Sai Life Sciences Ltd.'s shares rose after Morgan Stanley initiated coverage citing cost advantage, infrastructure, and global supply chain diversification. The company is one of India's largest integrated contract research, development, and manufacturing organisations. It offers one-stop discovery, development and manufacturing. Its distinctive onshore and offshore delivery platforms should drive above-industry growth, according to Morgan Stanley.

As per Frost & Sullivan, India's contract research, development and manufacturing organisation sector is among the fastest-growing APAC industries. The CRDMO segment is projected to grow at 14% by Frost & Sullivan, taking its 2028 global market share to 4.7%.

Sai's end-to-end approach 'follow the molecule' is their strategy of actively guiding a drug molecule through the entire drug development process, from initial discovery to commercialisation. This provides the benefits of speed and cost, opening multiple entry points for customers and promoting cross-sales of services. Geographically, the company has a differentiated model with a presence in innovation hubs such as the US and UK, facilitating access to the latest research trends and a talented global workforce, according to Morgan Stanley.

This structure helps foster customer relationships and access to facilities in India, enabling Sai to offer a cost-competitive advantage for conducting drug discovery research at scale, drug development, and large-scale commercial production, according to the firm.

Outlook

The approach has been investment-heavy. Thus, while Sai's gross margins are in line with peer levels, its Ebitda margins are below industry average. Morgan Stanley believes its early investments in the platform will drive faster-than-peer growth with operating leverage gains.

The brokerage expects a 17% revenue CAGR to drive a 32% Ebitda CAGR. Combined with debt paydown post IPO, it forecasts a 58% financial year 2024-27 net income. The target price is set at Rs 841 based on 54 times price to earnings, which is in line with Syngene's one-year-forward multiple. The brokerage benchmarks Syngene as it is the only other listed India CRDMO.

Key downside risks according to the brokerage are the possibilities of lower revenue from commercial products. The loss of revenue from key customers, and US FDA warning letters to key plants remain concerns too.

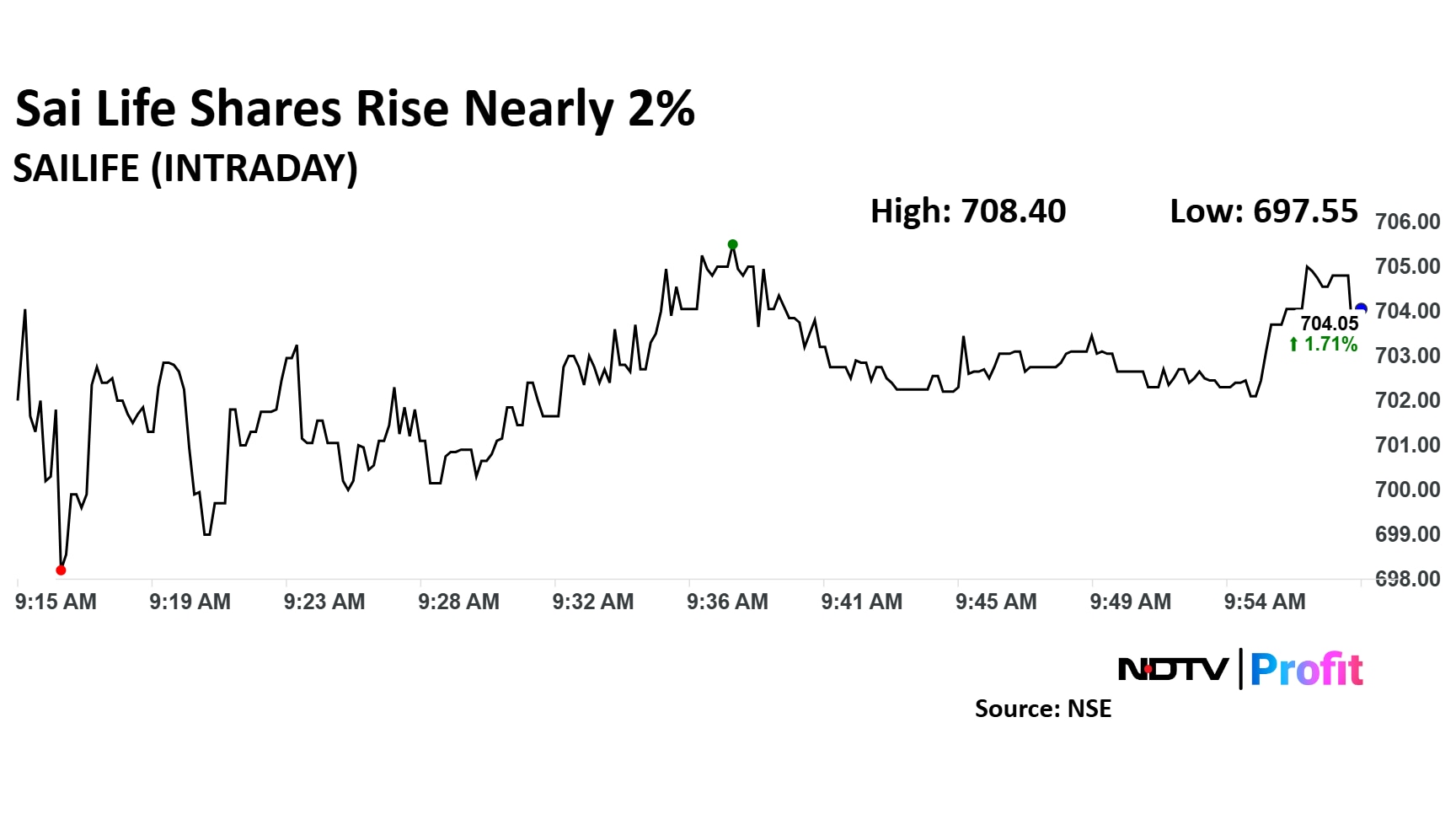

Sai Life Share Price

Sai Life stock rose as much as 2.34% during the day to Rs 708.40 apiece on the NSE. It was trading 1.70% higher at Rs 704 apiece, compared to a 0.18% advance in the benchmark Nifty 50 as of 9:59 a.m.

It had fallen 8.11% in the last 12 months. The relative strength index was at 41.6. Morgan Stanley is the only brokerage covering the company and has given a 'buy' rating on the stock, according to Bloomberg data. The 12-month analysts' consensus target price on the stock is Rs 841, implying an upside of 19.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.