.jpg?downsize=1080:540)

India’s stock benchmarks logged over 3% gains in the last 5 sessions to snap a two-week losing streak. It was a milestone week with both the S&P BSE Sensex and NSE Nifty hitting record highs as investors anticipated a status quo on rates by the Monetary policy Committee of the RBI. The gains, however, were capped after the benchmarks faced pressure on Friday as the MPC decision was not unanimous.

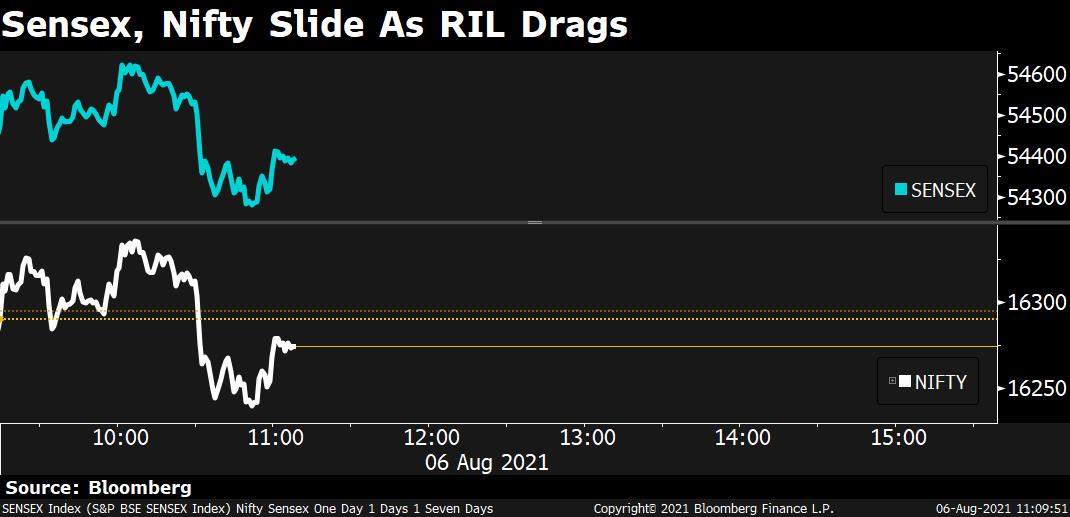

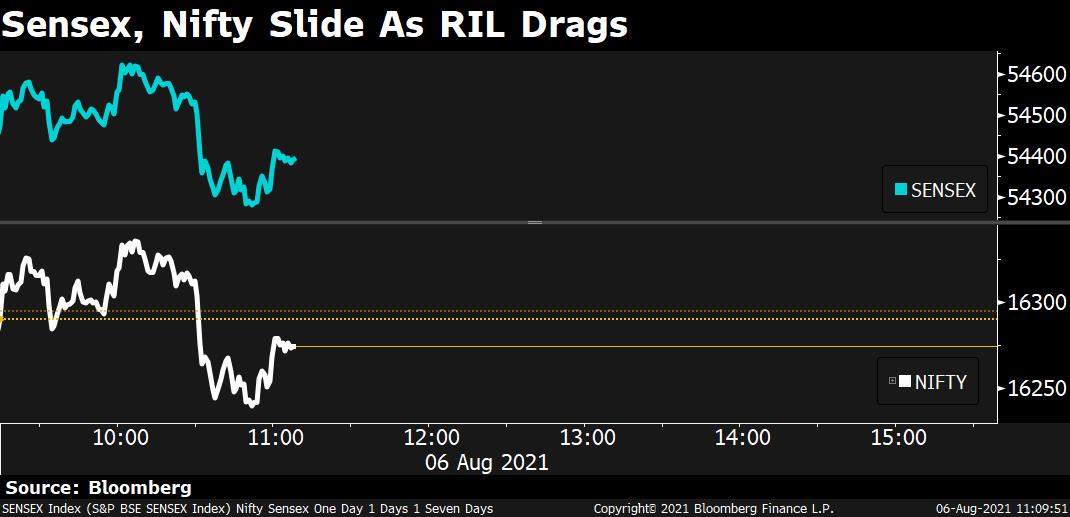

The Sensex shed 0.39% to 54,277.72. The Nifty 50 Index declined by similar magnitude to 16,238.20. Sensex index hit a new high of 54,717.24 mark and Nifty logged a record high of 16,349.45 during the week.

Index heavyweight Reliance Industries led the losses on Friday as it declined over 2% after the Supreme Court ruled in favour of Amazon against Future Retail and found the emergency arbitrator’s interim award to be valid.

India’s stock benchmarks logged over 3% gains in the last 5 sessions to snap a two-week losing streak. It was a milestone week with both the S&P BSE Sensex and NSE Nifty hitting record highs as investors anticipated a status quo on rates by the Monetary policy Committee of the RBI. The gains, however, were capped after the benchmarks faced pressure on Friday as the MPC decision was not unanimous.

The Sensex shed 0.39% to 54,277.72. The Nifty 50 Index declined by similar magnitude to 16,238.20. Sensex index hit a new high of 54,717.24 mark and Nifty logged a record high of 16,349.45 during the week.

Index heavyweight Reliance Industries led the losses on Friday as it declined over 2% after the Supreme Court ruled in favour of Amazon against Future Retail and found the emergency arbitrator’s interim award to be valid.

The broader markets outperformed the larger peers with both the BSE MidCap and BSE SmallCap gaining over 0.2%. Eleven out of the 19 sectoral indices compiled by the BSE Ltd. declined with S&P BSE Energy shedding nearly 1.5%.

The market breadth was skewed in favour of bulls. About 1,821 stocks advanced, 1,392 declined and 116 remained unchanged on the BSE.

Shares of Hindalco Ltd. gained 2.88% to Rs 455.85 apiece after the company reported net sales in-line with average analyst estimate in the first quarter.

June Quarter (Consolidated)

Net income at Rs 2,787 crore vs Rs 1,928 crore QoQ

Revenue at Rs 41,358 crore vs estimate of Rs 41,433 crore

Ebitda at Rs 6,790 crore vs Rs 5,845 crore QoQ

Of the 27 analysts tracking the company, 26 maintained ‘buy’ and 1 analyst maintained ‘sell’ recommendations. The overall consensus price of analysts tracked by Bloomberg implied an upside of 8.2%.

Shares of Muthoot Finance Ltd. shed 5% to Rs 1,505 apiece after reporting net income that missed average analyst estimate in the June Quarter

First Quarter Results (Consolidated)

Net income at Rs 978.58 crore vs estimate of Rs 1,020 crore (Bloomberg Consensus)

Revenue at Rs 2,955.83 crore vs Rs 3,104.50 crore QoQ

Total costs at Rs 1,653.59 crore vs Rs 1,733.82 crore QoQ

Other income at Rs 7.59 crore vs Rs 14.48 crore QoQ

The company’s board also approved the appointment of K Hariharan as the chief risk officer.

Of the 18 analysts tracking the company, 13 maintained ‘buy’, 3 maintained ‘hold’ and 2 maintained ‘sell’ recommendations. The overall consensus price of analysts tracked by Bloomberg implied an upside of 4.4%.

Shares of Alkem Laboratories Ltd. added 3.97% to Rs 3,534.70 apiece after reporting net income for the first quarter than beat the average analyst estimate.

June Quarter Results (Consolidated)

Net income at Rs 468.12 crore vs estimate of Rs 366 crore (Bloomberg Consensus)

Revenue at Rs 2,731.36 crore vs estimate of Rs 2,273 crore

Total expenses at Rs 2,221.89 crore vs Rs 1,980.28 crore QoQ

Other income at Rs 46.65 crore vs Rs 46.28 crore QoQ

Of the 23 analysts tracking the company, 18 maintained ‘buy’, 4 maintained ‘hold’ and 1 analyst maintained ‘sell’ recommendations. The overall consensus price of analysts tracked by Bloomberg hinted at an upside of 1.6%.

Shares of Metropolis Healthcare Ltd declined 4.75% to Rs 2.865 apiece after reporting net income for the first quarter that beat the average analyst estimate.

June Quarter Results (Consolidated)

Net income at Rs 74.89 crore vs estimate of Rs 64.45 crore (Bloomberg Consensus)

Revenue at Rs 326.76 crore vs estimate of Rs 303 crore

Total costs at Rs 243.34 crore vs Rs 212.14 crore QoQ

Other income at Rs 3.76 crore vs Rs 2.06 crore QoQ

Of the 13 analysts tracking the company, 8 maintained ‘buy’, 1 maintained ‘hold’ and 4 analysts maintained ‘sell’ recommendations. The overall consensus price of analysts tracked by Bloomberg implied a downside of 11.7%. Shares of Metropolis Healthcare added over 50% in 2021 so far as compared to 22% gains for S&P BSE Healthcare.

Shares of Narayana Hrudayalaya Ltd. gained 9.05%, the most in over two months, to Rs 548.80 apiece after it reported sequential growth in net profit in June quarter post market hours on Thursday

June Quarter Numbers

Net profit at Rs 76.24 crore vs Rs 68.02 crore QoQ

Revenue at Rs 859.7 crore vs Rs 837.7 crore QoQ

Total expenses at Rs 787.9 crore vs Rs 759.1 crore QoQ

Other income at Rs 6.68 crore vs Rs 8.54 crore QoQ

Of the 13 analysts tracking the company, 10 maintained ‘buy’, 2 maintained ‘hold’ and 1 analyst maintained ‘sell’ recommendation. The overall consensus price of analysts tracked by Bloomberg implied an upside of 4.7%. Shares of Narayana Hrudayalaya gained 19% in 2021 so far.

Cairn Energy climbed as much as 8.5% after Investec upgraded the company to 'buy' from 'hold', adding to Thursday’s 26% surge that followed the Indian government saying it is seeking to scrap a rule mandating overseas companies pay back taxes on local assets they bought or sold indirectly.

Investec

More than doubles the price target.

The legislation is an important step to allow repayment of ~$1.2 Billion to Cairn.

Cairn has no major capex planned, meaning most of the proceeds will probably be passed to shareholders.

Upgrade and price target hike driven by the potential for “outsized returns” returns”

India's key stock benchmarks and bonds slid in afternoon trading after a lack of unanimity in the MPC’s decision to keep an accommodative stance and the apex court's decision against the RIL-Future deal weighed on sentiment.

The S&P BSE Sensex shed 0.25% to 54,357.50. The NSE Nifty 50 Index declined by similar magnitude to 16,266.50.

India's key stock benchmarks and bonds slid in afternoon trading after a lack of unanimity in the MPC’s decision to keep an accommodative stance and the apex court's decision against the RIL-Future deal weighed on sentiment.

The S&P BSE Sensex shed 0.25% to 54,357.50. The NSE Nifty 50 Index declined by similar magnitude to 16,266.50.

The broader markets outperformed the larger peers with both the BSE MidCap and BSE SmallCap gaining over 0.3%. Ten out of the 19 sectoral indices compiled by the BSE Ltd. advanced with S&P BSE Telecom Index gaining nearly 2%.

India's key stock benchmarks and bonds slid in afternoon trading after a lack of unanimity in the MPC’s decision to keep an accommodative stance and the apex court's decision against the RIL-Future deal weighed on sentiment.

The S&P BSE Sensex shed 0.25% to 54,357.50. The NSE Nifty 50 Index declined by similar magnitude to 16,266.50.

India's key stock benchmarks and bonds slid in afternoon trading after a lack of unanimity in the MPC’s decision to keep an accommodative stance and the apex court's decision against the RIL-Future deal weighed on sentiment.

The S&P BSE Sensex shed 0.25% to 54,357.50. The NSE Nifty 50 Index declined by similar magnitude to 16,266.50.

The broader markets outperformed the larger peers with both the BSE MidCap and BSE SmallCap gaining over 0.3%. Ten out of the 19 sectoral indices compiled by the BSE Ltd. advanced with S&P BSE Telecom Index gaining nearly 2%.

The market breadth was skewed in favour of bulls. About 1,816 stocks advanced, 1,274 declined and 111 remained unchanged on the BSE.

India's key stock benchmarks and bonds slid in afternoon trading after a lack of unanimity in the MPC’s decision to keep an accommodative stance and the apex court's decision against the RIL-Future deal weighed on sentiment.

The S&P BSE Sensex shed 0.25% to 54,357.50. The NSE Nifty 50 Index declined by similar magnitude to 16,266.50.

India's key stock benchmarks and bonds slid in afternoon trading after a lack of unanimity in the MPC’s decision to keep an accommodative stance and the apex court's decision against the RIL-Future deal weighed on sentiment.

The S&P BSE Sensex shed 0.25% to 54,357.50. The NSE Nifty 50 Index declined by similar magnitude to 16,266.50.

The broader markets outperformed the larger peers with both the BSE MidCap and BSE SmallCap gaining over 0.3%. Ten out of the 19 sectoral indices compiled by the BSE Ltd. advanced with S&P BSE Telecom Index gaining nearly 2%.

India's key stock benchmarks and bonds slid in afternoon trading after a lack of unanimity in the MPC’s decision to keep an accommodative stance and the apex court's decision against the RIL-Future deal weighed on sentiment.

The S&P BSE Sensex shed 0.25% to 54,357.50. The NSE Nifty 50 Index declined by similar magnitude to 16,266.50.

India's key stock benchmarks and bonds slid in afternoon trading after a lack of unanimity in the MPC’s decision to keep an accommodative stance and the apex court's decision against the RIL-Future deal weighed on sentiment.

The S&P BSE Sensex shed 0.25% to 54,357.50. The NSE Nifty 50 Index declined by similar magnitude to 16,266.50.

The broader markets outperformed the larger peers with both the BSE MidCap and BSE SmallCap gaining over 0.3%. Ten out of the 19 sectoral indices compiled by the BSE Ltd. advanced with S&P BSE Telecom Index gaining nearly 2%.

The market breadth was skewed in favour of bulls. About 1,816 stocks advanced, 1,274 declined and 111 remained unchanged on the BSE.

Shares of Voltas gained 2.74% to Rs 1,073.90 apiece after it reported its numbers for the first quarter.

June Quarter Numbers (Consolidated)

Net income at Rs 122.44 crore vs Rs 238.72 crore QoQ

Revenue at Rs 1,785.20 crore vs Rs 2,651.66 crore QoQ

Total costs at Rs 1,651.53 crore vs Rs 2,340.22 crore QoQ

Other income at Rs 74.97 crore vs Rs 31.58 crore QoQ

Of the 41 analysts tracking the company, 25 maintained ‘buy’, 10 maintained ‘hold’ and 6 maintained ‘sell’ recommendations. The overall consensus price of analysts tracked by Bloomberg implied an upside of 1.5%. Shares of Voltas added over 28% in 2021 so far.

Mahindra & Mahindra Ltd reported net income for the first quarter that missed average analyst estimates.

June Quarter Earnings (Standalone)

Net income at Rs 855.61 crore vs estimate of Rs 909 crore

Revenue at Rs 11,762.79 crore vs estimate of Rs 12,360 crore

Total costs at Rs 10,761.14 crore vs Rs 12,064.70 crore QoQ

Other income at Rs 205.21 crore vs Rs 117.82 crore QoQ

Of the 41 analysts tracking the company, 35 maintained ‘buy’, 1 maintained ‘hold’ and 5 analysts maintained ‘sell recommendations. The overall consensus price of analysts tracked by Bloomberg implied an upside of 26%.

The average yield on top-rated rupee-denominated corporate bonds maturing in up to three years rose 3-5bps on Friday, traders said, after the Reserve Bank of India announced some measures to drain cash from the financial system.

The rise in the yields on Friday is the first since Monday when rates jumped 27bps, according to data compiled by Bloomberg.

The central bank said it would enhance the amount of the so-called variable rate reverse repos to drain liquidity from the banking system in stages.

Shares of Cipla Ltd. shed 3.11% to Rs 916 apiece after analysts turned cautious despite the company reporting net income in the June quarter that beat average analyst estimate post market hours on Thursday.

June Quarter Numbers (Consolidated)

Net income at Rs 714.72 crore vs estimate of Rs 641 crore (Bloomberg consensus)

Revenue at Rs 5,470.7 crore vs estimate of Rs 5,134 crore

Total costs at Rs 4,449.14 crore vs Rs 4,122.85 crore QoQ

Other income at Rs 64.93 crore vs Rs 60.13 crore QoQ

Credit Suisse

Downgrades to ‘neutral’ from ‘outperform’ with the target price unchanged at Rs 910.

Bigger launches are at least a year away and U.S. base business remains weaker than expected.

June quarter earnings had multiple one-offs like one-time profit share on API , Covid drug benefit and above-normals sales in base business in India.

June quarter Ebitda margin driven by higher operating leverage, one-time API profitability and lower promotion expenses.

Motilal Oswal

Maintains ‘neutral’ with a target price of Rs 1,000.

Superior product mix, operational cost efficiency and one-time income from the API segment

Company poised to outperform the domestic formulation market and progressing well on building a complex product pipeline for North America.

While the company has lined up few complex products to improve U.S. sales trajectory, meaningful improvement is expected only from FY23.

Out of the 42 analysts tracking the company, 34 maintained ‘buy’, 6 maintained ‘hold’ and 2 analysts maintained ‘sell’ recommendations. The overall consensus price of analysts tracked by Bloomberg implied an upside of 13.8%. Shares of Cipla gained 11.7% in 2021 so far compared to 12.49% gains for Nifty Pharma.

Shares of Barbeque-Nation Hospitality Ltd. gained 18.58% to a new high of Rs 1,217.00 apiece.

Barbeque-Nation reported a consolidated net loss of Rs 42.63 crore in June quarter and revenue of Rs 101.97 crore on Tuesday.

Both the analysts tracking the company maintained ‘buy’ recommendations. The overall consensus price of analysts tracked by Bloomberg implied a downside of 7.8%. The Relative Strength index is 87 suggesting that the stock may be overbought.

Investor interest in the four IPOs of Devyani International Ltd., Krsnaa Diagnostics Ltd., Exxaro Tiles Ltd. and Windlas Biotech Ltd. persisted on the final day of the issues.

The offers of Exxaro Tiles and Windlas Biotech were subscribed 17.32 and 14.86 times, while Devyani International and Krsnaa Diagnostics were subscribed 69.07 and 18.46 times respectively, at the time the markets closed Friday.

Follow live subscription updates here:

Shares of Reliance Industries Ltd. shed 2.30% to Rs 2,085.25 apiece after the Supreme Court ruled in favour of Amazon in its case versus Future Retail.

The apex court ruled that the order of Singapore emergency arbitrator that halted the deal between Reliance and Future Retail as enforceable in India.

Shares of Future Retail slipped nearly 10% post the verdict.

Future Retail On Supreme Court Verdict

The judgement addresses two limited points related to the enforceability of the Emergency Arbitrator’s order and not the merits of the disputes.

FRL is advised that it has remedies available in law, which it will exercise.

Source: Stock Exchange Statement

Shares of Tata Chemicals Ltd. added 9.71% to Rs 844 apiece after it reported net income for the first quarter that beat the average analyst estimate.

June Quarter Results (Consolidated)

Net income at Rs 287.96 crore vs estimate of Rs 136 crore (Bloomberg Consensus)

Revenue at Rs 2,977.24 crore vs estimate of Rs 2,819 crore

Total costs at Rs 2,654.67 crore vs Rs 2,630.07 crore QoQ

Other income at Rs 54.29 crore vs Rs 64.51 crore QoQ

Of the 9 analysts tracking the company, 3 maintained ‘buy’, 4 maintained ‘hold’ and 2 analysts maintained ‘sell’ recommendation. The overall consensus price of analysts tracked by Bloomberg implied a downside of 28.6%.

Shares of Tata Chemicals gained 77% in 2021 so far. The Relative Strength Index is 72 suggesting that the stock may be overbought.

Shares of Aditya Birla Capital Ltd. gained 7.09% to Rs 121.65 apiece after the company reported its June quarter numbers post market hours on Thursday.

First Quarter Results (Consolidated)

Net income Rs 302.03 crore vs Rs 375.15 crore QoQ

Revenue at Rs 4,298.88 crore vs Rs 5,586.63 crore QoQ

Total costs at Rs 3,983.93 crore vs Rs 5,171.60 crore QoQ

Other income at Rs 2.95 crore vs Rs 5.13 crore QoQ

All the 10 analysts tracking the company maintained ‘buy’ recommendations. The overall consensus price of analysts tracked by Bloomberg implied an upside of 21.9%. Shares of Aditya Birla Capital gained over 41% in 2021 so far compared to 15.2% for Sensex.

Shares of Glenmark Life Sciences Ltd. gained on debut after its initial public offering witnessed strong investor interest.

The stock began trading at Rs 751.10 apiece on the National Stock Exchange—a 4.3% premium to its issue price of Rs 720. It saw an intraday high of Rs 768.75 (up 6.8%) thereafter.

Shares of GAIL (India) Ltd. gained 6.93% to Rs 152.80 apiece after analysts turned bullish post the June quarter earnings.

First Quarter Results (Standalone)

Net profit at Rs 1,529.92 crore vs estimate of Rs 1,740 crore (Bloomberg Consensus)

Revenue at Rs 17,386.63 crore vs estimate of Rs 16,210 crore

Total expenses at Rs 15,530.48 crore vs 13,505.89 crore QoQ

Other income at Rs 197.58 crore vs Rs 568.41 crore QoQ

Credit Suisse

Upgrades to ‘outperform’ from ‘neutral’ with the target price raised to Rs 168 from Rs 165 earlier.

FY21-24 transmission volumes are expected to grow at 6-8% CAGR

Volumes have already increased 4-5%.

Full commissioning of four more fertilizer plants in the East should add to production capacity.

LNG profitability expected to improve in upcoming quarters.

Jefferies

Maintains hold with the target price unchanged at Rs 150.

Sharp rally in LNG price is expect to sustain profitability.

Strong performance in gas transmission segment a positive.

Nirmal Bang

Upgrades to ‘buy’ from ‘accumulate’ with the target price increased to Rs 188 from Rs 183.

Healthy 6-8% growth in gas demand and investments in end-use sectors are growth catalysts.

Plenty of potential in revival in the stranded gas-based units.

Capex plan likely to support long-term growth in gas transmission, trading and petchem segments.

India's key equity benchmarks swung between gains and losses ahead of RBI's Monetary Policy Decision.

The S&P BSE Sensex was little changed at 54,534.53. The NSE Nifty traded flat at 16,311.65. So far this week, Nifty rose 3.5%, heading for the biggest advance since the week ended Feb. 7. Both measures closed at record highs yesterday.

HDFC Bank Ltd. contributed the most to the index gain, increasing 0.3%. IndusInd Bank Ltd. had the largest increase, rising 2.7%.

India's key equity benchmarks swung between gains and losses ahead of RBI's Monetary Policy Decision.

The S&P BSE Sensex was little changed at 54,534.53. The NSE Nifty traded flat at 16,311.65. So far this week, Nifty rose 3.5%, heading for the biggest advance since the week ended Feb. 7. Both measures closed at record highs yesterday.

HDFC Bank Ltd. contributed the most to the index gain, increasing 0.3%. IndusInd Bank Ltd. had the largest increase, rising 2.7%.

The broader markets outperformed their larger peers.. The BSE MidCap index gained 0.3% while the BSE SmallCap advanced nearly 0.5%. Barring BSE Information Technology and BSE Teck, all the other 17 sectoral indices compiled by the BSE Ltd gained.

India's key equity benchmarks swung between gains and losses ahead of RBI's Monetary Policy Decision.

The S&P BSE Sensex was little changed at 54,534.53. The NSE Nifty traded flat at 16,311.65. So far this week, Nifty rose 3.5%, heading for the biggest advance since the week ended Feb. 7. Both measures closed at record highs yesterday.

HDFC Bank Ltd. contributed the most to the index gain, increasing 0.3%. IndusInd Bank Ltd. had the largest increase, rising 2.7%.

India's key equity benchmarks swung between gains and losses ahead of RBI's Monetary Policy Decision.

The S&P BSE Sensex was little changed at 54,534.53. The NSE Nifty traded flat at 16,311.65. So far this week, Nifty rose 3.5%, heading for the biggest advance since the week ended Feb. 7. Both measures closed at record highs yesterday.

HDFC Bank Ltd. contributed the most to the index gain, increasing 0.3%. IndusInd Bank Ltd. had the largest increase, rising 2.7%.

The broader markets outperformed their larger peers.. The BSE MidCap index gained 0.3% while the BSE SmallCap advanced nearly 0.5%. Barring BSE Information Technology and BSE Teck, all the other 17 sectoral indices compiled by the BSE Ltd gained.

The market breadth was skewed in favour of the bulls. About 1,542 stocks declined, 653 rose and 70 remained unchanged.

The central bank has kept rates on hold for the last six policies to support the economy hit hard by the pandemic. This has led to a surge in first-time investors, willing to buy riskier assets as returns on traditional instruments like bank deposits decline

India’s central bank to announce its monetary policy decision at 10 a.m. Policy makers are likely to leave interest rates untouched for a seventh straight meeting, as their focus remains more on fixing a fickle economy than on controlling stubborn price pressures.

The RBI will probably lift its inflation projection for fiscal 2022 to an average 5.5%-6% from the 5.1% forecast in June. It is likely to highlight supply shocks are fueling inflationary pressures and it will look through any temporary bump in inflation.Abhishek Gupta, India Economist at Bloomberg

USD/INR little changed at 74.175 on Thursday

Implied opening from forwards suggest spot may start trading around 74.14

10-year yields rose by 1bp to 6.21% on Thursday

All 21 economists surveyed by Bloomberg as of Wednesday afternoon expect the MPC to leave the benchmark repurchase rate unchanged at 4% on Friday. While the RBI is widely expected to announce another tranche of its so-called government securities acquisition program, bond traders will be watching for any cues on return to policy normalisation.

Click here to read the full story.

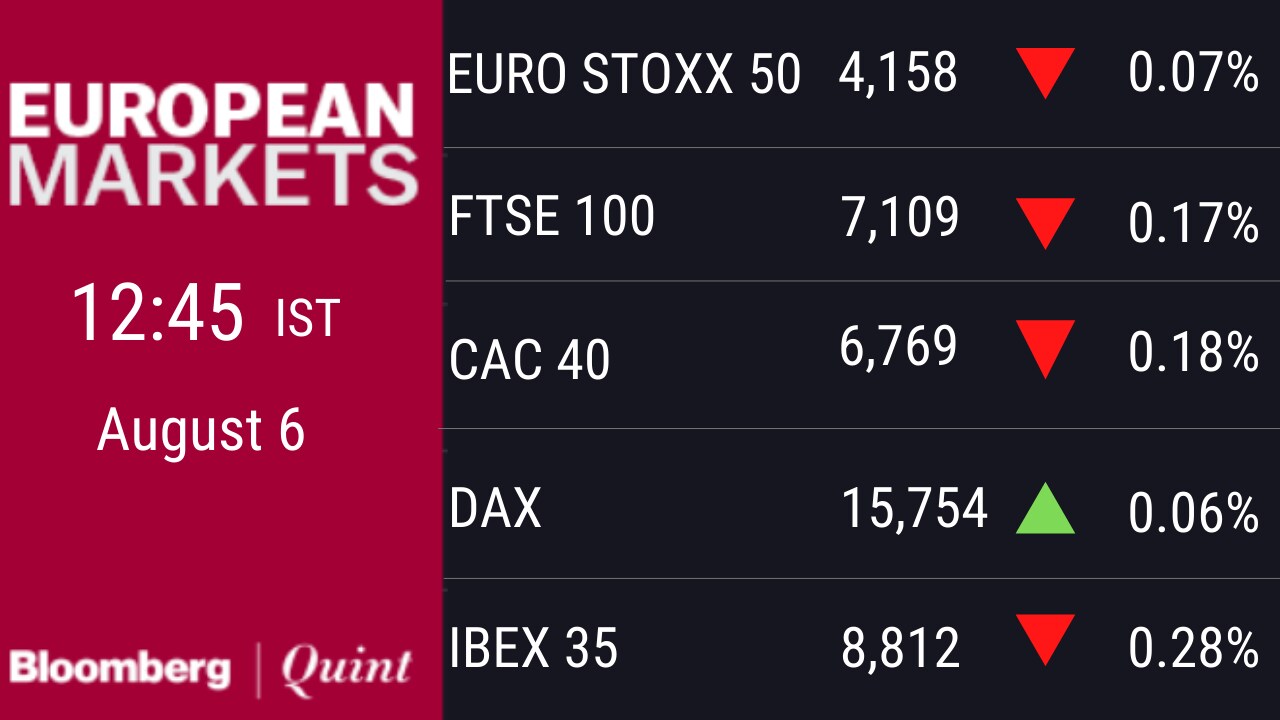

Most Asian stocks dipped Friday as traders weighed the spread of the delta coronavirus strain against a record Wall Street close while awaiting key U.S. payrolls data.

Shares fell in Hong Kong and China, where Beijing’s regulatory crackdown and a warning about a possible downward spiral at China Evergrande Group -- the world’s most indebted developer -- subdued sentiment. Japan fluctuated, with Nintendo Co. weighing after a profit miss. U.S. contracts were little changed in the wake of fresh peaks for the S&P 500 and Nasdaq 100 on solid earnings.

India's SGX Nifty 50 Index futures for Aug. delivery rose 0.1% to 16,322.00, while MSCI Asia Pacific Index fell 0.3%. The NSE Nifty 50 Index added 0.2% Thursday to 16,294.60.

An overnight release showing a second weekly drop in U.S. jobless claims stoked some expectations for a strong payrolls report Friday that could spark market swings. Treasuries retreated.

Crude oil headed for its biggest weekly loss this year on demand risks from Covid-19. Australia’s dollar was the weakest performer among Group of 10 currencies after the nation’s central bank governor Philip Lowe said a lower exchange rate from monetary stimulus was welcome.

Back home, Cipla, Tata Chemicals, Adani Power, Thermax, Indiabulls Housing, Gujarat Gas, Bajaj Consumer, Quess Corp, Honeywell Automation may react as the companies reported quarterly results after the market closed Thursday. Mahindra, Hindalco, SAIL, Voltas, Zee, Tata Power, Berger Paints are among the companies scheduled to report earnings Friday. Mahindra, Bandhan Bank, Thermax are holding their annual shareholders’ meetings.

Glenmark Life Sciences to debut after IPO. Foreign investors bought net Rs 3,470 crore of stocks on Wednesday, according to NSDL website.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.