Shares of Shriram Finance Ltd. rose as InCred Equities said the financier is positioned well to overcome any slowdown in vehicle finance. It sees a 43% upside in the stock.

The brokerage maintained an 'add' rating on the stock with a target price of Rs 4,250 per share, a potential upside of 43% from the previous close.

InCred Equities added Shriram Finance to its high-conviction list as it believes the company is well-positioned to dodge the slowdown in the vehicle finance sector versus its peers. The brokerage expects the declining interest rate scenario to be beneficial to the non-banking financial company, it said in a note Dec. 07.

Net interest margin is set to improve in fiscal 2026, led by strong asset under-management growth, falling interest rates and improving system liquidity, it said. The brokerage "finds comfort in the asset quality trend improving in the non-vehicle loan book."

The recent 20% correction in the stock price amid sluggishness in the vehicle industry has overplayed, InCred Equities said. "Shriram Finance is much better placed than its larger peers."

Slower-than-expected growth and a spike in fresh loan slippage are the key risks for the analyst's estimates, it said.

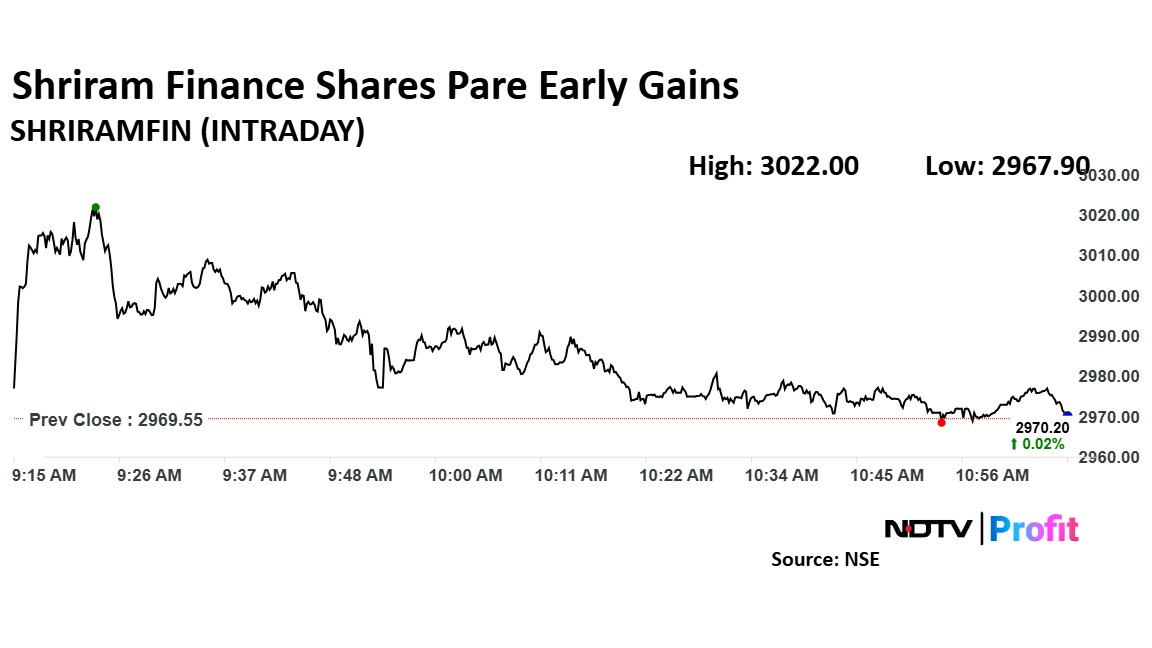

Shriram Finance's stock rose as much as 1.77% during the day to Rs 3,022 apiece on the NSE. It was trading 0.22% higher at Rs 2,976 apiece, compared to a 0.53% advance in the benchmark Nifty 50 as of 11:06 a.m.

The shares have risen 35% during the last 12 months. The relative strength index was at 47.

Thirty-nine out of the 41 analysts tracking the company have a 'buy' rating on the stock, one suggests a 'hold' and one has a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 22.8%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.