Shares of South Indian Bank are in focus as the bank recorded its highest ever quarterly net profit in its third quarter results of FY26. The bank on Thursday, January 15, reported a net profit of Rs 374 crore for the quarter ended December 31, 2025 (Q3FY26), marking a 9% increase from the Rs 342 crore posted in the same period last year.

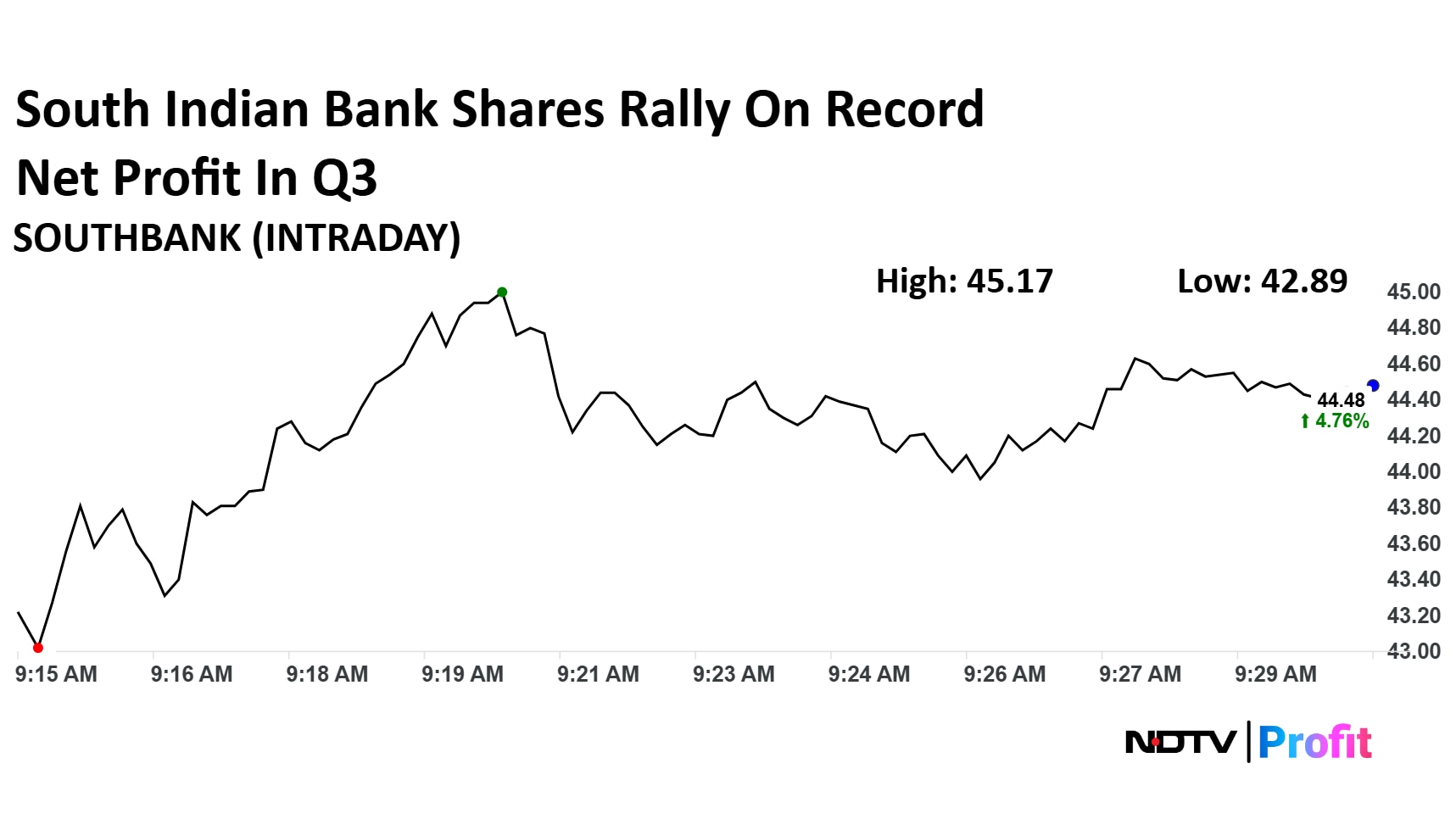

The shares of South Indian Bank Ltd are up over 4.6%, and are trading over the Rs 45 apiece level. The stock is up by 66.23% in the last 12 months.

Of the six analysts, tracked by Bloomberg, with coverage on this stock, four have a 'buy' rating, and two have a 'hold' call on the stock.

The bank's net interest income (NII) for the quarter rose 19% year-on-year, reaching Rs 486 crore compared to Rs 409.2 crore in Q3 FY25. The Kerala-headquartered lender also reported a 10% rise in pre-provisioning operating profit, which increased to Rs 584.33 crore from Rs 528.84 crore a year earlier.

South Indian Bank said it continued to maintain positive operating leverage in the nine months ending December 2025. Net total income during the period grew 7.44%, while operating expenses rose 3.61% compared to the corresponding period in 2024. As of December 31, 2025, the bank's gross non-performing assets (NPA) improved significantly, falling 163 basis points to 2.67% from 4.30% a year earlier. Net NPA also declined 80 bps, dropping to 0.45% from 1.25% YoY.

The bank's return on assets (ROA) stayed above 1%, reflecting stable operational efficiency. Asset quality strengthened further, with the slippage ratio easing to 0.16% in Q3 FY26 from 0.33% in the same quarter last year.

Retail deposits increased by 13% YoY, rising ₹13,142 crore to Rs 1,15,563 crore from Rs 1,02,421 crore. NRI deposits grew 9% to Rs 33,965 crore from Rs 31,132 crore. The bank's CASA deposits expanded by 15% year-on-year, led by a 14% rise in savings accounts and a 20% jump in current accounts. Gross advances saw 11% growth, climbing to Rs 96,764 crore from Rs 86,966 crore in the previous year.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.