Overseas investors remained net sellers of Indian equities on Thursday.

Foreign portfolio investors sold stocks worth Rs 1,356.29 crore, according to provisional data from the National Stock Exchange.

Domestic institutional investors remained buyers and mopped up equities worth Rs 139.47 crore, the NSE data showed.

Foreign institutions have been net buyers of Rs 16619 crore worth of Indian equities so far in 2024, according to data from the National Securities Depository Ltd., updated till the previous trading day.

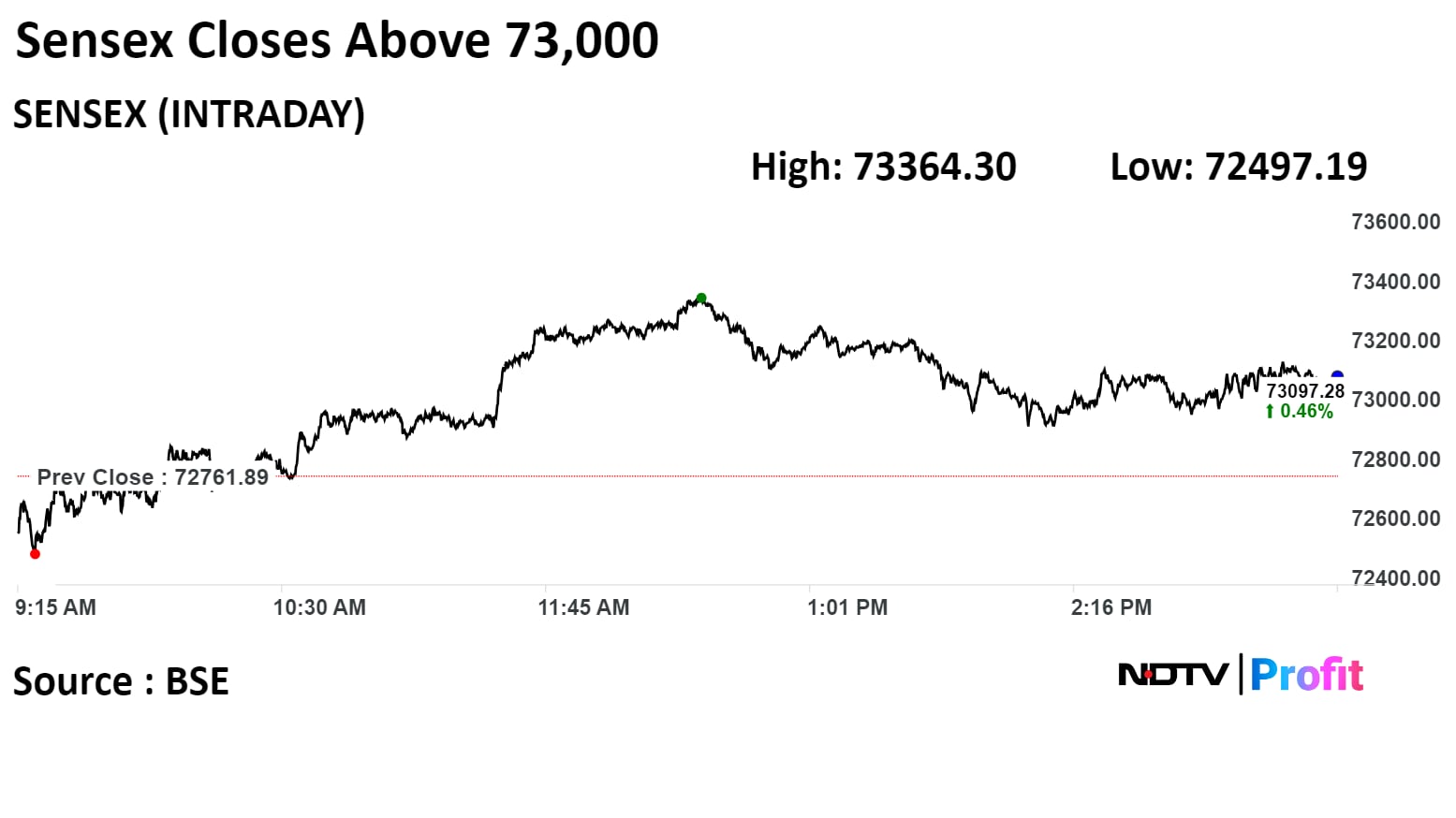

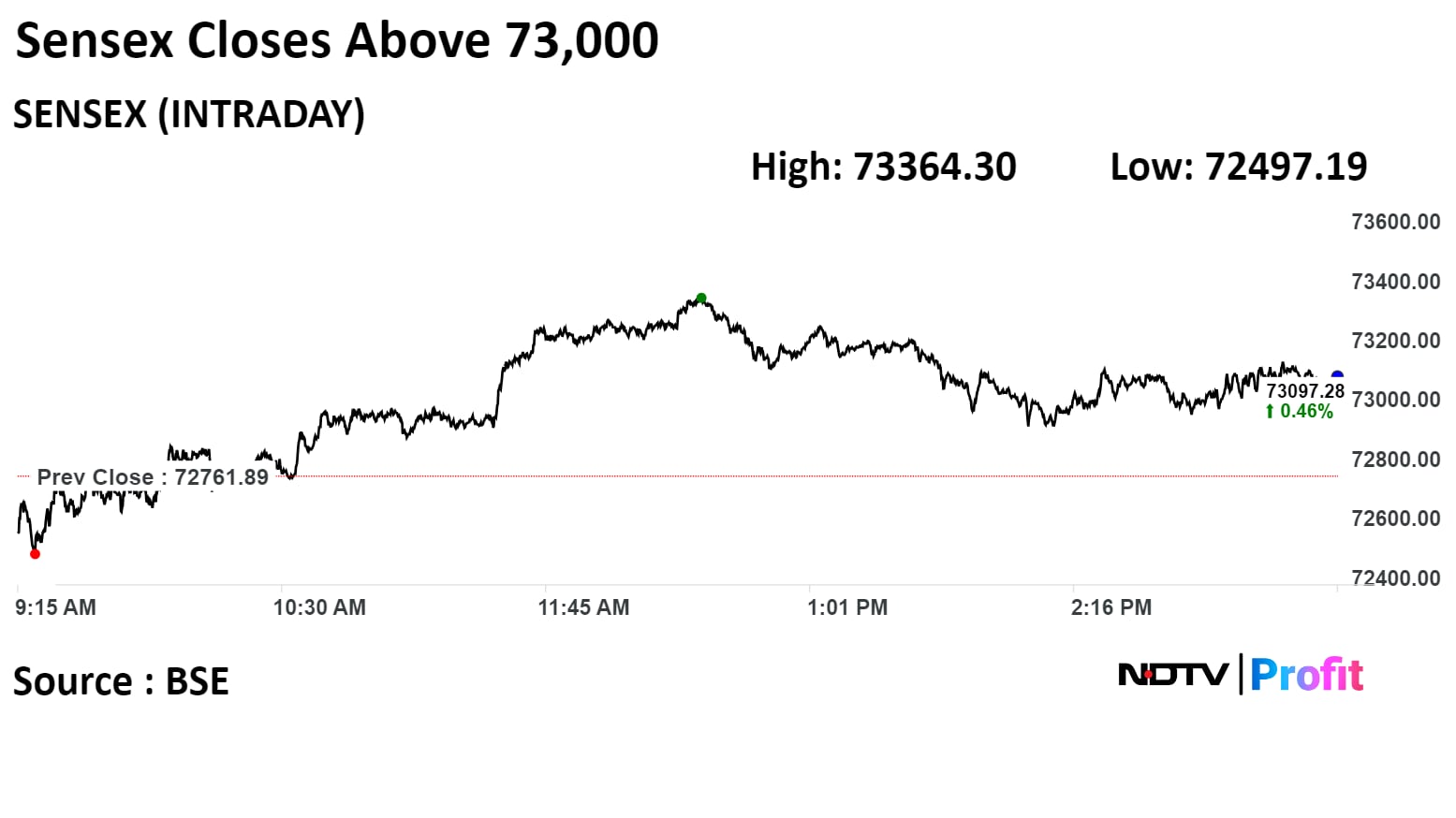

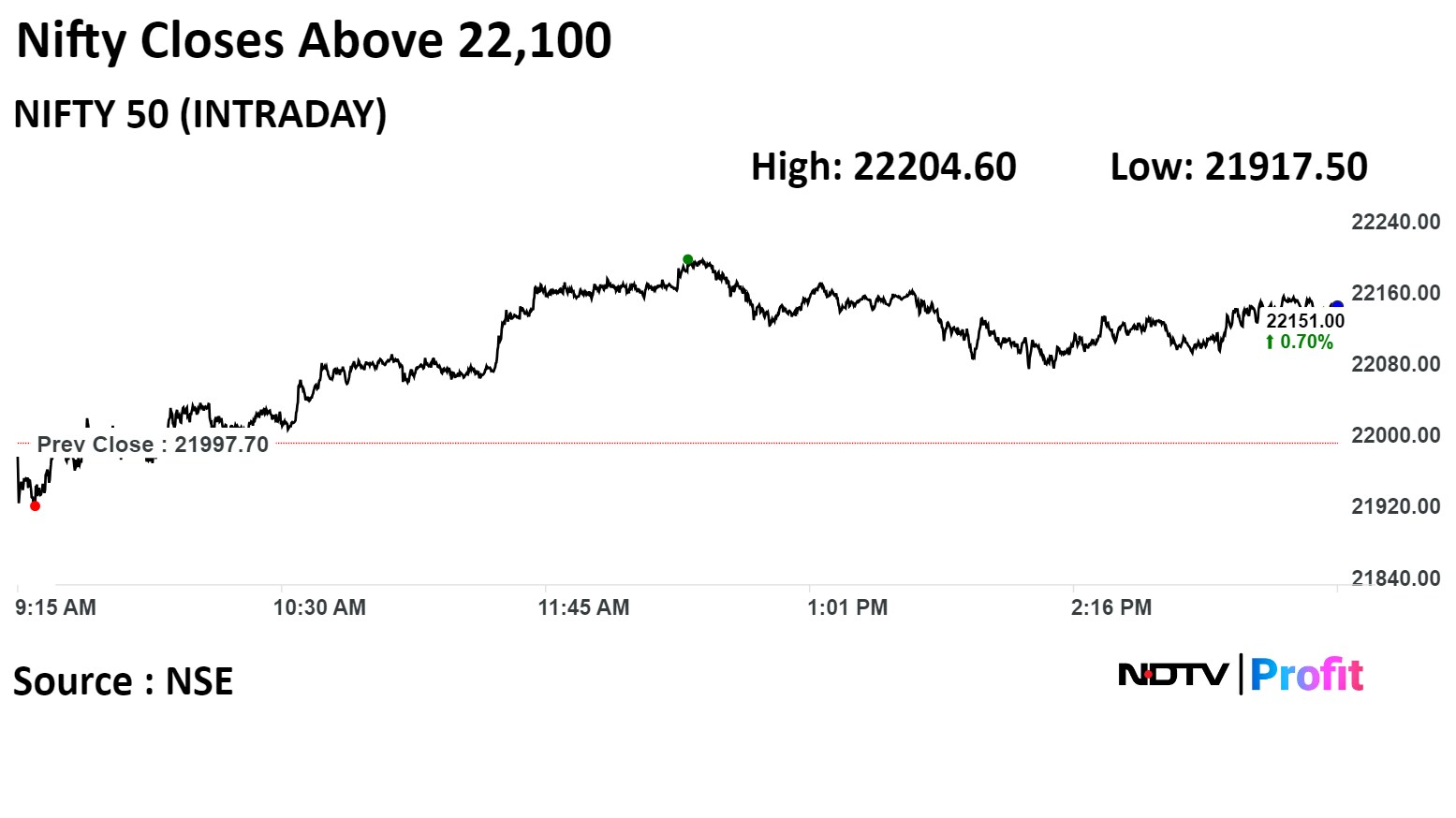

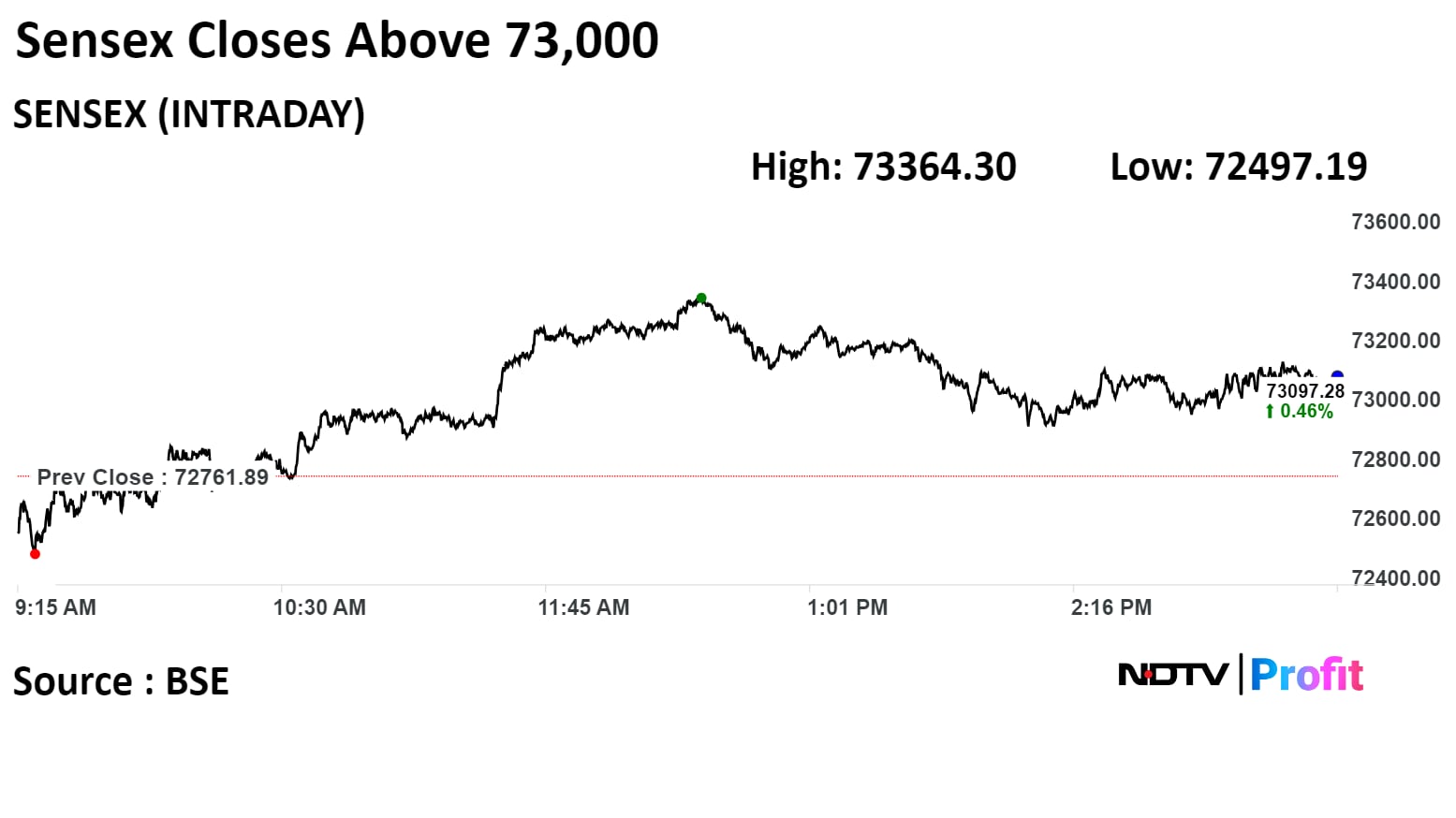

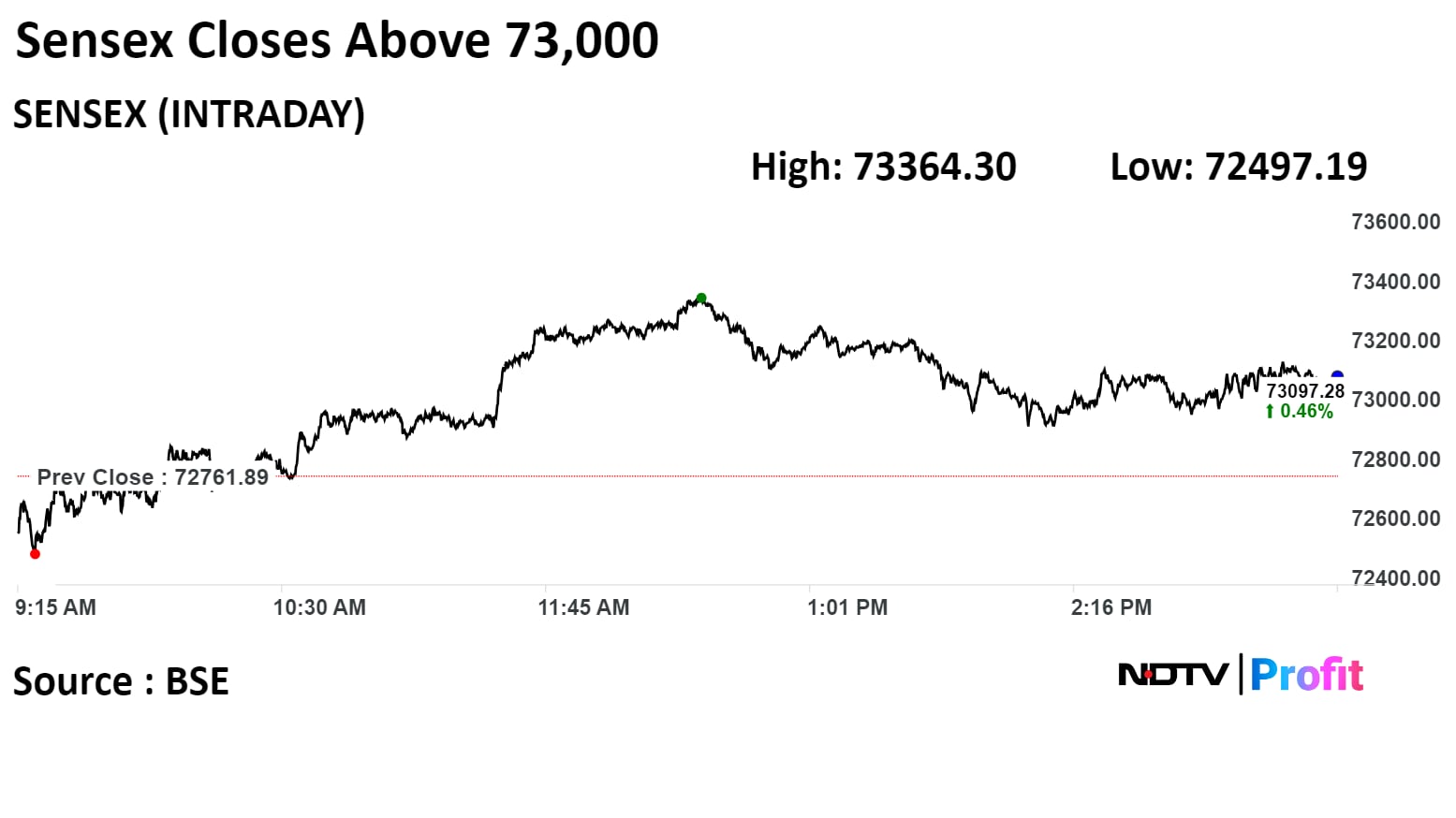

The NSE Nifty 50 closed 153.30 points or 0.7% higher at 22,151.00, and the S&P BSE Sensex ended 335.39 points or 0.46% up at 73,097.28.

The yield on the 10-year bond closed flat at 7.04% on Thursday.

Source: Bloomberg

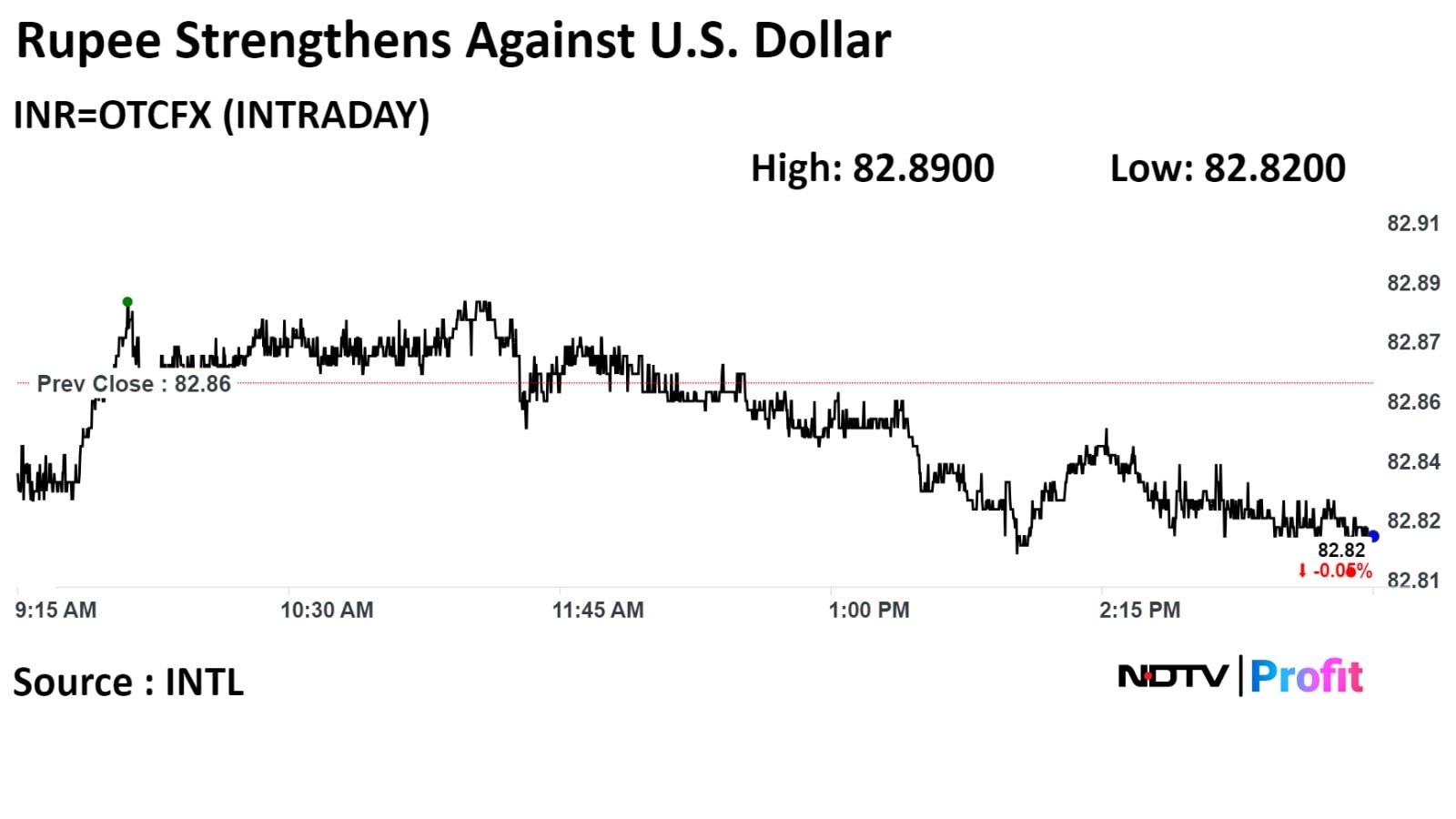

The local currency strengthened by 3 paise to close at 82.83 against the U.S. Dollar.

It closed at 82.86 on Wednesday.

Source: Bloomberg

The local currency strengthened by 3 paise to close at 82.83 against the U.S. Dollar.

It closed at 82.86 on Wednesday.

Source: Bloomberg

India's benchmark indices recovered from worst selloff in over a month to end Thursday's trading session higher as Infosys Ltd., Larsen & Toubro Ltd., and Bharti Airtel Ltd. gained.

The NSE Nifty 50 settled 148.95 points or 0.68% higher at 22,146.65, and the S&P BSE Sensex ended 335.39 points or 0.46% up at 73,097.28.

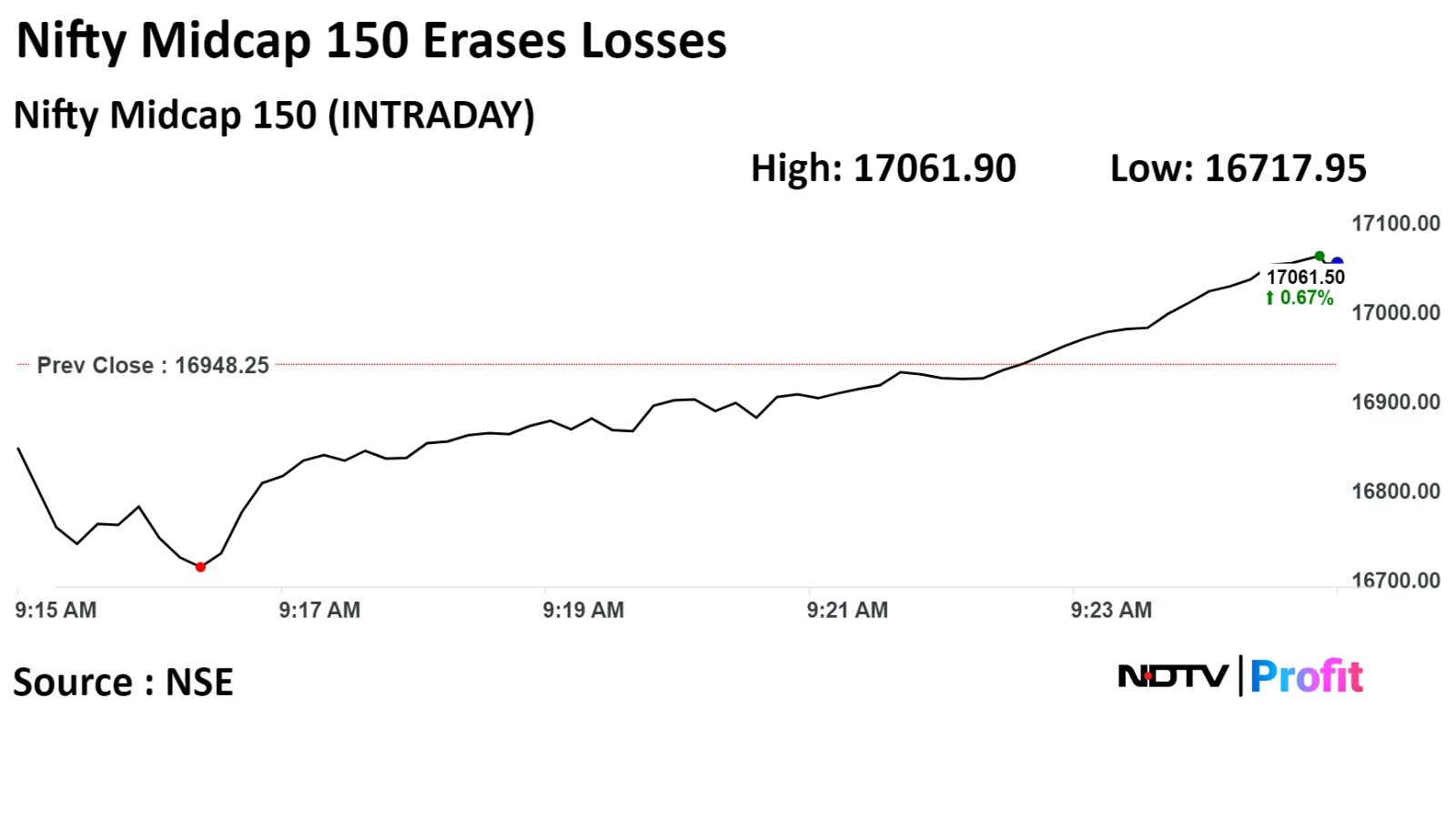

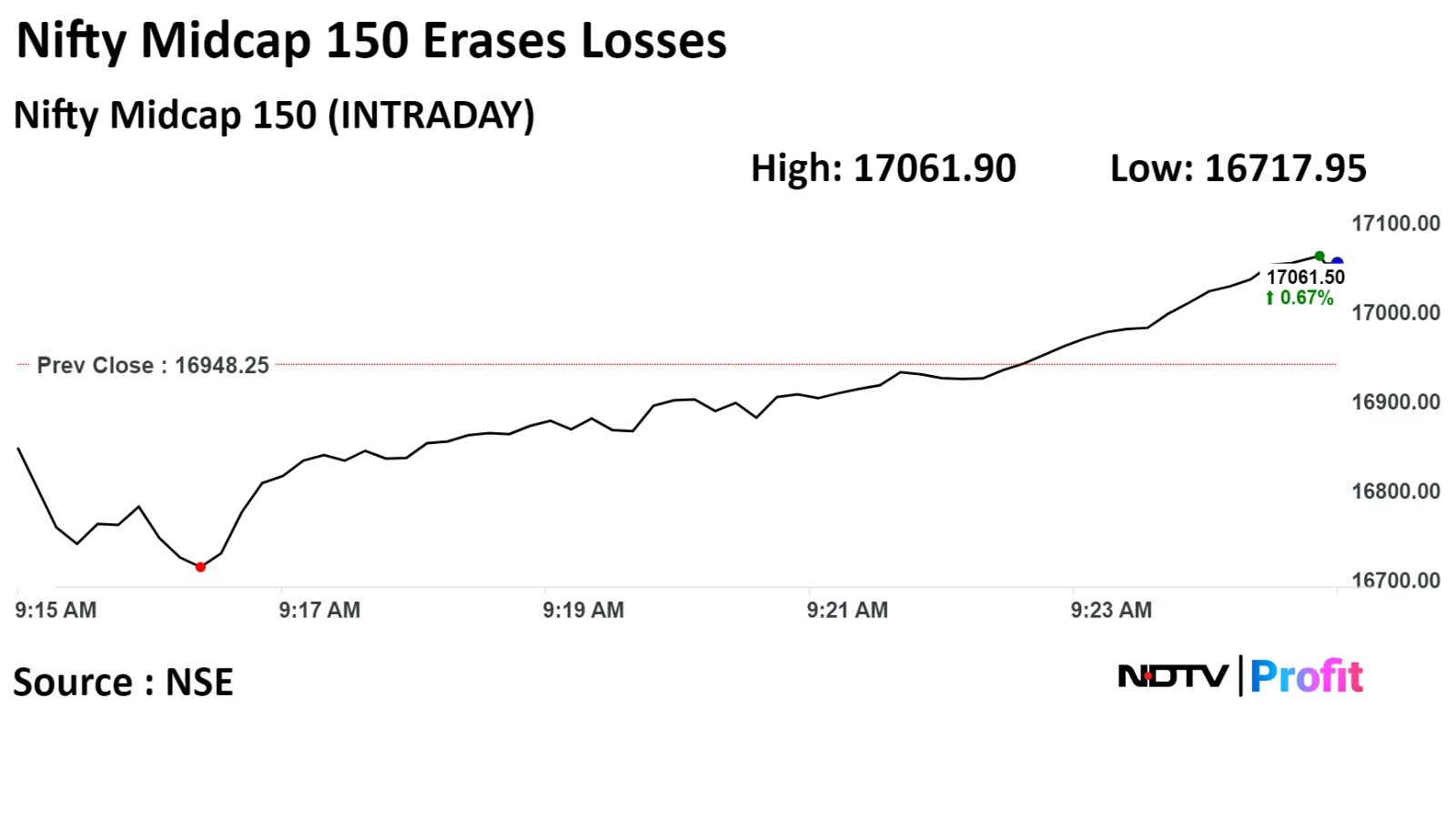

Broader markets also rebounded from three-day decline. The NSE Nifty Smallcap 250 ended 3.11% higher at 13,892.70. The NSE Nifty Midcap 150 settled 2.3% higher at 17,308.75.

Intrday, the NSE Nifty 50 0.94% to 22,204.60, and the S&P BSE Sensex rose 0.83% to 73,364.30.

India's benchmark indices recovered from worst selloff in over a month to end Thursday's trading session higher as Infosys Ltd., Larsen & Toubro Ltd., and Bharti Airtel Ltd. gained.

The NSE Nifty 50 settled 148.95 points or 0.68% higher at 22,146.65, and the S&P BSE Sensex ended 335.39 points or 0.46% up at 73,097.28.

Broader markets also rebounded from three-day decline. The NSE Nifty Smallcap 250 ended 3.11% higher at 13,892.70. The NSE Nifty Midcap 150 settled 2.3% higher at 17,308.75.

Intrday, the NSE Nifty 50 0.94% to 22,204.60, and the S&P BSE Sensex rose 0.83% to 73,364.30.

India's benchmark indices recovered from worst selloff in over a month to end Thursday's trading session higher as Infosys Ltd., Larsen & Toubro Ltd., and Bharti Airtel Ltd. gained.

The NSE Nifty 50 settled 148.95 points or 0.68% higher at 22,146.65, and the S&P BSE Sensex ended 335.39 points or 0.46% up at 73,097.28.

Broader markets also rebounded from three-day decline. The NSE Nifty Smallcap 250 ended 3.11% higher at 13,892.70. The NSE Nifty Midcap 150 settled 2.3% higher at 17,308.75.

Intrday, the NSE Nifty 50 0.94% to 22,204.60, and the S&P BSE Sensex rose 0.83% to 73,364.30.

India's benchmark indices recovered from worst selloff in over a month to end Thursday's trading session higher as Infosys Ltd., Larsen & Toubro Ltd., and Bharti Airtel Ltd. gained.

The NSE Nifty 50 settled 148.95 points or 0.68% higher at 22,146.65, and the S&P BSE Sensex ended 335.39 points or 0.46% up at 73,097.28.

Broader markets also rebounded from three-day decline. The NSE Nifty Smallcap 250 ended 3.11% higher at 13,892.70. The NSE Nifty Midcap 150 settled 2.3% higher at 17,308.75.

Intrday, the NSE Nifty 50 0.94% to 22,204.60, and the S&P BSE Sensex rose 0.83% to 73,364.30.

"Today, the benchmark indices witnessed pullback rally, the Nifty ends 153 points higher while the Sensex was up by 314 points. Among Sectors, Media, Digital, Oil and Gas, Metal stocks registered intraday buying interest whereas Banking and Financial stocks witnessed intraday selling pressure at higher levels," said Shrikant Chouhan, head equity research, Kotak Securities.

Technically, after muted opening the market bounce back sharply but it failed to close above 20-day Simple Moving Average resistance level. We are of the view that, the short-term market texture is still in to the weak side but intraday texture suggesting pullback formation is likely continue in the near future. For day traders now, 22,000/72,500 would be the crucial support level, above which, the nifty could continue the pullback formation till 22,250-22,275/73,400-73,500., Chouhan said.

On the flip side, below 22,000/72,500 the selling pressure is likely to accelerate. Below 22,000/72,500, the market could slip till 21,900-21,850/72,200-72,000. The intraday market texture is volatile hence; level based trading would be the ideal strategy for the day traders, he added.

India's benchmark indices recovered from worst selloff in over a month to end Thursday's trading session higher as Infosys Ltd., Larsen & Toubro Ltd., and Bharti Airtel Ltd. gained.

The NSE Nifty 50 settled 148.95 points or 0.68% higher at 22,146.65, and the S&P BSE Sensex ended 335.39 points or 0.46% up at 73,097.28.

Broader markets also rebounded from three-day decline. The NSE Nifty Smallcap 250 ended 3.11% higher at 13,892.70. The NSE Nifty Midcap 150 settled 2.3% higher at 17,308.75.

Intrday, the NSE Nifty 50 0.94% to 22,204.60, and the S&P BSE Sensex rose 0.83% to 73,364.30.

India's benchmark indices recovered from worst selloff in over a month to end Thursday's trading session higher as Infosys Ltd., Larsen & Toubro Ltd., and Bharti Airtel Ltd. gained.

The NSE Nifty 50 settled 148.95 points or 0.68% higher at 22,146.65, and the S&P BSE Sensex ended 335.39 points or 0.46% up at 73,097.28.

Broader markets also rebounded from three-day decline. The NSE Nifty Smallcap 250 ended 3.11% higher at 13,892.70. The NSE Nifty Midcap 150 settled 2.3% higher at 17,308.75.

Intrday, the NSE Nifty 50 0.94% to 22,204.60, and the S&P BSE Sensex rose 0.83% to 73,364.30.

India's benchmark indices recovered from worst selloff in over a month to end Thursday's trading session higher as Infosys Ltd., Larsen & Toubro Ltd., and Bharti Airtel Ltd. gained.

The NSE Nifty 50 settled 148.95 points or 0.68% higher at 22,146.65, and the S&P BSE Sensex ended 335.39 points or 0.46% up at 73,097.28.

Broader markets also rebounded from three-day decline. The NSE Nifty Smallcap 250 ended 3.11% higher at 13,892.70. The NSE Nifty Midcap 150 settled 2.3% higher at 17,308.75.

Intrday, the NSE Nifty 50 0.94% to 22,204.60, and the S&P BSE Sensex rose 0.83% to 73,364.30.

India's benchmark indices recovered from worst selloff in over a month to end Thursday's trading session higher as Infosys Ltd., Larsen & Toubro Ltd., and Bharti Airtel Ltd. gained.

The NSE Nifty 50 settled 148.95 points or 0.68% higher at 22,146.65, and the S&P BSE Sensex ended 335.39 points or 0.46% up at 73,097.28.

Broader markets also rebounded from three-day decline. The NSE Nifty Smallcap 250 ended 3.11% higher at 13,892.70. The NSE Nifty Midcap 150 settled 2.3% higher at 17,308.75.

Intrday, the NSE Nifty 50 0.94% to 22,204.60, and the S&P BSE Sensex rose 0.83% to 73,364.30.

"Today, the benchmark indices witnessed pullback rally, the Nifty ends 153 points higher while the Sensex was up by 314 points. Among Sectors, Media, Digital, Oil and Gas, Metal stocks registered intraday buying interest whereas Banking and Financial stocks witnessed intraday selling pressure at higher levels," said Shrikant Chouhan, head equity research, Kotak Securities.

Technically, after muted opening the market bounce back sharply but it failed to close above 20-day Simple Moving Average resistance level. We are of the view that, the short-term market texture is still in to the weak side but intraday texture suggesting pullback formation is likely continue in the near future. For day traders now, 22,000/72,500 would be the crucial support level, above which, the nifty could continue the pullback formation till 22,250-22,275/73,400-73,500., Chouhan said.

On the flip side, below 22,000/72,500 the selling pressure is likely to accelerate. Below 22,000/72,500, the market could slip till 21,900-21,850/72,200-72,000. The intraday market texture is volatile hence; level based trading would be the ideal strategy for the day traders, he added.

Infosys Ltd., Larsen & Toubro Ltd., Bharti Airtel Ltd., Tata Consultancy Services Ltd., and HCL Technologies Ltd added positively to the index.

Axis Bank Ltd., HDFC Bank Ltd., ITC Ltd., State Bank of India, and Bajaj Finance Ltd limited gains to the index.

On NSE, 10 sectors advanced, and two declined out of 12 sectors. the Nifty Oil & Gas sector rose the most among sectoral indices, and the Nifty Bank index fell the most.

Broader markets outperformed. S&P BSE MidCap closed 2.28% higher and S&P BSE SmallCap ended 3.11% higher.

On BSE, all 20 sectoral indices ended higher, with the S&P BSE Services rising the most.

Market breadth was skewed in favour of buyers. Around 2,733 stocks rose, 1,143 declined, and 82 remained unchanged on BSE.

TVS Motor Co. Ltd is to consider issuance of redeemable preferential shares March 20.

Source: Exchange Filing

Bharat Electronics received orders worth Rs 1,940 crore .

It also got an order worth Rs 847.7 crore from L&T for supply of Warfare Sensors.

Bharat Electronics got other defence orders worth Rs 1,092.65 crore.

Source: Exchange Filing

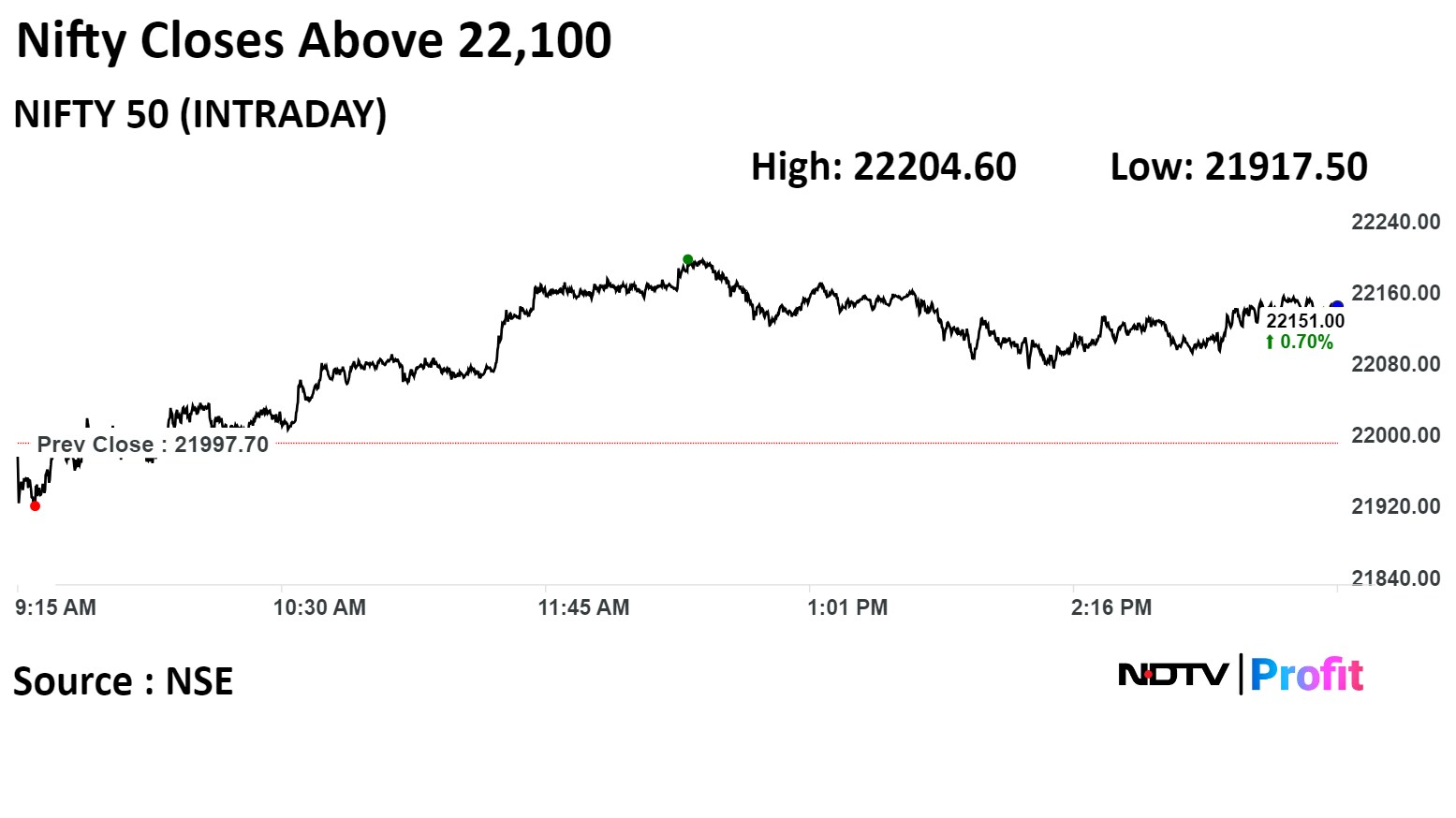

Biocon Biologics Ltd. had signed a 10-year supply pact with Eris Lifesciences.

It approved sale of branded formulations in India.

The pact worth Rs 1,242 crore to expand patient access to companies portfolio of products in India.

Source: Exchange Filing

Biocon Biologics Ltd. had signed a 10-year supply pact with Eris Lifesciences.

It approved sale of branded formulations in India.

The pact worth Rs 1,242 crore to expand patient access to companies portfolio of products in India.

Source: Exchange Filing

Shares of Hindustan Copper Ltd snapped their five day losing streak and jumped a day after the three- month contract of LME Copper jumped above $8900/tonne for the first time since April 2023.

Copper price jumped amid production cuts by smelters in China. "China's copper smelters pledged to control capacity while stopping short of coordinated output cuts, as the industry responds to a tightening in the global concentrate market that’s led to processing fees falling to near nothing," Bloomberg reported.

However, a report by Kotak Securities noted that, "There were no specific rates or volumes set for smelters to cut their production and each smelter will independently determine their extent of reduction."

The stock jumped as much as 11.15% to hit a high of Rs 261.25 apiece. It had fallen 17.59% in the last five sessions.

It pared gains to trade 10.91% higher at Rs 260.65 apiece, as of 3:00 p.m. This compares to a 0.53% advance in the NSE Nifty 50 Index.

It has risen 165.12% in the last twelve months. Total traded volume so far in the day stood at 2.28 times its 30-day average. The relative strength index was at 48.22.

Shares of Hindustan Copper Ltd snapped their five day losing streak and jumped a day after the three- month contract of LME Copper jumped above $8900/tonne for the first time since April 2023.

Copper price jumped amid production cuts by smelters in China. "China's copper smelters pledged to control capacity while stopping short of coordinated output cuts, as the industry responds to a tightening in the global concentrate market that’s led to processing fees falling to near nothing," Bloomberg reported.

However, a report by Kotak Securities noted that, "There were no specific rates or volumes set for smelters to cut their production and each smelter will independently determine their extent of reduction."

The stock jumped as much as 11.15% to hit a high of Rs 261.25 apiece. It had fallen 17.59% in the last five sessions.

It pared gains to trade 10.91% higher at Rs 260.65 apiece, as of 3:00 p.m. This compares to a 0.53% advance in the NSE Nifty 50 Index.

It has risen 165.12% in the last twelve months. Total traded volume so far in the day stood at 2.28 times its 30-day average. The relative strength index was at 48.22.

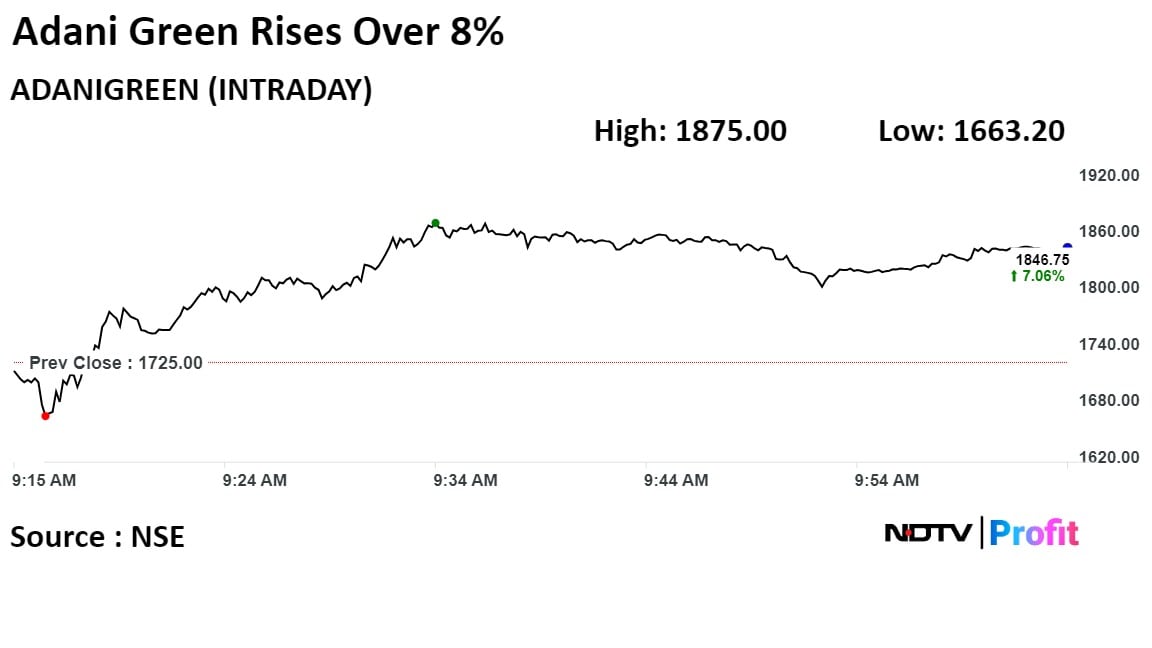

Adani Green Energy Ltd.'s unit operationalised incremental 126 MW of merchant wind power project in Gujarat.

The company's total operational renewable generation capacity now stands at 9,604 MW.

Source: Exchange Filing

Banks place bids worth Rs 39,670 crore in overnight VRR auction conducted today.

Notified amount for the auction was Rs 50,000 crore.

Auction cut-off was at 6.49%.

Source: RBI

Lupin Ltd has executed amendment pact of business transfer to record pending minor post-closing adjustments.

Alert: Signed Business Transfer Agreement with Lupin Manufacturing Solutions on Oct 16, 2023.

Source: Exchange Filing

Genesys International received a Rs 156 crore order from BMC to develop Mumbai's 3D city model and map stack.

Source: Exchange Filing

Unitech Ltd. had 1.03 crore shares or 0.4% equity changed hands in a large trade.

Buyers and sellers not known immediately.

Source: Bloomberg

Infibeam Avenues Ltd. had 70 lakh shares or 0.3% equity changed hands in a large trade.

Buyers and sellers are not known immediately.

Source: Bloomberg

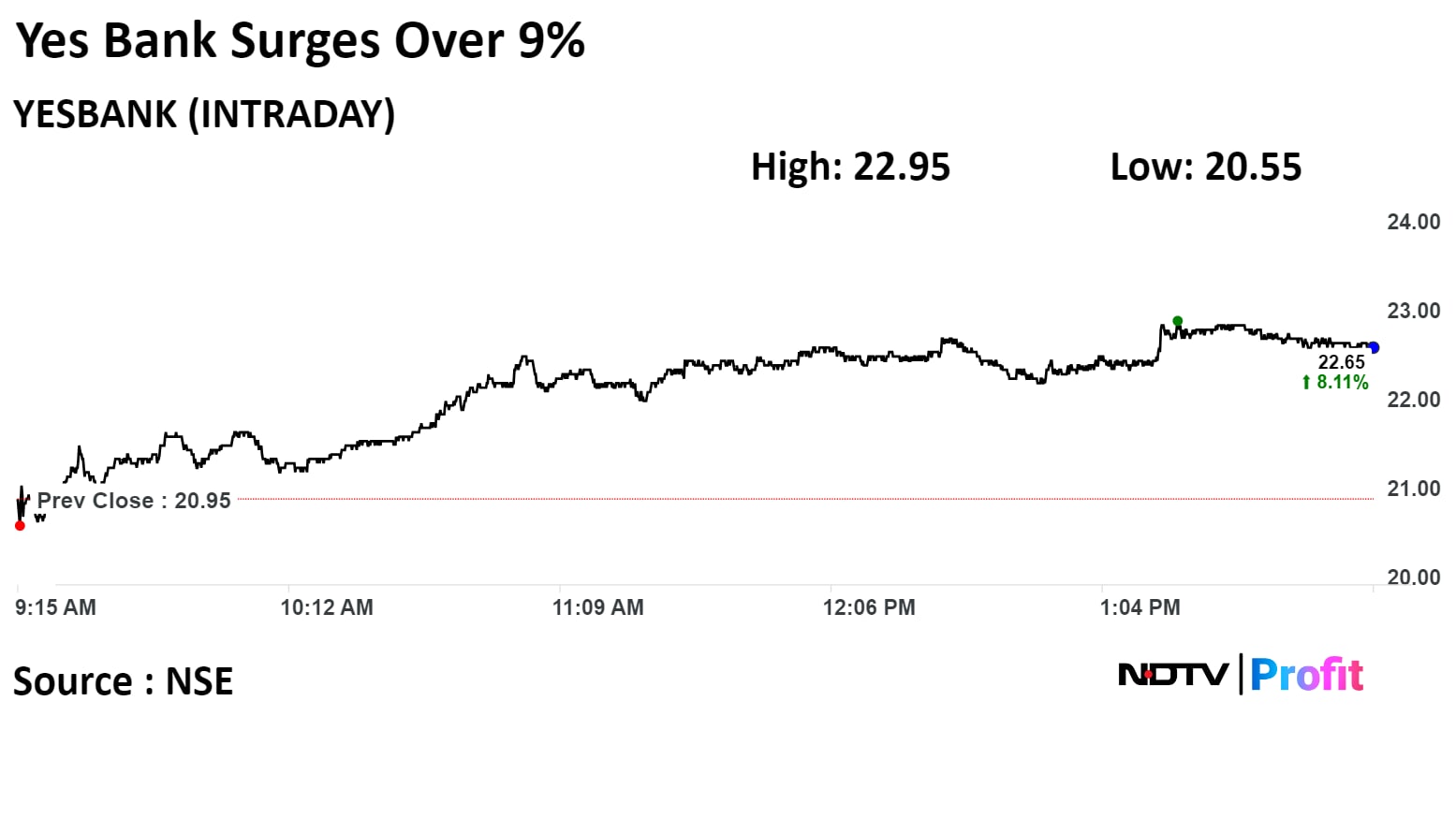

Yes Bank Ltd jumped over 9% on news that the promoter is looking to sell 51% stake to increase its valuation between $8-$9 billion.

However, Yes Bank has said the news is speculative in nature, and it doesn't feel right to comment on the article. Additionally, they clarified there are no 'material development' which is required to be disclosed, the lender said in the exchange filing.

The private lender has sent invitations to various lenders, including present stake holders in this regard. It has also reached out seek buyers in West Asia, Europe, and Japan, reported Money Control.

The scrip rose as much as 9.55% to Rs 22.95 apiece on NSE. It was trading 9.07% higher at Rs 22.85 as of 2:15 p.m., compared to 0.47% advance on NSE Nifty 50 index. The scrip had declined for last three consecutive session.

It has added 46.95% in 12 months. Total traded volume so far in the day stood at 1.3 times its 30-day average. The relative strength index was at 42.03.

Out of 11 analysts tracking the company, two recommend a 'hold', and nine suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an downside of 29.5%.

Yes Bank Ltd jumped over 9% on news that the promoter is looking to sell 51% stake to increase its valuation between $8-$9 billion.

However, Yes Bank has said the news is speculative in nature, and it doesn't feel right to comment on the article. Additionally, they clarified there are no 'material development' which is required to be disclosed, the lender said in the exchange filing.

The private lender has sent invitations to various lenders, including present stake holders in this regard. It has also reached out seek buyers in West Asia, Europe, and Japan, reported Money Control.

The scrip rose as much as 9.55% to Rs 22.95 apiece on NSE. It was trading 9.07% higher at Rs 22.85 as of 2:15 p.m., compared to 0.47% advance on NSE Nifty 50 index. The scrip had declined for last three consecutive session.

It has added 46.95% in 12 months. Total traded volume so far in the day stood at 1.3 times its 30-day average. The relative strength index was at 42.03.

Out of 11 analysts tracking the company, two recommend a 'hold', and nine suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an downside of 29.5%.

Praveg received an order for tent resorts in Bangaram and Thinnakara Islands from Lakshadweep Tourism department.

Source: Exchange Filing

Gujarat Mineral Development Corp appointed Anupma K. Iyer as CFO effective March 11.

Source: Exchange Filing

RBI to conduct overnight VRRR auction on March 14

Notified amount for the auction is Rs 50,000 crore

Date of reversal for auction is March 15

Source: RB

GAIL (India) is planning to enter LNG retail business with Rs 650 crore investment.

Source: Exchange Filing

Motherson Sumi Wiring India Ltd. had 15.9 lakh shares or 0.04% equity changed hands in a large trade.

Buyers and sellers are not known immediately.

Source: Bloomberg

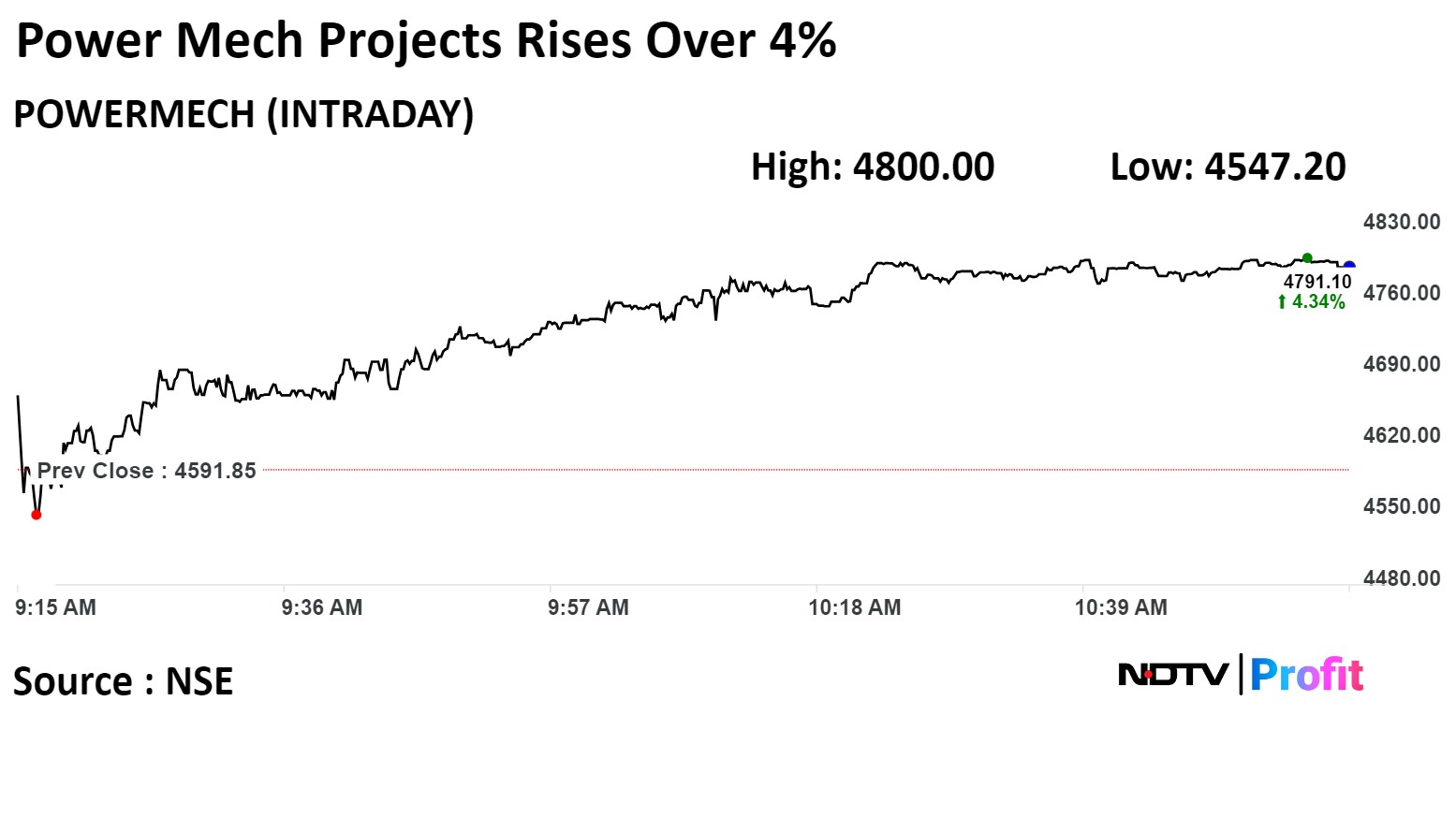

Power Mech Projects Ltd received an order worth Rs 306 crore for railway work from South East Central Railway.

Source: Exchange Filing

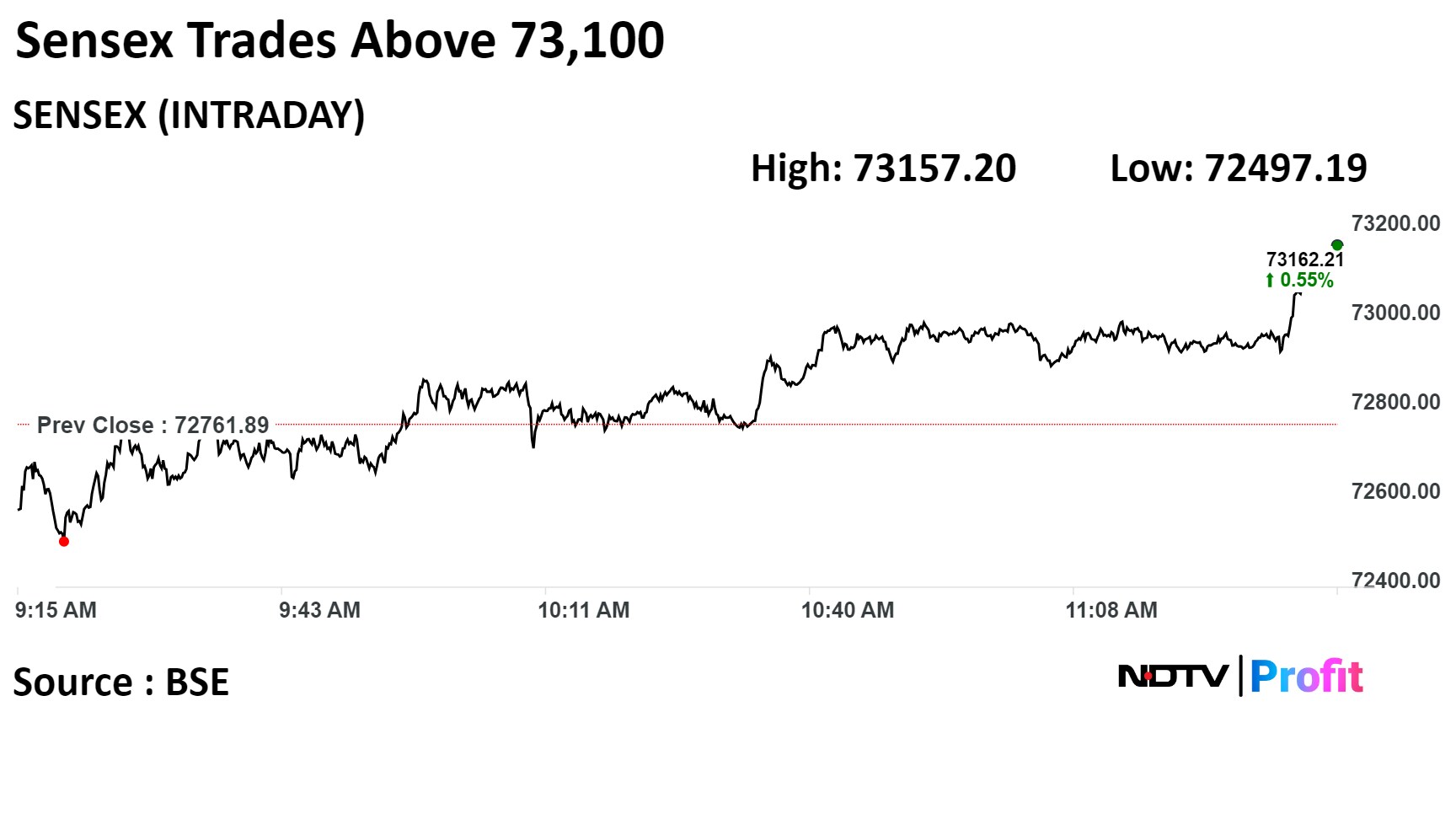

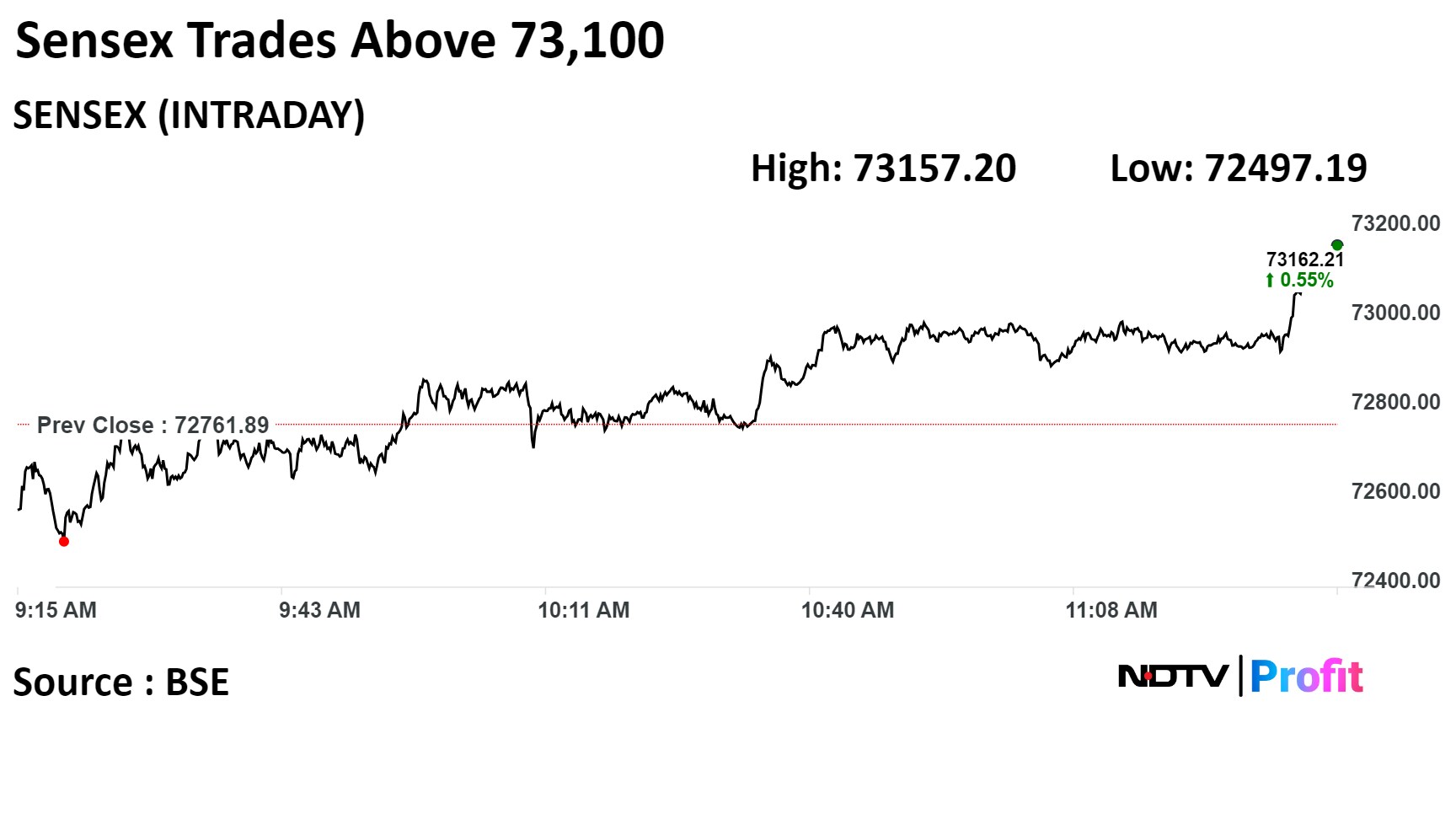

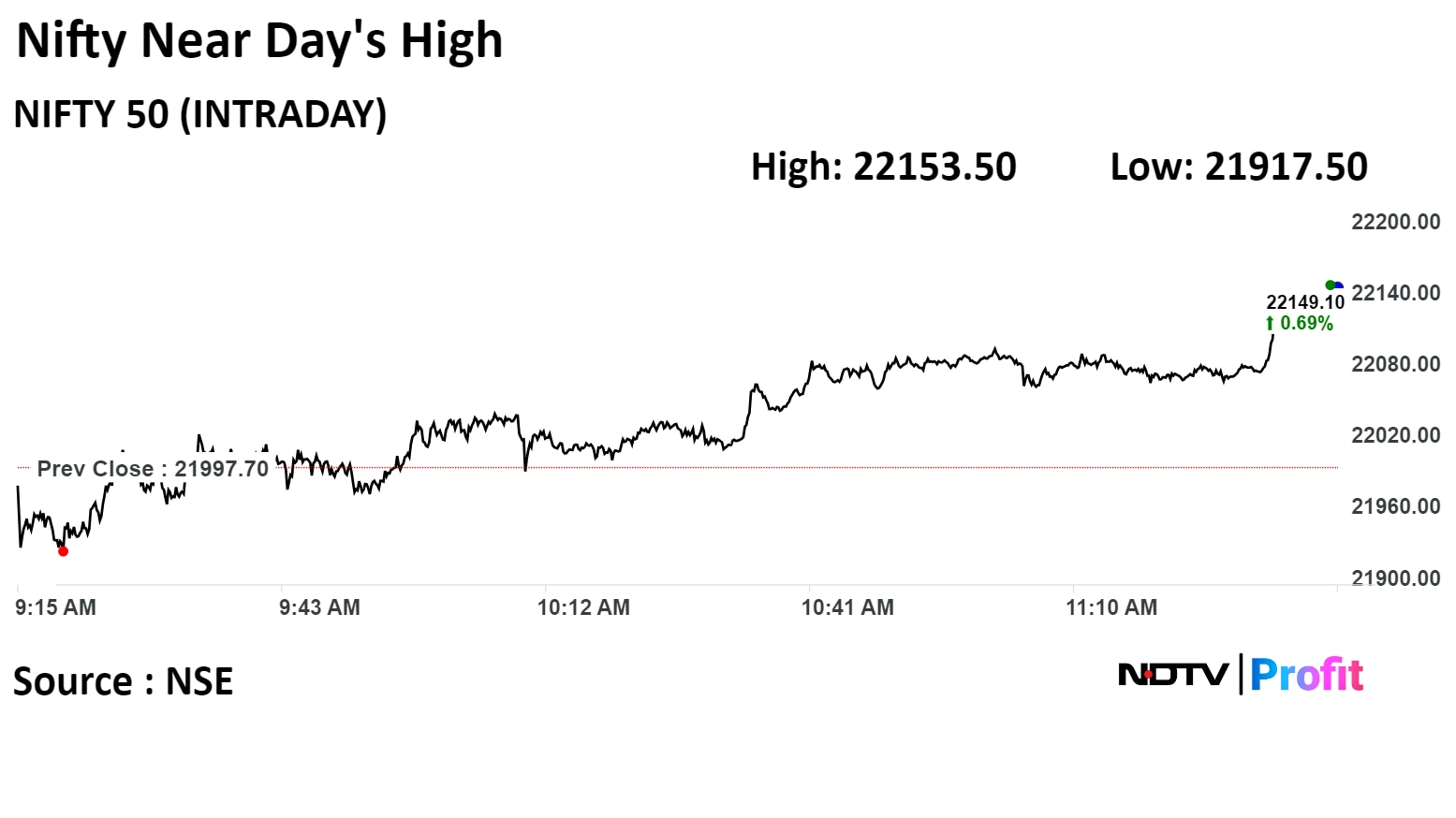

The benchmark equity indices erased their early losses on Thursday and were trading at their day's highs through midday.

The broader market indices came out of their losing streak and outperformed the benchmarks.

At 11:40 a.m., the NSE Nifty 50 traded at 22,142.15, up 144.45 points or 0.66%, while the S&P BSE Sensex was at 73,160.23, 398.34 points or 0.55%.

Analysts see Wednesday's fall in the markets as a buying opportunity. "If Nifty continues to fall toward the strong support level of 21,800, investors might view this as a good time to make new medium- to long-term investments," Deven Mehata, research analyst at Choice Broking, said.

Market veteran Vijay Kedia told NDTV Profit in an interview that this correction in the market is an indication of the next bull market. It is anticipated that the market will correct itself, thereby setting a trend for a new bull market or a new upswing, he said.

However, Mehata recommends that traders trade with extreme caution and strictly adhere to stop-loss levels.

The benchmark equity indices erased their early losses on Thursday and were trading at their day's highs through midday.

The broader market indices came out of their losing streak and outperformed the benchmarks.

At 11:40 a.m., the NSE Nifty 50 traded at 22,142.15, up 144.45 points or 0.66%, while the S&P BSE Sensex was at 73,160.23, 398.34 points or 0.55%.

Analysts see Wednesday's fall in the markets as a buying opportunity. "If Nifty continues to fall toward the strong support level of 21,800, investors might view this as a good time to make new medium- to long-term investments," Deven Mehata, research analyst at Choice Broking, said.

Market veteran Vijay Kedia told NDTV Profit in an interview that this correction in the market is an indication of the next bull market. It is anticipated that the market will correct itself, thereby setting a trend for a new bull market or a new upswing, he said.

However, Mehata recommends that traders trade with extreme caution and strictly adhere to stop-loss levels.

The benchmark equity indices erased their early losses on Thursday and were trading at their day's highs through midday.

The broader market indices came out of their losing streak and outperformed the benchmarks.

At 11:40 a.m., the NSE Nifty 50 traded at 22,142.15, up 144.45 points or 0.66%, while the S&P BSE Sensex was at 73,160.23, 398.34 points or 0.55%.

Analysts see Wednesday's fall in the markets as a buying opportunity. "If Nifty continues to fall toward the strong support level of 21,800, investors might view this as a good time to make new medium- to long-term investments," Deven Mehata, research analyst at Choice Broking, said.

Market veteran Vijay Kedia told NDTV Profit in an interview that this correction in the market is an indication of the next bull market. It is anticipated that the market will correct itself, thereby setting a trend for a new bull market or a new upswing, he said.

However, Mehata recommends that traders trade with extreme caution and strictly adhere to stop-loss levels.

The benchmark equity indices erased their early losses on Thursday and were trading at their day's highs through midday.

The broader market indices came out of their losing streak and outperformed the benchmarks.

At 11:40 a.m., the NSE Nifty 50 traded at 22,142.15, up 144.45 points or 0.66%, while the S&P BSE Sensex was at 73,160.23, 398.34 points or 0.55%.

Analysts see Wednesday's fall in the markets as a buying opportunity. "If Nifty continues to fall toward the strong support level of 21,800, investors might view this as a good time to make new medium- to long-term investments," Deven Mehata, research analyst at Choice Broking, said.

Market veteran Vijay Kedia told NDTV Profit in an interview that this correction in the market is an indication of the next bull market. It is anticipated that the market will correct itself, thereby setting a trend for a new bull market or a new upswing, he said.

However, Mehata recommends that traders trade with extreme caution and strictly adhere to stop-loss levels.

The benchmark equity indices erased their early losses on Thursday and were trading at their day's highs through midday.

The broader market indices came out of their losing streak and outperformed the benchmarks.

At 11:40 a.m., the NSE Nifty 50 traded at 22,142.15, up 144.45 points or 0.66%, while the S&P BSE Sensex was at 73,160.23, 398.34 points or 0.55%.

Analysts see Wednesday's fall in the markets as a buying opportunity. "If Nifty continues to fall toward the strong support level of 21,800, investors might view this as a good time to make new medium- to long-term investments," Deven Mehata, research analyst at Choice Broking, said.

Market veteran Vijay Kedia told NDTV Profit in an interview that this correction in the market is an indication of the next bull market. It is anticipated that the market will correct itself, thereby setting a trend for a new bull market or a new upswing, he said.

However, Mehata recommends that traders trade with extreme caution and strictly adhere to stop-loss levels.

The benchmark equity indices erased their early losses on Thursday and were trading at their day's highs through midday.

The broader market indices came out of their losing streak and outperformed the benchmarks.

At 11:40 a.m., the NSE Nifty 50 traded at 22,142.15, up 144.45 points or 0.66%, while the S&P BSE Sensex was at 73,160.23, 398.34 points or 0.55%.

Analysts see Wednesday's fall in the markets as a buying opportunity. "If Nifty continues to fall toward the strong support level of 21,800, investors might view this as a good time to make new medium- to long-term investments," Deven Mehata, research analyst at Choice Broking, said.

Market veteran Vijay Kedia told NDTV Profit in an interview that this correction in the market is an indication of the next bull market. It is anticipated that the market will correct itself, thereby setting a trend for a new bull market or a new upswing, he said.

However, Mehata recommends that traders trade with extreme caution and strictly adhere to stop-loss levels.

The benchmark equity indices erased their early losses on Thursday and were trading at their day's highs through midday.

The broader market indices came out of their losing streak and outperformed the benchmarks.

At 11:40 a.m., the NSE Nifty 50 traded at 22,142.15, up 144.45 points or 0.66%, while the S&P BSE Sensex was at 73,160.23, 398.34 points or 0.55%.

Analysts see Wednesday's fall in the markets as a buying opportunity. "If Nifty continues to fall toward the strong support level of 21,800, investors might view this as a good time to make new medium- to long-term investments," Deven Mehata, research analyst at Choice Broking, said.

Market veteran Vijay Kedia told NDTV Profit in an interview that this correction in the market is an indication of the next bull market. It is anticipated that the market will correct itself, thereby setting a trend for a new bull market or a new upswing, he said.

However, Mehata recommends that traders trade with extreme caution and strictly adhere to stop-loss levels.

The benchmark equity indices erased their early losses on Thursday and were trading at their day's highs through midday.

The broader market indices came out of their losing streak and outperformed the benchmarks.

At 11:40 a.m., the NSE Nifty 50 traded at 22,142.15, up 144.45 points or 0.66%, while the S&P BSE Sensex was at 73,160.23, 398.34 points or 0.55%.

Analysts see Wednesday's fall in the markets as a buying opportunity. "If Nifty continues to fall toward the strong support level of 21,800, investors might view this as a good time to make new medium- to long-term investments," Deven Mehata, research analyst at Choice Broking, said.

Market veteran Vijay Kedia told NDTV Profit in an interview that this correction in the market is an indication of the next bull market. It is anticipated that the market will correct itself, thereby setting a trend for a new bull market or a new upswing, he said.

However, Mehata recommends that traders trade with extreme caution and strictly adhere to stop-loss levels.

Shares of Infosys Ltd., Larsen & Toubro Ltd., ICICI Bank Ltd., Bharti Airtel Ltd. and Adani Enterprises Ltd. contributed the most to the gains in the Nifty.

HDFC Bank Ltd., Tata Steel Ltd., Tata Motors Ltd., ITC Ltd. and Reliance Industries Ltd. capped the upside.

All sectoral indices on the NSE recovered, except Nifty Realty, which traded flat. The Nifty Media gained the most, followed by Oil & Gas.

The broader markets outperformed as the BSE MidCap traded 1.9% higher and the BSE SmallCap traded 2.8% higher.

All the 20 sectoral indices on the BSE gained, with S&P BSE Services rising the most.

The market breadth was skewed in favour of the buyers as 2,634 stocks gained, 1,101 declined and 99 remain unchanged on the BSE.

NTPC Group crosses 400 billion units power generation in 2023-24.

Group surpasses generation of 399.3 BU in previous year.

Average plant loading factor of 77.065 for NTPC coal stations.

DB Realty Ltd approved incorporation of unit Advent International.

The company will separate hospitality operations into new unit Advent International.

Shareholders will get one share of Advent International for each share held of company.

Unit Advent International to be listed on BSE & NS.

Source: Exchange Filing

HSBC upgrades IPCA Labs to Buy; TP: 1335 (earlier 1125)

Expect Ipca to see margin expansion

Margins aided by: growth in focus markets, easing cost pressure

Margins to improve from 16% to 21%; PAT CAGR of c50% for FY24-26e

Start of US supplies will be a key catalyst

Risks: slowdown in the India market and adverse developments in export markets

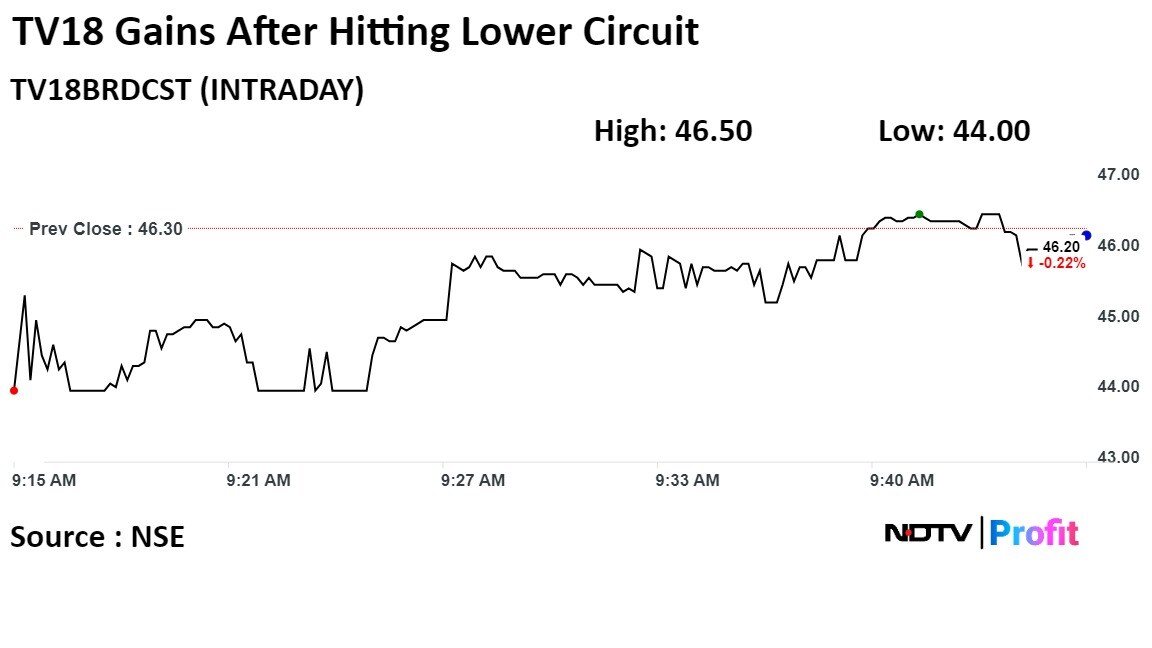

Ministry of Information and Broadcasting has blocked 18 OTT platforms for obscene and vulgar content after multiple warnings.

The ministry blocked 19 websites, 10 apps, 57 social media handles of OTT platforms nationwide.

Action on OTT platforms as content in violation of IT Act, Indian Penal Code.

Action on OTT platforms as content in violation of Indecent representation of Women (Prohibition) Act.

Source: PIB

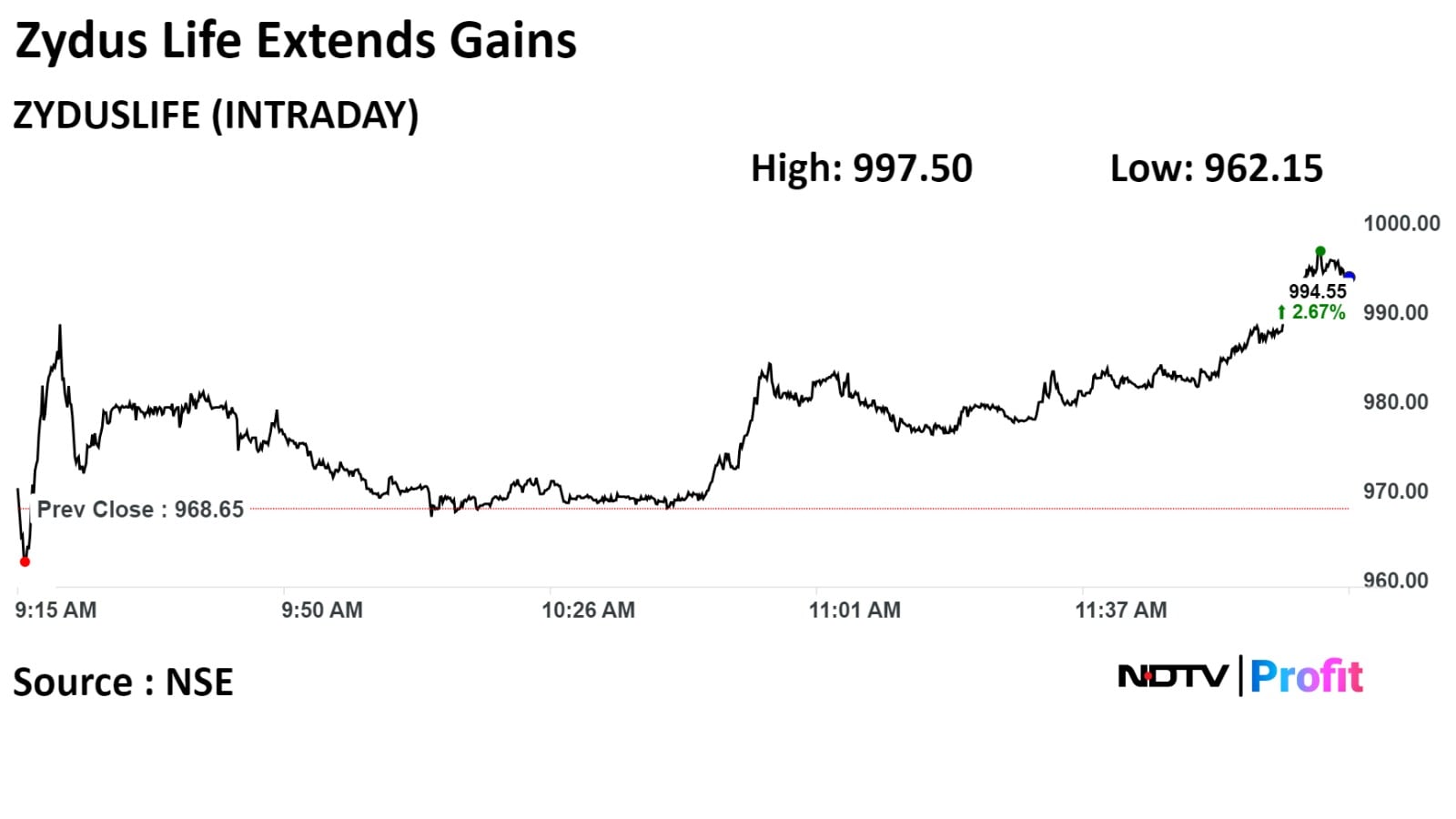

Zydus Lifesciences received U.S. Food and Drug Administration approval for Chlorpromazine Hydrochloride injection.

Alert: Chlorpromazine Hydrochloride Injection is used to treat mental/mood disorders.

Source: Exchange Filing

Zydus Lifesciences received a tentative approval from U.S. FDA for Edaravone Injection.

Alert: Edaravone is used to treat certain type of nerve disease.

Source: Exchange Filing

Zydus Lifesciences received U.S. Food and Drug Administration approval for Chlorpromazine Hydrochloride injection.

Alert: Chlorpromazine Hydrochloride Injection is used to treat mental/mood disorders.

Source: Exchange Filing

Zydus Lifesciences received a tentative approval from U.S. FDA for Edaravone Injection.

Alert: Edaravone is used to treat certain type of nerve disease.

Source: Exchange Filing

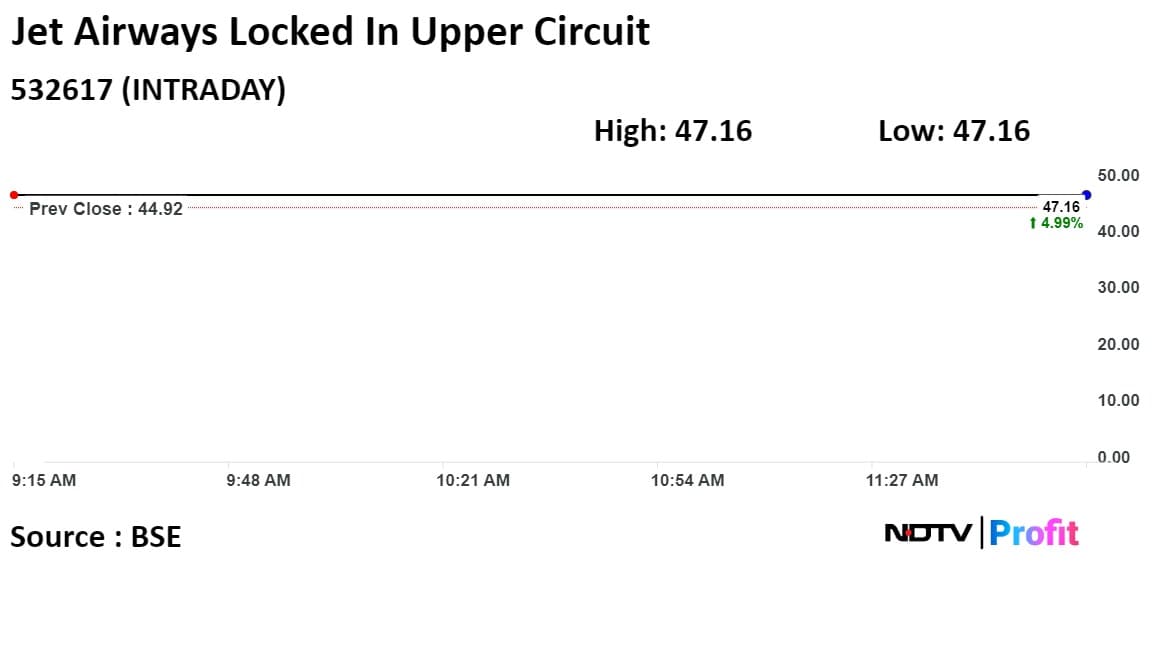

The shares of Jet Airways (India) Ltd. rose as much as 4.99% to 47.16 apiece, to be locked in upper circuit. This compares to a 0.69% advance in the BSE Sensex Index as of 11:58 a.m.

It has fallen 28.20% in the last 12 months. Total traded volume so far in the day stood at 1.6 times its 30-day average. The relative strength index was at 48.

The shares of Jet Airways (India) Ltd. rose as much as 4.99% to 47.16 apiece, to be locked in upper circuit. This compares to a 0.69% advance in the BSE Sensex Index as of 11:58 a.m.

It has fallen 28.20% in the last 12 months. Total traded volume so far in the day stood at 1.6 times its 30-day average. The relative strength index was at 48.

Groww: Client count up 9.1% MOM to 9.2m, market share rises to 22.9%

Zerodha: Client count up 3.3% MoM to 7.2m, market share falls to 18%

AngelOne: Client count up 5.2% MoM to 5.9m, market share at 14.9%

Upstox: Client count up 4.1% MoM to 2.5m, market share falls to 6.2%

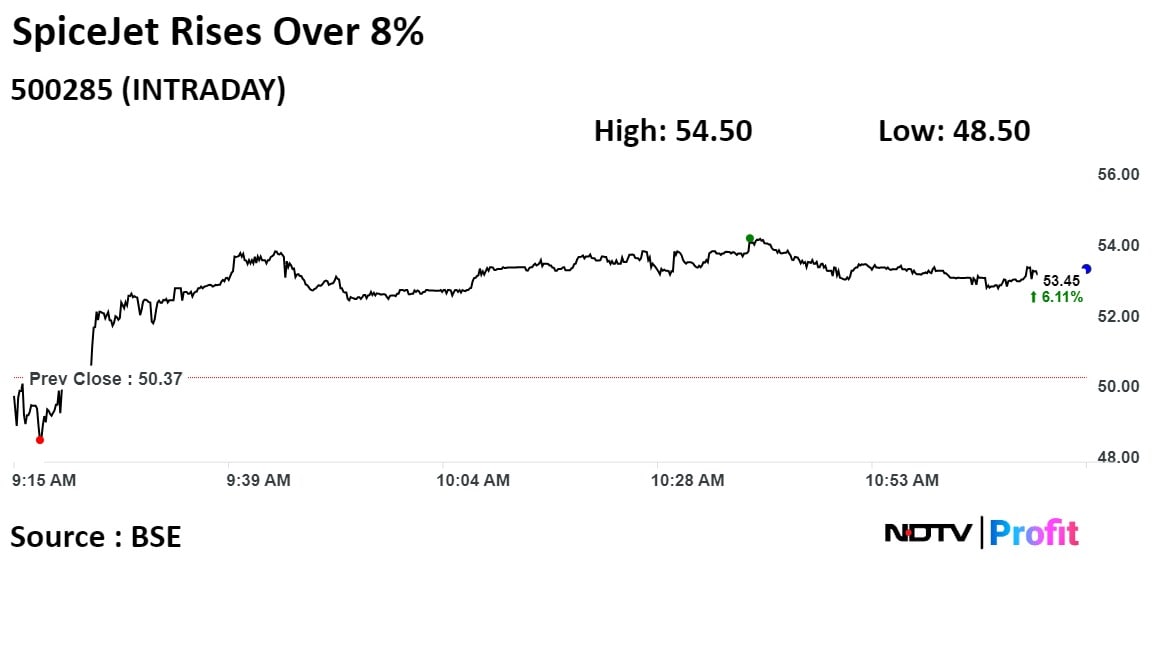

The shares of SpiceJet Ltd. rose on Thursday after it finalised lease agreement for 10 aircraft as part of its efforts to boost capacity in preparation for the upcoming summer schedule.

The scrip rose as much as 8.20% to 54.50 apiece, the highest level since March 13. It pared gains to trade 5.82% higher at Rs 53.30 apiece, as of 11:15 a.m. This compares to a 0.27% advance in the BSE Sensex Index.

It has risen 59.72% in the last 12 months. Total traded volume so far in the day stood at 1.3 times its 30-day average. The relative strength index was at 34.

Out of four analysts tracking the company, one maintains a 'buy' rating, three recommend a 'hold',

according to Bloomberg data. The average 12-month consensus price target implies an upside of 60%.

The shares of SpiceJet Ltd. rose on Thursday after it finalised lease agreement for 10 aircraft as part of its efforts to boost capacity in preparation for the upcoming summer schedule.

The scrip rose as much as 8.20% to 54.50 apiece, the highest level since March 13. It pared gains to trade 5.82% higher at Rs 53.30 apiece, as of 11:15 a.m. This compares to a 0.27% advance in the BSE Sensex Index.

It has risen 59.72% in the last 12 months. Total traded volume so far in the day stood at 1.3 times its 30-day average. The relative strength index was at 34.

Out of four analysts tracking the company, one maintains a 'buy' rating, three recommend a 'hold',

according to Bloomberg data. The average 12-month consensus price target implies an upside of 60%.

Kakinada plant to begin production in Q1 FY25

Looking for inorganic opportunities in India

Open to buying suitable cos, brands in India

India and emerging market operations to drive company's growth

Emerging market sales growth below potential right now

Source: Cogencis

Bajel Projects Ltd got an order worth Rs 358 crore from Power Grid for supply of goods & services.

Source: Exchange Filing

Fitch Ratings forecasts GDP growth at 7.8% for FY24, up from 6.5% earlier.

Expects an easing in growth momentum in Q4FY24.

Source: Fitch Ratings

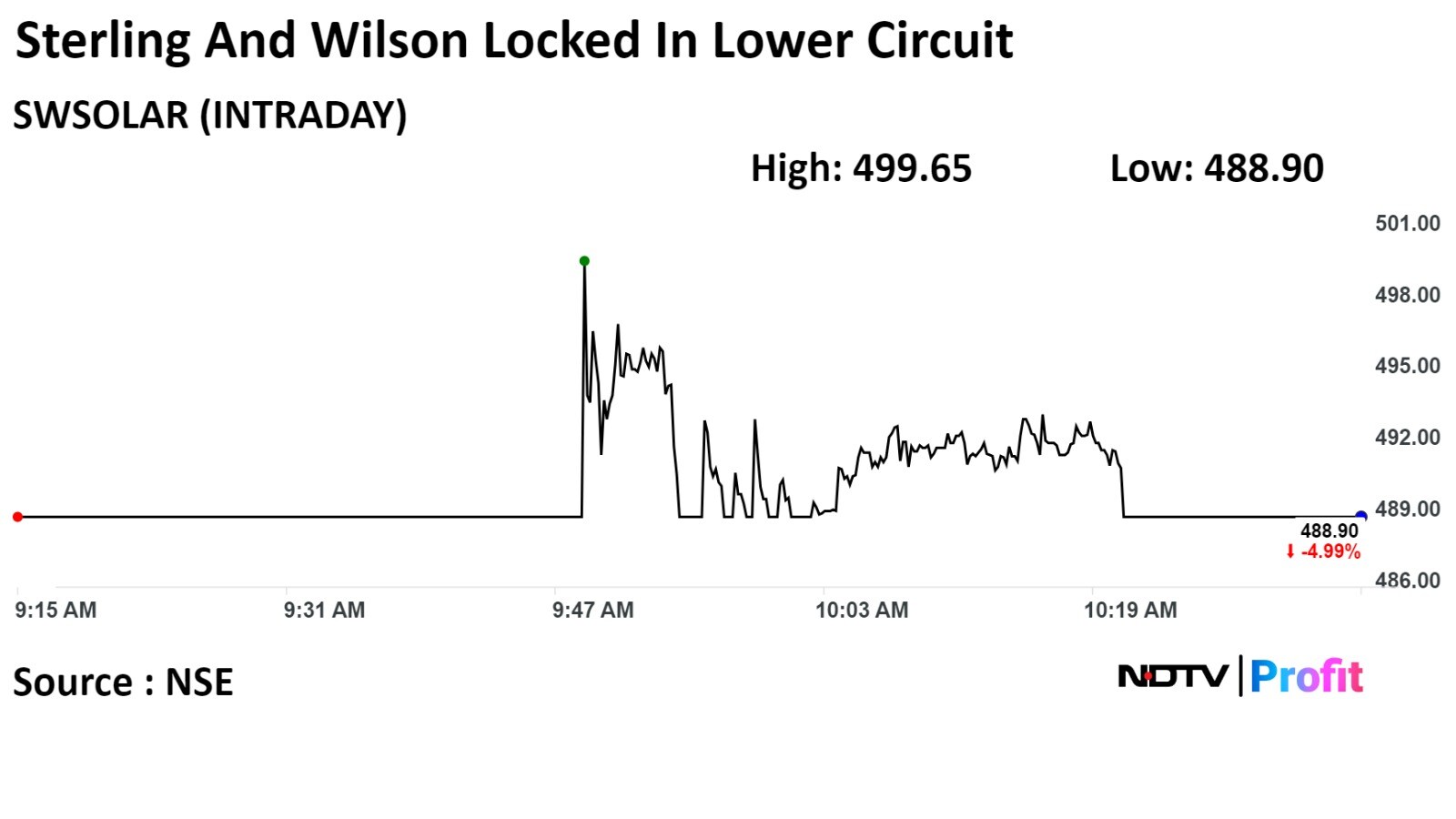

Sterling and Wilson Renewable Energy at 5.98x its 30 day average, down 3%

Mold- Tek Packaging at 3.72x its 30 day average, down 1%

Atul at 2.56x its 30 day average, up 0.7%

Ipca Laboratories at 2.33x its 30 day average, up 2.4%

Bls International Services at 2.07x its 30 day average, up 11%

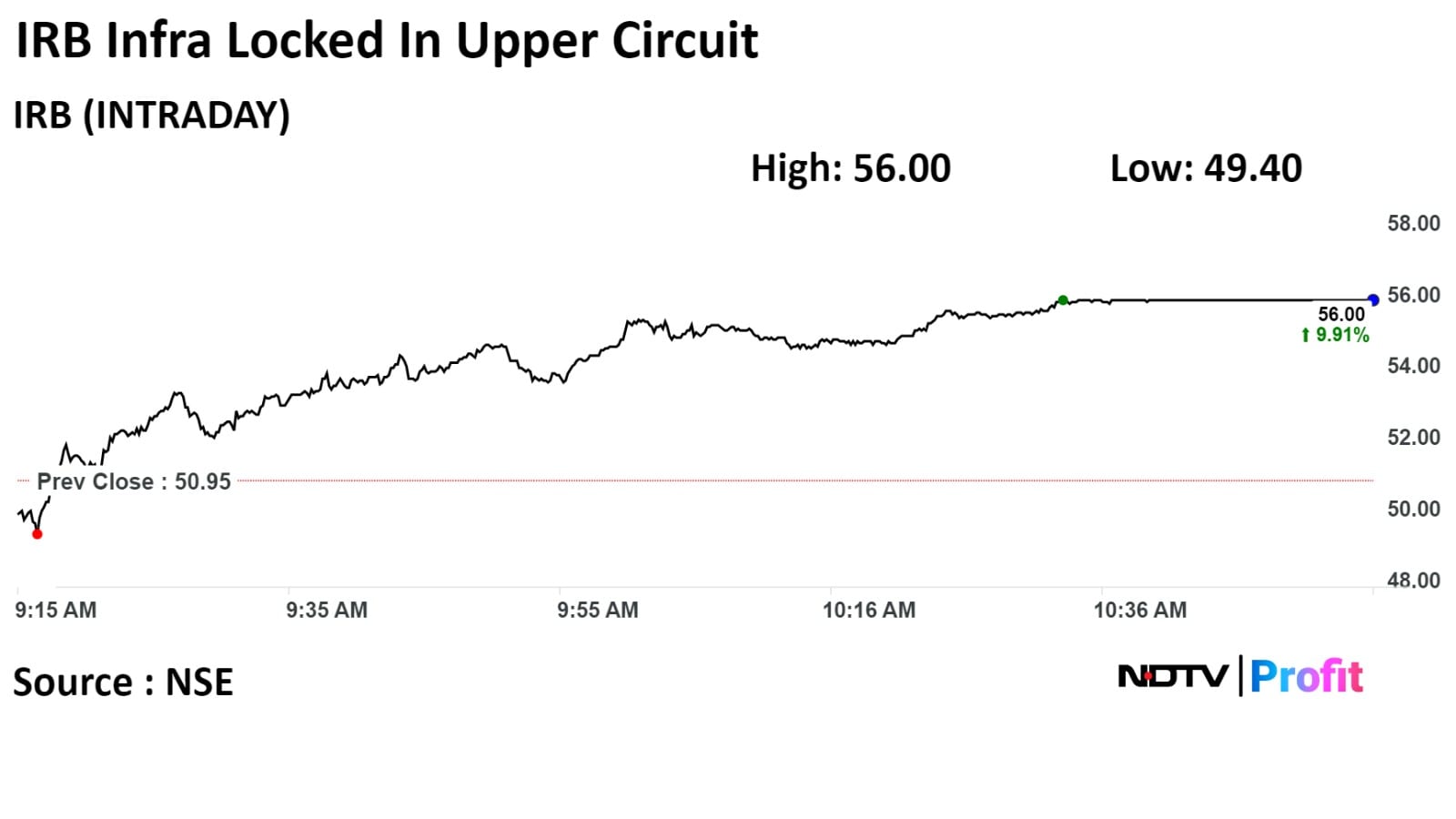

Shares of IRB Infrastructure Developers Ltd. jumped to its upper circuit limit after falling consecutively in the last three session following the company's disclosure that Cintra, a subsidiary of Ferrovial will buy 24% stake in IRB Infrastructure Trust from GIC affiliates.

"It is clarified that the company will continue to act as the sponsor and the project manager to the private InvIT and will continue to hold approximately 51% of the units in the private InvIT and approximately 51% of the equity share capital of the Investment Manager," the exchange filing said.

Shares of IRB Infrastructure Developers Ltd. jumped to its upper circuit limit after falling consecutively in the last three session following the company's disclosure that Cintra, a subsidiary of Ferrovial will buy 24% stake in IRB Infrastructure Trust from GIC affiliates.

"It is clarified that the company will continue to act as the sponsor and the project manager to the private InvIT and will continue to hold approximately 51% of the units in the private InvIT and approximately 51% of the equity share capital of the Investment Manager," the exchange filing said.

Shares of Power Mech Projects Ltd. rose as much as 4.53% to Rs 4,800.00 apiece, the highest level since March 13. It was trading 4.38% higher at Rs 4,792.15 as of 11:05 a.m., as compared to 0.42% advance on NSE Nifty 50 index.

Power Mech Projects rebounded from a three-day decline on Thursday. It added 94.03% in 12 months. Total traded volume so far in the day stood at 0.31 times its 30-day average. The relative strength index was at 40.97.

Out of two analysts tracking the company, two maintain a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target implies an upside of 14.3%.

Shares of Power Mech Projects Ltd. rose as much as 4.53% to Rs 4,800.00 apiece, the highest level since March 13. It was trading 4.38% higher at Rs 4,792.15 as of 11:05 a.m., as compared to 0.42% advance on NSE Nifty 50 index.

Power Mech Projects rebounded from a three-day decline on Thursday. It added 94.03% in 12 months. Total traded volume so far in the day stood at 0.31 times its 30-day average. The relative strength index was at 40.97.

Out of two analysts tracking the company, two maintain a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target implies an upside of 14.3%.

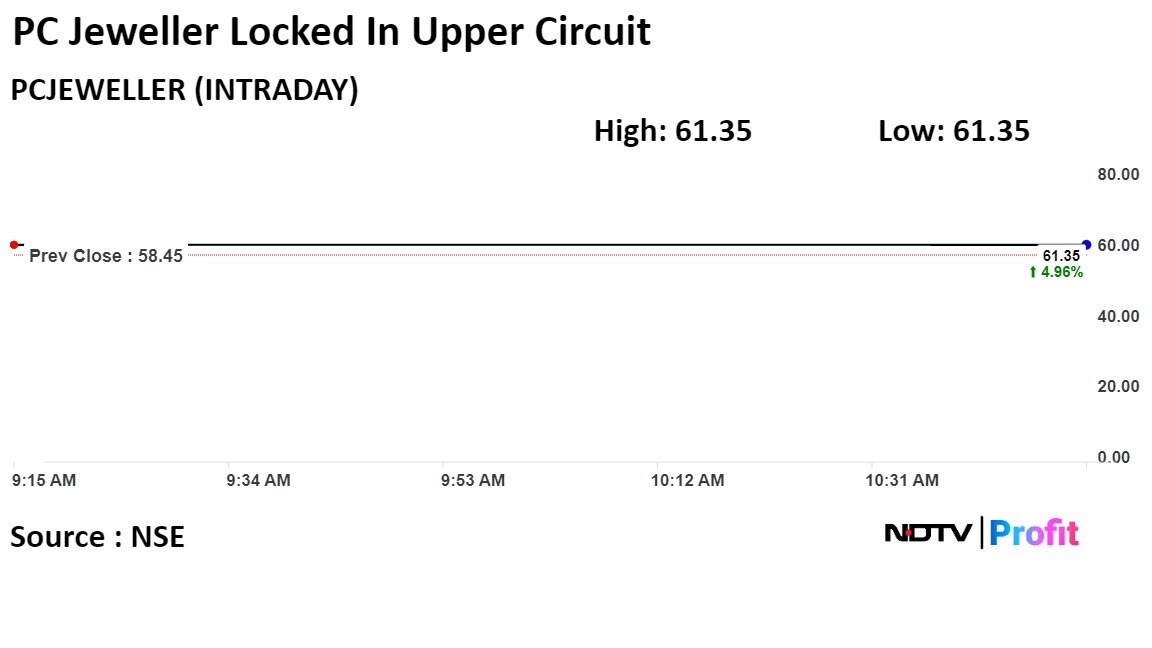

The shares of PC Jeweller Ltd. were locked in upper circuit on Thursday after the State Bank of India accepted its proposal for one time settlement of its outstanding debt.

The terms of the approved one time settlement include cash and equity component, release of securities and mortgaged properties, the company said through an exchange filing on Wednesday. The company received a letter from SBI informing the acceptance of the proposal by the relevant authorities.

The company had been in talks with the lenders led by SBI for an out of-court settlement.

The scrip rose as much as 4.96% to 61.35 apiece, to be locked in upper circuit. This is the highest level since March 13. This compares to a 0.34% advance in the NSE Nifty 50 Index as of 10:41 a.m.

It has risen 97.58% in the last 12 months. Total traded volume so far in the day stood at 0.9 times its 30-day average. The relative strength index was at 57

The shares of PC Jeweller Ltd. were locked in upper circuit on Thursday after the State Bank of India accepted its proposal for one time settlement of its outstanding debt.

The terms of the approved one time settlement include cash and equity component, release of securities and mortgaged properties, the company said through an exchange filing on Wednesday. The company received a letter from SBI informing the acceptance of the proposal by the relevant authorities.

The company had been in talks with the lenders led by SBI for an out of-court settlement.

The scrip rose as much as 4.96% to 61.35 apiece, to be locked in upper circuit. This is the highest level since March 13. This compares to a 0.34% advance in the NSE Nifty 50 Index as of 10:41 a.m.

It has risen 97.58% in the last 12 months. Total traded volume so far in the day stood at 0.9 times its 30-day average. The relative strength index was at 57

Lists at Rs 351 on NSE vs issue price of Rs 401

Lists at a discount of 12.5% to the issue price on NSE

Lists at Rs 350 on NSE vs issue price of Rs 401

Lists at a discount of 12.7% to the issue price on BSE

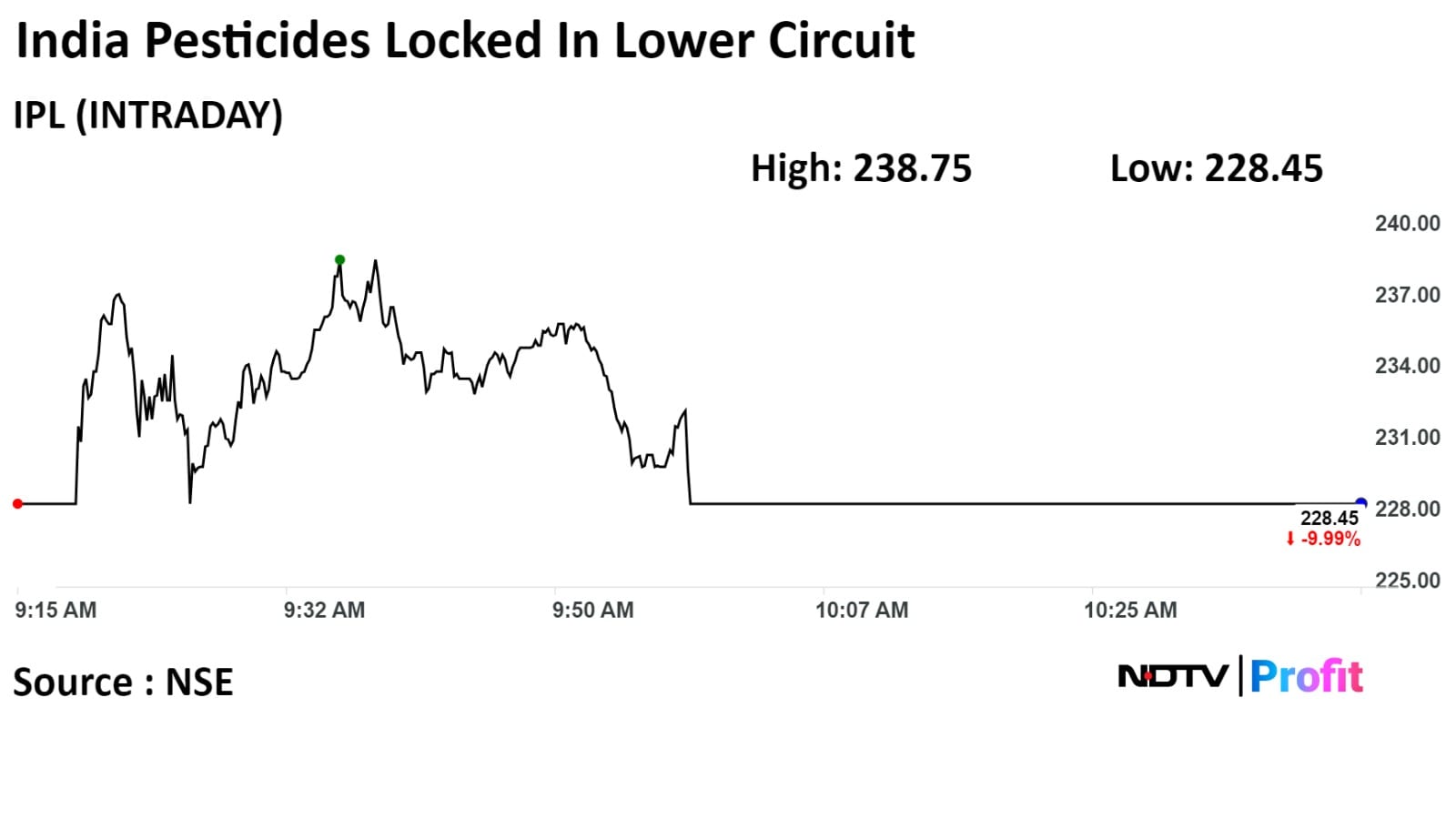

India Pesticides Ltd. hit a lower circuit of 10%, and fell to 228.45 apiece, the lowest level since Aug 29, 2023. As of 10:49 a.m., the scrip remained locked in the lower circuit, compared to 0.39% advance in the NSE Nifty 50 index.

India Pesticides have been decline for five sessions in a row. It has added 11.49% in 12 months. Total traded volume so far in the day stood at 4.0 times its 30-day average. The relative strength index was at 16.33, which implied the stock is oversold.

Out of two analysts tracking the company, one maintained a 'Hold' rating, and another suggest 'Sell', according to Bloomberg Data.

India Pesticides Ltd. hit a lower circuit of 10%, and fell to 228.45 apiece, the lowest level since Aug 29, 2023. As of 10:49 a.m., the scrip remained locked in the lower circuit, compared to 0.39% advance in the NSE Nifty 50 index.

India Pesticides have been decline for five sessions in a row. It has added 11.49% in 12 months. Total traded volume so far in the day stood at 4.0 times its 30-day average. The relative strength index was at 16.33, which implied the stock is oversold.

Out of two analysts tracking the company, one maintained a 'Hold' rating, and another suggest 'Sell', according to Bloomberg Data.

Among comparable economies, we are the fastest growing economy.

Keeping pace with growth rate, our exports have grown. Given this growth, one can aspire to have a larger share of global trade.

Currently, India’s share in global trade is 1.8% in goods, 4.1% in services.

India’s services share in global trade can go up to 8-9% in coming years.

We estimate India’s e-commerce exports at $5-10 billion. This is much less compared to China which has leveraged e-commerce exports better.

This implies more potential to promote our craftsmen to join the export bandwagon.

We are undertaking MoUs with Amazon, Shiprocket and with DHL later today to promote Indian exports.

Source: Asia Pacific e-Commerce Policy Summit

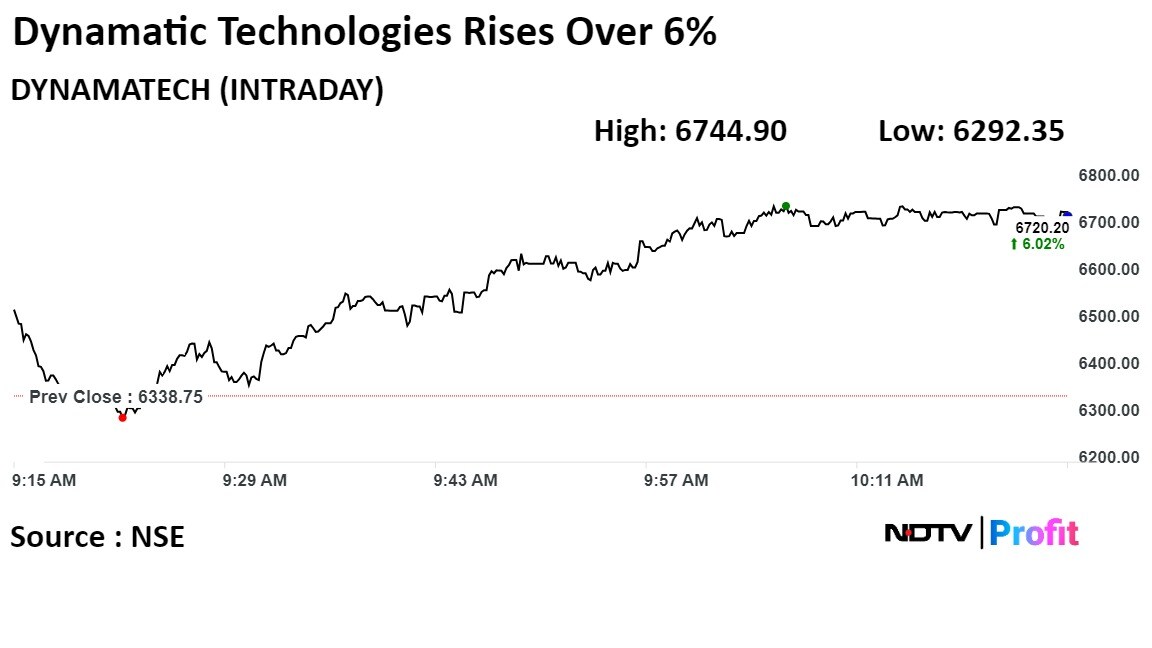

The shares of Dynamatic Technolgies Ltd. gained on Thursday after the company announced a new partnership with Deutsche Aircraft.

The scrip rose as much as 6.41% to 6,744.90 apiece, the highest level since March 13. It pared gains to trade 6.28% higher at Rs 6,736.95 apiece, as of 10:25 a.m. This compares to a 0.16% advance in the NSE Nifty 50 Index.

It has risen 157.25% in the last 12 months. Total traded volume so far in the day stood at 1.6 times its 30-day average. The relative strength index was at 47

The shares of Dynamatic Technolgies Ltd. gained on Thursday after the company announced a new partnership with Deutsche Aircraft.

The scrip rose as much as 6.41% to 6,744.90 apiece, the highest level since March 13. It pared gains to trade 6.28% higher at Rs 6,736.95 apiece, as of 10:25 a.m. This compares to a 0.16% advance in the NSE Nifty 50 Index.

It has risen 157.25% in the last 12 months. Total traded volume so far in the day stood at 1.6 times its 30-day average. The relative strength index was at 47

The shares of Adani Green Energy Ltd. rose on Thursday after its stepdown subsidiary Adani Renewable Energy Fifty Nine Ltd. signed a power purchase agreement.

The scrip rose as much as 8.70% to 1,875 apiece, the highest level since March 13. It pared gains to trade 6.43% higher at Rs 1,836 apiece, as of 10:00 a.m. This compares to a 0.18% advance in the NSE Nifty 50 Index.

It has risen 160.73% in the last 12 months. Total traded volume so far in the day stood at 2.2 times its 30-day average. The relative strength index was at 48.

One analyst tracking the company maintains 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 162.4%.

The shares of Adani Green Energy Ltd. rose on Thursday after its stepdown subsidiary Adani Renewable Energy Fifty Nine Ltd. signed a power purchase agreement.

The scrip rose as much as 8.70% to 1,875 apiece, the highest level since March 13. It pared gains to trade 6.43% higher at Rs 1,836 apiece, as of 10:00 a.m. This compares to a 0.18% advance in the NSE Nifty 50 Index.

It has risen 160.73% in the last 12 months. Total traded volume so far in the day stood at 2.2 times its 30-day average. The relative strength index was at 48.

One analyst tracking the company maintains 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 162.4%.

Disclaimer: NDTV is a subsidiary of AMG Media Networks Limited, an Adani Group Company.

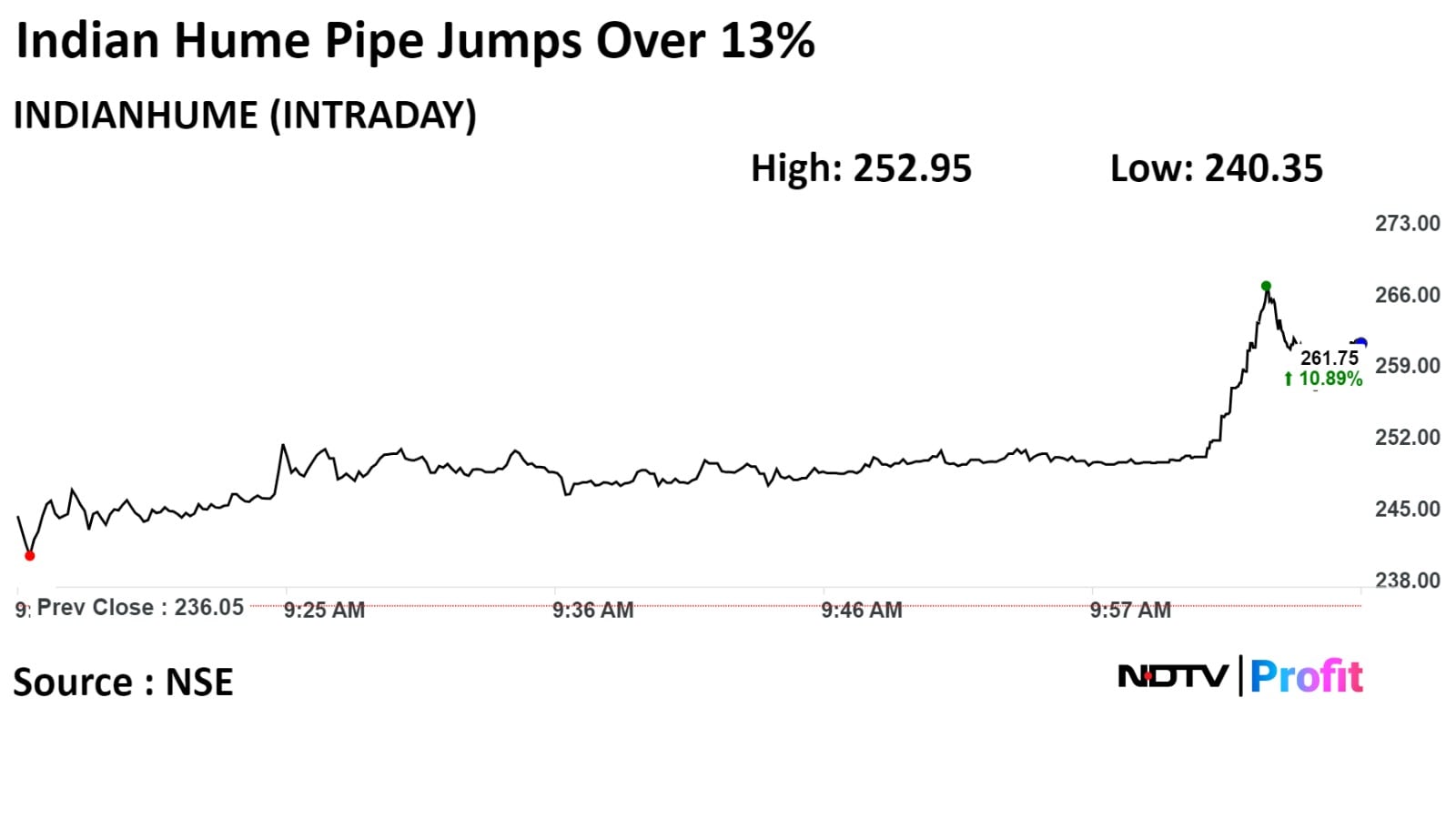

Shares of Indian Hume Pipe Co Ltd. snapped their four day fall a day after the company informed exchanges that its joint venture has been awarded a work order relating to water supply and sewerage projects under AMRUT 2.0 by Government of Telangana.

Shares of Indian Hume Pipe Co Ltd. snapped their four day fall a day after the company informed exchanges that its joint venture has been awarded a work order relating to water supply and sewerage projects under AMRUT 2.0 by Government of Telangana.

L&T classifies major orders in Rs 5,000-10,000 crore range

Hydrocarbon verticals secures onshore gas pipeline project

Scope: EPC of 2 new 56 pipelines

Largest cross country pipeline EPC project awarded to L&T

Source: Exchange Filing

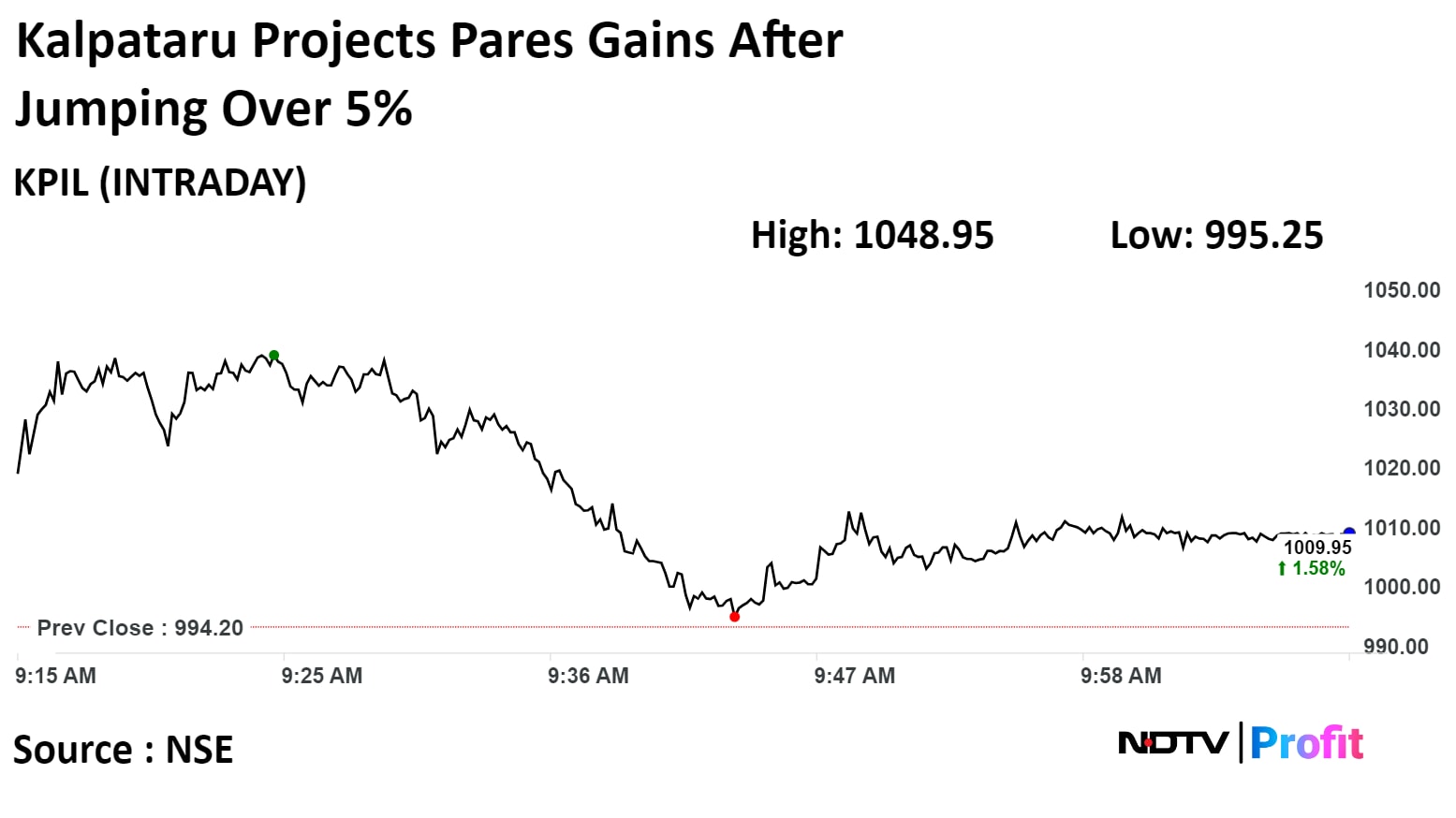

Kalpataru Projects International Ltd. rose over 5% after along with its joint ventures and international subsidiaries secured new orders of awards of Rs 2,445 Crores.

On the NSE, Kalpataru Projects International's stock rose as much as 5.51% during the day to Rs 1,048.95 piece. It was trading 1.59% higher at Rs 1,010 per share, compared to a benchmark NSE Nifty 50 which advance 0.18% as of 9:39 a.m.

The share price has risen 76.94% in the last 12 months. The total traded volume so far in the day stood at 5 times its 30-day average. The relative strength index was at 56.99.

Out of 15 analysts tracking the company, 13 maintain a 'buy' rating on the stock, one recommend 'hold' and one suggests 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential The average 12-month consensus price target implies a downside of 2.4%.

Kalpataru Projects International Ltd. rose over 5% after along with its joint ventures and international subsidiaries secured new orders of awards of Rs 2,445 Crores.

On the NSE, Kalpataru Projects International's stock rose as much as 5.51% during the day to Rs 1,048.95 piece. It was trading 1.59% higher at Rs 1,010 per share, compared to a benchmark NSE Nifty 50 which advance 0.18% as of 9:39 a.m.

The share price has risen 76.94% in the last 12 months. The total traded volume so far in the day stood at 5 times its 30-day average. The relative strength index was at 56.99.

Out of 15 analysts tracking the company, 13 maintain a 'buy' rating on the stock, one recommend 'hold' and one suggests 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential The average 12-month consensus price target implies a downside of 2.4%.

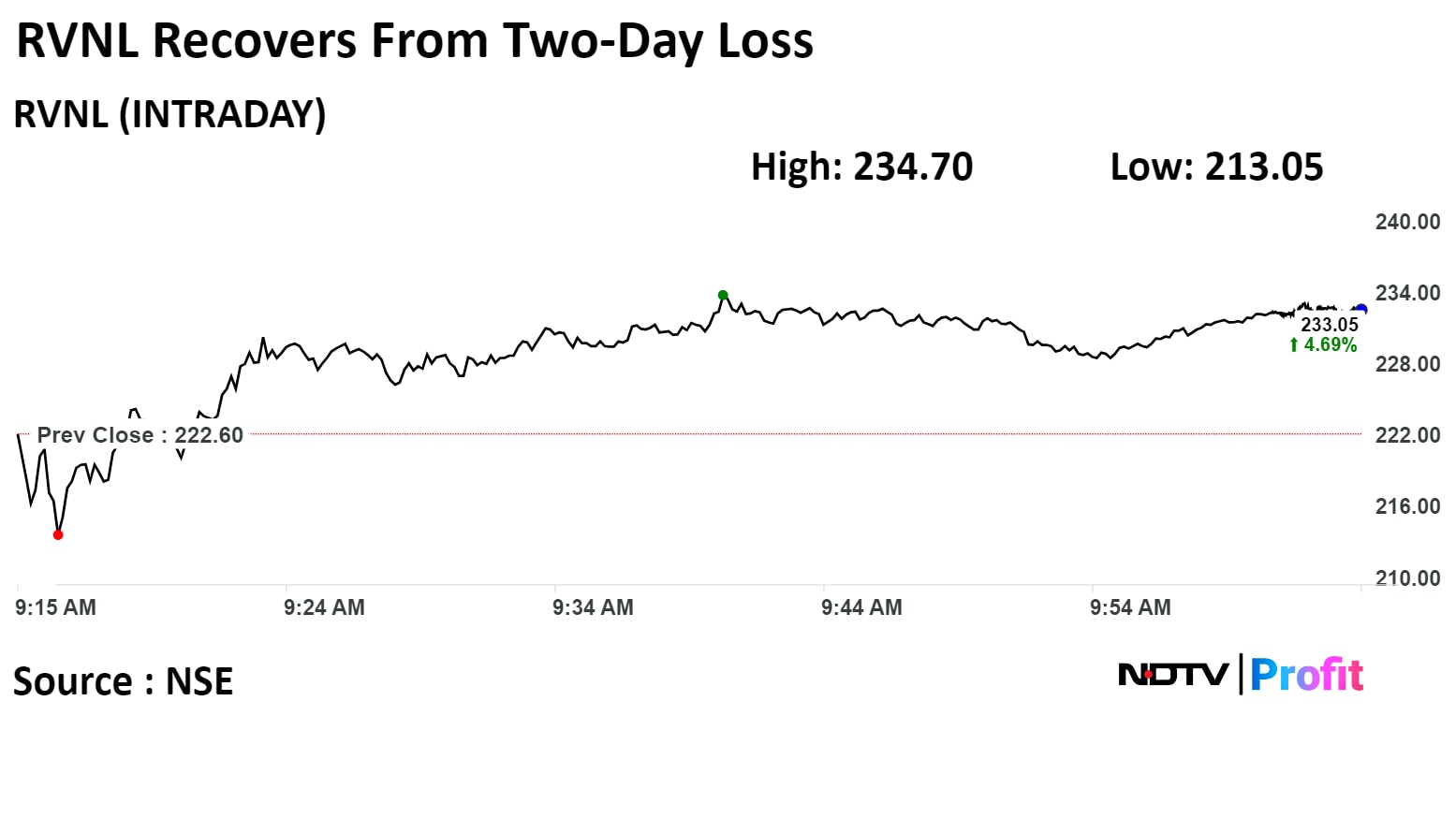

Shares of Rail Vikas Nigam Ltd. rose as much as 5.44% to Rs 234.70 apiece on NSE. The scrip was trading 4.58% higher at Rs 238.80 as of 10:07 a.m., compared to 0.17% gain in NSE Nifty 50 index.

Rail Vikas Nigam was falling for last two session. It has added 240.6% in 12 months. Total traded volume so far in the day stood at 0.63 times its 30-day average. The relative strength index was at 42.03.

Shares of Rail Vikas Nigam Ltd. rose as much as 5.44% to Rs 234.70 apiece on NSE. The scrip was trading 4.58% higher at Rs 238.80 as of 10:07 a.m., compared to 0.17% gain in NSE Nifty 50 index.

Rail Vikas Nigam was falling for last two session. It has added 240.6% in 12 months. Total traded volume so far in the day stood at 0.63 times its 30-day average. The relative strength index was at 42.03.

The shares of TV18 Broadcast Ltd. hit lower circuit on Thursday after Paramount Global entered into an agreement to sell entire stake in Viacom 18 Media Private Ltd. to Reliance Industries for Rs 4,286 crore.

The scrip fell as much as 4.97% to 44 apiece, to hit lower circuit. It pared losses to trade 0.11% higher at Rs 46.35 apiece, as of 9:42 a.m. This compares to a 0.04% advance in the NSE Nifty 50 Index.

It has risen 53.48% in the last 12 months. Total traded volume so far in the day stood at 2.5 times its 30-day average. The relative strength index was at 26 indicating it was underbought.

One analyst tracking the company maintains a 'sell' rating according to Bloomberg data. The average 12-month consensus price target implies an upside of 51.5%.

The shares of TV18 Broadcast Ltd. hit lower circuit on Thursday after Paramount Global entered into an agreement to sell entire stake in Viacom 18 Media Private Ltd. to Reliance Industries for Rs 4,286 crore.

The scrip fell as much as 4.97% to 44 apiece, to hit lower circuit. It pared losses to trade 0.11% higher at Rs 46.35 apiece, as of 9:42 a.m. This compares to a 0.04% advance in the NSE Nifty 50 Index.

It has risen 53.48% in the last 12 months. Total traded volume so far in the day stood at 2.5 times its 30-day average. The relative strength index was at 26 indicating it was underbought.

One analyst tracking the company maintains a 'sell' rating according to Bloomberg data. The average 12-month consensus price target implies an upside of 51.5%.

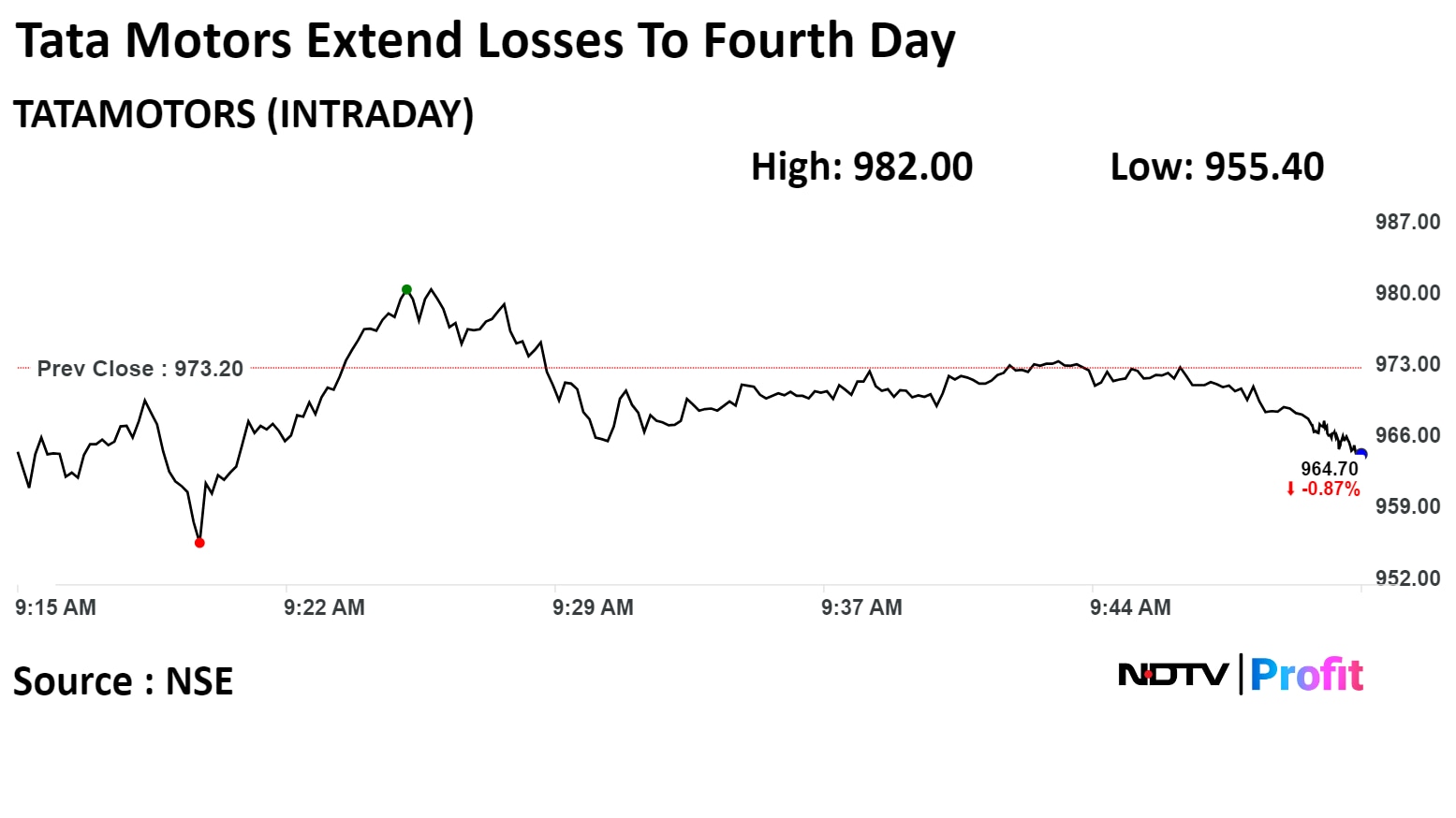

Tata Motors Ltd fell as much as 1.83% to Rs 955.40 apiece on NSE. The scrip was trading 0.99% lower at Rs 963.60 as of 09:54 a.m., compared to 0.04% decline on NSE Nifty 50 index.

Tata Motors Ltd fell as much as 1.83% to Rs 955.40 apiece on NSE. The scrip was trading 0.99% lower at Rs 963.60 as of 09:54 a.m., compared to 0.04% decline on NSE Nifty 50 index.

Page Industries at Rs 33,609.90

Atul at Rs 5,947.6

Navin Flourine International at Rs 2,899.25

HUL at Rs 2,301.85

Bata India at Rs 1,367.05

PVR Inox at Rs 1284.10

SBI Cards and Payment Services at Rs 6,78.9

UPL at Rs 447.8

Balrampur Chini Mills at Rs 3,43.5

Campus Activewear at Rs 219.15

Bandhan Bank at Rs 173.15

Hindustan Aeronautics Ltd. received orders worth Rs 8,073 crore from Defence Ministry.

Defence Ministry order for 34 Advanced Light Helicopters.

Source: Exchange filing.

Kalpataru Projects International Ltd received a new order worth Rs 2,445 crore for transmission and distribution construction businesses along with its JVs

Source: Exchange filing

DB Realty set issue price for QIP at Rs 258 per share.

Issue price indicates a discount of 4.75% to the floor price.

To raise Rs 920.2 crore via issuance of 3.56 crore shares.

Source: Exchange filing

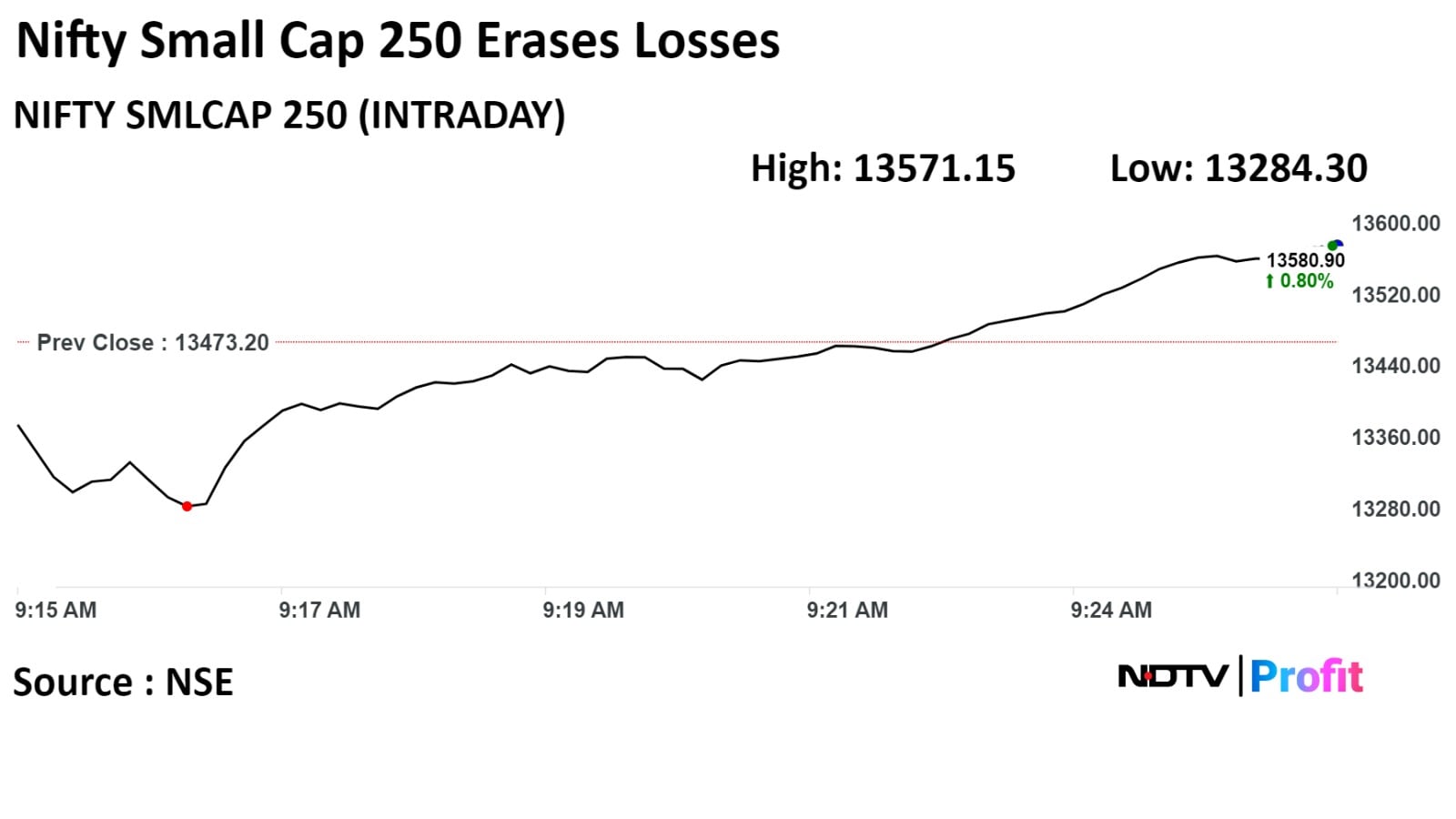

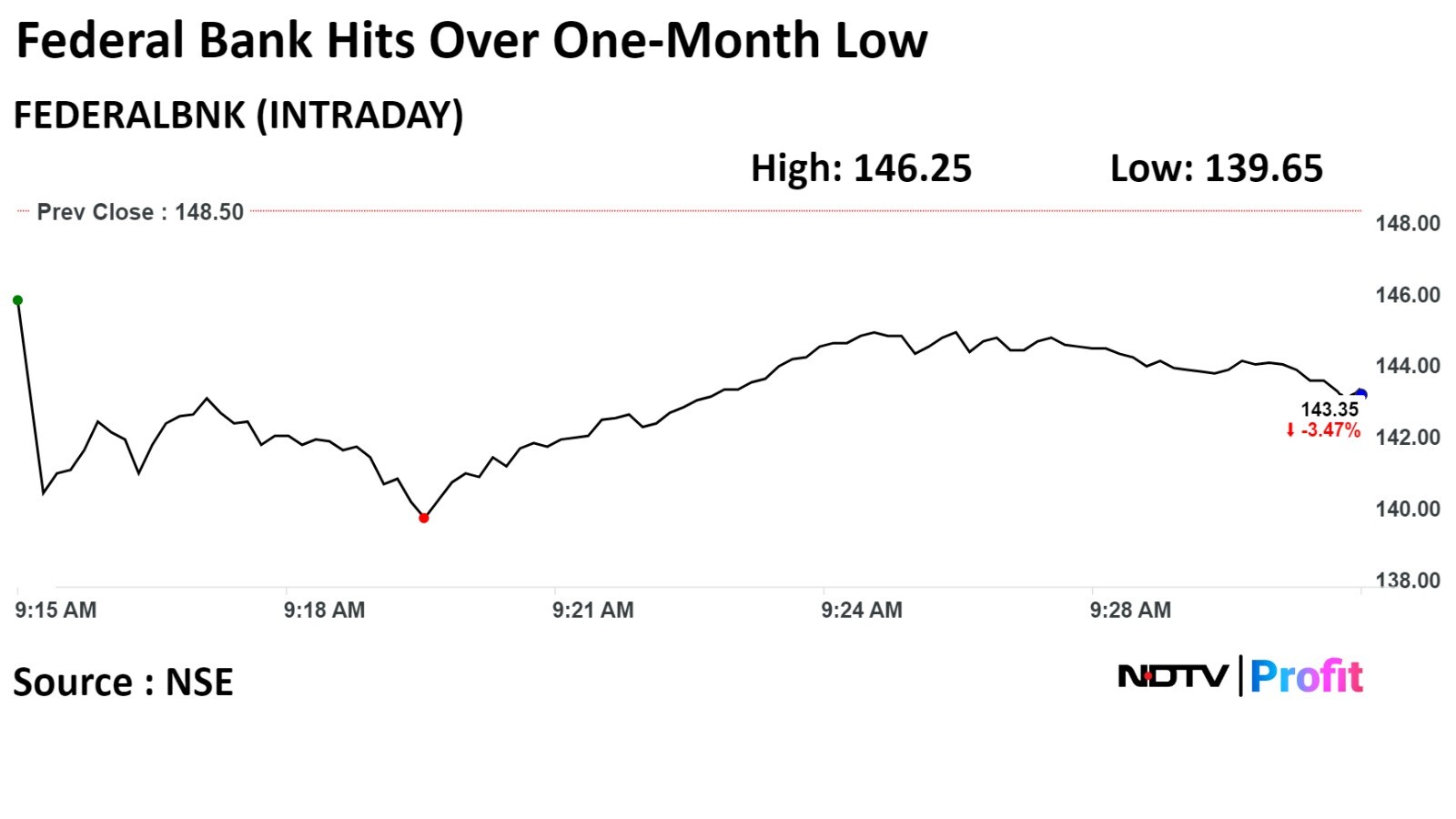

Shares of Federal Bank slumped after it informed the exchanged that it has stopped issuance of new co-branded credit cards and will seek regulatory clearance prior to resumption of new issuance.

The scrip fell as much as 5.96% to Rs 139.65 piece, the lowest level since Jan 24. It pared losses to trade 3% lower at Rs 144 apiece, as of 9:39 a.m. This compares to a flat NSE Nifty 50 Index.

It has risen 8.92% in the last twelve months. Total traded volume so far in the day stood at 0.39 times its 30-day average. The relative strength index was at 37.12.

Out of 41 analysts tracking the company, 33 maintain a 'buy' rating, seven recommend a 'hold', and one suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an downside/upside of 23.5%.

Shares of Federal Bank slumped after it informed the exchanged that it has stopped issuance of new co-branded credit cards and will seek regulatory clearance prior to resumption of new issuance.

The scrip fell as much as 5.96% to Rs 139.65 piece, the lowest level since Jan 24. It pared losses to trade 3% lower at Rs 144 apiece, as of 9:39 a.m. This compares to a flat NSE Nifty 50 Index.

It has risen 8.92% in the last twelve months. Total traded volume so far in the day stood at 0.39 times its 30-day average. The relative strength index was at 37.12.

Out of 41 analysts tracking the company, 33 maintain a 'buy' rating, seven recommend a 'hold', and one suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an downside/upside of 23.5%.

Nifty Midcap 150 down 0.16% higher

Losers led by Phoenix Mills and Prestige and Federal Bank

Nifty Smallcap 250 down 0.06%

Losers led by Sun Pharma Advanced and Tata Investment Corp

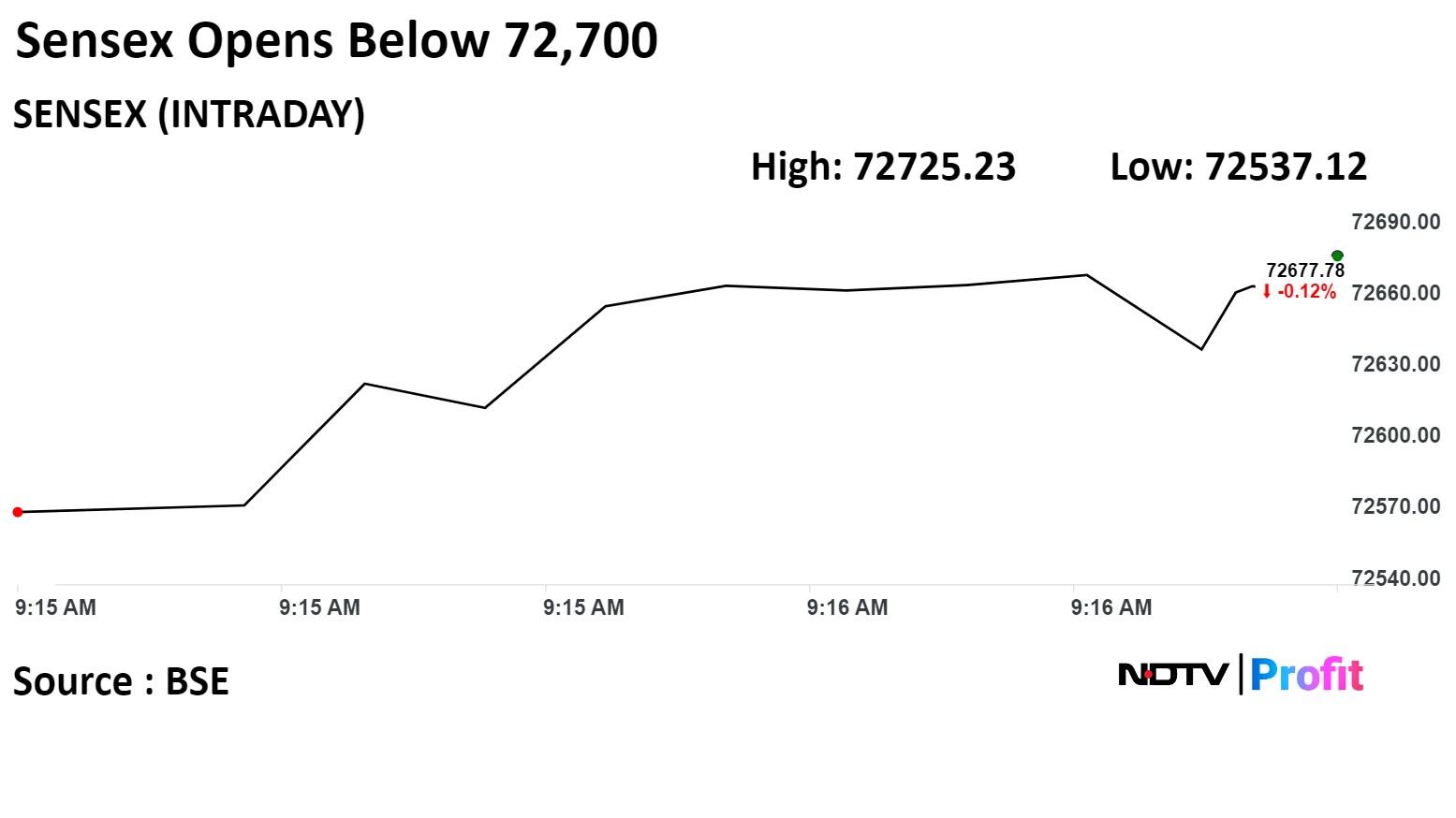

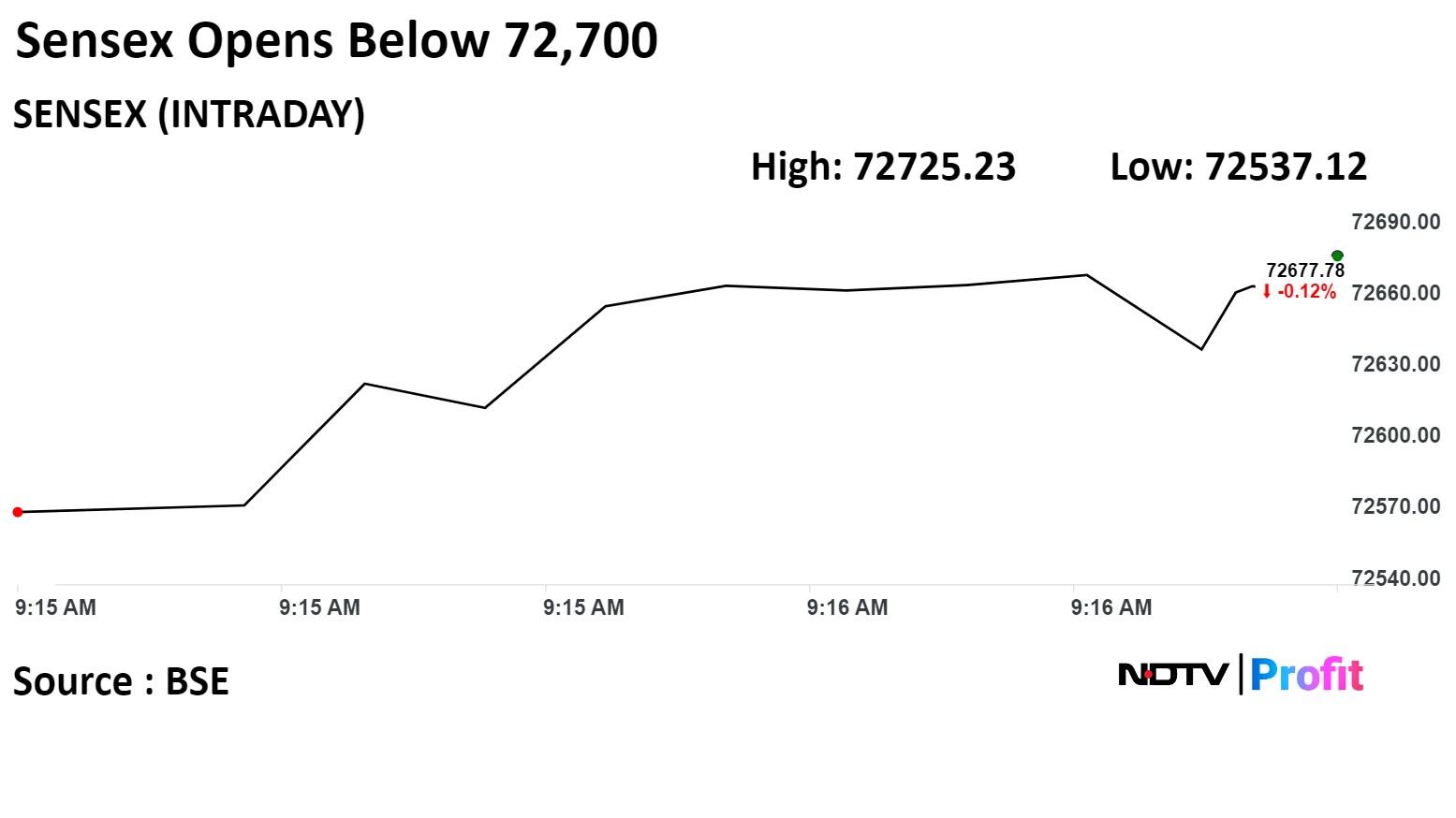

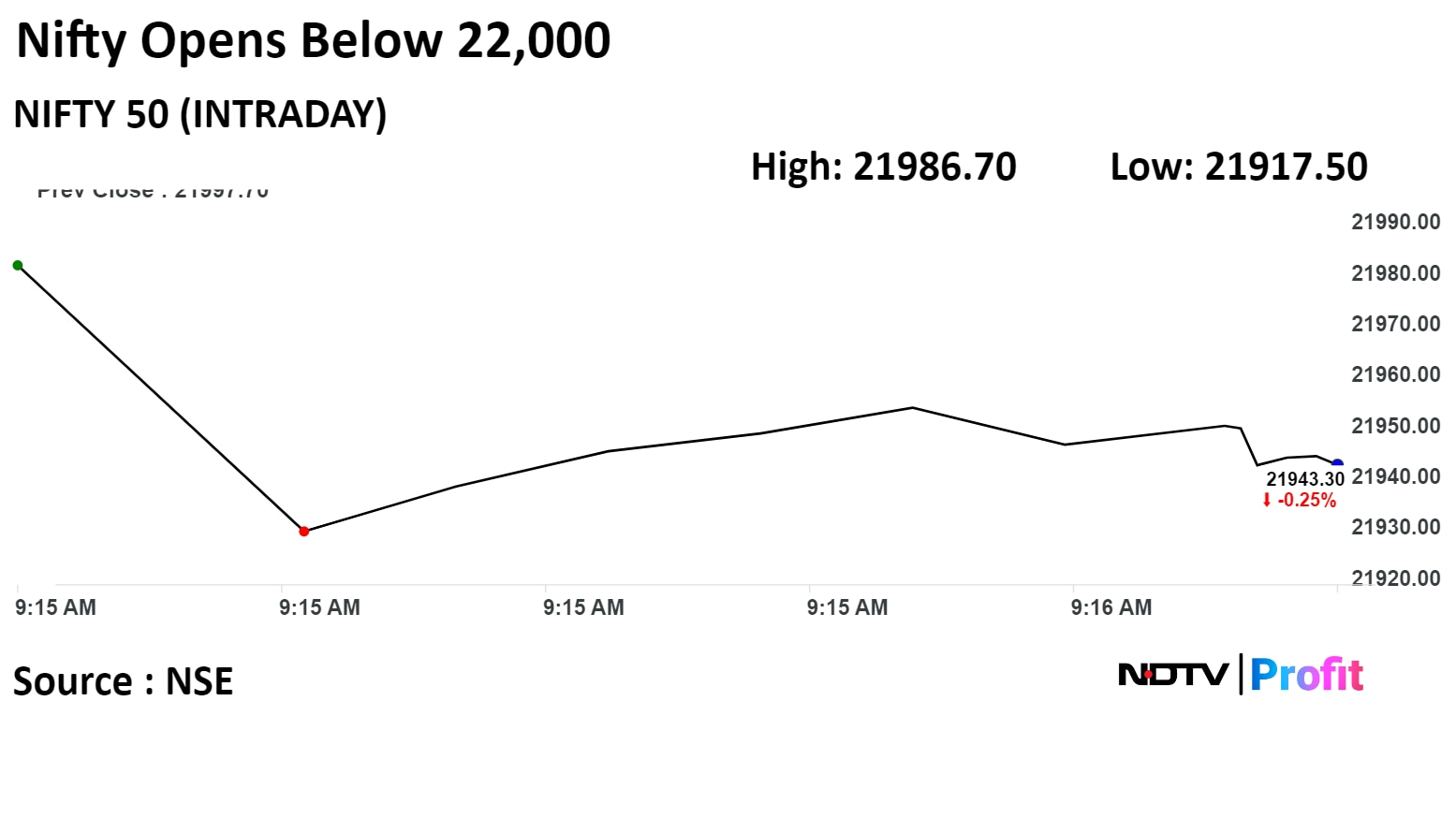

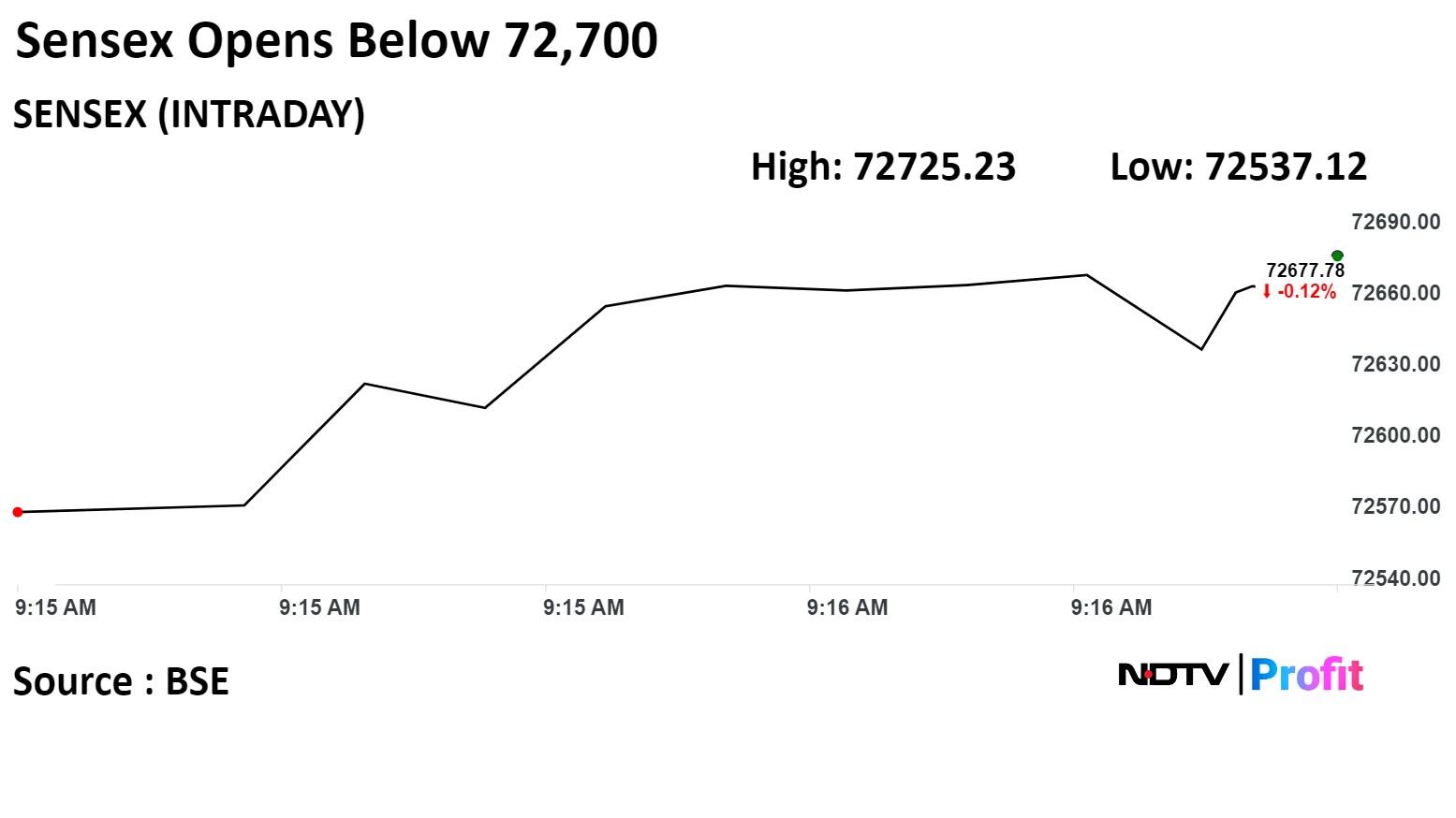

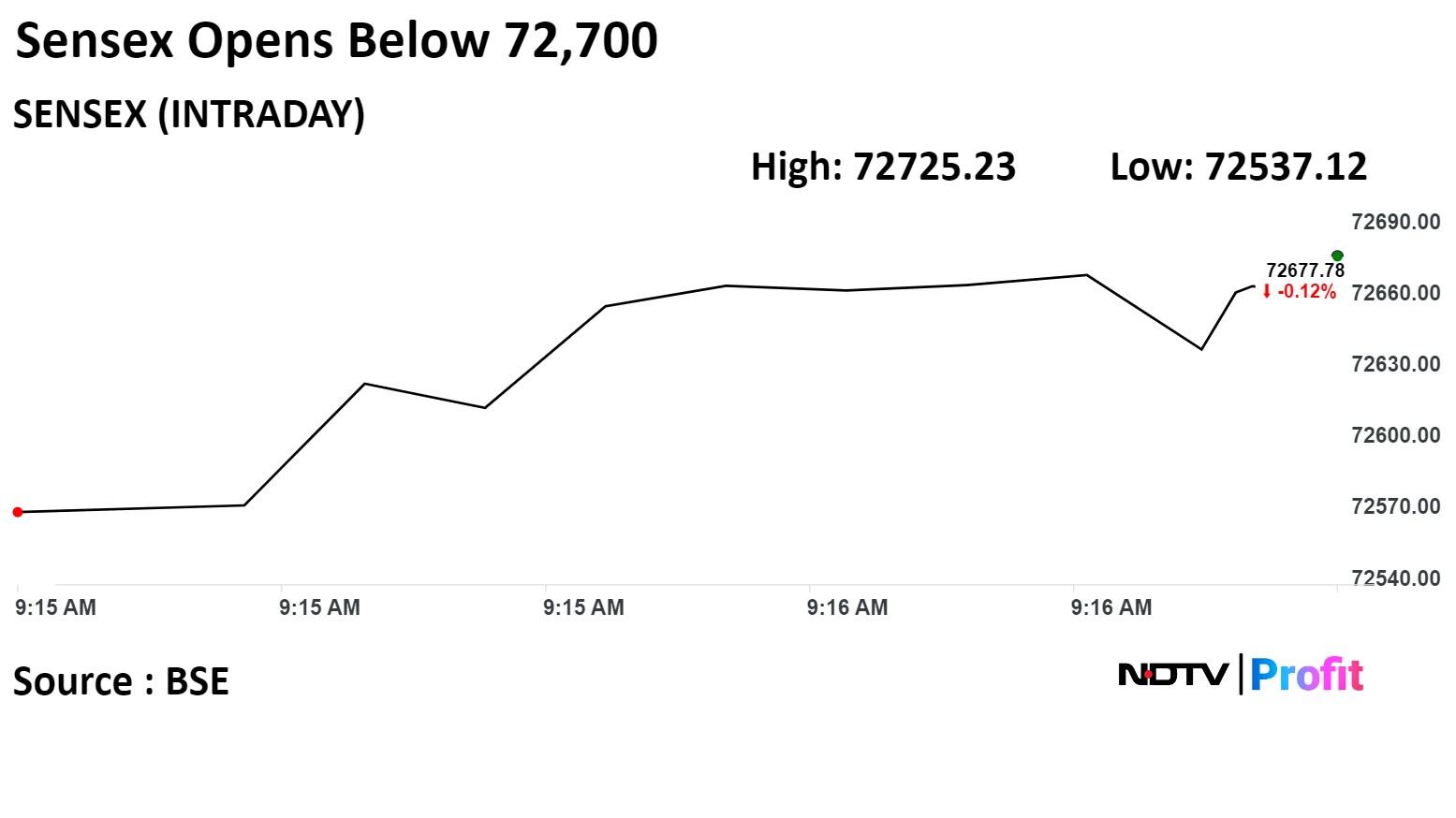

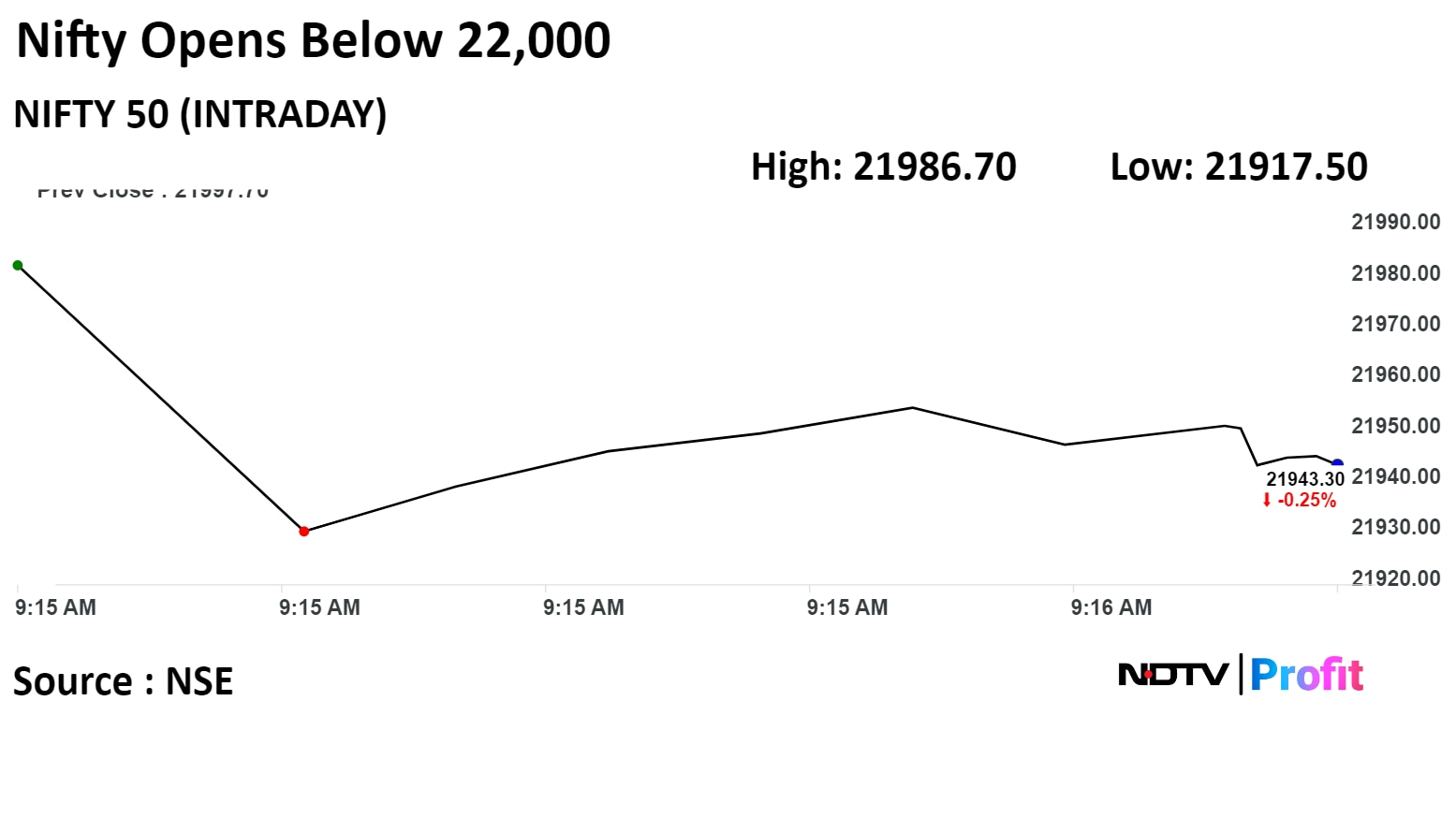

India's benchmark indices extended losses at open tracking a fall in shares of Bajaj Finance Ltd., ITC Ltd., and ICICI Bank Ltd.

As of 09:21 a.m., the S&P BSE Sensex was trading 218.75 points or 0.30% lower at 72,543.14, the NSE Nifty 50 was trading 53.90 points or 0.25% lower at 21,943.80.

"Expected weakness in the domestic market may continue and further profit booking in the mid-cap and small cap stocks may not be ruled out on account of rally in the last few months," said Vikas Jain, senior research analyst at Reliance Securities.

The recent correction in the Nifty Small cap index by 15% from its February 8th peak, was triggered partly by regulatory interventions from the SEBI rally. India Vix soared 6% to above 14 yesterday. Metal stocks will be in focus after the news that China mulls output cuts, Jain said.

Investors are now awaiting the release of wholesale inflation and retail sales data to be released today, he added.

India's benchmark indices extended losses at open tracking a fall in shares of Bajaj Finance Ltd., ITC Ltd., and ICICI Bank Ltd.

As of 09:21 a.m., the S&P BSE Sensex was trading 218.75 points or 0.30% lower at 72,543.14, the NSE Nifty 50 was trading 53.90 points or 0.25% lower at 21,943.80.

"Expected weakness in the domestic market may continue and further profit booking in the mid-cap and small cap stocks may not be ruled out on account of rally in the last few months," said Vikas Jain, senior research analyst at Reliance Securities.

The recent correction in the Nifty Small cap index by 15% from its February 8th peak, was triggered partly by regulatory interventions from the SEBI rally. India Vix soared 6% to above 14 yesterday. Metal stocks will be in focus after the news that China mulls output cuts, Jain said.

Investors are now awaiting the release of wholesale inflation and retail sales data to be released today, he added.

India's benchmark indices extended losses at open tracking a fall in shares of Bajaj Finance Ltd., ITC Ltd., and ICICI Bank Ltd.

As of 09:21 a.m., the S&P BSE Sensex was trading 218.75 points or 0.30% lower at 72,543.14, the NSE Nifty 50 was trading 53.90 points or 0.25% lower at 21,943.80.

"Expected weakness in the domestic market may continue and further profit booking in the mid-cap and small cap stocks may not be ruled out on account of rally in the last few months," said Vikas Jain, senior research analyst at Reliance Securities.

The recent correction in the Nifty Small cap index by 15% from its February 8th peak, was triggered partly by regulatory interventions from the SEBI rally. India Vix soared 6% to above 14 yesterday. Metal stocks will be in focus after the news that China mulls output cuts, Jain said.

Investors are now awaiting the release of wholesale inflation and retail sales data to be released today, he added.

India's benchmark indices extended losses at open tracking a fall in shares of Bajaj Finance Ltd., ITC Ltd., and ICICI Bank Ltd.

As of 09:21 a.m., the S&P BSE Sensex was trading 218.75 points or 0.30% lower at 72,543.14, the NSE Nifty 50 was trading 53.90 points or 0.25% lower at 21,943.80.

"Expected weakness in the domestic market may continue and further profit booking in the mid-cap and small cap stocks may not be ruled out on account of rally in the last few months," said Vikas Jain, senior research analyst at Reliance Securities.

The recent correction in the Nifty Small cap index by 15% from its February 8th peak, was triggered partly by regulatory interventions from the SEBI rally. India Vix soared 6% to above 14 yesterday. Metal stocks will be in focus after the news that China mulls output cuts, Jain said.

Investors are now awaiting the release of wholesale inflation and retail sales data to be released today, he added.

India's benchmark indices extended losses at open tracking a fall in shares of Bajaj Finance Ltd., ITC Ltd., and ICICI Bank Ltd.

As of 09:21 a.m., the S&P BSE Sensex was trading 218.75 points or 0.30% lower at 72,543.14, the NSE Nifty 50 was trading 53.90 points or 0.25% lower at 21,943.80.

"Expected weakness in the domestic market may continue and further profit booking in the mid-cap and small cap stocks may not be ruled out on account of rally in the last few months," said Vikas Jain, senior research analyst at Reliance Securities.

The recent correction in the Nifty Small cap index by 15% from its February 8th peak, was triggered partly by regulatory interventions from the SEBI rally. India Vix soared 6% to above 14 yesterday. Metal stocks will be in focus after the news that China mulls output cuts, Jain said.

Investors are now awaiting the release of wholesale inflation and retail sales data to be released today, he added.

India's benchmark indices extended losses at open tracking a fall in shares of Bajaj Finance Ltd., ITC Ltd., and ICICI Bank Ltd.

As of 09:21 a.m., the S&P BSE Sensex was trading 218.75 points or 0.30% lower at 72,543.14, the NSE Nifty 50 was trading 53.90 points or 0.25% lower at 21,943.80.

"Expected weakness in the domestic market may continue and further profit booking in the mid-cap and small cap stocks may not be ruled out on account of rally in the last few months," said Vikas Jain, senior research analyst at Reliance Securities.

The recent correction in the Nifty Small cap index by 15% from its February 8th peak, was triggered partly by regulatory interventions from the SEBI rally. India Vix soared 6% to above 14 yesterday. Metal stocks will be in focus after the news that China mulls output cuts, Jain said.

Investors are now awaiting the release of wholesale inflation and retail sales data to be released today, he added.

India's benchmark indices extended losses at open tracking a fall in shares of Bajaj Finance Ltd., ITC Ltd., and ICICI Bank Ltd.

As of 09:21 a.m., the S&P BSE Sensex was trading 218.75 points or 0.30% lower at 72,543.14, the NSE Nifty 50 was trading 53.90 points or 0.25% lower at 21,943.80.

"Expected weakness in the domestic market may continue and further profit booking in the mid-cap and small cap stocks may not be ruled out on account of rally in the last few months," said Vikas Jain, senior research analyst at Reliance Securities.

The recent correction in the Nifty Small cap index by 15% from its February 8th peak, was triggered partly by regulatory interventions from the SEBI rally. India Vix soared 6% to above 14 yesterday. Metal stocks will be in focus after the news that China mulls output cuts, Jain said.

Investors are now awaiting the release of wholesale inflation and retail sales data to be released today, he added.

India's benchmark indices extended losses at open tracking a fall in shares of Bajaj Finance Ltd., ITC Ltd., and ICICI Bank Ltd.

As of 09:21 a.m., the S&P BSE Sensex was trading 218.75 points or 0.30% lower at 72,543.14, the NSE Nifty 50 was trading 53.90 points or 0.25% lower at 21,943.80.

"Expected weakness in the domestic market may continue and further profit booking in the mid-cap and small cap stocks may not be ruled out on account of rally in the last few months," said Vikas Jain, senior research analyst at Reliance Securities.

The recent correction in the Nifty Small cap index by 15% from its February 8th peak, was triggered partly by regulatory interventions from the SEBI rally. India Vix soared 6% to above 14 yesterday. Metal stocks will be in focus after the news that China mulls output cuts, Jain said.

Investors are now awaiting the release of wholesale inflation and retail sales data to be released today, he added.

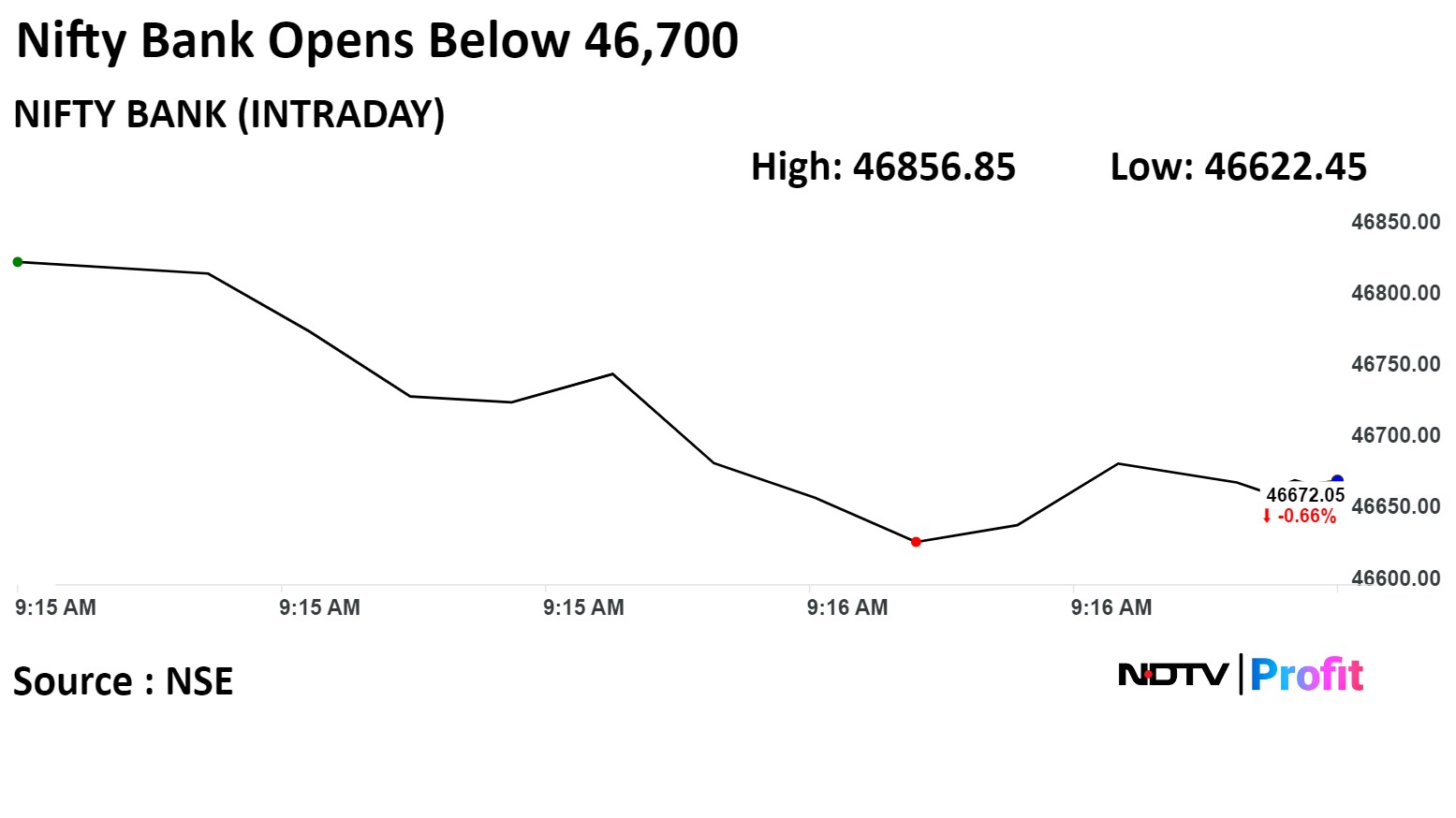

Bajaj Finance Ltd., ITC Ltd., ICICI Bank Ltd., Tata Motors Ltd., and Oil and Natural Gas Corporation of India Ltd. weighed on the benchmark index.

Reliance Industries Ltd., Bharti Airtel Ltd., Kotak Mahindra Bank Ltd., HDFC Bank Ltd., Tata Consultancy Services capped losses in the index.

On NSE, nine sectoral indices were trading lower, and three were trading higher. The Nifty Oil & Gas index was the top performing index, while the Nifty Realty index declined the most.

Broader markets outperformed benchmark indices on BSE. The S&P BSE Smallcap index rebounded, and was trading 0.62% higher. Similarly, the S&P BSE Midcap index was trading 0.62% higher.

On BSE, 17 indices out of 20 advanced, and three declined. The S&P BSE Utilities index rose the most, while the S&P BSE Realty index fell the most among sectoral indices.

Market breadth was skewed in favour of the buyers. Around 1,910 stocks rose, and 1,211 stocks declined, and 75 remained unchanged on BSE.

At pre-open, the NSE Nifty 50 was trading 15.15 points lower or 0.07% down at 21,982.55, and the S&P BSE Sensex was trading 191.79 points or 0.26% lower at 72,570.10.

The yield on the 10-year bond opened flat at 7.04%.

Source: Bloomberg

The local currency opened flat at 82.85 against the U.S. Dollar.

Source: Bloomberg

Citi Research reiterated 'Buy' on Godrej Consumer Products Ltd with a target price of Rs 1,350.

Remains as top pick in India Consumer Staples

GCPL holds exclusivity to new molecule based incense sticks over medium term

Believes new molecule to accelerate medium-term growth through market share gains

Management aims to simplify African cluster business to remove loss-making segments

Management targets to improve Africa cluster EBITDA margin to over 15% in two years

Sees long term opportunity in liquid detergents category

Godrej Properties Ltd. acquired 3 acre land parcel in Hyderabad having estimated booking value of Rs 1,300 crore.

Source: Exchange filing

Primary check suggests strong demand in housing, MSME, unsecured personal loans.

PSU Banks increasing their sales strength, reducing turnaround times for HLs.

Early evidence of slowdown in PLs.

Lenders also tightening criteria along with raising rates on PLs.

Large private banks and NBFCs dominate LAP/MSME.

Few NBFCs are selectively underwriting even subprime customers.

Most PSU Banks are offering better lending rates and have increased commissions.

MSME Growth: 15% for PSU Banks; 25% for large private banks and mid-teens for mid sized.

AU Small Finance Bank Ltd.'s RoA to remain supressed in near term.

Expect RoA to improve to 1.7% by FY26.

Fincare SFB merger to help diversify lending portfolio.

Fincare SFB merger liabilities, costs to offset near term benefit.

Estimate loan CAGR of 25% post-merger.

Funding cost pressures to dilute near-term margin performance.

Estimate GNPA/NNPA ratio at 2%/0.7% in FY26.

U.S. Dollar Index at 102.79

U.S. 10-year bond yield at 4.19%

Brent crude up 0.17% at $84.17 per barrel

Nymex crude up 0.16% at $79.85 per barrel

Bitcoin was down 0.54% at $72,763.50

The Indian rupee weakened by 9 paise to close at 82.86 against the U.S. dollar.

Nifty March futures down by 1.65% to 22,103.25 at a premium of 105.55 points.

Nifty March futures open interest down by 2.6%.

Nifty Bank March futures down by 1.06% to 47,081.35 at a premium of 100.05 points.

Nifty Bank March futures open interest down by 1.3%.

Nifty Options March 14 Expiry: Maximum call open interest at 22,500 and maximum put open interest at 21,700.

Bank Nifty Options March Expiry: Maximum call open Interest at 50,000 and maximum put open interest at 47,000.

Securities in ban period: Aditya Birla Fashion, Hindustan Copper, Manappuram Finance, National Aluminium, Piramal Enterprise, RBL Bank, SAIL, Tata Chemical, and Zee Entertainment Enterprise.

Price band changes from 20% to 10%: HLV, India Pesticides, Paisalo Digital, Railtel Corp., Swan Energy.

Price band changes from 10% to 5%: GMR Power and Urban Infra, HMA Agro Industries, India Tourism Development Corp., Mahanagar Telephone Nigam.

Ex/record Dividend: Wonder Electricals.

Moved out short-term ASM framework: Action Construction Equipment

Titan: To meet analysts and investors on March 21.

Vishnu Chemicals: To meet analysts and investors on March 15.

Century Textiles: To meet analysts and investors on March 19.

Alkem Laboratories: To meet analysts and investors on March 19.

Heritage Foods: To meet analysts and investors on March 18.

Tips Industries: To meet analysts and investors on March 18.

Mahindra Holidays and Resorts India: To meet analysts and investors on March 18.

Chambal Fertilizers and Chemicals: Promoter Group Master Exchange and Finance created the pledge of 2 lakh shares on March 7.

Maharashtra Seamless: Promoter Sudha Apparels bought 28,500 shares on March 11.

Nirlon: Promoter Kunal Virenchee Sagar sold 13.29 lakh shares, while Alfano Pte sold 9.23 lakh shares on March 12.

Som Distilleries and Breweries: Promoter Jagdish Kumar Arora bought 20,000 shares on March 13.

Man Industries: Promoter Man Finance bought 35,225 shares between March 6 and 7.

Gokul Agro Resources: Promoter Ritika Infracon bought 3.23 lakh shares between March 11 and 12.

Bharat Wire Ropes: Promoter Gyanshankar E-Trading LLP bought 3.02 lakh shares between March 6 and 12.

APL Apollo Tubes: New World Fund Inc. bought 27.89 lakh shares (1%) at Rs 1,601.1 apiece, while Principal Global Investors Collective Investment Trust sold 15.31 lakh shares (0.55%) at Rs 1,600.16 apiece.

Lancer Container Lines: Minerva Ventures Fund sold 60.6 lakh shares (2.8%) at Rs 69 apiece.

ITC: Tobacco Manufacturers (India) sold 43.68 crore shares (3.5%) at Rs 400.2 apiece, while ICICI Prudential Mutual Fund bought 12.4 crore shares (0.99%), Government of Singapore bought 9.15 crore shares (0.73%), BofA Securities Europe SA bought 2.04 crore (0.16%), Societe Generale bought 1.83 crore shares (0.14%) at Rs 400.2 apiece.

Popular Vehicles and Services: The public issue was subscribed 0.45 times on day 2. The bids were by non-institutional investors (0.2 times), retail investors (0.78 times) and a portion reserved for employees (6.16 times).

Krystal Integrated Services: The company will offer its shares for bidding on Thursday. The price band is set from Rs 680 to Rs 715 per share. The 300.1-crore IPO is a combination of a fresh issue and an offer for sale. The company has raised Rs 90 crore from anchor investors.

Gopal Snacks: The company's shares will debut on the stock exchanges on Thursday. The Rs 650 crore IPO was subscribed 9.02 times on its third and final day. Bids were led by institutional investors (17.5 times), retail investors (4.01 times), non-institutional investors (9.5 times), portion reserved for employees (6.88 times).

Tata Motors: The company signed an MoU with Tamil Nadu government to set-up vehicle manufacturing facility. This MoU requires investment of Rs 9,000 crore over a five-year period.

Hindustan Aeronautics: The defence ministry signed two contracts with a combined value of Rs 8,073 crore with HAL for acquisition of 34 advanced light helicopters and associated equipment for the Indian Army and the Coast Guard.

KEC International: The company received new orders worth Rs 2,257 crore across various business verticals.

Auto Stocks: The central government has announced a new scheme to promote the adoption of electric mobility in India, ahead of the expiration of a previous scheme that lasted for five years. The Electric Mobility Promotion Scheme 2024 has an outlay of Rs 500 crore over four months for electric two-wheelers and three-wheelers.

Rail Vikas Nigam: The company and Salasar JV has received a letter of award from Madhya Pradesh Power Transmission for construction of transmission lines and associated feeder bays in eastern MP.

Adani Enterprises: Adani ConneX’s Hyderabad site gets five-star grading from the British Safety Council.

IIFL Finance: The company approved raising up to Rs 1,500 crore via issue of shares and up to Rs 500 crore via NCDs on a private placement basis.

Vedanta: The company will appeal against the SEBI order directing it to pay Rs 77.6 crore to Cairn UK before the appropriate forum.

DLF: The company’s unit raised up to Rs 600 crore via NCDs on private placement basis.

Balkrishna Industries: The Income Tax Department is conducting a search at office premises and manufacturing units since March 11. The company is fully cooperating with the authorities and providing all necessary information and support.

Azad Engineering: The company signed a $35 million, seven-year strategic contract with the steam power business of GE Vernova for the supply of high-complex rotating airfoils for nuclear, industrial and thermal power industry.

Sanofi India: The company has approved a distribution and promotion agreement with Emcure Pharmaceuticals to distribute cardiovascular products.

PC Jeweller: State Bank of India has accepted the company's proposal for one time settlement of outstanding dues.

Dynamatic Technologies: The company in pact with Deutsche Aircraft to manufacture rear fuselage for regional aircraft D328eco.

South Indian Bank: The bank will not on-board any fresh customers in co-branded credit cards until bank fully complies with regulatory guidelines but will continue to service existing customers holding co-branded credit cards issued by bank.

Federal Bank: The bank has stopped issuance of new co-branded credit cards and will seek regulatory clearance prior to resumption of new issuance. The bank will continue to service existing customers holding co-branded credit cards issued by the bank.

Power Mech Projects: The company incorporated a new wholly owned subsidiary by name PMTS.

DroneAcharya Aerial: The company received a service order from Dhamra Port Co. to provide DGCA-certified drone pilot training.

Cyient: The company has signed a multiyear services agreement with Airbus for cabin and cargo engineering.

Cholamandalam Investment: The company purchased land worth Rs 735 crore from DLF IT Offices Chennai admeasuring 4.67 acres.

L&T Finance: The company issued the clarification that the company will continue to offer a range of financial products & services under the brand name 'L&T Finance'.

Indian Hume Pipe: The company received orders worth Rs 230 crore from Telangana government for water supply and sewerage projects.

Bharat Forge: The company approved the fundraise of Rs 12.5 crore by way of the issuance of NCDs on a private placement basis and an unsecured loan up to Rs 37.5 crore.

Most markets in the Asia-Pacific region were trading lower, taking cues from overnight losses on Wall Street as investors look forward to the release of U.S. PPI data.

The Nikkei 225 was trading 259.00 points 0.67% down at 38,436.97, and the S&P ASX 200 was trading 8.64 points or 0.11% down at 7,720.80 as of 07:07 a.m.

Bucking the trend, the KOSPI index was trading 7.69 points or 0.29% higher at 2,701.26 as of 07:08 a.m.

U.S. stocks retreated from their all-time highs as a handful of big techs fell and traders awaited a $22 billion sale of long-term Treasury securities, reported Bloomberg.

The S&P 500 Index and Nasdaq Composite settled 0.19% and 0.54% down, respectively, on Wednesday. The Dow Jones Industrial Average ended 0.10% higher.

Brent crude was trading 0.06% higher at $84.06 a barrel. Gold was higher by 0.09% at $2,176.30 an ounce.

The GIFT Nifty was trading 21.5 points or 0.1% lower at 22,036.00 as of 07:09 a.m.

India's benchmark equity indices ended lower on Wednesday and broader market indices continued a selloff for the third consecutive day.

The Nifty ended below 22,000 for the first time in March at 21,997.70, down 338 points or 1.51%. The S&P BSE Sensex closed at 72,761.89, down 906.07 points or 1.23%.

Overseas investors turned net sellers of Indian equities on Wednesday after buying for five sessions. Foreign portfolio investors sold stocks worth Rs 4,595.1 crore, while domestic institutional investors mopped up equities worth Rs 9,093.7 crore, the NSE data showed.

The Indian rupee weakened by 9 paise to close at 82.86 against the U.S. dollar.

Most markets in the Asia-Pacific region were trading lower, taking cues from overnight losses on Wall Street as investors look forward to the release of U.S. PPI data.

The Nikkei 225 was trading 259.00 points 0.67% down at 38,436.97, and the S&P ASX 200 was trading 8.64 points or 0.11% down at 7,720.80 as of 07:07 a.m.

Bucking the trend, the KOSPI index was trading 7.69 points or 0.29% higher at 2,701.26 as of 07:08 a.m.

U.S. stocks retreated from their all-time highs as a handful of big techs fell and traders awaited a $22 billion sale of long-term Treasury securities, reported Bloomberg.

The S&P 500 Index and Nasdaq Composite settled 0.19% and 0.54% down, respectively, on Wednesday. The Dow Jones Industrial Average ended 0.10% higher.

Brent crude was trading 0.06% higher at $84.06 a barrel. Gold was higher by 0.09% at $2,176.30 an ounce.

The GIFT Nifty was trading 21.5 points or 0.1% lower at 22,036.00 as of 07:09 a.m.

India's benchmark equity indices ended lower on Wednesday and broader market indices continued a selloff for the third consecutive day.

The Nifty ended below 22,000 for the first time in March at 21,997.70, down 338 points or 1.51%. The S&P BSE Sensex closed at 72,761.89, down 906.07 points or 1.23%.

Overseas investors turned net sellers of Indian equities on Wednesday after buying for five sessions. Foreign portfolio investors sold stocks worth Rs 4,595.1 crore, while domestic institutional investors mopped up equities worth Rs 9,093.7 crore, the NSE data showed.

The Indian rupee weakened by 9 paise to close at 82.86 against the U.S. dollar.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.