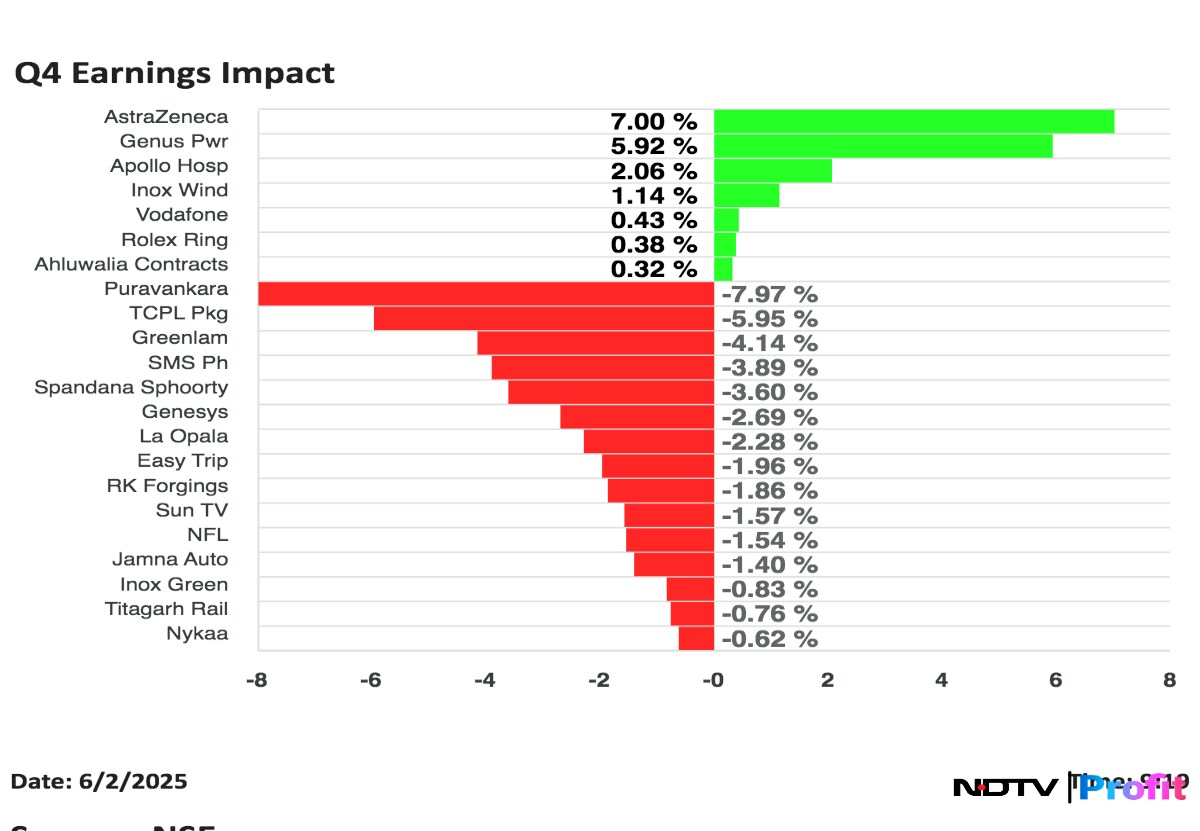

Shares of Nykaa parent FSN E-Commerce Ventures Ltd., Vodafone Idea Ltd. and Apollo Hospitals Enterprise Ltd. were in focus on Monday, after the companies announced their fourth quarter results.

Genus Power Ltd. shares rose the most, while Purvankara Ltd. fell the most, among the companies that announced their results for quarter ended March.

Earnings Post Market Hours

Vodafone Idea Q4 Highlights (Consolidated, QoQ)

Shares rose 0.72% to Rs 6.97.

Revenue down 1% to Rs 11,013 crore versus Rs 11,117 crore.

Ebitda down 1.1% at Rs 4,660 crore versus Rs 4,712 crore.

Margin at 42.3% versus 42.4% (Bloomberg estimate: 41.4%)

Net loss widens at Rs 7,166 crore versus 6,609 crore.

Apollo Hospitals Q4 Highlights (Consolidated, YoY)

Shares rose 2.39% to Rs 7,045.

Revenue up 13.1% to Rs 5,592.20 crore versus Rs 4,943.90 crore (Estimate Rs 5,620 crore).

Ebitda up 20% to Rs 769.70 crore versus Rs 640.50 crore (Estimate Rs 785 crore).

Margin at 13.8% versus 13.0% (Estimate 14%).

Net profit up 54% to Rs 389.60 crore versus Rs 253.80 crore (Estimate Rs 374 crore).

AstraZeneca Pharma Q4 Highlights (YoY)

Shares up 8.69% to Rs 8,664.50.

Revenue up 25.3% to Rs 480 crore versus Rs 383 crore.

Ebitda up 74.4% to Rs 85.8 crore versus Rs 49.2 crore.

Margin at 17.9% versus 12.8%.

Net profit up 47.5% to Rs 58.3 crore versus Rs 39.5 crore.

Inox Green Q4 Highlights (Consolidated, YoY)

Shares fell 3.25% to Rs 177.55.

Revenue up 30.4% to Rs 68.4 crore versus Rs 52.4 crore.

Ebitda down 92.9% to Rs 81 lakh versus Rs 11.5 crore.

Margin at 1.2% versus 21.8%.

Net profit down 73.9% to Rs 5.6 crore versus Rs 21.3 crore.

Ebitda dragged due to increase in EPC, O&M, Common infrastructure facility and Employee Benefits Expenses.

PAT fell due to higher tax expense.

Puravankara Q4 Highlights (Consolidated, YoY)

Shares fell 9.98% to Rs 238.90.

Revenue down 41.1% to Rs 541.57 crore versus Rs 919.97 crore.

Ebitda down 73% to Rs 30.45 crore versus Rs 113.40 crore.

Margin at 5.6% versus 12.3%.

Net loss widens by 1211% to Rs 88.00 crore versus Rs 6.71 crore.

SUN TV Q4 Highlights (Consolidated, YoY)

Shares down 2.05% to Rs 616.75.

Revenue down 2.2% to Rs 941 crore versus Rs 961 crore.

Ebitda down 18% to Rs 429 crore versus Rs 523 crore.

Margin at 45.6% versus 54.4%.

Net profit down 10.4% to Rs 372 crore versus Rs 415 crore.

Inox Wind Q4 Highlights (Consolidated, YoY)

Shares rose 3.08% to Rs 201.

Revenue at Rs 1,248 crore versus Rs 528 crore.

Ebitda at Rs 227 crore versus Rs 98.6 crore.

Margin at 18.2% versus 18.7%.

Net profit at Rs 187 crore versus Rs 46.5 crore.

Nykaa Q4 Highlights (Consolidated, YoY)

Shares fell 3.52% to Rs 196.10.

Revenue up 23.63% to Rs 2,061 crore versus Rs 1,667 crore.

Ebitda up 42.39% to Rs 131 crore versus Rs 92 crore.

Ebitda margin up 83 bps at 6.35% versus 5.51%.

Net profit up 111.11% to Rs 19 crore versus Rs 9 crore.

Beauty GMV grew 30%.

Profitable store network delivered 31% YoY GMV growth.

Superstore by Nykaa saw GMV growth of 57%.

Fashion saw revenue growth of 19% YoY.

TCPL Packaging Q4 Highlights (Consolidated, YoY)

Shares fell 6.42% to Rs 3,945.40.

Revenue up 5.5% to Rs 422 crore versus Rs 401 crore.

Ebitda up 2.4% to Rs 72.1 crore versus Rs 70.4 crore.

Margin at 17.1% versus 17.6%.

Net profit up 32.8% to Rs 38 crore versus Rs 28.6 crore.

Jamna Auto Q4 EARNINGS (Consolidated, YoY)

Shares fell 1.93% to Rs 90.51.

Revenue down 0.4% at Rs 638 crore versus Rs 640 crore

Ebitda down 5.9% at Rs 83.5 crore versus Rs 88.7 crore

Margin at 13.1% versus 13.9%

Net profit down 8.1% at Rs 50.3 crore versus Rs 54.8 crore

Ahluwalia Contracts Q4 Highlights (Consolidated, YoY)

Shares rose 2.36% to Rs 996.

Revenue up 4.5% to Rs 1,216 crore versus Rs 1,164 crore.

Ebitda up 18.7% to Rs 124 crore versus Rs 104 crore.

Margin at 10.2% versus 9%.

Net profit down 58.3% to Rs 83.3 crore versus Rs 200 crore.

Spandanna Sporty Q4 Highlights (Consolidated, YoY)

Shares fell 6.93% to Rs 269.80.

NII down 46.64% at Rs 206 crore versus Rs 386 crore.

Net loss at Rs 434 crore versus profit of Rs 129 crore.

GNPA at 4.85% vs 4.88% (QoQ).

NNPA at 0.96% vs 0.97% (QoQ).

Rolex Rings Q4 Highlights (Consolidated, YoY)

Shares fell 2.04% to Rs 1,570.20.

Revenue down 10.3% to Rs 284 crore versus Rs 316 crore.

Ebitda down 27.4% to Rs 52.2 crore versus Rs 72 crore.

Margin at 18.4% versus 22.7%.

Net profit at Rs 54.6 crore versus Rs 23.6 crore.

Inox Wind Energy Q4 Highlights (Consolidated, YoY)

Shares rose 3.08% to Rs 201.

Revenue at Rs 1,275 crore versus Rs 528 crore.

Ebitda at Rs 254 crore versus Rs 98.7 crore.

Margin at 19.9% versus 18.7%.

Net profit at Rs 67 crore versus Rs 19 crore.

La Opala Q4 Highlights (YoY)

Shares fell 2.33% to Rs 95.30.

Revenue down 6.6% to Rs 77 crore versus Rs 82.5 crore.

Ebitda up 4.3% to Rs 26.7 crore versus Rs 25.6 crore.

Margin at 34.6% versus 31%.

Net profit up 8.6% to Rs 25.7 crore versus Rs 23.7 crore.

SMS Pharmaceuticals Q4 Highlights (Consolidated, YoY)

Shares rose 6.08% to Rs 248.65.

Revenue up 1% to Rs 248 crore versus Rs 246 crore.

Ebitda up 21.4% to Rs 40.8 crore versus Rs 33.6 crore.

Margin at 16.4% versus 13.7%.

Net profit up 17.6% to Rs 20.3 crore versus Rs 17.3 crore.

Titagarh Rail Systems (Consolidated, YoY)

Shares fell 2.92% to Rs 865.55.

Revenue down 4.5% at Rs 1,006 crore versus Rs 1,052 crore.

Ebitda down 15.3% at Rs 102 crore versus Rs 120 crore.

Margin at 10.1% versus 11.4%.

Net profit down 18.4% at Rs 64.5 crore versus Rs 78.9 crore.

Genus Power Infrastructures (Consolidated, YoY)

Shares rose 8.75% to Rs 430.

Revenue at Rs 937 crore versus Rs 420 crore.

Ebitda at Rs 196 crore versus Rs 51.2 crore.

Margin at 21% versus 12.2%.

Net profit at Rs 123 crore versus Rs 24.3 crore.

Greenlam Industries (Consolidated, YoY)

Shares fell 5.48% to Rs 249.75.

Revenue up 9.2% at Rs 682 crore versus Rs 624 crore.

Ebitda down 23.4% at Rs 64 crore versus Rs 83.53 crore.

Margin at 9.4% versus 13.4%.

Net profit down 94.9% at Rs 2.1 crore versus Rs 41 crore.

Easy Trip Planners (Consolidated, QoQ)

Shares fell 2.41% to Rs 10.95.

Revenue down 7.4% at Rs 139.4 crore versus Rs 150.5 crore.

Ebitda down 71.9% at Rs 13.4 crore versus Rs 47.7 crore.

Margin at 9.6% versus 31.7%.

Net profit down 54.5% at Rs 15.3 crore versus Rs 33.6 crore.

National Fertilizers (Consolidated, YoY)

Shares fell 3.05% to Rs 95.30.

Revenue down 15.7% at Rs 4,457 crore versus Rs 5,284 crore.

Ebitda down 38.2% at Rs 234 crore versus Rs 379 crore.

Margin at 5.3% versus 7.2%.

Net profit down 35% at Rs 135 crore versus Rs 208 crore.

Ramkrishna Forgings (Consolidated, YoY)

Shares fell 3.18% to Rs 587.

Revenue down 2.8% at Rs 947 crore versus Rs 974 crore.

Ebitda down 47.6% at Rs 98.5 crore versus Rs 188 crore.

Margin at 10.4% versus 19.3%.

Net profit at Rs 200 crore versus Rs 65.3 crore.

Total tax at negative Rs 223 crore versus Rs 34 crore.

Deferred tax credit of Rs 184 crore versus deferred tax charge of Rs 73 crore.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.