Shares of United Spirits Ltd., NHPC Ltd. and Gland Pharma Ltd. were in focus on Wednesday, after the companies announced their fourth quarter results.

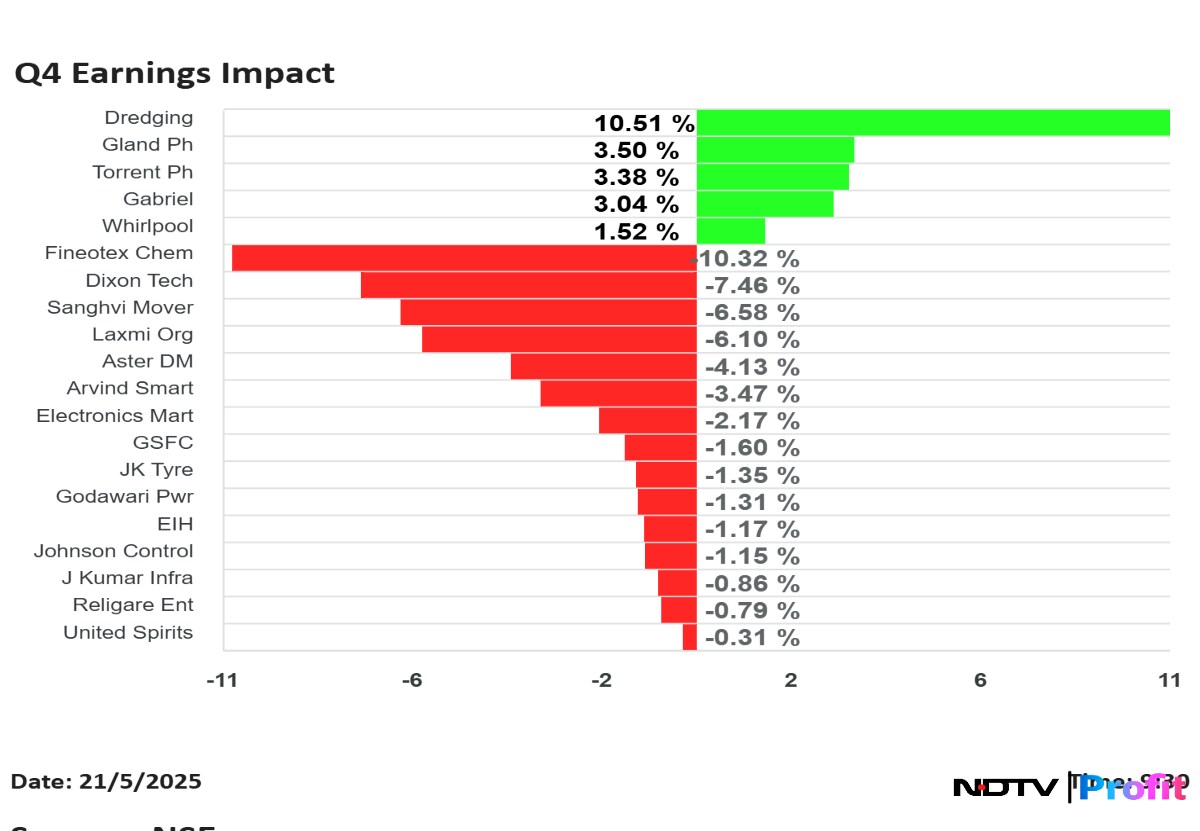

Dredging Corp. shares rose the most, while Sanghvi Movers Ltd. fell the most, among the companies that announced their results for quarter ended March.

Dixon Tech Q4 Highlights (Consolidated, YoY)

Share price fell 5.11% to Rs 15,720.

Revenue up 121% to Rs 10,293 crore versus Rs 4,658 crore (Bloomberg estimate: Rs 10,748 crore).

Ebitda up 143% to Rs 443 crore versus Rs 182 crore (Bloomberg estimate: Rs 403 crore).

Margin expands to 4.3% versus 3.9% (Bloomberg estimate: 3.7%).

Net profit up 322% to Rs 401 crore versus Rs 95 crore (Bloomberg estimates: Rs 217 crore).

Exceptional Gain of Rs 250 crore in Q4 FY25.

Mobile and other EMS Division grew by 194% to Rs 9,102 crore from Rs 3,091 crore.

Torrent Pharma Q4 FY25 Results Highlights (Consolidated, YoY)

Share price rose 1.93% at Rs 3,304.

Revenue up 7.8% at Rs 2,959 crore versus Rs 2,745 crore.

Ebitda up 9.2% at Rs 964 crore versus Rs 883 crore.

Margin at 32.6% versus 32.2%.

Net profit up 11% at Rs 498 crore versus Rs 449 crore.

Note: Exceptional loss of Rs 24 crore in Q4.

Exceptional items relate to closure of DPCO pending litigation for previous years.

Net profit up by 11%, driven by robust India business.

The board approved plans to raise up to Rs 5,000 crore via QIP.

GSFC Q4 Earnings (Consolidated, YoY)

Share price falls 1.36% at Rs 202.70.

Revenue down 2.2% at Rs 1,922 crore versus Rs 1,965 crore.

Ebitda up 3 times at Rs 80 crore versus Rs 26 crore.

Margin at 4.2% versus 1.3%.

Net Profit up 2.9 times Rs 71.7 crore versus Rs 24.7 crore.

Ebitda aided by lower power fuel and Employee Expenses.

PAT aided by increase by other income by 4 crore and higher tax expense in Q4 FY24.

To pay dividend of Rs 5 per share.

United Spirits Q4 FY25 Results Highlights (Consolidated, YoY)

Share price down 3.53% at Rs 1,501.70.

Revenue up 2.4% to Rs 2,946 crore versus Rs 2,666 crore (Bloomberg estimate: Rs 2,977 crore).

Ebitda up 39.5% to Rs 505 crore versus Rs 362 crore (Bloomberg estimate: Rs 446 crore).

Margin at 17.1% versus 13.6% (Bloomberg estimate: 15%).

Net profit up 17.4% to Rs 451 crore versus Rs 384 crore (Bloomberg estimate: Rs 308 crore).

PAT boosted by 57% uptick in other income.

Exceptional loss of Rs 31 crore in Q4 FY24.

Godawari Power Q4 FY25 Results Highlights (Consolidated, YoY)

Share price falls 2% at Rs 194.

Revenue down 4% at Rs 1,468 crore versus Rs 1,530 crore.

Ebitda down 3.2% at Rs 318 crore versus Rs 329 crore.

Margin at 21.7% versus 21.5%.

Net profit up 1.3% at Rs 221 crore versus Rs 218 crore.

Ebitda down due to 35% uptick in Employee Expenses.

PAT uptick is due to lower tax expense in the current quarter.

The company approved the enhancement of steel melting capacity by 50,000 MTs at its existing steel plant.

Will revise the proposed capacity of solar power plant from 95 MWp to 125 MWp. The additional solar power capacity shall be used for operating expanded steel melting shop.

The board also cleared plans to raise long-term debt of Rs 300 crore from banks/financial institutions.

Gland Pharma Q4 FY25 Results Highlights (Consolidated, YoY)

Share price falls 2.81% at Rs 1,456.20.

Revenue down 7.3% to Rs 1,425 crore versus Rs 1,537 crore (Bloomberg estimate: Rs 1,552 crore).

Ebitda down 0.7% to Rs 347.4 crore versus Rs 350 crore (Bloomberg estimate: Rs 376 crore).

Margin at 24.4% versus 22.8% (Bloomberg estimate: 24.2%).

Net profit down 3.1% to Rs 186 crore versus Rs 192 crore (Bloomberg estimate: Rs 233 crore).

Ebitda flat on 6% uptick in employee expenses.

JK Tyre & Industries Q4 FY25 Results Highlights (Standalone, YoY)

Share price falls 3.56% at Rs 335.50.

Revenue up 2.2% to Rs 2,674 crore versus Rs 2,616 crore.

Ebitda down 21% to Rs 263 crore versus Rs 333 crore.

Margin at 9.8% versus 12.7%.

Net profit down 34% to Rs 96.5 crore versus Rs 146 crore.

Aster DM Healthcare Q4 Highlights (Consolidated, YoY)

Share price falls 3.24% at Rs 560.60.

Revenue up 2.7% at Rs 1,000 crore versus Rs 974 crore.

Ebitda up 20.8% at Rs 192 crore versus Rs 159 crore.

Margin at 19.2% versus 16.4%.

Net profit at Rs 79 crore versus a loss of Rs 24 crore.

Dredging Corp Q4 Highlights (YoY)

Share price rises 12.26% at Rs 761.

Revenue up 42.5% to Rs 462 crore versus Rs 324 crore.

Ebitda up 46.7% to Rs 76.7 crore versus Rs 52.3 crore.

Margin at 16.6% versus 16%.

Net profit up 33.8% to Rs 21.4 crore versus Rs 16 crore.

Arvind SmartSpaces Q4 Highlights (Consolidated, YoY)

Share price falls 5.46% at Rs 682.

Revenue up 39% to Rs 163 crore versus Rs 117 crore.

Ebitda up 7.3% to Rs 33.6 crore versus Rs 31.3 crore.

Margin at 20.6% versus 26.7%.

Net profit up 22.6% to Rs 19 crore versus Rs 15.5 crore.

J Kumar Infra Q4 FY25 Results Highlights (Consolidated, YoY)

Share price falls 2.33% at Rs 715.40.

Revenue up 14.6% to Rs 1,633 crore versus Rs 1,425 crore.

Ebitda up 16.3% to Rs 236 crore versus Rs 203 crore.

Margin at 14.5% versus 14.2%.

Net profit up 14% to Rs 114 crore versus Rs 100 crore.

Johnson Controls- Hitachi Q4 FY25 Results Highlights (Consolidated, YoY)

Share price rises 2.56% at Rs 1,831.20.

Revenue up 20.8% at Rs 932 crore versus Rs 772 crore.

Ebitda up 12.6% at Rs 91.7 crore versus Rs 81.4 crore.

Margin at 9.8% versus 10.5%.

Net profit up 14.7% at Rs 56 crore versus Rs 48.8 crore.

Fineotex Chemical Q4 Highlights (Consolidated, YoY)

Share price falls 9.85% at Rs 232.

Revenue down 21.6% to Rs 120 crore versus Rs 153 crore.

Ebitda down 44.4% to Rs 21.3 crore versus Rs 38.3 crore.

Margin at 17.8% versus 25%.

Net profit down 33.3% to Rs 20 crore versus Rs 30 crore.

Fortis Health Q4 Highlights (Consolidated, YoY)

Share price falls 1.76% at Rs 667.20.

Revenue up 12.4% at Rs 2,007 crore versus Rs 1,786 crore (Bloomberg estimate: Rs 2,020 crore).

Ebitda up 14.3% at Rs 435 crore versus Rs 381 crore (Bloomberg estimate: Rs 424 crore).

Margin at 21.7% versus 21.3% (Bloomberg estimate: 21%).

Net profit up 2.8% at Rs 184 crore versus Rs 179 crore (Bloomberg estimate: Rs 218 crore).

Whirlpool of India Q4 FY25 Earnings Highlights (Consolidated, YoY)

Share price falls 7.75% at Rs 1,395.90.

Revenue up 15.6% at Rs 2,005 crore versus Rs 1,734 crore (Bloomberg estimate: Rs 1,990 crore).

Ebitda up 27.4% at Rs 183 crore versus Rs 144 crore (Bloomberg estimate: Rs 157 crore).

Margin at 9% versus 8.3% (Bloomberg estimate: 7.9%).

Net Profit up 53.6% at Rs 119 crore versus Rs 77.6 crore (Bloomberg estimate: Rs 100 crore).

NHPC Q4 FY25 Earnings Highlights (Consolidated, YoY)

Share price rises 3.05% at Rs 89.25.

Revenue up 24.39% at Rs 2,346 crore versus Rs 1,886 crore.

Ebitda down 5.22% at Rs 1,089.91 crore versus Rs 1,150 crore.

Ebitda margin down 1,451 bps at 46.45% versus 60.97%.

Net profit up 56.8% at Rs 853 crore versus Rs 544 crore.

Sanghvi Movers Q4 FY25 Results Highlights (Consolidated, QoQ)

Share price falls 12.58% at Rs 306.

Revenue up 28% at Rs 274 crore versus Rs 214 crore.

Ebitda up 38% at Rs 113 crore versus Rs 82.2 crore.

Margin at 41.4% versus 38.4%.

Net profit up 62.7% at Rs 53.8 crore versus Rs 33 crore.

Religare Enterprises Q4 FY25 Earnings Highlights (Consolidated, YoY)

Share price rises 1.52% at Rs 222.60.

NII up 15.54% at Rs 168.21 crore versus Rs 145.58 crore.

Net profit down 20.8% at Rs 99 crore vs Rs 125 crore.

Exceptional gain in fourth quarter of Rs 230 crore.

Laxmi Organics Q4 FY25 Earnings Highlights (Consolidated, YoY)

Share price falls 6.40% at Rs 183.50.

Revenue down 10.4% at Rs 710 crore versus Rs 792 crore.

Ebitda down 34.6% at Rs 58.9 crore versus Rs 90 crore.

Margin at 8.3% vs 11.4%.

Net profit down 51% at Rs 21.7 crore vs Rs 44.3 crore.

Gabriel India Q4 Highlights (Consolidated, YoY)

Share price rises 4.20% at Rs 645.95.

Revenue up 17% to Rs 1,073 crore versus Rs 917 crore.

Ebitda up 35.6% to Rs 109 crore versus Rs 80.4 crore.

Margin at 10% versus 8.8%.

Net profit up 31.2% to Rs 64.3 crore versus Rs 49 crore.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.