The Indian benchmark indices continued trading under pressure on Friday as most sectors were in the red, except oil and gas stocks.

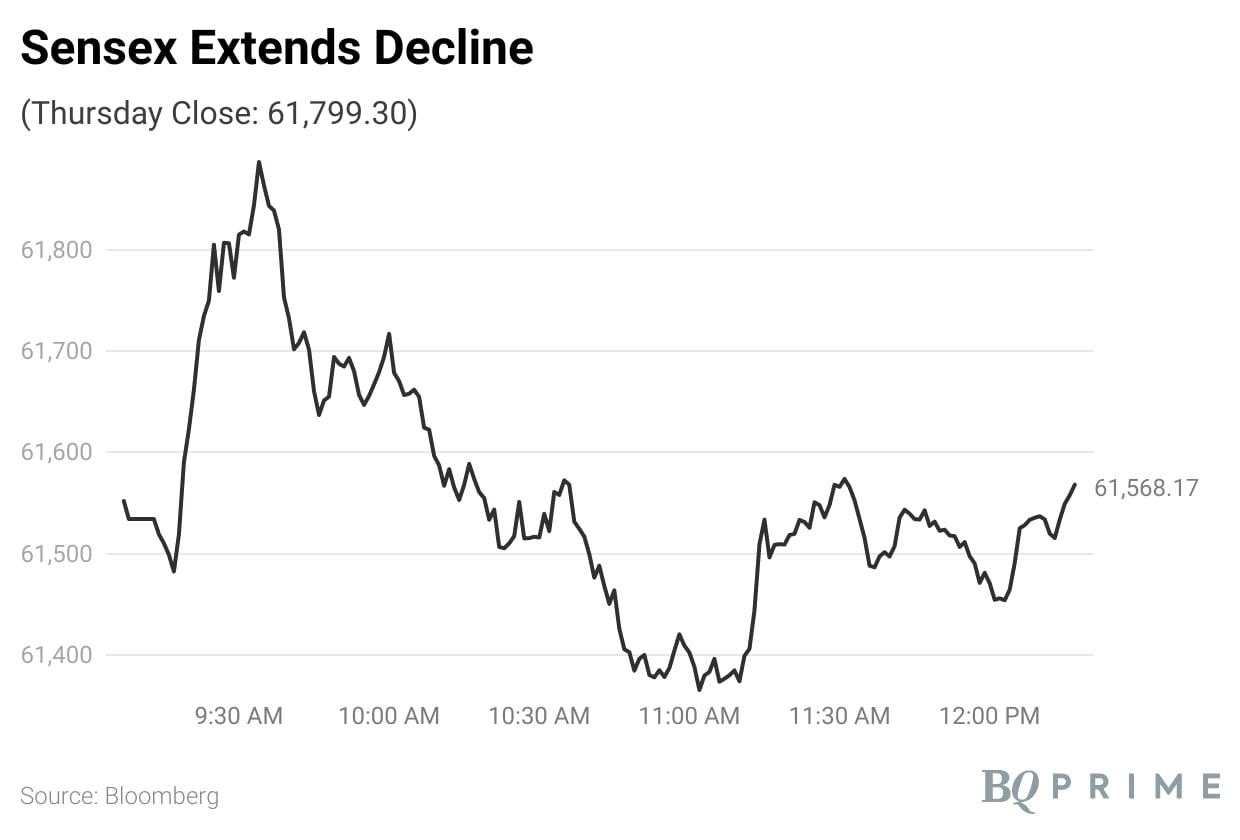

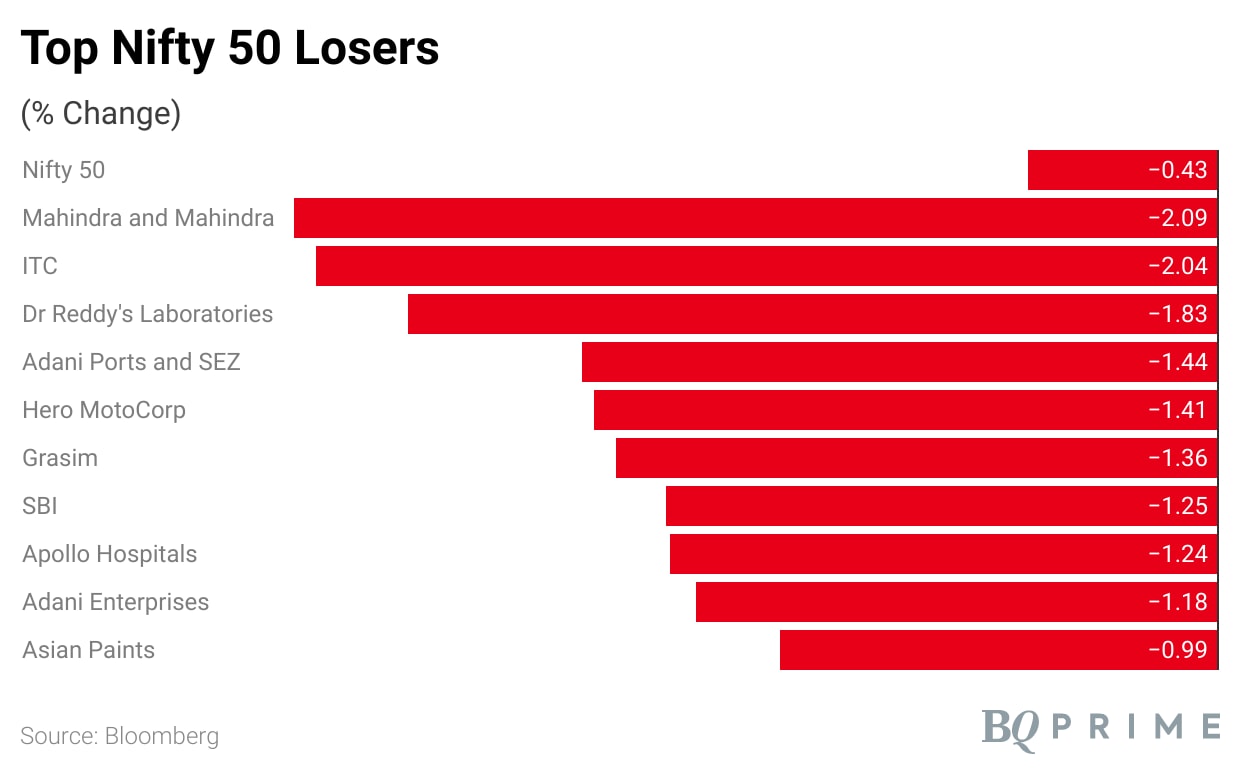

As of 12:17 p.m., the S&P BSE Sensex was down 236 points, or 0.38%, at 61,526.83, while the NSE Nifty 50 was 78 points, or 0.43%, lower at 18,336.60.

ONGC Ltd., Reliance Industries Ltd., HDFC Life Insurance Co., Tech Mahindra Ltd., and Eicher Motors Ltd. were the top gainers among the NSE Nifty 50 constituents.

Whereas, Mahindra and Mahindra Bank Ltd., ITC Ltd., Dr Reddy's Laboratories Ltd., Adani Ports and SEZ Ltd., and Hero MotoCorp Ltd. were the top laggards in the gauge.

The broader market indices underperformed their larger peers, as the S&P BSE MidCap was down by 1.07%, whereas the S&P BSE SmallCap was up by 0.49%.

Seventeen of the BSE's 20 sectoral indices went down, while only S&P BSE Energy, S&P BSE Telecommunication, and S&P BSE Oil & Gas went up.

The market breadth was skewed in favour of the bears. About 1,389 stocks rose, 2,012 declined, and 130 remained unchanged on the BSE.

Market Movements

All sectoral indices traded in red except Oil and Gas.

GMM Pfaudler falls the most in over three years after 16% equity changes hands.

After dragging the indices on Thursday, IT stocks continued their downfall on Friday.

Shares of Venky's India Ltd. gained after Malaysia allowed the entry of chicken eggs from India amid a supply shortage.

The shares of Patel Engineering Ltd. rose after it announced a fundraise via rights issue in an exchange filing.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.