The yield on the 10-year bond closed flat at 7.17% on Monday.

Source: Bloomberg

The local currency weakened by 3 paise to 83.14 against the U.S dollar.

It closed at 83.11 on Thursday.

Source: Bloomberg

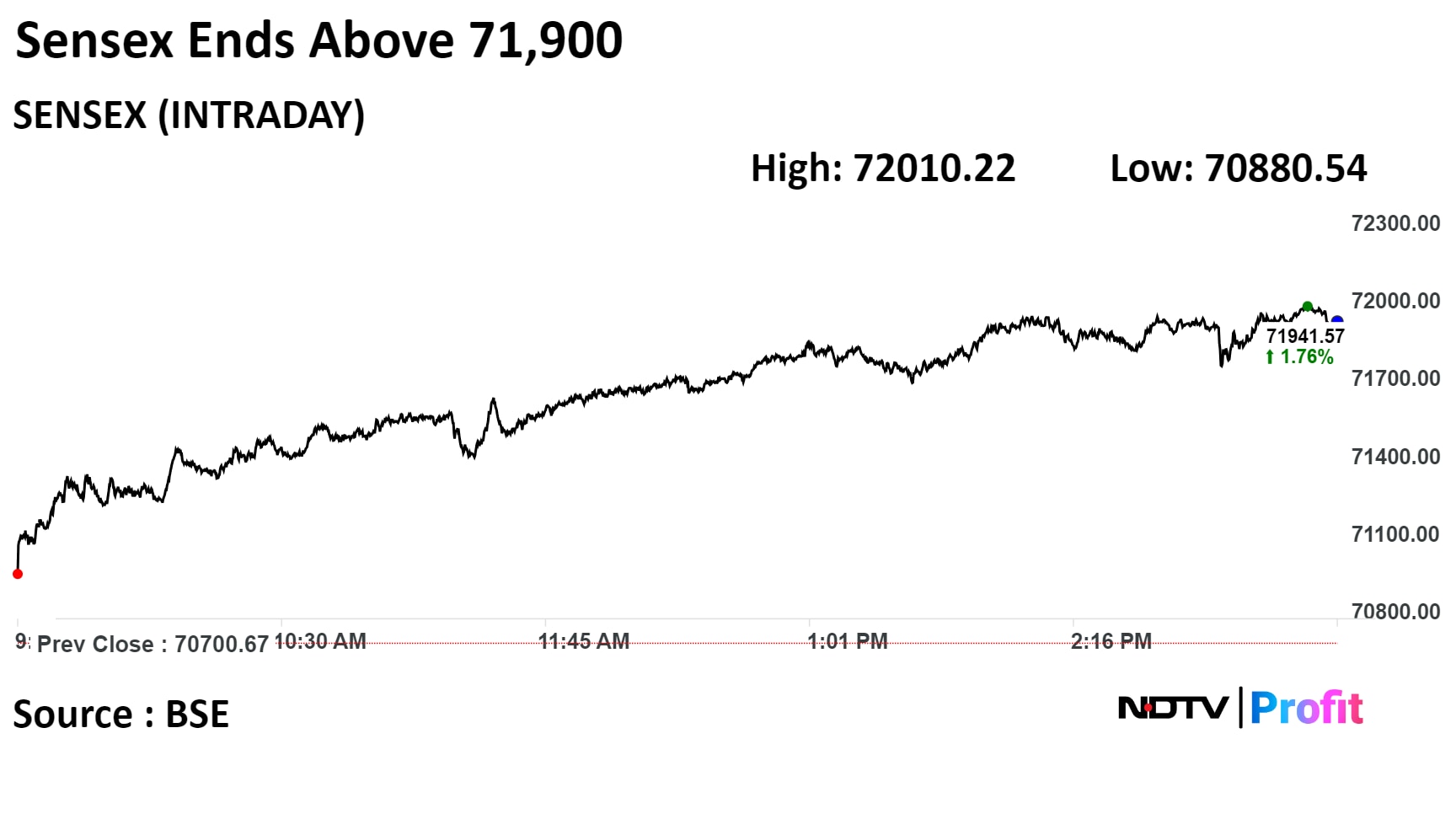

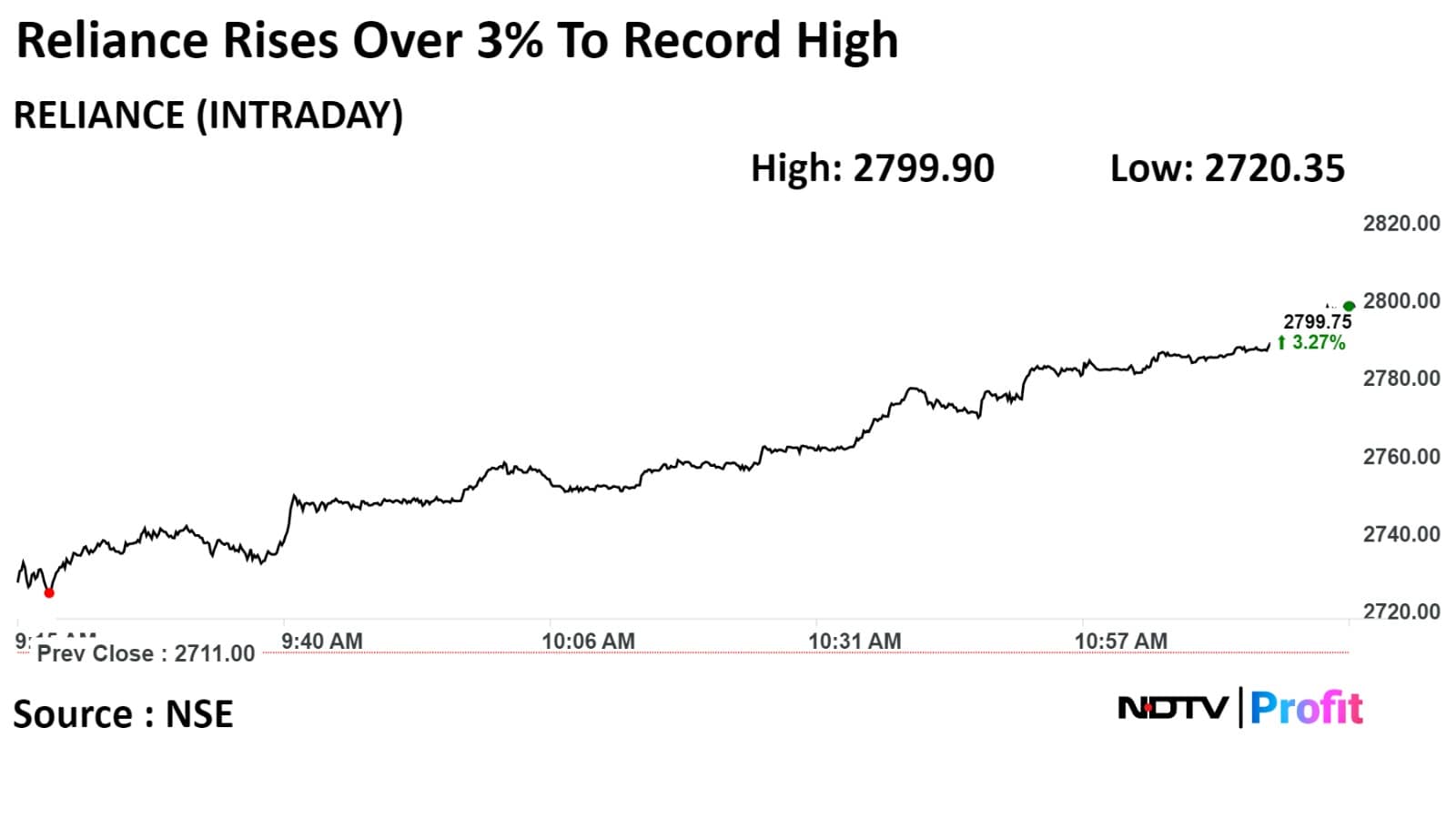

Equity benchmarks ended the first day of the week with their biggest single day gains since December 4 with heavyweight Reliance Industries contributing the most to the gains.

Intraday, shares of Reliance Industries rose over 7% to hit their lifetime high of Rs 2,904.40 as crude prices rose amid escalating tensions in the Middle East.

The Nifty 50 ended at 21,737.60, up 385.00 points or 1.80% while the Sensex jumped 1,240.90 points or 1.76% to end at 71,941.57.

“The surge in the Nifty 50 can be largely attributed to investor optimism in anticipation of the upcoming interim budget, where significant allocations are expected in key sectors like infrastructure and energy," said Sonam Srivastava, smallcase manager at Wright Research.

According to Aditya Gaggar, director of Progressive Shares, "In one go only, the Index has breached its multiple hurdles (21,500 & 21,700) and formed a strong bullish candle on the daily chart; however, we assume that Nifty may witness some pressure around 21,750."

He added, "It is premature to say but there is a possibility of forming an Inverted Head & Shoulder pattern. The immediate resistance is placed at 21,850 while the downside seems to be protected at 21,570."

Equity benchmarks ended the first day of the week with their biggest single day gains since December 4 with heavyweight Reliance Industries contributing the most to the gains.

Intraday, shares of Reliance Industries rose over 7% to hit their lifetime high of Rs 2,904.40 as crude prices rose amid escalating tensions in the Middle East.

The Nifty 50 ended at 21,737.60, up 385.00 points or 1.80% while the Sensex jumped 1,240.90 points or 1.76% to end at 71,941.57.

“The surge in the Nifty 50 can be largely attributed to investor optimism in anticipation of the upcoming interim budget, where significant allocations are expected in key sectors like infrastructure and energy," said Sonam Srivastava, smallcase manager at Wright Research.

According to Aditya Gaggar, director of Progressive Shares, "In one go only, the Index has breached its multiple hurdles (21,500 & 21,700) and formed a strong bullish candle on the daily chart; however, we assume that Nifty may witness some pressure around 21,750."

He added, "It is premature to say but there is a possibility of forming an Inverted Head & Shoulder pattern. The immediate resistance is placed at 21,850 while the downside seems to be protected at 21,570."

Equity benchmarks ended the first day of the week with their biggest single day gains since December 4 with heavyweight Reliance Industries contributing the most to the gains.

Intraday, shares of Reliance Industries rose over 7% to hit their lifetime high of Rs 2,904.40 as crude prices rose amid escalating tensions in the Middle East.

The Nifty 50 ended at 21,737.60, up 385.00 points or 1.80% while the Sensex jumped 1,240.90 points or 1.76% to end at 71,941.57.

“The surge in the Nifty 50 can be largely attributed to investor optimism in anticipation of the upcoming interim budget, where significant allocations are expected in key sectors like infrastructure and energy," said Sonam Srivastava, smallcase manager at Wright Research.

According to Aditya Gaggar, director of Progressive Shares, "In one go only, the Index has breached its multiple hurdles (21,500 & 21,700) and formed a strong bullish candle on the daily chart; however, we assume that Nifty may witness some pressure around 21,750."

He added, "It is premature to say but there is a possibility of forming an Inverted Head & Shoulder pattern. The immediate resistance is placed at 21,850 while the downside seems to be protected at 21,570."

Equity benchmarks ended the first day of the week with their biggest single day gains since December 4 with heavyweight Reliance Industries contributing the most to the gains.

Intraday, shares of Reliance Industries rose over 7% to hit their lifetime high of Rs 2,904.40 as crude prices rose amid escalating tensions in the Middle East.

The Nifty 50 ended at 21,737.60, up 385.00 points or 1.80% while the Sensex jumped 1,240.90 points or 1.76% to end at 71,941.57.

“The surge in the Nifty 50 can be largely attributed to investor optimism in anticipation of the upcoming interim budget, where significant allocations are expected in key sectors like infrastructure and energy," said Sonam Srivastava, smallcase manager at Wright Research.

According to Aditya Gaggar, director of Progressive Shares, "In one go only, the Index has breached its multiple hurdles (21,500 & 21,700) and formed a strong bullish candle on the daily chart; however, we assume that Nifty may witness some pressure around 21,750."

He added, "It is premature to say but there is a possibility of forming an Inverted Head & Shoulder pattern. The immediate resistance is placed at 21,850 while the downside seems to be protected at 21,570."

Equity benchmarks ended the first day of the week with their biggest single day gains since December 4 with heavyweight Reliance Industries contributing the most to the gains.

Intraday, shares of Reliance Industries rose over 7% to hit their lifetime high of Rs 2,904.40 as crude prices rose amid escalating tensions in the Middle East.

The Nifty 50 ended at 21,737.60, up 385.00 points or 1.80% while the Sensex jumped 1,240.90 points or 1.76% to end at 71,941.57.

“The surge in the Nifty 50 can be largely attributed to investor optimism in anticipation of the upcoming interim budget, where significant allocations are expected in key sectors like infrastructure and energy," said Sonam Srivastava, smallcase manager at Wright Research.

According to Aditya Gaggar, director of Progressive Shares, "In one go only, the Index has breached its multiple hurdles (21,500 & 21,700) and formed a strong bullish candle on the daily chart; however, we assume that Nifty may witness some pressure around 21,750."

He added, "It is premature to say but there is a possibility of forming an Inverted Head & Shoulder pattern. The immediate resistance is placed at 21,850 while the downside seems to be protected at 21,570."

Equity benchmarks ended the first day of the week with their biggest single day gains since December 4 with heavyweight Reliance Industries contributing the most to the gains.

Intraday, shares of Reliance Industries rose over 7% to hit their lifetime high of Rs 2,904.40 as crude prices rose amid escalating tensions in the Middle East.

The Nifty 50 ended at 21,737.60, up 385.00 points or 1.80% while the Sensex jumped 1,240.90 points or 1.76% to end at 71,941.57.

“The surge in the Nifty 50 can be largely attributed to investor optimism in anticipation of the upcoming interim budget, where significant allocations are expected in key sectors like infrastructure and energy," said Sonam Srivastava, smallcase manager at Wright Research.

According to Aditya Gaggar, director of Progressive Shares, "In one go only, the Index has breached its multiple hurdles (21,500 & 21,700) and formed a strong bullish candle on the daily chart; however, we assume that Nifty may witness some pressure around 21,750."

He added, "It is premature to say but there is a possibility of forming an Inverted Head & Shoulder pattern. The immediate resistance is placed at 21,850 while the downside seems to be protected at 21,570."

Equity benchmarks ended the first day of the week with their biggest single day gains since December 4 with heavyweight Reliance Industries contributing the most to the gains.

Intraday, shares of Reliance Industries rose over 7% to hit their lifetime high of Rs 2,904.40 as crude prices rose amid escalating tensions in the Middle East.

The Nifty 50 ended at 21,737.60, up 385.00 points or 1.80% while the Sensex jumped 1,240.90 points or 1.76% to end at 71,941.57.

“The surge in the Nifty 50 can be largely attributed to investor optimism in anticipation of the upcoming interim budget, where significant allocations are expected in key sectors like infrastructure and energy," said Sonam Srivastava, smallcase manager at Wright Research.

According to Aditya Gaggar, director of Progressive Shares, "In one go only, the Index has breached its multiple hurdles (21,500 & 21,700) and formed a strong bullish candle on the daily chart; however, we assume that Nifty may witness some pressure around 21,750."

He added, "It is premature to say but there is a possibility of forming an Inverted Head & Shoulder pattern. The immediate resistance is placed at 21,850 while the downside seems to be protected at 21,570."

Equity benchmarks ended the first day of the week with their biggest single day gains since December 4 with heavyweight Reliance Industries contributing the most to the gains.

Intraday, shares of Reliance Industries rose over 7% to hit their lifetime high of Rs 2,904.40 as crude prices rose amid escalating tensions in the Middle East.

The Nifty 50 ended at 21,737.60, up 385.00 points or 1.80% while the Sensex jumped 1,240.90 points or 1.76% to end at 71,941.57.

“The surge in the Nifty 50 can be largely attributed to investor optimism in anticipation of the upcoming interim budget, where significant allocations are expected in key sectors like infrastructure and energy," said Sonam Srivastava, smallcase manager at Wright Research.

According to Aditya Gaggar, director of Progressive Shares, "In one go only, the Index has breached its multiple hurdles (21,500 & 21,700) and formed a strong bullish candle on the daily chart; however, we assume that Nifty may witness some pressure around 21,750."

He added, "It is premature to say but there is a possibility of forming an Inverted Head & Shoulder pattern. The immediate resistance is placed at 21,850 while the downside seems to be protected at 21,570."

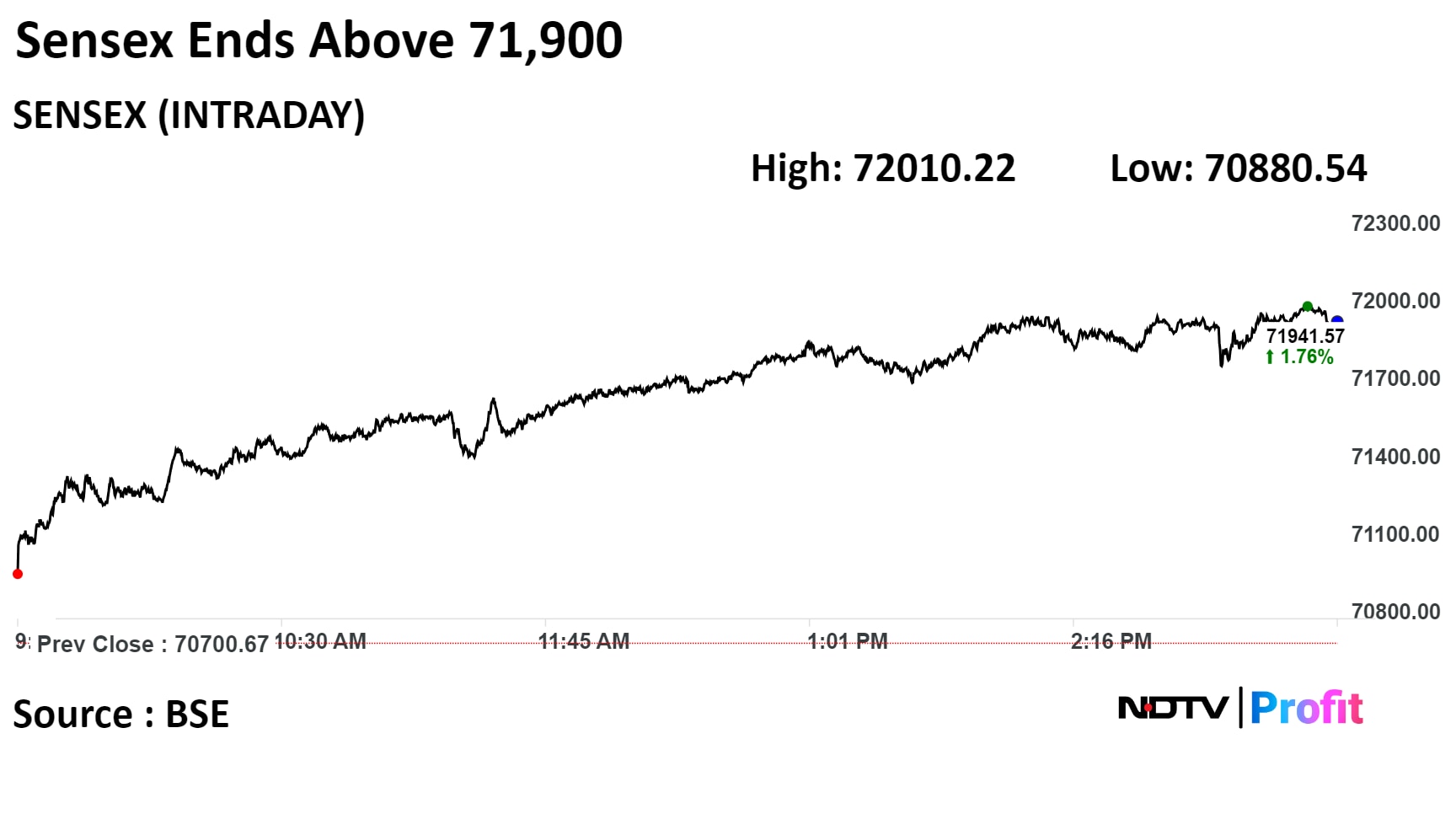

Most sectoral indices ended in the green with Nifty Energy and Nifty Oil & Gas surging more than 5%. Meanwhile, Nifty Media and Nifty FMCG fell.

The broader markets rose in line with the benchmark indices. The S&P BSE Midcap gained 1.63%, and the S&P BSE Smallcap rose 1.00%.

On BSE, 17 out of 20 sectors declined, while three advanced. The S&P BSE Utilities rose the most among sectoral indices.

Market breadth was skewed in favour of buyers. Around 2,271 stocks rose, 1,649 stocks declined, and 144 remained unchanged on BSE.

Revenue up 5.19% at Rs 34,697.78 crore vs Rs 32,985.71 crore

Net profit up 30.75% at Rs 3,193.34 crore vs Rs 2,442.18 crore

Ebitda up 17.54% at Rs 4,208.3 crore vs Rs 3,580.23 crore

Ebitda margin at 12.12% vs 10.85%

Revenue up 5.19% at Rs 34,697.78 crore vs Rs 32,985.71 crore

Net profit up 30.75% at Rs 3,193.34 crore vs Rs 2,442.18 crore

Ebitda up 17.54% at Rs 4,208.3 crore vs Rs 3,580.23 crore

Ebitda margin at 12.12% vs 10.85%

23.2 lakh shares changed hands in a large trade

0.1% equity changed hands at price range of Rs 61.15 to Rs 64.15 apiece

Buyers and sellers not known immediately

Source: Bloomberg

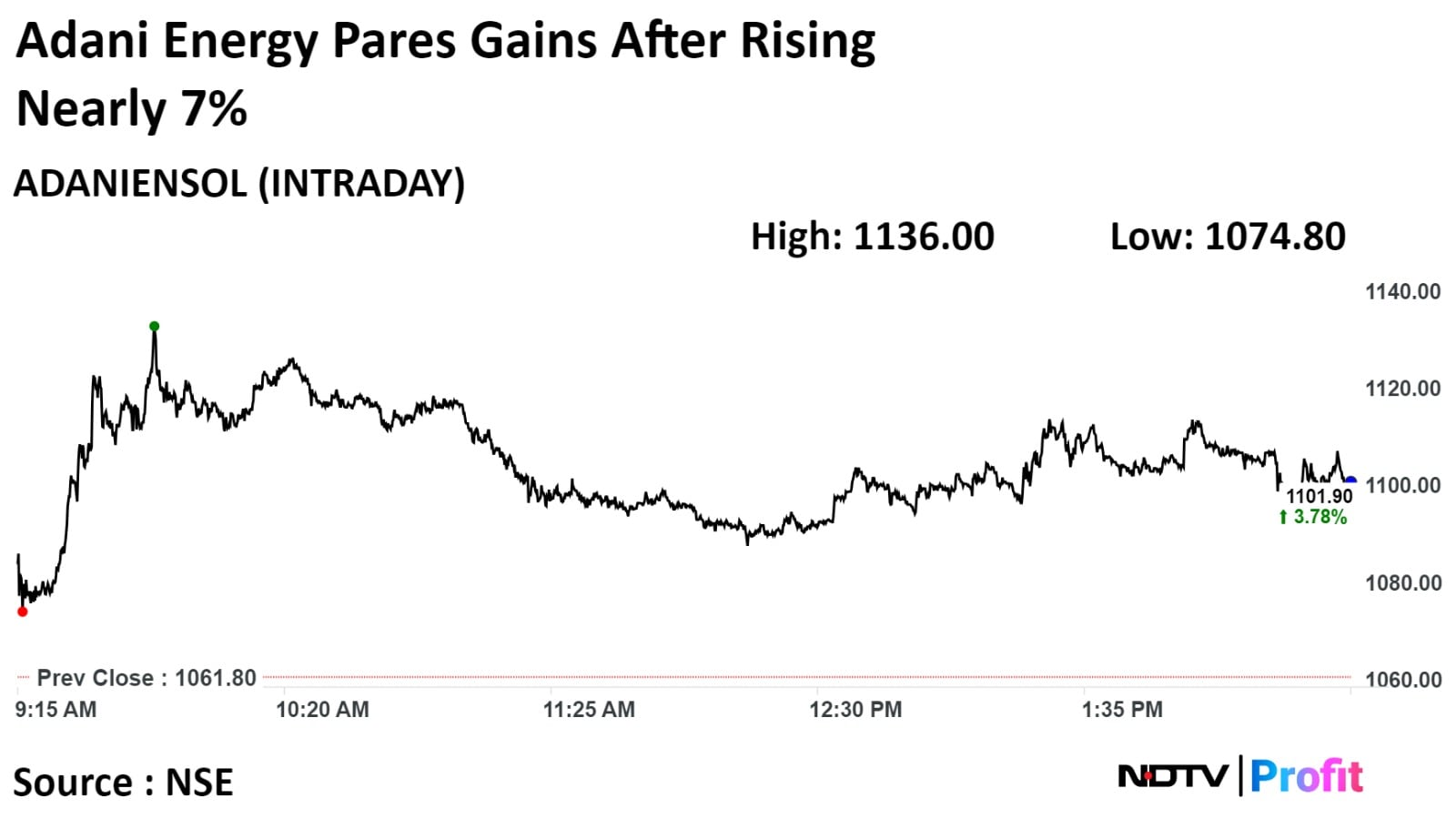

Revenue up 24.2% at Rs 4562.7 crore vs Rs 3673.87 crore

Net profit up 22.6% at Rs 348.3 crore vs Rs 284.09 crore

Ebitda up 1.5% at Rs 1,527.3 crore vs Rs 1,504.6 crore

Ebitda margin at 33.47% vs 40.95%

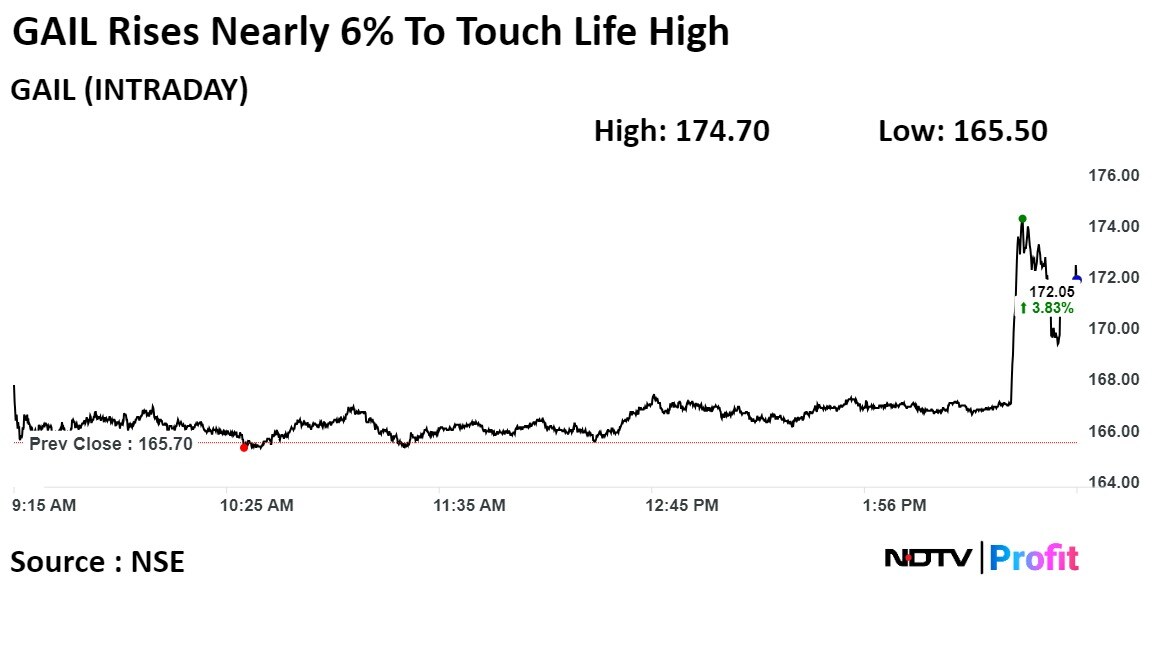

Shares of Adani Energy Solutions Ltd rose 6.99% to Rs 1,136.00. It pared gains to trade 3.69% higher at Rs 1,101.00 as of 2:42 p.m. This compares to 1.32% advance on NSE Nifty 50 index.

Revenue up 24.2% at Rs 4562.7 crore vs Rs 3673.87 crore

Net profit up 22.6% at Rs 348.3 crore vs Rs 284.09 crore

Ebitda up 1.5% at Rs 1,527.3 crore vs Rs 1,504.6 crore

Ebitda margin at 33.47% vs 40.95%

Shares of Adani Energy Solutions Ltd rose 6.99% to Rs 1,136.00. It pared gains to trade 3.69% higher at Rs 1,101.00 as of 2:42 p.m. This compares to 1.32% advance on NSE Nifty 50 index.

One analyst tracking the company maintained 'Buy' rating. The average 12-month consensus price target implies an upside of 24.5%.

Revenue up 6.38% at Rs 221.6 crore vs Rs 236.7 crore

Net profit up 86.83% at Rs 9.08 crore vs Rs 4.86 crore

Ebitda up 25.63% at Rs 20.19 crore vs Rs 16.07 crore

Ebitda margin at 9.11% vs 6.78%

Revenue up 14.26% at Rs 408.5 crore vs Rs 357.5 crore

Net profit up 86.22 at Rs 94.6 crore vs Rs 50.8 crore

Ebitda up 89.17% at Rs 104.84 crore vs Rs 55.42 crore

Margin at 25.66% vs 15.5%

14.2 lakh shares changed hands in a large trade

0.2% equity changed hands at Rs 508 apiece

Buyers and sellers not known immediately

Source: Bloomberg

Revenue up 0.21% at Rs 4,162.2 crore vs Rs 4,153.1 crore

Net profit up 40.22% at Rs 860.3 crore vs Rs 613.5 crore

Ebitda up 24.22% at Rs 1,072.61 crore vs Rs 863.42 crore

Ebitda Margin at 25.77% vs 20.78%

Revenue up 11.47% at Rs 1,15,494.24 crore vs Rs 1,02,985.56 crore

Net profit down 61.03% at Rs 3,397.27 crore vs Rs 8,501.17 crore

Ebitda down 51.77% at Rs 6,226.25 crore vs Rs 12,907.98 crore

Ebitda Margin at 5.39% vs 12.53%

Commissions 2.6 MTPA greenfield grinding capacity at Rajpura, Punjab

Co's total grey cement manufacturing capacity in India now at 135.59 MTPA

Source: Exchange Filing

Net profit down 4% YoY at Rs 150 crore vs Rs 156 crore

Net interest income up 9% YoY at Rs 382.7 crore vs Rs 349.7 crore

Net NPA at 0.31% vs 0.33% QoQ

Gross NPA at 1.22% vs 1.27% QoQ

Revenue up 17.3% YoY at Rs 2,311 crore vs Rs 1,971 crore

Net profit up 148.5% YoY at Rs 256 crore vs Rs 103 crore

Ebitda up 49.3% at Rs 1,742 crore vs Rs 1,167 crore

Ebitda Margin at 75.37% vs 59.2%

23.6 lakh shares changed hands in a large trade

0.4% equity changed hands at Rs 508 apiece

Buyers and sellers not known immediately

Source: Bloomberg

20.2 lakh shares changed hands in a large trade

0.02% equity changed hands at Rs 251.85 apiece

Buyers and sellers not known immediately

Source: Bloomberg

Alert: SpiceJet owes a total of $12.9 million to two engine lessors

Source: Cogencis

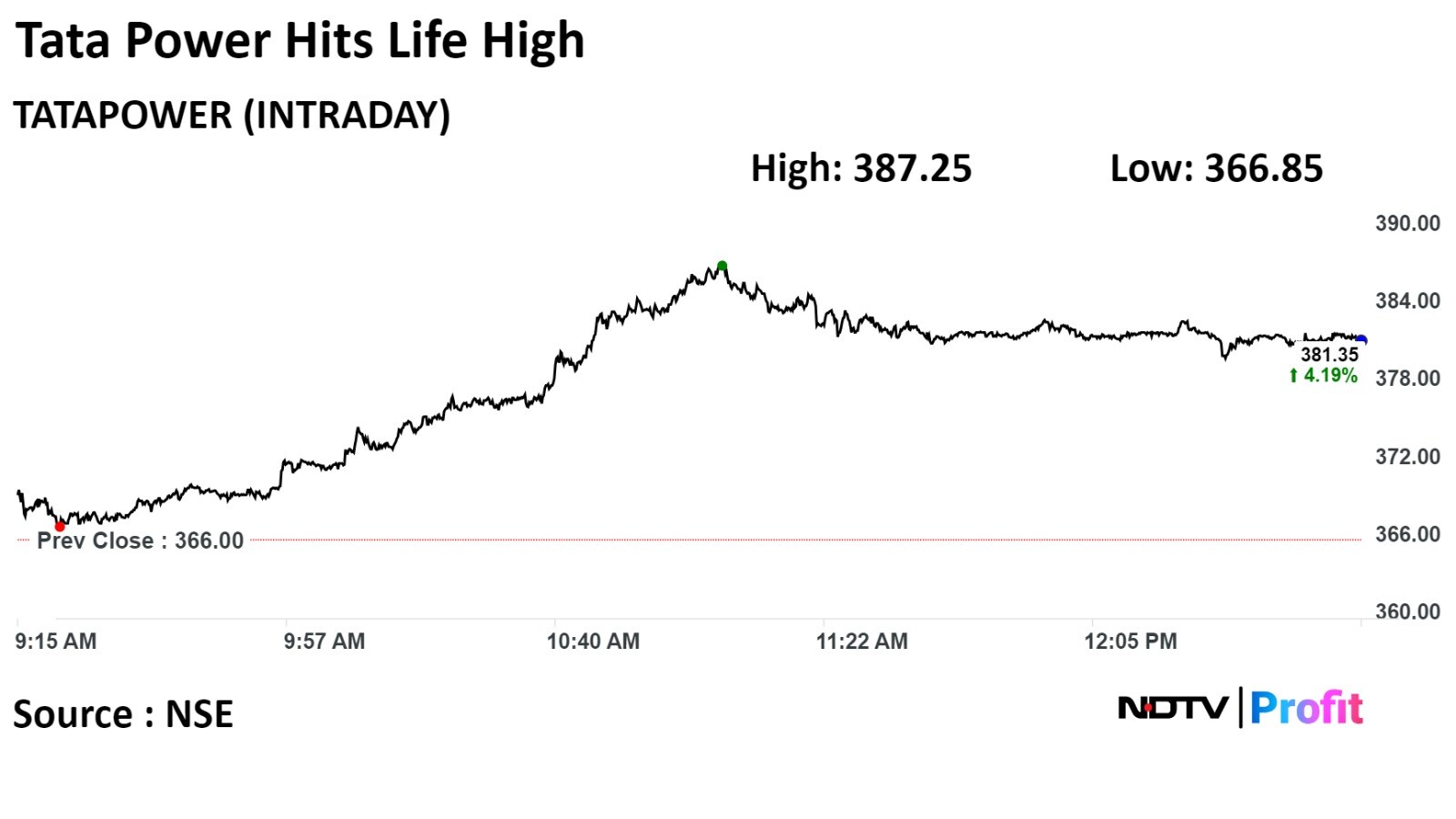

Shares of Tata Power Ltd surged over 6% and hit a life high on NSE after the company said to the exchanges its renewable unit installed a first ever on-ground bifacial modules in eastern India.

Tata Power Renewable Energy Ltd has commissioned a 1,040-KW Bifacial Solar System Project in Chengmari Tea Estate, the exchange filing said on Monday.

The company installed approximately 1,900 modules within six months, and it is estimated to produce 1.5 MUs of energy annually for the Chengmari Tea estate, the exchange filing said.

Shares of Tata Power Ltd surged over 6% and hit a life high on NSE after the company said to the exchanges its renewable unit installed a first ever on-ground bifacial modules in eastern India.

Tata Power Renewable Energy Ltd has commissioned a 1,040-KW Bifacial Solar System Project in Chengmari Tea Estate, the exchange filing said on Monday.

The company installed approximately 1,900 modules within six months, and it is estimated to produce 1.5 MUs of energy annually for the Chengmari Tea estate, the exchange filing said.

On NSE, Tata Power rose as much as 6.07% to Rs 387.25 apiece, the highest level since its listing on Apr 3, 1996. It pared gains/losses trade 4.35% higher at Rs 381.65 apiece, as of 12:57 p.m. This compares to a 1.14% advance in the NSE Nifty 50 Index.

It has risen 86.79% in 12 months. Total traded volume so far in the day stood at 2.2 times its 30-day average. The relative strength index was at 77.53, which implied the stock is overbought.

Out of 21 analysts tracking the company, 11 maintain a 'buy' rating, three recommend a 'hold,' and seven suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies a downside of 21.5%.

Added 14 new stores to the existing count of 29 stores in the city

Source: Exchange Filing

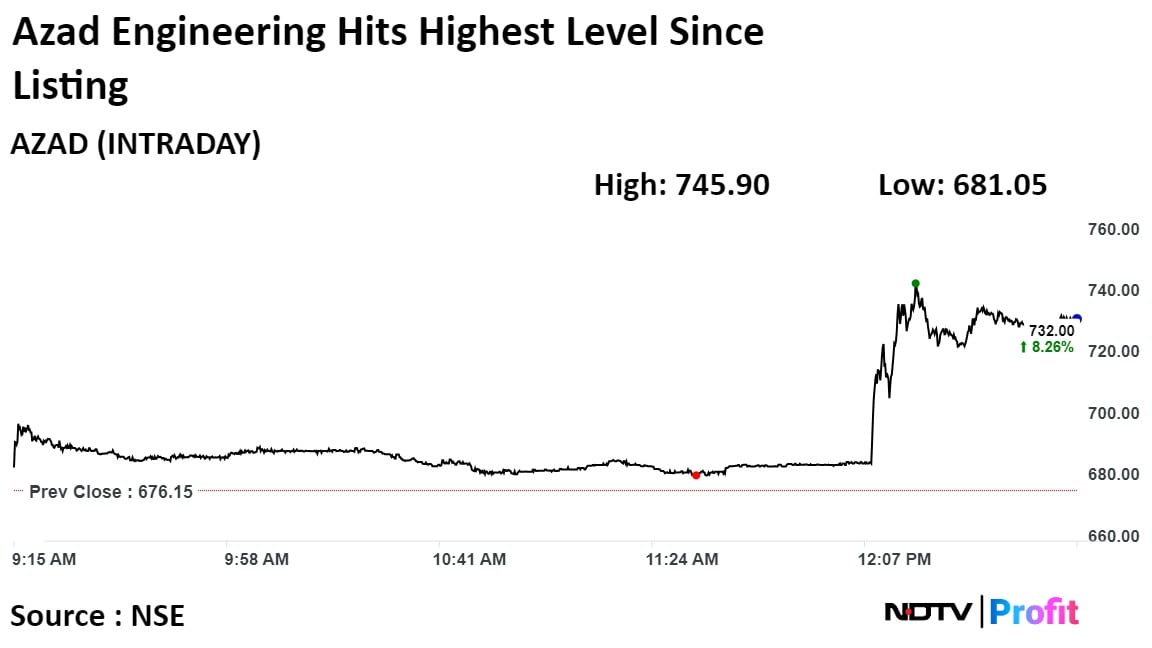

Shares of Azad Engineering Ltd rose on Monday to touch a new life high after it signed a long-term contract with Rolls-Royce PLC.

The company on Monday signed a seven-year contract with Rolls-Royce for production and supply of engine parts, Azad Engineering announced through an exchange filing. The order includes production and supply of critical engine parts for the defence/ military aircraft engine of Rolls-Royce.

Shares of Azad Engineering Ltd rose on Monday to touch a new life high after it signed a long-term contract with Rolls-Royce PLC.

The company on Monday signed a seven-year contract with Rolls-Royce for production and supply of engine parts, Azad Engineering announced through an exchange filing. The order includes production and supply of critical engine parts for the defence/ military aircraft engine of Rolls-Royce.

Azad Engineering was listed on the NSE on Dec. 28, 2023, at Rs 720 with a 37.40% premium over its IPO price. It listed on the BSE at Rs 710, a 35.50% premium.

The scrip rose as much as 10.32% to 745 apiece, the highest level since its listing and touched a new life high on Monday. It pared gains to trade 7.82% higher at Rs 729 apiece, as of 12:43 p.m. This compares to a 1.57% advance in the NSE Nifty 50 Index.

It has risen 7.60% since listing. Total traded volume so far in the day stood at 2.2 times its 30-day average. The relative strength index was at 80 indicating it was overbought.

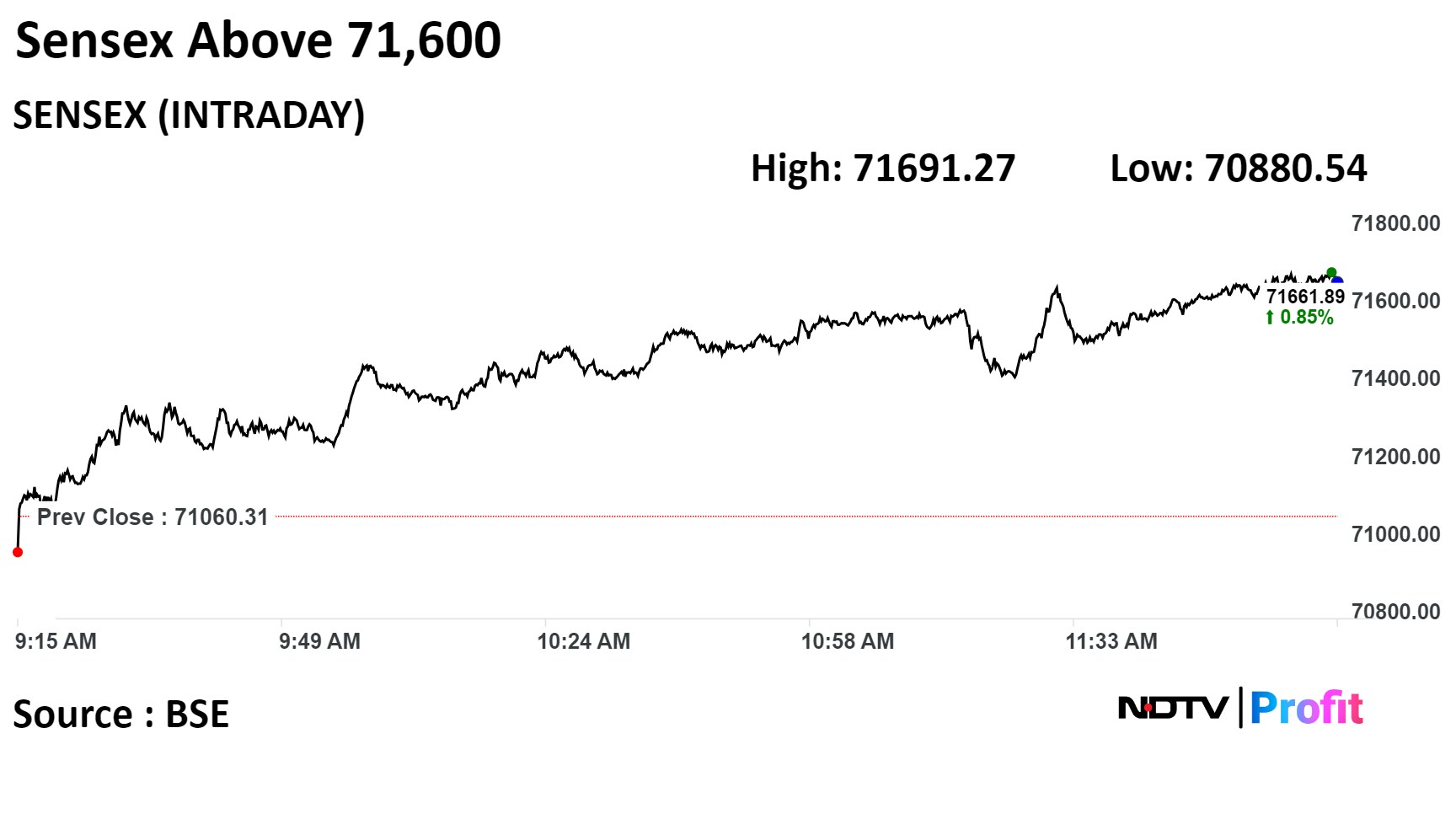

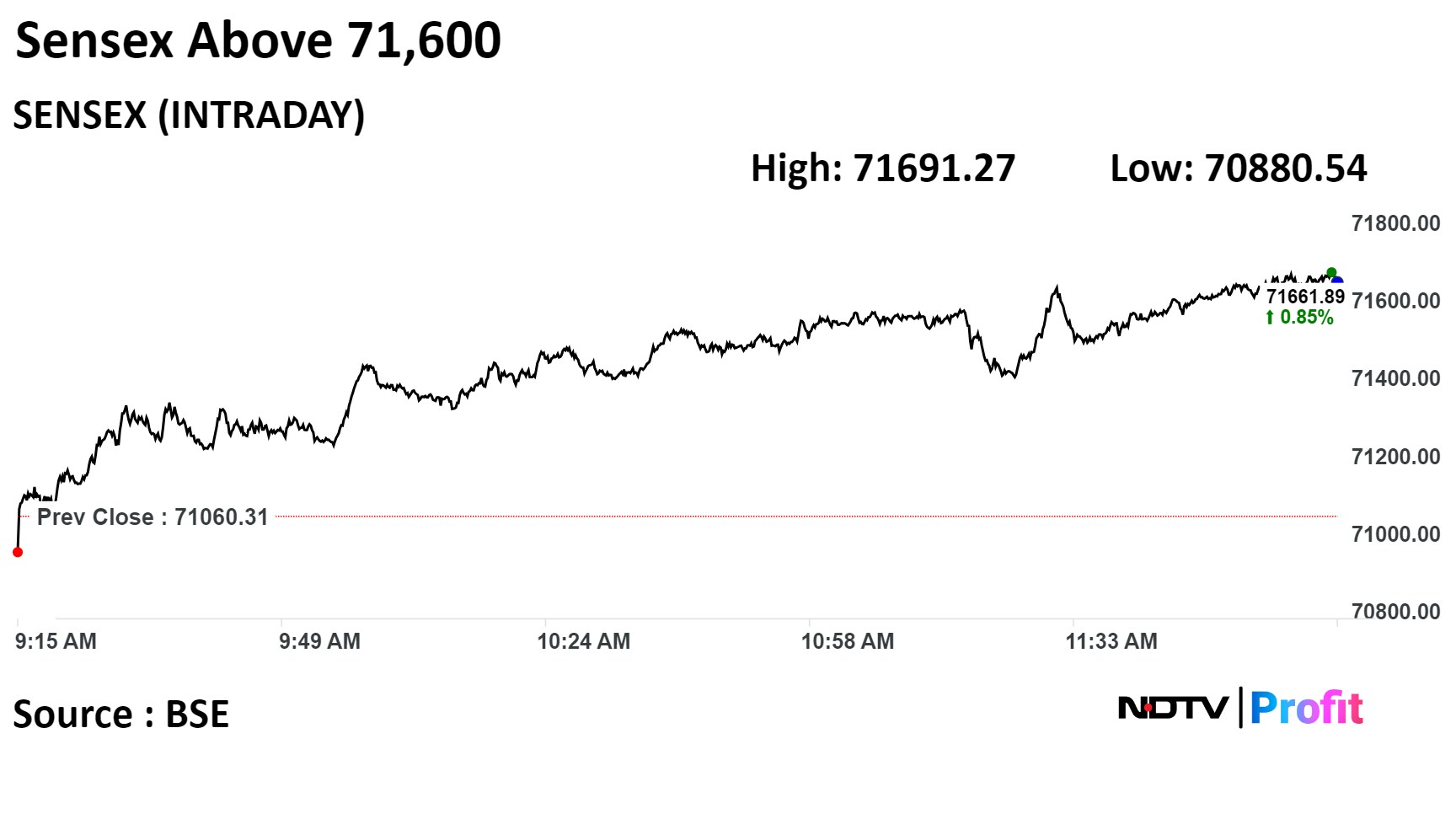

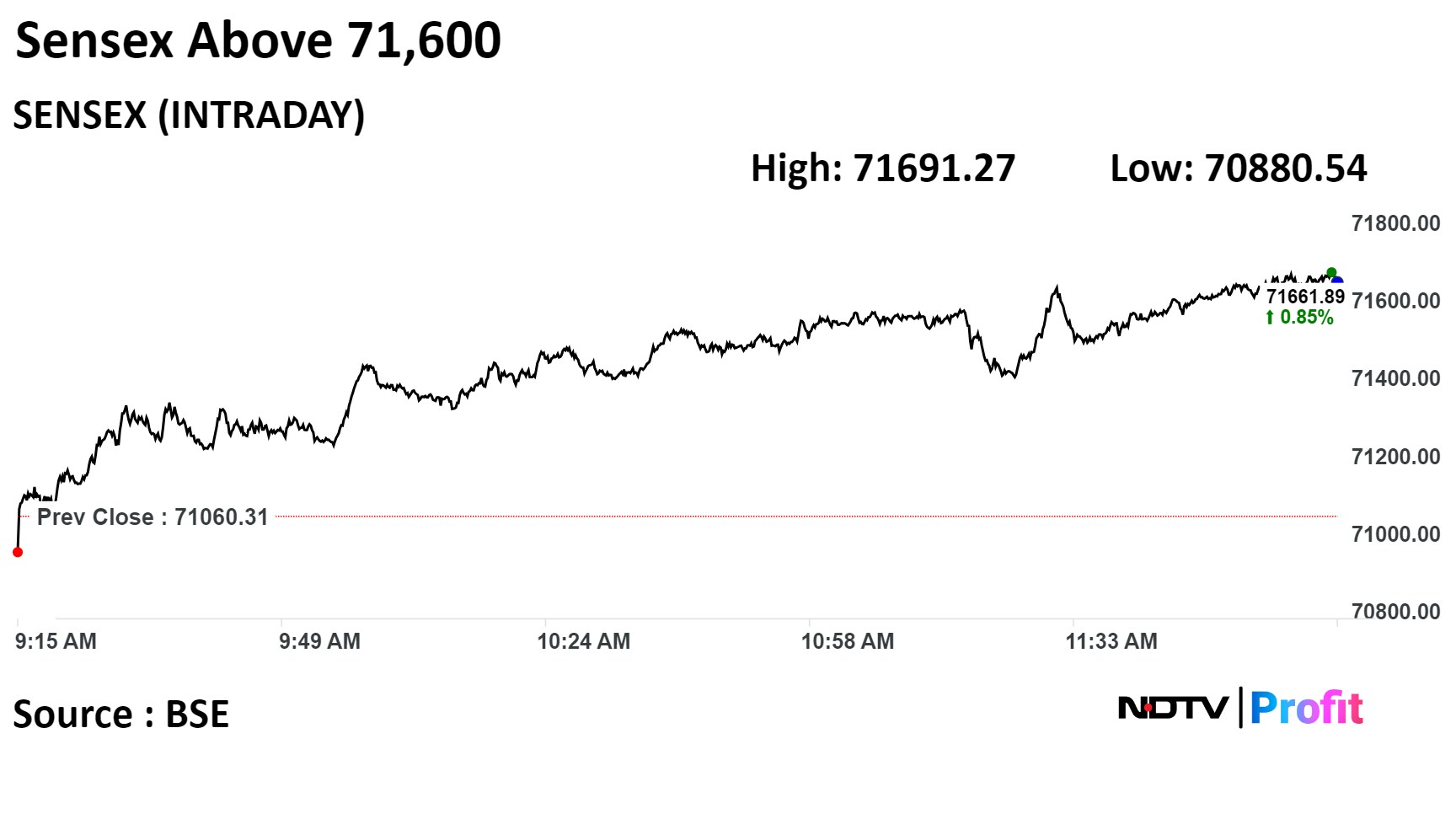

India's benchmark stock indices were trading near the day's high on Monday, led by sharp gains in Reliance Industries Ltd., HDFC Bank Ltd., and Larsen & Toubro Ltd.

The surge in oil and gas stocks supported the gains in the benchmark indices.

As of 11:59 a.m., the NSE Nifty 50 rose 302.80 points, or 1.42%, to 21,655.40, and the S&P BSE Sensex gained 958.88 points, or 1.36%, to 71,659.55. The Nifty hit an intraday high of 21,664.35, and the Sensex touched a high of 71,691.27.

"Dalal Street grapples with surging WTI crude oil prices and foreign institutional investors in a selling spree. As all eyes turn to Finance Minister Nirmala Sitharaman's Union Budget presentation, the market awaits cues for the economic blueprint and its potential to elevate India to a top-three global economic power by 2030," said Prashanth Tapse, senior vice president of research at Mehta Equities Ltd.

"Technical analysis of the Nifty suggests critical support at 21,137 and resistance at 21,757," he said.

India's benchmark stock indices were trading near the day's high on Monday, led by sharp gains in Reliance Industries Ltd., HDFC Bank Ltd., and Larsen & Toubro Ltd.

The surge in oil and gas stocks supported the gains in the benchmark indices.

As of 11:59 a.m., the NSE Nifty 50 rose 302.80 points, or 1.42%, to 21,655.40, and the S&P BSE Sensex gained 958.88 points, or 1.36%, to 71,659.55. The Nifty hit an intraday high of 21,664.35, and the Sensex touched a high of 71,691.27.

"Dalal Street grapples with surging WTI crude oil prices and foreign institutional investors in a selling spree. As all eyes turn to Finance Minister Nirmala Sitharaman's Union Budget presentation, the market awaits cues for the economic blueprint and its potential to elevate India to a top-three global economic power by 2030," said Prashanth Tapse, senior vice president of research at Mehta Equities Ltd.

"Technical analysis of the Nifty suggests critical support at 21,137 and resistance at 21,757," he said.

India's benchmark stock indices were trading near the day's high on Monday, led by sharp gains in Reliance Industries Ltd., HDFC Bank Ltd., and Larsen & Toubro Ltd.

The surge in oil and gas stocks supported the gains in the benchmark indices.

As of 11:59 a.m., the NSE Nifty 50 rose 302.80 points, or 1.42%, to 21,655.40, and the S&P BSE Sensex gained 958.88 points, or 1.36%, to 71,659.55. The Nifty hit an intraday high of 21,664.35, and the Sensex touched a high of 71,691.27.

"Dalal Street grapples with surging WTI crude oil prices and foreign institutional investors in a selling spree. As all eyes turn to Finance Minister Nirmala Sitharaman's Union Budget presentation, the market awaits cues for the economic blueprint and its potential to elevate India to a top-three global economic power by 2030," said Prashanth Tapse, senior vice president of research at Mehta Equities Ltd.

"Technical analysis of the Nifty suggests critical support at 21,137 and resistance at 21,757," he said.

India's benchmark stock indices were trading near the day's high on Monday, led by sharp gains in Reliance Industries Ltd., HDFC Bank Ltd., and Larsen & Toubro Ltd.

The surge in oil and gas stocks supported the gains in the benchmark indices.

As of 11:59 a.m., the NSE Nifty 50 rose 302.80 points, or 1.42%, to 21,655.40, and the S&P BSE Sensex gained 958.88 points, or 1.36%, to 71,659.55. The Nifty hit an intraday high of 21,664.35, and the Sensex touched a high of 71,691.27.

"Dalal Street grapples with surging WTI crude oil prices and foreign institutional investors in a selling spree. As all eyes turn to Finance Minister Nirmala Sitharaman's Union Budget presentation, the market awaits cues for the economic blueprint and its potential to elevate India to a top-three global economic power by 2030," said Prashanth Tapse, senior vice president of research at Mehta Equities Ltd.

"Technical analysis of the Nifty suggests critical support at 21,137 and resistance at 21,757," he said.

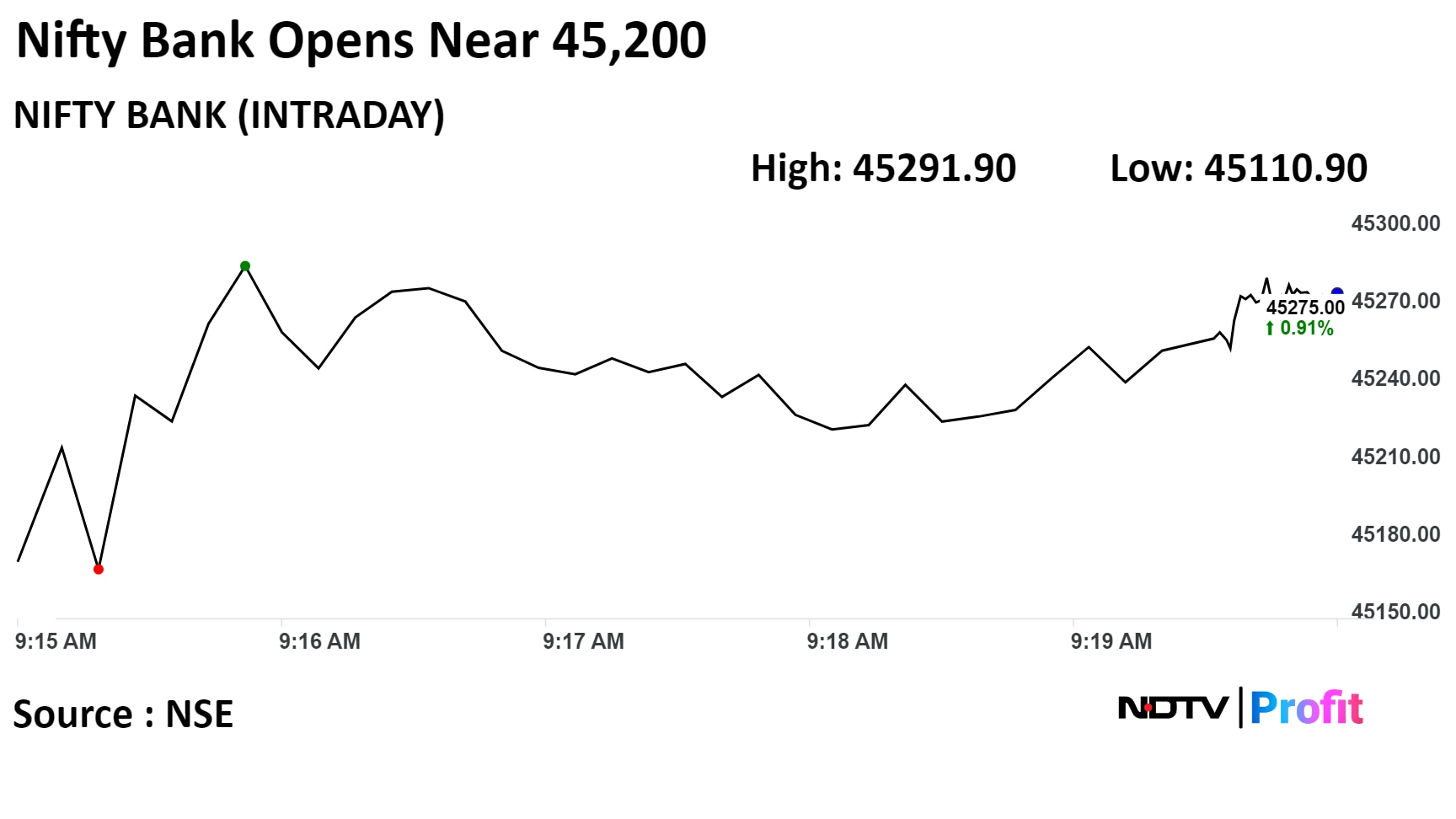

"The direction of the market largely depends upon Bank Nifty and at present, it stands at its long-term trendline support. The immediate support is placed at 44,400," said Aditya Gaggar, director at Progressive Shares.

India's benchmark stock indices were trading near the day's high on Monday, led by sharp gains in Reliance Industries Ltd., HDFC Bank Ltd., and Larsen & Toubro Ltd.

The surge in oil and gas stocks supported the gains in the benchmark indices.

As of 11:59 a.m., the NSE Nifty 50 rose 302.80 points, or 1.42%, to 21,655.40, and the S&P BSE Sensex gained 958.88 points, or 1.36%, to 71,659.55. The Nifty hit an intraday high of 21,664.35, and the Sensex touched a high of 71,691.27.

"Dalal Street grapples with surging WTI crude oil prices and foreign institutional investors in a selling spree. As all eyes turn to Finance Minister Nirmala Sitharaman's Union Budget presentation, the market awaits cues for the economic blueprint and its potential to elevate India to a top-three global economic power by 2030," said Prashanth Tapse, senior vice president of research at Mehta Equities Ltd.

"Technical analysis of the Nifty suggests critical support at 21,137 and resistance at 21,757," he said.

India's benchmark stock indices were trading near the day's high on Monday, led by sharp gains in Reliance Industries Ltd., HDFC Bank Ltd., and Larsen & Toubro Ltd.

The surge in oil and gas stocks supported the gains in the benchmark indices.

As of 11:59 a.m., the NSE Nifty 50 rose 302.80 points, or 1.42%, to 21,655.40, and the S&P BSE Sensex gained 958.88 points, or 1.36%, to 71,659.55. The Nifty hit an intraday high of 21,664.35, and the Sensex touched a high of 71,691.27.

"Dalal Street grapples with surging WTI crude oil prices and foreign institutional investors in a selling spree. As all eyes turn to Finance Minister Nirmala Sitharaman's Union Budget presentation, the market awaits cues for the economic blueprint and its potential to elevate India to a top-three global economic power by 2030," said Prashanth Tapse, senior vice president of research at Mehta Equities Ltd.

"Technical analysis of the Nifty suggests critical support at 21,137 and resistance at 21,757," he said.

India's benchmark stock indices were trading near the day's high on Monday, led by sharp gains in Reliance Industries Ltd., HDFC Bank Ltd., and Larsen & Toubro Ltd.

The surge in oil and gas stocks supported the gains in the benchmark indices.

As of 11:59 a.m., the NSE Nifty 50 rose 302.80 points, or 1.42%, to 21,655.40, and the S&P BSE Sensex gained 958.88 points, or 1.36%, to 71,659.55. The Nifty hit an intraday high of 21,664.35, and the Sensex touched a high of 71,691.27.

"Dalal Street grapples with surging WTI crude oil prices and foreign institutional investors in a selling spree. As all eyes turn to Finance Minister Nirmala Sitharaman's Union Budget presentation, the market awaits cues for the economic blueprint and its potential to elevate India to a top-three global economic power by 2030," said Prashanth Tapse, senior vice president of research at Mehta Equities Ltd.

"Technical analysis of the Nifty suggests critical support at 21,137 and resistance at 21,757," he said.

India's benchmark stock indices were trading near the day's high on Monday, led by sharp gains in Reliance Industries Ltd., HDFC Bank Ltd., and Larsen & Toubro Ltd.

The surge in oil and gas stocks supported the gains in the benchmark indices.

As of 11:59 a.m., the NSE Nifty 50 rose 302.80 points, or 1.42%, to 21,655.40, and the S&P BSE Sensex gained 958.88 points, or 1.36%, to 71,659.55. The Nifty hit an intraday high of 21,664.35, and the Sensex touched a high of 71,691.27.

"Dalal Street grapples with surging WTI crude oil prices and foreign institutional investors in a selling spree. As all eyes turn to Finance Minister Nirmala Sitharaman's Union Budget presentation, the market awaits cues for the economic blueprint and its potential to elevate India to a top-three global economic power by 2030," said Prashanth Tapse, senior vice president of research at Mehta Equities Ltd.

"Technical analysis of the Nifty suggests critical support at 21,137 and resistance at 21,757," he said.

"The direction of the market largely depends upon Bank Nifty and at present, it stands at its long-term trendline support. The immediate support is placed at 44,400," said Aditya Gaggar, director at Progressive Shares.

Reliance Industries Ltd, HDFC Bank Ltd, Larsen & Toubro Ltd, ICICI Bank Ltd, and Oil and Natural Gas Corporation Ltd contributed positively to the index.

Losses in shares of Infosys Ltd, Cipla Ltd, Tata Consultancy Services Ltd, and ITC Ltd weighed on the index.

All 12 sectors on NSE gained, with the Nifty Oil & Gas emerging as the top performing sectors among its peers.

The Nifty Oil & Gas sector rose as much as 3.61% on improved sentiment after the Brent Crude prices crossed $80-per-barrel mark due to heightening crisis in Red Sea.

The Nifty IT index managed only 0.06% gain to become the worst performer among sectoral indices.

Broader markets also rose in line with the benchmark indices. The S&P BSE Midcap rose 1.32%, and the S&P BSE Smallcap gained 0.96% through midday on Monday.

On BSE, 18 out of 20 sectors rose, and two declined. The S&P BSE Oil & Gas sector surged 3,64% to become the best performer among, while the S&P BSE IT sector fell 0.22% to become the worst performer.

Market breadth was skewed in favour of the buyers. On BSE, around 2,307 stocks rose, 1,466 shares declined, and 193 stocks remained unchanged.

In pact with BVM Global Schools to provide both academic and non-academic services.

Source: Exchange Filing

Unit commissions solar project with Chengmari

Source: Exchange Filing

Launches ‘Aaradhya Onepark’ with 4 lk sq ft carpet area in Mumbai's Ghatkopar area

Expects strong sales momentum for Mumbai's Ghatkopar project

Expects to generate Rs 1,200 crore in next 4 years from Mumbai's Ghatkopar project

Source: Exchange Filing

Signs long-term contract of 7 years with Rolls-Royce

Rolls-Royce contract for producing, supply critical engine parts for defence/military aircraft engines

Source: Exchange Filing

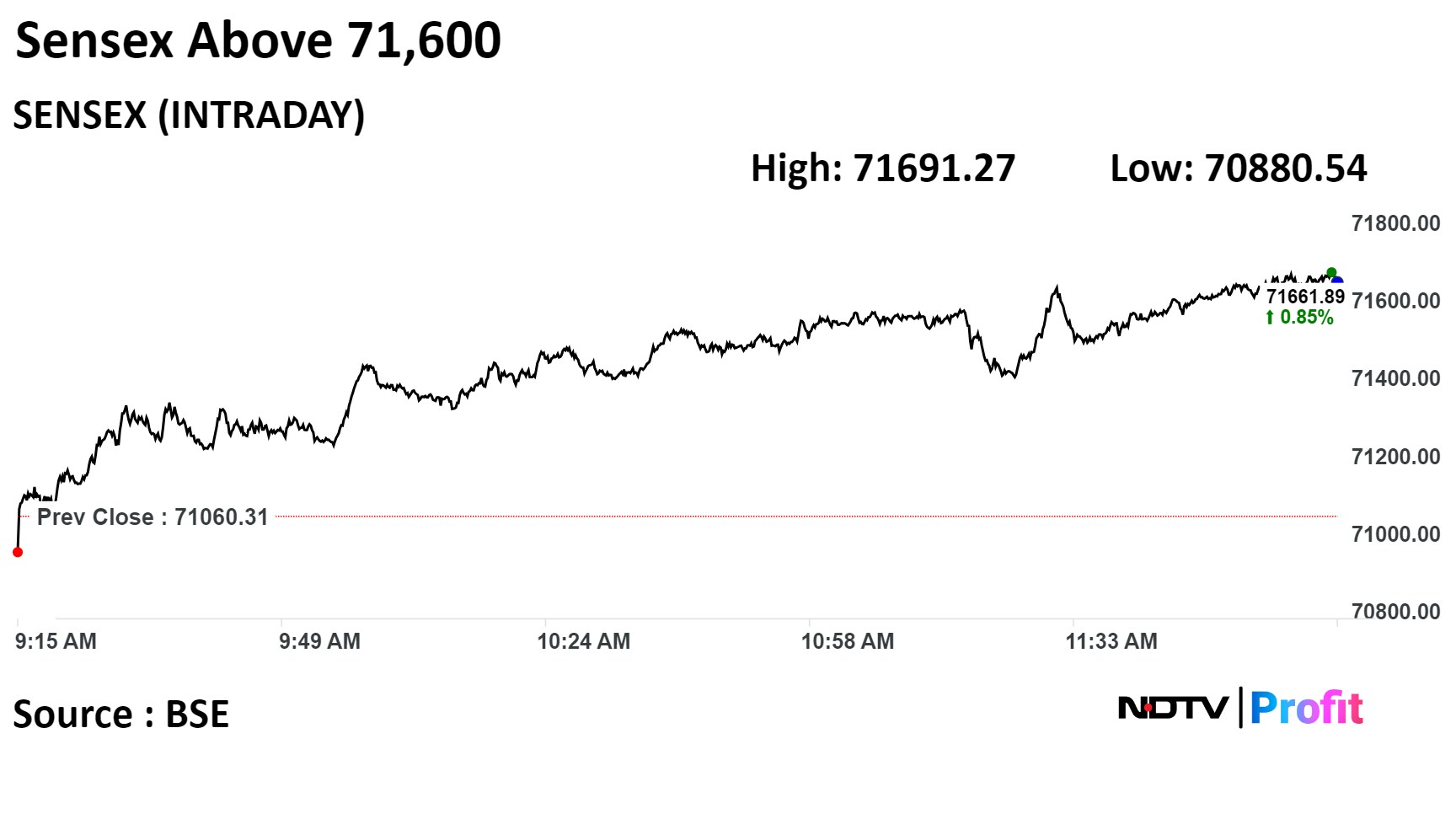

Shares of ONGC rose as much as 7.95%, the highest since March 08, 2022, It is trading 7.75% higher at 12:07 p.m. This compares to a 1.43% advance in the NSE Nifty 50.

Total traded volume so far in the day stood at 3.1 times its 30-day average. The relative strength index was at 73, implying the stock is overbought.

Of the 28 analysts tracking the company, 15 maintain a 'buy', five recommends a 'hold,' and five suggests a 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies a downside of 11.2%

Shares of ONGC rose as much as 7.95%, the highest since March 08, 2022, It is trading 7.75% higher at 12:07 p.m. This compares to a 1.43% advance in the NSE Nifty 50.

Total traded volume so far in the day stood at 3.1 times its 30-day average. The relative strength index was at 73, implying the stock is overbought.

Of the 28 analysts tracking the company, 15 maintain a 'buy', five recommends a 'hold,' and five suggests a 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies a downside of 11.2%

Shares of ONGC and Reliance Industries contributed the most to the gains.

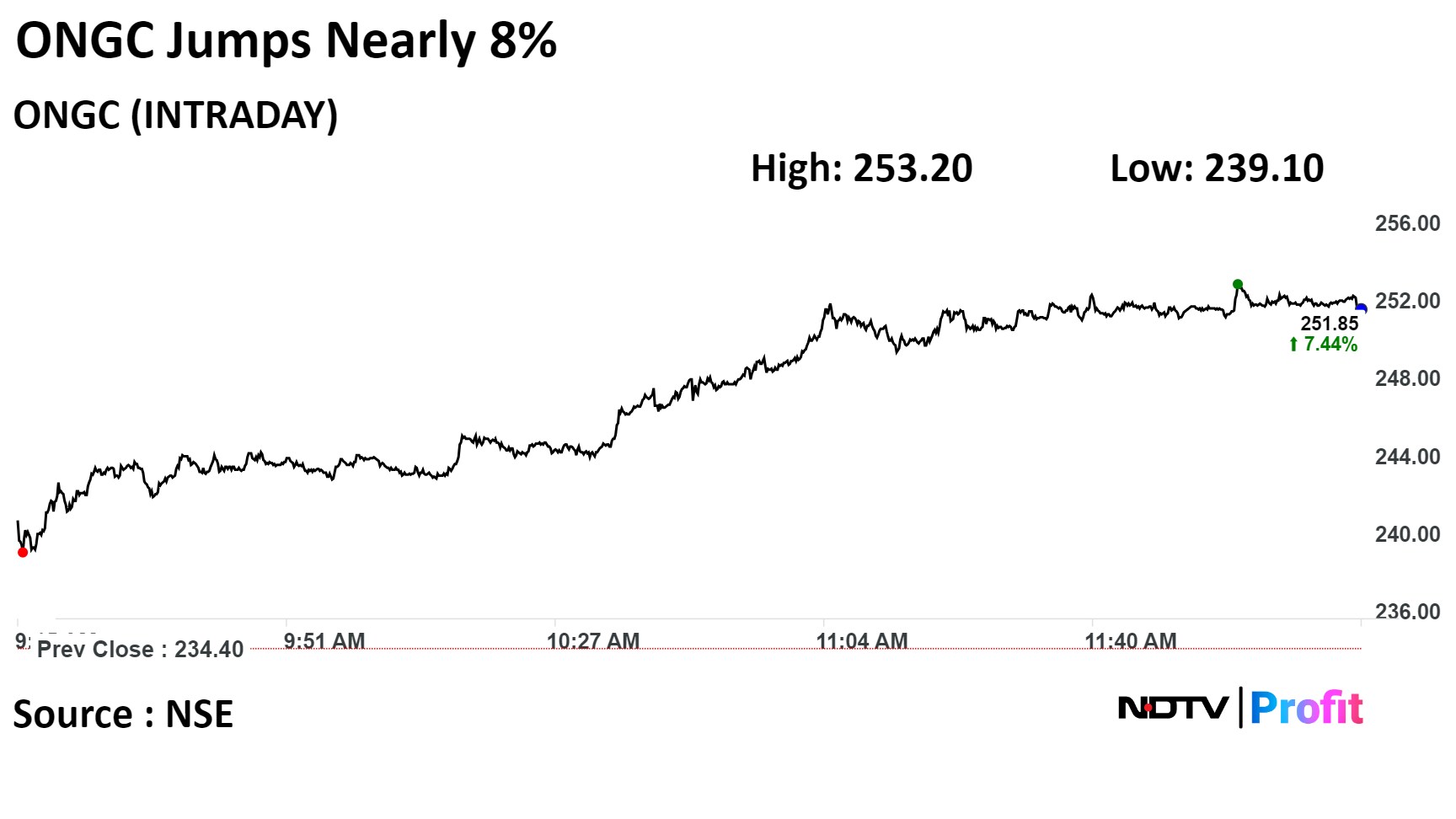

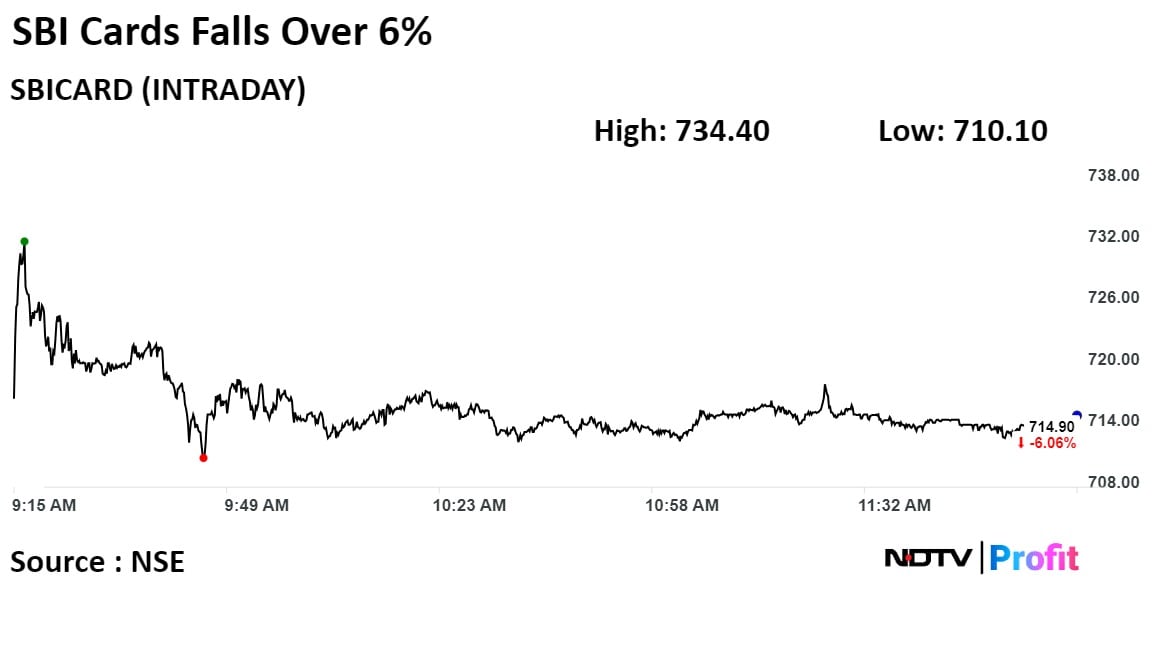

SBI Cards and Payments Services Ltd. reported a jump in its net profit in the third quarter but missed analysts estimates. The shares of the company fell on Monday as brokerages downgrade the stock amid credit cost concerns.

SBI Cards and Payments Services Ltd. reported a jump in its net profit in the third quarter but missed analysts estimates. The shares of the company fell on Monday as brokerages downgrade the stock amid credit cost concerns.

The scrip fell as much as 6.55% to 710 apiece, the lowest level since Mar. 28, 2023. It was trading 6.14% lower at Rs 713.20 apiece, as of 12:03 p.m. This compares to a 1.43% advance in the NSE Nifty 50 Index.

It has fallen 0.45% in the last 12 months. Total traded volume so far in the day stood at 7.1 times its 30-day average. The relative strength index was at 33.

Out of 28 analysts tracking the company, 9 maintain a 'buy' rating, 8 recommend a 'hold,' and 11 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 2.4%.

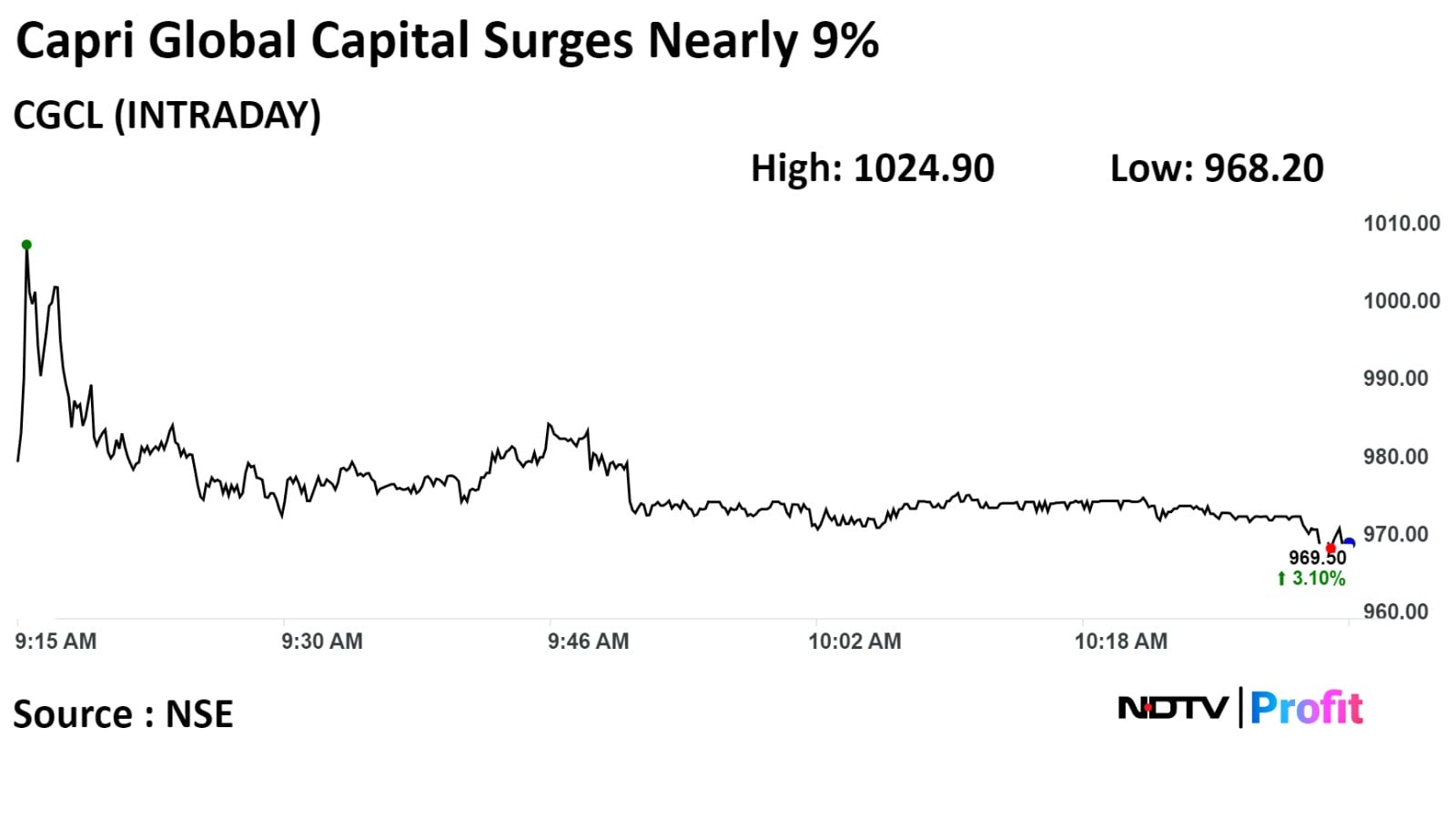

Shares of Capri Global Capital Ltd. surged to the highest in over a week on Monday after its consolidated net profit jumped 81% in the third quarter.

Shares of Capri Global Capital Ltd. surged to the highest in over a week on Monday after its consolidated net profit jumped 81% in the third quarter.

On the NSE, Capri's stock rose as much as 8.99% during the day to Rs 1,024.90 apiece, the highest since Jan 18. It was trading 2.94% higher at Rs 968 per share, compared to a 0.84% advance in the benchmark Nifty 50 as of 10:57 a.m.

The share price has risen 34.62% in the last 12 months. The total traded volume so far in the day stood at 1.84 times its 30-day average. The relative strength index was at 65.88.

An analyst tracking the company has a 'buy' rating on the stock, according to Bloomberg data. The average of 12-month analyst price targets implies a potential downside of 17.3%.

Revenue down 8.3% YoY at Rs 214.58 crore vs Rs 233.98 crore

Net profit up 30.42% YoY at Rs 31.34 crore vs Rs 24.03 crore

Ebitda up 21.46% at Rs 47.81 crore vs Rs 39.36 crore

Ebitda Margin at 22.28% vs 16.82%

Maintains neutral with price target of Rs 800 (earlier Rs 820)

Steady loan growth of 4% QoQ, partially dragged by securitization

Miss on higher credit costs

Strong deposit momentum at 6% brought momentum down to 83%

Low visibility on ROA trajectory in FY25

Management thinks of cards as customer acquisition tool and expects to sell liability product

Bank expects loan growth of 25% YoY in near term, lower than deposit growth

The scrip rose 3.34% Rs 2,799.90 apiece, the highest level since its lifetime high level. It was trading 3.35% higher at Rs 2,796.70 apiece, as of 11:25 a.m. This compares to a 1.17% advance in the NSE Nifty 50 Index.

The stock contributed 90 points out of 315.25 points that Nifty 50 gained. The company has added Rs 84,000 crore in M-Cap.

The scrip rose 3.34% Rs 2,799.90 apiece, the highest level since its lifetime high level. It was trading 3.35% higher at Rs 2,796.70 apiece, as of 11:25 a.m. This compares to a 1.17% advance in the NSE Nifty 50 Index.

The stock contributed 90 points out of 315.25 points that Nifty 50 gained. The company has added Rs 84,000 crore in M-Cap.

It has risen in 30.90% in 12 months. Total traded volume so far in the day stood at 1.3 times its 30-day average. The relative strength index was at 68.90.

Out of 35 analysts tracking the company, 28 maintain a 'buy' rating, five recommend a 'hold,' and two suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 6.1%.

Dodla Dairy at 7.81 times its 30 day average

Eris Lifesciences at 5.48 times its 30 day average

Au Small Finance Bank at 5.14 times its 30 day average

Shakti Pumps at 4.31 times its 30 day average

Indian Metals & Ferro Alloys at 4.2 times its 30 day average

10.8 lakh shares changed hands in a large trade

0.02% equity changed hands at Rs 83.15 apiece

Buyers and sellers not known immediately

Source: Bloomberg

Gets orders from RVNL, Neyveli Uttar Pradesh Power

Gets Rs 381.3 crore order from RVNL for execution of civil construction works

Gets Rs 263.6 crore order from Neyveli Uttar Pradesh Power for operations, maintenance of thermal power project

Source: Exchange Filing

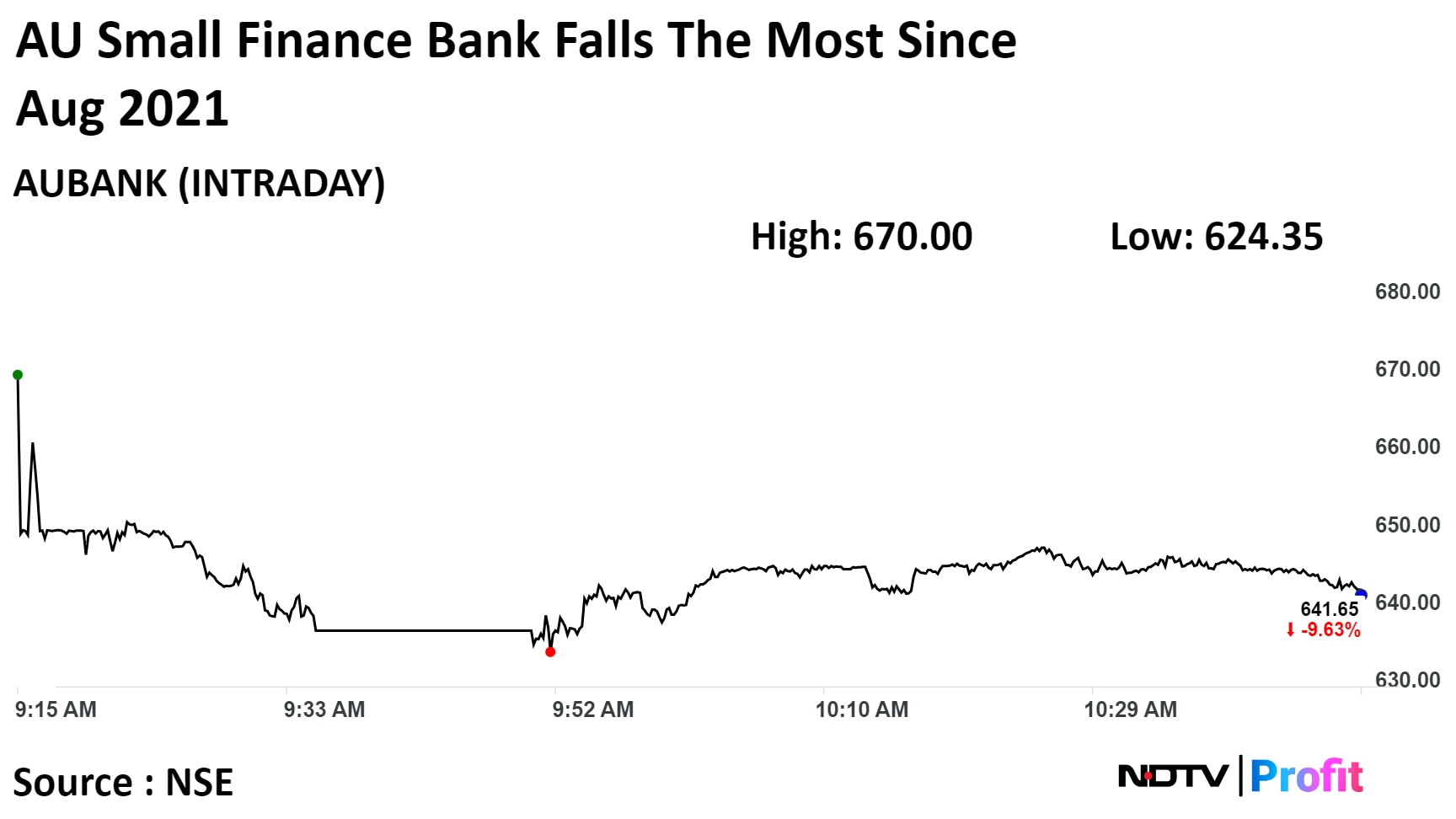

Shares of AU Small Finance Bank Ltd. saw their biggest fall since Aug 31, 2021 after the bank reported a 4.5% year-on-year fall in its net profit for the December quarter due to higher provisions.

Shares of AU Small Finance Bank Ltd. saw their biggest fall since Aug 31, 2021 after the bank reported a 4.5% year-on-year fall in its net profit for the December quarter due to higher provisions.

The scrip fell as much as 11.80% to Rs 624.35 piece, the lowest level since April 10. It pared losses to trade 9.18% lower at Rs 642.85 apiece, as of 11:01 a.m. This compares to a 1.28% advance in the NSE Nifty 50 Index.

It has risen 6.16% in the last twelve months. Total traded volume so far in the day stood at 16 times its 30-day average. The relative strength index was at 27.7, indicating that the stock may be underbought.

Out of 27 analysts tracking the company, ten maintain a 'buy' rating, seven recommend a 'hold,' and ten suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 15.6%.

12 lakh shares changed hands in a large trade

0.02% equity changed hands at Rs 55.15 apiece

Buyers and sellers not known immediately

Source: Bloomberg

10.3 lakh shares changed hands in a large trade

0.1% equity changed hands at Rs 1,166.05 apiece

Buyers and sellers not known immediately

Source: Bloomberg

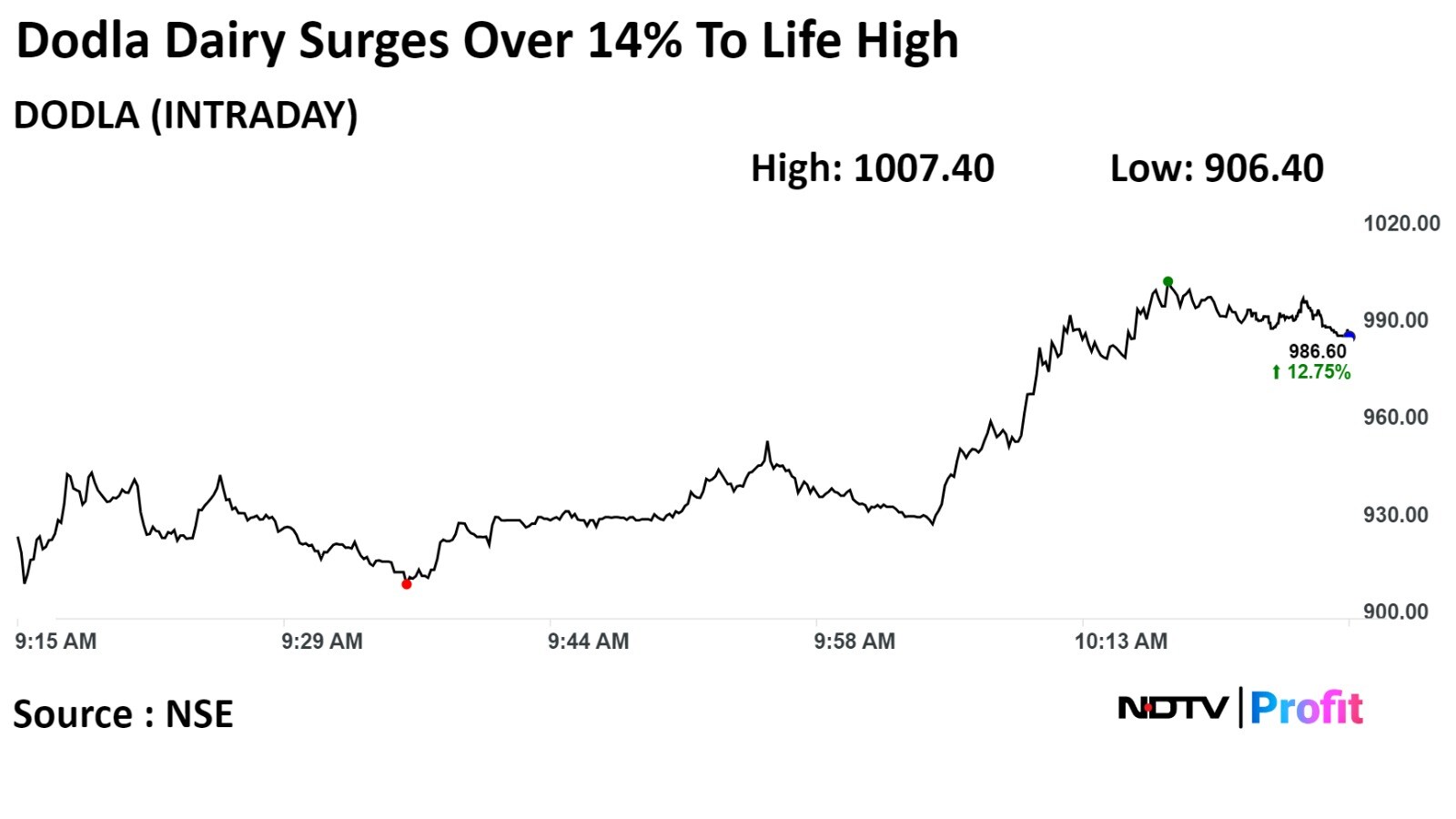

Shares of Dodla Dairy Ltd. jumped over 14% to record high on Monday after the company reported more than 16% rise in its quarter three net profit.

The Hyderabad-based dairy company posted consolidated Rs 41.33 crore net profit in October-December of the current financial year compared to Rs 35.39 crore net profit in the previous year.

However, Dodla Dairy has failed to meet analysts' estimate for the quarter three.

Shares of Dodla Dairy Ltd. jumped over 14% to record high on Monday after the company reported more than 16% rise in its quarter three net profit.

The Hyderabad-based dairy company posted consolidated Rs 41.33 crore net profit in October-December of the current financial year compared to Rs 35.39 crore net profit in the previous year.

However, Dodla Dairy has failed to meet analysts' estimate for the quarter three.

The scrip rose as much as 14.54% to Rs 1,007.40 apiece, the highest level since its listing on Jun 28, 2021. It was trading 12.99% higher at Rs 993.80 apiece, as of 10:24 a.m. This compares to a 0.62% advance in the NSE Nifty 50 Index.

It has risen 94.82% in 12 months. Total traded volume so far in the day stood at 9.6 times its 30-day average. The relative strength index was at 74.57, which implied the stock is overbought.

Two analysts tracking the company, maintained a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target implies a downside of 17.3%.

Adani Group stocks added as much as Rs 69,719.21 crore in investor wealth, taking their total market capitalisation to Rs 15.51 lakh crore, intraday.

At 10:02 a.m., the shares added Rs 54,989 crore in market value taking the capitalisation to Rs 15.37 lakh crore.

The gains were led by shares of Adani Energy Solutions and Adani Enterprises and traded around 5% higher each.

Disclaimer: NDTV is a subsidiary of AMG Media Networks Limited, an Adani Group Company.

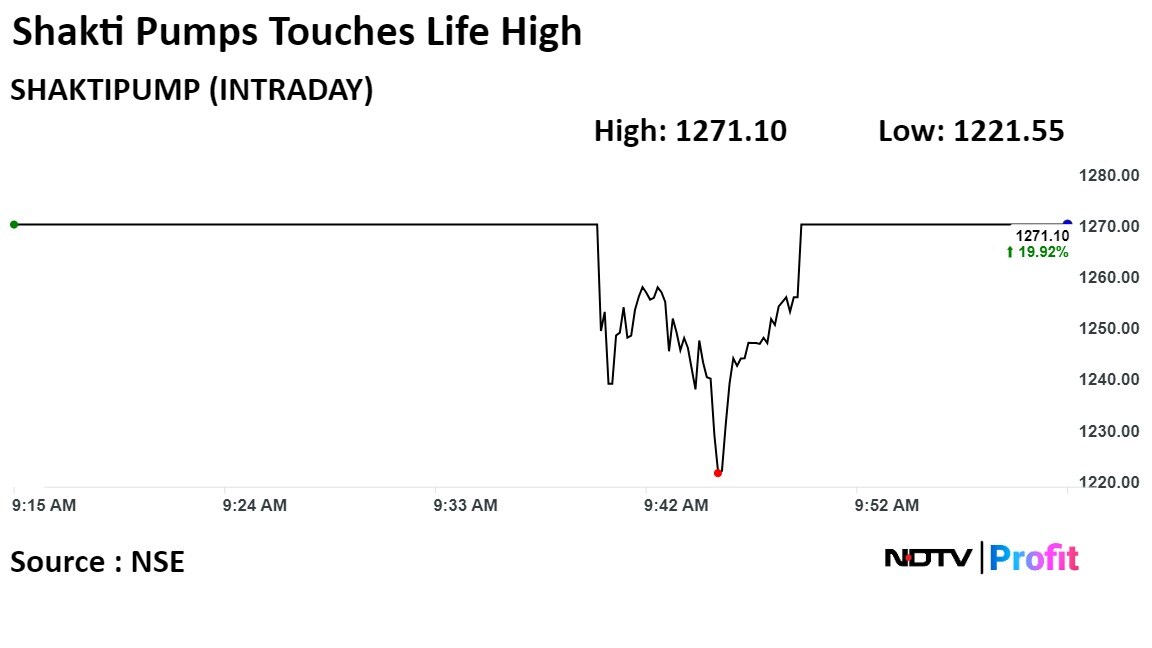

Shares of Shakti Pumps Ltd. were locked in upper circuit on Monday after the company reported a strong earning in the third quarter.

The company on Thursday reported its earnings for the quarter ended in December. The revenue was up 57.7% at Rs 495.6 crore and the net profit was up at Rs 45.19 crore.

The scrip rose as much as 20% to 1,271.10 apiece to touch its lifetime high. It last hit life high on Oct. 20, 2023. This compares to a 0.83% advance in the NSE Nifty 50 Index.

It has risen 113.42% in the last 12 months. Total traded volume so far in the day stood at 5.2 times its 30-day average. The relative strength index was at 73 indicating it was overbought.

Shares of Shakti Pumps Ltd. were locked in upper circuit on Monday after the company reported a strong earning in the third quarter.

The company on Thursday reported its earnings for the quarter ended in December. The revenue was up 57.7% at Rs 495.6 crore and the net profit was up at Rs 45.19 crore.

The scrip rose as much as 20% to 1,271.10 apiece to touch its lifetime high. It last hit life high on Oct. 20, 2023. This compares to a 0.83% advance in the NSE Nifty 50 Index.

It has risen 113.42% in the last 12 months. Total traded volume so far in the day stood at 5.2 times its 30-day average. The relative strength index was at 73 indicating it was overbought.

25.1 lakh shares or 0.02% equity changed hands in two large trades

Buyers and sellers not known immediately

Source: Bloomberg

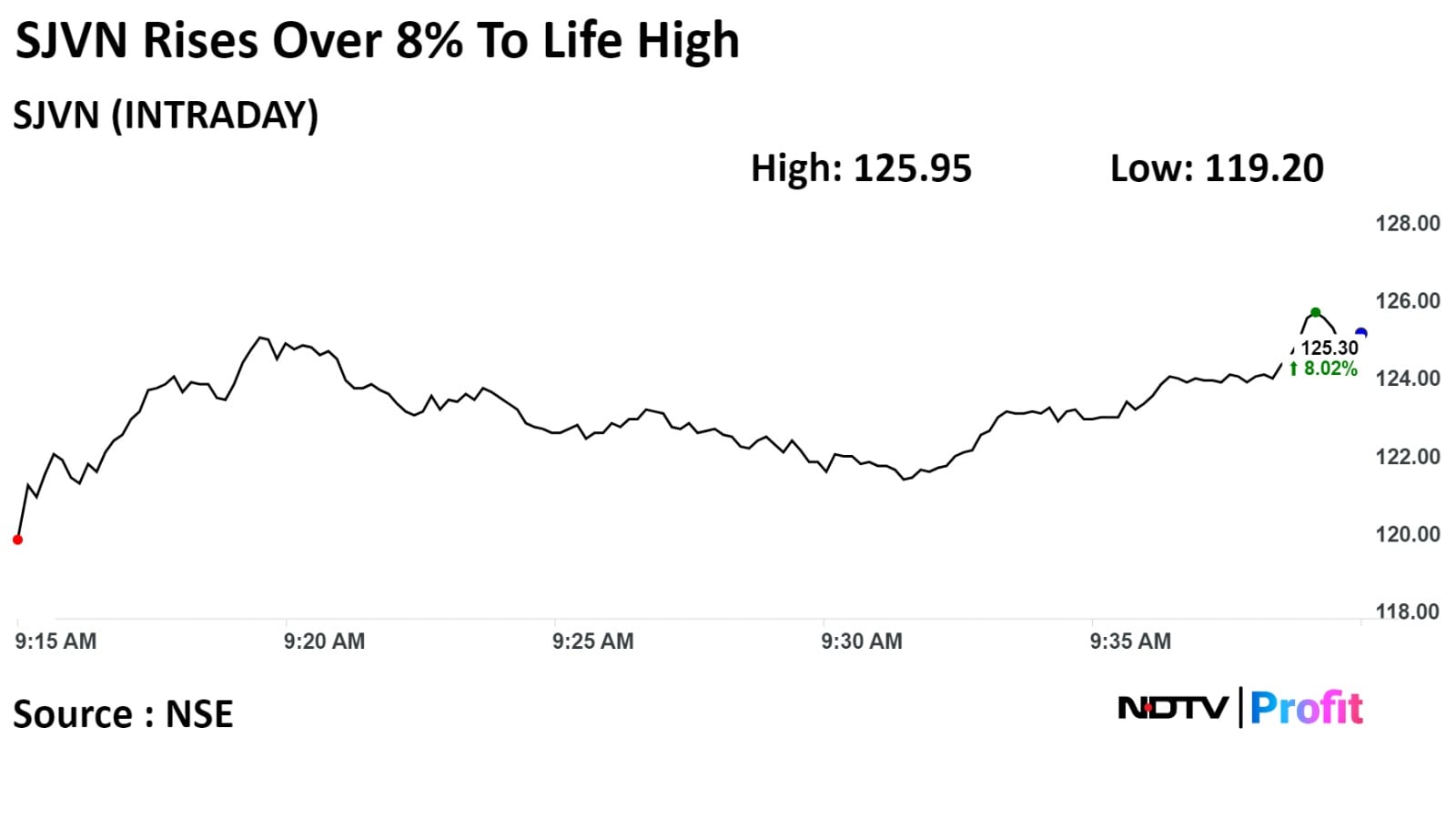

Shares of SJVN Ltd surged over 8% on Monday and touched a life-time high as the company won 100-MW solar power project from Gujarat Urja Vikas Nigam Ltd, the company said in an exchange filing.

Shares of SJVN Ltd surged over 8% on Monday and touched a life-time high as the company won 100-MW solar power project from Gujarat Urja Vikas Nigam Ltd, the company said in an exchange filing.

The scrip rose as much as 8.16% to Rs 125.95 apiece, the highest level since its listing on May 19, 2010. It was trading 7.17% higher at Rs 124.80 apiece, as of 09:50 a.m. This compares to a 0.89% advance in the NSE Nifty 50 Index.

It has risen 272% in 12 months. Total traded volume so far in the day stood at 3.6 times its 30-day average. The relative strength index was at 75.95, which implies the stock is overbought.

Out of four analysts tracking the company, two maintain a 'buy' rating, one recommend a 'hold,' and one suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies a downside of 39.3%.

Initiates with an Overweight; TP: 4368

To grow, India needs to invest in both digital and physical infra

AEL at the core of everything India wishes to accomplish

Current valuation does not reflect all the parts

Despite being a large co, AEL has no analyst coverage

AEL has proven history of incubating and spinning out businesses

AEL has made notable progress on improving balance sheet

Disclaimer: NDTV is a subsidiary of AMG Media Networks Limited, an Adani Group Company.

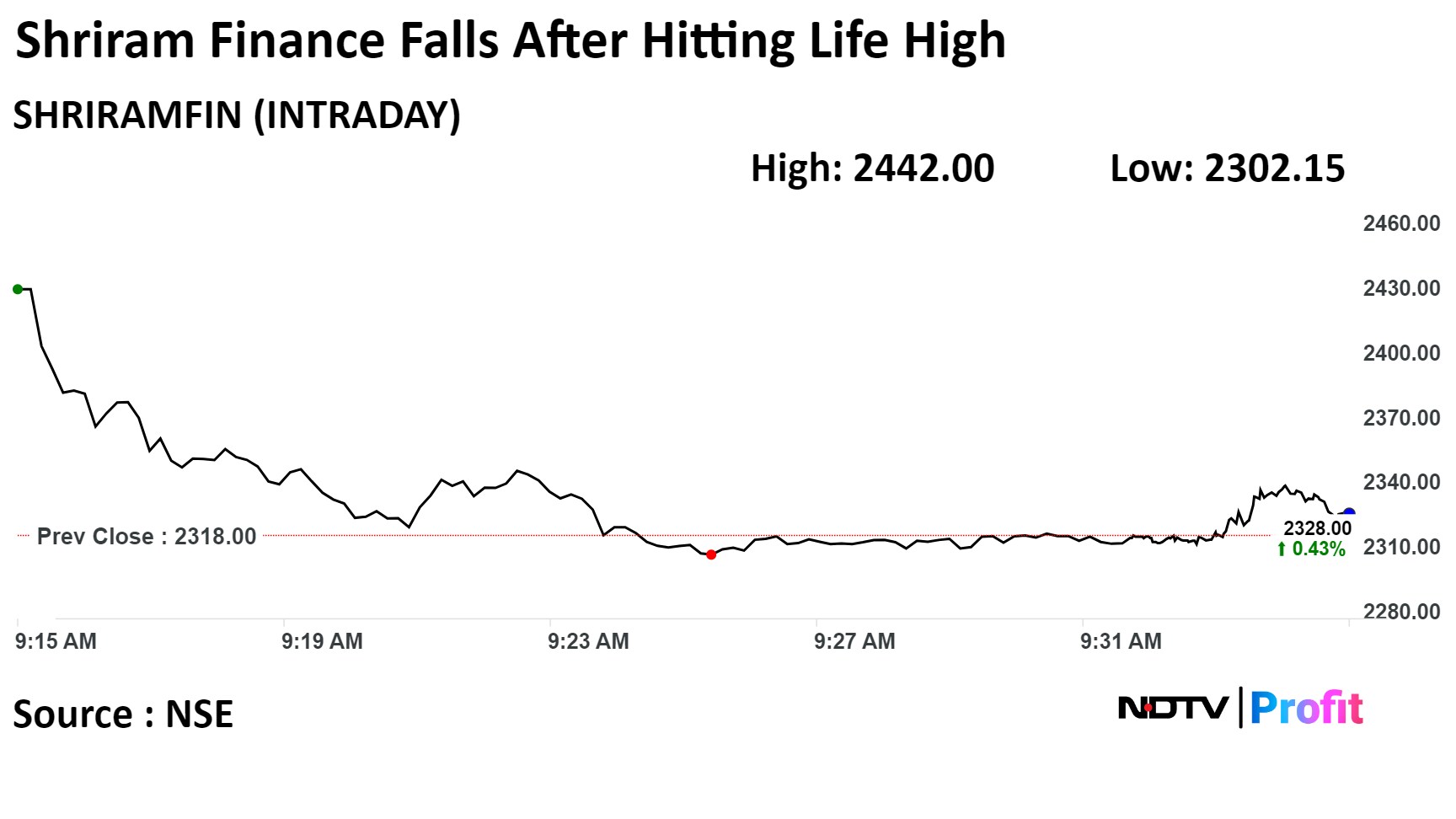

Shriram Finance Ltd.'s shares hit an all-time after the company reported a 2.3% jump in the net profit meeting the analyst estimates.

The company reported a net profit of Rs 1,818.3 crore on year-on-year basis against a Bloomberg estimate of Rs 1.894 crore.

Shriram Finance reported an operationally healthy quarter with a healthy AUM growth across all its products and delivered a further expansion in NIM, according to Motilal Oswal Financial Services.

Shriram Finance Ltd.'s shares hit an all-time after the company reported a 2.3% jump in the net profit meeting the analyst estimates.

The company reported a net profit of Rs 1,818.3 crore on year-on-year basis against a Bloomberg estimate of Rs 1.894 crore.

Shriram Finance reported an operationally healthy quarter with a healthy AUM growth across all its products and delivered a further expansion in NIM, according to Motilal Oswal Financial Services.

16.4 lakh shares or 0.5% equity changed hands in a pre-market large trade

Buyers and sellers not known immediately

Source: Bloomberg

65.2 lakh shares or 5.1% equity changed hands in a large trade

Buyers and sellers not known immediately

Source: Bloomberg

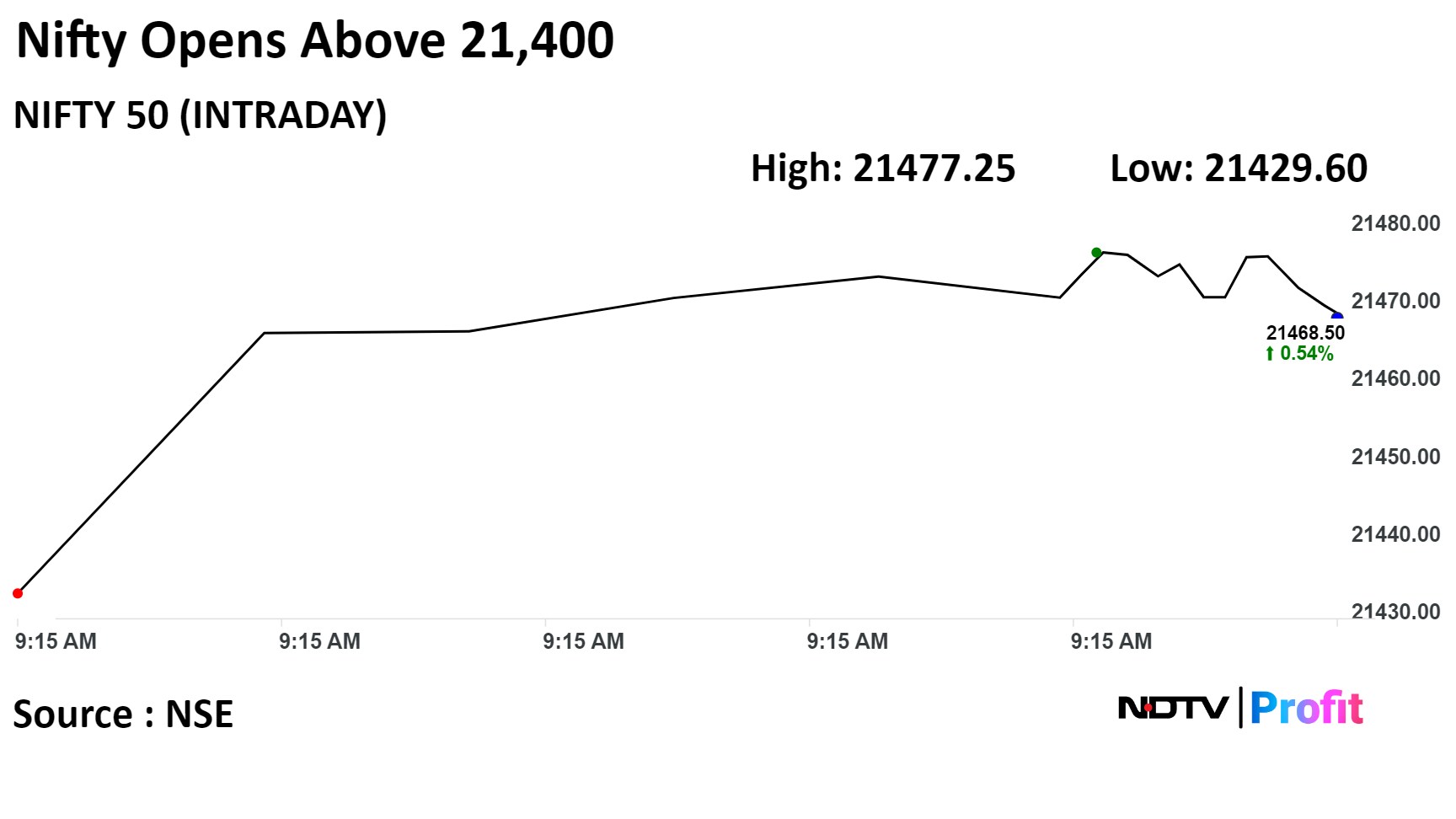

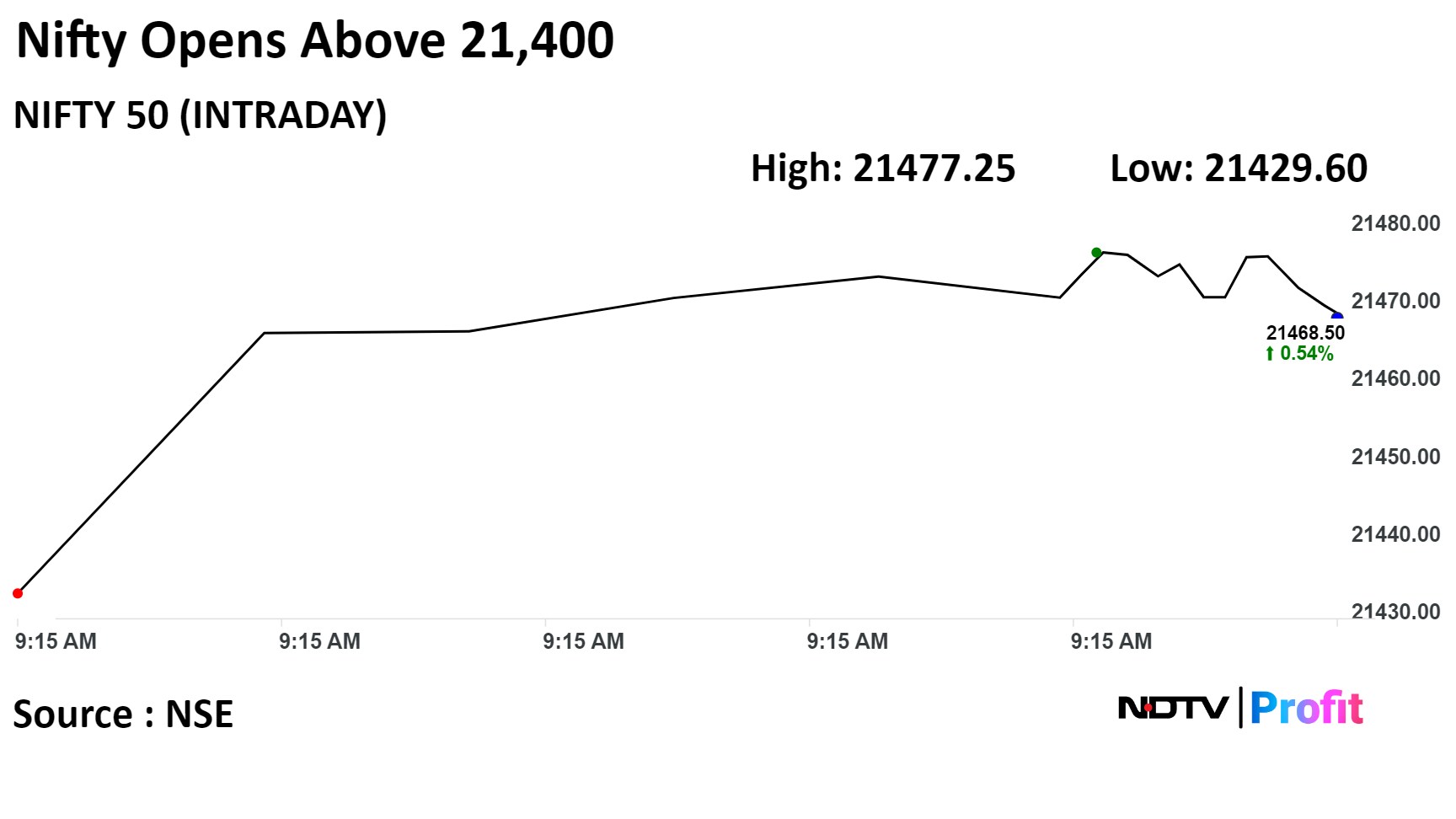

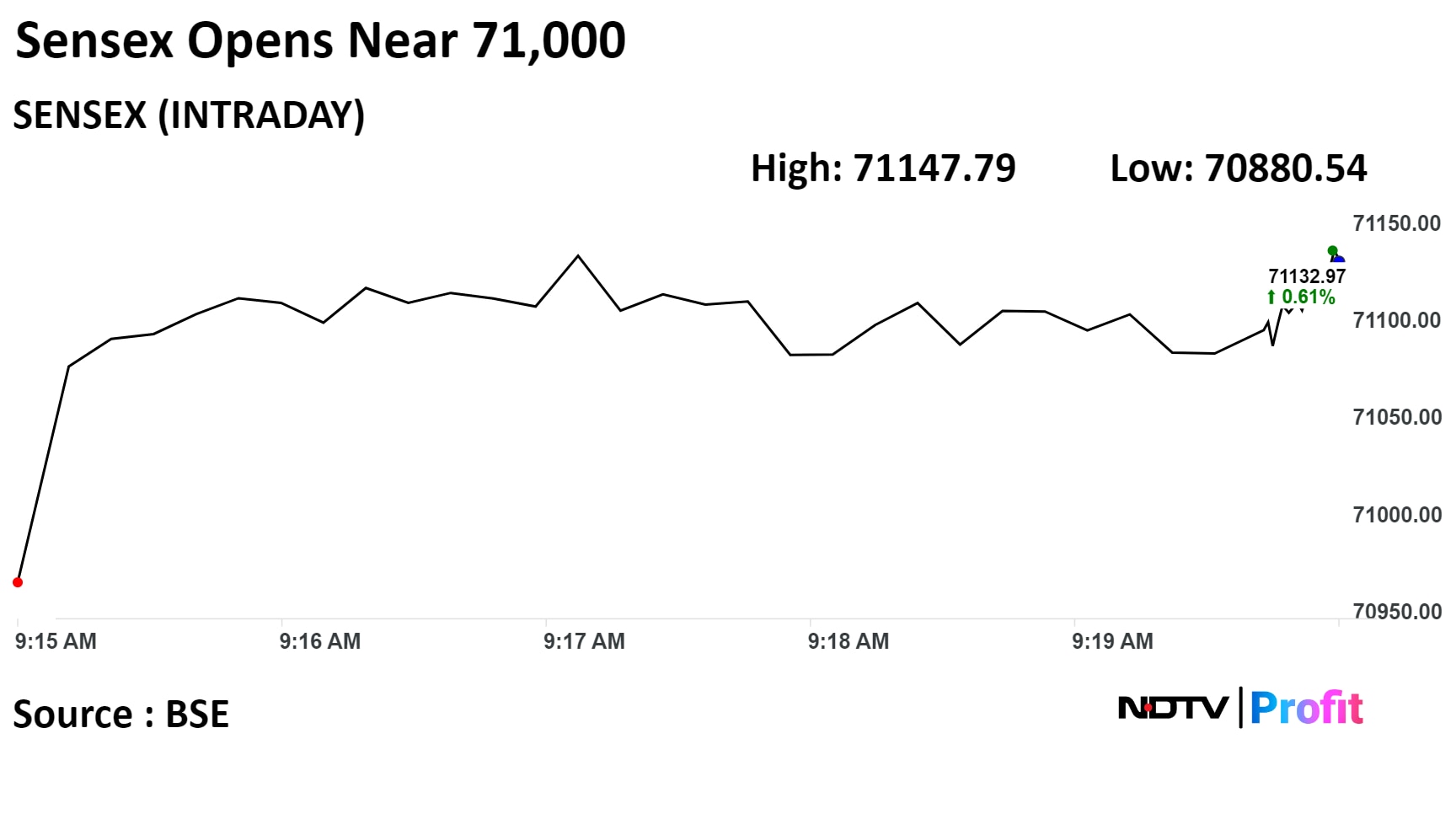

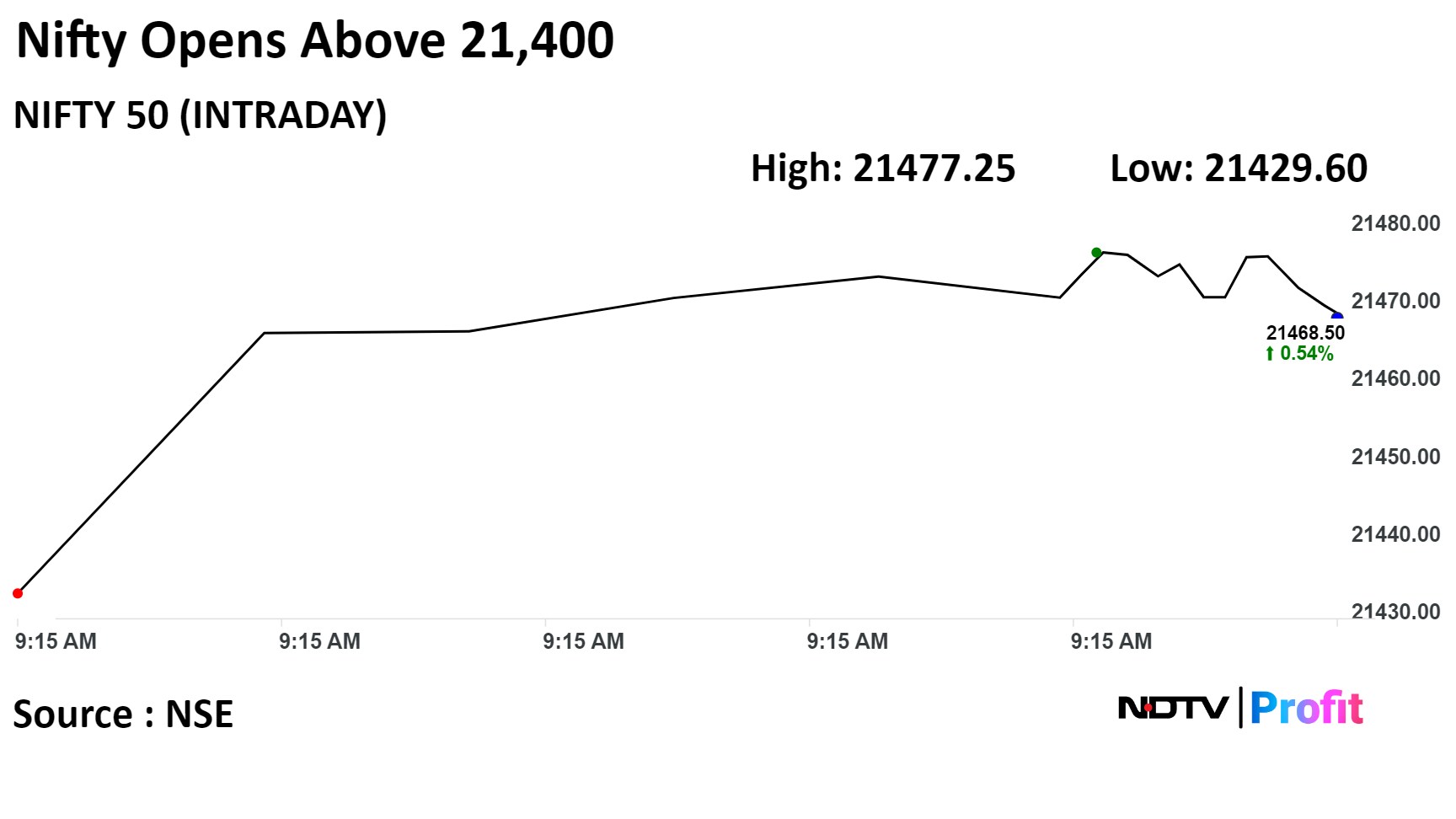

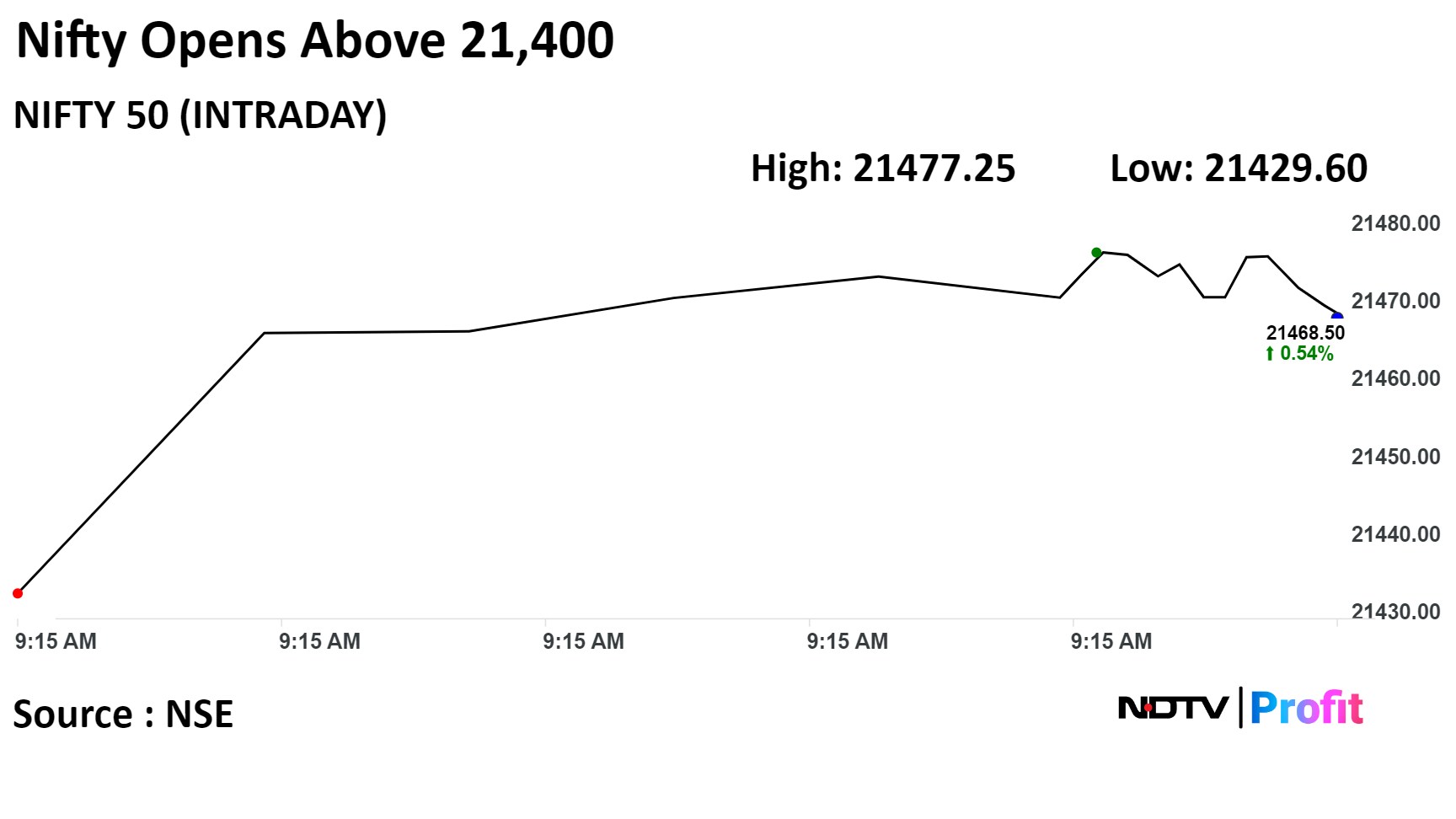

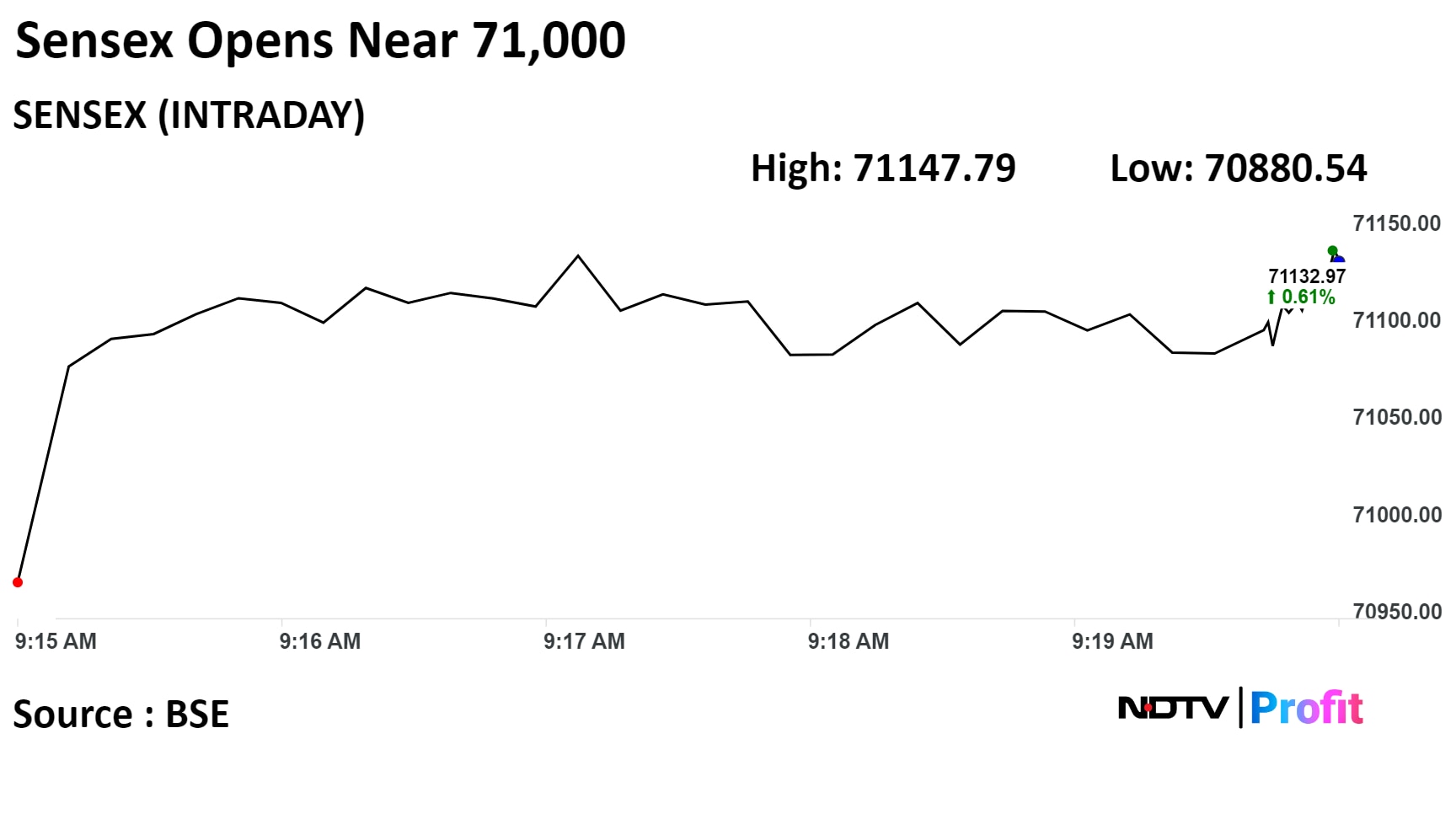

Benchmark indices opened the week on a positive note as heavyweights HDFC Bank and Reliance Industries gained.

At pre-open both the Nifty and Sensex traded 0.38% higher at 21,433.10 points and 70,969.79 points respectively.

"Our view is that, as long as the index is trading below 21550/71400, the weak sentiment is likely to continue. Below which, it may slip to 50-day SMA or 21050/70000,"said Shrikant Chouhan, head of equity research at Kotak Securities

He added that further decline may continue which may drag the market towards 20900-20800/69500-69200 levels. "On the other hand, the pullback move above 21550/71400 is likely to continue till 21650-21750-21850/71700-72000-72300. However, the real trend would emerge if it crosses 22150," he said.

Benchmark indices opened the week on a positive note as heavyweights HDFC Bank and Reliance Industries gained.

At pre-open both the Nifty and Sensex traded 0.38% higher at 21,433.10 points and 70,969.79 points respectively.

"Our view is that, as long as the index is trading below 21550/71400, the weak sentiment is likely to continue. Below which, it may slip to 50-day SMA or 21050/70000,"said Shrikant Chouhan, head of equity research at Kotak Securities

He added that further decline may continue which may drag the market towards 20900-20800/69500-69200 levels. "On the other hand, the pullback move above 21550/71400 is likely to continue till 21650-21750-21850/71700-72000-72300. However, the real trend would emerge if it crosses 22150," he said.

Benchmark indices opened the week on a positive note as heavyweights HDFC Bank and Reliance Industries gained.

At pre-open both the Nifty and Sensex traded 0.38% higher at 21,433.10 points and 70,969.79 points respectively.

"Our view is that, as long as the index is trading below 21550/71400, the weak sentiment is likely to continue. Below which, it may slip to 50-day SMA or 21050/70000,"said Shrikant Chouhan, head of equity research at Kotak Securities

He added that further decline may continue which may drag the market towards 20900-20800/69500-69200 levels. "On the other hand, the pullback move above 21550/71400 is likely to continue till 21650-21750-21850/71700-72000-72300. However, the real trend would emerge if it crosses 22150," he said.

Benchmark indices opened the week on a positive note as heavyweights HDFC Bank and Reliance Industries gained.

At pre-open both the Nifty and Sensex traded 0.38% higher at 21,433.10 points and 70,969.79 points respectively.

"Our view is that, as long as the index is trading below 21550/71400, the weak sentiment is likely to continue. Below which, it may slip to 50-day SMA or 21050/70000,"said Shrikant Chouhan, head of equity research at Kotak Securities

He added that further decline may continue which may drag the market towards 20900-20800/69500-69200 levels. "On the other hand, the pullback move above 21550/71400 is likely to continue till 21650-21750-21850/71700-72000-72300. However, the real trend would emerge if it crosses 22150," he said.

Benchmark indices opened the week on a positive note as heavyweights HDFC Bank and Reliance Industries gained.

At pre-open both the Nifty and Sensex traded 0.38% higher at 21,433.10 points and 70,969.79 points respectively.

"Our view is that, as long as the index is trading below 21550/71400, the weak sentiment is likely to continue. Below which, it may slip to 50-day SMA or 21050/70000,"said Shrikant Chouhan, head of equity research at Kotak Securities

He added that further decline may continue which may drag the market towards 20900-20800/69500-69200 levels. "On the other hand, the pullback move above 21550/71400 is likely to continue till 21650-21750-21850/71700-72000-72300. However, the real trend would emerge if it crosses 22150," he said.

Benchmark indices opened the week on a positive note as heavyweights HDFC Bank and Reliance Industries gained.

At pre-open both the Nifty and Sensex traded 0.38% higher at 21,433.10 points and 70,969.79 points respectively.

"Our view is that, as long as the index is trading below 21550/71400, the weak sentiment is likely to continue. Below which, it may slip to 50-day SMA or 21050/70000,"said Shrikant Chouhan, head of equity research at Kotak Securities

He added that further decline may continue which may drag the market towards 20900-20800/69500-69200 levels. "On the other hand, the pullback move above 21550/71400 is likely to continue till 21650-21750-21850/71700-72000-72300. However, the real trend would emerge if it crosses 22150," he said.

Benchmark indices opened the week on a positive note as heavyweights HDFC Bank and Reliance Industries gained.

At pre-open both the Nifty and Sensex traded 0.38% higher at 21,433.10 points and 70,969.79 points respectively.

"Our view is that, as long as the index is trading below 21550/71400, the weak sentiment is likely to continue. Below which, it may slip to 50-day SMA or 21050/70000,"said Shrikant Chouhan, head of equity research at Kotak Securities

He added that further decline may continue which may drag the market towards 20900-20800/69500-69200 levels. "On the other hand, the pullback move above 21550/71400 is likely to continue till 21650-21750-21850/71700-72000-72300. However, the real trend would emerge if it crosses 22150," he said.

Benchmark indices opened the week on a positive note as heavyweights HDFC Bank and Reliance Industries gained.

At pre-open both the Nifty and Sensex traded 0.38% higher at 21,433.10 points and 70,969.79 points respectively.

"Our view is that, as long as the index is trading below 21550/71400, the weak sentiment is likely to continue. Below which, it may slip to 50-day SMA or 21050/70000,"said Shrikant Chouhan, head of equity research at Kotak Securities

He added that further decline may continue which may drag the market towards 20900-20800/69500-69200 levels. "On the other hand, the pullback move above 21550/71400 is likely to continue till 21650-21750-21850/71700-72000-72300. However, the real trend would emerge if it crosses 22150," he said.

Shares of HDFC Bank Ltd., Reliance Industries Ltd., ICICI Bank Ltd., Infosys Ltd., and Kotak Mahindra Bank Ltd. contributed the most to the gains in the Nifty.

Meanwhile, those of ITC Ltd., Cipla Ltd., Tata Consultancy Services Ltd., Dr. Reddy's Laboratories Ltd., and Bajaj Auto Ltd. capped the upside.

Most sectoral indices gained but Nifty Auto, Nifty FMCG and Nifty Pharma fell. Nifty Media and Nifty PSU Bank gained over 1%.

The broader markets also rose; the S&P BSE MidCap Index was up 0.48%, whereas S&P BSE SmallCap Index was up 0.81%.

All 20 sectoral indices compiled by BSE advanced. S&P BSE Services rose the most.

The market breadth was skewed in the favour of the buyers. About 2,233 stocks rose, 838 declined, while 125 remained unchanged on the BSE.

11.5 lakh shares or 0.02% equity changed hands in a pre-market large trade

Buyers and sellers not known immediately

Source: Bloomberg

The yield on the 10-year bond opened flat at 7.18%.

Source: Bloomberg

The local currency weakened by 3 paise to 83.15 against the U.S dollar.

It closed at 83.12 on Thursday.

Source: Bloomberg

At pre-open both the Nifty and Sensex traded 0.38% higher at 21,433.10 points and 70,969.79 points respectively.

Nomura

Maintain Buy rating with TP of Rs 2700

Sees current valuations of 1.6x FY25F BV relatively undemanding

PPOP growth of 12% YoY/ 6% QoQ in line with expectations

Management guided for ~20%/15% AUM growth in FY24/25F

Incremental CoF inched up to 8.95% in 3Q24 (vs 8.7% in 2Q24)

Management confident in maintaining margins at 8.9% for FY24

HSBC

Maintains buy with TP of Rs 2720 (vs Rs 2630 earlier)

Revised EPS estimates by -2.1%/+3.4%/+2.1% for FY24E/25E/26E

Expect 17% AUM CAGR over FY24-26E driven by non-vehicle consumer businesses

Operating performance in line with estimates

Valued at 1.5x FY26e BVPS

Expected to deliver 3.3-3.5% ROA and 15.5-16.5% ROE over FY24e-26e

Hindustan Petroleum Corporation Ltd. reported an 87.8% quarter-on-quarter decline in net profit in the quarter that ended in December on the back of 55-day maintenance shutdown in Vizag plant and lower-than-estimated realized marketing margins.

Analysts see possibility of sharp price cut and lower oil demand to have an impact on the company's profitability.

Jefferies

Maintain underperform with price target of Rs 330

Ebitda was ahead on better marketing profitability, with refining in line

Profitability ahead of normative levels in Q4, raising possibility of a retail price cut

Adverse refining to marketing ratio puts it at a disadvantage to peers in the case of a price cut

See valuations unfavorable at premium over last cycle average

Maintain underperform on unfavorable risk/reward after the >80% 3-month rally

Morgan Stanley

Maintain overweight with price target of Rs 555

Core earnings missed estimates on 55-day shutdown in Vizag

Remains among preferred refinery picks as global fuel shortages remain

Upside risks: Upward trend in marketing margins, improvement in benchmark margin trends

Downside risks: Govt. control of fuel prices if oil prices spike, lower diesel demand growth

Motilal Oswal

Upgrade to Buy rating at TP of Rs 530

Raises P/B valuation multiple to 1.3x (vs 1.1x earlier)

Sees some scope for FY25E earnings to get upgraded

Q3FY24 EBITDA lower than expectations led by suppressed diesel margins

Believes among OMCs, HPCL has the highest leverage in marketing

Sees demerger of lubricant business providing a value-unlocking opportunity

Sharekhan

Maintains 'Hold', at Rs 470 target

Q3 net profit significantly lagged brokerage estimates

GRM above estimate despite 37% QoQ fall

Weak near term earnings outlook on possible fuel price cut

Key Upside risks:

1. Higher-than-expected refining & marketing margin

2. Possible value unlocking from lubes business

Nomura

Maintain neutral with price target of Rs 305

Results missed estimates on lower marketing margins, higher opex

Vizag bottom-upgradation to commence in 1HFY25; HRRL to commence from end-CY24

Auto fuel price cuts key to watch out for

Rising refining spreads mean room for price cuts has fallen sharply

Maintains "Equal-weight" rating at Rs 413 target

Q3 net profit missed brokerage estimate by 10%

Weak earnings on higher gas sourcing costs

Rating due to limited growth with low margin support

Cheaper LNG in 2024 to accelerate industrial demand

Maintain neutral with price target of Rs 2,910

Targeting phase-wise commissioning of its solar mfg. capacity from H2CY24

Project returns could be hampered by oversupply in China

Green H2 incentives too are still insufficient

RIL’s HJT technology not popular among cell makers

Morgan Stanley

Downgrade to Equal Weight; TP: Rs 750 (earlier Rs 950)

Net slippages in Q3FY24 higher than estimates

2 more quarters of elevated credit costs, no confidence of normalisation beyond

PE multiple to be capped until clarity on credit cost emerges

TP falls materially more; at 23x Dec-25 PE

Jefferies

Downgrade to hold; TP: Rs 830

PAT was in line but credit costs rose 80bps QoQ

Credit cost to stay elevated for two quarters

Revolver mix fell, cost of funds may rise further

Stabilisation of asset quality and rate cuts are possible positives

Rates 'sell' with TP of Rs 425

Elevated MTM supporting domestic MF revenues

Seasonality coupled with momentum in primary market and corporate earnings driving robust revenues in MF

Low base aiding growth in international/domestic alternates RTA business

Will revisit their estimates post the earnings call

Maintains 'sell', TP cut to Rs 2,150 from Rs 2,300 earlier

Better-than-expected volumes, drove the earnings beating their estimates

Uncertainty in volume revival has been exacerbated by the recent freight issues

Raw material cost pressures are not easing

Signs Accord for setting up 100 Bio-CNG plants

Source: Exchange Filing

U.S. Dollar Index at 103.53

U.S. 10-year bond yield at 4.14%

Brent crude up 0.35% at $83.84 per barrel

Nymex crude up 0.38% at $78.3 per barrel

GIFT Nifty was up 0.33% at 21,625 as of 07:43 a.m.

Bitcoin was up 0.6% at $42,229.8

U.S. Dollar Index at 103.53

U.S. 10-year bond yield at 4.14%

Brent crude up 0.35% at $83.84 per barrel

Nymex crude up 0.38% at $78.3 per barrel

GIFT Nifty was up 0.33% at 21,625 as of 07:43 a.m.

Bitcoin was up 0.6% at $42,229.8

Nifty February futures fell by 0.47% to 21,488.55, a premium of 135.95 points.

Nifty February futures open interest up by 33%.

Nifty Bank February futures down by 0.35% to 45,291.65, a premium of 425.5 points.

Nifty Bank February futures open interest up 80.39%.

Nifty Options Feb. 1 Expiry: Maximum call open interest at 22,500 and Maximum put open interest at 20,000.

Bank Nifty Options Jan. 31 Expiry: Maximum call open interest at 45,000 and Maximum put open interest at 45,000.

Price band revised from 20% to 10%: Transformers and Rectifiers (India).

Price band revised from 10% to 5%: Dhanlaxmi Bank.

Ex-Date Dividend: 360 One Wam, Accelya Solutions, PCBL.

Record Date Dividend: 360 One Wam, Accelya Solutions, PCBL.

Moved into short-term ASM framework: Allied Digital Services, Dynamatic Technologies, HFCL, Swelect Energy Systems.

Moved out of short-term ASM framework: Shriram Pistons and Rings.

Adani Ports and Special Economic Zone: Societe Generale sold 2.81 lakh shares (0.01%) at Rs 1120.6 apiece

Aurobindo Pharma: Societe Generale sold 1.07 lakh shares (0.01%) at Rs 1160.1 apiece.

BHEL: Societe Generale sold 5.15 lakh shares (0.01%) at Rs 209.9 apiece.

BPCL: Societe Generale sold 12.43 lakh shares (0.05%) at Rs 477.15 apiece.

Container Corp of India: Societe Generale sold 1.53 lakh shares (0.02%) at Rs 841.1 apiece, while Marshall Wace Investment Strategies Market Neutral Tops Fund bought 1.41 lakh shares (0.02%) at Rs 841.1 apiece.

D B Realty: Griffin Growth Fund VCC bought 34.82 lakh shares (0.64%) at Rs 253.05 apiece, while Trinity Opportunity Fund sold 34.82 lakh shares (0.64%) at Rs 253.05 apiece.

Dalmia Bharat: Societe Generale sold 2.34 lakh shares (0.12%) at Rs 2154.75 apiece, while Marshall Wace Investment Strategies bought 2.34 lakh shares (0.12%) at Rs 2154.75 apiece.

Devyani International: Societe Generale sold 8.27 lakh shares (0.06%) at Rs 176.25 apiece, while Marshall Wace Investment Strategies Eureka Fund bought 8.16 lakh shares (0.06%) at Rs 176.25 apiece.

FSN E-Commerce Ventures: Societe Generale sold 47.34 lakh shares (0.16%) at Rs 162.45 apiece, while Marshall Wace Investment Strategies Eureka Fund bought 45.46 lakh shares (0.15%) at Rs 162.45 apiece.

Grasim: Eriska Investment Fund Ltd. bought 8.1 lakh shares (0.12%) at Rs 2060 apiece, while Griffin Growth Fund Vcc sold 8.1 lakh shares (0.12%) at Rs 2060 apiece.

HCL Tech: Marshall Wace Investment Strategies Market Neutral Tops Fund bought 3.38 lakh shares (0.01%) at Rs 1576.4 apiece, while Societe Generale sold 3.38 lakh shares (0.01%) at Rs 1576.4 apiece.

ICICI Prudential Life Insurance Co: Societe Generale sold 6.79 lakh shares (0.04%) at Rs 488.55 apiece, while Marshall Wace Investment Strategies Market Neutral Tops Fund bought 6 lakh shares (0.04%) at Rs 488.55 apiece.

Indian Bank: Societe Generale sold 8.35 lakh shares (0.06%) at Rs 441.6 apiece.

Nova Agritech: The public issue was subscribed 109.37 times on day 3. The bids were led by non-institutional investors (224.08 times), institutional investors (79.31 times), and retail investors (77.12 times).

HDFC Bank: Life Insurance Corp. has received the Reserve Bank of India's nod for acquiring up to a 9.99% stake in HDFC Bank Ltd.

Adani Green Energy: The company raised Rs 2,337.5 crore through the issuance of warrants. The warrants were allotted to Ardour Investment Holding on a private placement basis.

Adani Power: The company entered into a Memorandum of Understanding to sell two wholly owned subsidiaries to AdaniConnex Pvt. for Rs 540 crore. The power major will sell a 100% stake in Aviceda Infra Park Ltd. for Rs 190 crore and Innovant Buildwell Pvt. for Rs 350 crore to AdaniConnex.

DLF: The company entered into a pact with three lenders for the purchase of bonds with a face value of Rs 600 crore face value. It entered into a pact with Standard Chartered Bank, DB International (Asia), and Deutsche Investments India for a total consideration of Rs 825 crore.

Laurus Labs: The company will form a 49:51 joint venture with Slovenia's Krka Pharma in Hyderabad.

Himatsingka Seide: The company's board approved a fundraise of up to Rs 400 crore via qualified institutional placement in one or more tranches.

Coal India: The company emerged as the lowest bidder for a 300 MW solar project in Khavda, Gujarat.

Strides Pharma: The company's Singapore unit received US FDA approval for Pregabalin capsules.

Shriram Finance:. The company approved a change in the list of key managerial personnel. Accordingly, five senior management personnel will cease to be designated as KMP with effect from Jan. 25. The company also declared a second interim dividend of Rs 10 per equity share with a face value of Rs 10 each.

SJVN: The company won the GUVNL auction for a 100 MW solar project at Rs 2.54 per unit on a build-own-operate basis through a tariff-based competitive bidding process in GUVNL Phase XXI.

Dhanlaxmi Bank: The bank received the Reserve Bank of India's nod for extending JK Shivan's term as managing director and chief executive officer till his successor assumes office.

L&T Finance: The company appointed Sudipta Roy as the managing director and chief executive officer effective Jan. 24, 2024.

Lemon Tree Hotels: The company announced its latest signing: Lemon Tree Hotel, Motihari, Bihar. The property, which will be franchised by Lemon Tree Hotels, is expected to open in FY25.

Jubilant Ingrevia: Jubilant Infrastructure Ltd., a wholly owned subsidiary of the company, has purchased 6.67% of Forum I Aviation Pvt. from Max Ateev Ltd. Post-acquisition, JIL holds 9.12% equity shares in FAPL.

Associated Alcohols & Breweries: The company approved the incorporation of a wholly-owned subsidiary, Associated Alcohols & Breweries (Awadh) Ltd. The company’s subsidiary will be incorporated mainly for the green field project to be set up at Unnao, Uttar Pradesh, for which the land acquisition is in process.

Oberoi Realty: The company appointed Nilesh Kushe as executive vice president, construction. Basav Mukherjee resigned from the post of chief executive officer of Leisure homes.

Shilpa Medicare: The Europe GMP inspection of its facility in Jadcherla, Telangana, by AGES, Austria, from Jan. 22 to Jan. 26 was concluded with two minor observations.

Adani Energy Solutions: The company incorporated a new subsidiary for the transmission, distribution and power supply business.

Yes Bank: The board approved the transfer of investment banking and merchant banking businesses from Yes Securities to the company, effective Jan. 1.

Sarda Energy & Minerals: South Eastern Coalfields issued a letter of acceptance to a consortium, in which the company has a 67% share, for re-opening, rehabilitating and operating Bartunga Hill high-grade coal mine.

Aditya Birla Sun Life AMC, Adani Green Energy, Apollo Pipes, Bajaj Finance, Bharat Electronics, Bharat Petroleum Corporation, CSB Bank, GAIL, Garware Technical Fibres, Gateway Distriparks, Godfrey Phillips India, Heritage Foods, Indo Count Industries, Vodafone Idea, ITC, Jaiprakash Power Ventures, Latent View Analytics, L.G.Balakrishnan & Bros, Mahindra Logistics, Maharashtra Seamless, Marico, Muthoot Microfin, Nippon Life India Asset Management, NTPC, Nuvoco Vistas Corporation, Piramal Enterprises, Petronet LNG, Restaurant Brands Asia, R R Kabel, Stylam Industries, Tata Investment Corporation, UTI Asset Management Company, Venus Pipes & Tubes, and Voltamp Transformers.

Cholamandalam Investment Q3 Earnings FY24 (Standalone, YoY)

Revenue up 48.7% at Rs 5,018.7 crore vs Rs 3,375 crore.

Gross NPA at 3.92% vs 4.07% QoQ.

Net NPA at 2.56% vs 2.59% QoQ.

Net profit up 28% at Rs 876.2 crore vs Rs 684.3 crore.

AU Small Finance Bank Q3 Earnings FY24 (Standalone, YoY)

NII up 15.3% YoY at Rs 1,329.4 crore vs Rs 1,152.8 crore.

Net profit down 4.5% YoY at Rs 375.3 crore vs Rs 392.8 crore.

Gross NPA at 1.98% vs 1.91% QoQ.

Net NPA at 0.68% vs 0.60% QoQ.

Vedanta Q3 Earnings FY24 (Consolidated, YoY)

Revenue up 4.2% at Rs 35,541 crore vs Rs 34,102 crore.

Ebitda up 20.7% at Rs 8,531 crore vs Rs 7,067 crore.

Margin up 328 bps at 24% vs 20.72%.

Net profit down 7.2% at Rs 2,868 crore vs Rs 3,091 crore.

TVS Holdings Q3 Earnings FY24 (Consolidated, YoY)

Revenue up 17.9% at Rs 9,996.4 crore vs Rs 8,475.4 crore.

Ebitda up 46.8% at Rs 1,535.6 crore vs Rs 1,047 crore.

Margin up 300 bps at 15.36% vs 12.35%.

Net profit up 84.3% at Rs 532.3 crore vs Rs 288.9 crore.

Intellect Design Arena Q3 Earnings FY24 (Consolidated, QoQ)

Revenue up 2.5% at Rs 634.4 crore vs Rs 619.1 crore.

EBIT up 9.8% at Rs 96.75 crore vs Rs 88.14 crore.

Margin up 101 bps at 15.25% vs 14.23%.

Net profit up 19.9% at Rs 84.88 crore vs Rs 70.8 crore.

Cyient Q3 Earnings FY24 (Consolidated, QoQ)

Revenue up 2.4% at Rs 1,821.4 crore vs Rs 1,778.5 crore.

EBIT up 0.1% at Rs 326.1 crore vs Rs 325.8 crore.

Margin down 41 bps at 17.9% vs 18.31%.

Net profit down 16.6% at Rs 153.2 crore vs Rs 183.6 crore.

Tata Technologies Q3 Earnings FY24 (Consolidated, QoQ)

Revenue up 1.6% at Rs 1,289.45 crore vs Rs 1,269.17 crore.

EBIT up 11.3% at Rs 209.4 crore vs Rs 188.1 crore.

Margin up 141 bps at 16.23% vs 14.82%.

Net profit up 6.1% at Rs 170.22 crore vs Rs 160.38 crore.

Aeroflex Industries Q3 Earnings FY24 (Consolidated, YoY)

Revenue up 11% at Rs 73.13 crore vs Rs 65.9 crore.

Ebitda up 50.5% at 13.82 crore vs Rs 9.18 crore.

Margin up 496 bps at 18.89% vs 13.93%.

Net profit up 75.5% at Rs 9.04 crore vs Rs 5.15 crore.

Shriram Finance Q3 Earnings FY24 (Standalone)

Revenue from operations up 17.26% YoY at Rs 8.922.39 crore vs Rs 7,608.83 crore.

Net profit up 2.3% YoY at Rs 1,818.3 crore vs Rs 1,777 crore.

Gross NPA at 5.66% vs 5.79% QoQ.

Net NPA at 2.72% vs 2.80% QoQ.

Adani Power Q3 Earnings FY24 (Consolidated, YoY)

Revenue up 67.3% at Rs 12,991.4 crore vs Rs 7,764.4 crore.

Ebitda at Rs 4,645.3 crore vs Rs 1,469.7 crore.

Margin up 1682 bps at 35.75% vs 18.92%.

Net profit at Rs 2,738 crore vs Rs 8.8 crore.

Prepaid long term debt worth Rs 810 crore during Q3FY24 & Rs250 crore during Jan. 2024.

KFin Technologies Q3 Earnings FY24 (Consolidated, QoQ)

Revenue up 4.7% at Rs 218.7 crore vs Rs 209 crore.

EBIT up 4.16% at Rs 84.47 crore vs Rs 81.09 crore.

Margin down 18 bps at 38.62% vs 38.8%.

Net profit up 8.8% at Rs 66.8 crore vs Rs 61.37 crore.

SBI Cards & Payment Services Q3 Earnings FY24 (YoY)

Revenue from operations up 31.7% at Rs 4,621.7 crore vs Rs 3,507.12 crore.

Net profit up 7.8% at Rs 549.1 crore vs Rs 509.5 crore.

Shakti Pumps Q3 Earnings FY24 (Consolidated, YoY)

Revenue up 57.7% at Rs 495.6 crore vs Rs 314.2 crore.

Ebitda at Rs 70.97 crore vs Rs 21.88 crore.

Margin up 735 bps at 14.31% vs 6.96%.

Net profit at Rs 45.19 crore vs Rs 11.25 crore.

Yes Bank Q3 FY24

Net profit up 4.45 times at Rs 231.46 crore vs 52 crore (YoY) (Bloomberg estimate: Rs 367 crore)

NII up 2.3% at Rs 2017 crore vs Rs 1971 crore (YoY)

GNPA at 2% vs 2% (QoQ)

NNPA at 0.9% vs 0.9% (QoQ)

Zen Technologies Q3 FY24 (Consolidated, YoY)

Revenue at Rs 99.5 crore vs Rs 52.5 crore

Ebitda at Rs 42.4 crore vs Rs 16.7 crore

Margin at 42.61% vs 31.8%, up 1080 basis points

Net profit at Rs 29.8 crore vs Rs 11.9 crore

Company to raise Rs 1,000 crore via QIP.

Olectra Greentech Q3 FY24 (Consolidated, YoY)

Revenue up 33.4% at Rs 342.1 crore vs Rs 256.4 crore

Ebitda up 39% at Rs 48.8 crore vs Rs 35.1 crore

Margin at 14.26% vs 13.68%, up 57 basis points

Net profit up 77.1% at Rs 27.1 crore vs Rs 15.3 crore

Sanghi Industries Q3 FY24 (Consolidated, YoY)

Revenue at Rs 189.11 crore vs Rs 132.76 crore, up 41.5% (Bloomberg estimate: Rs 285 crore)

Ebitda loss of Rs 22.79 crore vs Ebitda loss of Rs 17.9 crore (Bloomberg estimate: Rs 32 crore Ebitda loss)

Net loss at Rs 201.6 crore vs loss of Rs 144 crore (Bloomberg estimate: Rs 132 crore loss)

Bhansali Engineering Ploymers Q3 FY24 (Consolidated, YoY)

Revenue at Rs 291.8 crore vs Rs 338.9 crore, down 13.9%

Ebitda at Rs 46.77 crore vs Rs 41.33 crore, up 13.16%

Margin at 16.02% vs 12.19%, up 383 bps

Net profit at Rs 40.2 crore vs Rs 33.5 crore, up 20%

Craftsman Automation Q3 FY24 (Consolidated, YoY)

Revenue at Rs 1,129.7 crore vs Rs 749 crore, up 50.8% (Bloomberg estimate: Rs 1,170 crore)

Ebitda at Rs 220.2 crore vs Rs 158.28 crore, up 39.1% (Bloomberg estimate: Rs 239 crore)

Margin at 19.49% vs 21.13%, down 164 basis points (Bloomberg estimate: 20%)

Net profit at Rs 81.5 crore vs Rs 51.6 crore, up 57.9% (Bloomberg estimate: Rs 93 crore)

APL Apollo Tubes Q3 FY24 (Consolidated, YoY)

Revenue at Rs 4,177.8 crore vs Rs 4,327.1 crore, down 3.5% (Bloomberg estimate: Rs 4,245 crore)

Ebitda at Rs 279.6 crore vs Rs 272.8 crore, up 2.5% (Bloomberg estimate: Rs 291 crore)

Margin at 6.69% vs 6.3%, up 38 basis points (Bloomberg estimate: 7%)

Net profit at Rs 165.5 crore vs Rs 169.2 crore, down 2.2% (Bloomberg estimate: Rs 178 crore)

Macrotech Developers Q3 FY24 (Consolidated, YoY)

Revenue at Rs 2,930.6 crore vs Rs 1,773.8 crore, up 65.2% (Bloomberg estimate: Rs 2,459 crore)

Ebitda at Rs 882.7 crore vs Rs 403.8 crore, up 118.6% (Bloomberg estimate: Rs 625 crore)

Margin at 30.12% vs 22.76%, up 735 bps (Bloomberg estimate: 25%)

Net profit at Rs 505.2 crore vs Rs 405 crore, up 24.7% (Bloomberg estimate: Rs 370 crore)

Utkarsh Small Finance Bank Q3 FY24

NII up 22.6% at Rs 482.31 crore vs Rs 393.53 crore (YoY)

Net profit up 24.12% at Rs 116.06 crore vs Rs 93.5 crore (YoY) (Bloomberg estimate: Rs 109 crore)

GNPA at 3.04% vs 2.81%

NNPA at 0.19% vs 0.16%

Capri Global Capital Q3 FY24 (Consolidated)

Total income up 57.34% at Rs 605.55 crore vs Rs 384.85 crore (YoY)

Net profit up 81.67% at Rs 67.98 crore vs Rs 37.42 crore (YoY)

GNPA at 2.1% vs 1.96% (QoQ)

NNPA at 1.36% vs 1.32% (QoQ)

The board approved sub-division of each stock with face value Rs 2 into one equity share of face value Rs 1.

The board approved increasing the company's authorised share capital.

Dodla Dairy Q3 FY24 (Consolidated, YoY)

Revenue at Rs 746.84 crore vs Rs 675.43 crore, up 10.57% (Bloomberg estimate: Rs 743 crore)

Ebitda at Rs 82.83 crore vs Rs 53.61 crore, up 54.5% (Bloomberg estimate: Rs 82 crore)

Margin at 11.09% vs 7.93% up 315 basis points (Bloomberg estimate: 11%)

Net profit at Rs 41.33 crore vs Rs 35.39 crore, up 16.78% (Bloomberg estimate: Rs 51 crore)

Markets in the Asia-Pacific region gained in early trade on Monday as market participants looked forward to the rate decision by the Federal Reserve, scheduled for release on Wednesday.

S&P ASX 200 was trading 0.19% up at 7,569.80 as of 07:48 a.m. This week traders will be focusing on Australia's fourth quarter inflation figure, due to be released on Wednesday. Japan's Nikkei 225 gained nearly 1%, and South Korea's Kospi was up by over 1%.

Wall Street traders pushed U.S. stocks towards another all-time high on speculation the Federal Reserve will be able to engineer a soft landing as the U.S. economy remains fairly resilient and inflation shows signs of cooling, Bloomberg reported.

Brent crude was trading up 0.35% at $83.84 per barrel. Gold was up 0.21% at $2,022.77 an ounce.

GIFT Nifty was trading 0.4% higher at 21,640.50 as of 08:13 a.m.

India's benchmark stock indices ended lower in a truncated week on Thursday, weighed by losses in index heavyweights HDFC Bank Ltd. and Axis Bank Ltd. On a weekly basis, the indices closed lower for the second week, with both the Nifty and the Sensex falling 1% this week.

The NSE Nifty 50 settled 101.35 points, or 0.47%, lower at 21,352.60, and the S&P BSE Sensex fell 359.64 points, or 0.51%, to end at 70,700.67.

Overseas investors remained net sellers of Indian equities for the seventh consecutive session on Thursday. Foreign portfolio investors offloaded stocks worth Rs 2,144.1 crore, while domestic institutional investors mopped up equities worth Rs 3,474.9 crore, according to provisional data from the National Stock Exchange.

The Indian currency strengthened by two paise to close at Rs 83.11 against the U.S. dollar.

Markets in the Asia-Pacific region gained in early trade on Monday as market participants looked forward to the rate decision by the Federal Reserve, scheduled for release on Wednesday.

S&P ASX 200 was trading 0.19% up at 7,569.80 as of 07:48 a.m. This week traders will be focusing on Australia's fourth quarter inflation figure, due to be released on Wednesday. Japan's Nikkei 225 gained nearly 1%, and South Korea's Kospi was up by over 1%.

Wall Street traders pushed U.S. stocks towards another all-time high on speculation the Federal Reserve will be able to engineer a soft landing as the U.S. economy remains fairly resilient and inflation shows signs of cooling, Bloomberg reported.

Brent crude was trading up 0.35% at $83.84 per barrel. Gold was up 0.21% at $2,022.77 an ounce.

GIFT Nifty was trading 0.4% higher at 21,640.50 as of 08:13 a.m.

India's benchmark stock indices ended lower in a truncated week on Thursday, weighed by losses in index heavyweights HDFC Bank Ltd. and Axis Bank Ltd. On a weekly basis, the indices closed lower for the second week, with both the Nifty and the Sensex falling 1% this week.

The NSE Nifty 50 settled 101.35 points, or 0.47%, lower at 21,352.60, and the S&P BSE Sensex fell 359.64 points, or 0.51%, to end at 70,700.67.

Overseas investors remained net sellers of Indian equities for the seventh consecutive session on Thursday. Foreign portfolio investors offloaded stocks worth Rs 2,144.1 crore, while domestic institutional investors mopped up equities worth Rs 3,474.9 crore, according to provisional data from the National Stock Exchange.

The Indian currency strengthened by two paise to close at Rs 83.11 against the U.S. dollar.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.