India's benchmark stock indices advanced on Tuesday, snapping two days of decline as Reliance Industries Ltd. and HDFC Bank Ltd. led.

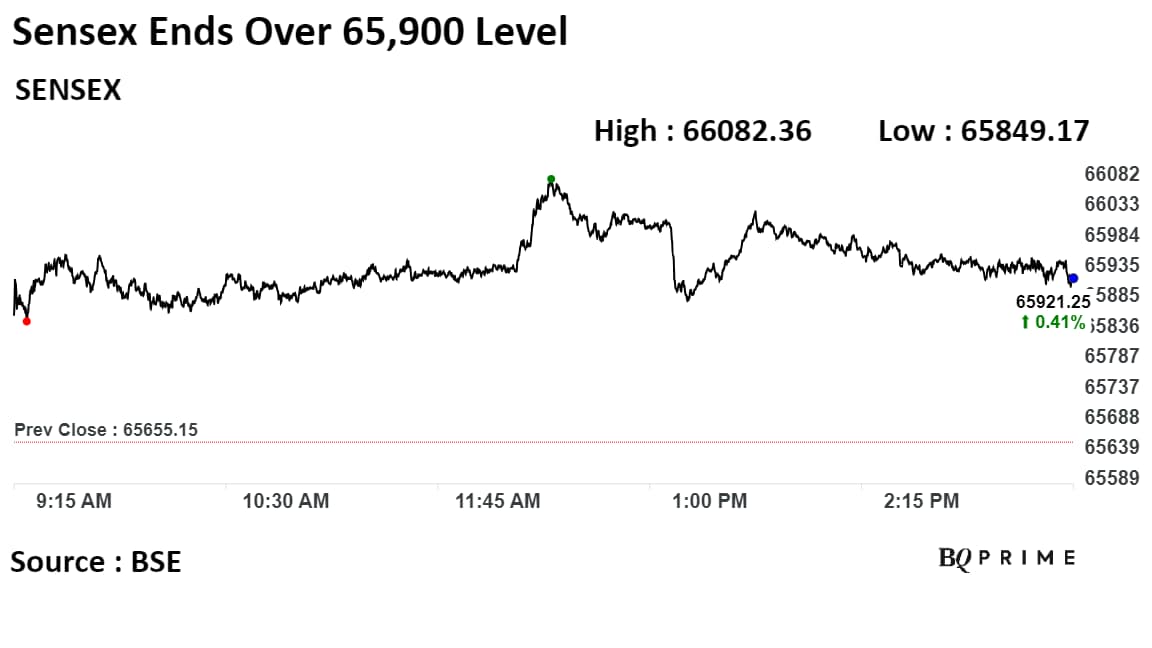

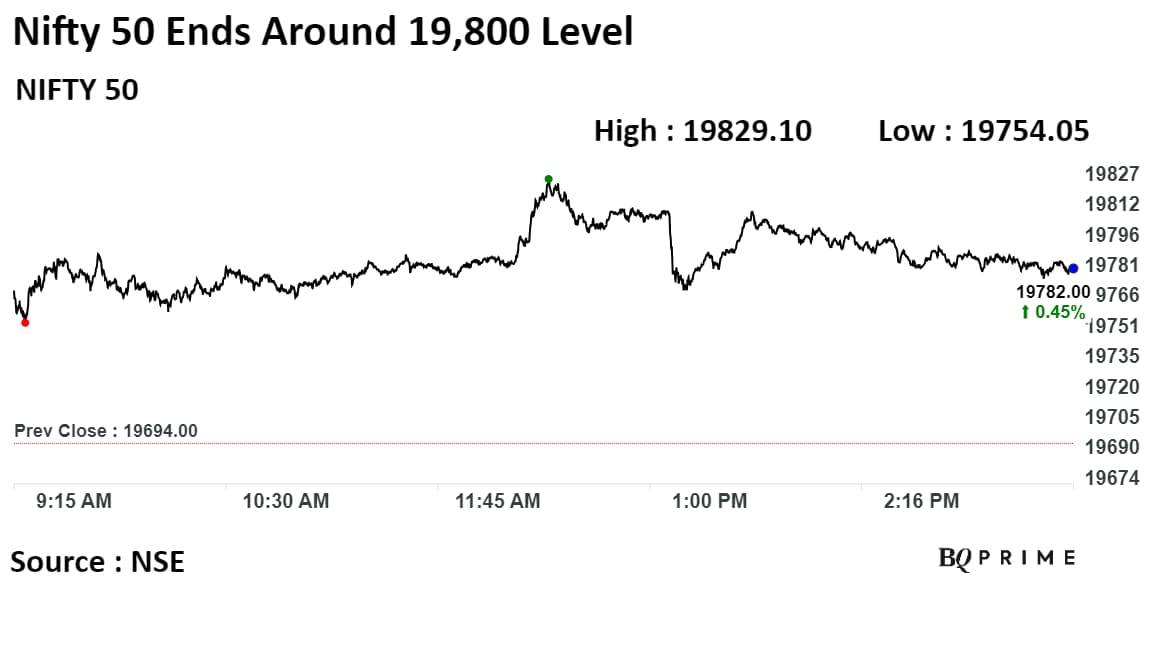

The S&P BSE Sensex closed 276 points, or 0.42%, up at 65,930.77, while the NSE Nifty 50 ended 89 points, or 0.45%, higher at 19,783.40.

Intraday, the Nifty Midcap 150 and Smallcap 250 hit lifetime highs. Among sectoral indices, realty, metal, and consumer durables advanced the most, while fast-moving consumer goods and public sector banks faced pressure.

The index is moving sideways as of now and would need a decisive breach on either side of the 19,800 or 19,650 level for the confirmation of further directional move, according to Vaishali Parekh, vice president-technical research at Prabhudas Lilladher Pvt. "The support for the day is seen at 19,600, while the resistance is seen at 19,850."

Asian stocks were steady on Tuesday, buoyed by extended gains in Wall Street and a $16 billion sale of 20-year Treasury notes that lured bond buyers.

Hong Kong's Hang Seng and Japan's Nikkei 225 indices ended lower after a volatile day of trade, whereas South Korea's Kospi, mainland China, and Australian shares closed higher.

On Monday, the S&P 500 had its strongest close since August, and the Nasdaq 100 hit a 22-month high. Both Nvidia Corp., which will report quarterly results on Tuesday, and Microsoft Corp. climbed to fresh peaks amid a revival of the artificial intelligence bid.

Here's How Indian Benchmark Indices Fared:

Reliance Industries Ltd., HDFC Bank Ltd., ICICI Bank Ltd., Bharti Airtel Ltd., and Titan Co. were positively adding to the change in the Nifty.

Coal India Ltd., Oil and Natural Gas Corp., Larsen and Toubro Ltd., State Bank of India, and Tata Consultancy Services Ltd. were negatively contributing to the change.

"We remain cautiously optimistic on the market from a medium-term perspective," Vinay Paharia, chief investment officer at PGIM India Mutual Fund, said. "Our caution is because markets are trading at a premium to its current fair value."

"However, this fair value is likely to grow at a strong pace in the medium-term. Hence, we remain optimistic from a medium- to long-term perspective," Paharia said.

The broader markets ended higher. The BSE Midcap was up 0.14%, while the BSE Smallcap was 0.20% higher.

Twelve out of the 20 sectors compiled by BSE Ltd. advanced, while eight sectors declined. Consumer durables and realty rose the most.

The market breadth was skewed in favour of buyers. About 2,029 stocks rose, 1,688 declined and 137 remained unchanged on the BSE.

As the market remains rangebound, it is likely to wait until the outcome of the state elections is known, according to VK Vijayakumar, chief investment strategist at Geojit Financial Services.

"If the state election outcome indicates political stability after the general elections of 2024, that will act as the trigger for the rally. And, if such a rally happens, it is likely to be led by large caps across the board in sectors like banking, IT, automobiles, capital goods, telecom, real estate and construction-related segments," Vijayakumar said.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.