Steel Authority of India Ltd. is on the right track despite a sequential decline in its first-quarter financial performance, a trend anticipated within the steel market, according to the company.

Amarendu Prakash, chairman and managing director of SAIL, highlights that the quarterly dip was on the back of planned maintenance activities at plants. Calling it a one-time accounting hit, he said that the gap in numbers is related to stock valuation, which is not expected to affect the company in the future.

Prakash emphasised the company has grown in cost efficiency and production growth, reinforcing their target of 8% growth for financial year 2026 over 2025.

"Our cost efficiency has gone up along with our production. We have targeted 8% growth in financial year 2026 over 2025. The gap in the numbers are purely on account of the stock valuation. This is more of a one time accounting hit, and will no longer affect us going forward," he said.

He also stressed the importance of continued government support through safeguard duties, which have helped stabilise pricing and ensure a level playing field for domestic players in the steel industry.

"Pricing has been stable after the safe-guard duty and what we need to watch for is that the government continues to work on this. This will ensure a level playing field for all," he added.

SAIL's consolidated net profit for Q1 FY26 dropped 41% to Rs 745 crore, down from Rs 1,251 crore in the March quarter. Further, on a year-on-year basis, the company has shown a surge in profit.

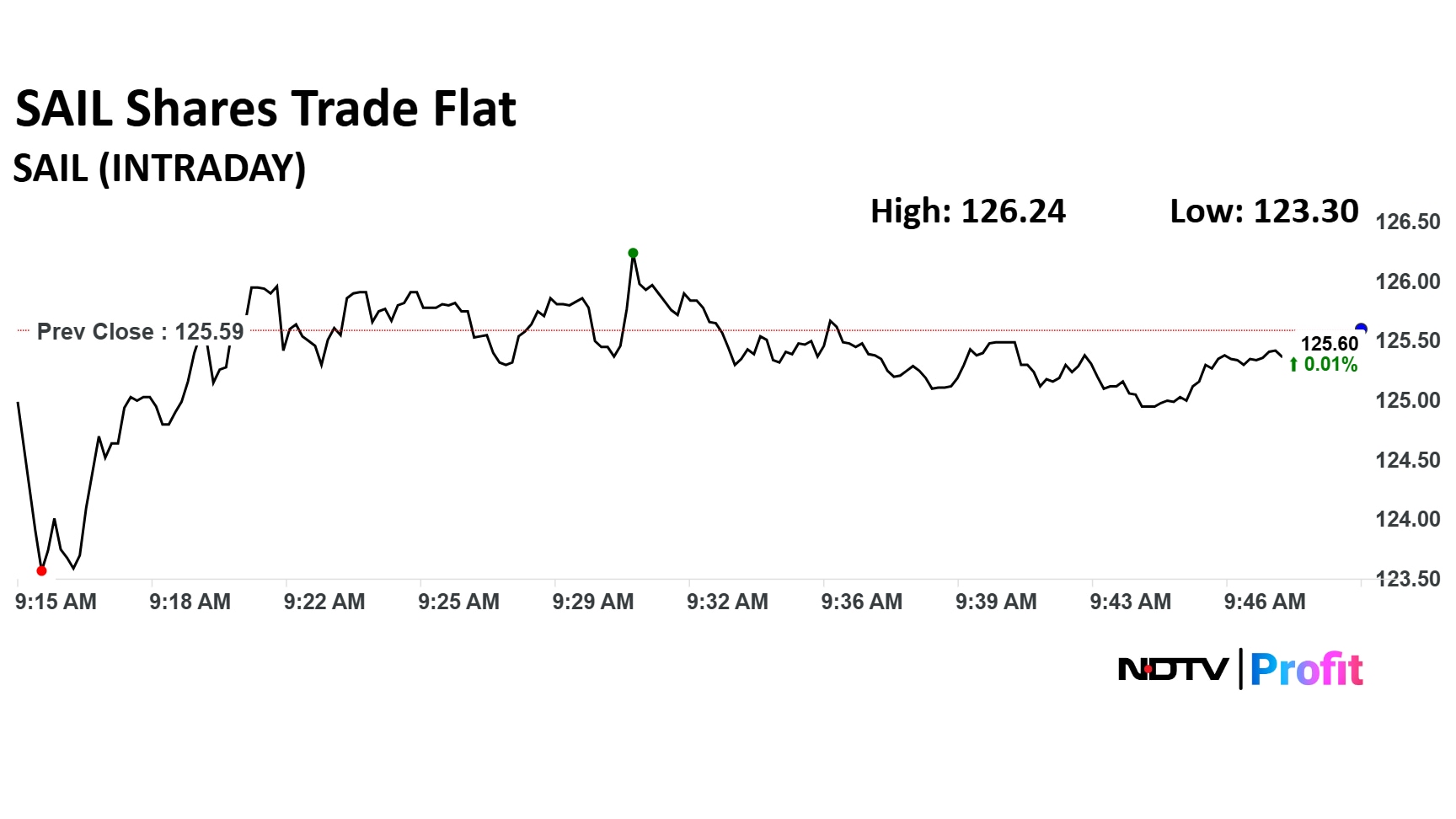

SAIL Share Price

SAIL stock fell as much as 1.82% during the day to Rs 123.30 apiece on the NSE. It was trading 0.14% lower at Rs 125.4 apiece, compared to an 0.05% advance in the benchmark Nifty 50 as of 9:51 a.m.

It has declined 15.18% in the last 12 months and 10.81% on a year-to-date basis. The relative strength index was at 34.

Four out of the 27 analysts tracking the company have a 'buy' rating on the stock, 11 recommend a 'hold' and 12 suggest a 'sell', according to Bloomberg data. The 12-month analysts' consensus target price on the stock is Rs 122.3, implying a downside of 2.2%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.