Indian equity benchmarks ended higher on Monday. The indices swung amid volatility to settle with gains led by auto, banking, and real estate stocks.

Crude oil futures surged the most in almost a year after the Organization of the Petroleum Exporting Countries announced a production cut that threatened to worsen inflation and push global central banks to tighten monetary policy further.

Brent crude is headed for the biggest gain since April 2022. West Texas Intermediate was poised for its best day since May after the oil cartel announced an output reduction of more than 1 million barrels per day.

Energy stocks rallied in Europe, with BP Plc and TotalEnergies SE climbing more than 4%. The benchmark Stoxx Europe 600 was little changed. Asian markets were steady.

Investors across asset classes rushed to adjust for the risk that inflationary pressure may be more persistent than previously thought.

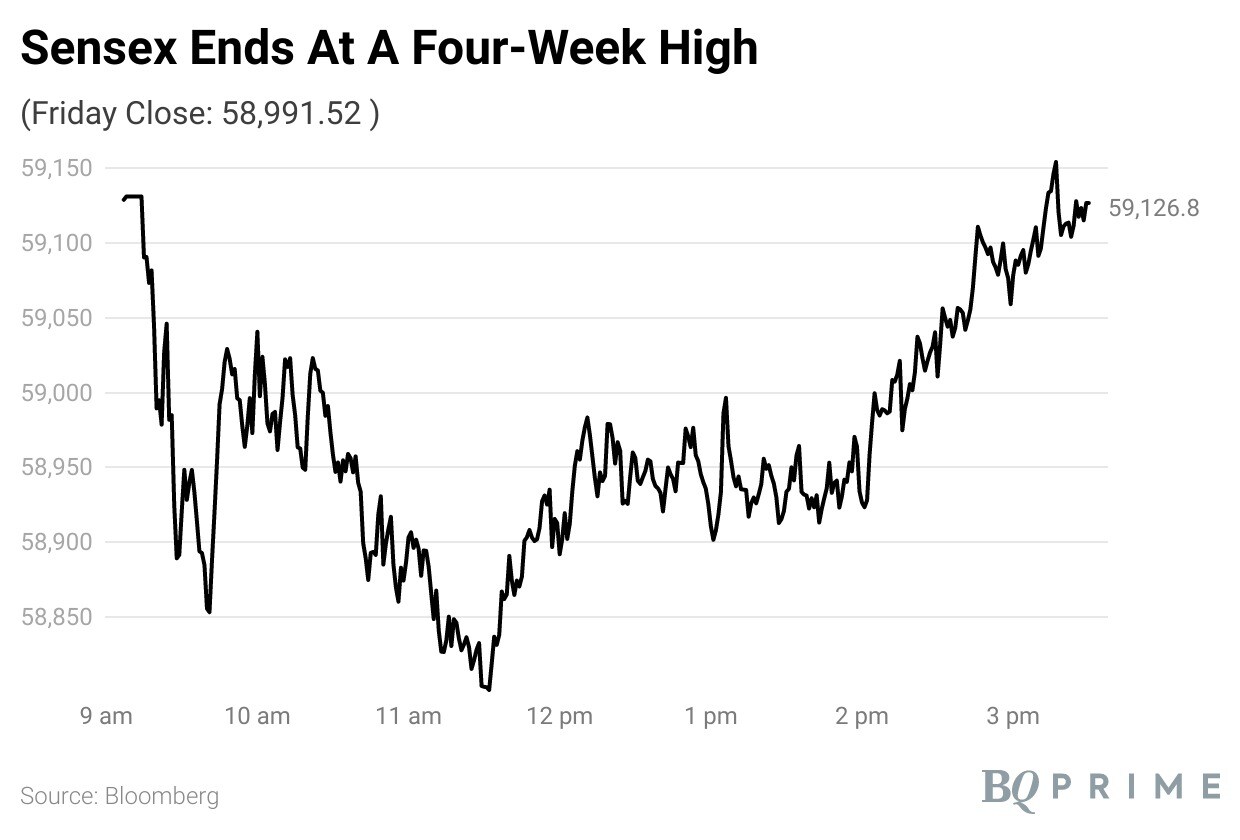

The S&P BSE Sensex closed 115 points higher, or 0.19%, at 59,106.44, while the NSE Nifty 50 ended higher by 38 points, or 0.22%, at 17,398.05.

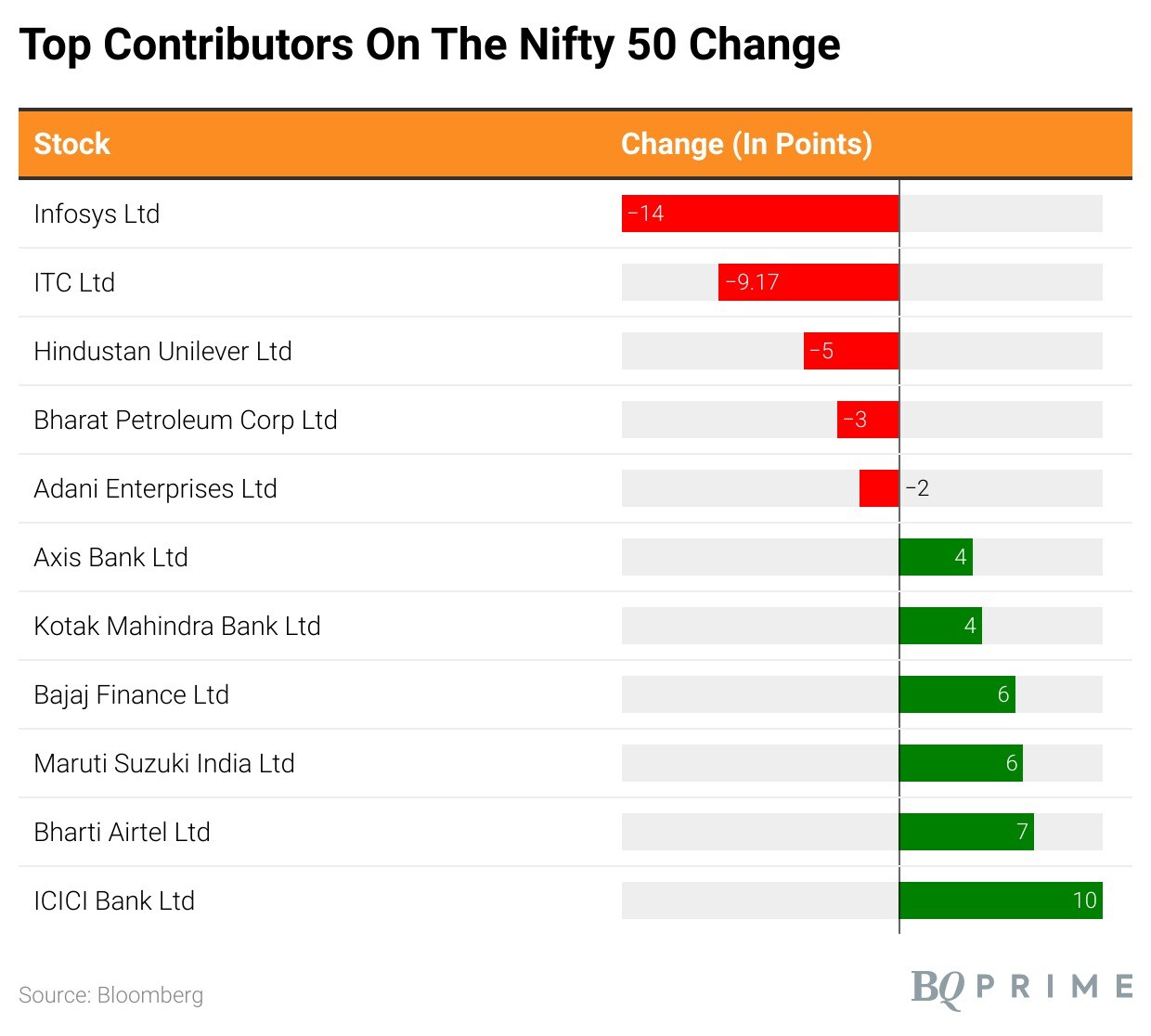

Axis Bank Ltd., Bajaj Finance Ltd., Bharti Airtel Ltd., ICICI Bank Ltd., Kotak Mahindra Bank Ltd., and Maruti Suzuki India Ltd. were positively adding to the change.

Adani Enterprises Ltd., Bharat Petroleum Corp. Ltd., Hindustan Unilever Ltd., Infosys Ltd., and ITC Ltd. weighed down the Nifty 50.

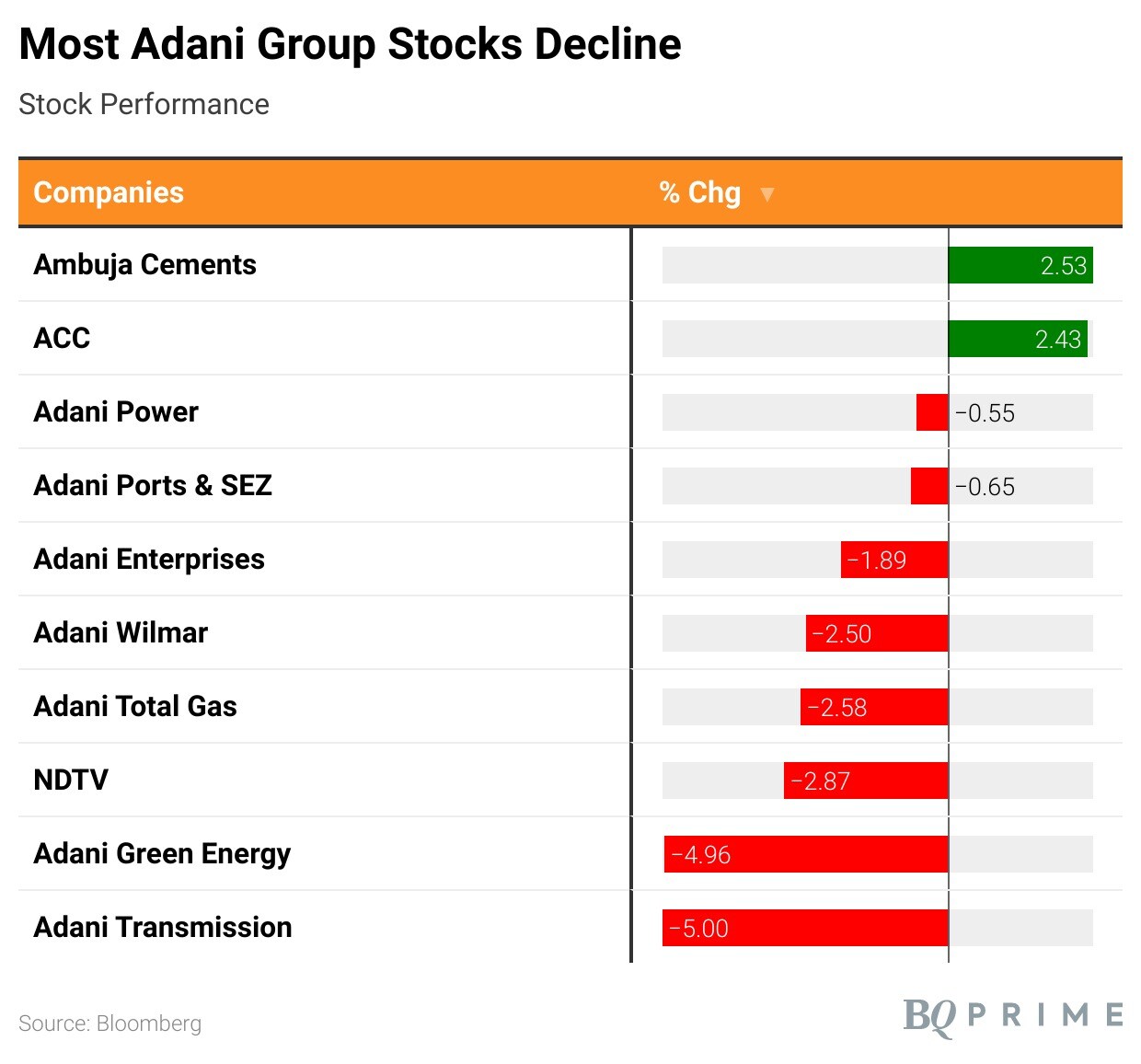

All Adani Group company stocks declined in trade, except ACC Ltd. and Ambuja Cements Ltd.

The broader market indices outperformed their larger peers; the S&P BSE MidCap was up 0.36%, whereas the S&P BSE SmallCap was higher by 1.17%.

Thirteen out of the 19 sectors compiled by BSE Ltd. advanced. The S&P BSE Fast Moving Consumer Goods, Information Technology, Oil and Gas, Utilities, Power, Energy, and Teck indices declined.

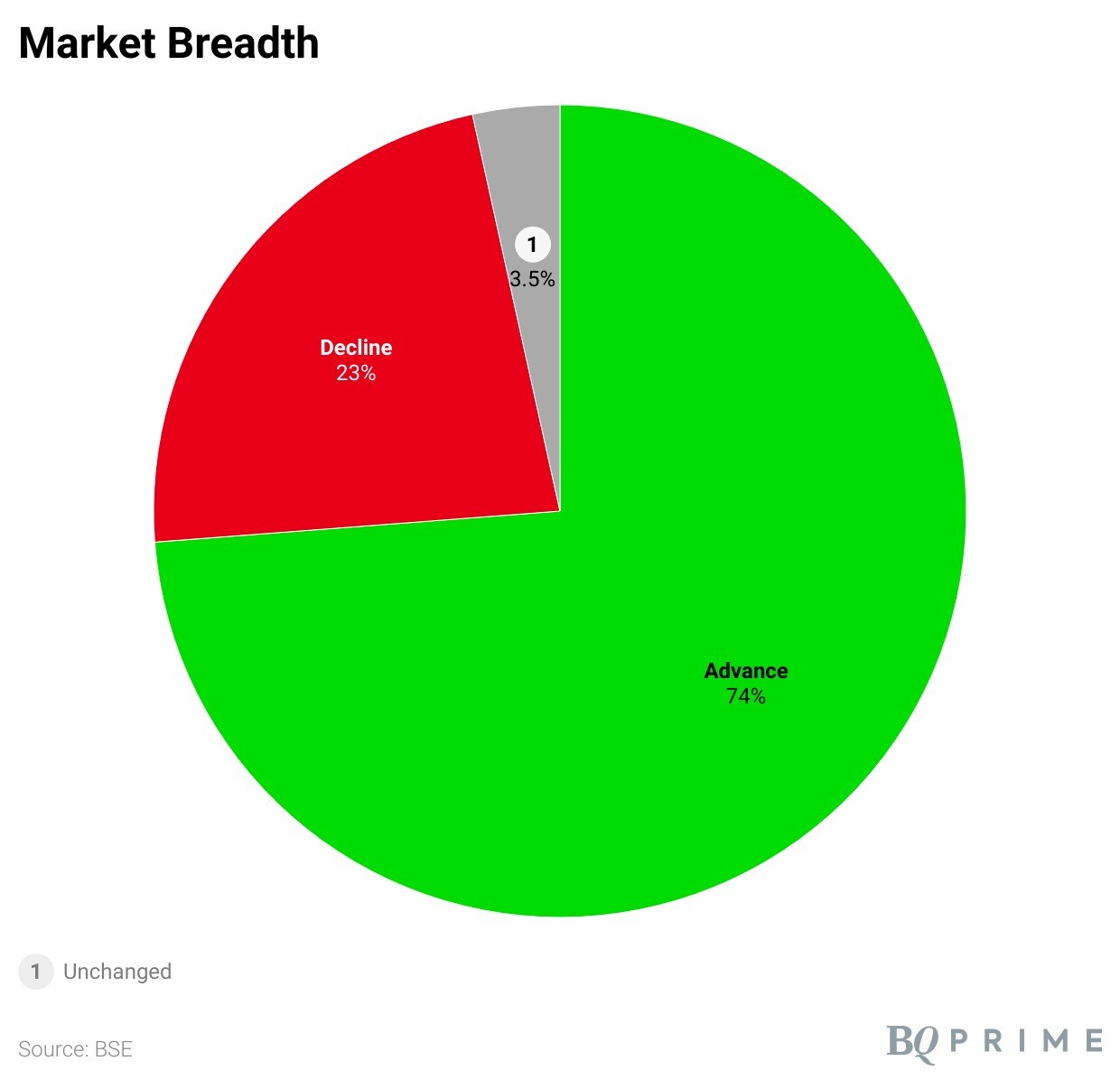

The market's breadth was skewed in favour of buyers. About 2,775 stocks rose, 856 declined, and 130 remained unchanged on the BSE.

Disclaimer: AMG Media Networks Ltd., a subsidiary of Adani Enterprises Ltd., holds a 49% stake in Quintillion Business Media Ltd., the owner of BQ Prime.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.