Reliance Infrastructure Ltd.'s share price dropped by 4.40% on Thursday, likely due to profit-taking after the stock surged nearly 13% and reached nearly seven-year high on Wednesday.

The earlier surge followed the National Company Law Appellate Tribunal suspending insolvency proceedings against the company. Reliance Infrastructure had argued that it had settled the entire outstanding amount of Rs 92.68 crore owed to Dhursar Solar Power Pvt.

The Mumbai bench of the National Company Law Tribunal issued the suspension order on May 30. The insolvency plea was initially filed by IDBI Trusteeship in April 2022, citing a default of Rs 88.68 crore and an interest rate of 1.25% per month.

The default pertained to 10 invoices issued between 2017 and 2018 by Dhursar Solar Power Pvt. for supplying solar energy to Reliance Infrastructure. As the security trustee for DSPPL, IDBI Trusteeship sought payments from Reliance Infrastructure.

On Monday, Reliance Infrastructure contended that it had fully paid Rs 92.68 crore to Dhursar Solar Power for tariff claims, rendering the insolvency proceedings unnecessary.

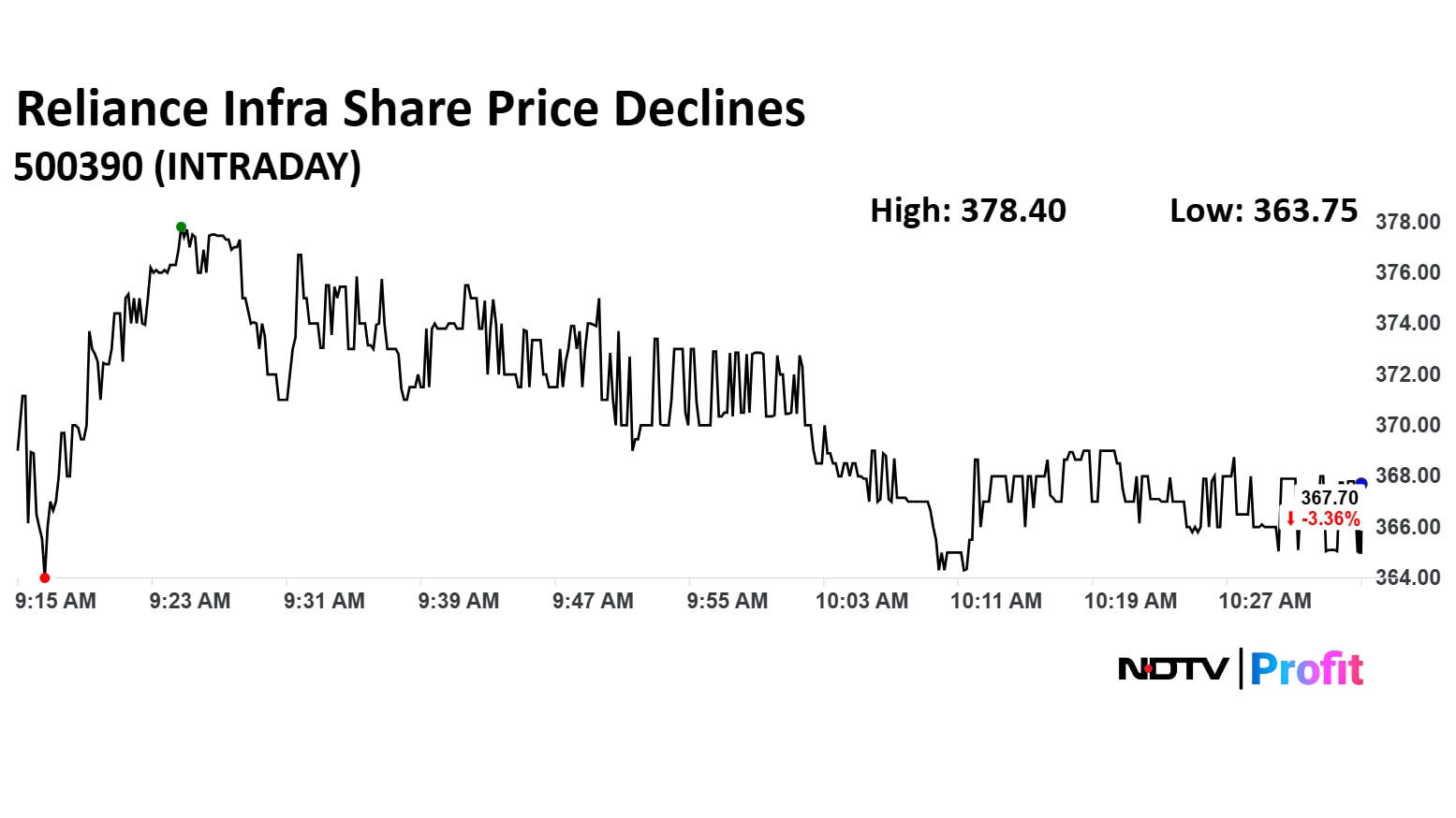

Reliance Infra Share Price Today

The scrip fell as much 4.62% to Rs 363 apiece, compared to a 0.43% advance in the NSE Nifty 50.

It has risen 143% in the last 12 months. Total traded volume so far in the day stood at 1 times its 30-day average. The relative strength index was at 70.

Out of five analysts tracking the company, three maintain a 'buy' rating and two suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an downside of 28.5%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.