Shares of Reliance Industries slipped in early trade on Friday following a sharp rise in oil prices after Israel launched a wave of military strikes against targets in Iran, heightening fears of a broader conflict in a region responsible for about one-third of global crude production. Brent crude spiked more than 13% on Thursday, while West Texas Intermediate also soared, marking the largest one-day gains since May 2022.

Israeli Prime Minister Benjamin Netanyahu stated that the attacks targeted Iran's nuclear program and military capabilities, emphasising that the operation would continue until the threat was eliminated. Iranian state media reported the death of Hossein Salami, commander of the Islamic Revolutionary Guard Corps, amid the strikes.

This escalation comes as oil is on track for its biggest weekly gain since 2022, erasing earlier losses driven by global trade tensions and OPEC+ decisions to increase production capacity. The strikes have raised concerns about potential disruptions to oil supplies, with analysts noting that any significant retaliation by Iran on regional oil infrastructure could severely impact global supply, given the strategic importance of the Strait of Hormuz.

The strikes also cast uncertainty over the scheduled sixth round of nuclear talks between the US and Iran in Oman, with US President Donald Trump expressing diminished confidence in reaching a deal to curb Iran's nuclear ambitions in exchange for sanctions relief. The US has stated it was not involved in the Israeli strikes, and officials have urged caution to avoid further escalation.

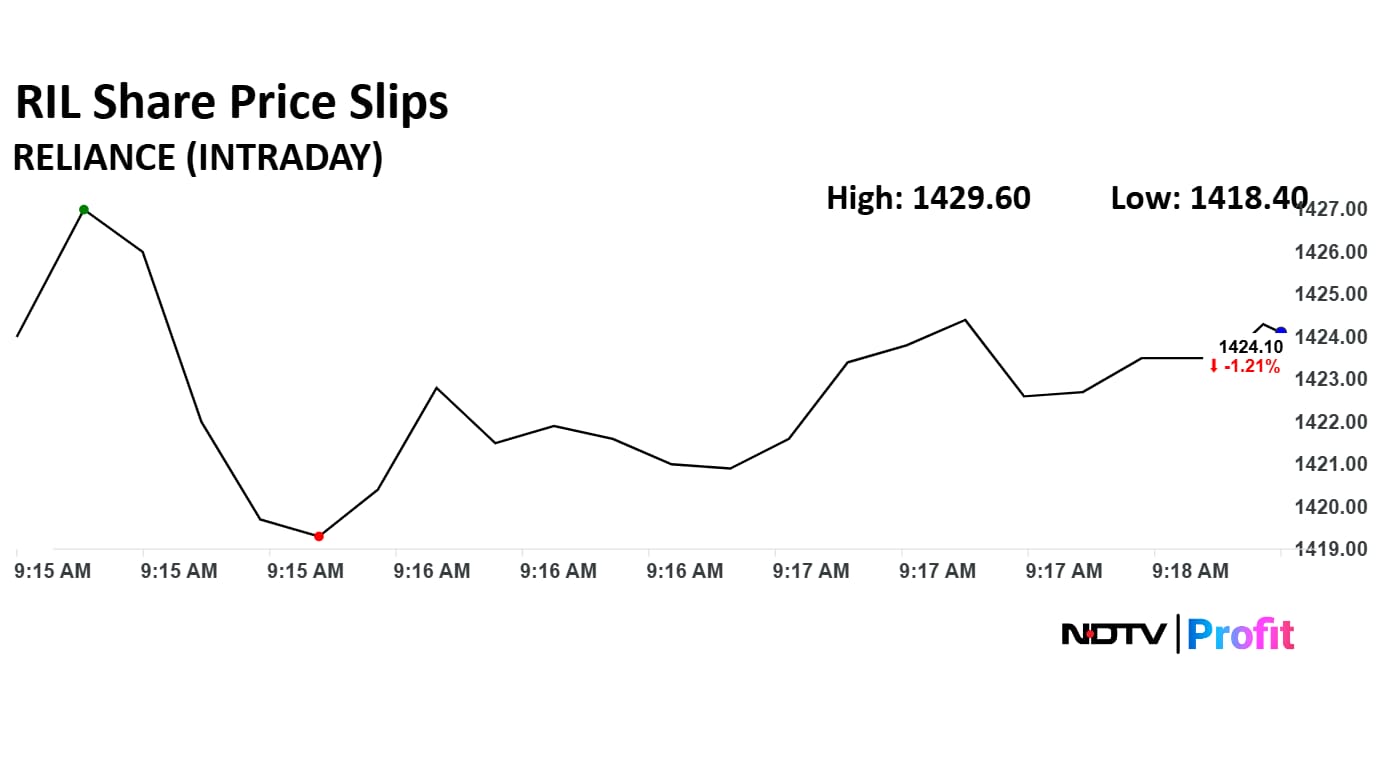

Reliance Share Price Today

The scrip fell as much as 1.61% to Rs 1,418.40 apiece. It pared losses to trade 1.18% lower at Rs 1,424.60 apiece, as of 09:17 a.m. This compares to a 1.15% decline in the NSE Nifty 50 Index.

It has risen 18.61% on a year-to-date basis, but has dipped 1.61% in the last 12 months. The relative strength index was at 48.78.

Out of 38 analysts tracking the company, 36 maintain a 'buy' rating, and two suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 8%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.