Indian equities seesawed through gains and losses but closed lower for the second consecutive day on Friday as financials, pharma and energy stocks weighed. Gains in information-technology stocks helped soften decline.

The NSE Nifty 50 ended 95 points or 0.4% lower at 23,431.5, while BSE Sensex closed 241.3 points or 0.31% down at 77,378.91. During the session, the Nifty declined as much as 0.77%, to an intraday low of 23,344, while the Sensex fell 0.67% to 77,099.

The Nifty entered the correction zone for the second time in two months. The index has declined over 10% from its 52-week high of 26,178 in late September. The Nifty was in correction territory in late November as well when it dipped below 23,400.

Tata Consultancy Services Ltd. was the top gainer on the Nifty, rising 5.6% after the company's third quarter earnings and management commentary impressed analysts and investors. Shriram Finance Ltd. shed 5.31%.

The market breached the 200-day simple-moving-average support zone this week, leading to intensified selling pressure, according to Amol Athawale, research analyst at Kotak Securities Ltd.

On the technical front, a long bearish candle has formed on the weekly charts, accompanied by a lower top formation on the intraday charts, indicating a largely negative trend. While the market's current texture appears weak, it is also in an oversold zone, suggesting a strong possibility of a pullback rally from current levels, he said.

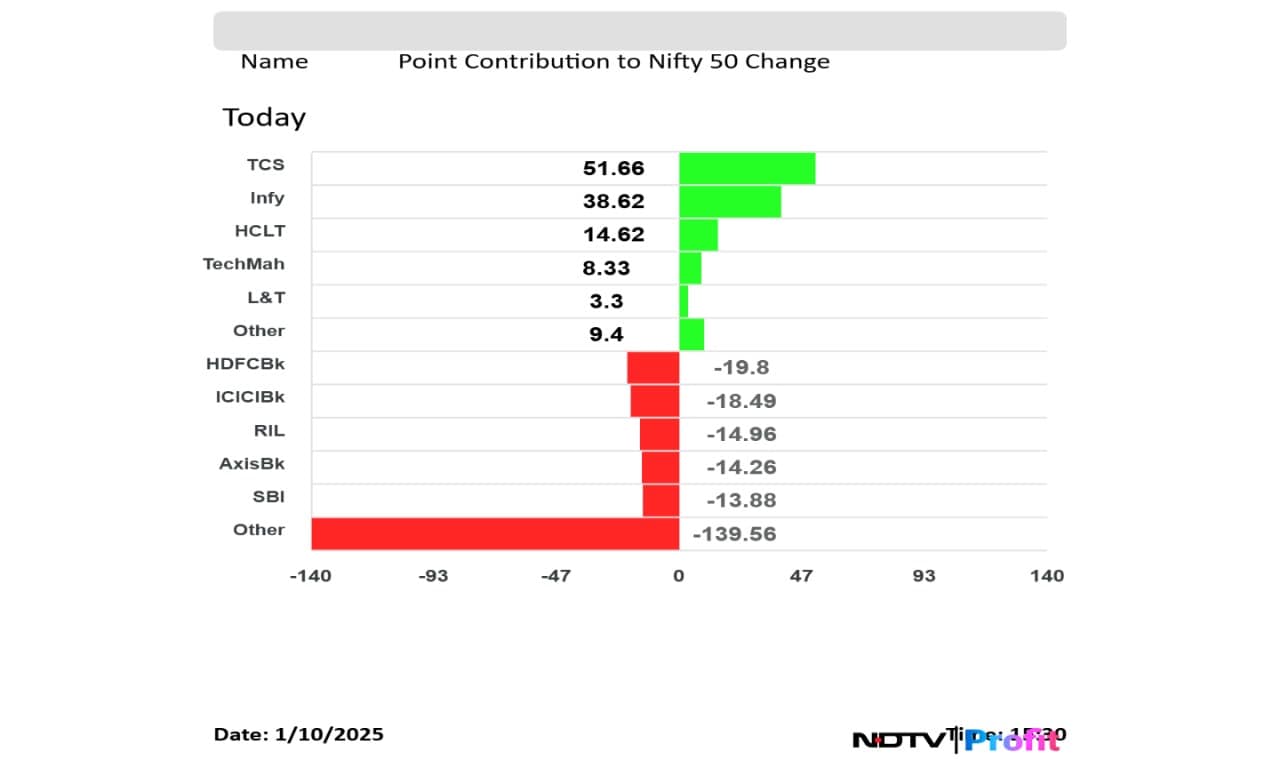

HDFC Bank Ltd., ICICI Bank Ltd., Reliance Industries Ltd., Axis Bank Ltd. and State Bank of India weighed on the Nifty the most in terms of points contribution.

TCS, Infosys Ltd., HCL Technologies Ltd., Tech Mahindra Ltd. and Larsen & Toubro led the gains in the index.

Eighteen out of the 21 sectors on the BSE declined, with Power falling the the most, while the BSE Focused IT rose the most.

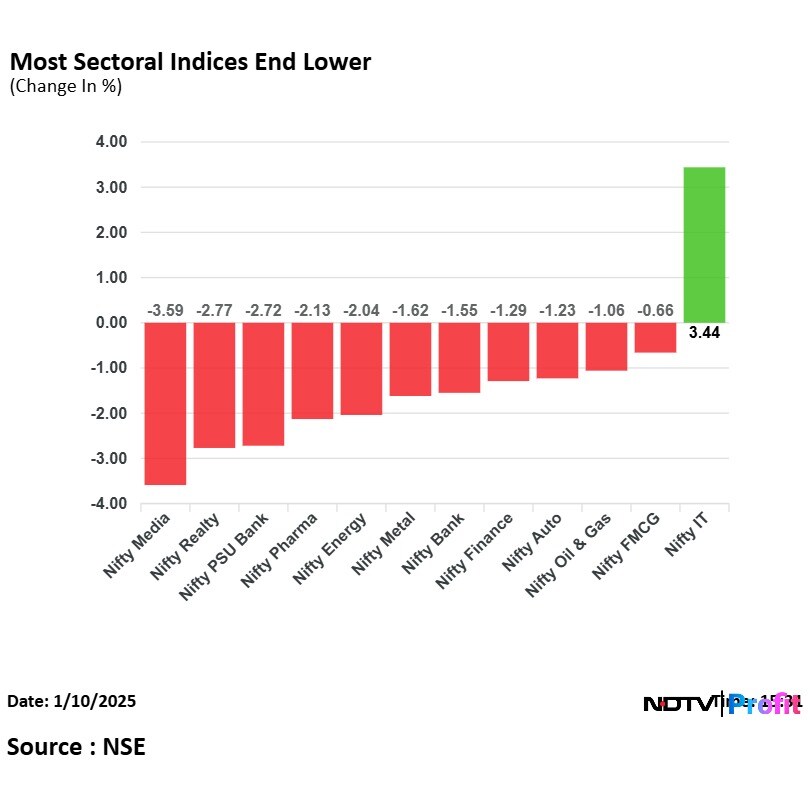

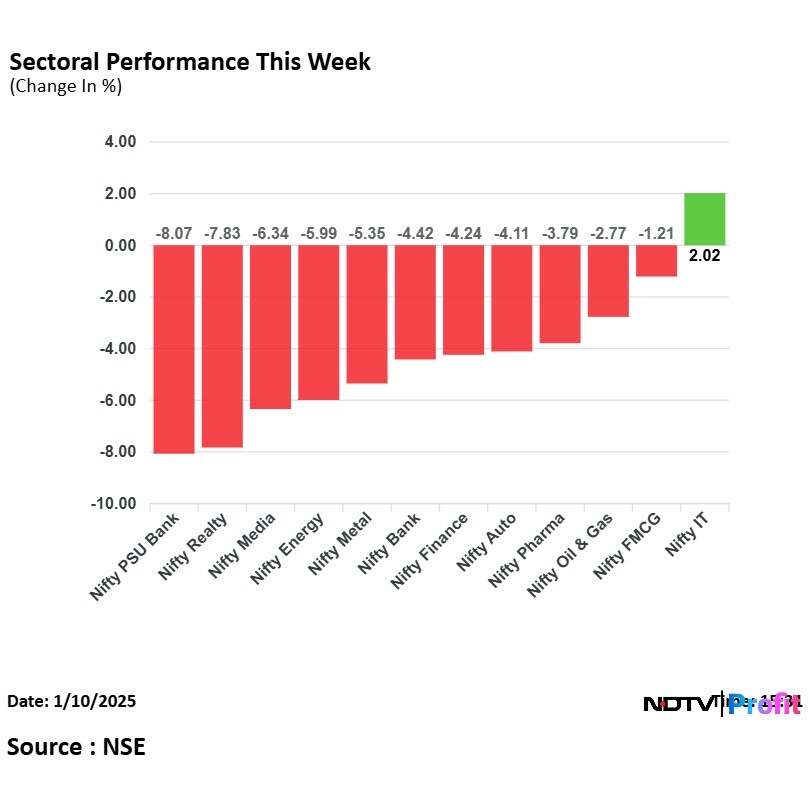

Except Nifty IT, all the sectoral gauges on the National Stock Exchange fell, with the Nifty Media, Realty and PSU Bank falling the most.

The broader markets underperformed the benchmark indices as the BSE MidCap and SmallCap ended 2.13% and 2.4% down respectively.

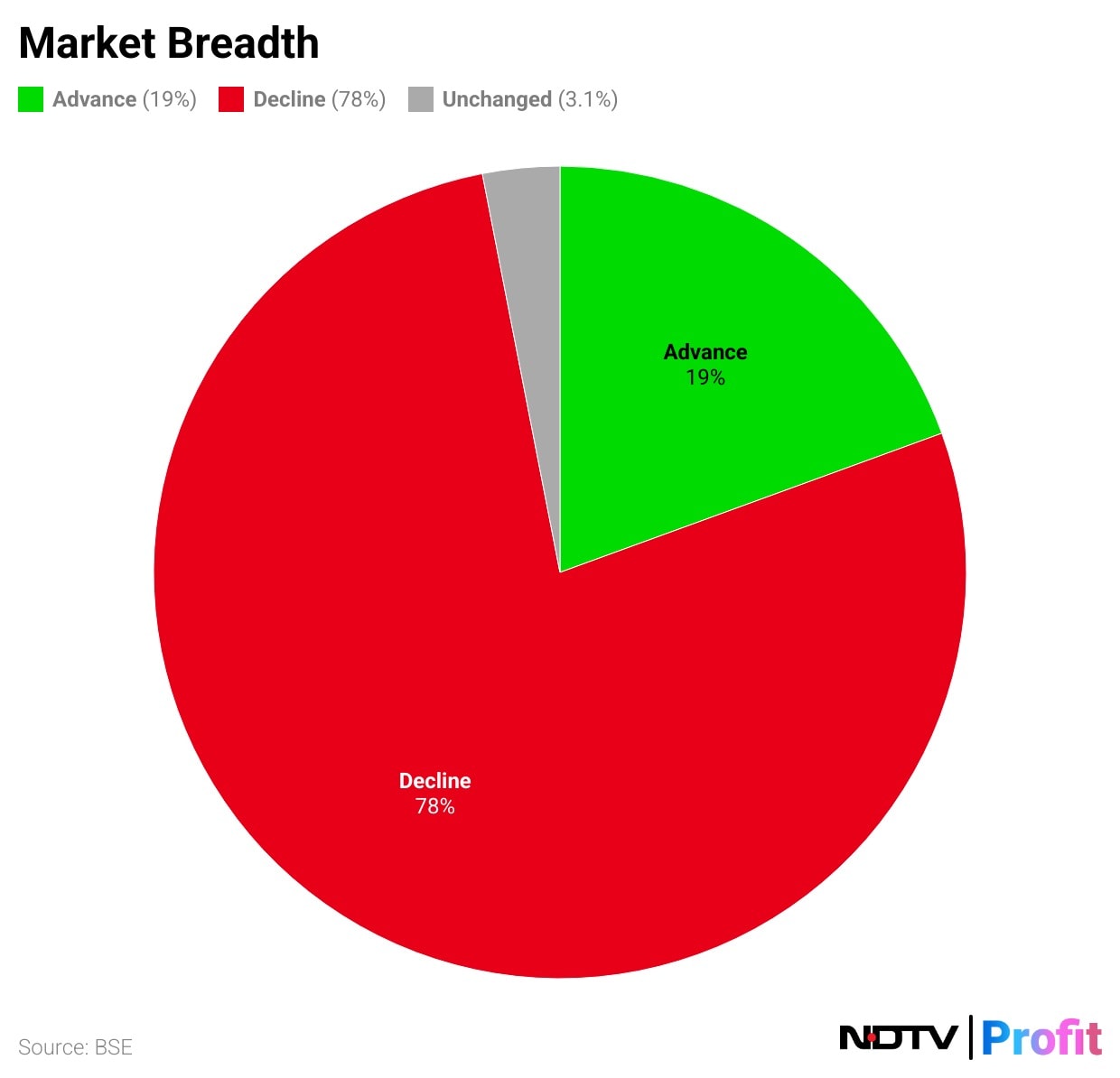

The market breadth was skewed in favour of the sellers as 3,190 stocks declined, 800 advanced and 87 remained unchanged on the BSE.

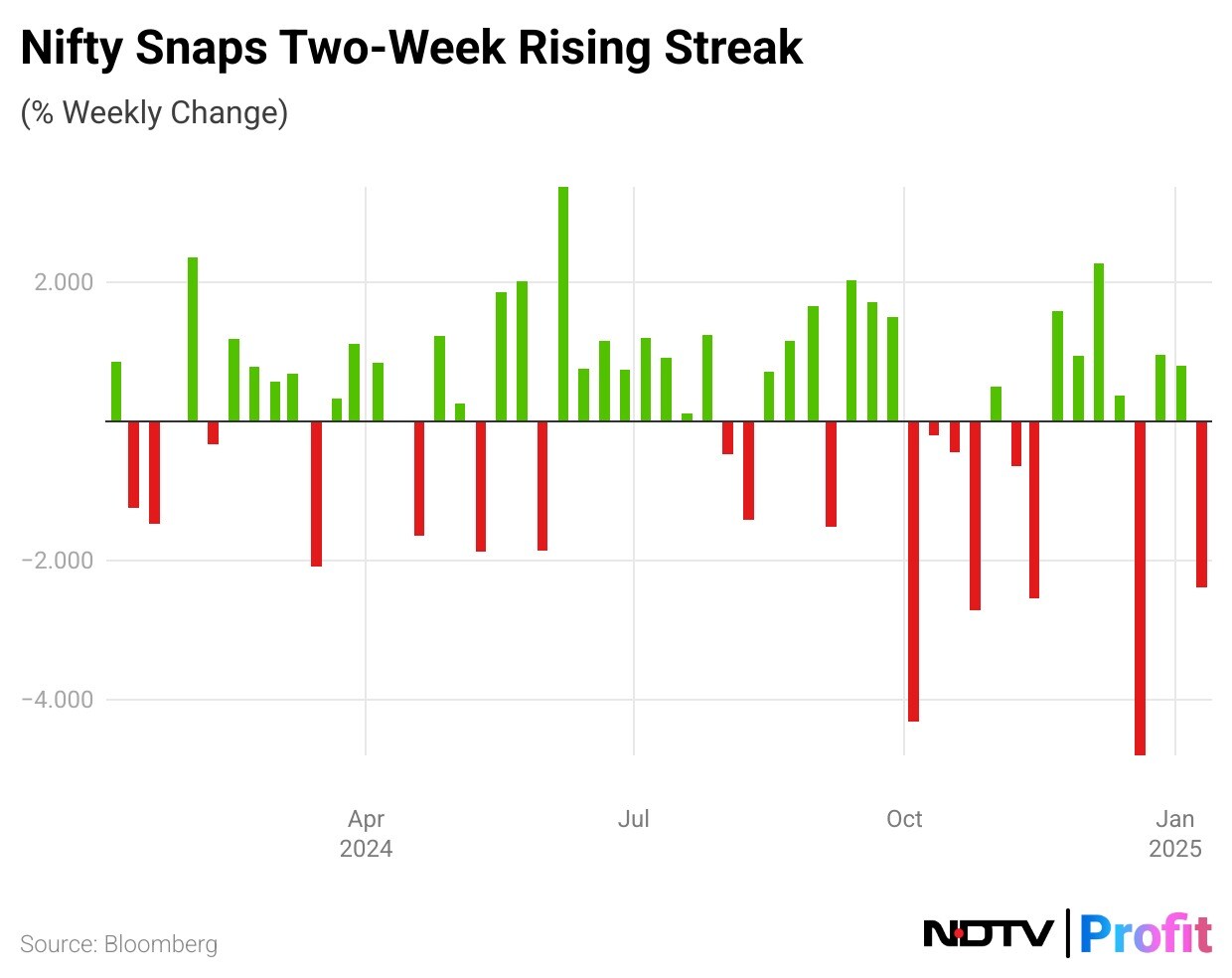

On a weekly basis, the benchmarks fell after a two-week rally. The Nifty and Sensex lost 2.39% and 2.33% respectively in the trading week ended Jan. 10.

The Nifty and Sensex lost 2.39% and 2.33% respectively in the trading week ended Jan. 10.Among sectors, the Nifty IT added 2%, while Nifty PSU Bank shed 8%. Union Bank of India and Bank of Maharashtra were the top laggards.

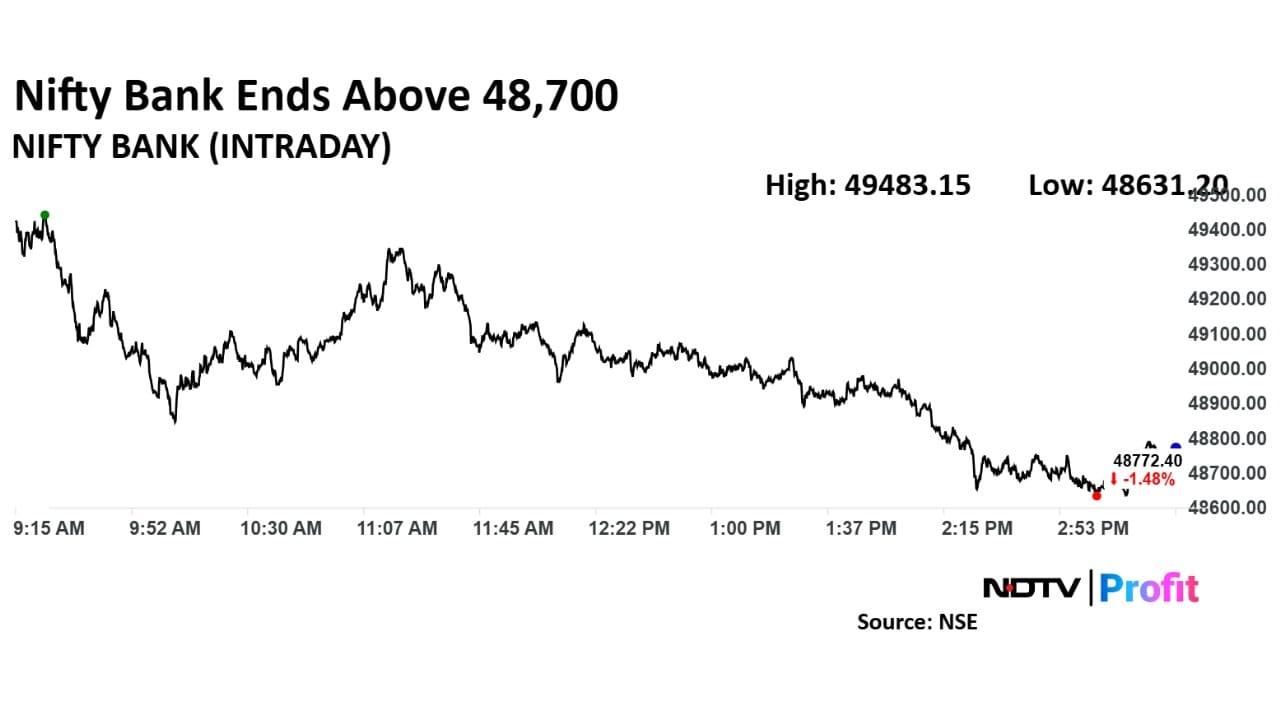

The Nifty Financial Services and the Nifty Bank declined for the second week in a row. The Nifty Auto recorded its longest losing streak in three months.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.