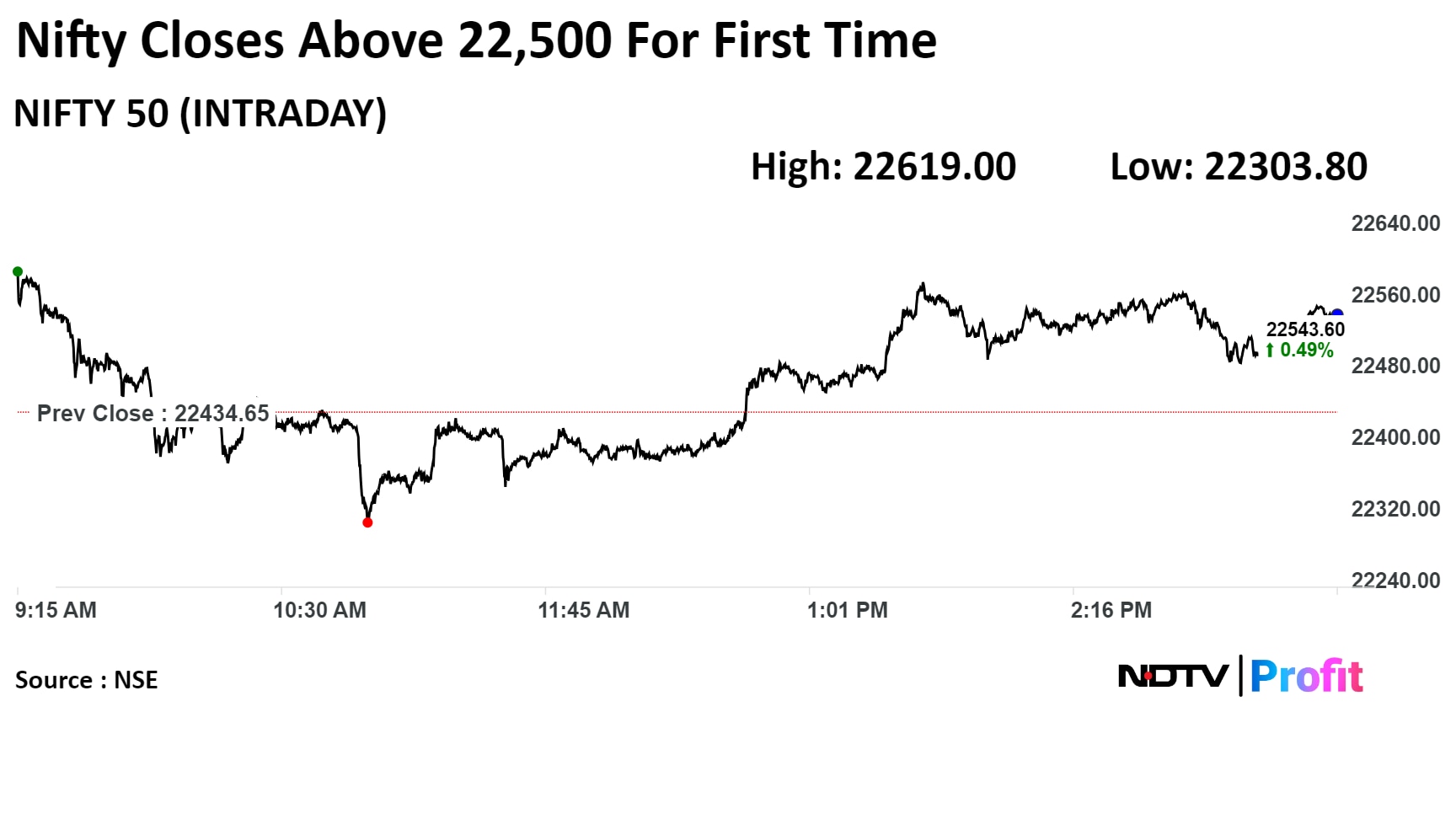

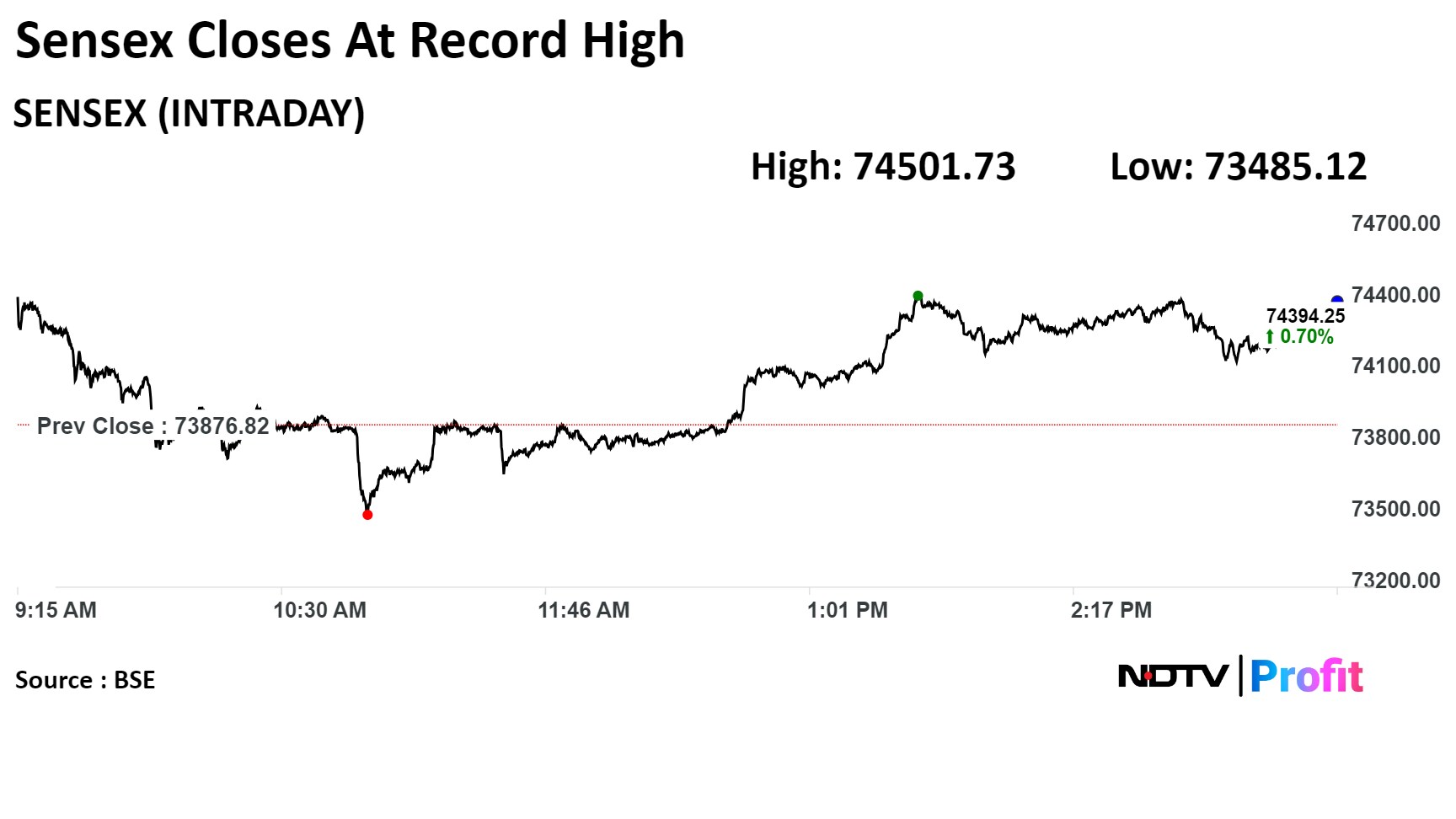

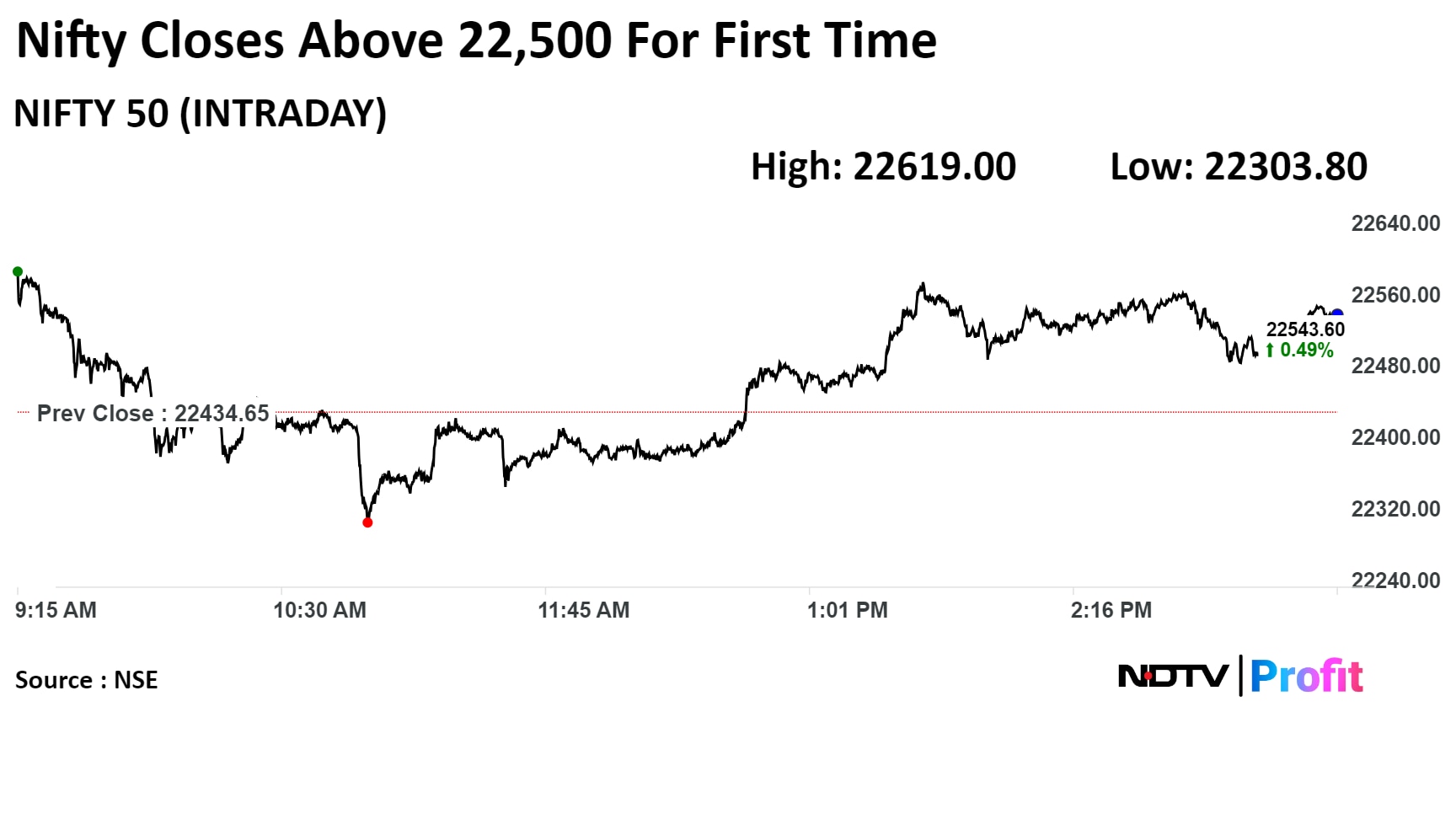

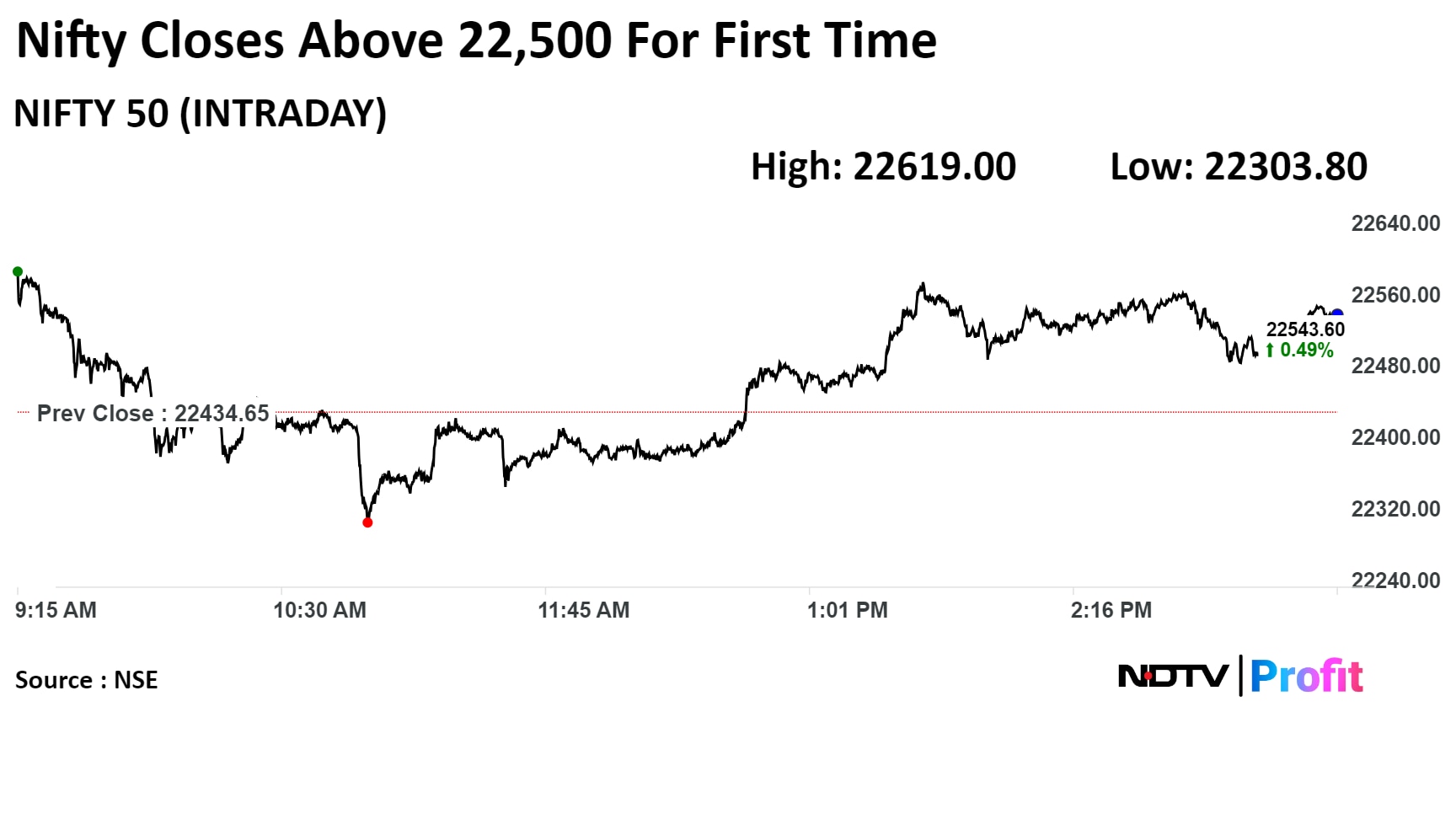

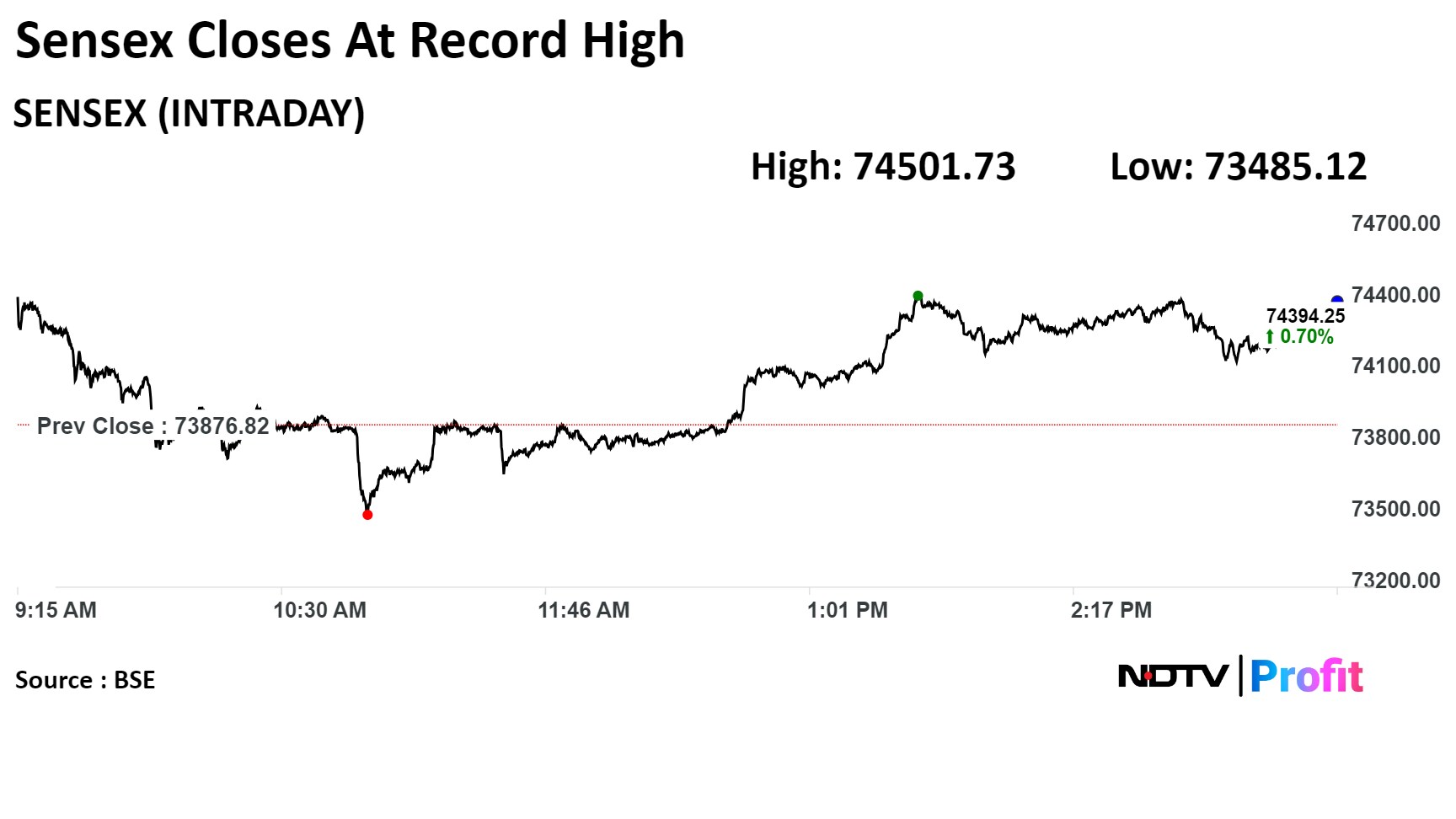

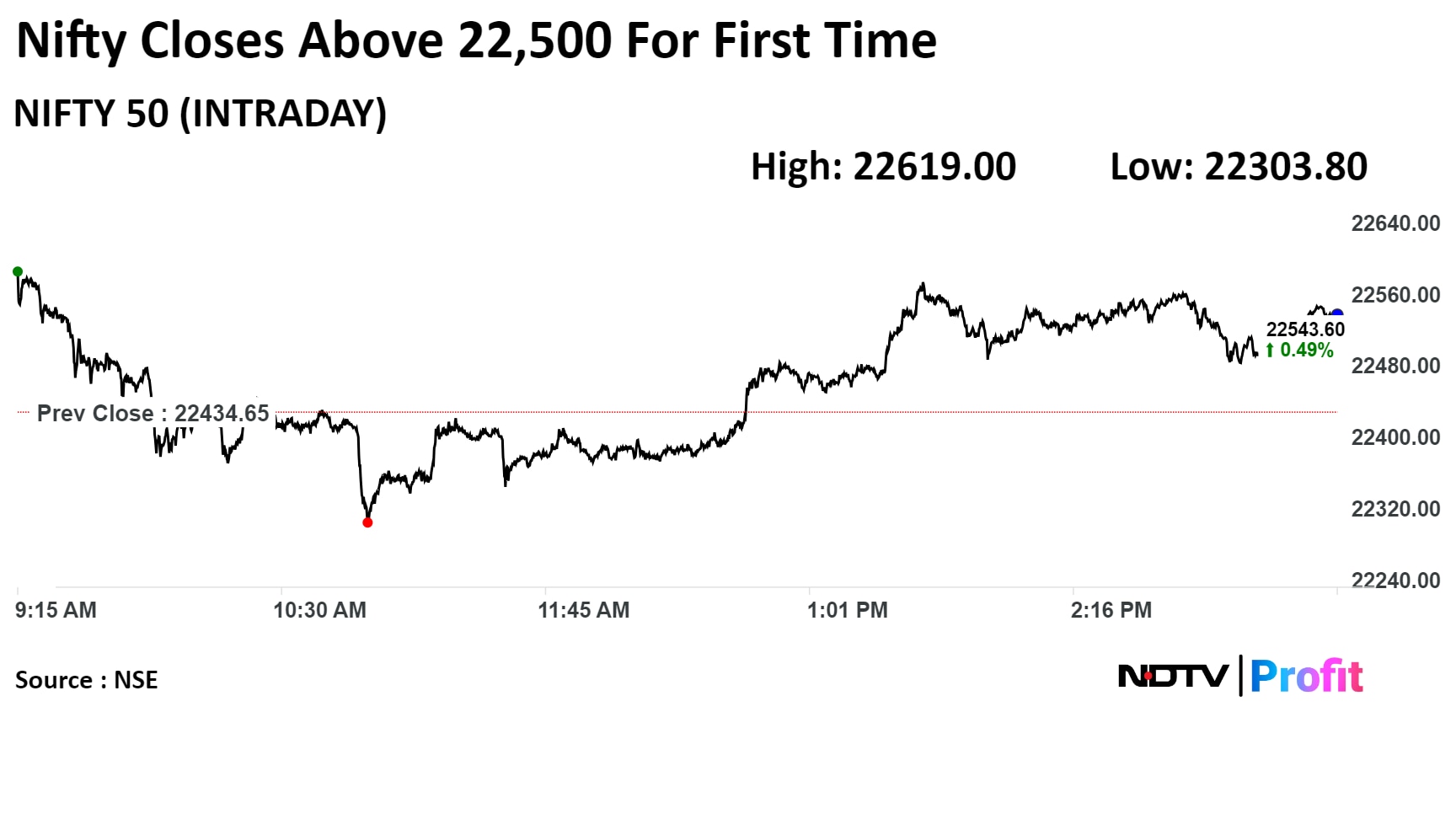

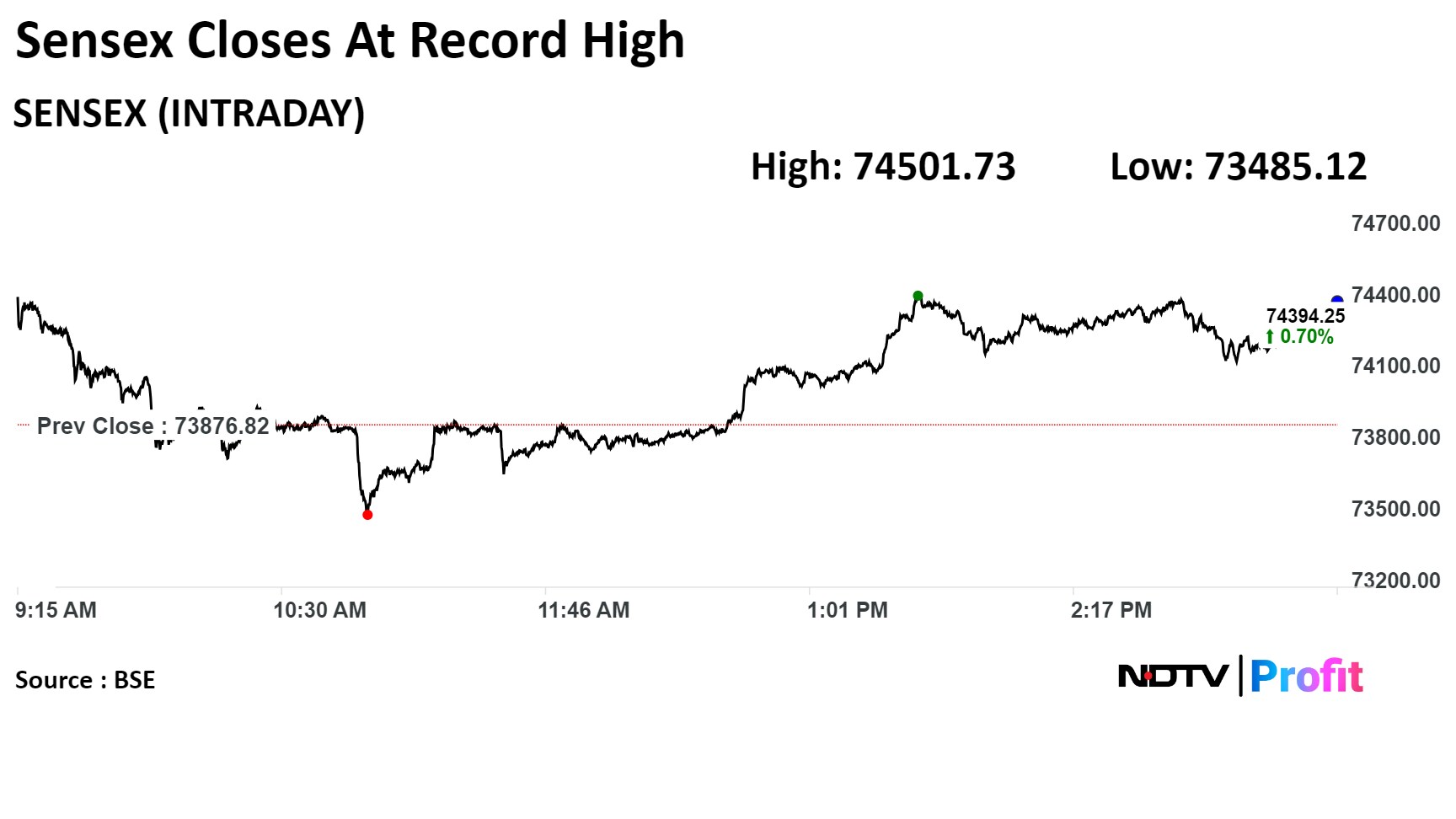

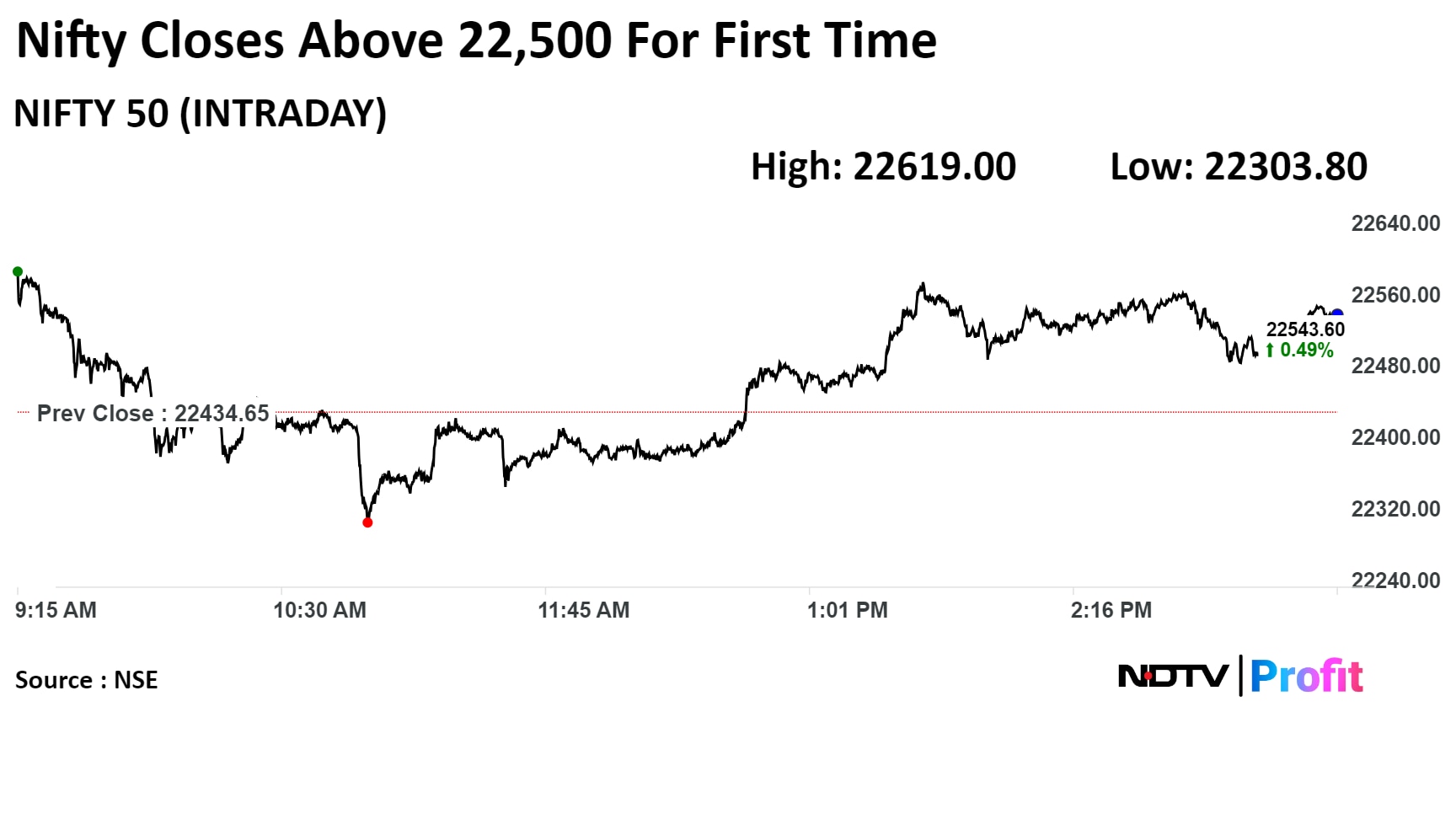

Benchmark equity indices came out of their two-day losing streak to end at highest closing levels amid gains in global markets after Fed Chair Powell restored hopes of rate cuts this year but also said that the timing for rate cuts is uncertain.

Investors now await the outcome of the upcoming meeting of the monetary policy committee due Friday. The Reserve Bank of India will likely keep its benchmark repurchase rate at 6.5% for a seventh straight policy meeting, according to all 39 economists surveyed by Bloomberg.

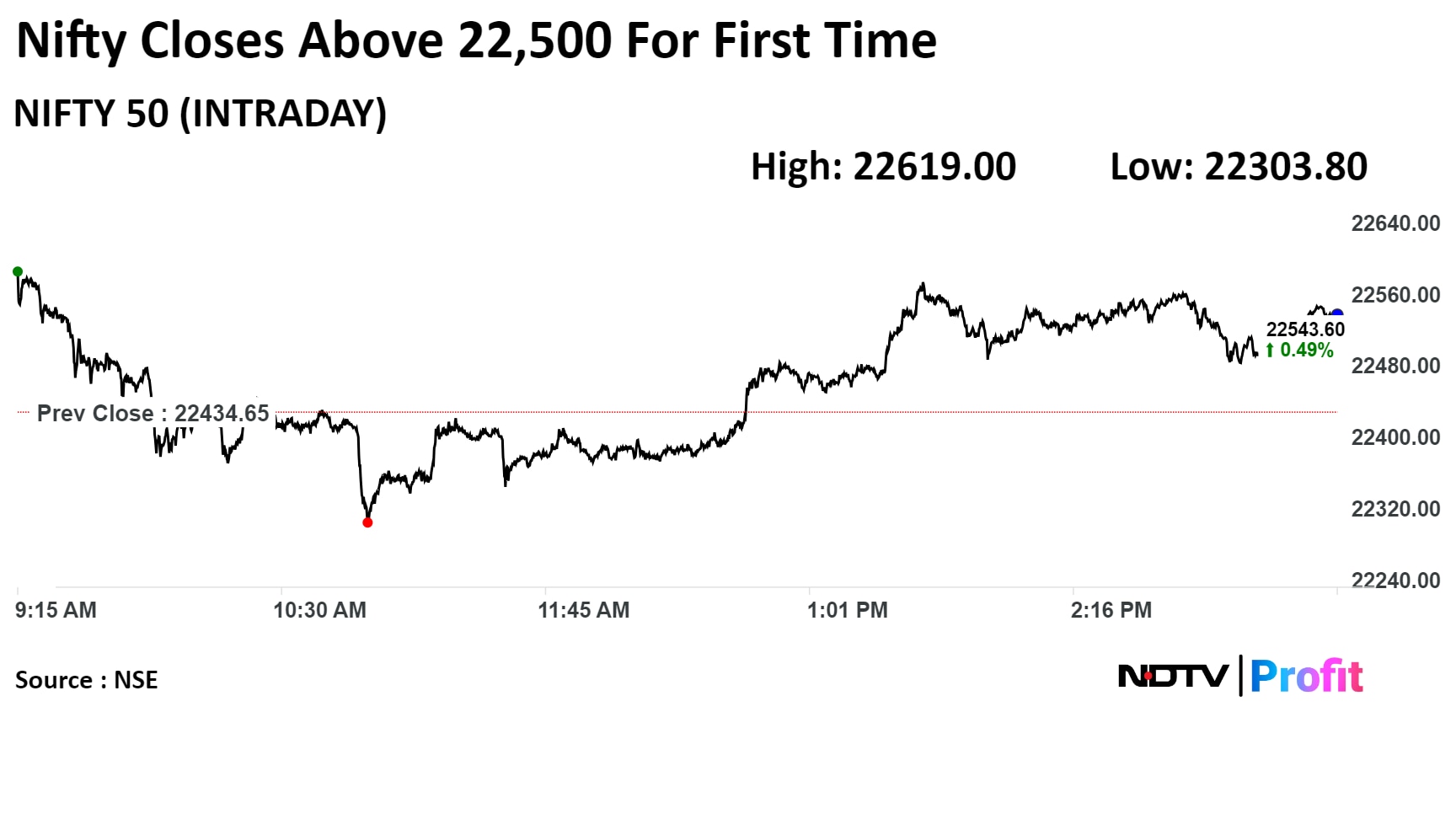

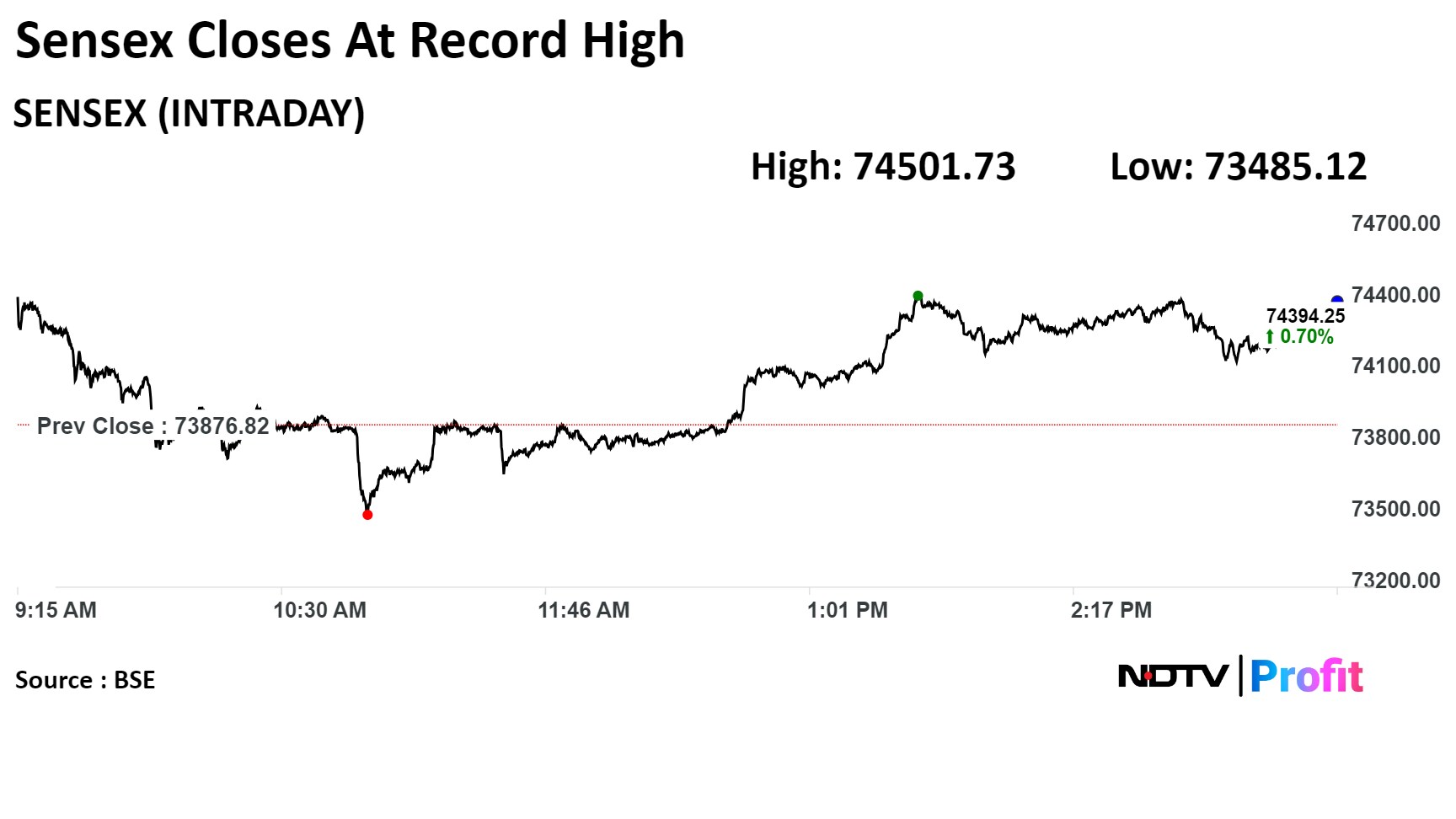

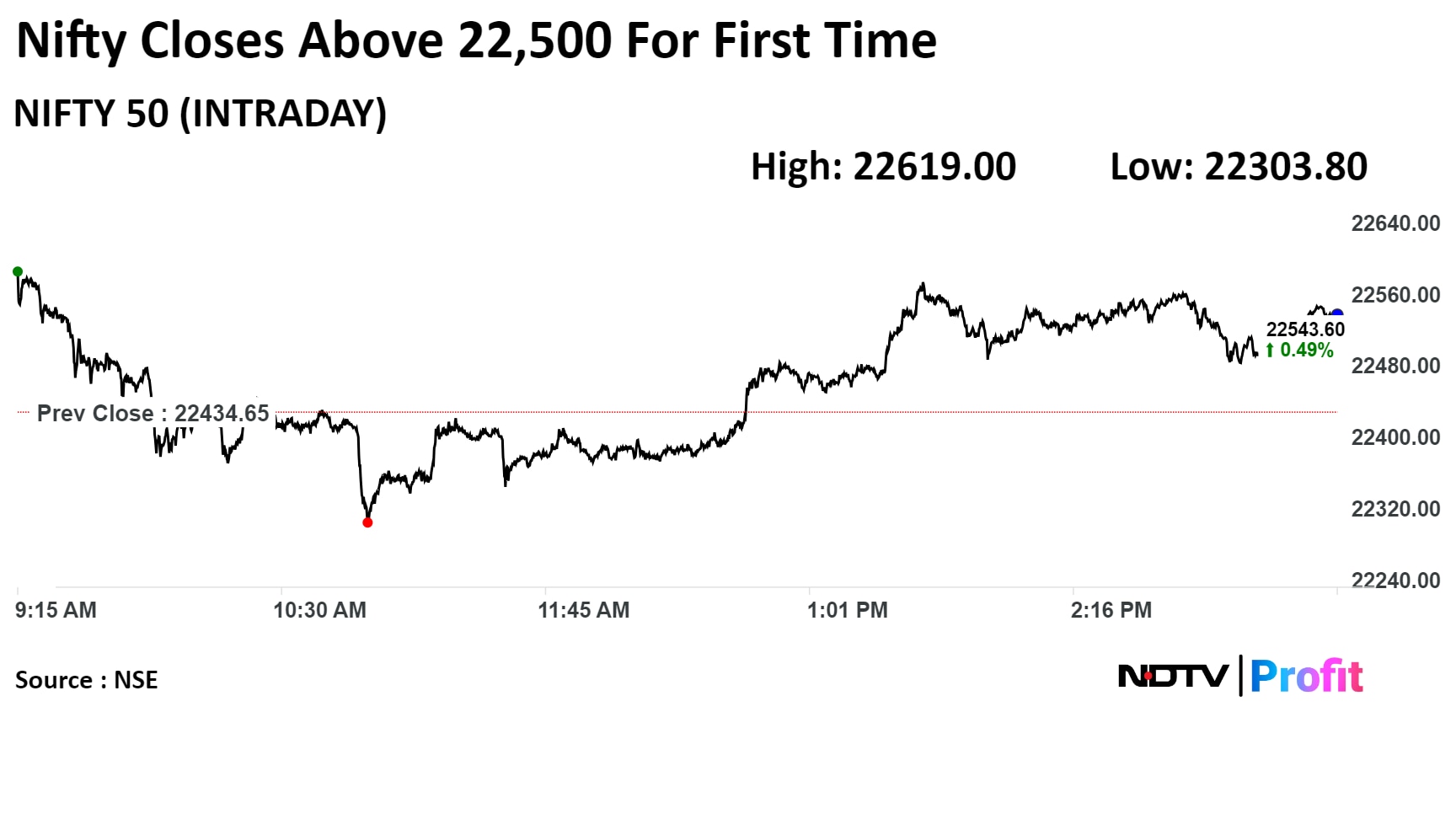

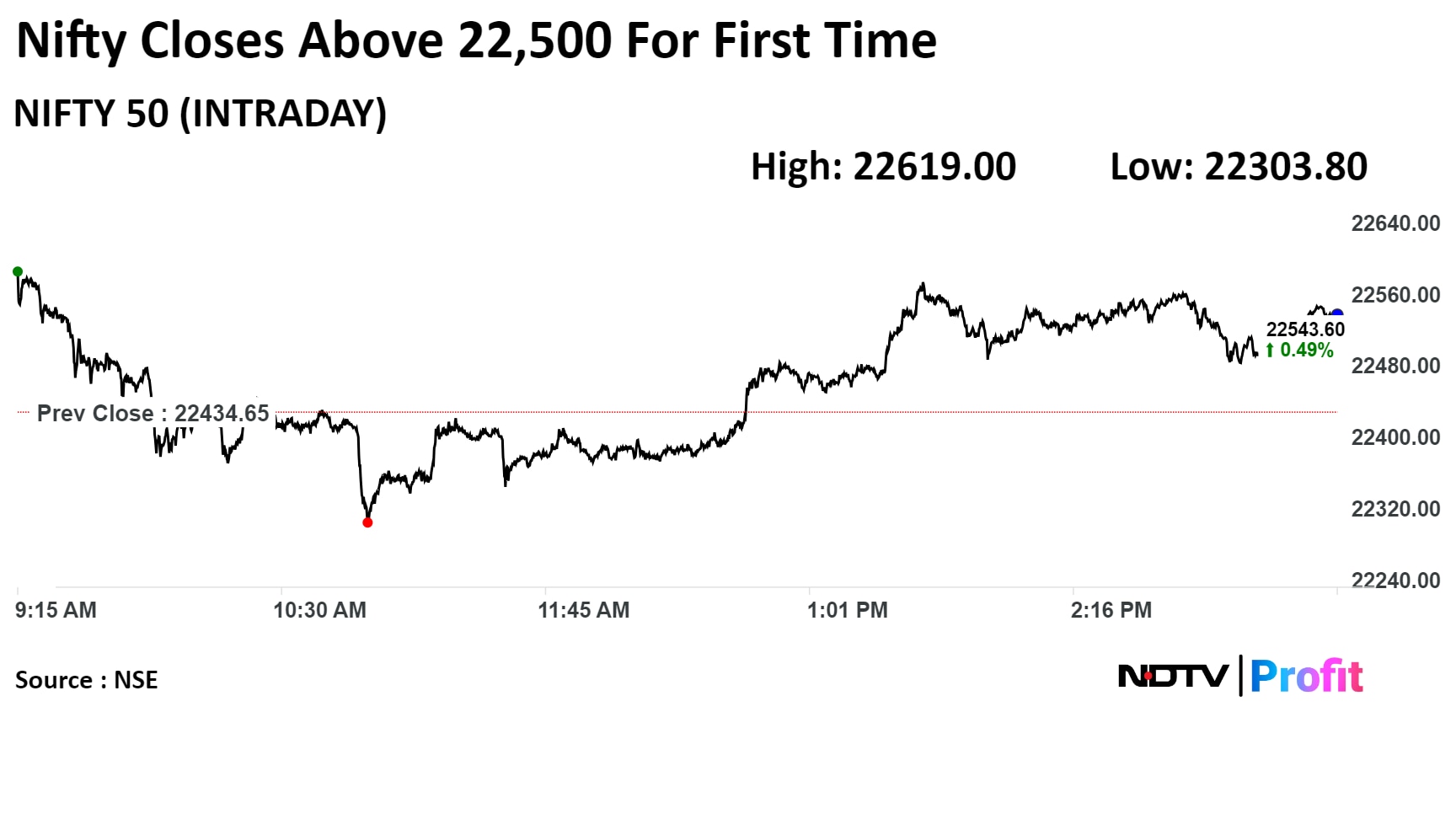

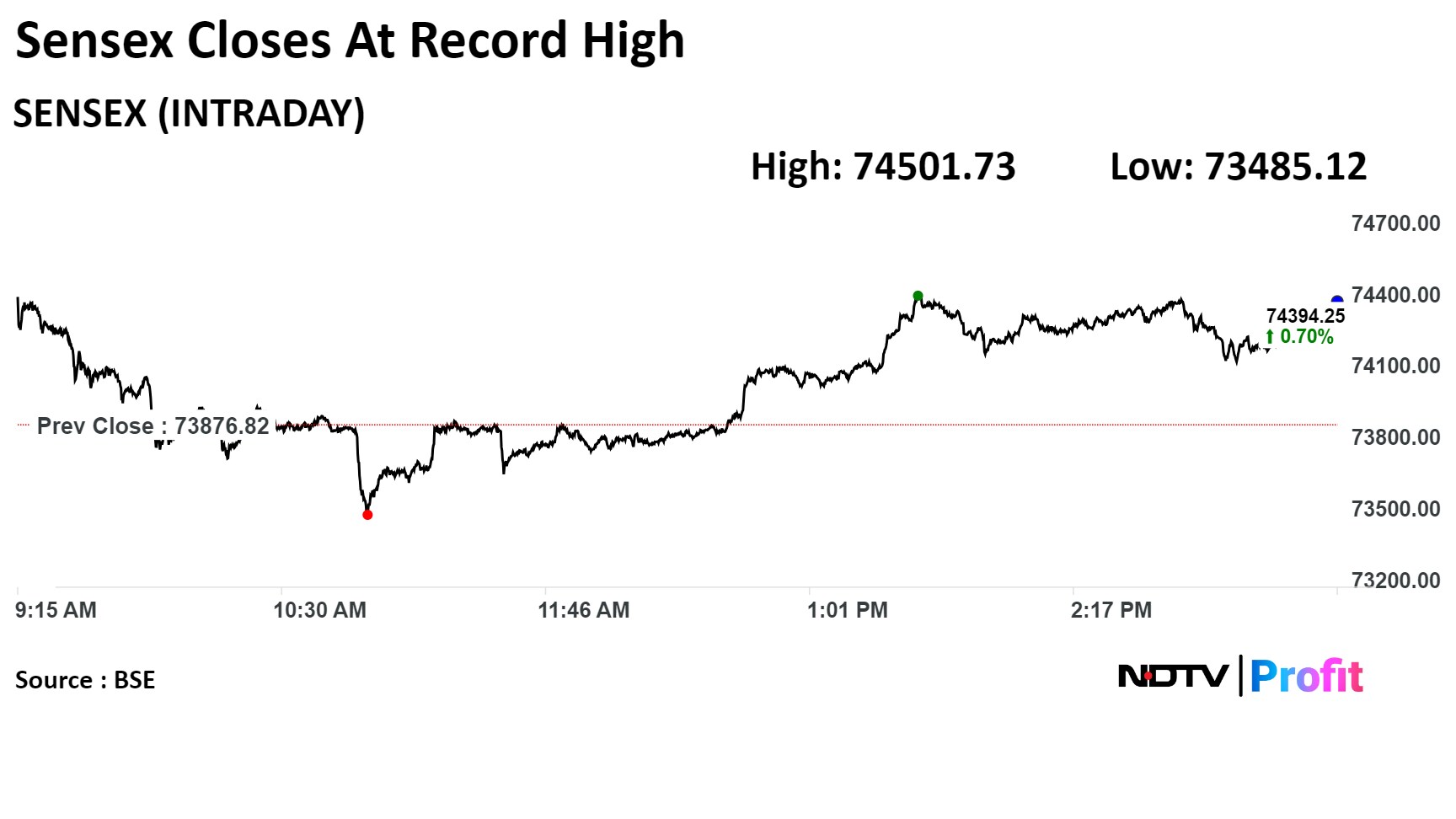

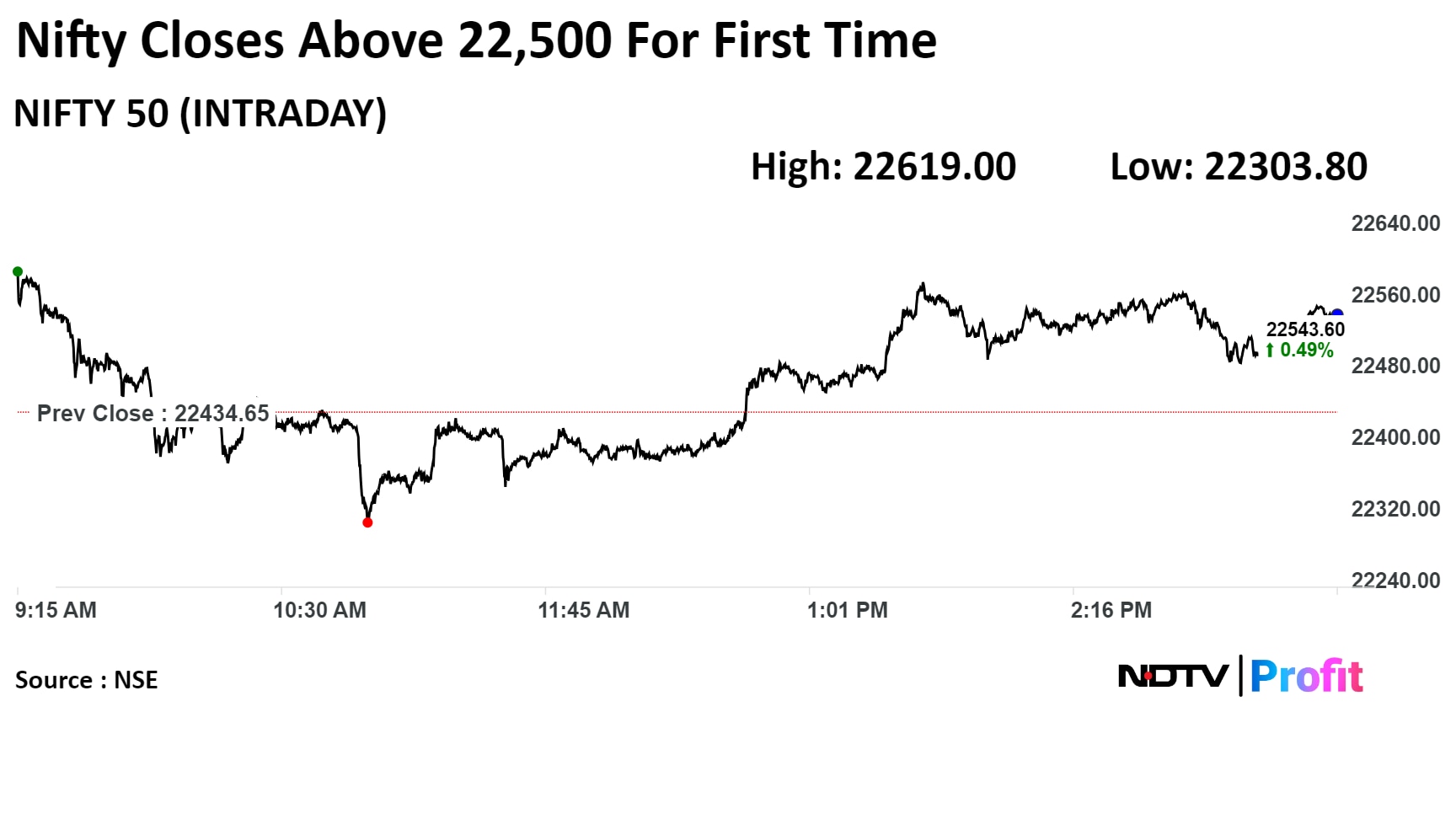

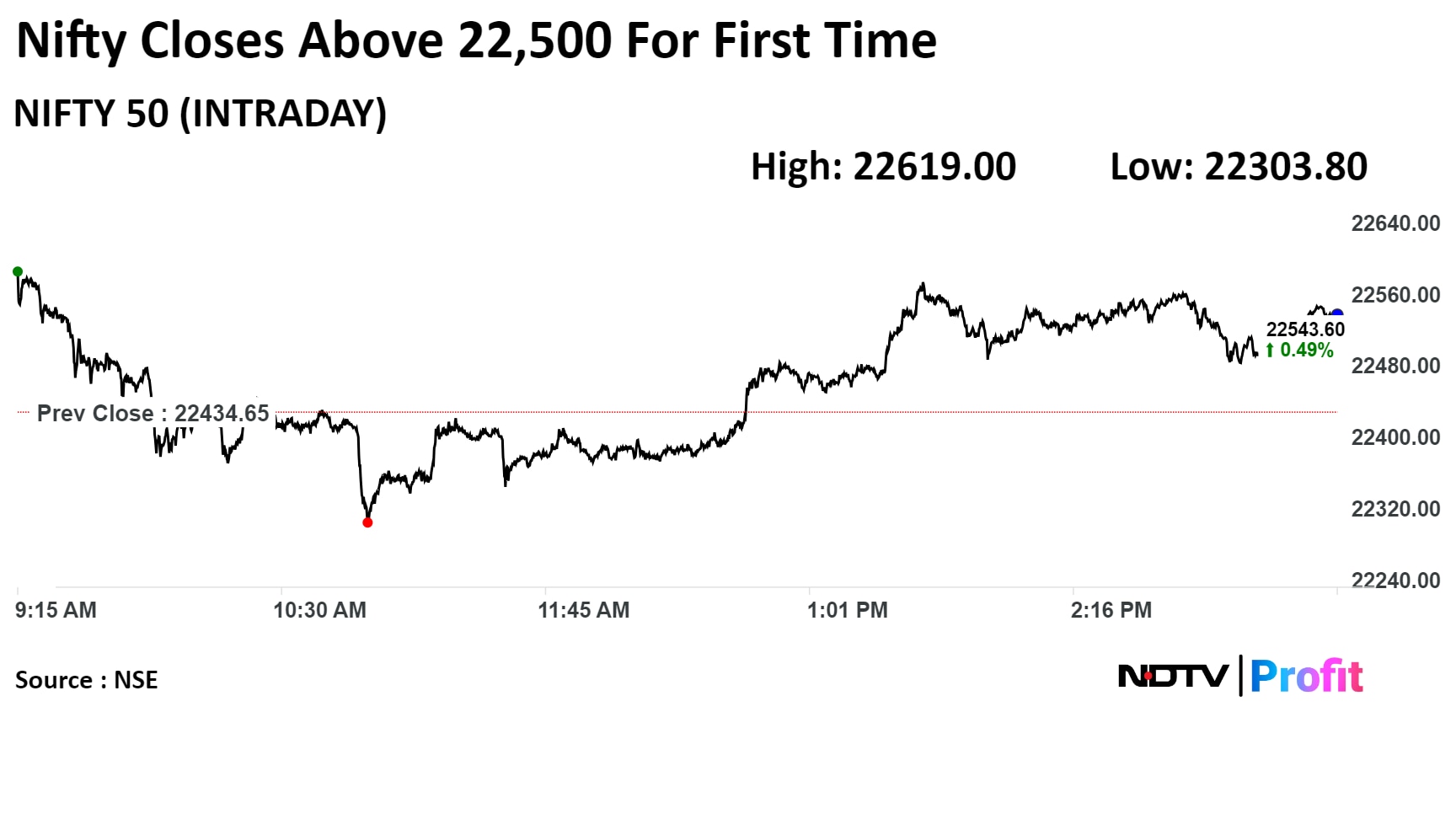

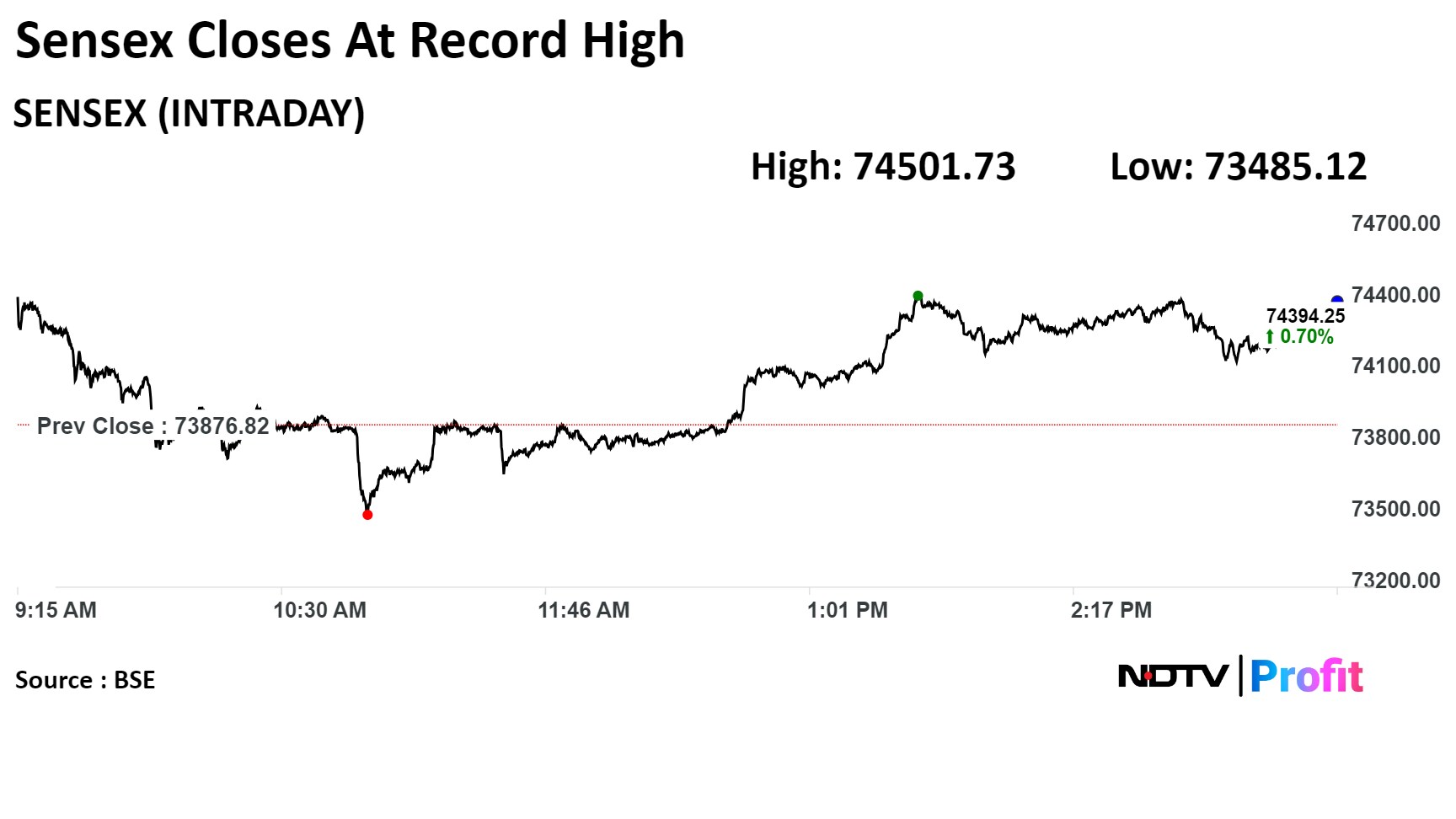

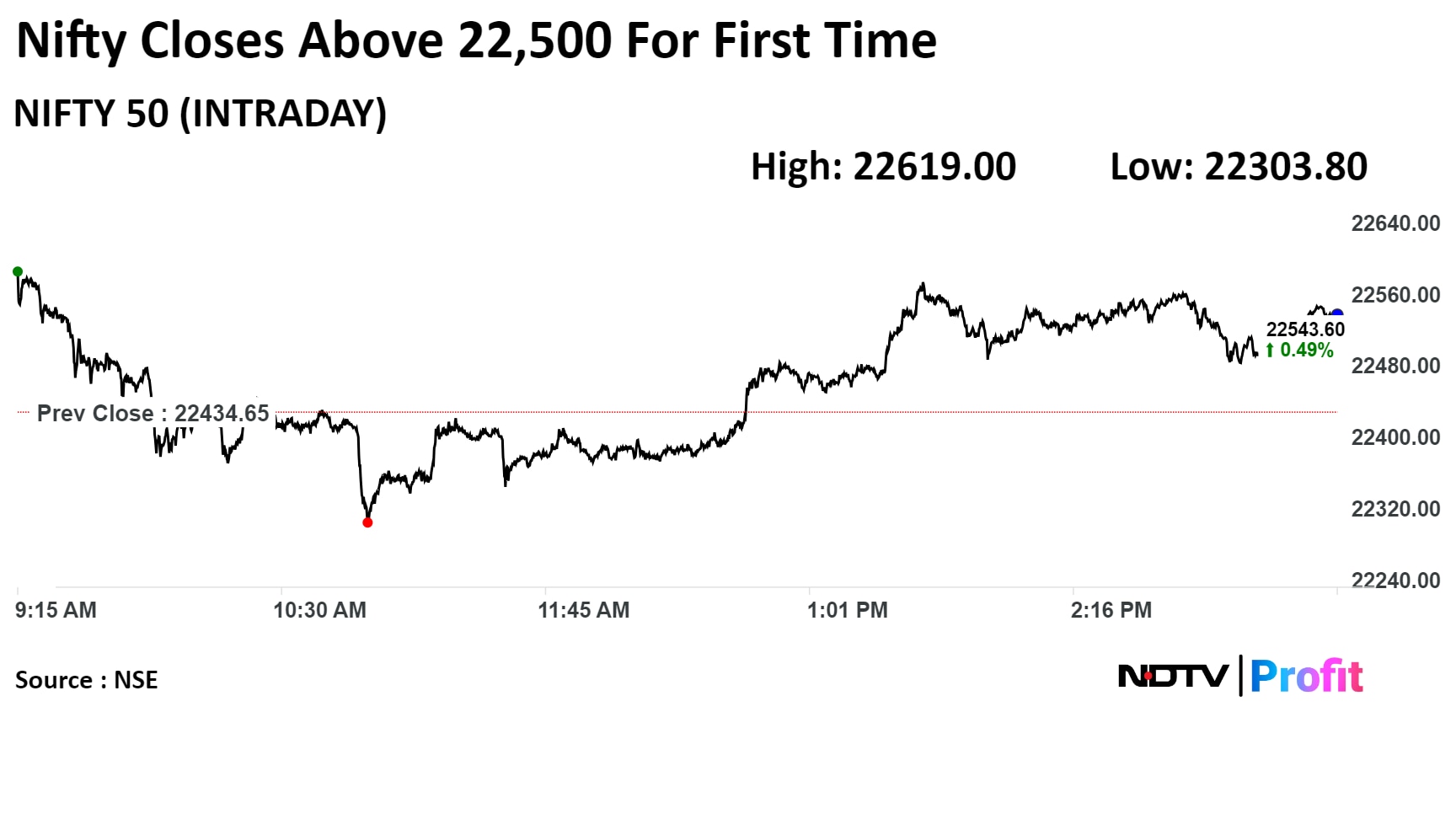

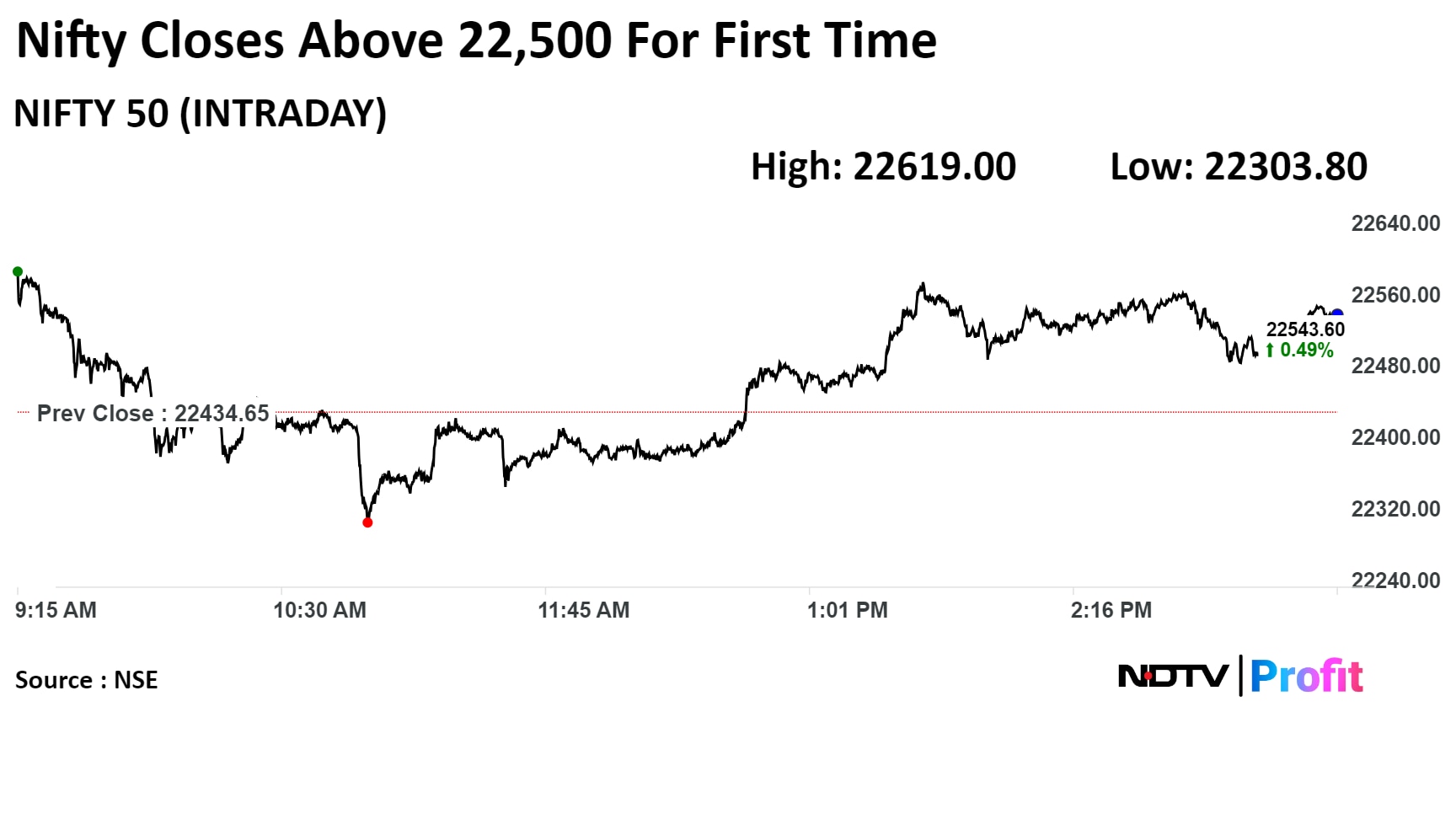

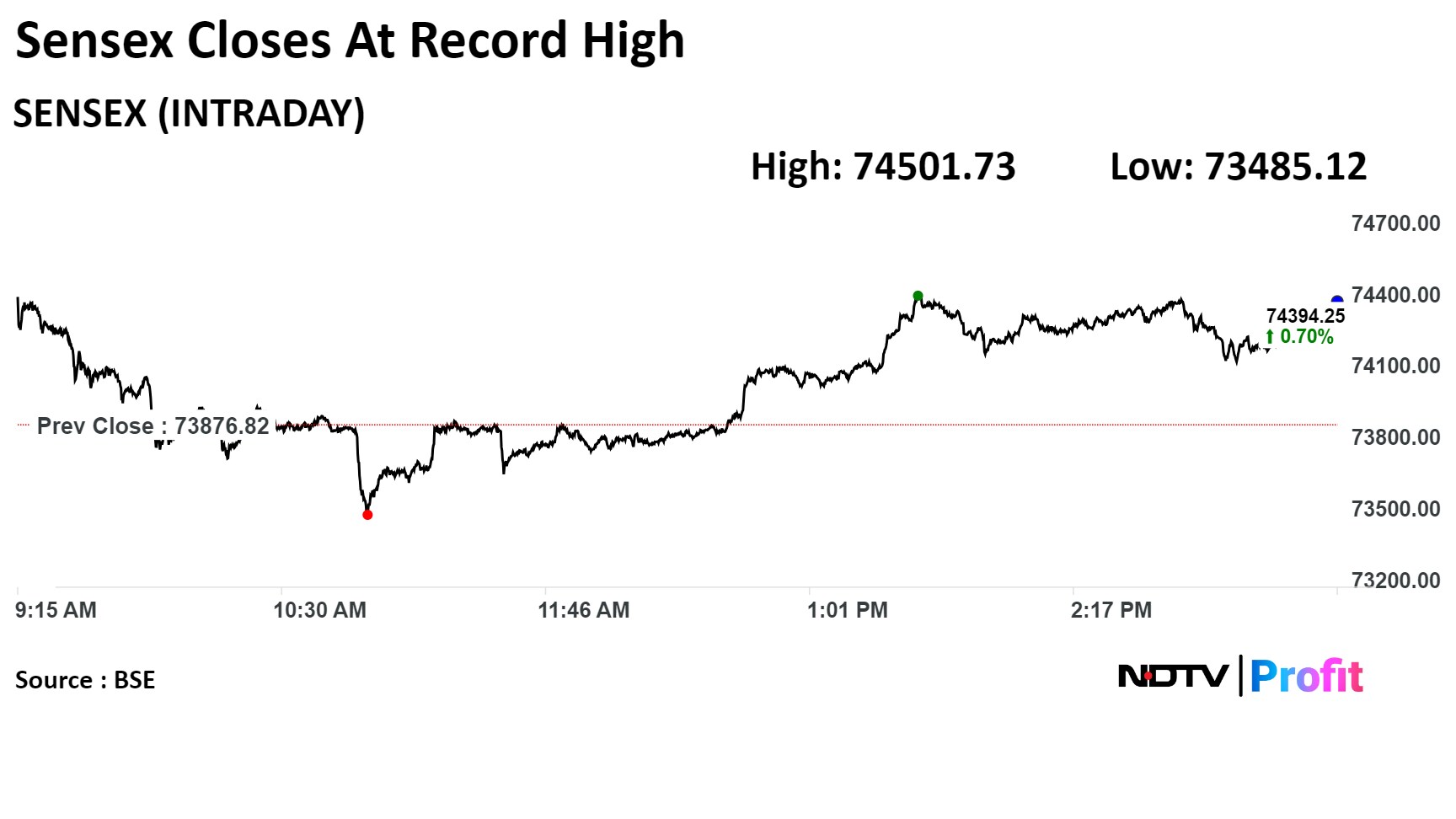

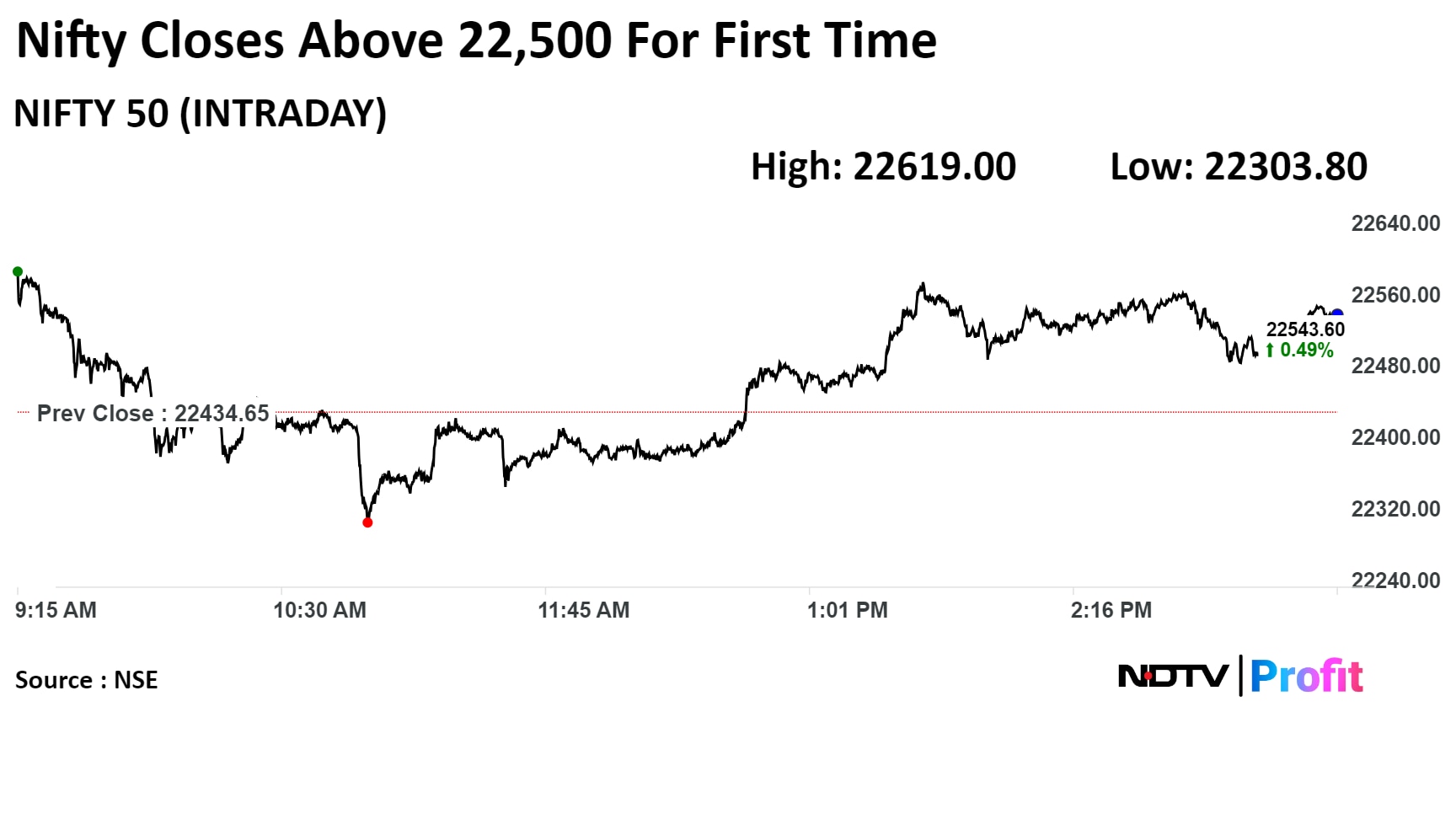

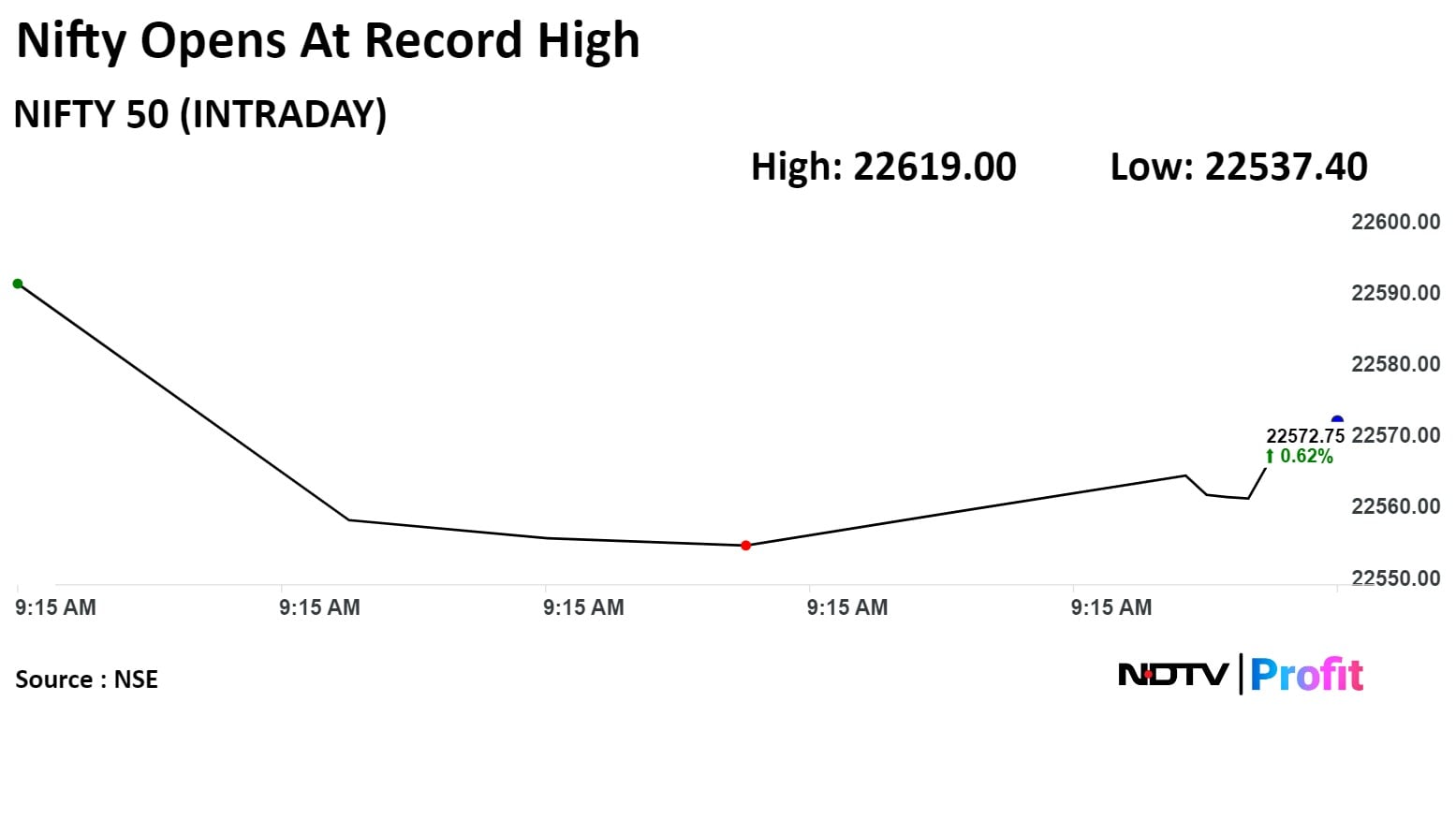

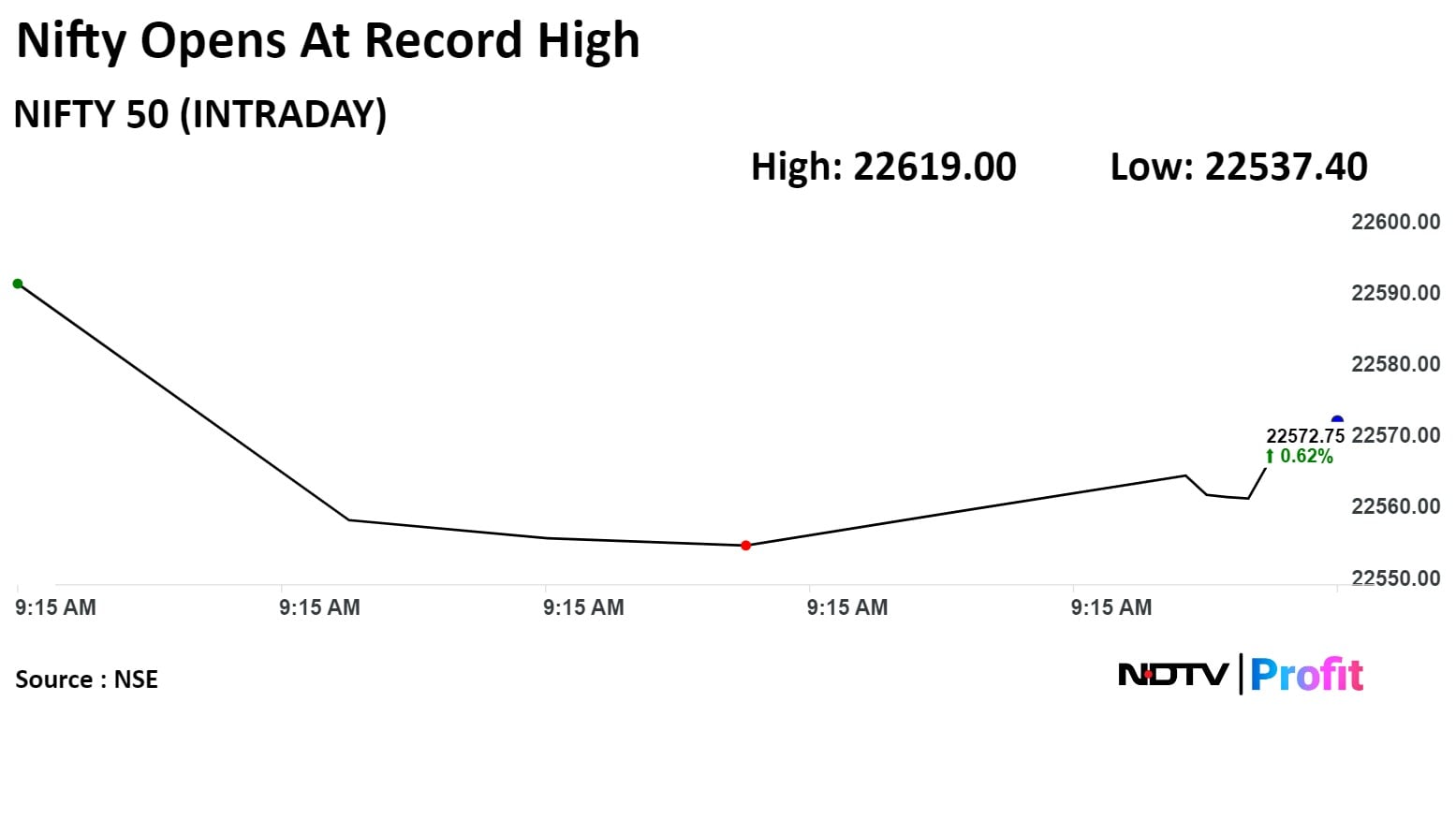

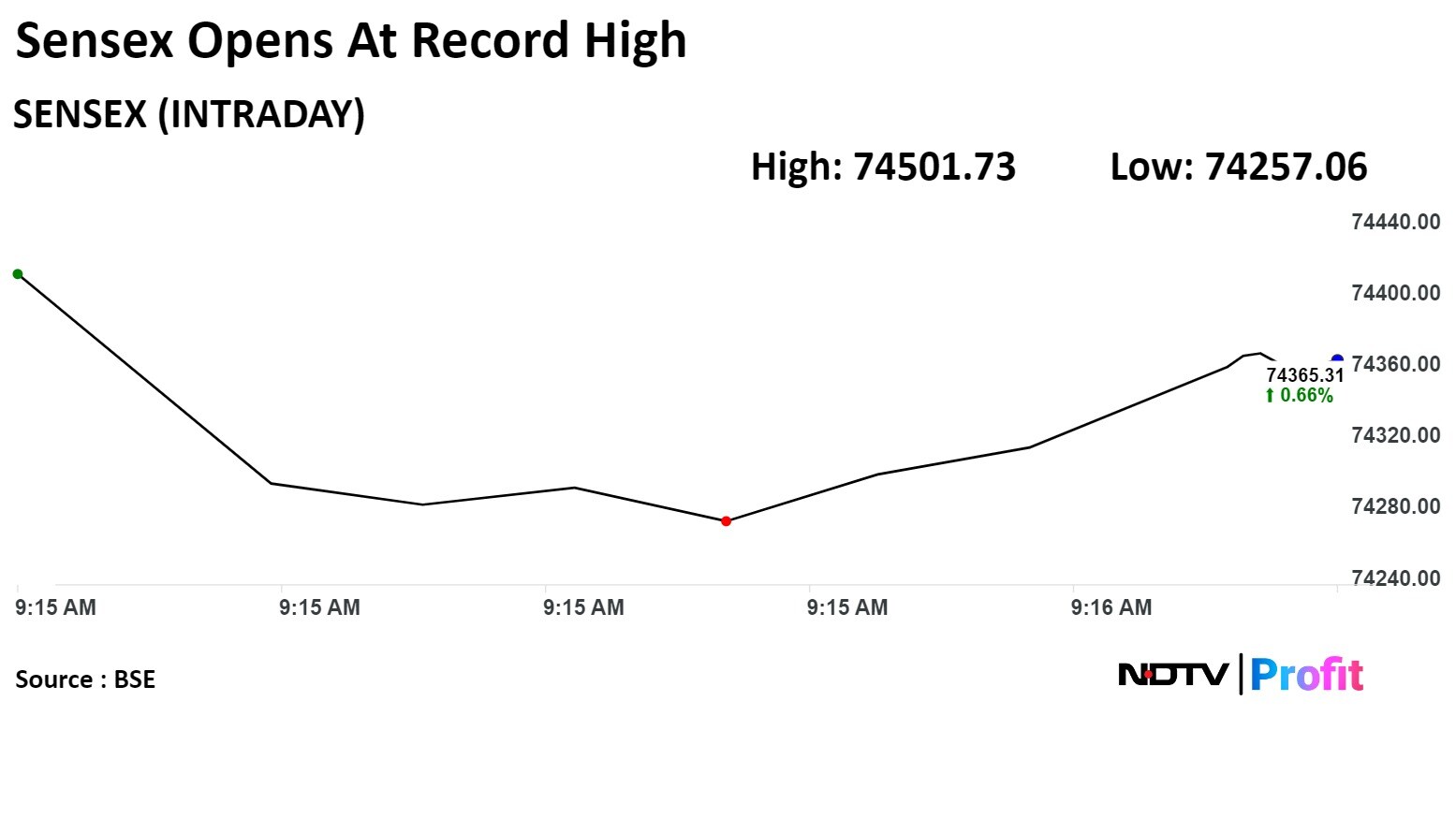

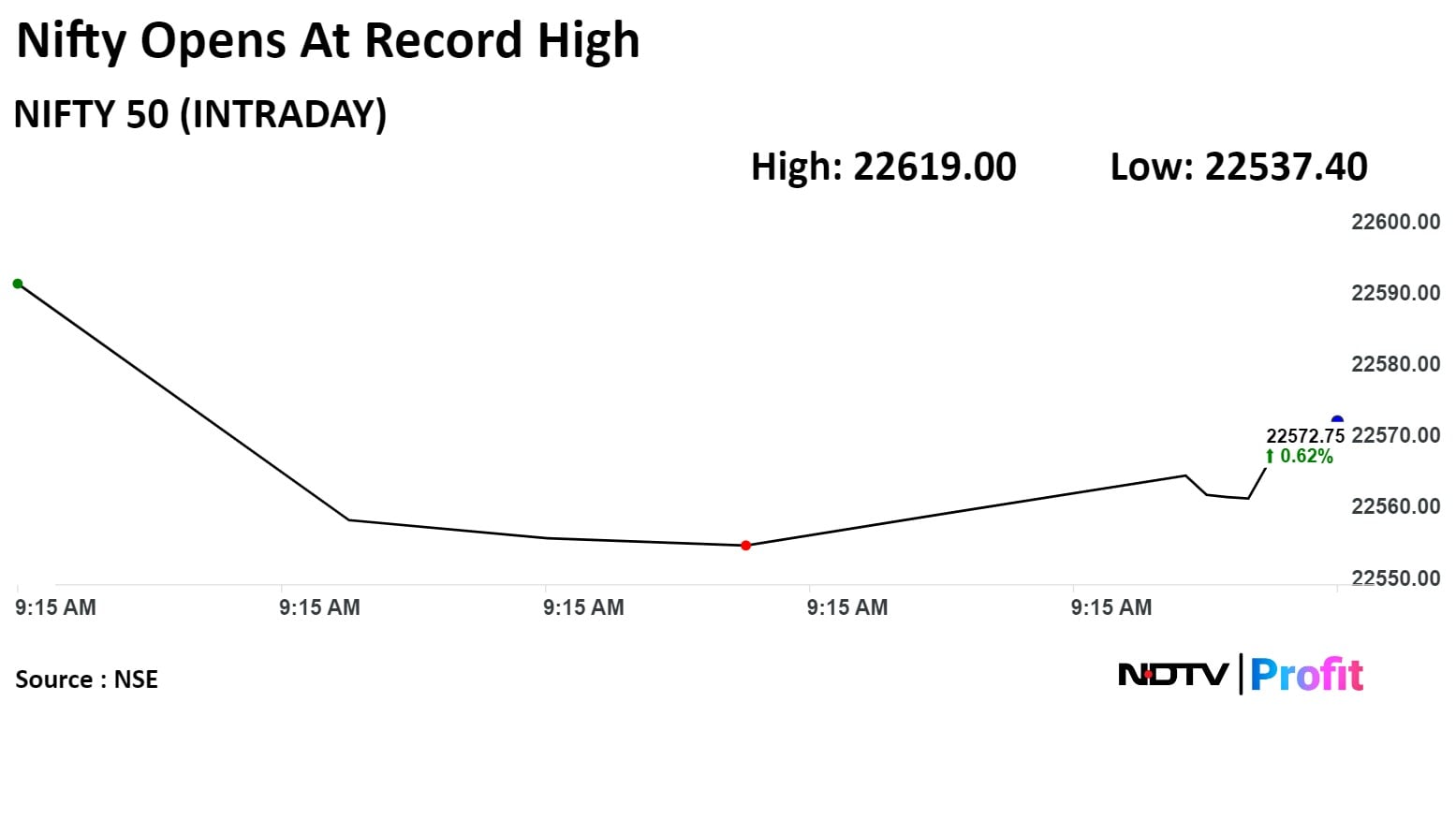

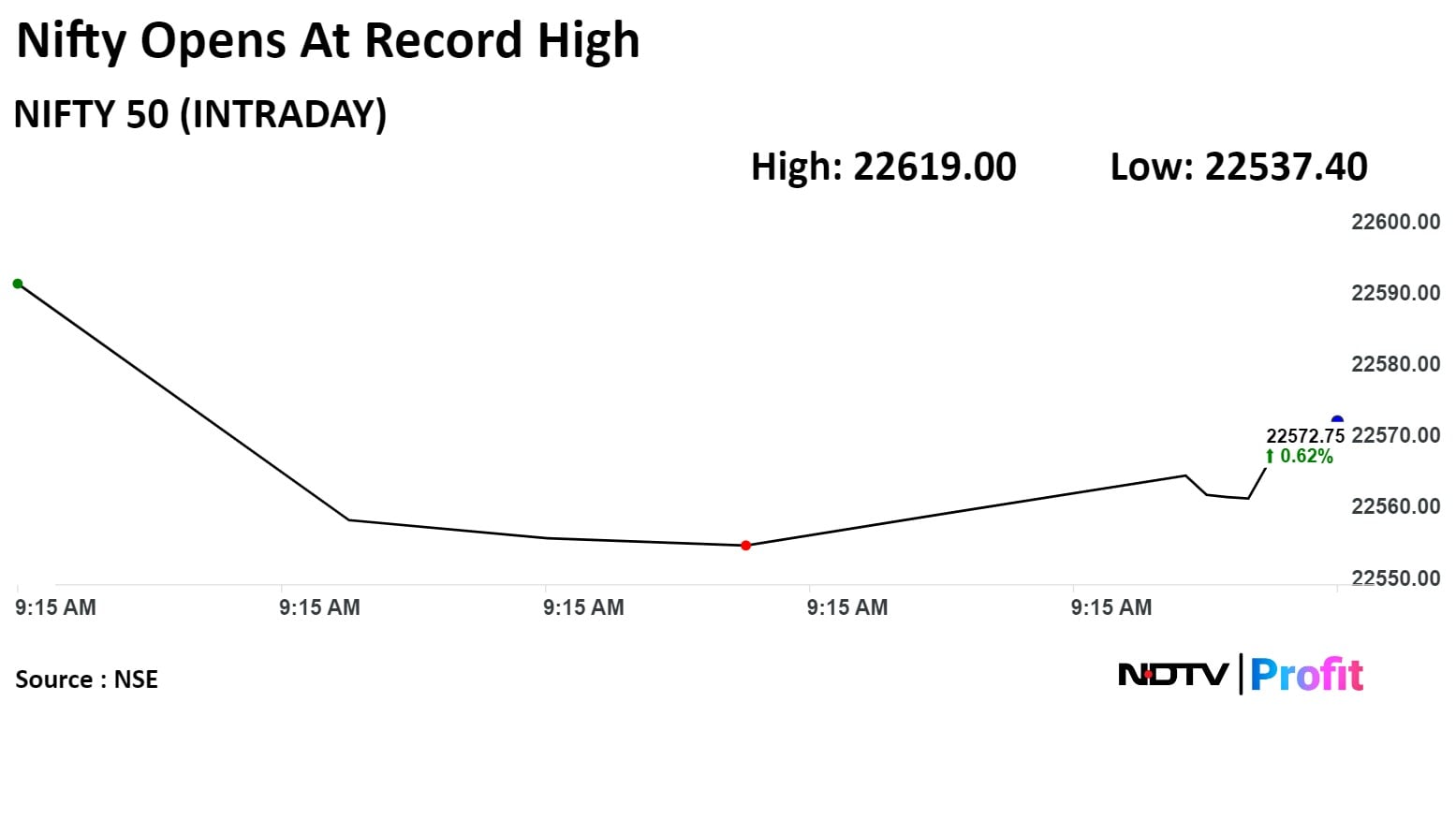

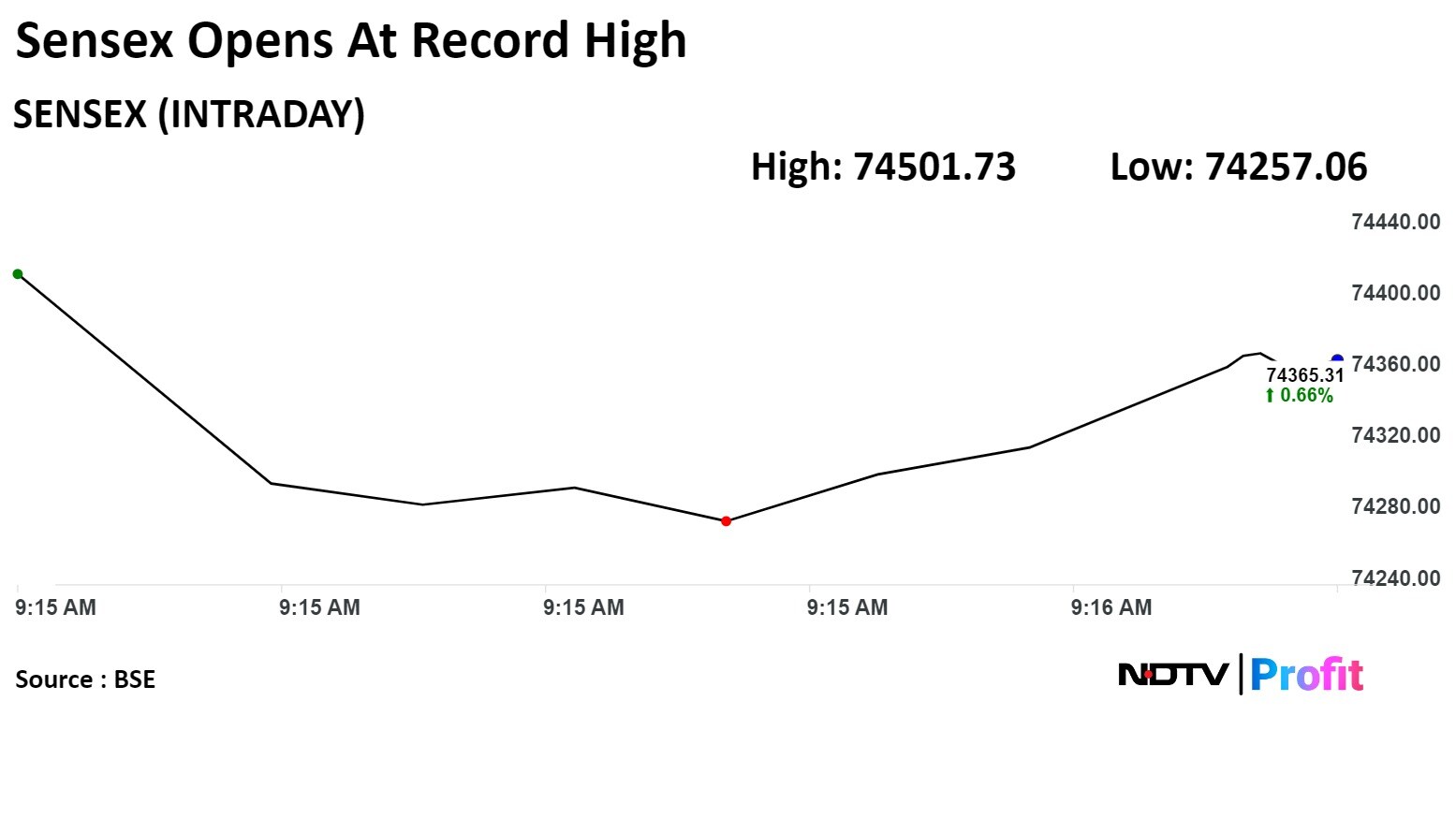

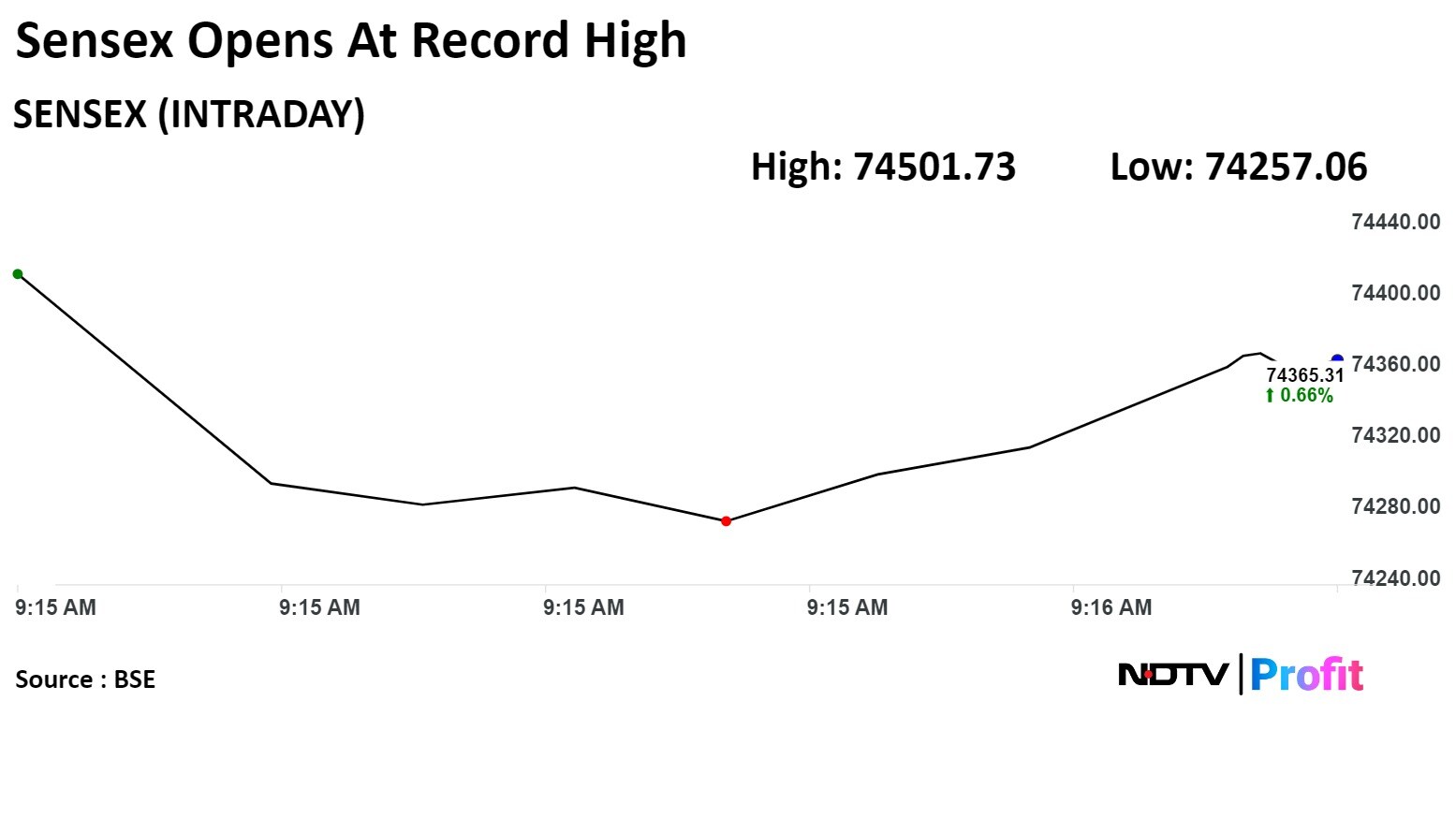

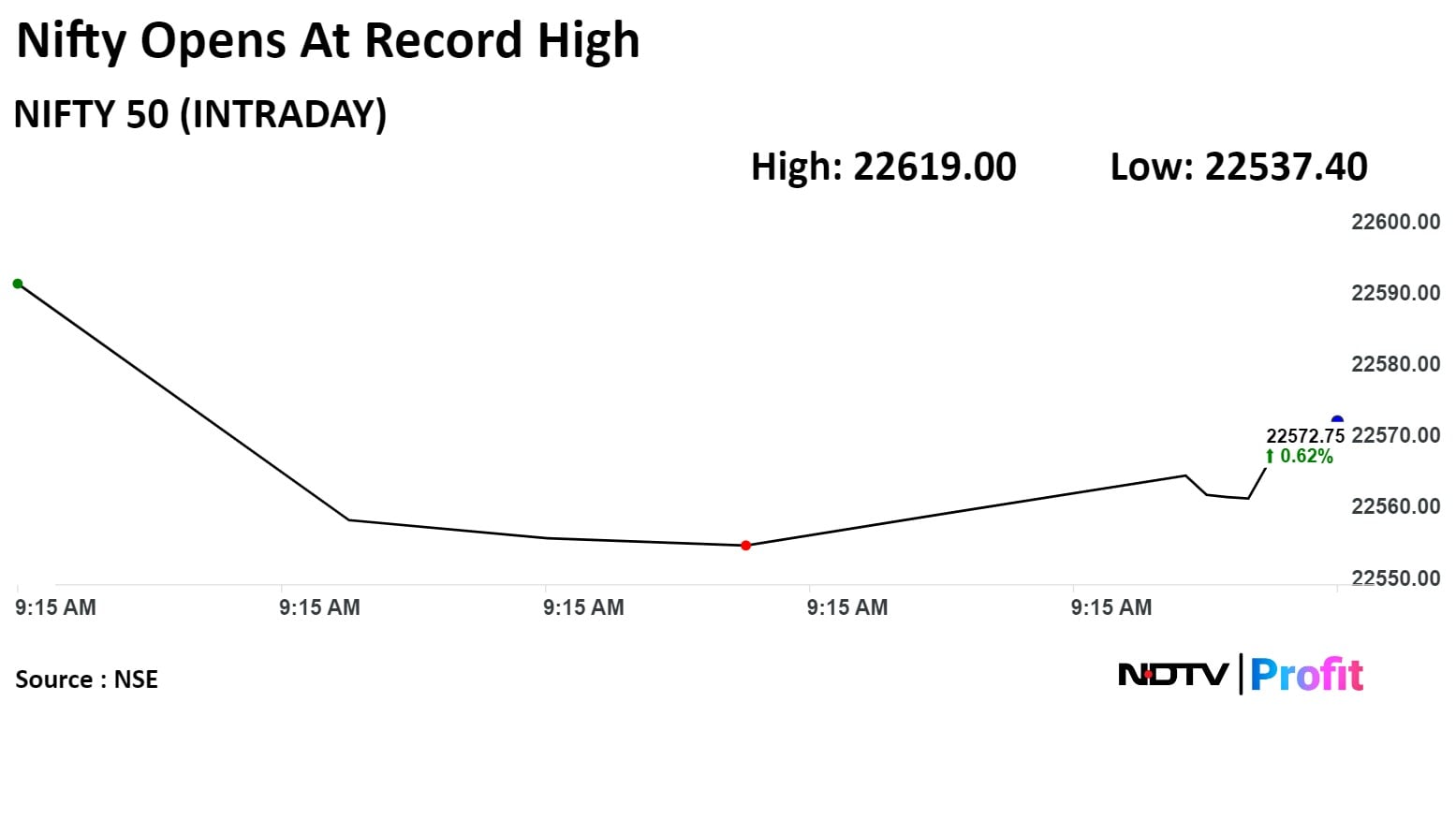

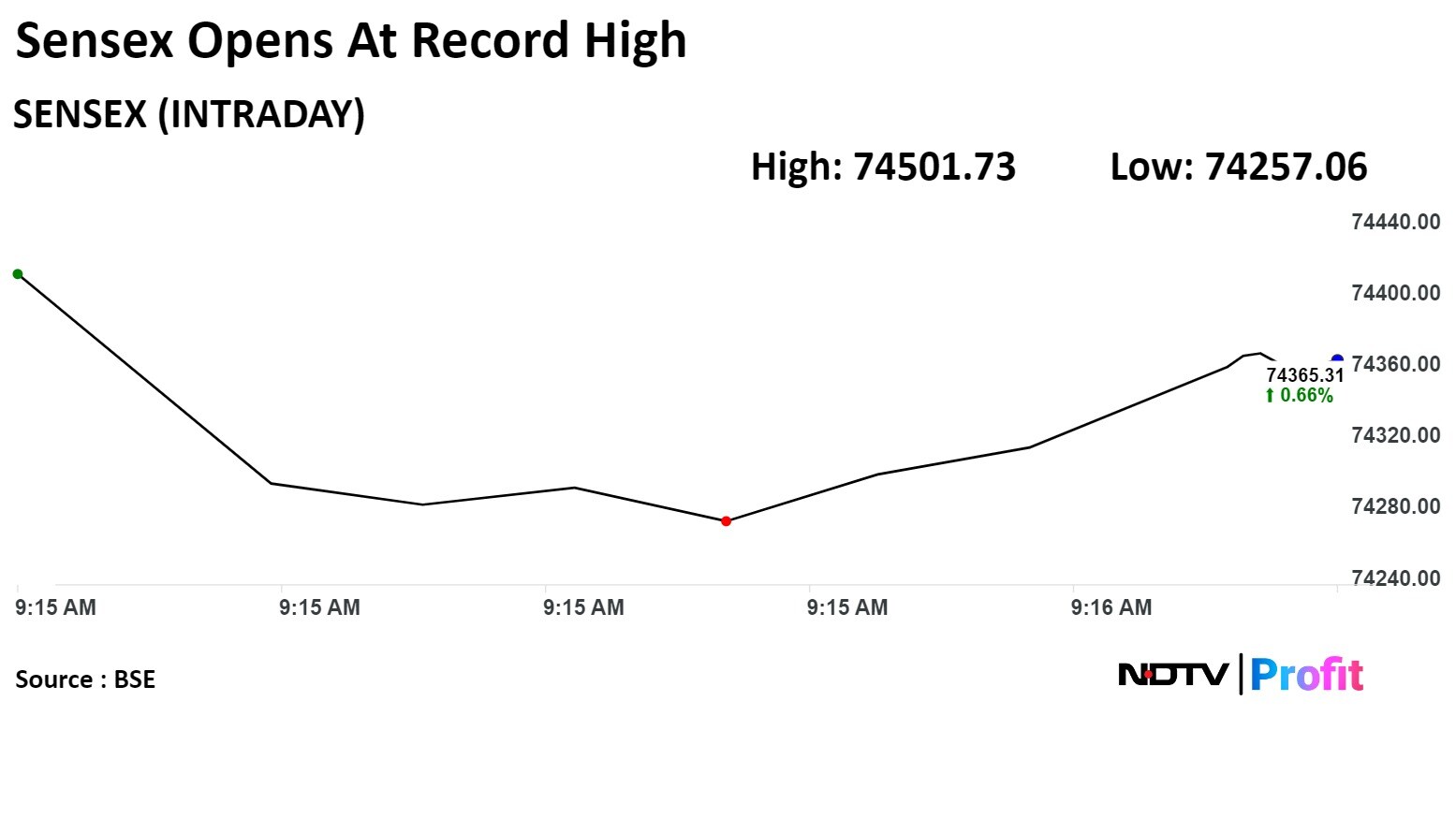

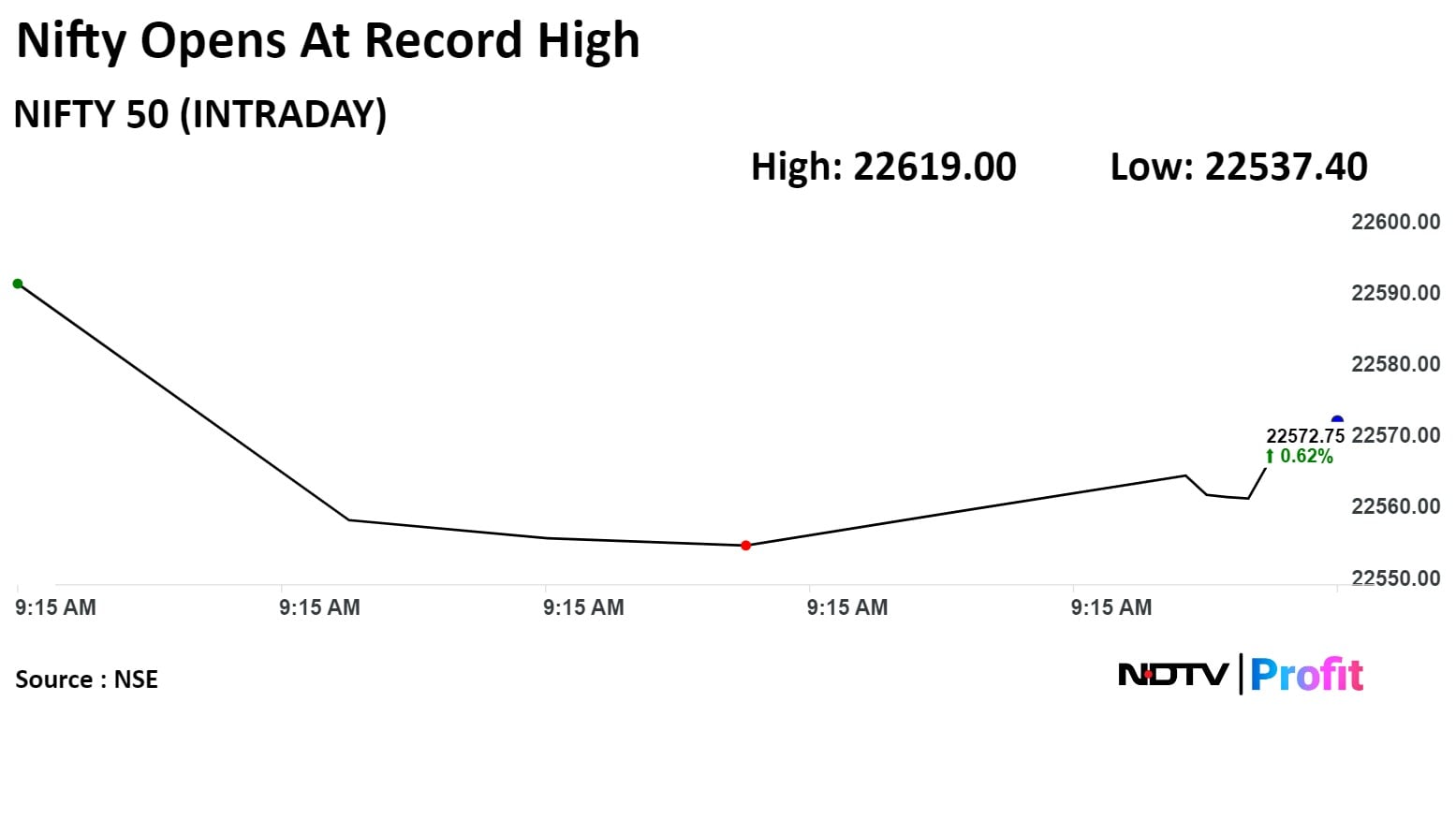

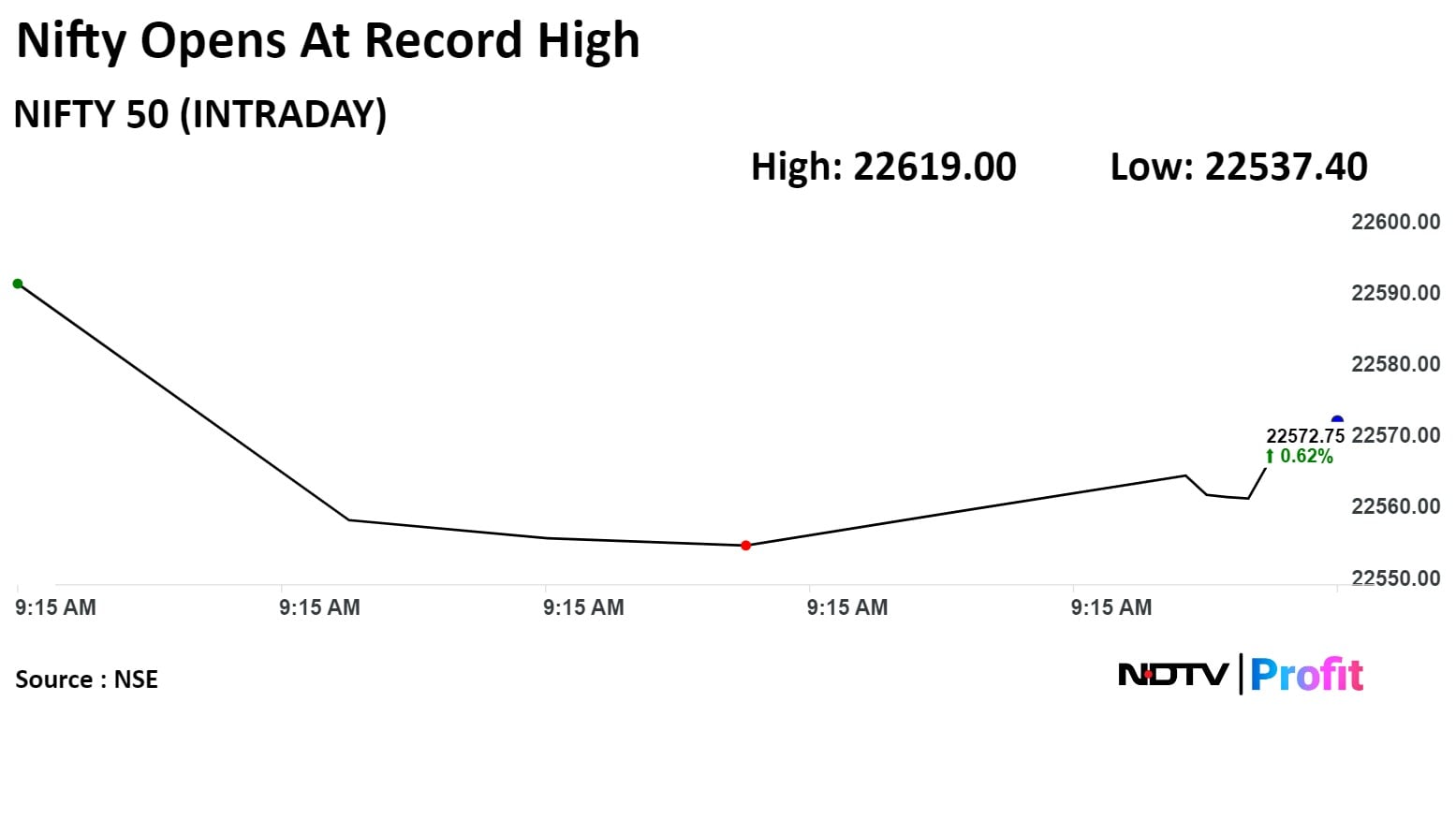

Today, the Nifty closed 80 points or 0.36% higher at 22,514.65 and the Sensex closed 350.81 points or 0.47% higher at 74,227.63. Intraday, the Nifty hit a high of 22,619 points and the Sensex hit 74,501.73.

"After dismissal of 22600/74500, the market could rally up to 22700-22750/74800-75000," said Shrikant Chouhan, head of equity research at Kotak Securities. "On the flip side, below 22350/73500 the sentiment could change. Below 22350/73500, the market could retest the level of 22200-22100/73100-72800."

Benchmark equity indices came out of their two-day losing streak to end at highest closing levels amid gains in global markets after Fed Chair Powell restored hopes of rate cuts this year but also said that the timing for rate cuts is uncertain.

Investors now await the outcome of the upcoming meeting of the monetary policy committee due Friday. The Reserve Bank of India will likely keep its benchmark repurchase rate at 6.5% for a seventh straight policy meeting, according to all 39 economists surveyed by Bloomberg.

Today, the Nifty closed 80 points or 0.36% higher at 22,514.65 and the Sensex closed 350.81 points or 0.47% higher at 74,227.63. Intraday, the Nifty hit a high of 22,619 points and the Sensex hit 74,501.73.

"After dismissal of 22600/74500, the market could rally up to 22700-22750/74800-75000," said Shrikant Chouhan, head of equity research at Kotak Securities. "On the flip side, below 22350/73500 the sentiment could change. Below 22350/73500, the market could retest the level of 22200-22100/73100-72800."

Benchmark equity indices came out of their two-day losing streak to end at highest closing levels amid gains in global markets after Fed Chair Powell restored hopes of rate cuts this year but also said that the timing for rate cuts is uncertain.

Investors now await the outcome of the upcoming meeting of the monetary policy committee due Friday. The Reserve Bank of India will likely keep its benchmark repurchase rate at 6.5% for a seventh straight policy meeting, according to all 39 economists surveyed by Bloomberg.

Today, the Nifty closed 80 points or 0.36% higher at 22,514.65 and the Sensex closed 350.81 points or 0.47% higher at 74,227.63. Intraday, the Nifty hit a high of 22,619 points and the Sensex hit 74,501.73.

"After dismissal of 22600/74500, the market could rally up to 22700-22750/74800-75000," said Shrikant Chouhan, head of equity research at Kotak Securities. "On the flip side, below 22350/73500 the sentiment could change. Below 22350/73500, the market could retest the level of 22200-22100/73100-72800."

Benchmark equity indices came out of their two-day losing streak to end at highest closing levels amid gains in global markets after Fed Chair Powell restored hopes of rate cuts this year but also said that the timing for rate cuts is uncertain.

Investors now await the outcome of the upcoming meeting of the monetary policy committee due Friday. The Reserve Bank of India will likely keep its benchmark repurchase rate at 6.5% for a seventh straight policy meeting, according to all 39 economists surveyed by Bloomberg.

Today, the Nifty closed 80 points or 0.36% higher at 22,514.65 and the Sensex closed 350.81 points or 0.47% higher at 74,227.63. Intraday, the Nifty hit a high of 22,619 points and the Sensex hit 74,501.73.

"After dismissal of 22600/74500, the market could rally up to 22700-22750/74800-75000," said Shrikant Chouhan, head of equity research at Kotak Securities. "On the flip side, below 22350/73500 the sentiment could change. Below 22350/73500, the market could retest the level of 22200-22100/73100-72800."

Benchmark equity indices came out of their two-day losing streak to end at highest closing levels amid gains in global markets after Fed Chair Powell restored hopes of rate cuts this year but also said that the timing for rate cuts is uncertain.

Investors now await the outcome of the upcoming meeting of the monetary policy committee due Friday. The Reserve Bank of India will likely keep its benchmark repurchase rate at 6.5% for a seventh straight policy meeting, according to all 39 economists surveyed by Bloomberg.

Today, the Nifty closed 80 points or 0.36% higher at 22,514.65 and the Sensex closed 350.81 points or 0.47% higher at 74,227.63. Intraday, the Nifty hit a high of 22,619 points and the Sensex hit 74,501.73.

"After dismissal of 22600/74500, the market could rally up to 22700-22750/74800-75000," said Shrikant Chouhan, head of equity research at Kotak Securities. "On the flip side, below 22350/73500 the sentiment could change. Below 22350/73500, the market could retest the level of 22200-22100/73100-72800."

Benchmark equity indices came out of their two-day losing streak to end at highest closing levels amid gains in global markets after Fed Chair Powell restored hopes of rate cuts this year but also said that the timing for rate cuts is uncertain.

Investors now await the outcome of the upcoming meeting of the monetary policy committee due Friday. The Reserve Bank of India will likely keep its benchmark repurchase rate at 6.5% for a seventh straight policy meeting, according to all 39 economists surveyed by Bloomberg.

Today, the Nifty closed 80 points or 0.36% higher at 22,514.65 and the Sensex closed 350.81 points or 0.47% higher at 74,227.63. Intraday, the Nifty hit a high of 22,619 points and the Sensex hit 74,501.73.

"After dismissal of 22600/74500, the market could rally up to 22700-22750/74800-75000," said Shrikant Chouhan, head of equity research at Kotak Securities. "On the flip side, below 22350/73500 the sentiment could change. Below 22350/73500, the market could retest the level of 22200-22100/73100-72800."

Benchmark equity indices came out of their two-day losing streak to end at highest closing levels amid gains in global markets after Fed Chair Powell restored hopes of rate cuts this year but also said that the timing for rate cuts is uncertain.

Investors now await the outcome of the upcoming meeting of the monetary policy committee due Friday. The Reserve Bank of India will likely keep its benchmark repurchase rate at 6.5% for a seventh straight policy meeting, according to all 39 economists surveyed by Bloomberg.

Today, the Nifty closed 80 points or 0.36% higher at 22,514.65 and the Sensex closed 350.81 points or 0.47% higher at 74,227.63. Intraday, the Nifty hit a high of 22,619 points and the Sensex hit 74,501.73.

"After dismissal of 22600/74500, the market could rally up to 22700-22750/74800-75000," said Shrikant Chouhan, head of equity research at Kotak Securities. "On the flip side, below 22350/73500 the sentiment could change. Below 22350/73500, the market could retest the level of 22200-22100/73100-72800."

Benchmark equity indices came out of their two-day losing streak to end at highest closing levels amid gains in global markets after Fed Chair Powell restored hopes of rate cuts this year but also said that the timing for rate cuts is uncertain.

Investors now await the outcome of the upcoming meeting of the monetary policy committee due Friday. The Reserve Bank of India will likely keep its benchmark repurchase rate at 6.5% for a seventh straight policy meeting, according to all 39 economists surveyed by Bloomberg.

Today, the Nifty closed 80 points or 0.36% higher at 22,514.65 and the Sensex closed 350.81 points or 0.47% higher at 74,227.63. Intraday, the Nifty hit a high of 22,619 points and the Sensex hit 74,501.73.

"After dismissal of 22600/74500, the market could rally up to 22700-22750/74800-75000," said Shrikant Chouhan, head of equity research at Kotak Securities. "On the flip side, below 22350/73500 the sentiment could change. Below 22350/73500, the market could retest the level of 22200-22100/73100-72800."

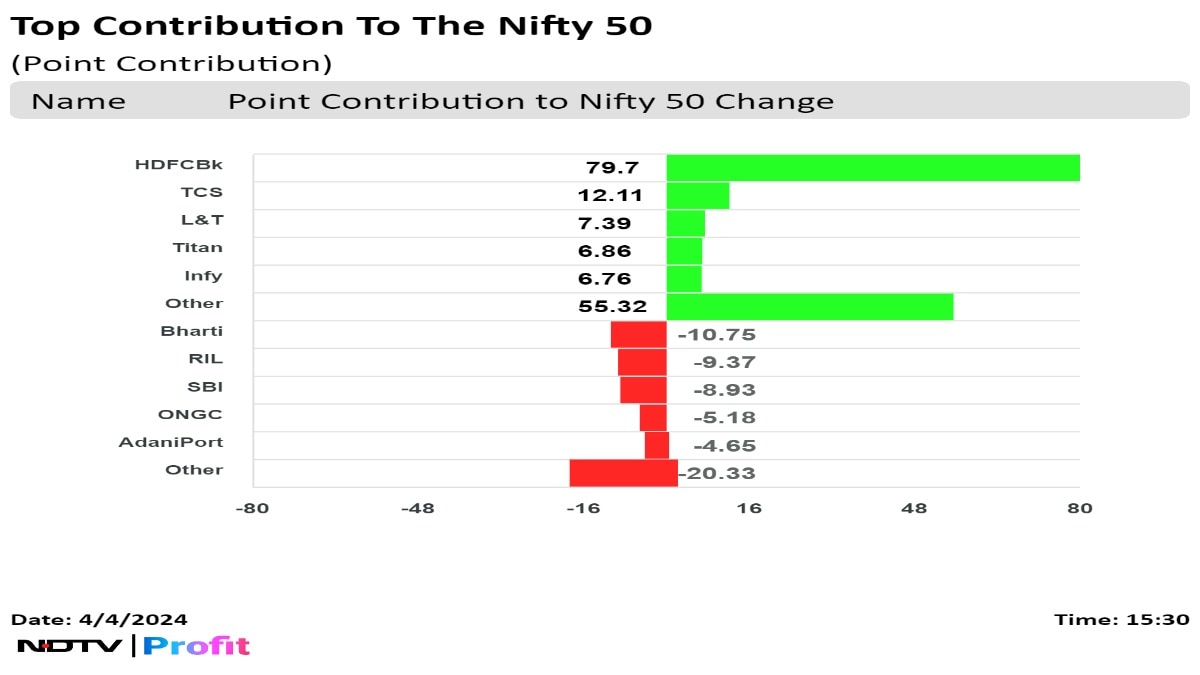

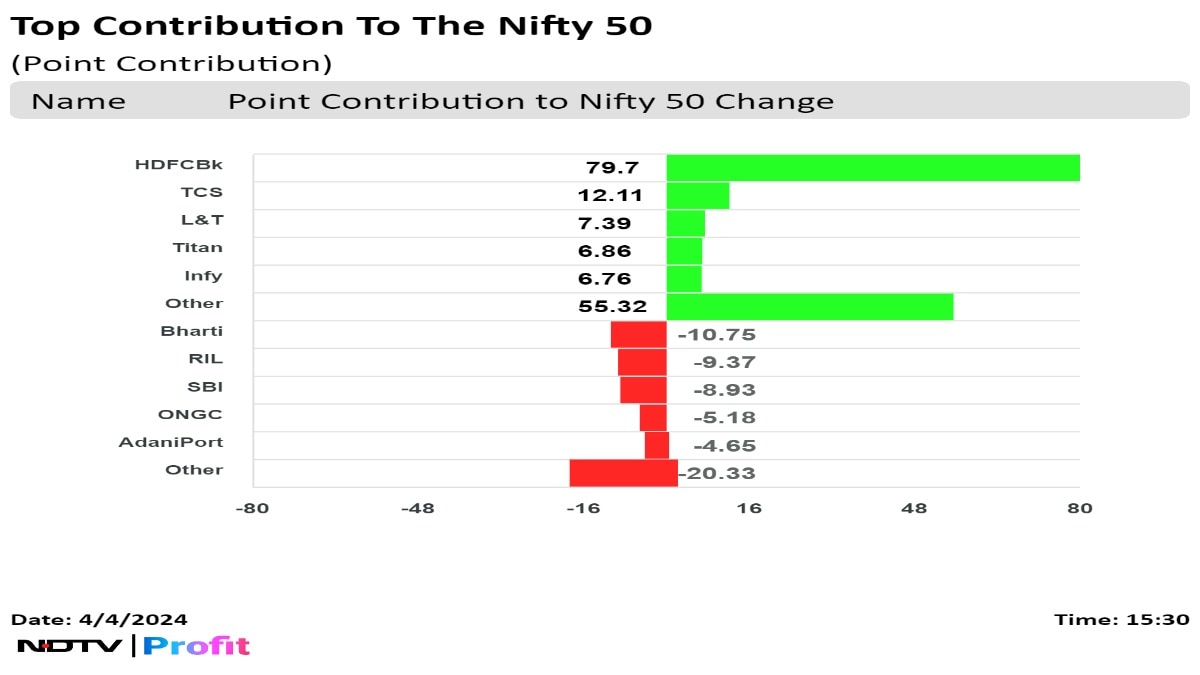

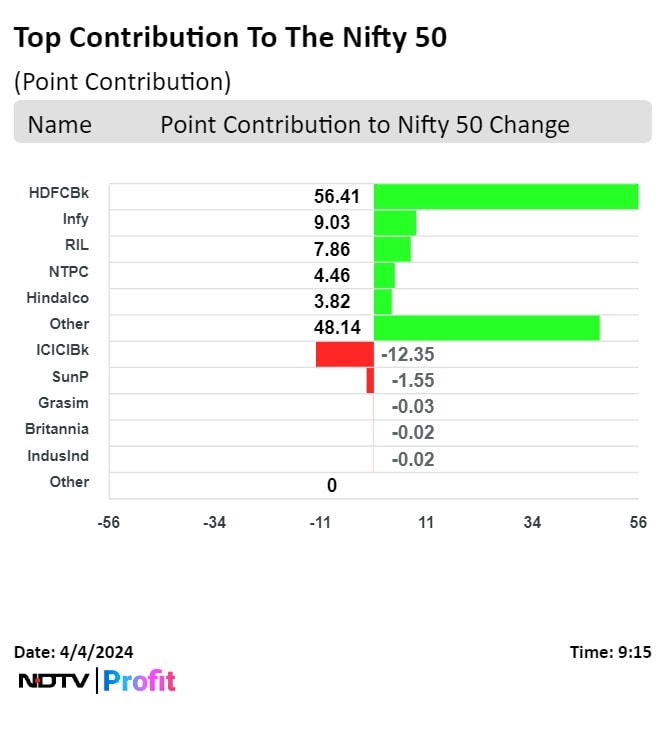

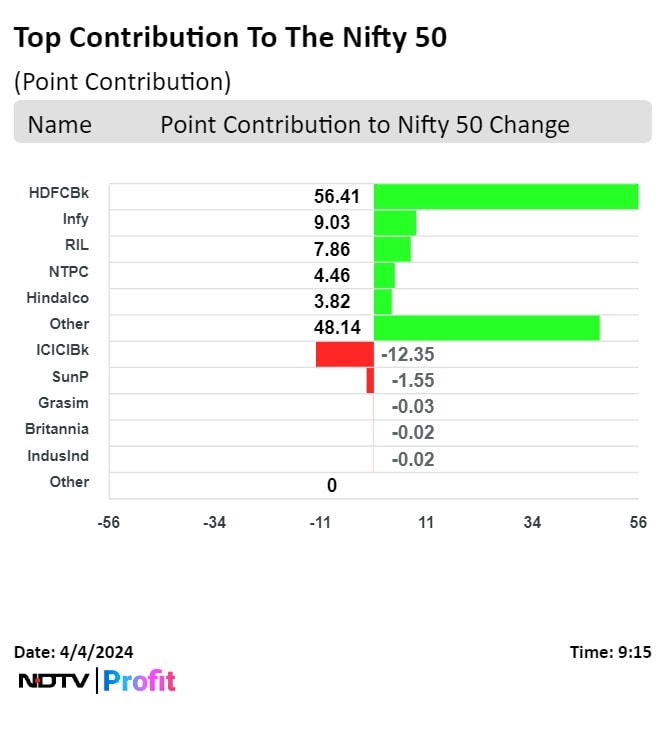

Shares of HDFC Bank Ltd. contributed the most to the gains followed by Tata Consultancy Services Ltd., Larsen & Toubro Ltd., Titan Company Ltd., and Infosys Ltd.

Meanwhile, those of Adani Ports and Special Economic Zone Ltd., Oil and Natural Gas Corp Ltd., State Bank Of India, Reliance Industries Ltd., and Bharti Airtel Ltd. capped the upside.

Benchmark equity indices came out of their two-day losing streak to end at highest closing levels amid gains in global markets after Fed Chair Powell restored hopes of rate cuts this year but also said that the timing for rate cuts is uncertain.

Investors now await the outcome of the upcoming meeting of the monetary policy committee due Friday. The Reserve Bank of India will likely keep its benchmark repurchase rate at 6.5% for a seventh straight policy meeting, according to all 39 economists surveyed by Bloomberg.

Today, the Nifty closed 80 points or 0.36% higher at 22,514.65 and the Sensex closed 350.81 points or 0.47% higher at 74,227.63. Intraday, the Nifty hit a high of 22,619 points and the Sensex hit 74,501.73.

"After dismissal of 22600/74500, the market could rally up to 22700-22750/74800-75000," said Shrikant Chouhan, head of equity research at Kotak Securities. "On the flip side, below 22350/73500 the sentiment could change. Below 22350/73500, the market could retest the level of 22200-22100/73100-72800."

Benchmark equity indices came out of their two-day losing streak to end at highest closing levels amid gains in global markets after Fed Chair Powell restored hopes of rate cuts this year but also said that the timing for rate cuts is uncertain.

Investors now await the outcome of the upcoming meeting of the monetary policy committee due Friday. The Reserve Bank of India will likely keep its benchmark repurchase rate at 6.5% for a seventh straight policy meeting, according to all 39 economists surveyed by Bloomberg.

Today, the Nifty closed 80 points or 0.36% higher at 22,514.65 and the Sensex closed 350.81 points or 0.47% higher at 74,227.63. Intraday, the Nifty hit a high of 22,619 points and the Sensex hit 74,501.73.

"After dismissal of 22600/74500, the market could rally up to 22700-22750/74800-75000," said Shrikant Chouhan, head of equity research at Kotak Securities. "On the flip side, below 22350/73500 the sentiment could change. Below 22350/73500, the market could retest the level of 22200-22100/73100-72800."

Benchmark equity indices came out of their two-day losing streak to end at highest closing levels amid gains in global markets after Fed Chair Powell restored hopes of rate cuts this year but also said that the timing for rate cuts is uncertain.

Investors now await the outcome of the upcoming meeting of the monetary policy committee due Friday. The Reserve Bank of India will likely keep its benchmark repurchase rate at 6.5% for a seventh straight policy meeting, according to all 39 economists surveyed by Bloomberg.

Today, the Nifty closed 80 points or 0.36% higher at 22,514.65 and the Sensex closed 350.81 points or 0.47% higher at 74,227.63. Intraday, the Nifty hit a high of 22,619 points and the Sensex hit 74,501.73.

"After dismissal of 22600/74500, the market could rally up to 22700-22750/74800-75000," said Shrikant Chouhan, head of equity research at Kotak Securities. "On the flip side, below 22350/73500 the sentiment could change. Below 22350/73500, the market could retest the level of 22200-22100/73100-72800."

Benchmark equity indices came out of their two-day losing streak to end at highest closing levels amid gains in global markets after Fed Chair Powell restored hopes of rate cuts this year but also said that the timing for rate cuts is uncertain.

Investors now await the outcome of the upcoming meeting of the monetary policy committee due Friday. The Reserve Bank of India will likely keep its benchmark repurchase rate at 6.5% for a seventh straight policy meeting, according to all 39 economists surveyed by Bloomberg.

Today, the Nifty closed 80 points or 0.36% higher at 22,514.65 and the Sensex closed 350.81 points or 0.47% higher at 74,227.63. Intraday, the Nifty hit a high of 22,619 points and the Sensex hit 74,501.73.

"After dismissal of 22600/74500, the market could rally up to 22700-22750/74800-75000," said Shrikant Chouhan, head of equity research at Kotak Securities. "On the flip side, below 22350/73500 the sentiment could change. Below 22350/73500, the market could retest the level of 22200-22100/73100-72800."

Benchmark equity indices came out of their two-day losing streak to end at highest closing levels amid gains in global markets after Fed Chair Powell restored hopes of rate cuts this year but also said that the timing for rate cuts is uncertain.

Investors now await the outcome of the upcoming meeting of the monetary policy committee due Friday. The Reserve Bank of India will likely keep its benchmark repurchase rate at 6.5% for a seventh straight policy meeting, according to all 39 economists surveyed by Bloomberg.

Today, the Nifty closed 80 points or 0.36% higher at 22,514.65 and the Sensex closed 350.81 points or 0.47% higher at 74,227.63. Intraday, the Nifty hit a high of 22,619 points and the Sensex hit 74,501.73.

"After dismissal of 22600/74500, the market could rally up to 22700-22750/74800-75000," said Shrikant Chouhan, head of equity research at Kotak Securities. "On the flip side, below 22350/73500 the sentiment could change. Below 22350/73500, the market could retest the level of 22200-22100/73100-72800."

Benchmark equity indices came out of their two-day losing streak to end at highest closing levels amid gains in global markets after Fed Chair Powell restored hopes of rate cuts this year but also said that the timing for rate cuts is uncertain.

Investors now await the outcome of the upcoming meeting of the monetary policy committee due Friday. The Reserve Bank of India will likely keep its benchmark repurchase rate at 6.5% for a seventh straight policy meeting, according to all 39 economists surveyed by Bloomberg.

Today, the Nifty closed 80 points or 0.36% higher at 22,514.65 and the Sensex closed 350.81 points or 0.47% higher at 74,227.63. Intraday, the Nifty hit a high of 22,619 points and the Sensex hit 74,501.73.

"After dismissal of 22600/74500, the market could rally up to 22700-22750/74800-75000," said Shrikant Chouhan, head of equity research at Kotak Securities. "On the flip side, below 22350/73500 the sentiment could change. Below 22350/73500, the market could retest the level of 22200-22100/73100-72800."

Benchmark equity indices came out of their two-day losing streak to end at highest closing levels amid gains in global markets after Fed Chair Powell restored hopes of rate cuts this year but also said that the timing for rate cuts is uncertain.

Investors now await the outcome of the upcoming meeting of the monetary policy committee due Friday. The Reserve Bank of India will likely keep its benchmark repurchase rate at 6.5% for a seventh straight policy meeting, according to all 39 economists surveyed by Bloomberg.

Today, the Nifty closed 80 points or 0.36% higher at 22,514.65 and the Sensex closed 350.81 points or 0.47% higher at 74,227.63. Intraday, the Nifty hit a high of 22,619 points and the Sensex hit 74,501.73.

"After dismissal of 22600/74500, the market could rally up to 22700-22750/74800-75000," said Shrikant Chouhan, head of equity research at Kotak Securities. "On the flip side, below 22350/73500 the sentiment could change. Below 22350/73500, the market could retest the level of 22200-22100/73100-72800."

Benchmark equity indices came out of their two-day losing streak to end at highest closing levels amid gains in global markets after Fed Chair Powell restored hopes of rate cuts this year but also said that the timing for rate cuts is uncertain.

Investors now await the outcome of the upcoming meeting of the monetary policy committee due Friday. The Reserve Bank of India will likely keep its benchmark repurchase rate at 6.5% for a seventh straight policy meeting, according to all 39 economists surveyed by Bloomberg.

Today, the Nifty closed 80 points or 0.36% higher at 22,514.65 and the Sensex closed 350.81 points or 0.47% higher at 74,227.63. Intraday, the Nifty hit a high of 22,619 points and the Sensex hit 74,501.73.

"After dismissal of 22600/74500, the market could rally up to 22700-22750/74800-75000," said Shrikant Chouhan, head of equity research at Kotak Securities. "On the flip side, below 22350/73500 the sentiment could change. Below 22350/73500, the market could retest the level of 22200-22100/73100-72800."

Shares of HDFC Bank Ltd. contributed the most to the gains followed by Tata Consultancy Services Ltd., Larsen & Toubro Ltd., Titan Company Ltd., and Infosys Ltd.

Meanwhile, those of Adani Ports and Special Economic Zone Ltd., Oil and Natural Gas Corp Ltd., State Bank Of India, Reliance Industries Ltd., and Bharti Airtel Ltd. capped the upside.

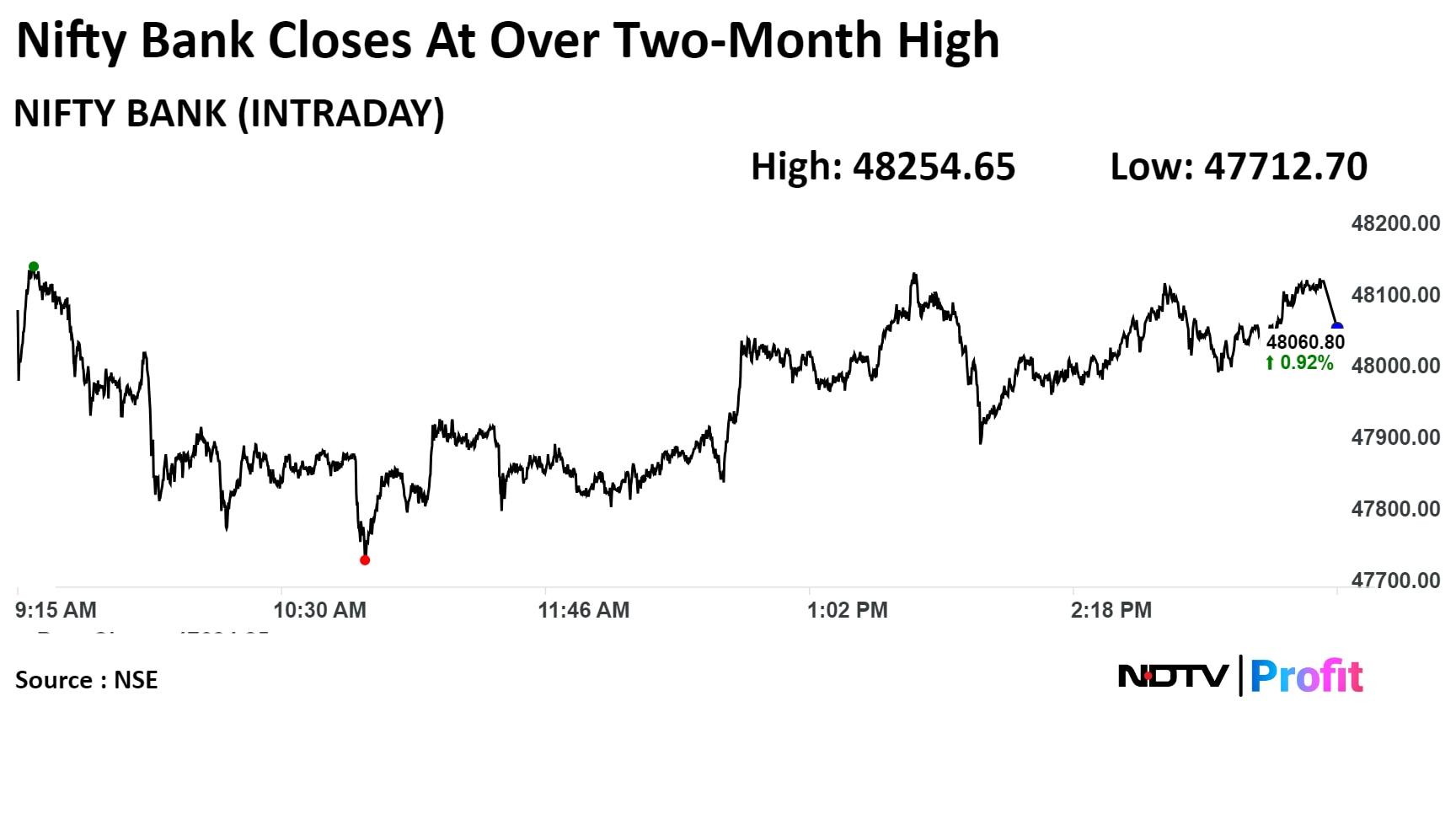

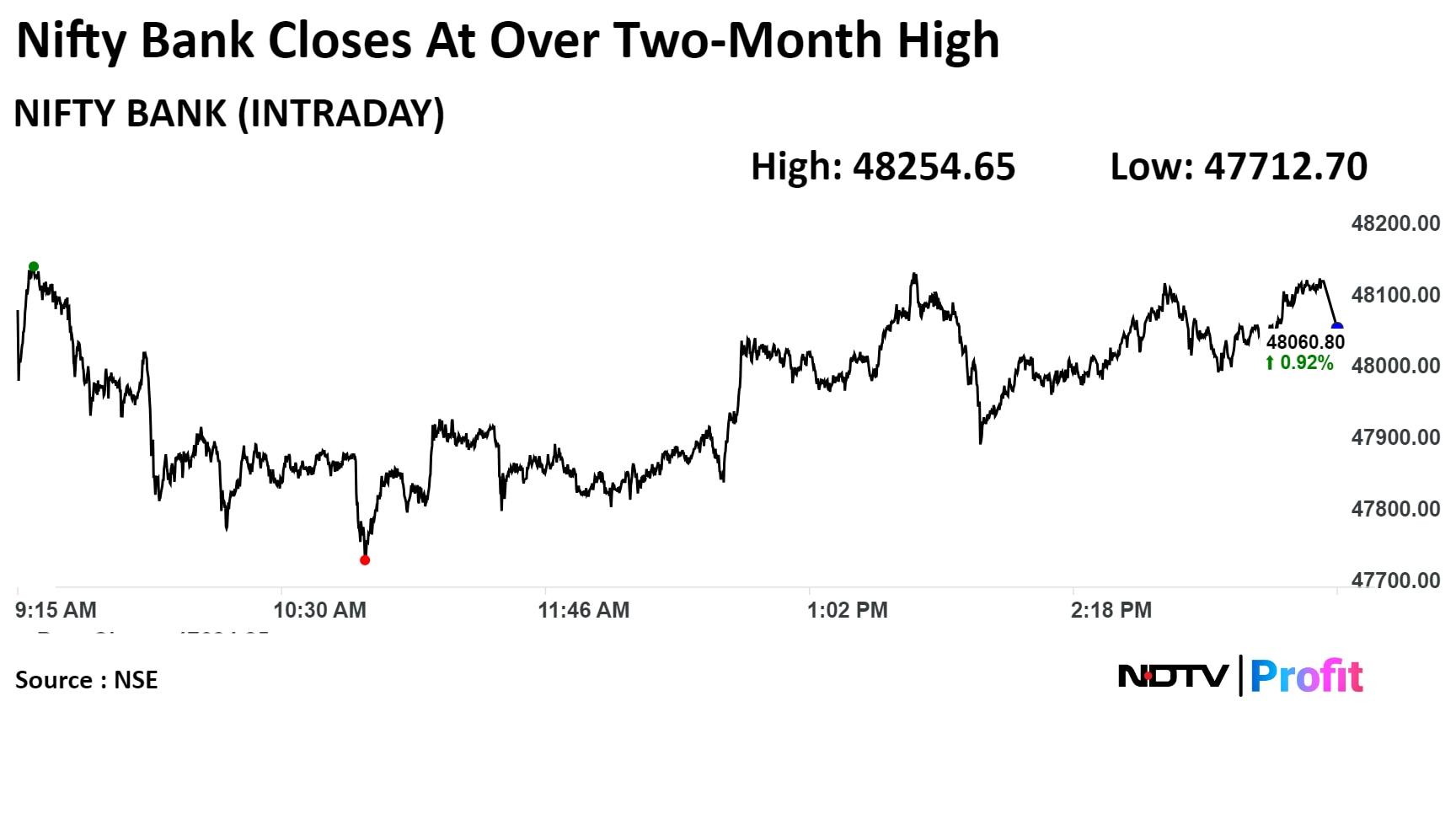

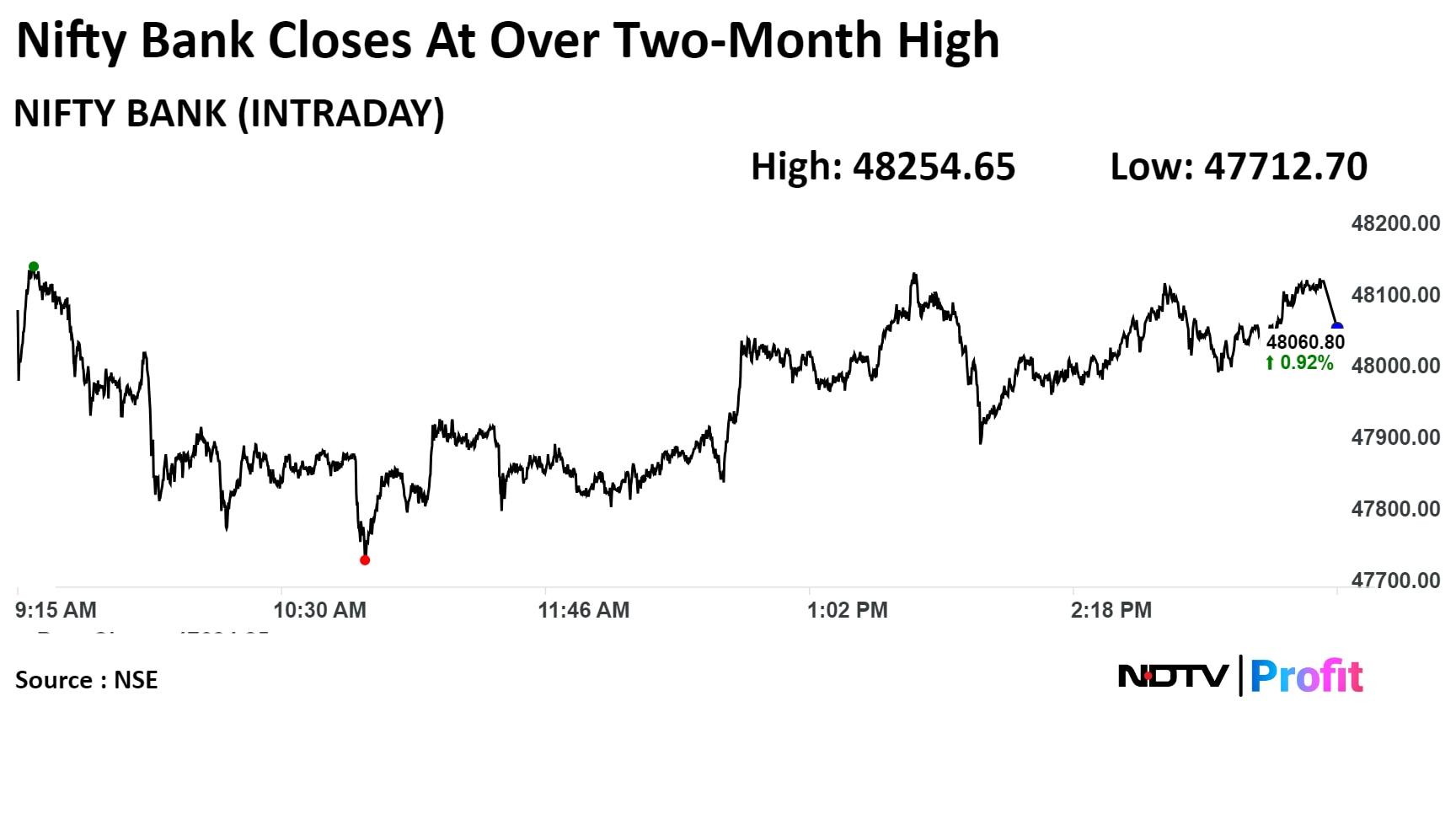

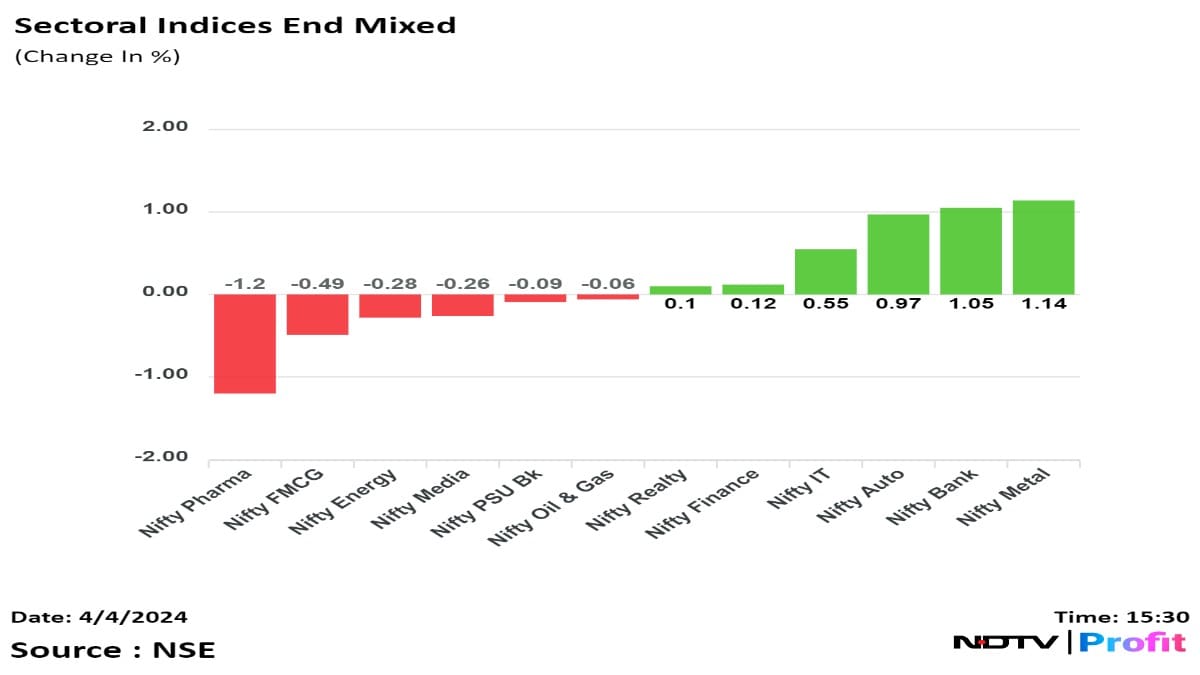

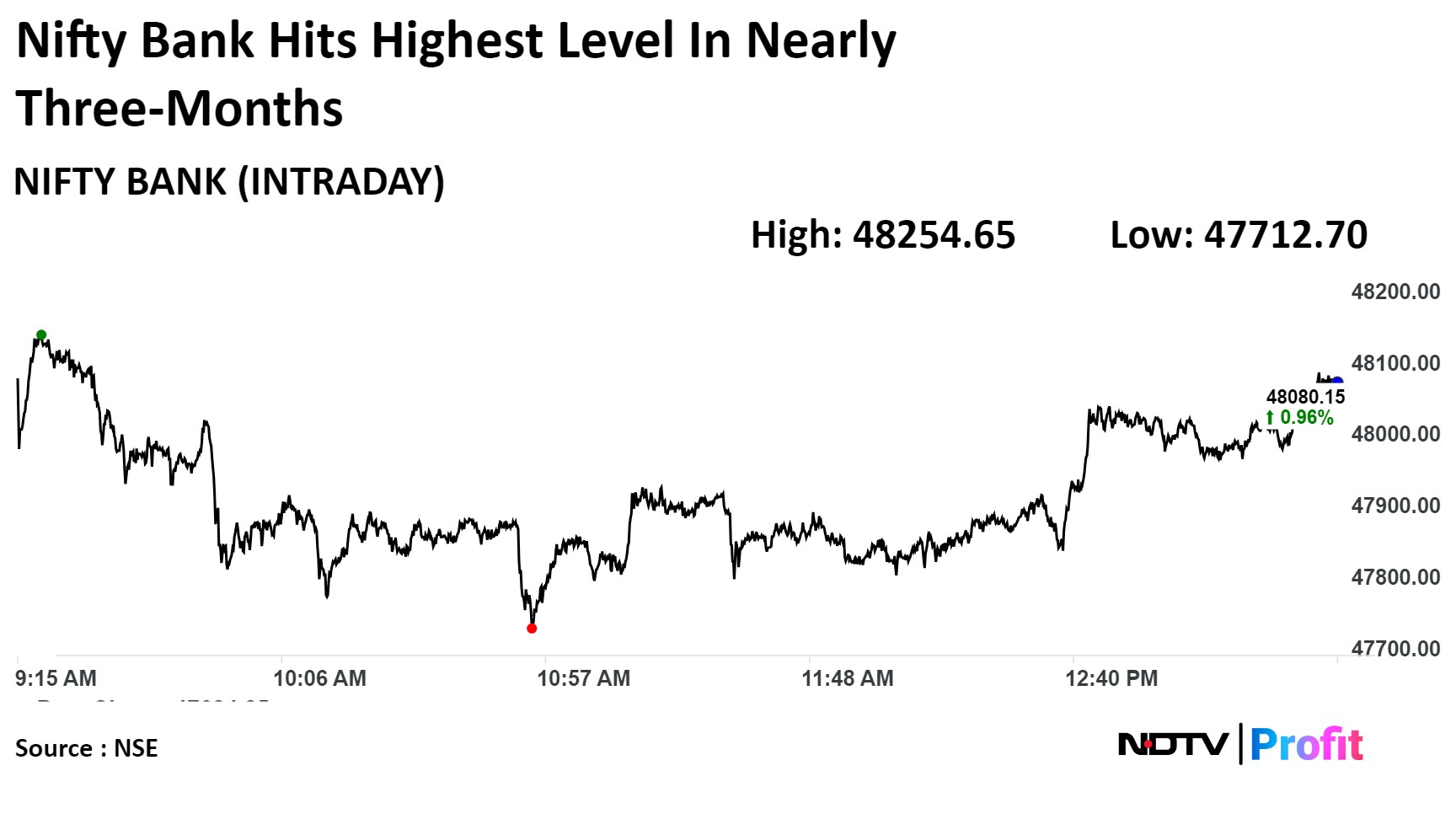

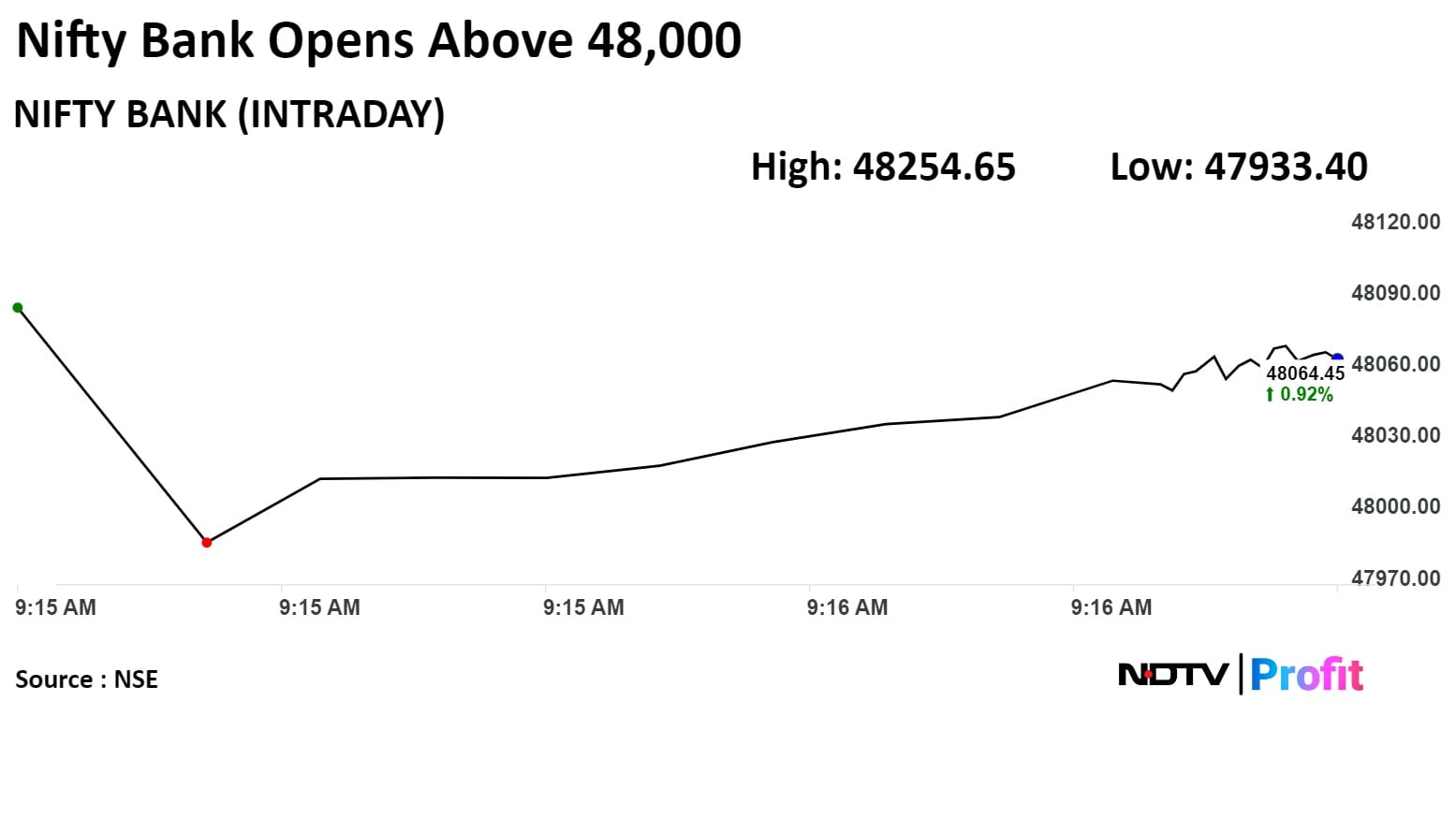

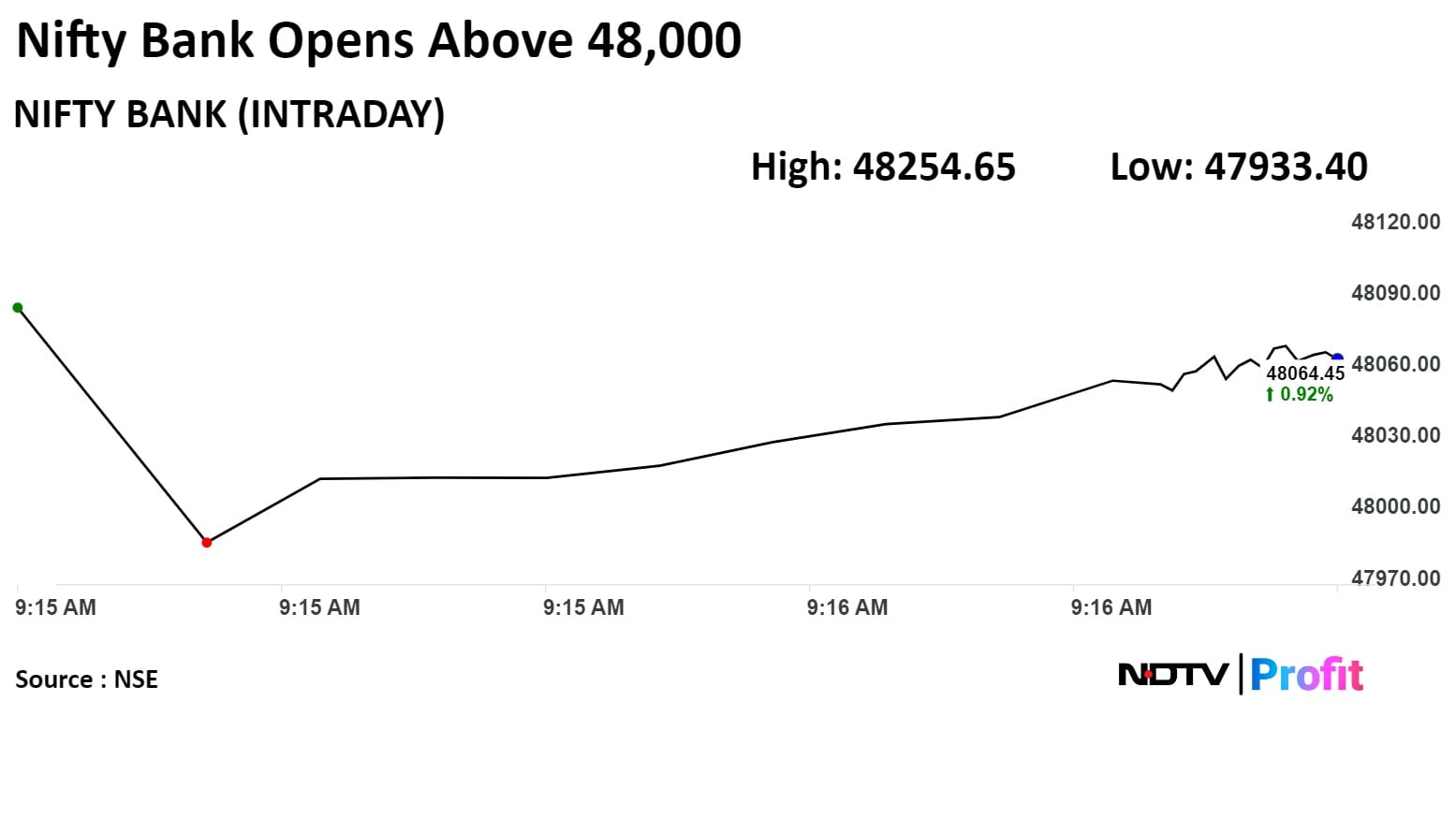

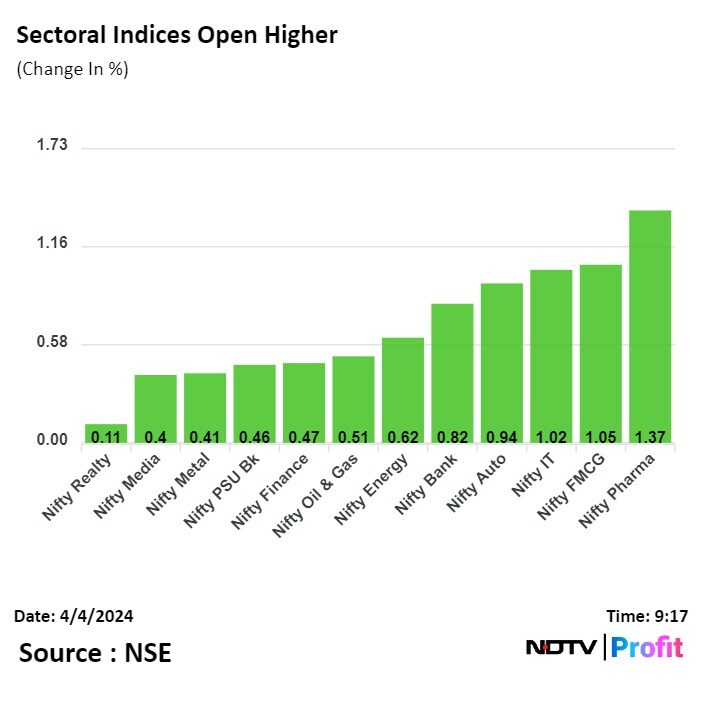

Sectoral indices were mixed at close with Nifty Metal and Nifty Bank gaining over 1% and Nifty Pharma shed 1.2%.

Benchmark equity indices came out of their two-day losing streak to end at highest closing levels amid gains in global markets after Fed Chair Powell restored hopes of rate cuts this year but also said that the timing for rate cuts is uncertain.

Investors now await the outcome of the upcoming meeting of the monetary policy committee due Friday. The Reserve Bank of India will likely keep its benchmark repurchase rate at 6.5% for a seventh straight policy meeting, according to all 39 economists surveyed by Bloomberg.

Today, the Nifty closed 80 points or 0.36% higher at 22,514.65 and the Sensex closed 350.81 points or 0.47% higher at 74,227.63. Intraday, the Nifty hit a high of 22,619 points and the Sensex hit 74,501.73.

"After dismissal of 22600/74500, the market could rally up to 22700-22750/74800-75000," said Shrikant Chouhan, head of equity research at Kotak Securities. "On the flip side, below 22350/73500 the sentiment could change. Below 22350/73500, the market could retest the level of 22200-22100/73100-72800."

Benchmark equity indices came out of their two-day losing streak to end at highest closing levels amid gains in global markets after Fed Chair Powell restored hopes of rate cuts this year but also said that the timing for rate cuts is uncertain.

Investors now await the outcome of the upcoming meeting of the monetary policy committee due Friday. The Reserve Bank of India will likely keep its benchmark repurchase rate at 6.5% for a seventh straight policy meeting, according to all 39 economists surveyed by Bloomberg.

Today, the Nifty closed 80 points or 0.36% higher at 22,514.65 and the Sensex closed 350.81 points or 0.47% higher at 74,227.63. Intraday, the Nifty hit a high of 22,619 points and the Sensex hit 74,501.73.

"After dismissal of 22600/74500, the market could rally up to 22700-22750/74800-75000," said Shrikant Chouhan, head of equity research at Kotak Securities. "On the flip side, below 22350/73500 the sentiment could change. Below 22350/73500, the market could retest the level of 22200-22100/73100-72800."

Benchmark equity indices came out of their two-day losing streak to end at highest closing levels amid gains in global markets after Fed Chair Powell restored hopes of rate cuts this year but also said that the timing for rate cuts is uncertain.

Investors now await the outcome of the upcoming meeting of the monetary policy committee due Friday. The Reserve Bank of India will likely keep its benchmark repurchase rate at 6.5% for a seventh straight policy meeting, according to all 39 economists surveyed by Bloomberg.

Today, the Nifty closed 80 points or 0.36% higher at 22,514.65 and the Sensex closed 350.81 points or 0.47% higher at 74,227.63. Intraday, the Nifty hit a high of 22,619 points and the Sensex hit 74,501.73.

"After dismissal of 22600/74500, the market could rally up to 22700-22750/74800-75000," said Shrikant Chouhan, head of equity research at Kotak Securities. "On the flip side, below 22350/73500 the sentiment could change. Below 22350/73500, the market could retest the level of 22200-22100/73100-72800."

Benchmark equity indices came out of their two-day losing streak to end at highest closing levels amid gains in global markets after Fed Chair Powell restored hopes of rate cuts this year but also said that the timing for rate cuts is uncertain.

Investors now await the outcome of the upcoming meeting of the monetary policy committee due Friday. The Reserve Bank of India will likely keep its benchmark repurchase rate at 6.5% for a seventh straight policy meeting, according to all 39 economists surveyed by Bloomberg.

Today, the Nifty closed 80 points or 0.36% higher at 22,514.65 and the Sensex closed 350.81 points or 0.47% higher at 74,227.63. Intraday, the Nifty hit a high of 22,619 points and the Sensex hit 74,501.73.

"After dismissal of 22600/74500, the market could rally up to 22700-22750/74800-75000," said Shrikant Chouhan, head of equity research at Kotak Securities. "On the flip side, below 22350/73500 the sentiment could change. Below 22350/73500, the market could retest the level of 22200-22100/73100-72800."

Benchmark equity indices came out of their two-day losing streak to end at highest closing levels amid gains in global markets after Fed Chair Powell restored hopes of rate cuts this year but also said that the timing for rate cuts is uncertain.

Investors now await the outcome of the upcoming meeting of the monetary policy committee due Friday. The Reserve Bank of India will likely keep its benchmark repurchase rate at 6.5% for a seventh straight policy meeting, according to all 39 economists surveyed by Bloomberg.

Today, the Nifty closed 80 points or 0.36% higher at 22,514.65 and the Sensex closed 350.81 points or 0.47% higher at 74,227.63. Intraday, the Nifty hit a high of 22,619 points and the Sensex hit 74,501.73.

"After dismissal of 22600/74500, the market could rally up to 22700-22750/74800-75000," said Shrikant Chouhan, head of equity research at Kotak Securities. "On the flip side, below 22350/73500 the sentiment could change. Below 22350/73500, the market could retest the level of 22200-22100/73100-72800."

Benchmark equity indices came out of their two-day losing streak to end at highest closing levels amid gains in global markets after Fed Chair Powell restored hopes of rate cuts this year but also said that the timing for rate cuts is uncertain.

Investors now await the outcome of the upcoming meeting of the monetary policy committee due Friday. The Reserve Bank of India will likely keep its benchmark repurchase rate at 6.5% for a seventh straight policy meeting, according to all 39 economists surveyed by Bloomberg.

Today, the Nifty closed 80 points or 0.36% higher at 22,514.65 and the Sensex closed 350.81 points or 0.47% higher at 74,227.63. Intraday, the Nifty hit a high of 22,619 points and the Sensex hit 74,501.73.

"After dismissal of 22600/74500, the market could rally up to 22700-22750/74800-75000," said Shrikant Chouhan, head of equity research at Kotak Securities. "On the flip side, below 22350/73500 the sentiment could change. Below 22350/73500, the market could retest the level of 22200-22100/73100-72800."

Benchmark equity indices came out of their two-day losing streak to end at highest closing levels amid gains in global markets after Fed Chair Powell restored hopes of rate cuts this year but also said that the timing for rate cuts is uncertain.

Investors now await the outcome of the upcoming meeting of the monetary policy committee due Friday. The Reserve Bank of India will likely keep its benchmark repurchase rate at 6.5% for a seventh straight policy meeting, according to all 39 economists surveyed by Bloomberg.

Today, the Nifty closed 80 points or 0.36% higher at 22,514.65 and the Sensex closed 350.81 points or 0.47% higher at 74,227.63. Intraday, the Nifty hit a high of 22,619 points and the Sensex hit 74,501.73.

"After dismissal of 22600/74500, the market could rally up to 22700-22750/74800-75000," said Shrikant Chouhan, head of equity research at Kotak Securities. "On the flip side, below 22350/73500 the sentiment could change. Below 22350/73500, the market could retest the level of 22200-22100/73100-72800."

Benchmark equity indices came out of their two-day losing streak to end at highest closing levels amid gains in global markets after Fed Chair Powell restored hopes of rate cuts this year but also said that the timing for rate cuts is uncertain.

Investors now await the outcome of the upcoming meeting of the monetary policy committee due Friday. The Reserve Bank of India will likely keep its benchmark repurchase rate at 6.5% for a seventh straight policy meeting, according to all 39 economists surveyed by Bloomberg.

Today, the Nifty closed 80 points or 0.36% higher at 22,514.65 and the Sensex closed 350.81 points or 0.47% higher at 74,227.63. Intraday, the Nifty hit a high of 22,619 points and the Sensex hit 74,501.73.

"After dismissal of 22600/74500, the market could rally up to 22700-22750/74800-75000," said Shrikant Chouhan, head of equity research at Kotak Securities. "On the flip side, below 22350/73500 the sentiment could change. Below 22350/73500, the market could retest the level of 22200-22100/73100-72800."

Shares of HDFC Bank Ltd. contributed the most to the gains followed by Tata Consultancy Services Ltd., Larsen & Toubro Ltd., Titan Company Ltd., and Infosys Ltd.

Meanwhile, those of Adani Ports and Special Economic Zone Ltd., Oil and Natural Gas Corp Ltd., State Bank Of India, Reliance Industries Ltd., and Bharti Airtel Ltd. capped the upside.

Benchmark equity indices came out of their two-day losing streak to end at highest closing levels amid gains in global markets after Fed Chair Powell restored hopes of rate cuts this year but also said that the timing for rate cuts is uncertain.

Investors now await the outcome of the upcoming meeting of the monetary policy committee due Friday. The Reserve Bank of India will likely keep its benchmark repurchase rate at 6.5% for a seventh straight policy meeting, according to all 39 economists surveyed by Bloomberg.

Today, the Nifty closed 80 points or 0.36% higher at 22,514.65 and the Sensex closed 350.81 points or 0.47% higher at 74,227.63. Intraday, the Nifty hit a high of 22,619 points and the Sensex hit 74,501.73.

"After dismissal of 22600/74500, the market could rally up to 22700-22750/74800-75000," said Shrikant Chouhan, head of equity research at Kotak Securities. "On the flip side, below 22350/73500 the sentiment could change. Below 22350/73500, the market could retest the level of 22200-22100/73100-72800."

Benchmark equity indices came out of their two-day losing streak to end at highest closing levels amid gains in global markets after Fed Chair Powell restored hopes of rate cuts this year but also said that the timing for rate cuts is uncertain.

Investors now await the outcome of the upcoming meeting of the monetary policy committee due Friday. The Reserve Bank of India will likely keep its benchmark repurchase rate at 6.5% for a seventh straight policy meeting, according to all 39 economists surveyed by Bloomberg.

Today, the Nifty closed 80 points or 0.36% higher at 22,514.65 and the Sensex closed 350.81 points or 0.47% higher at 74,227.63. Intraday, the Nifty hit a high of 22,619 points and the Sensex hit 74,501.73.

"After dismissal of 22600/74500, the market could rally up to 22700-22750/74800-75000," said Shrikant Chouhan, head of equity research at Kotak Securities. "On the flip side, below 22350/73500 the sentiment could change. Below 22350/73500, the market could retest the level of 22200-22100/73100-72800."

Benchmark equity indices came out of their two-day losing streak to end at highest closing levels amid gains in global markets after Fed Chair Powell restored hopes of rate cuts this year but also said that the timing for rate cuts is uncertain.

Investors now await the outcome of the upcoming meeting of the monetary policy committee due Friday. The Reserve Bank of India will likely keep its benchmark repurchase rate at 6.5% for a seventh straight policy meeting, according to all 39 economists surveyed by Bloomberg.

Today, the Nifty closed 80 points or 0.36% higher at 22,514.65 and the Sensex closed 350.81 points or 0.47% higher at 74,227.63. Intraday, the Nifty hit a high of 22,619 points and the Sensex hit 74,501.73.

"After dismissal of 22600/74500, the market could rally up to 22700-22750/74800-75000," said Shrikant Chouhan, head of equity research at Kotak Securities. "On the flip side, below 22350/73500 the sentiment could change. Below 22350/73500, the market could retest the level of 22200-22100/73100-72800."

Benchmark equity indices came out of their two-day losing streak to end at highest closing levels amid gains in global markets after Fed Chair Powell restored hopes of rate cuts this year but also said that the timing for rate cuts is uncertain.

Investors now await the outcome of the upcoming meeting of the monetary policy committee due Friday. The Reserve Bank of India will likely keep its benchmark repurchase rate at 6.5% for a seventh straight policy meeting, according to all 39 economists surveyed by Bloomberg.

Today, the Nifty closed 80 points or 0.36% higher at 22,514.65 and the Sensex closed 350.81 points or 0.47% higher at 74,227.63. Intraday, the Nifty hit a high of 22,619 points and the Sensex hit 74,501.73.

"After dismissal of 22600/74500, the market could rally up to 22700-22750/74800-75000," said Shrikant Chouhan, head of equity research at Kotak Securities. "On the flip side, below 22350/73500 the sentiment could change. Below 22350/73500, the market could retest the level of 22200-22100/73100-72800."

Benchmark equity indices came out of their two-day losing streak to end at highest closing levels amid gains in global markets after Fed Chair Powell restored hopes of rate cuts this year but also said that the timing for rate cuts is uncertain.

Investors now await the outcome of the upcoming meeting of the monetary policy committee due Friday. The Reserve Bank of India will likely keep its benchmark repurchase rate at 6.5% for a seventh straight policy meeting, according to all 39 economists surveyed by Bloomberg.

Today, the Nifty closed 80 points or 0.36% higher at 22,514.65 and the Sensex closed 350.81 points or 0.47% higher at 74,227.63. Intraday, the Nifty hit a high of 22,619 points and the Sensex hit 74,501.73.

"After dismissal of 22600/74500, the market could rally up to 22700-22750/74800-75000," said Shrikant Chouhan, head of equity research at Kotak Securities. "On the flip side, below 22350/73500 the sentiment could change. Below 22350/73500, the market could retest the level of 22200-22100/73100-72800."

Benchmark equity indices came out of their two-day losing streak to end at highest closing levels amid gains in global markets after Fed Chair Powell restored hopes of rate cuts this year but also said that the timing for rate cuts is uncertain.

Investors now await the outcome of the upcoming meeting of the monetary policy committee due Friday. The Reserve Bank of India will likely keep its benchmark repurchase rate at 6.5% for a seventh straight policy meeting, according to all 39 economists surveyed by Bloomberg.

Today, the Nifty closed 80 points or 0.36% higher at 22,514.65 and the Sensex closed 350.81 points or 0.47% higher at 74,227.63. Intraday, the Nifty hit a high of 22,619 points and the Sensex hit 74,501.73.

"After dismissal of 22600/74500, the market could rally up to 22700-22750/74800-75000," said Shrikant Chouhan, head of equity research at Kotak Securities. "On the flip side, below 22350/73500 the sentiment could change. Below 22350/73500, the market could retest the level of 22200-22100/73100-72800."

Benchmark equity indices came out of their two-day losing streak to end at highest closing levels amid gains in global markets after Fed Chair Powell restored hopes of rate cuts this year but also said that the timing for rate cuts is uncertain.

Investors now await the outcome of the upcoming meeting of the monetary policy committee due Friday. The Reserve Bank of India will likely keep its benchmark repurchase rate at 6.5% for a seventh straight policy meeting, according to all 39 economists surveyed by Bloomberg.

Today, the Nifty closed 80 points or 0.36% higher at 22,514.65 and the Sensex closed 350.81 points or 0.47% higher at 74,227.63. Intraday, the Nifty hit a high of 22,619 points and the Sensex hit 74,501.73.

"After dismissal of 22600/74500, the market could rally up to 22700-22750/74800-75000," said Shrikant Chouhan, head of equity research at Kotak Securities. "On the flip side, below 22350/73500 the sentiment could change. Below 22350/73500, the market could retest the level of 22200-22100/73100-72800."

Benchmark equity indices came out of their two-day losing streak to end at highest closing levels amid gains in global markets after Fed Chair Powell restored hopes of rate cuts this year but also said that the timing for rate cuts is uncertain.

Investors now await the outcome of the upcoming meeting of the monetary policy committee due Friday. The Reserve Bank of India will likely keep its benchmark repurchase rate at 6.5% for a seventh straight policy meeting, according to all 39 economists surveyed by Bloomberg.

Today, the Nifty closed 80 points or 0.36% higher at 22,514.65 and the Sensex closed 350.81 points or 0.47% higher at 74,227.63. Intraday, the Nifty hit a high of 22,619 points and the Sensex hit 74,501.73.

"After dismissal of 22600/74500, the market could rally up to 22700-22750/74800-75000," said Shrikant Chouhan, head of equity research at Kotak Securities. "On the flip side, below 22350/73500 the sentiment could change. Below 22350/73500, the market could retest the level of 22200-22100/73100-72800."

Shares of HDFC Bank Ltd. contributed the most to the gains followed by Tata Consultancy Services Ltd., Larsen & Toubro Ltd., Titan Company Ltd., and Infosys Ltd.

Meanwhile, those of Adani Ports and Special Economic Zone Ltd., Oil and Natural Gas Corp Ltd., State Bank Of India, Reliance Industries Ltd., and Bharti Airtel Ltd. capped the upside.

Sectoral indices were mixed at close with Nifty Metal and Nifty Bank gaining over 1% and Nifty Pharma shed 1.2%.

Broader markets ended on a mixed note. The S&P BSE Midcap index settled 0.11% lower, and the S&P BSE Smallcap index ended 0.54% higher.

On BSE, 13 sectors advanced, and seven sectors declined out of 20. The S&P BSE IT index rose nearly 1% to emerge as the top performer among sectoral indices. The S&P BSE Oil and Gas declined over 1% to become the top loser.

Market breadth was skewed in favour of buyers. On BSE, 2,469 stocks rose, 1,379 stocks declined, and 99 remained unchanged.

Gross advances as of March 31 stand at Rs 34,337 crore, up 23% YoY

Total deposits as of March 31 stand at Rs 36,129 crore, up 43% YoY

Q4 CASA Ratio at 32% vs 33% QoQ

Source: Exchange Filing

Total deposits at Rs 31,650 crore, up 24% YoY

CASA ratio at 26.3% vs 25.5% QoQ

Gross loan book at `29,779 crore, up 24% YoY

Disbursements at Rs 6,681 crore, up 11% YoY

Source: Exchange Filing

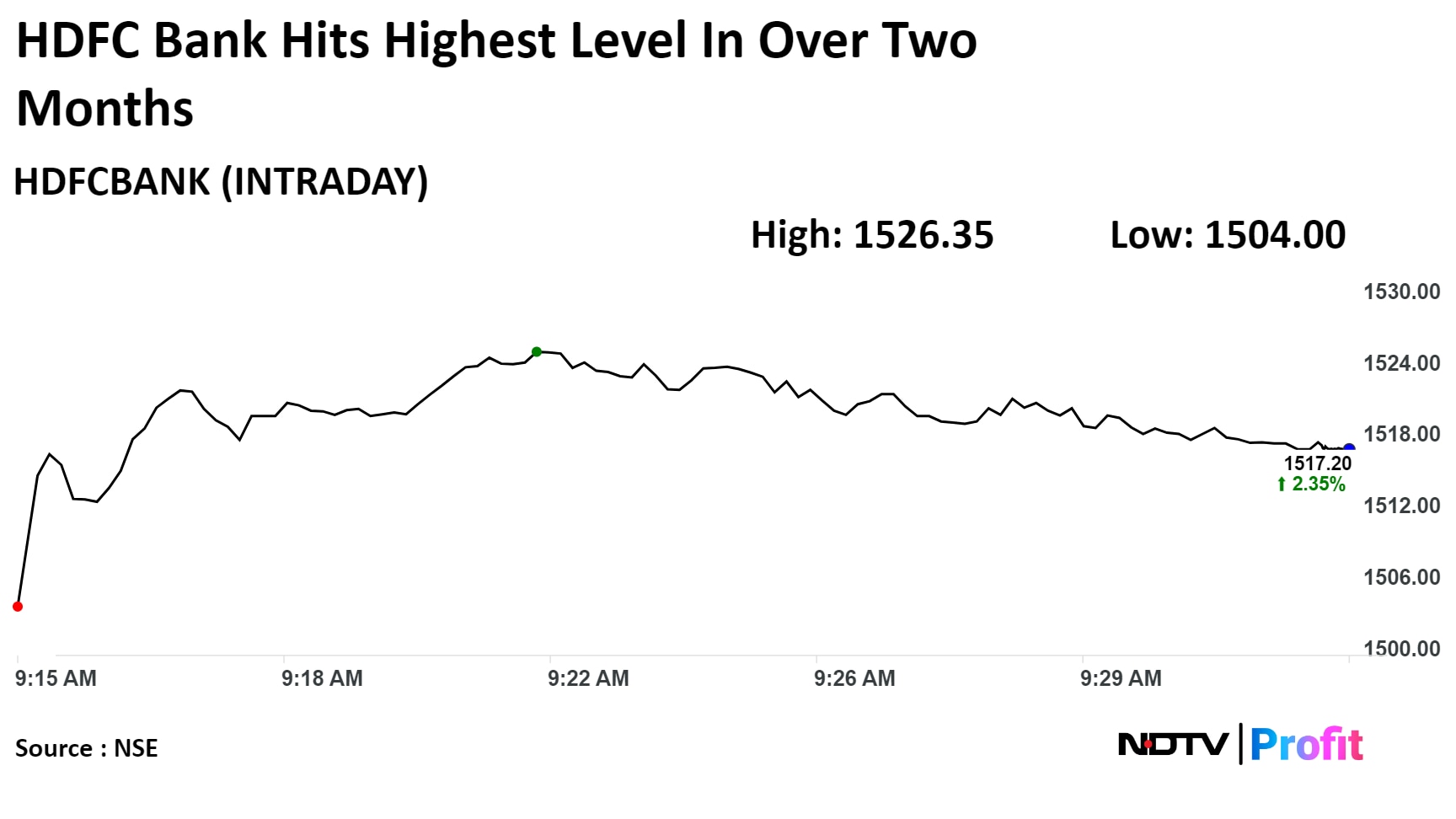

FIIs reduce shareholding in the bank by 4.5% QoQ; Current stake stands at 47.8%

MSCI weights may go up as a result of decrease in the FII ownership in the bank

MSCI weights may trigger $2 billion inflow into the stock

Source: BSE Shareholding Pattern

HDFC Bank contributed over 400 points to the gains in the index.

HDFC Bank contributed over 400 points to the gains in the index.

Approves raising up to Rs 2,500 crore via NCDs

Source: Exchange Filing

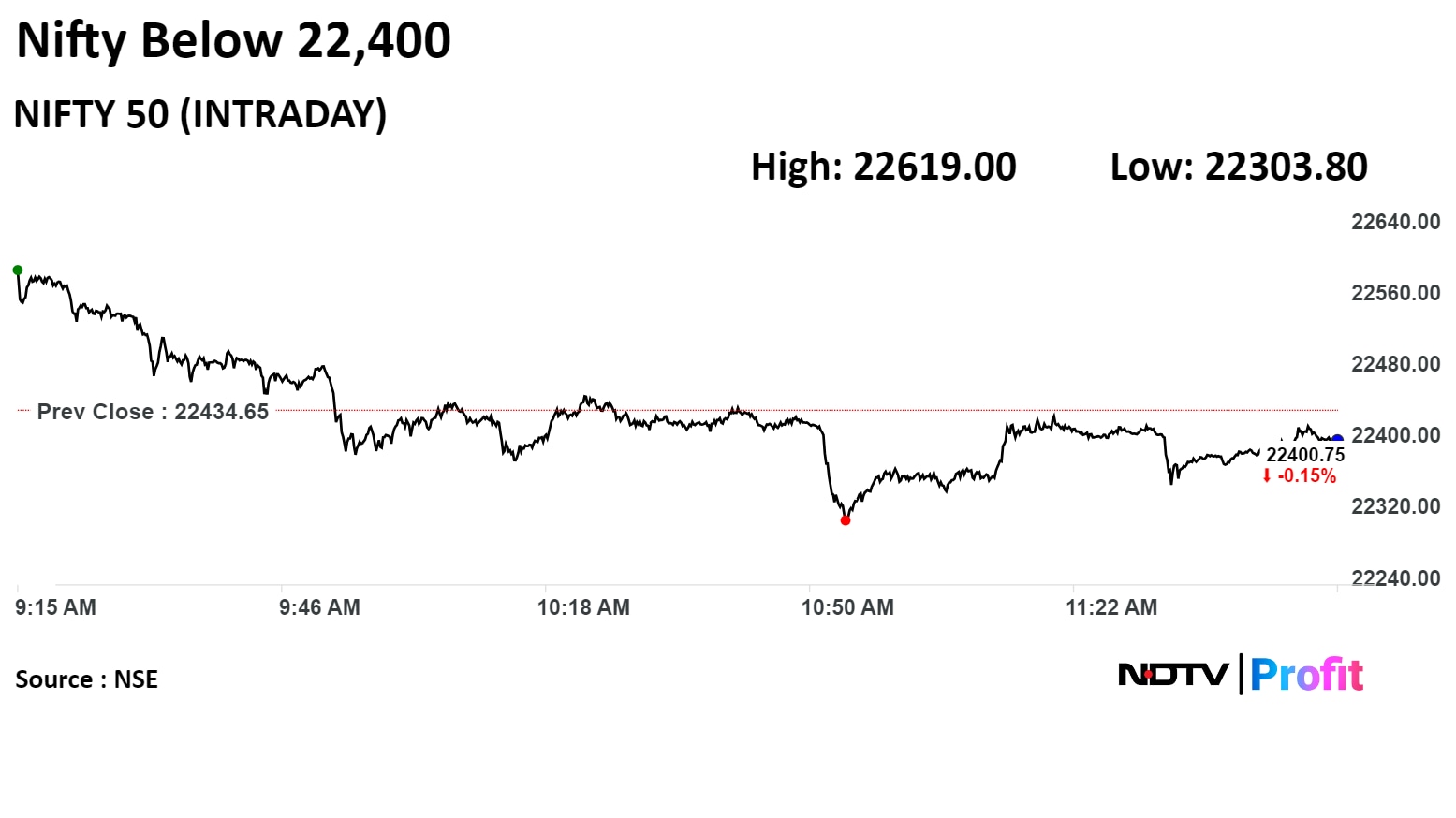

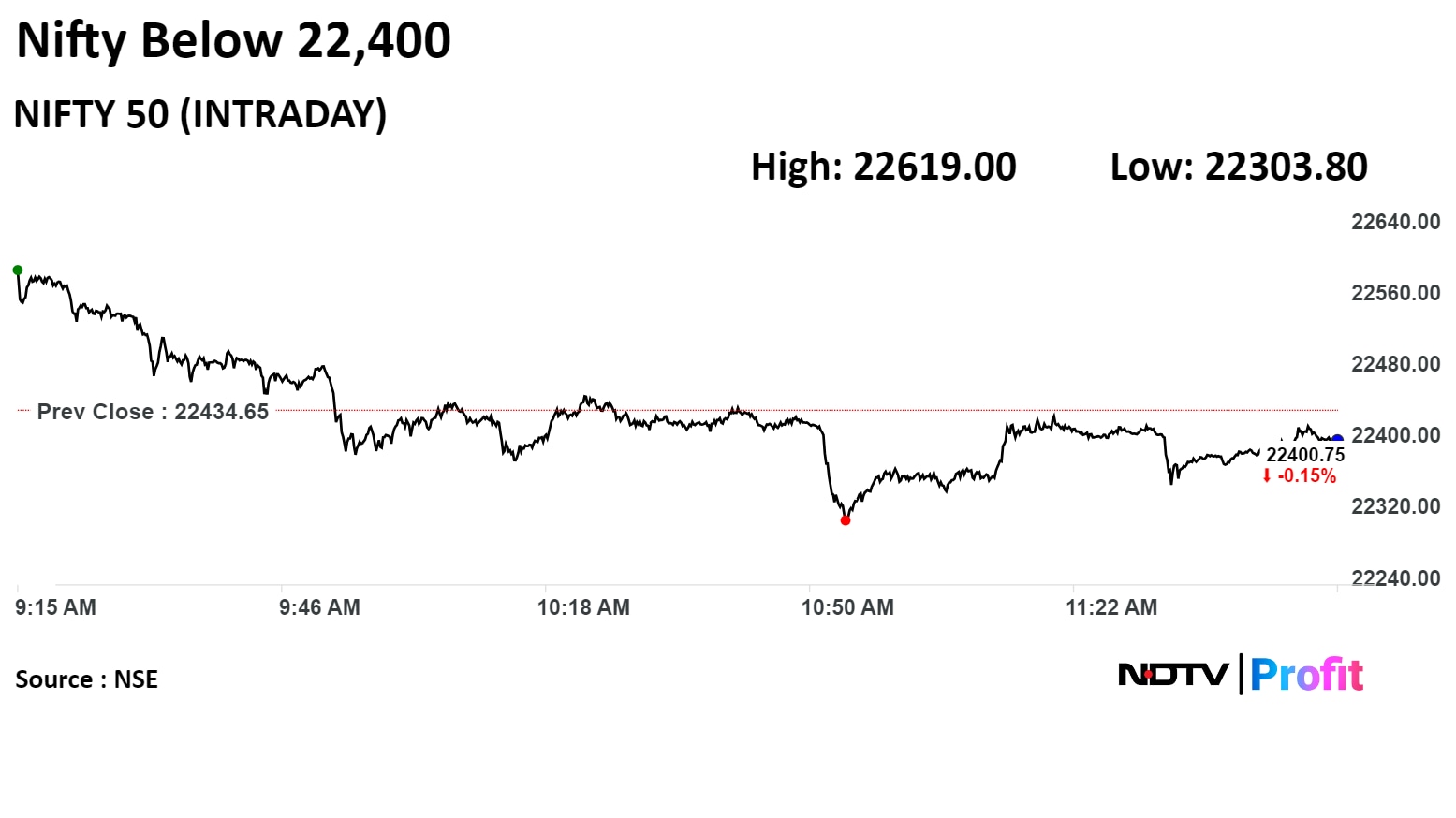

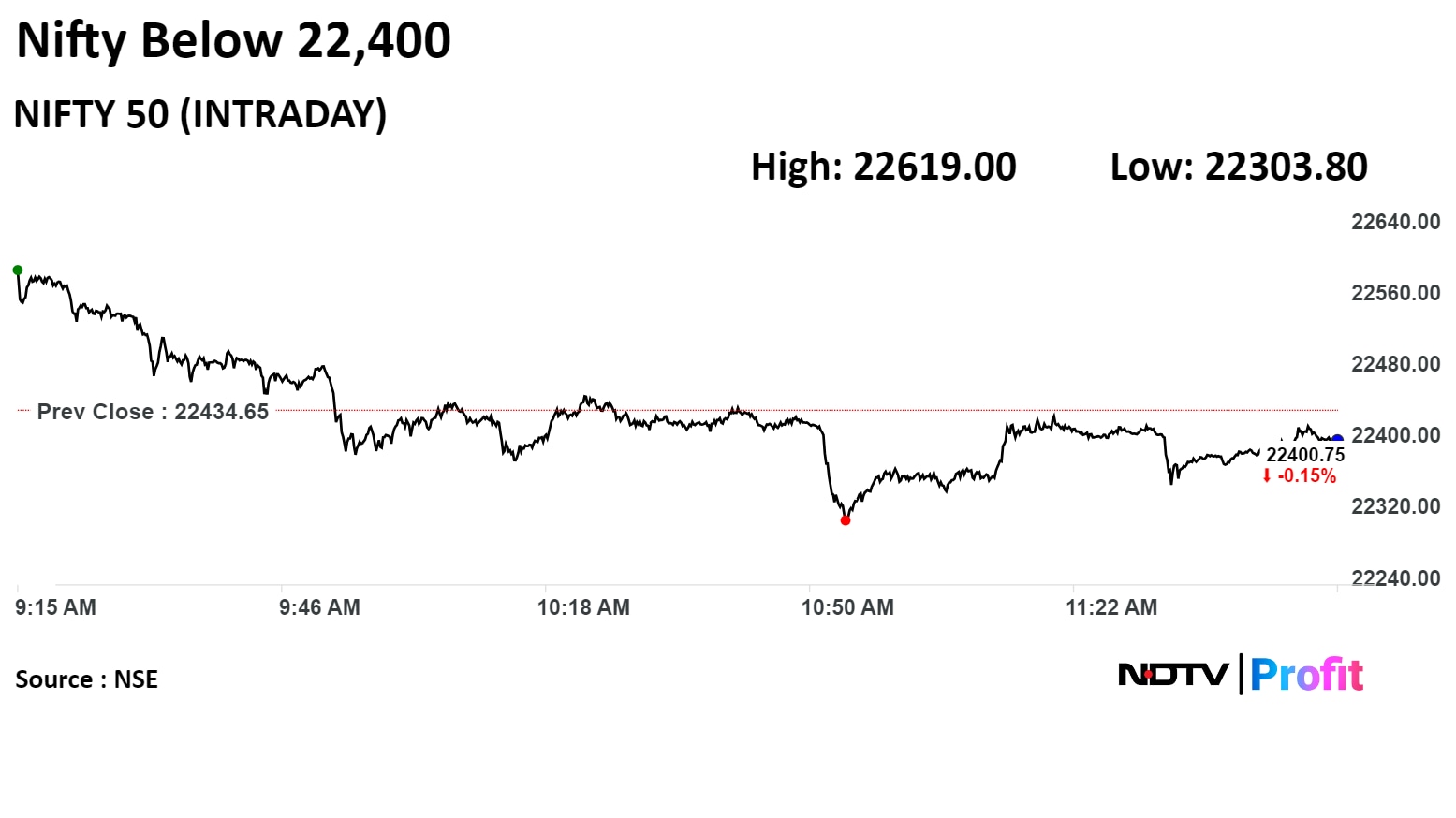

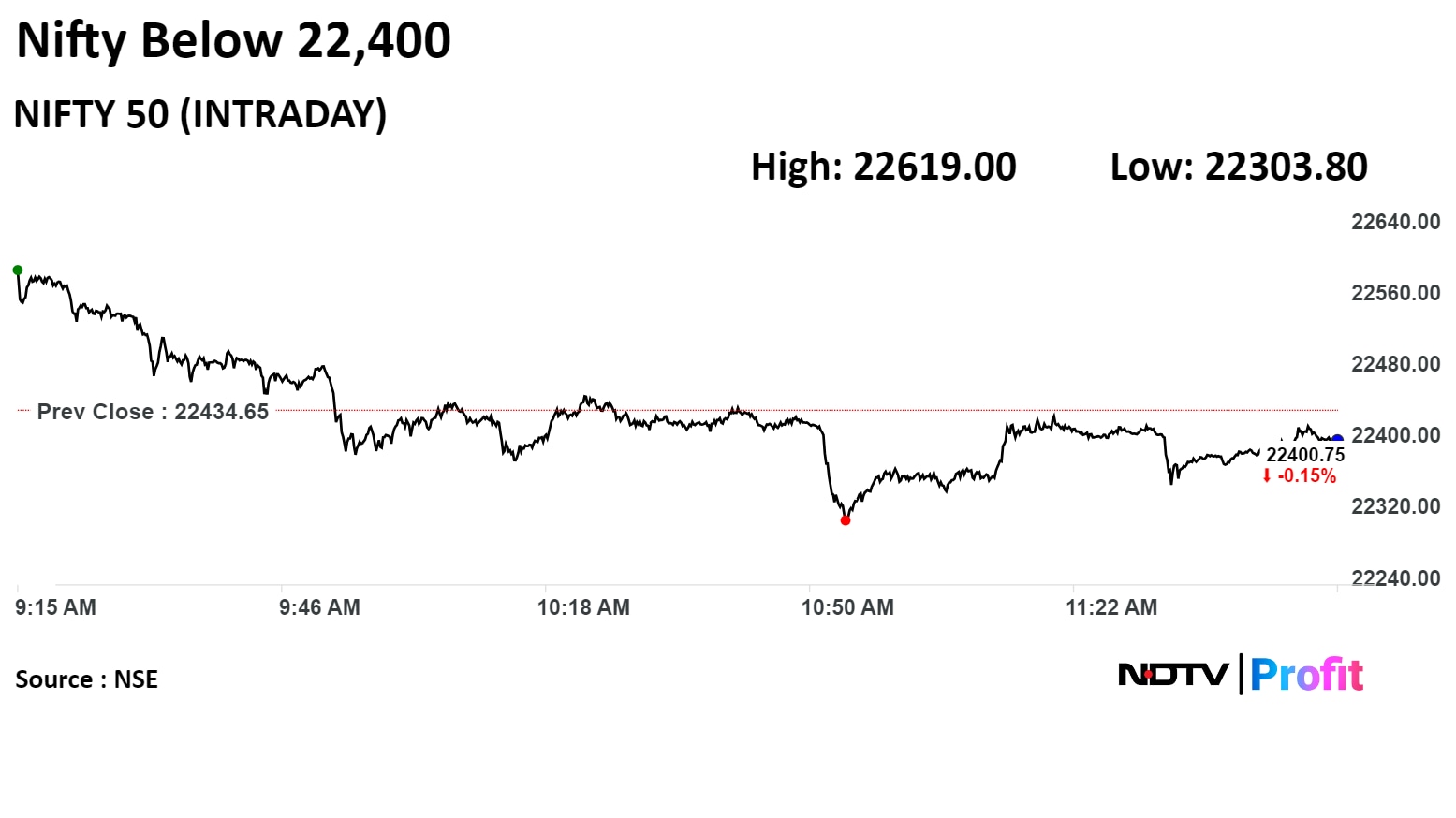

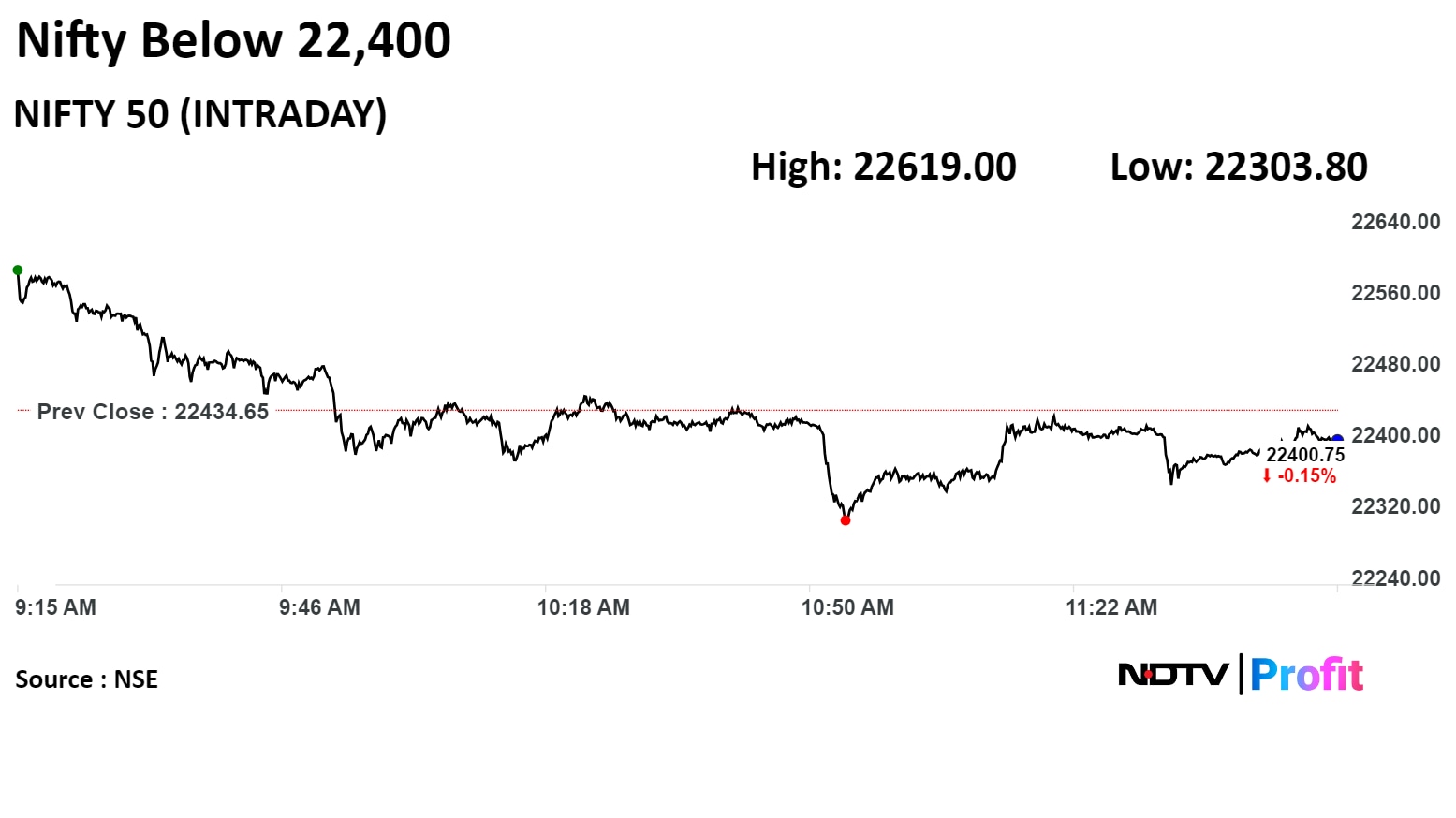

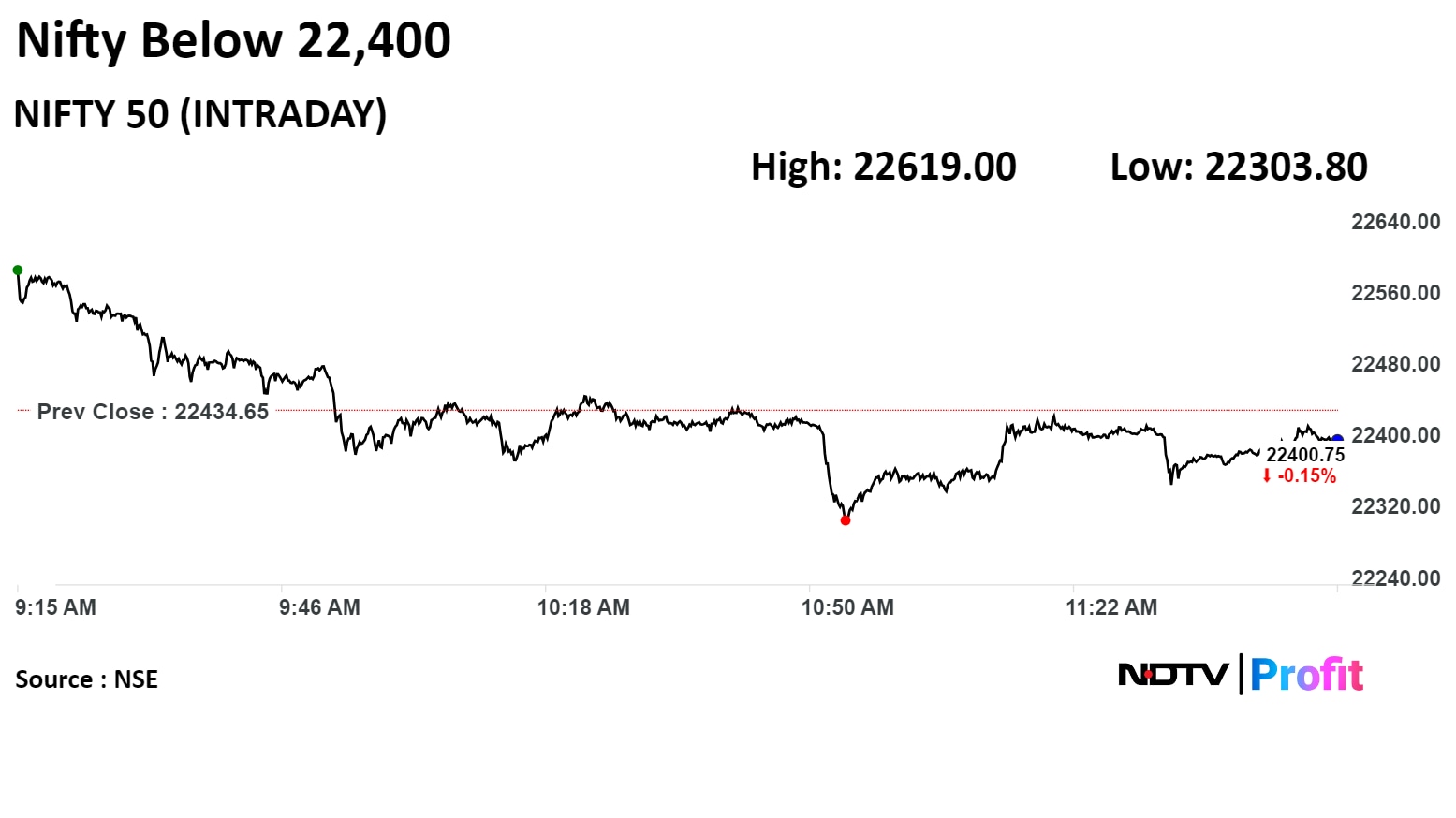

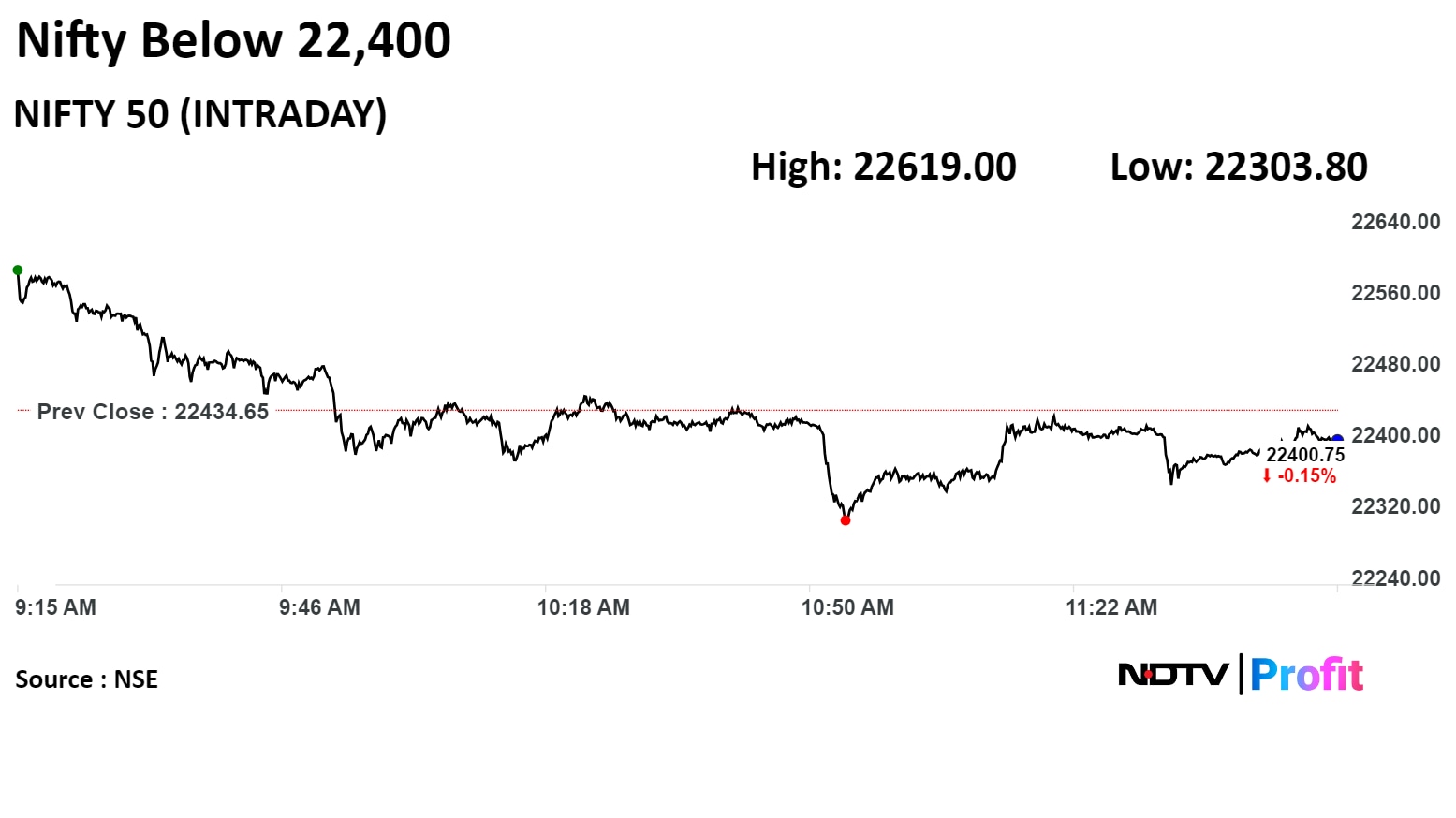

India's benchmark stock indices fell from the fresh record high during early trade on Thursday, weighed by losses in index heavyweights such as Reliance Industries Ltd., ICICI Bank Ltd., and Larsen & Toubro Ltd.

As of 11:52 a.m., the NSE Nifty 50 declined 31.10 points, or 0.14%, to trade at 22,403.55, and the S&P BSE Sensex fell 36.00 points, or 0.049%, to 73,840.82.

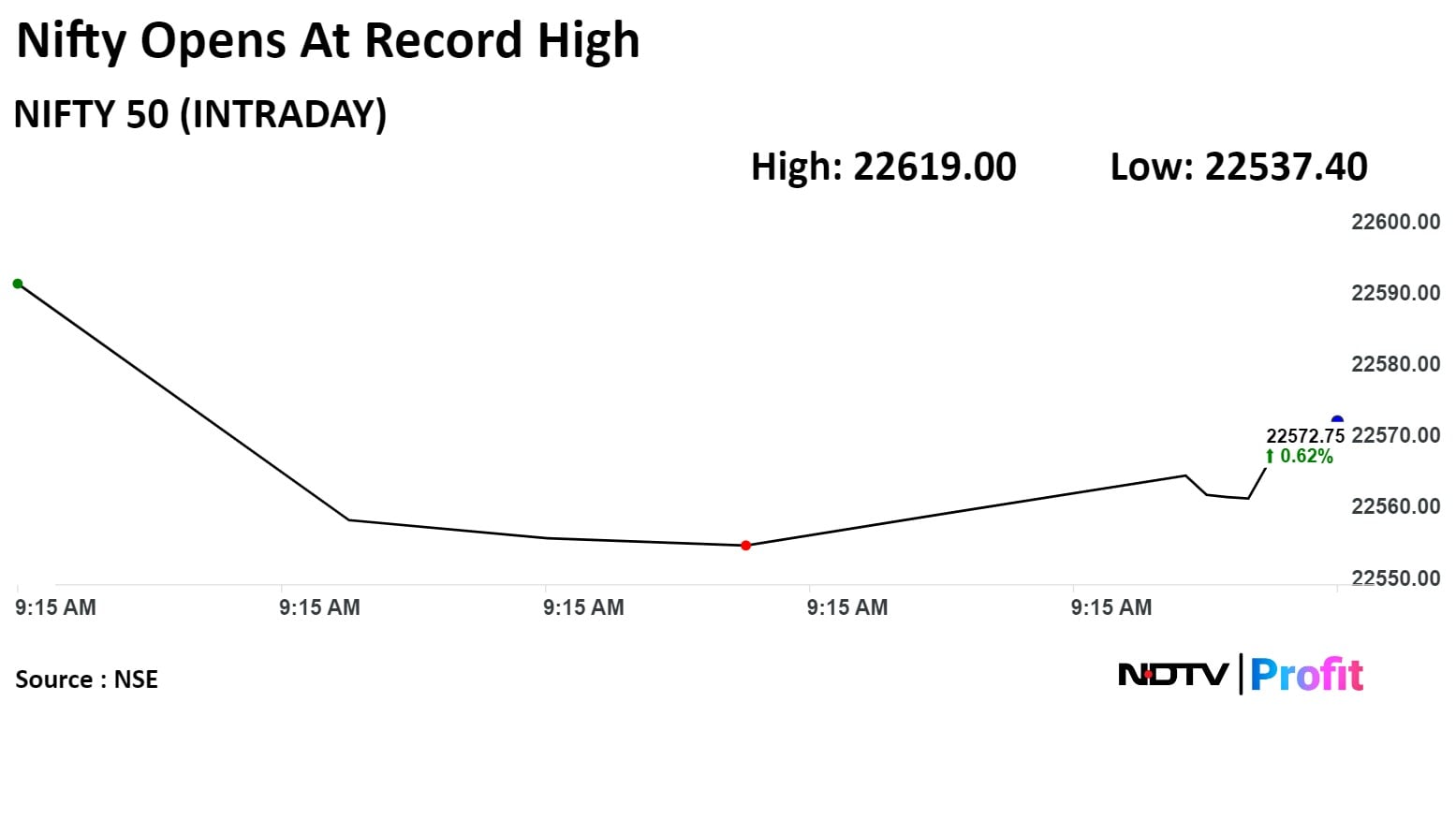

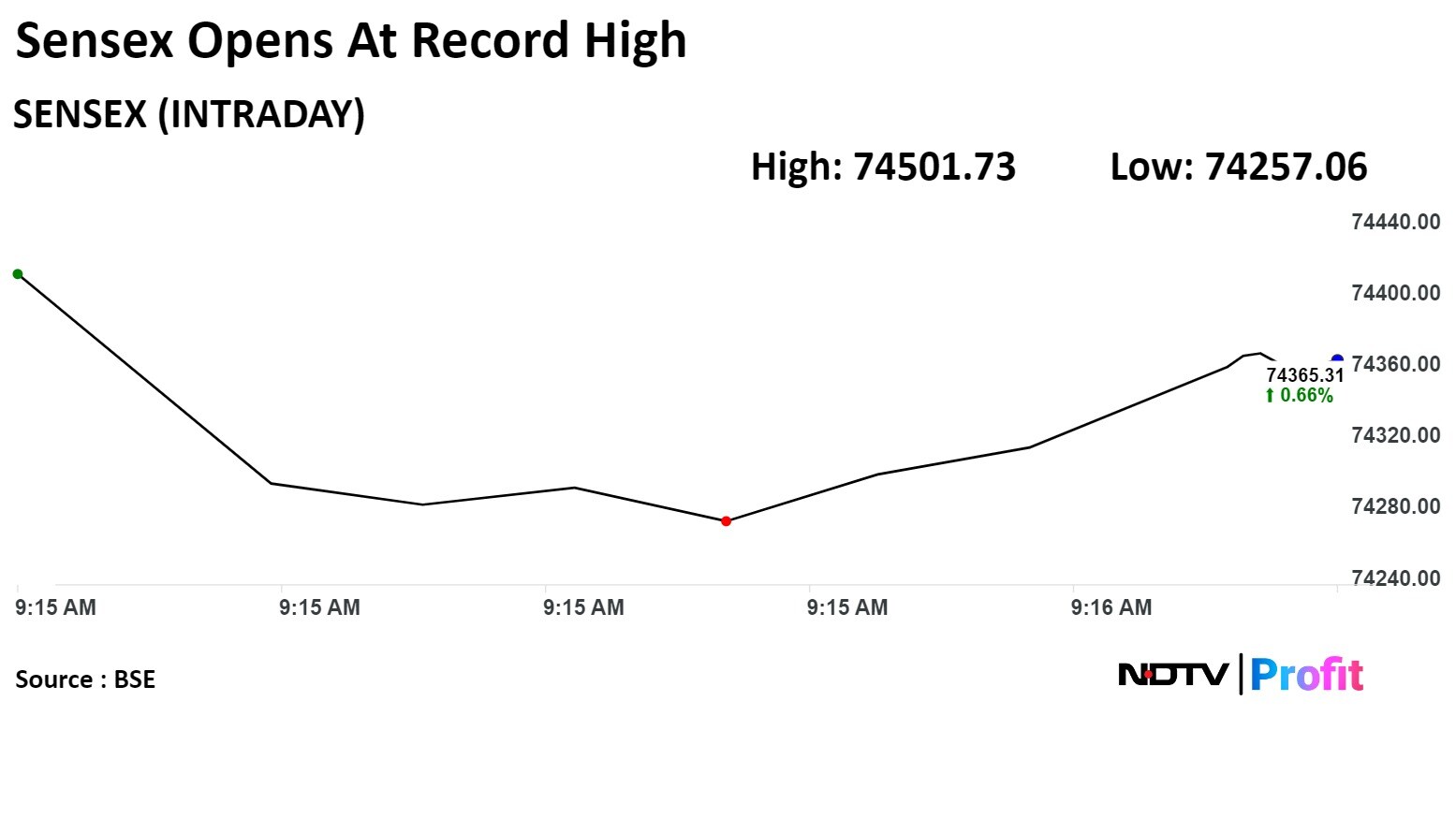

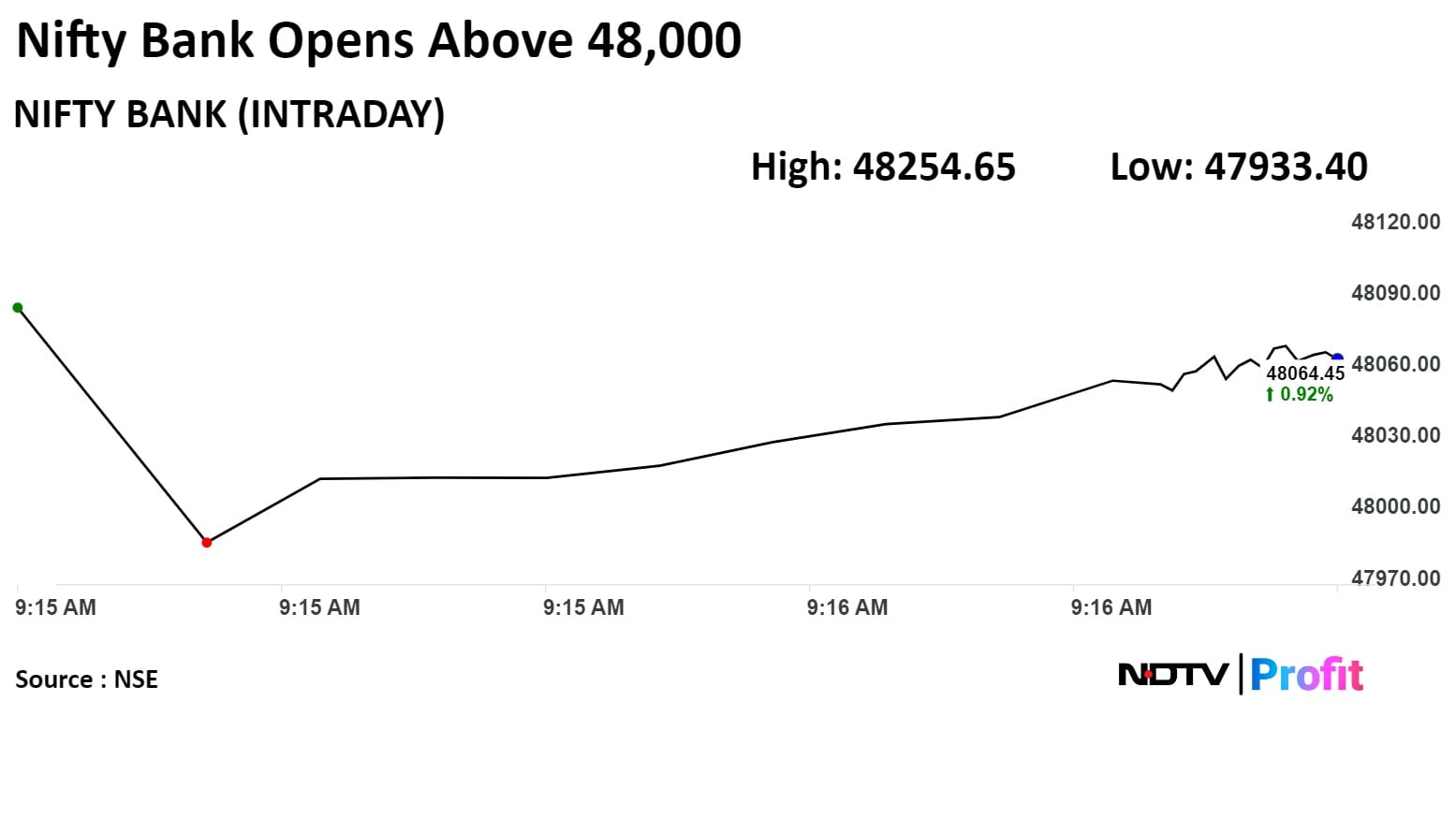

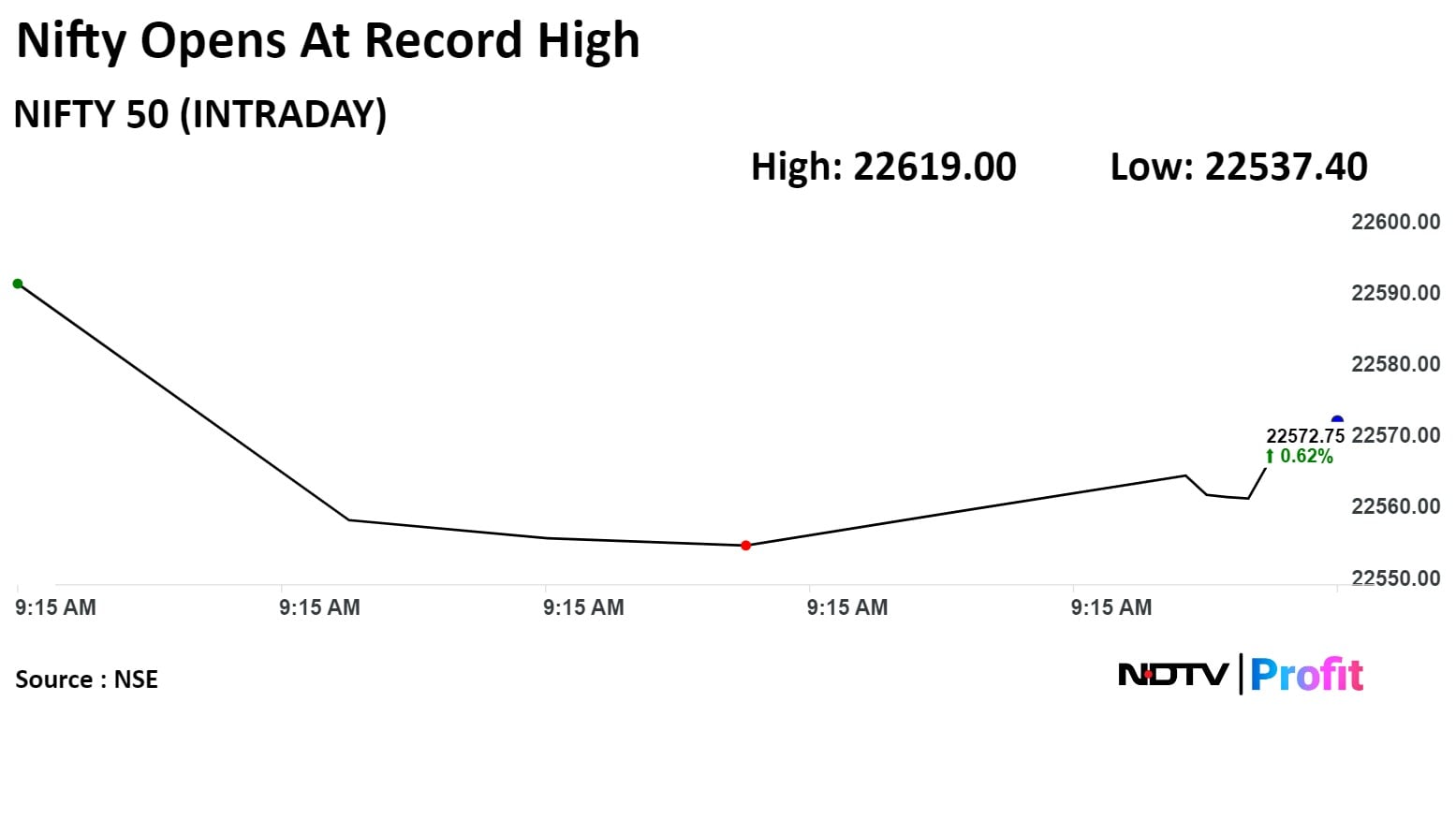

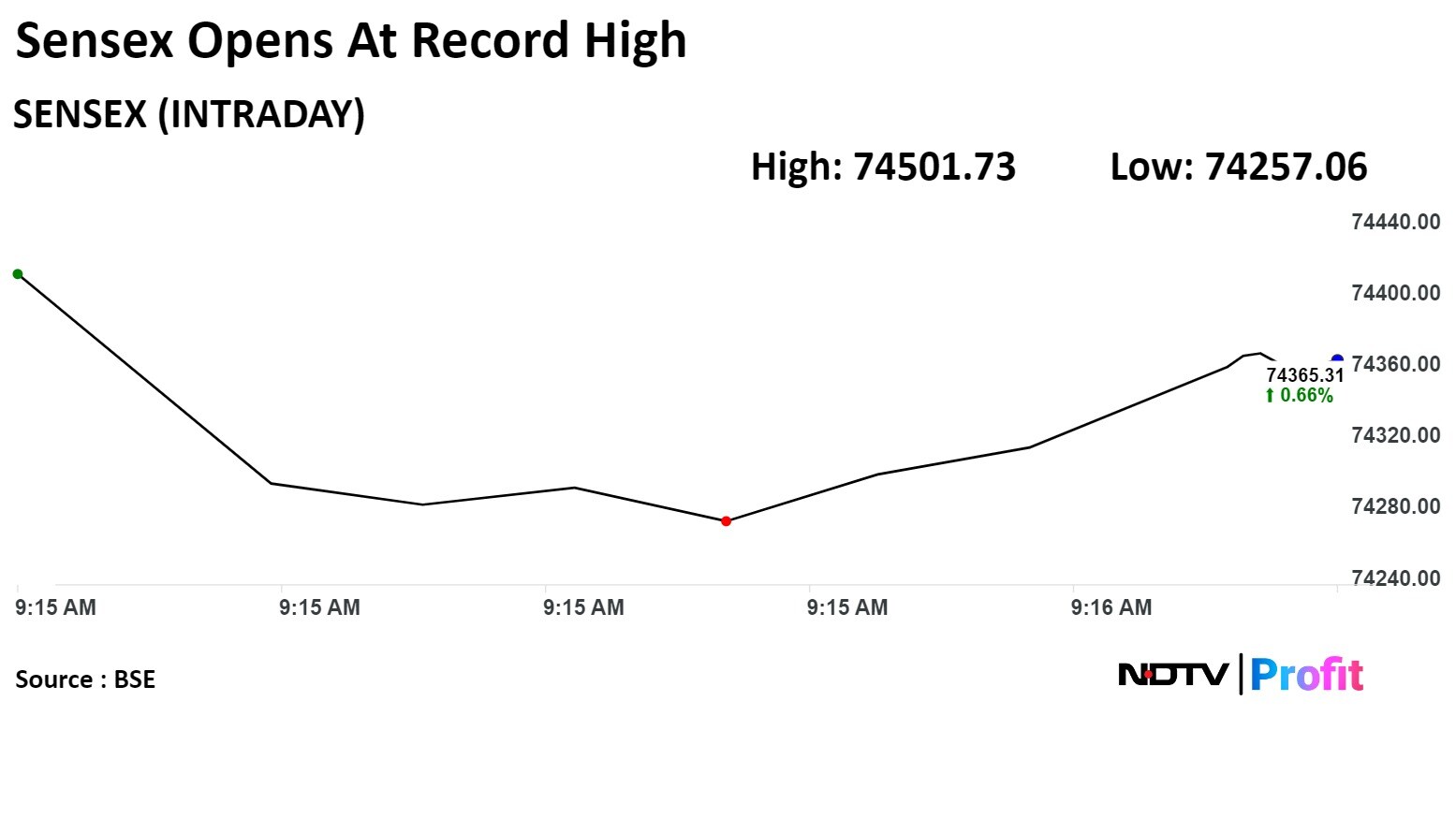

The Nifty hit a record high of 22,619.00 and the Sensex touched a new lifetime high of 74,501.73 as sentiments improved for risky assets after Federal Reserve Chair Jerome Powell indicated rate cuts are imminent this year despite resilient inflation in the US.

"The benchmark equity indices Sensex and Nifty commenced the trading session at unprecedented peaks, driven by significant gains in the heavyweight HDFC Bank. Additionally, the Nifty midcap index reached a milestone, breaching the 50,000 mark for the first time," said Shrey Jain, founder and chief executive at SAS Online.

India's benchmark stock indices fell from the fresh record high during early trade on Thursday, weighed by losses in index heavyweights such as Reliance Industries Ltd., ICICI Bank Ltd., and Larsen & Toubro Ltd.

As of 11:52 a.m., the NSE Nifty 50 declined 31.10 points, or 0.14%, to trade at 22,403.55, and the S&P BSE Sensex fell 36.00 points, or 0.049%, to 73,840.82.

The Nifty hit a record high of 22,619.00 and the Sensex touched a new lifetime high of 74,501.73 as sentiments improved for risky assets after Federal Reserve Chair Jerome Powell indicated rate cuts are imminent this year despite resilient inflation in the US.

"The benchmark equity indices Sensex and Nifty commenced the trading session at unprecedented peaks, driven by significant gains in the heavyweight HDFC Bank. Additionally, the Nifty midcap index reached a milestone, breaching the 50,000 mark for the first time," said Shrey Jain, founder and chief executive at SAS Online.

India's benchmark stock indices fell from the fresh record high during early trade on Thursday, weighed by losses in index heavyweights such as Reliance Industries Ltd., ICICI Bank Ltd., and Larsen & Toubro Ltd.

As of 11:52 a.m., the NSE Nifty 50 declined 31.10 points, or 0.14%, to trade at 22,403.55, and the S&P BSE Sensex fell 36.00 points, or 0.049%, to 73,840.82.

The Nifty hit a record high of 22,619.00 and the Sensex touched a new lifetime high of 74,501.73 as sentiments improved for risky assets after Federal Reserve Chair Jerome Powell indicated rate cuts are imminent this year despite resilient inflation in the US.

"The benchmark equity indices Sensex and Nifty commenced the trading session at unprecedented peaks, driven by significant gains in the heavyweight HDFC Bank. Additionally, the Nifty midcap index reached a milestone, breaching the 50,000 mark for the first time," said Shrey Jain, founder and chief executive at SAS Online.

India's benchmark stock indices fell from the fresh record high during early trade on Thursday, weighed by losses in index heavyweights such as Reliance Industries Ltd., ICICI Bank Ltd., and Larsen & Toubro Ltd.

As of 11:52 a.m., the NSE Nifty 50 declined 31.10 points, or 0.14%, to trade at 22,403.55, and the S&P BSE Sensex fell 36.00 points, or 0.049%, to 73,840.82.

The Nifty hit a record high of 22,619.00 and the Sensex touched a new lifetime high of 74,501.73 as sentiments improved for risky assets after Federal Reserve Chair Jerome Powell indicated rate cuts are imminent this year despite resilient inflation in the US.

"The benchmark equity indices Sensex and Nifty commenced the trading session at unprecedented peaks, driven by significant gains in the heavyweight HDFC Bank. Additionally, the Nifty midcap index reached a milestone, breaching the 50,000 mark for the first time," said Shrey Jain, founder and chief executive at SAS Online.

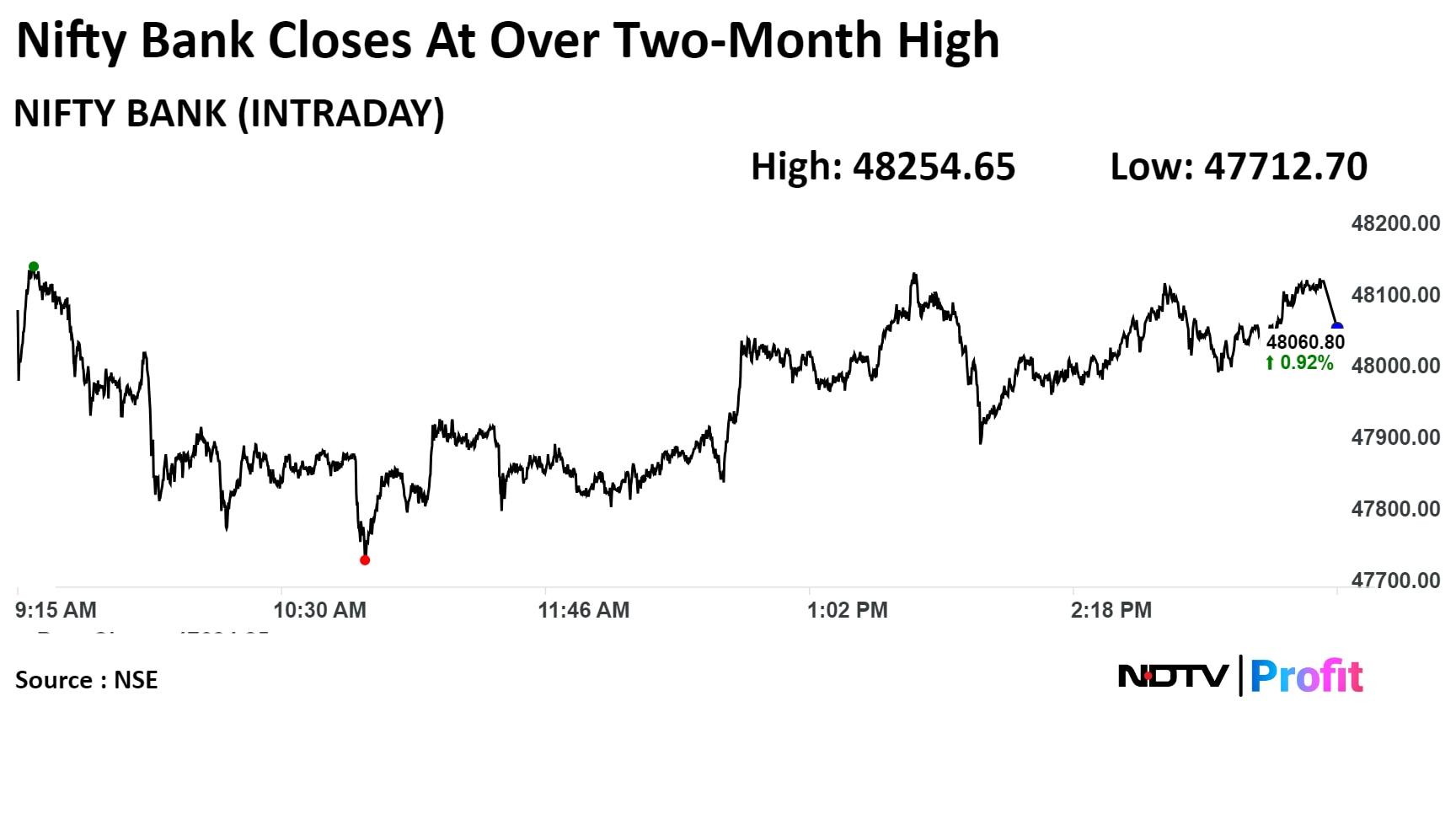

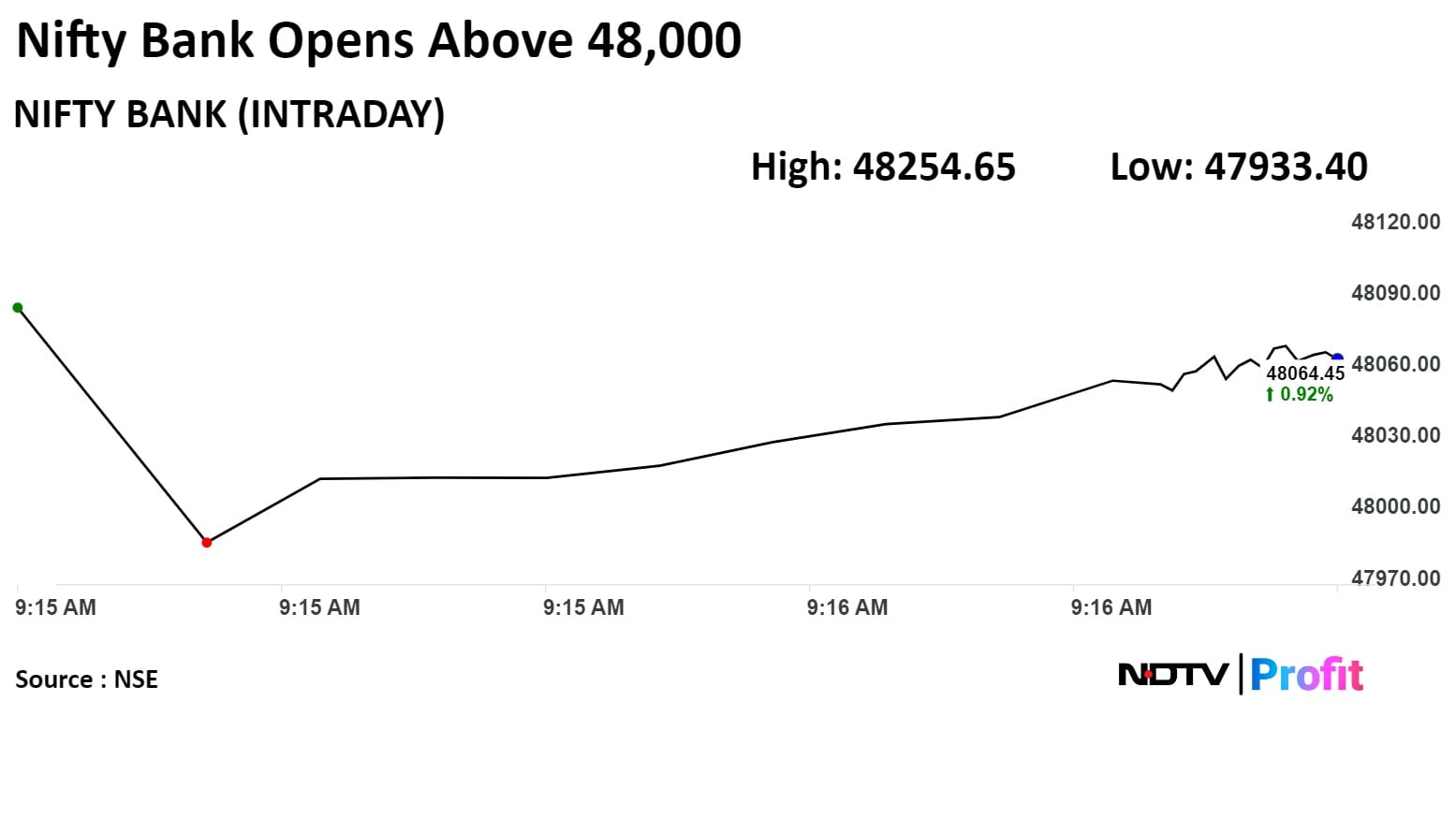

"Looking ahead, we anticipate the Bank Nifty to maintain its positive bias, consolidating within the broader range of 47,500-48,000 throughout the trading day," Jain said.

India's benchmark stock indices fell from the fresh record high during early trade on Thursday, weighed by losses in index heavyweights such as Reliance Industries Ltd., ICICI Bank Ltd., and Larsen & Toubro Ltd.

As of 11:52 a.m., the NSE Nifty 50 declined 31.10 points, or 0.14%, to trade at 22,403.55, and the S&P BSE Sensex fell 36.00 points, or 0.049%, to 73,840.82.

The Nifty hit a record high of 22,619.00 and the Sensex touched a new lifetime high of 74,501.73 as sentiments improved for risky assets after Federal Reserve Chair Jerome Powell indicated rate cuts are imminent this year despite resilient inflation in the US.

"The benchmark equity indices Sensex and Nifty commenced the trading session at unprecedented peaks, driven by significant gains in the heavyweight HDFC Bank. Additionally, the Nifty midcap index reached a milestone, breaching the 50,000 mark for the first time," said Shrey Jain, founder and chief executive at SAS Online.

India's benchmark stock indices fell from the fresh record high during early trade on Thursday, weighed by losses in index heavyweights such as Reliance Industries Ltd., ICICI Bank Ltd., and Larsen & Toubro Ltd.

As of 11:52 a.m., the NSE Nifty 50 declined 31.10 points, or 0.14%, to trade at 22,403.55, and the S&P BSE Sensex fell 36.00 points, or 0.049%, to 73,840.82.

The Nifty hit a record high of 22,619.00 and the Sensex touched a new lifetime high of 74,501.73 as sentiments improved for risky assets after Federal Reserve Chair Jerome Powell indicated rate cuts are imminent this year despite resilient inflation in the US.

"The benchmark equity indices Sensex and Nifty commenced the trading session at unprecedented peaks, driven by significant gains in the heavyweight HDFC Bank. Additionally, the Nifty midcap index reached a milestone, breaching the 50,000 mark for the first time," said Shrey Jain, founder and chief executive at SAS Online.

India's benchmark stock indices fell from the fresh record high during early trade on Thursday, weighed by losses in index heavyweights such as Reliance Industries Ltd., ICICI Bank Ltd., and Larsen & Toubro Ltd.

As of 11:52 a.m., the NSE Nifty 50 declined 31.10 points, or 0.14%, to trade at 22,403.55, and the S&P BSE Sensex fell 36.00 points, or 0.049%, to 73,840.82.

The Nifty hit a record high of 22,619.00 and the Sensex touched a new lifetime high of 74,501.73 as sentiments improved for risky assets after Federal Reserve Chair Jerome Powell indicated rate cuts are imminent this year despite resilient inflation in the US.

"The benchmark equity indices Sensex and Nifty commenced the trading session at unprecedented peaks, driven by significant gains in the heavyweight HDFC Bank. Additionally, the Nifty midcap index reached a milestone, breaching the 50,000 mark for the first time," said Shrey Jain, founder and chief executive at SAS Online.

India's benchmark stock indices fell from the fresh record high during early trade on Thursday, weighed by losses in index heavyweights such as Reliance Industries Ltd., ICICI Bank Ltd., and Larsen & Toubro Ltd.

As of 11:52 a.m., the NSE Nifty 50 declined 31.10 points, or 0.14%, to trade at 22,403.55, and the S&P BSE Sensex fell 36.00 points, or 0.049%, to 73,840.82.

The Nifty hit a record high of 22,619.00 and the Sensex touched a new lifetime high of 74,501.73 as sentiments improved for risky assets after Federal Reserve Chair Jerome Powell indicated rate cuts are imminent this year despite resilient inflation in the US.

"The benchmark equity indices Sensex and Nifty commenced the trading session at unprecedented peaks, driven by significant gains in the heavyweight HDFC Bank. Additionally, the Nifty midcap index reached a milestone, breaching the 50,000 mark for the first time," said Shrey Jain, founder and chief executive at SAS Online.

"Looking ahead, we anticipate the Bank Nifty to maintain its positive bias, consolidating within the broader range of 47,500-48,000 throughout the trading day," Jain said.

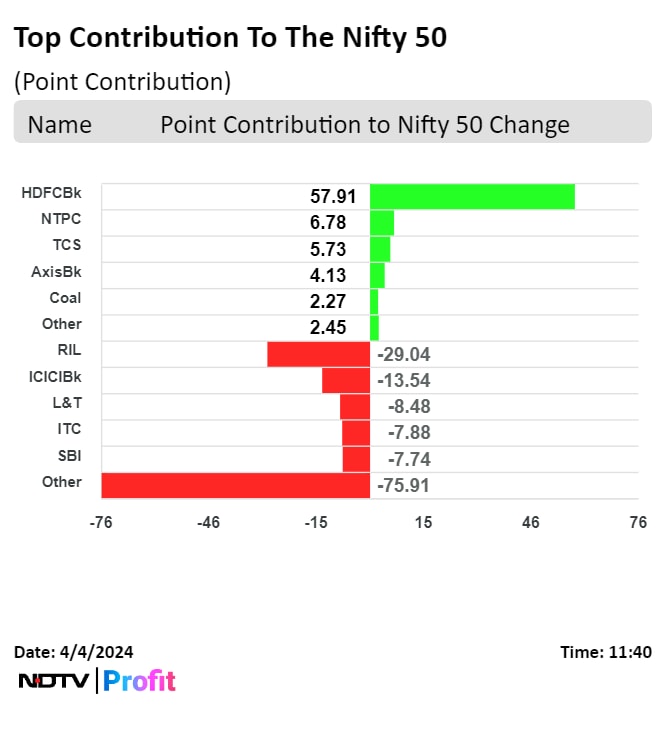

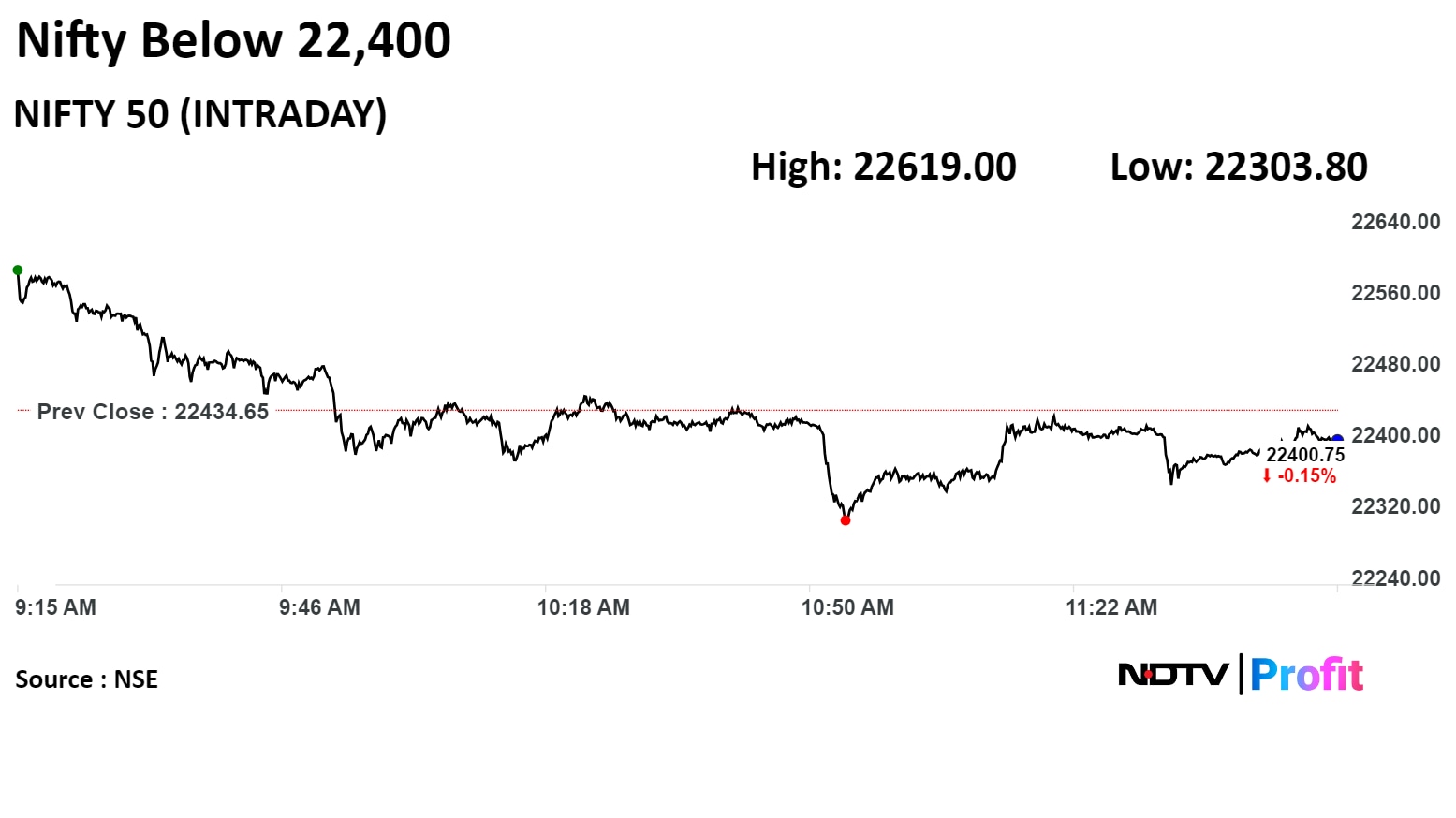

Reliance Industries Ltd., ICICI Bank Ltd., Larsen & Toubro Ltd., ITC Ltd., and State Bank of India weighed on the index.

HDFC Bank Ltd., NTPC Ltd., Tata Consultancy Services Ltd., Axis Bank Ltd., and Coal India Ltd. added to the gains in the index.

India's benchmark stock indices fell from the fresh record high during early trade on Thursday, weighed by losses in index heavyweights such as Reliance Industries Ltd., ICICI Bank Ltd., and Larsen & Toubro Ltd.

As of 11:52 a.m., the NSE Nifty 50 declined 31.10 points, or 0.14%, to trade at 22,403.55, and the S&P BSE Sensex fell 36.00 points, or 0.049%, to 73,840.82.

The Nifty hit a record high of 22,619.00 and the Sensex touched a new lifetime high of 74,501.73 as sentiments improved for risky assets after Federal Reserve Chair Jerome Powell indicated rate cuts are imminent this year despite resilient inflation in the US.

"The benchmark equity indices Sensex and Nifty commenced the trading session at unprecedented peaks, driven by significant gains in the heavyweight HDFC Bank. Additionally, the Nifty midcap index reached a milestone, breaching the 50,000 mark for the first time," said Shrey Jain, founder and chief executive at SAS Online.

India's benchmark stock indices fell from the fresh record high during early trade on Thursday, weighed by losses in index heavyweights such as Reliance Industries Ltd., ICICI Bank Ltd., and Larsen & Toubro Ltd.

As of 11:52 a.m., the NSE Nifty 50 declined 31.10 points, or 0.14%, to trade at 22,403.55, and the S&P BSE Sensex fell 36.00 points, or 0.049%, to 73,840.82.

The Nifty hit a record high of 22,619.00 and the Sensex touched a new lifetime high of 74,501.73 as sentiments improved for risky assets after Federal Reserve Chair Jerome Powell indicated rate cuts are imminent this year despite resilient inflation in the US.

"The benchmark equity indices Sensex and Nifty commenced the trading session at unprecedented peaks, driven by significant gains in the heavyweight HDFC Bank. Additionally, the Nifty midcap index reached a milestone, breaching the 50,000 mark for the first time," said Shrey Jain, founder and chief executive at SAS Online.

India's benchmark stock indices fell from the fresh record high during early trade on Thursday, weighed by losses in index heavyweights such as Reliance Industries Ltd., ICICI Bank Ltd., and Larsen & Toubro Ltd.

As of 11:52 a.m., the NSE Nifty 50 declined 31.10 points, or 0.14%, to trade at 22,403.55, and the S&P BSE Sensex fell 36.00 points, or 0.049%, to 73,840.82.

The Nifty hit a record high of 22,619.00 and the Sensex touched a new lifetime high of 74,501.73 as sentiments improved for risky assets after Federal Reserve Chair Jerome Powell indicated rate cuts are imminent this year despite resilient inflation in the US.

"The benchmark equity indices Sensex and Nifty commenced the trading session at unprecedented peaks, driven by significant gains in the heavyweight HDFC Bank. Additionally, the Nifty midcap index reached a milestone, breaching the 50,000 mark for the first time," said Shrey Jain, founder and chief executive at SAS Online.

India's benchmark stock indices fell from the fresh record high during early trade on Thursday, weighed by losses in index heavyweights such as Reliance Industries Ltd., ICICI Bank Ltd., and Larsen & Toubro Ltd.

As of 11:52 a.m., the NSE Nifty 50 declined 31.10 points, or 0.14%, to trade at 22,403.55, and the S&P BSE Sensex fell 36.00 points, or 0.049%, to 73,840.82.

The Nifty hit a record high of 22,619.00 and the Sensex touched a new lifetime high of 74,501.73 as sentiments improved for risky assets after Federal Reserve Chair Jerome Powell indicated rate cuts are imminent this year despite resilient inflation in the US.

"The benchmark equity indices Sensex and Nifty commenced the trading session at unprecedented peaks, driven by significant gains in the heavyweight HDFC Bank. Additionally, the Nifty midcap index reached a milestone, breaching the 50,000 mark for the first time," said Shrey Jain, founder and chief executive at SAS Online.

"Looking ahead, we anticipate the Bank Nifty to maintain its positive bias, consolidating within the broader range of 47,500-48,000 throughout the trading day," Jain said.

India's benchmark stock indices fell from the fresh record high during early trade on Thursday, weighed by losses in index heavyweights such as Reliance Industries Ltd., ICICI Bank Ltd., and Larsen & Toubro Ltd.

As of 11:52 a.m., the NSE Nifty 50 declined 31.10 points, or 0.14%, to trade at 22,403.55, and the S&P BSE Sensex fell 36.00 points, or 0.049%, to 73,840.82.

The Nifty hit a record high of 22,619.00 and the Sensex touched a new lifetime high of 74,501.73 as sentiments improved for risky assets after Federal Reserve Chair Jerome Powell indicated rate cuts are imminent this year despite resilient inflation in the US.

"The benchmark equity indices Sensex and Nifty commenced the trading session at unprecedented peaks, driven by significant gains in the heavyweight HDFC Bank. Additionally, the Nifty midcap index reached a milestone, breaching the 50,000 mark for the first time," said Shrey Jain, founder and chief executive at SAS Online.

India's benchmark stock indices fell from the fresh record high during early trade on Thursday, weighed by losses in index heavyweights such as Reliance Industries Ltd., ICICI Bank Ltd., and Larsen & Toubro Ltd.

As of 11:52 a.m., the NSE Nifty 50 declined 31.10 points, or 0.14%, to trade at 22,403.55, and the S&P BSE Sensex fell 36.00 points, or 0.049%, to 73,840.82.

The Nifty hit a record high of 22,619.00 and the Sensex touched a new lifetime high of 74,501.73 as sentiments improved for risky assets after Federal Reserve Chair Jerome Powell indicated rate cuts are imminent this year despite resilient inflation in the US.

"The benchmark equity indices Sensex and Nifty commenced the trading session at unprecedented peaks, driven by significant gains in the heavyweight HDFC Bank. Additionally, the Nifty midcap index reached a milestone, breaching the 50,000 mark for the first time," said Shrey Jain, founder and chief executive at SAS Online.

India's benchmark stock indices fell from the fresh record high during early trade on Thursday, weighed by losses in index heavyweights such as Reliance Industries Ltd., ICICI Bank Ltd., and Larsen & Toubro Ltd.

As of 11:52 a.m., the NSE Nifty 50 declined 31.10 points, or 0.14%, to trade at 22,403.55, and the S&P BSE Sensex fell 36.00 points, or 0.049%, to 73,840.82.

The Nifty hit a record high of 22,619.00 and the Sensex touched a new lifetime high of 74,501.73 as sentiments improved for risky assets after Federal Reserve Chair Jerome Powell indicated rate cuts are imminent this year despite resilient inflation in the US.

"The benchmark equity indices Sensex and Nifty commenced the trading session at unprecedented peaks, driven by significant gains in the heavyweight HDFC Bank. Additionally, the Nifty midcap index reached a milestone, breaching the 50,000 mark for the first time," said Shrey Jain, founder and chief executive at SAS Online.

India's benchmark stock indices fell from the fresh record high during early trade on Thursday, weighed by losses in index heavyweights such as Reliance Industries Ltd., ICICI Bank Ltd., and Larsen & Toubro Ltd.

As of 11:52 a.m., the NSE Nifty 50 declined 31.10 points, or 0.14%, to trade at 22,403.55, and the S&P BSE Sensex fell 36.00 points, or 0.049%, to 73,840.82.

The Nifty hit a record high of 22,619.00 and the Sensex touched a new lifetime high of 74,501.73 as sentiments improved for risky assets after Federal Reserve Chair Jerome Powell indicated rate cuts are imminent this year despite resilient inflation in the US.

"The benchmark equity indices Sensex and Nifty commenced the trading session at unprecedented peaks, driven by significant gains in the heavyweight HDFC Bank. Additionally, the Nifty midcap index reached a milestone, breaching the 50,000 mark for the first time," said Shrey Jain, founder and chief executive at SAS Online.

"Looking ahead, we anticipate the Bank Nifty to maintain its positive bias, consolidating within the broader range of 47,500-48,000 throughout the trading day," Jain said.

Reliance Industries Ltd., ICICI Bank Ltd., Larsen & Toubro Ltd., ITC Ltd., and State Bank of India weighed on the index.

HDFC Bank Ltd., NTPC Ltd., Tata Consultancy Services Ltd., Axis Bank Ltd., and Coal India Ltd. added to the gains in the index.

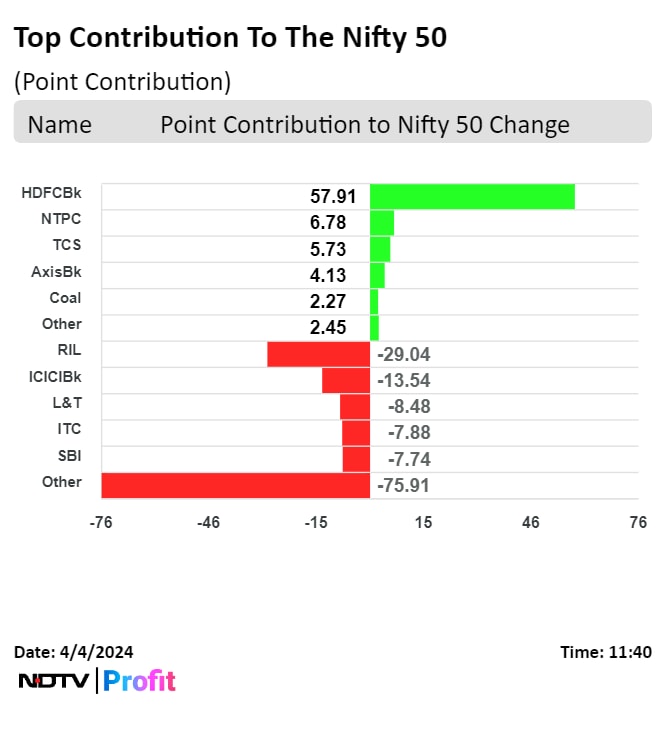

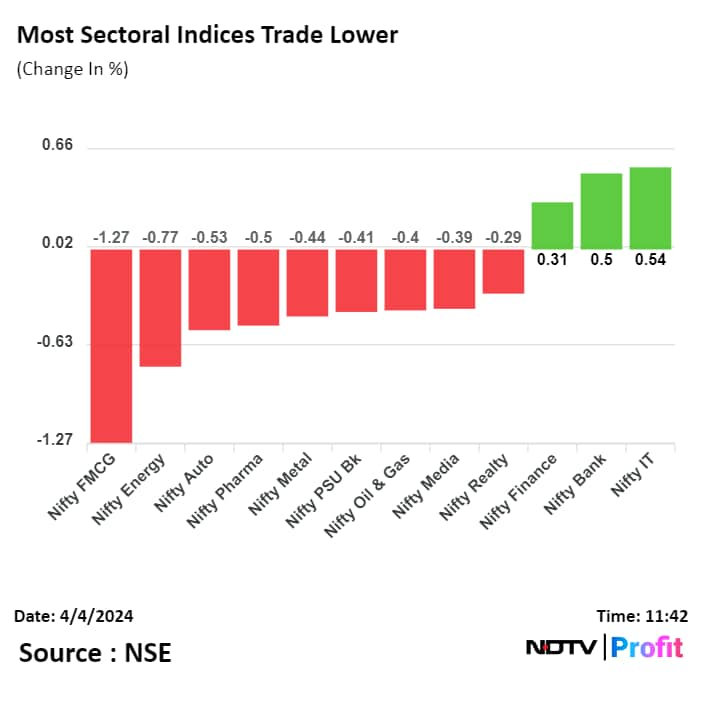

On NSE, nine sectoral indices declined, and three advanced. The NSE Nifty FMCG index fell the most among sectoral indices, and the NSE Nifty IT index rose the most among sectoral indices.

India's benchmark stock indices fell from the fresh record high during early trade on Thursday, weighed by losses in index heavyweights such as Reliance Industries Ltd., ICICI Bank Ltd., and Larsen & Toubro Ltd.

As of 11:52 a.m., the NSE Nifty 50 declined 31.10 points, or 0.14%, to trade at 22,403.55, and the S&P BSE Sensex fell 36.00 points, or 0.049%, to 73,840.82.

The Nifty hit a record high of 22,619.00 and the Sensex touched a new lifetime high of 74,501.73 as sentiments improved for risky assets after Federal Reserve Chair Jerome Powell indicated rate cuts are imminent this year despite resilient inflation in the US.

"The benchmark equity indices Sensex and Nifty commenced the trading session at unprecedented peaks, driven by significant gains in the heavyweight HDFC Bank. Additionally, the Nifty midcap index reached a milestone, breaching the 50,000 mark for the first time," said Shrey Jain, founder and chief executive at SAS Online.

India's benchmark stock indices fell from the fresh record high during early trade on Thursday, weighed by losses in index heavyweights such as Reliance Industries Ltd., ICICI Bank Ltd., and Larsen & Toubro Ltd.

As of 11:52 a.m., the NSE Nifty 50 declined 31.10 points, or 0.14%, to trade at 22,403.55, and the S&P BSE Sensex fell 36.00 points, or 0.049%, to 73,840.82.

The Nifty hit a record high of 22,619.00 and the Sensex touched a new lifetime high of 74,501.73 as sentiments improved for risky assets after Federal Reserve Chair Jerome Powell indicated rate cuts are imminent this year despite resilient inflation in the US.

"The benchmark equity indices Sensex and Nifty commenced the trading session at unprecedented peaks, driven by significant gains in the heavyweight HDFC Bank. Additionally, the Nifty midcap index reached a milestone, breaching the 50,000 mark for the first time," said Shrey Jain, founder and chief executive at SAS Online.

India's benchmark stock indices fell from the fresh record high during early trade on Thursday, weighed by losses in index heavyweights such as Reliance Industries Ltd., ICICI Bank Ltd., and Larsen & Toubro Ltd.

As of 11:52 a.m., the NSE Nifty 50 declined 31.10 points, or 0.14%, to trade at 22,403.55, and the S&P BSE Sensex fell 36.00 points, or 0.049%, to 73,840.82.

The Nifty hit a record high of 22,619.00 and the Sensex touched a new lifetime high of 74,501.73 as sentiments improved for risky assets after Federal Reserve Chair Jerome Powell indicated rate cuts are imminent this year despite resilient inflation in the US.

"The benchmark equity indices Sensex and Nifty commenced the trading session at unprecedented peaks, driven by significant gains in the heavyweight HDFC Bank. Additionally, the Nifty midcap index reached a milestone, breaching the 50,000 mark for the first time," said Shrey Jain, founder and chief executive at SAS Online.

India's benchmark stock indices fell from the fresh record high during early trade on Thursday, weighed by losses in index heavyweights such as Reliance Industries Ltd., ICICI Bank Ltd., and Larsen & Toubro Ltd.

As of 11:52 a.m., the NSE Nifty 50 declined 31.10 points, or 0.14%, to trade at 22,403.55, and the S&P BSE Sensex fell 36.00 points, or 0.049%, to 73,840.82.

The Nifty hit a record high of 22,619.00 and the Sensex touched a new lifetime high of 74,501.73 as sentiments improved for risky assets after Federal Reserve Chair Jerome Powell indicated rate cuts are imminent this year despite resilient inflation in the US.

"The benchmark equity indices Sensex and Nifty commenced the trading session at unprecedented peaks, driven by significant gains in the heavyweight HDFC Bank. Additionally, the Nifty midcap index reached a milestone, breaching the 50,000 mark for the first time," said Shrey Jain, founder and chief executive at SAS Online.

"Looking ahead, we anticipate the Bank Nifty to maintain its positive bias, consolidating within the broader range of 47,500-48,000 throughout the trading day," Jain said.

India's benchmark stock indices fell from the fresh record high during early trade on Thursday, weighed by losses in index heavyweights such as Reliance Industries Ltd., ICICI Bank Ltd., and Larsen & Toubro Ltd.

As of 11:52 a.m., the NSE Nifty 50 declined 31.10 points, or 0.14%, to trade at 22,403.55, and the S&P BSE Sensex fell 36.00 points, or 0.049%, to 73,840.82.

The Nifty hit a record high of 22,619.00 and the Sensex touched a new lifetime high of 74,501.73 as sentiments improved for risky assets after Federal Reserve Chair Jerome Powell indicated rate cuts are imminent this year despite resilient inflation in the US.

"The benchmark equity indices Sensex and Nifty commenced the trading session at unprecedented peaks, driven by significant gains in the heavyweight HDFC Bank. Additionally, the Nifty midcap index reached a milestone, breaching the 50,000 mark for the first time," said Shrey Jain, founder and chief executive at SAS Online.

India's benchmark stock indices fell from the fresh record high during early trade on Thursday, weighed by losses in index heavyweights such as Reliance Industries Ltd., ICICI Bank Ltd., and Larsen & Toubro Ltd.

As of 11:52 a.m., the NSE Nifty 50 declined 31.10 points, or 0.14%, to trade at 22,403.55, and the S&P BSE Sensex fell 36.00 points, or 0.049%, to 73,840.82.

The Nifty hit a record high of 22,619.00 and the Sensex touched a new lifetime high of 74,501.73 as sentiments improved for risky assets after Federal Reserve Chair Jerome Powell indicated rate cuts are imminent this year despite resilient inflation in the US.

"The benchmark equity indices Sensex and Nifty commenced the trading session at unprecedented peaks, driven by significant gains in the heavyweight HDFC Bank. Additionally, the Nifty midcap index reached a milestone, breaching the 50,000 mark for the first time," said Shrey Jain, founder and chief executive at SAS Online.

India's benchmark stock indices fell from the fresh record high during early trade on Thursday, weighed by losses in index heavyweights such as Reliance Industries Ltd., ICICI Bank Ltd., and Larsen & Toubro Ltd.

As of 11:52 a.m., the NSE Nifty 50 declined 31.10 points, or 0.14%, to trade at 22,403.55, and the S&P BSE Sensex fell 36.00 points, or 0.049%, to 73,840.82.

The Nifty hit a record high of 22,619.00 and the Sensex touched a new lifetime high of 74,501.73 as sentiments improved for risky assets after Federal Reserve Chair Jerome Powell indicated rate cuts are imminent this year despite resilient inflation in the US.

"The benchmark equity indices Sensex and Nifty commenced the trading session at unprecedented peaks, driven by significant gains in the heavyweight HDFC Bank. Additionally, the Nifty midcap index reached a milestone, breaching the 50,000 mark for the first time," said Shrey Jain, founder and chief executive at SAS Online.

India's benchmark stock indices fell from the fresh record high during early trade on Thursday, weighed by losses in index heavyweights such as Reliance Industries Ltd., ICICI Bank Ltd., and Larsen & Toubro Ltd.

As of 11:52 a.m., the NSE Nifty 50 declined 31.10 points, or 0.14%, to trade at 22,403.55, and the S&P BSE Sensex fell 36.00 points, or 0.049%, to 73,840.82.

The Nifty hit a record high of 22,619.00 and the Sensex touched a new lifetime high of 74,501.73 as sentiments improved for risky assets after Federal Reserve Chair Jerome Powell indicated rate cuts are imminent this year despite resilient inflation in the US.

"The benchmark equity indices Sensex and Nifty commenced the trading session at unprecedented peaks, driven by significant gains in the heavyweight HDFC Bank. Additionally, the Nifty midcap index reached a milestone, breaching the 50,000 mark for the first time," said Shrey Jain, founder and chief executive at SAS Online.

"Looking ahead, we anticipate the Bank Nifty to maintain its positive bias, consolidating within the broader range of 47,500-48,000 throughout the trading day," Jain said.

Reliance Industries Ltd., ICICI Bank Ltd., Larsen & Toubro Ltd., ITC Ltd., and State Bank of India weighed on the index.

HDFC Bank Ltd., NTPC Ltd., Tata Consultancy Services Ltd., Axis Bank Ltd., and Coal India Ltd. added to the gains in the index.

India's benchmark stock indices fell from the fresh record high during early trade on Thursday, weighed by losses in index heavyweights such as Reliance Industries Ltd., ICICI Bank Ltd., and Larsen & Toubro Ltd.

As of 11:52 a.m., the NSE Nifty 50 declined 31.10 points, or 0.14%, to trade at 22,403.55, and the S&P BSE Sensex fell 36.00 points, or 0.049%, to 73,840.82.

The Nifty hit a record high of 22,619.00 and the Sensex touched a new lifetime high of 74,501.73 as sentiments improved for risky assets after Federal Reserve Chair Jerome Powell indicated rate cuts are imminent this year despite resilient inflation in the US.

"The benchmark equity indices Sensex and Nifty commenced the trading session at unprecedented peaks, driven by significant gains in the heavyweight HDFC Bank. Additionally, the Nifty midcap index reached a milestone, breaching the 50,000 mark for the first time," said Shrey Jain, founder and chief executive at SAS Online.

India's benchmark stock indices fell from the fresh record high during early trade on Thursday, weighed by losses in index heavyweights such as Reliance Industries Ltd., ICICI Bank Ltd., and Larsen & Toubro Ltd.

As of 11:52 a.m., the NSE Nifty 50 declined 31.10 points, or 0.14%, to trade at 22,403.55, and the S&P BSE Sensex fell 36.00 points, or 0.049%, to 73,840.82.

The Nifty hit a record high of 22,619.00 and the Sensex touched a new lifetime high of 74,501.73 as sentiments improved for risky assets after Federal Reserve Chair Jerome Powell indicated rate cuts are imminent this year despite resilient inflation in the US.

"The benchmark equity indices Sensex and Nifty commenced the trading session at unprecedented peaks, driven by significant gains in the heavyweight HDFC Bank. Additionally, the Nifty midcap index reached a milestone, breaching the 50,000 mark for the first time," said Shrey Jain, founder and chief executive at SAS Online.

India's benchmark stock indices fell from the fresh record high during early trade on Thursday, weighed by losses in index heavyweights such as Reliance Industries Ltd., ICICI Bank Ltd., and Larsen & Toubro Ltd.

As of 11:52 a.m., the NSE Nifty 50 declined 31.10 points, or 0.14%, to trade at 22,403.55, and the S&P BSE Sensex fell 36.00 points, or 0.049%, to 73,840.82.

The Nifty hit a record high of 22,619.00 and the Sensex touched a new lifetime high of 74,501.73 as sentiments improved for risky assets after Federal Reserve Chair Jerome Powell indicated rate cuts are imminent this year despite resilient inflation in the US.

"The benchmark equity indices Sensex and Nifty commenced the trading session at unprecedented peaks, driven by significant gains in the heavyweight HDFC Bank. Additionally, the Nifty midcap index reached a milestone, breaching the 50,000 mark for the first time," said Shrey Jain, founder and chief executive at SAS Online.

India's benchmark stock indices fell from the fresh record high during early trade on Thursday, weighed by losses in index heavyweights such as Reliance Industries Ltd., ICICI Bank Ltd., and Larsen & Toubro Ltd.

As of 11:52 a.m., the NSE Nifty 50 declined 31.10 points, or 0.14%, to trade at 22,403.55, and the S&P BSE Sensex fell 36.00 points, or 0.049%, to 73,840.82.

The Nifty hit a record high of 22,619.00 and the Sensex touched a new lifetime high of 74,501.73 as sentiments improved for risky assets after Federal Reserve Chair Jerome Powell indicated rate cuts are imminent this year despite resilient inflation in the US.

"The benchmark equity indices Sensex and Nifty commenced the trading session at unprecedented peaks, driven by significant gains in the heavyweight HDFC Bank. Additionally, the Nifty midcap index reached a milestone, breaching the 50,000 mark for the first time," said Shrey Jain, founder and chief executive at SAS Online.

"Looking ahead, we anticipate the Bank Nifty to maintain its positive bias, consolidating within the broader range of 47,500-48,000 throughout the trading day," Jain said.

India's benchmark stock indices fell from the fresh record high during early trade on Thursday, weighed by losses in index heavyweights such as Reliance Industries Ltd., ICICI Bank Ltd., and Larsen & Toubro Ltd.

As of 11:52 a.m., the NSE Nifty 50 declined 31.10 points, or 0.14%, to trade at 22,403.55, and the S&P BSE Sensex fell 36.00 points, or 0.049%, to 73,840.82.

The Nifty hit a record high of 22,619.00 and the Sensex touched a new lifetime high of 74,501.73 as sentiments improved for risky assets after Federal Reserve Chair Jerome Powell indicated rate cuts are imminent this year despite resilient inflation in the US.

"The benchmark equity indices Sensex and Nifty commenced the trading session at unprecedented peaks, driven by significant gains in the heavyweight HDFC Bank. Additionally, the Nifty midcap index reached a milestone, breaching the 50,000 mark for the first time," said Shrey Jain, founder and chief executive at SAS Online.

India's benchmark stock indices fell from the fresh record high during early trade on Thursday, weighed by losses in index heavyweights such as Reliance Industries Ltd., ICICI Bank Ltd., and Larsen & Toubro Ltd.

As of 11:52 a.m., the NSE Nifty 50 declined 31.10 points, or 0.14%, to trade at 22,403.55, and the S&P BSE Sensex fell 36.00 points, or 0.049%, to 73,840.82.

The Nifty hit a record high of 22,619.00 and the Sensex touched a new lifetime high of 74,501.73 as sentiments improved for risky assets after Federal Reserve Chair Jerome Powell indicated rate cuts are imminent this year despite resilient inflation in the US.

"The benchmark equity indices Sensex and Nifty commenced the trading session at unprecedented peaks, driven by significant gains in the heavyweight HDFC Bank. Additionally, the Nifty midcap index reached a milestone, breaching the 50,000 mark for the first time," said Shrey Jain, founder and chief executive at SAS Online.

India's benchmark stock indices fell from the fresh record high during early trade on Thursday, weighed by losses in index heavyweights such as Reliance Industries Ltd., ICICI Bank Ltd., and Larsen & Toubro Ltd.

As of 11:52 a.m., the NSE Nifty 50 declined 31.10 points, or 0.14%, to trade at 22,403.55, and the S&P BSE Sensex fell 36.00 points, or 0.049%, to 73,840.82.

The Nifty hit a record high of 22,619.00 and the Sensex touched a new lifetime high of 74,501.73 as sentiments improved for risky assets after Federal Reserve Chair Jerome Powell indicated rate cuts are imminent this year despite resilient inflation in the US.

"The benchmark equity indices Sensex and Nifty commenced the trading session at unprecedented peaks, driven by significant gains in the heavyweight HDFC Bank. Additionally, the Nifty midcap index reached a milestone, breaching the 50,000 mark for the first time," said Shrey Jain, founder and chief executive at SAS Online.

India's benchmark stock indices fell from the fresh record high during early trade on Thursday, weighed by losses in index heavyweights such as Reliance Industries Ltd., ICICI Bank Ltd., and Larsen & Toubro Ltd.

As of 11:52 a.m., the NSE Nifty 50 declined 31.10 points, or 0.14%, to trade at 22,403.55, and the S&P BSE Sensex fell 36.00 points, or 0.049%, to 73,840.82.

The Nifty hit a record high of 22,619.00 and the Sensex touched a new lifetime high of 74,501.73 as sentiments improved for risky assets after Federal Reserve Chair Jerome Powell indicated rate cuts are imminent this year despite resilient inflation in the US.

"The benchmark equity indices Sensex and Nifty commenced the trading session at unprecedented peaks, driven by significant gains in the heavyweight HDFC Bank. Additionally, the Nifty midcap index reached a milestone, breaching the 50,000 mark for the first time," said Shrey Jain, founder and chief executive at SAS Online.

"Looking ahead, we anticipate the Bank Nifty to maintain its positive bias, consolidating within the broader range of 47,500-48,000 throughout the trading day," Jain said.

Reliance Industries Ltd., ICICI Bank Ltd., Larsen & Toubro Ltd., ITC Ltd., and State Bank of India weighed on the index.

HDFC Bank Ltd., NTPC Ltd., Tata Consultancy Services Ltd., Axis Bank Ltd., and Coal India Ltd. added to the gains in the index.

On NSE, nine sectoral indices declined, and three advanced. The NSE Nifty FMCG index fell the most among sectoral indices, and the NSE Nifty IT index rose the most among sectoral indices.

Broader markets were trading on a mixed note with the S&P BSE Midcap falling 0.06% and the S&P BSE Smallcap rising 0.29% through midday on Thursday.

On BSE, 14 sectors declined, six advanced. The S&P BSE Oil and Gas index declined the most among sectoral index, and the S&P BSE Utilities index rose the most among its peers.

Market breadth was skewed in favour of buyers. Around 2,155 stocks advanced, 1,515 stocks declined, and 134 stocks remained unchanged on BSE.

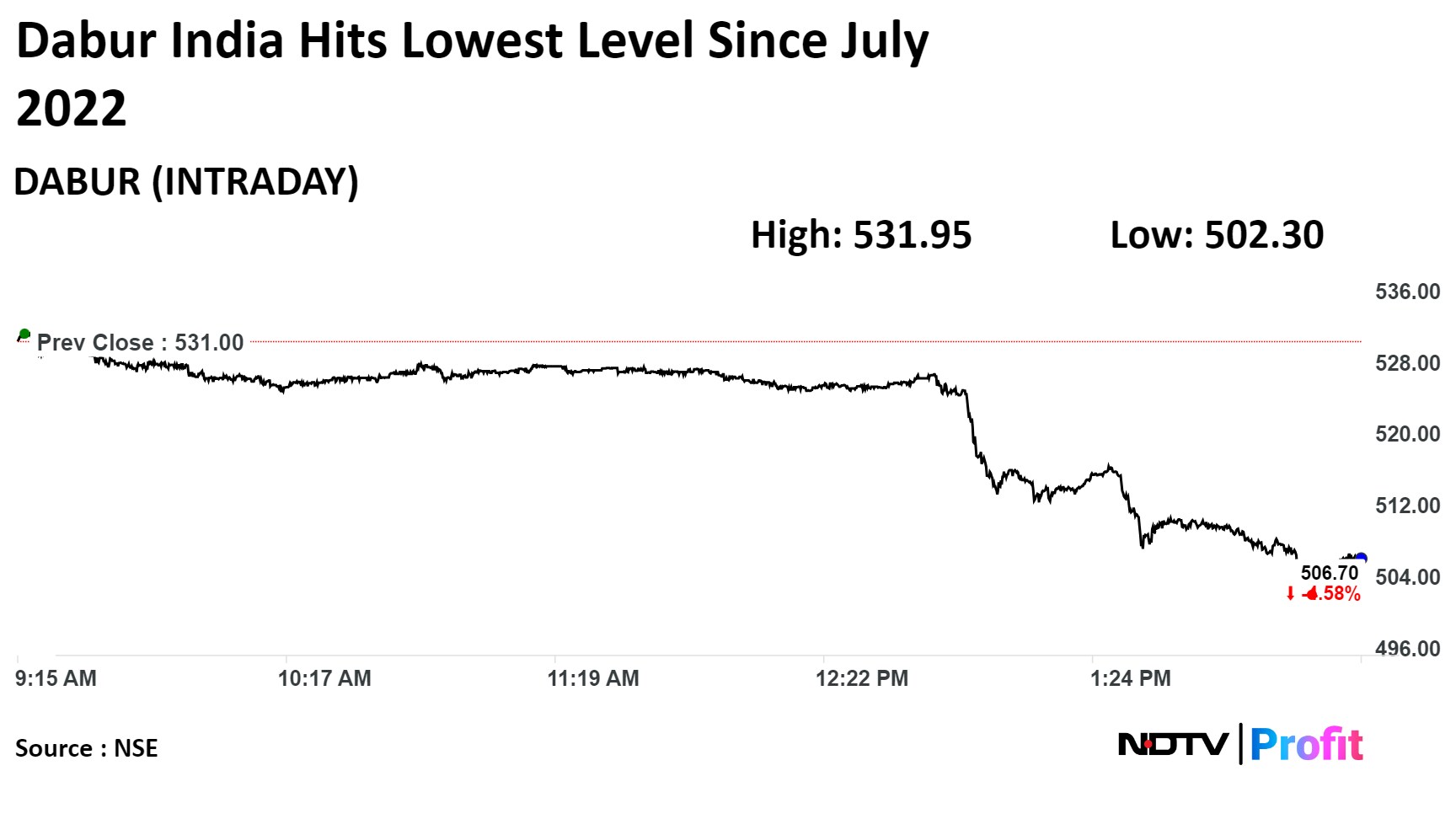

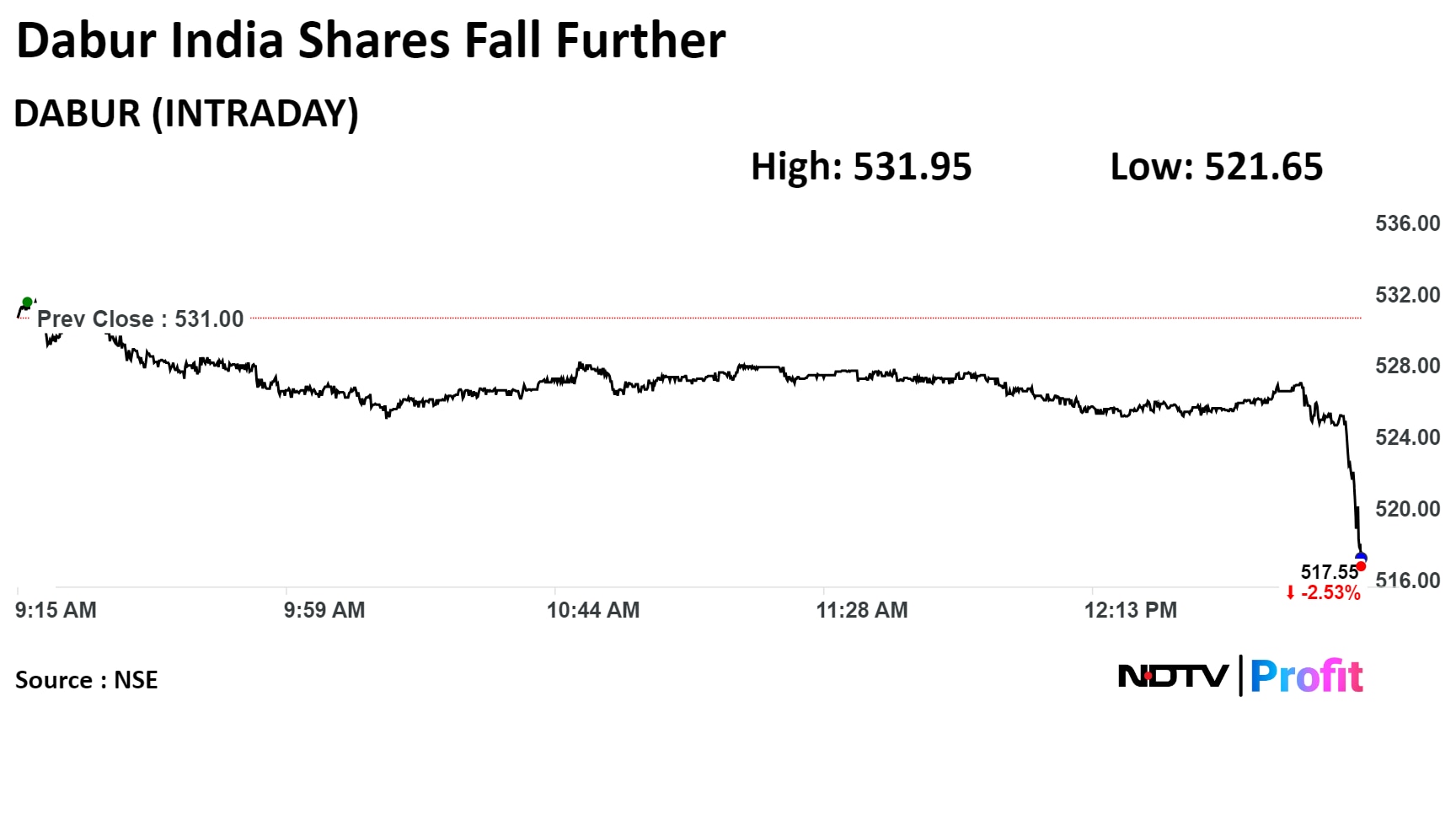

Demand trends remained sluggish in Q4

Q4 revenue to register mid-single digit growth

HPC segment is expected to grow in high-single digits

Q4 operating profit seen rising slightly ahead of revenue, post YoY improvement

International business is expected to register double-digit growth in CC terms

Gap between rural & urban consumption narrowed as rural growth picked up on price rollbacks in staples

Gross margins are likely to continue to witness expansion on account of deflation in input cost

Source: Exchange filing

Demand trends remained sluggish in Q4

Q4 revenue to register mid-single digit growth

HPC segment is expected to grow in high-single digits

Q4 operating profit seen rising slightly ahead of revenue, post YoY improvement

International business is expected to register double-digit growth in CC terms

Gap between rural & urban consumption narrowed as rural growth picked up on price rollbacks in staples

Gross margins are likely to continue to witness expansion on account of deflation in input cost

Source: Exchange filing

Inks pact to open 300-room 5-star hotel in Mumbai near Terminal 2 of Mumbai International Airport

Source: Exchange filing

The stock fell as much as 4.3%, snapping their three-day rally, after they hit a lifetime high in the early session.

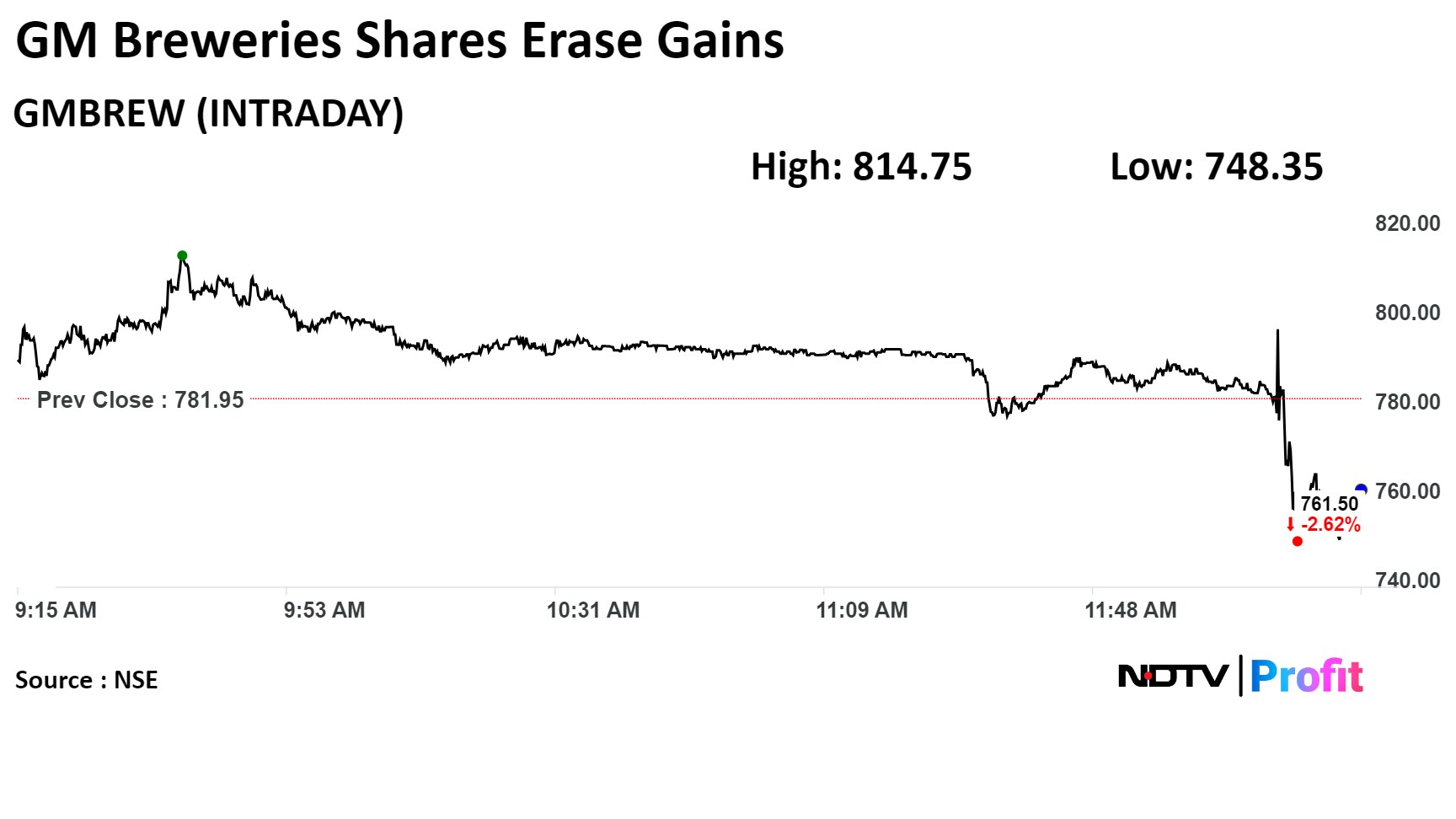

GM Breweries Q4 Results Key Highlights (YoY)

Revenue up 3.3% at Rs 159.8 crore vs Rs 155.9 crore

Ebitda down 19.74% at Rs 25.2 crore vs Rs 31.4 crore

Margin down 437 bps at 15.76% vs 20.14%

Net profit up 148.57% at Rs 87 crore vs Rs 35 crore

The stock fell as much as 4.3%, snapping their three-day rally, after they hit a lifetime high in the early session.

GM Breweries Q4 Results Key Highlights (YoY)

Revenue up 3.3% at Rs 159.8 crore vs Rs 155.9 crore

Ebitda down 19.74% at Rs 25.2 crore vs Rs 31.4 crore

Margin down 437 bps at 15.76% vs 20.14%

Net profit up 148.57% at Rs 87 crore vs Rs 35 crore

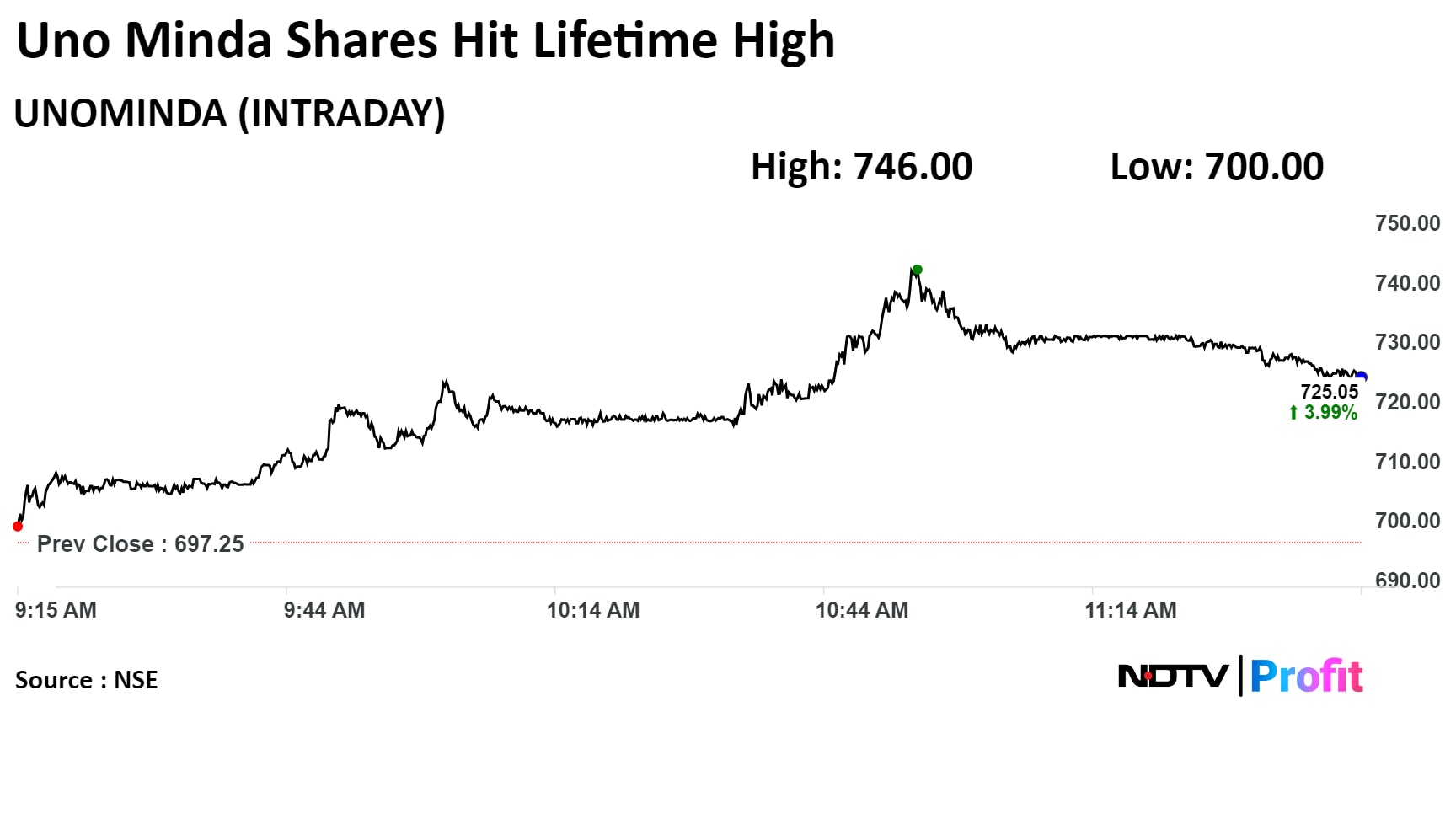

The stock continued gains in the second consecutive session today and has added 8% to hit its lifetime high.

The stock continued gains in the second consecutive session today and has added 8% to hit its lifetime high.

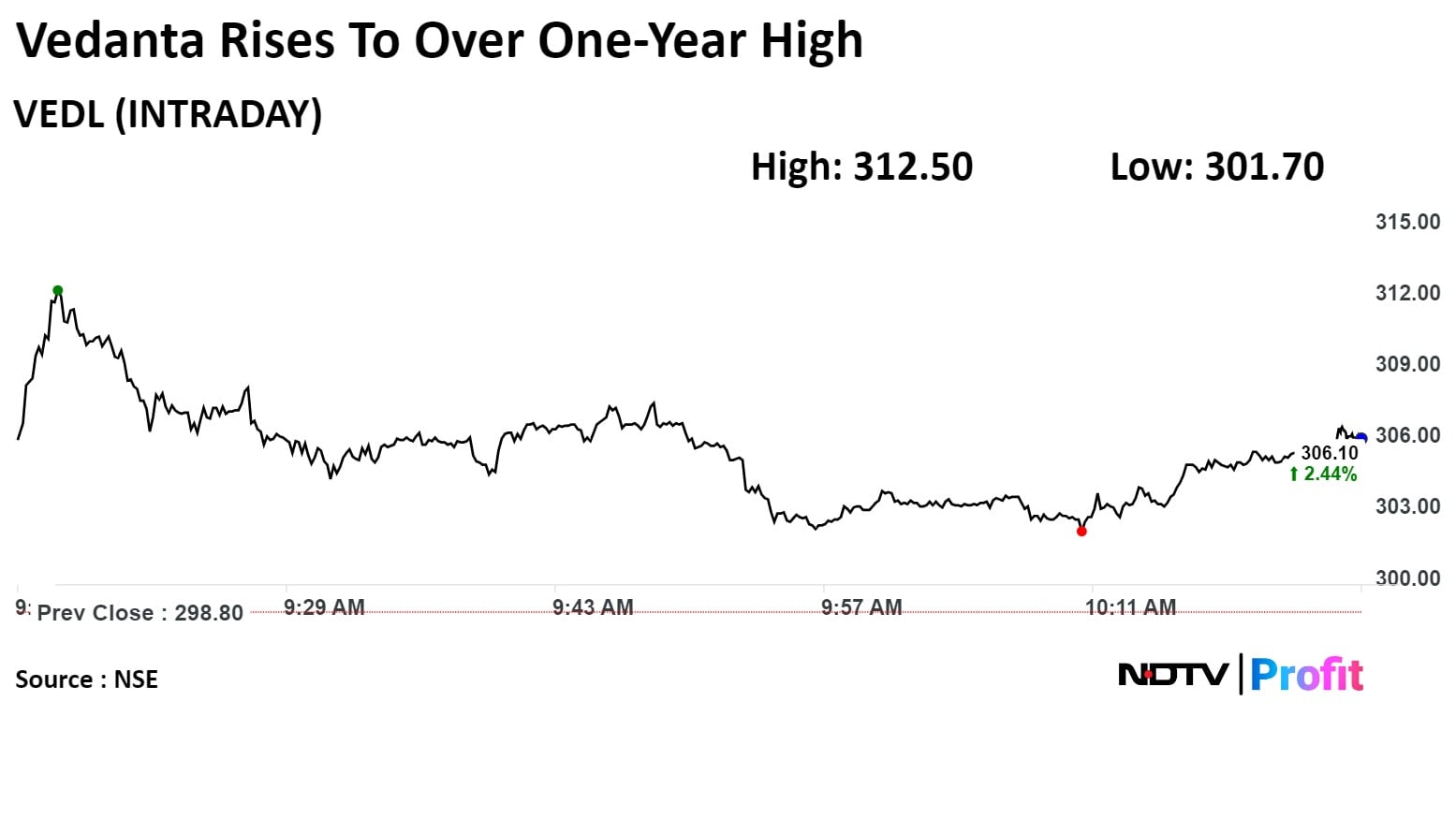

Shares of Vedanta Ltd. rose as much as 4.59% to Rs 312.50, the highest level since Feb 21, 2023. It was trading 2.01% higher at Rs 304.80 as of 120:47 a.m., as compared to 0.07% decline in the NSE Nifty 50 index.

The scrip has gained 6.38% in 12 months. Total traded volume so far in the day stood at 2.6 times its 30-day average. The relative strength index was at 69.62.

Out of 13 analysts tracking the company, seven maintain a 'buy' rating, three recommend a 'hold,' and three suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies a downside of 2.6%.

Shares of Vedanta Ltd. rose as much as 4.59% to Rs 312.50, the highest level since Feb 21, 2023. It was trading 2.01% higher at Rs 304.80 as of 120:47 a.m., as compared to 0.07% decline in the NSE Nifty 50 index.

The scrip has gained 6.38% in 12 months. Total traded volume so far in the day stood at 2.6 times its 30-day average. The relative strength index was at 69.62.

Out of 13 analysts tracking the company, seven maintain a 'buy' rating, three recommend a 'hold,' and three suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies a downside of 2.6%.

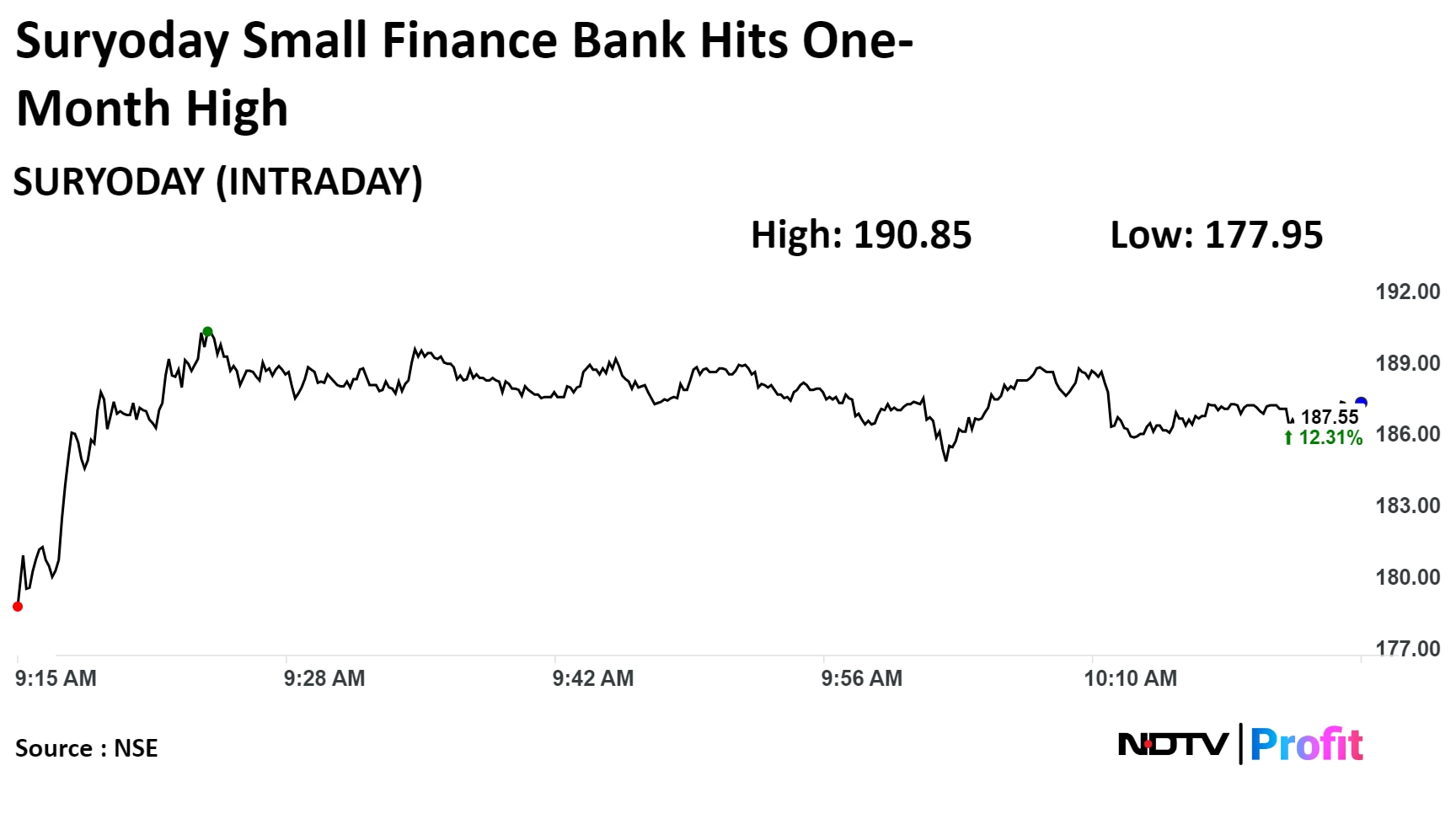

Shares of Suryoday Small Finance Bank jumped to hit its highest level in a month after the lender reported a 41% year-on-year increase in its gross advances to Rs 8,650 crore and a 50% increase in its total deposits to Rs 7,775 crore.

Shares of Suryoday Small Finance Bank jumped to hit its highest level in a month after the lender reported a 41% year-on-year increase in its gross advances to Rs 8,650 crore and a 50% increase in its total deposits to Rs 7,775 crore.

The scrip rose as much as 14.28% to Rs 190.85 apiece, the highest level since March 5. It pared gains to trade 12% higher at Rs 187 apiece, as of 10:45 a.m. This compares to a 0.07% decline in the NSE Nifty 50 Index.

It has risen 80.94% in the last twelve months. Total traded volume so far in the day stood at 14 times its 30-day average. The relative strength index was at 63.

One analyst tracing the company has a 'buy' rating for the stock, according to Bloomberg data. The average 12-month consensus price target implies an upside of 34%.

KEC International Ltd. has jumped to fresh high on Thursday as it has secured multiple orders worth total Rs 816 crore in civil infrastructure, transmission and distribution, and cables categories.

KEC International Ltd. has jumped to fresh high on Thursday as it has secured multiple orders worth total Rs 816 crore in civil infrastructure, transmission and distribution, and cables categories.

Forecast revenues for companies under coverage to increase 14% yoy in 4QFY24

Led by 27% yoy growth in the 2W segment’s production volumes

High single-digit growth yoy in the PV segment’s production volumes

Mid-to-high single-digit increase in ASPs due to price rises and richer product mix

Expect EBITDA for companies under coverage to increase 33% yoy in 4QFY24

Led by Raw Material tailwinds and operating leverage benefits

M&M, Tata Motors, Motherson Sumi and bearing companies top picks

Maruti and Eicher expected to report strong earnings performance

Targets for IOCL/BPCL/HPCL at Rs 115/440/320 implying 34%/8%/48% downside

Key concerns: Lack of pricing freedom on petrol, diesel and LPG

Reported gross margins have been to high; seem too good to believe

Gap in reported gross margins vs estimates based on product slate has widened

Russian crude benefit seems highest for BPCL, least for HPCL

Marketing margins on non-transport fuels recovered from FY23 levels

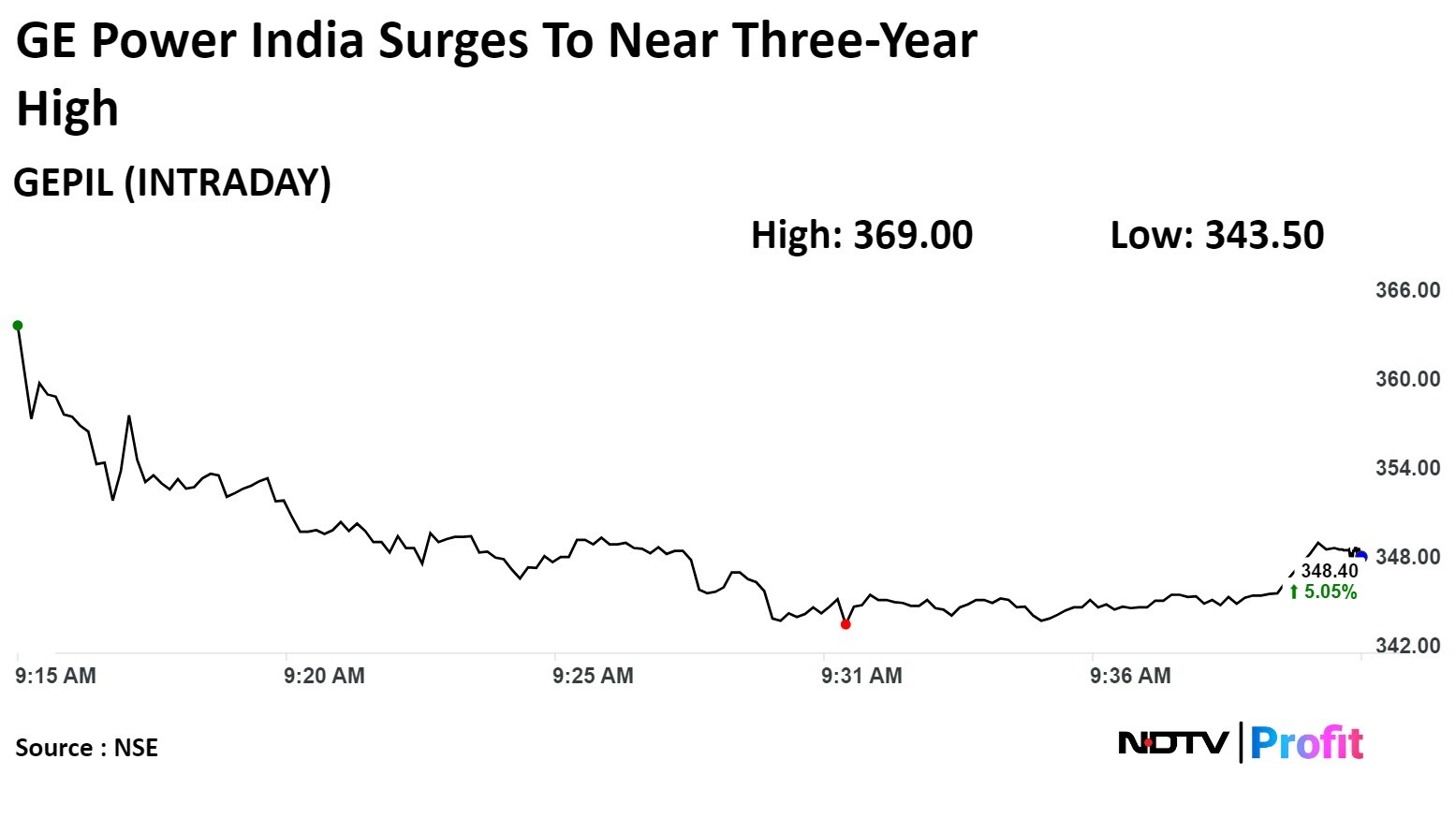

GE Power India Ltd. surged to near three-year high on Thursday securing an order worth Rs 774.9 crores.

The company has secured the order from Jaiprakash Power Ventures Ltd. for dilation and evacuation, and supply of certain critical components for the Thermal Power Plant at Bina, according to an exchange filing.

The order will be executed in 30 months.

GE Power India Ltd. surged to near three-year high on Thursday securing an order worth Rs 774.9 crores.

The company has secured the order from Jaiprakash Power Ventures Ltd. for dilation and evacuation, and supply of certain critical components for the Thermal Power Plant at Bina, according to an exchange filing.

The order will be executed in 30 months.

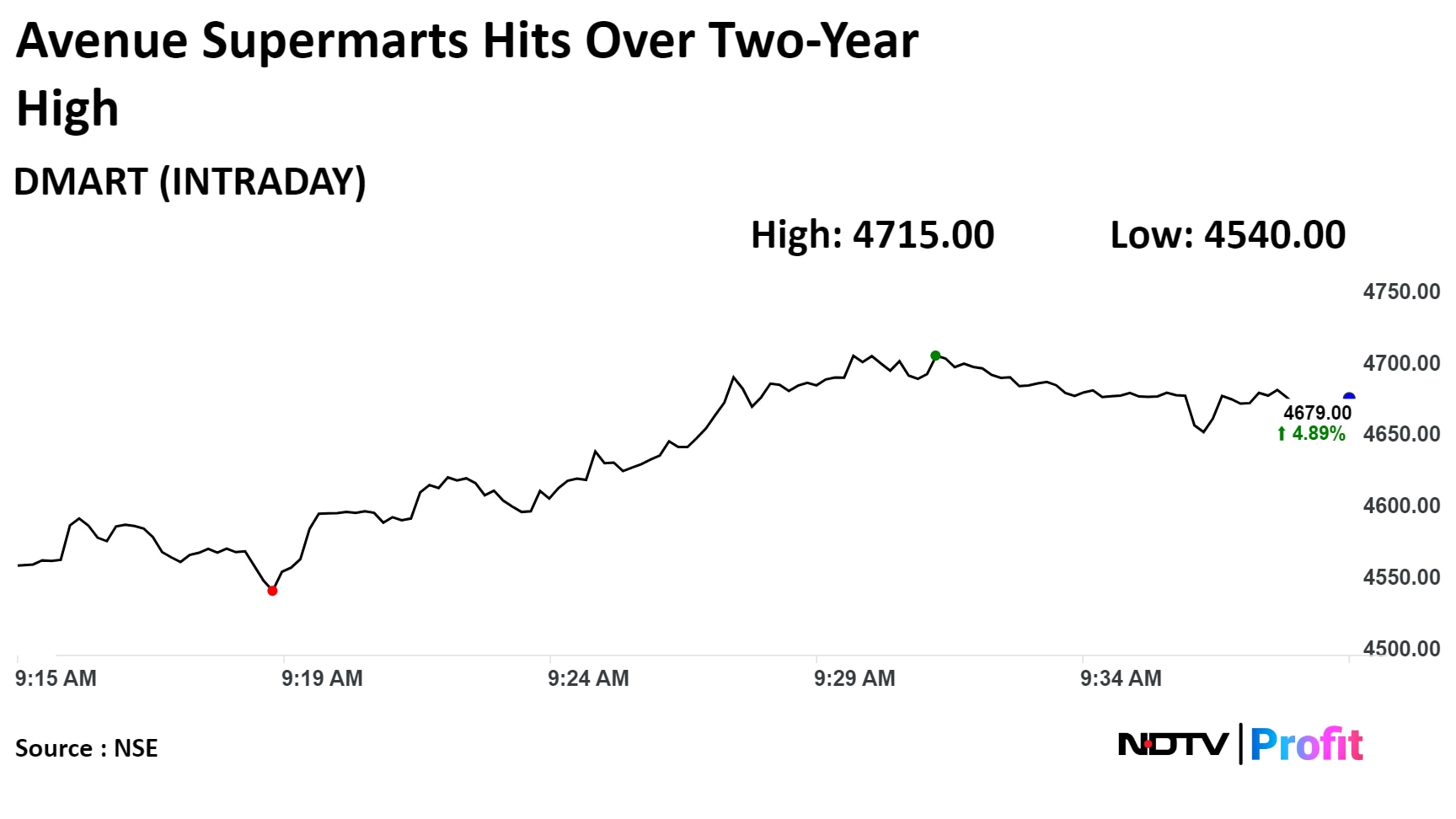

The stock jumped as much as 5.7% to Rs 4,540, its highes level since January 2022.

The stock jumped as much as 5.7% to Rs 4,540, its highes level since January 2022.

The stock rose as much as 2.97% to Rs 1,526.30, its highest level since January 17.

The stock rose as much as 2.97% to Rs 1,526.30, its highest level since January 17.

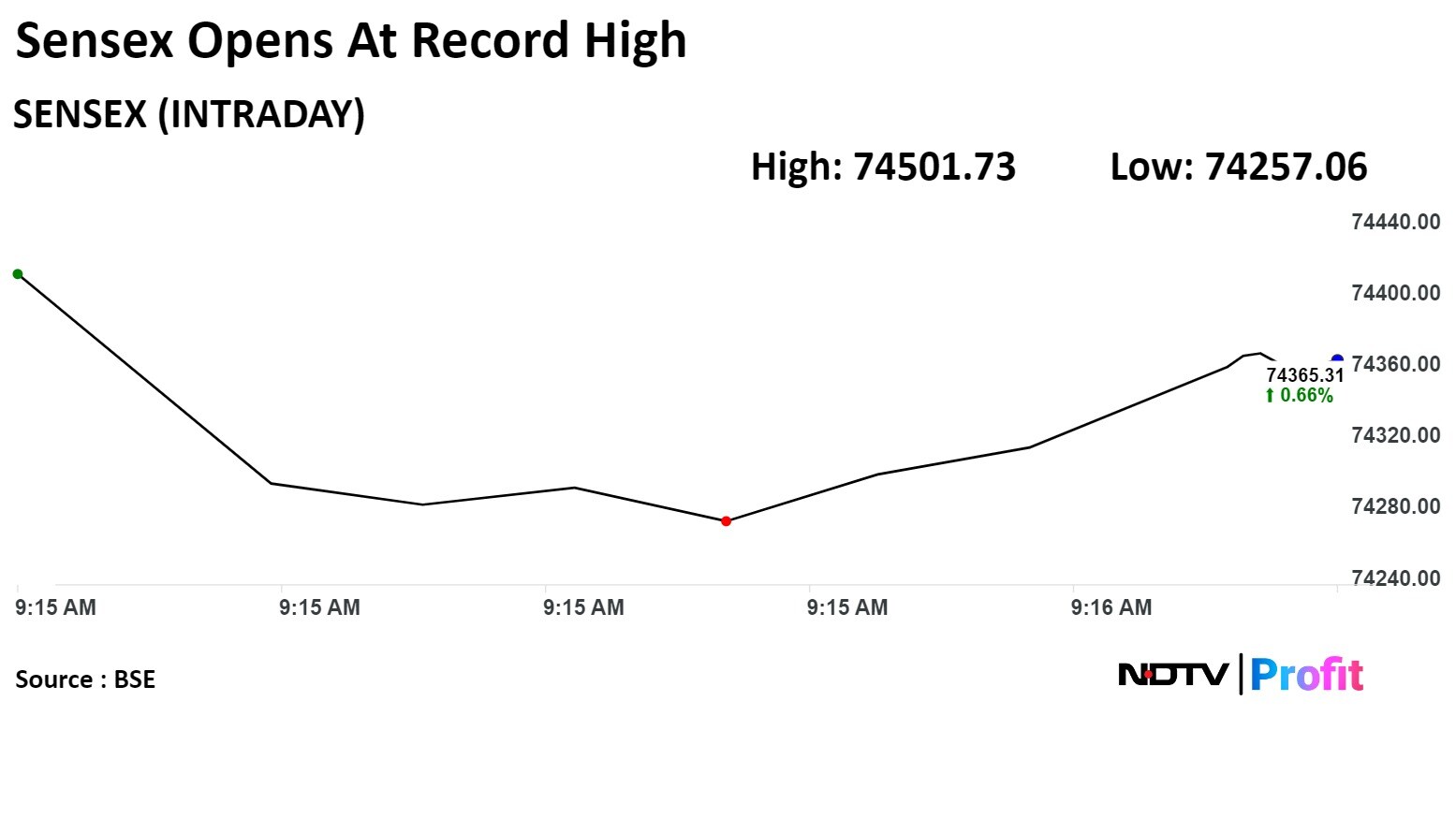

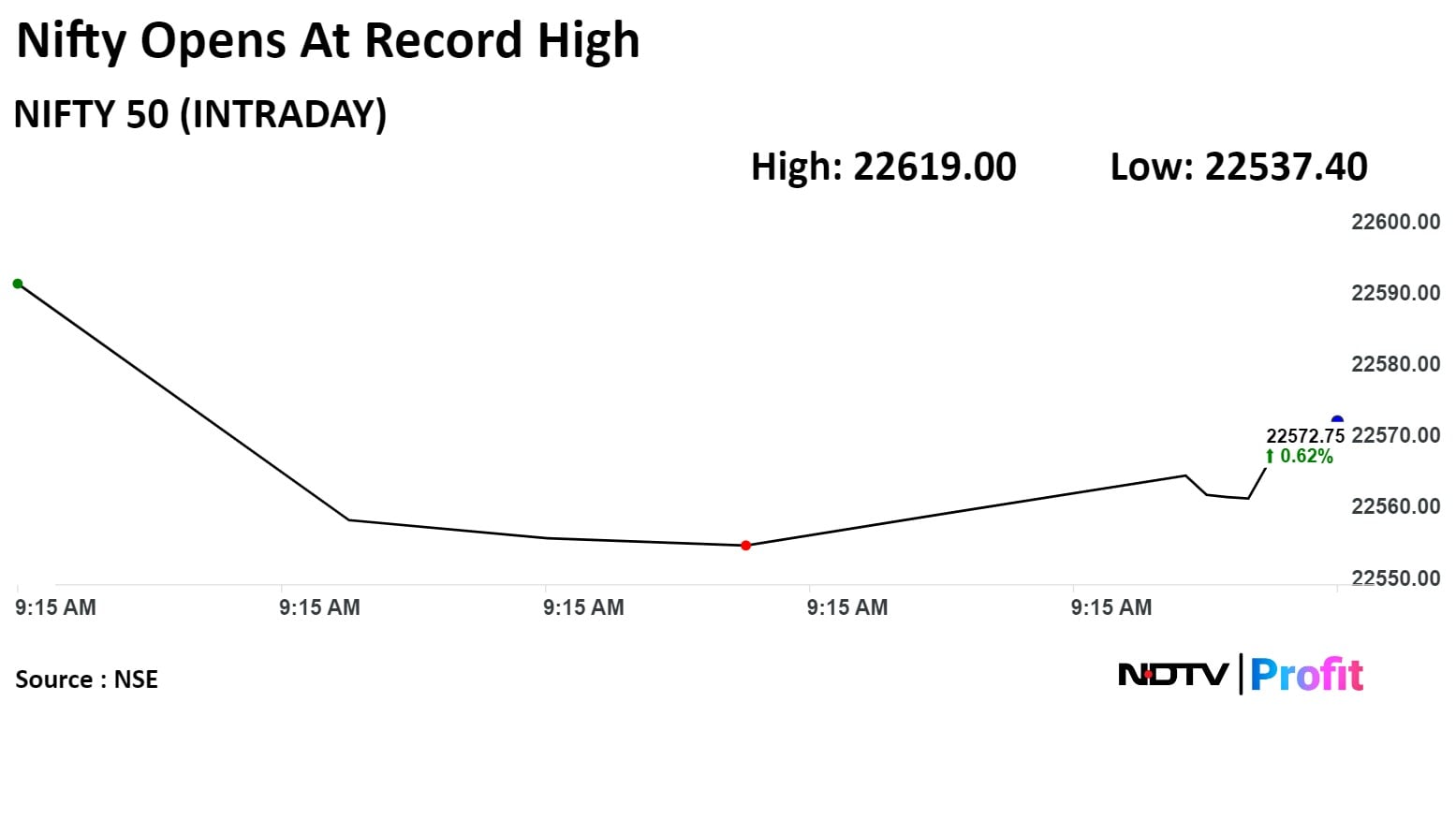

Benchmark equity indices recovered from two-day losses at opened at their lifetime high tracking the sentiment of global markets after Federal Reserve Chair Jerome Powell indicated rate cuts were imminent this year.

At pre-open, the S&P BSE Sensex Index was at 74,413.82, up 537.00 points or 0.73% while the NSE Nifty 50 was at 22,592.10, 157.45 points or 0.70%. The Nifty hit its lifetime high of 22,619 points and the Sensex hit 74,501.3 points.

"Nifty can find support at 22,350 followed by 22,300 and 22,250. On the higher side, 22,500 can be an immediate resistance, followed by 22,550 and 22,700," said Deven Mehata, research analyst at Choice Broking.

Benchmark equity indices recovered from two-day losses at opened at their lifetime high tracking the sentiment of global markets after Federal Reserve Chair Jerome Powell indicated rate cuts were imminent this year.

At pre-open, the S&P BSE Sensex Index was at 74,413.82, up 537.00 points or 0.73% while the NSE Nifty 50 was at 22,592.10, 157.45 points or 0.70%. The Nifty hit its lifetime high of 22,619 points and the Sensex hit 74,501.3 points.